Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION - Black Sea Metals Inc. | ex31_2.htm |

| EX-31.1 - CERTIFICATION - Black Sea Metals Inc. | ex31_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

x |

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended November 30, 2009 |

||

|

OR |

||

|

o |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 000-51563

TEXADA VENTURES INC.

(Exact Name of Registrant as Specified in its Charter)

|

Nevada |

|

98-0431245 |

|

(State of other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

11616 E. Montgomery Drive, Suite #54 |

|

|

|

Spokane Valley, Washington |

|

99206 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

(509) 301-6635

(Registrant’s Telephone Number, including Area Code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT: None

|

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: |

Common Stock, par value $0.001 |

| (Tile of Class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o Nox

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o Nox

Indicate by checkmark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by checkmark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to the Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “Accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act (Check one):

|

|

Large Accelerated Filer o |

Accelerated Filer o |

Non-Accelerated Filer o |

Smaller Reporting Company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o Nox

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $1,844,000 as of May 31, 2009

The number of shares of the Registrant’s Common Stock outstanding as of March 15, 2010 was 24,293,334.

Documents Incorporated by Reference: None.

Texada Ventures Inc.

FORM 10-K

November 30, 2009

TABLE OF CONTENTS

|

2 |

|

14 |

|

38 |

|

44 |

|

45 |

Certain statements contained in this Annual Report on Form 10-K constitute “forward-looking statements”. These statements, identified by words such as “plan”, “anticipate”, “believe”, “estimate”, “should,” “expect” and similar expressions include our expectations and objectives regarding our future financial position, operating results and business strategy. These statements reflect the current views of management with respect to future events and are subject to risks, uncertainties and other factors that may cause our actual results, performance or achievements, or industry results, to be materially different from those described in the forward-looking statements. Information concerning the interpretation of drill results and mineral resource estimates also may be deemed to be forward-looking statements, as such information constitutes a prediction of what mineralization might be found to be present if and when a project is actually developed. You are cautioned that any such forward-looking statements are not guarantees and may involve risks and uncertainties. Our actual results may differ materially from those in the forward-looking statements due to risks facing us or due to actual facts differing from the assumptions underlying our predictions. Some of these risks and assumptions include:

|

|

• |

general economic and business conditions, including changes in interest rates, fluctuations in the prices for base metals, fluctuations in prices for securities in the resource sector, demand for base metals and other economic and business conditions; |

|

|

• |

natural phenomena or disasters that may affect completion of drill programs, exploration work, completion of feasibility studies or development, if warranted; |

|

|

• |

actions by government authorities, including changes in government regulation, permitting requirements or environmental legislation; |

|

|

• |

the Company’s ability to raise sufficient financing to complete its planned exploration work on its properties and to place its properties into development, if warranted, and to continue as a going concern; |

|

|

• |

the Company’s ability to complete the proposed transaction with Diamond Industry Associates Ltd. under the Term Sheet effective as of February 15, 2010; |

|

|

• |

the Company’s ability to complete transactions, attract additional capital and continue as a going concern; |

|

|

• |

future decisions by management in response to changing conditions, and |

|

|

• |

misjudgments, inaccurate assumptions or changes in conditions related to forward-looking statements. |

Certain risks and uncertainties include those set forth under the caption “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in this Form 10-K. We advise you to carefully review the reports and documents we file from time to time with the Securities and Exchange Commission (the “SEC”), particularly our quarterly reports on Form 10-Q and our current reports on Form 8-K.

We advise you that these cautionary remarks expressly qualify in their entirety all forward-looking statements attributable to us or persons acting on our behalf. The Company assumes no obligation to update its forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting such statements. You should not place undue reliance on such forward-looking statements.

As used in this Annual Report, the terms “we”, “us”, “our”, “Texada” and the “Company” mean Texada Ventures Inc., unless otherwise indicated. All dollar amounts in this Annual Report are expressed in U.S. dollars unless otherwise indicated.

Overview

Texada Ventures Inc. (the “Company”) is engaged in the business of acquisition and exploration of mineral and resource properties. We were incorporated on October 17, 2001 under the laws of the State of Nevada. Our principal office is located at 11616 E. Montgomery Drive, Suite 54, Spokane Valley, WA 99206. Our phone number is 509-301-6635. Our facsimile number is 509-924-2524.

We have acquired a 100% undivided interest in a group of mineral claims located in the Wheaton River District in the Yukon Territory, Canada that we refer to as the Peek Claims. We have not earned any revenues to date. Our plan of operation is to continue to carry out exploration work on these claims in order to ascertain whether they possess commercially exploitable mineral deposits. We are presently in the exploration stage of our business and we can provide no assurance that commercially viable mineral deposits exist on our claims or that we will discover commercially exploitable levels of mineral resources on our properties, or if such deposits are discovered, that we will enter into further substantial exploration programs. We will not be able to determine whether or not our mineral claims contain a commercially exploitable mineral deposit, or reserve, until appropriate exploratory work is done and an economic evaluation based on that work concludes economic viability.

We generally conduct our business through verbal agreements with consultants and arms-length third parties. Our verbal agreement with our geologist includes his reviewing all of the results from the exploratory work performed upon the site and making recommendations based on those results in exchange for payments equal to the usual and customary rates received by geologists performing similar consulting services.

As a result of our failure to generate substantial revenues since our inception, we have decided to review our initial business plan in order to evaluate the progress of our mining business. We have not attained profitable operations to date and are dependent upon obtaining financing to pursue our plan of operation. Following Dr. John Veltheer’s acquisition of 49% of our issued and outstanding shares and his appointment to the board of Texada in October 2006, we have decided to continue to develop our current mining business and to seek other business opportunities. In accordance with that decision, in September 2008, we appointed Ted R. Sharp as our President, Chief Executive Officer, Chief Financial Officer, Treasurer, Secretary and a member of our Board of Directors.

RECENT SIGNIFICANT CORPORATE DEVELOPMENTS

We have experienced the following significant corporate developments during our fiscal year ended November 30, 2009:

Term Sheet - REX:

On September 16, 2008, we signed a Term Sheet (the “Term Sheet”) that sets forth the principal terms upon which we proposed to enter into a definitive agreement (the “Definitive Agreement”) to acquire Royalty Exploration, LLC (“REX”) and commenced a concurrent financing of $40,000,000. REX had entered into an agreement to acquire substantially all of the assets of a business unit of a large research and development and manufacturing company engaged in the business of providing exploration and environmental surveys to resource companies for a purchase price of $40,000,000, of which $30,000,000 was due at closing and the balance was payable by issuing a promissory note. The Term Sheet was non-binding, except for customary binding provisions. The Term Sheet was subsequently amended on November 12, 2008 and March 9, 2009.

On August 25, 2009, we signed a Letter Agreement, among the Company and REX, which details the responsibilities of the parties going forward with respect to the transaction described in the Amended and Restated Term Sheet dated March 9, 2009. That transaction has not been consummated and the Term Sheet expired. The Letter Agreement identifies conditions under which expenses or a breakup fee would be reimbursed or paid by REX to the Company should REX be successful in consummating the anticipated transaction without our involvement.

The significant terms and disclosures of the Term Sheet, its subsequent amendments and the Letter Agreement were reported in Forms 8-K filed with the SEC on September 22, 2008, November 12, 2008, March 11, 2009 and September 1, 2009, respectively, which are herein incorporated by reference.

Term Sheet - DIA:

Subsequent to the end of fiscal 2009, on February 15, 2010 we entered into a Term Sheet with Diamond Industry Associates Ltd. (“DIA”) whereby we will acquire 100% of DIA’s issued and outstanding shares or alternatively the assets and contractual obligations of DIA. The acquisition will be subject to a definitive agreement and customary terms and conditions. In conjunction with the transaction, we plan to commence a private placement financing of up to $3 million.

DIA seeks to become a leading diamond producer in the Democratic Republic of the Congo (“DRC”), a historically rich diamond producing region of the world. DIA’s alluvial diamond concessions are located along 40km of the Mbujimayi River in the Kasai Oriental region of the DRC. The area has been subject to extensive artisanal prospecting since the 1920s. The concessions are just northeast of the Polygon, which is one of the richest diamond reserves in the world, estimated to contain a cluster of at least 12 kimberlites having produced 650 million carats of diamonds since 1917.

The geology in this region is dominated by the sediments of the Precambrian Mbuji-Mayi Formation, which locally comprise dolomites, sandstones and argillites, as well as doleritic volcanics. This formation was intruded by highly diamondiferous Bakwanga kimberlites during the Lower Cretaceous period. It was the subsequent erosion of these deposits that led to the rise of some of the largest high-grade alluvial diamond deposits in the world. The most economically important alluvial deposits (terraces) are Holocene in age, with the modern-day meandering Mbuji-Mayi river system cutting down into the valley floor of the Mbuji-Mayi Formation.

We are in the process of completing our due diligence and negotiating a definitive agreement with DIA. We cannot assure you that the DIA transaction will be completed. The significant terms and disclosures of the Term Sheet were reported in a Form 8-K filed with the SEC on February 23, 2010, which is herein incorporated by reference.

PLAN OF OPERATION

As a result of our failure to generate any revenues since our inception, we have not been satisfied with our initial business plan to this point. In September 2008, we appointed Ted R. Sharp as a member of our Board of Directors and as our President, Chief Executive Officer and Chief Financial Officer. We are presently reviewing the current state of our business in detail with consultants in order to evaluate the progress of our mining business. As a result of its change in strategic direction, we entered into the Term Sheet with REX described above, which subsequently expired, and then into the Term Sheet with DIA described above. We are currently evaluating financing options to complete the transaction with DIA but there can be no assurance that such financing will be available in acceptable terms, if at all.

Mineral Properties:

As described in previous filings, we have taken a phased approach to our exploration efforts on the Peek Claims, and have received a geological report on the results of Phase III of our program with further recommendations from our geological consultant of additional activities prior to engaging in Phase IV of our plan. In his report, our geologist recommended that, prior to proceeding with Phase IV, further geological engineering should be undertaken to define the exact source areas for the known and new vein float material. Our geologist recommended reserving a total of $10,000 for a two-stage delineation program prior to commencing Phase IV of our exploration program. We proceeded with our geologist’s recommendation and completed the first phase of the delineation program during the summer exploration season of 2006. A detailed, close-spaced, soil geochemical survey over the conductors using a plugger style overburden sampling drill was recommended to locate the bed rock source of the mineralization following completion of Phase I of the delineation program.

Our decision to proceed to Phase IV of our initial exploration program will be made based on factors such as other business opportunities, the final assay results and the recommendations of our geologist, the grades of any mineralization found, the size and extent of the mineralized zones, and the strength of metal prices in international markets.

Our expenditures toward the exploration of our mineral claims may not result in the discovery of mineral deposits. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. If the results of exploration do not reveal viable commercial mineralization, we may decide to abandon our claims and acquire new claims for new exploration. The acquisition of additional claims will be dependent upon our possessing sufficient capital resources at the time in order to purchase such claims. If no funding is available, we may be forced to abandon our operations. This assessment will include an assessment of our cash reserves after the completion of Phase III, the price of minerals and the market for financing of mineral exploration projects at the time of our assessment.

Corporate Acquisition:

In February 2010, we signed a Term Sheet with DIA, under which we would raise $3,000,000 and acquire all of the stock or assets of that company, subject to certain conditions. We are in the process of negotiating a definitive agreement, which we expect to enter into upon the successful completion of due diligence work by both parties to the transaction. As we move through the acquisition process, we will perform appropriate due diligence activities to more fully assure investors of the benefits of this strategic move. We cannot assure you that our capital raising efforts will be successful given the current state of the financial markets or that we can successfully complete the acquisition of DIA.

Planned Expenditures:

During the exploration stage, Ted R. Sharp, our President, Secretary, Treasurer, Chief Executive Officer and Chief Financial Officer, and Dr. Veltheer will only be devoting approximately twenty hours per week of their time to our business. We do not foresee this limited involvement as negatively impacting the Company over the next twelve months. All exploratory work on our mining properties, if any, is being performed by our geological consultant, Mr. Timmins, who contracts with appropriately experienced parties to complete work programs. However, if as a result of our acquisition efforts, the demands of our business require more business time of Mr. Sharp or Dr. Veltheer, such as raising additional capital or addressing unforeseen issues with regard to our exploration efforts, they are prepared to adjust their timetable to devote more time to our business.

If our acquisition of DIA is successful, we anticipate that we will require capital for the following over the next twelve months:

|

Category |

Planned Expenditures over the Next Twelve Months (US$) |

|

Acquisition Due Diligence |

$250,000 |

|

Professional Fees |

$150,000 |

|

General and Administrative Expenses |

$300,000 |

|

Mineral Exploration Expenses |

$2,300,000 |

|

TOTAL 12-MONTH BUDGET |

$3,000,000 |

The Company has issued four separate 6% convertible debentures with principal amounts totaling $585,000 which were due and payable on December 31, 2008. Each of these convertible debentures has been extended to December 31, 2010. Interest is payable at the option of the Company in cash or shares. As at November 30, 2009, the Company had not made any interest payments and pursuant to the debentures has accrued default interest of 8% since the quarter ended May 31, 2008. Interest payable has accumulated to a total of $101,827. The principal and accrued interest on the debentures may be converted at any time into shares of the Company’s common stock at a price of $0.25 per share, at the option of the holder. As part of the financing arrangements required to fund and close the DIA transaction, the Company will be required to negotiate with holders of the convertible debentures to convert the debentures and accrued interest into common stock.

In the event that we are unsuccessful in our efforts to fund the DIA acquisition, we will not have cash sufficient to satisfy the debentures in cash. We estimate that we would require a minimum of $1.5 million to fund payment of our current liabilities. Absent such financing, we may negotiate with the holders of the debentures to extend the due dates, convert them to common stock or modify terms sufficient to remove or delay the requirement to satisfy the obligations with cash. Should we be unable to reach conversion or modification of the debentures on terms acceptable to us, we may be required to default on the obligations.

We also maintain our position in mining claims in our mineral property referred to as the Peek Claim. In the event we decide to proceed with Phase IV of our exploration program, which is estimated to cost $120,000, we will need to obtain additional financing of nearly $1,000,000 to fund exploration, operating expenses and working capital deficit.

As of November 30, 2009, we had a working capital deficit of $698,874. We do not expect our business to achieve profitability in the near future as we expect to continue to incur substantial acquisition, development and operating expenses. We will require additional funding to fund our working capital requirements. However, we cannot provide investors with any assurance that we will be able to raise sufficient funding from the sale of our common stock or debt to fund our estimated general administration, exploration and other working capital requirements.

Currently, we do not have any financing arrangements in place and there is no assurance that we will be able to obtain sufficient financing to fund our capital requirements. If we do not obtain the necessary financing, then our plan of operation will be scaled back according to the amount of funds available. The inability to raise the necessary financing will severely restrict our ability to continue exploration programs or acquisition activities as planned.

Not required for smaller reporting companies.

ITEM 1B UNRESOLVED STAFF COMMENTS

Not required for smaller reporting companies.

PEEK CLAIMS

We purchased a 100% interest in eight mineral claims known as the Peek Claims, located in Canada’s Yukon Territory, from Glen MacDonald of Vancouver, British Columbia, by an agreement dated November 2, 2001, for consideration of $2,500. At the time of the acquisition of the Peek Claims, we were seeking a potential high-grade gold/silver project. There was, at the time, an extensive technical file available detailing the history of exploration on the Peek Claims property. We also considered the existence of a nearby milling plant as advantageous. Mr. Timmins, P.Eng. and Mr. Laurie Stephenson, P.Eng. were involved in assisting us in the selection process.

The YQMA and its regulations govern the procedures involved in the location, recording and maintenance of mineral titles in the Yukon Territory. The YQMA also governs the issuance of quartz mining licenses which are long-term licenses to produce minerals. Under the YQMA, title to Yukon quartz mineral claims can only be held by individuals or Yukon corporations. Because of this regulation, Barclay McDonald, Glen MacDonald’s son, is holding the mineral claim in trust for us until we can determine whether there are significant mineral reserves on our claim. If we determine that there are significant mineral reserves on our claim we will incorporate a Yukon subsidiary to hold title to the claim and Barclay MacDonald will transfer the mineral claim to the subsidiary. The transfer will be at no cost to us other than the costs associated with the incorporation of the Yukon subsidiary.

Location, Infrastructure and Access

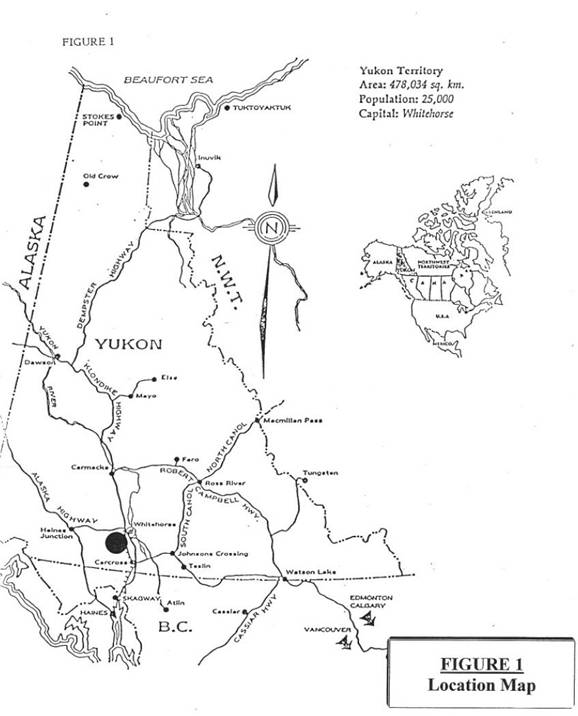

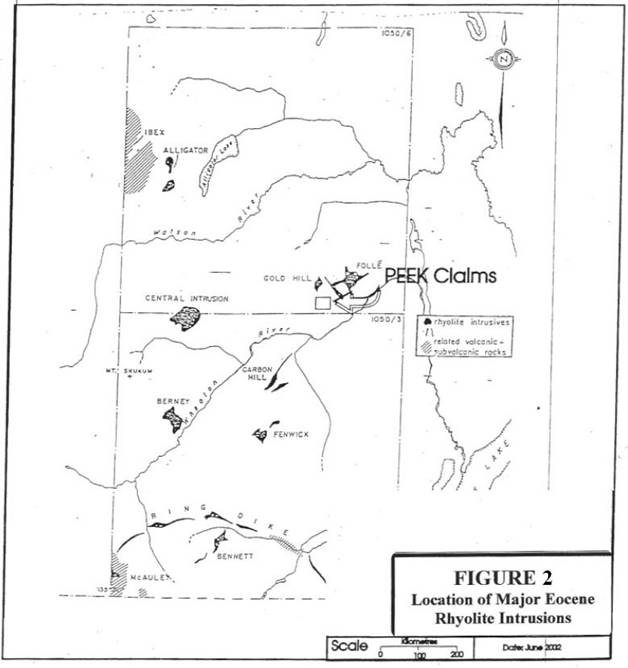

The Peek Claims cover a broad northwest trending ridge south of Pugh Peak (referred to locally as “Gold Hill”), extending from the Wheaton River to Hodnett Lakes. The property lies 40 km south of Whitehorse, the capital of the Yukon Territory, at geographical coordinates 60 16’N latitude, 135 06’W longitude, see Figures 1 and 2 below. Whitehorse is a modern city with a population of 25,000, with most services available for conducting mineral exploration. Daily scheduled flights link the city with Vancouver, British Columbia, Edmonton, Alberta and Fairbanks, Alaska.

The Peek Claims are accessible via an all-weather gravel and paved government-maintained road system which includes a tidewater port road link to Skagway, Alaska. The claims are linked by a secondary road with the Mount Skukum gold mill approximately 12.4 miles away. The Mount Skukum gold mill is a modern gold and silver production facility that is capable of producing both doré bars and metal concentrates depending on the type of ore being processed. The mill is currently idle.

The Alaska and Klondike Highways, and the Wheaton River-Mount Skukum all-season gravel road provide access to the area. A four-wheel drive road follows Thompson Creek from the Wheaton Road to the property. Presently access to the Peek Claims is on foot, by all terrain vehicles or by helicopter because the road is closed by a slide. Further exploration of the property would require approximately $2,000 of road construction work to make the road accessible. We intend to initiate road construction work to make the road accessible prior to commencing Phase IV of our recommended exploration program, as described below.

Physiography, Climate and Vegetation

The Wheaton River district lies in the Boundary Ranges of the Coast Mountains, a rolling uplands area featuring prominent peaks and steep-walled stream and river valleys. Glacial action has modified major river valleys to deep U-shaped drainages with terrace and outwash deposits. Topographically, the area becomes progressively more severe to the southwest, culminating in mountains and ice fields at the headwaters of the Wheaton and Watson Rivers.

A maximum elevation of 6,069 feet is reached on the Peek Claims while the lowest lying feature nearby is Wheaton River at 2,900 feet. The claims cover a barren northwest-trending ridge extending from the Wheaton River to Hodnett Lakes. Outcrop is common on steep slopes descending from the rounded ridge top. The effects of local alpine glaciation are evident on the northern side of Pugh Peak, where cirques and tarns are present. The upland portion of Gold Hill is a rolling grassy plain with outcrop of less than 5%. Consequently most of the geological interpretation is based upon bulldozer trenches to expose bedrock at depths of ranging from six to sixteen feet.

Southwestern Yukon has a dry sub-arctic climate, locally modified by the Pacific Ocean. Summer temperatures average 12°C and annual precipitation totals approximately sixteen inches. The exploration season lasts from May until October.

Vegetation in the upland consists of dwarf grasses, moss and lichen. Timber is restricted to the main valleys at elevations below 3,936 feet.

History of Exploration

The Peek Claims property has been progressively explored since 1983 with work to date including road construction, bulldozer trenching, grid controlled geophysical, geochemical, and geological surveying and prospecting.

The Wheaton River/Lake Bennett district was first explored by prospectors traveling along the major lakes and rivers of southwestern Yukon in the early 1890’s. More intensive exploration began in 1906 after the discovery of free gold and gold-silver tellurides on Gold Hill. Wagon roads were built along the Wheaton River, Thompson Creek and Stevens Creek to provide access to numerous adits and pits on Mount Anderson. Limited mining of high grade gold and silver bearing ore occurred on the Gold Reef vein at the northeastern end of Gold Hill and on the Becker-Cochran (Whirlwind) property on the west face of Mount Anderson.

From the mid 1920’s to the late 1960’s, little exploration of significance took place. By the 1970’s, many of the old showings were restaked as an increase in the value of base and precious metals rekindled the interest of prospectors and mining companies in the area. The Venus and Arctic mines again operated on Montana Mountain from 1969 to 1971. The Venus Mine was again rehabilitated during 1980 to 1981 and a new mill was installed at the southern end of Windy Arm, but no ore was processed.

On the area covered by the Peek Claims, recent exploration started in 1984 to 1985 when the Wheaton River Joint Venture performed prospecting, grid development, mapping, geochemical and geophysical surveys, bulldozer trenching and road building. Mineralized quartz veins and stockworks were discovered in several locations along a five kilometer long ridge on the claim property. The property was owned by the Wheaton River Syndicate from 1983 to 1986.

During 1987 and 1988, Ranger Pacific Minerals Ltd. and others conducted additional geochemical and geophysical surveys. Also, blast trenching work was undertaken to better define target zones previously identified and to further explore the property. The Peek Claims property was owned by Ranger Pacific Minerals Ltd. from 1987 to 1990.

During the period from 1991 to 2001, the property was owned by Glen MacDonald of Vancouver, British Columbia. From 1991 to 2001, exploration work on the property has included bulldozer trenching, road construction, geological mapping and prospecting. Exploration work conducted from 1984 to 1998 covered most of the Gold Hill area, including but not limited to, the area of the Peek Claims.

In 2001, we purchased a 100% interest in the Peek Claims from Glen MacDonald by way of a purchase agreement dated November 2, 2001.

Although exploratory work on the claims conducted by prior owners has indicated some potential showings of mineralization, we are uncertain as to the reliability of these prior exploration results and thus we are uncertain as to whether a commercially viable mineral deposit exists on our mineral claims. Further exploration of these mineral claims is required before a final determination as to their viability can be made.

Mineralization

Precious metal values to date have occurred on the Peek Claims in two types of quartz veins: (i) quartz veins up to 6.5 feet wide in granite and meta-sedimentary/metavolcanic rocks, and (ii) narrow quartz and/or quartz-calcite veins in limestones, quartzites and schists; and silver occurs disseminated in siliceous pyritic schist.

Quartz veins in the first group have a general northwest orientation and are continuous over long distances. The Gold Reef vein on the northwest end of Gold Hill is considered a typical example, and has been traced by underground workings, and surface pits for over 984 feet where the average width has been 5 feet.

Quartz and quartz-calcite veins appear less continuous and have more random orientations. They are generally spatially related to Eocene intrusive rocks.

Alteration and accessory minerals present around the vein systems include clays (kaolinite, alunite) black and green chalcedonic breccias, fluorite, barite, pyrite and hematite. Carbonatization is common in andesitic rocks near veins, and carbonatization and massive chloritization are present in the shear zones in andesitic rocks.

Mineralization on the Peek Claims occurs as either of the following veins and siliceous stockworks:

|

|

1. |

Epithermal gold-silver veins associated with northeast-trending normal faults hosted with bi-modal calc-alkaline andesitic volcanics of the Skukum Group and associated with Eocene rhyolite porphyry dykes outside the volcanic complex. |

|

|

2. |

Gold-silver and telluride bearing quartz veins spatially related to the “Tally-Ho Shear Zone”, sheared and chloritized mafic volcanic rocks and nearby sheared or unsheared granitic rocks and Jurassic Laberge Group arkosic sedimentary rocks. |

Compliance with Governmental Regulation

We will be required to comply with all regulations, rules and directives of governmental authorities and agencies applicable to the exploration of minerals in the Yukon Territory. The main agency that governs the exploration of minerals in the Yukon Territory, Canada, is the Minerals Management Branch of the Yukon Department of Energy Mines and Resources.

The material legislation applicable to us is the Yukon Quartz Mining Act (the “YQMA”), administered by the Minerals Management Branch. The YQMA and its regulations govern the procedures involved in the location, recording and maintenance of mineral titles in the Yukon Territory. The Government of the Yukon Territory retains freehold ownership of the land which is subject to the mineral claims.

All mineral exploration activities carried out on a mineral claim or mining lease in the Yukon must be in compliance with the Yukon Quartz Mining Land Use Regulations (the “Yukon Regulations”). The Yukon Regulations apply to all mines during exploration, development, construction, production, closure, reclamation and abandonment. Also, the Yukon Regulations contain standards for exploration activities including construction and maintenance, site preparation, drilling, trenching and work in and about a water body. An annual exploration expenditure of approximately $80 per claim is required by the YQMA to maintain the claims in good standing. Alternatively an annual payment of approximately $80 per claim in lieu of work is sanctioned by the YQMA to maintain claims in good standing. Our annual cost of compliance with the YQMA is presently approximately $672 per year.

We will also have to sustain the cost of reclamation and environmental remediation for all exploration work undertaken. Reclamation is the process of bringing the land back to its natural state after completion of exploration activities. Environmental remediation refers to the physical activity of taking steps to remediate, or remedy, any environmental damage caused, i.e. refilling trenches after sampling or cleaning up fuel spills.

Recommendation of Geological Report and Geological Exploration Program

In June 2002, we received an initial Geological Report on the Peek Claims. Based on this report, we planned a four phase exploration program, at an estimated cost of $140,000, to be undertaken on the property to assess its potential to host high grade gold mineralization within quartz and sulphide veins. The four phase program consists of the following:

|

Phase |

Exploration Program |

Status |

Cost |

|

|

Phase I |

Compilation of previous exploration data, and geological analysis of the data. |

Completed in August 2002. |

$5,000 |

|

|

|

||||

|

Phase II |

Detailed field examination and study of known mineral zones including localized geophysical surveys. |

Completed in December 2003. |

$10,000 |

|

|

|

||||

|

|

||||

|

Phase III |

Detailed field examination of potential exploration sites, including geological mapping, localized geophysical surveys and sampling using the knowledge obtained from the known exploration areas. |

Completed April 2006. |

$5,000 |

|

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

Phase IV |

Test diamond drilling (to 1,200 metres) of the targets delineated within the potential exploration sites. |

To be determined subject to availability of exploration funds and the results of exploratory work. |

$120,000 |

|

|

|

||||

|

|

||||

|

|

Based upon favorable results of Phase I and Phase II of our geological exploration program, we performed Phase III of the program which consisted of geological mapping, geophysical surveying and sampling, to select targets for the Phase IV drilling program consisting of 1,200 meters (approximately 3,936 feet) of diamond drilling, again contingent upon favorable results of Phase III. A Phase IV drilling program would be dependent upon a number of factors such as the geologists’ recommendations based upon previous phases and our available funds. See “Present Condition of the Property and Current State of Exploration” below.

The projected costs of each phase of our exploration program included provision for mobilization and support costs. The expenditures made by us in the exploration of our mineral claim may not result in the discovery of mineral deposits. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. If the results of exploration do not reveal viable commercial mineralization, we may decide to abandon our claim and acquire new claims for new exploration. The acquisition of additional claims will be dependent upon our possessing sufficient capital resources at the time in order to purchase such claims. If no funding is available, we may be forced to abandon our operations.

We have complete Phases I through III of the recommended exploration program. In the event that we proceed with Phase IV, we intend to implement a drilling program which will target any mineralized zones or zones of interest identified in earlier phases’ exploration results. The results of any drilling will be used to assess whether further geological exploration and drilling of identified mineralized areas is warranted. The funding required for the drilling program and our ability to complete the drilling program is expected to be dependent on the amount of funds we have available for exploration and our exploration priorities. Completion of our planned Phase IV drilling program is estimated to cost $120,000 and is expected to include the following:

|

|

(a) |

|

Hiring of local contractors familiar with the mining region and drill conditions to perform the drilling operations and supply the drill and all other equipment and drill technicians required to perform the drilling operations; |

|

|

(b) |

|

Oversight of drilling program by a Professional Mining Engineer or Certified Geologist; |

|

|

(c) |

|

Outside laboratory analysis, particularly for prospective lode gold; |

|

|

(d) |

|

In-house and external review of results, including any feasibility studies; and |

|

|

(e) |

|

Hiring of lab technicians. |

The primary expenses related to the drilling program are expected to be labor and contract costs, including transportation and on-site support.

The number of personnel involved in the drilling is expected to be four drilling personnel and/or a foreman and geologist. All personnel are expected to be contract employees. The geologist is expected to be the onsite technical person who will be able to evaluate and direct the program. We believe these types of contract employees are readily available, if needed.

Due to our strategic priority of closing the DIA acquisition, at this time, we currently do not plan to execute our Phase IV exploration strategy during fiscal 2010. Raising the $3,000,000 to fund the DIA transaction precludes a competing effort to raise the funds necessary to embark upon a continuing exploration program. We cannot provide investors with any assurance that we will be able to raise sufficient funding from the sale of our common stock to fund our either of these activities. We believe that debt financing will not be an alternative for funding. The risky nature of this enterprise and lack of tangible assets places debt financing beyond the credit-worthiness required by most banks or typical investors of corporate debt at this time. We presently do not have any arrangements in place for any future equity financing.

Present Condition of the Property and Current State of Exploration

In years prior to 2009, we conducted exploration activities on the Peek Claims to determine whether there is commercially exploitable gold and silver mineralization or other metals. The following is a summary of the status of our exploration program on the Peek Claims:

Summary of Phase I – Exploration Program Results

The results of our Phase I exploration program delineated three main zones of mineralization in addition to other mineralized showings that warrant additional exploration work. The three main mineralization zones identified by our geologist are described as follows:

|

|

(i) |

|

the North grid, containing moderate gold-silver and silver-lead soil geochemical anomalies and include intense “spot” highs; |

|

|

(ii) |

|

the north end of Gold Hill which has a moderate to strong VLF-EM conductor and significant gold and silver values in quartz veins carrying galena and tetrahedrite occurring in the gully at the north end of Gold Hill and in float trains on the ridge top of Gold Hill; and |

|

|

(iii) |

|

the south end of Gold Hill, in which gold-silver bearing galena and tetrahedrite mineralization has been identified.

|

Our geologist concluded that the results of Phase I warranted a further program of exploration.

Summary of Phase II – Exploration Program Results

The second phase consisted of detailed geophysical surveys utilizing new and more sensitive geophysical techniques to enhance the data that previously existed on the claims. Our work focused specifically upon the already known areas which our consultant had indicated may host minerals. This phase also included a detailed field examination and study of known mineral zones including localized geophysical surveys. Phase II was completed in late 2003 and we received a geological report on the results in April, 2004.

The results of our Phase II exploration program confirmed the anomaly concerning the gold-silver bearing galena and tetrahedrite mineralization developing along the contacts on the north and south ends of Gold Hill. The anomaly was confirmed in the more detailed “vector geophysics survey” and warrants further exploration according to our geologist. Our geologist concluded that the results of Phase II confirmed that the geological review identified areas which warranted a further program of exploration. The report recommends further evaluation of data obtained from the detailed geophysical surveying, which demonstrated that the areas evaluated have a geophysical signature that could indicate an unseen depth or length extent, and recommended further geological surveying and sampling to identify and confirm targets for the Phase IV drilling.

Summary of Phase III – Exploration Program Results

In 2005, our geologist visited the Peek Claims property to conduct testing on areas of interest indicated by Phase II of our geological program for prospective gold-silver mineralization. New showings were located and sampled. The samples were submitted for analysis and we received our geologist’s report with the assay result of Phase III in April 2006.

According to the Phase III report, during the 2005 exploration season, our geologist completed detailed prospecting and geological investigation of a portion of the claims with geophysical anomalies identified during 2003. Samples of vein material present as “float” were collected, reviewed and submitted for geochemical analysis. Our geologist confirmed that the original epithermal vein systems contained copper, whereas the 2005 discovery contained copper in silver-deficient chalcopyrite. Six samples returned copper values ranging from 1,030 parts per million (ppm) (0.100%) to 4,974 ppm (0.497%) while two samples contained trace amounts.

In April 2006, we received the geological report on the results of Phase III of our 2005 exploration program. During the 2005 exploration season we completed detailed prospecting and geological investigation of a portion of the claims with geophysical anomalies identified during 2003. Samples of vein material present as “float” were collected, reviewed and submitted for geochemical analysis. Our geologist concluded that these results confirm earlier sample analyses by Texada and others. Prior to proceeding with Phase IV, our geologist recommends further geological engineering on the Peek Claims properties to define the exact source areas for the known and new vein float material because frost action may have moved the vein material further than originally assumed. Our geologist recommends a total of $10,000 to be reserved for a two stage delineation program.

During the summer exploration season of 2006, we proceeded with the first phase of the delineation program. A field crew selected one of the sample sites and excavated a pit nearby, upslope, to examine the soil profile and suggest where the bedrock source for the float might occur. Boulder-rich overburden was present to a depth of seven feet, including more fragments of sulphide-rich quartz. Below seven feet the ground is frozen by permafrost and the quartz vein fragments discontinued. Thus, our geologist concluded the source of the float lies further upslope and perhaps is within the geophysical conductors located earlier. A detailed, close-spaced, soil geochemical survey over the conductors using a plugger style overburden sampling drill was recommended to locate the bed rock source of the mineralization.

Phase IV – Exploration Program

In the event that we proceed with Phase IV of our exploration program, we will implement a drilling program expected to take place over a period of two weeks, which will target any mineralized zone or zones of interest identified in our Phase I, II and III exploration results. The results of any drilling will be used to assess whether further geological exploration and drilling of identified mineralized areas is warranted. The funding required for the

drilling program and our ability to complete the drilling program will be dependent on the amount of funds we have available for exploration and our corporate priorities.

We will not be able to determine whether or not our mineral claims contain a commercially exploitable mineral deposit, or reserve, until appropriate exploratory work is done and an economic evaluation based on that work concludes economic viability.

Peek Claim Status

The Peek claims are located in the Whitehorse Mining District of Yukon Territory. The property consists of eight claims as detailed in Table 1 below. Claims such as these are administered under the provisions of the YQMA by the supervising mining recorder located in Whitehorse. An annual exploration expenditure of approximately $80 per claim is required by the YQMA to maintain the claims in good standing. Alternatively an annual payment of approximately $80 per claim in lieu of work is sanctioned by the YQMA to maintain claims in good standing. Our annual cost of compliance with the YQMA is presently approximately $672 per year.

Table 1 - Claim Status

|

Claim Name |

Grant Numbers |

Current Expiry Date |

|

PEEK 1-8 |

YC 19158 – 165 |

August 19, 2010 |

COMPETITION

We are an exploration stage company. We compete with other mineral resource exploration and development companies for financing and for the acquisition of new mineral properties. Many of the mineral resource exploration and development companies with whom we compete have greater financial and technical resources than us. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford greater geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration and development. This competition could adversely impact on our ability to finance further exploration and to achieve the financing necessary for us to develop our mineral properties.

EMPLOYEES

We have no employees as of the date of this annual report. We generally conduct our business through agreements with consultants and arms-length third parties.

Neither we nor any of our properties are currently subject to any material legal proceedings or other regulatory proceedings.

ITEM 4. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is quoted on the Over the Counter (OTC) Bulletin Board which is sponsored by the Financial Industry Regulatory Authority, Inc. (FINRA). The OTC Bulletin Board is a network of security dealers who buy and sell stock. The dealers are connected by a computer network which provides information on current “bids” and “asks” as well as volume information. The OTC Bulletin Board is not considered a “national exchange.”

Our Common stock is traded on the FINRA OTC Bulletin Board under the symbol “TXDV”. The following table shows the high and low bid information for the Common stock for each quarter of the fiscal years 2008 and 2009.

|

Fiscal Year |

Low Closing |

High Closing |

|

2008 |

|

|

|

First Quarter |

$0.70 |

$1.25 |

|

Second Quarter |

$1.01 |

$1.25 |

|

Third Quarter |

$0.42 |

$1.01 |

|

Fourth Quarter |

$0.40 |

$1.28 |

|

Fiscal Year |

Low Closing |

High Closing |

|

2009 |

|

|

|

First Quarter |

$1.28 |

$1.28 |

|

Second Quarter |

$0.05 |

$1.75 |

|

Third Quarter |

$0.15 |

$0.15 |

|

Fourth Quarter |

$0.15 |

$2.40 |

The above quotations reflect inter-dealer prices, without retail mark-up, markdown or commission and may not necessarily represent actual transactions.

Holders of Record

As of November 30, 2009 there were 4 shareholders of record of our common stock with an unknown number of additional shareholders who hold shares through brokerage firms.

Dividends

We have not paid any dividends and do not anticipate the payment of dividends in the foreseeable future.

Securities Authorized for Issuance under Equity Compensation Plans

None.

Issuer Purchase of Equity Securities

During our fiscal year ended November 30, 2009, neither the Company nor any of its affiliates repurchased common shares of the Company.

Recent Sales of Unregistered Securities

On March 25, 2009, the Company entered into a promissory note with a third party for $25,000, which is unsecured, due on demand and bears interest at 5% per annum. Interest and principal are due on demand.

The foregoing transactions were conducted by the Company in private placements to non-U.S. persons outside the United States in off-shore transactions pursuant to an exemption from registration available under Rule 903 of Regulation S of the United States Securities Act of 1933, as amended.

ITEM 5. SELECTED FINANCIAL DATA

Not required for smaller reporting companies.

ITEM 6. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

General

This discussion and analysis should be read in conjunction with the accompanying financial statements and related notes. This discussion and analysis contains forward-looking statements that involve risks, uncertainties and assumptions. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of many factors. The discussion and analysis of the financial condition and results of operations are based upon the financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of any contingent liabilities at the financial statement date and reported amounts of revenue and expenses during the reporting period. On an on-going basis the Company reviews its estimates and assumptions. The estimates were based on historical experience and other assumptions that we believe to be reasonable under the circumstances. Actual results are likely to differ from those estimates under different assumptions or conditions, but the Company does not believe such differences will materially affect our financial position or results of operations. Critical accounting policies, the policies the Company believes are most important to the presentation of its financial statements and require the most difficult, subjective and complex judgments, are outlined below in “Critical Accounting Policies,” as disclosed in this Form 10-K.

Plan of Operation

As a result of our failure to generate substantial revenues since our inception, we have not been satisfied with our initial business plan to this point. We are presently reviewing the current state of our business in detail with consultants in order to evaluate the progress of our mining business. At the present time, we intend to continue to develop our current mining business and complete an acquisition under our revised management and corporate governance structure.

Mining:

Phase I of our exploration program, which consisted of a geological review of prior exploration work on the Peek Claims, was completed in the summer of 2002 at a cost of $5,000. Phase II of the recommended geological exploration program cost $10,000 and was completed in late 2003. Based on the results of Phase II of our exploration program, we proceeded with Phase III of our exploration program which was substantially completed during the summer exploration season of 2005. On April 11, 2006, we received the geological report on the results of Phase III of our exploration program.

In his report, our geologist recommended that, prior to proceeding with Phase IV, further geological engineering should be undertaken to define the exact source areas for the known and new vein float material. Our geologist recommended reserving a total of $10,000 for a two stage delineation program prior to commencing Phase IV of our exploration program. We proceeded with our geologist’s recommendation and completed the first phase of the delineation program during the summer exploration season of 2006. A detailed, close-spaced, soil geochemical survey over the conductors using a plugger style overburden sampling drill was recommended to locate the bed rock source of the mineralization following completion of Phase I of the delineation program.

Our decision to proceed to Phase IV of our initial exploration program will be made based on factors such as the final assay results and the recommendations of our geologist, the grades of any mineralization found, the size and extent of the mineralized zones, and the strength of metal prices in international markets.

The expenditures made by us in the exploration of our mineral claims may not result in the discovery of mineral deposits. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. If the results of exploration do not reveal viable commercial mineralization, we may decide to abandon our claims and acquire new claims for new exploration. The acquisition of additional claims will be dependent upon our possessing sufficient capital resources at the time in order to purchase such claims. If no funding is available, we may be forced to abandon our operations. This assessment will include an assessment of our cash reserves after the completion of Phase III, the price of minerals and the market for financing of mineral exploration projects at the time of our assessment.

Acquisition:

Term Sheet - REX:

On September 16, 2008, we signed a Term Sheet (the “Term Sheet”) that sets forth the principal terms upon which we proposed to enter into a definitive agreement (the “Definitive Agreement”) to acquire Royalty Exploration, LLC (“REX”) and commenced a concurrent financing of $40,000,000. The Term Sheet was subsequently amended on November 12, 2008 and March 9, 2009 and we signed a letter agreement on August 25, 2009, which details the responsibilities of the parties going forward with respect to the transaction. The significant terms and disclosures of the Term Sheet and the letter agreement were reported in Forms 8-K filed with the SEC on September 22, 2008, November 12, 2008, March 11, 2009 and September 1, 2009, respectively, which are herein incorporated by reference. The Term Sheet expired and the transaction with REX was not completed.

Term Sheet - DIA:

Subsequent to the end of fiscal 2009, on February 15, 2010 we entered into a Term Sheet with Diamond Industry Associates Ltd (“DIA”) whereby we will acquire 100% of DIA’s issued and outstanding shares or alternatively the assets and contractual obligations of DIA. The acquisition will be subject to a definitive agreement and customary terms and conditions. In conjunction with the transaction, we plan to commence a private placement financing of up to $3 million.

DIA seeks to become a leading diamond producer in the Democratic Republic of the Congo (“DRC”), a historically rich diamond producing region of the world. DIA’s alluvial diamond concessions are located along 40km of the Mbujimayi River in the Kasai Oriental region of the DRC. The area has been subject to extensive artisanal prospecting since the 1920s. The concessions are just northeast of the Polygon, which is one of the richest diamond reserves in the world, estimated to contain a cluster of at least 12 kimberlites having produced 650 million carats of diamonds since 1917.

The geology in this region is dominated by the sediments of the Precambrian Mbuji-Mayi Formation, which locally comprise dolomites, sandstones and argillites, as well as doleritic volcanics. This formation was intruded by highly diamondiferous Bakwanga kimberlites during the Lower Cretaceous period. It was the subsequent erosion of these deposits that led to the rise of some of the largest high-grade alluvial diamond deposits in the world. The most economically important alluvial deposits (terraces) are Holocene in age, with the modern-day meandering Mbuji-Mayi river system cutting down into the valley floor of the Mbuji-Mayi Formation.

We are in the process of completing our due diligence and negotiating a definitive agreement with DIA. The significant terms and disclosures of the Term Sheet were reported in a Form 8-K filed with the SEC on February 23, 2010, which is herein incorporated by reference.

Results of Operations

We did not earn any revenues from November 30, 2008 to November 30, 2009. We do not anticipate earning revenues until such time as we have entered into commercial production of our mineral properties, which is not expected for several years, if at all. We are presently in the exploration stage of our business and we can provide no assurance that we will discover commercially exploitable levels of mineral resources on our properties, or if such resources are discovered, that we will enter into commercial production of our mineral properties. Alternatively, we may begin to earn revenues with the acquisition of DIA, but cannot assure that this acquisition will be consummated.

We incurred operating expenses in the amount of $185,032 for the period ended November 30, 2009 compared with $175,944 for the period ended November 30, 2008. These operating expenses included Consulting fees of $76,404 and General and administrative costs of $100,008 and $8,620 loss on foreign exchange activities. The lower operating expenses during fiscal 2009 compared to fiscal 2008 resulted from decreased business activity related to exploring potential acquisitions. Costs during fiscal 2010 are anticipated to be consistent with those consulting and general and administrative expenses incurred in fiscal 2009; however, operational expenses may increase substantially if the acquisition of DIA is successful.

We incurred a net loss in the amount of $351,966 for the fiscal year ended November 30, 2009, compared to $517,805 for the fiscal year ended November 30, 2008. The change in net loss was attributable primarily to a smaller accretion of discounts on convertible debentures, increases in interest costs on increased borrowings and increases in operating costs described above, offset by the non-occurrence of write downs in oil and gas deposit assets in fiscal 2009 compared with $115,000 for the prior year . In 2009, the Company recognized a reserve of $93,160 for potential uncollectability of the receivable from REX for previously advanced due diligence funding to that company that is refundable to us in twelve equal monthly payments.

Liquidity and Capital Resources

As of November 30, 2009, we had a working capital deficiency of $698,874. We do not expect our business to achieve profitability in the near future as we expect to continue to incur substantial development and operating expenses. We will require additional funding to fund our working capital requirements. However, we cannot provide investors with any assurance that we will be able to raise sufficient funding from the sale of our common stock or debt to fund our estimated general administration, exploration and other working capital requirements. We believe that debt financing will not be an alternative for funding. The risky nature of this enterprise and lack of tangible assets places debt financing beyond the credit-worthiness required by most banks or typical investors of corporate debt until we locate mineral reserves on our mineral claims.

Currently, we do not have any financing arrangements in place and there is no assurance that we will be able to obtain sufficient financing to fund our capital requirements. If we do not obtain the necessary financing, then our plan of operation will be scaled back according to the amount of funds available. The inability to raise the necessary financing will severely restrict our ability to continue exploration programs or acquisition activities as planned.

Our continued existence and plans for future growth depend on our ability to obtain the capital necessary to operate by the sale of equity shares. We will need to raise additional capital of $3,000,000 in coming months to fund our capital requirements through November 30, 2010, and to complete the transactions contemplated by the DIA Term Sheet.

We believe there is substantial doubt that we can continue as a going concern which, if true, raises substantial doubt that a purchaser or holder of our common stock will receive a return on his or her investment. As at November 30, 2009, we had cash of $2,416, a working capital deficit of $698,874 and an accumulated deficit of $1,642,777, and will likely continue to incur further losses as we continue our exploration program and acquisition activities. Our future is dependent upon our ability to obtain financing and upon future profitable operations from the development of our mineral properties or successfully acquiring additional properties or business opportunities. If we cannot raise sufficient capital, we may be required to liquidate our assets, issue securities or debt on terms extremely dilutive to existing shareholders or file for bankruptcy. Our financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should we be unable to continue as a going concern.

We have not declared or paid dividends on our shares since incorporation and do not anticipate doing so in the foreseeable future.

Off-Balance Sheet Arrangements

We had no off-balance sheet transactions.

Contractual Obligations

We have entered into contracts with various individuals or companies which require minimum future payments or investments in exploration activities to satisfy the terms of the contract.

|

Contractual obligations |

Payments due by period |

||||

|

Total |

Less than 1 year |

2-3 years |

3-5 years |

More than 5 years |

|

|

Convertible Debentures |

585,000 |

- |

585,000 |

- |

- |

|

Promissory Notes |

365,000 |

365,000 |

- |

- |

- |

|

Total |

950,000 |

365,000 |

585,000 |

- |

- |

In February of 2010, we signed a Term Sheet with DIA. Under the Term Sheet, the Company agreed to commence a financing of $3,000,000 to fund the acquisition of DIA.

Critical Accounting Policies

We have identified our critical accounting policies, the application of which may materially affect the financial statements, either because of the significance of the financials statement item to which they relate, or because they require management’s judgment in making estimates and assumptions in measuring, at a specific point in time, events which will be settled in the future. The critical accounting policies, judgments and estimates which management believes have the most significant effect on the financial statements are set forth below:

|

|

a) |

Stock-based Compensation |

The Company records stock-based compensation in accordance with ASC 718, “Compensation – Stock Based Compensation”, using the fair value method. All transactions in which goods or services are the consideration received for the issuance of equity instruments are accounted for based on the fair value of the consideration received or the fair value of the equity instrument issued, whichever is more reliably measurable.

|

|

b) |

Financial Instruments |

ASC 820, “Fair Value Measurements” requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. ASC 820 establishes a fair value hierarchy based on the level of independent, objective evidence surrounding the inputs used to measure fair value. A financial instrument’s categorization within the fair value hierarchy is based upon the lowest level of input that is significant to the fair value measurement. ASC 820 prioritizes the inputs into three levels that may be used to measure fair value:

Level 1

Level 1 applies to assets or liabilities for which there are quoted prices in active markets for identical assets or liabilities.

Level 2

Level 2 applies to assets or liabilities for which there are inputs other than quoted prices that are observable for the asset or liability such as quoted prices for similar assets or liabilities in active markets; quoted prices for identical assets or liabilities in markets with insufficient volume or infrequent transactions (less active markets); or model-derived valuations in which significant inputs are observable or can be derived principally from, or corroborated by, observable market data.

Level 3

Level 3 applies to assets or liabilities for which there are unobservable inputs to the valuation methodology that are significant to the measurement of the fair value of the assets or liabilities.

Our financial instruments consist principally of cash, note receivable, accounts payable, amounts due to related parties, promissory notes payable, and convertible debentures. Pursuant to ASC 820, the fair value of our cash equivalents is determined based on “Level 1” inputs, which consist of quoted prices in active markets for identical assets. We believe that the recorded values of all of our other financial instruments approximate their current fair values because of their nature and respective maturity dates or durations.

The Company has operations in Canada, which results in exposure to market risks from changes in foreign currency rates. The financial risk is the risk to the Company’s operations that arise from fluctuations in foreign exchange rates and the degree of volatility of these rates. Currently, the Company does not use derivative instruments to reduce its exposure to foreign currency risk.

Adopted Accounting Pronouncements

In May 2009, FASB issued ASC 855, Subsequent Events, which establishes general standards of for the evaluation, recognition and disclosure of events and transactions that occur after the balance sheet date. Although there is new terminology, the standard is based on the same principles as those that currently exist in the auditing standards. The standard, which includes a new required disclosure of the date through which an entity has evaluated subsequent events, is effective for interim or annual periods ending after June 15, 2009. The adoption of ASC 855 did not have a material effect on the Company’s financial statements. Refer to Note 13.

In June 2009, the FASB issued guidance now codified as ASC 105, Generally Accepted Accounting Principles as the single source of authoritative accounting principles recognized by the FASB to be applied by nongovernmental entities in the preparation of financial statements in conformity with U.S. GAAP, aside from those issued by the SEC. ASC 105 does not change current U.S. GAAP, but is intended to simplify user access to all authoritative U.S. GAAP by providing all authoritative literature related to a particular topic in one place. The adoption of ASC 105 did not have a material impact on the Company’s financial statements, but did eliminate all references to pre-codification standards

The Company has implemented all new accounting pronouncements that are in effect and that may impact its financial statements and does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of operations.

Going concern

The Company has never generated revenues since inception and has never paid any dividends and is unlikely to pay dividends or generate earnings in the immediate or foreseeable future. The continuation of the Company as a going concern is dependent upon the continued financial support from its shareholders, the ability of the Company to obtain necessary equity financing to continue operations, confirmation of the Company’s interests in the underlying properties, and the attainment of profitable operations. As at November 30, 2009, the Company has a working capital deficit of $698,874, and has accumulated losses of $1,642,777 since inception. These factors raise substantial doubt regarding the Company’s ability to continue as a going concern. These financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

As at November 30, 2009, the Company had cash of $2,416 on hand. The Company does not have sufficient funds to meet planned expenditures over the next twelve months, and will need to seek additional debt or equity financing to meet its planned expenditures. Management believes that it will need to raise approximately $40,000,000 in additional financing to complete the transactions contemplated by the REX Term Sheet and meet its other planned expenditures. The Company currently has no commitment for such financing. Accordingly, there is a risk that the Company will be unable to raise the required financing and complete the transactions contemplated by the REX Term Sheet and its other planned expenditures.

Private Placements

On March 25, 2009, the Company entered into a promissory note with a third party for $25,000, which is unsecured, due on demand and bears interest at 5% per annum. Interest and principal are due on demand.

On December 19, 2008, the Company entered into a promissory note with a third party for $50,000, which is unsecured, due on demand and bears interest at 5% per annum. Interest and principal are due on demand.

On October 27, 2008, the Company entered into a promissory note with a third party for $140,000, which is due on demand and bears interest at 5% per annum. Interest and principal are due on demand.

The foregoing transactions were conducted by the Company in private placements to non-U.S. persons outside the United States in off-shore transactions pursuant to an exemption from registration available under Rule 903 of Regulation S of the United States Securities Act of 1933, as amended.

Convertible Debenture

On April 10, 2007, the Company issued a 6% convertible debenture with a principal amount of $200,000 which was due and payable on December 31, 2008. On December 18, 2008, the maturity date was extended to December 31, 2010. Interest is payable semi-annually beginning on September 30, 2007, and thereafter on March 31st and September 30th of each year, payable at the option of the Company in cash or shares. As at November 30, 2009, the Company had not made any interest payments and pursuant to the debenture has accrued default interest of 8% since September 30, 2007. The principal and accrued interest on the debenture may be converted at any time into shares of the Company’s common stock at a price of $0.25 per share, at the option of the holder. The Company recognized the intrinsic value of the embedded beneficial conversion feature of $80,000 as additional paid-in capital and an equivalent discount which will be charged to operations over the term of the convertible debenture. The Company records accretion expense over the term of the convertible debenture up to its face value of $200,000. As at November 30, 2009, $78,515 has been accreted increasing the carrying value of the convertible debenture to $198,516.

On May 2, 2007, the Company issued a 6% convertible debenture with a principal amount of $125,000 which was due and payable on December 31, 2008. On December 18, 2008, the maturity date was extended to December 31, 2010. Interest is payable semi-annually beginning on September 30, 2007, and thereafter on March 31st and September 30th of each year, payable at the option of the Company in cash or shares. As at November 30, 2009, the Company had not made any interest payments and pursuant to the debenture has accrued default interest of 8% since September 30, 2007. The principal and accrued interest on the debenture may be converted at any time into shares of the Company’s common stock at a price of $0.25 per share, at the option of the holder. The Company recognized the intrinsic value of the embedded beneficial conversion feature of $50,000 as additional paid-in capital and an equivalent discount which will be charged to operations over the term of the convertible debentures. The Company records accretion expense over the term of the convertible debenture up to its face value of $125,000. As at November 30, 2009, $49,101 has been accreted increasing the carrying value of the convertible debenture to $124,050.

On November 19, 2007, the Company issued a 6% convertible debenture with a principal amount of $110,000 which was due and payable on December 31, 2008. On December 18, 2008, the maturity date was extended to December 31, 2010. Interest is payable semi-annually beginning on May 31, 2008, and thereafter on May 31st and November 30th of each year, payable at the option of the Company in cash or shares. As at November 30, 2009, the Company had not made any interest payments and pursuant to the debenture has accrued default interest of 8% since May 31, 2008. The principal and accrued interest on the debenture may be converted at any time into shares of the Company’s common stock at a price of $0.25 per share, at the option of the holder. The Company recognized the intrinsic value of the embedded beneficial conversion feature of $44,000 as additional paid-in capital and an equivalent discount which will be charged to operations over the term of the convertible debenture. The Company records accretion expense over the term of the convertible debenture up to its face value of $110,000. As at November 30, 2009, $42,885 has been accreted increasing the carrying value of the convertible debenture to $108,885.

On March 11, 2008, the Company issued a 6% convertible debenture with a principal amount of $150,000 which was due and payable on December 31, 2008. On December 18, 2008, the maturity date was extended to December 31, 2010. Interest is payable semi-annually beginning on May 31, 2008, and thereafter on May 31st and November 30th of each year, payable at the option of the Company in cash or shares. As at November 30, 2009, the Company had not made any interest payments and pursuant to the debenture has accrued default interest of 8% since May 31, 2008. The principal and accrued interest on the debenture may be converted at any time into shares of the Company’s common stock at a price of $0.25 per share, at the option of the holder. The Company recognized the intrinsic value of the embedded beneficial conversion feature of $60,000 as additional paid-in capital and an equivalent discount which will be charged to operations over the term of the convertible debenture. The Company records accretion expense over the term of the convertible debenture up to its face value of $150,000. As at November 30, 2009, $58,052 has been accreted increasing the carrying value of the convertible debenture to $148,052.

In each case, the Company accounted for the embedded beneficial conversion feature in accordance with ASC 470-20 “Debt with Conversion and Other Options”.

The foregoing transactions were conducted by the Company in private placements to non-U.S. persons outside the United States in off-shore transactions pursuant to an exemption from registration available under Rule 903 of Regulation S of the United States Securities Act of 1933, as amended.

ITEM 6A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not required for smaller reporting companies.

ITEM 7. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA