Attached files

Table of Contents

As filed with the Securities and Exchange Commission on March 24, 2010

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

AMERICAN BAR ASSOCIATION MEMBERS/

STATE STREET COLLECTIVE TRUST

(Exact name of registrant as specified in its charter)

| New Hampshire | 6799 | 04-6691601 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

20 Trafalgar Square, Suite 449, Nashua, New Hampshire 03063

(603) 589-4097

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Nancy E. Grady

President

State Street Bank and Trust Company of New Hampshire

20 Trafalgar Square

Suite 449

Nashua, New Hampshire 03063

(603) 589-4097

(Name, address including zip code, and telephone number, including area code, of agent for service)

with copies to:

Dennis V. Osimitz

Andrew H. Shaw

Sidley Austin LLP

One South Dearborn Street

Chicago, IL 60603

(312) 853-7000

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x Smaller reporting company ¨

(Do not check if a smaller

reporting company)

Pursuant to Rule 429 under the Securities Act, the prospectus contained in this Registration Statement also relates to Registration Statement Nos. 333-155737, 333-158263 and 333-159466.

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered |

Proposed maximum aggregate offering price |

Amount of registration fee | ||

| Units representing beneficial interests in Stable Asset Return Fund |

100,000,000 | $7,130 | ||

| Units representing beneficial interests in Bond Index Fund |

10,000,000 | $713 | ||

| Units representing beneficial interests in Large Cap Index Equity Fund |

10,000,000 | $713 | ||

| Units representing beneficial interests in 2020 Retirement Date Fund |

10,000,000 | $713 | ||

| Units representing beneficial interests in 2030 Retirement Date Fund |

10,000,000 | $713 | ||

| Total Units of beneficial interest |

140,000,000(1)(2) | $9,982 | ||

| (1) | The Collective Trust may offer and sell an unlimited number of units representing interests in separate funds and portfolios of the Collective Trust, each unit to be offered and sold at the per unit net asset value of the corresponding fund or portfolio. |

| (2) | Does not include units previously registered and remaining unsold as of the date hereof. The registered but unsold units are being carried forward pursuant to Rule 429 under the Securities Act. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information contained in this prospectus is not complete and may be changed. The Collective Trust may not sell these securities until the registration statement relating to this offering and filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion. Dated March 24, 2010

ABA RETIREMENT FUNDS PROGRAM

UNITS OF BENEFICIAL INTEREST

AMERICAN BAR ASSOCIATION MEMBERS/ STATE STREET COLLECTIVE TRUST

The American Bar Association Members/State Street Collective Trust (“we” or the “Collective Trust”) is offering Units representing pro rata beneficial interests in a total of 20 collective investment funds established under the Collective Trust. We refer to each of these collective investment funds individually as a Fund and together as the Funds. We group the Funds into five categories, as follows:

| • | we offer five predominantly actively managed Funds as listed on the following page, which we refer to as the Managed Funds, |

| • | we offer six Funds, each of which is designed to replicate a specific securities index, as listed on the following page, which we refer to as the Index Funds, |

| • | we offer the Real Asset Return Fund, which seeks to provide investors with investment returns in excess of inflation as measured by the Core Consumer Price Index (which excludes food and energy), |

| • | we offer five Retirement Date Funds, a group of balanced investment funds, each of which is designed to correspond to a particular time horizon to retirement, and |

| • | we offer three Target Risk Funds, each of which is designed to represent risk and reward characteristics that reflect a certain level of investment risk. |

In addition, assets contributed under the Program may be invested in any publicly traded debt and equity securities and shares of numerous mutual funds through Self-Managed Brokerage Accounts. The Self-Managed Brokerage Accounts are not registered under the Securities Act of 1933 and these Self-Managed Brokerage Accounts, together with the Balanced Fund, Units of which ceased to be offered as of July 2, 2009, are described in this prospectus for information purposes only.

Each of the Funds is an investment option under the ABA Retirement Funds program, which we refer to as the Program. The Program is a comprehensive retirement program sponsored by ABA Retirement Funds in which lawyers and law firms who are members or associates of the American Bar Association, most state and local bar associations and their employees and employees of certain organizations related to the practice of law are eligible to participate. There are no stated minimum initial or subsequent investment requirements to participate in the Program. The Units do not trade on any national exchange. Rather, Units may be purchased through the trustee of the Collective Trust, which is State Street Bank and Trust Company of New Hampshire, which we refer to as the Trustee or State Street. Transfers and withdrawals with respect to the Units may be made as described herein.

State Street is a subsidiary of State Street Bank and Trust Company, which we refer to as State Street Bank. State Street operates the Funds. ING Life Insurance and Annuity Company, which we refer to as ING Life, acting through its affiliates, including ING Institutional Plan Services, LLC, which we refer to as ING Services, provides recordkeeping, communication, marketing and administration services to the Program. The Northern Trust Company, which we refer to as Northern Trust, as investment fiduciary, makes recommendations to State Street on behalf of ABA Retirement Funds regarding certain Funds and the engagement and termination of Investment Advisors with respect to those Funds. Northern Trust is a wholly-owned subsidiary of Northern Trust Corporation, a publicly-traded bank holding company.

For a discussion of the risk factors relating generally to the Program, please refer to page 33. For a discussion of the risk factors applicable to investment in the Units of the respective Funds, please refer to page 43 (Stable Asset Return Fund), page 48 (Bond Core Plus Fund), page 52 (Large Cap Equity Fund), page 55 (Small-Mid Cap Equity Fund), page 59 (International All Cap Equity Fund), page 63 (Bond Index Fund), page 65 (Large Cap Index Equity Fund), page 67 (All Cap Index Equity Fund), page 69 (Mid Cap Index Equity Fund), page 71 (Small Cap Index Equity Fund), page 73 (International Index Equity Fund), page 78 (Real Asset Return Fund), page 86 (Retirement Date Funds) and page 92 (Target Risk Funds).

The offering of Units with a proposed offering price of approximately $1.65 billion under the Registration Statements to which this prospectus relates represents 48% of the total value of Units outstanding as of December 31, 2009. The Units will be offered based on the respective net asset values of the Funds as determined from time to time. Such net asset values are calculated as of the close of the regular trading session of the New York Stock Exchange on each Business Day.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

None of the Funds is registered as an investment company under the Investment Company Act of 1940, and, therefore, none of the Funds is subject to compliance with the requirements of this Act. Units are not “redeemable securities” within the meaning of the Investment Company Act of 1940. See “Regulation of Collective Trust.”

The date of this prospectus is April , 2010.

Table of Contents

MANAGED FUNDS

STABLE ASSET RETURN FUNDSM invests primarily in high quality fixed-income instruments and investment contracts issued by insurance companies, banks or other financial institutions with the objective of providing current income consistent with preserving principal and maintaining liquidity.

BOND CORE PLUS FUND invests in debt securities of varying maturities with the objective of achieving a competitive total return from current income and capital appreciation.

LARGE CAP EQUITY FUND invests primarily in equity securities of large capitalization companies with the objective of achieving long-term growth of capital. Any income received is incidental to this objective. Large capitalization companies are considered those with a market capitalization of greater than $1 billion.

SMALL-MID CAP EQUITY FUND invests primarily in equity securities of small and medium capitalization companies with the objective of achieving long-term growth of capital. Any income received is incidental to this objective. Small and mid capitalization companies are considered those with a market capitalization between $100 million and $20 billion.

INTERNATIONAL ALL CAP EQUITY FUND invests primarily in equity securities of issuers domiciled outside of the U.S. The Fund may invest in companies of any size located in a number of countries throughout the world.

INDEX FUNDS

BOND INDEX FUND invests in U.S. Government Obligations and U.S. dollar-denominated corporate debt securities, mortgage-backed securities, commercial mortgage-backed securities and asset-backed securities with the objective of replicating the total rate of return of the Barclays Capital U.S. Aggregate Bond Index.

LARGE CAP INDEX EQUITY FUND invests in securities of U.S. companies included in the S&P 500® with the objective of replicating the total rate of return of the S&P 500.

ALL CAP INDEX EQUITY FUND invests in common stocks included in the Russell 3000® Index with the objective of replicating the total rate of return of the Russell 3000 Index.

MID CAP INDEX EQUITY FUND invests in securities of U.S. companies included in the S&P MidCap 400® with the objective of replicating the total rate of return of the S&P MidCap 400.

SMALL CAP INDEX EQUITY FUND invests in securities of U.S. companies included in the Russell 2000® Index with the objective of replicating the total rate of return of the Russell 2000 Index.

INTERNATIONAL INDEX EQUITY FUND invests in securities of non-U.S. companies included in the Morgan Stanley Capital International All-Country World Ex-U.S. Index, which we refer to as the MSCI ACWI ex-US Index, with the objective of replicating the total rate of return of the MSCI ACWI ex-US Index.

REAL ASSET RETURN FUND

REAL ASSET RETURN FUND invests in a diversified portfolio of primarily Treasury Inflation Protected Securities, or so-called TIPS, commodity futures and real estate investment trusts with the objective of achieving a total return in excess of inflation as measured by the Core Consumer Price Index (which excludes food and energy).

Table of Contents

RETIREMENT DATE FUNDS

Assets contributed under the Program may also be invested in the RETIREMENT DATE FUNDS, a group of five balanced investment funds each of which is designed to correspond to a particular time horizon to retirement.

TARGET RISK FUNDS

Assets contributed under the Program may also be invested in TARGET RISK FUNDS, each of which is designed to represent risk and reward characteristics that reflect varying levels of investment risk such as conservative, moderate or aggressive.

SPECIAL NOTE REGARDING RECENT AND EXPECTED CHANGES TO THE PROGRAM

Northern Trust has been appointed by ABA Retirement Funds to act as investment fiduciary with respect to certain aspects of the Program. As investment fiduciary, Northern Trust exercises the rights previously exercised by ABA Retirement Funds to make recommendations to the Trustee regarding certain of the investment options and the engagement and termination of Investment Advisors with respect to these options, consistent with an investment policy for the Program developed by Northern Trust and accepted by ABA Retirement Funds.

Northern Trust, acting through its wholly-owned subsidiary Northern Trust Investments, is expected to be substituted for State Street as trustee of the Collective Trust no later than September 30, 2011, although the substitution is currently expected to occur on or about July 1, 2010. From and after the date of the substitution, Northern Trust Investments, as trustee of the Collective Trust, will have exclusive discretion and control over the assets of the Collective Trust, and Northern Trust no longer will act as investment fiduciary.

Upon the substitution of Northern Trust Investments for State Street as the trustee of the Collective Trust, State Street will no longer serve as trustee of the Collective Trust and the Declaration of Trust of the Collective Trust is expected to be amended and restated as the American Bar Association Members/Northern Trust Collective Trust.

For a description of upcoming expected changes relating to the Program, see “Recent and Expected Changes to the Program; Role of Northern Trust.”

Table of Contents

| Page | ||

| 1 | ||

| 33 | ||

| 38 | ||

| 38 | ||

| 40 | ||

| 40 | ||

| 43 | ||

| 47 | ||

| 48 | ||

| 51 | ||

| 52 | ||

| 54 | ||

| 55 | ||

| 58 | ||

| 59 | ||

| 62 | ||

| 62 | ||

| 63 | ||

| 65 | ||

| 65 | ||

| 66 | ||

| 67 | ||

| 69 | ||

| 69 | ||

| 71 | ||

| 71 | ||

| 73 | ||

| 73 | ||

| 76 | ||

| 78 | ||

| 80 | ||

| 86 | ||

| 90 | ||

| 92 | ||

| 94 | ||

| 96 | ||

| 99 | ||

| 101 | ||

| 103 | ||

| 105 | ||

| 106 | ||

| 107 | ||

| 108 | ||

| 112 | ||

| Recent and Expected Changes to the Program; Role of Northern Trust |

112 | |

| 114 | ||

| 115 | ||

| 119 | ||

| 120 |

i

Table of Contents

| Page | ||

| 127 | ||

| 130 | ||

| 132 | ||

| 135 | ||

| 135 | ||

| 136 | ||

| 136 | ||

| 137 |

References in this prospectus to “Business Day” mean any day that the New York Stock Exchange is open for trading.

For additional information regarding all aspects of the Program and its investment options, contact State Street Bank and Trust Company by phone at (800) 826-8901 or by writing to ABA Retirement Funds Program, P.O. Box 5142, Boston, Massachusetts 02206-5142.

The Collective Trust has not authorized any person to give any information or to make any representations in connection with this offering other than those in this prospectus.

The investment options described below are not deposits or obligations of, or guaranteed or endorsed by, State Street or State Street Bank, and Units of beneficial interest are not insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board, or any other governmental agency, are not deposits of State Street, State Street Bank or any other bank and involve risks, including the possible loss of principal.

ii

Table of Contents

This summary highlights information contained elsewhere in this prospectus. Because it is a summary, it does not contain all of the information that you should consider before investing. You should read the entire prospectus carefully, including the “Risk Factors” information included in the description of each of the Funds and elsewhere in this prospectus.

The Program

The ABA Retirement Funds program, which we refer to as the Program, is a comprehensive retirement program that provides eligible employers that adopt the Program with tax-qualified employee retirement plans, a variety of investment options and related recordkeeping and administrative services. The Program is sponsored by ABA Retirement Funds, an Illinois not-for-profit corporation, which was organized by the American Bar Association to encourage lawyers to provide retirement benefits for themselves and their employees by sponsoring retirement programs.

The Collective Trust itself has no employees. State Street Bank and Trust Company of New Hampshire, a New Hampshire chartered non-depository trust company, which we refer to as State Street or the Trustee, in its role as trustee of the Collective Trust, offers the investment options available under the Program’s Collective Trust. State Street is a wholly-owned subsidiary of State Street Bank and Trust Company, which we refer to as State Street Bank. The board of directors of State Street is responsible for management of State Street’s business and affairs, including its service as trustee of the Collective Trust. State Street Bank maintains the Self-Managed Brokerage Accounts. For a more complete description of the relationship between State Street and State Street Bank, see “State Street and State Street Bank.” For a description of certain expected changes to the above-described arrangements with State Street and State Street Bank, see “Recent and Expected Changes to the Program; Role of Northern Trust.”

ING Life Insurance and Annuity Company, a Connecticut corporation, which we refer to as ING Life, acting through its affiliates, including ING Institutional Plan Services, LLC, a Delaware limited liability company, which we refer to as ING Services, provides recordkeeping, communication, marketing and administration services to the Program, including maintenance of individual account records or accrued benefit information for Participants whose Employers choose to have the Program’s administrator maintain those account records. ING Services also provides certain account and investment information to Employers and Participants, manages the receipt of all plan contributions, forwards investment and transaction instructions to the appropriate parties and forwards instructions relating to distribution of benefits provided by the plans.

The Northern Trust Company, which we refer to as Northern Trust, as investment fiduciary appointed by ABA Retirement Funds, makes recommendations to State Street regarding certain Funds and the engagement and termination of Investment Advisors with respect to those Funds. Northern Trust Investments, N.A., which we refer to as Northern Trust Investments, is a national banking association and a wholly-owned subsidiary of Northern Trust, which in turn is a wholly-owned subsidiary of Northern Trust Corporation, a publicly-traded bank holding company registered with the Federal Reserve Board pursuant to the Federal Bank Holding Company Act of 1956, as amended.

Investment Options

Assets contributed or held under the Program may be invested in any of the following Funds or a Self-Managed Brokerage Account.

1

Table of Contents

Managed Funds

The Collective Trust offers five Managed Funds that are predominantly actively managed. The Stable Asset Return Fund invests primarily in high quality fixed-income instruments and investment contracts. The Bond Core Plus Fund invests primarily in debt securities of varying maturities. The Large Cap Equity Fund, the Small-Mid Cap Equity Fund and the International All Cap Equity Fund are multi-manager Funds and invest primarily in various types of equity securities.

Index Funds

The Collective Trust offers the following six Index Funds, each of which is designed to replicate a specific securities index: the Bond Index Fund, the Large Cap Index Equity Fund, the All Cap Index Equity Fund, the Mid Cap Index Equity Fund, the Small Cap Index Equity Fund and the International Index Equity Fund.

Real Asset Return Fund

The Collective Trust offers the Real Asset Return Fund, a diversified portfolio which is designed to provide investors with a return in excess of inflation as measured by the Core Consumer Price Index (which excludes food and energy).

Retirement Date Funds

The Collective Trust offers five Retirement Date Funds, a group of balanced investment funds, each of which is designed to correspond to a particular time horizon to retirement.

Target Risk Funds

The Collective Trust offers three Target Risk Funds, each of which is designed to represent risk and reward characteristics that reflect a certain level of investment risk such as conservative, moderate or aggressive.

Self-Managed Brokerage Account

Assets contributed or held under the Program can also be invested in a wide variety of publicly traded debt and equity securities and shares of numerous mutual funds through a self-managed brokerage account, which we refer to as a Self-Managed Brokerage Account. Self-Managed Brokerage Accounts are not registered under the Securities Act of 1933 and are described in this prospectus for informational purposes only. See “Self-Managed Brokerage Accounts.”

Investment Options

In this prospectus, we refer to the Funds and the Self-Managed Brokerage Account as “investment options.” As of July 2, 2009, the Balanced Fund ceased to be offered and thus the Balanced Fund is no longer an investment option, although certain assets held under the Program continue to be invested in this fund. See “Balanced Fund.”

State Street may make additional investment options available from time to time, subject to consultation with Northern Trust as investment fiduciary appointed by ABA Retirement Funds. State Street may also terminate or amend the terms of certain investment options from time to time upon notice to, and in consultation with, Northern Trust as investment fiduciary. For a description of certain expected changes to the above-described arrangements, see “Recent and Expected Changes to the Program; Role of Northern Trust.”

2

Table of Contents

The following charts provide a summary of the features of the Funds that are available under the Program.

SUMMARY OF FUNDS*

| Managed Funds | ||||||||||

| Stable |

Bond Core |

Large Cap |

Small-Mid Cap |

International | ||||||

| Investment Objective: |

Current income consistent with preserving principal and maintaining liquidity | Total return from capital appreciation and current income |

Long-term growth of capital | Long-term growth of capital | Long-term growth of capital | |||||

| Invests Primarily In: |

High quality short-term instruments and investment contracts of insurance companies, banks and financial institutions | Debt securities of various maturities |

U.S. equities with capitalization in excess of $1 billion |

U.S. equities with capitalization between $100 million and $20 billion. |

Common stocks and other equity securities of established non- U.S. companies | |||||

| Risk to Principal: |

Low risk to principal | Average credit risk for a debt-oriented intermediate bond fund; also risk of loss related to movements in interest rates | Average risk to principal for a large cap U.S. equity fund | Above average risk to principal for a U.S. equity fund but average risk for a small-mid cap U.S. equity fund | Above average risk to principal for a U.S. equity fund but average risk to principal for an international equity fund, including risks due to currency fluctuations | |||||

| Primary Source of Potential Return: |

Interest income | Interest income and capital appreciation | Capital appreciation | Capital appreciation | Capital appreciation | |||||

| Estimated Maturity or Duration: |

1.88 years(5) | Generally 3 to 6 years duration | N/A | N/A | N/A | |||||

| Volatility of Return: |

Subject to interest rate fluctuation | Below average volatility for a fund investing in debt securities; volatility subject to fluctuations in interest rates | Comparable to the Russell 1000® Index | Comparable to the Russell 2500™ Index | Above average for an equity fund | |||||

| Transfer Permitted:(6) |

Daily | Daily | Daily | Daily | Daily | |||||

| * | In addition, certain plans permit the establishment of a self-managed brokerage account. See “Self-Managed Brokerage Accounts.” Certain plans also continue to be invested in the Balanced Fund, which invests in both debt and equity securities through the Bond Core Plus Fund and the Large Cap Equity Fund. The Balanced Fund ceased to be offered as an investment option as of July 2, 2009. See “Balanced Fund.” |

| (1) | Invests through the State Street Global Advisors, the investment management division of State Street Bank which we refer to as SSgA, Stable Asset Fund Trust, a collective investment fund maintained by State Street Bank, which in turn invests a portion of its assets in the State Street Bank and Trust Company Short Term Investment Fund, a collective investment fund maintained by State Street Bank. |

| (2) | Invests a portion of its assets through the SSgA Russell Large Cap® Index Securities Lending Series Fund (which engages in securities lending) and the SSgA Russell Large Cap® Index Non-Lending Series Fund (which does not engage in securities lending), each a collective investment fund maintained by State Street Bank and having the same investment objective, as well as the SSgA Russell 1000® Index Non-Lending Fund. Over time, the portion of the Large Cap Equity Fund invested in the Russell Large Cap® Index Securities Lending Series Fund is being transitioned to the SSgA Russell Large Cap® Index Non-Lending Series Fund. |

| (3) | Invests a portion of its assets through the SSgA Russell Small Cap® Index Securities Lending Series Fund (which engages in securities lending) and the SSgA S&P MidCap® Index Non-Lending Series Fund (which does not engage in securities lending), each a collective investment fund maintained by State Street Bank. Over time, the portion of the Small-Mid Cap Equity Fund invested in the SSgA Russell Small Cap® Index Securities Lending Series Fund is being transitioned to the SSgA S&P MidCap® Index Non-Lending Series Fund. |

| (4) | Invests a portion of the cash reserve of the Fund in one or more collective investment funds maintained by State Street Bank. |

| (5) | Average weighted maturity as of December 31, 2009. |

| (6) | For information regarding special restrictions on transfers involving the Funds and, in particular, the International All Cap Equity Fund and the International Index Equity Fund, see “Transfers Among Investment Options and Withdrawals—Frequent Trading; Restrictions on Transfers.” |

3

Table of Contents

SUMMARY OF FUNDS

| Index Funds(1) | ||||||||||||

| Bond |

Large Cap |

All Cap |

Mid Cap |

Small Cap |

International | |||||||

| Investment Objective: |

Replication of the total return of the Barclays Capital U.S. Aggregate Bond Index | Replication of the total return of the S&P 500 | Replication of the total return of the Russell 3000 Index | Replication of the total return of the S&P MidCap 400 | Replication of the total return of the Russell 2000® Index | Replication of the total return of the MSCI ACWI ex-US Index | ||||||

| Invests Primarily In: |

Debt securities included in the Barclays Capital U.S. Aggregate Bond Index | The common stocks included in the S&P 500 | The common stocks included in the Russell 3000 Index | The common stocks included in the S&P MidCap 400 | The common stocks included in the Russell 2000 Index | The common stocks included in the MSCI ACWI ex-US Index | ||||||

| Risk to Principal: |

Average credit risk for a debt-oriented bond index fund; also risk of loss related to movements in interest rates | Average for a U.S. equity fund | Average for a diversified U.S. equity fund | Above average for a U.S. equity fund | Above average for a U.S. equity fund | Above average for a U.S. equity fund but average for an international index equity fund, including risks due to currency fluctuations | ||||||

| Primary Source of Potential Return: |

Interest income and capital appreciation | Capital appreciation and dividend income | Capital appreciation and dividend income | Capital appreciation | Capital appreciation | Capital appreciation | ||||||

| Estimated Maturity or Duration: |

4.57 years(8) | N/A | N/A | N/A | N/A | N/A | ||||||

| Volatility of Return: |

Comparable to the Barclays Capital U.S. Aggregate Bond Index | Comparable to the S&P 500 | Comparable to the Russell 3000 Index | Comparable to the S&P MidCap 400 | Comparable to the Russell 2000 Index | Comparable to the MSCI ACWI ex-US Index | ||||||

| Transfer Permitted:(9) |

Daily | Daily | Daily | Daily | Daily | Daily | ||||||

| (1) | The Index Funds obtain exposure to various equity, fixed-income and cash asset classes by investment in respective collective investment funds maintained by State Street Bank. |

| (2) | Invests through the SSgA U.S. Bond Index Non-Lending Series Fund, a collective investment fund maintained by State Street Bank. |

| (3) | Invests through the SSgA S&P 500® Index Non-Lending Series Fund, a collective investment fund maintained by State Street Bank. |

| (4) | Invests through the SSgA Russell All Cap® Index Securities Lending Series Fund (which engages in securities lending), and the SSgA Russell All Cap Index Non-Lending Series Fund (which does not engage in securities lending), each a collective investment fund and having the same investment objective. Over time, the portion of the All Cap Index Equity Fund invested in the SSgA Russell All Cap® Index Securities Lending Series Fund is being transitioned to the SSgA Russell All Cap Index Non-Lending Series Fund. |

| (5) | Invests through the SSgA S&P MidCap® Index Non-Lending Series Fund, a collective investment fund maintained by State Street Bank. |

| (6) | Invests through the SSgA Russell Small Cap Index Non-Lending Series Fund, a collective investment fund maintained by State Street Bank. |

| (7) | Invests through the SSgA Global Equity ex U.S. Index Non-Lending Series Fund, a collective investment fund maintained by State Street Bank. |

| (8) | Effective duration of the underlying index as of December 31, 2009. |

| (9) | For information regarding special restrictions on transfers involving the Funds and, in particular, the International All Cap Equity Fund and the International Index Equity Fund, see “Transfers Among Investment Options and Withdrawals—Frequent Trading; Restrictions on Transfers.” |

4

Table of Contents

SUMMARY OF FUNDS

| Real Asset Return Fund(1) | ||||

| Investment Objective: |

Growth of capital in excess of inflation as measured by the Core Consumer Price Index (which excludes food and energy) | |||

| Invests Primarily In: |

U.S. real estate investment trusts, commodity futures and treasury inflation-protected securities | |||

| Allocates Assets |

REIT Index Fund | 10% to 40% | ||

| As of the Date Hereof To: |

TIPS NL Fund | 20% to 60% | ||

| Commodity Index NL Fund | 10% to 40% | |||

| Cash | 0% to 20% | |||

| Risk to Principal: |

Below average risk to principal | |||

| Primary Source of Potential Return: |

Capital appreciation and income | |||

| Estimated Maturity or Duration: |

N/A | |||

| Volatility of Return: |

Less than the S&P 500 | |||

| Transfer Permitted:(2) |

Daily | |||

| (1) | The Real Asset Return Fund obtains exposure to various asset classes by investment in collective investment funds maintained by State Street Bank. For definitions of the terms used in the chart, see “Real Asset Return Fund—Strategy.” |

| (2) | For information regarding special restrictions on transfers involving the Funds and, in particular, the International All Cap Equity Fund and the International Index Equity Fund, see “Transfers Among Investment Options and Withdrawals—Frequent Trading; Restrictions on Transfers.” |

5

Table of Contents

SUMMARY OF FUNDS

| Retirement Date Funds(1) |

||||||||||||||||||||||||

| Lifetime Income |

2010 Retirement Date Fund |

2020 Retirement Date Fund |

||||||||||||||||||||||

| Investment Objectives: |

Avoidance of significant loss of principal for those who have reached or are beyond their retirement date | A blend of capital appreciation and stability of principal for those planning to retire in or around 2010 | Long-term capital appreciation and more limited stability of principal for those planning to retire in or around 2020 | |||||||||||||||||||||

| Allocates Assets in 2010 To:(2) |

Fixed-Income: |

65.0 | % | Fixed-Income: |

52.5 | % | Fixed-Income: |

30.5 | % | |||||||||||||||

| Long Government Bond Fund |

0.0 | % | Long Government Bond Fund |

15.0 | % | Long Government Bond Fund |

20.0 | % | ||||||||||||||||

| Bond Market Index Fund |

20.0 | Bond Market Index Fund |

17.5 | Bond Market Index Fund |

3.5 | |||||||||||||||||||

| High Yield Bond Fund |

5.0 | High Yield Bond Fund |

5.0 | High Yield Bond Fund |

3.5 | |||||||||||||||||||

| Intermediate Bond Fund |

20.0 | Intermediate Bond Fund |

2.5 | Intermediate Bond Fund |

0.0 | |||||||||||||||||||

| TIPS Fund |

20.0 | TIPS Fund |

12.5 | TIPS Fund |

3.5 | |||||||||||||||||||

| Equity: |

30.0 | % | Equity: |

42.5 | % | Equity: |

69.5 | % | ||||||||||||||||

| S&P 500 Index Fund |

22.0 | % | S&P 500 Index Fund |

29.0 | % | S&P 500 Index Fund |

41.5 | % | ||||||||||||||||

| MSCI ACWI ex-US Index Fund |

4.0 | MSCI ACWI ex-US Index Fund |

8.0 | MSCI ACWI ex-US Index Fund |

16.5 | |||||||||||||||||||

| S&P MidCap Index Fund |

2.5 | S&P MidCap Index Fund |

3.5 | S&P MidCap Index Fund |

6.5 | |||||||||||||||||||

| Russell 2000 Index Fund |

1.5 | Russell 2000 Index Fund |

2.5 | Russell 2000 Index Fund |

5.0 | |||||||||||||||||||

| Other: |

5.0 | % | Other: |

5.0 | % | Other: |

0.0 | % | ||||||||||||||||

| Real Estate Fund |

5.0 | % | Real Estate Fund |

5.0 | % | Real Estate Fund |

0.0 | % | ||||||||||||||||

| Transfer Permitted:(3) |

Daily |

Daily |

Daily |

|||||||||||||||||||||

| 2030 Retirement Date Fund |

2040 Retirement Date Fund |

|||||||||||||||

| Investment Objectives: |

Long-term capital appreciation for those planning to retire in or around 2030 | Long-term capital appreciation for those planning to retire in or around 2040 | ||||||||||||||

| Allocates Assets in 2010 To:(2) |

Fixed-Income: |

17.0 | % | Fixed-Income: |

10.0 | % | ||||||||||

| Long Government Bond Fund |

17.0 | % | Long Government Bond Fund |

10.0 | % | |||||||||||

| Bond Market Index Fund |

0.0 | Bond Market Index Fund |

0.0 | |||||||||||||

| TIPS Fund |

0.0 | TIPS Fund |

0.0 | |||||||||||||

| Principal Accumulation Fund |

0.0 | Principal Accumulation Fund |

0.0 | |||||||||||||

| Equity: |

83.0 | % | Equity: |

90.0 | % | |||||||||||

| S&P 500 Index Fund |

45.0 | % | S&P 500 Index Fund |

45.0 | % | |||||||||||

| MSCI ACWI ex-US Index Fund |

21.5 | MSCI ACWI ex-US Index Fund |

25.0 | |||||||||||||

| S&P MidCap Index Fund |

8.0 | S&P MidCap Index Fund |

10.0 | |||||||||||||

| Russell 2000 Index Fund |

8.0 | Russell 2000 Index Fund |

10.0 | |||||||||||||

| Other: |

0.0 | % | Other: |

0.0 | % | |||||||||||

| Real Estate Fund |

0.0 | % | Real Estate Fund |

0.0 | % | |||||||||||

| Transfer Permitted:(3) |

Daily |

Daily |

||||||||||||||

| (1) | The Retirement Date Funds obtain exposure to various equity, fixed-income and other asset classes by investment in collective investment funds maintained by State Street Bank under its Investment Funds for Tax Exempt Retirement Plans, which in turn invest in various index and other collective investment funds maintained by State Street Bank. For definitions of the terms used in the chart, see “Retirement Date Funds—Strategy.” |

| (2) | Except for the Lifetime Income Retirement Date Fund, annual reallocations will result in asset allocations becoming progressively more conservative as the year in which the Retirement Date Fund will reach its most conservative investment mix draws nearer. |

| (3) | For information regarding special restrictions on transfers involving the Funds and, in particular, the International All Cap Equity Fund and the International Index Equity Fund, see “Transfers Among Investment Options and Withdrawals—Frequent Trading; Restrictions on Transfers.” For information regarding certain restrictions on transfers involving the Retirement Date Funds, see “Information with Respect to the Funds—Investment Prohibitions” and “Retirement Date Funds—Risk Factors—Liquidity and Transfers.” |

6

Table of Contents

SUMMARY OF FUNDS

| Target Risk Funds(1) |

||||||||||||||||||||||||

| Conservative Risk Fund |

Moderate Risk Fund |

Aggressive Risk Fund |

||||||||||||||||||||||

| Investment Objectives: |

Higher current investment income and some capital appreciation | High current investment income and greater capital appreciation | Long-term growth of capital and lower current investment income | |||||||||||||||||||||

| Allocates Assets To: |

Equity |

29.0 | % | Equity |

57.0 | % | Equity |

83.0 | % | |||||||||||||||

| Russell 3000 Index NL Fund |

17.5 | % | Russell 3000 Index NL Fund |

37.0 | % | Russell 3000 Index NL Fund |

55.0 | % | ||||||||||||||||

| Daily EAFE NL Fund |

5.5 | MSCI ACWI ex-US Index |

14.0 | MSCI ACWI ex-US Index |

22.0 | |||||||||||||||||||

| REIT Index Fund |

6.0 | REIT Index Fund |

6.0 | REIT Index Fund |

6.0 | |||||||||||||||||||

| Fixed-Income |

71.0 | % | Fixed-Income |

41.0 | % | Fixed-Income |

14.0 | % | ||||||||||||||||

| Bond Market Index NL Fund |

55.0 | % | Bond Market Index NL Fund |

34.0 | % | Bond Market Index NL Fund |

14.0 | % | ||||||||||||||||

| TIPS NL Fund |

10.0 | TIPS NL Fund |

5.0 | Other |

3.0 | % | ||||||||||||||||||

| STIF |

6.0 | STIF |

2.0 | Commodity Index NL Fund |

3.0 | % | ||||||||||||||||||

| Other |

2.0 | % | ||||||||||||||||||||||

| Commodity Index NL Fund |

2.0 | % | ||||||||||||||||||||||

| Transfer Permitted:(2) |

Daily |

Daily |

Daily |

|||||||||||||||||||||

| (1) | The Target Risk Funds obtain exposure to various asset classes by investment in respective collective investment funds maintained by State Street Bank. For definitions of the terms used in the chart, see “Target Risk Funds—Strategy.” |

| (2) | For information regarding special restrictions on transfers involving the Funds and, in particular, the International All Cap Equity Fund and the International Index Equity Fund, see “Transfers Among Investment Options and Withdrawals—Frequent Trading; Restrictions on Transfers.” |

The Units

Interests in each Fund are represented by Units of beneficial interest. Each Unit represents an equal pro rata interest in the net assets of a Fund. Although the Funds are similar in some respects to registered open-end management investment companies commonly referred to as mutual funds, the Funds are not required to be and are not registered as investment companies under the Investment Company Act of 1940 and are not subject to compliance with the requirements of that Act. Units are not “redeemable securities” as defined in the Investment Company Act of 1940. See “Description of Investment Options” and “Regulation of Collective Trust.” Units representing interests in the Funds are held by State Street Bank, as trustee of the American Bar Association Members Retirement Trust, which we refer to as the Retirement Trust, and the American Bar Association Members Pooled Trust for Retirement Plans, which we refer to as the Pooled Trust. We refer to the Retirement Trust and the Pooled Trust together as the ABA Members Trusts. Neither the Units nor the assets of the Funds are subject to the claims of the creditors of State Street or State Street Bank. The Units are not insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other governmental agency and are not deposits of State Street Bank, State Street or any other bank. The activities of each of State Street and State Street Bank in connection with the operation and management of the Collective Trust and the ABA Members Trusts, respectively, are subject to the requirements of the Employee Retirement Income Security Act of 1974, which is known as ERISA, a federal statute specifically designed to regulate the activities of pension plan fiduciaries. See “Regulation of Collective Trust.”

The Collective Trust issues both Units that are registered under the Securities Act of 1933 and Units that are unregistered. Unregistered Units are offered and sold in reliance upon the exemption from registration under Section 3(a)(2) of the Securities Act of 1933 or, in the case of Units offered and sold to certain employee benefit plans covering self-employed individuals, commonly called “Keogh” or “H.R.10” plans, Rule 180 promulgated thereunder. See “Regulation of Collective Trust.”

7

Table of Contents

Eligible Employers and Participants

Attorneys who are sole practitioners, partnerships (including limited liability companies) and professional corporations engaged in the practice of law may adopt the Program for their law practices if they or at least one of their partners or shareholders is a member or associate of the American Bar Association or of a state or local bar association that is represented in the American Bar Association’s House of Delegates. Such a state or local bar association or an organization closely associated with the legal profession which has, as an owner or member of its governing board, a member or associate of the American Bar Association may also be eligible to adopt the Program. We refer to law practices, bar associations and other organizations which are eligible to adopt the Program as Eligible Employers, and we refer to those that adopt the Program as Employers. We refer to self-employed individuals and employees (together with their beneficiaries where applicable) of Employers which have adopted the Program for their practices as Participants.

Plans Available Under the Program

Eligible Employers that elect to participate in the Program may do so by adopting a master plan under one or both of two American Bar Association Members Plans sponsored by ABA Retirement Funds. One of these Members Plans is the American Bar Association Members Retirement Plan, a defined contribution master plan, and the other is the American Bar Association Members Defined Benefit Plan, a defined benefit master plan. Eligible Employers that design and maintain their own individually designed plans may also participate in most aspects of the Program through those individually designed plans.

The ABA Members Trusts

Assets contributed under the Program are held by State Street Bank as trustee of the Retirement Trust in the case of assets contributed under master plans and of the Pooled Trust in the case of assets contributed under individually designed plans. Assets contributed under the Program are allocated among the investment options available under the Program in accordance with the instructions of the person or entity having responsibility for determining the allocation under the terms of the particular plan. For a description of the expected change of trustee of the ABA Members Trusts, see “Recent and Expected Changes to the Program; Role of Northern Trust.”

HISTORICAL RETURN INFORMATION

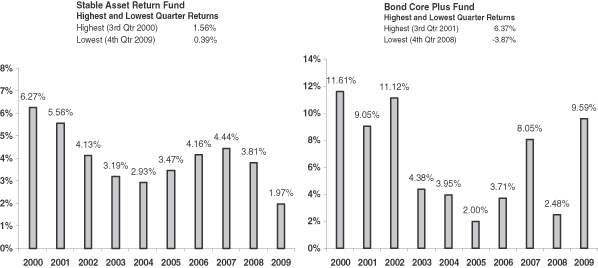

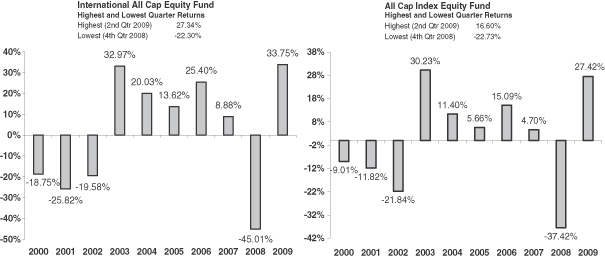

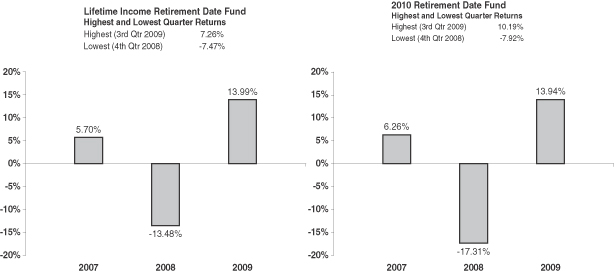

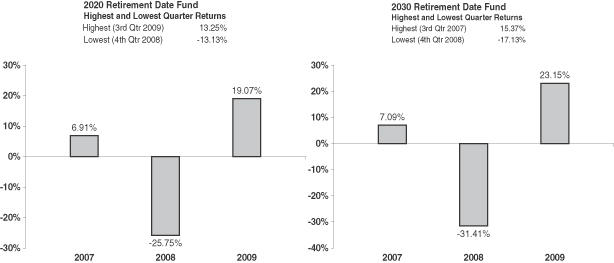

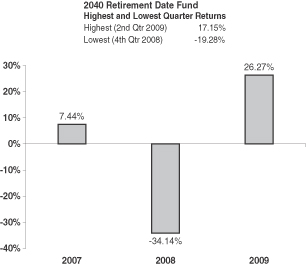

The bar charts below indicate the risk of investing in the Funds that were in operation for at least a full calendar year as of December 31, 2009 by showing changes in performance from year to year. Past performance of a Fund is not a guarantee of future results. Shorter term performance swings are shown by the highest and lowest quarter returns during the years depicted on the charts. Performance information for the Stable Asset Return Fund, the Bond Core Plus Fund, the International All Cap Equity Fund and the All Cap Index Equity Fund is included for ten years. Performance information for the Lifetime Income Retirement Date Fund, the 2010 Retirement Date Fund, the 2020 Retirement Date Fund, the 2030 Retirement Date Fund and the 2040 Retirement Date Fund is included for each full fiscal year in which such Fund has been in operation. State Street manages the various Funds with the advice of different Investment Advisor(s) that may change over time, and the Funds may have employed different investment strategies and guidelines during the various periods for which performance is shown.

8

Table of Contents

No performance information is included for the Funds the operations of which commenced since December 31, 2008.

9

Table of Contents

10

Table of Contents

The following table shows, with respect to the Funds listed below, the total annual return, after expenses, over one-year, five-year and ten-year periods ended December 31, 2009, or since inception, if shorter. After-tax returns are not included inasmuch as the Program is open only to tax-qualified employee retirement plans which are not subject to federal income tax. The table also provides average annual returns for comparative market indices for each of these Funds. The market indices shown generally do not include an allowance for fees and expenses that an investor would pay to invest in the securities that comprise the index. State Street manages the various Funds with the advice of different Investment Advisor(s) that may change over time, and the Funds may have employed different investment strategies and guidelines during various periods for which performance is shown. Additionally, the Funds have had changes in fees and expenses applicable to them during and, in certain cases, after the periods for which performance is shown, and performance shown would have been different had current fees and expenses been applicable for the entire period(s). Finally, the performance of the Funds is reduced by the Program Expense Fees that pay for the administration of the plans maintained under the Program. The past performance of a Fund or an index shown is no guarantee of future performance.

| Periods Ended December 31, 2009 | ||||||||||||

| Average Annual Total Returns(1) |

1 Year | 5 Year | Shorter of 10 Years or Since Inception(2) |

Inception Date |

||||||||

| Managed Funds |

||||||||||||

| Stable Asset Return Fund |

1.97 | % | 3.57 | % | 3.99 | % | 09/05/95 | |||||

| 70% Ryan Labs Three Year GIC Index/ 30% iMoneyNet MFR Prime Institutional Money Market Fund Average |

3.23 | % | 3.84 | % | 4.16 | % | ||||||

| 70% Ryan Labs Three Year GIC Index/ 30% iMoneyNet MFR Prime Institutional Money Market Fund Average less 0.5% per year(3) |

2.73 | % | 3.34 | % | 3.66 | % | ||||||

| Bond Core Plus Fund |

9.59 | % | 5.12 | % | 6.54 | % | 09/05/95 | |||||

| Barclays Capital U.S. Aggregate Bond Index |

5.93 | % | 4.97 | % | 6.33 | % | ||||||

| Large Cap Equity Fund |

— | — | 21.75 | % | 07/02/09 | |||||||

| Russell 1000 Index |

— | — | 22.53 | % | ||||||||

| Small-Mid Cap Equity Fund |

— | — | 22.22 | % | 07/02/09 | |||||||

| Russell 2500 Index |

— | — | 24.52 | % | ||||||||

| International All Cap Equity Fund(4) |

33.75 | % | 2.68 | % | (1.24 | )% | 09/05/95 | |||||

| MSCI EAFE Index |

31.78 | % | 3.54 | % | 1.17 | % | ||||||

| MSCI ACWI ex-US Index |

41.45 | % | 5.83 | % | 2.79 | % | ||||||

| Index Funds |

||||||||||||

| Bond Index Fund(5) |

— | — | 5.94 | % | 02/03/09 | |||||||

| Barclays Capital U.S. Aggregate Bond Index(6) |

— | — | 6.87 | % | ||||||||

| Large Cap Index Equity Fund(5) |

— | — | 30.65 | % | 02/09/09 | |||||||

| S&P 500 |

— | — | 31.15 | % | ||||||||

| All Cap Index Equity Fund |

27.42 | % | 0.30 | % | (0.79 | )% | 09/05/95 | |||||

| Russell 3000 Index |

28.34 | % | 0.76 | % | (0.20 | )% | ||||||

| Mid Cap Index Equity Fund(5) |

— | — | 51.24 | % | 02/03/09 | |||||||

| S&P MidCap 400 |

— | — | 47.65 | % | ||||||||

| Small Cap Index Equity Fund(5) |

— | — | 47.65 | % | 02/03/09 | |||||||

| Russell 2000 Index |

— | — | 41.15 | % | ||||||||

| International Index Equity Fund(5)(7) |

— | — | 75.20 | % | 03/03/09 | |||||||

| MSCI ACWI ex-US Index |

— | — | 80.28 | % | ||||||||

| Real Asset Return Fund |

||||||||||||

| Real Asset Return Fund |

— | — | 20.89 | % | 07/07/09 | |||||||

| Composite Benchmark(8) |

— | — | 20.55 | % | (9 | ) | ||||||

| Retirement Date Funds(10) |

||||||||||||

| Lifetime Income Retirement Date Fund |

13.99 | % | — | 2.70 | % | 08/09/06 | ||||||

| Composite Benchmark(11) |

14.96 | % | — | 3.45 | % | (12 | ) | |||||

| 2010 Retirement Date Fund |

13.94 | % | — | 1.88 | % | 08/08/06 | ||||||

| Composite Benchmark(11) |

14.44 | % | — | 2.31 | % | (12 | ) | |||||

| 2020 Retirement Date Fund |

19.07 | % | — | 1.00 | % | 08/02/06 | ||||||

| Composite Benchmark(11) |

19.61 | % | — | 1.19 | % | (12 | ) | |||||

| 2030 Retirement Date Fund |

23.15 | % | — | 0.12 | % | 08/02/06 | ||||||

| Composite Benchmark(11) |

23.86 | % | — | 0.33 | % | (12 | ) | |||||

| 2040 Retirement Date Fund |

26.27 | % | — | (0.23 | )% | 08/03/06 | ||||||

| Composite Benchmark(11) |

27.05 | % | — | 0.26 | % | (12 | ) | |||||

| Target Risk Funds |

||||||||||||

| Conservative Risk Fund |

— | — | 10.71 | % | 07/07/09 | |||||||

| Composite Benchmark(13) |

— | — | 11.00 | % | (14 | ) | ||||||

| Moderate Risk Fund |

— | — | 17.33 | % | 07/07/09 | |||||||

| Composite Benchmark(13) |

— | — | 17.77 | % | (14 | ) | ||||||

| Aggressive Risk Fund |

— | — | 24.16 | % | 07/07/09 | |||||||

| Composite Benchmark(13) |

— | — | 24.16 | % | (14 | ) | ||||||

| (1) | The Managed Funds, the All Cap Index Equity Fund and the Retirement Date Funds participate to varying degrees in the State Street Bank securities lending program as described under “Information with Respect to the Funds—Loans of Portfolio Securities.” The cash collateral |

11

Table of Contents

| received by these Funds in connection with the securities lending program is invested in cash collateral funds that utilize constant ($1.00 per unit) amortized cost pricing although such cash collateral funds, at December 31, 2009, had an average value on a mark-to-market basis of a lower amount per unit. The returns shown in the table above are based on amortized cost pricing of these cash collateral funds because such funds have effected (and continue to effect) purchases and redemptions of interests therein at 100% of principal invested, and purchases and redemptions of Units of these Funds were effected (and continue to be effected) at net asset values that do not reflect mark-to-market valuations. See “Risk Factors Relating Generally to the Program—Risks Related to Securities Lending.” |

| (2) | Inception to date returns annualized where Fund has at least one year of performance. Where Fund has greater than 10 years of performance history, the 10 year annualized return is reported. |

| (3) | This benchmark is shown to account for reductions since late 2008 in the Stable Asset Return Fund’s yield due to increases in money market-type investments resulting from uncertainties in the Synthetic GIC market and an increased emphasis on benchmark credit quality. |

| (4) | On or about July 6, 2009, the International All Cap Equity Fund engaged a new line-up of Investment Advisors. |

| (5) | The Index Funds introduced in February and March 2009 experienced tracking error for periods from inception through September 24, 2009 due to a difference in timing of investment of contributions by participants in the underlying funds in which the respective Funds invest and also a difference in timing of redemptions of investments of participants out of such underlying funds (in addition to the impact of Fund expenses). Since September 25, 2009, each of the Index Funds has been invested in an underlying fund that matches the timing of contributions and redemptions, which State Street believes should lower future tracking error after taking into account the impact of Fund expenses. |

| (6) | Index since inception data reflects performance from February 2, 2009. |

| (7) | As described in this prospectus, State Street may utilize fair value pricing adjustments for the Fund in certain circumstances that may at certain times result in a difference in the Fund’s net asset value in comparison to that which would have resulted based on the Fund’s more customary pricing methodology. The MSCI ACWI ex-US Index does not apply fair value pricing adjustments, and the reported Index returns would not be adjusted for any fair value pricing adjustments made by the Fund. |

| (8) | The Composite Benchmark for the Real Asset Return Fund is the composite performance of the benchmarks for the three underlying asset classes to which the Real Asset Return Fund allocates assets. The benchmarks comprising the Composite Benchmark currently include the Dow Jones U.S. Select REIT Index, Dow Jones-UBS Commodity Index and the Barclays Capital U.S. Treasury Inflation Protected Securities Index and are weighted based on the Fund’s target allocations to the asset classes to which such benchmarks relate. See “Real Asset Return Fund.” |

| (9) | Benchmark comparison begins July 1, 2009. |

| (10) | Effective May 1, 2007, the Retirement Date Funds implemented a number of changes, including (i) a deferral of the year in which each Retirement Date Fund (other than the Lifetime Income Retirement Date Fund) will reach its most conservative investment mix until five years after the target retirement date, and (ii) changes in certain of the asset classes to which the Retirement Date Funds maintain exposure and the weightings of exposures to asset classes at various time horizons to most conservative investment mix. For instance, aggregate exposure to equity asset classes generally increased at any given such time horizon. Effective December 31, 2009, the Retirement Date Funds implemented certain additional changes, including (i) incorporating a wider range of asset classes and (ii) adjusting the weightings of exposures to asset classes at various time horizons to most conservative investment mix. See “Retirement Date Funds.” |

| (11) | Composite Benchmark since inception data reflects performance from August 1, 2006. The Composite Benchmark for each of the Retirement Date Funds is the composite performance of the respective benchmarks for the underlying asset classes to which the respective Retirement Date Funds allocate assets from time to time. From May 1, 2007 to December 30, 2009, the respective benchmarks comprising the Composite Benchmarks included some or all of the Ryan Labs Three Year GIC Index, the Barclays Capital U.S. Aggregate Bond Index, the Barclays Capital U.S. Long Government Bond Index, the Barclays Capital U.S. Treasury Inflation Protected Securities Index, the S&P 500, the S&P MidCap 400, the Russell 2000 Index and the Morgan Stanley Capital International All-Country World Ex-U.S. Index and are weighted based on each Fund’s respective current target allocations to the asset classes to which such benchmark relates. |

| (12) | Benchmark comparison begins August 1, 2006. |

| (13) | The Composite Benchmark for each of the Target Risk Funds is the composite performance of the respective benchmarks for the underlying asset classes to which the respective Target Risk Funds allocate assets. The respective benchmarks comprising the Composite Benchmarks currently include some or all of the Barclays Capital U.S. Aggregate Bond Index, the Barclays Capital U.S. Treasury Inflation Protected Securities Index, the Dow Jones U.S. Select REIT Index, the Dow Jones-UBS Commodity Index, the Russell 3000 Index, the Citigroup 3-Month T-Bill, the Morgan Stanley Capital International EAFE Index and the Morgan Stanley Capital International All-Country World Ex-U.S. Index and are weighted based on each Fund’s respective target allocations to the asset classes to which such benchmark relates. See “Target Risk Funds.” |

| (14) | Benchmark comparison begins July 1, 2009. |

Total returns reflected in the bar charts and table above have been determined by calculating the difference between the per Unit net asset value of a Fund at the end of the period and the per Unit net asset value of such Fund at the beginning of the period and then dividing the difference by the per Unit net asset value of that Fund at the beginning of the period. All such calculations have been determined to the sixth decimal place. Total returns in the financial statements included in the Collective Trust’s Annual Report on Form 10-K for the year ended December 31, 2009 and incorporated by reference into this prospectus have been determined in the same manner (except the total returns in the financial statements of the Funds specified in footnote (1) above value direct and indirect investments in the cash collateral funds at their market values, notwithstanding that transactions have been, and continue to be, effected as of this date on the basis of amortized cost values) but with calculations determined to the second decimal place.

Summary of Deductions and Fees

The table below provides information regarding the various costs and expenses of the Collective Trust with respect to an investment in each of the Funds. These estimated annual expenses are stated as a percentage of the

12

Table of Contents

assets of each Fund. The Trust, Management and Administration Fees are calculated based on the total assets of the Program as of December 31, 2009 and utilizing fee rates in effect on or about such date, except as otherwise noted below, and Program Expense Fees and Other Fees are calculated based on estimates of expected expenses for 2010 (although this table does not give effect to the expected changes to the Program discussed in “Expected Changes to the Program”). For a discussion of the manner in which deductions and fees are calculated and the portions of these deductions and fees paid to certain parties in connection with the Program, see “Deductions and Fees.”

| Investment Advisor Fees(1)(2) |

Program Expense Fees(1) |

Trustee, Management and Administration Fee and Other Fees(1)(3)(4) |

Acquired Fund Fees and Expenses(5) |

Total Fees |

Approximate Assets as of December 31, 2009 (in millions)(1) | ||||||||||||

| Managed Funds |

|||||||||||||||||

| Stable Asset Return Fund |

0.000 | % | 0.601 | % | 0.223 | % | 0.012 | % | 0.836 | % | 1,007 | ||||||

| Bond Core Plus Fund |

0.275 | % | 0.601 | % | 0.223 | % | 0.001 | % | 1.100 | % | 381 | ||||||

| Large Cap Equity Fund |

0.259 | %(6) | 0.601 | % | 0.223 | % | 0.005 | % | 1.088 | % | 819 | ||||||

| Small-Mid Cap Equity Fund |

0.504 | % | 0.601 | % | 0.223 | % | 0.003 | % | 1.331 | % | 286 | ||||||

| International All Cap Equity Fund |

0.482 | %(6) | 0.601 | % | 0.223 | % | 0.001 | % | 1.307 | % | 166 | ||||||

| Index Funds |

|||||||||||||||||

| Bond Index Fund |

0.040 | % | 0.601 | % | 0.223 | % | 0.020 | % | 0.884 | % | 36 | ||||||

| Large Cap Index Equity Fund |

0.020 | % | 0.601 | % | 0.223 | % | 0.010 | % | 0.854 | % | 34 | ||||||

| All Cap Index Equity Fund |

0.050 | % | 0.601 | % | 0.223 | % | 0.020 | % | 0.894 | % | 267 | ||||||

| Mid Cap Index Equity Fund |

0.050 | % | 0.601 | % | 0.223 | % | 0.020 | % | 0.894 | % | 25 | ||||||

| Small Cap Index Equity Fund |

0.050 | % | 0.601 | % | 0.223 | % | 0.020 | % | 0.894 | % | 15 | ||||||

| International Index Equity Fund |

0.100 | % | 0.601 | % | 0.223 | % | 0.050 | % | 0.974 | % | 24 | ||||||

| Real Asset Return Fund |

0.090 | % | 0.601 | % | 0.223 | % | 0.025 | % | 0.939 | % | 5 | ||||||

| Retirement Date Funds |

|||||||||||||||||

| Lifetime Income Retirement Date Fund |

0.100 | % | 0.601 | % | 0.223 | % | 0.030 | % | 0.954 | % | 29 | ||||||

| 2010 Retirement Date Fund |

0.100 | % | 0.601 | % | 0.223 | % | 0.023 | % | 0.947 | % | 62 | ||||||

| 2020 Retirement Date Fund |

0.100 | % | 0.601 | % | 0.223 | % | 0.022 | % | 0.946 | % | 107 | ||||||

| 2030 Retirement Date Fund |

0.100 | % | 0.601 | % | 0.223 | % | 0.026 | % | 0.950 | % | 77 | ||||||

| 2040 Retirement Date Fund |

0.100 | % | 0.601 | % | 0.223 | % | 0.028 | % | 0.952 | % | 49 | ||||||

| Target Risk Funds |

|||||||||||||||||

| Conservative Risk Fund |

0.060 | % | 0.601 | % | 0.223 | % | 0.025 | % | 0.909 | % | 6 | ||||||

| Moderate Risk Fund |

0.060 | % | 0.601 | % | 0.223 | % | 0.025 | % | 0.909 | % | 13 | ||||||

| Aggressive Risk Fund |

0.060 | % | 0.601 | % | 0.223 | % | 0.025 | % | 0.909 | % | 4 | ||||||

| 3,412 |

| (1) | This table is based on approximate assets of the Collective Trust on December 31, 2009, which totaled $3,412 million. For purposes of this table, Balanced Fund assets invested through, respectively, the Bond Core Plus Fund and the Large Cap Equity Fund are reflected under the Bond Core Plus Fund and the Large Cap Equity Fund, respectively, and fees payable by the Bond Core Plus Fund and the Large Cap Equity Fund attributable to assets of the Balanced Fund invested therein are assumed to be payable by the Bond Core Plus Fund and the Large Cap Equity Fund, respectively. This table is based on the approximate allocation of the Collective Trust’s assets among the investment options and the Balanced Fund as of December 31, 2009. This table does not give effect to the changes to the Program expected to occur in connection with the substitution of Northern Trust as trustee of the Collective Trust as described in “Recent and Expected Changes to the Program; Role of Northern Trust.” |

| (2) | Investment Advisor fees are payable based on a percentage of daily net assets. The Stable Asset Return Fund pays no Investment Advisor fees independent of the Trust, Management and Administration Fee payable to State Street Bank, which is included under a separate heading. |

| (3) | The Trust, Management and Administration Fee is 0.114% of the assets of each Fund. |

| (4) | Includes the amortization of deductions and fees relating to recurring operational expenses, such as printing, legal, registration, consulting and auditing expenses, including investment fiduciary consulting fees payable to Northern Trust. The table does not include fees for the Self-Managed Brokerage Account or the Balanced Fund. |

| (5) | Each Fund invests at least some of its assets directly or indirectly through collective investment funds maintained by State Street Bank. As a result, investors in the Funds indirectly bear expenses of those underlying collective investment funds, including audit, administration and legal fees. |

| (6) | Investment Advisor fees for the Large Cap Equity Fund and the International All Cap Equity Fund are calculated utilizing fee rates and asset allocations among the respective Investment Advisors to such Funds as of January 19, 2010. |

13

Table of Contents

The following table demonstrates how expense ratios may translate into dollar amounts and helps you to compare the cost of investing in the Funds with that of investing in other investment funds. Although your actual costs may be higher or lower, the table shows how much you would pay on an initial investment of $10,000 if operating expenses remain the same, you earn a 5% annual return on your investment in the Fund indicated, and you hold your investment in the Fund for the following periods.

| 1 Year | 3 Years | 5 Years | 10 years | |||||||||

| Managed Funds |

||||||||||||

| Stable Asset Return Fund |

$ | 85 | $ | 267 | $ | 464 | $ | 1,032 | ||||

| Bond Core Plus Fund |

$ | 112 | $ | 350 | $ | 606 | $ | 1,340 | ||||

| Large Cap Equity Fund |

$ | 111 | $ | 346 | $ | 600 | $ | 1,326 | ||||

| Small-Mid Cap Equity Fund |

$ | 136 | $ | 422 | $ | 729 | $ | 1,603 | ||||

| International All Cap Equity Fund |

$ | 133 | $ | 414 | $ | 717 | $ | 1,576 | ||||

| Index Funds |

||||||||||||

| Bond Index Fund |

$ | 90 | $ | 282 | $ | 490 | $ | 1,089 | ||||

| Large Cap Index Equity Fund |

$ | 87 | $ | 273 | $ | 474 | $ | 1,054 | ||||

| All Cap Index Equity Fund |

$ | 91 | $ | 285 | $ | 495 | $ | 1,101 | ||||

| Mid Cap Index Equity Fund |

$ | 91 | $ | 285 | $ | 495 | $ | 1,101 | ||||

| Small Cap Index Equity Fund |

$ | 91 | $ | 285 | $ | 495 | $ | 1,101 | ||||

| International Index Equity Fund |

$ | 99 | $ | 310 | $ | 538 | $ | 1,194 | ||||

| Real Asset Return Fund |

$ | 96 | $ | 299 | $ | 520 | $ | 1,154 | ||||

| Retirement Date Funds |

||||||||||||

| Lifetime Income Retirement Date Fund |

$ | 97 | $ | 304 | $ | 528 | $ | 1,171 | ||||

| 2010 Retirement Date Fund |

$ | 97 | $ | 302 | $ | 524 | $ | 1,163 | ||||

| 2020 Retirement Date Fund |

$ | 97 | $ | 301 | $ | 523 | $ | 1,162 | ||||

| 2030 Retirement Date Fund |

$ | 97 | $ | 303 | $ | 525 | $ | 1,166 | ||||

| 2040 Retirement Date Fund |

$ | 97 | $ | 303 | $ | 527 | $ | 1,169 | ||||

| Target Risk Funds |

||||||||||||

| Conservative Risk Fund |

$ | 93 | $ | 290 | $ | 503 | $ | 1,118 | ||||

| Moderate Risk Fund |

$ | 93 | $ | 290 | $ | 503 | $ | 1,118 | ||||

| Aggressive Risk Fund |

$ | 93 | $ | 290 | $ | 503 | $ | 1,118 | ||||

Transaction costs, such as brokerage fees, commissions and other expenses, attributable to a Participant’s or Employer’s Self-Managed Brokerage Account are charged in accordance with the schedule provided to the Participant and the Employer from time to time. See “Deductions and Fees.”

14

Table of Contents

SUMMARY FINANCIAL DATA

The summary financial data below provides information with respect to income, expenses and capital changes for each of the Funds attributable to each Unit outstanding for the periods indicated. The summary financial data for each of the periods ended December 31 have been derived from financial statements audited by PricewaterhouseCoopers LLP, an independent registered public accounting firm. The summary financial data should be read in conjunction with the financial statements of the Funds, including the related Notes thereto, included in the Collective Trust’s Annual Report on Form 10-K for the year ended December 31, 2009, which is incorporated by reference into this prospectus. See “Where You Can Find More Information.” Per Unit calculations of investment income and expense have been prepared using the monthly average number of Units outstanding during the period.

Managed Funds

| Stable Asset Return Fund: |

||||||||||||||||||||

| Year ended December 31, | ||||||||||||||||||||

| 2005 | 2006 | 2007 | 2008 | 2009 | ||||||||||||||||

| Investment income† |

$ | 1.18 | $ | 1.45 | $ | 1.59 | $ | 1.47 | $ | .96 | ||||||||||

| Expenses(†)†† |

(.16 | ) | (.17 | ) | (.18 | ) | (.20 | ) | (.28 | ) | ||||||||||

| Net investment income (loss) |

1.02 | 1.28 | 1.41 | 1.27 | .68 | |||||||||||||||

| Distributions of net investment income |

— | — | — | — | — | |||||||||||||||

| Net increase (decrease) in unit value |

$ | 1.02 | $ | 1.28 | $ | 1.41 | $ | 1.27 | $ | .68 | ||||||||||

| Net asset value at beginning of period |

29.56 | 30.58 | 31.86 | 33.27 | 34.54 | |||||||||||||||

| Net asset value at end of period |

$ | 30.58 | $ | 31.86 | $ | 33.27 | $ | 34.54 | $ | 35.22 | ||||||||||

| Ratio of expenses to average net assets†† |

.52 | % | .57 | % | .54 | % | .58 | % | .81 | % | ||||||||||

| Ratio of net investment income (loss) to average net assets |

3.42 | % | 4.07 | % | 4.35 | % | 3.73 | % | 1.95 | % | ||||||||||

| Total return |

3.45 | % | 4.19 | % | 4.43 | % | 3.82 | % | 1.97 | % | ||||||||||

| Net assets at end of period (in thousands) |

$ | 870,500 | $ | 845,842 | $ | 878,342 | $ | 967,092 | $ | 1,066,993 | ||||||||||

| Bond Core Plus Fund*: |

||||||||||||||||||||

| Year ended December 31, | ||||||||||||||||||||

| 2005 | 2006 | 2007 | 2008 | 2009 | ||||||||||||||||

| Investment income† |

$ | .81 | $ | .96 | $ | 1.06 | $ | 1.21 | $ | 1.14 | ||||||||||

| Expenses(†)†† |

(.15 | ) | (.16 | ) | (.16 | ) | (.18 | ) | (.25 | ) | ||||||||||

| Net investment income (loss) |

.66 | .80 | 0.90 | 1.03 | .89 | |||||||||||||||

| Net realized and unrealized gain (loss) |

(.29 | ) | (.08 | ) | 0.69 | (.51 | ) | 1.21 | ||||||||||||

| Net increase (decrease) in unit value |

.37 | .72 | 1.59 | .52 | 2.10 | |||||||||||||||

| Net asset value at beginning of period |

18.79 | 19.16 | 19.88 | 21.47 | 21.99 | |||||||||||||||

| Net asset value at end of period |

$ | 19.16 | $ | 19.88 | $ | 21.47 | $ | 21.99 | $ | 24.09 | ||||||||||

| Ratio of expenses to average net assets†† |

.79 | % | .84 | % | .81 | % | .84 | % | 1.09 | % | ||||||||||

| Ratio of net investment income (loss) to average net assets |

3.48 | % | 4.14 | % | 4.42 | % | 4.73 | % | 3.88 | % | ||||||||||

| Portfolio turnover |

458 | % | 389 | % | 489 | % | 806 | % | 1,422 | % | ||||||||||

| Total return |

1.97 | % | 3.76 | % | 8.00 | % | 2.42 | % | 9.55 | % | ||||||||||

| Net assets at end of period (in thousands) |

$ | 454,045 | $ | 457,719 | $ | 484,362 | $ | 398,724 | $ | 386,246 | ||||||||||

| † | Calculations prepared using the daily average number of units outstanding during the period. |

| †† | Expenses includes only those expenses charged directly to the Fund and does not include expenses charged to the collective investment fund in which the Fund invests a portion of its assets. |

| * | Formerly named the Intermediate Bond Fund. |

15

Table of Contents

Large Cap Equity Fund:

| For the period July 2, 2009(a) to December 31, 2009 |

||||

| Investment income† |

$ | .07 | ||

| Expenses(†)†† |

(.07 | ) | ||

| Net investment income (loss) |

— | |||

| Net realized and unrealized gain (loss) |

2.15 | |||

| Net increase (decrease) in unit value |

2.15 | |||

| Net asset value at beginning of period |

10.00 | |||

| Net asset value at end of period |

$ | 12.15 | ||

| Ratio of expenses to average net assets*†† |

1.17 | % | ||

| Ratio of net investment income (loss) to average net assets* |

.11 | % | ||

| Portfolio turnover**††† |

68 | % | ||

| Total return** |

21.50 | % | ||

| Net assets at end of period (in thousands) |

$ | 811,636 | ||

Small-Mid Cap Equity Fund:

| For the period July 2, 2009(a) to December 31, 2009 |

||||

| Investment income† |

$ | .11 | ||

| Expenses(†)†† |

(.09 | ) | ||

| Net investment income (loss) |

.02 | |||

| Net realized and unrealized gain (loss) |

2.30 | |||

| Net increase (decrease) in unit value |

2.32 | |||

| Net asset value at beginning of period |

11.00 | |||

| Net asset value at end of period |

$ | 13.32 | ||

| Ratio of expenses to average net assets*†† |

1.44 | % | ||

| Ratio of net investment income (loss) to average net assets* |

.29 | % | ||

| Portfolio turnover**††† |

61 | % | ||

| Total return** |

21.09 | % | ||

| Net assets at end of period (in thousands) |

$ | 283,199 | ||

| (a) | Commencement of operations. |

| * | Annualized for the period from July 2, 2009 to December 31, 2009. |

| ** | Not annualized for the period from July 2, 2009 to December 31, 2009. |

| † | Calculations prepared using the daily average number of units outstanding during the period. |

| †† | Expenses includes only those expenses charged directly to the Fund and does not include expenses charged to the collective investment funds in which the Fund invests a portion of its assets. |

| ††† | With respect to the portion of the Fund’s assets invested in collective investment funds, portfolio turnover reflects purchases and sales by the Fund of units of such collective investment funds, rather than portfolio turnover of the underlying portfolios of such collective investment funds. |

16

Table of Contents

International All Cap Equity Fund*:

| Year ended December 31, | ||||||||||||||||||||

| 2005 | 2006 | 2007 | 2008 | 2009 | ||||||||||||||||

| Investment income† |

$ | .59 | $ | .79 | $ | 1.06 | $ | 1.27 | $ | .66 | ||||||||||

| Expenses(†)†† |

(.25 | ) | (.32 | ) | (.36 | ) | (.31 | ) | (.29 | ) | ||||||||||

| Net investment income (loss) |

.34 | .47 | .70 | .96 | .37 | |||||||||||||||

| Net realized and unrealized gain (loss) |

2.64 | 5.84 | 2.07 | (16.45 | ) | 6.10 | ||||||||||||||

| Net increase (decrease) in unit value |

2.98 | 6.31 | 2.77 | (15.49 | ) | 6.47 | ||||||||||||||

| Net asset value at beginning of period |

21.87 | 24.85 | 31.16 | 33.93 | 18.44 | |||||||||||||||

| Net asset value at end of period |

$ | 24.85 | $ | 31.16 | $ | 33.93 | $ | 18.44 | $ | 24.91 | ||||||||||

| Ratio of expenses to average net assets†† |

1.11 | % | 1.14 | % | 1.08 | % | 1.13 | % | 1.37 | % | ||||||||||

| Ratio of net investment income (loss) to average net assets |

1.50 | % | 1.69 | % | 2.12 | % | 3.45 | % | 1.77 | % | ||||||||||

| Portfolio turnover††† |

35 | % | 30 | % | 30 | % | 33 | % | 160 | % | ||||||||||

| Total return |

13.63 | % | 25.39 | % | 8.89 | % | (45.65 | )% | 35.09 | % | ||||||||||

| Net assets at end of period (in thousands) |

$ | 202,106 | $ | 273,525 | $ | 309,162 | $ | 133,960 | $ | 165,528 | ||||||||||

| * | Formerly named the International Equity Fund. On or about July 6, 2009, the International All Cap Equity Fund engaged a new line-up of Investment Advisors. |

| † | Calculations prepared using the daily average number of units outstanding during the year. |

| †† | Expenses includes only those expenses charged directly to the Fund and does not include expenses charged to the collective investment fund in which the Fund invests a portion of its assets. |