Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2009

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

COMMISSION FILE NUMBER: 001-15941

UTEK CORPORATION

| Delaware | 59-3603677 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

2109 Palm Avenue

Tampa, FL 33605

(Address of principal executive offices)

(813) 754-4330

(Registrant’s telephone number)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

| TITLE OF EACH CLASS |

NAME OF EACH EXCHANGE ON WHICH REGISTERED | |

| COMMON STOCK, $.01 PAR VALUE | NYSE Amex |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter periods as the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x Smaller reporting company ¨

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the registrant’s Common Stock held by non-affiliates at June 30, 2009 was $35,748,372.

As of March 18, 2010, there were 11,797,140 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for the 2010 Annual Meeting of Shareholders are incorporated by reference into Part III of this report.

Table of Contents

UTEK CORPORATION

Annual Report on Form 10-K for the Fiscal Year Ended December 31, 2009

| Page | ||||

| 1 | ||||

| ITEM 1. |

1 | |||

| ITEM 1A. |

7 | |||

| ITEM 1B. |

15 | |||

| ITEM 2. |

15 | |||

| ITEM 3. |

15 | |||

| ITEM 4. |

15 | |||

| 16 | ||||

| ITEM 5. |

16 | |||

| ITEM 6. |

18 | |||

| ITEM 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

19 | ||

| ITEM 7A. |

40 | |||

| ITEM 8. |

41 | |||

| ITEM 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

88 | ||

| ITEM 9A. |

88 | |||

| ITEM 9B. |

88 | |||

| 89 | ||||

| ITEM 10. |

89 | |||

| ITEM 11. |

89 | |||

| ITEM 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

89 | ||

| ITEM 13. |

Certain Relationships and Related Transactions, and Director Independence |

90 | ||

| ITEM 14. |

90 | |||

| 91 | ||||

| ITEM 15. |

91 | |||

| 94 | ||||

Table of Contents

| Item 1. | Business |

Unless the context requires otherwise, reference in this Form 10-K to “UTEK,” the “Company,” “we,” “us” and words of similar import refer to UTEK Corporation and its wholly owned subsidiaries, UTEK-Europe, Ltd. (Europe), UTEKip, Ltd. (Israel) and UTEK Real Estate Holdings, Inc. UTEKip, Ltd. was dissolved in 2008 and all operations of that subsidiary are currently being serviced by UTEK. In addition, the legal entities for Innovaro, Ltd., Pharmalicensing, Ltd. and Carmi, Inc. (Strategos) still exist, but their operations have been assumed by UTEK and UTEK-Europe, Ltd.

We commenced operations in 1997 and were originally incorporated under the laws of the State of Florida, and subsequently under the laws of the State of Delaware in July 1999.

Until September 30, 2009, we were a non-diversified, closed-end management investment company that had elected to be treated as a business development company (“BDC”) under the Investment Company Act of 1940 (“1940 Act”).

Withdrawal of our Election to be Treated as a Business Development Company under the Investment Company Act of 1940

On October 1, 2009, we filed a notification on Form N-54C with the Securities and Exchange Commission (“SEC”) withdrawing our election to be regulated as a BDC under the 1940 Act. As such, we are reporting as an operating company as of October 1, 2009.

We determined, based on our current business focus and the fact that the equity interests we hold have constituted a declining amount of our assets over the last couple of years, that we no longer met the requirements to be regulated as a BDC under the 1940 Act. Accordingly, and after careful consideration of the requirements applicable to BDCs under the 1940 Act, the cost of compliance with the provisions of the 1940 Act and a thorough assessment of our current business model, our Board of Directors determined that we should withdrawal our election to be regulated as a BDC under the 1940 Act.

The withdrawal of our election to be regulated as a BDC caps the transition of our business to a global IP licensing and innovation services company. We believe that this change will reduce our administrative and regulatory compliance costs, including the significant legal, valuation and other compliance-related expenses associated with the business development company regulatory regime, as well as increase our ability to raise financing and provide us with greater flexibility in operating our business.

As an operating company, we are required to consolidate UTEK Real Estate Holdings, Inc. and its subsidiaries: Ybor City Group, Inc., 22nd Street of Ybor City, Inc., ABM of Tampa Bay, Inc. and Cortez 114, LLC (collectively “UTEK Real Estate”). This represents a change because, pursuant to accounting standards applicable to BDCs, UTEK’s investments in these companies were categorized as portfolio company investments and were not consolidated into UTEK. The assets, liabilities and results of operations of UTEK Real Estate have been included in our consolidated financial statements from October 1, 2009. The consolidation of UTEK Real Estate had a significant effect on our balance sheet as of December 31, 2009 as it added approximately $500,000 in investments, $8.0 million in land and buildings and $4.2 million in related long-term debt. The consolidation did not have a material effect on our results of operations for the three months ended December 31, 2009.

As a result of our de-election from BDC status, we make reference to both Investment Company Accounting and Operating Company Accounting throughout this document. Investment Company Accounting, as we refer to it, is defined as accounting in accordance with U.S. generally accepted accounting principles (“US GAAP”) for investment companies under the 1940 Act. Operating Company Accounting, as we refer to it, is defined as accounting in accordance with US GAAP other than for Investment Companies under the 1940 Act.

1

Table of Contents

Business Overview

We help clients become stronger innovators, develop compelling strategies to drive and catalyze growth, rapidly source externally developed technologies, create added value from their intellectual property and gain foresight into marketplace and technology developments that affect their business. These services are primarily provided throughout the United States and the United Kingdom.

Innovation Consulting Services

Strategic Innovation Consulting

Our clients require strategies to help them embrace greater innovation capabilities. We apply innovation insights and build those strategies with supporting infrastructure, processes & mechanisms, creating a culture primed for repeatable innovation success. We help organizations create and realize new, breakthrough growth strategies, create and execute non-incremental new growth platforms and opportunities, and develop the capability for ongoing creation and execution of those growth platforms and concepts.

We provide strategic innovation consulting services to enable clients to become more efficient by finding new avenues to growth, fighting commoditization, improving return on investment, transforming the organization, and removing barriers to innovation. Business value is delivered to our clients through working with a team of seasoned and experienced professionals capable of unlocking an organization’s capacity by offering the following services:

| • | Identify and develop new segments and markets; |

| • | Create and act on game-changing strategies; |

| • | Build an enterprise-wide capability for innovation; |

| • | Accelerate and improve new product development processes; and |

| • | Assess a company’s innovation capability. |

Foresight and Trend Research

Foresight is the ability of an organization to understand the ways in which the future might emerge and to apply that understanding in organizationally useful ways. Strategic foresight may also be used to detect adverse conditions, guide policy and help shape strategy. We provide services to clients that build the capacity for foresight, including monitoring trends, researching topics of interest, forecasting alternative scenarios, developing technology roadmaps, creating growth platforms and embedding futures thinking within the organization.

We also offer innovative futures programs that provide clients with up-to-the-minute knowledge, expert insight, high-level learning experiences, and opportunities to network with experts and peers. Our futures programs are as follows:

Futures Consortium is a membership service that provides members access to research briefs, member meetings and networking events, and onsite workshops.

Futures Observatory is a membership service that provides members a steady stream of “observations” that illustrate the latest developments in key global trends. The observations are brief, timely discussions of real-life events or circumstances in key markets, which exemplify how trends are playing out in the market.

Futures Interactive is a customizable, web-based knowledge management tool that gathers and organizes information from across a company in one, intuitive platform.

2

Table of Contents

Clients

Approximately 70%, 55% and 0% of our revenue in 2009, 2008 and 2007, respectively, was from innovation consulting services. We have a global client base including both private and public sector organizations, representing multiple industries including fast moving consumer goods, consumer packaged goods, retail, medical, telecommunications, chemicals, media, financial services, energy, utilities and government agencies. We had one significant consulting client for the year ended December 31, 2009 and two significant consulting clients for the year ended December 31, 2008, which accounted for 10% and 27% of the total revenue, respectively.

Competition

The strategic innovation consulting business is highly competitive. We currently have significant competitors for many of our service offerings, including but not limited to McKinsey & Company, The Boston Consulting Group and Monitor Group, Inc. for strategic innovation consulting and Forrester Research, Inc. and Gartner, Inc. for foresight and trend research.

Sale of Technology Rights

Our services enable companies to acquire externally developed technologies from universities, university incubators, federal labs, medical centers, and corporate research laboratories worldwide to augment their internal research and development efforts. A sale of technology rights refers to the process by which these technologies are licensed to companies for potential commercial development and use. Our goal is to provide our clients an opportunity to acquire and commercialize innovative technologies primarily developed external to their business.

Historically, to effectuate a technology transfer, we would typically create a newly formed company to acquire a new technology from a university, medical center, corporation or federal research laboratory and then sell this newly formed company to our client for securities or cash. In the ordinary course of business, we would then sell the securities we received in exchange for cash or other assets. A benefit of effectuating technology transfers through this process is that such transactions did not result in a current taxable event for income tax purposes. A disadvantage resulted from the fact that our business focused on small- and mid-cap companies, which are typically more volatile and left us open to the risk of declining stock prices.

Overall equity market conditions generally forced micro-capitalization stock prices down, making it more difficult for some of our clients to issue a reasonable amount of stock with sufficient value in exchange for these technologies during 2008. In addition, we began to pursue technology transfers on a more selective basis to mitigate the risk of declining stock prices with respect to the stock consideration we have historically received in connection with our technology transfers.

Following our study of the potential market and resulting opportunity for UTEK, we shifted our focus from technology transfers with small- and micro-cap companies to developing relationships with large capitalization clients in 2009. Our shift toward these larger capitalization clients, which are expected to be more stable and more amenable to cash based technology transfer services, requires us to develop a modified sales approach. This strategy helps us mitigate the risk of declining stock prices with respect to the stock consideration previously received in connection with technology transfers with small- to mid-cap companies whose stock is typically more volatile.

Our client make up is now more heavily weighted towards larger capitalization companies, which has caused a significant slowdown in the process to complete a technology transfer given the more measured decision making process with respect to executing a technology transfer by these companies. This has resulted in a decrease in the number of executed technology transfers during 2009.

3

Table of Contents

Clients

Approximately 0%, 23% and 81% of our revenue in 2009, 2008 and 2007, respectively, was from the sale of technology rights. We have a global client base including private and public sector organizations of varying sizes, representing a wide range of industries.

Competition

We have capable competitors in the licensing business including, IP Group plc, British Technology Group plc, Intellectual Ventures, Yet2.com, Competitive Technologies, Inc. and many other firms. In addition, university technology commercialization offices also provide location specific competition with regard to the intellectual property which they have developed and have available for license.

Subscription and Other Services

Subscription and other services include income from both our subscription services segment and our other services segment.

Online Licensing Platform

Our online licensing services division provides the following subscription-based website services:

| • | Pharmalicensing is a biopharmaceutical innovation resource designed for life science professionals driving partnering, licensing and business development worldwide. Pharmalicensing affords clients the ability to in-license and out-license intellectual property and also provides partnering services, business development reports, industry news and a jobs source for candidates and employers. To further grow traffic, we are continuing to develop partnerships with sites such as Patents.com. |

| • | Medical Device Licensing is an online global resource for open innovation, partnering, licensing and business development within the medical device industry. Medical Device Licensing benefits from the Pharmalicensing traffic and partnerships as well as establishing some of its own with member associations around the globe to further its reach and exposure. |

| • | Knowledge Express is a searchable database of information for licensing professionals, which provides clients with comprehensive coverage of licensing agreements, corporate profiles, clinical trials, deals, drug pipelines, drug sales, licensable technologies, patents and royalty rates. |

| • | Pharma Transfer provides a source of research and peer reviewed business development opportunities for the international pharmaceutical market encompassing all areas of pipeline development including early-stage discovery, pre-clinical and clinical trials and registered products that are all available for co-development or licensing. |

| • | TekScout, a development stage platform, enables companies to outsource unfinished R&D projects to scientists from around the world. TekScout provides a platform for companies to supplement internal R&D and resources to accelerate product development. |

Global Technology Licensing

Our global technology licensing service enables clients to enhance their new product pipeline through the acquisition of proprietary technologies primarily from universities, medical centers, federal research laboratories, select corporations, and university incubator programs. A global network of technology providers, coupled with an in-house staff of scientists and researchers, offers companies low-cost, low-risk access to review and acquire new technologies from research centers around the world. After gaining an understanding of our clients’ technology and business needs, we find and assess technologies for our clients. With the added benefit of licensing professionals, we negotiate agreements on behalf of our clients and offer a variety of flexible terms and transaction models.

4

Table of Contents

A component of our global technology licensing division is our patent analytic service designed to help our clients create marketplace value from their intellectual property (“IP”). We help clients identify the strengths and weaknesses of their own IP as well as that of companies in the same or adjacent industries. Additionally, by identifying gaps and opportunities in the IP landscape, we assist clients with developing IP acquisition, disposition, and management strategies.

Clients

Approximately 30%, 20% and 16% of our revenue in 2009, 2008 and 2007, respectively, was from online subscription and other services. Clients for our subscription services segment include universities, research centers and primarily large companies across a diversified group of industries. Clients for our other services segment include both private and public sector organizations, representing multiple industry sectors including retail, government, telecommunications, chemicals, media, financial services, energy and utilities.

Competition

Competitors for online licensing services are significant and include: Reed Elsevier, PharmaVentures, Nerac, Inc., Thomson S.A., BioPharm Insight, EvaluatePharma and many others. Competitors for global technology licensing that are significant and well developed include: IP Group plc, British Technology Group plc, Competitive Technologies, Inc. and Yet2.com. Competitors for patent analytic services include: The Patent Board, Ocean Tomo, LLC, PatentCafé, 1790 Analytics and many other private firms. In addition, university technology commercialization offices also provide location specific competition with regard to the intellectual properties, which they have developed and are available for license.

We believe the primary factors affecting competition in our market include firm and consultant reputations, client relationships and experiences, a legacy of successes, referrals and referral sources, the ability to attract and retain top talent, the ability to manage client engagements effectively, responsiveness, and the ability to listen and provide high quality services. There is competition on price, especially during this last economic downturn. However, given the critical nature of many of the issues that our services address, we are not typically competing on price alone. Many of our competitors have greater mindshare in the market, more high profile personnel and greater financial and marketing resources than we do. We believe that our experience, our heritage, our reputation (collectively and as previously independent businesses), our focus on innovation, and our comprehensive approach to our clients’ innovation challenges enable us to compete favorably and effectively in this marketplace.

Business Development and Marketing

Our business development and marketing efforts are aimed to develop relationships and build strong awareness and brand reputation with the key economic buyers and influences, specifically; innovation leaders, business and business unit leaders, research and consumer insights professionals, R&D leaders, product marketers, brand managers, licensing professionals, industry analysts, academic institutions, legal firms, and others. We believe strong relationships and a client-driven approach to service are critical to building and maintaining our business and brand reputation. We emphasize high quality client service to all of our employees.

We generate new business opportunities through relationships with individuals, through direct sales, cross selling, trade show and conference participation and sponsorship, direct marketing outreach, and our extensive network of contacts. We have thought leadership programs in action to generate awareness and build brand associations of expertise. These activities include a quarterly Innovation Index which ranks businesses in a different industry each quarter in terms of their level of innovation; an Innovation Update, which is a topical monthly opinion piece; bi-annual Innovation Leaders rankings; and book sponsorships, most recently including The Future of Innovation.

5

Table of Contents

Financial Information about Financial Segments and Geographic Areas

Information concerning sales and segment income attributable to each of our product segments and geographic areas is set forth in Note 11 of our Notes to Consolidated Financial Statements under Item 8. “Financial Statements and Supplementary Data” and is incorporated herein by reference.

Recent Developments

Beginning in 2008, we have acquired and integrated certain companies in an effort to enhance our ability to provide end-to-end innovation services. During 2010, we will bring those companies together under a single go-to-market brand strategy, expecting to leverage both market and cost efficiencies while creating a more comprehensive brand with the large-capitalization companies we increasingly serve.

| • | In January 2008, we acquired Pharmalicensing Limited (“Pharmalicensing”), a leading biopharmaceutical innovation website designed for professionals involved with partnering, licensing and business development worldwide. Actively supporting in- and out-licensing activities, Pharmalicensing provides partnering services, business development reports and industry news. With the acquisition of Pharmalicensing, we significantly expanded our online marketplace presence. We are able to use it as a platform to launch other targeted marketplaces, such as our 2009 launch of the Medical Device Licensing marketplace, and we will continue to launch market specific verticals in the future. It is also a substantial online traffic generator and awareness builder for our entire business. |

| • | In April 2008, we acquired Carmi, Inc., a 100% owned subsidiary of Strategos, LLC that we refer to as “Strategos.” Founded in 1995 by a small group of experienced consultants and industry veterans, including management strategist Gary Hamel, the firm focuses on helping clients achieve and sustain industry leadership, develop innovative growth strategies, identify and bring to market new growth opportunities and build a culture of innovation into their organization. Strategos helps companies bring innovation to their core business and organization. The acquisition of Strategos lends credibility to our move into Global 1000 list of clients and prospects, providing us with a thought leadership platform, considerable consulting and management strength and better positions us with the innovation leadership of the Global 1000. |

| • | In July 2008, we acquired Innovaro Limited (“Innovaro”). Founded in 2000, Innovaro was headquartered in London (UK) and has a global client base including both private and public sector organizations. Innovaro provides consulting and insight support to many organizations, across industry sectors ranging from fast moving consumer goods, retail, government and telecommunications to chemicals, media, financial services, energy and utilities. The acquisition of Innovaro, like Strategos, lends credibility to our move into Global 1000 list of clients and prospects, extending us geographically into western Europe, providing us with a thought leadership platform, considerable consulting and management strength and better positions us with the innovation leadership of the Global 1000. |

| • | In October 2008, we acquired Social Technologies Group, Inc. (“Social Technologies”). Founded in 1999, Social Technologies is headquartered in Washington, D.C. The firm has helped clients across a wide range of industries guide policy, shape business strategy, explore new markets, and develop new products and services. The firm helps organizations protect against unexpected risks, spot opportunities before competitors do, and ultimately better prepare for the future from a far more informed, empowered perspective. The acquisition of Social Technologies enhances our service offerings to the research and insights professionals in the Global 1000 and beyond, a critical role in an organization’s innovation development. |

Our business strategy has evolved significantly since our inception. Starting as a company in 1997, we focused solely on working with the technology transfer offices at universities. We now also serve mid- and large-cap organizations who are increasingly seeking the technologies our university partners have developed. We have aligned our management structure to maximize the benefit gained from the talented executives within

6

Table of Contents

our team. We have hired experienced professionals from a variety of leading organizations. We have added executives and functions to progress us in our mission, including a VP of Marketing. We have gone from being a sole office in Tampa, FL, our current headquarters, to also having offices in Chicago, IL, Washington, D.C. and York, England.

As of March 16, 2010, we began doing business as Innovaro and changed our ticker symbol to NYSE Amex: INV. Our proxy statement for the 2010 Annual Meeting of Shareholders will include a proposal to amend our articles of incorporation to change the corporate name to Innovaro, Inc. Beginning in March 2010, the Company will reorganize into three primary business groups, all working under the Innovaro brand: Strategic Services—driven by Strategos, an advanced innovation consultancy; Technology Marketplaces—online platforms, partnering services, global licensing and technology transfer services; Insights & Research—futures and trends, research, information services and more. In connection therewith, our business segments will change beginning with our quarterly reporting period ending March 31, 2010 and this change will require certain reclassifications to prior period financial information.

Scientific Advisory Council

Our Scientific Advisory Council is comprised of more than 40 experts in a broad range of scientific, medical and engineering disciplines. Our Scientific Advisory Council assists our management in the evaluation of new technologies for our clients.

Employees

As of March 16, 2010, we had 61 employees. We believe our relations with our employees are good.

Corporate Offices and Available Information

Our executive offices are located at 2109 Palm Avenue, Tampa, Florida 33605 and our telephone number is (813) 754-4330. We also have offices in Illinois, Washington D.C. and the United Kingdom.

Our Internet address is www.innovaro.com. We make available free of charge through our website our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Information contained on our website is not incorporated by reference into this annual report on Form 10-K, and you should not consider information contained on our website to be part of this annual report on Form 10-K.

| Item 1A. | Risk Factors |

Investing in our common stock involves a high degree of risk. As a result, there can be no assurance that we will achieve our business objectives. You should consider carefully the risks described below. In addition to the risk factors described below, other factors that could cause actual results to differ materially include:

| • | Changes in the economy; |

| • | Changes in the market for technology transfer and innovation services; |

| • | Risks associated with possible disruption in our operations due to terrorism; |

| • | Future regulatory actions and conditions in our operating areas; and |

| • | Other risks and uncertainties as may be detailed from time to time in our public announcements and SEC filings. |

7

Table of Contents

Our business, financial condition and results of operations may be materially impacted by economic conditions and related fluctuations in customer demand for innovation consulting, technology licensing, patent analysis and other consulting services.

The market for our consulting services tends to fluctuate with economic cycles. During economic cycles in which many companies are experiencing financial difficulties or uncertainty, clients and potential clients may cancel or delay spending on technology, intellectual property and other business initiatives. In particular, current uncertainty in global economic conditions may cause companies to cancel or delay consulting initiatives for which they have engaged us. Further, if the rate of project cancellations or delays significantly increases, our business, financial condition and results of operations could be materially and adversely impacted.

It is important to our future success that we expand the breadth and depth of our service offerings to stay abreast of the competition and to enhance our potential for growth of revenues and profits.

We are primarily a service business. It is important to our future success to expand the breadth and depth of our service offerings to stay abreast of the competition and to enhance our potential for growth of revenues and profits. Expansion of our service categories and service offerings in this manner will require significant additional expenditures and could strain our management, financial and operational resources. For example, we are currently seeking to build up our intellectual property analysis service business. We cannot be certain that we will be able to do so in a cost-effective or timely manner or that we will be able to offer certain services in demand by our clients, or to do so in a quality manner. Furthermore, any new service offering that is not favorably received by our clients could damage our reputation. The lack of market acceptance of new services or our inability to generate satisfactory revenues from expanded service offerings to offset their costs could harm our business. If we do not successfully expand our operations, our revenues may fall below expectations. If we do not successfully expand our operations on an ongoing basis to accommodate increases in demand, we will not be able to fulfill our clients’ needs in a timely manner, which would harm our business.

Our growth strategy is partially dependent on completing additional acquisitions of innovation services companies.

As part of our strategy for growth, we have made and may continue to make acquisitions of complementary innovation services companies. However, we may not be able to identify suitable acquisition candidates, complete acquisitions, or integrate acquisitions successfully. In this regard, acquisitions involve numerous risks, including difficulties in the integration of the operations, technologies, services and products of the acquired companies and the diversion of management’s attention from other business concerns. Although our management will endeavor to evaluate the risks inherent in any particular transaction, there can be no assurance that we will properly ascertain all such risks. In addition, prior acquisitions have resulted, and future acquisitions could result, in the incurrence of substantial additional indebtedness and other expenses. Future acquisitions may also result in potentially dilutive issuances of equity securities. There can be no assurance that difficulties encountered with acquisitions will not have a material adverse effect on our business, financial condition and results of operations.

Our quarterly and annual results fluctuate significantly.

Our quarterly and annual operating results fluctuate significantly due to a number of factors. These factors include fluctuations in the amount of consulting services we provide, the degree to which we encounter competition in our markets, and general economic conditions. As a result of these factors, quarterly and annual results are not necessarily indicative of our performance in future quarters and years.

The agreements we have with universities, medical research centers, corporate research laboratories and federal research laboratories do not guarantee that such entities will grant licenses to us or other companies.

We do not invent new technologies or products. We depend on relationships with universities, corporations, government agencies, research institutions, inventors, and others to provide technology-based opportunities that

8

Table of Contents

we can develop into profitable royalty-bearing licenses. Failure to maintain these relationships or to develop new relationships could adversely affect our operating results and financial condition. If we are unable to forge new relationships or to maintain current relationships, we may be unable to identify new technology-based opportunities and enter into royalty-bearing licenses. We also are dependent on our clients’ abilities to develop new technologies, introduce new products, and adapt to changes in technology and economic needs.

We cannot be certain that current or new relationships will provide the volume or quality of available new technologies necessary to sustain our business. In some cases, universities and other sources of new technologies may compete against us as they seek to develop and commercialize these technologies themselves, or through entities that they develop, finance and/or control. In other cases, universities receive financing for basic research from companies in exchange for the exclusive right to commercialize any resulting inventions. These and other strategies may reduce the number of technology sources, potential clients, to whom we can market our services. If we are unable to secure new sources of technology, it could have a material adverse effect on our operating results and financial condition.

We are focusing our business on providing innovation services to our clients which is a new and uncertain trend in our industry.

We are focused on providing innovation services to our clients. While these services utilize our well established technology transfer capabilities, they also incorporate additional products and services which in their entirety are as yet unproven in their ability to generate consistent significant revenue. As a result, if our innovation services are not well received by our clients or if industry changes its focus off of innovation, this may result in reduced revenue and profitability for us.

The consulting services business is highly competitive, and we may not be able to compete effectively.

The innovation consulting services business in which we operate includes a large number of participants and is intensely competitive. We face competition from other business operations and financial consulting firms, general management consulting firms, the consulting practices of major accounting firms, technical and economic advisory firms, regional and specialty consulting firms and the internal professional resources of organizations. In addition, because there are relatively low barriers to entry, we expect to continue to face additional competition from new entrants into the business operations and financial consulting industries. Many of our competitors have a greater national and international presence, as well as have significantly greater personnel, financial, technical and marketing resources. In addition, these competitors may generate greater revenues and have greater name recognition than we do. Our ability to compete also depends in part on the ability of our competitors to hire, retain and motivate skilled professionals, the price at which others offer comparable services and our competitors’ responsiveness to their clients. If we are unable to compete successfully with our existing competitors or with any new competitors, it could negatively affect our operating results.

Our inability to hire and retain talented people in an industry where there is great competition for talent could have a serious negative effect on our services and results of operations.

Our innovation consulting services business involves the delivery of professional services and is highly labor-intensive. Our success depends largely on our general ability to attract, develop, motivate and retain highly skilled professionals. The loss of a significant number of our professionals or the inability to attract, hire, develop, train and retain additional skilled personnel could have a serious negative effect on us, including our ability to manage, staff and successfully complete our existing engagements and obtain new engagements. Qualified professionals are constantly in demand, and we face significant competition for both senior and junior professionals with the requisite credentials and experience. Our principal competition for talent comes from other research and consulting firms, as well as from organizations seeking to staff their internal professional positions. Many of these competitors may be able to offer significantly greater compensation and benefits or more attractive lifestyle choices, career paths or geographic locations than we do. Therefore, we may not be successful

9

Table of Contents

in attracting and retaining the skilled consultants we require to conduct and expand our operations successfully. Increasing competition for these revenue-generating professionals may also significantly increase our labor costs, which could negatively affect our operating results.

The profitability of our fixed-fee engagements with clients may not meet our expectations if we underestimate the cost of these engagements.

When making proposals for fixed-fee engagements, we estimate the costs and timing for completing the engagements. These estimates reflect our best judgment regarding the efficiencies of our methodologies and consultants as we plan to deploy them on engagements. Any increased or unexpected costs or unanticipated delays in connection with the performance of fixed-fee engagements, including delays caused by factors outside our control, could make these contracts less profitable or unprofitable, which could negatively affect our operating results.

A significant portion of our revenue is derived from a limited number of clients, which may cause our operating results to be unpredictable.

As an innovation services firm, we have derived, and expect to continue to derive, a significant portion of our revenue from a limited number of clients. Our clients typically retain us on an engagement-by-engagement basis, rather than under fixed-term contracts; the volume of work performed for any particular client is likely to vary from year to year and a major client in one fiscal period may not require or decide not to use our services in any subsequent fiscal period. Moreover, a large portion of our new engagements comes from existing clients. Accordingly, the failure to obtain new large engagements or multiple engagements from existing or new clients could have a material adverse effect on the amount of revenues we generate. In addition, if we fail to collect a large trade receivable or group of receivables, we could be subject to significant financial exposure.

Our ability to maintain and attract new business depends upon our reputation, the professional reputation of our revenue-generating employees and the quality of our services.

As an innovation services firm, our ability to secure new engagements depends heavily upon our corporate brand and reputation and the individual reputations of our professionals. Any factor that diminishes our reputation or that of our employees, including not meeting client expectations, misconduct by our employees, or dissemination of inappropriate information from outside sources, could make it substantially more difficult for us to attract new engagements and clients. Similarly, because we obtain many of our new engagements from former or current clients or from referrals by those clients or by law firms that we have worked with in the past, any client that questions the quality of our work or that of our consultants could impair our ability to secure additional new engagements and clients.

We depend on non-recurring consulting engagements and our failure to secure new engagements could lead to a decrease in our revenues.

Innovation consulting segment revenues constituted approximately 70% of our total revenues for 2009. These consulting engagements typically are project-based and non-recurring. Our ability to replace consulting engagements is subject to numerous factors, including the following:

| • | Delivering consistent, high-quality consulting services to our clients; |

| • | Tailoring our consulting services to the changing needs of our clients; and |

| • | Our ability to match skills and competencies of our consulting staff to the skills required for the fulfillment of existing or potential innovation consulting engagements. |

Any material decline in our ability to replace consulting arrangements could have an adverse impact on our revenues and our financial condition.

10

Table of Contents

The absence of long-term contracts with our clients reduces the predictability of our revenue.

Our clients are generally able to reduce or cancel their use of our professional services without penalty and, in some circumstances, with little notice. As a result, we believe that the number of clients or the number and size of our existing projects are not reliable indicators or measures of future revenue. We will need to continuously acquire new clients and/or new projects to meet our expenses. When a client defers, modifies or cancels a project, there is no assurance that we will be able to rapidly redeploy our professionals to other projects in order to minimize the underutilization of employees and the resulting adverse impact on operating results. We may not be able to replace cancelled or reduced contracts with new business while at the same time our expenses are generally longer term in nature with the result that our revenue and profits may decline.

Our revenue growth depends on our ability to understand the technology requirements of our customers in the context of their markets. If we fail to understand their technology needs or markets, we limit our ability to meet those needs and to generate revenue.

We believe that by focusing on the technology needs of our customers, we are better positioned to generate revenues by providing technology solutions to them. The market demands of our customers drive our revenues. The better we understand their markets and requirements, the better we are able to identify and obtain effective technology solutions for our customers. We rely on our professional staff and contract business development consultants to understand our customers’ technical, commercial, and market requirements and constraints, and to identify and obtain effective technology solutions for them.

Additional hiring and business acquisitions could disrupt our operations, increase our costs or otherwise harm our business.

Our business strategy is dependent in part upon our ability to grow by hiring individuals or groups of individuals and by acquiring complementary businesses. However, we may be unable to identify, hire, acquire or successfully integrate new employees and acquired businesses without substantial expense, delay or other operational or financial obstacles. Competition for future hiring and acquisition opportunities in our markets could increase the compensation we offer to potential employees or the prices we pay for businesses we wish to acquire. In addition, we may be unable to achieve the financial, operational and other benefits we anticipate from any hiring or acquisition, including those we have completed so far. Hiring additional employees or acquiring businesses could also involve a number of additional risks, including:

| • | The diversion of management’s time, attention and resources from managing the Company; |

| • | The failure to retain key acquired personnel; |

| • | The adverse short-term effects on reported operating results from the amortization or write-off of acquired goodwill and other intangible assets; |

| • | The potential impairment of existing relationships with our clients, such as client satisfaction or performance problems, whether as a result of integration or management difficulties or otherwise; |

| • | The creation of conflicts of interest that require us to decline or resign from engagements that we otherwise could have accepted; |

| • | The potential need to raise significant amounts of capital to finance a transaction or the potential issuance of equity securities that could be dilutive to our existing stockholders; |

| • | Increased costs to improve, coordinate or integrate managerial, operational, financial and administrative systems; |

| • | The usage of contingent earnouts based on the future performance of our business acquisitions may deter the acquired company from fully integrating into our existing business; and |

| • | A decision not to fully integrate an acquired business may lead to the perception of inequalities if different groups of employees are eligible for different benefits and incentives or are subject to different policies and programs. |

11

Table of Contents

If we fail to successfully address these risks, our ability to compete may be impaired.

The failure to integrate or negotiate successfully any future acquisitions could harm our business and operating results.

If we acquire businesses in the future and are unable to integrate successfully these businesses, it could harm our business and operating results. In order to remain competitive or to expand our business, we may find it necessary or desirable to acquire other businesses, products or technologies. We may be unable to identify appropriate acquisition candidates. If we identify an appropriate acquisition candidate, we may not be able to negotiate the terms of the acquisition successfully, finance the acquisition or integrate the acquired businesses, products or technologies into our existing business and operations. Further, completing a potential acquisition and integrating an acquired business may strain our resources and require significant management time. In addition, we may revalue or write-down the value of goodwill and other intangible assets in connection with future acquisitions, which would negatively affect our operating results.

Changes in the laws or regulations that govern us could have a material impact on our operations.

Any change in the laws or regulations that govern our business could have a material impact on us or on our operations. Laws and regulations may be changed from time to time, and the interpretations of the relevant laws and regulations also are subject to change.

We are subject to certain risks associated with our foreign operations.

We have operations in the United Kingdom and may seek to expand our operations in other countries.

Certain risks are inherent in foreign operations, including:

| • | difficulties in enforcing agreements and collecting receivables through certain foreign legal systems; |

| • | foreign clients may have longer payment cycles than clients in the US; |

| • | tax rates in certain foreign countries may exceed those in the US and foreign earnings may be subject to withholding requirements, exchange controls or other restrictions; |

| • | general economic and political conditions in countries where we operate may have an adverse effect on our operations; |

| • | exposure to risks associated with changes in foreign exchange rates; |

| • | difficulties associated with managing a large organization spread throughout various countries; |

| • | difficulties in enforcing intellectual property rights; and |

| • | required compliance with a variety of foreign laws and regulations. |

Investing in foreign companies, including innovation services firms, may expose us to additional risks not typically associated with investing in US companies. These risks include changes in foreign exchange rates, exchange control regulations, political and social instability, expropriation, imposition of foreign taxes, less liquid markets and less available information than is generally the case in the US, higher transaction costs, less government supervision of exchanges, brokers and issuers, less developed bankruptcy laws, difficulty in enforcing contractual obligations, lack of uniform accounting and auditing standards and greater price volatility.

As we continue to expand our business globally, our success will depend, in part, on our ability to anticipate and effectively manage these and other risks. We cannot assure you that these and other factors will not have a material adverse effect on our international operations or our business as a whole.

12

Table of Contents

We may issue shares of our common stock and warrants at a discount to the market price for such shares, which may put downward pressure on the market price for shares of our common stock.

If we issue shares of our common stock at a discount to the market price for such shares, it may put downward pressure on the market price for shares of our common stock. Such downward pressure could in turn encourage short sales or similar trading with respect to shares of our common stock, which could in itself, place further downward pressure on the market price for shares of our common stock.

We may issue shares of our common stock and warrants in conjunction with the acquisition of other businesses, which may put downward pressure on the market price for shares of our common stock and create additional dilution of the current shares outstanding.

Consistent with our current strategy, we may seek to acquire other businesses through the issuances of common stock and or cash. If common stock is used in these transactions, it would create additional dilution of the current shares outstanding. Further, such issuances may result in downward pressure on our share price as a result of these additional shares being issued. Also, there is the potential that the market may not respond favorably to potential new acquisitions, which could also negatively affect our share price.

We may need additional capital in the future and it may not be available on acceptable terms.

We have historically relied on equity financing and, to a lesser extent, cash flow from operations including the sale of our investments and debt financing to fund our operations, capital expenditures and expansion. However, we may require additional capital in the future to fund our operations or respond to competitive pressures or strategic opportunities. We cannot assure that additional financing will be available on terms favorable to us, or at all. In addition, the terms of available financing may place limits on our financial and operating flexibility. If we are unable to obtain sufficient capital in the future, we may:

| • | be forced to reduce our operations; |

| • | not be able to expand or acquire complementary businesses; and |

| • | not be able to develop new services or otherwise respond to changing business conditions or competitive pressures. |

Our common stock price may be volatile.

The trading price of our common stock has fluctuated significantly and may continue to fluctuate substantially, depending on many factors, many of which are beyond our control and may not be directly related to operating performance. These factors include the following:

| • | price and volume fluctuations in the overall stock market from time to time; |

| • | significant volatility in the market price and trading volume of securities of innovation services firms and technology transfer companies; |

| • | changes in regulatory policies, accounting or tax guidelines with respect to innovation services firms and technology transfer companies; |

| • | actual or anticipated changes in our sales or earnings or fluctuations in our operating results; |

| • | actual or anticipated changes in the value of our investments; |

| • | changes in financial reporting requirements; |

| • | general economic conditions and trends; |

| • | loss of a major funding source; |

| • | departures of key personnel; |

13

Table of Contents

| • | changes to the market or shareholder’s acceptance of our unique technology transfer business; or |

| • | the consummation of mergers or acquisitions of related businesses. |

As a publicly held company, we have significantly higher administrative costs.

The Sarbanes-Oxley Act of 2002, as well as new rules implemented by the SEC and new listing requirements adopted by the American Stock Exchange in response to the Sarbanes-Oxley Act of 2002, has required changes in corporate governance practices, internal control policies and audit control practices of public companies. These new rules, regulations, and requirements have increase our legal, audit, financial, compliance and administrative costs, and have made certain other activities more time consuming and costly. The additional costs are expected to continue. These rules and regulations may make it more difficult and more expensive for us to obtain directors and officers liability insurance in the future, and could make it more difficult for us to attract and retain qualified members for our Board of Directors, particularly to serve on our audit committee.

We may experience outages and disruptions in connection with our online licensing services if we fail to maintain an adequate operations infrastructure.

We have spent and expect to continue to spend substantial amounts to maintain equipment and to upgrade our technology and network infrastructure relating to our online licensing services. However, any inefficiencies or operational failures could diminish the quality of our services, and client experience, resulting in damage to our reputation and loss of current and potential users, and subscribers, harming our operating results and financial condition.

The agreements relating to our indebtedness may restrict our current and future operations.

Our debt agreements contain, and any future agreements may include, a number of restrictive covenants that impose significant operating and financial restrictions on, among other things, our ability to:

| • | incur additional debt, including guarantees; |

| • | incur liens; |

| • | sell or otherwise dispose of assets; |

| • | make investments, loans or advances; |

| • | make some acquisitions; |

| • | engage in mergers or consolidations; |

| • | make capital expenditures; and |

| • | pay dividends. |

Any future debt could contain financial and other covenants more restrictive than those that are currently applicable.

Our failure to comply with the agreements relating to our outstanding indebtedness, including as a result of events beyond our control, could result in an event of default that could materially and adversely affect our operating results and our financial condition.

If there were an event of default under any of the agreements relating to our outstanding indebtedness the holders of the defaulted debt could cause all amounts outstanding with respect to that debt to be due and payable immediately. We cannot assure you that our assets or cash flow would be sufficient to fully repay borrowings under our outstanding debt instrument, either upon maturity or if accelerated upon an event of default. Further, if we were unable to repay, refinance or restructure our indebtedness under our secured debt, the holders of such

14

Table of Contents

debt could proceed against the collateral securing that indebtedness. In addition, any event of default or declaration or acceleration under one debt instrument could also result in an event of default under one or more of our other debt instruments.

We may not be able to generate sufficient cash flow to meet our debt service obligations.

Our ability to generate sufficient cash flow from operations to make scheduled payments on our debt obligations will depend on our future financial performance, which will be affected by a range of economic, competitive and business factors, many of which are outside our control. If we do not generate sufficient cash flow from operations to satisfy our debt obligations, we may have to undertake alternative financing plans, such as refinancing or restructuring our debt, selling assets, reducing or delaying capital investments or seeking to raise additional capital. We cannot assure you that any refinancing would be possible, that any assets could be sold, or, if sold, of the timing of the sales and the amount of proceeds realized from those sales, or that additional financing could be obtained on acceptable terms, if at all, or would be permitted under the terms of our various debt agreements then in effect. Our inability to generate sufficient cash flow to satisfy our debt obligations, or to refinance our obligations on commercially reasonable terms, would have an adverse effect on our business, financial condition and results of operations, as well as on our ability to satisfy our debt obligations.

| Item 1B. | Unresolved Staff Comments |

None.

| Item 2. | Properties |

Our principal office is located in Tampa, Florida. This office space is owned by our subsidiary, UTEK Real Estate and is encumbered. This property is utilized by all of our product segments and is adequate for our current domestic office needs. If our office requirements increase beyond our current expectations, we believe that additional office space may be available for use at this location.

We also lease office space in Illinois, Washington D.C. and the United Kingdom. The Illinois and Washington D.C. properties are utilized by our innovation consulting services segment and the United Kingdom property is utilized by our subscription services segment and our other services segment. These properties are adequate for our current needs.

| Item 3. | Legal Proceedings |

We may be a party from time to time in certain lawsuits in the normal course of our business. While the outcome of these legal proceedings cannot at this time be predicted with certainty, we do not expect that these proceedings will have a material effect upon our financial condition or results of operations.

| Item 4. | Reserved |

15

Table of Contents

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Our shares of common stock trade on the NYSE Amex under the symbol “UTK” though March 15, 2010. As of March 16, 2010, we began doing business as Innovaro and changed our ticker symbol to NYSE Amex: “INV”. Computershare Trust Company, Inc., 350 Indiana Street, Suite 800, Golden, CO 80401; 303-262-0600, serves as transfer agent for our common stock.

We had approximately 3,000 stockholders of record at March 15, 2010.

Price Range of Common Stock and Dividends

The following table reflects the high and low closing prices for our common stock as reported on the NYSE Amex and the cash dividends declared per common share for the periods indicated:

| High | Low | Dividends | ||||||

| Fiscal year 2009 |

||||||||

| First quarter |

$ | 8.90 | $ | 6.00 | — | |||

| Second quarter |

$ | 6.65 | $ | 3.79 | — | |||

| Third quarter |

$ | 5.15 | $ | 3.75 | — | |||

| Fourth quarter |

$ | 4.55 | $ | 3.60 | — | |||

| Fiscal year 2008 |

||||||||

| First quarter |

$ | 13.05 | $ | 9.95 | — | |||

| Second quarter |

$ | 11.10 | $ | 9.98 | — | |||

| Third quarter |

$ | 11.05 | $ | 9.50 | — | |||

| Fourth quarter |

$ | 10.29 | $ | 8.65 | — | |||

Our Board of Directors has sole discretion in determining whether to declare and pay cash dividends in the future. The declaration of cash dividends will depend on our profitability, financial condition, cash requirements, future prospects and other factors deemed relevant by our Board of Directors. Our ability to pay cash dividends in the future could be limited or prohibited by regulatory requirements and the terms of financing agreements that we may enter into or by the terms of any preferred stock that we may authorize and issue.

Securities Authorized for Issuance under Equity Compensation Plans

The information required by this item appears under “Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” included elsewhere in this Annual Report on Form 10-K.

16

Table of Contents

Performance Graph

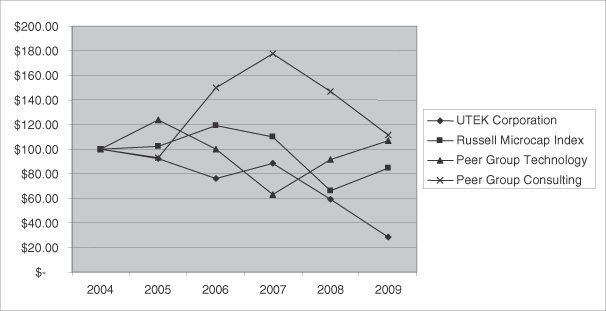

The following graph shows a comparison of the five-year cumulative total return, assuming the reinvestment of dividends, on our common stock with that of the Russell Microcap Index, our sale of technology rights peer group (“Peer Group Technology”) including British Technology Group plc, Competitive Technologies, Inc., IP Group plc, and Sagentia Group AG, and our innovation consulting services peer group (“Peer Group Consulting”) including Forrester Research, Inc., Gartner, Inc., Huron Consulting Group, Inc. and Diamond Management and Technology Consultants Inc. The graph assumes $100 was invested on December 31, 2004 in our common stock, the Russell Microcap Index companies, and the companies in both of the peer groups. Note that historical stock price performance is not necessarily indicative of future stock price performance.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN

AMONG UTEK, RUSSELL MICROCAP INDEX AND UTEK’S PEER GROUPS

17

Table of Contents

| Item 6. | Selected Financial Data |

The following table presents our selected consolidated financial and other data and has been derived from our audited financial statements for the three months ended December 31, 2009, nine months ended September 30, 2009, and the years ended December 31, 2008, 2007, 2006 and 2005. The information below should be read in conjunction with “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the notes thereto, each of which is included in another section of this annual report on Form 10-K.

| Operating Company Accounting |

Investment Company Accounting | ||||||||||||||||||||

| Three Months Ended Dec 31, 2009(1) |

Nine Months Ended Sept 30, 2009(1) |

Year Ended December 31, | |||||||||||||||||||

| 2008 | 2007 | 2006 | 2005 | ||||||||||||||||||

| Consolidated Statement of Operations Data: |

|||||||||||||||||||||

| Revenue / Income from operations |

$ | 3,012,839 | $ | 7,764,664 | $ | 20,178,119 | $ | 20,300,949 | $ | 56,952,937 | $ | 22,743,823 | |||||||||

| Net (loss) income from operations |

(624,006 | ) | (9,340,651 | ) | (10,034,812 | ) | 3,776,742 | 19,944,207 | 5,887,830 | ||||||||||||

| Net (loss) income from operations per diluted common share |

$ | (0.05 | ) | $ | (0.83 | ) | $ | (1.01 | ) | $ | 0.42 | $ | 2.27 | $ | 0.80 | ||||||

| Weighted average shares: |

|||||||||||||||||||||

| Diluted |

11,605,373 | 11,257,663 | 9,947,221 | 8,989,234 | 8,786,605 | 7,325,312 | |||||||||||||||

| Cash dividends declared per common share |

— | — | — | — | $ | 0.04 | — | ||||||||||||||

| Dec 31, 2009(2) |

Dec 31, 2008 |

Dec 31, 2007 |

Dec 31, 2006 |

Dec 31, 2005 | |||||||||||

| Balance Sheet Data: |

|||||||||||||||

| Total assets |

$ | 40,331,181 | $ | 45,886,209 | $ | 45,221,077 | $ | 53,040,810 | $ | 49,005,960 | |||||

| Long-term debt |

6,329,252 | 839,765 | — | — | — | ||||||||||

| Net asset value per share |

n/a | $ | 3.42 | $ | 4.85 | $ | 5.71 | $ | 5.58 | ||||||

| (1) | Financial data for the year ended December 31, 2009 has been segregated into two sections to conform to the financial statement presentation in our consolidated financial statements, which is included in another section of this annual report on Form 10-K. Financial data for the nine months ended September 30, 2009 reflect our operations as an investment company and financial data for the three months ended December 31, 2009 reflect our operations as an operating company. See Note 1 to the consolidated financial statements, which are included in another section of this annual report on Form 10-K, for further discussion of UTEK’s change in status from an investment company to operating company. |

| (2) | Balance sheet data as of December 31, 2009 includes approximately $8.9 million in total assets and $4.2 million in long-term debt of our newly consolidated subsidiary, UTEK Real Estate Holdings, Inc. See Note 1 to the consolidated financial statements, which are included in another section of this annual report on Form 10-K, for further discussion of the circumstances relating to the consolidation of UTEK Real Estate Holdings, Inc. with those of UTEK. |

18

Table of Contents

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Special Note Regarding Forward-Looking Statements

The following discussion should be read in conjunction with our consolidated financial statements and the notes thereto included elsewhere in this annual report on Form 10-K. This annual report on Form 10-K contains forward-looking statements regarding the plans and objectives of management for future operations. These forward-looking statements may involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by any forward-looking statements. Forward-looking statements, which involve assumptions and describe our future plans, strategies and expectations, are generally identifiable by use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend” or “project” or the negative of these words or other variations on these words or comparable terminology. These forward-looking statements are based on assumptions that may be incorrect, and we cannot assure you that the projections included in these forward-looking statements will come to pass. Our actual results could differ materially from those expressed or implied by the forward-looking statements as a result of various factors.

Overview

For comparability purposes, the revenues and expenses for the nine months ended September 30, 2009 under Investment Company Accounting and for the three months ended December 31, 2009 under Operating Company Accounting are presented combined for the year ended December 31, 2009 throughout management’s discussion and analysis. Management believes this presentation to be more meaningful to the reader as there has been no significant change in our revenue streams as a result of our change in status.

In addition, we refer to “income from operations,” which is revenue under investment company presentation, simply as “revenue” throughout this and certain other sections of this annual report on Form 10-K in order to eliminate confusion.

Financial Condition

Our total assets were $40.3 million at December 31, 2009, compared to $45.9 million at December 31, 2008. At the end of fiscal year 2009, we had $6.3 million in long-term debt outstanding, $2.1 million in cash and cash equivalents and $492,000 of investments in certificates of deposit.

Revenue totaled approximately $10.8 million for fiscal year 2009 compared to $20.2 million for fiscal year 2008. Net loss from operations totaled approximately $10.0 million for both fiscal years ended 2009 and 2008. Net realized losses on investments, net of any related deferred tax effect, totaled approximately $49.6 million in 2009 as compared to $4.2 million in 2008. In this regard, we received gross proceeds of $3.1 million in 2009 and $2.3 million in 2008 in connection with the sale of the securities we received in connection with our global technology licensing agreements and technology transfers. Proceeds received in connection with the sale of our investments for the year ended December 31, 2009 included $1.1 million in cash, $218,000 in common stock, $201,000 in an additional investment in UTEK Real Estate Holdings, Inc., and $1.5 million in a note receivable. Net change in unrealized appreciation (depreciation) of investments, net of any related deferred tax benefit, was $44.3 million in 2009 as compared to $(12.2) million in 2008. The unrealized appreciation of $44.3 million in 2009 is related to the reversal of previously recorded unrealized depreciation upon the sale of certain investments for a realized loss of 49.6 million.

Current Market Conditions

Since mid-2007, global credit and other financial markets have suffered substantial stress, volatility, illiquidity and disruption. These forces reached unprecedented levels in late 2008, resulting in the bankruptcy or acquisition of, or government assistance to, several major domestic and international financial institutions. These

19

Table of Contents

events have significantly diminished overall confidence in the financial markets and caused increasing global economic uncertainty. This reduced confidence and uncertainty could further exacerbate the overall market disruptions and risks to businesses in need of capital, including us. Moreover, the deterioration in the equity markets has had a significant impact on the cash proceeds that we have been able to obtain upon the sale of our investments. In addition, the deterioration in consumer confidence and a general reduction in spending by consumers and business have had an adverse effect on our innovation consulting services operations as businesses have delayed spending on these types of services. Although the market and economic conditions have recently improved, we can provide no assurance that we will not be negatively impacted by these market and economic conditions.

Investment Portfolio Activity

Until September 30, 2009, the Company was a non-diversified, closed-end management investment company that had elected to be treated as a business development company (“BDC”) under the Investment Company Act of 1940 (“1940 Act”). On October 1, 2009, because we no longer met the requirements, the Company filed a notification on Form N-54C with the SEC withdrawing its election to be regulated as a BDC under the 1940 Act. As such, the Company began reporting as an operating company as of October 1, 2009.

In connection with our plan to de-elect BDC status, we liquidated a significant portion of our investment portfolio during 2009. We sold some or all of our shares in a significant number of our portfolio companies for $3.1 million in cash and other assets, which resulted in realized losses of $49.6 million and unrealized appreciation of $44.3 million, which is primarily related to the reversal of previously recorded unrealized depreciation upon the sale of these investments.

Conversion from Investment Company Presentation to Operating Company Presentation

The withdrawal of the Company’s election to be regulated as a BDC under the 1940 Act resulted in a significant change in the Company’s method of accounting. Investment company financial statement presentation and accounting utilizes the value method of accounting used by investment companies, which requires investment companies to value their investments at market value as opposed to historical cost, and recognize income related to unrealized gains and losses in the current period. As an operating company, the required financial statement presentation and accounting for investments held is either fair value or historical cost methods of accounting, depending on the classification of the investment and the Company’s intent with respect to the period of time it intends to hold the investment.

In addition, the financial accounts of majority-owned entities were not consolidated with those of the Company under Investment Company Accounting; rather, investments in those entities were reflected in the Company’s balance sheet at fair value. As an operating company, the Company is required to consolidate the accounts of majority-owned entities in which we have a controlling financial interest with those of the Company. In this regard, the accounts of UTEK Real Estate Holdings, Inc., which was previously reflected as an investment in the Company’s balance sheet at fair value, have been consolidated with the accounts of the Company from October 1, 2009. The consolidation of UTEK Real Estate Holdings, Inc. had a significant effect on the Company’s balance sheet as of December 31, 2009, as it added approximately $500,000 in investments, $8.0 million in land and buildings and $4.2 million in related long-term debt. The consolidation did not have a material effect on the Company’s results of operations for the three months ended December 31, 2009.

For a detailed discussion of the impact of the withdrawal of the Company’s election to be regulated as a BDC under the 1940 Act on its method of accounting and a discussion of how the Company accounts for investments as an operating company, see Notes 1 and 2 to the consolidated financial statements contained elsewhere in this annual report on Form 10-K.

20

Table of Contents

Results of Operations

Summary of Results for Years Ended December 31, 2009, 2008 and 2007

Revenue / Income from Operations

| (in thousands, except percentages) |

2009 | 2008 | 2007 | Percent Change 2009 versus 2008 |

Percent Change 2008 versus 2007 |

||||||||||

| Innovation consulting services |

$ | 7,491 | $ | 11,135 | $ | — | (33 | )% | 100 | % | |||||

| Sale of technology rights |

— | 4,685 | 16,373 | (100 | )% | (71 | )% | ||||||||

| Subscription and other services |

3,227 | 3,959 | 3,343 | (18 | )% | 18 | % | ||||||||

| Investment income, net |

60 | 399 | 585 | (85 | )% | (32 | )% | ||||||||

| Revenue |

$ | 10,778 | $ | 20,178 | $ | 20,301 | (47 | )% | (1 | )% | |||||

Innovation Consulting Services

Innovation consulting services revenue includes income from strategic innovation consulting and foresight and trend research. Innovation consulting services revenue decreased $3.6 million for the year ended December 31, 2009 compared to the year ended December 31, 2008. Throughout 2009, we had the innovation consulting income of three divisions, which were acquired intermittently during 2008. We recognized revenue for all three divisions for the entire year of 2009 versus having recognized revenue for these divisions for only a portion of 2008. However, the revenue of all of our acquired innovation consulting companies suffered significantly throughout 2009 due to the adverse economic conditions. During economic cycles in which companies are experiencing financial difficulties or uncertainty, companies generally cancel or delay spending on consulting type services.