Attached files

| file | filename |

|---|---|

| 8-K - RESULTS OF OPERATIONS AND FINANCIAL CONDITION - HOOPER HOLMES INC | form8k.htm |

| EX-99.2 - TRANSCRIPT OF EARNINGS CONFERENCE CALL - HOOPER HOLMES INC | exhibit99-2.htm |

News

Release

For

further information:

Hooper

Holmes

Roy H.

Bubbs

President

and Chief Executive Officer

(908)

766-5000

Investors:

Andrew Berger

S.M.

Berger & Company

(216)

464-6400

Hooper

Holmes Announces Fourth Quarter and Year-End 2009 Results

BASKING

RIDGE, N.J., March 12, 2010 -- Hooper Holmes (NYSE Amex:HH) today announced

financial results for the fourth quarter and year ended December 31,

2009.

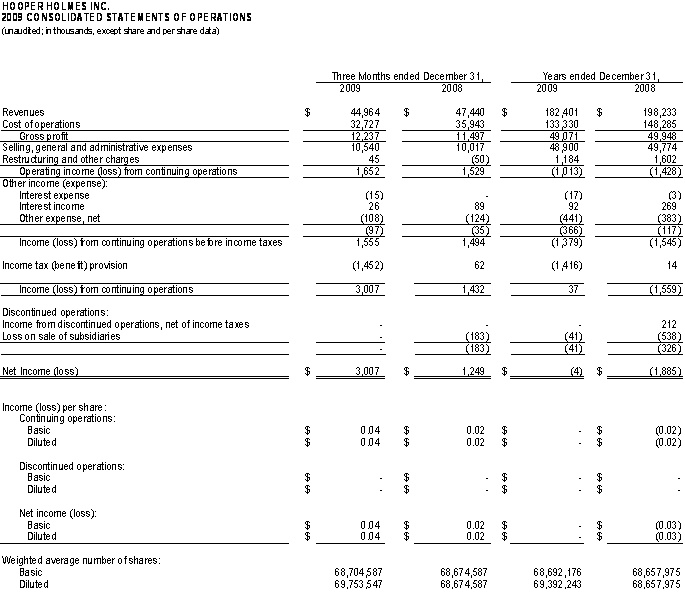

Consolidated

revenues totaled $45.0 million for the fourth quarter of 2009, representing a 5%

revenue decline from the $47.4 million in the fourth quarter of

2008. The Company recorded net income of $3.0 million for the fourth

quarter of 2009, or $0.04 per share, compared to net income of $1.2 million, or

$0.02 per share in 2008. The fourth quarter 2009 results include a

$1.5 million federal tax benefit pertaining to the utilization of fully reserved

net operating losses, pursuant to the Business Assistance Act signed into law in

the fourth quarter of 2009. Net income for the fourth quarter of 2008

included a reversal of approximately $1.6 million in SG&A incentive

accruals, along with a loss of $0.2 million from discontinued

operations.

For the

year-ended December 31, 2009, consolidated revenues were $182.4 million compared

to $198.2 million in 2008. The Company’s net income for the

year-ended December 31, 2009 was approximately breakeven, or $0.00 per share,

compared to a net loss of $1.9 million, or ($0.03) per share in

2008. The results for the year-ended December 31, 2009 include a

non-cash charge of $2.7 million attributable to increased depreciation expense

resulting from a reduction in the estimated useful life of the Company’s current

IT system, along with restructuring and other charges totaling $1.2

million. The 2009 results also include a $1.5 million federal tax

benefit pertaining to the utilization of fully reserved net operating

losses. The net loss in 2008 included restructuring and other charges

of $1.6 million and a $0.3 million loss from discontinued

operations.

Fourth

quarter 2009 revenues by service line:

|

§

|

Portamedic

revenue declined 3% to $32.3 million in the fourth quarter of 2009

compared to $33.2 million in the fourth quarter of 2008, primarily due to

a 4% decline in paramedical exams completed during the

quarter.

|

|

§

|

Heritage

Labs revenue totaled $3.1 million for the fourth quarter of 2009, an

increase of 5% compared to the fourth quarter of

2008.

|

1

|

§

|

Hooper

Holmes Services (formerly Underwriting Solutions and Infolink) revenue

totaled $5.5 million for the fourth quarter of 2009, a decline from $8.4

million in the fourth quarter of 2008, primarily due to reduced demand for

the Company’s outsourced underwriting

services.

|

|

§

|

Health

& Wellness revenue totaled $4.1 million for the fourth quarter of

2009, an increase of 39% from $3.0 million in the comparable fourth

quarter of 2008.

|

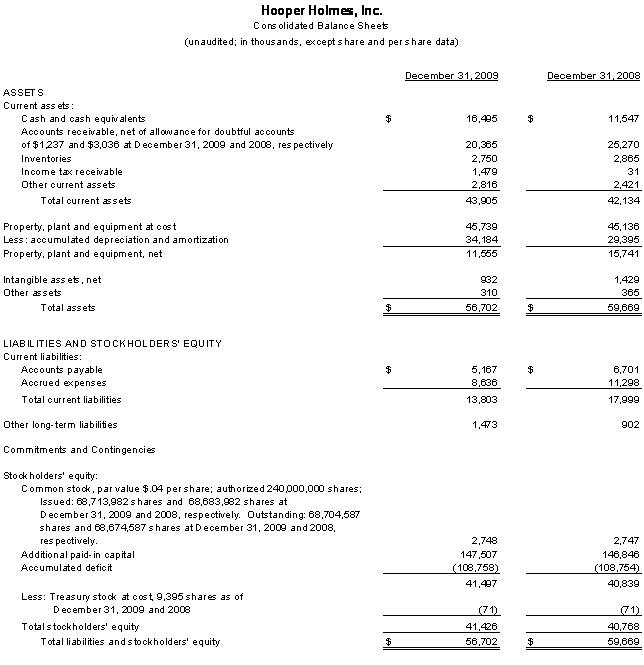

Cash

provided by continuing operations approximated $3.1 million in the fourth

quarter of 2009, and $8.7 million for the year-ended December 31,

2009. Capital expenditures totaled $0.7 million in the fourth quarter

of 2009 and $3.1 million for the year-ended December 31, 2009. As of

December 31, 2009, cash and cash equivalents totaled $16.5 million, with no

borrowings under the Company’s credit facility.

Roy H.

Bubbs, President and CEO commented, “We are encouraged by the improvements

realized in the fourth quarter, and the entire year, including a significant

reduction in costs, improved cash flow and positive indications on several new

revenue initiatives. However, economic conditions in the insurance

industry remain challenging and are expected to negatively impact our revenues

and operating results in the first quarter, and possibly throughout

2010.”

Conference

Call

The

Company will host a conference call, today, March 12, 2010 at 11:00am ET to

discuss fourth quarter 2009 results.

To

participate in the conference call, please dial 877-941-1427 or internationally

480-629-9664 conference ID 4259042 five to ten minutes before the call is

scheduled to begin. A live web cast will be hosted on the Company's web site

located at www.hooperholmes.com. Listeners may also access a telephone replay of

the conference call, available from 2:00 p.m. on March 12, 2010 until midnight

on March 19, 2010, by dialing 800-406-7325 or internationally

303-590-3030. The access code for the replay is 4259042.

About Hooper

Holmes

Hooper

Holmes is a leader in collecting personal health data and transforming it into

useful information, enabling customers to take actions that manage or reduce

their risks and expenses. As a leading provider of risk assessment

services for the insurance industry, Hooper Holmes provides insurers with the

widest range of medical exam, data collection, laboratory testing and

underwriting services in the industry.

With

presence in over 250 markets and a network of thousands of examiners, Hooper

Holmes can arrange a medical exam anywhere in the U.S. and deliver the results

to its customers. Each year we arrange more medical exams than any

other company and process several million specimens in our

laboratory. We provide a complete service for wellness, disease

management, and managed care companies including scheduling support, fulfillment

of supplies, blood collection kits, medical screenings, lab testing and data

transmission. We underwrite thousands of cases annually and complete

more than a million telephone interviews.

2

- -

This

press release contains “forward-looking” statements, as such term is defined in

the Private Securities Litigation Reform Act of 1995. These

forward-looking statements are based on the Company’s current expectations and

beliefs and are subject to a number of risks, uncertainties and

assumptions. Among the important factors that could cause actual

results to differ materially from those expressed in, or implied by, these

forward-looking statements are our ability to successfully implement our

business strategy; our working capital requirements over the next 12 to 24

months; our ability to maintain compliance with the financial covenant in our

credit facility; the level of our liquidity in operating cash flows; customer

and creditor concerns about our financial health; and the rate of life insurance

application activity. Additional information about these and other factors that

could affect the Company’s business is set forth in the Company’s annual report

on Form 10-K for the year ended December 31, 2008, filed with the Securities and

Exchange Commission on March 16, 2009. The Company undertakes no

obligation to update or release any revisions to these forward-looking

statements to reflect events or circumstances after the date of this press

release to reflect the occurrence of unanticipated events, except as required by

law.

3

- -

4

- -

# # #

5