Attached files

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

(Mark

One)

x ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

OF 1934

For the

fiscal year ended December 31, 2009

OR

¨ TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

OF 1934

For the

transition period from _________ to __________

Commission

file number: 1-32733

RESOURCE

CAPITAL CORP.

(Exact

name of registrant as specified in its charter)

|

Maryland

(State

or other jurisdiction

of

incorporation or organization)

|

_____20-2287134

(I.R.S.

Employer

Identification

No.)

|

|

712

5th

Avenue, 10th

Floor, New York, NY 10019

|

|

|

(Address

of principal executive offices) (Zip code)

|

|

|

(212)

506-3870

|

|

|

(Registrant’s

telephone number, including area code)

|

|

|

Securities

registered pursuant to Section 12(b) of the Act:

|

|

|

Common

Stock, $.001 par value

|

New

York Stock Exchange (NYSE)

|

|

Title of each class

|

Name of each exchange on which

registered

|

|

Securities

registered pursuant to Section 12(g) of the Act:

|

|

|

None

|

|

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes o No R

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(a) of the Act. Yes o No R

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes R No o

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding

12 months (or for such shorter period that the registrant was required to submit

and post such files). Yes ¨ No ¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant's knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. R

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See definition of “large accelerated filer,” “accelerated

filer” and “smaller reporting company” in Rule 12b-2 of the Exchange

Act.

|

Large

accelerated

filer

|

o |

Accelerated

filer

|

R | |

|

Non-accelerated

filer

|

o |

(Do

not check if a smaller reporting company)

|

Smaller

reporting company

|

o |

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Act). Yes o No R

The

aggregate market value of the voting common equity held by non-affiliates of the

registrant, based on the closing price of such stock on the last business day of

the registrant’s most recently completed second fiscal quarter (June 30, 2009)

was approximately $63,790,874.

The

number of outstanding shares of the registrant’s common stock on March 8, 2010

was 38,938,950 shares.

DOCUMENTS

INCORPORATED BY REFERENCE

[None]

RESOURCE

CAPITAL CORP. AND SUBSIDIARIES

ON

FORM 10-K

|

Page

|

|||

| Forward-Looking Statements | |||

|

PART

I

|

|||

|

PART

II

|

|||

|

PART

III

|

|||

|

PART

IV

|

|||

FORWARD-LOOKING

STATEMENTS

This

report contains certain forward-looking statements. Forward-looking statements

relate to expectations, beliefs, projections, future plans and strategies,

anticipated events or trends and similar expressions concerning matters that are

not historical facts. In some cases, you can identify forward-looking

statements by terms such as “anticipate,” “believe,” “could,” “estimate,”

“expects,” “intend,” “may,” “plan,” “potential,” “project,” “should,” “will” and

“would” or the negative of these terms or other comparable

terminology.

Forward-looking statements contained in

this report are based on our beliefs, assumptions and expectations of our future

performance, taking into account all information currently available to

us. These beliefs, assumptions and expectations can change as a

result of many possible events or factors, not all of which are known to us or

are within our control. If a change occurs, our business, financial

condition, liquidity and results of operations may vary materially from those

expressed in our forward-looking statements. Forward-looking

statements we make in this report are subject to various risks and uncertainties

that could cause actual results to vary from our forward-looking statements,

including:

|

|

·

|

the

factors described in this report, including those set forth under the

sections captioned “Risk Factors” and

“Business;”

|

|

|

·

|

changes

in our industry, interest rates, the debt securities markets, real estate

markets or the general economy;

|

|

|

·

|

increased

rates of default and/or decreased recovery rates on our

investments;

|

|

|

·

|

availability,

terms and deployment of capital;

|

|

|

·

|

availability

of qualified personnel;

|

|

|

·

|

changes

in governmental regulations, tax rates and similar

matters;

|

|

|

·

|

changes

in our business strategy;

|

|

|

·

|

availability

of investment opportunities in commercial real estate-related and

commercial finance assets;

|

|

|

·

|

the

degree and nature of our

competition;

|

|

|

·

|

the

adequacy of our cash reserves and working capital;

and

|

|

|

·

|

the

timing of cash flows, if any, from our

investments.

|

We caution you not to place undue

reliance on these forward-looking statements which speak only as of the date of

this report. All subsequent written and oral forward-looking

statements attributable to us or any person acting on our behalf are expressly

qualified in their entirety by the cautionary statements contained or referred

to in this section. Except to the extent required by applicable law

or regulation, we undertake no obligation to update these forward-looking

statements to reflect events or circumstances after the date of this filing or

to reflect the occurrence of unanticipated events.

PART

I

|

BUSINESS

|

General

We are a specialty finance company that

focuses primarily on commercial real estate and commercial

finance. We are organized and conduct our operations to qualify as a

real estate investment trust, or REIT, for federal income tax

purposes. Our objective is to provide our stockholders with total

returns over time, including quarterly distributions and capital appreciation,

while seeking to manage the risks associated with our investment

strategy. We invest in a combination of commercial real estate debt

and other real estate-related assets and, to a lesser extent, higher-yielding

commercial finance assets. We have financed virtually all of our

portfolio investments through borrowing strategies seeking to match the

maturities and repricing dates of our financings with the maturities and

repricing dates of those investments, and to mitigate interest rate risk through

derivative instruments.

We are externally managed by Resource

Capital Manager, Inc., which we refer to as the Manager, a wholly-owned indirect

subsidiary of Resource America, Inc. (NASDAQ-GS: REXI), a specialized asset

management company that uses industry specific expertise to generate and

administer investment opportunities for its own account and for outside

investors in the commercial finance, real estate, and financial fund management

sectors. As of December 31, 2009, Resource America managed

approximately $13.3 billion of assets in these sectors. To provide

its services, the Manager draws upon Resource America, its management team and

their collective investment experience.

Our investments targeted asset

classes as follows:

|

Asset

Class

|

Principal

Investments

|

|

|

Commercial

real estate-related assets

|

· First

mortgage loans, which we refer to as whole loans

·

First priority interests in first mortgage real estate loans, which

we refer to as A notes

·

Subordinated interests in first mortgage real estate loans, which

we refer to as B notes

·

Mezzanine debt related to commercial real estate that is senior to

the borrower’s equity position but subordinated to other third-party

financing

·

Commercial mortgage-backed securities, which we refer to as

CMBS

|

|

|

Commercial

finance assets

|

· Senior

secured corporate loans, which we refer to as bank loans

·

Other asset-backed securities, which we refer to as other

ABS,

· Equipment

leases and notes, principally small- and middle-ticket commercial direct

financing leases and notes

· Debt

tranches of collateralized debt obligations and collateralized loan

obligations, which we refer to as CDOs and CLOs, respectively

|

Beginning in the second half of 2007,

there have been unprecedented disruptions in the credit markets, abrupt and

significant devaluations of assets directly or indirectly linked to the U.S.

real estate finance markets, and the attendant removal of liquidity, both long

and short term, from the capital markets. These conditions have had, and

we expect will continue to have, an adverse effect on us and companies we

finance. During the years ended December 31, 2009 and 2008, we recorded

provisions for loan and lease losses of $61.4 million and $46.2 million,

respectively. We also recorded net impairment losses during the year

ended December 31, 2009 of $13.5 million on our available-for-sale and

held-to-maturity securities. In addition, we recorded losses through

other comprehensive income of $47.6 million and $46.9 million on our

available-for-sale portfolio as of December 31, 2009 and 2008,

respectively.

The events occurring in the credit

markets have impacted our financing strategies. Historically, we have

used CDOs as a principal source of long-term match-funded financing; however,

the market for securities issued by new securitizations collateralized by assets

similar to those in our investment portfolio has largely disappeared, and we do

not expect to be able to sponsor new securitizations for the foreseeable

future. The availability of short-term financing through warehouse

lines of credit and repurchase agreements has contracted severely as a result of

the increased volatility in the valuation of assets similar to those we

originate. These events have impacted (and we expect will continue to

impact) our ability to grow and finance our business on a long-term,

match-funded basis and our ability to build our investment portfolio

securities.

We calculate our distributions to our

shareholders based on our estimate of our REIT taxable income, which may vary

greatly from our net income calculated in accordance with U.S. generally

accepted accounting principles, or GAAP. We expect that our REIT taxable income

will be comprised primarily of our net investment income and our fee

income. We expect that our REIT taxable income will be greater than

our GAAP net income primarily because asset impairments and provisions for loan

and lease losses are not deductible until realized for tax purposes as well as

net book to tax adjustments for our taxable foreign REIT subsidiaries and fee

income received by our taxable REIT subsidiaries, or TRSs, that is dividended to

us and included in our REIT taxable income but deferred or eliminated for GAAP

purposes. For further discussion, see “Management’s Discussion and

Analysis of Financial Condition and Results of Operations.”

Our

Business Strategy

The core components of our business

strategy are:

Managing our

investment portfolio. As of December

31, 2009, we managed $1.8 billion of assets, including $1.6 billion of assets

financed and held in CDOs. The core of our management process is

credit analysis which we use to actively monitor our existing investments and as

a basis for evaluating new investments. Senior management of our

Manager and Resource America has extensive experience in underwriting the credit

risk associated with our targeted asset classes, and conducts detailed due

diligence on all credit-sensitive investments, including the use of proprietary

credit stratifications and collateral stresses. After making an

investment, the Manager and Resource America engage in active monitoring of our

investments for early detection of troubled and deteriorating

securities. If a default occurs, we will use our senior management

team’s asset management skills to mitigate the severity of any losses, and we

will seek to optimize the recovery from assets if we foreclose upon

them.

Managing our

interest rate and liquidity risk. We generally seek to manage

interest rate and liquidity risk so as to reduce the effects of interest rate

changes on us. On our long-term financing we seek to match the

maturity and repricing dates of our investments with the maturities and

repricing dates of our financing. Historically, we have used CDO

vehicles structured for us by our Manager to achieve this

goal. Currently, we finance new investments through existing capacity

in our CDOs or through cash available from principal repayments on or payoffs of

existing investments. We also seek to mitigate interest rate risk

through derivative instruments.

Historically, we managed our interest

rate and liquidity risk on our short-term financing, principally repurchase

agreements, by limiting the amount of our financial exposure under the

facilities to either a stated investment amount or a fixed guaranty

amount. As a result of current market conditions, as of December 31,

2009 we had paid off our short term repurchase agreements.

Investment in

real estate and commercial finance assets. We expect to

continue to invest in commercial real estate whole loans, B notes, mezzanine

debt, CMBS rated below AAA by Standard & Poors, or S&P, commercial

finance assets, including bank loans, and to a lesser extent, direct financing

leases and notes, subject to the availability of investment funds and

financing. Our equity at December 31, 2009 was invested 76.4% in

commercial real estate loans, 23.2% in commercial bank loans and 0.4% in direct

financing lease and notes. In 2010, we expect to recycle capital

within our CDO structures to make a limited amount of new investments to replace

loans that have been paid down or paid off and to replace loans that may be

sold.

Debt

repurchase. We have been able to take advantage of market

illiquidity that resulted in limited trading of our CRE CDO notes by buying

these debt securities at substantial discounts to par. This strategy,

which has generated significant gains on the extinguishment of the debt, has

allowed us to offset credit losses in the loan and lease portfolio and

impairment losses in the investment securities portfolio. In 2009, we

bought $55.5 million par value of our CRE CDO debt at a discount to par of

80.23% for approximately $11.0 million (or approximately $0.20 on the

dollar). As a result, our gain on the extinguishment of debt for 2009

was $44.5 million which offset in part the credit and impairment losses we

realized in 2009.

Diversification

of investments. We seek to manage our investment risk by

maintaining a diversified portfolio of real estate-related and commercial

finance assets. As funds become available for investment or

reinvestment, we seek to maintain that diversification while allocating our

capital to those sectors that we believe are the most economically

attractive. The percentage of assets that we may invest in certain of

our targeted asset classes is subject to the federal income tax requirements for

REIT qualification and the requirements for exclusion from Investment Company

Act regulation.

Our

Operating Policies and Strategies

Investment

guidelines. We have established investment policies,

procedures and guidelines that are reviewed and approved by our investment

committee and board of directors. The investment committee meets

regularly to monitor the execution of our investment strategies and our progress

in achieving our investment objectives. As a result of our investment

strategies and targeted asset classes, we acquire our investments primarily for

income. We do not have a policy that requires us to focus our

investments in one or more particular geographic areas.

Financing

policies. We have used leverage in order to increase potential

returns to our stockholders and for financing our portfolio. We do

not speculate on changes in interest rates. While we have identified

our leverage targets for each of our targeted asset classes, our investment

policies require no minimum or maximum leverage and our investment committee has

the discretion, without the need for further approval by our board of directors,

to increase the amount of leverage we incur above our targeted range for

individual asset classes.

We have historically used borrowing and

securitization strategies, substantially through CDOs, to accomplish our

long-term match funding, financing strategy. However, the

developments in the credit markets, particularly since the second half of 2007,

have significantly limited our ability to execute our long term financing

strategy. In the foreseeable future, we will seek to finance our

investments through investing restricted cash and reinvesting loan repayments

received under our current securitized financings, and to the extent available,

bank lines of credit and other methods that preserve our capital.

Hedging and

interest rate management strategy. We use derivative financial

instruments to hedge a portion of the interest rate risk associated with our

borrowings. Under the federal income tax laws applicable to REITs, we

generally will be able to enter into transactions to hedge indebtedness that we

may incur, or plan to incur, to acquire or carry real estate assets, provided

that our total gross income from such hedges and other non-qualifying sources

must not exceed 25% of our total gross income. These hedging

transactions may include interest rate swaps, collars, caps or floors, puts and

calls and options.

Credit and risk

management policies. Our Manager focuses its attention on

credit and risk assessment from the earliest stage of the investment selection

process. In addition, the Manager screens and monitors all potential

investments to determine their impact on maintaining our REIT qualification

under federal income tax laws and our exclusion from investment company status

under the Investment Company Act of 1940. Risks related to portfolio

management, including the management of risks related to credit losses, interest

rate volatility, liquidity and counterparty credit are generally managed on a

portfolio-by-portfolio basis by each of Resource America’s asset management

divisions, although there is often interaction and cooperation between divisions

in this process.

Our

Investment Strategy

General

The following table describes our

investment-class allocations and certain characteristics of each class as of

December 31, 2009 (dollars in thousands):

|

Amortized

cost

|

Estimated

fair

value

(1)

|

Percent

of

portfolio

|

Weighted

average coupon

|

|||||||||||||

|

Loans

Held for Investment:

|

||||||||||||||||

|

Commercial real estate

loans:

|

||||||||||||||||

|

Mezzanine loans

|

$ | 182,686 | $ | 176,117 | 11.1% | 4.82% | ||||||||||

|

B notes

|

81,477 | 80,283 | 5.0% | 6.07% | ||||||||||||

|

Whole loans

|

484,195 | 460,612 | 29.0% | 5.50% | ||||||||||||

|

Bank loans

|

865,501 | 827,951 | 52.1% | 2.91% | ||||||||||||

| 1,613,859 | 1,544,963 | 97.2% | ||||||||||||||

|

Investments

in Available-for-Sale Securities:

|

||||||||||||||||

|

CMBS

|

92,110 | 44,518 | 2.8% | 4.69% | ||||||||||||

|

Other ABS

|

24 | 24 | −% | 2.74% | ||||||||||||

| 92,134 | 44,542 | 2.8% | ||||||||||||||

|

Investments

in direct financing leases and notes

|

2,067 | 927 | −% | 9.30% | ||||||||||||

|

Total portfolio/weighted

average

|

$ | 1,708,060 | $ | 1,590,432 | 100.0% | 4.08% | ||||||||||

|

(1)

|

The

fair value of our investments represents our management’s estimate of the

price that a market participant would pay for such

assets. Management bases this estimate on the underlying

interest rates and credit spreads for fixed-rate securities and, to the

extent available, quoted market

prices.

|

Commercial

Real Estate-Related Investments

Whole

loans. We originate first

mortgage loans, or whole loans, directly to borrowers. The direct

origination of whole loans enables us to better control the structure of the

loans and to maintain direct lending relationships with the

borrowers. We may create senior tranches of a loan, consisting of an

A note (described below), B notes (described below), mezzanine loans or other

participations, which we may hold or sell to third parties. We do not

obtain ratings on these investments. At origination, our whole loan

investments had loan to value, or LTV, ratios of up to 80%. We expect

to hold our whole loans to their maturity. In 2008 and 2009, we

modified 28 commercial real estate loans which in many cases involved adjusting

LIBOR floors to bring the interest rates on these loans closer to

market.

Senior interests

in whole loans (A notes). We invest in

senior interests in whole loans, referred to as A notes, either directly

originated or purchased from third parties. A notes are loans that,

generally, consist of senior participations in, or a senior tranche within a

first mortgage. We do not obtain ratings on these

investments. At the date of investment, our A note investments had

LTV ratios of up to 70%. We expect to hold our A note investments to

their maturity.

Subordinate

interests in whole loans (B notes). We invest in

subordinate interests in whole loans, referred to as B notes, which we either

directly originate or purchase from third parties. B notes are loans

secured by a first mortgage and subordinated to an A note. The

subordination of a B note is generally evidenced by an intercreditor or

participation agreement between the holders of the A note and the B

note. In some instances, the B note lender may require a security

interest in the stock or partnership interests of the borrower as part of the

transaction. B note lenders have the same obligations, collateral and

borrower as the A note lender, but typically are subordinated in recovery upon a

default to the A note lender. B notes share certain credit

characteristics with second mortgages in that both are subject to greater credit

risk with respect to the underlying mortgage collateral than the corresponding

first mortgage or A note. We do not obtain ratings on these

investments. At the date of investment, our B note investments had

LTV ratios of between 55% and 80%. Typical B note investments will

have terms of three years to five years, and are generally structured with an

original term of up to three years, with one-year extensions that bring the loan

to a maximum term of five years. We expect to hold our B note

investments to their maturity.

In addition to the interest payable on

the B note, we may earn fees charged to the borrower under the note or

additional income by receiving principal payments in excess of the discounted

price (below par value) we paid to acquire the note. Our ownership of

a B note with controlling class rights may, in the event the financing fails to

perform according to its terms, cause us to elect to pursue our remedies as

owner of the B note, which may include foreclosure on, or modification of, the

note. In some cases, the owner of the A note may be able to foreclose

or modify the note against our wishes as owner of the B note. As a

result, our economic and business interests may diverge from the interests of

the owner of the A note.

Mezzanine

financing. We invest in

mezzanine loans that are senior to the borrower’s equity in, and subordinate to

a first mortgage loan on, a property. These loans are secured by

pledges of ownership interests, in whole or in part, in entities that directly

own the real property. In addition, we may require other collateral

to secure mezzanine loans, including letters of credit, personal guarantees of

the principals of the borrower, or collateral unrelated to the

property. We may structure our mezzanine loans so that we receive a

stated fixed or variable interest rate on the loan as well as a percentage of

gross revenues and a percentage of the increase in the fair market value of the

property securing the loan, payable upon maturity, refinancing or sale of the

property. Our mezzanine loans may also have prepayment lockouts,

penalties, minimum profit hurdles and other mechanisms to protect and enhance

returns in the event of premature repayment. At the date of

investment, our mezzanine investments had LTV ratios between 65% and

90%. We expect the stated maturity of our mezzanine financings to

range from three to five years. Mezzanine loans may have maturities

that match the maturity of the related mortgage loans but may have shorter or

longer terms. We expect to hold these investments to

maturity.

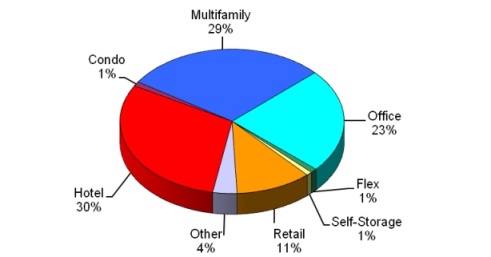

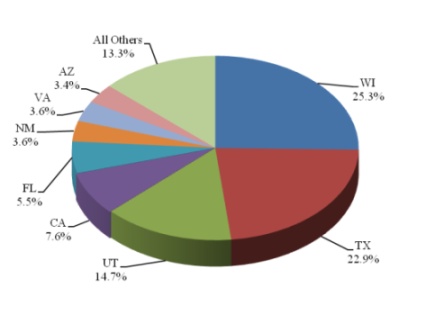

The

following charts describe the loan type, property type and the geographic

breakdown of our commercial real estate loan portfolio as of December 31, 2009

(based on par value):

Loan

Type

Property

Type

Geographic

by State

As these charts demonstrate, our

portfolio contains a diversified mix of property types with approximately 93% of

the portfolio focus on four types, Multifamily 29%, Office 23%, Hotel 30% and

Retail 11%.

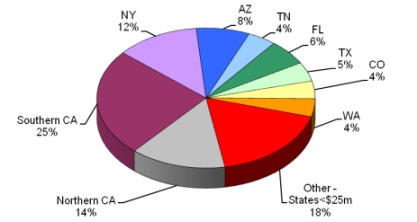

Our geographic mix includes

approximately 39% in California, or CA, which we split into Southern (25%) and

Northern (14%) regions. Within the Southern CA region, we have 86% of

our portfolio in whole loans and 82% in four property types, Hotel 48%, Office

15%, Retail 12% and Multifamily 7%. Within the Northern CA region, we

have 86% of our portfolio in whole loans and 86% in two property types,

Multifamily 63% and Retail 23%. As noted in these statistics, this

portfolio is made up primarily of whole loans where we are able to better

control the structure of the loan and maintain a direct lending relationship

with the borrower. We view the investment and credit strategy as

being adequately diversified across property type and loan type across both the

Southern and Northern CA regions.

CMBS. We invest in

CMBS, which are securities that are secured by or evidence interests in a pool

of mortgage loans secured by commercial properties. These securities

may be senior or subordinate and may be either investment grade or

non-investment grade. The majority of our CMBS investments have been

rated by at least one nationally recognized rating agency.

The yields on CMBS depend on the timely

payment of interest and principal due on the underlying mortgage loans and

defaults by the borrowers on such loans may ultimately result in deficiencies

and defaults on the CMBS. In the event of a default, the trustee for

the benefit of the holders of CMBS has recourse only to the underlying pool of

mortgage loans and, if a loan is in default, to the mortgaged property securing

such mortgage loan. After the trustee has exercised all of the rights

of a lender under a defaulted mortgage loan and the related mortgaged property

has been liquidated, no further remedy will be available. However,

holders of relatively senior classes of CMBS will be protected to a certain

degree by the structural features of the securitization transaction within which

such CMBS were issued, such as the subordination of the relatively more junior

classes of the CMBS.

The yields on CMBS depend on the timely

payment of interest and principal due on the underlying mortgage loans and

defaults by the borrowers on such loans may ultimately result in deficiencies

and defaults on the CMBS. In the event of a default, the trustee for

the benefit of the holders of CMBS has recourse only to the underlying pool of

mortgage loans and, if a loan is in default, to the mortgaged property securing

such mortgage loan. After the trustee has exercised all of the rights

of a lender under a defaulted mortgage loan and the related mortgaged property

has been liquidated, no further remedy will be available. However,

holders of relatively senior classes of CMBS will be protected to a certain

degree by the structural features of the securitization transaction within which

such CMBS were issued, such as the subordination of the relatively more junior

classes of the CMBS.

Other

Real Estate Investments

We invest in joint ventures and other

interests that finance the acquisition

of distressed commercial properties and mortgage loans on distressed commercial properties. These

interests have the objective of repositioning the directly owned properties and

the collateral underlying the mortgages, where applicable, to enhance their

value and realize capital appreciation. During 2009, these

investments did not constitute a material portion of our assets. During

2010, depending upon our capital position, credit market conditions and the

availability of investment opportunities, we may seek to expand our investments

in this area. Our investment is included in investments in

unconsolidated subsidiaries at December 31, 2009 on our consolidated balance

sheet.

Residential

Real Estate-Related Investments

Historically, we had invested in agency

RMBS and non-agency ABS-RMBS portfolios. We sold our agency RMBS

portfolio in September 2006. We sold 10% of the equity invested in

Ischus CDO II in November 2007 and as a result, impaired the investment by $26.3

million in 2007. As a result of the sale, we deconsolidated the

variable interest entity that owned the portfolio in the quarter ended December

31, 2007 and recovered the balance of our remaining investment in

2008. We do not anticipate investing in agency RMBS or non-agency

RMBS for the foreseeable future.

Commercial

Finance Investments

Subject to limitations imposed by REIT

qualification standards and requirements for exclusion from regulation under the

Investment Company Act of 1940, which we refer to as the Investment Company Act,

we may invest in the following commercial finance assets:

Bank

loans. We acquire senior

and subordinated, secured and unsecured loans made by banks or other financial

entities. Bank loans may also include revolving credit facilities,

under which the lender is obligated to advance funds to the borrower under the

credit facility as requested by the borrower from time to time. We

expect that some amount of these loans will be secured by mortgages and liens on

the assets of the borrowers. Certain of these loans may have an

interest-only payment schedule, with the principal amount remaining outstanding

and at risk until the maturity of the loan. These loans may include

restrictive financial and operating covenants. We also have invested,

to a lesser extent, in bonds which pay holders a coupon periodically until

maturity of the bonds, when the face value is due.

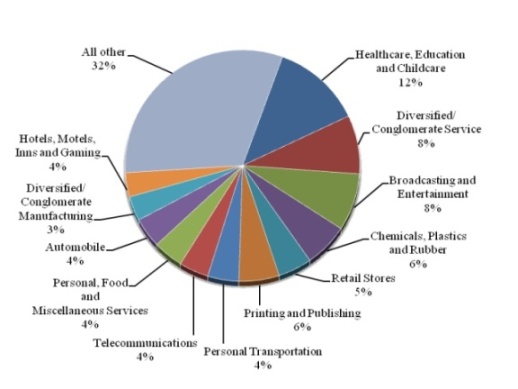

The following chart describes the

industry breakdown of our bank loans as of December 31, 2009 (based on par

value):

(1) All

other is made up of the following industries (by percentage):

|

CLO

securities

|

3.8%

|

||

|

Aerospace

and defense

|

2.8%

|

||

|

Leisure,

Amusement, Motion Pictures, Entertainment

|

2.8%

|

||

|

Buildings

and real estate

|

2.2%

|

||

|

Beverage,

food and tobacco

|

2.1%

|

||

|

Ecological

|

2.1%

|

||

|

Utilities

|

2.1%

|

||

|

Electronics

|

2.1%

|

||

|

Finance

|

2.1%

|

||

|

Containers,

packaging and glass

|

1.8%

|

||

|

Oil

and gas

|

1.8%

|

||

|

Personal

and nondurable consumer products

|

1.7%

|

||

|

Machinery

(non-agriculture, non-construction, non-electronic)

|

1.2%

|

||

|

Cargo

transport

|

0.9%

|

||

|

Mining,

steel, iron and non-precious metals

|

0.7%

|

||

|

Textiles

and leather

|

0.6%

|

||

|

Insurance

|

0.5%

|

||

|

Home

and office furnishings, housewares and durable consumer

products

|

0.4%

|

||

|

Farming

and agriculture

|

0.3%

|

Equipment leases

and notes. We invest in

small- and middle-ticket full payout equipment leases and

notes. Under full payout leases and notes, the payments we receive

over the term of the financing will return our invested capital plus an

appropriate return without consideration of the value of the leased equipment at

the end of the lease or note term, known as the residual, and the obligor will

acquire the equipment at the end of the payment term. We focus on

equipment and other assets that are essential for businesses to conduct their

operations so that end users will be highly motivated to make required monthly

payments. We focus on equipment in the following areas:

|

|

·

|

general

office equipment, such as office machinery, furniture and telephone and

computer systems;

|

|

|

·

|

medical

and dental practices and equipment for diagnostic and treatment

use;

|

|

|

·

|

energy

and climate control systems;

|

|

|

·

|

industrial

equipment, including manufacturing, material handling and electronic

diagnostic systems; and

|

|

|

·

|

agricultural

equipment and facilities.

|

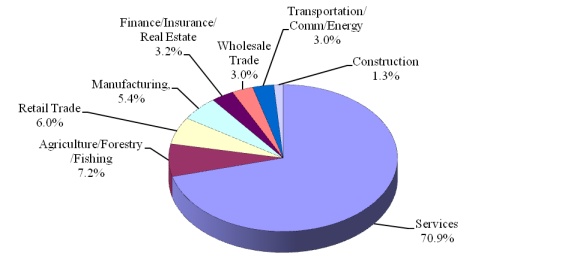

The following charts describe the

industry and the geographic breakdown of our equipment leases and notes as of

December 31, 2009 (based on par value):

Equipment Lease and

Notes by Industry

Geographic

by State

Trust preferred

securities and other ABS. We have one

investment (less than 0.1% of our total assets) in trust preferred

securities. Trust preferred securities are issued by a special

purpose trust that holds a subordinated debenture or other debt obligation

issued by a company to the trust. The sponsoring company holds the

equity interest in the trust, with the preferred securities of the trust being

sold to investors. The trust invests the proceeds of the preferred

securities in the sponsoring company through the purchase of a debenture issued

by it that tracks the terms of the trust preferred

securities. Issuers of trust preferred securities are generally

affiliated with financial institutions because, under current regulatory and tax

structures, unlike the proceeds from debt securities the proceeds from trust

preferred securities may be treated as primary regulatory capital by the

financial institution, while it may deduct the interest it pays on the debt

obligation held by the trust from its income for federal income tax

purposes.

Competition

See “Risk Factors” - “Risks Relating to

Our Business”

Management

Agreement

We have a management agreement with the

Manager and Resource America under which the Manager provides the day-to-day

management of our operations. The management

agreement requires the Manager to manage our business affairs in conformity with

the policies and the investment guidelines established by our board of

directors. The Manager’s role as manager is under the supervision and

direction of our board of directors. The Manager is responsible for

the selection, purchase and sale of our portfolio investments, our financing

activities, and providing us with investment advisory services. The

Manager also must provide us with a Chief Financial Officer. The

Manager receives fees and is reimbursed for its expenses as

follows:

|

|

·

|

A

monthly base management fee equal to 1/12th of the amount of our equity

multiplied by 1.50%. Under the management agreement, ‘‘equity’’

is equal to the net proceeds from any issuance of shares of common stock

less offering related costs, plus or minus our retained earnings

(excluding non-cash equity compensation incurred in current or prior

periods) less any amounts we have paid for common stock

repurchases. The calculation is adjusted for one-time events

due to changes in accounting principles generally accepted in the United

States, which we refer to as GAAP, as well as other non-cash charges, upon

approval of our independent

directors.

|

|

|

·

|

Incentive

compensation calculated as follows: (i) twenty-five percent

(25%) of the dollar amount by which (A) our Adjusted Operating

Earnings (before Incentive Compensation but after the Base Management Fee)

for such quarter per Common Share (based on the weighted average number of

Common Shares outstanding for such quarter) exceeds (B) an

amount equal to (1) the weighted average of the price per share of

the Common Shares in the initial offering by us and the prices per share

of the Common Shares in any subsequent offerings by us, in each case at

the time of issuance thereof, multiplied by (2) the greater of

(a) 2.00% and (b) 0.50% plus one-fourth of the Ten Year Treasury

Rate for such quarter, multiplied by (ii) the weighted average number

of Common Shares outstanding during such quarter subject to adjustment; to

exclude events pursuant to changes in GAAP or the application of GAAP, as

well as non-recurring or unusual transactions or events, after discussion

between the Manager and the Independent Directors and approval by a

majority of the Independent Directors in the case of non-recurring or

unusual transactions or

events.

|

|

|

·

|

Reimbursement

of out-of-pocket expenses and certain other costs incurred by the Manager

that relate directly to us and our

operations.

|

|

|

·

|

Pursuant

to an amendment on October 16, 2009, the Manager will, in addition to a

Chief Financial Officer, provide us with three accounting professionals,

each of whom will be exclusively dedicated to our operations, and a

director of investor relations who will be 50% dedicated to our

operations. The amendment also provides that we will reimburse

the Manager for the expense of the wages, salaries and benefits of the

Chief Financial Officer and three accounting professionals and 50% of the

salary and benefits of the director of investor

relations.

|

Incentive compensation is paid

quarterly to the extent any is earned. Up to seventy-five percent

(75%) of the incentive compensation will be paid in cash and at least

twenty-five percent (25%) will be paid in the form of a stock

award. The Manager may elect to receive more than 25% of its

incentive compensation in stock. All shares are fully vested upon

issuance. However, the Manager may not sell such shares for one year

after the incentive compensation becomes due and payable unless the management

agreement is terminated. Shares payable as incentive compensation are

valued as follows:

|

|

·

|

if

such shares are traded on a securities exchange, at the average of the

closing prices of the shares on such exchange over the thirty day period

ending three days prior to the issuance of such

shares;

|

|

|

·

|

if

such shares are actively traded over-the-counter, at the average of the

closing bid or sales price as applicable over the thirty day period ending

three days prior to the issuance of such shares;

and

|

|

|

·

|

if

there is no active market for such shares, at the fair market value as

reasonably determined in good faith by our board of

directors.

|

In conjunction with the December 2009

common stock offering, we and Resource America agreed that for the quarters

ending on December 31, 2009 and March 31, 2010, the total incentive management

fee payable to the Manager pursuant to the Amended and Restated Management

Agreement dated as of June 30, 2008, shall not exceed $1.5 million per

quarter.

The initial term of the management

agreement expired on March 31, 2009 with automatic one year renewals on that

date and each anniversary thereafter. Our board of directors reviews

the Manager’s performance annually. The management agreement may be

terminated annually upon the affirmative vote of at least two-thirds of our

independent directors, or by the affirmative vote of the holders of at least a

majority of the outstanding shares of our common stock, based upon

unsatisfactory performance that is materially detrimental to us or a

determination by our independent directors that the management fees payable to

the Manager are not fair, subject to the Manager’s right to prevent such a

compensation termination by accepting a mutually acceptable reduction of

management fees. Our board of directors must provide 180 days’ prior notice of

any such termination. If we terminate the management agreement, the

Manager is entitled to a termination fee equal to four times the sum of the

average annual base management fee and the average annual incentive compensation

earned by the Manager during the two 12-month periods immediately preceding the

date of termination, calculated as of the end of the most recently completed

fiscal quarter before the date of termination.

We may also terminate the management

agreement for cause with 30 days’ prior written notice from our board of

directors. No termination fee is payable with respect to a

termination for cause. The management agreement defines cause

as:

|

|

·

|

the

Manager’s continued material breach of any provision of the management

agreement following a period of 30 days after written notice

thereof;

|

|

|

·

|

the

Manager’s fraud, misappropriation of funds, or embezzlement against

us;

|

|

|

·

|

the

Manager’s gross negligence in the performance of its duties under the

management agreement;

|

|

|

·

|

the

bankruptcy or insolvency of the Manager, or the filing of a voluntary

bankruptcy petition by the Manager;

|

|

|

·

|

the

dissolution of the Manager; and

|

|

|

·

|

a

change of control (as defined in the management agreement) of the Manager

if a majority of our independent directors determines, at any point during

the 18 months following the change of control, that the change of control

was detrimental to the ability of the Manager to perform its duties in

substantially the same manner conducted before the change of

control.

|

Cause does not include unsatisfactory

performance that is materially detrimental to our business.

The management agreement will terminate

at the Manager’s option, without payment of the termination fee, in the event we

become regulated as an investment company under the Investment Company Act, with

such termination deemed to occur immediately before such event.

Regulatory

Aspects of Our Investment Strategy: Exclusion from Regulation Under

the Investment Company Act.

We operate our business so as to be

excluded from regulation under the Investment Company Act. Because we

conduct our business through wholly-owned subsidiaries, we must ensure not only

that we qualify for an exclusion from regulation under the Investment Company

Act, but also that each of our subsidiaries so qualifies.

We believe that RCC Real Estate, Inc.,

the subsidiary that as of December 31, 2009 held all of our commercial real

estate loan assets, is excluded from Investment Company Act regulation under

Sections 3(c)(5)(C) and 3(c)(6), provisions designed for companies that do

not issue redeemable securities and are primarily engaged in the business of

purchasing or otherwise acquiring mortgages and other liens on and interests in

real estate. To qualify for this exclusion, at least 55% of RCC Real

Estate’s assets must consist of mortgage loans and other assets that are

considered the functional equivalent of mortgage loans for purposes of the

Investment Company Act, which we refer to as “qualifying real estate

assets.” Moreover, 80% of RCC Real Estate’s assets must consist of

qualifying real estate assets and other real estate-related

assets. RCC Real Estate has not issued, and does not intend to issue,

redeemable securities.

We treat our investments in whole

mortgage loans, specific types of B notes and specific types of mezzanine loans

as qualifying real estate assets for purposes of determining our eligibility for

the exclusion provided by Section 3(c)(5)(C) to the extent such treatment

is consistent with guidance provided by the SEC or its staff. We believe that

SEC staff guidance allows us to treat B notes as qualifying real estate assets

where we have unilateral rights to instruct the servicer to foreclose upon a

defaulted mortgage loan, replace the servicer in the event the servicer, in its

discretion, elects not to foreclose on such a loan, and purchase the A note in

the event of a default on the mortgage loan. We believe, based upon

an analysis of existing SEC staff guidance, that we may treat mezzanine loans as

qualifying real estate assets where (i) the borrower is a special purpose

bankruptcy-remote entity whose sole purpose is to hold all of the ownership

interests in another special purpose entity that owns commercial real property,

(ii) both entities are organized as limited liability companies or limited

partnerships, (iii) under their organizational documents and the loan

documents, neither entity may engage in any other business, (iv) the

ownership interests of either entity have no value apart from the underlying

real property which is essentially the only asset held by the property-owning

entity, (v) the value of the underlying property in excess of the amount of

senior obligations is in excess of the amount of the mezzanine loan,

(vi) the borrower pledges its entire interest in the property-owning entity

to the lender which obtains a perfected security interest in the collateral, and

(vii) the relative rights and priorities between the mezzanine lender and

the senior lenders with respect to claims on the underlying property is set

forth

in an

intercreditor agreement between the parties which gives the mezzanine lender

certain cure and purchase rights in case there is a default on the senior

loan. If the SEC staff provides future guidance that these

investments are not qualifying real estate assets, we will treat them, for

purposes of determining our eligibility for the exclusion provided by

Section 3(c)(5)(C), as real estate-related assets or miscellaneous assets,

as appropriate. Historically, we have held “whole pool certificates”

in mortgage loans, although, at December 31, 2009, we had no whole pool

certificates in our portfolios. Pursuant to existing SEC staff

guidance, we consider whole pool certificates to be qualifying real estate

assets. A whole pool certificate is a certificate that represents the

entire beneficial interest in an underlying pool of mortgage

loans. By contrast, a certificate that represents less than the

entire beneficial interest in the underlying mortgage loans is not considered to

be a qualifying real estate asset for purposes of the 55% test, but constitutes

a real estate-related asset for purposes of the 80% test. We do not

expect that investments in CDOs, other ABS, bank loans, equipment leases and

notes, trust preferred securities and private equity will constitute qualifying

real estate assets. Moreover, to the extent that these investments

are not backed by mortgage loans or other interests in real estate, they will

not constitute real estate-related assets. Instead, they will

constitute miscellaneous assets, which can constitute no more than 20% of RCC

Real Estate’s assets.

To the extent RCC Real Estate holds its

commercial real estate loan assets through wholly-owned CDO subsidiaries, RCC

Real Estate also intends to conduct its operations so that it will not come

within the definition of an investment company set forth in Section 3(a)(1)(C)

of the Investment Company Act because less than 40% of the value of its total

assets on an unconsolidated basis will consist of “investment securities,” which

we refer to as the 40% test. “Investment securities” exclude U.S.

government securities and securities of majority-owned subsidiaries that are not

themselves investment companies and are not relying on the exception from the

definition of investment company under Section 3(c)(1) or

Section 3(c)(7) of the Investment Company Act. Certain of the

wholly-owned CDO subsidiaries of RCC Real Estate rely on Section 3(c)(5)(C)

for their Investment Company Act exemption, with the result that RCC Real

Estate’s interests in the CDO subsidiaries do not constitute “investment

securities” for the purpose of the 40% test.

Our other subsidiaries, RCC Commercial,

Inc. and Resource TRS, Inc. do not qualify for the Section 3(c)(5)(C)

exclusion. However, we believe they qualify for exclusion under

either Section 3(c)(1) or 3(c)(7). As required by these

exclusions, we will not allow either entity to make, or propose to make, a

public offering of its securities. In addition, with respect to those

subsidiaries for which we rely upon the Section 3(c)(1) exclusion, and as

required thereby, we limit the number of holders of their securities to not more

than 100 persons calculated in accordance with the attribution rules of Section

3(c)(1) and, with respect to those subsidiaries for which we rely on the Section

3(c)(7) exclusion, and as required thereby, we limit ownership of their

securities to “qualified purchasers.” If we form other subsidiaries,

we must ensure that they qualify for an exemption or exclusion from regulation

under the Investment Company Act.

Moreover, we must ensure that Resource

Capital Corp. itself qualifies for an exclusion from regulation under the

Investment Company Act. We will do so by monitoring the value of our interests

in our subsidiaries. At all times, we must ensure that Resource

Capital Corp. meets the 40% test. Our interest in RCC Real Estate

does not constitute an “investment security” for purposes of the 40% test, but

our interest in RCC Commercial does, and our interest in Resource TRS may in the

future, constitute “investment securities.” Accordingly, we must

monitor the value of our interest in these two subsidiaries to ensure that the

value of our interests in them never exceeds 40% of the value of our total

assets.

We have not received, nor have we

sought, a no-action letter from the SEC regarding how our investment strategy

fits within the exclusions from regulation under the Investment Company

Act. To the extent that the SEC provides more specific or different

guidance regarding the treatment of assets as qualifying real estate assets or

real estate-related assets, we may have to adjust our investment

strategy. Any additional guidance from the SEC could further inhibit

our ability to pursue our investment strategy.

Employees

We have no direct

employees. Under our management agreement, the Manager provides us

with all management and support personnel, including a Chief Financial Officer,

and services necessary for our day-to-day operations. Pursuant to an

amendment on October 16, 2009, the Manager will provide us with three accounting

professionals, each of whom will be exclusively dedicated to our operations, and

a director of investor relations who will be 50% dedicated to our

operations. The amendment also provides we will bear the expense of

the wages, salaries and benefits of the Chief Financial Officer and three

accounting professionals, and 50% of the salary and benefits of the director of

investor relations. We depend upon the Manager and Resource America

for personnel and administrative infrastructure. To provide its

services, the Manager draws upon the expertise and experience of Resource

America. As of December 31, 2009, Resource America had 721 employees

involved in asset management, including 118 asset management professionals and

603 asset management support personnel, respectively.

Corporate Governance and Internet

Address

We emphasize the importance of

professional business conduct and ethics through our corporate governance

initiatives. Our board of directors consists of a majority of

independent directors, as defined in the Securities Exchange Act of 1934, as

amended, and relevant New York Stock Exchange, or NYSE, rules. The

audit, compensation and nominating/corporate governance committees of our board

of directors are composed exclusively of independent directors. We

have adopted corporate governance guidelines and a code of business conduct and

ethics, which delineate our standards for our officers and directors, and

employees of our manager.

Our internet address is

www.resourcecapitalcorp.com. We make available, free of charge

through a link on our site, all reports filed with the SEC as soon as reasonably

practicable after such filing. Our site also contains our code of

business conduct and ethics, corporate governance guidelines and the charters of

the audit committee, nominating and governance committee and compensation

committee of our board of directors. A complete list of our filings

is available on the Securities and Exchange Commission’s website at www.sec.gov. Any

of our filings are also available at the Securities and Exchange Commission’s

Public Reference Room at 100 F Street, N.E., Room 1580, Washington, D.C.

20549. The Public Reference Room may be contacted at telephone number

(800) 732-0330 for further information.

|

RISK

FACTORS

|

This section describes material risks

affecting our business. In connection with the forward-looking statements that

appear in this annual report, you should carefully review the factors discussed

below and the cautionary statements referred to in “Forward-Looking

Statements.”

Impact

of Current Economic Conditions

Continuance

of current economic conditions could further harm our financial condition,

income and ability to make distributions to our stockholders.

Beginning in mid-2007 and continuing

through the date of this report, the financial system in the United States,

including credit markets and markets for real estate and real estate-related

assets, has been subject to unprecedented turmoil. This turmoil has

resulted in severe limitations on the availability of credit, significant

declines in the value of real estate and real estate related assets, impairment

of the ability of many borrowers to repay their obligations and illiquidity in

the markets for real estate and real estate-related assets. These

events have had significant adverse effects on us including incurrence of

impairment charges with respect to investments we hold, significant increases in

our provision for loan losses and the unavailability of financing to support new

investments. As a result, our income, our ability to make

distributions and the price of our common stock have declined

significantly. Continuation of current economic conditions could

further harm our financial condition, income, ability to make distributions to

our stockholders and the price of our common stock.

Actions

taken by the U.S. government and governmental agencies may not reverse, or even

stabilize, current economic conditions.

In response to current economic and

market conditions, the U.S. government and a number of governmental agencies

have established or proposed a series of programs designed to stabilize the

financial system and credit markets, including programs established pursuant to

the Emergency Economic Stabilization Act of 2008 and the American Recovery and

Reinvestment Tax Act of 2009. We are unable to evaluate whether these

programs have had or will have in the future their intended effect, or, if they

have effects in the future, whether they will have a beneficial impact upon our

financial condition, income or ability to make distributions to our stockholders

or if the proposed programs will be instituted in their current

form.

Risks

Related to Our Financing

Our

portfolio has been financed in material part through the use of leverage, which

may reduce the return on our investments and cash available for

distribution.

Our portfolio has been financed in

material part through the use of leverage. Using leverage subjects us

to risks associated with debt financing, including the risks that:

|

|

·

|

the

cash provided by our operating activities will not be sufficient to meet

required payments of principal and

interest,

|

|

|

·

|

the

cost of financing may increase relative to the income from the assets

financed, reducing the income we have available to pay distributions,

and

|

|

|

·

|

our

investments may have maturities that differ from the maturities of the

related financing and, consequently, the risk that the terms of any

refinancing we obtain will not be as favorable as the terms of existing

financing.

|

If

we are unable to secure refinancing of our currently outstanding financing, when

due, on acceptable terms, we may be forced to dispose of some of our assets at

disadvantageous terms or to obtain financing at unfavorable terms, either of

which may result in losses to us or reduce the cash flow available to meet our

debt service obligations or to pay distributions.

Financing that we may obtain and

financing we have obtained through CDOs, does require us to maintain a specified

ratio of the amount of the financing to the value of the assets

financed. A decrease in the value of these assets may lead to margin

calls or calls for the pledge of additional assets which we will have to

satisfy. We may not have sufficient funds or unpledged assets to

satisfy any such calls.

Under

current economic and market conditions we are significantly constrained in our

ability to obtain the capital and financing necessary for growth. As

a result, our profitability, ability to make distributions and the market price

of our common stock have been harmed. Continuation or further

deterioration of current conditions could further harm our profitability,

ability to make distributions and the market price of our common

stock.

We depend upon the availability of

adequate funding and capital for our operations. Although we

successfully completed an offering of common stock in December 2009, in general,

our ability to obtain debt financing and, to a lesser extent, equity capital has

been significantly constrained as a result of current economic and market

conditions, which has impaired our profitability, our ability to make

distributions and the market price of our common stock. Moreover, as

a REIT, we must distribute annually at least 90% of our REIT taxable income,

determined without regard to the deduction for dividends paid and excluding net

capital gain, to our stockholders and are therefore not able to retain

significant amounts of our earnings for new investments. While the

newly-promulgated Rev. Proc. 2010-12, allows us to satisfy this requirement by

distributing common shares for up to 90% of the amount of a required

distribution, such regulatory relief is currently only available through

December 2011. Moreover, although Resource TRS, our TRS, may retain

earnings as new capital, we are subject to REIT qualification requirements which

limit the relative value of TRS stock and securities to the other assets owned

by a REIT. Consequently, we depend upon the availability of financing

and additional capital to provide us with the funding necessary to permit

growth. Continuation or further deterioration of current economic and

market conditions could further impair our ability to acquire and finance

assets, thereby reducing or eliminating our profitability and ability to make

distributions, impairing the market price of our common

stock. Moreover, even if funding or capital were available, we cannot

assure you that it would be on terms that would enable us to strengthen our

profitability or ability to make distributions.

Historically,

we have financed most of our investments through CDOs and have retained the

equity. CDO equity receives distributions from the CDO only if the CDO generates

enough income to first pay the holders of its debt securities and its

expenses.

We have financed most of our

investments through CDOs in which we retained the equity

interest. Depending on market conditions, credit availability, and

resolution of current credit market conditions, we may seek to use CDOs to

finance our investments in the future. The equity interests of a CDO

are subordinate in right of payment to all other securities issued by the

CDO. The equity is usually entitled to all of the income generated by

the CDO after the CDO pays all of the interest due on the debt securities and

other expenses. However, there will be little or no income available

to the CDO equity if there are excessive defaults by the issuers of the

underlying collateral which would significantly reduce the value of that

interest. Reductions in the value of the equity interests we have in

a CDO, if we determine that they are other than temporary, will reduce our

earnings. In addition, the equity securities of CDOs are generally

illiquid, and because they represent a leveraged investment in the CDO’s assets,

the value of the equity securities will generally have greater fluctuations than

the value of the underlying collateral.

If

our CDO financings fail to meet their performance tests, including

over-collaterization requirements, our net income and cash flow from these CDOs

will be eliminated.

Our CDOs generally provide that the

principal amount of their assets must exceed the principal balance of the

related securities issued by them by a certain amount, commonly referred to as

“over-collateralization.” The CDO terms provide that, if

delinquencies and/or losses exceed specified levels based on the analysis by the

rating agencies (or any financial guaranty insurer) of the characteristics of

the assets collateralizing the securities issued by the CDO issuer, the required

level of over-collateralization may be increased or may be prevented from

decreasing as would otherwise be permitted if losses or delinquencies did not

exceed those levels. In addition, a failure by a CDO to satisfy an

over-collateralization test typically results in accelerated distributions to

the holders of the senior debt securities issued by the CDO entity. Our equity

holdings and, when we acquire debt interests in CDOs, our debt interests, if

any, are subordinate in right of payment to the other classes of debt securities

issued by the CDO entity. Accordingly, if overcollateralization tests

are not met, distributions on the subordinated debt and equity we hold in these

CDOs will cease, resulting in a substantial reduction in our cash

flow. Other tests (based on delinquency levels or other criteria) may

restrict our ability to receive cash distributions from assets collateralizing

the securities issued by the CDO entity. Although at December 31,

2009, all of our CDOs met their performance tests, we cannot assure you that our

CDOs will satisfy the performance tests in the future.

If any of our CDOs fails to meet

collateralization or other tests relevant to the most senior debt issued and

outstanding by the CDO issuer, an event of default may occur under that

CDO. If that occurs, our Manager’s ability to manage the CDO likely

would be terminated and our ability to attempt to cure any defaults in the CDO

would be limited, which would increase the likelihood of a reduction or

elimination of cash flow and returns to us in those CDOs for an indefinite

time.

If

we issue debt securities, the terms may restrict our ability to make cash

distributions, require us to obtain approval to sell our assets or otherwise

restrict our operations in ways which could make it difficult to execute our

investment strategy and achieve our investment objectives.

Any debt securities we may issue in the

future will likely be governed by an indenture or other instrument containing

covenants restricting our operating flexibility. Holders of senior

securities may be granted the right to hold a perfected security interest in

certain of our assets, to accelerate payments due under the indenture if we

breach financial or other covenants, to restrict distributions, and to require

approval to sell assets. These covenants could limit our ability to

operate our business or manage our assets effectively. Additionally,

any convertible or exchangeable securities that we issue may have rights,

preferences and privileges more favorable than those of our common

stock. We, and indirectly our stockholders, will bear the cost of

issuing and servicing such securities.

Depending

upon market conditions, we may in the future seek financing through CDOs, which

would expose us to risks relating to the accumulation of assets for use in the

CDOs.

Historically, we have financed a

significant portion of our assets through the use of CDOs, and have accumulated

assets for these financings through short-term credit facilities, typically

repurchase agreement facilities. Depending upon market conditions, we

may seek similar financing arrangements in the future. These

arrangements could expose us to a number of credit risks, including the

following:

|

|

·

|

If

we accumulate assets for a CDO on a short-term credit facility and do not

complete the CDO financing, or if a default occurs under the facility, the

short-term lender will sell the assets and we would be responsible for the

amount by which the original purchase price of the assets exceeds their

sale price, up to the amount of our investment or

guaranty.

|

|

|

·

|

An

event of default under one short-term facility may constitute a default

under other credit facilities we may have, potentially resulting in asset

sales and losses to us, as well as increasing our financing costs or

reducing the amount of investable funds available to

us.

|

|

|

·

|

We

may be unable to acquire a sufficient amount of eligible assets to

maximize the efficiency of a CDO issuance, which would require us to seek

other forms of term financing or liquidate the assets. We may

not be able to obtain term financing on acceptable terms, or at all, and

liquidation of the assets may be at prices less than those we paid,

resulting in losses to us.

|

|

|

·

|

Using

short-term financing to accumulate assets for a CDO issuance may require

us to obtain new financing as the short-term financing

matures. Residual financing may not be available on acceptable

terms, or at all. Moreover, an increase in short-term interest

rates at the time that we seek to enter into new borrowings would reduce

the spread between the income on our assets and the cost of our

borrowings. This would reduce returns on our assets, which

would reduce earnings and, in turn, cash available for distribution to our

stockholders.

|

|

|

·

|

We

will lose money on our repurchase transactions if the counterparty to the

transaction defaults on its obligation to resell the underlying security

back to us at the end of the transaction term, or if the value of the

underlying security has declined as of the end of the term or if we

default on our obligations under the repurchase

agreements.

|

Our

hedging transactions may not completely insulate us from interest rate risk and

may result in poorer overall investment performance than if we had not engaged

in any hedging transactions.

Subject to maintaining our

qualification as a REIT, we pursue various hedging strategies to seek to reduce

our exposure to losses from adverse changes in interest rates. Our interest rate

hedging activity varies in scope depending upon market conditions relating to,

among other factors, the level and volatility of interest rates and the type of

assets we hold. There are practical limitations on our ability to

insulate our portfolio from all of the negative consequences associated with

changes in short-term interest rates, including:

|

|

·

|

Available

interest rate hedges may not correspond directly with the interest rate

risk against which we seek

protection.

|

|

|

·

|

The

duration of the hedge may not match the duration of the related

liability.

|

|

|

·

|

Interest

rate hedging can be expensive, particularly during periods of rising and

volatile interest rates. Hedging costs may include structuring

and legal fees and fees payable to hedge counterparties to execute the

hedge transaction.

|

|

|

·

|

Losses

on a hedge position may reduce the cash available to make distributions to

stockholders, and may exceed the amounts invested in the hedge

position.

|

|

|

·

|

The

amount of income that a REIT may earn from hedging transactions, other

than through a TRS, is limited by federal tax provisions governing

REITs.

|

|

|

·

|

The

credit quality of the party owing money on the hedge may be downgraded to

such an extent that it impairs our ability to sell or assign our side of

the hedging transaction.

|

|

|

·

|

The

party owing money in the hedging transaction may default on its obligation

to pay.

|

We have adopted written policies and

procedures governing our hedging activities. Under these policies and

procedures, our board of directors is responsible for approving the types of

hedging instruments we may use, absolute limits on the notional amount and term

of a hedging instrument and parameters for the credit-worthiness of hedge

counterparties. The senior managers responsible for each of our

targeted asset classes are responsible for executing transactions using the

services of independent interest rate risk management consultants, documenting

the transactions, monitoring the valuation and effectiveness of the hedges, and

providing reports concerning our hedging activities and the valuation and

effectiveness of our hedges, to the audit committee of our board of directors no

less often than quarterly. Our guidelines also require us to engage