Attached files

| file | filename |

|---|---|

| EX-32 - CERTIFICATION - STRATECO RESOURCES INC | exhibit32.htm |

| EX-31.2 - CERTIFICATION - STRATECO RESOURCES INC | exhibit31-2.htm |

| EX-31.1 - CERTIFICATION - STRATECO RESOURCES INC | exhibit31-1.htm |

| OMB APPROVAL OMB Number: Expires: 3235-0063 April 30, 2012 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2009

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____________________________ to_____________________________

Commission file number: 0-49942

STRATECO RESOURCES INC.

(Exact name of registrant as specified in its

charter)

| QUÉBEC, CANADA | N/A |

| State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organisation | Identification No.) |

1

225 GAY-LUSSAC, BOUCHERVILLE,

QUÉBEC, CANADA, J4B 7K1

(Address of principal executive

offices) (Zip Code)

Registrant’s telephone number, including area code: (450) 641-0775

Securities registered pursuant to Section 12(g) of the Act:

| Title of each class | Name of each exchange on which registered |

| ________________________ | Toronto Stock Exchange in Canada (RSC) |

| (Title of class) | Frankfurt in Germany:(RF9) |

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes[ ] No[ ]

Indicate by check mark if the registrant is not required to file

reports pursuant to Section 13 or Section 15(d) of the Act.

Yes[

] No[ ]

Note – Checking the box above will not relieve any

registrant required to file reports pursuant to Section 13 or 15(d) of the

Exchange.

2

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13

or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter

period that the registrant was required to file such reports), and (2) has

been subject to such filing

requirements for the past 90 days

[X]

Yes [ ] No

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web

site, if any, every

Interactive Data File required to be submitted and posted pursuant to Rule 405

of Regulation

S-T (§ 232.405 of this chapter) during the preceding 12 months

(or for such shorter period that the registrant

was required to submit and

post such files).

[X] No [ ]Yes

Indicate by check mark if disclosure of delinquent filers

pursuant to Item 405 of Regulation S-K (§ 229.405 of this

chapter) is not

contained herein, and will not be contained, to the best of registrant’s

knowledge, in definitive

proxy or information statements incorporated by

reference in Part III of this Form 10-K or any amendment to this

Form

10-K. [ ]

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer, a non-accelerated filer,

or a

smaller reporting company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting

company” in Rule 12b-2 of the

Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [X] | |

| Non-accelerated filer [ ] | (Do not check if a smaller reporting company) | Smaller reporting company [ ] |

Indicate by check mark whether the registrant is a shell company

(as defined in Rule 12b-2 of the Act).

[ ]

Yes [X] No

State the aggregate market value of the voting and non-voting

common equity held by non-affiliates computed by reference

to the price at

which the common equity was last sold, or the average bid and asked price of

such common equity, as of the

last business day of the registrant’s most

recently completed second fiscal quarter.

As of the last business day of the registrant’s most recently

completed second financial quarter as of June 30, 2009, the

common share was

last sold at the price of CAN$0.92 per share for and aggregate market value with

119,266,462 common

shares outstanding of CAN$109,725,117.

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all

documents and reports required to be filed by Section 12, 13 or

15(d) of the

Securities Exchange Act of 1934 subsequent to the distribution of securities

under a plan confirmed by a court.

[ ]

Yes [ ] No

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

3

Indicate the number of shares outstanding of each of the

registrant’s classes of common stock, as of the latest

practicable date.

As of March 10, 2010, 122,695,906 common shares were outstanding

4

DOCUMENTS INCORPORATED BY REFERENCE

(1) Part

Item 8: Financial Statements of an exploration stage company

The Company, an exploration stage company, incorporates for reference to the present document the Strateco Resources Inc. audited financial statements for the fiscal year ending December 31, 2009 and audited financial statements for the fiscal year ending December 31, 2008 that include the report of U.S. GAAP reconciliation at Note 23. These financial statements follow the signature page of the present document.

INDEX:

5

PART I

Item 1. Business

All amounts mentioned in this following section are in Canadian dollars.

The Company was incorporated under the Canada Business Corporations Act by articles of incorporation dated April 13, 2000.

The Company is primarily engaged in the exploration of mining properties with a view to commercial production. It does not currently have any mines in production. The Company has a portfolio of five wholly-owned mining properties, as well as an interest in or options on three mining properties in Quebec, Canada. These properties comprise 1,068 claims for a total area of 56,747 hectares (567 km2). The Company’s activities are focused on the development of the MATOUSH PROJECT, which consists of four uranium properties.

Recovery of the cost of mining assets is subject to the discovery of economically recoverable reserves, the Company's ability to obtain the financing required to pursue exploration and development of its properties, and profitable future production or the proceeds from the sale of its properties. The Company must periodically obtain new funds in order to pursue its activities. While it has always succeeded in doing so to date, there can be no assurance that it will continue to do so in the future.

The Company is involved in exploration of uranium and to its cognizance; there exists no competition between companies involved in that kind of exploration. The main business of the Company is to discover by exploration as much as possible of resources of uranium to eventually become a producer of uranium and to sell this uranium at the market value. Most of the companies cooperate with each other, exchange or trade equipment, consultant services and knowledge regarding the complex requirements of health and safety standards, permits and governmental authorizations, methods of exploration or production. Since most companies in Canada involved in exploration or production of uranium are public companies all technical information is publicly disclosed as well.

However, in the mining industry in Canada in general, a certain competition may exist when a company needs to retain and to hire geologists and mining technicians which are difficult to find in Québec or in Canada The Company was however able up to now to recruit in Europe and in Québec and to retain qualified personnel and consultants.

Another aspect of competition for the whole mining industry in general is the acquisition of claims and many factors may influence their value. But once the interest in the claims of the property is acquired by the Company or is subject to an agreement, the claims of the property and the adjacent claims as well, are protected by the agreement as an interest area. For the moment the Company holds sufficient mining claims to pursue its objectives.

The Company had initiated voluntarily an Environmental Impact Study for the MATOUSH PROJECT through a specialized firm, Golder Associates in 2007, at approximate costs of $268,000 during the year 2007, that represented less than 1.5% of the Company’s expenses in exploration in the approximate amount of $18.7M.

As of December 31, 2008, the Company has spent a sum of $1,193,640 for environmental impact studies and had paid to a management company the sum of $20,420 for the services on a permanent basis of an environmental manager in the months of November and December 2008 to prepare the environmental requirements in view of the underground exploration program. This total amount of $1,214,060 represented only 5.40% of the Company's expenses in exploration in the amount of $22,317,849.

6

For the fiscal year ended December 31, 2009, the Company has spent an approximate amount of $976,000 to obtain environmental permits and licenses, to comply with environmental obligations of different levels of government and to retain though a management company, the services of the environmental manager throughout the year. This approximate amount represents approximately 5.6% of the explorations expenses of the company for that year. Compliance with Environmental Laws at the Federal, provincial and local levels, for as long as the Company remains at the exploration stage for uranium, does not require material capital expenditures for the Company.

The Company has no employees and only a few consultants since it has a Services Agreement with BBH Géo-Management Inc. that provides employees and consultants in management, secretarial, geology, operations, legal affairs, investor relations, technical and environmental matters and professional services as fully disclosed in Item 7 of Management’s Discussion and Analysis of Financial Condition and Results of Operation -Related-Party Transactions and Item 10-Executive Compensation.”

Financing

On October 1st, 2008, the Company closed a non-brokered private placement of flow-through common shares with two funds for aggregate gross proceeds of $8,000,001.75. The private placement consists of 4,102,565 flow-through common shares issued at a price of $1.95 per share. The flow-through proceeds have been used by the Company before December 31, 2009 to incur eligible exploration expenses on its MATOUSH PROJECT located in Quebec, Canada and described in details in Item 2. Properties

On December 8, 2009, the Company completed a flow-through private placement of $2.5Million with one insider holding more than 10% of the share capital of the Company, through one fund and one accredited investor that are related, for an aggregate amount of $2.4M and another accredited investor for an amount of $100,000 for a total flow-through financing of $2,500,000. This private placement was made with two (3) subscribers from the Province of Ontario in Canada. The Company issued in this private placement a total of 2,500,000 flow-through common shares at the price of $1.00 per share.

The flow-through proceeds will be used by the Company to incur eligible exploration expenses on its MATOUSH PROJECT including MATOUSH, MATOUSH EXTENSION, ECLAT and PACIFIC BAY-MATOUSH properties and also on the MISTASSINI property, all located in Quebec, Canada and described in details in Item 2. Properties.The Company paid an amount of $100,000 as Finder’s fees.

Subscribers of flow through common shares are entitled to tax rebates in Canada and in the Province of Quebec when the holder is a resident of Quebec because the Company renounce to the credits to which it would be entitled in favor of the subscribers. The Company engages itself to spend the flow-through financing amounts on exploration expenses eligible to tax credits on or before December 31, 2010.

All the securities issued pursuant to the placement were subject to a hold period of four months and one day from the date of closing.

On January 27, 2010, the Company closed a non-brokered private placement for a total financing of $15 million. The financing was subscribed by Sentient Executive GP III Limited on behalf of two funds from Cayman Islands (“Sentient”), an equity fund that manages natural resource sector investments (“Sentient”).

Pursuant to the private placement, Sentient subscribed for 100,000 units at a price of $0.95 per unit for an amount of $95,000. Each unit consists of one common share (a "share") of the Company and one-half of one warrant. Each warrant entitles its holder to purchase one share of the Company for $1.00 during a 24-month period following the closing and for $1.05 during the subsequent period of 24 to 36 months after the closing (“warrant”). On closing, the Company issued a total of 100,000 shares and 50,000 warrants in consideration of the subscription price of the units.

Sentient also subscribed for 14,905 convertible notes maturing on February 27, 2015, for an amount of $14,905,000. Each tranche of $1,000 in notes is accompanied by 527 warrants, for a total of 7,844,737 warrants with the same exercise conditions as the warrants included in the units.

Until the maturity date of the notes, Sentient has the option of converting the notes into 1,053 shares per tranche of $1,000 based on a conversion price of $0.95 per share, for a total of 15,689,474 shares.

7

The Company paid Sentient transaction fees equal to 5% of the gross proceeds of the private placement. These transaction fees in the amount of $750,000 were paid through the issuance at closing of 789,474 units, being 789,474 shares and 394,737 warrants with the same exercise conditions as the warrants included in the units.

The Company plans to use the net proceeds of the private placement to finance exploration work, primarily for the acquisition of materials and infrastructure for its MATOUSH uranium PROJECT, which comprises THE MATOUSH, MATOUSH EXTENSION, ECLAT AND PACIFIC-BAY MATOUSH PROPERTIES in Quebec’s Otish Mountains in Canada located in Quebec, Canada and described in details in Item 2: Properties.

All the securities issued pursuant to the placement were subject to a hold period of four months and one day from the date of closing.

Item 1A: Risk Factors.

Exploration and Mining

The Company is at an exploration stage. Exploration and mining activities are subject to a high level of risk. Few exploration properties reach the production stage. Unusual or unexpected formations, fires, power failures, labour conflicts, floods, rockbursts, subsidence, landslides and the inability to locate the appropriate or adequate manpower, machinery or equipment are all risks associated with mining activities and the execution of exploration programs.

The development of resource properties is subject to many factors, including the cost of mining, variations in the material mined, fluctuations in the commodities and exchange markets, the cost of processing equipment and other factors such as aboriginal claims, government regulations including in particular regulations on royalties, authorized production, importation and exportation of natural resources and environmental protection. Depending on the price of the natural resources produced, the Company may decide not to undertake or continue commercial production. Most exploration projects do not result in the discovery of ore.

The probability of an individual prospect ever having reserves that meet the requirements of Industry Guide 7 is extremely remote. In all probabilities, the majority of the properties do not contain any reserves and any funds spent on exploration will probably be lost.

Even if the Company completes the current exploration program and it is successful in identifying a mineral deposit, the Company will have to spend substantial funds on further drilling and engineering studies before the Company knows if it has a commercially viable mineral deposit, a reserve.

Environmental and Other Regulations

Current, possible or future environmental legislation, regulations and measures may entail unforeseeable additional costs, capital expenditures, restrictions or delays in the Company's activities. The requirements of the environmental regulations and standards are constantly re-evaluated and may be considerably increased, which could seriously hamper the Company or its ability to develop its properties economically. Before a property can enter into production, the Company must obtain regulatory and environmental approvals. There can be no assurance that such approvals will be obtained or that they will be obtained in a timely manner. The cost related to assessing changes in government regulations may reduce the profitability of the operation or altogether prevent a property from being developed. The Company considers that it is in material compliance with the existing environmental legislation.

Financing and Development

The Company has incurred losses to date and does not presently have the financial resources required to finance all of its planned exploration and development programs. Development of the Company's properties therefore depends on its ability to obtain the additional financing required. There can be no assurance that

8

the Company will succeed in obtaining the required funding. Failure to do so may lead to substantial dilution of its interests (existing or proposed) in its properties. Furthermore, the Company has limited experience in developing a resource property, and its ability to do so depends on the services of experienced people or in the signature of agreements with major resource companies that can produce such expertise.

Commodities Prices

The market for uranium, gold, diamond, base metals or other mineral discovered can be affected by factors beyond the Company's control. Commodities prices have fluctuated widely, particularly in recent years. The impact of these factors cannot be accurately predicted.

Uninsured Risks

The Company could become liable for subsidence, pollution and other risks against which it cannot insure itself or chooses not to insure itself due to the high cost of premiums or for some other reason. Payment of such liabilities could decrease or even eliminate the funds available for exploration and mining activities.

Item 1B: Unresolved Staff Comments

The Company did not receive any comments from the U.S. Securities and Exchange Commission during the fiscal year to which the present report relates.

Item 2: Properties. All amounts mentioned in this following section are in Canadian dollars.

The following technical data has been read and revised by Jean-Pierre Lachance, Geo., Executive Vice President of Strateco Resources Inc., and David A. Ross, P.Geo., Senior geologist at Scott Wilson Roscoe Postle Associates Inc. (Scott Wislon RPA) who are qualified persons as defined under Canadian National Instrument 43-101 (NI 43-101).

At December 31, 2009, the Company had a portfolio of five wholly owned mining properties and interests or options on three mining properties in Quebec covering more than 56,747 hectares. Of these eight (8) properties, the Company explores actively for uranium on five (5) of them.

The table below represents the number of claims, the surface area for each property held by the Company as of December 31, 2009, the kind of minerals subject to exploration on this property, the interests of the Company in each property and applicable royalties:

| Number of claims |

Surface Area in Hectares |

Company’s Interest (I) and Options (O) |

Percentage |

Exploration (1) |

Royalties |

|

| MATOUSH PROJECT | ||||||

| Matoush | 25 | 1,328.46 | I | 100% | U3O8 | 2% NSR Yellow Cake (2) |

| Matoush Extension | 198 | 10,503.85 | I | 100% | U3 O8 | - |

| Eclat | 90 | 4,786.90 | I(3) | 100% | U3O8 | 2% NSR (3) |

| Pacific-Bay- Matoush | 277 | 14,576.33 | O(4) | 60% | U3O8 | 2% Yellow Cake (4) |

| MISTASSINI | 171 | 9,114.47 | O(5) | 60% | U3O8 | 2% Yellow Cake(5) |

| APPLE | 194 | 9,928.13 | I | 100% | U3O8 | 2% NSR (6) |

| MONT-LAURIER URANIUM | 80 | 4,710.35 | I | 100% | U3 O8 | |

| QUÉNONISCA | 33 | 1,798.77 | I (7) | 50% | ZN,PB,CU,AG | |

| TOTAL | 1,068 | 56,747.26 | ||||

9

|

(1) |

Exploration for uranium: U O and base metals exploration: ZN, PB, CU and AG;3 8 |

|

| |

| (2) |

This Royalty will be payable by the Company to Ditem Explorations Inc.; upon production; |

|

| |

| (3) |

The Company holds a 100% interest in all minerals other than diamonds in the ECLAT PROPERTY since June 15, 2009. This Royalty will be payable, upon production, in favour of the Vija Ventures Corporation on all minerals other than diamonds and 2% portion in favour of Vija Ventures Corporation of all gross proceeds from the sale or disposition of carbon emission rights tied to the production of uranium from the property; |

|

| |

| (4) |

The Company detains an option to acquire a 60% interest in the PACIFIC BAY-MATOUSH PROPERTY over a period of 4 years ending in 2011. Only Pacific Bay Minerals Ltd. its successors and assigns will be responsible to pay this Yellow Cake Royalty to Pierre Angers, upon production; |

|

| |

| (5) |

The Company detains an option over a period of 3 years ending in 2011 to acquire an interest of 60% on uranium rights only, on the Mistassini Property. This Royalty will be payable upon production by the parties to the option and joint venture agreement in favour of Northern Superior Resources Inc; |

|

| |

| (6) |

This Yellow Cake Royalty will be payable on all minerals, in favour of Virginia Mines Inc., upon production, subject to buyback right of the Company to purchase one percent (1%) NSR against a cash payment of one million dollars (CAN$1,000,000). |

|

| |

| (7) |

The Company and SOQUEM, each holds a 50% interest in this property. Upon production, each partner is entitled to its share of the production but if the interest of one party is of 10% or less it must transfer its interest to the other party and will hold thereafter a 1% NSR royalty. |

10

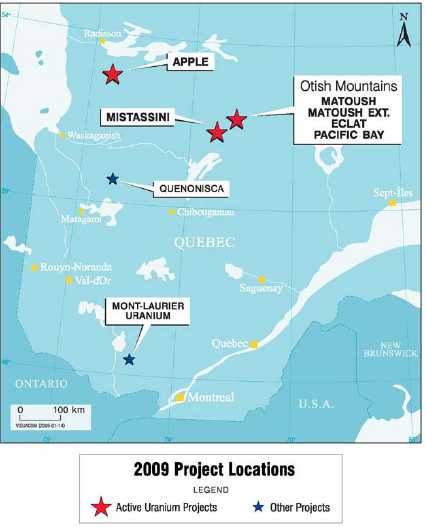

The map in Figure 1 below represents the regional location of all properties and projects of the Company as of March 2010 in the Province of Québec, Canada:

Following is the order for the Company’s discussion of its eight (8) properties:

SUMMARY OF URANIUM EXPLORATION ANALYTICAL PROCEDURES

| A. |

MATOUSH PROJECT |

||

| A.1 | MATOUSH PROPERTY | ||

MT-34 ZONE

MT-006 ZONE

TECHNICAL REPORTS

SCOPING STUDY

| A.2 |

MATOUSH EXTENSION PROPERTY | |

| A.3 |

ECLAT PROPERTY | |

| A.4 |

PACIFIC-BAY-MATOUSH PROPERTY | |

| A.5 |

PERMITS AND LICENSE |

| B. |

MISTASSINI PROPERTY | |

| C. |

APPLE PROPERTY | |

| D. |

MONT-LAURIER PROPERTY | |

| E. |

QUÉNONISCA PROPERTY |

11

The Company is mainly involved in exploration work for uranium on properties described in details in subsections Item 2: Properties subsections A throughD, so the Company will present at the outset, a brief Summary of Uranium Exploration analytical procedures in the following paragraphs and a detailed description of these procedures at the end of this Item 2- Note entitled: Detailed Uranium Exploration Analytical procedures.

Item 2: SUMMARY OF URANIUM EXPLORATION ANALYTICAL PROCEDURES:

Summary of Sampling Methods, Quality Assurance and Quality Control

The sampling program at MATOUSH PROJECT, including all aspects of Quality Assurance and Quality Control (“QA/QC”), is supervised by the Company’s Chief Geologist, Jonathan Lafontaine, P. Geo., who is a Qualified Person as defined under Canadian National Instrument 43-101 (“NI 43-101”).

Drill core is hydraulically split on-site by dedicated personnel and samples are collected over 30 cm to 3 m intervals based on geology. All reported samples are split with hydraulic splitter. Samples are individually bagged and tagged and shipped as per transportation protocols. Blanks, duplicates, and standards are randomly inserted in the sample shipment within the sample number sequence.

Prior to shipping, sealed sample bags are stored in a locked facility. Samples are shipped via air to Témiscamie float plane base, trucked to Chibougamau and from there sent by courier to the Geo-analytical Laboratories at the Saskatchewan Research Council (“SRC”) in Saskatoon, in the Province of Saskatchewan in Canada. The laboratory is accredited by the Standards Council of Canada as an ISO/IEC 17025 Laboratory for Mineral Analysis Testing. On arrival at SRC, samples are sorted into lots according to radioactivity level and prepped and analyzed in that order. Samples are dried and jaw crushed to 60% passing -2 mm and 100 g to 200 g sub sample split out using a riffler. The sub-sample is pulverized to 90% passing 106 microns using a ring and puck grinding mill. The mills are cleaned between samples using steel wool and compressed air.

After sample preparation, SRC analyzes for U3O8content by several means. ICP 4-3R (partial digestion) and fluorimetry are used on samples with U3O8 less than 100 PPM. ICP 4-3 (total digestion) is employed on samples with normal to high radioactivity, hence for the majority of the samples submitted. Samples with greater than 1,000 PPM U3O8 are also subjected to an Aqua Regia digestion before determination of wt% U3O8 also by ICP. The Company independently adds one blank sample and one quarter split duplicate each with every 14 samples. Results are reviewed on an ongoing basis.

In addition to chemical analysis, the Company employs a down-hole gamma probe instrument to estimate uranium grades. Prior to probing, the holes are washed to eliminate minor mineralization smearing or radon effects. Probe results, in cps units, are converted to eU3O8 (equivalent U3O8) using well established algorithms specifically calibrated to the Matoush deposit. A calibration hole (MT-07-29), for which there are complete chemical analyses, is probed at least once per month to ensure the probe is calibrated accurately and functioning properly. Results are also compared with chemical analysis when received. Discrepancies in results are immediately investigated and corrected.

Analytical results are received and imported into the Company’s data base. Laboratory replicates and laboratory standards are checked. Internal duplicates, blanks and standards are checked. Analytical drift from expected results triggers re-analysis.

Results are also compared with estimated Grade and Thickness (“GT”) values from in-situ down-hole probing, and with counts per second (“CPS”) values logged during initial core logging procedures.

In the following text covering in details exploration works on the Company’s properties, the letter “e” in “eU3O8” represents the estimated orequivalent value of U3O8 as determined by down-hole calibrated geophysical probing.

12

Further information on the various technical subjects relating to exploration work for uranium, namely the “eU3O8” and “CPS” nomenclatures, exploration program analysis methods, sampling techniques, quality control for the results obtained by the gamma probe and laboratory chemical analyses is available on the Company’s website at www.stratecoinc.com in section “Investor Relations” subsection “Q/A and Q/C” and in this annual report at Item 2 Properties- in the Note: Detailed Uranium exploration analytical procedures.

Item 2 A: MATOUSH PROJECT

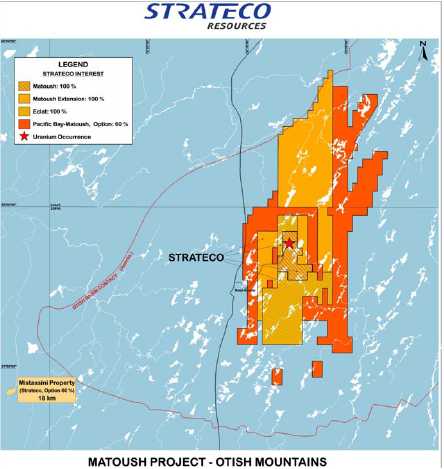

The map in Figure 2 below represents the Company interests in different properties constituting the MATOUSH PROJECT including MATOUSH PROPERTY, MATOUSH EXTENSION PROPERTY, ECLAT PROPERTY and PACIFIC BAY-MATOUSH PROPERTY.

The MATOUSH PROJECT (See subsection A) is located in the Otish Mountains in northern Quebec, Canada, about 275 kilometres north of Chibougamau, and consists of the wholly-owned MATOUSH PROPERTY (See subsection A.1), the wholly-owned MATOUSH EXTENSION PROPERTY (See subsection A.2), the wholly-owned ECLAT PROPERTY (See subsection A.3) and PACIFIC-BAY-MATOUSH PROPERTY in which the Company has an option to earn a 60% interest (See subsection A.4). The MATOUSH PROJECT currently comprises 590 claims for a total area of 32,195.54 hectares (321 km2).

13

The project is accessible by air, and in winter by the Eastmain winter road, which runs about seven kilometres to the west of the Project. The winter road has been upgraded over a 142-km length to allow access to the camp and transport of equipment and fuel required for 2009. The winter road repair work was carried out as planned. The contract was awarded to Entreprises CARSA Inc. for a second consecutive year. Repair work began in mid-December 2008 and maintenance was ongoing until March 20, 2009. In addition to various materials and a shovel excavator 700,000 litres of fuel and four new 50,000-litre fuel tanks were transported to the site. The four drills belonging to Major Drilling Group International Inc. that were on site were taken away and replaced by two new drills.

The workers and consultants benefit from a 50 persons camp completed in 2007, with all modern commodities.

The technical data in the following text is based on a report entitled: Technical Report on the Mineral Resources Update for the Matoush Uranium Project Central Quebec, Canada, dated September 16, 2008, prepared in accordance with National Instrument 43-101 respecting standards of disclosure for mineral projects (“NI 43-101”). This data has also been reviewed by the authors of the report, David A. Ross, M. Sc. P. Geo. and R. Barry Cook, P. Eng. of Scott Wilson RPA. The technical data in the following text is also based on a memorandum entitled Matoush Mineral Resource Update, dated September 18, 2009, and reviewed by David A. Ross, M. Sc. P. Geo. of Scott Wilson RPA. The technical data based on recent information has been reviewed by Jean-Pierre Lachance, Executive Vice President of the Company. All three are qualified persons as defined in NI 43-101.

Cautionary Note to U.S. Investors concerning estimates of Measured and Indicated Resources. This section uses the terms “measured” and “indicated resources”. We advise U.S. investors that while those terms are recognized and required by Canadian regulations, the U.S. Securities and Exchange Commission does not recognize them. U.S. investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves.

Cautionary Note to U.S. Investors concerning estimates of Inferred Resources. This section uses the term “inferred resources”. We advise U.S. investors that while this term is recognized and required by Canadian regulations, the U.S. Securities and Exchange Commission does not recognize it. “Inferred resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. U.S. investors are cautioned not to assume that part or all of an inferred resource exists, or is economically or legally minable.

In 2008, the Company began a 40,000-metre drilling program on the MATOUSH PROJECT and planned a budget of $22 million in exploration works. The Company carried out an extensive drilling program on its wholly-owned MATOUSH PROPERTY, located in the Otish Mountains, 275 km north of Chibougamau and the Company obtained interesting drill results. The potential and size of the new MT-22 mineralized zone was confirmed, as well as the extension of the AM-15 zone at depth.

In the second quarter of 2008, drilling was primarily focused on the new MT-34 mineralized zone that lies in the depth extension of the AM-15 zone, as well as on the MT-22 mineralized zone.

Third quarter of 2008, exploration work on the MATOUSH PROJECT essentially consisted of drilling and prospecting. A total of 16,837 metres were drilled in 52 holes. Of this total, 15,327 metres (45 holes) were drilled on the MATOUSH PROPERTY and the remaining 1,510 metres (7 holes) on the PACIFIC BAY-MATOUSH PROPERTY.

The Company prospected in the Laurent Martin area, 5.0 km to the east of the AM-15 lens, where a train of boulders including one that returned nearly 60,000 counts per second had been identified during prospection in summer 2007.

In the fourth quarter 2008, drilling continued on the MATOUSH PROJECT in the northern and southern extensions of well defined lenses and also along the Matoush fault with the objective to identify new mineralised lenses.

Twenty three drillings have been completed for a total of 9,517 metres during the fourth quarter 2008. These drillings explored at the North of the MT-22 lens and the south of the MT-34 lens.

14

In 2008, a total of 119 holes were drilled on the MATOUSH PROJECT for a total of 59,603 meters leading tothe delineation of Indicated mineral resources of 3.73M pounds U3O8and Inferred mineral Resources of 13.070 M pounds U3O8 as reported in Item 2: Properties-Technical Reports of Form 10K for the year ended December 31, 8.

All exploration drill holes results for the year 2009, longitudinal sections as well as photos of the mineralized intersections can be seen on the company’s website at www.stratecoinc.com.

In 2009, the Company continued to focus its efforts on the exploration and development of its uranium project, the MATOUSH PROJECT, using advanced exploration methods. The Company drilled 75 holes on its various properties for a total of 35,026 metres of drilling, including 34,240 metres on the MATOUSH PROJECT. Most notably, the holes drilled on the MATOUSH PROJECT resulted in the doubling of the indicated mineral resource to 7.46 million pounds of U3O8at the high grade of 0.78% U3O8.

The true width of the mineralized intersections of the holes drilled in 2009 has not yet been determined.

In order to describe the exploration work in 2009 conducted on its uranium properties in details, the Company must include in this annual report a description of the techniques used and required for exploration work, namely: (i) analytical procedures used in the exploration program; (ii) sampling methods; (iii) quality assurance and control (including information on the use of the letter “e” in eU3O8, which represents the estimatedor equivalentU3O8value determined using a calibrated spectral or gamma probe); (iv) the methodology for the use of the gamma probe; and, finally, (v) a comparison of eU3O8and U3O8 results.

This technical description can be found in the NOTE following the Item 2: Properties and in the QA/QC section under the About Strateco tab on the Company’s website, at www.stratecoinc.com.

In 2009, 68 holes totalling 34,240 metres were drilled on the MATOUSH PROJECT as a whole. Drilling was distributed as follows: 26,144 metres in 44 holes on the MATOUSH PROPERTY; 4,375 metres in 11 holes on the ECLAT property, and 3,721 metres in 13 holes on the PACIFIC BAY-MATOUSH property. No drilling was done on the MATOUSH EXTENSION property. In all, 160,216 metres (378 holes) have been drilled on the MATOUSH PROJECT since exploration began in 2006.

The 2009 drilling program began in early February on the MATOUSH PROJECT, with two drills in operation. One drill was assigned to drilling on the southern extension of the MT-34 zone, about 1 km away from that zone, with the goal of identifying a new lens at a depth of between -400 and -650 metres. The second drill was first mobilized on the PACIFIC BAY-MATOUSH property to drill 1,500 metres in the Rabbit Ears South area, and was then moved in early March to an area of the ECLAT property 9.5 km south of the MT-34 zone, near Hole EC-08-01, which returned very interesting results in the winter of 2008.

Drilling was temporarily suspended during the spring thaw, from April 27 to May 27. Drilling then resumed, with two drills operating on the properties, as well as one helicopter-borne drill for holes drilled on the MISTASSINI and PACIFIC BAY-MATOUSH properties. Besides the exploration holes, five geotechnical holes totalling 526 metres were drilled as part of the preparatory work for the underground exploration program. The 2009 drilling program ended on November 26.

The MATOUSH PROJECT remains the Company’s priority in the pursuit of its objective to become the first Québec Company to advance a uranium exploration project to the underground exploration stage.

Item 2: A1. MATOUSH PROPERTY

The Company owns a 100% interest in this uranium property representing for the moment the main focus of the MATOUSH PROJECT located about 275 km north of Chibougamau, in the Otish Mountains, in Québec, Canada (See Figure 1 for regional location of the MATOUSH PROPERTY).

15

Location and Access

This property is accessible by air, and in winter by the Eastmain winter road, which runs about seven kilometres to the west of the property.

Mining Claims

The property consists of 25 claims covering an area of 1,328.46 hectares.

A letter of intent dated May 12, 2005 provided for the Company to earn a 51% interest from Ditem Explorations Inc. ("Ditem"), which owned then a 100% interest in the MATOUSH PROPERTY, in consideration of payments totalling $125,000 over two years, including $5,000 on signature of the agreement; $750,000 in exploration work over three years, including $200,000 the first year; and the issuance of 600,000 common shares of the Company over two years. The Beaver Lake Area project, which lied approximately 20 kilometres to the west, was also covered by this initial agreement.

A new letter of intent was signed with Ditem on February 21, 2006, giving the Company a 100% interest in the MATOUSH PROPERTY under the following terms: The Company paid $10,000 at the execution of the letter of intent and within five days following approval of the transaction by regulatory authorities, the Company paid to Ditem $140,000 and issued to Ditem 400,000 common shares. The shares were subject to a resale restriction of four months plus a day. Ditem became entitled upon production to a 2% NSR, as defined by industry standards. The claims in the Beaver Lake area have not been renewed by the Company upon acquisition of this 100% interest in the MATOUSH PROPERTY.

Uranium Potential

The Otish Mountains area is well known for its uranium potential, particularly due to exploration conducted by Uranerz Exploration and Mining (“Uranerz”) and Cogema in the late 1970s and early 1980s.

The results of exploration conducted by Uranerz in the early 1980s before uranium prices tumbled, as well as those obtained by the Company in 2006, 2007, 2008 and 2009, indicated that the MATOUSH PROPERTY had a very good potential.

Uranerz only explored a 900-metre section of the Matoush structure, which had been traced over 3,900 metres on this property. The Matoush structure was discovered in the early 1980s by the German company. In 1984, Uranerz drilled 23 holes, including Hole AM-15, which returned a 16-metre intersection at a vertical depth of 200 metres grading 0.95%U3O8 or over 20 pounds of U3O8 per tonne of ore, a very high grade by today’s standards. Due to low uranium prices from 1985 to 2005, the uranium potential of the MATOUSH PROPERTY was not explored any further. Uranerz exploration work results dated from the late 1970s and early 1980s and preceded the Canadian National Instrument 43-101 (“NI 43-101”)

Cautionary Note: A qualified person has not done sufficient work to classify the historical estimate by Uranerz as current mineral resources or mineral reserves. The Company does not consider resources or reserves of an historical estimate to be mineral resources or mineral reserves, as these categories are defined in articles 1.2 and 1.3 of the NI 43-101, as amended. The investor or reader should not rely upon this historical estimate.

This exploration work by Uranerz served however as the Company's point of departure for exploration of the MATOUSH PROPERTY.

The holes drilled on the MATOUSH PROPERTY indicated that the uranium mineralization was closely linked to the fuschite and tourmaline alteration on both sides of a gabbros dike in the sediments. The alteration envelope associated with the Matoush structure was symmetrical, with an average thickness of 40 metres. Typically, adjacent to and moving outward from the dike was first a tourmaline zone, then a chlorite-fuschite-muscovite zone and a limonite-hematite zone.

In 2009, the Company carried out surface exploration on 26,144 metres in 44 holes of surface drilling on the property.

16

Given the structural context at MATOUSH PROPERTY, various zones of varying grade and thickness were outlined using a smaller drill grid.

It should be noted that the southern extension of the AM-15 zone was tested in the winter of 2006-2007 along the ACF unit that hosts the AM-15 resources.

Detailed geological interpretation of the AM-15 zone as part of the NI 43-101 resource estimate in September 2007 revealed that the AM-15 zone dips about 200 to the south and that the mineralization appears to continue in the underlying CBF unit. Drilling carried out on the lake ice showed clearly that the AM-15 zone continues at depth toward the south.

The five holes drilled in the less porous, 75-metre thick intermediate CBF unit all intersected the fault zone, with variable thicknesses and grades that averaged 0.08% eU3O8over 4.2metres. The mineralization extends to the lower CBF contact, and the goal was to explore the underlying ACF unit in the extension of the AM-15 zone plunge.

The potential of this major mineralized zone was supported by the marked presence of fuschite alteration and the absence of dykes in the three most northern holes (MT-08-001, MT-08-003, MT-07-129), which returned the best intersections. Drilling on the AM-15 lens had shown that the best intersections corresponded to the intensity of the fuschite alteration and the absence of dykes.

The drill results resulted in an initial resource estimate for the AM-15 zone in September 2007, discovery of a new zone (MT-22) and confirmation of the extension of the AM-15 zone at depth. On September 27, 2007, Scott Wilson Roscoe Postle Associates Inc. (Scott Wilson RPA) completed a NI 43-101 technical report on the MATOUSH PROPERTY, including a resource estimate on the AM-15 core zone.

Scott Wilson RPA prepared the initial mineral resource estimate for the AM-15 core zone at MATOUSH PROPERTY using drill-hole data available as of September 27, 2007. This technical report concluded that, Indicated mineral resources were estimated to total 201,000 tonnes grading 0.79%U3O8 containing 3.48million pounds of U3O8. Inferred mineral resources were estimated to total 65,000 tonnes grading 0.43%U3O8 containing 0.62 million pounds.

Results of this resource estimate have been described in details in Form 10-KSB for the year ended December 31, 2007 at Item 2 Properties-MATOUSH PROPERTY.

Through geophysical surveys and several drill holes on the MATOUSH PROPERTY, the Company also established the presence of the Matoush fault and sedimentary horizons ACF-3 (AM-15 zone) and ACF-4 (MT-22 and MT-34 zones) on a distance of over 15 km, including a mineralized section located by Hole EC-08-01, 8.5 km south of the AM-15 zone. This hole intersected 0.15% eU3O8over 2.1metres at a vertical depth of 550 metres in the ACF-4. These ACF horizons of coarse sediments represent a favourable context for uranium precipitation.

Two holes drilled in the ACF-4 (MT-08-019 and MT-08-027) proved encouraging, both in terms of geological context and the potential size of the mineralized body and showed a fault offset that is a prime site for uranium precipitation.

During the second quarter of 2008, the drill results confirmed the potential in uranium sought by the Company, especially on the MT-34 zone, which lies in the ACF-4, as does the MT-22 zone.

Extensive surface exploration and airborne VLF geophysics were carried out during the summer 2008 on MATOUSH PROPERTY.

During the third quarter of 2008, the exploration holes drilled in the northern extension of the AM-15 zone (600 m to the north) and the MT-22 zone (200 m to the north) resulted in the identification of a new fault, the Coonishish fault. This fault lies about 200 m east of the Matoush fault and is sub parallel to it. Two sections spaced at approximately 75 metres were drilled to determine the fault’s strike and dip and assess its uranium potential. The task proved relatively arduous, as the Coonishish fault is cut by other siliceous, clayey faults. From an exploration perspective, the results

17

were compelling, as the genesis model allowed the confirmation of a second system detached from the Matoush fault. The Coonishish fault was intersected in almost all the layers: ACF 1, 2 and 3 and CBF 1, 2 and 3. Only one hole has intercepted mineralization to date, with the notable presence of fuschite alteration, which remains a key element for exploration. Hole MT-08-084 returned an intersection of 0.04% eU3O8over 2.0metres.

Exploration work

MT-22 ZONE

The new MT-22 mineralized zone discovered by the Company in 2007 on the MATOUSH PROPERTY lies under the AM-15 zone and is parallel to its plunge. The MT-22 lens drilled on a grid of approximately 100 m, lies at a vertical depth of between -300 m and -650 m and over a length of 450 m, between sections 31+50S and 27+00S and remained open to the north over its full height (350 m) (see longitudinal section on the Company’s website: www.stratecoinc.com ). Given the known structural context of MATOUSH PROPERTY, several lenses with various grades and thicknesses were expected from drilling on a tighter grid and were also expected to return significant grades at the intersection with the Matoush fault.

In comparison, the AM-15 zone is 50 metres high and 300 metres long, contained an estimated resource of 4.1million pounds of U3O8 according to the Technical Report on the Matoush Uranium Project Central Quebec, Canada NI 43-101 of Scott Wilson RPA dated September 27, 2007.

Between November 2007 and March 2008, more than 25 holes had been drilled on this new MT-22 zone. Good results on the MT-22 zone were obtained in the two last holes drilled in 2007, MT-07-129 and MT-07-130, and were located 80 metres apart at the same depth, -350 metres. Hole MT-07-129, which intersected 8.3 metres at 0.24% eU3O8, including 3.7metres at 0.51%eU3O8, was encouraging, particularly as the alteration halo in this hole is identical to that of the AM-15 zone.

The holes drilled in the first quarter of 2008 on the MT-22 zone proved positive, with impressive intersections that confirm the importance of this major new zone. The best intersections included Hole MT-08-003, with 2.86%eU3O8 over 5.8 metres including 4.48% eU3O8 over 3.4metres and Hole MT-08-013 with 0.52% eU3O8over 7.2metres.

In February 2008 the Company intersected a new high grade section at the North End of the MT-22 lens and in March 2008, the Company realised that the MT-22 mineralized zone on the MATOUSH PROPERTY, discovered at depth under the AM-15 zone, was proving to be major and planned for 50,000 metres of drilling during the year 2008 on this property.

During the second quarter of 2008, drilling on the MT-22 mineralized zone, continued on a 50-metre grid in preparation for the next resource estimate. The results for this zone were conclusive. The best results were obtained in holes MT-08-022, 028, 036 and 043. Hole MT-08-022 intersected 0.37% eU3O8 over 18.4m, including 1.16% eU3O8 over 5.3m. Hole MT-08-027, drilled in early April 2008, returned an exceptionally wide mineralized section of 63 metres downhole, representing a true width of about 23 metres. The hole intersected 0.05% eU3O8 over 63.2 metres, including 0.13% eU3O8over 8.0metres showing a strong potential for this sector. Hole MT-08-028 intersected 0.47% eU3O8 over 41.6m, including 2.40% eU3O8 over 7.0m. Hole MT-08-036 intersected 0.41% eU3O8over 7.5m, including 1.25%eU3O8 over 2.0m, and Hole MT-08-043 intersected 2.45% eU3O8 over 10.5 m, including an high-grade section of 2.0 m at 8.97% eU3O8.

The most interesting holes drilled up to the end of the second quarter of 2008 on the MT-22 zone are indicated in bold in the following table:

18

| Core | ||||||||||

| Az. | Angle | From | To | length | % | Max. | ||||

| Hole | Collar | (º) | (º) | (m) | (m) | (m) | eU3 O8 | cps | lb/tonne | |

| East | North | |||||||||

| MT-08-001 | 13+46E | 27+00S | 264 | -45 | 707.2 | 709.5 | 2.3 | 0.62 | 20,000 | 13.64 |

| MT-08-003 | 12+40E | 26+50S | 273 | -45 | 573.5 | 580.3 | 6.8 | 2.43 | 65,000 | 53.46 |

| Including | 576.6 | 580.0 | 3.4 | 4.48 | 98.56 | |||||

| MT-08-013 | 12+15E | 27+42S | 264 | -60 | 467.1 | 474.3 | 7.2 | 0.52 | 8,300 | 11.44 |

| Including | 469.5 | 471.5 | 2.0 | 1.21 | 26.62 | |||||

| MT-08-015 | 12+78E | 26+52S | 276 | -63 | 565.8 | 567.1 | 1.3 | 0.85 | 10,000 | 18.70 |

| 584.6 | 591.3 | 6.7 | 0.47 | 10.34 | ||||||

| MT-08-018 | 12+75E | 26+50S | 262 | -65 | 636.9 | 638.1 | 1.2 | 0.90 | 25,000 | 19.80 |

| MT-08-020 | 11+55E | 28+70S | 267 | -64 | 455.3 | 463.6 | 8.30 | 0.31 | 1,900 | 6.82 |

| MT-08-022 | 11+70E | 28+05S | 267 | -62 | 450.5 | 468.9 | 18.40 | 0.37 | 14,200 | 8.14 |

| Including | 451.9 | 457.2 | 5.30 | 1.16 | 25.52 | |||||

| MT-08-028 | 12+15E | 27+40S | 284 | -59 | 409.9 | 451.5 | 41.6 | 0.47 | 56,000 | 10.34 |

| Including | 431.2 | 438.2 | 7.0 | 2.40 | 52.80 | |||||

| MT-08-035 | 13+12E | 25+46S | 264 | -55 | 520.6 | 523.4 | 2.8 | 0.63 | 12.6 | |

| MT-08-036 | 11+72E | 28+07S | 277 | -70 | 556.9 | 564.4 | 7.5 | 0.41 | 8.2 | |

| Including | 562.4 | 564.4 | 2.0 | 1.25 | 25.0 | |||||

| MT-08-043 | 12+13E | 27+39S | 272 | -61 | 475.0 | 485.0 | 10.5 | 2.45 | 49.0 | |

| Including | 481.5 | 483.5 | 2.0 | 8.97 | 179.4 | |||||

| MT-08-046 | 12+13E | 27+39S | 280 | -67 | 565.0 | 576.5 | 11.5 | 0.26 | 5.2 | |

| Including | 565.0 | 567.6 | 2.6 | 0.81 | 16.2 | |||||

| MT-07-022 | 13+25E | 31+50S | 273 | -53 | 769.3 | 769.9 | 0.6 | 1.18* | 8,600 | 25.96 |

| 830.8 | 832.2 | 1.4 | 0.31* | 6.83 | ||||||

| MT-07-101 | 12+40E | 30+60S | 275 | -48 | 524.1 | 526.6 | 2.5 | 0.25 | 5,900 | 5.50 |

| MT-07-116 | 14+81E | 28+96S | 275 | -49 | 797.6 | 798.9 | 1.3 | 0.72 | 32,000 | 15.84 |

| MT-07-120 | 15+64E | 28+03S | 275 | -45 | 840.2 | 840.8 | 0.6 | 0.36 | 5,000 | 7.92 |

| MT-07-126 | 13+94E | 30+80S | 275 | -45 | 753.5 | 760.8 | 7.3 | 0.10 | 5,800 | 2.20 |

| MT-07-129 | 11+93E | 28+65S | 269 | -47 | 491.6 | 499.9 | 8.3 | 0.24 | 6,400 | 5.28 |

| Including | 496.2 | 499.9 | 3.7 | 0.51 | 11.22 | |||||

| MT-07-130 | 11+93E | 28+65S | 280 | -47 | 499.3 | 504.3 | 5.0 | 0.11 | 1,020 | 2.42 |

| Including | 499.3 | 501.0 | 1.7 | 0.24 | 5.28 |

* Grades determined by chemical analysis

The true width of the mineralized sections has not yet been determined.

These equivalent uranium values were generated by the Gamma probe.

During the third quarter of 2008, five holes (3,096 metres) were drilled for the definition of the MT-22 zone on the MATOUSH PROPERTY. Two holes (MT-08-061 and 064) were drilled in the MT-22 zone to provide geological information within the mineral resource envelope. The three other holes (MT-08-077, 079 and 080) were drilled within the envelope in the northern extension of the MT-22 zone between the -400 m and -450 m levels. The hole MT-08-077 intersected 0.80% eU3O8 over 7.0m, including 2.07% eU3O8 over 2.2m.

19

The holes in the northern part were drilled from 500 metres to 1 km from the MT-22 zone, between sections 18+00S and 22+00S, from near surface to -425 metres. These holes failed to intersect any new zones. However, three of the four holes drilled on section 20+00S intercepted very strong fuschite alteration, which represented a favourable environment for the deposition of uranium mineralization. The best result was obtained in Hole MT-08-098, which returned a grade of 0.06% eU3O8over 2.8 metres in the ACF 3.

These results were not part of the resource estimate of September 2008 since the cut-off date of this technical Report was July 25, 2008 (See Item 2: sub-section A-1, entitled: TECHNICAL REPORTS).

All the results of MT-22 zone can be viewed on the longitudinal section on the Company’s website, at www.stratecoinc.com.

MT-34 ZONE

During the winter of 2006-2007, the Southern Extension of the AM-15 zone was drilled along the ACF horizon hosting the AM-15 estimated resources.

Detailed geological interpretation of the AM-15 zone revealed that the zone dipped about 200 to the south, and that the mineralization appeared to continue in the underlying CBF unit. Drilling to be carried out on the lake ice began at the end of January 2008. The holes drilled show clearly that the AM-15 zone continues at depth toward the south. The goal was then to explore the underlying ACF layer, the same unit that hosted the MT-22 zone to the north.

In 2008, the Company explored and outlined the Southern Extension of the AM-15 zone at depth. This new zone had returned impressive core lengths with lower U3O88 grades than the AM-15 and MT-22 zones. However, it should be noted that exploration of this area had just begun, and based on the MT-22 zone model, there were likely high-grade zone in the ACF at depths of between -300 and -650 metres.

Five holes were drilled in the CBF unit, and intersected values similar to those seen in the same CBF unit above the MT-22 zone.

This drilling on the Southern Extension of AM-15 led to the discovery of a new mineralized zone, the MT-34 lens, on the Company’s MATOUSH PROPERTY at the end of April 2008.

Drilled in this new area at the end of the first quarter of 2008, holes MT-08-019 and MT-08-027 (see table above) revealed a major displacement of the Matoush fault between the two holes. Hole MT-08-034 was planned on the basis of this observation.

The understanding of the geology and mineralization obtained from three years of work led to the discovery of this new, high-grade uranium zone and could likely result in the discovery of other mineralized zones. In fact, work by the Company has shown that the high-grade areas of the AM-15 and MT-22 uranium zones are associated with horizontal displacement of the Matoush fault.

The new zone, named MT-34, was intersected by Hole MT-08-034 at a vertical depth of 370 metres, south of the AM-15 and MT-22 zones. The Hole MT-08-034 was the most interesting hole drilled by the Company at that time on the MATOUSH PROPERTY (the location of Hole MT-08-034 can be seen at www.stratecoinc.com).

Hole MT-08-034 had intersected mineralization over a 54.4 -metre section of drill core and graded an average of 0.69%eU3O8, including a 28.0 -metre section grading at an average of 1.32% eU3O8 (29 lbs/tonne) and a 4.80 -metre section with a grade of 6.13% eU3O8 (135 lbs/tonne). The true width of the mineralized sections had not yet been determined. The equivalent uranium values were generated by the Gamma probe.

Following Hole MT-08-034, 11 other holes were drilled in the MT-34 area to test the extensions of this new mineralized zone. The results were conclusive, showing a high-grade core within the MT-34 zone. Hole MT-08-047 intersected a 10.0 -metre mineralized zone grading an average of 2.24% eU3O8, including a 3.0 -metre section grading 3.20% eU3O8 at a vertical depth of 454 metres, about 70 metres south of hole MT-08-034.

20

The most interesting hole drilled on the MT-34 zone were: Hole MT-08-047, at a vertical depth of 454 metres about 70 metres south of MT-08-034, which intersected a 10.0 -metre mineralized section grading an average of 2.24% eU3O8, including 3.0metres with a grade of 3.20% eU3O8.

Two other holes drilled between holes MT-08-034 and MT-08-047 on a 40-metre grid in preparation for the next resource estimate confirmed the potential of this new zone. Hole MT-08-050 intersected the mineralized zone over 21.6 metres averaging 0.44% eU3O8, including1.8metres grading 1.88% eU3O8, while hole MT-08-053 intersected an 11.4 -metre mineralized section averaging 2.02% eU3O8, including 5.2m grading 4.38% eU3O8.

The most interesting results for holes drilled on the MT-34 zone are indicated in bold in the following table:

| Hole |

Collar |

Az. (º) |

Angle (º) |

From (m) |

To (m) |

Core Length (m) |

% eU3 O8 |

lb/tonne |

|

| East | North | ||||||||

| MT-08-034 | 9+86E | 33+48S | 268 | -67 | 383.5 | 437.9 | 54.4 | 0.69 | 13.8 |

| Including | 383.3 | 411.3 | 28.0 | 1.32 | 26.4 | ||||

| Including | 397.8 | 402.6 | 4.8 | 6.13 | 122.6 | ||||

| MT-08-037 | 10+55E | 32+08S | 262 | -61 | 380.2 | 399.3 | 19.1 | 0.10 | 2.0 |

| Including | 396.2 | 399.3 | 3.1 | 0.22 | 4.4 | ||||

| MT-08-041 | 11+48E | 34+75S | 277 | -51 | 557.8 | 564.8 | 7.0 | 0.13 | 2.6 |

| MT-08-047 | 12+42E | 32+97S | 259 | -46 | 616.3 | 626.3 | 10.0 | 2.24 | 44.8 |

| Including | 619.3 | 622.3 | 3.0 | 3.20 | 64.0 | ||||

The true width of the mineralized sections has not yet been determined.

The equivalent uranium values were generated by the Gamma probe.

Holes MT-08-062 and MT-08-068, drilled to an approximate depth of -450 m about 190 m north of the heart of the MT-34 zone, returned interesting results, with respective intersections of 1.86% eU3O8 over 3.1m (including 2.3% eU3O8 over 2.3m) and 0.05% eU3O8 over 1.39m. In the depth extension, hole MT-08-058 (-530 m) returned a notable intersection of 0.03% eU3O8 over 19.3m, including 0.13% U3O8 over 1.6m. Hole MT-08-069 (-580 m) returned 0.19% eU3O8 over 1.0m. (The hole pierce points and results can be seen on longitudinal section on the Company’s website at www.stratecoinc.com).

Hole MT-08-105 intersected 0.06% eU3O8 over 3.5metres and Hole MT-08-107 intersected 0.02% eU3O8 over 7.1 metres, including 0.10% eU3O8 over 0.9metres.

Finally, six holes were drilled in the MT-34 zone extensions, particularly the southern extension. The best hole was MT-08-083, which returned 0.16% eU3O8 over 7.7metres, including 0.37% eU3O8 over 1.2metres. Drilling ended on December 5, 2008.

With the exception of Hole MT-08-062, these holes were not part of the resource estimate as of July 25, 2008 (See following Item 2 A.1, sub-section entitled: TECHNICAL REPORTS).

As of April, 2009, the 30,000-metre exploration drilling program which started in February 2009 had already resulted in the discovery of two new mineralized zones on the Company’s MATOUSH PROJECT.

Hole MT-006, drilled in April 2009, is located on section 46+00S, 1.0 km south of the MT-34 core zone. The new mineralized zone was intersected by Hole MT-09-006, which returned an 8.9 -metre intersection grading 0.21% eU3O8, including 1.1 metres at 0.96% eU3O8. This intersection is strongly altered in fuschite with the presence of pitchblende and uranophanes, and is similar in size, grade and alteration to intersections near the MT-34 and MT-22 core zones.

21

Hole |

Collar | Az. | Angle (º) | From (m) | To | Vertical | Length | eU3 O8 | |

| East | North | (º) | (m) | Depth (m) | (m)* | (%) | |||

| MT-09-006 | 11+01E | 43+92S | 249 | -64 | 601.0 | 609.9 | 555 | 8.9 | 0.21 |

| Including | 603.0 | 604.1 | 1.1 | 0.96 | |||||

*Core length

The true width of the mineralized sections has not yet been determined.

The equivalent uranium grades are obtained using a spectral probe.

As of the end of May 2009, the Company resumed exploration drilling campaign that had been halted temporarily at the end of April 2009 for the spring break-up. This campaign was part of the 30,000-metre exploration drilling program which started in February 2009, on the Company’s wholly-owned MATOUSH PROPERTY.

MT-006 ZONE

Drilling continued with one of two drills, in Hole MT-09-011 which was interrupted at a depth of 180 metres and is located on the new MT-006 zone discovered in April 2009. The MT-006 zone is located on section 46+00S, 1.0 km south of the MT-34 core zone. Hole MT-09-006 returned an 8.9 -metre intersection grading 0.21% eU3O8including1.1 metres at 0.96% eU3O8. Thisintersection is strongly altered in fuschite with the presence of pitchblende and uranophanes and is similar in size, grade and alteration to intersections near the MT-34 and MT-22 core zones.

As for the second drill mobilized for geotechnical drilling as part of preliminary work for the underground drilling program, it went back to exploration drilling in the first week of June 2009.

Before going back to the MT-006 zone, the drill made a stop in the sector of the high grade MT-34 lens, where hole MT-08-034 had intersected 1.32% eU3O8 on 28.0metres including 6.13% eU3O8 on 4.8metres. Two strategic drill holes were carried out in order to expand already delineated mineral resources.

On the MT-34 zone, indicated mineral resources are estimated to total 88,000 tonnes grading 0.97% U3O8 containing 1,890,000 pounds U3O8 and inferred resources that were estimated to total 527,000 tonnes grading 0.55% U3O8 containing 6,350,000 pounds U3O8 These results came from the NI 43-101 resource estimate updated by Scott Wilson RPAin September 2008.

As of July 2009, one of the two drills in operation on the MATOUSH PROPERTY, wholly-owned by the Company, had been assigned to the MT-34 zone area. Due to the high grades obtained in Hole MT-34 (1.36% U3O8 over 27.50 m including 6.03% U3O8 over 4.80 m) relative to the other grades and thicknesses for the zone, the influence of Hole MT-34 in the September 2008 resource estimate done by Scott Wilson RPA was voluntarily limited. Furthermore, because a 50 m x 70 m drill grid was used in the area of Hole MT-34 in 2008, this resource could not be categorized as an indicated resource.

The four holes drilled in June and the fifth hole allowed the total MT-34 zone resource to be increased and a portion of the resource to be upgraded from inferred to indicated.

Scott Wilson RPA was retained to prepare an update of the resource estimate for the MT-34 zone. The memorandum is entitled: Matoush Mineral Resources Update, dated September 18, 2009 prepared by David A. Ross, M.Sc. P. Geo of Scott Wilson RPA and is further detailed in Item 2 A.1, sub-section entitled: TECHNICAL REPORTS

Four holes (MT-09-012, 014, 016 and 019) were drilled in the upper part of the MT-34 zone in June 2009. Three of the four holes intersected high grades over considerable intervals.

Hole MT-09-019, with a pierce point in the upper part of the ACF-4 near the contact with the CBF, 35 m north of Hole MT-08-051 (0.40% eU3O8 over 5.1 m), intersected 0.26% eU3O8 over 14.1metres, including a section of 0.95% eU3O8 over 2.8m. Hole MT-09-017 was drilled on the same section, but was abandoned due to excessive deviation. Hole MT-09-014 returned an intersection of 0.08% eU3O8over 5.1m. This hole lies at the lower limit of the MT-34 zone. Hole MT-09-020 was drilled to test the extension of Hole MT-08-034 up dip from the MT-34 zone

22

in the direction of the upper part of the ACF-4. Another hole was planned on the MT-34 zone at a vertical depth of -470 m between holes MT-08-047 and MT-08-055, alongside the MT-34 zone in an area where no resources were estimated.

| Hole |

Collar | Az. (º) |

Angle (º) |

From (m) |

To (m) |

Vert. Depth (m) |

Length (m)* |

eU3

O8 (%) | |

| Easting | Northing | ||||||||

| MT-09-012 | 12+18E | 34+76S | 286.5 | -47.6 | 507.0 | 532.7 | 383.4 | 25.7 | 0.61 |

| including | 509.9 | 517.3 | 383.4 | 7.4 | 1.30 | ||||

| MT-09-014 | 12+54E | 33+72S | 273 | -48.2 | 554.5 | 559.6 | 405.8 | 5.1 | 0.08 |

| MT-09-016 | 12+20E | 34+76S | 287.5 | -45.9 | 506.0 | 532.9 | 376.8 | 26.9 | 0.42 |

| including | 507.9 | 520.8 | 376.8 | 12.9 | 0.66 | ||||

| including | 508.2 | 509.5 | 376.8 | 1.3 | 2.41 | ||||

| MT-09-019 | 12+09E | 34+76S | 287.5 | -45.6 | 486.9 | 501.0 | 345.4 | 14.1 | 0.25 |

| including | 495.1 | 497.9 | 345.4 | 2.8 | 0.95 | ||||

*Core length

The true width of the mineralized sections has not yet been determined.

The equivalent uranium grades are obtained using a spectral probe.

All exploration drill holes results of 2009 and longitudinal sections can be seen on the company’s website at www.stratecoinc.com.

The drill results for the first quarter of 2009 were promising, particularly south of the MT-34 zone. Hole MT-09-006, drilled 1 km away from the heart of the MT-34 zone on Section 46 + 00S, intersected a 8.9 -metre zone strongly altered in fuschite with the presence of pitchblende and uranophanes. This intersection graded 0.27% U3O8 over 9.5 metres, including 0.97% U3O8 over 1.2metres.

The four completed holes (MT-09-011, 013, 015 and 018) all intercepted the Matoush fault, with anomalous uranium values.

In the second quarter, another eight holes were drilled in the MT-006 area on a 100-metre grid to test the continuity of the Hole MT-09-006 intersection. The best hole was MT-09-009, drilled to a vertical depth of -600 metres along the presumed plunge of MT-09-006, 100 metres away. It intersected 0.11% U3O8 over 2.4metres at the level of the fault.

Early in June, one of the two drills in operation on the MATOUSH PROPERTY was assigned to the MT-34 zone area. Due to the high grades obtained in Hole MT-08-034 (1.36% U3O8 over 27.5 m including 6.03% U3O8 over 4.8 m) relative to the other grades and thicknesses for the zone, the influence of Hole MT-08-034 in the September 2008 resource estimate done by Scott Wilson RPA was voluntarily limited.

Furthermore, because a 50 m x 70 m drill grid was used in the area of MT-08-034 in 2008, this resource could not be categorized as an indicated resource.

Four holes were drilled in the upper part of the MT-34 zone in June 2009. Three of the four holes intersected high grades over considerable intervals.

Hole MT-09-012, whose pierce point lies just a few metres from Hole MT-08-50 due to strong deviation, returned an intersection of 0.69% U3O8 over 25.5 metres, including 1.44% U3O8 over 7.2 metres.

Hole MT-09-016, whose pierce point lies midway between holes MT-08-050 and MT-08-34, returned an intersection of 0.56% U3O8 over 25.8 metres, including 0.94% U3O8 over 12.5 metres, while Hole MT-08-050 previously intersected 0.49% U3O8 over 21.3m, including 1.99% U3O8 over 2.0m.

23

On or about the end of July 2009, the Company discovered a uranium high grade intersection in the extension of the MT-34 lens.

In fact, hole MT-09-022 has intersected 0.99% eU3O8 over 30.6 metres including 5.98% eU3O8 over 4.5 metres.

This drill hole, with a pierce point located on section 34+85S at a vertical depth of 456 metres in the extension on the MT-34 lens, is one of the best holes drilled to date by the Company on its wholly-owned MATOUSH PROPERTY.

The pierce point of MT-09-022 is located outside of the resources estimated by Scott Wilson RPA published in September 2008 and as such its results are interesting.

Another drill hole was planned at the same elevation, 50 metres south of MT-09-022, to fill in the gap between holes MT-09-022 and MT-08-062 located 100 metres apart.

The true width of the mineralized sections has not yet been determined.

Location of pierce point of Hole MT-09-022 can be seen on the MT-34 longitudinal section available on the Company’s website at www.stratecoinc.com.

As of July, 2009, 20,000 metres of the planned 30,000 metres of exploration drilling in 2009 had been completed.

At the end of September 2009, the Company increased its 2009 surface exploration program from 30,000 metres to 35,000 metres of drilling.

In the third quarter of 2009, drilling continued steadily on the MATOUSH PROPERTY, with two drills in operation. One drill (1419) was dedicated to definition drilling on the MT-34 zone to improve data quality in preparation for a new resource estimate. The second drill (1420) was essentially used for exploration drilling on the southern extension of the MT-34 zone (widely-spaced holes).

The closely-spaced holes drilled on the MT-34 zone returned very good results overall, confirming and increasing confidence in the geological continuity and high grades, as can be seen by the increase in the indicated resource and grades in the new September 2009 update of the resource estimate.

The 2009 drilling program continued with two drills working on the property. One of these was assigned to systematic drilling on a 200-metre grid to locate new mineralized zones in the southern extension of the MT-34 zone, in the upper part of the ACF-4 stratigraphic unit.

The Company plans to carry out 60,000 metres of surface drilling per year in 2010 and 2011, in parallel with underground exploration work. The results of the surface drilling program should allow the maximum capacity of the Matoush ore processing plant to be established.

In 2011, the Company plans to begin the environmental studies required for mill and tailings pond construction. These studies are required to obtain a mine construction permit.

In addition to the definition drilling, the results for the 12 exploration holes drilled to the south of the AM-15 zone in the ACF-3 and south of the MT-34 zone in the upper ACF-4 confirmed the new-zone discovery potential. Of the three holes drilled approximately 400 metres south of the AM-15 zone in the ACF-3 (MT-09-30, 031, 032), Hole MT-09-030 proved the most encouraging, with a mineralized intersection of 3.9 metres grading 0.26% U3O8. The nine holes drilled in the ACF-4 over a distance of 1,800 metres along strike, relatively loosely spaced at about 200 metres, all intersected the Matoush fault and an alteration halo typical of the one around the mineralized zones. The three last holes (MT-09-035 to 038), drilled in virgin ground, proved the most interesting, with intersections of 0.17% U3O8 over 2.0 metres in Hole MT-09-035 and 0.48% U3O8 over 4.2 metres in Hole MT-09-036.

24

The 2009 drilling program continued, with two drills working on the property. One of these is assigned to systematic drilling on a 200-metre grid to locate new mineralized zones in the southern extension of the MT-34 zone, in the upper part of the ACF-4 stratigraphic unit. The two most recent holes confirmed mineralization to the south. Hole MT-09-035, drilled 1.0 km south of the edge of the current mineral resources, intersected the mineralized zone over 2.9 metres grading 0.12% eU3O8,lying characteristically at the contact of the Matoush fault. Hole MT-09-036 was drilled 200 metres further south from MT-09-035, and intersected a 4.7 -metre section of mineralization grading 0.26% eU3O8(see longitudinal sections at www.stratecoinc.com).

These results confirm the very important potential for increasing the resource on the MATOUSH and ECLAT PROPERTIES over an 11.1 km distance along the Matoush fault, to the south of the mineralized envelope hosting the resources. As previously reported, two holes drilled 200 metres apart, last winter in the upper part of the ACF-4 (EC-09-05 and EC-09-06) more than 6 km south of Hole MT-09-036 returned very good results (0.12% eU3O8 over 2.6 metres and 0.11% eU3O8 over 2.1 metres).

TECHNICAL REPORTS

Mineral Resource and Mineral Reserve Estimates

Cautionary Note to U.S. Investors concerning estimates of Measured and Indicated Resources. This section uses the terms “measured” and “indicated resources”. We advise U.S. investors that while those terms are recognized and required by Canadian regulations, the U.S. Securities and Exchange Commission does not recognize them. U.S. investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves.

Cautionary Note to U.S. Investors concerning estimates of Inferred Resources. This section uses the term “inferred resources.” We advise U.S. investors that while this term is recognized and required by Canadian regulations, the U.S. Securities and Exchange Commission does not recognize it. “Inferred resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. U.S. investors are cautioned not to assume that part or all of an inferred resource exists, or is economically or legally minable.

1. Mineral Resource Classification, Category and Definition

The Canadian Institute of Mining, Metallurgy and Petroleum (CIM) guideline for resource classification includes the following definitions which are pertinent to the classification of the Matoush Property resource:

A Mineral Resource is a concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge.

An Inferred Mineral Resource is that part of a mineral resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes.

An Indicated Mineral Resource is that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through

25

appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed.

The Technical Report on the Mineral Resources Update for the Matoush Uranium Project Central Quebec, Canada, NI 43-101 resource estimate completed by Scott Wilson Roscoe Postle Associates Inc. ("Scott Wilson RPA") on September 16, 2008, assessed the resources for the MATOUSH PROJECT of the AM-15, MT-22 and MT-34 zones. On September 18, 2008, the Company deposited on SEDAR, (www.sedar.com), this technical report prepared by Mr. R. Barry Cook, P.Eng. and Mr. David A. Ross, P.Geo.of Scott Wilson RPA, who are qualified persons pursuant to NI 43-101.

Scott Wilson RPA has updated the NI 43-101 Resource estimate for the MATOUSH PROJECT using drill hole data available as of July 25, 2008, at a cut-off grade of 0.05% U3O8, Indicated mineral resources were estimated to total 250 thousand tonnes grading 0.68% U3O8 containing 3.73 million pounds U3O8. Inferred mineral resources were estimated to total1.3 million tonnes grading 0.44% U3O8 containing13.07 million pounds U3O8.The Mineral Resources are contained within three zones: AM-15, MT-22 and MT-34.

This resource estimate showed, as of August 2008, with the data as of July 25, 2008, an increase of 300% from the last technical report pursuant to NI 43-101 dated September 27, 2007.

Scott Wilson RPA concluded that there is also potential for unconformity-type uranium deposits on the MATOUSH PROPERTY.

There are no mineral reserves estimated at MATOUSH PROJECT. See longitudinal section on www.stratecoinc.com.

Table 1 - Mineral Resource Estimate for Matoush, July 25, 2008

| Tonnes | Grade | Pounds U3 O8 | |

| (x 1,000) | (% U3 O8 ) | (x 1,000) | |

| Indicated | |||

| AM-15 | 162 | 0.52 | 1,840 |

| MT-34 | 88 | 0.97 | 1,890 |

| Total Indicated | 250 | 0.68 | 3,730 |

| Inferred | |||

| AM-15 | 16 | 0.14 | 50 |

| MT-22 | 801 | 0.38 | 6,680 |

| MT-34 | 527 | 0.55 | 6,350 |

| Total Inferred | 1,344 | 0.44 | 13,070 |

Notes:

| 1. |

CIM Definitions were followed for Mineral Resources. | |

| 2. |

The cut-off grade of 0.05% U3 O8 was estimated using a price of US$55/lb and assumed operating costs. | |

| 3. |

Wireframes at 0.05% U3 O8 and a minimum true thickness of 1.5 metres were used to constrain the grade interpolation. | |

| 4. |

High U3 O8 grades were cut to 9% prior to compositing to two metre lengths | |

| 5. |

Several blocks less than 0.05% U3 O8 were included for continuity or to expand the lenses to the minimum thickness. | |

| 6. |

Totals may not sum correctly due to rounding. |