Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ALTERRA CAPITAL HOLDINGS Ltd | d8k.htm |

A

Merger of Equals March 17, 2010 Specialty Insurance & Reinsurance Exhibit 99.1 |

2 Cautionary Note Regarding Forward-Looking Statements: This presentation includes statements about future economic performance, finances, expectations, plans and

prospects of Max and Harbor Point, both individually and on a consolidated basis, that

constitute forward-looking statements for purposes of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ

materially from those expressed in or suggested by such statements. For further information

regarding cautionary statements and factors affecting future results of Max, please refer to the most recent Annual Report on Form 10-K (as amended by Max’s Form 10-K/A on March 12, 2010), Quarterly Reports on Form 10-Q filed subsequent to the Annual Report and

other documents filed by Max with the Securities Exchange Commission (“SEC”) and, in

the case of Harbor Point, please refer to the joint proxy statement/prospectus included in the registration statement on Form S-4 filed by Max with the SEC. These documents are also available free of charge, in the case of Max, by directing a request to Max through Joe

Roberts, Chief Financial Officer, or Susan Spivak Bernstein, Senior Vice President, Investor

Relations, at 441-295-8800 and, in the case of Harbor Point, by directing a request to Gayle Gorman, Senior Vice President, at 441-294-6743. Neither Max nor Harbor Point undertakes any obligation to update or revise publicly any forward-looking statement

whether as a result of new information, future developments or otherwise. This presentation

contains certain forward-looking statements within the meaning of the U.S. federal securities laws. Statements that are not historical facts, including statements about our beliefs, plans or expectations, are forward-looking statements. These statements are based on

Max’s or Harbor Point’s current plans, estimates and expectations. Some forward- looking statements may be identified by use of terms such as “believe,” “anticipate,”

“intend,” “expect,” “project,” “plan,” “may,” “should,” “could,” “will,” “estimate,” “predict,” “potential,” “continue,” and similar words, terms or statements of a future or forward-looking nature. In

light of the inherent risks and uncertainties in all forward-looking statements, the inclusion of such statements in this presentation should not be considered as a representation by Max, Harbor Point or

any other person that Max’s or Harbor Point’s objectives or plans, both individually

and on a consolidated basis, will be achieved. A non-exclusive list of important factors that could cause actual results to differ materially from those in such forward-looking statements includes the following: (a) the occurrence of natural or man-made catastrophic events with a

frequency or severity exceeding expectations; (b) the adequacy of loss reserves and the need to

adjust such reserves as claims develop over time; (c) the failure of any of the loss limitation methods the parties employ; (d) any lowering or loss of financial ratings of any wholly owned operating subsidiary; (e) the effect of competition on market trends and

pricing; (f) cyclical trends, including with respect to demand and pricing in the insurance and

reinsurance markets; (g) changes in general economic conditions, including changes in interest rates and/or equity values in the United States of America and elsewhere; and (h) other factors set forth, in the case of Max, in its recent reports on Form 10-K,

Form 10-Q and other documents of Max on file with the SEC and, in the case of Harbor Point,

in the joint proxy statement/prospectus included in the registration statement on Form S-4 filed by Max with the SEC. Risks and uncertainties relating to the proposed amalgamation include the risks that: (1) the parties will

not obtain the requisite shareholder or regulatory approvals for the transaction; (2) the

anticipated benefits of the transaction will not be realized; (3) the parties may not be able to retain key personnel; (4) the conditions to the closing of the proposed amalgamation may not be satisfied or waived; and (5) the outcome of any legal proceedings to the extent initiated

against Max or Harbor Point or its respective directors and officers following the announcement

of the proposed amalgamation is uncertain. These risks, as well as other risks of the combined company and its subsidiaries, may be different from what the companies expect and each party’s management may respond differently to any of the aforementioned factors.

These risks, as well as other risks associated with the amalgamation, are more fully discussed

in the joint proxy statement/prospectus included in the registration statement on Form S-4 filed by Max with the SEC. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made.

Additional Information about the Proposed Amalgamation and Where to Find It: Participants in the Solicitation:

Max and its directors and executive officers may be deemed to be participants in any

solicitation of Max’s shareholders in connection with the proposed amalgamation. Information about Max’s directors and executive officers is available in Max’s Form 10-K/A filed with the

SEC on March 12, 2010. John Berger, Chief Executive Officer and President, and Andrew Cook,

Chief Financial Officer, of Harbor Point, may also be deemed to be participants in any solicitation of Max’s shareholders in connection with the proposed amalgamation. Information about Mr. Berger and Mr. Cook is

available in the joint proxy statement/prospectus included in the registration statement on Form

S-4 filed by Max with the SEC. This presentation relates to a proposed amalgamation between Max and Harbor Point. On March 12, 2010, Max filed with the SEC a registration statement on Form S-4, which included a preliminary joint proxy statement/prospectus. This presentation is not a substitute for the definitive

joint proxy statement/prospectus that Max will file with the SEC or any other document that Max filed or may file with the SEC or that Max or Harbor Point may send to its shareholders in connection with the proposed amalgamation. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PRELIMINARY JOINT PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS FILED OR

THAT WILL BE FILED WITH THE SEC OR SENT TO SHAREHOLDERS, INCLUDING THE DEFINITIVE JOINT PROXY STATEMENT/PROSPECTUS THAT WILL BE PART OF THE REGISTRATION STATEMENT ON FORM S-4, AS THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED AMALGAMATION. All such documents are, or when filed will be, available in the case of Max, free of charge at the

SEC’s website (www.sec.gov) or by directing a request to Max through Joe Roberts, Chief Financial Officer, or Susan Spivak Bernstein, Senior Vice President, Investor Relations, at 441-295-8800 and, in the case of Harbor Point, by directing a request to Gayle Gorman, Senior Vice President, at 441-294-6743. |

3 Alterra means “high ground” — a place of security Alterra Capital Holdings Limited Bermuda Ireland United States Lloyd’s Latin America |

4 Alterra – A Winning Combination Merger of Equals of two strong organizations Enhances position with clients and brokers Combines “best in class" reinsurance group with a global specialty platform

Provides diversified and stable earnings over time Established platforms in all major insurance markets Delivers flexibility to optimize portfolio composition Larger capital base with approximately $3 billion in equity Enhances financial flexibility Strong and deep management and underwriting teams Committed to growth in book value Creates Value for All Shareholders |

5 Structure Stock for stock merger of equals Exchange Ratio 3.7769 shares of Max for each Harbor Point share Fixed exchange ratio Pro Forma Ownership 52% by Harbor Point shareholders (fully diluted) 48% by Max shareholders (fully diluted) Extraordinary Dividend $2.50 per share cash dividend (~$300 million) to all shareholders post-closing Subject to combined board approval Management Marty Becker – President, Chief Executive Officer and Director John Berger – Chief Executive Officer of Reinsurance and Vice Chairman of Board Board of Directors 14 member Board of Directors with 7 directors from each of Harbor Point and Max Michael O’Reilly, Non-Executive Chairman Approvals Shareholder approvals Customary regulatory approvals Expected Closing Second quarter 2010 Transaction Overview |

6 Combining Strong Management With Deep Experience Name

Position Marty Becker President, Chief Executive Officer, Director John Berger Chief Executive Officer of Reinsurance, Vice Chairman of Board Peter Minton Chief Operating Officer Joe Roberts Chief Financial Officer Andrew Cook Chief Integration Officer and EVP, Global Development Carol Rivers General Counsel Angelo Guagliano Chief Executive Officer, Insurance David Kalainoff Chief Underwriting Officer, U.S. Reinsurance Adam Mullan Chief Executive Officer, Max at Lloyd’s Wayne Paglieri Chief Operating Officer, Reinsurance Greg Richardson Chief Underwriting Officer, Bermuda Reinsurance Steve Vaccaro Chief Executive Officer, Max Specialty Tom Wafer President, U.S. Reinsurance |

7 World Class Board Led by Michael O’Reilly Name Affiliations Michael O’Reilly Chairman Retired Vice Chairman and CFO of The Chubb Corporation John Berger Vice Chairman President and CEO of Harbor Point. Former President and CEO of Chubb Re and F&G Re James Carey Deputy Chairman Former Chairman of Paris Re. Senior Principal of Stone Point and a member of the Investment Committees of the Trident Funds Thomas Forrester Retired CFO of The Progressive Corporation Meryl Hartzband Former Director of ACE Limited and Travelers. Chief Investment Officer of Stone Point and a member of the Investment Committees of the Trident Funds Stephan Newhouse Retired President of Morgan Stanley and Chairman of Morgan Stanley International Inc. Andy Rush Founder and Senior Managing Director of Diamond Castle Holdings LLC. Former Managing Director at DLJ Merchant Banking Name Affiliations Gordon Cheesbrough Deputy Chairman Managing Partner of Blair Franklin Capital Partners, Inc. Former President and CEO of Altamira Investment Services Inc. Former Chairman and CEO of Scotia Capital Markets Marty Becker CEO Chairman and CEO of Max Capital Group Ltd. Former Chairman and CEO of Orion Capital Corporation Bruce Connell Former EVP and Group Underwriting Officer of XL Capital Ltd. Willis King Chairman of First Protective Insurance Company James MacNaughton Former Senior Advisor, Managing Director and Global Partner of Rothschild Inc. Mario Torsiello President and Chief Executive Officer, Torsiello Capital Advisors Inc. James Zech President of High Ridge Capital, LLC. President and CEO of Kinloch Holdings, Inc. Max Harbor Point |

8 $2.1 $1.9 $1.7 $1.6 $1.6 $1.5 $1.2 $7.1 $6.1 $5.0 $4.0 $4.0 $4.0 $3.2 $3.2 $3.2 $3.0 $2.6 $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 $8.0 PRE RE AXS TRH VR ACGL AWH RNR AHL ENH PTP Harbor Point MRH AGII MXGL Ariel FSR Combination Enhances Market Profile Combination provides greater size and scale Enhances valuation and ratings profile Provides greater financial flexibility Enhanced position with clients and brokers Platform / underwriters are in place Ability to more efficiently manage capital Excess capital to support underwriting opportunities or returned to shareholders ____________________ (1) Pro forma for expected post-closing dividend of ~$300 million ($2.50 per

share). Before purchase accounting adjustments. ( $ in billions)

Common Equity (12/31/09) (1) |

9 Global Reach Through Established Platforms Reinsurance Insurance Lloyd’s U.S. Specialty Insurance Major Classes Agriculture Aviation Excess liability Medical malpractice Professional liability Property Marine and energy Whole account Workers’ comp Life and annuity Aviation Excess liability Professional liability Property Personal accident Financial institutions Professional liability Property International casualty treaty reinsurance Excess liability Marine Property Miscellaneous professional liability Operating Regions United States Latin America Canada European Union Japan Australia New Zealand United States European Union United Kingdom Japan Denmark Latin America United States Offices Bermuda Dublin Bogotá New Jersey Bermuda Dublin Hamburg London Leeds Tokyo Copenhagen Rio de Janeiro New York Los Angeles Philadelphia Richmond Atlanta Dallas San Francisco |

10

15% 36% 49% Harbor Point – “Best in Class” Franchise 2009 GPW: $608 million Formed in 2005 with “A” A.M. Best rating No legacy exposures Longstanding franchise led by John Berger Chubb Re management team and book of business Diversified reinsurer with an excellent track record Strong and experienced Board Michael O’Reilly, formerly Vice Chairman & CFO of The Chubb Corporation, will be Chairman of Alterra Sophisticated, knowledgeable shareholder group Stone Point Capital and The Chubb Corporation are largest investors Casualty Property Specialty 2009 Net Premiums Written $601.9 Combined Ratio 80.6% Cash and Investments (12/31) $2,585.0 Shareholders' Equity (12/31) $1,889.7 Tangible Equity (12/31) $1,631.8 Net Operating Income $180.9 ROE (operating) 10.1% Tangible ROE (operating) 11.8% |

11

Strong operational flexibility, well positioned to support opportunistic growth over

time Harbor Point Max ____________________ (1) Pro forma for expected post-closing dividend of ~$300 million ($2.50

per share). Before purchase accounting adjustments. Conservative Operating Leverage

(1) vs. 0.61x average for peer group As of December 31, 2009 ($ millions) Gross Premiums Written $1,375.0 $607.5 $1,982.5 Net Premiums Written $894.5 $601.9 $1,496.4 Retention 65% 99% 75% Shareholders' Equity $1,564.6 $1,889.7 $3,154.1 Combined Ratio 88.1% 80.6% 85.0% Net Operating Income $208.9 $180.9 $389.8 ROE (operating) 14.7% 10.1% 12.7% NPW / Equity 0.57x 0.32x 0.47x |

12

Strong Financial Position Well-positioned balance sheet with conservative financial leverage Harbor Point Max (1) vs. 16.0% average for peer group ____________________ (1) Pro forma for expected post-closing dividend of ~$300 million ($2.50

per share). Before purchase accounting adjustments. As of December 31, 2009 ($ millions) Cash and Investments $5,259.1 $2,585.0 $7,543.9 Loss & LAE Reserves $4,550.6 $707.8 $5,258.4 Debt $90.5 $200.0 $290.5 Shareholders' Equity $1,564.6 $1,889.7 $3,154.1 Total Debt / Capitalization 5.5% 9.6% 8.4% |

13

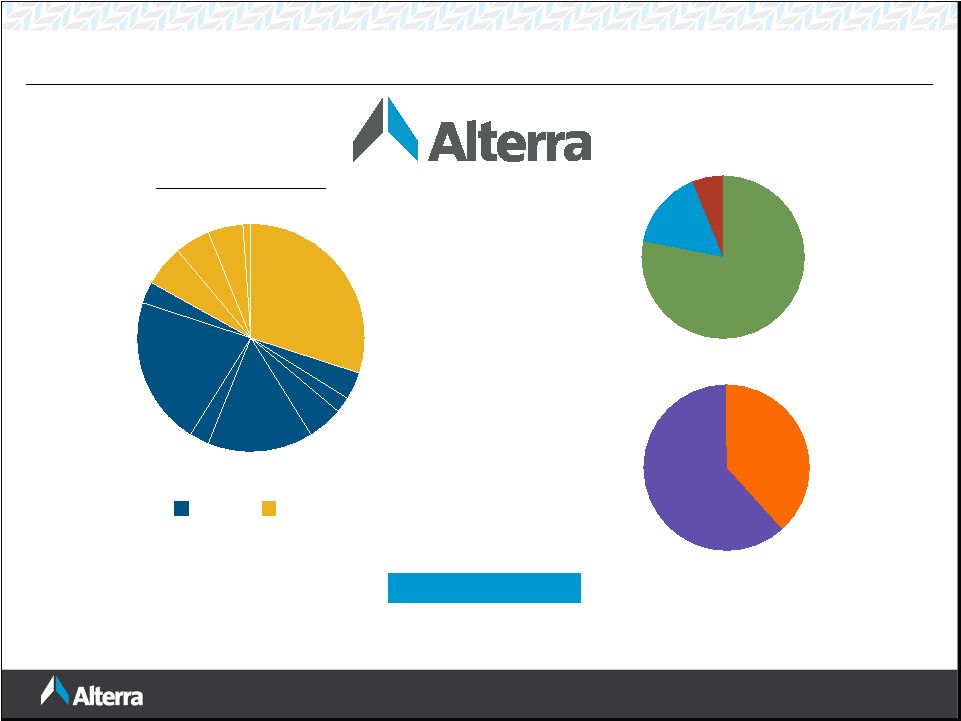

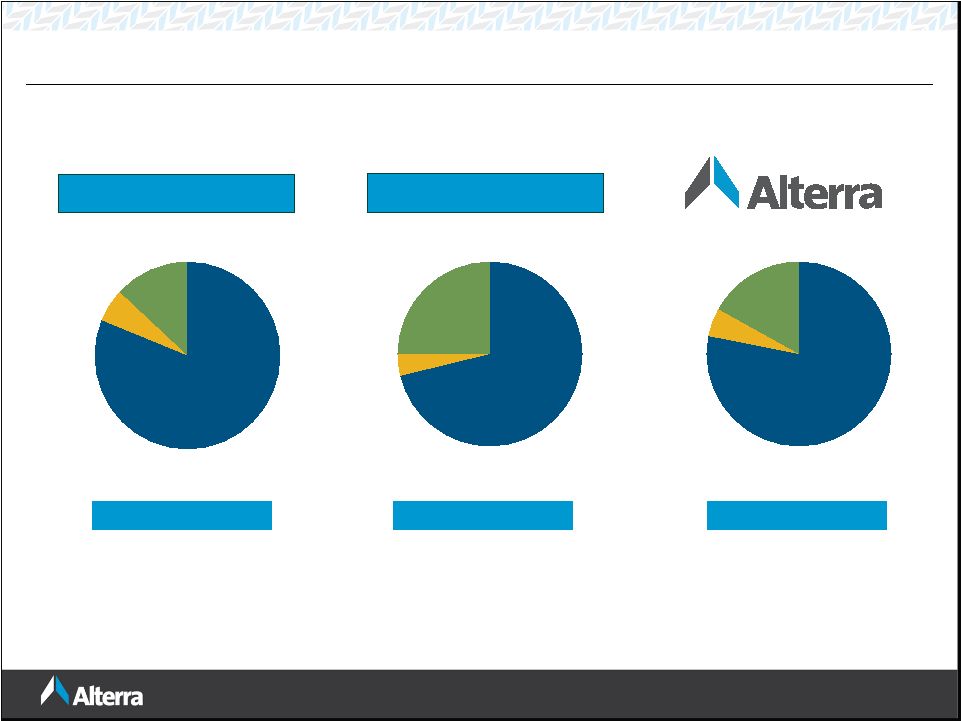

53% 47% 52% 48% 53% 47% Diversified and Balanced Business Mix Harbor Point 2009 GPW = $1,983 million A compelling strategic fit, with limited overlap 2009 GPW = $608 million Max 2009 GPW = $1,375 million ____________________ Note: Before intercompany eliminations of gross premiums written of approximately $36 million. 55% 22% 14% 7% 2% 36% 31% 21% 9% 3% Short-tail Long-tail Short-tail Long-tail Short-tail Long-tail Insurance Reinsurance U.S. Specialty Lloyd’s Life & Annuity Insurance Reinsurance U.S. Specialty Lloyd’s Life & Annuity 100% Reinsurance |

14

38% 62% Alterra Will Have a Diversified Portfolio of Business Long-Tail Short-Tail 2009 GPW = $1,983 million Line of Business ____________________ Note: Before intercompany eliminations of gross premiums written of approximately $36 million. (1) Includes Reinsurance segment (55.3%), Life & Annuity reinsurance (2.2%)

and reinsurance written through Lloyd’s platform (4.2%). 78% 16% 6% 30% 4% 2% 5% 15% 3% 21% 3% 6% 5% 5% 1% North America Europe Other Other Short-Tail Agriculture Marine & Energy Property Aviation Auto Professional Liability Medical Malpractice General Casualty Workers’ Comp / Clash Life Other Long-Tail Reinsurance Insurance (1) |

15

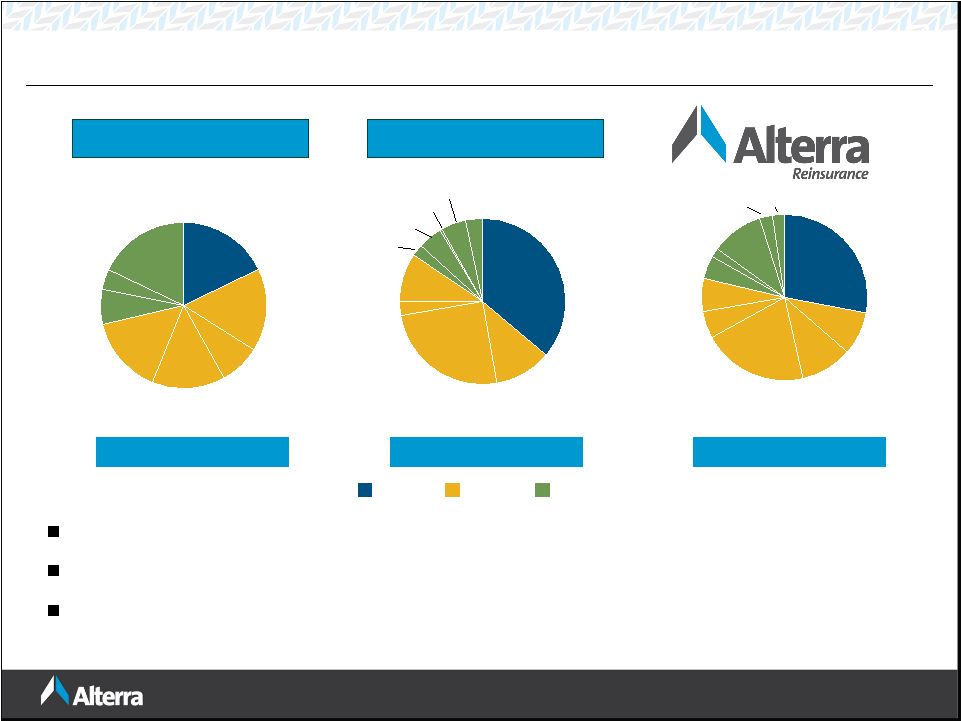

Complementary Portfolio of Business: Reinsurance Harbor Point Max - Reinsurance 2009 GPW = $489 million 2009 GPW = $608 million 2009 GPW = $1,097 million Property Casualty Specialty 10% 28% 9% 20% 5% 10% 2% 5% 6% 3% 2% Property Workers’ Compensation General Casualty Auto Professional Liability Marine & Energy Aviation Agriculture Other Specialty Property General Casualty Professional Marine & Energy Aviation Agriculture Other Specialty Property Workers’ Compensation General Casualty Medical Malpractice Professional Liability Marine & Energy Aviation Agriculture Other Specialty Auto WCC / Clash Credit Business lines written by Max and Harbor Point are similar Businesses are complementary and leverage different areas of expertise Harbor Point tends to focus on larger accounts than Max ____________________ Note: Before intercompany eliminations of gross premiums written. Credit Medical Malpractice |

16

$7.8 billion Conservative Investment Posture Harbor Point Max Fixed Income Other Investments Cash / Short Term Fixed Income Other Investments Cash / Short Term Fixed Income Other Investments Cash / Short Term 81% 6% 13% 71% 4% 25% 78% 5% 17% As of December 31, 2009 $2.6 billion $5.3 billion |

17

High Quality Fixed Income Portfolio $7.4 billion Conservatively positioned Average rating of “AA” 69% in cash and short-term investments, U.S. Government and Agencies, and AAA securities Duration of 4.1 years U.S. Gov’t and Agencies Cash and Short- Term Investments AAA AA A BBB BBB or Lower 18% 21% 30% 8% 18% 2% 3% As of December 31, 2009 |

18

Compelling Transaction for Alterra Shareholders Max shareholders merge with a “best in class” reinsurance franchise Harbor Point shareholders merge with a global specialty insurer and reinsurer Capital of ~$3 billion enhances market position with clients and brokers Ability to fully capitalize on market opportunities in a soft or hard market Capital benefit – $300 million expected post-closing dividend Key Harbor Point shareholders committed to this transaction Negligible impact on book value and 2010E ROE guidance of 13% Alterra shareholders will benefit from stronger, more stable book value growth over time |

19

Alterra means “high ground” – a place of security Alterra Capital Holdings Limited Bermuda Ireland United States Lloyd’s Latin America |

20

Appendix |

21

Shares Outstanding ____________________ Note: Before the impact of the expected post-closing dividend of ~$300

million ($2.50 per share). (1) Based on exchange ratio of 3.7769 shares of Max for each Harbor Point

share. (2) Includes restricted shares/units. As of December 31, 2009 Millions, except per share amounts Harbor Point (1) Max Primary Shares Outstanding (2) 56.3 62.1 118.3 Warrant Shares 2.3 8.8 11.1 Weighted average strike price $15.67 $22.62 $21.18 Option Shares 1.7 2.2 3.9 Weighted average strike price $22.32 $26.64 $24.73 |

22

Alterra Ownership ____________________ Note: As of December 31, 2009. Max shareholdings based on public

filings. (1) Includes restricted shares/units. (2) Includes options and warrants on an if-converted basis. Harbor Point Max Shareholder Primary (1) Diluted (2) Primary (1) Diluted (2) Primary (1) Diluted (2) Trident III (Stone Point Capital) 0.0% 0.0% 13.6% 17.3% 7.2% 9.5% Louis Bacon and Moore Capital Management LLC 17.0% 19.5% 0.0% 0.0% 8.1% 8.8% The Chubb Corporation 0.0% 0.0% 12.2% 16.1% 6.4% 8.8% JP Morgan Partners 0.0% 0.0% 12.2% 10.3% 6.4% 5.7% Fidelity Management & Research 6.8% 6.4% 0.0% 0.0% 3.2% 2.9% DLJ Merchant Banking Partners 0.0% 0.0% 6.1% 5.2% 3.2% 2.8% Morgan Stanley & Co. 0.0% 0.0% 6.1% 5.2% 3.2% 2.8% Diamond Castle Partners 0.0% 0.0% 6.1% 5.2% 3.2% 2.8% Institutional Investor 0.0% 0.0% 6.1% 5.2% 3.2% 2.8% T. Rowe Price Associates, Inc. 6.0% 5.6% 0.0% 0.0% 2.8% 2.5% Others -- None More than 2.5% of Alterra 70.3% 68.6% 37.7% 35.6% 53.2% 50.5% Total 100.0% 100.0% |

23

____________________ (1) Includes restricted shares/units. (2) Reflects the net value based on the treasury stock method using Max’s

closing share price as of March 3, 2010 of $24.27, or the value implied by such share price. Transaction Values ($ in millions, except per share amounts) Implied Multiple of 12/31/09 Book Value (Diluted) Implied Multiple of 12/31/09 Tangible Book Value (Diluted) Transaction Values 0.89x 0.80x Max Harbor Point 0.92x 0.93x Max Harbor Point Harbor Point Max Max share price (03/03/10) $24.27 $24.27 Exchange ratio 3.7769 Implied transaction value per share of HP $91.67 Equity market value (1) $1,355.9 $1,506.4 $2,862.3 Plus: Unvested restriced stock units 9.9 0.0 9.9 Plus: Net impact of options (2) 6.4 0.0 6.4 Plus: Net impact of warrants (2) 19.8 14.6 34.4 Fully diluted equity market value $1,392.0 $1,521.0 $2,913.0 |

24

Calculation of Book Value Per Share As of December 31, 2009 ($ in thousands, except shares and per share amounts) 1.9% dilutive to Max 0.4% dilutive to Max ____________________ Note: Book value per share figures are “non-GAAP financial measures” as defined in Regulation G. For more information, see the joint proxy statement/prospectus filed with the SEC by Max on March 11, 2010. (1) Includes restricted shares/units. (2) Reflects the net value based on the treasury stock method using Max’s closing share price as of December 31, 2009 of $22.30, or the value implied by such share price. (3) Includes the impact of purchase accounting adjustments. Excludes the impact of the expected post-closing dividend of ~$300 million ($2.50 per share) and merger- related transaction costs. (4) Reflects the elimination of Harbor Point goodwill of $251.7 million under

purchase accounting. Harbor Point Max (3) Translation into Max Shares at 3.7769 Shares outstanding Basic shares (1) 55,867,125 16,433,945 62,069,367 117,936,492 Warrants (net) (2) 683,163 607 2,229 685,392 Stock options (net) (2) 221,656 0 0 221,656 Unvested restricted stock units 406,514 0 0 406,514 Diluted shares outstanding 57,178,458 16,434,552 62,071,596 119,250,054 Book value per share Shareholders' equity $1,564,633 $1,889,700 $3,202,604 (4) Goodwill and intangible assets (48,686) (257,929) Tangible shareholders' equity $1,515,947 $1,631,771 $3,147,718 Diluted book value per share $27.36 $114.98 $26.86 Diluted tangible book value per share $26.51 $99.29 $26.40 |

25

Harbor Point – Financial Highlights Shareholders’ Equity ($ in millions) Premiums Written ($ in millions) Combined Ratio 2009 Gross Premiums Written Total = $608 million 36% 49% 15% 49.1% 38.7% 33.3% 36.3% 44.3% 69.9% 47.3% 43.7% 0.0% 20.0% 40.0% 60.0% 80.0% 100.0% 120.0% 2006 2007 2008 2009 86.0% 92.8% 103.2% 80.6% Casualty Property Specialty $642.6 $672.5 $511.7 $607.5 $601.9 $506.8 $567.9 $590.4 $0 $100 $200 $300 $400 $500 $600 $700 2006 2007 2008 2009 $1,889.7 $1,691.5 $1,579.0 $1,461.9 $0 $400 $800 $1,200 $1,600 $2,000 2006 2007 2008 2009 NPW GPW Loss & LAE Ratio Expense Ratio |

26

Property Casualty Specialty Total Harbor Point Has A Well-Diversified Portfolio of Business 15% 36% 49% 75% 20% 5% 86% 14% 23% 31% 4% 16% 26% 2009 GPW: $296 million 2009 GPW: $221 million 2009 GPW: $91 million 2009 GPW: $608 million Quota Share Per Risk Catastrophe Excess of Loss Crop Quota Share Marine/Energy Credit Multi-line Aviation Property Casualty Specialty $220.9 $225.3 $313.4 $220.4 $0 $100 $200 $300 $400 2006 2007 2008 2009 $295.9 $246.6 $282.3 $296.3 $0 $100 $200 $300 $400 2006 2007 2008 2009 $90.8 $39.8 $76.8 $126.0 $0 $100 $200 $300 $400 2006 2007 2008 2009 $607.5 $511.7 $672.5 $642.6 $0 $100 $200 $300 $400 $500 $600 $700 $800 2006 2007 2008 2009 |

27

Max – Financial Highlights Premiums Written ($ in millions) 2009 Gross Premiums Written Shareholders’ Equity ($ in millions) Combined Ratio Total = $1,375 million U.S. Specialty Max at Lloyd’s Life & Annuity Reinsurance Bermuda / Dublin Insurance Bermuda / Dublin Reinsurance $1,564.6 $1,280.3 $1,583.9 $1,390.1 $0 $400 $800 $1,200 $1,600 $2,000 2006 2007 2008 2009 $865.2 $1,078.3 $1,254.3 $1,375.0 $634.7 $796.6 $840.2 $894.5 $0 $300 $600 $900 $1,200 $1,500 2006 2007 2008 2009 NPW GPW 18.7% 24.2% 23.0% 25.7% 62.4% 68.9% 64.0% 67.7% 0.0% 20.0% 40.0% 60.0% 80.0% 100.0% 120.0% 2006 2007 2008 2009 88.2% 86.4% 91.9% 88.1% 21% 9% 3% 31% 36% Loss & LAE Ratio Expense Ratio |

28

Max Has a Strong Market Position in Specialty Classes … Bermuda / Dublin Insurance (31% of GPW) Bermuda / Dublin Reinsurance (36% of GPW) 16% 27% 42% 15% Professional Liability Property Excess Liability 2009 GPW: $428 million 2009 GPW: $489 million Aviation Excess Liability Property Aviation Workers Comp. Professional Liability Other Med. Mal. Marine & Energy Agriculture $427.8 $389.4 $382.9 $396.6 $300 $400 $500 2006 2007 2008 2009 $489.0 $419.5 $345.2 $423.6 $300 $400 $500 2006 2007 2008 2009 17% 7% 6% 4% 14% 15% 18% 16% 3% |

29

…With an Attractive Position in the U.S. Market and Lloyd’s Max at Lloyd’s (9% of GPW) U.S. Specialty (21% of GPW) Launched in 2007 Nationwide niche E&S underwriter 91% non-admitted 2009 combined ratio = 99.5% Acquired in November 2008 Direct and reinsurance 3 syndicates under management 2009 combined ratio = 86.3% 18% 2% 18% 15% 47% 31% 21% 1% 47% 2009: $285 million 2009: $129 million Professional Liability Property Marine General Casualty Property Aviation Fin. Institutions Prof. Liability Accident & Health |