Attached files

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form 10-K

|

|

||

|

þ

|

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

OF 1934

|

|

|

For

the fiscal year ended January 2, 2010

|

||

|

OR

|

||

|

o

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

OF 1934

|

|

|

For

the transition period

from

to

|

||

PGT,

Inc.

(Exact

name of registrant as specified in its charter)

|

|

||

|

Delaware

|

20-0634715

|

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

(I.R.S.

Employer

Identification

No.)

|

|

|

1070

Technology Drive

North

Venice, Florida

(Address of

principal executive offices)

|

34275

(Zip

Code)

|

Registrant’s

telephone number, including area code:

(941) 480-1600

Former

name, former address and former fiscal year, if changed since last

report: Not applicable

Securities

registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Name of Exchange on Which

Registered

|

|

|

Common

stock, par value $0.01 per share

|

NASDAQ

Global Market

|

|

Securities

registered pursuant to Section 12 (g) of the

Act: None

.

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes o No þ

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Exchange Act. Yes

o

No þ

Indicate

by check mark whether the registrant (1) has filed all reports required to

be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to

such filing requirements for the past 90 days. Yes þ

No o

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the

best of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any

amendment to this Form 10-K. o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

definition of “accelerated filer,” “large accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

Large

accelerated filer o

Accelerated

filer o

Non-accelerated filer þ

Smaller reporting company o

(Do not

check if a smaller reporting company)

Indicate by check mark whether the

registrant is a shell company (as defined by Rule 12b-2 of the Exchange

Act). Yes o

No þ

The

aggregate market value of the registrant’s common stock held by non-affiliates

of the registrant as of July 2, 2009 was approximately $23,261,535 based on the

closing price per share on that date of $1.54 as reported on the NASDAQ Global

Market.

The

number of shares of the registrant’s common stock, par value $0.01, outstanding

as of March 16, 2010 was 54,005,439.

DOCUMENTS

INCORPORATED BY REFERENCE

Portions

of the Company’s Proxy Statement for the Company’s 2010 Annual Meeting of

Stockholders are incorporated by reference into Part III of this

Form 10-K.

|

Page

|

||||||||||

|

|

||||||||||

|

2

|

||||||||||

|

|

6

|

|||||||||

|

10

|

||||||||||

|

10

|

||||||||||

|

10

|

||||||||||

|

11

|

||||||||||

|

|

||||||||||

|

11

|

||||||||||

|

12

|

||||||||||

|

14

|

||||||||||

|

31

|

||||||||||

|

32

|

||||||||||

|

67

|

||||||||||

|

67

|

||||||||||

|

69

|

||||||||||

|

|

||||||||||

|

69

|

||||||||||

|

71

|

||||||||||

|

71

|

||||||||||

|

71

|

||||||||||

|

71

|

||||||||||

|

|

||||||||||

|

71

|

||||||||||

|

Item 1.

|

BUSINESS

|

GENERAL DEVELOPMENT OF

BUSINESS

Description

of the Company

We are

the leading U.S. manufacturer and supplier of residential impact-resistant

windows and doors and pioneered the U.S. impact-resistant window and door

industry. Our impact-resistant products, which are marketed under the WinGuard®,

PremierVue ™ and PGT Architectural Systems brand names, combine heavy-duty

aluminum or vinyl frames with laminated glass to provide protection from

hurricane-force winds and wind-borne debris by maintaining their structural

integrity and preventing penetration by impacting objects. Impact-resistant

windows and doors satisfy increasingly stringent building codes in

hurricane-prone coastal states and provide an attractive alternative to shutters

and other “active” forms of hurricane protection that require installation and

removal before and after each storm. Combining the impact resistance of WinGuard

with our insulating glass creates energy efficient windows that can

significantly reduce cooling and heating costs. We also manufacture

non-impact resistant products in both aluminum and vinyl frames including our

new SpectraGuard ™ line of products launched over the past two

years. Our current market share in Florida, which is the largest

U.S. impact-resistant window and door market, is significantly greater than

that of any of our competitors.

The

geographic regions in which we currently operate include the Southeastern U.S.,

the Gulf Coast, the Caribbean, Central America and Canada. We distribute our

products through multiple channels, including over 1,300 window distributors,

building supply distributors, window replacement dealers and enclosure

contractors. This broad distribution network provides us with the flexibility to

meet demand as it shifts between the residential new construction and repair and

remodeling end markets.

We

operate manufacturing facilities in North Venice, Florida and in Salisbury,

North Carolina, which produce fully-customized windows and doors. We are

vertically integrated with glass tempering and laminating facilities in both

states, which provide us with a consistent source of impact-resistant laminated

glass, shorter lead times, and lower costs relative to third-party sourcing. Our

facility in Lexington, North Carolina is vacant and subsequent to January 2,

2010 is being marketed for sale.

History

Our

subsidiary, PGT Industries, Inc., was founded in 1980 as Vinyl Technology, Inc.

The PGT brand was established in 1987, and we introduced our WinGuard branded

product line in the aftermath of Hurricane Andrew in 1992.

PGT, Inc.

is a Delaware corporation formed on December 16, 2003, as JLL Window

Holdings, Inc. by an affiliate of JLL Partners, our largest stockholder, in

connection with its acquisition of PGT Holding Company on January 29,

2004. On February 15, 2006, we changed our name to PGT, Inc.,

and on June 27, 2006 we became a publicly listed company on the NASDAQ National

Market under the symbol “PGTI”.

FINANCIAL INFORMATION ABOUT

INDUSTRY SEGMENTS

The FASB

has issued guidance under the Segment Reporting topic of

the Codification which defines operating segments as components of an enterprise

about which separate financial information is available that is evaluated

regularly by the chief operating decision maker in deciding how to allocate

resources and in assessing performance. Under this definition, we have concluded

that we operate as one segment, the manufacture and sale of windows and

doors. Additional required information is included in Item

8.

NARRATIVE DESCRIPTION OF

BUSINESS

Our

Products

We

manufacture complete lines of premium, fully customizable aluminum and vinyl

windows and doors and porch enclosure products targeting both the residential

new construction and repair and remodeling end markets. All of our products

carry the PGT brand, and our consumer-oriented products carry an additional,

trademarked product name, including WinGuard, Eze-Breeze, SpectraGuard, and,

introduced in late 2009, PremierVue.

Window

and door products

WinGuard. WinGuard is an

impact-resistant product line and combines heavy-duty aluminum or vinyl frames

with laminated glass to provide protection from hurricane-force winds and

wind-borne debris that satisfy increasingly stringent building codes and

primarily target hurricane-prone coastal states in the U.S., as well as the

Caribbean and Central America. Combining the impact resistance of WinGuard with

our insulating glass creates energy efficient windows that can significantly

reduce cooling and heating costs.

Aluminum. We offer a complete

line of fully customizable, non-impact-resistant aluminum frame windows and

doors. These products primarily target regions with warmer climates, where

aluminum is often preferred due to its ability to withstand higher temperatures

and humidity. Adding our insulating glass creates energy efficient windows that

can significantly reduce cooling and heating costs.

Vinyl. We offer a complete

line of fully customizable, non-impact-resistant vinyl frame windows and doors

primarily targeting regions with colder climates, where the energy-efficient

characteristics of vinyl frames are critical. In early 2008, we introduced

SpectraGuard, a new line of vinyl windows for new construction with insulating

glass and unsurpassed wood-like aesthetics, such as brick-mould frames,

wood-like trim detail and simulated divided lights. In early 2009, we added to

the SpectraGuard line with new vinyl replacement windows combining superior

energy performance and protection with unsurpassed wood-like detail and

character.

PremierVue. Introduced

in the Fall of 2009, PremierVue is a complete line of impact-resistant vinyl

window products that are tailored for the mid to high end of the replacement

market, primarily targeting single and multi-family homes and low to mid-rise

condominiums in Florida and other coastal regions of the Southeastern U.S..

Combining structural strength and energy efficiency, these products are designed

for flexibility in today’s market, offering both laminated and

laminated-insulated impact-resistant glass options. PremierVue’s large test

sizes and high design pressures, combined with vinyl’s inherent thermal

efficiency, make these products truly unique in the window

industry.

Architectural Systems.

Similar to WinGuard, Architectural Systems products are impact-resistant,

offering protection from hurricane-force winds and wind-borne debris for mid-

and high-rise buildings rather than single family homes.

Porch-enclosure

products

Eze-Breeze. Eze-Breeze

sliding panels for porch enclosures are vinyl-glazed, aluminum-framed products

used for enclosing screened-in porches that provide protection from inclement

weather.

Sales

and Marketing

Our sales

strategy primarily focuses on attracting and retaining distributors and dealers

by consistently providing exceptional customer service, leading product quality,

and competitive pricing and using our advanced knowledge of building code

requirements and technical expertise.

Our

marketing strategy is designed to reinforce the high quality of our products and

focuses on both coastal and inland markets. We support our markets

through print and web based advertising, consumer and builder

promotions, and selling and collateral materials. We also work with our dealers

and distributors to educate consumers and homebuilders on the advantages of

using impact-resistant and energy efficient products. We market our

products based on quality, building code compliance, outstanding service,

shorter lead times, and on-time delivery using our fleet of trucks and

trailers.

Our

Customers

We have a

highly diversified customer base that is comprised of over 1,300 window

distributors, building supply distributors, window replacement dealers and

enclosure contractors. Our largest customer accounts for

approximately 4.8% of net sales and our top ten customers account for

approximately 18.2% of net sales. Our sales are composed of residential new

construction and home repair and remodeling end markets, which represented

approximately 27% and 73% of our sales, respectively, during

2009. This compares to 37% and 63% in 2008.

We do not

supply our products directly to homebuilders but believe demand for our products

is also a function of our relationships with a number of national homebuilders,

which we believe are strong.

Materials

and Supplier Relationships

Our

primary manufacturing materials include aluminum and vinyl extrusions, glass,

and polyvinyl butyral. Although in many instances we have agreements with our

suppliers, these agreements are generally terminable by either party on limited

notice. All of our materials are typically readily available from

other sources. Aluminum and vinyl extrusions accounted for approximately 44% of

our material purchases during fiscal year 2009. Sheet glass, which is sourced

from two major national suppliers, accounted for approximately 17% of our

material purchases during fiscal year 2009. Sheet glass that we purchase comes

in various sizes, tints, and thermal properties. Polyvinyl butyral and

ionoplast, which are both used as inner layer in laminated glass, accounted for

approximately 17% of our material purchases during fiscal year 2009. We are in

the process of renegotiating our agreement, which ended in December 2009, with

our supplier for the purchase of polyvinyl butyral. We have an

agreement with this same supplier for the purchase of ionoplast, which is in

effect until 2012.

Backlog

As of

January 2, 2010, backlog was $8.5 million compared to $9.3 million at January 3,

2009. Our backlog consists of orders that we have received from

customers that have not yet shipped, and we expect that substantially all of our

current backlog will be recognized as sales in the first quarter of

2010. The decrease in our backlog resulted from the continuation of

the downturn in the housing market and the overall economy, which has had a

negative impact on order intake, but also due to a decrease in lead time between

order intake and product shipment. Future period to period

comparisons of backlog may be negatively affected if sales and the level of

order intake decrease further.

Intellectual

Property

We own

and have registered trademarks in the United States. In addition, we own several

patents and patent applications concerning various aspects of window assembly

and related processes. We are not aware of any circumstances that

would have a material adverse effect on our ability to use our trademarks and

patents. As long as we continue to renew our trademarks when

necessary, the trademark protection provided by them is perpetual.

Manufacturing

Our

manufacturing facilities, located in Florida and North Carolina, are capable of

producing fully-customized products. The manufacturing process typically begins

in one of our glass plants where we cut, temper and laminate sheet glass to meet

specific requirements of our customers’ orders.

Glass is

transported to our window and door assembly lines in a make-to-order sequence

where it is combined with an aluminum or vinyl frame. These frames are also

fabricated to order, as we start with a piece of extruded material that we cut

and shape into a frame that fits our customers’ specifications. After an order

has been completed, it is immediately staged for delivery and shipped within an

average of 48 hours of completion.

Competition

The

window and door industry is highly fragmented and the competitive landscape is

based on geographic scope. The competition falls into one of two categories:

local and regional manufacturers, and national window and door

manufacturers.

Local and Regional Window and Door

Manufacturers: This group of competitors consists of numerous local job

shops and small manufacturing facilities that tend to focus on selling products

to local or regional dealers and wholesalers. Competitors in this group

typically lack marketing support and the service levels and quality controls

demanded by larger distributors, as well as the ability to offer a full

complement of products.

National Window and Door

Manufacturers: This group of competitors tends to focus on selling

branded products nationally to dealers and wholesalers and has multiple

locations.

The

principal methods of competition in the window and door industry are the

development of long-term relationships with window and door dealers and

distributors, and the retention of customers by delivering a full range of

high-quality products on time while offering competitive pricing and flexibility

in transaction processing. Trade professionals such as contractors,

homebuilders, architects and engineers also engage in direct interaction and

look to the manufacturer for training and education of product and code.

Although some of our competitors may have greater geographic scope and access to

greater resources and economies of scale than do we, our leading position in the

U.S. impact-resistant window and door market and the high quality of our

products position us well to meet the needs of our customers and retain an

advantage over our competitors.

Environmental

Considerations

Although

our business and facilities are subject to federal, state, and local

environmental regulation, environmental regulation does not have a material

impact on our operations, and we believe that our facilites are in material

compliance with such laws and regulations.

Employees

As of

February 28, 2010, we employed approximately 1,150 people, none of whom were

represented by a union. We believe that we have good relations with our

employees.

FINANCIAL INFORMATION ABOUT

GEOGRAPHIC AREAS

Our net

sales to customers in the United States were $156.5 million in 2009, $205.9

million in 2008, and $263.2 million in 2007. Our net foreign

sales, including sales into the Caribbean, Central America and Canada, were $9.5

million in 2009, $12.7 million in 2008, and $15.2 million in 2007.

AVAILABLE

INFORMATION

Our Internet address is www.pgtindustries.com. Through our Internet website under

“Financial Information” in the Investors section, we make available free of

charge, as soon as reasonably practical after such information has been filed

with the SEC, our annual report on Form 10-K, quarterly reports on Form 10-Q,

current reports on Form 8-K, and amendments to those reports filed pursuant to

Section 13(a) or 15(d) of the Securities Exchange Act. Also available through

our Internet website under “Corporate Governance” in the Investors section is

our Code of Ethics for Senior Financial Officers. We are not including this or

any other information on our website as a part of, nor incorporating it by

reference into this Form 10-K, or any of our other SEC filings. The SEC

maintains an Internet site that contains our reports, proxy and information

statements, and other information that we file electronically with the SEC at

www.sec.gov.

Item 1A. RISK

FACTORS

We are subject to

regional and national economic conditions. The unprecedented decline in

the economy in Florida and throughout the United States could continue to

negatively affect demand for our products which has had, and which could

continue to have, an adverse impact on our sales and results of

operations.

A continuation of

the downturn in our markets could adversely impact our credit agreement.

As of January 2, 2010, we had $68.3 million of outstanding indebtedness.

As noted elsewhere in this report, we have experienced a significant

deterioration in the various markets in which we compete. A sustained and

continued significant deterioration in these markets may adversely impact our

ability to meet certain covenants under our credit agreement. Management

continues to evaluate what, if any, action or actions may be available or

necessary to maintain compliance with these various covenants, including cost

saving actions and the prepayment of debt.

The new home

construction and repair and remodeling markets have declined. Beginning

in the second half of 2006, we saw a significant slowdown in the Florida housing

market. This slowdown continued during 2007, 2008, and 2009, and we

expect this trend to continue through 2010 and possibly further. Like

many building material suppliers in the industry, we have been and will continue

to be faced with a challenging operating environment due to this decline in the

housing market. Specifically, new single family housing permits in

Florida decreased by 49% in 2007, 47% in 2008, and 30% in 2009, each as compared

to the prior year. Beginning in the third quarter of 2008, we began

to see a decrease in consumer spending for repair and remodeling projects as

credit tightened and many homeowners lost substantial equity in their homes. The

resulting decline in new home and repair and remodeling construction levels by

our customers has decreased demand for our products which has had, and which

could continue to have, an adverse impact on our sales and results of

operations.

Current economic

and credit market conditions have increased the risk that we may not collect a

greater percentage of our receivables. Economic and credit conditions

have negatively impacted our bad debt expense which has adversely impacted our

results of operations. If these conditions persist, our results of

operations may continue to be adversely impacted by bad debts. We monitor our

customers’ credit profiles carefully and make changes in our terms when

necessary in response to this heightened risk.

We are subject to

fluctuations in the prices of our raw materials. We experience

significant fluctuations in the cost of our raw materials, including aluminum

extrusion, polyvinyl butyral and glass. A variety of factors over which we have

no control, including global demand for aluminum, fluctuations in oil prices,

speculation in commodities futures and the creation of new laminates or other

products based on new technologies impact the cost of raw materials we purchase

for the manufacture of our products. While we attempt to minimize our risk from

severe price fluctuations by entering into aluminum forward contracts to hedge

these fluctuations in the purchase price of aluminum extrusion we use in

production, substantial, prolonged upward trends in aluminum prices could

significantly increase the cost of the unhedged portions of our aluminum needs

and have an adverse impact on our results of operations. We anticipate that

these fluctuations will continue in the future. While we have entered into a

three-year supply agreement through early 2012 with a major producer of

ionoplast inner layer that we believe provides us with a reliable, single source

for ionoplast with stable pricing on favorable terms, if one or both parties to

the agreement do not satisfy the terms of the agreement it may be terminated

which could result in our inability to obtain ionoplast on commercially

reasonable terms having an adverse impact on our results of operations.

Additionally, ionoplast accounted for approximately 22% of our inner layer

purchases in 2009, and we are currently negotiating for the purchase of

polyvinyl butyral (which accounted for approximately 78% of our inner layer

purchases in 2009). If we are unable to negotiate a long-term

agreement for the supply of polyvinyl butyral on commercially reasonable terms,

it may have an adverse impact on our results of operations. While

historically we have to some extent been able to pass on significant cost

increases to our customers, our results between periods may be negatively

impacted by a delay between the cost increases and price increases in our

products.

We depend on

third-party suppliers for our raw materials. Our ability to offer a wide

variety of products to our customers depends on receipt of adequate material

supplies from manufacturers and other suppliers. Generally, our raw materials

and supplies are obtainable from various sources and in sufficient quantities.

However, it is possible that our competitors or other suppliers may create

laminates or products based on new technologies that are not available to us or

are more effective than our products at surviving hurricane-force winds and

wind-borne debris or that they may have access to products of a similar quality

at lower prices. Although in many instances we have agreements with our

suppliers, these agreements are generally terminable by either party on limited

notice. Moreover, other than with our suppliers of polyvinyl butyral and

aluminum, we do not have long-term contracts with the suppliers of our raw

materials.

Transportation

costs represent a significant part of our cost structure. Although prices

decreased significantly in the fourth quarter of 2008 and stabilized somewhat in

2009, the increase in fuel prices earlier in 2008 had a negative effect on our

distribution costs. Another rapid and prolonged increase in fuel

prices may significantly increase our costs and have an adverse impact on our

results of operations.

The home building

industry and the home repair and remodeling sector are regulated. The

homebuilding industry and the home repair and remodeling sector are subject to

various local, state, and federal statutes, ordinances, rules, and regulations

concerning zoning, building design and safety, construction, and similar

matters, including regulations that impose restrictive zoning and density

requirements in order to limit the number of homes that can be built within the

boundaries of a particular area. Increased regulatory restrictions could limit

demand for new homes and home repair and remodeling products and could

negatively affect our sales and results of operations.

Our operating

results are substantially dependent on sales of our WinGuard branded line of

products. A majority of our net sales are, and are expected to continue

to be, derived from the sales of our WinGuard branded line of products.

Accordingly, our future operating results will depend on the demand for WinGuard

products by current and future customers, including additions to this product

line that are subsequently introduced. If our competitors release new products

that are superior to WinGuard products in performance or price, or if we fail to

update WinGuard products with any technological advances that are developed by

us or our competitors or introduce new products in a timely manner, demand for

our products may decline. A decline in demand for WinGuard products as a result

of competition, technological change or other factors could have a material

adverse effect on our ability to generate sales, which would negatively affect

our sales and results of operations.

Changes in

building codes could lower the demand for our impact-resistant windows and

doors. The market for our impact-resistant windows and doors depends in

large part on our ability to satisfy state and local building codes that require

protection from wind-borne debris. If the standards in such building codes are

raised, we may not be able to meet their requirements, and demand for our

products could decline. Conversely, if the standards in such building codes are

lowered or are not enforced in certain areas, demand for our impact-resistant

products may decrease. Further, if states and regions that are affected by

hurricanes but do not currently have such building codes fail to adopt and

enforce hurricane protection building codes, our ability to expand our business

in such markets may be limited.

Our industry is

competitive, and competition may increase as our markets grow or as more states

adopt or enforce building codes that require impact-resistant products.

The window and door industry is highly competitive. We face significant

competition from numerous small, regional producers, as well as a small number

of national producers. Some of these competitors make products from alternative

materials, including wood. Any of these competitors may (i) foresee the

course of market development more accurately than do we, (ii) develop

products that are superior to our products, (iii) have the ability to

produce similar products at a lower cost, (iv) develop stronger

relationships with window distributors, building supply distributors, and window

replacement dealers, or (v) adapt more quickly to new technologies or

evolving customer requirements than do we. As a result, we may not be able to

compete successfully with them.

In

addition, while we are skilled at creating finished impact-resistant and other

window and door products, the materials we use can be purchased by any existing

or potential competitor. New competitors can enter our industry, and existing

competitors may increase their efforts in the impact-resistant market.

Furthermore, if the market for impact-resistant windows and doors continues to

expand, larger competitors could enter, or expand their presence in the market

and may be able to compete more effectively. Finally, we may not be able to

maintain our costs at a level sufficiently low for us to compete effectively. If

we are unable to compete effectively, demand for our products and our

profitability may decline.

Our business is

currently concentrated in one state. Our business is concentrated

geographically in Florida. In fiscal year 2009, approximately 81% of our sales

were generated in Florida, and new single family housing permits in Florida

decreased by 30% in 2009 compared to the prior year. A further or prolonged

decline in the economy of the state of Florida or of the coastal regions of

Florida, a change in state and local building code requirements for hurricane

protection, or any other adverse condition in the state could cause a decline in

the demand for our products in Florida, which could have an adverse impact on

our sales and results of operations.

Our level of

indebtedness could adversely affect our ability to raise additional capital to

fund our operations, limit our ability to react to changes in the economy or our

industry, and prevent us from meeting our obligations under our debt

instruments. As of January 2, 2010, our indebtedness under our first lien

term loan was $68.0 million. All of our debt was at a variable interest

rate. In the event that interest rates rise, our interest expense would

increase. A 1.0% increase in interest rates would result in approximately

$0.7 million of additional interest expense annually.

The level

of our debt could have certain consequences, including:

|

· increasing

our vulnerability to general economic and industry

conditions;

|

|

· requiring

a substantial portion of our cash flow from operations to be dedicated to

the payment of principal and interest on our indebtedness, therefore

reducing our ability to use our cash flow to fund our operations, capital

expenditures, and future business opportunities;

|

|

· exposing

us to the risk of increased interest rates because certain of our

borrowings, including borrowings under our credit facilities, will be at

variable rates of interest;

|

|

· limiting

our ability to obtain additional financing for working capital, capital

expenditures, debt service requirements, acquisitions, and general

corporate or other purposes; and

|

|

· limiting

our ability to adjust to changing market conditions and placing us at a

competitive disadvantage compared to our competitors who have less

debt.

|

We may incur

additional indebtedness. We may incur additional indebtedness under our

credit facilities, which provide for up to $25 million of revolving credit

borrowings, under the current Third Amendment which became effective on March

17, 2010. In addition, we and our subsidiary may be able to incur substantial

additional indebtedness in the future, including secured debt, subject to the

restrictions contained in the agreements governing our credit facilities. If new

debt is added to our current debt levels, the related risks that we now face

could intensify.

Our debt

instruments contain various covenants that limit our ability to operate our

business. Our credit facility contains various provisions that limit our

ability to, among other things, transfer or sell assets, including the equity

interests of our subsidiary, or use asset sale proceeds; pay dividends or

distributions on our capital stock or repurchase our capital stock; make certain

restricted payments or investments; create liens to secure debt; enter into

transactions with affiliates; merge or consolidate with another company; and

engage in unrelated business activities.

In

addition, our credit facilities require us to meet specified financial ratios.

These covenants may restrict our ability to expand or fully pursue our business

strategies. Our ability to comply with these and other provisions of our credit

facilities may be affected by changes in our operating and financial

performance, changes in general business and economic conditions, adverse

regulatory developments, or other events beyond our control. The breach of any

of these covenants, including those contained in our credit facilities, could

result in a default under our indebtedness, which could cause those and other

obligations to become due and payable. If any of our indebtedness is

accelerated, we may not be able to repay it.

We may be

adversely affected by any disruption in our information technology systems.

Our operations are dependent upon our information technology systems,

which encompass all of our major business functions. A disruption in our

information technology systems for any prolonged period could result in delays

in receiving inventory and supplies or filling customer orders and adversely

affect our customer service and relationships.

We may be

adversely affected by any disruptions to our manufacturing facilities or

disruptions to our customer, supplier, or employee base. Any disruption

to our facilities resulting from hurricanes and other weather-related events,

fire, an act of terrorism, or any other cause could damage a significant portion

of our inventory, affect our distribution of products, and materially impair our

ability to distribute our products to customers. We could incur significantly

higher costs and longer lead times associated with distributing our products to

our customers during the time that it takes for us to reopen or replace a

damaged facility. In addition, if there are disruptions to our customer and

supplier base or to our employees caused by hurricanes, our business could be

temporarily adversely affected by higher costs for materials, increased shipping

and storage costs, increased labor costs, increased absentee rates, and

scheduling issues. Furthermore, some of our direct and indirect suppliers have

unionized work forces, and strikes, work stoppages, or slowdowns experienced by

these suppliers could result in slowdowns or closures of their facilities. Any

interruption in the production or delivery of our supplies could reduce sales of

our products and increase our costs.

The nature of our

business exposes us to product liability and warranty claims. We are

involved in product liability and product warranty claims relating to the

products we manufacture and distribute that, if adversely determined, could

adversely affect our financial condition, results of operations, and cash flows.

In addition, we may be exposed to potential claims arising from the conduct of

homebuilders and home remodelers and their sub-contractors. Although we

currently maintain what we believe to be suitable and adequate insurance in

excess of our self-insured amounts, we may not be able to maintain such

insurance on acceptable terms or such insurance may not provide adequate

protection against potential liabilities. Product liability claims can be

expensive to defend and can divert the attention of management and other

personnel for significant periods, regardless of the ultimate outcome. Claims of

this nature could also have a negative impact on customer confidence in our

products and our company.

We are subject to

potential exposure to environmental liabilities and are subject to environmental

regulation. We are subject to various federal, state, and local

environmental laws, ordinances, and regulations. Although we believe that our

facilities are in material compliance with such laws, ordinances, and

regulations, as owners and lessees of real property, we can be held liable for

the investigation or remediation of contamination on such properties, in some

circumstances, without regard to whether we knew of or were responsible for such

contamination. Remediation may be required in the future as a result of spills

or releases of petroleum products or hazardous substances, the discovery of

unknown environmental conditions, or more stringent standards regarding existing

residual contamination. More burdensome environmental regulatory requirements

may increase our general and administrative costs and may increase the risk that

we may incur fines or penalties or be held liable for violations of such

regulatory requirements.

We conduct all of

our operations through our subsidiary, and rely on payments from our subsidiary

to meet all of our obligations. We are a holding company and derive all

of our operating income from our subsidiary, PGT Industries, Inc. All of our

assets are held by our subsidiary, and we rely on the earnings and cash flows of

our subsidiary to meet our debt service obligations. The ability of our

subsidiary to make payments to us will depend on its respective operating

results and may be restricted by, among other things, the laws of its

jurisdiction of organization (which may limit the amount of funds available for

distributions to us), the terms of existing and future indebtedness and other

agreements of our subsidiary, including our credit facilities, and the covenants

of any future outstanding indebtedness we or our subsidiary incur.

We are exposed to

risks relating to evaluations of controls required by Section 404 of the

Sarbanes-Oxley Act of 2002. We are required to comply with

Section 404 of the Sarbanes-Oxley Act of 2002. While we have concluded that

at January 2, 2010, we have no material weaknesses in our internal controls over

financial reporting, we cannot assure you that we will not have a material

weakness in the future. A “material weakness” is a

deficiency, or combination of deficiencies,

in internal control over financial reporting, such that there is a reasonable

possibility that a material misstatement of the Company’s annual or interim

financial statements will not be prevented or detected on a timely basis. If we

fail to maintain a system of internal controls over financial reporting that

meets the requirements of Section 404, we might be subject to sanctions or

investigation by regulatory authorities such as the SEC or by the NASDAQ Stock

Market LLC. Additionally, failure to comply with Section 404 or the report

by us of a material weakness may cause investors to lose confidence in our

financial statements and our stock price may be adversely affected. If we fail

to remedy any material weakness, our financial statements may be inaccurate, we

may not have access to the capital markets, and our stock price may be adversely

affected.

The controlling

position of an affiliate of JLL Partners limits the ability of our minority

stockholders to influence corporate matters. An affiliate of

JLL Partners owned 52.6% of our outstanding common stock as of January 2,

2010. Accordingly, such affiliate of JLL Partners has significant influence

over our management and affairs and over all matters requiring stockholder

approval, including the election of directors and significant corporate

transactions, such as a merger or other sale of our company or its assets. This

concentration of ownership may have the effect of delaying or preventing a

transaction such as a merger, consolidation, or other business combination

involving us, or discouraging a potential acquirer from making a tender offer or

otherwise attempting to obtain control, even if such a transaction or change of

control would benefit minority stockholders. In addition, this concentrated

control limits the ability of our minority stockholders to influence corporate

matters, and such affiliate of JLL Partners, as a controlling stockholder, could

approve certain actions, including a going-private transaction, without approval

of minority stockholders, subject to obtaining any required approval of our

board of directors for such transaction. As a result, the market price of our

common stock could be adversely affected.

The controlling

position of an affiliate of JLL Partners exempts us from certain Nasdaq

corporate governance requirements. Although we have satisfied all

applicable Nasdaq corporate governance rules, for so long as an affiliate of

JLL Partners continues to own more than 50% of our outstanding shares, we

will continue to avail ourselves of the Nasdaq Rule 4350(c) “controlled

company” exemption that applies to companies in which more than 50% of the

stockholder voting power is held by an individual, a group, or another company.

This rule grants us an exemption from the requirements that we have a majority

of independent directors on our board of directors and that we have independent

directors determine the compensation of executive officers and the selection of

nominees to the board of directors. However, we intend to comply with such

requirements in the event that such affiliate of JLL Partners’ ownership

falls to or below 50%.

Our directors and

officers who are affiliated with JLL Partners do not have any obligation to

report corporate opportunities to us. Because some individuals may serve

as our directors or officers and as directors, officers, partners, members,

managers, or employees of JLL Partners or its affiliates or investment funds and

because such affiliates or investment funds may engage in similar lines of

business to those in which we engage, our amended and restated certificate of

incorporation allocates corporate opportunities between us and JLL Partners and

its affiliates and investment funds. Specifically, for so long as JLL Partners

and its affiliates and investment funds own at least 15% of our shares of common

stock, none of JLL Partners, nor any of its affiliates or investment funds, or

their respective directors, officers, partners, members, managers, or employees

has any duty to refrain from engaging directly or indirectly in the same or

similar business activities or lines of business as do we. In addition, if any

of them acquires knowledge of a potential transaction that may be a corporate

opportunity for us and for JLL Partners or its affiliates or investment funds,

subject to certain exceptions, we will not have any expectancy in such corporate

opportunity, and they will not have any obligation to communicate such

opportunity to us.

|

Item 2.

|

PROPERTIES

|

We own

facilities in one location in Florida and two locations in North Carolina that

are capable of producing all of our product lines. In North Venice, Florida, we

own a 363,000 square foot facility that contains our corporate headquarters

and main manufacturing plant. We also own an adjacent 80,000 square foot

facility used for glass tempering and laminating, a 42,000 square foot

facility for producing Architectural System products and simulated wood-finished

products, and a 3,590 square foot facility used for employee and customer

training. In Salisbury, North Carolina, we own a 393,000 square foot

manufacturing facility including glass tempering and laminating capabilities. We

also own a 225,000 square foot facility in Lexington, North Carolina which

is currently vacant and in January 2010 we entered into an agreement to market

that location for sale.

We lease

four properties in North Venice, Florida. The leases for the fleet maintenance

building, glass plant line maintenance building, fleet parking lot, and facility

maintenance/test lab in North Venice, Florida expire in January 2012, November

2011, June 2014 and November 2010, respectively. Each of the

leases provides for a fixed annual rent. The leases require us to pay taxes,

insurance and common area maintenance expenses associated with the

properties.

All of

our owned properties secure borrowings under our first lien credit agreement. We

believe all of these operating facilities are adequate in capacity and condition

to service existing customer locations.

|

LEGAL

PROCEEDINGS

|

We are

involved in various claims and lawsuits incidental to the conduct of our

business in the ordinary course. We carry insurance coverage in such amounts in

excess of our self-insured retention as we believe to be reasonable under the

circumstances and that may or may not cover any or all of our liabilities in

respect of claims and lawsuits. We do not believe that the ultimate resolution

of these matters will have a material adverse impact on our financial position,

cash flows or results of operations.

|

RESERVED

|

|

MARKET

FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER

PURCHASES OF EQUITY SECURITIES

|

Our

Common Stock has been traded on the NASDAQ Global Market ® under the symbol “PGTI”. On

February 8, 2010, the closing price of our Common Stock as reported on the

NASDAQ Global Market was $1.72. The approximate number of stockholders of record

of our Common Stock on that date was 128, although we believe that the number of

beneficial owners of our Common Stock is substantially

greater.

The table

below sets forth the price range of our Common Stock during the periods

indicated.

|

High

|

Low

|

|||||||

|

2009

1st

Quarter

|

$

|

1.50

|

$

|

0.80

|

||||

|

2nd

Quarter

|

$

|

2.88

|

$

|

1.20

|

||||

|

3rd

Quarter

|

$

|

3.19

|

$

|

1.50

|

||||

|

4th

Quarter

|

$

|

2.85

|

$

|

2.00

|

||||

|

2008

1st

Quarter

|

$

|

5.00

|

$

|

2.59

|

||||

|

2nd

Quarter

|

$

|

4.25

|

$

|

2.18

|

||||

|

3rd

Quarter

|

$

|

5.95

|

$

|

3.00

|

||||

|

4th

Quarter

|

$

|

3.98

|

$

|

0.85

|

||||

Dividends

We do not

pay a regular dividend. Any determination relating to dividend policy will be

made at the discretion of our board of directors. The tems of our senior secured

credit facility governing our notes currently restrict our ability to pay

dividends.

Unregistered

Sales of Equity Securities

None.

Performance

Graph

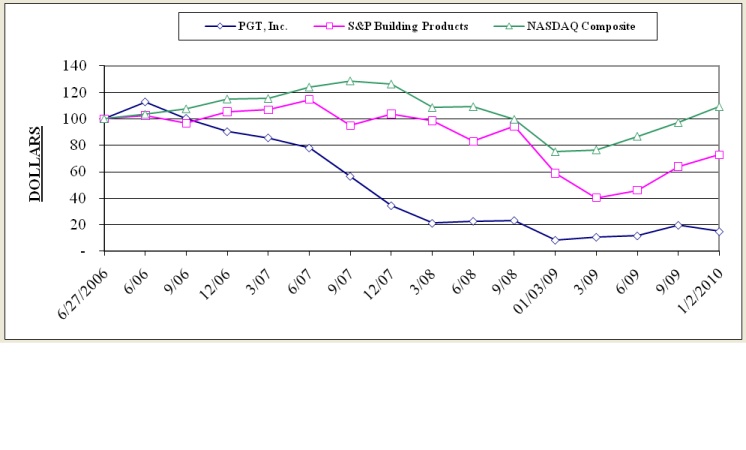

The

following graphs compare the percentage change in PGT, Inc.’s cumulative total

stockholder return on its Common Stock with the cumulative total stockholder

return of the Standard & Poor’s Building Products Index and the NASDAQ

Composite Index over the period from June 27, 2006 (the date we became a public

company) to January 2, 2010.

COMPARISON

OF 42 MONTH CUMULATIVE TOTAL RETURN*

AMONG

PGT, INC., THE NASDAQ COMPOSITE INDEX,

AND

THE S&P BUILDING PRODUCTS INDEX

|

6/27/2006

|

6/06 | 9/06 | 12/06 | 3/07 | 6/07 | 9/07 | 12/07 | |||||||||||||||||||||||||

|

PGT,

Inc.

|

100.00 | 112.86 | 100.43 | 90.36 | 85.71 | 78.07 | 56.64 | 34.50 | ||||||||||||||||||||||||

|

S&P

Building Products

|

100.00 | 102.51 | 96.65 | 105.41 | 106.85 | 114.67 | 95.04 | 103.78 | ||||||||||||||||||||||||

|

NASDAQ

Composite

|

100.00 | 103.42 | 107.53 | 115.00 | 115.30 | 123.95 | 128.63 | 126.28 | ||||||||||||||||||||||||

| 3/08 | 6/08 | 9/08 |

01/03/09

|

3/09 | 6/09 | 9/09 |

01/02/10

|

|||||||||||||||||||||||||

|

PGT,

Inc.

|

21.21 | 22.71 | 23.29 | 8.43 | 10.71 | 11.71 | 19.71 | 14.93 | ||||||||||||||||||||||||

|

S&P

Building Products

|

98.60 | 83.05 | 94.71 | 58.76 | 40.44 | 46.04 | 63.88 | 72.91 | ||||||||||||||||||||||||

|

NASDAQ

Composite

|

108.52 | 109.18 | 99.60 | 75.09 | 76.61 | 86.83 | 97.17 | 109.17 | ||||||||||||||||||||||||

* $100

invested on 06/27/2006 in stock or in index-including reinvestment of dividends

for 42 months ending January 2, 2010.

|

SELECTED

FINANCIAL DATA

|

The

following table sets forth selected historical consolidated financial

information and other data as of and for the periods indicated and have been

derived from our audited consolidated financial statements.

All information included in the following tables should be read in conjunction

with “Management’s Discussion and Analysis of Financial Condition and Results of

Operations” contained in Item 7, and with the consolidated financial statements

and related notes in Item 8. All years consisted of 52 weeks except for the

year ended January 3, 2009 which consisted of 53 weeks. We do not believe the

impact on comparability of results is significant.

|

Year

Ended

|

Year

Ended

|

Year

Ended

|

Year

Ended

|

Year

Ended

|

||||||||||||||||

|

Consolidated

Selected Financial Data

|

January

2,

|

January

3,

|

December 29,

|

December 30,

|

December 31,

|

|||||||||||||||

|

(in

thousands except per share data)

|

2010

|

2009

|

2007

|

2006

|

2005

|

|||||||||||||||

|

Net

sales

|

$ | 166,000 | $ | 218,556 | $ | 278,394 | $ | 371,598 | $ | 332,813 | ||||||||||

|

Cost

of sales

|

121,622 | 150,277 | 187,389 | 229,867 | 209,475 | |||||||||||||||

|

Gross

margin

|

44,378 | 68,279 | 91,005 | 141,731 | 123,338 | |||||||||||||||

|

Impairment

charges(1)

|

742 | 187,748 | 826 | 1,151 | 7,200 | |||||||||||||||

|

Stock

compensation expense(2)

|

- | - | - | 26,898 | 7,146 | |||||||||||||||

|

Selling,

general and administrative

|

||||||||||||||||||||

|

expenses

|

51,902 | 63,109 | 77,004 | 86,219 | 83,634 | |||||||||||||||

|

(Loss)

income from operations

|

(8,266 | ) | (182,578 | ) | 13,175 | 27,463 | 25,358 | |||||||||||||

|

Interest

expense

|

6,698 | 9,283 | 11,404 | 28,509 | 13,871 | |||||||||||||||

|

Other

(income) expense, net(3)

|

37 | (40 | ) | 692 | (178 | ) | (286 | ) | ||||||||||||

|

(Loss)

income before income taxes

|

(15,001 | ) | (191,821 | ) | 1,079 | (868 | ) | 11,773 | ||||||||||||

|

Income

tax (benefit) expense

|

(5,584 | ) | (28,789 | ) | 456 | 101 | 3,910 | |||||||||||||

|

Net

(loss) income

|

$ | (9,417 | ) | $ | (163,032 | ) | $ | 623 | $ | (969 | ) | $ | 7,863 | |||||||

|

Net

(loss) income per common share:

|

||||||||||||||||||||

|

Basic

|

$ | (0.26 | ) | $ | (5.08 | ) | $ | 0.02 | $ | (0.04 | ) | $ | 0.47 | |||||||

|

Diluted

|

$ | (0.26 | ) | $ | (5.08 | ) | $ | 0.02 | $ | (0.04 | ) | $ | 0.43 | |||||||

|

Weighted

average shares outstanding:

|

||||||||||||||||||||

|

Basic(4)

|

36,451 | 32,104 | 29,247 | 22,673 | 16,800 | |||||||||||||||

|

Diluted(4)

|

36,451 | 32,104 | 30,212 | 22,673 | 18,376 | |||||||||||||||

|

Other

financial data:

|

||||||||||||||||||||

|

Depreciation

|

$ | 10,435 | $ | 11,518 | $ | 10,418 | $ | 9,871 | $ | 7,503 | ||||||||||

|

Amortization

|

5,731 | 5,570 | 5,570 | 5,742 | 8,020 | |||||||||||||||

|

As

Of

|

As

Of

|

As

Of

|

As

Of

|

As

Of

|

||||||||||||||||

|

January

2,

|

January

3,

|

December 29,

|

December 30,

|

December 31,

|

||||||||||||||||

| 2010 | 2009 | 2007 | 2006 | 2005 | ||||||||||||||||

|

Balance

Sheet data:

|

||||||||||||||||||||

|

Cash

and cash equivalents

|

$ | 7,417 | $ | 19,628 | $ | 19,479 | $ | 36,981 | $ | 3,270 | ||||||||||

|

Total

assets

|

173,630 | 200,617 | 407,865 | 442,794 | 425,553 | |||||||||||||||

|

Total

debt, including current portion

|

68,268 | 90,366 | 130,000 | 165,488 | 183,525 | |||||||||||||||

|

Shareholders’

equity

|

68,209 | 74,185 | 210,472 | 205,206 | 156,571 | |||||||||||||||

|

(1)

|

In

2009, 2007 and 2006, amount relates to write-down of the value of our

Lexington, North Carolina property. In 2008, amount relates to intangible

asset impairment charges. See Note 7 in Item 8. In 2005,

amount relates to write-down of a trademark in connection with the sale of

the related product line.

|

|

(2)

|

Represents

compensation expense paid to stock option holders (including applicable

payroll taxes) in lieu of adjusting exercise prices in connection with the

dividends paid to shareholders in September 2005 and February 2006 of $7.1

million, including expenses, and $26.9 million, respectively. These

amounts include amounts paid to stock option holders whose other

compensation is a component of cost of sales of $1.3 million and $5.1

million, respectively.

|

|

(3)

|

Relates

to derivative financial

instruments.

|

|

(4)

|

Weighted

average common shares outstanding for all periods have been restated

to give effect to the bonus element in the 2010 rights

offering.

|

Item 7. Management’s Discussion and

Analysis of Financial Condition and Results of Operations

We advise

you to read Management’s Discussion and Analysis of Financial Condition and

Results of Operations in conjunction with our Consolidated Financial Statements

and the Notes to the Consolidated Financial Statements included in Item 8. We

also advise you read the risk factors in Item 1A. You should consider

the information in these items, along with other information included in this

Annual Report on Form 10-K.

RECENT

DEVELOPMENTS

In the

first quarter of 2010, we entered into an agreement with a broker to list our

Lexington, NC, plant facility. In the second quarter of 2009, we

ceased operating out of that facility and do not expect a potential sale to have

a material impact on our operations in the future.

On March

12, 2010, we completed our rights offering which generated net proceeds of $27.5

million used to repay a portion of the outstanding indebtedness under our

amended credit agreement in the amount of $15.0 million, and for general

corporate purposes in the amount of $12.5 million. See “Liquidity and

Capital Resources” for further information.

On March

18, 2010 our Board of Directors approved the Amended and Restated 2006 Equity

Incentive Plan, and authorized an Equity Exchange. Also, on March 8,

2010, our Board of Directors authorized a stock option exchange to eligible

employees. These three items are subject to approval at our annual

stockholders' meeting. Additional information appears in our

definitive proxy statement for our annual meeting of stockholders under the

captions “Amended and Restated 2006 Equity Incentive Plan”, “Issuer Tender

Offer”, and “Equity Exchange”.

EXECUTIVE

OVERVIEW

Sales

and Operations

On

February 11, 2010, we issued a press release and held a conference call on

Friday, February 19, 2010 to review the results of operations for our fiscal

year ended January 2, 2010. During the call, we also discussed

current market conditions, and progress made regarding certain of our growth

initiatives. The overview and estimates contained in this report are consistent

with those given in our press release. We are neither updating nor confirming

that information.

There

have been some positive signs in our industry lately, but certain statistics

such as housing starts are still at record lows. Single-Family

housing starts in Florida remained at approximately 6,000 per quarter in 2009,

compared to 60,000 during the housing boom and a realistic average of 25,000

based on Florida population. Other economic indicators such as

continuing high unemployment are likely to hamper the rate of growth for the

immediate future.

The

slowdown that we first experienced in fiscal 2007 has continued through fiscal

2009. Our 2009 net revenue was 40% lower than net revenue in 2007 and 24% lower

than net revenue in 2008. We believe over inflation in the housing market,

followed by a significant drop in consumer confidence and a lack of liquidity in

the credit markets, slowed the economy to a pace not experienced since the Great

Depression. As such, we believe the return of consumer confidence and a

sustained stabilization in the housing market are important aspects in the

recovery of our business. However, despite these conditions, we

maintained a positive cash flow while executing our strategic vision of gaining

market share in our core market of Florida and expanding our out-of-state

presence.

We

continue to believe in our ability to expand our sales into out-of-state

markets, which increased 24% during 2009 driven by the introduction of new

products and the expansion of our distribution base. Launched in 2008, our

SpectraGuard vinyl product line sales grew to $8.0 million in 2009 compared to

$1.4 million in 2008.

Our sales

into the new construction and repair and remodeling markets are down 45% and 12%

respectively in 2009. However, our mix of sales between these two end markets

has notably shifted over the past two years. Sales into the repair and

remodeling market represented 73% in 2009 compared to 54% in 2007 and 63% in

2008. This prominent shift has helped our company somewhat off-set the

significant decline in the new home construction market.

We sought

to balance between short-term cash flow goals and long-term strategic goals,

during the difficult market conditions described above. We

consistently re-evaluated our cost structure, identifying opportunities to drive

efficiencies and savings initiatives while remaining aware of the resources

needed to effectively serve our customers and exceed their

expectations.

As

a result, we implemented various initiatives to take cost out of our system

including reductions in our workforce, reductions in pay, renegotiating supply

agreements and cutting discretionary spending. We recorded $5.4 million in

restructuring costs in 2009 and $2.1 million in 2008 related to our efforts.

When combined, these actions are estimated to drive substantial cost savings

that will exceed $25 million annually. These efforts have helped off-set the

decline in sales volume which causes an unfavorable deleveraging of our fixed

costs.

Liquidity

and Cash Flow

We began

2007 with a total net debt balance of $128 million and ended fiscal 2009 with a

net debt of $61 million. Over the past three years we were able to reduce our

debt by combining our ability to generate cash from operations totaling $54

million, with net proceeds from the fully subscribed 2008 rights offering of

$29.3 million. Due to the focus on reducing debt, our net debt level

is currently at its lowest point since 2004.

As we

entered into 2010 we announced another rights offering which closed on March 12,

2010. This rights offering was 90% subscribed and generated $27.5

million of additional capital for our Company, bringing our net debt levels down

further to $34 million.

We used

$15.0 million of the proceeds to further pay down our term debt and make our

Third amendment to our credit facility, which we entered into on December 24,

2009, effective. This amendment further secures our position and

provides more flexibility to focus on long-term strategic

goals.

Acquisition

Pursuant

to an asset purchase agreement by and between Hurricane Window and Door Factory,

LLC (“Hurricane”) of Ft. Myers, Florida, and our operating subsidiary, PGT

Industries, Inc., effective on August 14, 2009, we acquired certain operating

assets of Hurricane for approximately $1.5 million in cash. Hurricane

designed and manufactured high-end vinyl impact products for the single- and

multi-family residential markets. The products provide long-term energy and

structural benefits, while qualifying homeowners for the government’s energy tax

credits through the American Recovery and Reinvestment Act of

2009. This product line was developed specifically for the hurricane

protection market and combines some of the highest structural ratings in the

industry with excellent energy efficiency. The acquisition of this

business expands our presence in the energy efficient vinyl impact-resistant

market, increases our ability to serve the multi-story condominium market, and

enhances our ability to offer a complete line of impact products to the

customer.

The

purchase price paid was allocated to the assets acquired based on their

estimated fair value on August 14, 2009. The assets acquired included

Hurricane’s inventory, comprised almost entirely of raw materials, and property

and equipment, primarily comprised of machinery and other manufacturing

equipment. We also acquired the right to use Hurricane’s design

technology through the end of 2010 and the option to purchase the technology at

any time through the end of 2010 and, if desired, we can extend the right to use

and the option to purchase Hurricane’s design technology for an additional one

year period through the end of 2011. The allocation of the $1.5

million cash purchase price to the fair value of the assets acquired as of the

August 14, 2009 acquisition date is as follows:

|

(in

thousands)

|

Fair Values

|

|||

|

Inventory

|

$ | 254 | ||

|

Property

and equipment

|

623 | |||

|

Identifiable

intangibles

|

575 | |||

|

Net

assets acquired

|

1,452 | |||

|

Purchase

price

|

1,452 | |||

|

Goodwill

|

$ | - | ||

The value

of inventory was established based on then current purchase prices of identical

materials available from Hurricane’s existing vendors. The value of

property and equipment was established based on Hurricane’s net carrying values

which we determined to approximate fair value due to, among other things, their

having been in service for less than one year. We engaged a

third-party valuation specialist to assist us in estimating the fair value of

the identifiable intangible assets consisting of the right to use Hurricane’s

design technology and the related purchase option. The fair value of

the identifiable intangible assets was estimated using an income approach based

on projections provided by management. The carrying value of the intangible

assets of $0.4 million is included in other intangible assets, net, in the

accompanying condensed consolidated balance sheet at January 2,

2010. The intangible assets are being amortized on the straight-line

basis over their estimated lives of approximately 1.4 years through the end of

2010. Amortization expense of $0.2 million is included in selling,

general and administrative expenses in the accompanying condensed consolidated

statement of operations for the year ended January 2,

2010. Acquisition costs of less than $0.1 million are included in

selling, general and administrative expenses in the accompanying consolidated

statement of operations for the year ended January 2,

2010. Hurricane’s operating results prior to the acquisition were

insignificant.

Restructurings

On

October 25, 2007, we announced a restructuring as a result of an in-depth

analysis of our target markets, internal structure, projected run-rate, and

efficiency. The restructuring resulted in a decrease in our workforce

of approximately 150 employees and included employees in both Florida and North

Carolina. The restructuring was undertaken in an effort to streamline

operations, as well as improve processes to drive new product development and

sales. As a result of the restructuring, we recorded a restructuring

charge of $2.4 million in 2007, of which $0.7 million was classified within cost

of goods sold and $1.7 million was classified within selling, general and

administrative expenses. The charge related primarily to employee

separation costs. Of the $2.4 million charge, $1.5 million was

disbursed in 2007 and $0.9 million was disbursed in 2008.

On March

4, 2008, we announced a second restructuring as a result of continued analysis

of our target markets, internal structure, projected run-rate, and

efficiency. The restructuring resulted in a decrease in our workforce

of approximately 300 employees and included employees in both Florida and North

Carolina. As a result of the restructuring, we recorded a

restructuring charge of $2.1 million in 2008, of which $1.1 million is

classified within cost of goods sold and $1.0 million is classified within

selling, general and administrative expenses in the accompanying consolidated

statement of operations for the year ended January 3, 2009. The

charge related primarily to employee separation costs. Of the $2.1

million, $1.8 million was disbursed in the first quarter of 2008. The

remaining $0.3 million is classified within accrued liabilities in the

accompanying consolidated balance sheet as of January 3, 2009 (Note 8) and was

disbursed in 2009.

On

January 13, 2009, March 10, 2009, September 24, 2009 and November 12, 2009, we

announced restructurings as a result of continued analysis of our target

markets, internal structure, projected run-rate, and efficiency. The

restructuring resulted in a decrease in our workforce of approximately 260 in

the first quarter, 80 in the second quarter and 140 in the fourth quarter for a

total of 480 employees in both Florida and North Carolina. As a

result of the restructurings, we recorded restructuring charges of $5.4 million

in the accompanying consolidated statement of operations for the year ended

January 2, 2010, of which $3.1 million is classified within cost of goods sold

with $1.4 million charged in the first quarter, $0.5 million in the third

quarter and $1.2 million in the fourth. The remaining $2.3 million is classified

within selling, general and administrative expenses of which $1.6 million is

charged in the first quarter, $0.4 million in the second quarter and $0.3

million in the fourth quarter in the accompanying consolidated statement of

operations for the year ended January 2, 2010. The charge related

primarily to employee separation costs. Of the $5.4 million, $2.6

million was disbursed in the first quarter of 2009, $0.3 million in the second

quarter, $0.4 million in the third quarter and $1.2 million in the fourth

quarter. The remaining $0.9 million is classified within accrued

liabilities in the accompanying consolidated balance sheet as of January 2, 2010

(Note 8) and is expected to be disbursed in 2010.

The

following table provides information with respect to the accrual for

restructuring costs:

|

Beginning

of Year

|

Charged

to Expense

|

Disbursed

in Cash

|

End

of Year

|

|||||||||||||

|

(in

thousands)

|

||||||||||||||||

|

Year

ended January 2, 2010:

|

||||||||||||||||

|

2008

Restructuring

|

$ | 332 | $ | - | $ | (332 | ) | $ | - | |||||||

|

2009

Restructurings

|

- | 5,395 | (4,497 | ) | 898 | |||||||||||

|

For

the year ended January 2, 2010

|

$ | 332 | $ | 5,395 | $ | (4,829 | ) | $ | 898 | |||||||

|

Year

ended January 3, 2009:

|

||||||||||||||||

|

2007

Restructuring

|

$ | 850 | $ | - | $ | (850 | ) | $ | - | |||||||

|

2008

Restructuring

|

- | 2,131 | (1,799 | ) | 332 | |||||||||||

|

For

the year ended January 3, 2009

|

$ | 850 | $ | 2,131 | $ | (2,649 | ) | $ | 332 | |||||||

|

Year

ended December 29, 2007:

|

||||||||||||||||

|

2007

Restructuring

|

$ | - | $ | 2,375 | $ | (1,525 | ) | $ | 850 | |||||||

Non-GAAP

Financial Measures – Items Affecting Comparability

Below is

a presentation of EBITDA, a non-GAAP measure, which we believe is useful

information for investors (in thousands):

|

Year

Ended

|

||||||||||||

|

January

2,

|

January

3,

|

December

29,

|

||||||||||

|

2010

|

2009

|

2007

|

||||||||||

|

Net

(loss) income

|

$ | (9,417 | ) | $ | (163,032 | ) | $ | 623 | ||||

|

Interest

expense

|

6,698 | 9,283 | 11,404 | |||||||||

|

Income

tax (benefit) expense

|

(5,584 | ) | (28,789 | ) | 456 | |||||||

|

Depreciation

|

10,435 | 11,518 | 10,418 | |||||||||

|

Amortization

|

5,731 | 5,570 | 5,570 | |||||||||

|

EBITDA

(1)(2)

|

$ | 7,863 | $ | (165,450 | ) | $ | 28,471 | |||||

|

(1)

Includes the impact of the following expenses:

|

||||||||||||

|

Restructuring

charges (a)

|

$ | (5,395 | ) | $ | (2,131 | ) | $ | (2,375 | ) | |||

|

Impairment

charges (b)

|

(742 | ) | (187,748 | ) | (826 | ) | ||||||

|

(a)

|

Represents

charges related to restructuring actions taken in 2009, 2008 and

2007. These charges relate primarily to employee separation

costs.

|

|

(b)

|

In

2009 and in 2007, represents the write-down of the value of the Lexington,

North Carolina property. In 2008, represents goodwill and indefinite lived

asset impairment charges.

|

|

|

(2)

EBITDA is defined as net income plus interest expense (net of interest

income), income taxes, depreciation, and amortization. EBITDA is a measure

commonly used in the window and door industry, and we present EBITDA to

enhance your understanding of our operating performance. We use EBITDA as

one criterion for evaluating our performance relative to that of our

peers. We believe that EBITDA is an operating performance measure that

provides investors and analysts with a measure of operating results

unaffected by differences in capital structures, capital investment

cycles, and ages of related assets among otherwise comparable companies.

While we believe EBITDA is a useful measure for investors, it is not a

measurement presented in accordance with United States generally accepted

accounting principles, or GAAP. You should not consider EBITDA in

isolation or as a substitute for net income, cash flows from operations,

or any other items calculated in accordance with

GAAP.

|

RESULTS

OF OPERATIONS

Analysis

of Selected Items from our Consolidated Statements of Operations

|

Year

Ended

|

Percent

Change

|