Attached files

| file | filename |

|---|---|

| 8-K - LINCOLN NATIONAL CORPORATION FORM 8-K - LINCOLN NATIONAL CORP | lincoln8k.htm |

Exhibit 99.1

©2010 Lincoln National Corporation

March 22, 2010

Fred Crawford

Chief Financial Officer

Lincoln Financial Group

J.P. Morgan

2010 Insurance Conference

2010 Insurance Conference

2

This presentation and certain oral statements made on LNC’s behalf may contain information that includes

or is a “forward-looking statement” within the meaning of the Private Securities Litigation Reform Act of

1995 (“PSLRA”). A forward-looking statement is a statement that does not strictly relate to a historical fact.

A forward look statement includes any statement that may predict, forecast, indicate or imply future results,

performance or achievements, and may contain words like: “believe”, “anticipate”, “expect”, “estimate”,

“project”, “will”, “shall” and other words or phrases with similar meaning. LNC claims the protection afforded

by the safe harbor for forward-looking statements provided by the PSLRA.

or is a “forward-looking statement” within the meaning of the Private Securities Litigation Reform Act of

1995 (“PSLRA”). A forward-looking statement is a statement that does not strictly relate to a historical fact.

A forward look statement includes any statement that may predict, forecast, indicate or imply future results,

performance or achievements, and may contain words like: “believe”, “anticipate”, “expect”, “estimate”,

“project”, “will”, “shall” and other words or phrases with similar meaning. LNC claims the protection afforded

by the safe harbor for forward-looking statements provided by the PSLRA.

Forward-looking statements involve risks and uncertainties that may cause actual results to differ

materially from the results contained in the forward-looking statements, legislative and regulatory changes

and proceedings, changes in interest rates, sudden or prolonged declines in the equity markets, continued

economic decline and credit-related illiquidity, deviation in actual experience regarding future persistency,

mortality, morbidity, interest rates or equity market returns from Lincoln’s assumptions used in pricing its

products, in establishing related insurance reserves, and in the amortization of intangibles that may result

in an increase in reserves and a decrease in net income; and changes in general economic or business

conditions. These risks and uncertainties, as well others, are described in LNC’s 2008 Form 10-K, 2009

Forms 8-K, and other documents filed with the Securities and Exchange Commission. Moreover, LNC

operates in a rapidly changing and competitive environment. New risk factors emerge from time to time

and it is not possible for management to predict all such risk factors.

materially from the results contained in the forward-looking statements, legislative and regulatory changes

and proceedings, changes in interest rates, sudden or prolonged declines in the equity markets, continued

economic decline and credit-related illiquidity, deviation in actual experience regarding future persistency,

mortality, morbidity, interest rates or equity market returns from Lincoln’s assumptions used in pricing its

products, in establishing related insurance reserves, and in the amortization of intangibles that may result

in an increase in reserves and a decrease in net income; and changes in general economic or business

conditions. These risks and uncertainties, as well others, are described in LNC’s 2008 Form 10-K, 2009

Forms 8-K, and other documents filed with the Securities and Exchange Commission. Moreover, LNC

operates in a rapidly changing and competitive environment. New risk factors emerge from time to time

and it is not possible for management to predict all such risk factors.

Further, it is not possible to assess the impact of all risk factors on LNC’s business or the extent to which

any factor, or combination of factors, may cause actual results to differ materially from those contained in

any forward-looking statements. Given these risks and uncertainties, investors should not place undo

reliance on forward-looking statements as a prediction of actual results. In addition, LNC disclaims any

obligation to update any forward-looking statements to reflect events or circumstances that occur after the

date of this presentation.

any factor, or combination of factors, may cause actual results to differ materially from those contained in

any forward-looking statements. Given these risks and uncertainties, investors should not place undo

reliance on forward-looking statements as a prediction of actual results. In addition, LNC disclaims any

obligation to update any forward-looking statements to reflect events or circumstances that occur after the

date of this presentation.

Safe Harbor

3

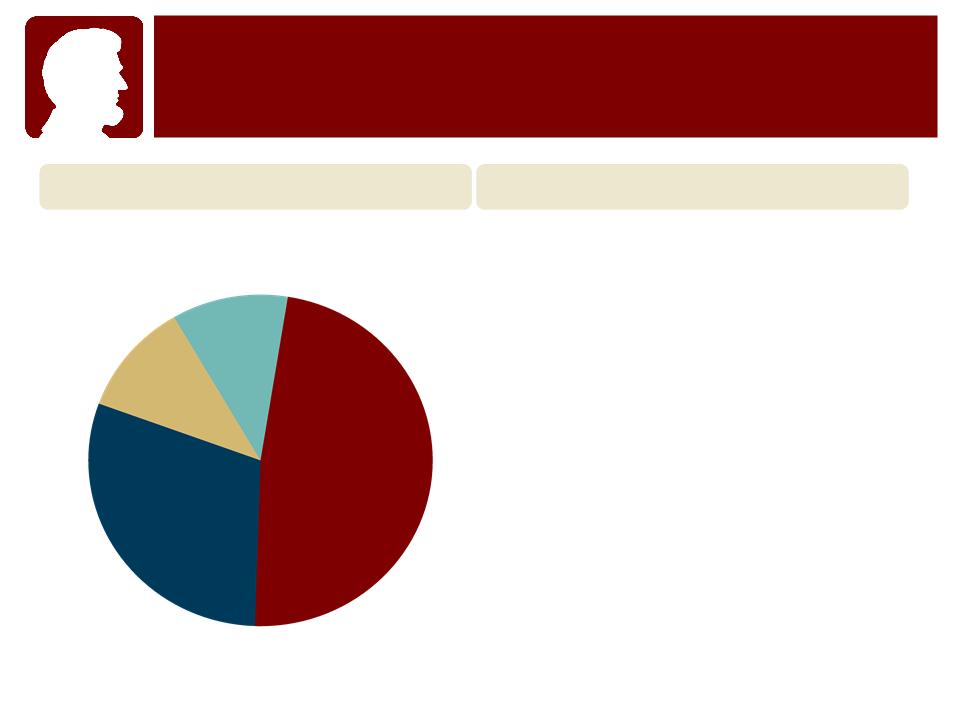

• Defined Contribution

– Invest in technology and service

platforms

platforms

• Group Protection

– Expand voluntary sales efforts

and develop products for new

distribution channels

and develop products for new

distribution channels

• Individual Annuities

– Continue to develop fixed and

indexed solutions

indexed solutions

– Maintain category leadership in

variable annuities

variable annuities

• Individual Life Insurance

– Maintain category leadership

Earnings1

2010 Focus

Life

Insurance

Insurance

48%

Individual

Annuities

30%

Defined

Contribution

11%

Group

Protection

11%

1 Based on LFG after-tax FY 2009 income from operations, excluding Other Operations.

Clearly Focused on Four Core Insurance

and Retirement Businesses

and Retirement Businesses

4

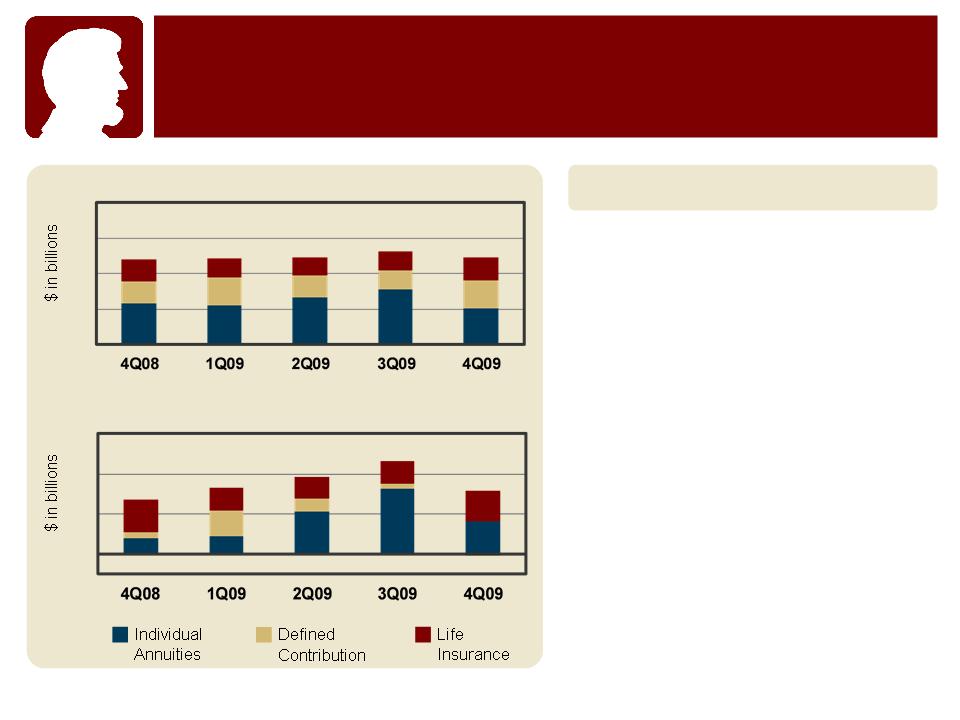

4.8

4.8

4.8

1.4

1.6

1.8

Consolidated Retirement & Insurance Deposits

Consolidated Retirement & Insurance Net Flows

5.3

4.9

2.3

1.5

$3

$2

$1

-$.5

$8

$6

$4

$2

$0

Solid Business Model

• Market share gains in major

lines of business

lines of business

• Updated flagship products

• 22% increase in wholesaler

productivity in 2009

productivity in 2009

• 26 new or expanded distribution

relationships during 2009

relationships during 2009

• 300 net new planners at Lincoln

Financial Network with over

7,700 nationwide

Financial Network with over

7,700 nationwide

• Added to employee base with

key hires

key hires

Market Leading Franchise Intact

Solid Deposits, Positive Net Flows

Solid Deposits, Positive Net Flows

5

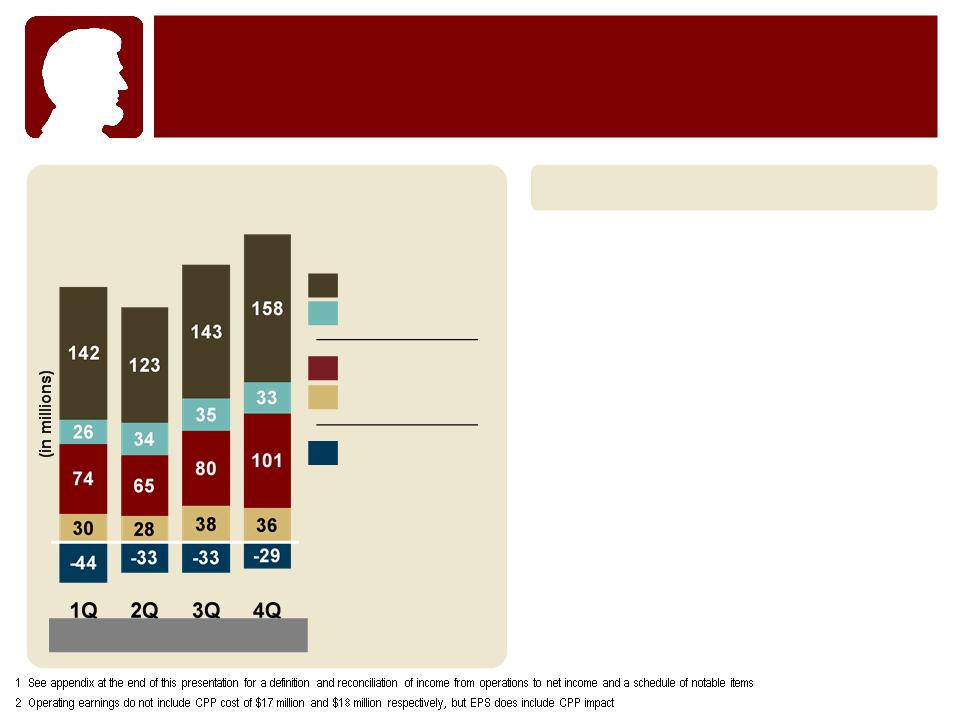

• Insurance Solutions:

– Stable growth rates

– Capital solution impact in 2010

– Strong group fundamentals

• Retirement Solutions:

– Account values benefit from net

flows and markets

flows and markets

– DAC and death benefit claims

expenses remain elevated

expenses remain elevated

– DC margins pressured

• Strong alternative investment

income in 4Q

income in 4Q

• Investing in model will impact

expenses in 2010

expenses in 2010

$228

$2632

Life Insurance

Group Protection

Annuities

Defined Contribution

Other Operations

Avg. diluted shares

257.8 262.4 310.0 311.6

2009 Income From Operations Adjusted for

Notable Items1

Notable Items1

Earnings Drivers Improving

$217

$2992

Fourth Quarter Results

Sequential Growth in Account Values and Earnings

Sequential Growth in Account Values and Earnings

6

Life 37%

Dental 9%

Disability 44%

Group Net Earned Premium $1.6b

Medical 10%

UL 41%

VUL 14%

UL SG 24%

MG 8%

Whole Life 10%

Term 3%

Life Segment 10%

• Stable returns with building

in-force and account vales

in-force and account vales

• Reinsurance and XXX transactions

impact on 2010 segment earnings

impact on 2010 segment earnings

• Alternative investment income

expected to recover

expected to recover

• Valuation conversion and

methodology review

methodology review

Group Segment 16%

• Overall fundamentals driving strong

returns

returns

• Favorable loss ratios below 70%

• Sales growth expected to drive

premium growth

premium growth

1 Reflects 2009 reported un-leveraged returns excluding goodwill.

Note: Life Insurance GAAP reserves as of December 31, 2009. Group Protection net earned premium represents FY 2009.

Return on Capital1

Life GAAP Reserves $43b

Insurance and Protection Businesses

Outlook: Stable and Building Returns

Outlook: Stable and Building Returns

7

Retirement AUM = $110 billion

DC Mutual

Funds 9%

DC Fixed

Annuities 11%

DC Variable

Annuities1 12%

Annuities1 12%

Individual Fixed

Annuities 14%

Individual

Variable

Variable

Annuities 50%

Fixed Portion of

Individual Variable

Annuities 4%

Individual Variable

Annuities 4%

Individual Annuities 15%

• Average account values recovering

• Positive flows expected to continue as

productivity improves

productivity improves

• Death benefit reserve and DAC

amortization elevated

amortization elevated

Defined Contribution 13%

• Average account values recovering

• Margins under pressure as higher

yielding investments mature

yielding investments mature

• Flows expected to be positive but

more variable

more variable

• Plans to invest in the platform

1 Excludes fixed portion of VA

2 Reflects 2009 reported un-leveraged returns excluding goodwill.

Return on Capital1

Retirement Returns

Diverse Portfolio Driving Balanced Returns

Diverse Portfolio Driving Balanced Returns

8

Individual VA Living Benefits

56%

Account Value

Step Up <1%

36%

Individual VA AUM1 = $59 billion

Hi-Water

Mark

8%

Return of

Premium

Individual VA Death Benefits

LB NAR3 $6.5b $2.6b

DB NAR3 $14.8b $6.0b

Hedge Target $3.7b $0.7b

Hedge Assets $4.3b $1.0b

GAAP Reserves $3.2b $0.8b

Statutory Reserves2 $1.1b $0.9b

12/31/08 12/31/09

16%

44%

40%

No

Guarantee

Guaranteed

Income

Benefit

Income

Benefit

Guaranteed

Withdrawal

Benefit

Withdrawal

Benefit

Reserve Metrics

1 Includes fixed portion of VA

2 Statutory reserves in 2009 include the adoption of VACARVM

3 Net amount at risk is calculated as the guaranteed amount minus account value, floored at zero

Individual Variable Annuities

Proven Risk Management and Full Economic Hedge

Proven Risk Management and Full Economic Hedge

9

Note: All data shown for available-for-sale securities. All realized loss data presented on a pre-DAC and tax basis; excludes losses on derivatives;

includes losses on sold securities. 2009 reflects the adoption of FASB Staff Position No. FAS 115-2 and 124-2.

* Excludes the impairment on Bank of America common stock securities of $131 million, pre-tax, held at the holding company.

246

236

174

212

Portfolio Allocation

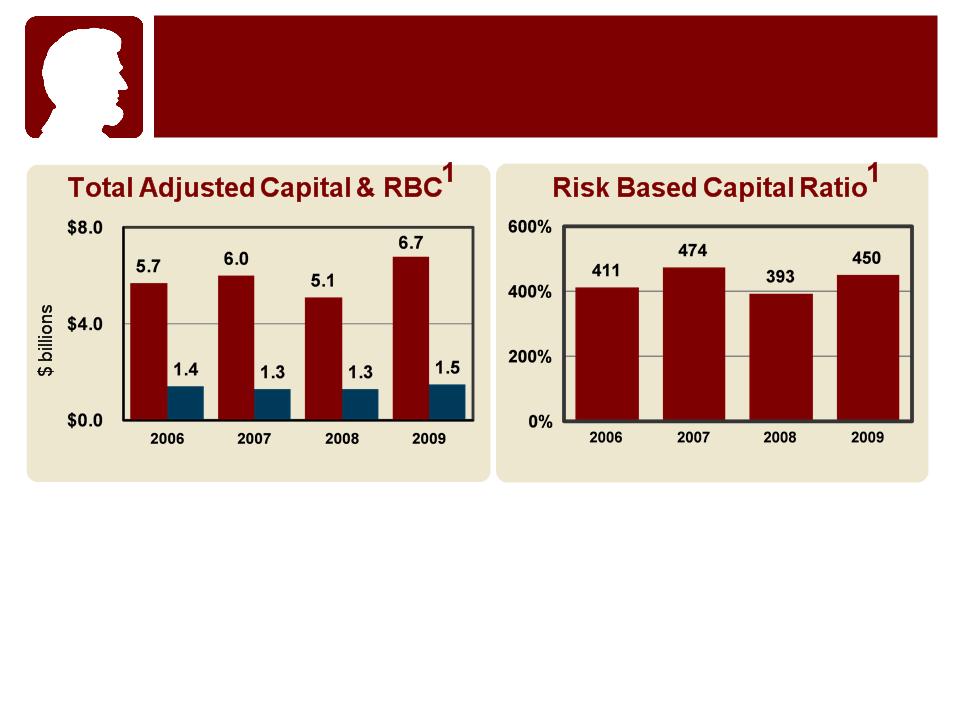

• Year-end activities - closed on long-term life capital solution, adopted VACARVM

and new NAIC RMBS treatment

and new NAIC RMBS treatment

• RBC at 450% - positioned to absorb economic weakness, support new business

growth rates, and allows patience in seeking life capital solutions

growth rates, and allows patience in seeking life capital solutions

1 Represents statutory results of Lincoln National Life Insurance Company, Lincoln Life & Annuity of New York, and First-Penn Pacific Life Insurance Company; The reporting of RBC measures is

not intended for the purpose of ranking any insurance company or for use in connection with any marketing, advertising or promotional activities.

not intended for the purpose of ranking any insurance company or for use in connection with any marketing, advertising or promotional activities.

10

Insurance Company Capitalization

Capital Positioned to Withstand Stressed Markets

Capital Positioned to Withstand Stressed Markets

11

Capital & Liquidity Strategy:

• Target $300-500 million

of liquid investments at the

holding company

of liquid investments at the

holding company

• Targeting long-term leverage

ratio in the 20%-25% range

ratio in the 20%-25% range

• Life capital solutions - blended

approach to funding with shorter-

term bank facility, long-term

funded solutions, and excess

capital

approach to funding with shorter-

term bank facility, long-term

funded solutions, and excess

capital

*As of December 31, 2009 and net of $250 million of debt maturing in March 2010

Financial Flexibility

Excess Holding Company Liquidity and Ready Capital

Excess Holding Company Liquidity and Ready Capital

• $1b of liquid investments

with $100mm of commercial

paper issued*

with $100mm of commercial

paper issued*

• Closed Delaware sale on

January 4th for $410mm

in proceeds

January 4th for $410mm

in proceeds

• $250 million injected into

captive reinsurance

subsidiary at YE 2009

captive reinsurance

subsidiary at YE 2009

• November debt offering

pre-funded $250mm

maturity in 2010

pre-funded $250mm

maturity in 2010

12

“We expect to repay CPP funds in the second half of 2010 or

first half of 2011 or as market conditions dictate and without

diluting operating earnings per share. “

first half of 2011 or as market conditions dictate and without

diluting operating earnings per share. “

Considerations:

– Regulatory and rating agency dialog around stress testing capital

influences final funding mix

influences final funding mix

The CPP Exit Question

“…as market conditions dictate”:

– Pace of economic recovery and impact on capital conditions

– The health of the markets and overall cost of capital

Questions

Appendix

15

Definition of Income (Loss) from Operations: Income (loss) from operations as used in this document is a non-GAAP financial measure

and is not a substitute for net income (loss) calculated using GAAP measures. Income (loss) from operations is the primary financial

measure we use to evaluate and assess our results. Our management and Board of Directors believe that this performance measure

explains the results of our ongoing businesses in a manner that allows for a better understanding of the underlying trends in our

current business because the excluded items are unpredictable and not necessarily indicative of current operating fundamentals or

future performance of the business segments, and, in most instances, decisions regarding these items do not necessarily relate to the

operations of the individual segments. We exclude the after-tax effects of the following items from GAAP net income (loss) to arrive at

income (loss) from operations: realized gains and losses associated with the following ("excluded realized gain (loss)"): sale or

disposal of securities; impairments of securities; change in the fair value of embedded derivatives within certain reinsurance

arrangements and the change in the fair value of our trading securities; change in the fair value of the derivatives we own to hedge our

guaranteed death benefit ("GDB") riders within our variable annuities, which is referred to as "GDB derivatives results"; change in the

fair value of the embedded derivatives of our guaranteed living benefit (“GLB”) riders within our variable annuities accounted for under

the Derivatives and Hedging and the Fair Value Measurements and Disclosures Topics of the FASB ASC (“embedded derivative

reserves”), net of the change in the fair value of the derivatives we own to hedge the changes in the embedded derivative reserves, the

net of which is referred to as “GLB net derivative results”; and changes in the fair value of the embedded derivative liabilities related to

index call options we may purchase in the future to hedge contract holder index allocations applicable to future reset periods for our

indexed annuity products accounted for under the Derivatives and Hedging and the Fair Value Measurements and Disclosures Topics

of the FASB ASC (“indexed annuity forward-starting option”); change in reserves accounted for under the Financial Services -

Insurance - Claim Costs and Liabilities for Future Policy Benefits Subtopic of the FASB ASC resulting from benefit ratio unlocking on

our GDB and GLB riders ("benefit ratio unlocking"); income (loss) from the initial adoption of new accounting standards; income (loss)

from reserve changes (net of related amortization) on business sold through reinsurance; gain (loss) on early extinguishment of debt;

losses from the impairment of intangible assets; and income (loss) from discontinued operations.

and is not a substitute for net income (loss) calculated using GAAP measures. Income (loss) from operations is the primary financial

measure we use to evaluate and assess our results. Our management and Board of Directors believe that this performance measure

explains the results of our ongoing businesses in a manner that allows for a better understanding of the underlying trends in our

current business because the excluded items are unpredictable and not necessarily indicative of current operating fundamentals or

future performance of the business segments, and, in most instances, decisions regarding these items do not necessarily relate to the

operations of the individual segments. We exclude the after-tax effects of the following items from GAAP net income (loss) to arrive at

income (loss) from operations: realized gains and losses associated with the following ("excluded realized gain (loss)"): sale or

disposal of securities; impairments of securities; change in the fair value of embedded derivatives within certain reinsurance

arrangements and the change in the fair value of our trading securities; change in the fair value of the derivatives we own to hedge our

guaranteed death benefit ("GDB") riders within our variable annuities, which is referred to as "GDB derivatives results"; change in the

fair value of the embedded derivatives of our guaranteed living benefit (“GLB”) riders within our variable annuities accounted for under

the Derivatives and Hedging and the Fair Value Measurements and Disclosures Topics of the FASB ASC (“embedded derivative

reserves”), net of the change in the fair value of the derivatives we own to hedge the changes in the embedded derivative reserves, the

net of which is referred to as “GLB net derivative results”; and changes in the fair value of the embedded derivative liabilities related to

index call options we may purchase in the future to hedge contract holder index allocations applicable to future reset periods for our

indexed annuity products accounted for under the Derivatives and Hedging and the Fair Value Measurements and Disclosures Topics

of the FASB ASC (“indexed annuity forward-starting option”); change in reserves accounted for under the Financial Services -

Insurance - Claim Costs and Liabilities for Future Policy Benefits Subtopic of the FASB ASC resulting from benefit ratio unlocking on

our GDB and GLB riders ("benefit ratio unlocking"); income (loss) from the initial adoption of new accounting standards; income (loss)

from reserve changes (net of related amortization) on business sold through reinsurance; gain (loss) on early extinguishment of debt;

losses from the impairment of intangible assets; and income (loss) from discontinued operations.

The company uses its prevailing corporate federal income tax rate of 35% while taking into account any permanent differences for

events recognized differently in its financial statements and federal income tax returns when reconciling non-GAAP measures to the

most comparable GAAP measure.

events recognized differently in its financial statements and federal income tax returns when reconciling non-GAAP measures to the

most comparable GAAP measure.

Definition of Income (Loss) From

Operations and ROE

Operations and ROE

16

|

($ in millions, except per share data)

|

1Q09

|

3Q09

|

4Q09

|

|

|

Net Income (Loss) available to common stockholders

|

$(579.0)

|

$137.0

|

$84.1

|

|

|

Less:

|

|

|

|

|

|

Preferred stock dividends and accretion of discount

|

|

|

(16.3)

|

(18.2)

|

|

Minority adjustment

|

(0.1)

|

|

|

|

|

Net Income (Loss)

|

(578.9)

|

153.3

|

102.3

|

|

|

Less:

|

|

|

|

|

|

Excluded realized gain (loss)

|

(136.4)

|

(296.8)

|

(248.3)

|

(98.3)

|

|

Benefit ratio unlocking

|

(52.0)

|

80.9

|

52.3

|

7.6

|

|

Income from reserve changes (net of related amortization)

on business sold through reinsurance |

0.4

|

0.4

|

0.4

|

0.5

|

|

Gain on early extinguishment of debt

|

41.8

|

|

|

|

|

Impairment of intangibles

|

(603.5)

|

0.6

|

1.4

|

(108.8)

|

|

Income(loss) from discontinued operations

|

7.7

|

(153.8)

|

72.0

|

4.1

|

|

Income from Operations

|

$163.1

|

$275.5

|

$297.2

|

|

|

Earnings per share (diluted)

|

|

|

|

|

|

Net Income (Loss)

|

$(2.27)

|

$(0.62)

|

$0.44

|

$0.27

|

|

Income from Operations

|

$0.64

|

$0.80

|

$0.84

|

$0.90

|

Net Income to Income from

Operations Reconciliation

Operations Reconciliation

17

* Reflects actual income or (loss) on alternative investment portfolio

|

($ in millions)

|

Retirement Solutions

|

Insurance Solutions

|

|||

|

Annuities

|

Life

Insurance |

||||

|

Reported

|

74

|

30

|

142

|

26

|

(108)

|

|

DAC Unlocking

|

|

|

|

|

|

|

Tax-related

items |

|

|

|

|

|

|

Expenses

|

|

|

|

|

|

|

Other (net)

|

|

|

|

|

(64)

|

|

Total

|

74

|

142

|

(44)

|

||

|

Alternative

Investments* |

|

|

(2)

|

|

|

1Q 2009 Income From Operations

Schedule of Notable Items

Schedule of Notable Items

18

* Reflects actual income or (loss) on alternative investment portfolio

|

($ in millions)

|

Retirement Solutions

|

Insurance Solutions

|

|||

|

Annuities

|

Life

Insurance |

||||

|

Reported

|

65

|

28

|

133

|

34

|

(52)

|

|

DAC Unlocking

|

|

|

|

|

|

|

Tax-related

items |

|

|

|

|

|

|

Expenses

|

|

|

2

|

|

(19)

|

|

Mortality

|

|

|

5

|

|

|

|

Other (net)

|

|

|

3

|

|

|

|

Total

|

65

|

28

|

123

|

(33)

|

|

|

Alternative

Investments* |

(5)

|

(3)

|

(20)

|

(2)

|

|

2Q 2009 Income From Operations

Schedule of Notable Items

Schedule of Notable Items

19

* Reflects actual income or (loss) on alternative investment portfolio

|

($ in millions)

|

Retirement Solutions

|

Insurance Solutions

|

|||

|

Annuities

|

Life

Insurance |

||||

|

Reported

|

95

|

43

|

137

|

35

|

(33)

|

|

DAC Unlocking

|

11

|

5

|

(12)

|

|

|

|

Tax-related

items |

3

|

|

6

|

|

|

|

Other

|

1

|

|

|

|

|

|

Total

|

80

|

143

|

(33)

|

||

|

Alternative

Investments* |

2

|

1

|

(5)

|

|

1

|

3Q 2009 Income From Operations

Schedule of Notable Items

Schedule of Notable Items

20

* Reflects actual income or (loss) on alternative investment portfolio

|

($ in millions)

|

Retirement Solutions

|

Insurance Solutions

|

|||

|

Annuities

|

Life

Insurance |

||||

|

Reported

|

120

|

33

|

158

|

30

|

(44)

|

|

DAC Unlocking

|

12

|

|

|

|

|

|

Tax-related

items |

7

|

(2)

|

|

|

13

|

|

Expenses

|

|

(1)

|

|

(3)

|

4

|

|

Disability

Business Review |

|

|

|

|

(33)

|

|

Other

|

|

|

|

|

1

|

|

Total

|

101

|

158

|

(29)

|

||

|

Alternative

Investments* |

6

|

4

|

7

|

3

|

2

|

4Q 2009 Income From Operations

Schedule of Notable Items

Schedule of Notable Items