Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Encompass Health Corp | form_8k-03222010presentation.htm |

1

Barclays Capital Global

Healthcare Conference

Healthcare Conference

March 23, 2010

Exhibit 99.1

Exhibit 99.1

2

Table of Contents

Exhibit 99.1

3

Note Regarding Forward-Looking Statements

The information contained in this presentation includes certain estimates, projections and other forward-looking information

that reflect our current views with respect to future events and financial performance. These estimates, projections and other

forward-looking information are based on assumptions that HealthSouth believes, as of the date hereof, are reasonable.

Inevitably, there will be differences between such estimates and actual results, and those differences may be material.

The information contained in this presentation includes certain estimates, projections and other forward-looking information

that reflect our current views with respect to future events and financial performance. These estimates, projections and other

forward-looking information are based on assumptions that HealthSouth believes, as of the date hereof, are reasonable.

Inevitably, there will be differences between such estimates and actual results, and those differences may be material.

There can be no assurance that any estimates, projections or forward-looking information will be realized. All such

estimates, projections and forward-looking information speak only as of the date hereof. HealthSouth undertakes no duty to

publicly update or revise the information contained herein.

estimates, projections and forward-looking information speak only as of the date hereof. HealthSouth undertakes no duty to

publicly update or revise the information contained herein.

This presentation also includes estimates and projections published by the Centers for Medicare and Medicaid Services

(“CMS”). We are not able to verify those estimates or projections or the detailed calculations thereof by CMS which are not

made public. Any changes or errors in those calculations, among other uncertainties such as those referred to below and

changes in CMS’s own rules and policies, could cause actual results to differ materially from CMS’s projections.

Furthermore, we do not believe that CMS numbers are consistent with financial reporting results. CMS data and projections

should not be used as an indication of financial performance.

(“CMS”). We are not able to verify those estimates or projections or the detailed calculations thereof by CMS which are not

made public. Any changes or errors in those calculations, among other uncertainties such as those referred to below and

changes in CMS’s own rules and policies, could cause actual results to differ materially from CMS’s projections.

Furthermore, we do not believe that CMS numbers are consistent with financial reporting results. CMS data and projections

should not be used as an indication of financial performance.

You are cautioned not to place undue reliance on the estimates, projections and other forward-looking information in this

presentation as they are based on current expectations and general assumptions and are subject to various risks,

uncertainties and other factors, including those set forth in our Form 10-K for the year ended December 31, 2009, and in

other documents we previously filed with the SEC, many of which are beyond our control, that may cause actual results to

differ materially from the views, beliefs and estimates expressed herein.

presentation as they are based on current expectations and general assumptions and are subject to various risks,

uncertainties and other factors, including those set forth in our Form 10-K for the year ended December 31, 2009, and in

other documents we previously filed with the SEC, many of which are beyond our control, that may cause actual results to

differ materially from the views, beliefs and estimates expressed herein.

Note Regarding Presentation of Non-GAAP Financial Measures

The following presentation includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities

Exchange Act of 1934. The Appendix at the end of this presentation includes reconciliations of the non-GAAP financial

measures found in the following presentation to the most directly comparable financial measures calculated and presented in

accordance with Generally Accepted Accounting Principles in the United States. Our Form 8-K, dated March 22, 2010, to

which the following presentation slides are attached, provides further explanation and disclosure regarding our use of non-

GAAP financial measures and should be read in conjunction with these presentation slides.

The following presentation includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities

Exchange Act of 1934. The Appendix at the end of this presentation includes reconciliations of the non-GAAP financial

measures found in the following presentation to the most directly comparable financial measures calculated and presented in

accordance with Generally Accepted Accounting Principles in the United States. Our Form 8-K, dated March 22, 2010, to

which the following presentation slides are attached, provides further explanation and disclosure regarding our use of non-

GAAP financial measures and should be read in conjunction with these presentation slides.

Cautionary Statements

Exhibit 99.1

4

IRH

LTCH

93 Rehabilitation Hospitals

40 Outpatient Rehabilitation Satellites

6 Long-Term Acute Care Hospitals

25 Hospital-Based Home

Health Agencies

Health Agencies

Portfolio

Largest Provider of Inpatient Rehabilitative Healthcare Services in the U.S.

Sites under Construction

Exchange (Symbol): NYSE (HLS)

Employees: ~ 22,000

Corporate Office: Birmingham, AL

Exhibit 99.1

5

“The Basics”: Our Rehabilitation Hospitals

Major Services:

• Physicians: manage and treat medical needs of patients

• Rehabilitation Nursing: oversees treatment program of patient

• Physical Therapy: addresses physical function, mobility, safety

• Occupational Therapy: promotes independence and re-integration

• Speech-Language Therapy: treats communication & swallowing disorders

• Case Managers: coordinate care plan with physician, caregivers, family

• Post-discharge services: outpatient therapy and home health

Note: IRF hospitals are not CAPEX intensive:

ü No Emergency Rooms, ORs, Cath Labs, etc.

Exhibit 99.1

6

“The Basics”: Our Patients

94%

5%

1%

Referral Sources

Acute Care Hospitals

Physician Offices

Skilled Nursing Facilities

All patients are admitted by a physician:

Most Common Cases (2009)

1. Stroke 17.5%

2. Neurological 13.3%

3. Fracture of the lower extremity 11.7%

4. Debility 11.5%

5. Knee/Hip replacement 9.6%

6. Other orthopedic conditions 9.5%

7. Brain injury 7.4%

8. Cardiac conditions 4.7%

9. Spinal cord injury 3.6%

10. All other 11.2%

ü Physicians and acute care hospital case managers are key decision-makers.

ü All IRF patients must meet medical necessity criteria.

ü All IRF patients must be medically stable and have potential to tolerate three hours

of therapy per day (minimum).

of therapy per day (minimum).

Exhibit 99.1

7

“The Basics”: Our Competitors

Competitors

• Freestanding IRFs

• Hospital IRF units

• Skilled nursing homes

Patients

Total Inpatient Rehabilitation Facilities (IRFs):1,181

Sources: FY 2010 CMS Rate Setting File and MedPAC March 2009 report; Internal HLS reports for HLS data;

Exhibit 99.1

8

Discharges

Consolidated Net Operating Revenues

($ Millions)

+4.5%

+5.4%

Dollar Amounts $928.2 $948.8 $448.9 $464.5 $93.8 $91.1

EPOB (3) 3.62 3.53

30 bps

Improvement

Improvement

20 bps

Improvement

Improvement

110 bps

Improvement

Improvement

Expenses

(1)

(2)

Solid, Sustained Operating Results

(Thousands)

Exhibit 99.1

9

Adjusted Income from Continuing

Operations per Diluted Share (1)

Adjusted Consolidated EBITDA

($ Millions)

+12.3%

90.8%

(1) Reconciliation to GAAP provided on slides 41 through 42.

Key Drivers:

üIncreased volumes

üImproved labor productivity

üDisciplined expense management

ü2.5% Medicare market basket increase effective October 1, 2009

Solid EBITDA and EPS Growth

Exhibit 99.1

10

(1) Notes on page 42.

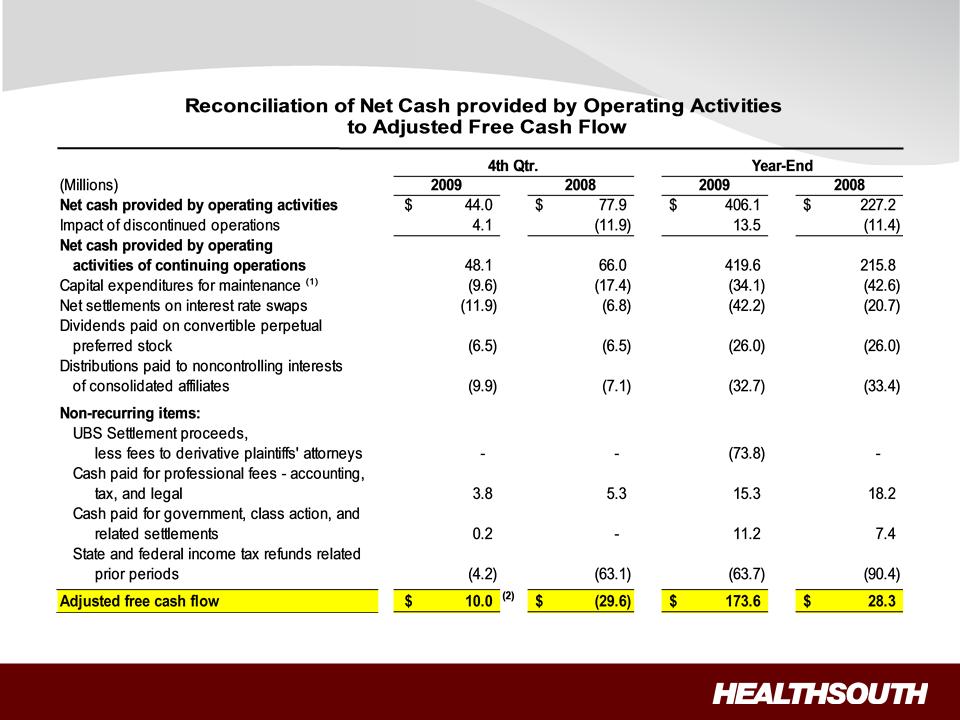

Performance Highlights: Strong Free Cash Flow

Exhibit 99.1

11

(1) Includes capital expenditures for the hospital refresh program.

(2) Reflects seasonal use of cash related to interest and insurance payments.

Performance Highlights: Strong Free Cash Flow

Exhibit 99.1

12

(1) Based on four quarter trailing Adjusted Consolidated EBITDA of $383.0 million; see related debt schedule on slide 37, and reconciliation to

GAAP on slides 41 through 42.

GAAP on slides 41 through 42.

Debt to EBITDA 6.3x 6.3x 5.3x 4.3x (1)

Year-End 2011 Goal: 3.5x to 4.0x

Liquidity

Continued Debt Reduction and Deleveraging

Performance Highlights

Exhibit 99.1

13

Business Outlook

3.5x to 4.0x Debt to EBITDA (by YE 2011)

(Exclusive of any E&Y settlement)

Organic growth through capacity

expansion and de novos

expansion and de novos

(~ $60 million in 2010)

IRF acquisitions/joint ventures

Deleveraging

Growth

Acquisitions of other,

complementary post-acute services

complementary post-acute services

Reform

1.Pricing

2.Bundling

Sector

Regulation

Regulation

Pilot/Demonstration

Projects

Projects

• LTCH: admission criteria; 25% Rule; MMSEA extension

• Home Health: outliers; reimbursement methodology

Deleveraging, Growth, Reform and Sector Regulation

No change Unknown at this time

2010 2011 2012 2013

Exhibit 99.1

14

Regulatory Uncertainty

Sources: Senate Reform Bill, CMS Regulatory published rules and MMSEA

Exhibit 99.1

15

2010 Guidance(1)

Guidance Philosophy

Appropriately conservative at beginning of year; consistent

with past practices; does not include acquisitions.

with past practices; does not include acquisitions.

+4% to +6%

Considerations:

üContinued market share gains

üMedicare pricing

üIT “pilot” investment

Adjusted EPS(1)(2): $1.60 to $1.70

+10% to +17%

Considerations:

ü$5 million of additional stock-based compensation expenses

ü5 million more diluted shares (Securities Litigation Settlement)

üAssumes LIBOR remains unchanged throughout year

üTougher “comps”: $0.69 Adjusted EPS growth (+90.8%) 2009 over

2008

2008

Business

Model

+5% to +8%

+15% to +20%

ü Start-up costs at two new

hospitals

hospitals

ü TeamWorks investment

(1) Reconciliation to GAAP provided on slides 41 through 42.

(2) Adjusted income from continuing operations per diluted share.

Exhibit 99.1

16

Q110 Initial Observations

Volume:

ü January - strong December discharges created steeper ramp up in January.

ü February - heavy snow falls affected some markets (e.g. Pennsylvania,

Virginia, Tennessee, New Jersey and Arkansas).

Virginia, Tennessee, New Jersey and Arkansas).

ü March - volume growth mid-month on track.

Expenses:

ü Expense management better than expected; improvement over Q109.

Earnings:

ü Reaffirm 2010 guidance

Exhibit 99.1

17

Summary

ü Industry Leader: Largest provider in attractive healthcare segment.

ü Strong Cash Flows: Directed toward debt reduction and growth.

ü Continued Deleveraging: Reduce leverage to between 3.5x and 4.0x

no later than YE 2011.

no later than YE 2011.

ü Solid Organic Growth: Volume growth + expense management.

ü Opportunistic, Disciplined Expansion: Capacity expansion and new

hospitals coming online over next three years.

hospitals coming online over next three years.

ü Well Positioned: High-quality + cost-effective provider; proven track

record of adapting to regulatory changes.

record of adapting to regulatory changes.

Value Proposition

Exhibit 99.1

18

Appendix

Exhibit 99.1

19

(1) Data provided by UDSMR, a data gathering and analysis organization for the rehabilitation industry; represents ~ 65-70% of industry, including 90 HealthSouth sites.

(2) Includes 90 consolidated HealthSouth inpatient rehab hospitals and six long-term acute-care hospitals.

Operational Excellence: Sustained Market Share Gains

HealthSouth vs. Industry

Quarterly Discharges

ü HealthSouth’s volume growth

has outpaced competitors’

has outpaced competitors’

ü TeamWorks = standardized

sales & marketing

sales & marketing

ü Capacity expansions will help

facilitate organic growth:

facilitate organic growth:

Ÿ ~ 100 new beds 2009

Ÿ ~ 100 new beds 2010

Exhibit 99.1

20

FIM Gain

LOS Efficiency

LOS Efficiency = Functional gain

divided by length of stay

divided by length of stay

Source: UDSmr Database - On Demand

Reports 2009 Year End Report

Reports 2009 Year End Report

FIM Gain = Change in Functional

Independent Measurement (based

Independent Measurement (based

on an 18 point assessment) from

Admission to Discharge

Admission to Discharge

** Average = Expected, Risk-adjusted LOS Efficiency

Operational Excellence = “High-Quality” Care

* Average = Expected, Risk-adjusted FIM Change Average

Exhibit 99.1

21

Operational Excellence = “Cost-Effective” Care

CMS Fiscal Year 2010 IRF Rate Setting File Analysis (1)

|

|

Freestanding

(2) |

Units (2)

|

Total

|

|

HealthSouth

|

|

|

Hospitals (2)

|

||||

|

Number of IRFs

|

228

|

953

|

1,181

|

|

94

|

|

Average # of Discharges per IRF

|

649

|

237

|

316

|

|

822

|

|

Outlier Payments as % of Total

Payments |

1.32%

|

4.08%

|

3.00%

|

|

0.43%

|

|

Average Estimated Total Payment

per Discharge for FY 2010 |

$16,452

|

$16,741

|

$16,626

|

|

$15,996

|

|

Average Estimated Cost per

Discharge for FY 2010 |

$14,021

|

$17,207

|

$15,945

|

|

$12,633

|

Notes:

(1) All data provided was filtered and compiled from the Centers for Medicare and Medicaid Services (CMS) Fiscal Year 2010 IRF rate setting final

rule file found at http://www.cms.hhs.gov/InpatientRehabFacPPS/07_DataFiles.asp#TopOfPage. The data presented was developed entirely by

CMS and is based on its definitions which are different in form and substance from the criteria HealthSouth uses for external reporting purposes.

Because CMS does not provide its detailed methodology, HealthSouth is not able to reconstruct the CMS projections or the calculation.

rule file found at http://www.cms.hhs.gov/InpatientRehabFacPPS/07_DataFiles.asp#TopOfPage. The data presented was developed entirely by

CMS and is based on its definitions which are different in form and substance from the criteria HealthSouth uses for external reporting purposes.

Because CMS does not provide its detailed methodology, HealthSouth is not able to reconstruct the CMS projections or the calculation.

(2) The CMS file contains data for each of the 1,181 inpatient rehabilitation facilities used to estimate the policy updates for the FY 2010 Final IRF-

PPS Rule. Most of the data represents historical information from the CMS fiscal year 2008 period and does not reflect the same HealthSouth

hospitals in operation today. The data presented was separated into three categories: Freestanding, Units, and HealthSouth. HealthSouth is a

subset of Freestanding and the Total.

PPS Rule. Most of the data represents historical information from the CMS fiscal year 2008 period and does not reflect the same HealthSouth

hospitals in operation today. The data presented was separated into three categories: Freestanding, Units, and HealthSouth. HealthSouth is a

subset of Freestanding and the Total.

Exhibit 99.1

22

Capacity expansions:

• Approximately 100 beds to be added in 2010.

• Average investment per bed including renovation:

– $100K to $250K

De novos:

• Expanded joint venture with St. Vincent Health System in Little Rock, AR, through the

purchase of a 23-bed rehabilitation unit.

purchase of a 23-bed rehabilitation unit.

• Acquired the rehabilitation unit in Altoona, PA, through a newly formed joint venture and

relocated its operations to one of our hospitals.

relocated its operations to one of our hospitals.

Organic Growth

Cash pay-back:

6 - 7 years

Cash pay-back:

2 - 4 years

2 - 4 years

Exhibit 99.1

23

IRFs have Lower Readmission Rates

Note: Use of home health care and hospice is based on care that starts within three days of discharge. Other PAC care starts within one day of

discharge. Home health use includes episodes that overlap an inpatient stay.

discharge. Home health use includes episodes that overlap an inpatient stay.

Source: Medicare Payment Advisory Commission, “A Data Book: Healthcare spending and the Medicare program,” Chart 9-3 (June 2008)

Exhibit 99.1

24

Revenues (Q4 2009 vs. Q4 2008)

• Inpatient revenue growth was driven by strong discharge volumes in Q4 2009 despite tough

comparisons in Q4 2008.

comparisons in Q4 2008.

– Volume growth was driven by the sustained sales and marketing effort.

– Same store discharge growth was 4.2%.

– Pricing reflects 2.5% Medicare market basket increase effective October 1, 2009.

• Outpatient revenue declined as a result of 10 fewer outpatient satellites quarter over quarter.

Exhibit 99.1

25

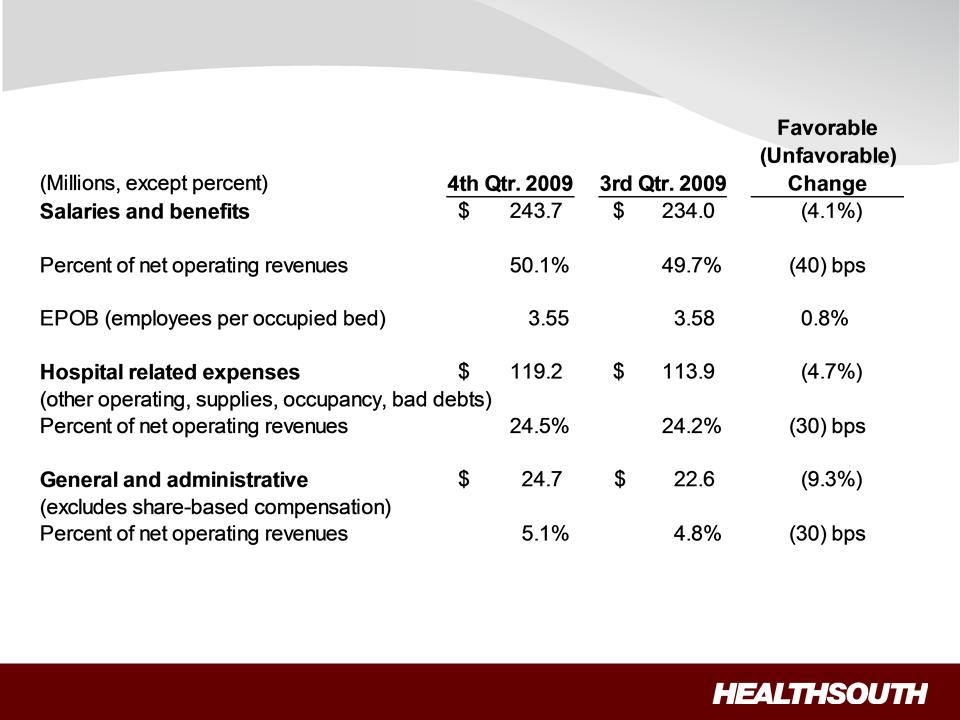

• Salaries and benefits increased as a result of an October 1, 2009, 2.3% merit increase.

– Continued improvement on labor productivity demonstrated by lower EPOB.

• Hospital-related expenses increased as a result of higher discharge volume.

Exhibit 99.1

26

Adjusted Consolidated EBITDA (1)

(Millions)

(Millions)

(1) Reconciliation to GAAP provided on slides 41 through 42.

• Improvements driven by:

– Increased volumes

– Improved labor productivity

– Disciplined expense management

– 2.5% Medicare market basket increase effective October 1, 2009

Exhibit 99.1

27

Adjusted Income per Diluted Share (4Q 2009)

(1) Reconciliation to GAAP provided on slides 41 through 42.

• The improvement in adjusted earnings per share, driven by higher Adjusted

Consolidated EBITDA and lower interest expense, was offset by a $15.6 million loss on

early extinguishment of debt.

Consolidated EBITDA and lower interest expense, was offset by a $15.6 million loss on

early extinguishment of debt.

– Interest expense was lower as a result of lower debt balances and a lower LIBOR rate.

Exhibit 99.1

28

(1) Reconciliation to GAAP provided on slides 41 through 42.

Exhibit 99.1

29

Revenues (Year-End)

Exhibit 99.1

30

Expenses (Year-End)

Exhibit 99.1

31

Revenues (Sequential)

Exhibit 99.1

32

Expenses (Sequential)

Exhibit 99.1

33

Operational and Labor Metrics (1)

(2) Represents discharges from HealthSouth’s 90 consolidated hospitals, which includes Mesa, Arizona starting in Q3 2009.

(3) Excludes approx. 400 full-time equivalents, who are considered part of corporate overhead with their salaries and benefits included in general

and administrative expenses in the Company’s condensed consolidated statements of operations. Full-time equivalents included in the above

table represent HealthSouth employees who participate in or support the operations of the Company’s hospitals.

and administrative expenses in the Company’s condensed consolidated statements of operations. Full-time equivalents included in the above

table represent HealthSouth employees who participate in or support the operations of the Company’s hospitals.

(4) Employees per occupied bed, or “EPOB,” is calculated by dividing the number of full-time equivalents, including an estimate of full-time

equivalents from the utilization of contract labor, by the number of occupied beds during each period. The number of occupied beds is determined

by multiplying the number of licensed beds by the Company’s occupancy percentage.

equivalents from the utilization of contract labor, by the number of occupied beds during each period. The number of occupied beds is determined

by multiplying the number of licensed beds by the Company’s occupancy percentage.

Exhibit 99.1

34

Payment Sources

(1) Managed Medicare revenues represent ~ 8% and 6% of total revenues for 2009 and 2008, respectively, and are included in “Managed care

and other discount plans.”

and other discount plans.”

Exhibit 99.1

35

Debt Maturities: No Near-Term Financing Needs

(Millions)

= Term Loan maturities

= 10.75% Fixed

= 8.125% Fixed

= Capital leases and term

loan amortization

loan amortization

As of December 31, 2009

Exhibit 99.1

36

Interest Rate Swaps

(Millions)

(Millions)

(1) In October 2009, the credit agreement was amended. The maturity for $300 million of the term loan has been extended to 2015. The extended

portion of the term loan will bear an interest rate of Libor plus 375.

(2) Cash settlements flow through investing activities.

(3) In June 2009, we entered into a receive-fixed rate swap as a mirror offset to $100.0 million of the $1,056 million interest rate swap.

(4) Forward-starting interest rate swaps (designated as cash flow hedges). Cash settlements will flow through operating activities as part of interest

expense.

Exhibit 99.1

37

Debt Schedule

(Millions)

(Millions)

(1) The Company had $80.9 million in cash and cash equivalents as of December 31, 2009.

(2) Based on four quarter trailing Adjusted Consolidated EBITDA of $383.0 million and $341.2 million respectively. See reconciliation to GAAP

on slides 41 through 42.

on slides 41 through 42.

Debt to EBITDA(2) 4.3x 5.3x

Exhibit 99.1

38

Credit Ratings

Exhibit 99.1

39

Non-Operating Cash/Tax Position

Cash Refunds as of Dec. 31, 2009

• Federal tax recoveries virtually complete.

– Approx. $43 million received.

• State tax refunds in progress.

– Approx. $21 million received.

– Approx. $10 million net receivable on

the balance sheet.

Future Cash Tax Payments

• Expect to pay about $5-7 million per year of income

tax.

tax.

– State income tax.

– Alternative Minimum Tax (AMT).

• The Company does not expect to pay significant

federal income taxes for the next 10-12 years, due

to approximately $905 million in deferred tax assets

as of 12/31/09 outlined in the Form 10-K to be filed

with the SEC. The majority of the deferred tax asset

is related to net operating losses (NOLs).

federal income taxes for the next 10-12 years, due

to approximately $905 million in deferred tax assets

as of 12/31/09 outlined in the Form 10-K to be filed

with the SEC. The majority of the deferred tax asset

is related to net operating losses (NOLs).

– At this time, we do not believe the use

of NOLs will be limited before they

expire, however, no assurances can

be provided.

• HealthSouth is not currently subject to an annual

use limitation (AUL) under the Internal Revenue

Code section 382.

use limitation (AUL) under the Internal Revenue

Code section 382.

• If we experienced a “change of ownership” as

defined by the Internal Revenue Code section 382,

we would be subject to an AUL, which is equal to

the value of the company at the time of the “change

of ownership” multiplied by the long-term tax exempt

rate.

defined by the Internal Revenue Code section 382,

we would be subject to an AUL, which is equal to

the value of the company at the time of the “change

of ownership” multiplied by the long-term tax exempt

rate.

GAAP Considerations

• HealthSouth’s balance sheet currently

reflects a valuation allowance for the

potential value of NOLs and future

deductions. The valuation allowance is

approximately $893 million.

reflects a valuation allowance for the

potential value of NOLs and future

deductions. The valuation allowance is

approximately $893 million.

• GAAP tax rate will net to small amount for

foreseeable future as there will be a

reduction in the valuation allowance when

NOLs are utilized.

foreseeable future as there will be a

reduction in the valuation allowance when

NOLs are utilized.

Exhibit 99.1

40

Outstanding Share Summary

(Millions)

(Millions)

Notes:

(1) Completed an equity offering for 8.8 million shares on June 27, 2008.

(2) Does not include 2.0 million warrants issued in connection with a January 2004 loan repaid to Credit Suisse First Boston. In connection with this

transaction, we issued warrants to the lender to purchase two million shares of our common stock. Each warrant has a term of ten years from the

date of issuance and an exercise price of $32.50 per share. The warrants were not assumed exercised for dilutive shares outstanding because

they were antidilutive in the periods presented.

transaction, we issued warrants to the lender to purchase two million shares of our common stock. Each warrant has a term of ten years from the

date of issuance and an exercise price of $32.50 per share. The warrants were not assumed exercised for dilutive shares outstanding because

they were antidilutive in the periods presented.

(3) The agreement to settle our class action securities litigation received final court approval in January 2007. These shares of common stock and

warrants were issued on September 30, 2009. The 5.0 million of common shares are now included in the outstanding shares. The warrants at a

strike price of $41.40 were not assumed exercised for the dilutive shares outstanding because they are anti-dilutive in the periods presented.

warrants were issued on September 30, 2009. The 5.0 million of common shares are now included in the outstanding shares. The warrants at a

strike price of $41.40 were not assumed exercised for the dilutive shares outstanding because they are anti-dilutive in the periods presented.

(4) The difference between the basic and diluted shares outstanding is primarily related to our convertible perpetual preferred stock.

Exhibit 99.1

41

Three & Twelve Months Reconciliation of Net Income to Adjusted Income

from Continuing Operations and Adjusted Consolidated EBITDA (1) (3)

from Continuing Operations and Adjusted Consolidated EBITDA (1) (3)

(1) (2) (3) (4) - Notes on page 42.

Exhibit 99.1

42

Reconciliation Notes

1. Adjusted income from continuing operations and Adjusted Consolidated EBITDA are

non-GAAP financial measures. The Company’s leverage ratio (Total Consolidated Debt

to Adjusted Consolidated EBITDA for the trailing four quarters) is, likewise, a non-GAAP

financial measure. Management and some members of the investment community

utilize adjusted income from continuing operations as a financial measure and Adjusted

Consolidated EBITDA and leverage ratio as liquidity measures on an ongoing basis.

These measures are not recognized in accordance with GAAP and should not be

viewed as an alternative to GAAP measures of performance or liquidity. In evaluating

these adjusted measures, the reader should be aware that in the future HealthSouth

may incur expenses similar to the adjustments set forth above.

non-GAAP financial measures. The Company’s leverage ratio (Total Consolidated Debt

to Adjusted Consolidated EBITDA for the trailing four quarters) is, likewise, a non-GAAP

financial measure. Management and some members of the investment community

utilize adjusted income from continuing operations as a financial measure and Adjusted

Consolidated EBITDA and leverage ratio as liquidity measures on an ongoing basis.

These measures are not recognized in accordance with GAAP and should not be

viewed as an alternative to GAAP measures of performance or liquidity. In evaluating

these adjusted measures, the reader should be aware that in the future HealthSouth

may incur expenses similar to the adjustments set forth above.

2. Per share amounts for each period presented are based on basic weighted average

common shares outstanding for all amounts except adjusted income from continuing

operations per diluted share, which is based on diluted weighted average shares

outstanding. The difference in shares between the basic and diluted shares outstanding

is primarily related to our convertible perpetual preferred stock.

common shares outstanding for all amounts except adjusted income from continuing

operations per diluted share, which is based on diluted weighted average shares

outstanding. The difference in shares between the basic and diluted shares outstanding

is primarily related to our convertible perpetual preferred stock.

3. Adjusted income from continuing operations per diluted share and Adjusted

Consolidated EBITDA are two components of our guidance.

Consolidated EBITDA are two components of our guidance.

4. The Company’s Credit Agreement allows certain other items to be added to arrive at

Adjusted Consolidated EBITDA, and there may be certain other deductions required.

Adjusted Consolidated EBITDA, and there may be certain other deductions required.