Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - Echo Global Logistics, Inc. | a2197184zex-32_1.htm |

| EX-31.2 - EXHIBIT 31.2 - Echo Global Logistics, Inc. | a2197184zex-31_2.htm |

| EX-31.1 - EXHIBIT 31.1. - Echo Global Logistics, Inc. | a2197184zex-31_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

Item 8. Financial Statements and Supplementary Data

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

| (Mark one) | ||

| ý | Annual report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended December 31, 2009 or | |

o |

Transition report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from to |

|

Commission file number 001-34470 |

||

ECHO GLOBAL LOGISTICS, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 20-5001120 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) | |

600 West Chicago Avenue, Suite 725 Chicago, Illinois |

60654 |

|

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant's Telephone Number, Including Area Code: (800) 354-7993

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

|---|---|---|

| Common Stock, Par Value $0.0001 per share | The NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer", "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

At June 30, 2009, there was no public market for the registrant's common stock.

The number of shares of the registrant's common stock outstanding as of the close of business on March 16, 2010 was 21,768,659.

Documents incorporated by reference:

Portions of the Registrant's Proxy Statement for its Annual Meeting of Stockholders are incorporated by reference into Part III, provided, that if such proxy statement is not filed with the Commission within 120 days after the end of the fiscal year covered by this Form 10-K, an amendment to this Form 10-K shall be filed no later than the end of such 120-day period.

2

Unless otherwise indicated or the context otherwise requires, references in this Annual Report on Form 10-K to "Echo Global Logistics, Inc.," "Echo," the "Company," "we," "us" or "our" are to Echo Global Logistics, Inc., a Delaware corporation and subsidiaries.

Certain statements in this Annual Report on Form 10-K are "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended (the Securities Act"), and Section 21E if the Securities Exchange Act of 1934, as amended (the Exchange Act"). These statements involve a number of risks, uncertainties, and other factors that could cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements. Factors which could materially affect such forward-looking statements can be found in the section entitled "Risk Factors" in Part I, Item IA and Part I, Item 7 entitled "Management's Discussion and Analysis of Financial Condition and Results of Operations" in this Annual Report on Form 10-K. Investors are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements made herein are only made as of the date hereof and we undertake no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances.

Our Company

We are a leading provider of technology enabled transportation and supply chain management services, delivered on a proprietary technology platform serving the transportation and logistics needs of our clients. Our web-based technology platform compiles and analyzes data from our network of over 24,000 transportation providers to serve our clients' shipping and freight management needs. Our technology platform, composed of web-based software applications and a proprietary database, enables us to identify excess transportation capacity, obtain competitive rates, and execute thousands of shipments every day while providing high levels of service and reliability. We focus primarily on arranging transportation across the major modes, including truckload (TL), less than truck load (LTL) and small parcel, and we also offer inter-modal (which involves moving a shipment by rail and truck), domestic air, expedited and international transportation services. Our core logistics services include rate negotiation, shipment execution and tracking, carrier management, routing compliance, freight bill audit and payment and performance management and reporting, including executive dashboard tools.

We believe our ability to identify and utilize excess capacity solves a long-standing transportation industry problem of failing to match demand with available supply and benefits both our clients and the carriers in our network. Through our proprietary technology platform and the real-time market information stored in our database, we are able to identify and utilize transportation providers with unused capacity on routes that our clients can employ. Our carrier network consists of over 24,000 transportation providers that have been selected based on their ability to effectively serve our clients in terms of price, capabilities, geographic coverage and quality of service. We believe the carriers in our network also benefit from the opportunity to serve the transportation needs of our clients with minimal sales, marketing or customer service expense.

Our proprietary web-based technology platform, Evolved Transportation Manager (ETM), allows us to analyze our clients' transportation requirements and provide recommendations that can result in cost savings for our enterprise clients of approximately 5% to 15%. Our clients communicate their transportation needs to us electronically through our EchoTrak web portal, other computer protocols, or by phone. Using pricing, service and available capacity data derived from our carrier network, historical transaction information and external market sources, ETM analyzes the capabilities and pricing options of our carrier network and recommends cost-effective shipping alternatives. The prices we quote to our clients for their shipping needs include the market cost of fuel, which we pass through

3

to our clients. After the carrier is selected, either by the client or us, we use our ETM technology platform to manage all aspects of the shipping process.

Our clients gain access to our carrier network through our proprietary web-based technology platform, which enables them to capitalize on our logistics knowledge, pricing intelligence and purchasing leverage. In some instances, our clients have eliminated their internal logistics departments altogether, allowing them to reduce overhead costs, redeploy internal resources and focus on their core businesses. Using our web-based software applications also provides our clients with the ability to track individual shipments, transfer shipment-level data to their financial management systems and create customized dashboards and reports detailing carrier activity on an enterprise-wide basis. These features provide our clients with greater visibility, business analytics and control of their freight expenditures.

We procure transportation and provide logistics services for more than 15,600 clients across a wide range of industries, such as manufacturing, construction, consumer products and retail. Our clients fall into two categories, enterprise and transactional. We typically enter into multi-year contracts with our enterprise clients, which are often on an exclusive basis for a specific transportation mode or point of origin. As part of our value proposition, we also provide core logistics services to these clients, including the management of both freight expenditures and logistical issues surrounding freight to be transported. We provide transportation and logistics services to our transactional clients on a shipment-by-shipment.

Initial Public Offering

In October 2009, we completed an initial public offering of shares of our common stock. We offered and sold 5,700,000 shares of common stock at a price to the public of $14.00 per share. All 5,700,000 shares were sold by us. The net proceeds to us from the initial public offering (IPO) were $68.6 million, which, in part, we used for dividend payments to certain shareholders, and to repay outstanding indebtedness under our line of credit and loan agreement with certain existing shareholders.

Our Founders

Eric P. Lefkofsky, Richard A. Heise, Jr. and Bradley A. Keywell (the "Founders") founded Echo in January 2005 ("Inception"). In December 2006, Douglas R. Waggoner was hired as our Chief Executive Officer. Mr. Waggoner has worked in the transportation industry for 29 years, most recently as the President and Chief Executive Officer of USF Bestway. In February 2007, Samuel K. Skinner became the Chairman of our Board of Directors. Mr. Skinner has extensive experience in the transportation industry, having served as Secretary of Transportation and White House Chief of Staff under President George H.W. Bush and as the Chairman, Chief Executive Officer and President of USF Corporation.

In recent years, the Founders have also been involved in the formation of other companies that, like Echo, are based on business models that employ innovative technology, logistics expertise and management experience to capitalize on inefficiencies in traditional supply chains and create compelling value propositions for both customers and suppliers. For example, Messrs. Lefkofsky and Heise were founders of InnerWorkings, Inc. (NASDAQ: INWK).

Prior to the hiring of Mr. Waggoner, Messrs. Keywell and Lefkofsky shared responsibility in overseeing day-to-day executive management of Echo's operations. Messrs. Keywell and Lefkofsky continue to have input that extends beyond their respective roles as members of our Board. In view of the significant role each of them played in our formation and development, members of our management continue to consult with each of Messrs. Keywell and Lefkofsky on a regular basis concerning a broad range of operating and strategic issues.

4

Our Market Opportunity

Overview of the Transportation and Logistics Market

Transportation involves the physical movement of goods, and logistics relates to the management and flow of those goods from origin to destination. The worldwide transportation and logistics market is an integral part of the global economy. According to the Council of Supply Chain Management Professionals, total transportation and logistics spend for the United States in 2008 was approximately $1.3 trillion. According to Armstrong & Associates, an independent research firm, gross revenue for third-party logistics in the United States in 2008 was approximately $127.0 billion.

We believe that a significant portion of available transportation capacity in the United States remains unused as a result of the inefficiencies in the transportation and logistics market relating to the absence of an established and automated marketplace. Without this marketplace, demand is not always matched with available supply due to constant fluctuations in transportation capacity and imperfect information, resulting in underutilized assets. Unused transportation capacity occurs, for example, when a transportation provider delivers its primary load, or headhaul, to a destination and does not have an adequate backhaul shipment back to its point of origin. Additionally, logistics decisions such as carrier selection are made with limited analysis and access to real-time capacity data. As a result, carrier selection is regularly driven by the effectiveness of a carrier's sales organization and decisions are made with limited price information.

Third-Party Logistics Services

As companies seek to become more competitive, they tend to focus on their core business processes and outsource their non-core business processes to third-party providers. Third-party logistics providers for the transportation industry offer services such as transportation, distribution, supply chain management, customs brokerage, warehousing and freight management. Third-party logistics providers may also provide a range of ancillary services such as packaging and labeling, freight tracking and integration with client-specific planning systems to facilitate supply chain management.

According to Armstrong & Associates, from 1996 to 2008, the United States third-party logistics market grew at a 12.5% compounded annual rate, from $30.8 billion to $127.0 billion in gross revenue. In addition, according to Armstrong & Associates, less than 10% of logistics expenditures for the United States were outsourced in 2008. We believe that the market penetration of third-party logistics in the United States will continue to expand and the third-party logistics market in the United States will continue to grow over the next several years. We also believe that many companies will look to outsource their entire shipping department to third-party logistics providers rather than contracting with providers on a shipment-by-shipment basis.

The market for third-party logistics providers is highly fragmented. According to the Transportation Intermediaries Association, a professional organization representing transportation intermediaries, no single third-party logistics provider controls more than 5% of the United States market. Although a variety of business models exist within the transportation and logistics market, transportation providers are generally divided into two primary categories: asset-based transportation providers and non-asset-based service providers. Most asset-based providers have significant capital equipment and infrastructure and typically focus on maximizing their individual asset utilization to limit the amount of unused transportation capacity and increase their return on investment. Non-asset-based providers do not own the transportation equipment that is used to transport their clients' shipments, but instead serve as intermediaries that procure access to physical transportation capacity for shippers and contract warehousing providers. According to Armstrong & Associates, measured by 2008 gross revenue, asset-based providers accounted for 23% of domestic U.S. transportation management services while non-asset-based providers accounted for the other 77%.

5

Many large third-party logistics providers are asset-based providers. Non-asset-based providers typically operate as small freight brokers with limited resources, limited carrier networks and modest or outdated information technology systems. We believe very few non-asset-based providers have more than 100 personnel and the small providers, comprising the vast majority, lack the scale to support the increasing requirements for national and global coverage across multiple modes of transportation, the ability to offer complete outsourcing and the ability to provide their clients with technology-driven logistics services.

Transportation and Logistics Services Trends

We believe that the following trends will continue to drive growth in the third-party logistics market:

Recognition of Outsourcing Efficiencies. Companies increasingly recognize that repetitive and non-core functions such as transportation and logistics management can be outsourced to specialists, resulting in cost savings, improved service and increased return on investment. By outsourcing transportation and logistics to third-party providers, companies can also achieve greater operational flexibility by redeploying resources to core activities. According to Armstrong & Associates, the United States outsourced logistics market has grown from $30.8 billion in 1996 to $127.0 billion in gross revenue in 2008, which we believe evidences the recognition of the benefits of outsourcing logistics.

Increasing Complexity of Global Supply Chains. As global supply chains become more complex, we believe customers will increasingly rely on single providers that can provide the full range of logistics services across multiple transportation modes. Additionally, as manufacturing processes continue to shift towards lower cost centers, raw materials and finished products are traveling greater distances to reach their destination for consumption. At the same time, companies are seeking ways to reduce costs and compete with global competitors. These challenges have forced companies to look for ways to benefit from low cost labor regions and optimize their business processes. We believe that globalization results in an increased demand for logistics service providers that have national and global carrier relationships across multiple modes of transportation.

Demand for Technology Enabled Transportation Management and Logistics Services. Logistics services have historically been focused on realizing immediate cost savings on a shipment-by-shipment basis using a labor-intensive, non-scalable process. Information technology is becoming an important catalyst for logistics services, and clients will benefit from providers that are technologically sophisticated and able to analyze data to optimize the marketplace. Technology enabled third-party logistics providers can also identify transportation routes and excess capacity and are able to aggregate purchasing power more efficiently than traditional third-party logistics providers.

Opportunity for Providers of Technology Enabled Transportation and Logistics Services

In the current state of the transportation and logistics market, we believe a third-party logistics provider with superior technology-driven services can differentiate itself by offering additional cost-savings through its ability to:

- •

- analyze real-time carrier pricing across multiple transportation modes through proprietary data repositories;

- •

- aggregate clients' shipping spend for better pricing;

- •

- build more sophisticated pricing algorithms;

- •

- analyze historical transportation spend data;

- •

- offer access to real-time tracking, monitoring and reporting on shipments;

6

- •

- integrate with clients' existing technology applications;

- •

- provide improved reporting and auditing capabilities; and

- •

- evaluate carrier performance.

Our Competitive Advantage

We believe a number of important competitive strengths will continue to drive our success in the future, including:

Innovative business model with compelling value proposition for clients. We believe our technology-driven, transportation and logistics services improve on traditional transportation outsourcing models because we aggregate fragmented supply and demand information across all major modes of transportation from our network of clients and carriers. By using our proprietary technology platform and market information (including current pricing, service and available capacity data as well as historical transaction information) stored in our database, we are able to recommend a carrier for each shipment regardless of mode, at any given moment, typically at a highly competitive price. Our clients benefit from our buying power aggregated through our more than 15,600 clients. We believe this buying power enables us to provide an efficient network of capacity at preferential rates. As a result, we are typically able to reduce many of our enterprise clients' total annual transportation and logistics costs by between approximately 5% to 15%, while providing high-quality service.

Scalable, proprietary technology platform. Our proprietary ETM technology platform is a web-based software application that provides competitive pricing, supply chain visibility and shipment execution across all major modes of transportation. Our proprietary technology platform can support a significant increase in the number of clients we serve and shipments we execute without a significant additional capital investment. ETM allows us to compile freight and logistics data from our diversified network of over 24,000 carriers to serve our clients' shipping needs and optimize their freight management. Our ETM database expands and becomes more difficult to replicate as we increase the number of shipments and the amount of pricing, service and available capacity data increases. We use our ETM technology platform to analyze the capabilities of our carrier network and recommend cost-effective carriers in the appropriate transportation mode. We also use our ETM technology platform to track individual shipments and provide customized reports throughout the lifecycle of each shipment, allowing us to manage the entire shipping process from pick-up to delivery as part of our value proposition. ETM provides client-specific information by giving them self-service access to carrier pricing information derived from data stored within ETM. The collective components of our ETM technology platform allow us to craft integrated transportation and supply chain management services for each client. We believe that the ability to provide these integrated transportation and supply chain management solutions furthers our competitive advantage.

End-to-end technology enabled services embedded in clients' business processes. Our proprietary technology platform provides a central, scalable and configurable portal interface that enables our clients to manage their transportation and logistics costs. Our web-based software provides our clients with access to transportation market analytics and business information capabilities. By using our suite of web-based applications, our clients can obtain real-time information on individual shipments and available capacity, transfer shipment-level data to their financial management systems and create customized dashboards and reports detailing carrier activity on an enterprise-wide basis. In addition, we offer our enterprise clients superior client care through dedicated teams of account executives and on-site support. We believe our proprietary technology and logistics expertise provide us with the ability to effectively serve the increasingly complex global supply chain needs of our client base and have enabled some of our clients to eliminate their internal logistics departments.

7

High levels of user satisfaction. Our web-based software applications enable our clients to manage the complexities in their transportation and supply chain functions. Our supply chain management services allow our clients to capitalize on our logistics expertise, pricing information and purchasing leverage in a user-friendly interface. We typically have received ratings indicating high levels of satisfaction from a wide range of our clients based on data collected from our periodic client surveys.

Multi-faceted sales strategy leveraging deep logistics expertise. We have built a multi-faceted sales strategy that effectively utilizes our enterprise sales representatives, transactional sales representatives and agent network. Our enterprise sales representatives typically have significant sales expertise and are focused on building relationships with our clients' senior management teams to execute multi-year enterprise contracts, typically with terms of one to three years. Our transactional sales representatives, with support from our account executives, are focused on building new transactional client relationships and migrating transactional accounts to enterprise accounts. From Inception through December 31, 2009, 35 of our enterprise accounts were converted from transactional accounts, and of the 24 contracts entered into with new enterprise clients in 2009, nine were converted from transactional accounts. Our network of agents enables us to benefit from seasoned industry professionals with access to regional shipping markets.

Our agents are typically experienced industry sales professionals focused on building relationships with department level transportation managers with both existing and prospective clients, such as shipping, traffic or logistics managers. From Inception through December 31, 2009, 60 of our enterprise accounts and 3,182 of our transactional accounts were sourced through our network of agents. Our multi-faceted sales strategy enables us to engage clients on a shipment-by-shipment basis (transactional) or a fully or partially outsourced basis (enterprise), which we believe significantly enhances our ability to attract new clients and increase our revenue from existing clients. Our ability to work with clients on a transactional basis also allows for a gradual and transparent transition to a fully-outsourced enterprise engagement, which we believe enhances our ability to sign new enterprise contracts.

Proven track record of success with large enterprise clients. We believe that our record of success in serving large enterprises is a key competitive advantage. As of December 31, 2009, we had contracts with 116 enterprise clients, and the total number of enterprise clients increased by 30 and 24 in 2008 and 2009, respectively. The size, diversity and reputation of these clients, combined with our track record of successful renewals, demonstrates our ability to handle complex client and industry-specific transportation needs.

Access to our carrier network. Our carrier network consists of over 24,000 carriers that have been selected based on their ability to effectively serve our clients on the basis of price, capabilities, geographic coverage and quality of service. We regularly monitor our carriers' pricing, shipment track record, capacity and financial stability using a system in which carriers are graded based on their performance against other carriers, giving our clients an enhanced level of quality control. By using our visibility into carrier capacity, we are also able to negotiate favorable rates, manage our clients' transportation spend and identify cost-effective shipping alternatives.

Experienced management team. We have a highly experienced management team with extensive industry knowledge. Our Chief Executive Officer, Douglas R. Waggoner, is the former President and CEO of USF Bestway, a regional carrier based in Scottsdale, Arizona, and Daylight Transport, a LTL carrier based in Long Beach, California. Our non-executive Chairman, Samuel K. Skinner, is the former Chairman, President and Chief Executive Officer of USF Corporation and the former Secretary of Transportation of the United States of America.

8

Our Strategy

Our objective is to become the premier provider of transportation and logistics services to corporate clients in the United States. Our business model and technological advantage have been the main drivers of our historical results and have positioned us for continued growth. The key elements of our strategy include:

Expand our client base. We intend to develop new long-term client relationships by using our industry experience and expanding our sales and marketing activities. As of December 31, 2009, we had contracts with 116 enterprise clients, and the total number of enterprise clients increased by 30 and 24 in 2008 and 2009, respectively. We seek to attract new enterprise clients by targeting companies with substantial transportation needs and demonstrating our ability to reduce their transportation costs by using our ETM technology platform. In addition, we plan to continue to hire additional sales representatives to build our transactional business across all major modes. We believe our business model provides us with a competitive advantage in recruiting sales representatives as it enables our representatives to leverage our proprietary technology and carrier network to market a broader range of services to their clients at competitive prices.

Further penetrate our established client base. We believe our established client base presents a substantial opportunity for growth. As we demonstrate our ability to execute shipments with high levels of service and favorable pricing, we are able to strengthen our relationships with our clients, penetrate incremental modes and geographic areas and generate more shipments. As we become more fully integrated into the businesses of our transactional clients and are able to identify additional opportunities for efficiencies, we seek to further penetrate our client base by selling our enterprise services to those clients. Of our 116 enterprise clients as of December 31, 2009, 35 began as our transactional clients.

Further invest in our proprietary technology platform. We intend to continue to improve and develop Internet and software-based information technologies that are compatible with our ETM platform. In order to continue to meet our clients' transportation requirements, we intend to invest in specific technology applications and personnel in order to improve and expand our offering. As of December 31, 2009, we had approximately 6,000 individual users of ETM and as the number of users expands, we will continue to invest in both IT development and infrastructure.

Selectively pursue strategic acquisitions. We have grown, in part, through acquisitions. We intend to selectively pursue strategic acquisitions that complement our business relationships and logistics expertise and expand our business into new geographic markets. Our objective is to increase our presence and capabilities in major commercial freight markets in the United States. We may also evaluate opportunities to access attractive markets outside the United States from time to time, or selectively consider strategic relationships that add new long-term client relationships, enhance our services or complement our business strategy.

Our Proprietary Technology Platform

Our proprietary ETM technology platform allows us to analyze our clients' transportation requirements and provide customized shipping recommendations that can result in cost savings of approximately 5% to 15% for our enterprise clients. We collect and store pricing and market capacity data in our ETM database from each interaction with carriers, and our database expands as a result of these interactions. We have also developed data acquisition tools that retrieve information from both private and public transportation databases, including subscription-based sources and public transportation rate boards, and incorporate that information into the ETM database. Using pricing, service and available capacity data derived from our carrier network, historical transaction information and external market sources, we are able to analyze the capabilities of our carrier network to

9

recommend cost-effective shipping alternatives. We believe that the carriers with the most available capacity typically offer the most competitive rates.

Our clients communicate their transportation needs to us electronically through our EchoTrak web portal, other computer protocols, or by phone. ETM generates pricing and carrier information for our clients by accessing pre-negotiated rates with preferred carriers or using present or historical pricing and capacity information contained in our database. If a client enters its own shipment, ETM automatically alerts the appropriate account executive. ETM's pricing algorithms are checked for accuracy before the rates are made available to our account executives. If an error occurs and an inaccurate rate is conveyed to a client, we will honor the quoted rate and correct the defective algorithm to ensure that all quoted rates going forward are accurately calculated. To date, any losses incurred as a result of an inaccurate quote have been negligible. After the carrier is selected, either by us or the client, our account executives use our ETM technology platform to manage all aspects of the shipping process.

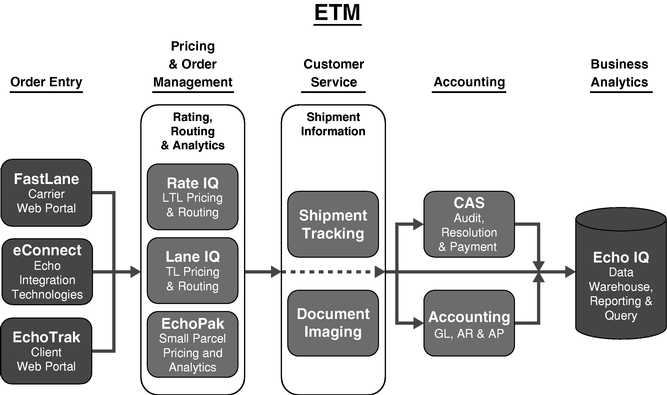

We have developed specialized software applications to provide our transportation and logistics services across all major modes of transportation. The software applications shown below reflect the key elements of our ETM technology platform:

The key elements of our ETM technology platform include:

FastLane is an Internet-based web portal that allows our carriers to view the status of all unpaid invoices, unbilled shipments, shipments in transit and other information used to quickly resolve any billing discrepancies.

eConnect is a set of tools that allows our clients and carriers to interact directly with ETM electronically through any of several computer protocols, including EDI, XML and FTP. The eConnect tools serve as an electronic bridge between the other elements of our ETM technology platform and our clients' enterprise resource planning (ERP), billing, accounts receivable, accounts payable, order management, back office and e-commerce systems. Through eConnect, our clients are able to request shipping services and receive financial and tracking data using their existing systems.

10

EchoTrak is an Internet-based web portal that connects and integrates our clients with ETM. By entering a username and password, our clients are able to display historical and active shipments in the ETM system using configurable data entry screens sorted by carrier, price, delivery date, destination and other relevant specifications. EchoTrak also generates automatic alerts to ensure that shipments are moving in accordance with the client specifications and timeline.

RateIQ is a pricing engine that manages LTL tariffs and generates rate quotes and transit times for LTL shipments. RateIQ also provides integrated tools to manage dispatch, communications, data collection and management functions relating to LTL shipments.

LaneIQ is a pricing engine that generates rate quotes for TL shipments. LaneIQ also provides integrated tools to manage dispatch, communications, headhaul and backhaul data collection and management functions relating to TL shipments.

EchoPak is a small parcel pricing and audit engine. For each small parcel shipped, EchoPak audits carrier compliance with on-time delivery requirements and pricing tariffs. In addition, EchoPak tracks information for each parcel and is able to aggregate and analyze that data for clients. For instance, clients are able to view shipments by date, business unit, product line and location, and clients can access information regarding service levels and pricing.

Shipment Tracking stores shipment information en-route and after final delivery. The shipment data is typically acquired through our carrier EDI integration, allowing our clients to track the location and status of all shipments on one screen, regardless of mode or carrier. Final delivery information is permanently archived, allowing us to provide our clients with carrier performance reporting by comparing actual delivery times with the published transit time standards.

Document Imaging allows us to store digital images of all shipping documents, including bills of lading and delivery receipts. We index the images with the shipment data so users are able to view documents associated with an executed transaction. We use Document Imaging internally to store carrier qualification documents, including W-9, U.S. Department of Transportation authority and proof of insurance.

CAS (Cost Allocation System) automatically audits carrier invoices against our rating engine and accounts payable accrual system. If the amounts match, the invoice is automatically released for payment. If the amounts do not match, the invoice is sent to various administrative personnel for manual processing and resolution. CAS also integrates to our general ledger, accounts receivable and accounts payable systems.

Accounting includes our general ledger, accounts receivable and accounts payable functions. Accounting is integrated with CAS and EchoIQ, which gives us the ability to access both financial and operational data in our data warehouse and reporting systems.

EchoIQ stores internally and externally generated data to support our reporting and analytic functions and integrates all of our core applications with ETM.

ETM fully supports our logistics services, which we provide to our clients as part of our value proposition. Our ETM technology platform is able to track individual shipments and provide customized data and reports throughout the lifecycle of the shipment, allowing us to manage the entire shipping process for our clients. Our customized reports also provide our clients with greater visibility and control over their transportation expenditures, and our ability to benchmark the performance of their internal operations helps identify opportunities for additional cost savings.

In 2007, 2008 and 2009 we spent approximately $3.0 million, $2.5 million and $3.4 million, respectively, on the development of ETM and related technologies.

Our IT infrastructure provides a high level of security for our proprietary software and database. The storage system for our proprietary data is designed to ensure that power and hardware failures do

11

not result in the loss of critical data. The proprietary data is protected from unauthorized access through a combination of physical and logical security measures, including firewalls, encryption, antivirus software, anti-spy software, passwords and physical security, with access limited to authorized IT personnel. In addition to our security infrastructure, our system is backed up daily to prevent the loss of our proprietary data due to catastrophic failures or natural disasters.

Our Services

We are a non-asset-based provider of technology enabled transportation and logistics services, meaning we do not own the transportation equipment used to transport our clients' freight or warehouse our clients' inventory. We believe this allows us to be flexible and seek shipping alternatives that are tailored to the specific needs of our clients, rather than the deployment of particular assets. Through our carrier network, we provide transportation services using a variety of modes of transportation.

Transportation Services

Truckload (TL). We provide TL services across all TL segments, including dry vans, temperature-controlled units and flatbeds. Using our LaneIQ technology, we provide advanced dispatch, communication and data collection tools that enable our dedicated TL team to quickly disseminate critical pricing and capacity information to our clients on a real-time basis.

Less than Truckload (LTL). We provide LTL services involving the shipment of single or multiple pallets of freight. Using our RateIQ technology, we obtain real-time pricing and transit time information for every LTL shipment from our database of LTL carriers.

Small Parcel. We provide small parcel services for packages of all sizes. Using our EchoPak technology, we are often able to deliver cost saving opportunities to our clients that spend over $500,000 annually to ship with major small parcel carriers.

Inter-Modal. Inter-modal transportation is the shipping of freight by multiple modes, typically using a container that is transferred between ships, railcars or trucks. We offer inter-modal transportation services for our clients that utilize both trucks and rail. Using our ETM technology, our dedicated inter-modal team can select, on a timely basis, the most advantageous combination of trucks and rail to meet our clients' individual shipping demands and pricing expectations.

Domestic Air and Expedited Services. We provide domestic air and expedited shipment services for our clients when traditional LTL services do not meet delivery requirements. We use ETM track and trace tools to ensure that up to date information is available to our clients via EchoTrak.

International. We provide air and ocean transportation services for our clients, offering a comprehensive international delivery option to our clients. Using ETM, our dedicated teams can consolidate shipments, coordinate routing, local pick-up and delivery methods and prearrange customs clearance to minimize the time and economic burdens associated with international transportation.

Logistics Services

In addition to arranging for transportation, we provide logistics services, either on-site (in the case of some enterprise clients) or off-site, to manage the flow of those goods from origin to destination. Our core logistics services include:

- •

- rate negotiation;

- •

- procurement of transportation, both contractually and in the spot market;

- •

- shipment execution and tracking;

12

- •

- carrier management, reporting and compliance;

- •

- executive dashboard presentations and detailed shipment reports;

- •

- freight bill audit and payment;

- •

- claims processing and service refund management;

- •

- design and management of inbound client freight programs;

- •

- individually configured web portals and self-service data warehouses;

- •

- ERP integration with transactional shipment data;

- •

- and integration of shipping applications into client e-commerce sites.

We believe that direct access to our web-based applications, process expertise and analytical capabilities is a critical component of our offering, and we provide our logistics services to our clients as part of our value proposition.

Our Clients

We provide transportation and logistics services to corporate clients across a wide range of industries, such as manufacturing, construction, consumer products and retail. In the 2009, we served over 15,600 clients using approximately 6,500 different carriers and, from Inception through December 31, 2009, we served over 22,900 clients using approximately 12,700 different carriers. Our clients fall into two categories: enterprise and transactional.

Enterprise Clients

We typically enter into multi-year contracts with our enterprise clients, generally with terms of one to three years, to provide some, or substantially all, of their transportation requirements. Each new enterprise client is assigned one or more dedicated account executives, who are able to work on-site or off-site, as required by the client. To foster a strategic relationship with these clients, we typically agree to a negotiated level of cost savings compared to the client's historical shipping expenditures over a fixed period of time. Cost savings are estimated periodically during the term of our engagement and if the negotiated amount is not achieved, our clients may have the right to terminate our engagement.

Our enterprise contracts are often on an exclusive basis for a certain transportation mode or point of origin and may apply to a single mode, such as LTL, several modes or all transportation modes used by the client. These contractual exclusivity provisions help ensure, but do not guarantee, that we receive a significant portion of the amount that our enterprise clients spend on transportation in the applicable mode or modes or from the applicable point of origin. In our experience, compliance with such provisions varies from client to client and over time. Reasons compliance may vary include the widely-dispersed nature of transportation decision-making in some clients' organizations and the learning process involved in implementing our services. We work with and expect our enterprise clients to maintain and improve compliance with any applicable exclusivity provisions.

We also provide small parcel consulting services to a limited number of our enterprise clients, which is included in our fee for service revenue. Under these arrangements, we review the client's small parcel shipping contracts and shipment data analyzing their volumes, distribution, rates and savings opportunities, prepare negotiation strategies and directly or indirectly participate in negotiations with carriers to improve the client's rates, charges, services and commitments.

Our annual revenue from individual enterprise clients typically ranges from $100,000 to $10.0 million. Our revenue from all enterprise clients increased in the last two years, from $53.2 million

13

in 2007 to $87.4 million in 2008 and to $109.1 million in 2009. Our revenue from enterprise clients as a percentage of total revenue was 56% in 2007, 43% in 2008 and 42% in 2009.

Transactional Clients

We provide transportation and logistics services to our transactional clients on a shipment-by-shipment basis, which are typically priced to our carriers on a spot, or transactional, basis. Our annual revenue from individual transactional clients typically ranges from $1,000 to $50,000. Of our 50 largest transactional clients in 2008, 45 placed orders with us during 2009, which we believe demonstrates our ability to meet a variety of transportation requirements on a recurring basis.

Our Carrier Network

Our carrier network provides our clients with substantial breadth and depth of offerings within each mode. In 2009, we used approximately 6,200 TL carriers, 100 LTL carriers, 16 small parcel carriers, 57 inter-modal carriers, 12 domestic air carriers and 80 international carriers. Our ability to attract new carriers to our network and maintain good relationships with our current carriers is critical to the success of our business. We rely on our carriers to provide the physical transportation services for our clients, valuable pricing information for our proprietary database and tracking information throughout the shipping process from origin to destination. We believe we provide value to our carriers by enabling them to fill excess capacity on traditionally empty routes, repositioning their equipment and therefore offsetting their substantial overhead costs to generate incremental revenue. In addition, we introduce many of our clients to new carriers and broaden each carrier's market presence by expanding its sales channels to a larger client base.

We select carriers based on their ability to effectively serve our clients with respect to price, technology capabilities, geographic coverage and quality of service. In the small parcel mode, we use nationally recognized carriers, such as FedEx and UPS. In other transportation modes, we maintain the quality of our carrier network by obtaining documentation to ensure each carrier is properly licensed and insured, and has an adequate safety rating. In addition, we continuously collect information on the carriers in our network regarding capacity, pricing trends, reliability, quality control standards and overall customer service. We believe this quality control program helps to ensure that our clients receive high-quality service regardless of the carrier that is selected for an individual shipment. In 2009, we used approximately 6,500 of the over 24,000 carriers in our network to provide shipping services to our clients.

The carriers in our network are of all sizes, including large national trucking companies, mid-sized fleets, small fleets and owner-operators of single trucks. We are not dependent on any one carrier, and our largest carriers by TL, LTL and small parcel accounted for less than 0.9%, 7.9% and 6.2%, respectively, of our total transportation costs across all modes in 2009. For international shipments, we currently rely on one forwarder to provide substantially all of our transportation. We consider our relationship with this carrier to be strong. In 2008 and 2009, international shipments accounted for 4% and 3% of our revenue, respectively.

Sales and Marketing

We market and sell our transportation and logistics services through our sales personnel located in four cities across the United States. As of December 31, 2009, our sales team consisted of 11 enterprise sales representatives, 353 transactional sales representatives and 172 agents. Our enterprise sales representatives typically have significant sales expertise and are focused on building relationships with clients' senior management teams to execute enterprise contracts. Our transactional sales representatives, located largely at our outbound call center in Chicago, are focused on building new transactional client relationships and migrating transactional accounts to enterprise accounts. Our

14

agents, located in regional shipping markets throughout the United States, are typically experienced industry sales professionals focused on building relationships with our clients' transportation managers. We support our sales team with account executives. These individuals are generally responsible for customer service, developing relationships with client personnel and managing the shipping process from origin to destination.

Our marketing efforts typically involve up to a six month selling cycle to secure a new enterprise client. Our efforts may begin in response to a perceived opportunity, a referral by an existing client, a request for proposal, a relationship between a member of our sales team and a potential client, new client prospects gained through acquisitions, an introduction by someone affiliated with our company, or otherwise. Our senior management team, sales representatives and agents are responsible for the sales process. An important aspect of this sales process is our analysis of a prospective client's historic transportation expenditures to demonstrate the potential savings that could be achieved by using our transportation and logistics services. We also try to foster relationships between our senior management team and our clients' senior management, and many of our enterprise clients were secured by marketing our services to "C-level" management contacts. These relationships ensure that both parties are focused on seamless process integration and using our services to provide tangible cost savings.

As we become more knowledgeable about a client's business and processes, our ability to identify opportunities to create value for the client typically increases, and we focus on trying to expand the services we provide to our existing enterprise and transactional clients. As a relationship with a client grows, the time requirement to win an engagement for additional services typically declines and we are able to recognize revenue from our sales efforts more quickly. Historically, many of our clients have been more willing to turn over more of their transportation and logistics requirements to us as we demonstrate our capabilities.

Each new enterprise client is assigned one or more dedicated account executives, who are able to work on-site or off-site, as required by the client. Our dedicated account executives integrate the client's existing business processes with our proprietary technology platform to satisfy the client's transportation requirements, and assist our sales representatives and agents in targeting potential deficiencies in the client's operations that could lead to expanded service offerings. Because the account executives we hire generally have significant sales experience, they can also begin marketing our services after limited training on our model and systems. Our agreements with our account executives require them to market and sell our transportation and logistics services on an exclusive basis and contain non-compete and non-solicitation provisions that apply during and for a specified period after the term of their service.

Our transactional sales representatives, who focus on sales of our transportation and logistics services on a shipment-by-shipment basis, concentrate on building relationships with our transactional clients that could benefit from the competitive pricing and enhanced service associated with our services. Our ability to work with clients on a transactional basis provides us with an opportunity to demonstrate the cost savings associated with our technology-driven services before the client considers moving to a fully-outsourced enterprise engagement. Since our Inception in January 2005, 35 transactional clients have migrated to an enterprise engagement.

Our sales team is critical to the success of our business and our ability to grow will depend on our ability to continue to attract, train and retain talented individuals. Candidates are recruited through search firms, Internet postings, advertisements in industry publications, industry event attendance, referrals and word-of-mouth networking. To attract these candidates, we will continue to offer attractive commission structures and highlight the advantages that our ETM technology platform provides in winning and maintaining new clients. We believe our business model provides us with a competitive advantage in recruiting sales representatives because it enables them to use our enhanced analytics technology and carrier network to market a broader range of services at competitive prices. Our

15

services can be offered at no upfront cost and our clients are generally able to immediately realize tangible cost savings.

We had 24 sales representatives and agents as of December 31, 2005, 57 as of December 31, 2006, 191 as of December 31, 2007, 383 as of December 31, 2008 and 536 as of December 31, 2009. We intend to continue to hire sales representatives and agents with established client relationships that we believe can be developed into new revenue opportunities. We also expect to augment our sales force through selective acquisitions of transportation and logistics service providers with experienced sales representatives and agents in strategic geographical locations.

Competition

The commercial freight transportation services and third-party logistics industries in which we operate are highly competitive and fragmented. We have a number of competitors offering services similar to ours, which include:

- •

- internal shipping departments at companies that have substantial transportation requirements, many of which represent

potential sales opportunities;

- •

- non-asset-based logistics companies, such as C.H. Robinson Worldwide, Freightquote.com, Ozburn-Hessey

Logistics, Total Quality Logistics and Transplace, with whom we compete most often;

- •

- asset-based logistics companies, such as Schneider, FedEx, JB Hunt and ABF;

- •

- carriers that offer logistics services, such as YRC, Conway and UPS, some of whom we frequently purchase transportation

services from on behalf of our clients;

- •

- freight forwarders that dispatch shipments via asset-based carriers, typically arranging for shipments to or from

international destinations, such as Expeditors International; and

- •

- smaller, niche service providers that provide services in a specific geographic market, industry segment or service area.

We believe the principal elements of competition in transportation and logistics services are price, customer service and reliability. Some of our competitors, such as C.H. Robinson Worldwide, have larger client bases and significantly more resources than we do. In addition, some of our competitors may have more expertise in a single transportation mode that allows them to prepare and process documentation and perform related activities pertaining to that mode of transportation more efficiently than Echo. We compete against these entities by establishing ourselves as a leading technology enabled service provider with industry expertise in all major modes of transportation, which enables us to respond rapidly to the evolving needs of our clients related to outsourcing transportation.

Our clients may choose not to outsource their transportation business to us in the future by performing formerly outsourced services for themselves, either in-house or through offshore partnerships or other arrangements. We believe our key advantage over in-house business processes is that ETM gives us the ability to obtain favorable pricing and terms relative to in-house service departments. In addition, we believe we give companies the opportunity to focus on their core products and services while we focus on service, delivery and operational excellence.

We also face competition from some of the larger services companies, such as IBM or Accenture, because they offer transportation procurement and logistics services to their clients. Their well-established client relationships, industry knowledge, brand recognition, financial and marketing capabilities, technical resources and pricing flexibility may provide them with a competitive advantage over us. These companies may include service companies based in offshore locations, divisions of large IT service companies and global services companies located in the United States or offshore.

16

Intellectual Property

We rely primarily on a combination of copyright, trademark and trade secret laws, as well as license agreements and other contractual provisions, to protect our intellectual property rights and other proprietary rights. To date, we have not registered any patents nor trademarks. Some of our intellectual property rights relate to proprietary business process enhancements. It is our practice to enter into confidentiality and invention assignment agreements with all of our employees and independent contractors that:

- •

- include a confidentiality undertaking by the employee or independent contractor;

- •

- ensure that all new intellectual property developed in the course of our relationship with employees or independent

contractors is assigned to us;

- •

- and require the employee or independent contractor to cooperate with us to protect our intellectual property during and after his or her relationship with us.

Government Regulation

Subject to applicable federal and state regulation, we may arrange for the transport of most types of freight to and from any point in the United States. Certain of our U.S. domestic ground transportation operations may be subject to regulation by the Federal Motor Carrier Safety Administration (the FMCSA), which is an agency of the U.S. Department of Transportation, and by various state agencies. The FMCSA has broad regulatory powers in areas such as safety and insurance relating to interstate motor carrier and broker operations. The ground transportation industry is also subject to possible regulatory and legislative changes (such as the possibility of more stringent environmental, safety or security regulations or limits on vehicle weight and size) that could affect the economics of the industry by requiring changes in operating practices or the cost of providing transportation services.

Our international operations are impacted by a wide variety of U.S. government regulations. These include regulations of the U.S. Department of State, U.S. Department of Commerce and the U.S. Department of Treasury. Regulations cover matters such as what commodities may be shipped to what destination and to what end-user, unfair international trade practices and limitations on entities with whom we may conduct business.

Our air freight business in the United States is subject to regulation as an indirect air carrier by the Transportation Security Administration (the TSA) and the Department of Transportation. We are in the process of having our indirect air carrier security program approved by the TSA as required by the applicable regulations. We are also in the process of having our directors and officers complete the Security Threat Assessments required by TSA regulations. The airfreight industry is subject to regulatory and legislative changes that could affect the economics of the industry by requiring changes in operating practices or influencing the demand for, and the costs of providing, services to clients.

Our ocean transportation business in the United States is subject to regulation by the Federal Maritime Commission (the FMC). The FMC licenses persons acting as ocean transportation intermediaries, including ocean freight forwarders and non-vessel operating common carrier operators. Ocean freight forwarders are subject to surety bond requirements and required to retain a "qualified individual" as an officer of the company. Non-vessel operating common carriers are subject to FMC tariff publication requirements, and must submit for review and public notice certain shipping agreements reached with clients. Ocean freight forwarders are also subject to regulatory oversight, particularly those terms proscribing rebating practices. The FMC provides a forum for persons to challenge actions or practices of ocean transportation intermediaries through private actions.

17

Our import and export business in the United States is subject to U.S. Customs regulations imposed by U.S. Customs and Border Protection (the CBP). These regulations include significant notice and registration requirements. While not technically a regulatory requirement, participation in CBP's "Customs-Trade Partnership against Terrorism" (C-TPAT) program will be commercially necessary as we expand our international transportation business. Under C-TPAT, a transportation entity must maintain an effective transportation security program and cooperate with CPB initiatives and guidance. Participation in C-TPAT permits more efficient and expedited processing of shipments through U.S. Customs. We are currently providing customs broker services through contracts with licensed customs brokers.

We are subject to a broad range of foreign and domestic environmental and workplace health and safety requirements, including those governing discharges to air and water and the handling, disposal and release of hazardous substances and wastes. In the course of our operations, we may be asked to store, transport or arrange for the storage or transportation of substances that could result in liability under applicable laws if released into the environment. If a release of hazardous substances occurs while being transported by our subcontracted carrier, we may be required to participate in, or may have liability for response costs and the remediation of such a release. In such case, we also may be subject to claims for personal injury, property damage and damage to natural resources. Our exposure to and potential liability for these claims may be managed through agreements with our clients and suppliers.

The transportation industry is one of the largest sources of man made greenhouse gas emissions that contribute to global warming. National and transnational laws and initiatives to reduce and mitigate the effects of such emissions, such as the Kyoto Protocols and current laws and legislative initiatives in the European Union and the U.S. could significantly impact transportation modes and the economics of the transportation industry. Future environmental laws in this area could adversely affect our carriers' costs and practices and our business.

Although our current operations have not been significantly affected by compliance with, or liability arising under, these environmental, health and safety laws, we cannot predict what impact future environmental, health and safety regulations might have on our business.

Transportation-related regulations are greatly affected by U.S. national security legislation and related regulatory initiatives, and remain in a state of flux. We believe that we are in substantial compliance with applicable material regulations and that the costs of regulatory compliance have not had a material adverse impact on our operations to date. However, our failure to comply with the applicable regulations or to maintain required permits or licenses could result in substantial fines or revocation of our operating permits or licenses. We cannot predict the degree or cost of future regulations on our business. If we fail to comply with applicable governmental regulations, we could be subject to substantial fines or revocation of our permits and licenses.

Risk Management and Insurance

If a shipment is damaged during the delivery process, our client files a claim for the damaged shipment with us. In the cases where we have agreed (either contractually or otherwise) to pay for claims for damage to freight while in transit, we pursue reimbursement from the carrier for the claims. If we are unable to recover all or any portion of the claim amount from our carrier, we may bear the financial loss. We mitigate this risk by using our quality program to carefully select carriers with adequate insurance, quality control procedures and safety ratings. We also take steps to ensure that the coverage we provide to our clients for damaged shipments is substantially similar to the coverage that our carriers provide to us. In addition, we carry our own insurance to protect against client claims for damaged shipments.

We extend credit to certain clients as part of our business model. These clients are subject to an approval process prior to any extension of credit or increase in their current credit limit. Our finance

18

department reviews each credit request and considers, among other things, payment history, current billing status, recommendations by various rating agencies and capitalization. Clients that pass our credit request procedures may receive a line of credit or an increase in their existing credit amount. We believe this review and approval process helps mitigate the risk of client defaults on extensions of credit and the related bad debt expense.

We require all motor carriers we work with to carry at least $1.0 million in auto and general liability insurance and $100,000 in cargo insurance. We also maintain a broad cargo liability insurance policy to protect us against catastrophic losses that may not be recovered from the responsible carrier, and carry various liability insurance policies, including auto and general liability. Our collective insurance policies have a cap of $20.0 million.

Properties

Our principal executive offices are located in Chicago, Illinois. We also maintain sales offices in Los Angeles, California, Vancouver, Washington, Park City, Utah, Troy, Michigan, Little Rock, Arkansas, Buffalo, Minnesota and Matteson, Illinois. We believe that our facilities are generally suitable to meet our needs for the foreseeable future; however, we will continue to seek additional space as needed to satisfy our growth.

Employees

As of December 31, 2009, we had 663 employees, consisting of 11 enterprise sales representatives, 353 transactional sales representatives, 181 account executives, 46 technology personnel and 72 administrative personnel. We also had 172 independent contractors working as sales agents, and a 53-person workforce based at our build, operate, transfer (BOT) facilities in Pune and Kolkata, India. We consider our employee relations to be good.

Legal Proceedings

We are not a party to any material pending legal proceedings.

19

Set forth below are certain risk factors that could harm our business, results of operations and financial condition. You should carefully read the following risk factors, together with the financial statements, related notes and other information contained in this Annual Report on Form 10-K. This Annual Report on Form 10-K contains forward-looking statements that contain risks and uncertainties. Please refer to the discussion of "Forward-Looking Statements" on page one of this Annual Report on Form 10-K in connection with your consideration of the risk factors and other important factors that may affect future results described below.

Investing in our common stock involves a high degree of risk. You should carefully consider the following risks and other information contained in this Annual Report on Form 10-K before you decide to buy our common stock. Our business, financial condition and operating results may suffer if any of the following risks are realized. If any of these risks or uncertainties occur, the trading price of our common stock could decline and you might lose all or part of your investment.

Risks Related to Our Business

If our carriers do not meet our needs or expectations, or those of our clients, our business could suffer.

The success of our business depends to a large extent on our relationships with clients and our reputation for providing high-quality technology enabled transportation and logistics services. We do not own or control the transportation assets that deliver our clients' freight, and we do not employ the people directly involved in delivering the freight. We rely on independent third-parties to provide TL, LTL, small parcel, inter-modal, domestic air, expedited and international services and to report certain information to us, including information relating to delivery status and freight claims. This reliance could cause delays in providing our clients with important service data and in the financial reporting of certain events, including recognizing revenue and recording claims. If we are unable to secure sufficient transportation services to meet our commitments to our clients, our operating results could be adversely affected, and our clients could switch to our competitors temporarily or permanently. Many of these risks are beyond our control and difficult to anticipate, including:

- •

- changes in rates charged by transportation providers;

- •

- supply shortages in the transportation industry, particularly among truckload carriers;

- •

- interruptions in service or stoppages in transportation as a result of labor disputes; and

- •

- changes in regulations impacting transportation.

If any of the third-parties we rely on do not meet our needs or expectations, or those of our clients, our professional reputation may be damaged and our business could be harmed. For international shipments, we currently rely on one carrier to provide substantially all of our transportation. If this carrier fails to meet our needs or expectations, our ability to offer international shipping services could be delayed or disrupted, and our costs may increase. In 2008 and 2009, international shipments accounted for 4% and 3% of our revenue, respectively.

Competition could substantially impair our business and our operating results.

Competition in the transportation services industry is intense. We compete against other non-asset-based logistics companies as well as asset-based logistics companies; freight forwarders that dispatch shipments via asset-based carriers; carriers offering logistics services; internal shipping departments at companies that have substantial transportation requirements; large business process outsourcing (BPO) service providers; and smaller, niche service providers that provide services in a specific geographic market, industry segment or service area. We also compete against carriers' internal sales forces and shippers' transportation departments. At times, we buy transportation services from our competitors.

20

Historically, competition has created a downward pressure on freight rates, and continuation of this rate pressure may adversely affect the Company's revenue and income from operations.

In addition, a software platform and database similar to ETM could be created over time by a competitor with sufficient financial resources and comparable experience in the transportation services industry. If our competitors are able to offer comparable services, we could lose clients, and our market share and profit margin could decline. Our competitors may also establish cooperative relationships to increase their ability to address client needs. Increased competition may lead to revenue reductions, reduced profit margins or a loss of market share, any one of which could harm our business.

A significant portion of our revenue is derived from a relatively limited number of large clients and any loss of, or decrease in sales to, these clients could harm our results of operations.

A significant portion of our revenue is derived from a relatively limited number of large clients. Revenue from our five largest clients, collectively, accounted for 19% of our revenue in 2009, and revenue from our 10 largest clients, collectively, accounted for 27% of our revenue in 2009. We are likely to continue to experience ongoing customer concentration, particularly if we are successful in attracting large enterprise clients. It is possible that revenue from these clients, either individually or as a group, may not reach or exceed historical levels in any future period. The loss or significant reduction of business from one or more of our major clients would adversely affect our results of operations.

If we are unable to expand the number of our sales representatives and agents, or if a significant number of our sales representatives and agents leaves us, our ability to increase our revenue could be negatively impacted.

Our ability to expand our business will depend, in part, on our ability to attract additional sales representatives and agents with established client relationships. Competition for qualified sales representatives and agents can be intense, and we may be unable to hire such persons. Any difficulties we experience in expanding the number of our sales representatives and agents could have a negative impact on our ability to expand our client base, increase our revenue and continue our growth.

In addition, we must retain our current sales representatives and agents and properly incentivize them to obtain new clients and maintain existing client relationships. If a significant number of our sales representatives and agents leave us, our revenue could be negatively impacted. We have entered into agreements with our sales representatives and agents that contain non-compete provisions to mitigate this risk, but we may need to litigate to enforce our rights under these agreements, which could be time-consuming, expensive and ineffective. A significant increase in the turnover rate among our current sales representatives and agents could also increase our recruiting costs and decrease our operating efficiency, which could lead to a decline in the demand for our services.

If our services do not achieve widespread commercial acceptance, our business will suffer.

Many companies coordinate the procurement and management of their logistics needs with their own employees using a combination of telephone, facsimile, e-mail and the Internet. Growth in the demand for our services depends on the adoption of our technology enabled transportation and logistics services. We may not be able to persuade prospective clients to change their traditional transportation management processes. Our business could suffer if our services are not accepted by the marketplace.

We may not be able to develop or implement new systems, procedures and controls that are required to support the anticipated growth in our operations.

Our revenue increased to $259.6 million in 2009 from $7.3 million in 2005, representing an annual revenue growth rate of 353% from 2005 to 2006, 188% from 2006 to 2007, 112% from 2007 to 2008

21

and 28% from 2008 to 2009. Between January 1, 2005 and December 31, 2009, the number of our employees, agents and independent contractors increased from 44 to 663. Continued growth could place a significant strain on our ability to:

- •

- recruit, motivate and retain qualified sales representatives and agents, carrier representatives and management personnel;

- •

- develop and improve our internal administrative infrastructure and execution standards; and

- •

- expand and maintain the operation of our technology infrastructure in a manner that preserves a quality customer experience.

To manage our growth, we must implement and maintain proper operational and financial controls and systems. Further, we will need to manage our relationships with various clients and carriers. We cannot give any assurance that we will be able to develop and implement, on a timely basis, the systems, procedures and controls required to support the growth in our operations or effectively manage our relationships with various clients and carriers. If we are unable to manage our growth, our business, operating results and financial condition could be adversely affected.

If we are unable to maintain ETM, our proprietary software, demand for our services and our revenue could decrease.