Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - International Coal Group, Inc. | frm8-k.htm |

Howard Weil Energy Conference

March 22, 2010

March 22, 2010

Ben Hatfield

President & Chief Executive Officer

Forward-Looking

Statements

Statements

n Statements in this presentation that are not historical facts are forward-looking statements within the “safe harbor” provision of the Private

Securities Litigation Reform Act of 1995 and may involve a number of risks and uncertainties. We have used the words “anticipate,” “believe,”

“could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project” and similar terms and phrases, including references to assumptions, to

identify forward-looking statements. These forward-looking statements are made based on expectations and beliefs concerning future events

affecting us and are subject to various risks, uncertainties and factors relating to our operations and business environment, all of which are difficult

to predict and many of which are beyond our control, that could cause our actual results to differ materially from those matters expressed in or

implied by these forward-looking statements. The following factors are among those that may cause actual results to differ materially from our

forward-looking statements: our ability to successfully refinance our outstanding indebtedness and reduce our leverage through the transactions

described in this presentation; market demand for coal, electricity and steel; availability of qualified workers; future economic or capital market

conditions; weather conditions or catastrophic weather-related damage; our production capabilities; consummation of financing, acquisition or

disposition transactions and the effect thereof on our business; a significant number of conversions of our 9.00% Convertible Senior Notes due

2012 prior to maturity; our plans and objectives for future operations and expansion or consolidation; our relationships with, and other conditions

affecting, our customers; availability and costs of key supplies or commodities, such as diesel fuel, steel, explosives and tires; availability and costs

of capital equipment; prices of fuels which compete with or impact coal usage, such as oil and natural gas; timing of reductions or increases in

customer coal inventories; long-term coal supply arrangements; reductions and/or deferrals of purchases by major customers; risks in or related to

coal mining operations, including risks related to third-party suppliers and carriers operating at our mines or complexes; unexpected maintenance

and equipment failure; environmental, safety and other laws and regulations, including those directly affecting our coal mining and production, and

those affecting our customers’ coal usage; ability to obtain and maintain all necessary governmental permits and authorizations; competition

among coal and other energy producers in the United States and internationally; railroad, barge, trucking and other transportation availability,

performance and costs; employee benefits costs and labor relations issues; replacement of our reserves; our assumptions concerning

economically recoverable coal reserve estimates; availability and costs of credit, surety bonds and letters of credit; title defects or loss of leasehold

interests in our properties which could result in unanticipated costs or inability to mine these properties; future legislation and changes in

regulations or governmental policies or changes in interpretations or enforcement thereof, including with respect to safety enhancements and

environmental initiatives relating to global warming or climate change; impairment of the value of our long-lived and deferred tax assets; our

liquidity, including our ability to adhere to financial covenants related to our borrowing arrangements; adequacy and sufficiency of our internal

controls; and legal and administrative proceedings, settlements, investigations and claims and the availability of related insurance coverage.

Securities Litigation Reform Act of 1995 and may involve a number of risks and uncertainties. We have used the words “anticipate,” “believe,”

“could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project” and similar terms and phrases, including references to assumptions, to

identify forward-looking statements. These forward-looking statements are made based on expectations and beliefs concerning future events

affecting us and are subject to various risks, uncertainties and factors relating to our operations and business environment, all of which are difficult

to predict and many of which are beyond our control, that could cause our actual results to differ materially from those matters expressed in or

implied by these forward-looking statements. The following factors are among those that may cause actual results to differ materially from our

forward-looking statements: our ability to successfully refinance our outstanding indebtedness and reduce our leverage through the transactions

described in this presentation; market demand for coal, electricity and steel; availability of qualified workers; future economic or capital market

conditions; weather conditions or catastrophic weather-related damage; our production capabilities; consummation of financing, acquisition or

disposition transactions and the effect thereof on our business; a significant number of conversions of our 9.00% Convertible Senior Notes due

2012 prior to maturity; our plans and objectives for future operations and expansion or consolidation; our relationships with, and other conditions

affecting, our customers; availability and costs of key supplies or commodities, such as diesel fuel, steel, explosives and tires; availability and costs

of capital equipment; prices of fuels which compete with or impact coal usage, such as oil and natural gas; timing of reductions or increases in

customer coal inventories; long-term coal supply arrangements; reductions and/or deferrals of purchases by major customers; risks in or related to

coal mining operations, including risks related to third-party suppliers and carriers operating at our mines or complexes; unexpected maintenance

and equipment failure; environmental, safety and other laws and regulations, including those directly affecting our coal mining and production, and

those affecting our customers’ coal usage; ability to obtain and maintain all necessary governmental permits and authorizations; competition

among coal and other energy producers in the United States and internationally; railroad, barge, trucking and other transportation availability,

performance and costs; employee benefits costs and labor relations issues; replacement of our reserves; our assumptions concerning

economically recoverable coal reserve estimates; availability and costs of credit, surety bonds and letters of credit; title defects or loss of leasehold

interests in our properties which could result in unanticipated costs or inability to mine these properties; future legislation and changes in

regulations or governmental policies or changes in interpretations or enforcement thereof, including with respect to safety enhancements and

environmental initiatives relating to global warming or climate change; impairment of the value of our long-lived and deferred tax assets; our

liquidity, including our ability to adhere to financial covenants related to our borrowing arrangements; adequacy and sufficiency of our internal

controls; and legal and administrative proceedings, settlements, investigations and claims and the availability of related insurance coverage.

n You should keep in mind that any forward-looking statement made by us in this presentation or elsewhere speaks only as of the date on which the

statements were made. See also the “Risk Factors” in our 2009 Annual Report on Form 10-K and subsequent filings with the Securities and

Exchange Commission, all of which are currently available on our website at www.intlcoal.com. New risks and uncertainties arise from time to time,

and it is impossible for us to predict these events or how they may affect us or our anticipated results. We have no duty to, and do not intend to,

update or revise the forward-looking statements in this presentation, except as may be required by law. In light of these risks and uncertainties, you

should keep in mind that any forward-looking statement made in this presentation might not occur. All data presented herein is as of December 31,

2009 unless otherwise noted.

Exchange Commission, all of which are currently available on our website at www.intlcoal.com. New risks and uncertainties arise from time to time,

and it is impossible for us to predict these events or how they may affect us or our anticipated results. We have no duty to, and do not intend to,

update or revise the forward-looking statements in this presentation, except as may be required by law. In light of these risks and uncertainties, you

should keep in mind that any forward-looking statement made in this presentation might not occur. All data presented herein is as of December 31,

2009 unless otherwise noted.

2

ICG Highlights

n Product and basin diversification

n Excellent reserve position, majority of which is owned

n Attractive cost position

n Underground-focused growth strategy

3

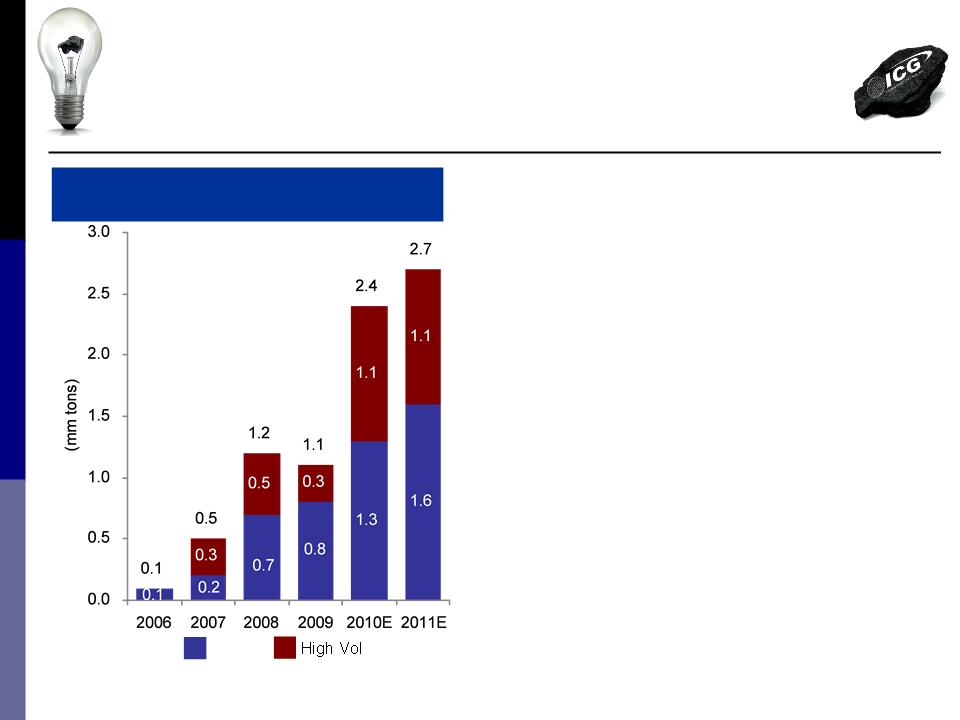

n Metallurgical sales expected to more than double in 2010 to 2.4 million tons

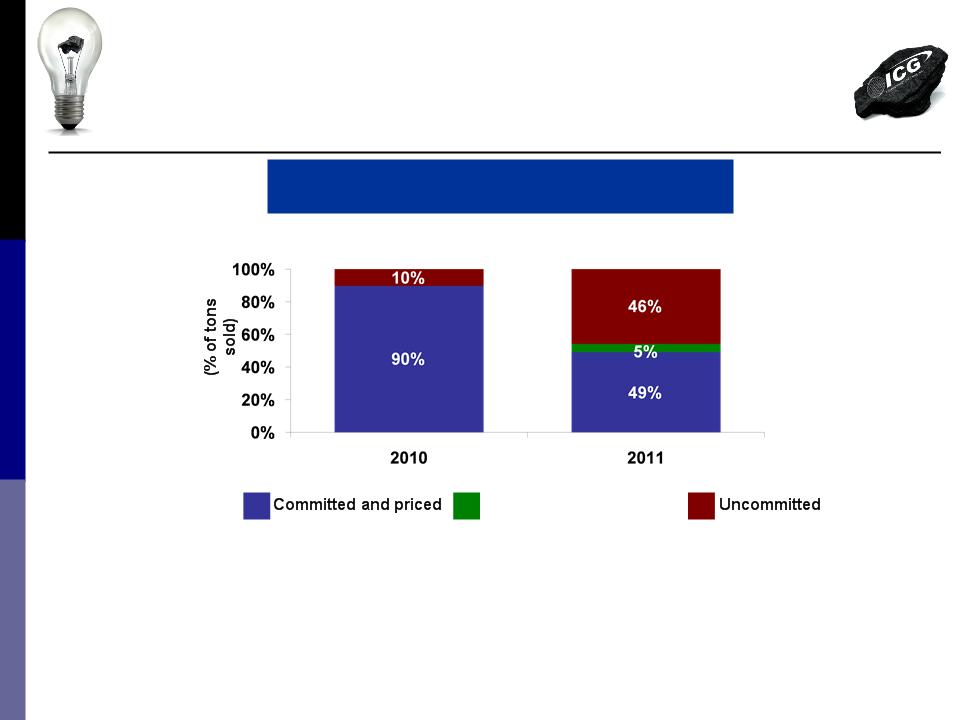

n Highly contracted 2010 with upside for 2011

n Sufficient open tonnage to take advantage of improving coal markets

n Nearly 3 million annual tons of idle production capacity available

n World-class 3.5 million tpy Tygart longwall development

n Additional opportunities to further increase metallurgical tons

n Demonstrated ability to grow profits and cash flow

n Consistent recent financial performance and favorable outlook

n Industry-leading legacy liability position

n Restructured balance sheet with reduced leverage levels and extended

maturity profile

maturity profile

Attractive Asset Portfolio

Positioned to Capitalize on

Favorable Industry Trends

Favorable Industry Trends

Significant Organic Growth Profile

Enhanced Financial Position

ICG Highlights

n Product and basin diversification

n Excellent reserve position, majority of which is owned

n Attractive cost position

n Underground-focused growth strategy

4

n Metallurgical sales expected to more than double in 2010 to 2.4 million tons

n Highly contracted 2010 with upside for 2011

n Sufficient open tonnage to take advantage of improving coal markets

n Nearly 3 million annual tons of idle production capacity available

n World-class 3.5 million tpy Tygart longwall development

n Additional opportunities to further increase metallurgical tons

n Demonstrated ability to grow profits and cash flow

n Consistent recent financial performance and favorable outlook

n Industry-leading legacy liability position

n Reduced leverage levels and extended maturity profile

Attractive Asset Portfolio

Positioned to Capitalize on

Favorable Industry Trends

Favorable Industry Trends

Significant Organic Growth Profile

Enhanced Financial Position

5

ICG Illinois

Illinois

Kentucky

Beckley

West

Virginia

Virginia

Virginia

MD

East Kentucky

Flint Ridge

Hazard

Knott County

Raven

Eastern

Buckhannon

Sentinel

Tygart Valley #1

Vindex

Current Operations

Future Operations

ICG Corporate

Powell Mountain

Note:

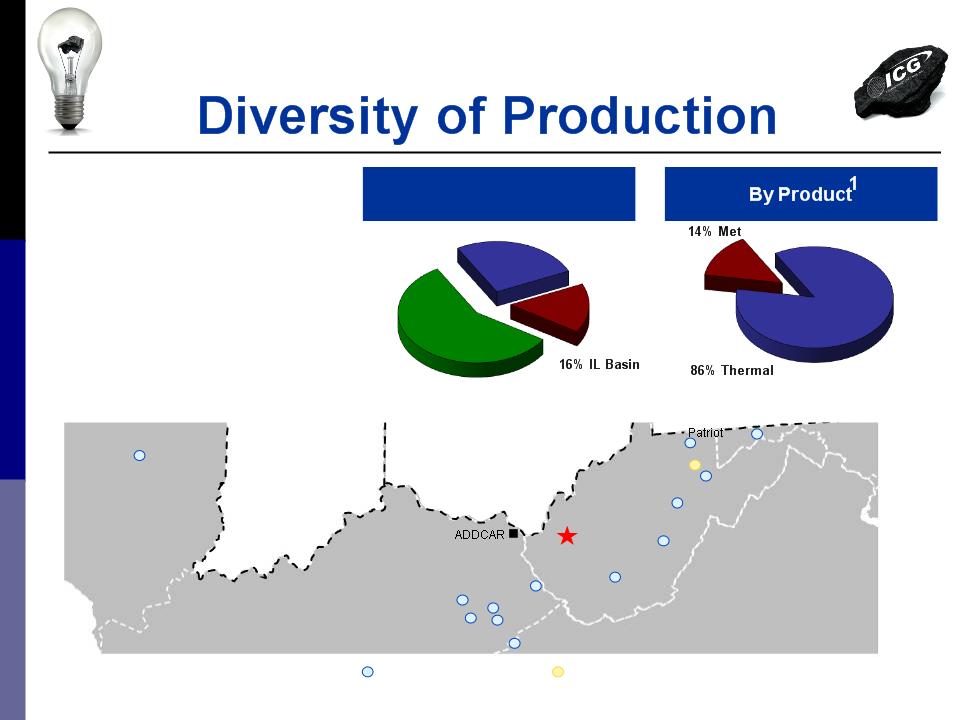

1 Management estimate for 2010 as of February 26, 2010

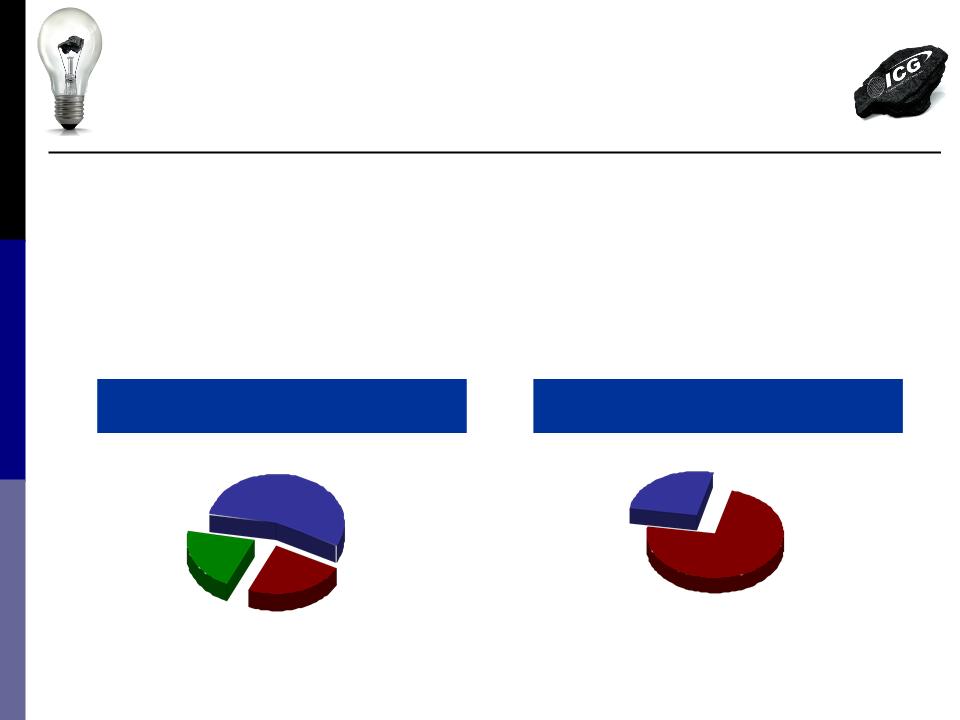

26% NAPP

By Basin1

58% CAPP

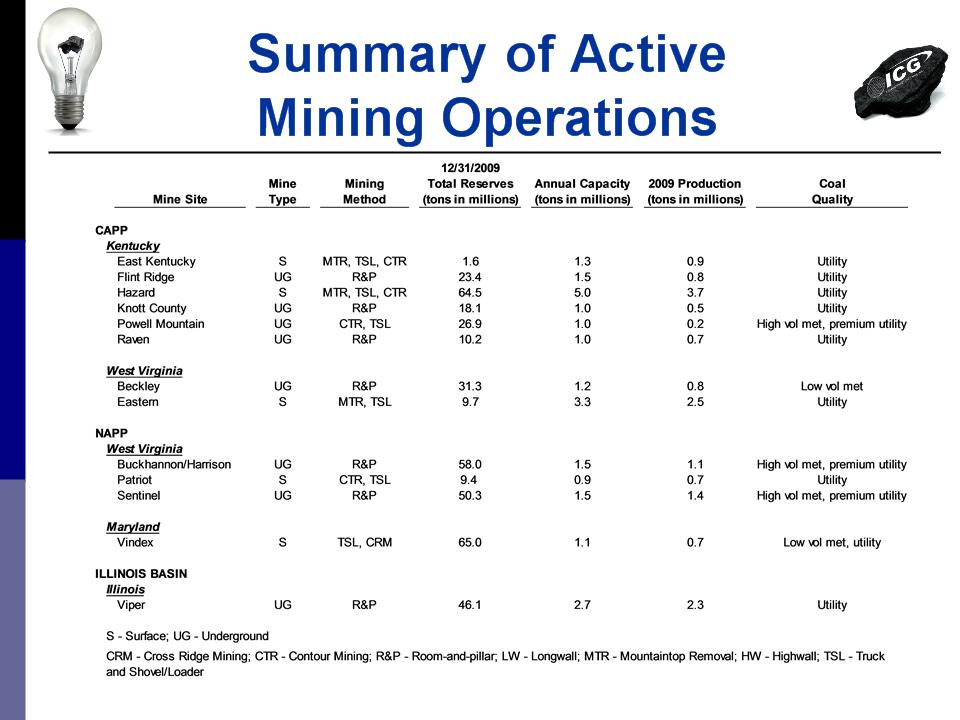

n 13 active mining complexes - 8 in

Central Appalachia, 4 in Northern

Appalachia and 1 in Illinois Basin

Central Appalachia, 4 in Northern

Appalachia and 1 in Illinois Basin

n Less reliant on any single mine for

a significant portion of total

production

a significant portion of total

production

n Additional benefits of

diversification in labor markets and

transportation

diversification in labor markets and

transportation

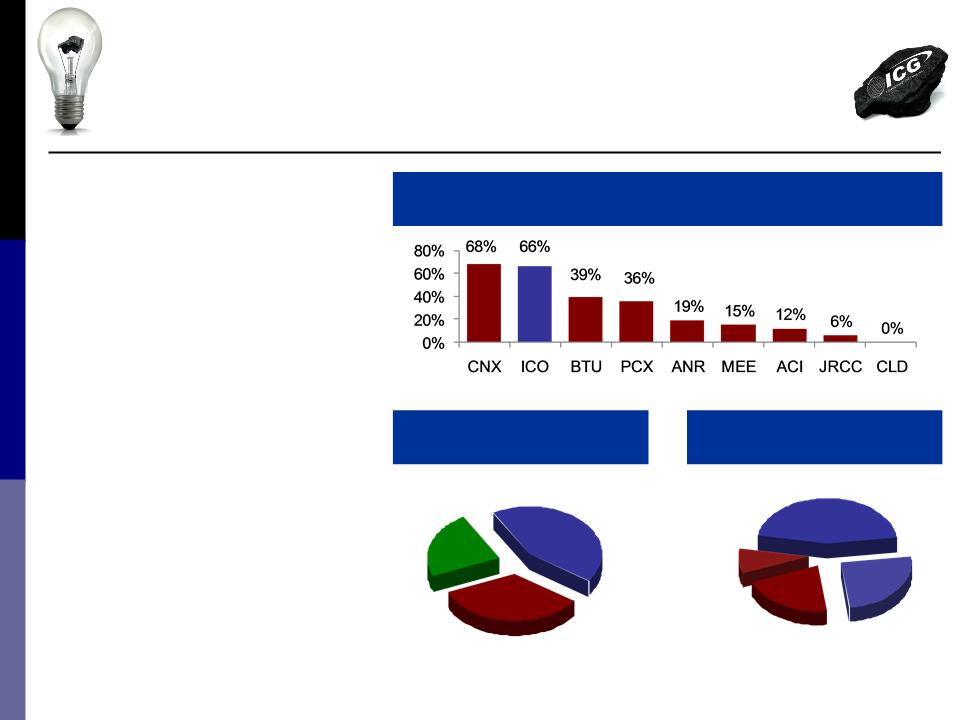

Excellent Reserve Position

n ICG owns a larger portion of

its reserves than nearly all

other public producers

its reserves than nearly all

other public producers

– Reduces royalty costs

n ICG controls 1.1 billion tons

of high-quality reserves that

are primarily high-BTU

metallurgical and low-sulfur

thermal coal

of high-quality reserves that

are primarily high-BTU

metallurgical and low-sulfur

thermal coal

– 325 million tons

metallurgical, 71% of

which are owned

metallurgical, 71% of

which are owned

% Ownership of Total Reserves

Geographic Distribution

of Reserves

of Reserves

21% Met

(Owned)

(Owned)

231 million tons

45% Thermal (Owned)

490 million tons

Reserves by Type

34% IL Basin

371 million tons

23% CAPP

256 million tons

43% NAPP

463 million tons

25% Thermal

(Leased)

(Leased)

275 million tons

9% Met

(Leased)

(Leased)

94 million tons

Source: Company filings as of 12/31/09 (Cloud Peak as of 9/30/09)

6

Attractive Competitive Position

7

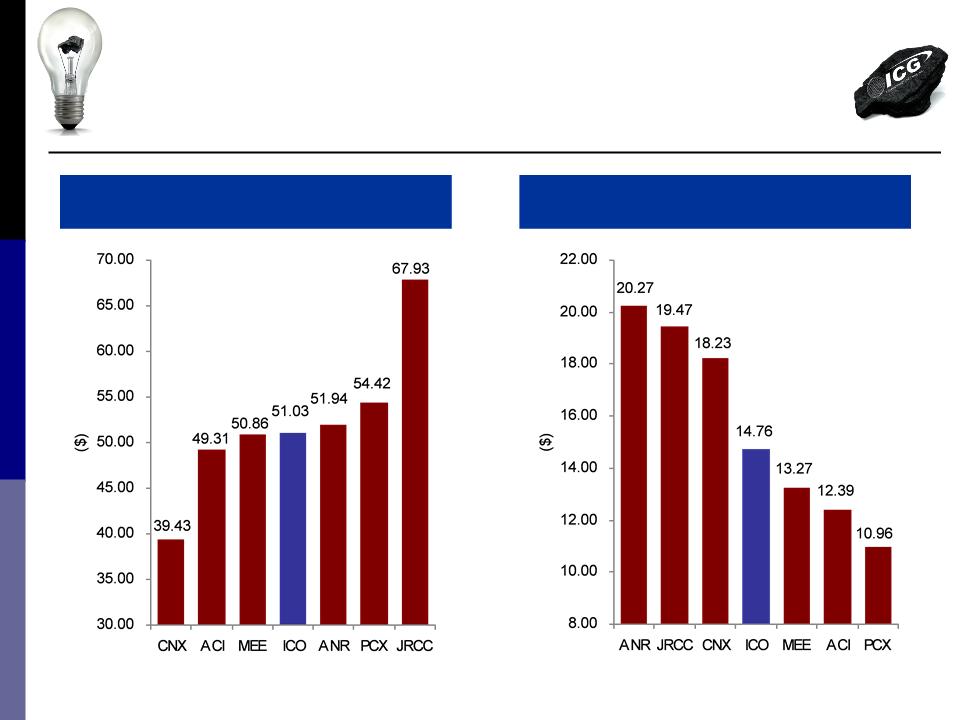

Appalachian Cash Cost / ton 1,2

Appalachian Cash Margin / ton 1

Notes:

1 Data represents 4Q09 reported cash costs and margins

2 Cash costs exclude DD&A expenses

Shift Towards Underground

Mitigates Regulatory Concerns

Mitigates Regulatory Concerns

n Nearly all ICG growth is projected to be new or

expanding underground mining operations

(rather than surface mines)

expanding underground mining operations

(rather than surface mines)

– Incremental deep mine growth totaling 1.7

million tpy by 2011 is planned at Illinois,

Vindex, Beckley, Eastern & Kentucky

operations

million tpy by 2011 is planned at Illinois,

Vindex, Beckley, Eastern & Kentucky

operations

– Major development is 3.5 million tpy Tygart

#1 complex in NAPP

#1 complex in NAPP

• Production ramp-up projected for 2012-15

n Underground mining operations generally have

fewer regulatory hurdles than surface mines

fewer regulatory hurdles than surface mines

n Reduced risk of regulatory permitting obstacles

Production by Mining Method

Surface

Underground

10% Surface

104 million tons

90% Underground

986 million tons

Reserves by Method

Note:

1 Management estimate as of February 26, 2010

1

1

ICG Highlights

n Product and basin diversification

n Excellent reserve position, majority of which is owned

n Attractive cost position

n Underground-focused growth strategy

9

n Metallurgical sales expected to more than double in 2010 to 2.4 million tons

n Highly contracted 2010 with upside for 2011

n Sufficient open tonnage to take advantage of improving coal markets

n Nearly 3 million annual tons of idle production capacity available

n World-class 3.5 million tpy Tygart longwall development

n Additional opportunities to further increase metallurgical tons

n Demonstrated ability to grow profits and cash flow

n Consistent recent financial performance and favorable outlook

n Industry-leading legacy liability position

n Reduced leverage levels and extended maturity profile

Attractive Asset Portfolio

Positioned to Capitalize on

Favorable Industry Trends

Favorable Industry Trends

Significant Organic Growth Profile

Enhanced Financial Position

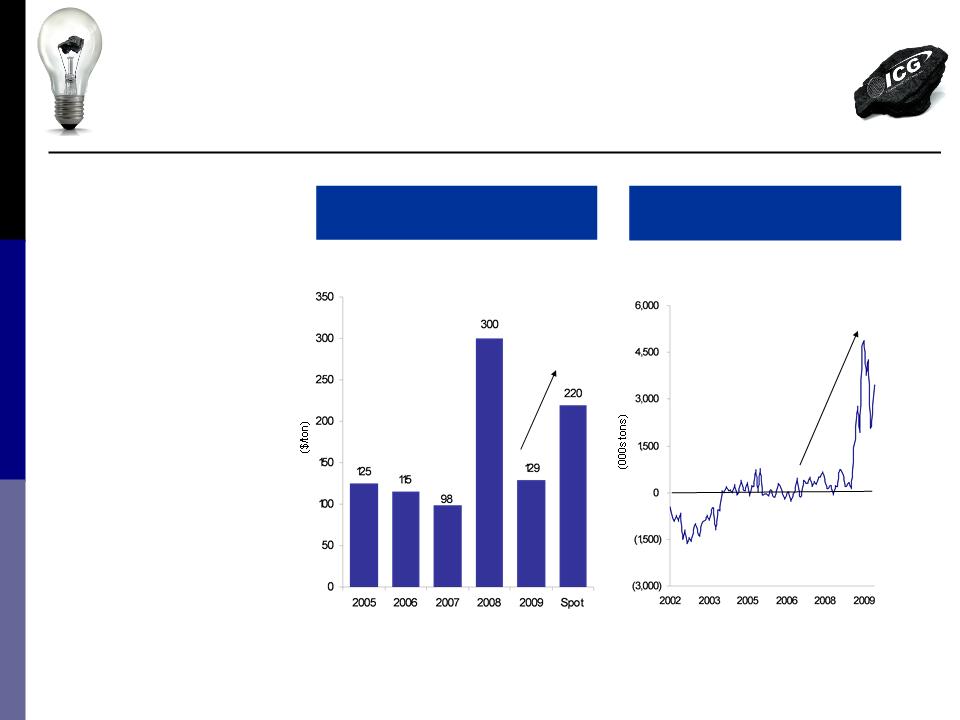

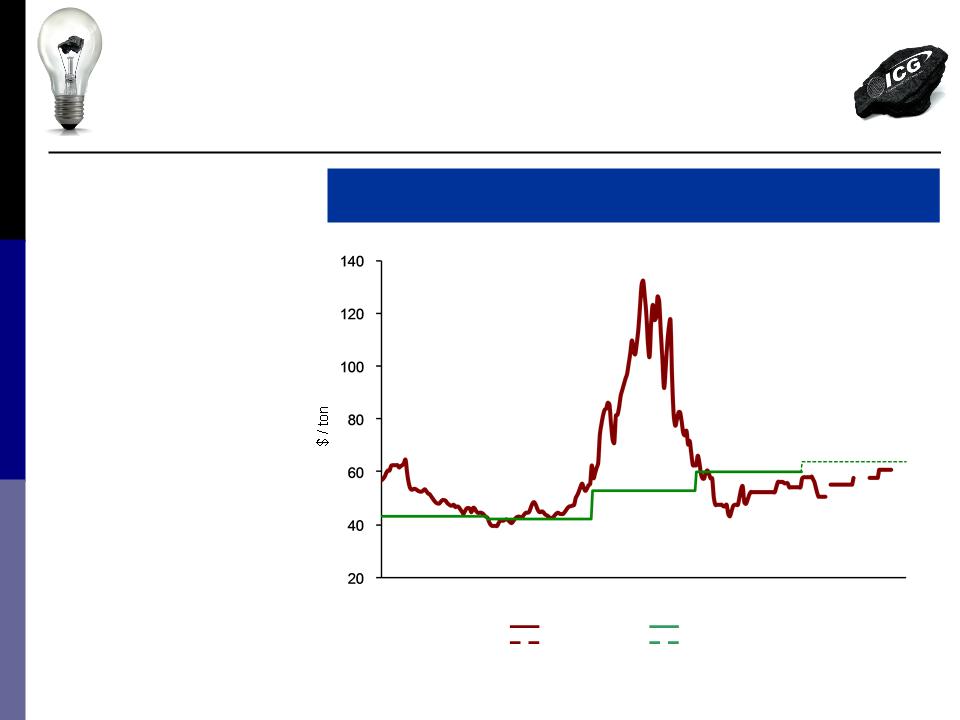

Seaborne Hard

Coking Coal Prices

Coking Coal Prices

Metallurgical Coal

Market Rebounding

10

China Net Importer of Coal

2005 - Current Spot

Chinese Coal Net Imports / (Exports)

Net Exports

Net Imports

n Metallurgical spot

prices have already

rebounded

substantially from

2009 levels

prices have already

rebounded

substantially from

2009 levels

n China met imports

continue to drive

market demand

continue to drive

market demand

n Industry analysts

expect that 2010

benchmark hard

coking coal prices will

settle in the $200 to

$240 range (fob

vessel, mt basis)

expect that 2010

benchmark hard

coking coal prices will

settle in the $200 to

$240 range (fob

vessel, mt basis)

Source: Industry Data

Metallurgical Portfolio

Expanding Rapidly

Expanding Rapidly

Metallurgical Sales Growth

Note:

1 Management estimate as of February 26, 2010

11

Key drivers of met growth:

n Projected production increase at met mines

during 2009-2011 of nearly 700K tons/year

during 2009-2011 of nearly 700K tons/year

– Added third section at Beckley (LV)

– Higher productivity at Sentinel (HV)

– New low volatile met Bismark mine in

development at Vindex; startup projected

for Q3 2010 and expected to reach full

production capacity in 2011

development at Vindex; startup projected

for Q3 2010 and expected to reach full

production capacity in 2011

n Portion of Sentinel sold as met projected to

increase from 14% in 2009 to 60% in 2010

increase from 14% in 2009 to 60% in 2010

– Completion of legacy utility contracts

– Increased demand for Sentinel quality

n Increase in met blend sales expected from

Powell Mtn (HV/PCI) and existing Vindex

mines (LV)

Powell Mtn (HV/PCI) and existing Vindex

mines (LV)

Low Vol

1

1

Thermal Coal Market

Showing Signs of Strength

Showing Signs of Strength

Thermal Coal Environment

CAPP Price

Futures

2006

2007

2008

2009

Source: Bloomberg, Company filings

n Expect 2010 to be a

rebalancing year for

coal supply/demand

rebalancing year for

coal supply/demand

n Cold weather

globally has led to

favorable burn,

accelerating thermal

coal inventory

drawdown

globally has led to

favorable burn,

accelerating thermal

coal inventory

drawdown

n Presents upside for

ICG to capitalize on

a rising price

environment

ICG to capitalize on

a rising price

environment

2010

12

ICG Realized Price

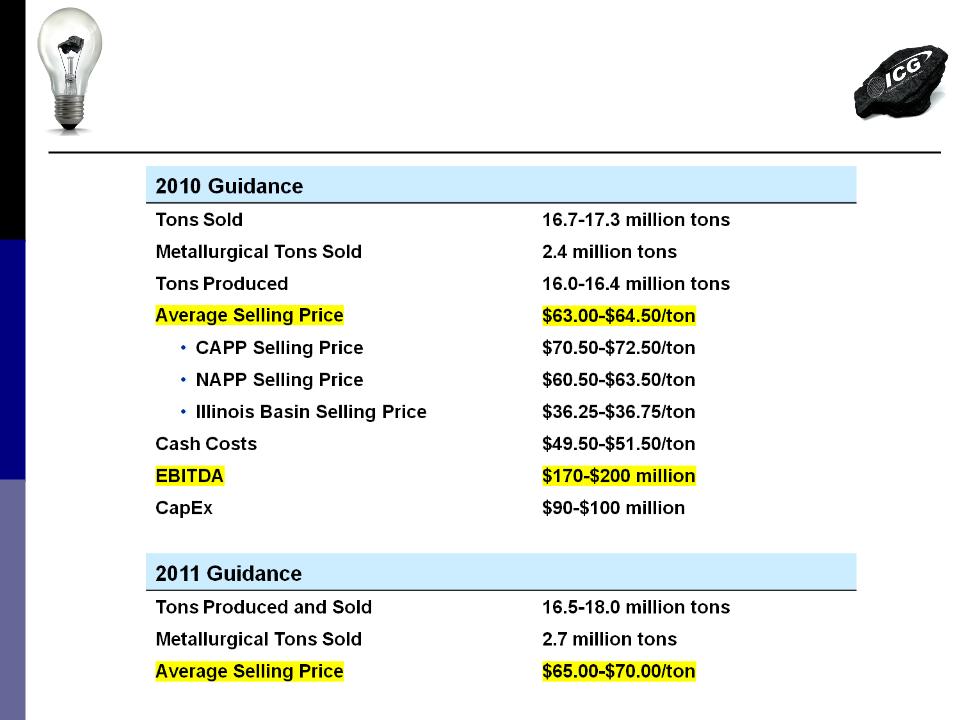

2010 Guidance

Committed and not priced

Projected Sales 16.7 - 17.3 16.5 - 18.0

(tons in millions)

(tons in millions)

Average Selling Price $63.00-$64.50 $65.00-$70.00

Metallurgical Uncommitted 1.0 2.6

(tons in millions)

(tons in millions)

Committed Tonnage1

Favorable Sales Position

13

Note:

1 Management estimate as of February 26, 2010

ICG Highlights

n Product and basin diversification

n Excellent reserve position, majority of which is owned

n Attractive cost position

n Underground-focused growth strategy

14

n Metallurgical sales expected to more than double in 2010 to 2.4 million tons

n Highly contracted 2010 with upside for 2011

n Sufficient open tonnage to take advantage of improving coal markets

n Nearly 3 million annual tons of idle production capacity available

n World-class 3.5 million tpy Tygart longwall development

n Additional opportunities to further increase metallurgical tons

n Demonstrated ability to grow profits and cash flow

n Consistent recent financial performance and favorable outlook

n Industry-leading legacy liability position

n Reduced leverage levels and extended maturity profile

Attractive Asset Portfolio

Positioned to Capitalize on

Favorable Industry Trends

Favorable Industry Trends

Significant Organic Growth Profile

Enhanced Financial Position

Significant Idle Production

Capacity Available

n Nearly 3 million tons annual production capacity can be promptly activated to take advantage of

strengthening market

strengthening market

– 2.15 million tpy held in "hot-idle" status requiring only moderate equipment investment for

re-start

re-start

– Another 0.75 million tpy production capacity permitted and available for development; 6-12

month start-up timeframe

month start-up timeframe

15

Quality of Idle Production

Status of Idle Production

21% LV Met

0.60 million tons

55% CAPP Thermal

1.60 million tons

24% NAPP Thermal

0.70 million tons

26% Undeveloped

0.75 million tons

74% Hot Idle

2.15 million tons

Tygart Represents World

Class Production Opportunity

n Tygart #1 will be the first of 3 or more mining

complexes planned for ICG’s 186 million ton

Hillman property in Northern West Virginia

complexes planned for ICG’s 186 million ton

Hillman property in Northern West Virginia

– High Btu, low- to medium-sulfur thermal and

high volatile met quality coal

high volatile met quality coal

– Anticipating low costs due to longwall mining,

owned property and favorable geology

owned property and favorable geology

– Management estimates Tygart will generate

a margin of plus $40/ton at full output1

a margin of plus $40/ton at full output1

n Expected to produce up to 3.5 million tpy at full

output (50% met/50% thermal)

output (50% met/50% thermal)

– Startup in late 2012; full output mid-2014

– Targets a 40-50 million ton reserve area

n Project capital of approximately $300 million is

expected to be financed through operating cash

flow

expected to be financed through operating cash

flow

n Favorable geographic position relative to

Atlantic terminals and NE customer base

Atlantic terminals and NE customer base

16

Note:

1 Based on the current coal pricing environment and production cost estimates

Growing

Metallurgical Production

Metallurgical Production

17

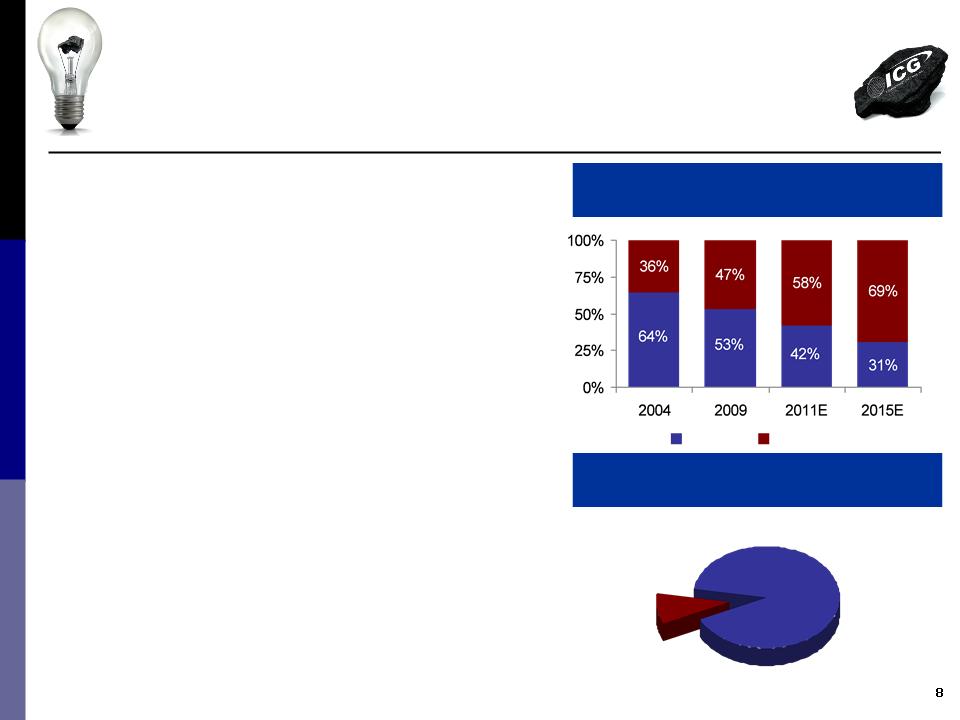

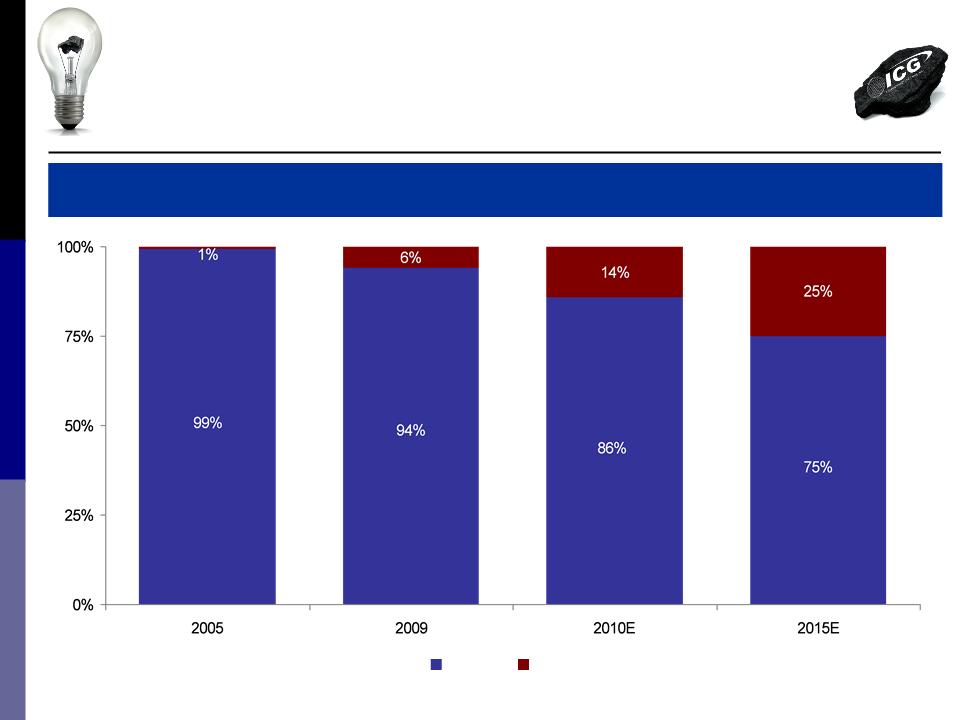

Metallurgical as Percent of Total Tons Sold

Thermal

Met

Note:

1 Management estimate as of February 26, 2010

1

1

ICG Highlights

n Product and basin diversification

n Excellent reserve position, majority of which is owned

n Attractive cost position

n Underground-focused growth strategy

18

n Metallurgical sales expected to more than double in 2010 to 2.4 million tons

n Highly contracted 2010 with upside for 2011

n Sufficient open tonnage to take advantage of improving coal markets

n Nearly 3 million annual tons of idle production capacity available

n World-class 3.5 million tpy Tygart longwall development

n Additional opportunities to further increase metallurgical tons

n Demonstrated ability to grow profits and cash flow

n Consistent recent financial performance and favorable outlook

n Industry-leading legacy liability position

n Restructured balance sheet with reduced leverage levels and extended

maturity profile

maturity profile

Attractive Asset Portfolio

Positioned to Capitalize on

Favorable Industry Trends

Favorable Industry Trends

Significant Organic Growth Profile

Enhanced Financial Position

Focused Execution Has

Driven Strong Margin Growth…

Driven Strong Margin Growth…

19

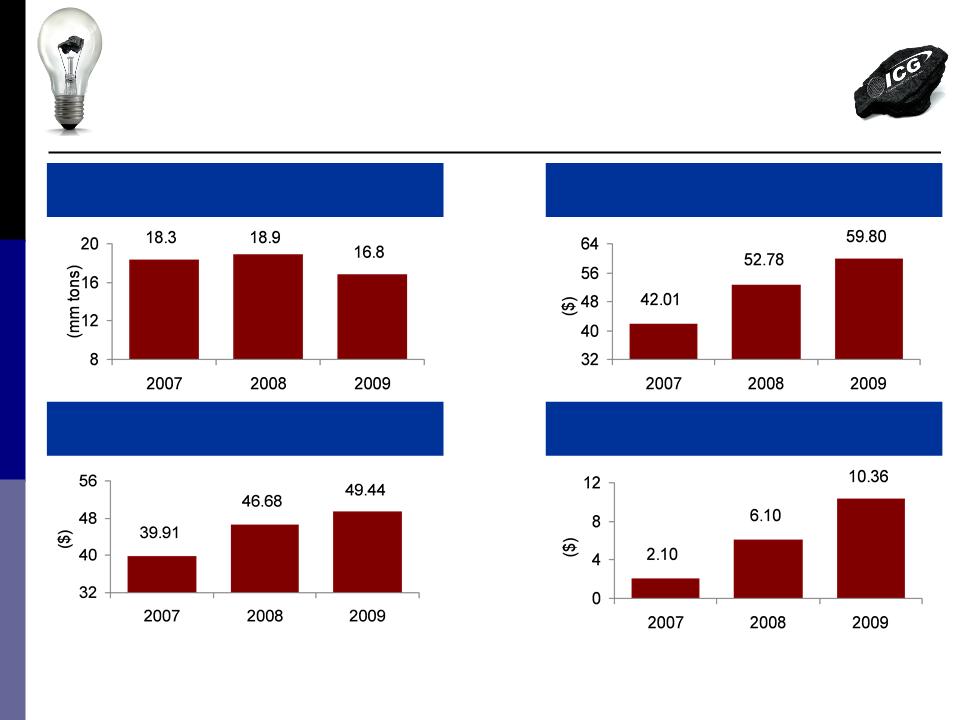

Tons Sold

Coal Sales Revenue Per Ton

Cost of Coal Sales Revenue Per Ton

Margin Per Ton

Source: Company filings

…Resulting in Record

EBITDA Generation

EBITDA Generation

20

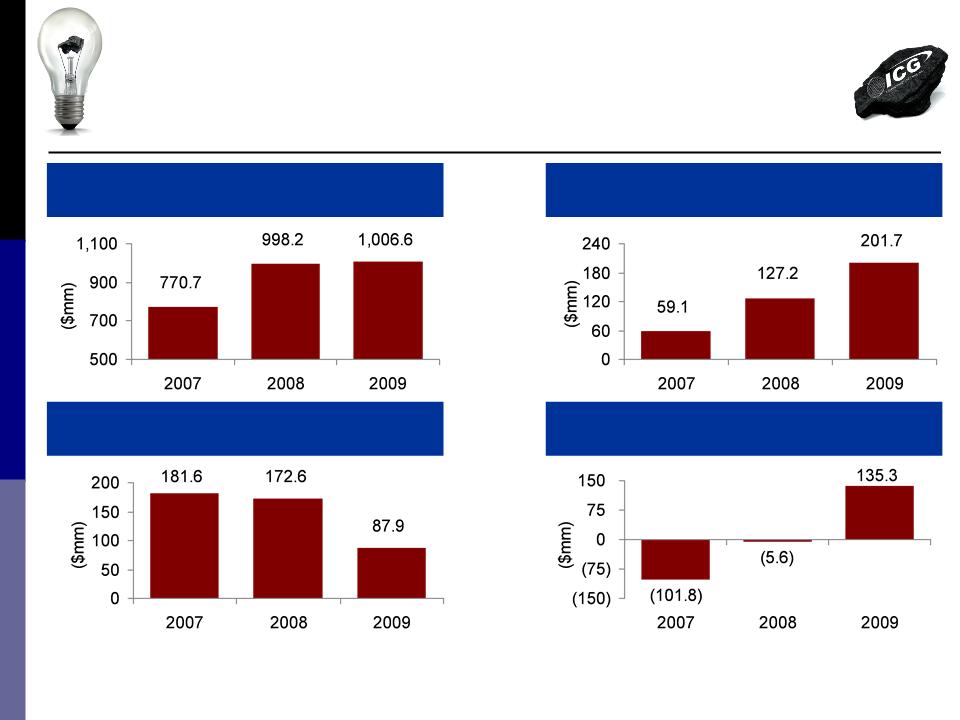

Coal Sales Revenue

Adjusted EBITDA1

GAAP Capital Expenditures

Adjusted EBITDA - Cash CapEx

Source: Company filings

Note:

1 EBITDA is a non-GAAP measure and reconciliations provided at end of presentation

Updated Guidance Summary

(Management Estimate as of February 26, 2010 )

(Management Estimate as of February 26, 2010 )

21

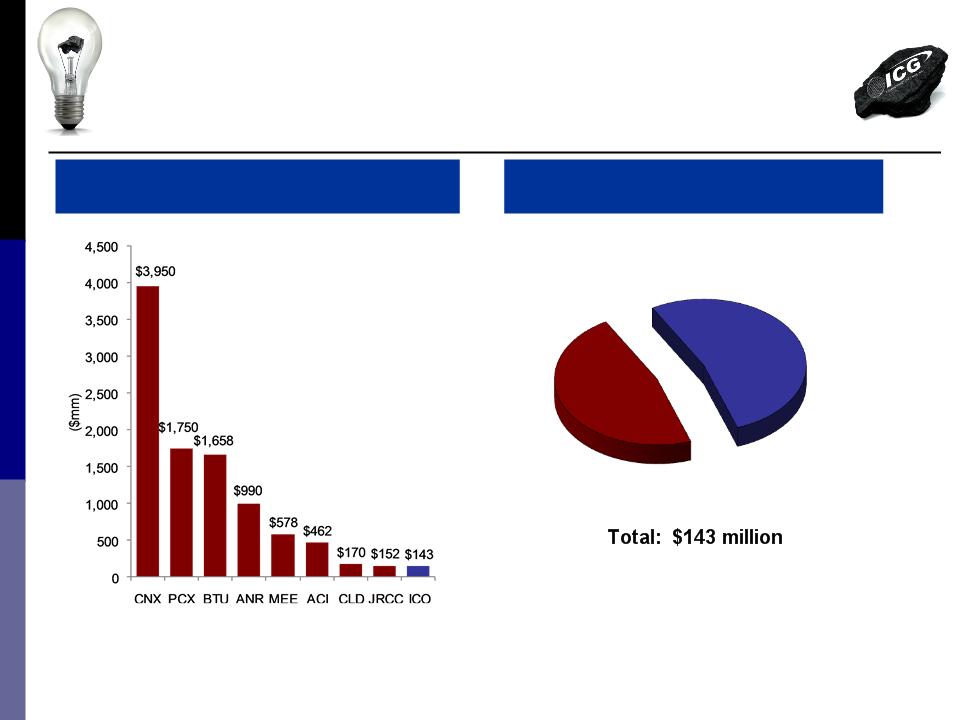

ICG Legacy Liabilities

Total Legacy Liabilities1

Note:

1 Company Annual Reports as of December 31, 2009 (Cloud Peak as of 9/30/09); legacy liabilities include accrued workers’ compensation liabilities,

liabilities under the Coal Industry Retiree Health Benefit Act of 1992, post-retirement employee obligations, “black lung” liabilities and reclamation

liabilities

liabilities under the Coal Industry Retiree Health Benefit Act of 1992, post-retirement employee obligations, “black lung” liabilities and reclamation

liabilities

Lowest Legacy Liabilities

Among Peer Group

22

Employee Benefits

47%

Reclamation

53%

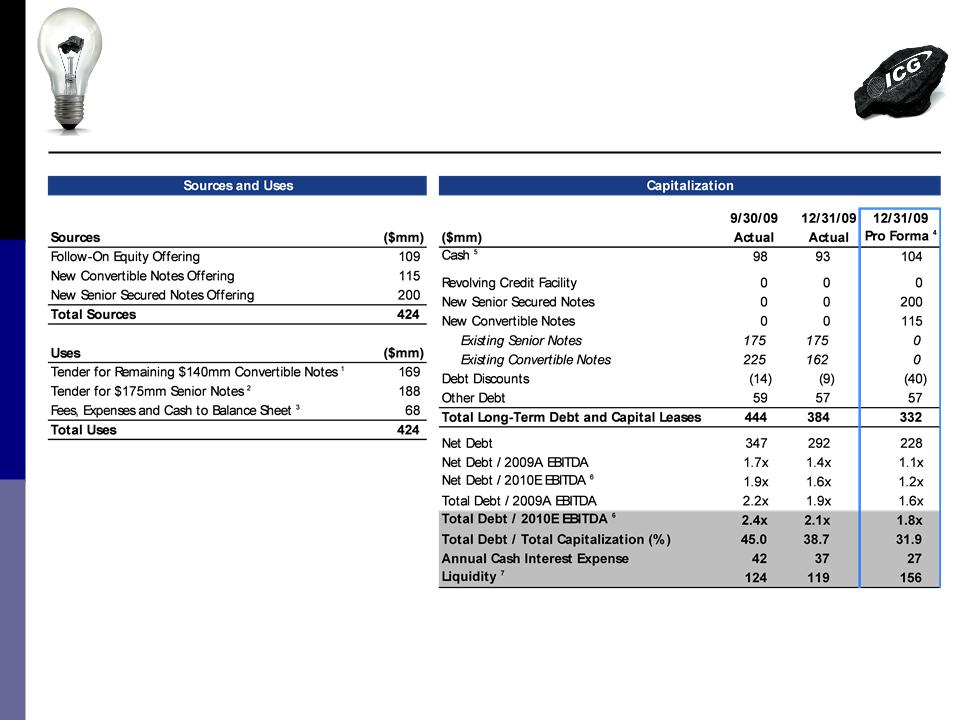

Capital Restructuring

n New ABL credit facility

– Increased borrowing capacity to $125 million

– Eliminated ongoing financial maintenance convents

– Capacity may be increased to $200 million

n Common Stock offering

– Raised $109 million through the sale of 24.4 million shares

n Convertible Senior Notes

– Sold $115 million of 7-year 4.00% convertible senior notes

with a 30% conversion premium

with a 30% conversion premium

n Senior Secured Second-Priority Notes

– Sold $200 million of 8-year 9.125% senior secured second-

priority notes priced to yield 9.25%

priority notes priced to yield 9.25%

23

Notes:

1 Assumes existing convertible tendered at price of 121.00

2 Assumes existing senior notes tendered at price of 107.25

3 Includes original issue discount on new senior secured notes of $1.4 million

4 Adjusted to give effect to new offerings, new ABL and $22mm of private exchanges for the existing convertible notes completed in January 2010

5 Pro forma cash includes accrued interest payments

6 2010E EBITDA based on midpoint of ICG guidance ($185 million)

7 Cash plus revolver availability

24

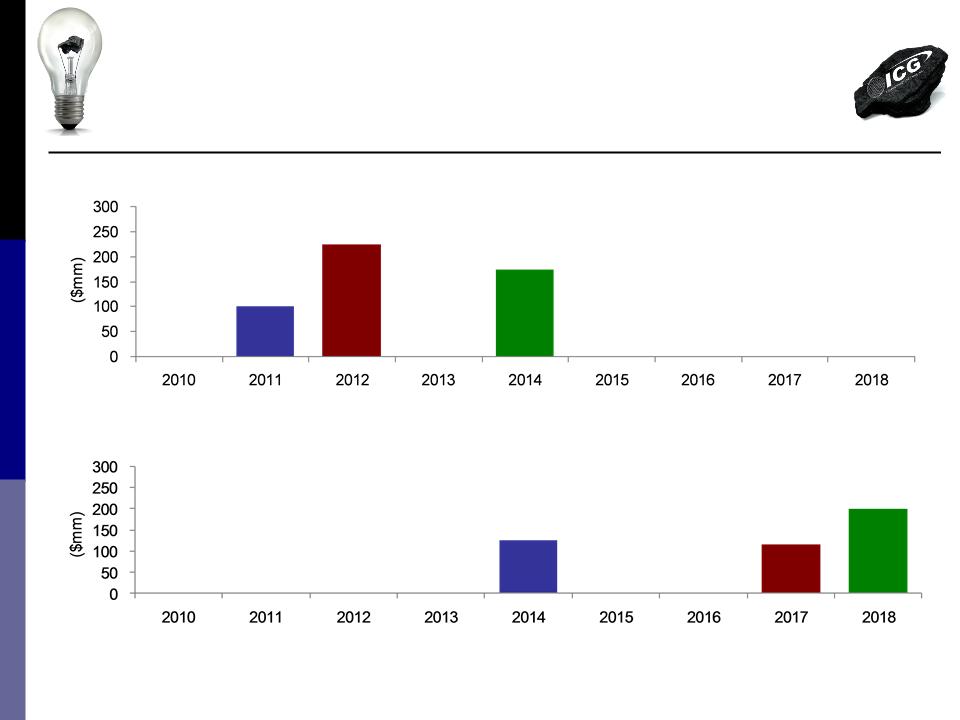

New Capital Structure

n New ABL increases revolver size from

$100 million to $125 million

$100 million to $125 million

Substantially Extends

Maturity Profile

9/30/09 Maturity Profile

Pro Forma 12/31/09 Maturity Profile

Revolver

$100mm

$100mm

Convertible

$225mm

$225mm

Bond

$175mm

$175mm

Revolver

$125mm

$125mm

Bond

$200mm

$200mm

Convertible

$115mm

$115mm

25

ICG Highlights

n Product and basin diversification

n Excellent reserve position, majority of which is owned

n Attractive cost position

n Underground-focused growth strategy

26

n Metallurgical sales expected to more than double in 2010 to 2.4 million tons

n Highly contracted 2010 with upside for 2011

n Sufficient open tonnage to take advantage of improving coal markets

n Nearly 3 million annual tons of idle production capacity available

n World-class 3.5 million tpy Tygart longwall development

n Additional opportunities to further increase metallurgical tons

n Demonstrated ability to grow profits and cash flow

n Consistent recent financial performance and favorable outlook

n Industry-leading legacy liability position

n Restructured balance sheet with reduced leverage levels and extended

maturity profile

maturity profile

Attractive Asset Portfolio

Positioned to Capitalize on

Favorable Industry Trends

Favorable Industry Trends

Significant Organic Growth Profile

Enhanced Financial Position

Thank You!

27

Appendices

28

29

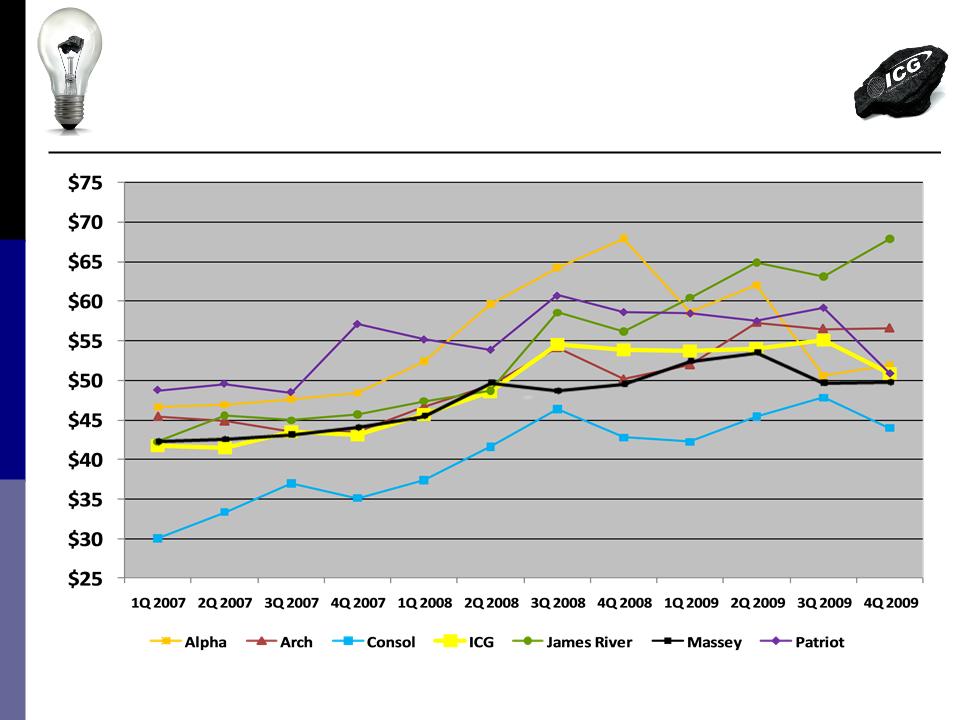

Peer Group

Cost and Margin Comparisons

30

Peer Group Cost Per Ton

Appalachian Production (2007-2009)

Appalachian Production (2007-2009)

31

Peer Group Cost Per Ton

Illinois Basin Production (2007-2009)

Illinois Basin Production (2007-2009)

32

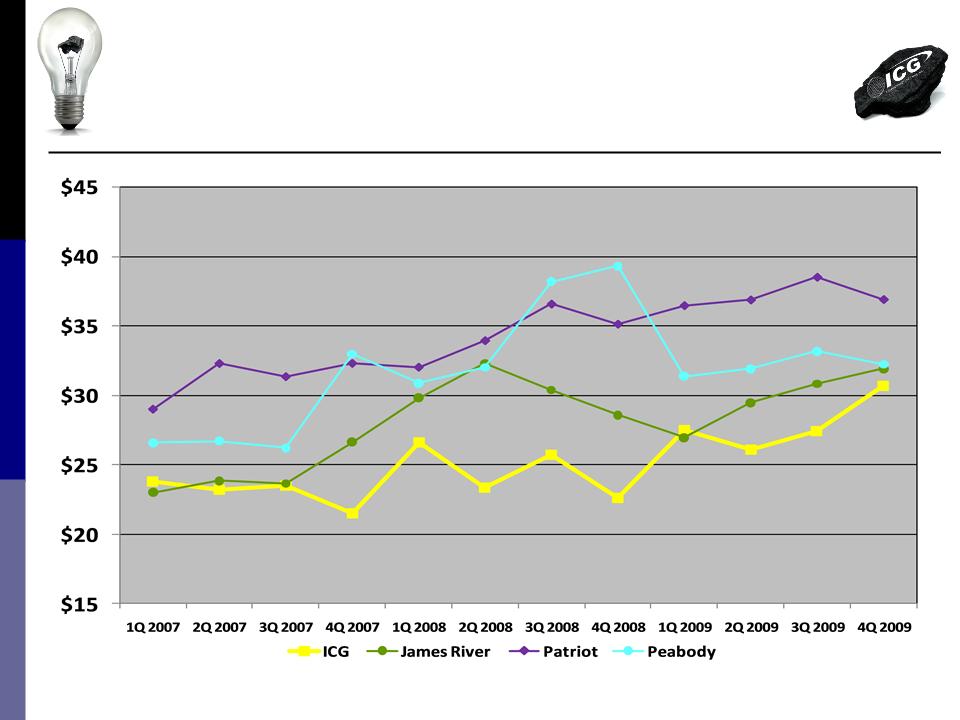

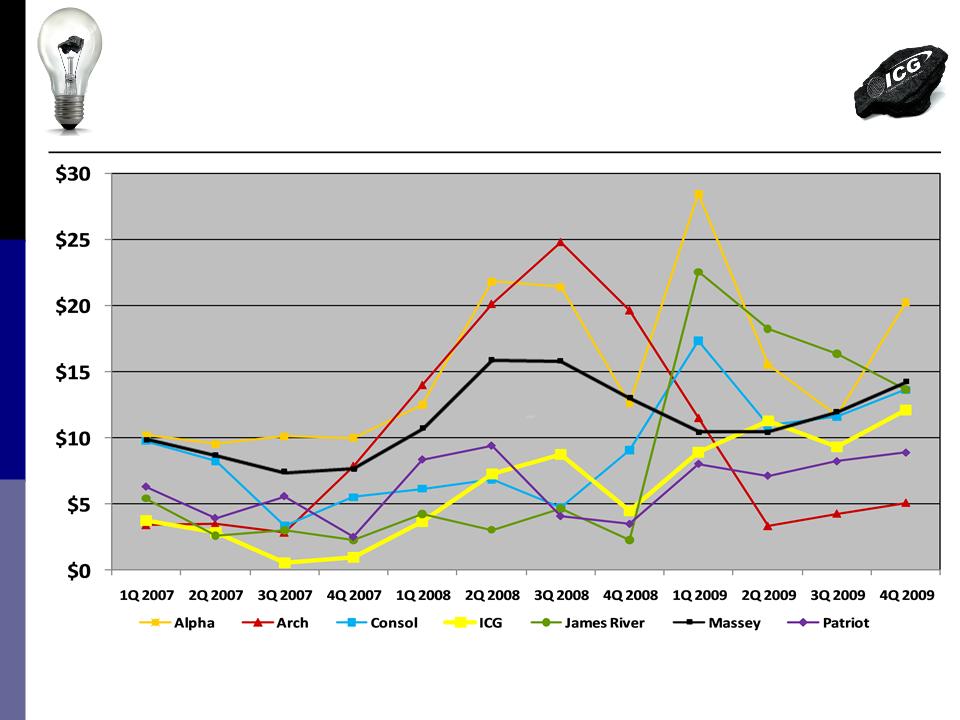

Peer Group Margin Comparison

Margin Per Ton in Dollars (2007-2009)

Margin Per Ton in Dollars (2007-2009)

Note: Margin comparison reflects Eastern US production only.

33

Non-GAAP Measures

n Adjusted EBITDA is a non-GAAP financial measure used by management to gauge operating

performance. We define Adjusted EBITDA as net income or loss attributable to International Coal

Group, Inc. before deducting interest, income taxes, depreciation, depletion, amortization, loss on

extinguishment of debt, impairment charges and noncontrolling interest. Adjusted EBITDA is not, and

should not be used as, a substitute for operating income, net income and cash flow as determined in

accordance with GAAP. We present Adjusted EBITDA because we consider it an important

supplemental measure of our performance and believe it is frequently used by securities analysts,

investors and other interested parties in the evaluation of companies in our industry, substantially all of

which present EBITDA or Adjusted EBITDA when reporting their results. We also use Adjusted

EBITDA as our executive compensation plan bases incentive compensation payments on our Adjusted

EBITDA performance measured against budgets. Our ABL Loan facility uses Adjusted EBITDA (with

additional adjustments) to measure our compliance with covenants, such as fixed charge coverage.

EBITDA or Adjusted EBITDA is also widely used by us and others in our industry to evaluate and price

potential acquisition candidates. Adjusted EBITDA has limitations as an analytical tool, and you should

not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. Some

of these limitations are that Adjusted EBITDA does not reflect all of our cash expenditures or any of

our future requirements, for capital expenditures or contractual commitments; changes in, or cash

requirements for, our working capital needs; or interest expense, or the cash requirements necessary

to service interest or principal payments, on our debts. Although depreciation, depletion and

amortization are non-cash charges, the assets being depreciated, depleted and amortized will often

have to be replaced in the future. Adjusted EBITDA does not reflect any cash requirements for such

replacements. Other companies in our industry may calculate EBITDA or Adjusted EBITDA differently

than we do, limiting its usefulness as a comparative measure.

performance. We define Adjusted EBITDA as net income or loss attributable to International Coal

Group, Inc. before deducting interest, income taxes, depreciation, depletion, amortization, loss on

extinguishment of debt, impairment charges and noncontrolling interest. Adjusted EBITDA is not, and

should not be used as, a substitute for operating income, net income and cash flow as determined in

accordance with GAAP. We present Adjusted EBITDA because we consider it an important

supplemental measure of our performance and believe it is frequently used by securities analysts,

investors and other interested parties in the evaluation of companies in our industry, substantially all of

which present EBITDA or Adjusted EBITDA when reporting their results. We also use Adjusted

EBITDA as our executive compensation plan bases incentive compensation payments on our Adjusted

EBITDA performance measured against budgets. Our ABL Loan facility uses Adjusted EBITDA (with

additional adjustments) to measure our compliance with covenants, such as fixed charge coverage.

EBITDA or Adjusted EBITDA is also widely used by us and others in our industry to evaluate and price

potential acquisition candidates. Adjusted EBITDA has limitations as an analytical tool, and you should

not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. Some

of these limitations are that Adjusted EBITDA does not reflect all of our cash expenditures or any of

our future requirements, for capital expenditures or contractual commitments; changes in, or cash

requirements for, our working capital needs; or interest expense, or the cash requirements necessary

to service interest or principal payments, on our debts. Although depreciation, depletion and

amortization are non-cash charges, the assets being depreciated, depleted and amortized will often

have to be replaced in the future. Adjusted EBITDA does not reflect any cash requirements for such

replacements. Other companies in our industry may calculate EBITDA or Adjusted EBITDA differently

than we do, limiting its usefulness as a comparative measure.

34