Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - OLIN Corp | form8kbbtsidotislides0310.htm |

1

BB&T Capital Markets

Commercial & Industrial

Conference

March 24, 2010

Commercial & Industrial

Conference

March 24, 2010

Exhibit 99.1

2

Olin Representatives

Joseph D. Rupp

Chairman, President & Chief Executive Officer

John E. Fischer

Vice President & Chief Financial Officer

John L. McIntosh

Vice President & President, Chlor Alkali Products Division

Larry P. Kromidas

Assistant Treasurer & Director, Investor Relations

lpkromidas@olin.com

(618) 258 - 3206

3

Company Overview

All financial data are for the years ending 2008 and 2009, and are presented in millions of U.S. dollars except for earnings per share.

Additional information is available on Olin’s website www.olin.com in the Investors section.

Additional information is available on Olin’s website www.olin.com in the Investors section.

Winchester

Chlor Alkali

Third Largest North American

Producer of Chlorine and Caustic Soda

Producer of Chlorine and Caustic Soda

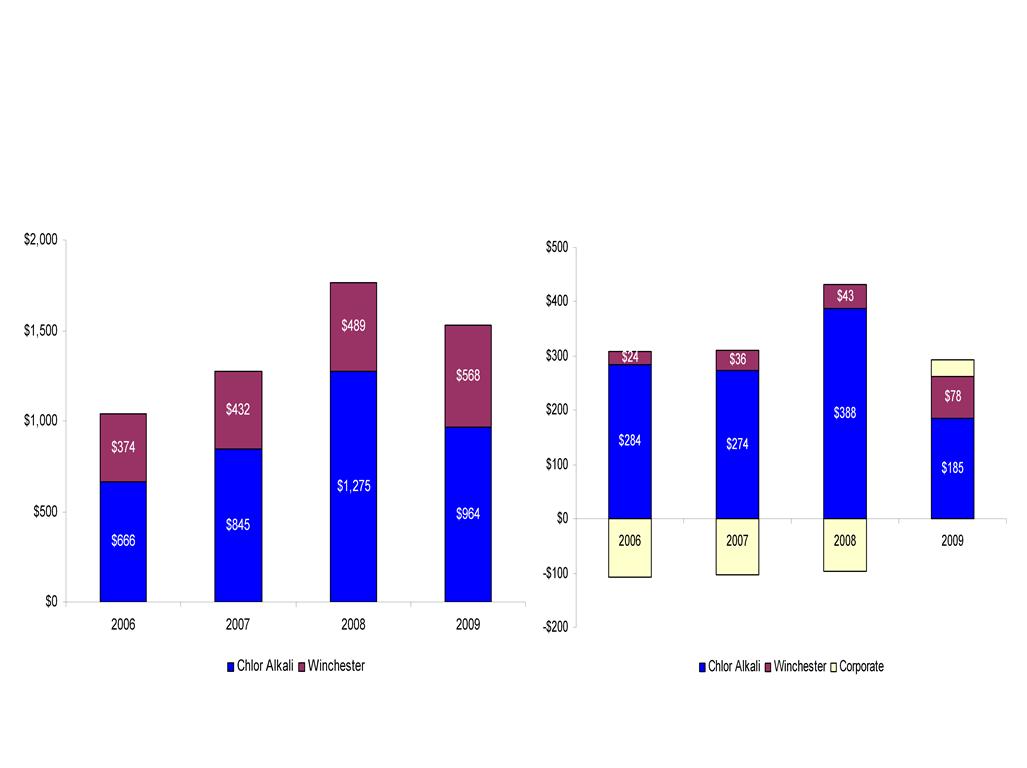

FY 2008 FY 2009

Revenue: $1,275 $964

Income: $ 328 $125

A Leading North American Producer

of Small Caliber Ammunition

of Small Caliber Ammunition

FY 2008 FY 2009

Revenue: $489 $568

Income: $ 33 $ 69

Revenue: $1,765 $ 1,532

EBITDA: $ 335 $ 292

Pretax Operating Inc.: $ 258 $ 210

EPS (Diluted): $ 2.07 $ 1.73

FY 2008 FY 2009

Olin

4

Olin Vision

To be a leading Basic Materials company delivering

attractive, sustainable shareholder returns

attractive, sustainable shareholder returns

• Being the low cost, high quality producer, and the

#1 or #2 supplier in the markets we serve

#1 or #2 supplier in the markets we serve

• Providing excellent customer service and

advanced technological solutions

advanced technological solutions

• Generating returns above the cost of capital over

the economic cycle

the economic cycle

5

Olin Corporate Strategy

1. Build on current leadership positions in the

Chlor-Alkali and Ammunition businesses

• Improve operating efficiency and profitability

• Integrate downstream selectively

2. Allocate resources to the businesses that can create the

most value

most value

3. Manage financial resources to satisfy legacy liabilities

Total Return to Shareholders in Top Third of S&P 1000

Return on Capital Employed Over Cost of Capital Through the Cycle

Olin Corporation Goal: Superior Shareholder Returns

6

Investment Rationale

• Leading North American producer of Chlor-Alkali

• Strategically positioned facilities

• Diverse end customer base

• Favorable industry dynamics

• Leading producer of industrial bleach with additional

growth opportunities

growth opportunities

• Pioneer synergies exceeded expectations

• Winchester’s leading industry position

7

Chlor Alkali Segment

ECU = Electrochemical Unit; a unit of measure reflecting the chlor alkali process outputs

of 1 ton of chlorine, 1.13 tons of 100% caustic soda and 0.3 tons of hydrogen.

of 1 ton of chlorine, 1.13 tons of 100% caustic soda and 0.3 tons of hydrogen.

N. American

Position

Position

% 2009

Sales

Sales

#3

#2

#1

Industrial

Industrial

#1

Merchant

Merchant

#1

Burner

Grade

Burner

Grade

8%

10%

4%

53%

24%

1%

Chlor Alkali Manufacturing Process

SALT + ELECTROLYSIS = OUTPUTS

Caustic Soda

(Sodium Hydroxide)

(Potassium Hydroxide)

Bleach

(Sodium Hypochlorite)

Chlorine

Salt

(

NaCl

)

or

Potcarb

(

KCl

)

KOH

HCl

(Hydrochloric Acid)

Hydrogen Gas

Caustic Soda

or KOH

Chlorine

Hydrogen

8

• Be the preferred supplier to chlor alkali customers in

addition to being the low cost producer

addition to being the low cost producer

• Goal is to increase the value of the Chlor Alkali

Division to Olin through:

Division to Olin through:

– Optimizing capacity utilization

– Higher margin downstream products

– Cost reduction and financial discipline

Olin’s Chlor Alkali Strategy

9

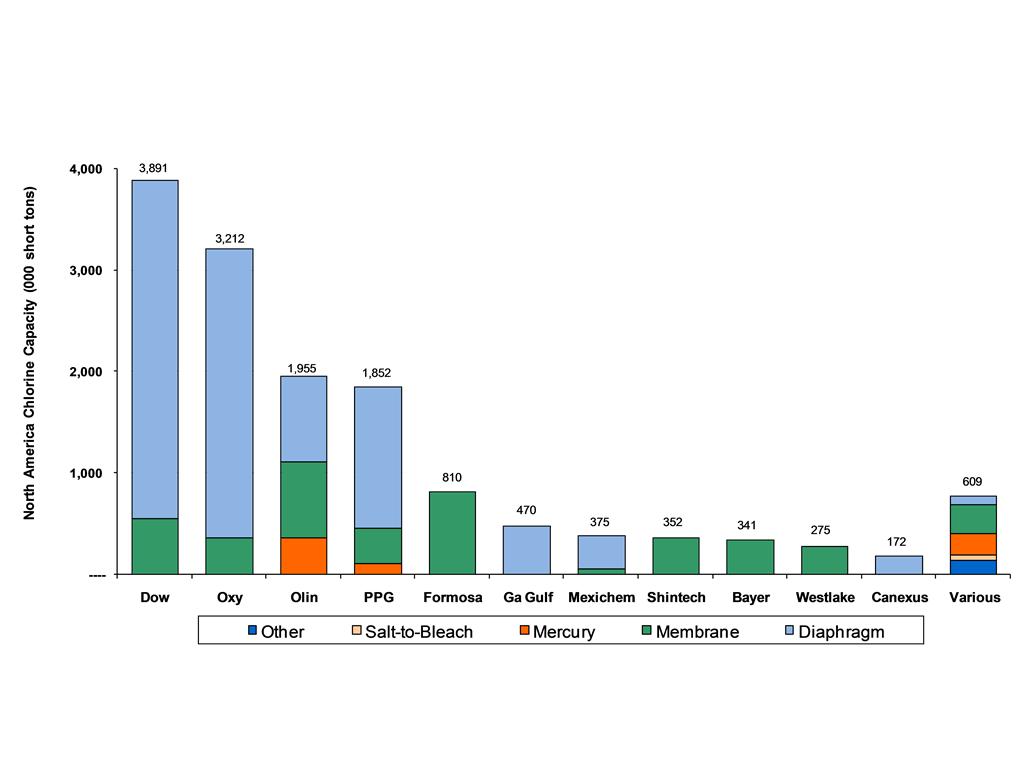

Source: CMAI/Olin - 2009 year-end figures

Oxy includes OxyVinyls and does not reflect the announced reduction of approximately 280,000 tons of capacity at their Taft, LA facility.

Olin includes 50% of Sunbelt joint venture.

Olin is #3 Chlor-alkali Producer

10

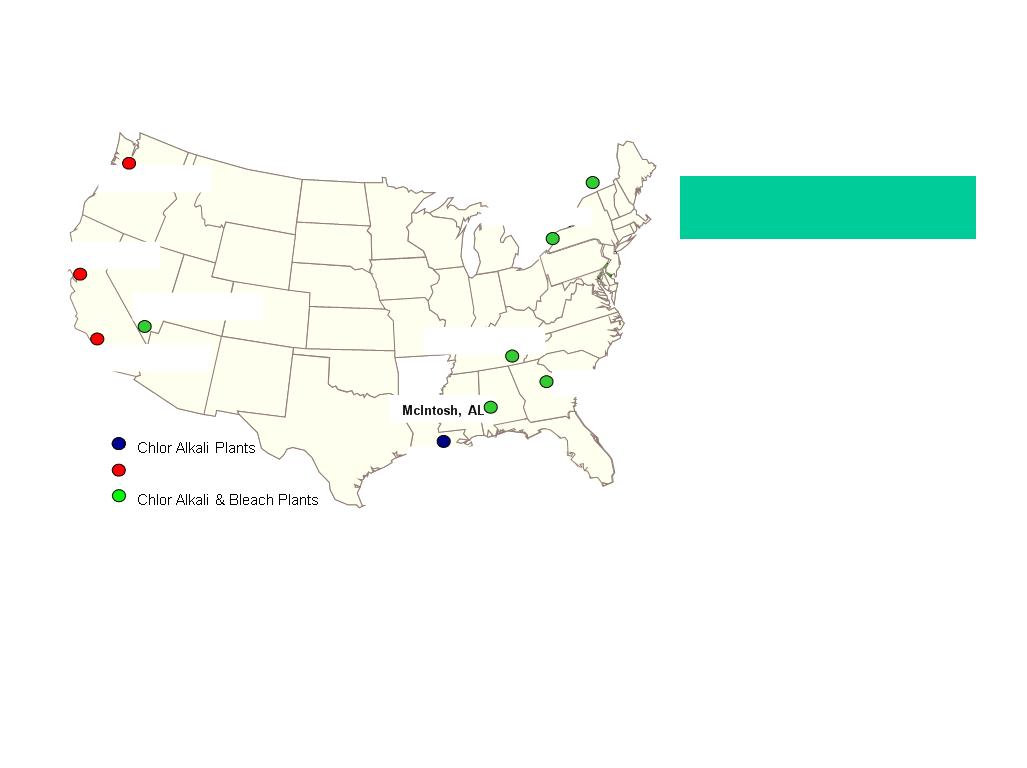

Bleach Plants

39

Tacoma, WA

Tracy, CA

Santa Fe Springs, CA

Henderson, NV

St. Gabriel, LA

Augusta, GA

Charleston, TN

Niagara Falls, NY

Becancour,

Quebec

Olin’s Geographic Advantage

Source: Olin.

(1) The Becancour Plant has 275,000 short tons diaphragm and 65,000 short tons membrane capacity.

(2) The St. Gabriel plant includes the announced 49,000 short tons capacity expansion and conversion to membrane cell technology.

|

Location

|

Chlorine Capacity

(-000’s Short Tons) |

|

McIntosh, AL

|

415

|

|

Becancour, Quebec (1)

|

340

|

|

Niagara Falls, NY

|

286

|

|

Charleston, TN

|

248

|

|

St. Gabriel, LA (2)

|

246

|

|

McIntosh, AL (50%

Sunbelt) |

160

|

|

Henderson, NV

|

152

|

|

Augusta, GA

|

108

|

|

Total

|

1,955

|

• Access to regional customers including bleach and water treatment

• Access to alternative energy sources

– Coal, hydroelectric, nuclear, natural gas

11

Diverse Customer Base

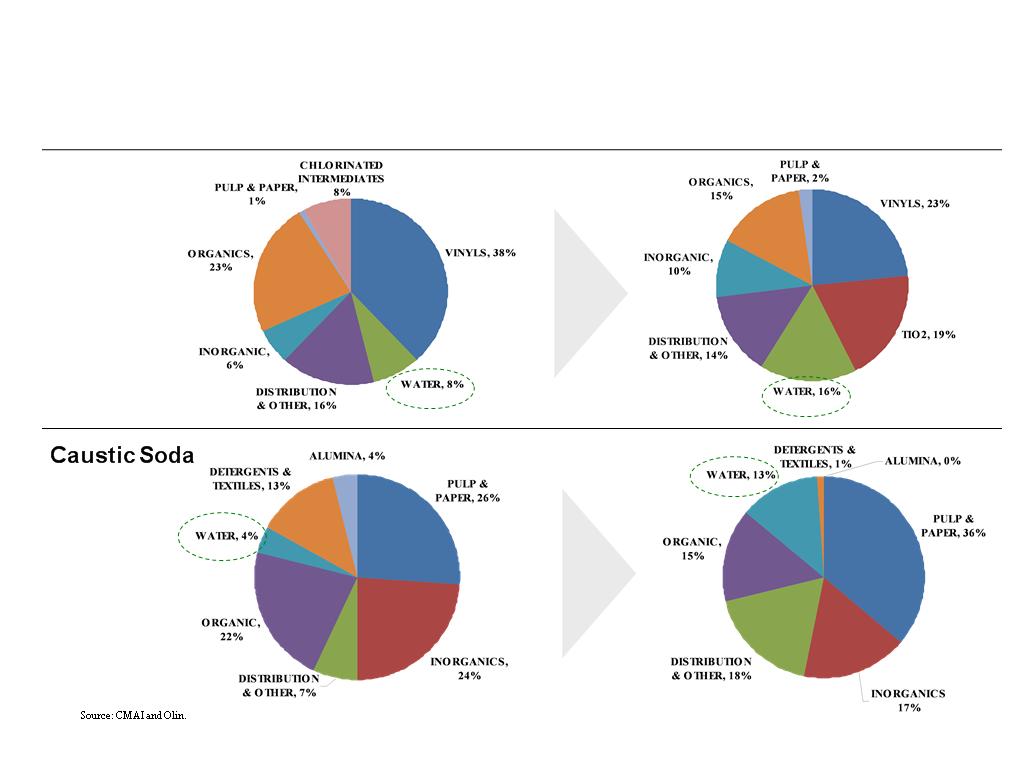

Chlorine: “Organics” includes: Propylene oxide, epichlorohydrin, MDI, TDI, polycarbonates. “Inorganics” includes: Titanium dioxide and bromine.

Caustic Soda: “Organics” includes: MDI, TDI, polycarbonates, synthetic glycerin, sodium formate, monosodium glutamate. “Inorganics” includes: titanium dioxide, sodium silicates, sodium cyanide.

Chlorine

North American Industry

Olin

12

Product Pricing Has Been Dynamic

North American Caustic Soda

Avg. Acquisition, US$/Short Ton

Avg. Acquisition, US$/Short Ton

North American Chlorine

Contract, US$/Short Ton

Contract, US$/Short Ton

13

Capacity Rationalization

Favorable Industry Dynamics

Target

Acquisition

Date

Date

Position

2007

2004

• Acquired by Olin

• 725,000 Short Tons ECU Capacity

• Then the #7 ranked producer in

North America

North America

• 4.7% of North American capacity

• Acquired by OxyChem

• 859,000 Short Tons ECU Capacity

• Then the #7 ranked producer in

North America

North America

• 5.5% of North American capacity

• 352,000 Short Ton ECU capacity

plant expansion on hold

plant expansion on hold

• Plant located at Geismar, LA

Source: CMAI.

Pioneer

Vulcan

Westlake Chemical

Industry Consolidation

Delayed Capacity Expansion

2.0 mm MT

or 13% of

2000 capacity

reduction

or 13% of

2000 capacity

reduction

mmMT

13.6

15.6

2009

2000

14

ECU Netback* Environment

• December caustic price increase of $75/ton is being implemented

• Implementation will take place through April

• An additional increase of $80 has been announced in February

• ECU Netbacks have risen from Q3 2009 trough levels

• Significant capacity reductions have occurred (Dow’s Oyster Creek,

TX closure of 396,000 tons) and may continue as older plants will soon

require significant investment of capital

TX closure of 396,000 tons) and may continue as older plants will soon

require significant investment of capital

• Caustic imports from China have dropped dramatically since first half

of the year with North American supply/demand roughly in balance

of the year with North American supply/demand roughly in balance

• Premium grade caustic demand exceeds supply

• We expect demand volume to increase slightly during Q1 2010

* ECU Netback = ECU price - freight +/- customer premiums/discounts

15

Why Industrial Bleach?

• Olin is the leading North American bleach producer with a

capacity of 250 million gallons (160,000 ECUs) in a 1 billion

gallon industry, with low-cost expansion opportunities

capacity of 250 million gallons (160,000 ECUs) in a 1 billion

gallon industry, with low-cost expansion opportunities

• Utilizes both chlorine and caustic soda in an ECU ratio

• Commands a $100 to $200/ton premium over ECU prices

• Demand is not materially impacted by economic cycles

• Regional nature of bleach business benefits Olin’s

geographic diversity, further enhanced by Olin’s proprietary

railcar technology to reach more distant customers

geographic diversity, further enhanced by Olin’s proprietary

railcar technology to reach more distant customers

• 2009 bleach volumes increase almost 18% over 2008 levels

16

Mercury Legislation

• On October 21, 2009, the U.S. House of Representatives

Committee on Energy and Commerce passed a bill that

would require chlor-alkali producers using mercury cell

technology to decide by 6/30/12 whether they would shut

down or convert those plants. The plants would need to be

shut down by 6/30/13 or converted by 6/30/15.

Committee on Energy and Commerce passed a bill that

would require chlor-alkali producers using mercury cell

technology to decide by 6/30/12 whether they would shut

down or convert those plants. The plants would need to be

shut down by 6/30/13 or converted by 6/30/15.

• During the third quarter of 2009, a companion bill was

introduced in the U.S. Senate

introduced in the U.S. Senate

• No votes have been taken on the House floor and the Senate

has not acted; outcome of legislation is uncertain

has not acted; outcome of legislation is uncertain

• Olin currently operates 2 mercury cell plants representing

356,000 ECUs or 18% of our total capacity *

356,000 ECUs or 18% of our total capacity *

* Olin’s total capacity includes 50% of SunBelt

17

Winchester Segment

Winchester Strategy

• Leverage existing strengths

– Seek new opportunities

to leverage the

legendary Winchester®

brand name

to leverage the

legendary Winchester®

brand name

– Investments that

maintain Winchester as

the retail brand of

choice, and lower costs

maintain Winchester as

the retail brand of

choice, and lower costs

• Focus on product line

growth

growth

– Continue to develop

new product offerings

new product offerings

• Provide returns in excess of

cost of capital

cost of capital

|

|

Hunters & Recreational Shooters

|

|

|

|

||

|

Products

|

Retail

|

Distributors

|

Mass

Merchants |

Law

Enforcement |

Military

|

Industrial

|

|

Rifle

|

ü

|

ü

|

ü

|

ü

|

ü

|

|

|

Handgun

|

ü

|

ü

|

ü

|

ü

|

ü

|

|

|

Rimfire

|

ü

|

ü

|

ü

|

ü

|

ü

|

ü

|

|

Shotshell

|

ü

|

ü

|

ü

|

ü

|

ü

|

ü

|

|

Components

|

ü

|

ü

|

ü

|

ü

|

ü

|

ü

|

Brands

18

Winchester’s Leading

Industry Position

Industry Position

• One of the three leading ammunition manufacturers

in the United States *

in the United States *

• Strong brand awareness

– Top 15 of all sporting goods brands

• Legendary brand image

– Positively associated with American heritage,

John Wayne, Teddy Roosevelt and

cowboy/western connotations

John Wayne, Teddy Roosevelt and

cowboy/western connotations

• Category leadership and expertise demonstrated by

selection to manage ammunition category for key,

national retailers

selection to manage ammunition category for key,

national retailers

• Leading consumer goods marketer with an increased

presence on television and the Internet

presence on television and the Internet

• Innovator of market-driven new products

* Source: National Shooting Sports Foundation.

19

Favorable Industry Dynamics

Commercial

• Economic environment leading to personal security concerns

• Fears of increased gun/ammunition control due to change in administration

• New gun and ammunition products

• Strong hunting activity in weak economy, driven by cost/benefit of hunting

for food and increased discretionary time

for food and increased discretionary time

Law

Enforcement

Enforcement

• Significant new federal agency contracts and solid federal law enforcement

funding

funding

• Higher numbers of law enforcement officers and increase in federal agency

hiring

hiring

• Increased firearms training requirements among state and local law

enforcement agencies

enforcement agencies

Military

• Sustained high demand for small caliber ammunition due to wars in Iraq and

Afghanistan

Afghanistan

• Commitment to maintaining the “Second-Source Program” to mitigate the

risk of a sole-source small caliber ammunition contract

risk of a sole-source small caliber ammunition contract

20

Winchester

• Record 2009 segment earnings are more than double

previous record 2008 earnings

previous record 2008 earnings

• Further manufacturing cost reductions with additional

relocation of operations to low-cost Oxford, MS plant

relocation of operations to low-cost Oxford, MS plant

• Long-term contracts with military and law enforcement

agencies now account for 25% to 30% of total revenue

agencies now account for 25% to 30% of total revenue

• Commercial backlog at year end is 3 times higher than

December 31, 2008 levels

December 31, 2008 levels

• Military and Law Enforcement backlog is $124 million

21

Financial Highlights

• Strong Balance Sheet

– Ample liquidity with lines of credit totaling $350 million

support seasonal working capital growth of $100 million

support seasonal working capital growth of $100 million

– Q4 2009 cash balance approximately $460 million

– 2009 environmental recoveries of $81 million

– Pension plan remains fully funded

• Profit Outlook

– ECU pricing is recovering

– Higher margin Bleach business is growing

– Pioneer synergies add $50 million annually

– Winchester continues to deliver strong performance

– Significant reduction in legacy costs

22

Historical Financial Performance

Revenues

($ millions)

($ millions)

EBITDA

($ millions)

($ millions)

$1,040

$1,277

$1,765

$1,532

$201

$207

$335

$292

Note: EBITDA is Income from Continuing Operations Before Taxes, excluding Interest Expense, Interest Income, and Depreciation and Amortization expense.

-$107

-$103

-$96

$29

23

Potential Uses of Cash

• Olin’s financial policies have prioritized conservatism,

caution and prudence

caution and prudence

• We have witnessed significant turbulence in the broader

credit and capital markets and significant weakening of our

Chlor Alkali business related to overall economic weakness

credit and capital markets and significant weakening of our

Chlor Alkali business related to overall economic weakness

• Cash levels to support:

• Annual working capital swings of up to $100 million

• $75 million notes due 2011

• $11.4 million notes due 2013

• Restructuring/downsizing of Chlor Alkali system necessitated by

low levels of industry operating rates

low levels of industry operating rates

• Potential small, bolt-on acquisitions

• Excess liquidity

24

Investment Rationale

• Leading North American producer of Chlor-Alkali

• Strategically positioned facilities

• Diverse end customer base

• Favorable industry dynamics

• Leading producer of industrial bleach with additional

growth opportunities

growth opportunities

• Pioneer synergies exceeded expectations

• Winchester’s leading industry position

25

Forward-Looking Statements

This presentation contains estimates of future

performance, which are forward-looking

statements and actual results could differ

materially from those anticipated in the forward-

looking statements. Some of the factors that could

cause actual results to differ are described in the

business and outlook sections of Olin’s Form 10-K

for the year ended December 31, 2009. This report

is filed with the U.S. Securities and Exchange

Commission.

performance, which are forward-looking

statements and actual results could differ

materially from those anticipated in the forward-

looking statements. Some of the factors that could

cause actual results to differ are described in the

business and outlook sections of Olin’s Form 10-K

for the year ended December 31, 2009. This report

is filed with the U.S. Securities and Exchange

Commission.

26

Appendix

1892 founded in East Alton, IL providing

blasting powder to Midwestern coal mines

blasting powder to Midwestern coal mines

1898 formed Western Cartridge Company

to manufacture small arms ammunition

to manufacture small arms ammunition

1931 acquires Winchester Repeating Arms

1940s & 1950s acquires cellophane, paper,

lumber & powder-actuated tools businesses

lumber & powder-actuated tools businesses

1892 founded in Saltville, VA to produce

soda ash.

soda ash.

1896 builds first chlor-alkali plant in US

1909 introduces first commercial

production of liquefied chlorine

production of liquefied chlorine

1940s & 1950s builds plants in Lake

Charles, LA & McIntosh, AL, buys Squibb

Charles, LA & McIntosh, AL, buys Squibb

1954 Merger creates the Olin Mathieson Chemical Corporation

1950s & 1960 entered into phosphates, aluminum, urethanes, TDI, skis, camping

equipment, homebuilding and expanded paper and forestry businesses

equipment, homebuilding and expanded paper and forestry businesses

1970s to 2000 consolidation back to core businesses, spin-offs included forest

products (Olinkraft), military ordnance (Primex) and specialty chemicals (Arch)

and sold aluminum, TDI, urethanes and Squibb businesses

products (Olinkraft), military ordnance (Primex) and specialty chemicals (Arch)

and sold aluminum, TDI, urethanes and Squibb businesses

2007 acquired Pioneer and sold the Metals business, resulting in a company

similar in businesses to that which existed in the late 1890s

similar in businesses to that which existed in the late 1890s

Olin Industries Mathieson Chemical Corp.

27

Capacity Rationalization: 2000-2012

Source: Olin Data

Technology Key: DIA=Diaphragm, HG=Mercury, MB=Membrane, STB=Salt-to-Bleach.

Chlor Alkali Capacity Reductions

Chlor Alkali Capacity Expansions

Company

Location

Tech

ECU

COMPLETED 3,827,000

Dow

Ft. Saskatchewan

DIA

526,000

Dow

Plaquemine, LA

DIA

375,000

Formosa Plastics

Baton Rouge, LA

DIA

201,000

La Roche

Gramercy, LA

DIA

198,000

Oxy Vinyls LP

Deer Park, TX

DIA/HG

395,000

Georgia Pacific

(3 locations)

DIA/HG

24,000

Pioneer

Tacoma, WA

DIA/MB

214,000

Atofina

Portland, OR

DIA/MB

187,000

St. Anne Chem

Nackawic, NB

MB

10,000

PPG

Lake Charles, LA

HG

280,000

Oxy (KOH)

Taft, LA

HG

210,000

Oxy

Delaware City, DE

HG

145,000

Olin (KOH)

Charleston, TN

HG

110,000

Holtra Chem

Orrington, ME

HG

80,000

Holtra Chem

Acme, NC

HG

66,000

Mexichem

Santa Clara, Mex

HG

40,000

Cedar Chem

Vicksburg, MS

HG

40,000

Olin

Dalhousie, NB

HG

36,000

Dow

Oyster Creek, TX

DIA

396,000

ERCO

Port Edwards, WI

HG

97,000

Olin

St. Gabriel, LA

HG

197,000

ANNOUNCED 2,424,000

Dow1

Freeport, TX

DIA

2,279,000

Canexus

North Vancouver,BC

DIA

145,000

Reductions

6,251,000

Completed Announced Total

Reductions (3,827,000) (2,424,000) (6,251,000)

Expansions 2,096,000 3,049,000 5,145,000

Net Reduction (1,731,000) 625,000 (1,106,000)

Company

Location

Tech

ECU

COMPLETED 2,096,000

Dow

Freeport, TX

MB

500,000

PPG

Lake Charles, LA

MB

280,000

Oxy

Geismer, LA

MB

210,000

Equachlor

Longview, WA

MB

88,000

Westlake

Calvert City, KY

MB

80,000

SunBelt

McIntosh, AL

MB

70,000

Mexichem

Santa Clara, Mex

MB

45,000

Oxy

Various Sites

MB

22,000

AV Nackawic

Nackawic, NB

MB

10,000

Kuehne

Delaware City, DE

STB

40,000

Trinity

Hamlet, NC

STB

40,000

Odyssey

Tampa, FL

STB

30,000

Shintech

Plaquemine, LA

MB

330,000

ERCO

Port Edwards, WI

MB

105,000

Olin

St. Gabriel

MB

246,000

ANNOUNCED 3,049,000

Shintech

Plaquemine, LA

MB

252,000

Westlake2

Geismar, LA

MB

352,000

Allied Universal

Fort Pierce, FL

STB

40,000

Dow1

Freeport, TX

MB

2,225,000

Canexus

North Vancouver, BC

MB

180,000

Expansions

5,145,000

Annual caustic demand growth: 0.8% or 110,000 Tons/Year

1 Dow’s announced Freeport, TX membrane conversion is on hold and under review; their supply agreement renewal with Shintech remains pending.

2 Westlake’s announced 352,000 ton green-field project has been postponed and is being reconsidered.