Attached files

| file | filename |

|---|---|

| 8-K - QUANTUM FUEL SYSTEMS FORM 8-K - QUANTUM FUEL SYSTEMS TECHNOLOGIES WORLDWIDE, INC. | d8k.htm |

Quantum Fuel Systems Technologies Worldwide, Inc. March 2010 “Driving Tomorrow’s Technology Today” Exhibit 99.1 |

Forward Looking Statements This presentation contains certain “forward-looking statements” within the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward

looking statements are based on management’s reasonable expectations

and assumptions as of the date of this presentation. These statements include words such as “may,” “could,” “will,” “should,” “assume,” “expect,” “anticipate,” “plan,” “intend,” “believe,” “predict,” “estimate,” “forecast,” “outlook,” “potential,” or “continue,” or the negative of these terms, and other comparable terminology. Various risks and other factors could

cause actual results to differ materially from those contemplated by the

forward looking statements including, without limitation, our ability to

raise sufficient capital to fund operations and execute our business plan, the success of and number of vehicles sold by Fisker Automotive, delays in development and production at Fisker Automotive, our ability to secure future development programs and supply contracts with Fisker Automotive and other Original Equipment Manufacturers, whether we are able to complete our acquisition

of Schneider Power, Inc., Schneider Power’s ability to receive

contracts under Ontario’s feed-in tariff program and develop commercially viable and profitable wind and solar farms, whether we are able to secure financing for Quantum Solar, changes in the

demand for alternative fuel vehicles, solar products and other renewable energies,

changes in environmental policies, commercial viability and acceptance of

our products, creation of an infrastructure to support alternative fuel

vehicles, the impact of competitive products and pricing, interruptions in

the supply of materials and parts, the growth and success of our affiliates,

loss of or inability to obtain adequate protection for our intellectual

property, our ability to attract, hire and retain qualified personnel, and results of litigation or regulatory activities. The Company disclaims any obligation or

undertaking to disseminate any updates or revisions to any

forward-looking statements contained in this presentation to reflect any

change in management’s assumptions, beliefs or expectations or any

change in events, conditions or circumstances upon which any forward-looking statements are based. |

Quantum Overview QUANTUM Renewable Energy Quantum Aerospace Ultra Lightweight Tanks (H2 & O2) Security & Aerospace Quantum DS Defense, Security, Reconnaissance and Humanitarian Vehicles ASOLA Germany Solar Module Manufacturing Quantum Solar Energy USA Solar Module Manufacturing Schneider Power Renewable Power Generation Hybrid Automotive Fisker Automotive (Q-Drive) Quantum OEM Military Hybrid Q-Force Quantum Development Other Customers/ OEMS |

Quantum Overview Fisker Premium Hybrid Vehicles Quantum Military Hybrids Quantum H2 and CNG Vehicles Lithium –Ion Batteries Powertrain Systems H2 and CNG Storage Systems Asola-Quantum Automotive Solar Asola Solar PV Modules Future Quantum Solar Energy |

Our

Customers & Partners |

Strategic Relationships Fisker Automotive •Well known brand, stellar team and diligent execution •$527.8 Million DOE loan •Contract to supply powertrain and solar roof in production quantities Schneider Power •Experienced developer of wind and solar energy projects •Significant growth potential in Ontario, Canada and other high growth markets •1 GW pipeline of new projects Asola •German designer and manufacturer of high quality solar photovoltaic modules •$100 million + in revenues •20+ years of experience and global relationships |

Experienced Management Team Dale L. Rasmussen, Chairman of the Board •Member of the Board of Directors since 2000; Chairman since 2002 •Founding member of Fisker Automotive •Over 25 years of experience in the alternative fuels industry •Instrumental in raising over half a billion in equity financing since 1996

Alan P. Niedzwiecki, President & CEO •President and CEO since Aug 2002 •“Entrepreneur of the Year” – Orange County Business Journal (March 2009) •Over 25 years of experience in the alternative fuels industry W. Brian Olson, Chief Financial Officer •CFO and Treasurer since August 2002 •Over 15 years of experience in the alternative fuels industry •Prior experience – CFO of $200 Million alternative energy company •Certified Management Accountant Dr. Neel Sirosh, Chief Technology Officer •CTO since 2005; Director of Advanced Technology since 1997 •20 years of experience in the alternative fuels industry •6 patents and 2 book chapters on clean energy; 35 papers/conference

presentations David Mazaika, Chief Operating Officer •Over 14 years of experience in hybrid vehicle development •Co-founder of the ISE Corporation and recipient of CALSTART’s “Blue Sky Award” (1997) •COO since December 2008 |

Fisker Automotive • A new Green American premium car company • Founded by Quantum and Fisker Coachbuild • Funded by: - Kleiner Perkins Caufield & Byers - Palo Alto Investors - Qatar Investment Authority • Business Week Magazine’s pick as Top Start-up of 2008 New York, Times Square, September 5, 2007 |

June

2009 |

Fisker Automotive • Production Starts 2011 – Karma models are planned to incorporate Quantum’s Plug-in Hybrid Electric

Vehicle (PHEV) powertrain – Q-Drive® • First model: PHEV Premium 4-door Sports Sedan - KARMA – Unveiled at the North American International Auto Show in Detroit, Jan 2008 – MSRP $87,900 – $7,500 Federal Tax Credit for PHEVs |

Fisker Karma Plug-In Hybrid with Quantum Q-Drive Electrification of the Automobile |

Electrification of the Automobile |

Electrification of the Automobile Fisker Automotive has acquired a 3.2 million sq ft former GM facility in Delaware

|

Electrification of the Automobile |

Detroit Auto Show |

Military Opportunities / Q-Force |

USPS Vehicle USPS LLV (Long Life Vehicle) • 12-15 mile daily driving route • 500-700 stops per day |

About

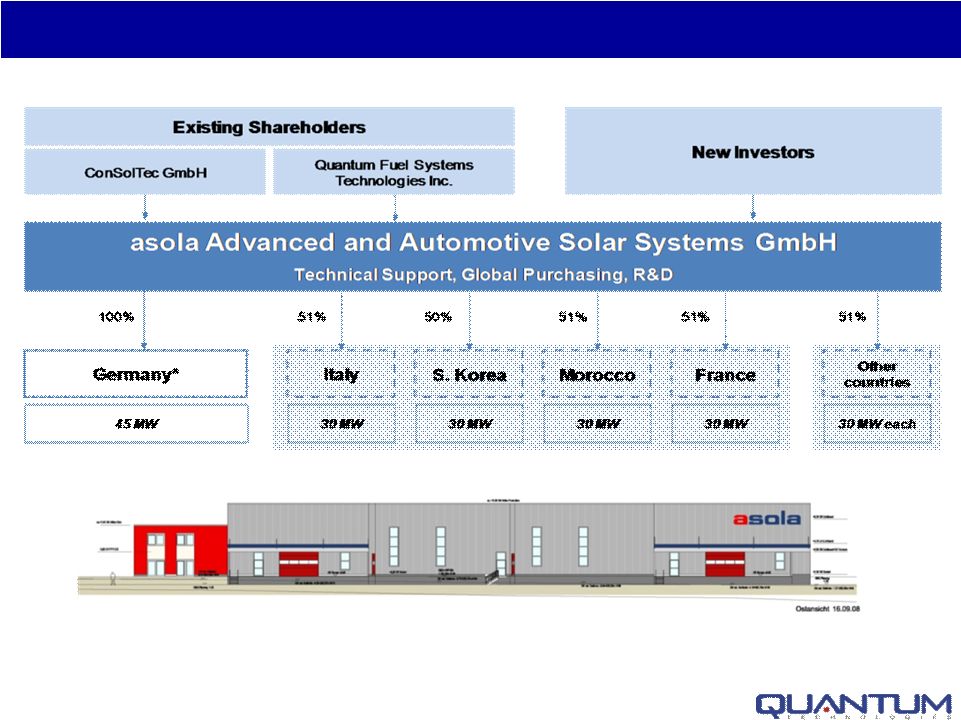

Asola (continued) • Asola GmbH is a privately-held German leader in development of crystalline silicon solar modules. • Manufacture high output (watt/panel) and high quality solar modules. • 2010 Revenue Projection - $100 million • Expertise in solar cell modularization for commercial, residential, automotive and

grid applications. Asola Germany 75% 25% USA 15% 85% |

About Asola (continued) Asola |

• Quantum and Asola will supply world's largest continuous- formed glass solar roof panel on a car, for Fisker KARMA. • Integral part of the vehicle onboard energy management strategy • Optimized to maximize solar ray absorption under various lighting conditions Automotive Solar Modules Asola |

PROPOSED: • 45 MW Solar Module Manufacturing Plant – Irvine, CA • Expansion of our German 45 MW Facility • 20+ years of Experience • Revenue Potential $100 Million per Year • Timing: • Start of production 2nd Quarter 2010 • Markets: • Commercial, Residential, Utility • Automotive Solar Roof Systems • Local manufacturing and jobs – key considerations for American Recovery and Reinvestment Act funding Quantum Solar Energy |

Schneider Power |

Operating and Development Assets Ontario Type Size Operational Arthur Wind 10 MW 2010 Spring Bay Wind 10 MW 2010 Grand Valley Wind 60 MW 2011 Trout Creek Wind 10 MW 2011 Innisfil Wind 10 MW 2011 Crystal Falls/ Dymond Solar 20 MW 2012 New Liskeard Solar 10 MW 2012 Manitoba Type Size Operational Hilltop Heights Wind 120 MW 2013 Rapid City Wind 240 MW 2014 Fairmont Wind 345 MW 2015 Nova Scotia Type Size Operational Goodwins Island Wind 20 MW 2012 Bahamas Type Size Operational New Providence/ Abaco Wind 24 MW 2012 Jasper Wind 150 MW 2014 |

Schneider Power 630 MW “Shovel Ready” Renewable Energy Projects 1. Development, Construction

& Management of Renewable Energy Facilities 2. 630 MW ‘Shovel Ready’ Renewable Energy Projects 3. 1 GW Pipeline of New Projects 4. Diversified Portfolio Mix 5. Significant Portfolio of Renewable Development Projects in Multiple Jurisdictions |

Financial Overview |

• Expanding business model with clearly defined revenue streams - Fisker Karma (Q-Drive) - Solar module manufacturing - Development fees on renewable energy projects • Projecting profitability in CY 2011 - Profitable revenue streams - Earnings in renewable energy partnerships and affiliates • Improving financial position - Equitized $20 million of debt in last nine months - Maturity dates pushed out into 2011 - $10 million commitment letter available to the Company Financial Overview |

Q-Drive Hybrid Business Model CY CY CY CY CY 2010 2011 2012 2013 2014 PHEV UNITS Q-Drive (Fisker) 250 15,000

15,000 15,000 15,000 Q-Drive (Light) - - 4,000 10,000 20,000 Forecasted 250 15,000

19,000 25,000 35,000 ASP 10,000 $

10,000 $

11,000 $

13,000 $

15,000 $

REVENUES Product 2,500,000 $ 150,000,000 $ 209,000,000 $ 325,000,000 $ 525,000,000 $ Development 10,000,000 $ 10,000,000 $ 10,000,000 $ 10,000,000 $ 10,000,000 $ CONTRIBUTION 1,600,000 $ 20,000,000 $ 27,400,000 $ 41,900,000 $ 66,900,000 $ |

Renewable Energy Business Model CY CY CY CY CY 2010 2011 2012 2013 2014 DEVELOPMENT PROJECTS MW Developed 20.0 80.0 100.0 150.0 280.0 Development Fee Revenue 5,400,000 $ 10,700,000 $ 14,600,000 $ 17,000,000 $ 19,000,000 $ Operating Income 2,300,000 $ 5,600,000 $ 8,800,000 $ 9,400,000 $ 9,400,000 $ Earnings in Equity Positions - $

1,000,000 $ 5,800,000 $ 8,500,000 $ 14,200,000 $ IRRs Expected 21% 23% 25% 27% 25% CY CY CY CY CY 2010 2011 2012 2013 2014 RENEWABLE ENERGY REVENUES Solar Module Manufacturing 22,500,000 $ 90,000,000 $ 94,500,000 $ 105,000,000 $ 126,000,000 $ Project Development Fees 5,400,000 10,700,000 14,600,000 17,000,000 19,000,000 27,900,000 $ 100,700,000 $ 109,100,000 $ 122,000,000 $ 145,000,000 $ CONTRIBUTION Solar Modules 2,250,000 $ 9,000,000 $ 9,450,000 $ 10,500,000 $ 12,600,000 $ Wind/Solar Farms 2,300,000 6,600,000 14,600,000 17,900,000 23,600,000 Asola, Earnings in Affiliate 1,600,000 3,300,000 6,600,000 9,900,000 13,200,000 6,150,000 $ 18,900,000 $ 30,650,000 $ 38,300,000 $ 49,400,000 $ |

Value Proposition • Positioned well within the alternative and clean energy industry – Well-established Tier 1 supplier to global OEMs – 2 decades of alternative energy experience • Proprietary position in 21 century “green” technologies • Strategic value in affiliates and strategic partnerships – Fisker Automotive – Asola – Schneider Power – Advanced Lithium Power – OEMs • Substantial improvement targeted in operating performance • NASDAQ Global Market: QTWW • Market Cap: $100 Million • Average trading volume 2.0 Million st |

… Driving Tomorrow’s Technology Today NASDAQ: QTWW www.qtww.com |