Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SCHLUMBERGER LIMITED/NV | d8k.htm |

Exhibit 99.1

Ladies and gentlemen good morning—it’s a pleasure once again to be back in New Orleans and I’d like to thank Paul Pursley and Bill Sanchez for their kind invitation.

1

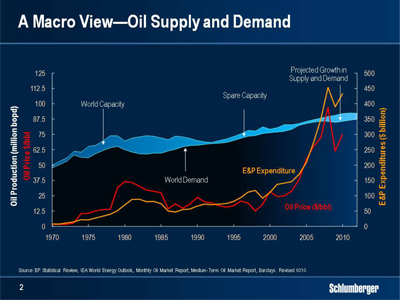

For five of the last six years I have stood here and explained that the issue with oil and gas supply and demand was supply. Last year, after the initial shock of the recession and the subsequent fall in economic activity, I explained that the issue was demand. This year the issue is both demand and supply as a nascent recovery in oil demand—coupled with OPEC discipline—has led to stronger prices and a growing fear that increased demand and lower investment will lead to even higher prices in the near future. Indeed, many people have described 2010 as a transition year for energy.

2

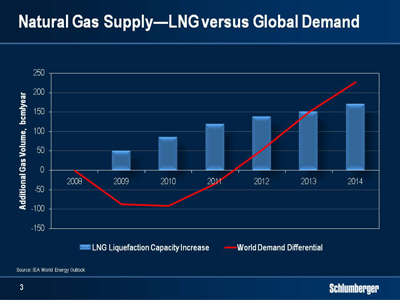

For natural gas, the picture is very different with short-term supply growing dramatically through a rapid increase in LNG capacity and the remarkable phenomenon of unconventional gas production.

In the oil and gas industry, however, a seminal change occurs periodically in the dynamics of supply. Examples include Spindletop, the opening of the Middle East, and the recovery of production in Russia with such shifts normally being followed by a period of low prices as the market adjusts to an excess of supply.

In the case of unconventional gas, this is only partially likely to be the case. The costs of extraction and the rapid initial decline rates—particularly for shale gas—mean that higher levels of activity are necessary to maintain production. In addition, demand for natural gas is forecast to increase rapidly with the IEA predicting growth of 1.5% per year over the period from 2007 to 2030.

It is astonishing that so recent a phenomenon as shale gas has changed the perceived supply-demand balance so rapidly. The US now talks of a considerable reduction in its natural gas imports. Europe suddenly seems to have multiple choices for sources of supply. While the gas industry may have some short-term issues related to current supply and demand, which are likely to be corrected by 2013 for reasons I have explained, there is no doubt that the longer-term future is extremely bright. After all, natural gas is the cleanest burning fossil fuel with the lowest carbon dioxide intensity of the fossil fuels.

To summarize our macro-economic industry outlook absent a double-dip recession, a combination of renewed demand, production decline rates, and project cancellations and delays are likely to keep oil prices robust. At the same time, the current short-term weakness in gas prices should rapidly correct from increased demand and higher decline rates.

3

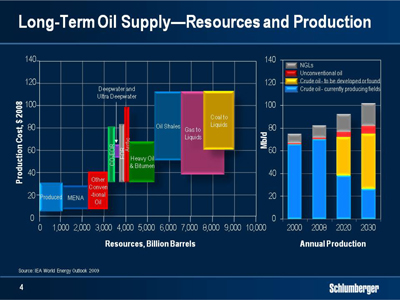

I would now like to offer a few remarks on the relative cost of the future sources of hydrocarbon supply in order to provide a framework for our strategy.

In addition to the replacement of production from existing fields with that from new areas, we will be challenged by more difficult types of hydrocarbon. The world however is not short of either oil or gas and I remain sceptical of any theory predicting that we will be unable to increase the amount of oil and gas we recover within a decade or two.

But while we have ample resources, we still face the task of transforming them into reserves, and it is here that the true role of technology lies. At $70-80 per barrel, most oil resources, except ultra deepwater, oil shales, some arctic areas, and various liquid conversions, remain economic to develop although huge unknowns lie in the effects that technology can have on both reserves and recovery. Costs will certainly be much higher as the diverse challenges of remoteness, deeper waters, heavier oils and many others will intensify.

In this environment, our customers will increasingly seek to mitigate risks that include the economics of ultimate recovery as well as those of project execution.

4

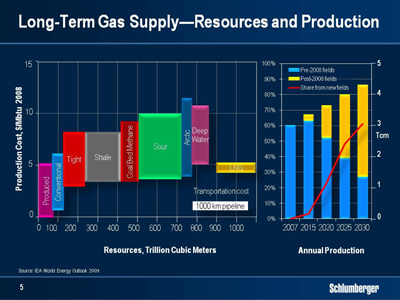

Natural gas resources show similar trends in the long term but with two significant factors. First the IEA predicts that more than 60 % of the production in 2030 will come from new fields placed on production since 2008 and second, the vast majority of the world’s natural gas resources are considered unconventional—trapped in low-permeability reservoirs, shales, and coalbed methane formations. Lower production costs and more efficient finding and development methods will undoubtedly come through technology, which will also eventually lower the waste that current methods engender. Although unconventional gas represents only 10% of total production today, that proportion will increase as consumption accelerates and conventional reservoirs deplete. Not only will we be producing more from unconventional reservoirs, we will also be producing more diverse types of gas including wet gas, sour gas and carbon dioxide—all of which further complicate the challenge.

5

Yet while technology is the answer, technology development demands long-term commitment and many steps are required. Research and development, adaptation of solutions from other industries, protection of intellectual property, and commercial timing all combine to make this a long and complex process.

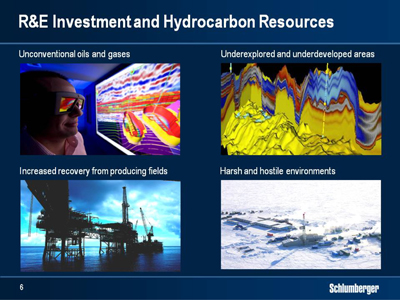

For both oil and gas, there are really three broad directions for the future.

First is the need for technology to help recover unconventional oils and gases. Here, we need new technologies and processes for better extraction, lower cost and smaller carbon footprint.

Second is the recovery of conventional hydrocarbons from the remaining under-explored and undeveloped areas. These include deepwater, the arctic and certain parts of the Eastern Hemisphere. They also include deeply buried reservoirs

Third are the increased recoveries from fields already in production. It is here that new technology is likely to make the biggest difference in the short to medium term.

In all of these directions the need to maximize hydrocarbon recovery is paramount. All require close cooperation and collaboration between technology provider and technology user. And many will develop in increasingly harsh and hostile environments.

6

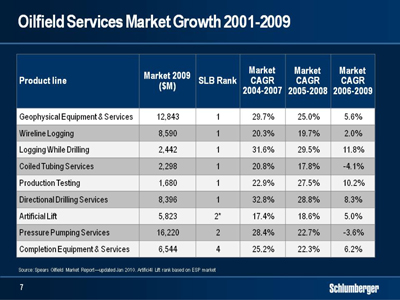

At Schlumberger we have always considered technology to be the basis of our competitive advantage. Across the oilfield markets in which we work, we always strive to hold a leadership position. But what is remarkable, is that with the exception of wireline logging and logging-while-drilling, our Technologies are the result of acquisitions to which we have added our skills and international footprint.

Over my career, I have seen our directional drilling operations develop from a loss-making acquisition with revenues of less than $100 million to a multi-billion dollar business offering strong technology leadership. In petrotechnical software we have grown the “Windows” of the oil and gas industry, starting from the purchase of a small company building exploration workstations and adding further acquisitions to internal development. Our seismic business has grown from a 50% share in a struggling Norwegian contractor into a leader in both size and technology. Indeed, when we purchased the minority share of WesternGeco from Baker Hughes in 2006, our key objective was to integrate seismic with other Schlumberger disciplines. After three years we are making good progress which we look forward to showing you later this year

I have selected just three examples, but I could equally have selected others. They show that we have a clear track record of producing industry leaders through a combination of acquisitions, technology development and geographical footprint.

7

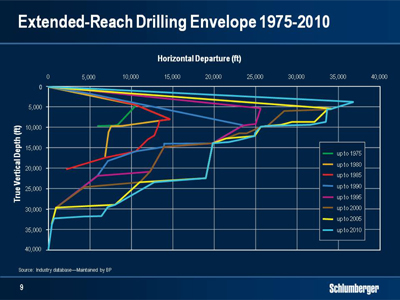

The three broad directions I mentioned earlier—unconventional hydrocarbons, more difficult or more remote reserves, and additional reserves recovery from producing fields—will all require higher or more complex levels of drilling. This complexity includes the continuing trend from vertical to deviated to horizontal and extended-reach profiles as, broadly speaking, these provide more efficient and more cost-effective methods of recovering oil and gas.

8

Horizontal or highly deviated wells will also be more complex, and will be drilled in more hostile environments. Such wells are generally driven by one of two motives. The first, and by far the most important, is to put more reservoir volume in contact with the wellbore. This applies to shale gas just as it applies to the maximum and extreme reservoir contact wells in Saudi Arabia. The second—deviated and horizontal drilling—has allowed operators to massively reduce cost and environmental footprint. Pad drilling on land is one example of this. Single structures offshore are another—supporting production from multiple deviated and horizontal wells to dramatically reduce the cost of infrastructure while increasing access to remote pockets of oil located far from the original reservoir. The same techniques have also allowed operators to access reserves in the near offshore without having to build offshore infrastructure.

Over time, the distances accessed through extended-reach drilling have increased significantly as technology developed and operator confidence increased. In addition, geosteering techniques, and in particular technologies such as Periscope deep-reading imaging-while-drilling services have dramatically increased the value of such wells in terms of well productivity and recoverable reserves by being able to steer the well within the reservoir.

However, I must point out that while successful wells are great commercial successes, the cost of failure increases with well complexity. In addition, as the elements of the downhole drilling package are developed in isolation, they are not optimized for the performance of the system as a whole—often acting against each other and often not designed to interact or operate together.

The evolution of horizontal drilling is a story of technologies successively leapfrogging each other. First came geometrical steering—without the means to tell us in real time where we were. Then, we added while-drilling measurements to tell us where we were going, but as these improved we became constrained by limited directional control. The advent of rotary steerable

9

systems brought better directional control and faster drilling rates, but once again we have reached a point where measurement technology is beginning to overtake directional technology. The system now needs optimizing as a whole to extract maximum benefit from both measurement and directional capability.

As the industry begins to drill longer horizontal sections and more deviated well profiles, the problem of transmitting mechanical energy to the drillbit becomes more and more difficult. Motors and drilling fluids become critical parts of the system—both to be able to drill and to condition the wellbore. Optimized measurement accuracy and directional control will have to be increasingly coordinated with other mechanical elements of the drilling system—particularly as measurement sensors become increasingly integrated with the mechanical elements of the drill string.

All this leads me to Smith. Firstly, let me say I am extremely pleased we have been able to make this deal and I look forward to welcoming the Smith employees to Schlumberger. I have no doubt they will provide us with a new growth engine for the company, and that the combination of our different and complementary skills will offer customers dramatically improved drilling performance at lower cost through increased reliability and enhanced technology.

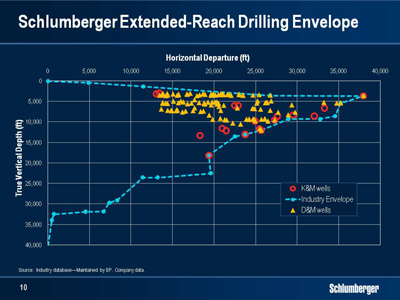

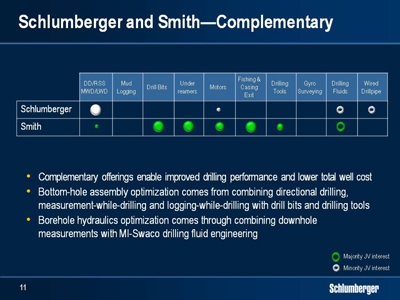

The complementary nature of Smith’s portfolio of drill bits, drilling tools, motors, drilling fluids and solids control systems with our own leading position in directional drilling, logging-while-drilling and geosteering technologies led us to the conclusion that a combination of the two companies will allow us to lead the market in the development of the drilling systems of tomorrow.

There are, of course other parts of Smith’s businesses that interest us. Pathfinder directional drilling, measurement-while-drilling and logging-while-drilling services are complementary to

10

Schlumberger Drilling and Measurements businesses as they address different customer needs. Pathfinder will remain as a separate entity within Drilling and Measurements providing services primarily focused on US land and Gulf of Mexico shelf operations. Similarly the high-temperature capabilities of Pathfinder services will add value for customers with Schlumberger marketing strength helping accelerate service availability.

The addition of Smith’s fishing and casing exiting services to the Schlumberger portfolio will enable marketing of a more complete offering for the drilling of re-entry wells. This will include Schlumberger slim and ultra-slim drilling systems as well as multi-lateral reservoir drainage technologies.

In summary, this transaction offers the prospect of a comprehensive drilling services group that will manage the development of next-generation performance drilling systems. Each element of the drillstring will inter-operate optimally, and be better adapted to varying downhole environmental challenges while improving the design and control of drilling fluid mechanics and rheology. It is important to note that Schlumberger has maintained engineering efforts in this area despite the fact that we did not own a drillbit and drilling tool operation. We therefore believe that it will not be long before we introduce new and differentiated services and products. We also believe that our customers will see these as key technology requirements—particularly in light of the increased focus on more complex formations and more challenging drilling environments.

Smith will also complement the current Schlumberger Completions portfolio with liner hanger products, certain packers and other completion elements the addition of which, as I have frequently mentioned, has been a long standing objective of ours. This will enable us to meet requests from customers who want broader completions solutions while accelerating our organic growth strategy.

Last but not least this merger will optimize interaction between MI-Swaco and the Schlumberger drilling Technologies. We expect to see improved integration of fluid engineering and real-time hydraulic control, new solutions for wellbore stability, better lost circulation management, and increased system reliability through reduced blockage, abrasive damage and chemical reaction.

11

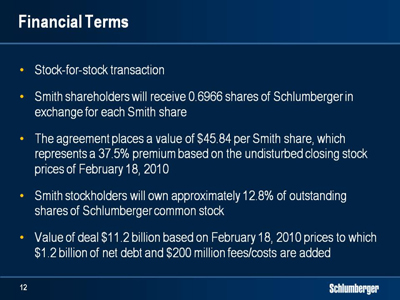

Our agreement with Smith is an all-share deal structured as a tax-free exchange of shares. For each share, Smith shareholders will receive 0.6966 shares of Schlumberger Limited. Upon closing, and reflecting the issue of approximately 170 million new Schlumberger shares, Smith shareholders will collectively own approximately 12.8% of the Schlumberger’s outstanding shares. The value of the transaction is $12.4 billion based on the closing stock price on February 19th, 2010 and this includes net debt of $1.2 billion.

I would like to comment briefly on the synergies we have referred to publicly. With the transaction expected to close in late 2010, 2011 is the first year in which we expect to extract meaningful benefits. We estimate pre-tax synergies to be $160 million in 2011 and $320 million in 2012. These numbers are net of integration costs and are mostly made up of cost as opposed to revenue synergies. The revenue synergies from the transaction are, however, significant and are expected to grow over the first few years following the transaction. As a result of these synergies, and based on consensus estimates for both companies, we expect the transaction to be accretive on an earnings-per-share basis in 2012. We will, of course aim to do better but that will depend on the speed at which we can realize some of the revenue synergies.

That is all I intend to say about these transactions and I would like to spend the remainder of my time talking about the prospects for 2010 before concluding with some remarks on the future of Schlumberger.

As I mentioned earlier, we see increasing signs that oil prices are stabilizing in a higher range. We have always said that a price above $75 would encourage our customers to spend more and we are therefore increasingly confident that activity for oil will remain robust throughout the year. We see the following effects on Schlumberger in 2010.

12

Despite further increases in capacity, the marine seismic market will remain in balance with activity increases absorbing capacity but not being sufficient to create significant pricing momentum. Land seismic will have a better year, driven principally by the Middle East and North Africa, and by the introduction of the second generation Q land system UniQ, which is already working in Kuwait and has fielded in excess of 80,000 live channels and this creates huge efficiencies in a variety of surveying modes. We also expect data processing and multiclient to improve. Several new large multiclient projects in the US Gulf of Mexico have received encouraging levels of pre-funding, and new processing techniques have radically improved turn-around times.

13

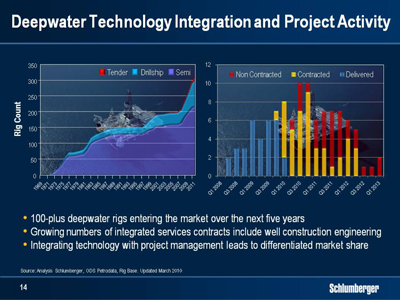

Within oilfield services, the biggest source of optimism will be increased deepwater activity. The strength of our deepwater technology portfolio is increasingly leading to differentiated market share within the 100-plus new deepwater rigs entering service over the next five years. 23 new rigs entered service in 2009—16 of which began drilling. 34 rigs are scheduled to enter service in 2010, 26 of which are expected to begin drilling before the end of the year. Overall, I am extremely satisfied with our contract win rate, which confirms our market position in this part of the business.

The success of our technology portfolio is also leading to new IPM contracts best illustrated by the award by OGX—the largest private E&P company in Brazil by offshore exploratory acreage—for an integrated services contract on an initial four semisubmersible rigs but which has now grown to five. The contract covers well construction engineering, project coordination, geomechanical modeling, logging, directional drilling, logging-while-drilling, and cementing, completion, well testing and artificial lift services. Other similar projects include integrated service contracts for ONGC in India, and StatoilHydro in Egypt.

We expect a stronger year in Russia. Last year Russian production was sustained largely through the ramp-up of Rosneft’s Vankor field as well as other field redevelopment. To sustain current production levels in excess of 10 million barrels a day, we believe higher levels of activity will be needed in Western Siberia and our current contracting activity would indicate that this will happen. In addition, continued increases in both Eastern Siberia and Sakhalin are expected. IPM activity will be strong both on land and offshore. Overall, we expect double-digit growth in Russia in 2010.

14

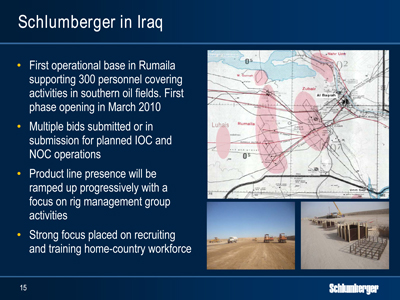

In Iraq, we are currently completing a new operating base in the south which will initially be able to securely house 300 people. This number is expected to double by early 2011. We have committed considerable capex to Iraq in 2010, including rigs, where we have not found a suitable partner to accompany us. We are currently bidding to 10 customers—both IOCs and NOCs—and we expect to commence wellsite operations before the end of the year and in the first phase of activity, we expect IPM well construction and integrated service packages to be the primary business model. Competition will be fierce, start up costs high, and we do not expect significant revenue before 2011. The significance of Iraq will only really emerge once the post-election political landscape is understood and some form of oil law has been passed.

15

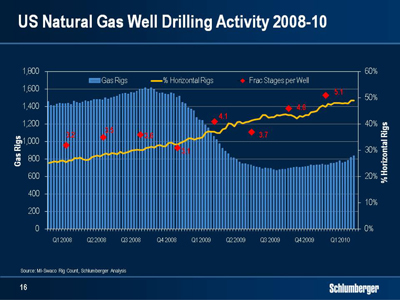

While we are encouraged by the resilience of the North American natural gas drilling rig count, and recognize that severe winter weather has reduced gas storage to a level that seemed difficult to achieve four months ago, we remain cautious on the future direction. The huge amount of new LNG capacity worldwide, the slow recovery in industrial demand and the unknowns around the true decline rates of shale gas are all factors that we feel will cap rig count growth at some point soon.

We note, however, that the current levels of activity, coupled with the severe wear and tear that the large shale gas fracturing treatments place on equipment has created some pricing momentum in pressure pumping. While this momentum will improve margins, it will not bring us back to satisfactory returns in North America. We are currently undergoing a complete review of our well services land operation organization and management. While this will inevitably lead to some one-time costs in 2010, it should also lead us to much improved performance in future years. In other technologies, we are seeing pricing momentum for directional drilling services as increasing horizontal rig count and longer horizontal sections are leading to some equipment shortages and more advanced technology usage.

16

In Mexico, IPM remains a vibrant business with an evolving portfolio of projects. But IPM is also growing elsewhere, and in 2009 we saw our project portfolio develop in other areas. Notable successes were scored in the increasing involvement of IPM in deepwater contracts but perhaps the most encouraging move was the development of the North Kuwait Jurassic gas field mentioned in our Annual Report.

This project is the first full-field IPM development project to grow completely from in-house Schlumberger reservoir expertise. It is truly a joint effort between Schlumberger and KOC, managed by a diverse group of 50 multi-disciplinary experts from both companies using the latest technology. It has grown from a sub-surface study to a full-field plan that has now begun execution. It will represent a very large service revenue stream for Schlumberger as well as representing a milestone in our ambition to move IPM away from pure well construction and more into field development and production management. The success achieved so far has not gone unnoticed, and has led to further awards of studies that could lead to similar projects in the Middle East and elsewhere.

The overall trends in IPM are therefore extremely positive. Despite a substantial drop in revenue in Mexico, growth will still be close to double digit, which means all other parts of the world are forecast to grow at high double-digit rates. This growth is less dependent on simple land well construction than in the past as we are seeing an increasing volume of integrated service contracts offshore that also include project management, and we are seeing a growing trend towards more field development and production projects. I am also pleased to see IPM rebalance its portfolio in such a way as it becomes less dependent on any one area with the strongest growth in 2010 likely to come from Brazil, Russia, North Africa and the Middle East.

17

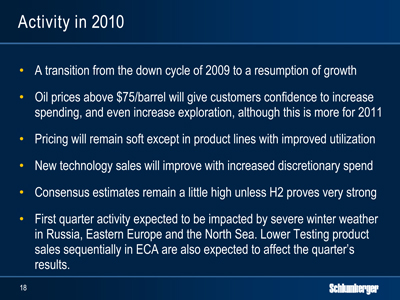

In summary, 2010 will be a year of transition from the sharp down cycle of 2009 to a slow resumption of growth driven by the factors I have just described. Oil prices above $75 will give customers confidence to increase spending, and even increase exploration budgets, though we see this more as a 2011 effect. Pricing will remain soft with recovery only occurring in certain product lines where improved utilization will drive it higher. It will be a better year for technology sales as we move into an environment where our customers loosen discretionary spending somewhat. We do feel however that street consensus estimates for the full year remain a little on the high side and would require a very strong second half year to achieve.

Looking now at the first quarter, severe winter weather in Russia, Eastern Europe and the North Sea has meaningfully impacted activity. Coupled with lower Testing product sales, and some administrative contract approval delays in North Africa, this means that sequential comparisons will be difficult for the ECA area. We should also not forget the quarterly swings in seismic, particularly following the strong multiclient library sales of the fourth quarter.

18

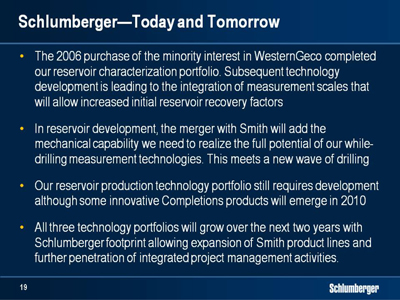

Ladies and Gentlemen, I would like to end with a short summary of where I see Schlumberger today and how I see the future. When we purchased the minority share of WesternGeco from Baker Hughes, we completed the technology portfolio we needed to become a clear leader in reservoir characterization. Seismic is the basic tool from which the reservoir model is built, and as technology moves forward we are breaking new ground in our ability to integrate the measurement scales between seismic, logging and logging-while-drilling measurements. We are already starting to commercialize products that demonstrate this. The significance of this is that it is these types of advances that will allow our customers to increase initial recovery factors from new and redeveloped fields. I therefore consider that apart from some niche technologies, our reservoir characterization portfolio is complete.

In reservoir development, while we are in a leading position in the directional drilling and logging-while-drilling businesses, we were lacking the mechanical capability to realize the full potential that our measurement technology can offer. We were also reaching the limits of drillstring reliability through not being able to engineer it as a system. The merger with Smith will give us the ability to satisfy both of those requirements. I am pleased that we have been able to do this in advance of a new wave of drilling that will be necessary to sustain the world’s oil and gas production. I consider that this portfolio is also largely complete.

Our reservoir production portfolio still needs work. We have made strong advances in completions, particularly in deepwater, but we still need to extend our product range. The Smith acquisition will bring us some complementary products but much remains to do. That said, we do expect to see some extremely innovative completions product introductions in 2010.

In the next two years you will see considerable advances from the three technology groups of Schlumberger. Our geographical spread will allow us to expand the Smith product lines at low levels of support cost and our GeoMarket organization in hand with IPM will allow new

19

opportunities to be identified. I am confident that the synergies we will obtain through the merger with Smith, in both cost and revenue, will allow us to maintain our traditional high levels of profitability and return on capital.

In order to maintain focus during the integration, I have split the responsibility for the management of the company. Our new Chief Operating Officer Paal Kibsgaard, who you will meet at future investor events, will focus on the day-to-day running of the company while I will concentrate on the Schlumberger technology portfolio and completing the acquisition and integration of Smith.

Ladies and Gentlemen, thank you for your attention.

20

21