Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2009

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 000-52642

Westway Group, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 20-4755936 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 365 Canal Street, Suite 2900, New Orleans, LA | 70130 | |

| (Address of principal executive offices) | (Zip Code) | |

(504) 525-9741

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of exchange on which registered | |

| Class A Common Stock, $0.0001 par value | The NASDAQ Stock Market LLC | |

| Warrants, each exercisable to purchase one share of Class A Common Stock | The NASDAQ Stock Market LLC | |

| Units, each consisting of one share of Class A Common Stock and two Warrants | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ¨ Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | x | |||||

| Non-accelerated filer | ¨ | (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | ||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant computed by reference to the price at which the registrant’s Class A Common Stock, par value $0.0001 per share, was last sold as of June 30, 2009, the last business day of the registrant’s most recently completed second fiscal quarter, was $51.4 million.

As of March 8, 2010, 13,951,933 shares of our Class A Common Stock, par value $0.0001 per share, and 12,624,003 shares of our Class B Common Stock, par value $0.0001, were outstanding. The number of shares of our Class A common stock outstanding stated above includes 1,000,000 shares issued to Shermen WSC Holding LLC and held in escrow to be released upon achievement of earnings or share price targets.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for its 2010 annual meeting of stockholders, which is expected to be filed with the Securities and Exchange Commission by April 30, 2010, are incorporated by reference into Part III of this Form 10-K.

Table of Contents

Westway Group, Inc. Index to Form 10-K

| Certain Defined Terms | 4 | |||

| Special Note Regarding Forward-Looking Statements | 4 | |||

| PART I | ||||

| Item 1. | 5 | |||

| 5 | ||||

| 7 | ||||

| 10 | ||||

| 13 | ||||

| 15 | ||||

| 20 | ||||

| 24 | ||||

| 26 | ||||

| 26 | ||||

| 27 | ||||

| 27 | ||||

| Item 1A. | 27 | |||

| Item 1B. | 42 | |||

| Item 2. | 42 | |||

| 42 | ||||

| 44 | ||||

| Item 3 | 45 | |||

| Item 4. | 46 | |||

| PART II | ||||

| Item 5. | 46 | |||

| Item 6. | 49 | |||

| Item 7. | Management Discussion and Analysis of Financial Condition and Results of Operations |

51 | ||

| 51 | ||||

| 52 | ||||

| 53 | ||||

| 54 | ||||

| 56 | ||||

| 62 | ||||

| 63 | ||||

| 66 | ||||

| 73 | ||||

| 73 | ||||

| 75 | ||||

| Item 7A. | 75 | |||

2

Table of Contents

| Item 8. | 77 | |||

| 82 | ||||

| 84 | ||||

| 86 | ||||

| 89 | ||||

| 90 | ||||

| 92 | ||||

| 92 | ||||

| 93 | ||||

| 94 | ||||

| 103 | ||||

| 108 | ||||

| 109 | ||||

| 111 | ||||

| 111 | ||||

| 112 | ||||

| 112 | ||||

| 113 | ||||

| 113 | ||||

| 115 | ||||

| 118 | ||||

| 120 | ||||

| 121 | ||||

| 121 | ||||

| 126 | ||||

| 130 | ||||

| 131 | ||||

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

132 | ||

| Item 9A. | 132 | |||

| Item 9B. | 133 | |||

| PART III | ||||

| Item 10. | 134 | |||

| Item 11. | 134 | |||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

134 | ||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence |

134 | ||

| Item 14. | 134 | |||

| PART IV | ||||

| Item 15. | 135 | |||

| SIGNATURES | 136 | |||

| EXHIBIT INDEX | 137 | |||

3

Table of Contents

Unless the context otherwise requires, when used in this annual report on Form 10-K:

| • | the “Company” or “we” or “us” or “Westway Group, Inc.” means the public company now named Westway Group, Inc. (which was named Shermen WSC Acquisition Corp. before May 28, 2009), together with its wholly-owned subsidiaries; |

| • | “WGI” means the public company now named Westway Group, Inc. only, not including any of its subsidiaries; |

| • | the “acquired business” or “predecessor” means the bulk liquid storage and liquid feed supplements businesses, prior to acquisition, that were acquired by the Company from the ED&F Man group in the business combination; |

| • | the “business combination” means the set of transactions consummated on May 28, 2009, by which the Company acquired the acquired business; |

| • | “ED&F Man” means ED&F Man Holdings Limited, on an unconsolidated basis; |

| • | “ED&F Man group” means ED&F Man and its direct and indirect subsidiaries; and |

| • | “Holdings” means Westway Holdings Corporation, a subsidiary of ED&F Man and member of the ED&F Man group; |

| • | In circumstances where we wish to stress that we are limiting the time period when we are referring to the Company, we have referred to the Company before the business combination as “Shermen WSC Acquisition Corp.” or simply “Shermen”; |

| • | “Class A common stock” means our Class A Common Stock, par value $0.0001 per share (this class is listed on NASDAQ; generally, shares of this class automatically convert into shares of Class B common stock at any time they become owned by a member of the ED&F Man group); |

| • | “Class B common stock” means our Class B Common Stock, par value $0.0001 per share (this class is not listed on NASDAQ; generally, shares of this class automatically convert into shares of Class A common stock at any time they cease to be owned by a member of the ED&F Man group); and |

| • | “Series A Convertible Preferred Stock” means our Series A Perpetual Convertible Preferred Stock, par value $.0001 per share (this class is not listed on NASDAQ). |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K includes statements reflecting assumptions, expectations, projections, plans, intentions, or beliefs about future events that are intended as “forward-looking statements.” The forward-looking statements are made within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We intend the forward-looking statements in this Annual Report on Form 10-K or made by us elsewhere to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and we are including this statement for purposes of complying with these safe harbor provisions.

We have based our forward-looking statements on our current expectations and projections about future events, trends, and uncertainties. There are a number of important factors that could cause our actual results and financial position to differ materially from those contemplated by our forward-looking statements. Our forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions, including, among other things, the risk factors discussed in the “Risk Factors” section of this Form 10-K.

Our business is highly complex and competitive, with many different factors affecting results. Any or all of our forward-looking statements may turn out to be wrong, and actual results may differ materially from those expressed or implied by our forward-looking statements. They can be affected by inaccurate assumptions or by known or unknown risks, uncertainties and other factors, many of which are beyond our control. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

4

Table of Contents

PART I

| ITEM 1. | BUSINESS |

We were originally incorporated as Shermen WSC Acquisition Corp., a “special purpose acquisition” corporation, in Delaware on April 18, 2006. We were formed for the purpose of acquiring an operating business in the agriculture industry through a merger, capital stock exchange, asset acquisition, stock purchase, or other similar business combination. From inception through May 28, 2009, we did not have any business or operations. Our activities were limited to raising capital in our initial public offering and subsequently identifying and acquiring an operating business.

On May 28, 2009, we completed the acquisition of the bulk liquid storage and liquid feed supplements businesses of the ED&F Man group (which we refer to as the “acquired business” or our “predecessor”) by effecting mergers of the two principal subsidiaries of ED&F Man engaged in the bulk liquid storage and liquid feed supplements businesses (Westway Terminal Company, Inc. and Westway Feed Products, Inc.) into two of our wholly-owned subsidiaries (now named Westway Terminal Company LLC and Westway Feed Products LLC) and by purchasing the equity interests of the other subsidiaries of ED&F Man engaged in the bulk liquid storage or liquid feed supplements businesses. The business combination was approved by our stockholders on May 26, 2009. In conjunction with the completion of the business combination, we changed our name from Shermen WSC Acquisition Corp. to Westway Group, Inc.

The consideration we paid in connection with the closing of the business combination consisted of approximately 12.6 million newly-issued shares of our Class B common stock (fair value of $63.1 million), approximately 30.9 million newly-issued shares of our Series A Convertible Preferred Stock (fair value of $177.3 million), including 12.2 million escrowed shares that are to be released from escrow only if the Company achieves certain earnings or share price targets, and $103.0 million in cash, plus certain post closing adjustments of $1.1 million which were settled in cash. If the targets are achieved and the shares are released from escrow, the Company estimates the aggregate value of the consideration to be $344.6 million.

Through our wholly-owned subsidiaries, we are a leading provider of bulk liquid storage and related value-added services, and a leading manufacturer and distributor of liquid animal feed supplements. We operate an extensive global network of 62 operating facilities providing 348 million gallons of total bulk liquid storage capacity and producing approximately 1.6 million tons of liquid feed supplements annually.

Our bulk liquid storage business is a global business with locations at key port and terminal sites throughout North America and in Western Europe and Asia. Our infrastructure includes a network of 25 terminals offering storage to manufacturers and consumers of agricultural and industrial liquids.

Our liquid feed supplements business produces liquid animal feed supplements that are sold directly to end users, which we refer to as “ranchers,” and feed manufacturers, primarily supplying the beef and dairy livestock industries. By using formulation processes that are tailored specifically to the needs of our customers, we blend molasses and essential nutrients to form feed rations that help to maximize the genetic potential of livestock.

This complementary relationship between our bulk liquid storage and liquid feed supplements businesses benefits from synergies including co-location of facilities, enhanced raw material supply logistics for liquid feed supplements, increased operational efficiency resulting from cross-business knowledge exchange, and resource optimization.

We also benefit significantly from the breadth of markets served by our businesses. Our bulk liquid storage business has maintained a long-term presence in a number of highly strategic, deep water ports around the world. This location advantage provides our international customer base access to strategic storage locations and the highest level of service for these critical markets. Our liquid feed supplements business is the leading North American manufacturer of liquid feed supplements and the only supplier with a true U.S. national footprint.

5

Table of Contents

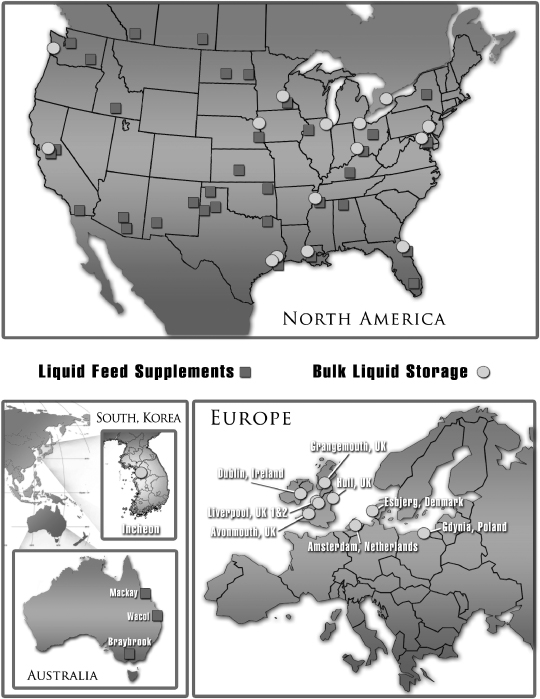

World Wide Locations

6

Table of Contents

At the beginning of 2009, we were a special purpose acquisition company named Shermen WSC Acquisition Corp. We neither engaged in any operations nor generated any revenues, other than interest income earned on the proceeds of our initial public offering and our private placement of warrants to our founders.

Since January 1, 2009, we have taken advantage of a number of opportunities and achieved a number of significant milestones. These include concluding the business combination in which we acquired the bulk liquid storage and liquid feed supplements businesses of the ED&F Man group, securing a credit facility with a syndicate of quality banks, and listing our Class A common stock on the NASDAQ stock market. These accomplishments and others since January 1, 2009 are discussed below.

First Quarter 2009

Having entered into an agreement with the ED&F Man group in November 2008 for the acquisition of their bulk liquid storage and liquid feed supplements businesses in exchange for shares of our common and preferred stock and cash, during the first quarter of 2009 we focused primarily on advancing the proposed business combination to a successful consummation. In January 2009 we filed our first preliminary proxy statement in connection with the proposed business combination. In February 2009 we held presentations for certain of our stockholders, as well as other persons who might be interested in purchasing our securities, regarding the transactions contemplated by the agreement between us and the ED&F Man group.

Second Quarter 2009

In the second quarter of 2009, after further work by us and the ED&F Man group, the proposed business combination was successfully consummated, and, with a new board and management team, we began operation of the bulk liquid storage and liquid feed supplements businesses that we acquired from the ED&F Man group. Meanwhile, our bulk liquid storage business embarked on two new expansion projects.

In May 2009, we entered into an amended and restated transaction agreement with the ED&F Man group that modified the terms under which we would acquire their bulk liquid storage and liquid feed supplements businesses. Among other things, the amended and restated agreement provided for ED&F Man to provide us with a $100 million revolving credit facility to facilitate the business combination and for purposes including working capital and capital expenditures. Also in May, as reflected in the amended and restated transaction agreement, ED&F Man sponsored a trust that acquired shares of our common stock through open market transactions, later voted them in favor of the business combination, and at the closing of the business combination exchanged the shares of our common stock for shares of ED&F Man held by employees who had elected to participate in the exchange.

On May 26, 2009, at our annual meeting, our stockholders approved the proposed business combination, as well as the amendment and restatement of our certificate of incorporation, which provided for our two classes of common stock and our new Series A Convertible Preferred stock, among other things. To facilitate the consummation of the business combination, we also entered into a letter agreement with the ED&F Man group and Shermen WSC Holding LLC that provided, among other things, for (i) ED&F Man’s consent to our purchase of 2,514,369 shares of our common stock in privately negotiated transactions (from stockholders who had indicated an intention to vote against the proposed business combination) and (ii) Shermen WSC Holding LLC’s agreement to return to us for cancellation 3,266,608 shares of our common stock. Meanwhile, 9,189,990 shares of our common stock were converted into the right to receive cash from our trust account established in connection with our initial public offering.

We completed our acquisition of the bulk liquid storage and liquid feed supplements businesses of the ED&F Man group on May 28, 2009. The business combination was effected by merging the two principal subsidiaries of

7

Table of Contents

ED&F Man that engaged in the bulk liquid storage and liquid feed supplements businesses into two of our wholly-owned subsidiaries and by our purchase of the equity securities of ED&F Man’s other subsidiaries that also engaged in the bulk liquid storage and liquid feed supplements businesses. In exchange, we paid $103 million in cash and issued 12,624,003 shares of our Class B common stock and 30,886,830 shares of our Series A Convertible Preferred stock to a subsidiary of ED&F Man (of which 12,181,818 shares of Series A Convertible Preferred stock were deposited in escrow for release upon our achievement of certain earnings or share price targets). We also incurred one-time business combination expenses of $13.9 million for advisory, investment banking, accounting, legal, and other professional and consulting fees. Various agreements were entered into at the closing of the business combination between us and the ED&F Man group, including but not limited to a molasses supply agreement, a storage strategic alliance agreement and terminal service agreement, a shared services agreement, a stockholders agreement, a stock escrow agreement, a registration rights agreement, and a $100 million interim credit facility agreement and related letter agreement.

As a result of the business combination, ED&F Man and its affiliates became our largest stockholder, owning 47.5% of our outstanding common stock and 100% of our Series A Convertible Preferred stock. The composition of our board of directors changed, with an ED&F Man subsidiary choosing three of our seven directors, and the holders of our Class A common stock (formerly our only class of common stock) electing the other four. Our new management was drawn from former management personnel of the ED&F Man group, and we changed our name to Westway Group, Inc. We began operation of the bulk liquid storage and liquid feed supplements businesses on May 29, 2009. We believe that the business combination provided an excellent platform for the growth of the bulk liquid storage and liquid feed supplements businesses and that they will reap strong benefits from our public company status.

In June 2009, in accordance with agreements made in connection with the business combination, our board of directors declared a special cash dividend of $1.00 per share, on our common stock, which dividend was waived by ED&F Man and its affiliates and by Shermen WSC Holding LLC.

In May 2009, about a week before the business combination, Westway Terminal Company, Inc., the principal ED&F Man subsidiary engaged in the bulk liquid storage business, reached an agreement with an international petroleum company for the storage of lube oils at the subsidiary’s Port Allen terminal located at the Port of Greater Baton Rouge in Louisiana. The new agreement provided for storage of 73,000 barrels in existing tankage, to commence in August 2009, and for storage of 95,000 barrels in new construction, to begin in October 2010, which we refer to as the Phase 1 expansion of the Port Allen terminal facility. The new agreement is expected to add approximately $2.2 million to our annual revenue. Similarly, in June 2009, we opened Phase 1 of a custom-built bulk liquid storage terminal for Nynas Americas at our Houston No. 1 terminal. The state-of-the-art, customized logistics hub, located along the Houston Ship Channel and initially consisting of 25 tanks with a storage capacity of 400,000 barrels, was designed to provide dedicated logistics, blending, and special loading facilities for Nynas specialty products and to accommodate maximum flexibility. Phase 1, which began in June, involved the transition of transformer oils. Phase 2 began in October when all other products were transitioned. The facility was completed at the end of 2009.

Third Quarter 2009

In the third quarter of 2009, we took advantage of several opportunities for acquisition and expansion. In July 2009, we acquired a bulk liquid storage facility, with 7.6 million gallons of capacity, located outside of San Francisco, California.

In August 2009, we launched the Phase 1 expansion of our Port Allen terminal facility. Phase 1 of our expansion plan included the construction of four 1-million gallon bulk liquid storage tanks. In September 2009, after having secured an additional long-term contract for storage at the Port Allen facility, we launched a second phase of the expansion, which is expected to provide an additional 1.5 million gallons of capacity, along with additional dock line and infrastructure, including truck loading and rail.

8

Table of Contents

In October 2009, we completed the acquisition of the storage assets and property of Southside River Rail Terminal, Inc., located in Cincinnati, Ohio, which was one of the largest independent, full-service bulk liquid handling facilities in the Mid-West U.S. The purchase price was approximately $20 million. The new facility is located immediately adjacent to one of our existing liquid animal feed supplement operations, and it handles barges, rail and truck operations, with 37 million gallons of bulk liquid storage capacity.

In August 2009, the Company entered into a $100 million revolving credit facility agreement with ED&F Man Treasury Management plc (“ED&F Man Treasury”) an affiliate of ED&F Man, that replaced and terminated the $100 million interim facility agreement that was previously entered into between the same parties upon the consummation of the business combination. The basic economic terms of the new agreement were substantially similar to the economic terms of the earlier agreement.

During the third quarter we also dealt with a change in management and the filing of a registration statement. In July 2009, Steve Boehmer was appointed Executive Vice President (and acting President) of Westway Feed Products, LLC as of August 1, 2009, and President of Westway Feed in September 2009. Mr. Boehmer previously served as Vice President Operations of Westway Feed or its predecessor from January 2003 to July 2009 and as National Operations Manager of the predecessor from August 1999 to January 2003. He has over 34 years of experience in the feed industry.

In August 2009, we filed with the SEC our Post-Effective Amendment No. 2 to our registration statement on Form S-1 relating to the shares of our Class A common stock issuable upon exercise of warrants that we previously issued to investors in connection with our initial public offering. The post-effective amendment became effective on August 7, 2009.

Fourth Quarter 2009

In the fourth quarter of 2009, we secured a significant new credit facility with a syndicate of banks, obtained listing of our Class A common stock on NASDAQ, and completed several expansion projects, while continuing to work on others.

In November 2009, we secured a new 3-year, $175 million senior secured revolving credit facility, provided by a nine-bank syndicate led by JPMorgan Chase Bank, N.A. and arranged by JPMorgan Securities Inc. In addition to JPMorgan Chase Bank, N.A., the initial syndicate consisted of Regions Bank, Capital One, N.A., Compass Bank, Rabobank Nederland, Suntrust Bank, Whitney National Bank, Societe Generale, and CoBank ACB. We were pleased with the high level of interest and willingness to commit significant funding to us by the syndicate of quality banks.

The new facility replaced the $100 million facility previously provided by ED & F Man Treasury. The new $175 million facility was used to refinance the approximately $88 million balance under the ED & F Man Treasury credit facility, leaving $87 million of available credit under the new facility for general corporate purposes, which could include among other things working capital, capital expenditures, and acquisitions. We believe the credit provided by this new facility signifies the completion of another important step in our growth strategy.

The new facility allows borrowing at the London Interbank Offered Rate (“LIBOR”) plus 350 bpts. The terms of the new facility are similar to those of the ED& F Man Treasury facility, except for the collateral provided and an accordion feature which allows the new facility to be expanded to $200 million. The new facility is described in detail below in “Liquidity and Capital Resources” section of Item 7 of this Form 10-K.

In December 2009, we were notified that our application to list our Class A common stock, warrants, and units on the NASDAQ stock market had been approved, and they began trading under the symbols “WWAY,” “WWAYW,” and “WWAYU,” respectively. We were very pleased to list our securities on NASDAQ, one of the

9

Table of Contents

world’s preeminent stock exchanges. We view this upgrade from the OTC Bulletin Board as a significant milestone in our development, as we hope to obtain higher visibility within the investment community and the media, leading to improved liquidity of our stock and the attraction of new stockholders.

We currently have several major facilities that were under construction and came on-line at the end of 2009 which will add to our core earning capacity, notably Gray’s Harbor, located in Washington state, and Phase 4 of our Houston No. 1 facility. Earnings from these facilities are not expected to be fully reflected in our results of operations until the first quarter of 2010.

Since January 1, 2010

In February 2010, as required by and as additional security for our obligations under the bank syndicate credit agreement, Westway Terminal Company LLC, Westway Terminal Cincinnati LLC, and Westway Feed Products LLC, all subsidiaries of ours, entered into seven first priority mortgage liens on their fee or leasehold interests, as applicable, in certain terminal and feed facilities having an aggregate fair market value of approximately $120 million. The facilities include two terminal facilities and one feed facility in Houston, Texas; a terminal facility and a feed facility in Cincinnati, Ohio; and a terminal facility in Grays Harbor, Aberdeen, Washington.

Also in February 2010, we filed with the SEC a registration statement on Form S-3 registering approximately 21.2 million shares of our Class A common stock for sale by various of our shareholders, including a subsidiary of ED&F Man, various former and current employees of the ED&F Man group, and various of our directors and officers. This registration statement became effective February 10, 2010.

In March 2010, we and the ED&F Man group reached a non-binding agreement in principle for the ED&F Man group’s lease of our Port of Inchon, South Korea terminal and all of the improvements and equipment thereon, to commence upon the expiration in May, 2010 of the terminal service agreement between the parties. Currently, the ED&F Man group is our sole bulk liquid storage customer at the Korean terminal. Pursuant to the proposed lease, the ED&F Man group would take full control and responsibility for the Korean terminal and the improvements and equipment thereon, hire our employees at the terminal, and operate the terminal for the storage of its bulk liquids. The lease would be a triple-net lease (where all expenses, insurance and taxes related to the leased property would be paid by the lessee) and would provide for rental to be paid to us in the amount of $400,000 per year. The lease is also expected to have a principal term of three years and grant an option to the ED&F Man group for the purchase of the Korean terminal and all of its improvements and equipment for a purchase price of $3,000,000, exercisable at any time during the term of the lease.

Risks

Our statements about our corporate plans, including our expansion plans, their cost, and their effect on our terminal capabilities and storage capacity, and statements about our hopes to obtain more visibility, stock liquidity, and stockholders, are forward-looking and involve not only opportunities and challenges but also risks. Important factors that could cause our actual results to differ materially include changes in demand for bulk liquid storage or for liquid animal feed supplements, unanticipated delays in construction or increased construction costs due to weather, disputes with contractors, or opposition by environmental groups, and our results of operations and general market conditions in the future. For a more detailed description of risks that we face, please see the “Risk Factors” section, Item 1A of this Form 10-K.

Increase Volumes of Existing Products and Services

We believe that global demand for our bulk liquid storage service and liquid feed supplements products will continue to increase over the long-term, although such demand may decline from time to time in particular years depending on global economic conditions.

10

Table of Contents

In the bulk liquid storage business, despite the uncertainty that is affecting the wider economy, growth is expected to be driven by the underlying expansion in long-term demand for a wide variety of agricultural and industrial raw materials that are fundamental to our target industries and sectors. In 2010, however, we are anticipating a reduction in demand for storage of molasses in Europe by our largest customer, the ED&F Man group. We are endeavoring to secure other customers to use the storage in Europe for other products, which typically support higher profit margins than molasses.

Likewise, in the long-term, we expect the liquid feed supplements business to continue to benefit from increasing global demand for higher protein content livestock feed and the ongoing shift toward liquid supplements from traditional dry feed products. This trend has become particularly significant in recent years as prices for traditional corn and dry protein meals have been highly volatile. In 2010, however, we expect that the weak state of the U.S. beef and dairy industries will continue to depress demand for cows and consequently animal feed, including liquid feed supplements.

In anticipation of long-term growing demand, we expect to utilize the significant capital resources provided by the business combination to increase storage and production volumes at existing facilities and to open new facilities at strategic locations in North America, Europe and Asia. For example, planning is underway on a 4.16 million gallon expansion of our existing storage facility in Amsterdam, Netherlands, and a 3.1 million gallon infill expansion in Houston, TX. We are also adding an additional 5.7 million gallons of capacity in Port Allen, LA during 2010. In the liquid feed supplements business, we intend to leverage our position as an international leader in liquid livestock supplement technology to market our products to various developing nations outside of North America. Additionally in North America, we intend to expand our successful feedlot liquid supplement business to states beyond the Texas panhandle.

When evaluating new facility development opportunities, we utilize a series of objective criteria to assess the potential benefits of additional infrastructure, logistics capability, overall environmental condition, political stability, and payback period. Through this process, we will analyze, prior to commitment, whether the proposed investments are expected to generate attractive financial returns and how to minimize execution risk. In addition, prior to construction or expansion of any new facilities, we will seek to secure significant interest from potential customers in order to ensure that our investments are supported by contracted base revenues.

Pursue Acquisitions

The bulk liquid storage and liquid feed supplement industry sectors remain highly fragmented, with numerous small and mid-sized companies operating in North America, Europe and Asia. We believe this market fragmentation provides us with significant opportunities for expansion. Our management maintains an active dialogue with numerous potential acquisition targets and frequently explores opportunities in the context of our strategic goals and financial return expectations. Our management team has significant experience acquiring and integrating new businesses in order to increase the size and scope of our operations, and intends to continue to pursue this strategy as new opportunities become available in the future. Our management has a history of successfully identifying both financially and strategically attractive targets. When evaluating potential acquisitions, our management team intends to focus on those opportunities which will increase storage or production capacity in key markets, enhance our product and service offering, or provide entry into strategically attractive geographies.

Develop New Products and Services

We are committed to developing a range of products and services that will further embed our business as a critical component in our customers’ supply chain, resulting in revenue and earnings growth opportunities for the Company.

In bulk liquid storage, we intend to offer new or expanded services to our customers through our high quality infrastructure and state-of-the-art technical competencies. In 2009, we brought a custom base oil blending

11

Table of Contents

system online at our Houston facility which was specifically designed for optimal market flexibility for one of our customers and resulted in an attractive 50 month payback period to us. Our base oil blending system provided this customer with a long-term technical solution to meet the demands of their ever changing market.

In addition, we intend to pursue opportunities to expand our product offering to accommodate storage of complementary agricultural and industrial liquids. For example, we are currently exploring the development of a major new hub for handling methanol at one of our facilities. Methanol is an important supply item for the bio-diesel industry, as well as for an array of other industrial manufacturing processes.

In our liquid feed supplements business, we see potential to further invest in the development and manufacture of innovative, nutritionally-enhanced livestock feed supplements by leveraging our strong research and development capabilities. Our strategy is to find products that incorporate and/or expand on newly developed technologies or raw materials that have not been previously utilized. These products typically provide the most significant potential for profit and have the most potential to differentiate us in the marketplace. For example, we are currently exploring new product opportunities related to emerging liquid by-products from the biofuel industry, edible packaging alternatives, new applications for calcium hydroxide (a reactive ingredient used to harden block products and in the manufacture of some of our suspension products), and low-cost suspension products for the beef industry. Suspension products are liquid feed supplements that contain insoluble ingredients (e.g. limestone or potassium chloride).

Expand into Complementary Businesses

We believe our international network of facilities, extensive management experience, and core operating capabilities in the manufacturing, storage, and distribution of liquid products creates numerous opportunities for us to expand into complementary businesses. For example, our management sees significant potential in exploring the North American liquid fertilizer market as an expansion opportunity. Distribution of traditional fertilizer products reflects competitive dynamics and infrastructure requirements similar to our existing liquid feed supplements business, and we have significant experience in storing and handling these products through our bulk liquid storage business.

Pursue International Joint Venture and Royalty Agreements

We intend to actively explore joint venture and strategic alliance opportunities with global business partners to expand our business interests and geographic network. In bulk liquid storage, we are exploring various strategic alliance agreements with biodiesel manufacturing companies that would utilize our tank capacity for both raw materials and finished product storage. Such partnerships would position us as a critical component of our partners’ supply chains and have the potential to create lasting commercial relationships. For example, in Houston, the construction of a biodiesel production plant by a third party on land leased by us has been completed. As a result of this arrangement, our Houston tank capacity will be utilized for all inbound and outbound liquids under contract for this third party.

In liquid feed supplements, we (including our predecessor) have expanded our geographic market in Australia through the Champion Liquid Feeds Pty Ltd. joint venture. Prior to establishing the joint venture in 2001, we had no exposure to Australia, and our joint venture partner, Australia’s largest manufacturer and distributor of dry animal feed products, had little exposure to the liquid feed supplement market. By combining our and their respective areas of expertise, we have created a successful liquid feed manufacturer that is poised for significant future growth in this market. In addition, there are significant opportunities to leverage our technological leadership in liquid feed supplements by establishing royalty agreements with complementary organizations for the manufacturing and distribution of our products worldwide.

12

Table of Contents

Leverage Relationship with the ED&F Man Group

Our strong ongoing relationship with the ED&F Man group provides significant opportunities for future growth. In the bulk liquid storage business, it is anticipated that the continued long-term growth and diversification of the ED&F Man group’s global trading of liquid agricultural products is likely to provide further opportunities to deploy and expand our storage footprint and service opportunities. For example, within the last several years, the ED&F Man group has significantly increased its trading activities in bio-diesel and tropical oils (e.g., palm and coconut oils). Currently, the global market for bio-diesel as a fuel substitute has declined due to changes in U.S. government policy; however, we anticipate a global expansion of tropical oils, which will provide additional growth opportunities. Should the U.S. government policy change, whereby the dollar per gallon blended tax credit is reinstated, we expect there would be a positive impact on this segment of the industry. Our liquid feed supplements business has the potential to benefit from the supply of new raw materials by the ED&F Man group for use in the production of new liquid feed supplement products. We will also be in the unique position to leverage the ED&F Man group’s global business network and strong agricultural commodity operating experience as we expand into new geographies and complementary businesses. Our Australian investment in Champion Liquid Feeds Pty Ltd. was a direct result of the ED&F Man group’s relationships in that region.

Forward-Looking Statements

This section regarding our growth strategies contains numerous forward-looking statements, including our statements about future growth in demand for various products and services and about our plans, intentions, or hopes to increase storage and production volumes, open new facilities, expand terminal capacity through target infill development, market products in developing nations, expand our feedlot liquid supplement business, pursue acquisitions, invest in the development of and develop new products and services, explore the North American fertilizer market, and explore joint venture and strategic alliance opportunities. There are a number of important factors that could cause actual results to differ materially from our forward-looking statements, including the factors discussed at length in the “Risk Factors” section, Item 1A of this Form 10-K.

Broad Geographic Footprint and Strategic Location of Facilities

We operate an extensive global network of 62 operating facilities providing 348 million gallons of total bulk liquid storage capacity and approximately 1.6 million tons of annual liquid feed supplements production. In our bulk liquid storage business, we operate 25 terminal locations globally, with a strong presence in the U.S. and Western Europe and an initial presence in Asia via our facility in Inchon, South Korea. Many of our storage facilities are located in highly strategic deep water port locations such as Houston, TX; Philadelphia, PA; Jacksonville, FL; Baltimore, MD; and Grays Harbor, WA in the U.S., as well as Amsterdam, Netherlands; Gydnia, Poland; and Liverpool, U.K. in Europe. In our liquid feed supplements business, we operate 37 facilities strategically located throughout the U.S. and Western Canada, including three facilities in Australia through our 50% interest in Champion.

Additionally, we benefit from our broad geographic footprint and the extensive experience of our management. We operate in a variety of regional, national and international markets. In our bulk liquid storage business, we offer our customers a truly global storage solution with a high level of expertise across multiple markets. We provide tailored services for customers initially commencing operations or requiring local infrastructure in specific markets. Our access to extensive high quality storage capacity in critical deep water port locations is a differentiating factor in the marketplace. The strategic locations of our bulk liquid storage terminals and the barriers to entry of additional competitors at these locations constitute key strengths of our bulk liquid storage business.

In liquid feed supplements, we provide the broadest geographic coverage of any North American liquid feed supplements manufacturer, and are the only producer capable of supplying all lower 48 U.S. states, as well

13

Table of Contents

as five provinces in Canada and parts of northern Mexico. Moreover, our seven deep-water port locations and a key alliance at the Melbourne, Australia port gives us a competitive advantage over other liquid feed supplements companies in our markets by allowing us to more readily obtain feed ingredients economically. By these means we are able to leverage our global network and extensive market insights to explore expansion opportunities in complementary markets.

Differentiated Product and Service Offering

We provide a differentiated service to manufacturers, bulk liquid traders, and those corporations looking to minimize cost and maximize flexibility of service in both the bulk liquid storage and liquid feed supplement markets.

In our bulk liquid storage business, we are one of the few service providers capable of providing a truly global service across a broad range of agricultural and industrial liquids. We offer numerous tailored services such as heating, blending, testing and transloading (the transfer of products from one transportation vehicle, such as a rail car or a ship, to a truck) and have customized our service contracts to meet specific customer requirements. Our bulk liquid storage business is nimble, responsive, and able to meet the changing storage- related needs of our customers.

We offer a broad range of liquid feed supplements, ranging from simple molasses-based blends and mill products to highly complex suspension products. Further, our proprietary manufacturing processes allow us to customize our feed products to meet specific customer nutritional requirements and to respond to changing availability of raw materials.

The range of our product and service offerings and our attention to a high level of customer service enables us to differentiate ourselves in the marketplace and to maintain our leading market positions in the bulk liquid storage and liquid feed supplements sectors. Our business approach reinforces the strategic nature of our relationships with customers, who we believe generally view us more as a long-term partner rather than merely as an industrial supplier.

Strong Relationships with Blue-Chip Customers

We have developed long-standing relationships with numerous well-established global customers, many of whom have been doing business with us (or our predecessor) for more than 10 years. Our ability to attract and retain these blue-chip customers is the direct result of our differentiated product and unparalleled customer service. Ongoing strategic customer relationships facilitate the achievement of long-term contracts, which in turn provide for more stable revenue and income streams.

To reduce the risk of unused capacity in our facilities, we build upon strategic relationships by tailoring new products and services to meet specific customer needs. For example, commissioning of the new 13.4 million gallon facility in Gray’s Harbor, WA in 2009 was the direct response to a specific customer need for bulk liquid storage in the Pacific Northwest. In this case, our staff worked closely with the customer to determine size, location and functionality of the new facility to meet the customer’s specifications. As a result, we were able to secure a long-term commitment for all of the new storage capacity at the new facility before beginning construction. Establishment of this site allows us to gain access to a key, previously untapped, North American market, thereby providing us with the ability to expand our storage capacity in this important market in the future.

In the liquid feed supplements business, quality customers and strategic alliances with industry leaders are key elements contributing to our growth. For example, we (through our predecessor) were able to secure the role of exclusive provider of liquid suspension and molasses blended products to a major US based cattle feed operation in 1995. This relationship has grown over the years and is now expected to lead to additional opportunities for growth in this market.

14

Table of Contents

Strategic Relationship with the ED&F Man Group

Our acquisition of the bulk liquid storage and liquid feed supplements businesses provided independence in the market and the capital resources necessary to optimize future growth, while maintaining the benefits of a close strategic relationship with the ED&F Man group. To this end, we and the ED&F Man group have entered into agreements that establish us as the ED&F Man group’s preferred supplier of bulk liquid storage services globally and establish the ED&F Man group as our preferred supplier of cane molasses for our liquid feed supplements business.

High-Quality and Experienced Management Team

We have a highly experienced senior management team comprised of Peter Harding as Chief Executive Officer, Thomas Masilla as Chief Financial Officer, Wayne N. Driggers as Chief Operating Officer, Scott MacKenzie as President of our bulk liquid storage business, and Steve Boehmer as President of our liquid feed supplements business. Mr. Harding has worked in agri-business for 35 years, and Messrs. Driggers, MacKenzie and Boehmer have 30, 20, and 34 years of relevant industry experience, respectively. Mr. Masilla possesses over 35 years of executive and financial management experience in publicly traded entities.

We also benefit from the commitment of a talented pool of middle managers who possess strong operational and market experience across our various functions and geographies. In particular, we believe one of the important strengths of our Company is our health, safety, environmental, and quality team, which provides continual reviews for policy and regulatory compliance, minimizes exposure to loss, ensures the highest quality of service to our customers, and maintains the life of our facilities. In keeping with our strategy for future growth, our management team possess the skill and experience of having designed and executed numerous acquisitions, new site openings, expansions of facilities, and new product introductions.

Overview

Our bulk liquid storage business operates a network of facilities located in North America, Western Europe, and Asia, providing storage and related services to manufacturers and purchasers of bulk liquid products. We coordinate closely with our customers’ technical services and product handling experts in designing and adapting the customized product handling systems required for each customer’s specific product. By this means, our facilities become critical links in the distribution chains of our customers. Our customers represent a diverse group of multi-national, national, and regional corporations. Our value-added services are customer specific and include transloading of bulk liquids as well as acting as regional distribution centers for our customers on an entirely outsourced basis. Underpinning all of our services is our foremost objective, which is to differentiate our service quality by achieving the highest level of customer satisfaction. Our proprietary systems, rapid execution, and superior commodity management expertise has led to many long-term customer relationships.

During the last three fiscal years (and during the approximate 7 month period from November 1, 2008 to May 28, 2009) our bulk liquid storage business (or its predecessor) had the following net revenues (in thousands) from external customers, operating income, and total assets:

| Predecessor | ||||||||||||

| Fiscal Year Ended December 31, 2009(1) |

November 1, 2008 through May 28, 2009 |

Fiscal Year Ended October 31, 2008 |

Fiscal Year Ended October 31, 2007 | |||||||||

| Net Revenues |

$ | 45,134 | $ | 40,715 | $ | 79,754 | $ | 69,630 | ||||

| Operating Income |

$ | 15,086 | $ | 12,722 | $ | 25,879 | $ | 18,459 | ||||

| Total Assets |

$ | 353,083 | $ | 115,680 | $ | 108,326 | ||||||

| (1) | Year ended December 31, 2009 includes only 217 days of acquired business operations. |

15

Table of Contents

Services—by Product Stored

We serve many diverse markets, focusing on the provision of bulk liquid storage services for a wide range of products that are best described by using eight primary product groupings, set out below. Our terminals handle a broad spectrum of specialty products through a number of features, including rail capacity, dedicated pipelines, on-scale, top-loading of trucks, heating capacity, and multiple tank sizes, including small and medium capacity tanks. This diverse product portfolio helps to minimize our exposure to significant customer risk. We are also active in businesses related to bulk liquid storage, such as direct transloading (primarily from railcars to trucks), blending, and dilutions.

The product groups stored by our bulk liquid storage business worldwide are further described as follows:

| • | Molasses and Liquid Animal Feed Products. Historically, storage of molasses for the liquid feed supplements and yeast production industries has comprised a major single component of our bulk liquid storage business. We are well positioned in this product category, given our significant experience handling highly viscous liquids and our specialized infrastructure that includes large, positive displacement pumps and large diameter pipelines. Due to our ongoing, long-term relationship with the ED&F Man group, these products are expected to remain a key part of our storage portfolio. |

| • | Vegetable Oils, Tallows, and Greases. For decades, we or our predecessor have handled customer requirements for storage and transportation of vegetable oils, tallows and greases. These products are utilized in the food, biofuels, industrial soaps, detergent, and biochemical industries and require specialized services such as heated tankage and kosher certification. |

| • | Lignin Sulphonate, Calcium Chloride, and Liquid Fertilizers. Our experience with non-hazardous bulk solutions such as calcium chloride, urea ammonium nitrate, and lignin sulphonate is extensive. These products are tied to basic industries such as agriculture and paper production. Because these products are corrosive, specialized tank linings are required to maintain quality control and safe handling. |

| • | Petroleum, Petro-Chemicals, Waxes, and Petroleum Oil. Our position in this category is primarily concentrated in storing niche products, such as paraffin waxes and lubrication oils, derived from the petroleum refining process for candle, coatings and automotive markets, in addition to certain other heavy industries. The heat and viscosity requirements of these products lend themselves to our high value-added service model. Generally, we do not handle petroleum fuels, gasoline, or traditional petro-chemicals (e.g. benzene or toluene). |

| • | Chemicals. Since the mid 1990s, we or our predecessor have expanded our storage services into a more diverse range of chemical products, for producers and distributors serving manufacturing and industrial markets. Subsequent improvements in industry-specific expertise have provided us with the experience necessary to handle these products. We conduct a thorough risk analysis when evaluating all new chemical opportunities to ensure minimal safety or environmental risk. |

| • | Caustics. Chloralkali products, including sodium and potassium hydroxide, are stored on behalf of industrial use producers and distributors and comprised the first product for which our predecessor commenced storage for external customers in the 1970s. Specialized heated tank linings and piping systems are utilized to protect product quality and ensure efficient handling of products for, among others, municipalities and the sanitation and paper production industries. |

| • | Methyl Esters (Bio-diesel). We or our predecessor have been handling methyl esters since 2002 on behalf of producers and distributors. Our employees are familiar with the unique properties of methyl esters and systems that exist to ensure that our quality control and safe handling standards are maintained. These systems include standardized handling processes and the use of specialized sealants to prevent moisture intrusion. The ED&F Man group’s trading of bio-fuels provides a base volume for us and is expected to be an opportunity for growth. |

16

Table of Contents

| • | Asphalts. We handle asphalt products used in roadways and in roofing applications. At our Baltimore, MD and St. Paul, MN facilities, special systems have been constructed to handle asphalts. We have boilers, hot oil systems, tank heating coils, and insulated tanks and pipelines which are necessary to keep these products flowing properly through our facilities. |

For each of the last three fiscal years (and for the approximate 7-month period from November 1, 2008 to May 28, 2009), no single class of similar services (i.e., services for the same product group) accounted for 10% or more of our total overall consolidated net revenue.

Services—by Activity Performed

We provide our customers with a broad range of value-added services across all stages of the bulk liquid storage value chain:

| Receipt |

Storage |

Handling |

Distribution |

Transloading |

Other | |||||

| Custom facilities Lab diagnostics | Carbon scrubbing Dry air treatment Foam systems Gauging Hot oil systems Lined/stainless tanks Nitrogen treatment |

Additive injection Custom blending Direct transfer Drumming Filtration Heating Packaging Piggable lines Recirculation Dilutions |

Logistics planning Rail scaling Rail services |

Rail to truck Truck to rail Ship to rail |

Audit Documentation FEMAS certification Food grading GMP certification ISO certification Marketing |

We work closely with our customers to design service packages and contracts that meet their specific storage and handling requirements. This process results in a varying degree of complexity across customer relationships and generates long-term, collaborative relationships. For example, some customers require only basic storage services such as tank storage, product receipt and delivery services, and occasional transloading. Others have more complex requirements, including the provision of temperature regulation, blending, or diagnostic testing services. At the greatest degree of complexity, we are able to operate regional distribution centers, functioning on an entirely outsourced basis and providing a full complement of value-added services, such as logistics planning and product marketing. The breadth of services and flexibility we provide to customers differentiates us in the marketplace and provides management with a distinct advantage when competing for new business.

Customers

Our customer-focused approach results in a number of long-standing relationships with major customers. No single customer, or group of customers under common control or that are affiliates of each other, accounts for more than 10% of our consolidated total revenues. The ED&F Man group accounts for 19% of the revenues of our bulk liquid storage business, which to that extent is dependent on the ED&F Man group, and the loss of the ED&F Man group as a customer would have a material adverse effect on our bulk liquid storage business. As discussed in more detail below in the subsection entitled “Our Relationship with the ED&F Man Group,” we have a long-term contractual relationship as a preferred supplier of bulk liquid storage to the ED&F Man group. Our bulk liquid storage business is not dependent on any other single or few customers, the loss of which would have a material adverse effect on the business.

A large proportion of our bulk liquid storage business’ sales are derived from highly-regarded multi-national corporations, many of which are included in the Forbes Global 2000 list of largest companies. Our relationships

17

Table of Contents

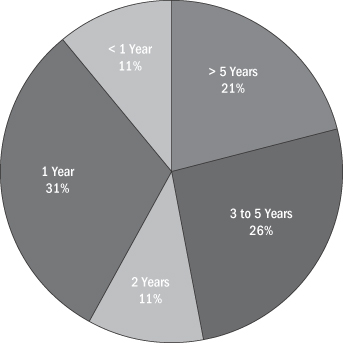

with these customers have resulted in longer term contracts. Approximately 58% of our bulk liquid storage contracts are two years or more in length and approximately 47% are three years or longer as of December 31, 2009. This is set out below in more detail:

Length of Storage Contracts—Terminals Worldwide as of December 31, 2009

Seasonality

Our bulk liquid storage business generally is not seasonal, but it is to a degree affected by the economy. Utilization of our terminal facilities is dependent in large part on the level of demand for customer products stored in our terminals in the markets served by these facilities. Demand for our terminal services generally increase or decrease with the demand for the stored products. For example, the demand for molasses generally is higher during winter and lower during summer. Despite this seasonality, the overall seasonal impact on the volume of product throughput at our terminals is not material.

Demand for most of the customer products we store tends to increase or decrease with the relative strength of the economy. The recent contraction in the global financial and credit markets has adversely affected the liquidity and the credit available to many enterprises and accordingly has lowered the demand for many products.

Working Capital Practices

Our bulk liquid storage business requires us to use working capital for maintenance, repairs, and upgrades to our storage facilities, as well as for personnel costs prior to receiving payments from customers. Our working capital requirements will vary with the timing of maintenance, repair, and upgrade projects throughout the year.

We normally invoice our customers for liquid bulk storage on the first of each month with repayment terms of 30 days. The average days outstanding for 2009 were approximately 28 days.

18

Table of Contents

Government Contracting

Many of our storage terminal facilities are located on land leased from federal, foreign, state or local governments, frequently from a local port authority. We have had excellent relationships with the port authorities over the years. We are aware, however, that at our Avonmouth terminal, the Port of Bristol is evaluating the market conditions for building a new container terminal. The proposed project scope of this container terminal would impact the continuance of our lease at our Avonmouth terminal. At this time, no decision has been made by the Port of Bristol.

Competition

Competitive Conditions

Our bulk liquid storage business competes in international, national, regional, and local markets, throughout the United States, western Canada, northern Mexico, portions of Western Europe, and Korea. The competitive environment in which we operate, the number of competitors, and our market position varies across different markets.

In the international market, competitors include multi-national providers such as NuStar Energy L.P. and Royal Vopak N.V. In the United States, at a national level, beyond NuStar, other major competitors include Kinder Morgan Energy Partners, International-Matex Tank Terminals (50% owned by Macquarie Infrastructure Company LLC), and TransMontaigne. At locations in Europe, such as Denmark and Poland, competition also derives from smaller independent storage businesses and former state-owned installations.

The principal competition for each of our facilities comes from other third-party bulk liquid storage facilities located in the same regional or local market. In regional and local markets, we face competition from independent storage businesses operating in a number of markets served by us, such as Simon Storage Ltd. (owned by Interpipeline Fund) in the United Kingdom. In some regional and local markets, such as St. Paul, MN, Jacksonville, FL, and Toledo, OH, our facilities represent a significant proportion of available bulk liquid storage capacity. In other markets, such as Houston, TX, our facilities represent only a small proportion of available bulk liquid storage capacity and have numerous competitors with facilities of similar or larger size and with similar capabilities.

The breadth of service we provide also results in customer offerings that compete directly with LBC Holdings LLC (owned by Challenger Infrastructure Fund), Royal Vopak N.V., and Stolt-Nielsen S.A. for more tailored, complex, and value-added services.

Across product groups, our bulk liquid storage business competes with companies having a primary focus in the storage of specific products, such as hydrocarbons and derivatives, as well as with businesses providing a more broad range of services.

We also compete with other companies involved in the bulk liquid storage business for acquisition and expansion opportunities.

Principal Methods of Competition

Independent terminal owners principally compete on the basis of the location and versatility of terminals, service, and price.

A favorably located terminal will have access to various cost-effective transportation modes both to and from the terminal. Transportation modes typically include waterways, railroads, and roadways.

19

Table of Contents

Terminal versatility is a function of the operator’s ability to offer complex handling requirements for diverse products. The services typically provided by the terminal include, among other things, the safe storage of the product at specified temperature, moisture, and other conditions, as well as receipt at and delivery from the terminal, all of which must be in compliance with applicable environmental regulations.

A terminal operator’s ability to obtain attractive pricing is often dependent on the quality, versatility, and reputation of the facilities owned by the operator. Although many products require modest terminal modification, operators with versatile storage capabilities typically require less modification prior to usage, ultimately making the storage cost to the customer more attractive.

Factors Affecting Competitive Position

Positive factors pertaining to our competitive position are discussed at length above in the subsection entitled “Competitive Strengths.” Negative factors pertaining to our competitive position include the fact that some of our competitors are larger than we are, have greater financial resources and lower costs of capital and control more storage capacity than we do, and accordingly sometimes are able to offer a better price or greater storage capacity. There are also occasions where a competitor has a facility in a location that enables it to serve a particular customer’s need more economically than our nearest facility. These negative factors are further described in the “Risk Factors” section of this Form 10-K.

Liquid Feed Supplements Business

Overview

Through our 37 strategically located facilities in North America, western Canada, and eastern Australia, we provide liquid feed supplements to the lower 48 U.S. states, five Canadian provinces, northern Mexico, and Australia. By using formulation processes that are tailored specifically to the needs of customers, we blend molasses and essential nutrients to form feed rations that help to maximize the genetic potential of livestock. Typically, these supplements contain concentrated forms of protein, energy, minerals, and vitamins, which normally comprise 5-10% of an animal’s daily diet. Beef cattle, dairy cattle, and horses consume the majority of our liquid feed supplements. We invest in research into new products and manufacturing processes in order to maintain the strength of our competitive position. To date, we have capitalized on the value of our intellectual property through a joint venture in Australia, and we are currently analyzing similar opportunities in New Zealand and Mexico.

In the United States, the liquid feed supplements industry dates back to the first report of a simple molasses-urea mix being fed to cattle in 1943, with the first commercial liquid supplement being introduced in 1951. Today, the industry has expanded into a dynamic, growing market, with new products blended into a wide variety of liquids and other ingredients to meet the needs of multiple livestock industries. Our manufacturing and distribution locations allow us to provide nutritional liquid feed supplements to the majority of the U.S. livestock markets. In addition, eight of our facilities are positioned at deep water port locations, allowing the receipt of off-shore ingredients such as molasses and condensed molasses solubles. These deep water port terminals provide a strategic barrier to entry into the North American liquid feed supplements business. The balance of our manufacturing locations are either strategically located on navigable inland river systems or have direct railroad access.

20

Table of Contents

During the last three fiscal years (and during the approximate 7 month period from November 1, 2008 to May 28, 2009), our liquid feed supplements business (or its predecessor) had the following net revenues (in thousands) from external customers, operating income, and total assets:

| Predecessor | ||||||||||||

| Fiscal Year ended December 31, 2009(1) |

November 1, 2008 through May 28, 2009 |

Fiscal Year ended October 31, 2008 |

Fiscal Year ended October 31, 2007 | |||||||||

| Net Revenues |

$ | 143,653 | $ | 171,304 | $ | 290,569 | $ | 222,871 | ||||

| Operating Income |

$ | 8,918 | $ | 6,784 | $ | 6,297 | $ | 3,991 | ||||

| Total Assets |

$ | 140,784 | $ | 96,064 | $ | 79,228 | ||||||

| (1) | Year ended December 31, 2009 includes only 217 days of acquired business operations. |

Products

Our finished products provide supplemental nutrients that allow livestock to perform to their maximum genetic potential. We use specialized manufacturing of complex formulations of several raw basic ingredients, including proteins, minerals, and vitamins, to produce complex liquid and block supplements for sale to livestock feed operators, dry feed mills, or distributors. We also produce less complex products that are utilized as an ingredient in livestock feeds specifically to enhance the appearance, preserve the product, improve the palatability, or act as a binding agent for other dry feed ingredients. Specialized least-cost formulation programs allow us to maximize margins while providing the best performing product for the customer.

Our product classes and their more specific subcategories are as follows:

Complex Liquid Feed Protein Supplements, Suspensions, and Mill Products

| • | Liquid Protein Supplements. Liquid protein supplements are typically either a “free choice” in pastures, or part of a “complete ration” for either dairy or beef animals. Free choice applications normally involve the use of a “lick wheel” feeder in pastures, where the animals are consuming approximately 90-95% of their daily diet of dormant native grasses/improved pastures or preserved forages (hay). These pastures are normally low in nutrients such as protein, energy, phosphors, and other minerals. Accordingly, the nutrient-dense liquid feed supplements provide a way to balance the nutritional requirements of livestock, allowing them to reproduce or gain weight at an optimum rate. In applications where liquid protein supplements are part of a complete ration, the inclusion rate of the supplement depends on the nutrient profile of the other dry feed ingredients. Nutrient profiles of the supplement can be adjusted to balance the nutrients of the dry feed ingredients. Livestock that consume the complete ration form of liquid feed supplements are normally held in confinement rather than in open pasture. Liquid protein supplements are utilized in virtually all regions of the United States and western Canada. They are marketed through both distributor and dealer networks as well as sold directly from us to the end users. |

| • | Liquid Suspension Products. Liquid suspension products are the most complex liquid feed supplements that we manufacture. Thixotropic technology allows insoluble ingredients such as calcium carbonate, potassium chloride, feathermeal, and salt to be suspended in a liquid supplement that can “flow.” These supplements provide a wide range of minerals, proteins, and medications, which are mainly utilized in confined beef feeding operations and large dairies. The largest concentration of customers of our liquid suspension products is in the Texas panhandle and northern California. In Texas, such supplements are sold directly to the end user, whereas in northern California they are marketed through large distributors. |

| • | Mill Products. Mill products are specialized molasses-based products sold to dry feed milling companies and mixed with other dry feed ingredients. These specialized products are used in two primary types of applications in the dry feed milling industry: texturized horse feed and pelleted products fed to different classes of livestock. Our “E-Z Glo” product is a mill product fortified with |

21

Table of Contents

| high-quality vegetable oil, minerals, and preservatives that is included in texturized horse feed as 5-15% of overall product content. Our “Pellet Partner” product is a mill product containing liquid lignin, a by-product from the timber industry, that is used to bind dry feed ingredients to form pellets or cubes. Mill products are utilized in dry feed mills throughout the United States. They are mainly sold direct to the feed mills. |

Molasses and Molasses Blends

| • | Molasses. Molasses is a standardized 79.5 brix product that is sold predominantly to the commercial dry feed industry. Standardized molasses is typically used for a coating on textured feeds and dry feed products. |

| • | Blends. Blends are the simplest form of value-added products. Typically blends include molasses blended with one or more of the following ingredients: corn steep liquor, condensed molasses solubles, whey permeate, distillers’ solubles, lignin sulphonate, and/or glycerine. Blends are normally utilized in complete feed rations to reduce the dust and improve the palatability of the ration. Virtually all blends are fed in confined feeding operations and are incorporated into livestock rations that do not use a protein supplement or a suspension. We use distribution and direct supply formats for the sale of blends. |

Other

| • | Blocks/Tubs. Blocks, or tubs as they are sometimes referred to, are a solid feed supplement that is fed, unmixed with any other food, as a free choice protein supplement to cattle on pasture or improved pastures. The primary package size is 200 lbs. and is marketed through a series of distributors and local farm stores. The majority of our blocks are toll manufactured for other feed companies and sold through their respective labels and fed primarily to beef cattle, dairy cattle, and horses, with some products sold for sheep, goats, and wild game. |

| • | Dried Products. Dried products results from mixing ground soybean hulls and sunflower hulls with cane molasses and drying the mix through a rotating drum drier. Dried products are typically used as either a sweetener to dry feed rations, or as a binding agent for other dry feed ingredients in the manufacture of solid feed supplements known as “blocks.” Target customers include small confined feeding operators that use it as a sweetener, and specialty small block manufacturers that use it as a binder and sweetener. All dried product marketing to confined feeding operators is done through a series of distributors. The majority of our dried products are consumed by beef and dairy cattle, with little consumed by horses, sheep, goats, swine, or poultry. |

| • | Other Ingredients. This category is comprised of liquid whey permeate, renewable fuel by-products, and other liquid ingredients sold typically direct to customers. |

For each of the last three fiscal years (and for the approximate 7-month period from November 1, 2008 to May 28, 2009), the percentage of consolidated net revenues contributed by each class of similar products that accounted for 10% or more of our overall consolidated net revenue in any of the last three fiscal years was as follows:

| Predecessor | ||||||||||||

| Fiscal Year ended December 31, 2009(1) |

November 1, 2008 through May 28, 2009 |

Fiscal Year ended October 31, 2008 |

Fiscal Year ended October 31, 2007 |

|||||||||

| Complex Liquid Feed Protein Supplements, Suspensions, and Mill Products |

43 | % | 44 | % | 45 | % | 48 | % | ||||

| Molasses and Molasses Blends |

21 | % | 22 | % | 20 | % | 19 | % | ||||

| Other |

12 | % | 15 | % | 13 | % | 10 | % | ||||

| (1) | Year ended December 31, 2009 includes only 217 days of acquired business operations. |

22

Table of Contents

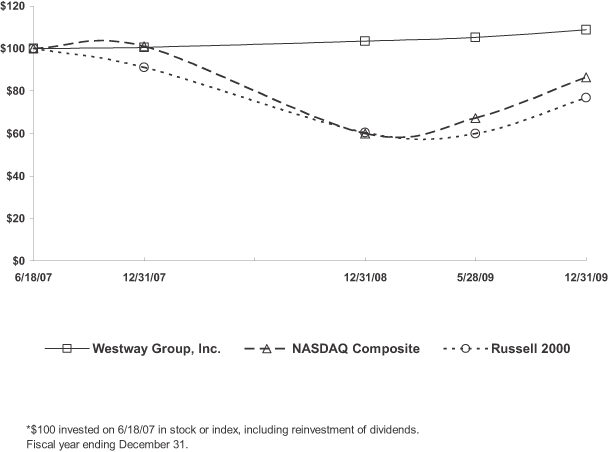

Champion Liquid Feeds Pty Ltd