Attached files

| file | filename |

|---|---|

| EX-32.1 - CHINA SKY ONE MEDICAL, INC. | v177689_ex32-1.htm |

| EX-31.1 - CHINA SKY ONE MEDICAL, INC. | v177689_ex31-1.htm |

| EX-31.2 - CHINA SKY ONE MEDICAL, INC. | v177689_ex31-2.htm |

| EX-32.2 - CHINA SKY ONE MEDICAL, INC. | v177689_ex32-2.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K/A

(Amendment No.

1)

(Mark

One)

|

x

|

ANNUAL REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For the

fiscal year ended: December

31, 2009

|

o

|

TRANSITION REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For the

transition period from ____________ to ____________

Commission

file number: 001-34080

CHINA

SKY ONE MEDICAL, INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

87-0430322

|

|

|

(State

or other jurisdiction of

|

(I.R.S.

Employer

|

|

|

incorporation

or organization)

|

Identification

No.)

|

|

No.

2158, North Xiang An Road, Song Bei District,

Harbin,

People’s

Republic of China

|

150028

|

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: 86-451-87032617

(China)

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

None

|

Name

of each exchange on which registered

Not

Applicable

|

Securities

registered pursuant to Section 12(g) of the Act:

|

Common

Stock

|

|

(Title

of Class)

|

Indicate

by check mark if the registrant is a well-known seasonal issuer, as defined in

Rule 405 of the Securities Act.

Yes o No

x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act.

Yes o No

x

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days.

Yes x No

o

Indicate by check mark whether the

registrant has submitted electronically and posted on its corporate Website, if any, every

Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T

(§232.405 of this chapter)

during the preceding 12 months (or for such shorter

period that the registrant was required to submit and post such

files).

Yes o No o

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K (§229.405 of this chapter) is not contained herein, and will not

be contained, to the best of registrant’s knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this Form 10-K

or any amendment to this Form

10-K.

o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a small reporting

company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act.

|

Large

accelerated filer o

|

Accelerated

filer x

|

|

|

Non-accelerated

filer o

(Do

not check if a smaller reporting company)

|

Smaller

reporting company o

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act).

Yes o No

x

As of

June 30, 2009, the aggregate market value of the voting and non-voting common

equity held by non-affiliates was approximately $135,214,631, based on the last

closing price of $13.48 per share, as quoted on the Nasdaq Global

Market.

As of

March 15, 2010, the registrant had 16,790,851 shares of common stock issued and

outstanding.

DOCUMENTS

INCORPORATED BY REFERENCE

None

EXPLANATORY NOTE

This

Amendment No. 1 to the Annual Report on Form 10-K (“Amended Form 10-K”) of

China Sky One Medical, Inc. amends our Annual Report on Form 10-K for the year

ended December 31, 2009, filed with the Securities and Exchange Commission

(“SEC”) on March 16, 2010 (the “Original Form 10-K”). This

Amended Form 10-K is being filed solely to correct inadvertent typographical

errors, which occurred during the edgarization process, in “Item 8. Financial

Statements and Supplementary Data” of the Original Form 10-K, resulting in the

order of certain numbers reported in the Stockholders’ Equity section of the

Consolidated Balance Sheets being reversed. We have amended the

Consolidated Balance Sheets to correct these errors.

Except as

described above, no other amendments are being made to the Original Form

10-K. This Amended Form 10-K does not reflect events occurring after

the Original Form 10-K or modify or update the disclosure contained therein in

any other way other than as required to reflect the amendments discussed

above.

The

Company has attached to this Amended Form 10-K updated certifications executed

as of the date of this Amended Form 10-K by the Chief Executive Officer and

Chief Financial Officer as required by Sections 302 and 906 of the Sarbanes

Oxley Act of 2002. These updated certifications are attached as

Exhibits 31.1, 31.2, 32.1 and 32.2 to this Amended Form 10-K.

CHINA

SKY ONE MEDICAL, INC.

ANNUAL

REPORT ON FORM 10-K

TABLE

OF CONTENTS

|

PAGE

|

||||

|

Special

Note Regarding Forward-Looking Statements

|

1

|

|||

|

|

||||

|

PART

I

|

2

|

|||

|

Item

1.

|

Business

|

2

|

||

|

Item

1A.

|

Risk

Factors

|

16

|

||

|

Item.

1B.

|

Unresolved

Staff Comments

|

30

|

||

|

Item

2.

|

Properties

|

30

|

||

|

Item

3.

|

Legal

Proceedings

|

30

|

||

|

Item

4.

|

Reserved

|

30

|

||

|

PART

II

|

31

|

|||

|

Item

5.

|

Market

for Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities

|

31

|

||

|

Item

6.

|

Selected

Financial Data

|

33

|

||

|

Item

7.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

34

|

||

|

Item

7A.

|

Quantitative

and Qualitative Disclosures About Market Risk

|

49

|

||

|

Item

8.

|

Financial

Statements and Supplementary Data

|

F-1

|

||

|

Item

9.

|

Changes

in and Disagreements With Accountants on Accounting and Financial

Disclosure

|

50

|

||

|

Item

9A.

|

Controls

and Procedures

|

50

|

||

|

Item

9B.

|

Other

Information

|

51

|

||

|

PART

III

|

52

|

|||

|

Item10.

|

Directors,

Executive Officers and Corporate Governance

|

52

|

||

|

Item

11.

|

Executive

Compensation

|

57

|

||

|

Item

12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

62

|

||

|

Item

13.

|

Certain

Relationships and Related Transactions, and Director

Independence

|

64

|

||

|

Item

14.

|

Principal

Accounting Fees and Services

|

64

|

||

|

Item

15.

|

Exhibits,

Financial Statement Schedules

|

65

|

||

|

Signatures

|

67

|

|||

- i

-

SPECIAL NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This Annual Report on Form 10-K,

together with other statements and information we publicly

disseminate, contains certain forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities

Exchange Act of 1934, as amended. We intend such

forward-looking statements to be covered by the safe harbor provisions for

forward-looking statements contained in the Private Securities Litigation

Reform Act of 1995, and include this statement for purposes of complying with

these safe harbor provisions.

Forward-looking statements, which are based on certain assumptions

and describe our future plans, strategies and expectations, are generally

identifiable by use of the words “believe,” “expect,” “intend,” “anticipate,” “estimate,” “project” or similar expressions. You should not rely on

forward-looking statements since they involve known and unknown

risks, uncertainties and other factors that are, in some cases, beyond our

control and which could materially affect actual results, performances or achievements.

Factors that may cause actual

results to differ materially from current

expectations include, but are not limited to the “Risk Factors” discussed in Part 1, Item 1A of this Annual Report on Form

10-K. Accordingly, there is no assurance that our expectations will

be realized. Except as otherwise

required by the federal securities laws, we disclaim any

obligations or undertaking to publicly release any updates or revisions to any

forward-looking statement contained herein (or elsewhere) to reflect any

change our expectations with regard thereto, or any change in events, conditions or circumstances on which

any such statement is based.

The terms

“the Company,” “we,” “us” and “our” refer to China Sky One Medical, Inc.,

together with our consolidated subsidiaries.

1

PART

I

Item 1. Business.

General

We are engaged, through our

China-based indirect subsidiaries described

below, in the development, manufacture, marketing and sale of over-the-counter,

branded nutritional supplements and over-the-counter plant and herb-based pharmaceutical and medicinal

products. Our principal products are external use Traditional Chinese

Herbal Remedies/Medicines, commonly referred to in the industry as “TCM.” We have evolved into an integrated manufacturer, marketer and distributor of

external-use TCM products sold primarily in the People’s Republic of China (“China” or “PRC” ) and through Chinese domestic pharmaceutical chains. Recently, we have been expanding our worldwide sales

effort as well. Prior

to 2009, we sold both our own manufactured products, as well as medicinal and pharmaceutical

products manufactured by others (the sale of third party products is referred to herein as “Contract Sales”). Commencing in 2009, we

discontinued all of our Contract Sales as part of our revised strategic plan.

Corporate History

We are a

Nevada corporation formed on February 7, 1986, formerly known as Comet

Technologies, Inc. On July 26, 2006, after our acquisition of a

China-based nutritional supplements business, we changed our name to “China Sky

One Medical, Inc.” We are a holding company doing business through

American California Pharmaceutical Group, Inc., a California corporation

(“ACPG”), our non-operating

United States (“U.S.”) holding company subsidiary, and ACPG’s direct and indirect

subsidiaries located in the People’s Republic of China (the “PRC”).

ACPG, was incorporated on December 16, 2003, under the name “QQ Group, Inc.” QQ Group changed its name to “American California Pharmaceutical

Group, Inc.” in anticipation of the stock exchange

transactions with our predecessor filer (then known as “Comet Technologies, Inc.”) and Harbin City Tian Di Ren

Medical Co., a company organized under the laws of the PRC (“TDR”), as further described below. On December 8, 2005, ACPG

completed a stock exchange transaction with

TDR and TDR’s subsidiaries, each of which was a

fully operating company in the PRC. In connection with this

transaction, ACPG

exchanged 100% of its issued and outstanding common stock for 100% of the

capital stock of TDR and

its subsidiaries.

Thereafter, on May 11, 2006, ACPG

entered into a Stock Exchange Agreement (the “Exchange Agreement”) with our shareholders. The transaction acquisition contemplated under the Exchange Agreement

was consummated on May 30, 2006. As a result of this transaction, we issued a total of 10,193,377 shares of our

common voting stock to the stockholders of ACPG, in exchange for

100% of the capital stock

of ACPG. As a result, ACPG became our wholly-owned subsidiary.

TDR was originally formed in 1994 and

its principal executive office is located in Harbin City, Heilongjiang Province, PRC. On December 29, 2000, TDR was reorganized and incorporated as a limited liability company under the

“Corporation Laws and

Regulations” of the PRC.

At the time of TDR’s acquisition by ACPG, in December of 2005, TDR had two

wholly-owned subsidiaries, Harbin First

Bio-Engineering Company Limited (“First”) and Kangxi Medical Care Product Factory (“Kangxi”). In July, 2006, First and

Kangxi merged, with First as the surviving subsidiary of

TDR.

As of October 16, 2006, we organized

Harbin Tian Qing Biotech Application Company as a wholly-owned PRC subsidiary of

TDR (“Tian Qing”), to conduct research and development in

the areas of tissue and stem cell banks, which is described in further detail below. As of December 31, 2009,

Tiang Qing had no operating activities.

On April 3, 2008, TDR completed

its acquisition of Heilongjiang Tianlong

Pharmaceutical, Inc., a

company organized under the laws of the PRC

(“Tianlong”), that has a variety of medicines approved by the PRC’s State Food and Drug Administration

(the “SFDA”) and new medicine applications, and which is in the business of

manufacturing external-use

pharmaceuticals. TDR previously acquired the Beijing sales office of Tianlong in mid-2006.

In connection with this

transaction, TDR

acquired 100% of the issued and outstanding capital stock of Tianlong from

its sole stockholder, in consideration for

an aggregate purchase price of approximately $8,300,000, consisting of $8,000,000 in cash, and 23,850 shares of our common

stock (valued at $12.00 per share).

2

On April 18, 2008, TDR consummated

its acquisition of Heilongjiang Haina

Pharmaceutical Inc., a

company organized under the laws of the PRC

(“Haina”), licensed as a wholesaler of TCM, bio-products, medicinal devices, antibiotics and chemical

medicines. Haina did not have an

established sales network and was

acquired for its primary asset, a Good Supply Practice

(“GSP”) license (License No. A-HLJ03-010), issued by the Heilongjiang Province office of the SFDA as of December 21, 2006. The SFDA only issues such licenses to pharmaceutical resellers that maintain certain quality

control standards. The GSP license will be up for renewal on January 29, 2012. In

connection with this transaction, TDR acquired 100% of the issued and outstanding capital stock of Haina from

its three stockholders in consideration for

payment of approximately $437,000.

On

September 5, 2008, TDR acquired Peng Lai Jin Chuang Pharmaceutical Company, a

company organized under the laws of the PRC (“Peng Lai ”), from its sole

stockholder. Peng Lai, which has received Good Manufacturing Practice

(“GMP”) certification from the SFDA, was organized to develop, manufacture and

distribute pharmaceutical, medicinal and diagnostic products in the

PRC. In connection with this transaction, TDR acquired all of Peng

Lai’s assets, including, without limitation, franchise, production and operating

rights to a portfolio of 20 medicines approved by the SFDA, for an aggregate

purchase price of approximately $7,000,000 million, consisting of approximately

$2,500,000 million in cash, and 381,606 shares of our common stock (valued at

$12.00 per share).

Principal

Products and Markets

We are engaged, through TDR, and its subsidiaries in the PRC, in the

development, manufacture, marketing and sale of over-the-counter,

branded nutritional supplements and over-the-counter plant and herb-based pharmaceutical and medicinal

products. We have evolved into an integrated manufacturer, marketer and distributor

of external use Chinese

medicine products sold primarily to and

through domestic

pharmaceutical chains in

the PRC. Historically, we handled sales of both our own manufactured products and Contract Sales of medicinal and pharmaceutical products manufactured by others. However, commencing in 2009, we discontinued all Contract Sales as part of our

revised sales strategy.

With the exception of Peng Lai, which is located in Shan Dong Province, PRC, all of our manufacturing

facilities are located in Heilongjiang Province, PRC. In addition, we have sales offices

located in 24 provinces across China.

Our principal products are external use TCMs. Using various formulas, we produce a

number of TCM products with several forms of delivery

including ointments, sprays, medicated skin patches, injections, capsules, suppositories,

tablets and granules. We also develop and sell bio-engineering products in the form of diagnostic

kits, which are used for testing for different diseases. Over the next few years, we intend to concentrate much of our efforts on the development, production and sales of TCM

products and testing kits, and antibiotic products.

Our principal operations are in

the PRC, where TDR and its subsidiaries have manufacturing

facilities and sales

distribution channels

covering most of the provinces in the PRC. Part of our sales strategy is to

expand our worldwide sales by locating

qualified distributors and sales agents outside of the PRC. Our overall revenues were approximately $130,092,000 in 2009, of which export overseas sales were approximately $10,121,000,

accounting for approximately 7.8% of our total revenue. Overseas sales were $7,570,000 in 2008, accounting for approximately 8.2% of our total revenues. Overseas sales were

$12,404,000 in 2007,

accounting for

approximately 25.2% of our

total revenue in

2007.

3

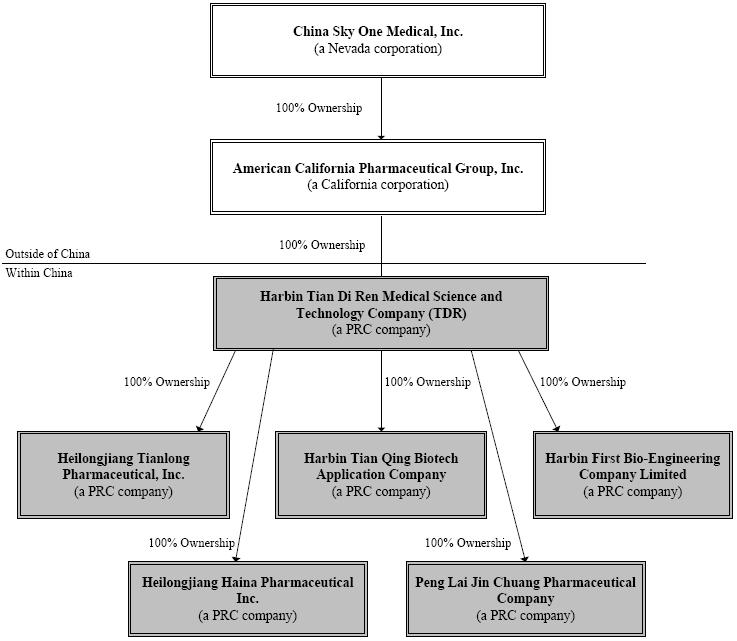

All of our significant operations and long lived assets are located in the PRC. Below is a chart depicting our corporate

organizational

structure:

SFDA Licenses

The SFDA issues the licenses to manufacture and

market pharmaceutical products in the PRC. Our licenses relate primarily to pharmaceutical production licenses, which are needed mainly for topical products, ointments and external test kits. TCM products also require a permit for sales, which

permits are generally granted on a non-exclusive basis for four to

five years depending on the product and subject to periodic review for renewal. For the year ended December 31, 2009, we commercialized 91 products through TDR and its subsidiaries. We have the necessary licenses and

permits for all of our products.

4

Our TDR Subsidiary Owns the Following

Subsidiaries in China

Harbin First

Bio-Engineering

On September 26, 2003, TDR formed First under the laws of the

PRC as its wholly owned subsidiary, with an

authorized capital of approximately $1,460,000 (10,000,000

RMB). First

focuses on research and development of the use of natural medicinal plants and biological technology products, such as our diagnostic kits. First, which officially commenced production on July 21, 2006, is one of

the first companies in Heilongjiang Province conducting research and development of

high technology

biological

products. First has two

product

lines:

|

·

|

an enzyme immunity reagent kit

product line;

and

|

|

·

|

a colloid gold product

line.

|

Harbin Tian Qing Biotech

Application

On October 16, 2006, TDR

organized Tian Qing under the laws of the

PRC as its wholly owned subsidiary, to conduct research and

development in the areas of tissue and stem cell banks, which is

described in more detail below. (See “Research and Development” below.) As of December 31, 2009, Tian Qing had

no significant operations.

Heilongjiang Tianlong

Pharmaceutical

On April 3, 2008, TDR

completed the acquisition of Tianlong, which is in the business of manufacturing

external-use pharmaceuticals. Tianlong’s assets included, among other things, GMP certified manufacturing facilities,

state-of-the-art

manufacturing equipment, a

research and development

center, and production and operating

rights to a portfolio of 69 medicines approved by the SFDA.

Heilongjiang Haina

Pharmaceutical

On April 18, 2008, TDR

consummated its acquisition of Haina, which is licensed as a wholesaler of TCM, bio-products, medicinal devices, antibiotics and chemical

medicines. At the time of the acquisition, Haina

did not have an established sales network and was

acquired for its primary asset, a GSP license issued by the Heilongjiang Province office of the SFDA as of December 21, 2006. The SFDA only issues such licenses to resellers of

medicines that maintain certain quality

control

standards. The GSP license will be up for renewal on January 29, 2012. Obtaining this license has enabled us to expand our sales of medicinal products without having to go through a

lengthy license application

process.

Peng Lai Jin Chuang

Pharmaceutical

On September 5, 2008, TDR acquired

Peng Lai, which received GMP certification from the SFDA,

and was organized to develop, manufacture

and distribute pharmaceutical products in the PRC. In connection with the acquisition of

Peng Lai , TDR acquired all of Peng Lai’s assets, including, without limitation,

franchise, production and operating rights to a portfolio of 20 medicines approved by the SFDA.

Product Line

In 2009, we manufactured and marketed 91 products. Our manufacturing operations are

conducted in our indirect

subsidiaries’ facilities located in Heilongjiang Province and Shan Dong Province in the PRC.

For the year ended December 31, 2009, we sold our products under five main categories:

|

·

|

Patches (7 products);

|

|

·

|

Ointments (18 products);

|

|

·

|

Sprays (15 products);

|

|

·

|

Diagnostic Kit (3 products);

|

|

·

|

Others (48 products)

|

5

A description of our principle products, which generated a majority of our sales revenue in

2009, is as follows:

Patch Category:

Sumei Slim Patch

The Sumei Slim Patch is

marketed and sold within and outside the PRC as a more natural

treatment to lose weight. The Sumei Slim Patch

uses Saponin as

its major ingredient, and is effective in regulating and restraining the excessive secretion of certain

hormones, while promoting others to foster weight loss as well as prevent weight gain.

Pain Relief Patch

A pain relief patch is designed to apply to the area of neck, shoulder, and waist. The patch is used for a number of ailments, including fever, headache,

heart dysentery, diarrhea, and stiffness and pain caused by hypertension.

Anti-Hypertension

Patch

The anti-hypertension patch is

based on five thousand years of Chinese

herbal vein therapy that has been adapted to a modern transdermal therapeutic system (“TTS”). The product utilizes a

Body-Yong-Guan point technique, which is believed to maximize the effectiveness of the

medicinal ingredients. The product is believed to stimulate blood capillaries and to be effective in

improving circulation and reducing blood

pressure.

Ointment Category:

Hemorrhoids Ointment

This product contains Acetate, Radix

Notoginseng, and Rhizoma Coptidis. It is made in soft ointment form that is effective in sterilizing and

relieving hemorrhoid symptoms, including itching, distending pain, burning, and

bleeding.

Compound Camphor

Cream

This product is made for the treatment of various pathogens on

the skin surface and subcutaneously, such as mycete, trichopytic, staphylococcal

bacteria aureus, bacillus coli, and candida albicans

(thrush).

Spray Category:

Stomatitis Spray

This spray is used for the treatment of dental ulcers, pharyngitis, and faucitis. It is made with pure herbal medicines and, thus, has minimum side effects to human bodies.

Diagnostic Kit Category:

Cardiac Arrest Early Examination

Kit

This product is used for early stage diagnosis of myocardial

infarction (heart attacks).

6

Kidney Disease Testing

Kit

The Urinate Micro Albumin Examination

Testing Kit is used in connection with early stage diagnosis for primary kidney

disease, hypertension and diabetes.

Other Product Category:

We include 48 of our products under the “Other” product category, because the categories of a pplications for these products do not separately represent a material

amount of our revenues.

The Other product category includes suppositories, eye drops,

nasal drops, capsules, granules, injections, tablets and wash fluids.

Naftopidil Dispersible

Tablet

This tablet is designed to treat benign enlargement of the prostate

among males in their middle age. It is effective in its treatment because its ingredients can be easily digested and absorbed by the human body.

Naphazoline Hydrochloride Eye Drop

Naphazoline is recommended for the temporary relief of eye

redness associated with minor irritations. This product can comfort the

eyes by lubricating them and relieving such

irritations.

Revenues

by Product Categories

We believe that the most meaningful presentation of

our products is by categories of method

of delivery. Our total revenues during fiscal

2009, 2008, and 2007 were approximately $130,092,000, $91,816,000, and $49,318,000, respectively. The following table sets forth our principal product categories

based on application type and the

approximate amount and

percentage of revenue from each of such product categories for the fiscal years ended December 31, 2009, 2008, and 2007:

|

For the Years Ended December

31

($ in

thousands)

|

||||||

|

2009

|

2008

|

2007

|

||||

|

Product

Category

|

Sales

|

%

of Sales

|

Sales

|

% of Sales

|

Sales

|

% of

Sales

|

|

Patches

|

$40,770

|

31.3%

|

$35,484

|

38.6%

|

$19,609

|

39.9%

|

|

Ointments

|

28,862

|

22.2%

|

23,068

|

25.1%

|

3,270

|

12.6%

|

|

Sprays

|

18,499

|

14.2%

|

10,613

|

11.6%

|

8,742

|

18.7%

|

|

Diagnostic Kits

|

10,239

|

7.9%

|

8,781

|

9.6%

|

2,994

|

6.1%

|

|

Contract

Sales

|

0

|

0.0%

|

5,655

|

6.2%

|

12,998

|

16.6%

|

|

Others

|

31,722

|

24.4%

|

8,215

|

8.9%

|

1,705

|

6.2%

|

|

Total

|

$130,092

|

100.0%

|

$91,816

|

100.0%

|

$49,318

|

100.0%

|

For a

narrative description of the reasons for the changes in our revenue by product

category over the past three years, see “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” below.

Research and

Development

We conduct all of our research

and development

(“R&D”) activities either internally or through

collaborative arrangements with universities and research

institutions in the PRC. We have our own research,

development and laboratory

facilities located in the facilities of First and

Tianlong. Our internal R&D team currently

consists of 38 people. Many of our team members are professors

affiliated with universities in the

PRC.

7

Additionally, we have established several long-term partnerships with

well-known universities and enterprises in the PRC. We

have:

|

·

|

Established a gene medicine laboratory for Small RNA project with Harbin Medical University;

and

|

|

·

|

Established a laboratory for Antroquinonol from Antrodia Camphorata

with Taiwan Golden Biotechnology Corporation.

|

Under our partnership arrangements with universities and research institutions,

we will generally hold the intellectual property rights to any developed technology. For example, as a result of our

collaboration with

Harbin Medical University, a product known as “Endostatin” is currently under development as a

cancer suppressing product. Although this technology still

bears the name of

Harbin Medical University, we own the intellectual property

rights pertaining to this

technology. Additional information relating to this

product and other products being developed is set forth under “Products Under Development” below and under the general product

descriptions throughout this report.

We invested approximately $14,960,000,

$7,413,000, and $3,158,000 in R&D for the years ended December 31, 2009, 2008, and 2007,

respectively. Additional information about our R&D

investments is included in the financial statements in Item 8 of this report (and notes thereto) and our

“Management Discussion and

Analysis on Financial Condition and Results of Operations” section below.

Products Under Development

The projects which accounted for a majority of our 2009 research and development expenses,

grouped by subsidiary, are as follows:

TDR

Breast Cancer

Technology

Hyperplasie Globulaire is the early stage of

Hyperplasia of the Mammary Glands that has a high occurrence among

females between twenty-five and forty-five years of age. Medicines

with Endocrine can have significant side effects to the

patient. Our Breast

Cancer Technology is

designed to effectively treat the Hyperplasie Globulaire with Traditional Chinese Medicine and with minimum side effects. We spent approximately $2,272,000, or 15.2% of total R&D

expenditure in 2009, for efficacy testing, acute and long term

toxicity testing.

Monoclonal Antibody Research

Monoclonal

antibody is a bioactive substance produced when human cells identify and resist

pathogenic intrusion from outside. Monoclonal antibody technology

can produce large

amounts of pure antibodies with

desired substance. Tumor cells that can replicate endlessly

are fused with mammalian cells that produce an

antibody. The result of this cell fusion

will continually produce antibodies. These antibodies are

called monoclonal because they come from only one type of cell, the hybridoma

cell. We believe Monoclonal antibodies have tremendous

applications in the field of diagnostics, therapeutics, targeted drug delivery systems, not only for

infectious disease caused by bacteria, viruses and

protozoa, but also for cancer, metabolic and

hormonal disorders. We spent approximately $965,000, or 6.5% of total R&D expenditure

in 2009, for application and performance appraisal. As of December 31, 2009, we completed this project and are able to manufacture and commercialize

these antibody materials.

Endostatin Research

Endostatin is a cancer treatment drug that works by

“starving” cancer cells by restricting the

generation of blood vessels around cancer lesions, thereby inhibiting, to a

degree, the source of nutrients upon which the cancer cells

survive. We have already completed teratogenicity testing, and have

established quality standards for this

drug. Further

developments are underway to improve the product

quality of Endostatin. We spent approximately $439,000, or 2.9%

of total R&D expenditure in 2009, for acute and long term toxicity

testing.

8

Patch Products

We spent approximately $1,820,000, or 12.2% of

total R&D expenditure in 2009, for the optimization experiments of several patch products including slim patch, anti-hypertension patch, asthma patch, and pain relief patch. The optimization experiments are focusing on optimization of the extracted ingredients and

irritation tests.

First

Diagnostic Kits

In 2009, we had 6 diagnostic kits under clinical trials. We spent approximately $2,727,000, or 18.2% of total R&D expenditure in

2009, on clinical trials

for these 6 diagnostic kits.

Tianlong

Antroquinonol Extracted from Antrodia

Cinnamomea

Antrodia Cinnamomea is well known

in Taiwan as a traditional Chinese medicine. For several decades, it

has been used in the treatment of food and drug intoxication, diarrhea,

abdominal pain, hypertension, rashes, and liver and lung cancer. We have

obtained an exclusive right to develop this technology with Taiwan Golden

Biotechnology Corporation, which has completed pre-clinical research on

Antroquinonol in the United Kingdom. The compound has been approved

by the Food and Drug Administration in the U.S. to enter into first stage

clinical trial. We spent approximately $387,000, or 2.6% of total R&D expenditure

on this project in 2009.

Injections

In 2009, we had 3 injections under clinical trials.

We spent approximately $1,944,000, or 13.1% of total R&D expenditure

in clinical

trials for these

projects in 2009.

Peng Lai

We spent an aggregate of approximately $879,000, or 5.9% of

total R&D expenditure

in 2009, in optimizing effectiveness test for

Naftopidil

Dispersible tablets for prostate treatment, Sertraline Hydrochloride capsules for the treatment of mental

depression, and Radix Isatidis granules and syrup to treat Influenza (flu).

Set forth below is a table of

our major research and development projects, respective stage of development and applicable expenses for 2009:

|

Major Research and

Development Expenses

in Fiscal

2009

($ in thousands)

|

|||

|

Projects

|

Stage

|

Expenses

|

% of total

R&D

|

|

Diagnostic Kits - 6 products

|

Clinical

trial

|

$2,727

|

18.2

|

|

Injections - 6 projects

|

Clinical

trial

|

1,944

|

13.0

|

|

Breast Cancer

Technology

|

Efficacy testing, Acute and Long Term

Toxicity testing

|

2,272

|

15.2

|

|

Patches - 4 products

|

Extraction optimization

testing

|

1,820

|

12.2

|

|

Monoclonal

Antibody

|

Completed

|

965

|

6.5

|

|

Endostatin

|

Efficacy testing, Acute and Long Term

Toxicity testing

|

439

|

2.9

|

|

Antroquinonol

|

Clinical

trial

|

387

|

2.6

|

|

Radix Isatidis granule and

syrup

|

Production process

optimization

|

282

|

1.9

|

|

Naftopidil Dispersible

tablets

|

Production process

optimization

|

256

|

1.7

|

|

Sertraline Hydrochloride

capsules

|

Production process

optimization

|

249

|

1.7

|

|

Total

|

|

$11,341

|

75.8

|

|

|

(a)

|

In

fiscal 2009, we spent approximately $2,272,000 on our breast cancer

technology, which represented approximately 15.2% of our total R&D

expenditures. No other product represented 10% or more of our

R&D expenses in fiscal 2009.

|

9

Total research and development expenses in

fiscal 2009

were $14,960,000.

The above listed projects comprise 75.8% of our total research

and development expenses in fiscal 2009. The other projects and miscellaneous materials make up the remaining 24.2% of total research and development expenses for the

year.

Set forth

below is a table of our research and development expenses for fiscal 2008,

classified by product category and stage of development:

|

Stage

of Development by Number of Projects and U.S. Dollar Amount

($

in thousands)

|

||||||||

|

Category

|

Application

and

Efficacy

|

Acute

and Long Term Toxicity

|

Long

Term Stability

|

Pending

SFDA Approval

|

Supplemental

Documentation

|

SFDA

Approval

|

TOTAL

|

|

|

Bio-Engineering

(a)

|

#

|

1

(b)

|

1

(c)

|

13

|

2

|

-

|

1

|

18

|

|

$

|

$948

|

$1,192

|

$2,261

|

-

|

-

|

-

|

$4,401

|

|

|

Eye

Drops

|

#

|

-

|

-

|

-

|

-

|

-

|

2

|

2

|

|

$

|

-

|

-

|

-

|

-

|

-

|

$103

|

$103

|

|

|

Nasal

Drops

|

#

|

-

|

-

|

-

|

-

|

-

|

1

|

1

|

|

$

|

-

|

-

|

-

|

-

|

-

|

$61

|

$61

|

|

|

Injections

|

#

|

-

|

-

|

-

|

1

|

-

|

4

|

5

|

|

$

|

-

|

-

|

-

|

$104

|

-

|

$510

|

$614

|

|

|

Spray

|

#

|

-

|

-

|

-

|

1

|

-

|

-

|

1

|

|

$

|

-

|

-

|

-

|

$139

|

-

|

-

|

$139

|

|

|

Ointment

|

#

|

-

|

-

|

-

|

1

|

1

|

1

|

3

|

|

$

|

-

|

-

|

-

|

$112

|

$90

|

$115

|

$317

|

|

|

Suppository

|

#

|

-

|

-

|

-

|

3

|

4

|

2

|

9

|

|

$

|

-

|

-

|

-

|

$273

|

$352

|

$217

|

$842

|

|

|

Gel

|

#

|

-

|

-

|

-

|

-

|

2

|

2

|

4

|

|

$

|

-

|

-

|

-

|

-

|

$293

|

$136

|

$429

|

|

|

Liquid

|

#

|

-

|

-

|

-

|

2

|

2

|

-

|

4

|

|

$

|

-

|

-

|

-

|

$209

|

$210

|

-

|

$419

|

|

|

TOTAL

|

#

|

1

|

1

|

13

|

10

|

9

|

13

|

47

(d)

|

|

$

|

$948

|

$1,192

|

$2,261

|

$837

|

$944

|

$1,142

|

$7,324

(e)

|

|

|

|

(a)

|

Bio-engineering

projects include our Endostatin cancer treatment drug, breast cancer drug

and diagnostic kits. The diagnostic kits are designed for

testing for different cancers and viruses, such as prostate cancer,

stomach cancer, ovarian cancer, rectal cancer, liver cancer, Hepatitis B

and C, human papilloma virus and mycoplasma virus. Diagnostic

kits accounted for approximately 30.5% of total R&D expenditures in

2008.

|

|

|

(b)

|

In

fiscal 2008, we spent approximately $948,000 on research and development

related to Monoclonal antibodies, which represented approximately 12.8% of

our total R&D expenses. Monoclonal antibodies are a bioactive

substance produced naturally when human cells identify and resist

pathogenic intrusion from outside. Monoclonal antibody technology can produce

large amounts of pure

antibodies. Therefore, Monoclonal antibodies have

tremendous applications in the field of diagnostics,

therapeutics,

and

targeted drug delivery systems, not only

for infectious disease caused by bacteria, viruses and protozoa

but also for cancer, metabolic and hormonal

disorders.

|

|

|

(c)

|

In

fiscal 2008, we spent approximately $1,192,000 on our Endostatin cancer

treatment drug, which represented approximately 16.1% of our total R&D

expenses. Endostatin is a cancer treatment drug that works

by “starving” cancer cells by restricting the

generation of blood vessels around cancer lesions, thereby inhibiting, to

a degree, the source

of nutrients upon which the cancer cells

survive.

|

|

|

(d)

|

Except

as set forth in notes (b) and (c) above, no single project represented a

material portion of our total R&D expenditures in fiscal

2008.

|

|

|

(e)

|

Does

not include costs for materials used in our R&D projects. Our total

R&D expenditures for fiscal 2008 were approximately

$7,413,000.

|

10

Cord Blood Stem Cell

Bank

In 2006, we began implementing a plan to

establish a cord blood stem cell bank in the PRC, for the treatment of various

diseases such as leukemia,

lymphoma and rebirth anemia. On October 16, 2006, the Health

Department of Heilongjiang Province granted us, through Tian Qing, the exclusive right and license to

become engaged in tissue and stem cell bank activities in Heilongjiang Province, PRC, through December 2010. Since the development of this project

will require substantial managerial, technical and financial resources, and a

number of significant risks, management is still evaluating the proper timing and strategy in launching this

project.

Sales Approach

Over the past several years, we have

continuously expanded our distribution channels for our

products. As a result, we have

established a sales network covering 24 provinces of

mainland China, and have positioned sales managers and representatives in

each of these markets.

In fiscal 2007, our sales model was

focused on the creation of our own distribution

channels. Therefore, we sold products directly to many small distributors and

retail store locations. Commencing in fiscal 2008, we changed our business model and

entered into distribution agreements with larger regional sales

agents, who resell to smaller distributors and

retail store locations. In addition, we entered into contracts with nationwide chain pharmacies.

These changes to our product

distribution channels resulted in our direct customer base

decreasing from 943

customers at December 31,

2007 to 212 customers at December 31, 2009. Our change in sales

strategy is further described in “Customers and Distribution” below.

We also managed to establish a marketing network through independent agents to develop an international

market for our

products. At present, our primary initial growth focus remains

in the PRC. However, part of our sales strategy is to expand

our sales outside of the PRC. Overseas sales accounted

for approximately 7.8%, 8.2% and 25.2% of sales revenue for the fiscal years

ended December 31, 2009, 2008 and 2007, respectively.

Materials and

Suppliers

We employ

purchasing staff with extensive knowledge of our products, who work with our

marketing, product development, and formulations and quality control personnel

to source raw materials for our products and other items. Raw

materials are sourced principally in the PRC, and are generally available from a

variety of suppliers. Harbin Zhong Jia Medicine Company and

Heilongjiang Kangda Medicine Company accounted for approximately 16% and 42% of

our total inventory purchases for the year ended December 31, 2009,

respectively. Heilongjiang Kangda Medicine Company accounted for

approximately 33% of our total inventory purchases for the year ended December

31, 2008. Harbin Yong Heng accounted for 23% of our total inventory

purchases for the year ended December 31, 2007. No other suppliers accounted for 10% or more of our total

inventory purchases in 2009, 2008, and

2007.

We seek

to mitigate the risk of a shortage of raw materials, through identification of

alternative suppliers for the same or similar raw materials, where

available. We believe raw materials are available through alternative

suppliers in the market place, if necessary. We manufacture bulk

branded products to allow more extensive vertical integration and to improve the

quality and consistency of raw materials.

Historically,

we have signed agreements with suppliers that allowed us to hold extra raw

materials at the cost of the suppliers. As a result, we could

minimize our own inventory carrying costs, and improve our cash management, by

keeping the inventory at the minimum level required to support our short-term

sales. However, due to price increases for raw materials, and the

related overhead costs for storing such raw materials, we started to increase

our inventory levels toward the second half of 2009. In anticipation

of continued price increases, management may further increase our inventory

levels in fiscal 2010.

11

Customers and

Distribution

In fiscal

2007, our sales model was focused on the creation of our own distribution

channels. Therefore, we sold products directly to many small distributors and

retail store locations. In fiscal 2008, we changed our business model

and entered into distribution agreements with larger regional sales agents, who

resell to smaller distributors and retail store locations. In

addition, we entered into contracts with nationwide chain pharmacies. Through

the extensive sales networks, of these nationwide chains, we were able to reach

all major metropolitan areas throughout the PRC. These changes to our product

distribution channels resulted in our direct customer base decreasing from 943

customers at December 31, 2007 to 233 customers (not including branches of

retail and drug supply chains) at December 31, 2008. As of December

31, 2009, we had 212 customers, not including branches of retail and drug supply

chains.

The

change in our sales strategy, which began in fiscal 2008, was initiated to

improve product channel efficiencies, and to give us access to an increased

number of ultimate purchasers. We believe that these changes will

continue to lead to increased revenue by extending the reach of our distribution

network. By reducing the number of customers we sell to directly, we

have streamlined our accounts receivable management and collection and reduced

channel distribution costs. These favorable cost variances have been

partially offset by product price incentives we grant to the larger agents with

which we have contracted.

For the year ended December 31, 2009, sales to Harbin Shiji Baolong Medicine Company and Shanxi Xintai

Medicine Company accounted for approximately 16% and 11% of total

revenues, respectively. Harbin Bao Da Medicine Company and Harbin Shiji Baolong

Medicine Company accounted for approximately 16% and 14% of our accounts receivable in 2009, respectively. For the year ended December 31, 2008, sales to Shanxi Xintai and Harbin Shiji Baolong

accounted for 15% and 12% of our total revenues, respectively. Harbin Shiji Baolong and Shanxi Xintai accounted for approximately 29% and 11% of our accounts receivable in 2008, respectively. For the year ended December 31, 2007, sales to Ning BoYue Hua Trading

Company and Guang Zhou Xing

He Trading Company accounted for approximately 14% and 11% of our total revenues, respectively. Hua Li Jiu Zhou Company

accounted for approximately 11% of our accounts receivable in 2007. No other customers accounted for 10% or more of our total

revenues or

accounts receivable in 2009, 2008, and

2007.

In 2009, we implemented various initiatives

toward promoting and marketing our products. Our advertising costs for the fiscal years ended December 31, 2009, 2008, and 2007 were

approximately are $14,527,000, $7,299,000 and $4,385,000,

respectively.

We will

continue efforts to expand our markets into other provinces and larger cities in

the PRC, and to other markets worldwide. Currently, our products are

sold primarily in the PRC. In 2009, 2008 and 2007, approximately

92.2%, 91.8% and 74.8% of our revenues in were from the sale of products in

China, respectively. Part of our sales strategy is to expand

our worldwide sales. As a means of accelerating our

distribution into other countries, we will seek to enter into strategic

marketing arrangements with qualified firms that have distribution channels,

brand name recognition, or other unique marketing strengths.

Competition

Competition in the TCM, pharmaceutical,

and over-the-counter nutraceutical business is intense in China, and throughout the world. We compete with various firms, many of

which produce and market products similar to our products, and many of which have greater

resources than us in terms of manufacturing and marketing capabilities,

management expertise and breadth, and financial wherewithal. Some of these competitors are far

larger, have more resources then us and have stronger sales and distribution

networks.

Our direct competitors are other

domestic firms engaged in developing, manufacturing and

marketing TCM and

nutraceutical products. There are many of these companies in the

PRC, in Heilongjiang Province, and even in the city of Harbin.

We expect that the competition for

medicinal products in the PRC and other world markets will become more intense over the next

few years, both from existing

competitors, and new market entrants. We will also face

competition from foreign companies who may have established products, a strong proprietary pipeline

and strong financial

resources. Our management believes that we have

certain competitive advantages in introducing new products to market due to key focus areas for

development, our existing distribution channels, research and development

capabilities and our

relationship with certain universities and other research institutions.

However, there can be no assurance that

we will be able to compete and continue to grow in this highly competitive

environment. Additional information relating to

competition in the PRC can

be found in the “Risk

Factors” section

below.

12

Government

Regulation

Regulatory

Environment

Our principal sales market is in the

PRC. We are subject to the Pharmaceutical

Administrative Law of the

PRC, which governs the

licensing, manufacturing, marketing and distribution of pharmaceutical

products in the PRC, and sets penalties for violations. Our business is subject to various

regulations and permit systems of the government of the PRC. Additionally, we are subject to government

licensing rights and regulations, which relating to our

stem cell R&D license. Permits we attain for TCM products are granted on a non-exclusive basis

and are subject to periodical review for

renewal.

The governmental approval process in the

PRC for a newly developed health product can be lengthy and

difficult. A product sample is first sent to a clinical testing agent

designated by the Ministry of Health, which

conducts extensive clinical testing and

examination of the product

to verify if it has the specified functions as stated by the company producing the

product. A report will then be prepared and issued by the clinical testing agent confirming or negating such

functions. After submittal

to the agency, it generally

takes six months to one year for a report to be issued by the testing agent. The report must then be

submitted to a provincial Health

Management Commission for

approval. Following this submittal, a letter of

approval issued by such commission will be

submitted to the Ministry of Health for the

issuance of a certificate that authorizes sale and marketing of the product in

the PRC.

This entire process will generally take

between eighteen months and

two years. The approval process will depend to a

certain extent on whether a specified product is a plant based pharmaceutical (“PBP”), or a plant based nutraceutical (“PBN”). PBPs are

products composed of herbs, roots and plants that do not use synthetic chemicals,

with certain medicinal functions for treatment of one or

more illnesses. PBPs are generally

prescription-based but in some cases may be sold

over-the-counter. PBNs, also frequently known as

“dietary

supplements” or “nutritional supplements,” are also composed of herbs, roots and plants, but are essentially prophylactic or

preventive in nature.

All PBNs are available over-the-counter

without a prescription. In the PRC, PBPs require the approval of the SFDA,

while PBNs only require the

approval of state and local governments prior to manufacturing and sale.

Obtaining the approval from

the SFDA is generally more

complex and lengthy.

Because we and our subsidiaries are

wholly-owned enterprises, we are subject to the law

of foreign investment enterprises in the PRC, and the foreign company provisions

of the Company Law of

China, which governs the conduct of our wholly-owned subsidiaries and their officers and

directors, and also limits our ability to pay

dividends.

Compliance with Environmental

Law

We comply with the Environmental Protection Law of the PRC, as

well as applicable local regulations. In addition to compliance with the PRC

law and local regulations, we consistently undertake active efforts to ensure the environmental

sustainability of our operations. Because the manufacturing of herb and

plant-based products does not generally cause significant

damage or pollution to the environment, the cost of complying with applicable

environmental laws is not material. In the event we fail to comply

with applicable laws, we

may be subject to penalties.

Intellectual

Property

We own

certain SFDA licenses for drug batch numbers and other proprietary

technologies. Historically, we included our proprietary

technologies and SFDA licenses for drug batch numbers within the category of

patents. We now believe it is more accurate to categorize such

intellectual property as SFDA licenses for drug batch numbers and other

proprietary technologies.

13

As of

December 31, 2009, our intellectual property breakdown by SFDA licenses for drug

batch numbers and other proprietary technologies is as follows:

|

IPs

(Intangible Assets)

|

Year

Acquired

|

Acquisition

Cost

$

in thousands

|

Reflected

under Intangible Assets

|

Proprietary

Technologies

|

Drug

Batch Numbers

|

|

Endostatin

|

2006

|

$1,727

|

Yes

|

Yes

|

-

|

|

SFDA

licenses for drug batch numbers

|

2008

|

$6,848

|

Yes

|

-

|

Yes

|

|

Monoclonal

Antibody

|

2008

|

$5,106

|

Yes

|

Yes

|

-

|

|

Breast

Cancer Technology

|

2008

|

$1,459

|

Yes

|

Yes

|

-

|

|

Antroquinonol

|

2009

|

$5,119

|

Yes

|

Yes

|

-

|

|

Small

RNAs Technology

|

2009

|

$5,850

|

Yes

|

Yes

|

-

|

We

purchased the rights to the patents for Endostatin and Antroquinonol, which are

registered under the names of Harbin Medical University and Taiwan Golden

Biotechnology Corporation, respectively.

We have

acquired certain additional proprietary technologies from non-related third

parties. The fair value of these proprietary technologies recorded in

our financial statements are appraised periodically and amortized during its

useful life.

As of the

date of this filing, we own two registered patents for product

packaging. As of December 31, 2009, these patents have nominal

carrying values.

Under the

PRC’s State Protection Law, certain herbal medicine products, which have

received approval from the SFDA, have automatic protection. SFDA

licenses for drug batch numbers we acquired in connection with our acquisitions

of Tianlong and Peng Lai in fiscal 2008 have been recorded as part of our

intangible assets. We did not appraise or assign any value to the

SFDA licenses for drug batch numbers developed internally by TDR or

First.

We have

registered “Kang Xi” as our trademark, which is used for all of our TCM

products. The “Kang Xi” trademark was developed internally and

registered by TDR before we became a public company. Our cost basis

in the trademark is nominal.

Employees

The number of our employees has

increased due to growth, increased research and development activities and expanded marketing and distribution efforts for our products. Our employees generally fall into the

following categories:

By subsidiary

company:

|

Number of

Employees

|

||||||||

|

Company

|

2009

|

2008

|

||||||

|

TDR

|

1,315 | 1,515 | ||||||

|

Tian Qing

|

0 | 0 | ||||||

|

First

|

107 | 97 | ||||||

|

Tianlong

|

207 | 97 | ||||||

|

Haina

|

399 | 24 | ||||||

|

Peng Lai

|

126 | 71 | ||||||

|

TOTAL:

|

2,154 | 1,804 | ||||||

14

By nature of job:

|

Number of

Employees

|

||||||||

|

Type of Job

|

2009

|

2008

|

||||||

|

Executives and managers

|

201 | 146 | ||||||

|

Production and clerical

|

424 | 359 | ||||||

|

Sales and marketing

|

1,491 | 1,261 | ||||||

|

Research and development, technology

|

38 | 38 | ||||||

|

TOTAL:

|

2,154 | 1,804 | ||||||

As of December 31, 2008, we had 1,804

full-time employees. Our 2,154 employees, as of December 31, 2009, includes both 305 full time employees and 1,849 individuals hired on a contract basis

through agencies. In 2009, we began hiring certain employees on a

contract basis, in order to take advantage of cost

efficiencies.

We do not have any employment

agreements in place with our executive officers. None of the employees are

covered by a collective bargaining agreement,

however, we believe our relationship with employees is good.

Available

Information

We file various reports with the SEC, including Annual

Reports on Form 10-K, Quarterly

Reports on Form 10-Q and Current

Reports on From 8-K, which are available though

the SEC’s electronic data gathering, analysis

and retrieval system by accessing the SEC’s home page (http://www.sec.gov). The

documents are also available to be read or

copied at the SEC’s Public Reference Room

located at 100 F Street, NE, Washington, D.C., 20549. Information on the Public Reference

Room may be obtained by calling the SEC at

1-800-SEC-0330.

We also make available free of charge

through our website (www.cski.com.cn) our Annual Report on Form 10-K, Quarterly

Reports on Form 10-Q, Current Reports on Form 8-K, and, if applicable,

amendments to those reports filed or furnished pursuant to the Exchange Act as soon as

reasonably practicable after we electronically file such material with, or furnishes it

to, the SEC.

15

Item 1A. Risk Factors.

We are subject to certain risks and

uncertainties as

described below. These risks and

uncertainties may not be the only ones we face. There may be

additional risks that we do not presently know of, or that we currently consider

immaterial. All of these risks could adversely affect our

business, financial

condition, results of operations and cash

flows. Our business and operations may be adversely

affected if any of such risks are

realized. All investors should

consider the following risk factors before deciding to purchase or sell our

securities.

Risks Related to Our Business

Adverse economic conditions may harm our

business.

In 2008,

general worldwide economic conditions declined due to sequential effects of the

sub prime lending crisis, general credit market crisis, collateral effects on

the finance and banking industries, concerns about inflation, slower economic

activity, decreased consumer confidence, reduced corporate profits and capital

spending, adverse business conditions and liquidity concerns. This

global economic downturn poses a risk as consumers and businesses may postpone

spending, or seek new ways to eliminate spending, in response to these uncertain

and challenging economic conditions. In addition, there could be a

number of follow-on effects including foreign currency exchange rate

fluctuations, insolvency of key suppliers and customer

insolvencies. We cannot predict the timing or duration of any

economic slowdown or recession or the timing or strength of a subsequent

recovery, worldwide, or in the specific markets we serve. If the

markets for our products significantly deteriorate due to these economic

effects, our business, financial condition and results of operations may be

materially and adversely affected.

Certain officers and directors have

significant control over our company.

Liu Yan-qing and Han Xiao-yan, who are officers and

directors of ours, also

serve as officers and

directors of ACPG, TDR and its subsidiaries. As of the date hereof, Dr. Liu and Ms. Han own, in the aggregate, approximately 36.5% of the issued and outstanding shares of our common stock.

As a result, these shareholders are

effectively able to control certain corporate governance matters requiring

shareholders’ approval. Such matters may include transactions in

which they have an interest other than as a shareholder of ours, the approval

of significant corporate

transactions such as increasing the authorized number of our shares to complete

acquisitions or raise capital, if necessary, and any other transactions

requiring a majority vote without seeking other shareholders’ approval. These persons also have the ability to

control other matters requiring shareholder approval including our election of

directors which could result in the entrenchment of

management.

We depend on our key management

personnel and the loss of

their services could adversely affect our business.

We place substantial reliance upon the

efforts and abilities of our executive

officers, Liu Yan-qing, President, Chief Executive Officer and Chairman of the

Board, Han Xiao-yan, Vice Chairman, and Stanley Hao, Chief Financial Officer and Secretary.

We do not have employment

agreements with these members of management.

Accordingly, if any of these persons

should leave the company, we would have no remedy or protections in place and would not be able to

prevent them from competing with us or working for competitors. The loss of the services of any of these

executive officers could have a material adverse effect on our business,

operations, revenues or prospects. In addition, we do not maintain key man life

insurance on the lives of these individuals.

Our expansion plan may not be

successful.

Part of our strategy is to continue our growth through increasing the distribution and

sales of our

products by penetrating existing

markets in the PRC, and entering new geographic

markets in the PRC as well as Asia, the

United States and other countries. However, many

obstacles to entering such new markets exist, including, but not limited to, international trade and tariff

barriers, regulatory constraints, product liability concerns, shipping

and delivery costs, costs associated with marketing efforts abroad and maintaining attractive

foreign exchange

ratios. Moreover, our expansion strategy may be

based on incorrect assumptions and may be

flawed, and may even damage our performance,

competitive position in the market and, ultimately, even our ability to survive in the

marketplace. We cannot, therefore, assure

shareholders that we will be able to successfully overcome such obstacles and

establish our products in any additional markets. Our inability to implement this growth

strategy successfully may have a negative impact on our growth, future financial condition,

results of operations or cash

flows.

16

There are many safety risks

involved in our products and services that could expose us to

liability or inhibit our ability to secure insurance.

Our products and services involve direct or indirect

impact on human health and life. The products we manufacture and sell may be

flawed and cause dangerous side

effects, and even fatality in certain cases, leading to major business losses

and legal and other

liabilities and damages to our company. In the event that any of our

products are alleged to have adverse side effects, we could be subject to product

liability claims. In addition to the threat of liability,

there may be insurance

costs if we enter into certain

markets or may not be able to obtain insurance

for certain products in some countries. Some

distributors may refuse to sell our products in certain countries if they perceive

such products to have a high risk or to be

uninsurable.

We do not maintain any insurance and are

exposed to all risks of loss, including

resulting form product liability, property loss or damages, or other harm that we may cause to

customers, vendors, suppliers and other third parties,

or securities law

claims.

We do not

maintain liability or property insurance coverage or director and officer

insurance coverage and, therefore, we are self-insured for all risks of

loss. Although we seek to reduce potential liability through measures

such as contractual indemnification provisions with distributors and suppliers,

we cannot assure you that such measures will be enforced or

effective. Our policy is to record losses associated with our lack of

insurance coverage at such time as realized loss is incurred. Historically, we

have not had any material losses in connection with our lack of insurance

coverage and are not party to any material pending legal proceedings as of the

date of this report. Management’s intention is to use our working

capital to fund any such losses incurred due to our exposure to inadequate

insurance coverage. Our operating results could be materially and

adversely affected if we were to pay significant damages or incur significant

defense costs in connection with a claim.

We are highly dependent upon the public

perception and quality of our products. Additionally, anti-corruption measures

taken by the government to correct corruptive practices in the pharmaceutical

industry could adversely affect our sales and reputation.

We are highly dependent upon

consumers’ perception of the safety and quality of our products as well as similar products distributed by other companies. Thus, the mere publication of

reports asserting that such products may be harmful could have a material

adverse effect on our business, regardless of whether these reports are scientifically supported.

The PRC government has recently taken anti-corruption

measures to correct corrupt practices. In the pharmaceutical industry, such

practices include, among

other things, acceptance of

kickbacks, bribery or other

illegal gains or benefits by the hospitals and medical practitioners from pharmaceutical

distributors in connection with the prescription of a certain

drug. Substantially all of our sales to our ultimate customers are

conducted through third-party distributors.

We have no control over our third-party

distributors, who may engage in corrupt practices to promote our

products. While we maintain strict anti-corruption

policies applicable to our internal sales force and third-party distributors, these

policies may not be effective. If any of our third-party distributors

engage in such practices and the government takes enforcement action, our

products may be seized and our own practices, and involvement

in the

distributors’ practices may be investigated. If this occurs, our sales

and reputation may be materially and adversely affected.

Our success will depend on our research

and the ability to develop new products.

Our growth depends on our ability to

consistently discover, develop and commercialize new products, and find new and improve on existing

technologies, platforms and products. As such, if we fail to make sufficient

investments in research, to be attentive to consumer needs, or fail to focus on the most

advanced technologies, our current and future

products could be surpassed by more effective or advanced products of other companies.

We currently rely on third parties to supply

the key raw materials we use to produce our products.

Our business depends upon the

availability of key raw materials. We rely on only external suppliers for

these raw materials. In fiscal year 2009, Harbin Zhong Jia Medicine Company and Heilongjiang Kangda

Medicine Company accounted for approximately 16% and 42% of our total inventory purchases, respectively. Heilongjiang Kangda Medicine Company accounted for approximately 33% of our total inventory purchases for the year

ended December 31, 2008. For the 2010 fiscal year, we expect that our raw material

suppliers will be

substantially similar to last year and the amount of raw materials will

increase commensurate with the increase in the demand of our products. If any of our major suppliers were to default or become

unable to deliver the raw materials in sufficient quantities, we may be

unable to purchase these raw materials from alternative sources on the same or

similar terms, which could result in a significant decrease in our operating

costs. In addition, any disruption in the

supply of our raw materials

could cause delay in the delivery of our products which would be harmful to our sales

reputation and business. If supply is disrupted the increased amount we have to pay for raw materials

could negatively impact our margins, cause us to cease production if an

alternate supplier cannot be found. If we are unable to procure replacement

supplies, our ability to meet the production demands of our customers could

cause the loss of costumers and/or market share. Our financial results could be negatively impacted by the lost sales or

decreased margins.

17

We

are dependent on a limited number of customers for a significant portion of our

revenues and accounts receivable and this dependence is likely to

continue.

We have

been dependent on a limited number of customers for a significant portion of our

revenue. For the year

ended December 31, 2009, sales to Harbin Shiji Baolong Medicine Company and

Shanxi Xintai Medicine Company accounted for approximately 16% and 11% of total revenues, respectively. For the year