Attached files

Exhibit 10.13

OFFICE LEASE

BETWEEN

WELLS VAF – PARKWAY AT OAK HILL, LLC

(“LANDLORD”)

AND

WELLS FARGO BANK, N.A.

(“TENANT”)

TABLE OF CONTENTS

| PAGE | ||||

| 1. |

Basic Lease Information |

1 | ||

| 2. |

Lease Grant |

3 | ||

| 3. |

Term; Adjustment of Commencement Date; Early Access |

3 | ||

| 4. |

Rent |

5 | ||

| 5. |

Tenant’s Use of Premises |

8 | ||

| 6. |

Security Deposit |

9 | ||

| 7. |

Services Furnished by Landlord |

9 | ||

| 8. |

Use of Electrical Services by Tenant |

10 | ||

| 9. |

Repairs and Alterations |

11 | ||

| 10. |

Entry by Landlord |

13 | ||

| 11. |

Assignment and Subletting |

13 | ||

| 12. |

Liens |

15 | ||

| 13. |

Indemnity |

15 | ||

| 14. |

Insurance |

15 | ||

| 15. |

Mutual Waiver of Subrogation |

16 | ||

| 16. |

Casualty Damage |

16 | ||

| 17. |

Condemnation |

17 | ||

| 18. |

Events of Default |

17 | ||

| 19. |

Remedies |

18 | ||

| 20. |

Limitation of Liability |

20 | ||

| 21. |

No Waiver |

20 | ||

| 22. |

Tenant’s Right to Possession |

20 | ||

| 23. |

Relocation |

20 | ||

| 24. |

Holding Over |

21 | ||

| 25. |

Subordination to Mortgages; Estoppel Certificate |

21 | ||

| 26. |

Attorneys’ Fees |

22 | ||

| 27. |

Notice |

22 | ||

| 28. |

Reserved Rights |

22 | ||

| 29. |

Surrender of Premises |

22 | ||

| 30. |

Hazardous Materials |

23 | ||

| 31. |

Miscellaneous |

24 | ||

EXHIBITS AND RIDERS:

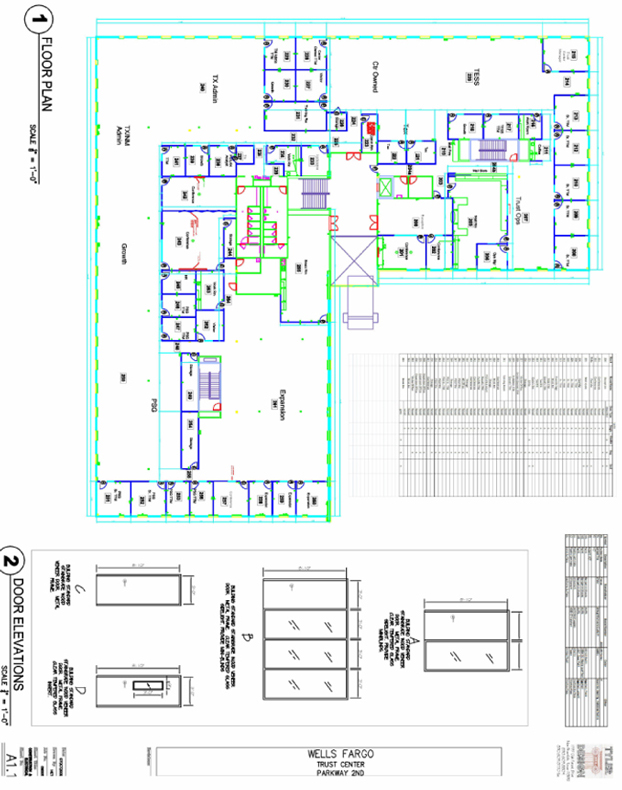

| EXHIBIT A-1 |

OUTLINE AND LOCATION OF PREMISES | |||

| EXHIBIT A-2 |

LEGAL DESCRIPTION OF PROPERTY | |||

| EXHIBIT B |

RULES AND REGULATIONS | |||

| EXHIBIT C |

COMMENCEMENT LETTER | |||

| EXHIBIT D |

WORK LETTER | |||

| EXHIBIT E |

PARKING AGREEMENT | |||

| EXHIBIT F |

ROOFTOP AND CABLING AGREEMENT | |||

| RIDER NO. 1 |

OPTION TO EXTEND | |||

| RIDER NO. 2 |

OPTION TO EXPAND | |||

| RIDER NO. 3 |

SUBORDINATED RIGHT OF FIRST OFFER | |||

i

OFFICE LEASE

This Office Lease (this “Lease”) is entered into by and between WELLS VAF – PARKWAY AT OAK HILL, LLC, a Delaware limited liability company (“Landlord”), and WELLS FARGO BANK, N.A., a national banking association (“Tenant”), and shall be effective as of the date set forth below Landlord’s signature (the “Effective Date”).

1. Basic Lease Information. The key business terms used in this Lease are defined as follows:

A. “Building”: The building commonly known as Building One of Parkway at Oak Hill and located at 4801 Southwest Parkway, Austin, TX 78735.

B. “Rentable Square Footage of the Building” is agreed and stipulated to be 59,376 square feet.

C. “Premises”: The area shown on Exhibit A-1 to this Lease. The Premises are located on floor 2 of the Building and known as suite number 200. The “Rentable Square Footage of the Premises” is deemed to be 31,019 square feet. If the Premises include, now or hereafter, one or more floors in their entirety, all corridors and restroom facilities located on such full floor(s) shall be considered part of the Premises. The exact Rentable Square Footage of the Premises shall be deemed to be as set forth in this Section 1.C; provided, however, within 30 days after the Commencement Date, Tenant may enlist its architect, at Tenant’s sole cost, to measure the Rentable Square Footage of the Premises using the Standard Method for Measuring Floor Area in Office Buildings ANSI Z65.1-1996 or successor standards, adopted by the Building Owners and Managers Association International (BOMA). If such measurement indicates that the Rentable Square Footage of the Premises is different by more than one percent (1%) of the number of square feet of Rentable Square Footage set forth in this Section 1.C, then Tenant may notify Landlord of Tenant’s architect’s calculation, and the parties, through reasonable good faith negotiations, shall endeavor to resolve such discrepancy. In the event the parties are unable to resolve such discrepancy in a timely manner, then Landlord’s architect for the Building and Tenant’s architect shall jointly appoint an independent architect to resolve such discrepancy and the determination of such independent architect shall be binding on both Landlord and Tenant. The fees of such independent architect shall be shared equally by Landlord and Tenant. Promptly following determination of the Rentable Square Footage of the Premises in accordance with this Section 1.C., the parties shall enter into an amendment to this Lease modifying the Rentable Square Footage of the Premises and the amount of the installments of Base Rent and other provisions as appropriate. Notwithstanding the foregoing, if such measurement of the Premises indicates a discrepancy of less than one percent (1%), then no change shall be made to this Lease.

D. “Base Rent”:

| Period | Annual Base Rent Rate Per Square Foot |

Monthly Base Rent | ||

| 1st Lease Year: May 1, 2010* through April 30, 2011 |

$0.00 | $0.00† | ||

| 2nd Lease Year: May 1, 2011‡ through April 30, 2012 |

$12.00 | $31,019.00 | ||

| 3rd Lease Year: May 1, 2012 to April 30, 2013 |

$15.00 | $38,773.75 | ||

| 4th Lease Year: May 1, 2013 to April 30, 2014 |

$17.50 | $45,236.04 | ||

| 5th Lease Year: May 1, 2014 to April 30, 2015 |

$18.00 | $46,528.50 | ||

| 6th Lease Year: May 1, 2015 to April 30, 2016 |

$18.50 | $47,820.96 | ||

| 7th Lease Year: May 1, 2016 to April 30, 2017 |

$19.00 | $49,113.42 | ||

| 8th Lease Year: May 1, 2017 to April 30, 2018 |

$19.50 | $50,405.88 | ||

| 9th Lease Year: May 1, 2018 to April 30, 2019 |

$20.00 | $51,698.33 | ||

| 10th Lease Year: May 1, 2019 to April 30, 2020 |

$20.50 | $52,990.79 | ||

* The schedule of Base Rent set forth above is predicated on a Commencement Date of May 1, 2010. In the event the Commencement Date, which is determined per Section 3.A, does not fall on May 1, 2010, the schedule shall be adjusted accordingly.

1

† Provided that Tenant is not then in Monetary Default under this Lease beyond any applicable notice and/or cure period, the monthly Base Rent and the OE Payment for each of the initial 12 months of the Term shall be abated.

‡ If the Commencement Date does not fall on the first day of the month, (i) Rent will be prorated for the first month of the 2nd Lease Year, and (ii) the 2nd Lease Year shall be extended through the last day of the calendar month during which it ends, such that the 3rd Lease Year and all subsequent Lease Years will start on the first of the month. (For example, if the Commencement Date is April 25, 2010, Rent will be prorated for the period of April 26-30, 2011, the Second Lease year will extend through April 30, 2012 and the Third Lease year will start on May 1, 2012.)

E. “Tenant’s Pro Rata Share”: The percentage equal to the Rentable Square Footage of the Premises divided by the Rentable Square Footage of the Building, and currently equals 52.242%.

F. “Term”: The period of approximately 120 months starting on the Commencement Date, subject to the provisions of Article 3.

G. “Commencement Date”: May 15, 2010 subject to adjustment, if any, as provided in Section 3.A and the Work Letter, if any.

H. “Security Deposit”: $0.00.

I. “Guarantor(s)”: None.

J. “Notice Addresses”:

Tenant: On or after the Commencement Date, notices shall be sent to Tenant at the Premises. Prior to the Commencement Date, notices shall be sent to Tenant at the following address:

Wells Fargo Bank, N.A.

3738 Bee Caves Rd., Suite B

Austin, TX 78746

Attn: Cliff Zachry, Vice President

Corporate Properties Group

| Landlord: | With a copy to: | |||

| Wells VAF – Parkway at Oak Hill, LLC c/o Wells Real Estate Funds 6200 The Corners Parkway Atlanta, GA 30092 Attn: Asset Management Phone #: 770-449-7800 Fax #: 770-243-4684 |

Jackson Walker L.L.P. 1401 McKinney Suite 1900 Houston, TX 77010 Attn: Michael K. Kuhn Phone #: 713-752-4309 Fax #: 713-752-4221 |

|||

K. Rent (defined in Section 4.A) is payable to the order of Wells VAF – Parkway at Oak Hill, LLC:

if by check:

Wells VAF – Parkway at Oak Hill, LLC

c/o Wells Real Estate Funds

6200 The Corners Parkway

Suite 250

Norcross, GA 30092

if by wire transfer:

Bank of America, Georgia

Atlanta, GA

ABA # XXXX

Account Name: Wells VAF – Parkway at Oak Hill

2

Account # XXXX

Reference: Wells Fargo Bank, N.A.

L. “Business Day(s)”: Monday through Friday of each week, exclusive of New Year’s Day, Memorial Day, Independence Day, Labor Day, Thanksgiving Day, the day after Thanksgiving and Christmas Day (“Holidays”). Landlord may designate additional Holidays, provided that the additional Holidays are commonly recognized by other office buildings in the area where the Building is located.

M. “Law(s)”: All applicable statutes, codes, ordinances, orders, rules and regulations of any municipal or governmental entity, now or hereafter adopted, including the Americans with Disabilities Act and any other law pertaining to disabilities and architectural barriers (collectively, “ADA”), and all laws pertaining to the environment, including the Comprehensive Environmental Response, Compensation and Liability Act, as amended, 42 U.S.C. §9601 et seq. (“CERCLA”), and all restrictive covenants existing of record and all rules and requirements of any existing association or improvement district affecting the Property.

N. “Normal Business Hours”: 7:00 A.M. to 6:00 P.M. on Business Days and 8:00 A.M. to 1:00 P.M. on Saturdays, exclusive of Holidays.

O. “Other Defined Terms”: In addition to the terms defined above, an index of the other defined terms used in the text of this Lease is set forth below, with a cross-reference to the paragraph in this Lease in which the definition of such term can be found:

| Additional Rent |

4.A | Mortgagee |

25 | |||||

| Affiliate |

11.E | OE Payment |

4.B | |||||

| Alterations |

9.C(1) | OFAC |

31.N | |||||

| Anti-Money Laundering Laws |

31.N | Operating Expenses |

4.D | |||||

| Audit Election Period |

4.G | Permitted Transfer |

11.E | |||||

| Cable |

9.A | Permitted Use |

5.A | |||||

| Claims |

13 | Prime Rate |

19.B | |||||

| Collateral |

19.E | Property |

2 | |||||

| Commencement Date |

3.A | Provider |

7.C | |||||

| Common Areas |

2 | Relocated Premises |

23 | |||||

| Completion Estimate |

16.B | Relocation Date |

23 | |||||

| Contamination |

30.C | Rent |

4.A | |||||

| Costs of Reletting |

19.B | Service Failure |

7.B | |||||

| Executive Order |

31.N | Special Installations |

29 | |||||

| Expiration Date |

3.A | Substantial Completion |

Work Letter | |||||

| Force Majeure |

31.C | Taking |

17 | |||||

| Hazardous Materials |

30.C | Tenant Parties |

13 | |||||

| Landlord Parties |

13 | Tenant’s Insurance |

14.A | |||||

| Landlord Work |

3.A | Tenant’s Property |

14.A | |||||

| Landlord’s Rental Damages |

19.B | Tenant’s Removable Property |

29 | |||||

| Leasehold Improvements |

29 | Time Sensitive Default |

18.B | |||||

| Minor Alterations |

9.C(1) | Transfer |

11.A | |||||

| Monetary Default |

18.A | Work Letter |

3.A | |||||

| Mortgage |

25 |

2. Lease Grant. Landlord leases the Premises to Tenant and Tenant leases the Premises from Landlord, together with the right in common with others to use any portions of the Property (defined below) that are designated by Landlord for the common use of tenants and others, such as sidewalks, common corridors, vending areas, lobby areas and, with respect to multi-tenant floors, restrooms and elevator foyers (the “Common Areas”). “Property” means the Building, Building Two (agreed and stipulated to contain 86,413 square feet of Rentable Square Footage) and the parcel(s) of land on which it is located as more fully described on Exhibit A-2, together with all other buildings and improvements located thereon, including without limitation the parking garage and other improvements serving the Building and Building Two.

3. Term; Adjustment of Commencement Date; Early Access.

3

A. Term. This Lease shall govern the relationship between Landlord and Tenant with respect to the Premises from the Effective Date through the last day of the Term specified in Section 1.F (the “Expiration Date”), unless terminated early in accordance with this Lease. The Term of this Lease (as specified in Section 1.F) shall commence on the “Commencement Date”, which shall be the earliest of (1) the date on which the Landlord Work (defined below) is Substantially Complete, as determined pursuant to the Work Letter (defined below), or (2) the date on which the Landlord Work would have been Substantially Complete but for Tenant Delay (as such term is defined in the Work Letter), or (3) the date Tenant takes possession of any part of the Premises for purposes of conducting business. The Commencement Date is estimated to occur on May 1, 2010 (the “Estimated Commencement Date”), provided that the Construction Documents are finalized on or before February 1, 2010. Any delay in the finalization of the Construction Documents beyond February 1, 2010 shall result in a postponement of the Estimated Commencement Date on a day-for-day basis. If Landlord is delayed in delivering possession of the Premises or any other space due to any reason, including Landlord’s failure to Substantially Complete, as determined pursuant to the Work Letter (defined below), the Landlord Work (defined below) by the Estimated Commencement Date, the holdover or unlawful possession of such space by any third party, or for any other reason, such delay shall not be a default by Landlord, render this Lease void or voidable, or otherwise render Landlord liable for damages. Tenant’s sole and exclusive remedy for any delay in Landlord’s achieving Substantial Completion for any reason other than Tenant Delay shall be the resulting postponement of the Commencement Date and the commencement of rental payments hereunder. Notwithstanding the foregoing, if Landlord has not delivered the Premises within 90 days after the Estimated Commencement Date (as may be adjusted as hereinabove provided, and further subject to extension for Tenant Delay and Force Majeure (as defined in Section 31.C)), then Tenant shall have the right, as its sole remedy, to terminate this Lease upon written notice to Landlord given at any time after such 90-day period and prior to delivery of the Premises. Promptly after the determination of the Commencement Date, the Expiration Date, the Rent schedule and any other variable matters, Landlord shall prepare and deliver to Tenant a commencement letter agreement substantially in the form attached as Exhibit C. If such commencement letter is not executed by Tenant within 30 days after delivery of same by Landlord, then Tenant shall be deemed to have agreed with the matters set forth therein. Notwithstanding any other provision of this Lease to the contrary, if the Expiration Date would otherwise occur on a date other than the last day of a calendar month, then the Term shall be automatically extended to include the last day of such calendar month, which shall become the Expiration Date. “Landlord Work” means the work that Landlord is obligated to perform in the Premises pursuant to a separate work letter agreement (the “Work Letter”) attached as Exhibit D.

B. Construction Supervision. Landlord agrees to cause, oversee and supervise the Landlord Work to be constructed in the Premises in accordance with the Work Letter, provided that Tenant’s construction representative(s) shall monitor the Landlord Work in accordance with the terms of the Work Letter and shall be entitled to attend and participate in all construction meetings concerning the Landlord Work. In consideration of Landlord’s supervision of the Landlord Work, Tenant shall pay Landlord a “Construction Supervisory Fee” equal to 3% of the aggregate contract price for the Landlord Work, which may be paid from the unused portion of the Budgeted Amount (defined in the Work Letter). If the unused portion of the Budgeted Amount is less than the Construction Supervisory Fee, Tenant shall pay the Construction Supervisory Fee to Landlord within 10 business days following the date of invoice.

C. Acceptance of Premises. The Premises are accepted by Tenant in “as is” condition and configuration subject to (1) any Landlord obligation to perform Landlord Work, and (2) any latent defects in the Premises of which Tenant notifies Landlord within 1 year after the Commencement Date (other than work performed by Tenant Parties [defined below]). TENANT HEREBY AGREES THAT THE PREMISES ARE IN GOOD ORDER AND SATISFACTORY CONDITION AND THAT, EXCEPT AS OTHERWISE EXPRESSLY SET FORTH IN THIS LEASE, THERE ARE NO REPRESENTATIONS OR WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, BY LANDLORD REGARDING THE PREMISES, THE BUILDING OR THE PROPERTY. If it is discovered that any portion of the Building or the Property (excluding space leased or leasable to tenants) is not in compliance with Laws (including without limitation ADA), then Landlord shall promptly make adjustments and/or repairs as needed to bring the Building and the Property into compliance, with the cost of same to be included in Operating Expenses to the extent permitted under Article 4 hereof and otherwise borne by Landlord as its expense.

4

D. Early Access. Prior to the date the Landlord Work is Substantially Complete, Tenant’s access to the Premises shall be permitted only with the prior written consent of Landlord. Early access to the Premises shall be subject to the terms and conditions of this Lease and Tenant shall pay Rent (defined in Section 4.A) to Landlord for each day of such early access. However, if such early access to the Premises is permitted by Landlord for the sole purpose of performing improvements or installing furniture, equipment or other personal property, except for the cost of services requested by Tenant (e.g., freight elevator usage), Tenant shall not be required to pay Base Rent and the OE Payment (defined in Section 4.B) the for any days of such early access.

4. Rent.

A. Payments. As consideration for this Lease, commencing on the Commencement Date, Tenant shall pay Landlord, without any demand, setoff or deduction (other than abatement as specified herein), the total amount due for the Term of (1) Base Rent and (2) Additional Rent (defined below) (all of which are sometimes collectively referred to as “Rent”). “Additional Rent” means the OE Payment and all other sums (exclusive of Base Rent) that Tenant is required to pay Landlord under this Lease. Tenant shall pay and be liable for all rental, gross receipts, sales and use, or other taxes, if any, imposed upon or measured by rents, receipts or income attributable to ownership, use, occupancy, rental, leasing, operation or possession of the Property. The monthly Base Rent and the OE Payment shall be due and payable in advance on the first day of each calendar month without notice or demand, provided that the installment of Base Rent and the OE Payment for the first full calendar month of the Term shall be payable upon the execution of this Lease by Tenant. Further, provided that Tenant is not then in Monetary Default under this Lease beyond any applicable notice and/or cure period, the monthly Base Rent and the OE Payment shall be abated pursuant to Section 1.D. All other items of Rent shall be due and payable by Tenant on or before 30 days after billing by Landlord. All payments of Rent shall be by good and sufficient check or by other means (such as automatic debit or electronic transfer) acceptable to Landlord. If the Term commences on a day other than the first day of a calendar month, the monthly Base Rent and the OE Payment for the month shall be prorated on a daily basis based on a 360 day calendar year. Landlord’s acceptance of less than the correct amount of Rent shall be considered a payment on account of the earliest Rent due, and such acceptance shall not constitute a waiver of the remaining unpaid balance. No endorsement or statement on a check or letter accompanying a check or payment shall be considered an accord and satisfaction, and either party may accept such check or payment without such acceptance being considered a waiver of any rights such party may have under this Lease or applicable Law. Tenant’s covenant to pay Rent is independent of every other covenant in this Lease.

B. Payment of Operating Expenses. Tenant shall pay Tenant’s Pro Rata Share of the Operating Expenses (the “OE Payment”) for each calendar year during the Term, except as set forth to the contrary in Section 1.D. On or about January 1 of each calendar year, Landlord shall provide Tenant with a good faith estimate of the OE Payment for such calendar year during the Term. On or before the first day of each month, Tenant shall pay to Landlord a monthly installment equal to one-twelfth of Landlord’s estimate of the OE Payment. If Landlord determines that its good faith estimate of the OE Payment was incorrect, Landlord may provide Tenant with a revised estimate. After its receipt of the revised estimate, Tenant’s monthly payments shall be based upon the revised estimate. If Landlord does not provide Tenant with an estimate of the OE Payment by January 1 of a calendar year, Tenant shall continue to pay monthly installments based on the most recent estimate(s) until Landlord provides Tenant with the new estimate. Upon delivery of the new estimate, an adjustment shall be made for any month for which Tenant paid monthly installments based on the same year’s prior incorrect estimate(s). Tenant shall pay Landlord the amount of any underpayment within 30 days after receipt of the new estimate. Any overpayment shall be credited against the next sums due and owing by Tenant or, if no further Rent is due, refunded directly to Tenant within 30 days of determination. The obligation of Tenant to pay the OE Payment as provided herein shall survive the expiration or earlier termination of this Lease; provided that Tenant shall not be responsible for OE Payments for periods prior to the Commencement Date or after the Expiration Date of this Lease.

C. Reconciliation of Operating Expenses. Within 120 days after the end of each calendar year or as soon thereafter as is practicable, Landlord shall furnish Tenant with a statement of the actual Operating Expenses and the OE Payment for such calendar year. If the most recent estimated OE Payment paid by Tenant for such calendar year is more than the actual OE Payment

5

for such calendar year, Landlord shall apply any overpayment by Tenant against Rent due or next becoming due; provided, if the Term expires before the determination of the overpayment, Landlord shall, within 30 days of determination, refund any overpayment to Tenant after first deducting the amount of Rent due. If the most recent estimated OE Payment paid by Tenant for the prior calendar year is less than the actual OE Payment for such year, Tenant shall pay Landlord, within 30 days after its receipt of the statement of Operating Expenses and the OE Payment, any underpayment for the prior calendar year.

D. Operating Expenses Defined. “Operating Expenses” means all costs and expenses incurred or accrued in each calendar year in connection with the ownership, operation, maintenance, management, repair and protection of the Property which are directly attributable or reasonably allocable to the Building, including Landlord’s personal property used in connection with the Property and including all costs and expenditures relating to the following:

(1) Operation, maintenance, repair and replacements of any part of the Property, including the mechanical, electrical, plumbing, HVAC, vertical transportation, fire prevention and warning and access control systems; materials and supplies (such as light bulbs and ballasts); equipment and tools; floor, wall and window coverings; personal property; required or beneficial easements; and related service agreements and rental expenses.

(2) Administrative and management costs and fees, including accounting, information and professional services (except for negotiations and disputes with specific tenants not affecting other parties); management office(s); and wages, salaries, benefits, reimbursable expenses and taxes (or allocations thereof) for full and part time personnel involved in operation, maintenance and management at or below the level of regional property manager and regional asset manager.

(3) Janitorial service; window cleaning; waste disposal; gas, water and sewer and other utility charges (including add-ons); and landscaping, including all applicable tools and supplies.

(4) Property, liability and other insurance coverages carried by Landlord that are specifically attributable to the Property, including deductibles and risk retention programs and a proportionate allocation of the cost of blanket insurance policies maintained by Landlord and/or its Affiliates (defined below).

(5) Real estate taxes, assessments, excises, association dues, fees, levies, charges and other taxes of every kind and nature whatsoever, general and special, extraordinary and ordinary, foreseen and unforeseen, including interest on installment payments, which may be levied or assessed against or arise in connection with ownership, use, occupancy, rental, leasing, operation or possession of the Property, or paid as rent under any ground lease (“Tax Expenses”). Tax Expenses shall include, without limitation: (i) any tax on the rent or other revenue from the Property, or any portion thereof, or as against the business of owning or leasing the Property, or any portion thereof, including any business, taxable margins, or similar tax payable by Landlord which is attributable to rent or other revenue derived from the Property, (ii) any assessment, tax, fee, levy, or charge allocable to or measured by the area of the Premises or the Rent payable hereunder, (iii) personal property taxes for property that is owned by Landlord and used in connection with the operation, maintenance and repair of the Property, (iv) any assessment, tax, fee, levy or charge, upon this transaction or any document to which Tenant is a party, creating or transferring an interest or an estate in the Premises, and (v) any assessment, tax, fee, levy or charge substituted, in whole or in part, for a tax previously in existence, or assessed in lieu of a tax increase. Tax Expenses shall not include Landlord’s estate, excise, income or franchise taxes (except to the extent provided above).

(6) Compliance with Laws, including license, permit and inspection fees (but not in duplication of capital expenditures amortized as provided in Section 4.D(9)); and all expenses and fees, including attorneys’ fees and court or other venue of dispute resolution costs, incurred in negotiating or contesting real estate taxes or the validity and/or applicability of any governmental enactments which may affect Operating Expenses; provided Landlord shall credit against Operating Expenses any refunds received from such negotiations or contests to the extent originally included in Operating Expenses (less Landlord’s costs not previously included in Operating Expenses).

(7) Building safety services, to the extent provided or contracted for by Landlord.

6

(8) Goods and services purchased from Landlord’s subsidiaries and Affiliates to the extent the cost of same is generally consistent with rates charged by unaffiliated third parties for similar goods and services.

(9) Amortization of capital expenditures incurred: (a) to conform with Laws that are amended, become effective or are interpreted or enforced differently, after the Effective Date; (b) primarily to upgrade Building security or otherwise improve the operating efficiency of the Building; or (c) with the intention of promoting safety or reducing or controlling increases in Operating Expenses, such as lighting retrofit and installation of energy management systems (it being agreed that Landlord may rely on manufacturers’ specifications and/or the good faith estimate of the Building’s engineer in establishing the intent to reduce or control Operating Expenses). Such expenditures shall be amortized uniformly over the following periods of time (together with interest on the unamortized balance at the Prime Rate (defined in Section 19.B) as of the date incurred plus 2%): for building improvements, the shorter of 10 years or the estimated useful life of the improvement; and for all other items, 3 years for expenditures under $50,000 and 5 years for expenditures in excess of $50,000. Notwithstanding the foregoing, Landlord may elect to amortize capital expenditures under this subsection over a longer period of time based upon (i) the purpose and nature of the expenditure, (ii) the relative capital burden on the Property, (iii) for cost savings projects, the anticipated payback period, and (iv) otherwise in accordance with sound real estate accounting principles consistently applied.

(10) Electrical services used in the operation, maintenance and use of the Property; sales, use, excise and other taxes assessed by governmental authorities on electrical services supplied to the Property, and other costs of providing electrical services to the Property.

E. Exclusions from Operating Expenses. Operating Expenses exclude the following expenditures:

(1) Leasing commissions, attorneys’ fees and all other expenses related to leasing tenant space and constructing improvements for the sole benefit of an individual tenant.

(2) Goods and services furnished to an individual tenant of the Building which are above building standard or which are separately reimbursable directly to Landlord in addition to the OE Payment.

(3) Repairs, replacements and general maintenance paid by insurance proceeds or condemnation proceeds.

(4) Except as provided in Section 4.D(9), depreciation, amortization, interest payments on any encumbrances on the Property and the cost of capital improvements or additions.

(5) Costs of installing any specialty service, such as an observatory, broadcasting facility, luncheon club, or athletic or recreational club.

(6) Expenses for repairs or maintenance related to the Property which have been reimbursed to Landlord pursuant to warranties or service contracts.

(7) Costs (other than maintenance costs) of any art work (such as sculptures or paintings) used to decorate the Building.

(8) Interest or principal payments on indebtedness secured by liens against the Property, or costs of refinancing such indebtedness., or any ground lease payments (other than such portion of such payments as may be for the payment of property taxes and insurance premiums).

(9) Rental, gross receipts, sales and use, or other taxes, if any, imposed upon or measured by rents, receipts or income attributable to ownership, use, occupancy, rental, leasing, operation or possession of the Property which have been paid by tenants pursuant to Section 4.A.

(10) Costs of capital repairs and/or replacement of the foundation, roof, exterior and load-bearing walls and/or any other structural elements of the Building except as provided in Section 4.D(9).

7

(11) Landlord’s general overhead and general administrative expenses except as provided in Section 4.D(2), including any costs incurred related to maintaining Landlord’s existence as an entity.

(12) The cost of goods or services purchased from Landlord’s subsidiaries and Affiliates to the extent the cost of same is in excess of rates generally charged by unaffiliated third parties for similar goods and services.

F. Proration of Operating Expenses; Adjustments. If Landlord incurs Operating Expenses for the Property together with one or more other buildings or properties, whether pursuant to a reciprocal easement agreement, common area agreement or otherwise, the shared costs and expenses shall be equitably prorated and apportioned by Landlord between the Property and the other buildings or properties. If the Building is not 100% occupied during any calendar year or partial calendar year or if Landlord is not supplying services to 100% of the total Rentable Square Footage of the Building at any time during a calendar year or partial calendar year, Operating Expenses shall be determined as if the Building had been 100% occupied and Landlord had been supplying services to 100% of the Rentable Square Footage of the Building during that calendar year. The extrapolation of Operating Expenses under this Section shall be performed by Landlord by adjusting the cost of those components of Operating Expenses that are impacted by changes in the occupancy of the Building.

G. Audit Rights. Within 60 days after Landlord furnishes its statement of actual Operating Expenses for any calendar year (the “Audit Election Period”), Tenant may, at its expense, elect to audit Landlord’s Operating Expenses for such calendar year only, subject to the following conditions: (1) there is no uncured event of default under this Lease; (2) the audit shall be prepared by an independent certified public accounting firm of recognized national standing; (3) in no event shall any audit be performed by a firm retained on a “contingency fee” basis; (4) the audit shall commence within 30 days after Landlord makes Landlord’s books and records available to Tenant’s auditor and shall conclude within 60 days after commencement; (5) the audit shall be conducted during Landlord’s normal business hours at the location where Landlord maintains its books and records and shall not unreasonably interfere with the conduct of Landlord’s business; (6) Tenant and its accounting firm shall treat any audit in a confidential manner and shall each execute Landlord’s commercially reasonable confidentiality agreement for Landlord’s benefit prior to commencing the audit; and (7) the accounting firm’s audit report shall, at no charge to Landlord, be submitted in draft form for Landlord’s review and comment before the final approved audit report is delivered to Landlord, and any reasonable and factual comments by Landlord shall be incorporated into the final audit report. This paragraph shall not be construed to limit, suspend, or abate Tenant’s obligation to pay Rent when due, including the OE Payment. Landlord shall credit any overpayment determined by the final approved audit report against the next Rent due and owing by Tenant or, if no further Rent is due, refund such overpayment directly to Tenant within 30 days of determination. Likewise, Tenant shall pay Landlord any underpayment determined by the final approved audit report within 30 days of determination. The foregoing obligations shall survive the expiration or termination of this Lease. If Tenant does not give written notice of its election to audit Landlord’s Operating Expenses during the Audit Election Period, Landlord’s Operating Expenses for the applicable calendar year shall be deemed approved for all purposes, and Tenant shall have no further right to review or contest the same. The right to audit granted hereunder is personal to the initial Tenant named in this Lease and to any assignee under a Permitted Transfer (defined below) and shall not be available to any subtenant under a sublease of the Premises.

5. Tenant’s Use of Premises.

A. Permitted Uses. The Premises shall be used only for general office use (the “Permitted Use”) and for no other use whatsoever. Tenant shall not use or permit the use of the Premises for any purpose which is illegal, creates obnoxious odors (including tobacco smoke), noises or vibrations, is dangerous to persons or property, could increase Landlord’s insurance costs, or which, in Landlord’s reasonable opinion, unreasonably disturbs any other tenants of the Building or interferes with the operation or maintenance of the Property. Except as provided below, the following uses are expressly prohibited in the Premises: schools, government offices or agencies; personnel agencies; collection agencies; credit unions; data processing, telemarketing or reservation centers; medical treatment and health care; radio, television or other telecommunications broadcasting; restaurants and other retail; customer service offices of a public utility company; or

8

any other purpose which would, in Landlord’s reasonable opinion, impair the reputation or quality of the Building, overburden any of the Building systems, Common Areas or parking facilities (including any use which would create a population density in the Premises which is in excess of the density which is standard for the Building), impair Landlord’s efforts to lease space or otherwise interfere with the operation of the Property. Notwithstanding the foregoing, the following ancillary uses are permitted in the Premises only so long as they do not, in the aggregate, occupy more than 10% of the Rentable Square Footage of the Premises or any single floor (whichever is less): (A) the following services provided by Tenant exclusively to its employees: schools, training and other educational services; credit unions; and similar employee services; and (B) the following services directly and exclusively supporting Tenant’s business: telemarketing; reservations; storage; data processing; debt collection; and similar support services.

B. Compliance with Laws. Tenant shall comply with all Laws regarding the operation of Tenant’s business and the use, condition, configuration and occupancy of the Premises and the use of the Common Areas. Tenant, within 10 days after receipt, shall provide Landlord with copies of any notices Tenant receives regarding a violation or alleged or potential violation of any Laws. Tenant shall comply with the rules and regulations of the Building attached as Exhibit B and such other reasonable rules and regulations (or modifications thereto) adopted by Landlord from time to time. Such rules and regulations will be applied in an equitable manner as determined by Landlord. Tenant shall also cause its agents, contractors, subcontractors, employees, customers, and subtenants to comply with all rules and regulations.

C. Tenant’s Security Responsibilities. Tenant shall (1) lock the doors to the Premises and take other reasonable steps to secure the Premises and the personal property of all Tenant Parties (defined in Article 13) and any of Tenant’s transferees, contractors or licensees in the Common Areas and parking facilities of the Building and Property, from unlawful intrusion, theft, fire and other hazards; (2) keep and maintain in good working order all security and safety devices installed in the Premises by or for the benefit of Tenant (such as locks, smoke detectors and burglar alarms); and (3) cooperate with Landlord and other tenants in the Building on Building safety matters. Tenant acknowledges that any security or safety measures employed by Landlord are for the protection of Landlord’s own interests; that Landlord is not a guarantor of the security or safety of the Tenant Parties or their property; and that such security and safety matters are the responsibility of Tenant and the local law enforcement authorities.

6. Security Deposit. [Intentionally deleted.]

7. Services Furnished by Landlord.

A. Standard Services. Subject to the provisions of this Lease, Landlord agrees to furnish (or cause a third party provider to furnish) the following services to Tenant during the Term:

(1) Water service for use in the lavatories on each floor on which the Premises are located.

(2) Heat and air conditioning in season during Normal Business Hours, at such temperatures and in such amounts as required by governmental authority or as Landlord determines are standard for the Building. Tenant, upon such notice as is reasonably required by Landlord, and subject to the capacity of the Building systems, may request HVAC service during hours other than Normal Business Hours. Tenant shall pay Landlord for such additional service at a rate equal to $30.00 per requested hour of operation per floor (the “Hourly HVAC Charge”). Landlord shall have the right, upon 30 days prior written notice to Tenant, to adjust the Hourly HVAC Charge from time to time, but not more than once per calendar year, based upon increases in HVAC costs, which costs include utilities, taxes, surcharges, labor, equipment, maintenance and repair.

(3) Maintenance and repair of the Property as described in Section 9.B.

(4) Janitorial service five days per week (excluding Holidays), as determined by Landlord. If Tenant’s use of the Premises, floor covering or other improvements requires special services in excess of the standard services for the Building, Tenant shall pay the additional cost attributable to the special services. The janitorial services to be provided by Landlord shall be generally in accordance with the specifications attached hereto as Exhibit G.

9

(5) Elevator service, subject to proper authorization and Landlord’s policies and procedures for use of the elevator(s) in the Building.

(6) Exterior window washing at such intervals as determined by Landlord.

(7) Electricity to the Premises for general office use, in accordance with and subject to the terms and conditions in Article 8.

(8) On-site building safety personnel services consistent with comparable buildings in the Southwest submarket of Austin, Texas from 3:00 P.M. to 11:00 P.M. on weekdays other than Holidays, subject to the provisions of Section 5.C.

Landlord agrees that the above-described services and maintenance of the Property, the Building and its components, including, without limitation, the Common Areas, shall be generally consistent with comparable office buildings in the southwest area of Austin, Texas, taking into account age, size, location and other relevant operating factors during the Term (and any renewals or extension thereof) (“Comparable Buildings”).

B. Service Interruptions. For purposes of this Lease, a “Service Failure” shall mean any interruption, suspension or termination of services being provided to Tenant by Landlord or by third-party providers, whether engaged by Tenant or pursuant to arrangements by such providers with Landlord, which are due to (1) the application of Laws; (2) the failure, interruption or malfunctioning of any electrical or mechanical equipment, utility or other service to the Building or Property; (3) the performance of repairs, maintenance, improvements or alterations; or (4) the occurrence of any other event or cause whether or not within the reasonable control of Landlord. In the event of a Service Failure, Landlord shall use commercially reasonable efforts to cause the Service Failure to be remedied as promptly as reasonably practicable. Except as otherwise provided herein, no Service Failure shall render Landlord liable to Tenant, constitute a constructive eviction of Tenant, give rise to an abatement of Rent, or relieve Tenant from the obligation to fulfill any covenant or agreement. In no event shall Landlord be liable to Tenant for any loss or damage, including the theft of Tenant’s Property (defined in Article 14), arising out of or in connection with any Service Failure or the failure of any Building safety services, personnel or equipment. Notwithstanding the foregoing, commencing on the 5th consecutive Business Day of any Essential Service Failure (defined below) within Landlord’s control to prevent or correct (unless the Essential Service Failure is caused by a fire or other casualty, in which event Article 16 controls), Tenant shall, as its sole remedy, be entitled to an equitable diminution of Base Rent based upon the pro rata portion of the Premises which is rendered unfit for the Permitted Use, except to the extent such Essential Service Failure is caused by a Tenant Party; commencing on the 120th consecutive day of any Essential Service Failure (unless the Essential Service Failure is caused by a fire or other casualty, in which event Article 16 controls), Tenant shall, as its sole remedy in addition to rental abatement provided above (except that Tenant shall not have the following remedy if and to the extent such Essential Service Failure is caused by a Tenant Party), be entitled to terminate this Lease upon written notice to Landlord, given prior to the earlier of: (i) the 150th day of the Essential Service Failure or (ii) cure of the Essential Service Failure. For purposes of this Section 7.B, the term, “Essential Service Failure” shall mean and be limited to any interruption, suspension or termination of any of the following services being provided to Tenant by Landlord or by third-party providers: ventilation, heating and air conditioning, access to the Building and/or the Premises, water, sewer service, and electricity.

C. Third Party Services. If Tenant desires any service which Landlord has not specifically agreed to provide in this Lease, such as private security systems or telecommunications services serving the Premises, Tenant shall procure such service directly from a reputable third party service provider (“Provider”) for Tenant’s own account. Tenant shall require each Provider to comply with the Building’s rules and regulations, all Laws, and Landlord’s reasonable policies and practices for the Building. Tenant acknowledges Landlord’s current policy that requires all Providers utilizing any area of the Property outside the Premises to be approved by Landlord and to enter into a written agreement acceptable to Landlord prior to gaining access to, or making any installations in or through, such area. Accordingly, Tenant shall give Landlord written notice sufficient for such purposes.

8. Use of Electrical Services by Tenant.

10

A. Landlord’s Electrical Service. Subject to the terms of this Lease, Landlord shall furnish building standard electrical service to the Premises sufficient to operate customary lighting, office machines and other equipment of similar low electrical consumption. Landlord may, at any time and from time to time, calculate Tenant’s actual electrical consumption in the Premises by a survey conducted by a reputable consultant selected by Landlord, all at Tenant’s expense. The cost of any electrical consumption in excess of that which Landlord determines is standard for the Building shall be paid by Tenant in accordance with Section 8.D. The furnishing of electrical services to the Premises shall be subject to the rules, regulations and practices of the supplier of such electricity and of any municipal or other governmental authority regulating the business of providing electrical utility service. Landlord shall not be liable or responsible to Tenant for any loss, damage or expense which Tenant may sustain or incur if either the quantity or character of the electrical service is changed or is no longer available or no longer suitable for Tenant’s requirements.

B. Selection of Electrical Service Provider. Landlord shall have and retain the sole right to select the provider of electrical services to the Building and/or the Property. To the fullest extent permitted by Law, Landlord shall have the continuing right to change such utility provider. All charges and expenses incurred by Landlord due to any such changes in electrical services, including maintenance, repairs, installation and related costs, shall be included in the electrical services costs referenced in Section 4.D(10), unless paid directly by Tenant.

C. Submetering. Landlord shall have the option to require that any high electrical consumption equipment installed and operated in the Premises (including, without limitation, supplemental HVAC units) be submetered, with the cost of installation of such submeter(s) to be at Tenant’s expense (which may be included in the Budgeted Amount pursuant to the Work Letter if the installation of such submeter occurs during the initial construction of leasehold improvements hereunder). Additionally, Landlord shall have the continuing right, upon 30 days written notice, to install a submeter for the Premises at Landlord’s expense. If submetering is installed for the Premises or any high electrical consumption equipment installed and operated therein, Landlord may charge for Tenant’s actual electrical consumption monthly in arrears for the kilowatt hours used, a rate per kilowatt hour equal to that charged to Landlord by the provider of electrical service to the Building during the same period of time (plus, to the fullest extent permitted by applicable Laws, an administrative fee equal to 15% of such charge), except (i) if Landlord is submetering all or substantially all of the tenants in the Building then no administrative fee shall be charged and (ii) as to electricity directly purchased by Tenant from third party providers after obtaining Landlord’s consent to the same. In the event Landlord is unable to determine the exact kilowatt hourly charge during the period of time, Landlord shall use the average kilowatt hourly charge to the Building for the first billing cycle ending after the period of time in question. Even if the Premises are submetered, Tenant shall remain obligated to pay Tenant’s Pro Rata Share of the cost of electrical services as provided in Section 4.B, except that Tenant shall be entitled to a credit against electrical services costs equal to that portion of the amounts actually paid by Tenant separately and directly to Landlord which are attributable to building standard electrical services submetered to the Premises.

D. Excess Electrical Service. Tenant’s use of electrical service shall not exceed, in voltage, rated capacity, use beyond Normal Business Hours or overall load, that which Landlord reasonably deems to be standard for the Building. If Tenant requests permission to consume excess electrical service, Landlord may refuse to consent or may condition consent upon conditions that Landlord reasonably elects (including the installation of utility service upgrades, meters, submeters, air handlers or cooling units). The costs of any approved additional consumption (to the extent permitted by Law), installation and maintenance shall be paid by Tenant.

9. Repairs and Alterations.

A. Tenant’s Repair Obligations. Tenant shall keep the Premises in good condition and repair, ordinary wear and tear excepted. Tenant’s repair obligations include, without limitation, repairs to: (1) floor covering and/or raised flooring; (2) interior partitions; (3) doors; (4) the interior side of demising walls; (5) electronic, phone and data cabling and related equipment (collectively, “Cable”) that is installed by or for the benefit of Tenant whether located in the Premises or in other portions of the Building; (6) supplemental air conditioning units, private showers and kitchens, including hot water heaters, plumbing, dishwashers, ice machines and similar facilities serving Tenant exclusively; (7) phone rooms used exclusively by Tenant; (8) Alterations (defined below) performed by contractors retained by Tenant, including related HVAC balancing; and (9) all of

11

Tenant’s furnishings, trade fixtures, equipment and inventory. Prior to performing any such repair obligation, Tenant shall give written notice to Landlord describing the necessary maintenance or repair. Upon receipt of such notice, Landlord may elect either to perform any of the maintenance or repair obligations specified in such notice, or require that Tenant perform such obligations by using contractors proposed by Tenant and approved by Landlord, all at Tenant’s expense. All work shall be performed at Tenant’s expense in accordance with the rules and procedures described in Section 9.C below. If Tenant fails to make any repairs to the Premises for more than 15 days after notice from Landlord (although notice shall not be required if there is an emergency), Landlord may, in addition to any other remedy available to Landlord, make the repairs, and Tenant shall pay to Landlord the reasonable cost of the repairs within 30 days after receipt of an invoice, together with an administrative charge in an amount equal to 10% of the cost of the repairs.

B. Landlord’s Repair Obligations. Landlord shall keep and maintain in good repair and working order and make repairs to and perform maintenance upon: (1) structural elements of the Building; (2) standard mechanical (including HVAC), electrical, plumbing and fire/life safety systems serving the Building generally; (3) Common Areas; (4) the roof of the Building; (5) exterior windows of the Building; and (6) elevators serving the Building. Landlord shall promptly make repairs (taking into account the nature and urgency of the repair) for which Landlord is responsible. If any of the foregoing maintenance or repair is necessitated due to the acts or omissions of any Tenant Party (defined in Article 13), Tenant shall pay the costs of such repairs or maintenance to Landlord within 30 days after receipt of an invoice, together with an administrative charge in an amount equal to 10% of the cost of the repairs.

C. Alterations.

(1) When Consent Is Required. Tenant shall not make alterations, additions or improvements to the Premises or install any Cable in the Premises or other portions of the Building (collectively, “Alterations”) without first obtaining the written consent of Landlord in each instance, such consent not to be unreasonably withheld, conditioned or delayed. However, Landlord’s consent shall not be required for any Alteration that satisfies all of the following criteria (a “Minor Alteration”): (a) is of a cosmetic nature such as painting, wallpapering, hanging pictures and installing carpeting; (b) is not visible from outside the Premises or Building; (c) will not affect the systems or structure of the Building; (d) does not require work to be performed inside the walls or above the ceiling of the Premises; and (e) is less than $20,000.00 in total costs.

(2) Requirements For All Alterations, Including Minor Alterations. Prior to starting work on any Alteration, Tenant shall furnish to Landlord for review and approval: plans and specifications; names of proposed contractors (provided that Landlord may designate specific contractors with respect to Building systems); copies of contracts; necessary permits and approvals; evidence of contractors’ and subcontractors’ insurance; and Tenant’s security for performance of the Alteration. Changes to the plans and specifications must also be submitted to Landlord for its reasonable approval. Some of the foregoing requirements may be waived by Landlord for the performance of specific Minor Alterations; provided that such waiver is obtained in writing prior to the commencement of such Minor Alterations. Landlord’s waiver on one occasion shall not waive Landlord’s right to enforce such requirements on any other occasion. Alterations shall be constructed in a good and workmanlike manner using materials of a quality that is at least equal to the quality designated by Landlord as the minimum standard for the Building. Landlord may designate reasonable rules, regulations and procedures for the performance of Alterations in the Building and, to the extent reasonably necessary to avoid disruption to the occupants of the Building, shall have the right to designate the time when Alterations may be performed. Tenant shall reimburse Landlord within 30 days after receipt of an invoice for out-of-pocket sums paid by Landlord for third party examination of Tenant’s plans for Alterations (but not Minor Alterations). In addition, within 30 days after receipt of an invoice from Landlord, Tenant shall pay to Landlord a fee equal to (a) 3% of the total cost of such Alterations for Landlord’s oversight and coordination of any Alterations, or (b) 1% of the total cost of such Alterations if Tenant coordinates the oversight and construction of any Alterations, provided that this sentence shall not be applicable to any Minor Alterations. No later than 30 days after completion of the Alterations, Tenant shall furnish “as-built” plans (which shall not be required for Minor Alterations), completion affidavits, full and final waivers of liens, receipts and bills covering all labor and materials. Tenant shall assure that the Alterations comply with all insurance requirements and Laws.

12

(3) Landlord’s Liability For Alterations. Landlord’s approval of an Alteration shall not be a representation by Landlord that the Alteration complies with applicable Laws or will be adequate for Tenant’s use. Tenant acknowledges that Landlord is not an architect or engineer, and that the Alterations will be designed and/or constructed using independent architects, engineers and contractors. Accordingly, Landlord does not guarantee or warrant that the applicable construction documents will comply with Laws or be free from errors or omissions, or that the Alterations will be free from defects, and Landlord will have no liability therefor.

10. Entry by Landlord. Landlord, its agents, contractors and representatives may enter the Premises to inspect or show the Premises, to clean and make repairs, alterations or additions to the Premises, and to conduct or facilitate repairs, alterations or additions to any portion of the Building, including other tenants’ premises. Except in emergencies or to provide janitorial and other Building services after Normal Business Hours, Landlord shall provide Tenant with reasonable prior notice of entry into the Premises, which may be given orally. Landlord shall have the right to temporarily close all or a portion of the Premises to perform repairs, alterations and additions, if reasonably necessary for the protection and safety of Tenant and its employees. Except in emergencies, Landlord will not close the Premises if the work can reasonably be completed on weekends and after Normal Business Hours; provided, however, that Landlord is not required to conduct work on weekends or after Normal Business Hours if such work can be conducted without closing the Premises. Entry by Landlord for any such purposes shall not constitute a constructive eviction or entitle Tenant to an abatement or reduction of Rent. In connection with any such entry, Landlord shall use commercially reasonable efforts not to interfere with the operations and normal office routine of Tenant. Tenant may, at its option, require that Landlord be accompanied by a representative of Tenant during any such entry (except in the event of emergency), provided that such representative of Tenant does not interfere with or delay Landlord in exercising its rights or satisfying its obligations hereunder.

11. Assignment and Subletting.

A. Landlord’s Consent Required. Subject to the remaining provisions of this Article 11, but notwithstanding anything to the contrary contained elsewhere in this Lease, Tenant shall not assign, transfer or encumber any interest in this Lease (either absolutely or collaterally) or sublease or allow any third party to use any portion of the Premises (collectively or individually, a “Transfer”) without the prior written consent of Landlord, which consent shall not be unreasonably withheld, conditioned or delayed. Without limitation, Tenant agrees that Landlord’s consent shall not be considered unreasonably withheld, conditioned or delayed if: (1) the proposed transferee’s financial condition does not meet the criteria Landlord uses to select Building tenants having similar leasehold obligations; (2) the proposed transferee is a governmental organization or present occupant of the Property, or Landlord is otherwise engaged in lease negotiations with the proposed transferee for other premises in the Property; (3) any uncured event of default exists under this Lease (or a condition exists which, with the passage of time or giving of notice, would become an event of default); (4) any portion of the Building or Premises would likely become subject to additional or different Laws as a consequence of the proposed Transfer; (5) the proposed transferee’s use of the Premises conflicts with the Permitted Use or any exclusive usage rights granted to any other tenant in the Building; (6) the use, nature, business, activities or reputation in the business community of the proposed transferee (or its principals, employees or invitees) does not meet Landlord’s commercially reasonable standards for Building tenants; (7) either the Transfer or any consideration payable to Landlord in connection therewith adversely affects the real estate investment trust qualification tests applicable to Landlord or its Affiliates; or (8) the proposed transferee is or has been involved in litigation with Landlord or any of its Affiliates. Tenant shall not be entitled to receive monetary damages based upon a claim that Landlord unreasonably withheld its consent to a proposed Transfer and Tenant’s sole remedy shall be an action to enforce any such provision through specific performance or declaratory judgment. Any attempted Transfer in violation of this Article is voidable at Landlord’s option.

B. Consent Parameters/Requirements. As part of Tenant’s request for, and as a condition to, Landlord’s consent to a Transfer, Tenant shall provide Landlord with financial statements for the proposed transferee, a complete copy (unexecuted) of the proposed assignment or sublease and other contractual documents, and such other information as Landlord may reasonably request. Landlord shall then have the right (but not the obligation) to terminate this Lease as of the date the Transfer would have been effective (“Landlord Termination Date”) with respect to the

13

portion of the Premises which Tenant desires to Transfer. In such event, Tenant shall vacate such portion of the Premises by the Landlord Termination Date and upon Tenant’s vacating such portion of the Premises, the rent and other charges payable shall be proportionately reduced. Consent by Landlord to one or more Transfer(s) shall not operate as a waiver of Landlord’s rights to approve any subsequent Transfers. In no event shall any Transfer or Permitted Transfer release or relieve Tenant from any obligation under this Lease, nor shall the acceptance of Rent from any assignee, subtenant or occupant constitute a waiver or release of Tenant from any of its obligations or liabilities under this Lease. Tenant shall pay Landlord a review fee of $1000 for Landlord’s review of any Permitted Transfer or requested Transfer, provided if Landlord’s actual reasonable costs and expenses (including reasonable attorney’s fees) exceed $1000, Landlord shall provide Tenant with its legal invoices as well as reasonable proof of payment of the same, and Tenant shall reimburse Landlord for its actual reasonable costs and expenses in lieu of a fixed review fee.

C. Payment to Landlord. If the aggregate consideration paid to a Tenant Party for a Transfer exceeds that payable by Tenant under this Lease (prorated according to the transferred interest), Tenant shall pay Landlord 50% of such excess (after deducting therefrom reasonable leasing commissions and reasonable costs of tenant improvements paid to unaffiliated third parties in connection with the Transfer, with proof of same provided to Landlord). Tenant shall pay Landlord for Landlord’s share of any excess within 30 days after Tenant’s receipt of such excess consideration. If any uncured event of default exists under this Lease (or a condition exists which, with the passage of time or giving of notice, would become an event of default), Landlord may require that all sublease payments be made directly to Landlord, in which case Tenant shall receive a credit against Rent in the amount of any payments received, but not to exceed the amount payable by Tenant under this Lease.

D. Change in Control of Tenant. Except for a Permitted Transfer, if Tenant is a corporation, limited liability company, partnership, national banking association, or similar entity, and if the entity which owns or controls a majority of the voting shares/rights in Tenant at any time sells or disposes of such majority of voting shares/rights, or changes its identity for any reason (including a merger, consolidation or reorganization), such change of ownership or control shall constitute a Transfer. The foregoing shall not apply so long as, both before and after the Transfer, Tenant is an entity whose outstanding stock is listed on a recognized U.S. securities exchange, or if at least 80% of its voting stock is owned by another entity, the voting stock of which is so listed; provided, however, that Tenant shall give Landlord written notice at least 30 days prior to the effective date of such change in ownership or control, if permitted by current Securities and Exchange Commission (“SEC”) rules and regulations, or as soon thereafter as lawfully permitted.

E. No Consent Required. Tenant may assign its entire interest under this Lease to its Affiliate (defined below) or to a successor to Tenant by purchase, merger, consolidation or reorganization without the consent of Landlord, provided that all of the following conditions are satisfied in Landlord’s reasonable discretion (a “Permitted Transfer”): (1) no uncured event of default exists under this Lease; (2) Tenant’s successor shall own all or substantially all of the assets of Tenant; (3) such Affiliate or Tenant’s successor shall have a net worth which is at least equal to the greater of Tenant’s net worth at the date of this Lease or Tenant’s net worth as of the day prior to the proposed purchase, merger, consolidation or reorganization; (4) no portion of the Building or Premises would likely become subject to additional or different Laws as a consequence of the proposed Transfer; (5) such Affiliate’s or Tenant’s successor’s use of the Premises shall not conflict with the Permitted Use or any exclusive usage rights granted to any other tenant in the Building; (6) neither the Transfer nor any consideration payable to Landlord in connection therewith adversely affects the real estate investment trust (or pension fund or other ownership vehicle) qualification tests applicable to Landlord or its Affiliates; (7) such Affiliate or Tenant’s successor is not and has not been involved in litigation with Landlord or any of Landlord’s Affiliates; and (8) to the extent permitted by SEC rules and regulations, Tenant shall give Landlord written notice at least 30 days prior to the effective date of the proposed Transfer, or as soon thereafter as lawfully permitted, along with all applicable documentation and other information necessary for Landlord to determine that the requirements of this Section 11.E have been satisfied, including if applicable, the qualification of such proposed transferee as an Affiliate of Tenant. The term “Affiliate” means any person or entity controlling, controlled by or under common control with Tenant or Landlord, as applicable. If requested by Landlord, the Affiliate of Tenant or Tenant’s successor shall sign a commercially reasonable form of assumption agreement.

14

12. Liens. Tenant shall not permit mechanic’s or other liens to be placed upon the Property, Premises or Tenant’s leasehold interest in connection with any work or service done or purportedly done by or for the benefit of Tenant. If a lien is so placed, Tenant shall, within 10 days of notice from Landlord of the filing of the lien, fully discharge the lien by settling the claim which resulted in the lien or by bonding or insuring over the lien in the manner prescribed by the applicable lien Law. If Tenant fails to discharge the lien, then, in addition to any other right or remedy of Landlord, Landlord may bond or insure over the lien or otherwise discharge the lien. Tenant shall, within 30 days after receipt of an invoice from Landlord, reimburse Landlord for any amount paid by Landlord, including reasonable attorneys’ fees, to bond or insure over the lien or discharge the lien.

13. Indemnity. Subject to Article 15, Tenant shall hold Landlord, its trustees, Affiliates, subsidiaries, members, principals, beneficiaries, partners, officers, directors, shareholders, employees, Mortgagee(s) (defined in Article 25) and agents (including the manager of the Property) (collectively, “Landlord Parties”) harmless from, and indemnify and defend such parties against, all liabilities, obligations, damages, penalties, claims, actions, costs, charges and expenses, including reasonable attorneys’ fees and other professional fees that may be imposed upon, incurred by or asserted against any of such indemnified parties (each a “Claim” and collectively “Claims”) that arise out of or in connection with any damage or injury occurring in the Premises, EVEN IF SUCH LIABILITIES ARE CAUSED SOLELY OR IN PART BY THE ORDINARY NEGLIGENCE OF A LANDLORD PARTY, BUT NOT TO THE EXTENT SUCH LIABILITIES ARE CAUSED BY THE GROSS NEGLIGENCE OR WILLFUL MISCONDUCT OF A LANDLORD PARTY. Subject to Articles 9.B, 15 and 20, Landlord shall hold Tenant, its trustees, members, principals, beneficiaries, partners, officers, directors, shareholders, employees and agents (collectively, “Tenant Parties”) harmless from, and indemnify and defend such parties against, all Claims that arise out of or in connection with any damage or injury occurring in or on the Property (excluding the Premises), to the same extent the Tenant Parties would have been covered had they been named as additional insureds on the commercial general liability insurance policy required to be carried by Landlord under this Lease, EVEN IF SUCH LIABILITIES ARE CAUSED SOLELY OR IN PART BY THE ORDINARY NEGLIGENCE OF TENANT, BUT NOT TO THE EXTENT SUCH LIABILITIES ARE CAUSED BY THE GROSS NEGLIGENCE OR WILLFUL MISCONDUCT OF TENANT.

14. Insurance.

A. Tenant’s Insurance. Tenant shall maintain the following insurance (“Tenant’s Insurance”), at its sole cost and expense: (1) commercial general liability insurance applicable to the Premises and its appurtenances providing, on an occurrence basis, a per occurrence limit of no less than $1,000,000; (2) causes of loss-special form (formerly “all risk”) property insurance, including flood and earthquake, covering all above building standard leasehold improvements and Tenant’s trade fixtures, equipment, furniture and other personal property within the Premises (“Tenant’s Property”) in the amount of the full replacement cost thereof; (3) business income (formerly “business interruption”) insurance written on an actual loss sustained form or with sufficient limits to address reasonably anticipated business interruption losses; (4) business automobile liability insurance to cover all owned, hired and nonowned automobiles owned or operated by Tenant providing a minimum combined single limit of $1,000,000; (5) workers’ compensation insurance as required by the state in which the Premises is located and in amounts as may be required by applicable statute (provided, however, if no workers’ compensation insurance is statutorily required, Tenant shall carry workers’ compensation insurance in a minimum amount of $500,000); (6) employer’s liability insurance in an amount of at least $500,000 per occurrence; and (7) umbrella liability insurance that follows form in excess of the limits specified in (1), (4) and (6) above, of no less than $4,000,000 per occurrence and in the aggregate. Any company underwriting any of Tenant’s Insurance shall have, according to A.M. Best Insurance Guide, a Best’s rating of not less than A- and a Financial Size Category of not less than VII. All insurance coverage required to be carried by Tenant may be effected by a policy or policies of blanket insurance. All commercial general liability, business automobile liability and umbrella liability insurance policies shall name Landlord (or any successor), Landlord’s property manager, Landlord’s Mortgagee (if any), and their respective members, principals, beneficiaries, partners, officers, directors, employees, and agents, and other designees of Landlord as the interest of such designees shall appear, as “additional insureds” and shall be primary with Landlord’s policy being secondary and noncontributory. If any aggregate limit is reduced because of losses paid to below 75% of the limit required by this Lease, Tenant will notify Landlord in writing within 10 days of the date of reduction. All policies of Tenant’s Insurance shall contain endorsements that the insurer(s) shall give Landlord and its

15

designees at least 30 days’ advance written notice of any change, cancellation, termination or lapse of insurance. Tenant shall provide Landlord with a certificate of insurance and all required endorsements evidencing Tenant’s Insurance prior to the earlier to occur of the Commencement Date or the date Tenant is provided access to the Premises for any reason, and upon renewals at least 10 days prior to the expiration of the insurance coverage. All of Tenant’s Insurance policies, endorsements and certificates will be on forms and with deductibles and self-insured retention, if any, reasonably acceptable to Landlord. The limits of Tenant’s insurance shall not limit Tenant’s liability under this Lease.

B. Landlord’s Insurance. Landlord shall maintain: (1) commercial general liability insurance applicable to the Property which provides, on an occurrence basis, a minimum combined single limit of no less than $5,000,000 (coverage in excess of $1,000,000 may be provided by way of an umbrella/excess liability policy); and (2) causes of loss-special form (formerly “all risk”) property insurance on the Building in the amount of the replacement cost thereof, as reasonably estimated by Landlord. The foregoing insurance and any other insurance carried by Landlord may be effected by a policy or policies of blanket insurance and shall be for the sole benefit of Landlord and under Landlord’s sole control. Consequently, Tenant shall have no right or claim to any proceeds thereof or any other rights thereunder.

15. Mutual Waiver of Subrogation. Notwithstanding anything in this Lease to the contrary, Tenant waives, and shall cause its insurance carrier(s) and any other party claiming through or under such carrier(s), by way of subrogation or otherwise, to waive any and all rights of recovery, Claim, action or causes of action against all Landlord Parties for any loss or damage to Tenant’s business, any loss of use of the Premises, and any loss, theft or damage to Tenant’s Property (including Tenant’s automobiles or the contents thereof), INCLUDING ALL RIGHTS (BY WAY OF SUBROGATION OR OTHERWISE) OF RECOVERY, CLAIMS, ACTIONS OR CAUSES OF ACTION ARISING OUT OF THE NEGLIGENCE OF ANY LANDLORD PARTY, which loss or damage is (or would have been, had the insurance required by this Lease been maintained) covered by insurance. In addition, Landlord waives (except to the extent of Landlord’s property insurance deductible, the same being addressed in Section 4.D(4)) and shall cause its insurance carrier(s) and any other party claiming through or under such carrier(s), by way of subrogation or otherwise, to waive any and all rights of recovery, Claim, action or causes of action against all Tenant Parties for any loss of or damage to or loss of use of the Building, any additions or improvements to the Building, or any contents thereof, INCLUDING ALL RIGHTS (BY WAY OF SUBROGATION OR OTHERWISE) OF RECOVERY, CLAIMS, ACTIONS OR CAUSES OF ACTION ARISING OUT OF THE NEGLIGENCE OF ANY TENANT PARTY, which loss or damage is (or would have been, had the insurance required by this Lease been maintained) covered by insurance.

16. Casualty Damage.

A. Repair or Termination by Landlord. If all or any part of the Premises are damaged by fire or other casualty, Tenant shall immediately notify Landlord in writing. Landlord shall have the right to terminate this Lease if: (1) the Building is damaged or destroyed by fire or other casualty so as to render untenantable more than fifty percent (50%) of the floor area of the Building (whether or not the Premises have been damaged); (2) Landlord is not permitted by Law to rebuild the Building in substantially the same form as existed before the fire or casualty; (3) the Premises have been materially damaged and there is less than 2 years of the Term remaining on the date of the casualty; (4) any Mortgagee requires that the insurance proceeds be applied to the payment of the mortgage debt; or (5) an uninsured loss of the Building occurs notwithstanding Landlord’s compliance with Section 14.B above. Landlord may exercise its right to terminate this Lease by notifying Tenant in writing within 60 days after the date of the casualty. If Landlord does not terminate this Lease under this Section 16.A, Landlord shall commence and proceed with reasonable diligence to repair and restore the Building and/or the Premises to substantially the same condition as existed immediately prior to the date of damage; provided, however, that Landlord shall only be required to reconstruct building standard leasehold improvements existing in the Premises as of the date of damage, and Tenant shall be required to pay the cost for restoring any other leasehold improvements. However, in no event shall Landlord be required to spend more than the insurance proceeds received by Landlord.

B. Timing for Repair; Termination by Either Party. If all or any portion of the Premises is damaged as a result of fire or other casualty, Landlord shall, with reasonable promptness,

16