Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2009.

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-33979

BPW ACQUISITION CORP.

(Exact name of Registrant as specified in its charter)

| Delaware |

26-1259837 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

750 Washington Boulevard Stamford, Connecticut 06901 (Address, including zip code, of principal executive offices)

(203) 653-5800 (Registrant’s telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Units consisting of one share of Common Stock and one Warrant |

New York Stock Exchange Amex | |

| Common Stock included in Units, par value $0.0001 per share |

New York Stock Exchange Amex | |

| Warrants included in Units, exercisable for Common Stock at an exercise price of $7.50 per share | New York Stock Exchange Amex |

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “small reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer x | Non-accelerated filer ¨ | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes x No ¨

The aggregate market value of the voting common stock, par value $0.0001 per share, held by non-affiliates of the registrant computed by reference to the closing sales price for the registrant’s common stock on June 30, 2009, as reported on the New York Stock Exchange Amex (formerly known as the American Stock Exchange) was approximately $335 million.

The number of shares of the registrant’s common stock outstanding as of March 16, 2010 was 41,176,471.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Table of Contents

| Page | ||||

| 1 | ||||

| PART I | ||||

| Item 1. |

2 | |||

| Item 1A. |

9 | |||

| Item 1B. |

14 | |||

| Item 2. |

14 | |||

| Item 3. |

14 | |||

| Item 4. |

Reserved |

15 | ||

| PART II | ||||

| Item 5. |

16 | |||

| Item 6. |

19 | |||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results

of |

20 | ||

| Item 7A. |

23 | |||

| Item 8. |

24 | |||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and

Financial |

24 | ||

| Item 9A(T). |

24 | |||

| Item 9B. |

24 | |||

| PART III | ||||

| Item 10. |

25 | |||

| Item 11. |

28 | |||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and

Related |

29 | ||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

30 | ||

| Item 14. |

33 | |||

| PART IV | ||||

| Item 15. |

34 | |||

| S-1 | ||||

| F-1 | ||||

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

The statements contained in this Annual Report that are not purely historical are forward-looking statements. Our forward-looking statements include, but are not limited to, statements regarding our or our management’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipates,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predicts,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this Annual Report may include, for example, statements about our:

| • | ability to complete our initial business combination; |

| • | success in retaining or recruiting, or changes required in, our officers, key employees or directors following our initial business combination; |

| • | officers and directors allocating their time to other businesses and potentially having conflicts of interest with our business or in approving our initial business combination, as a result of which they would then receive expense reimbursements; |

| • | potential ability to obtain additional financing to complete our initial business combination; |

| • | pool of prospective target businesses; |

| • | officers’ and directors’ ability to generate a number of potential investment opportunities; |

| • | potential change in control if we acquire one or more target businesses for stock; |

| • | public securities’ potential liquidity and trading; |

| • | listing or delisting of our securities from the New York Stock Exchange Amex (“NYSE Amex”, formerly known as the American Stock Exchange) or the ability to have our securities listed on the NYSE Amex or any other securities exchange following a business combination; |

| • | use of proceeds not held in the trust account or available to us from interest income on the trust account balance; |

| • | financial performance following our initial public offering; or |

| • | regulatory and operational risks associated with acquiring a financial services or business services firm. |

The forward-looking statements contained in this Annual Report are based on our current expectations and beliefs concerning future developments and their potential effects on us. There can be no assurance that future developments affecting us will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described under the heading “Risk Factors”. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

1

Table of Contents

References to “BPW,” “we,” “us” or “our company” refer to BPW Acquisition Corp., a Delaware corporation. References to our “management” or our “management team” refer to our officers and directors and references to our “sponsors” refer to Perella Weinberg Partners Acquisition LP, a Delaware limited partnership (“PWPA”), and BNYH BPW Holdings LLC, a Delaware limited liability company (“BNYH BPW”). References to our “founders” refer to Roger W. Einiger, J. Richard Fredericks, Wolfgang Schoellkopf and our sponsors. Unless the context otherwise requires, references to the “merger” refer to the merger contemplated by the definitive merger agreement dated December 8, 2009, by and among us, The Talbots, Inc., a Delaware corporation (“Talbots”) and Tailor Acquisition, Inc., a Delaware corporation, as amended on February 16, 2010.

| ITEM 1. | BUSINESS |

Company Overview

We are a blank check company formed in Delaware on October 12, 2007. We were formed to effect a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or other similar business combination with one or more operating businesses, which we refer to throughout this Annual Report as our initial business combination. We intend to effect our initial business combination using cash from the proceeds of our initial public offering, our capital stock, debt or a combination of cash, stock and debt.

On March 3, 2008, we completed our initial public offering of 35,000,000 units with each unit consisting of one share of our common stock and one warrant, each to purchase one share of our common stock at an exercise price of $7.50 per share. The units from the initial public offering were sold at an offering price of $10.00 per unit, generating total gross proceeds of $350 million. Simultaneously with the consummation of our initial public offering, we consummated the private sale of a total of 8,600,000 warrants to our sponsors at a price of $1.00 per warrant, generating gross proceeds of $8,600,000. After deducting the underwriting discounts and commissions and the initial public offering expenses, approximately $348,650,000 of the proceeds from the initial public offering and the private placement was deposited into a trust account maintained by Mellon Bank, N.A., as account agent. Such funds will not be released from the trust account to us until the earlier of completion of our initial business combination or our liquidation, although we may withdraw up to an aggregate of approximately $4.0 million of the interest income accumulated on the funds. After the payment of approximately $750,000 in expenses relating to the initial public offering plus the $9.1 million of underwriting discounts and commissions, $100,000 of the net proceeds of the public offering and private placement was not deposited into a trust account and retained by us for working capital purposes. Through December 31, 2009, we have generated approximately $3.7 million of interest earned on the net proceeds of our initial public offering held in the trust account, of which approximately $1.2 million was distributed to pay income taxes and $2 million for working capital. Of the $2 million distributed for working capital purposes, together with the $100,000 from the initial public offering not deposited in the trust account and $25,000 in initial founders’ equity, approximately $400,000 was used to pay offering costs and approximately $1,634,000 for operating, due diligence and formation costs. The net proceeds deposited into the trust account remain on deposit in the trust account earning interest. As of December 31, 2009, there was $349,198,387, including interest earned and not distributed of $548,387, held in the trust account.

We are not presently engaged in, and we will not engage in, any substantive commercial business until we consummate an initial business combination. We intend to utilize our cash, including the funds held in the trust account, capital stock, debt or a combination of the foregoing in effecting an initial business combination.

Recent Developments

On December 8, 2009, we entered into a definitive merger agreement pursuant to which we will be acquired by Talbots, a specialty retailer of women’s apparel.

2

Table of Contents

Under the terms of the merger agreement, as amended on February 16, 2010, holders of shares of our common stock will receive a number of shares of Talbots common stock based on the greater of: (i) 0.9853, which is the quotient (rounded to the nearest ten-thousandth) obtained by dividing $11.25 by the volume weighted average price per share (calculated to the nearest one-hundredth of one cent) of shares of Talbots common stock on the NYSE for the 15 consecutive trading days immediately preceding the fifth trading day prior to the date of the special meeting of BPW stockholders and (ii) the quotient obtained by dividing $11.25 by the average of the daily volume weighted average prices per share of Talbots common stock on the New York Stock Exchange over each of the 5 consecutive trading days immediately preceding the date of the completion of the merger, provided, however, that if such quotient is: (1) greater than 1.3235, then such quotient shall be deemed to be 1.3235 , or (2) less than 0.9000, then such quotient shall be deemed to be 0.9000. As part of the transaction, the founders will surrender an aggregate of 1,852,941 shares of BPW common stock, or approximately 30% of the shares held by the founders, for no consideration.

As contemplated by the amended merger agreement, Talbots has also commenced an exchange offer for our existing warrants held by public warrantholders. The exchange offer provides that 17,500,000 of our warrants (equal to 50% of our warrants held by public warrantholders) will be exchanged for a number of new Talbots warrants based on the ultimately applicable exchange ratio in the merger, and that the balance of our warrants held by warrantholders participating in the exchange offer will be exchanged for a number of Talbots common shares based on a floating exchange ratio equal to one-tenth of ultimately applicable exchange ratio in the merger as determined under the amended merger agreement. The founders have agreed to elect to exchange in the exchange offer all of their warrants to purchase shares of BPW common stock for Talbots common stock at the same floating exchange ratio, subject to the proration procedures described under the heading “Risk Factors—Our warrantholders may not receive all consideration in the form elected.”

The close of the transaction is expected to occur during the first calendar quarter of 2010.

Opportunity for stockholder approval of our initial business combination

As we have stated since our initial public offering, we will proceed with our initial business combination only if (i) a majority of the shares of common stock voted by the public stockholders are voted in favor of the business combination, (ii) a majority of the outstanding shares of our common stock are voted in favor of an amendment to our amended and restated certificate of incorporation to provide for our perpetual existence and (iii) public stockholders owning less than 35% of our shares of common stock sold in our initial public offering, on a cumulative basis, including the shares as to which conversion rights were exercised in connection with the stockholder vote, if any, required to approve an amendment to our amended and restated certificate of incorporation to provide for an extension of the time period within which we must complete our initial business combination and the stockholder vote required to approve our initial business combination, both vote against the business combination and/or extended period, as applicable, and exercise their conversion rights.

A special meeting of our stockholders was held on February 24, 2010 at 10:00 a.m. to consider the merger agreement, as amended. Stockholders who owned shares of our common stock at the close of business on January 15, 2010, the record date for the special meeting, were entitled to vote at the special meeting. As disclosed in the definitive proxy materials filed in connection with the transaction, stockholders were asked to vote on (i) the proposal to approve an amendment to our amended and restated certificate of incorporation to extend our corporate existence by two months, to twenty-six months in total from the date of our initial public offering, or the pre-closing certificate amendment proposal; (ii) the proposal to approve and adopt the merger agreement, as amended, or the merger proposal; (iii) the proposal to amend and restate, effective upon the closing of the Talbots transaction, our amended and restated certificate of incorporation to provide for our perpetual existence and eliminate provisions of our amended and restated certificate of incorporation that relate to our operation as a blank check company, or the post-closing certificate amendment proposal; and (iv) the proposal to approve the adjournment of the special meeting, including, if necessary or appropriate, to solicit additional proxies in the event that there are not sufficient votes at the time of the special meeting to approve the foregoing proposals, or the adjournment proposal. A total of 31,056,473 shares were represented at the special meeting, constituting 75.42% of the shares eligible to vote and therefore a quorum was present. BNY Mellon Shareowner

3

Table of Contents

Services acted as inspector and completed a review based on the proxies and ballots submitted and found that (i) 68% of the outstanding shares approved the pre-closing certificate amendment proposal with less than 1% of the outstanding shares having elected to convert their shares in connection with the pre-closing certificate amendment proposal; (ii) 68% of the outstanding shares, representing 88.54% of the shares issued in our initial public offering present and entitled to vote at the special meeting, approved the merger proposal with less than 1% of the outstanding shares having elected to convert their shares in connection with the merger proposal; (iii) 70% of the outstanding shares approved the post-closing certificate amendment proposal; and (iv) 62% of the outstanding shares approved the adjournment proposal.

Therefore, all of the proposals at the special meeting were properly approved and we plan to proceed with the merger, our initial business combination. If for any reason the merger is not consummated as planned, our amended and restated certificate of incorporation provides that we may extend our corporate existence, subject to stockholder approval, until up to August 26, 2010, and therefore we may request an additional extension from our stockholders until up to such date and may continue to seek other target businesses.

Following the approval of our stockholders at the special meeting of the pre-closing certificate amendment proposal, on February 24, 2010 we filed with the Secretary of State of the State of Delaware an amendment to our amended and restated certificate of incorporation extending our corporate existence from February 26, 2010 to April 26, 2010 (subject to further extension up to August 26, 2010).

Conversion rights for public stockholders voting to reject the pre-closing certificate amendment proposal and/or post-closing amendment certificate proposal

Subject to the procedures set forth in the definitive proxy materials filed in connection with the transaction, public stockholders who exercised their conversion rights and voted against the pre-closing certificate amendment proposal and/or the merger proposal are entitled to cause us to convert their common stock for a pro rata share of the aggregate amount in the trust account, before payment of deferred underwriting discounts and commissions and including interest earned on their pro rata share of the trust account, net of income taxes payable on such interest and net of up to an aggregate of $4.0 million of the interest income, net of taxes, on the trust account balance previously released to us to fund our working capital and general corporate requirements. Public stockholders who properly exercised their conversion rights in connection with the merger proposal only, or both the merger proposal and the pre-closing certificate amendment proposal, will have their shares converted promptly following completion of the merger into an amount of cash equal to their pro rata share of the cash then in the trust account, subject to certain adjustments as described in this Annual Report.

The actual per-share conversion price will be equal to the pro rata share of the aggregate amount then on deposit in the trust account, before payment of deferred underwriting discounts and commissions and including interest income on the trust account, net of taxes previously paid and net of any amounts previously released to us (calculated as of two business days prior to the consummation of the proposed business combination), divided by the number of shares sold in our initial public offering. The initial per-unit conversion price would be approximately $9.96, or $0.04 less than the per-unit offering price of $10.00 (assuming that the entire purchase price of the units was allocated to the common stock). The proceeds held in the trust account may be subject to claims which would take priority over the claims of our public stockholders and, as a result, the per-unit liquidation price could be less than $9.96 due to claims of such creditors.

In addition to certain other procedures set forth in the definitive proxy materials filed in connection with the transaction, in connection with the proposed business combination with Talbots described above, we required public stockholders to tender their certificates to our transfer agent or deliver their shares to the transfer agent electronically using the Depository Trust Company’s DWAC (Deposit/Withdrawal At Custodian) System, in each case prior to the special meeting, in order to properly exercise their conversion rights. We notified investors of this requirement in a Current Report on Form 8-K dated January 26, 2010.

4

Table of Contents

There is a nominal cost associated with the above-referenced tendering process and the act of certificating the shares or delivering them through the DWAC system. The transfer agent will typically charge the tendering broker $50 and it would be up to the broker whether or not to pass this cost on to the converting holder. The fee would be incurred regardless of whether or not we require holders seeking to exercise conversion rights to tender their shares prior to the meeting — the need to deliver shares is a requirement of conversion regardless of the timing of when such delivery must be effectuated.

Liquidation if no business combination

If we do not consummate our initial business combination by April 26, 2010 (or up to August 26, 2010 if extended pursuant to a subsequent stockholder vote), our corporate existence will automatically cease except for the purposes of winding up our affairs and liquidating pursuant to Section 278 of the Delaware General Corporation Law, in which case we will as promptly as practicable thereafter adopt a plan of distribution in accordance with Section 281(b) of the Delaware General Corporation Law. Section 278 provides that our existence will continue for at least three years after its expiration for the purpose of prosecuting and defending suits, whether civil, criminal or administrative, by or against us, and of enabling us gradually to settle and close our business, to dispose of and convey our property, to discharge our liabilities and to distribute to our stockholders any remaining assets, but not for the purpose of continuing the business for which we were organized.

Our existence will continue automatically even beyond the three-year period for the purpose of completing the prosecution or defense of suits begun prior to the expiration of the three-year period, until such time as any judgments, orders or decrees resulting from such suits are fully executed. Section 281(b) will require us to pay or make reasonable provision for all then-existing claims and obligations, including all contingent, conditional, or unmatured contractual claims known to us, and to make such provision as will be reasonably likely to be sufficient to provide compensation for any then-pending claims and for claims that have not been made known to us or that have not arisen but that, based on facts known to us at the time, are likely to arise or to become known to us within ten years after the date of dissolution. Payment or reasonable provision for payment of claims will be made in the discretion of the board of directors based on the nature of the claims and other factors deemed relevant by the board of directors. Claims may be satisfied by direct negotiation and payment, purchase of insurance to cover the claims, setting aside money as a reserve for future claims, or otherwise as determined by the board of directors in its discretion. Under Section 281(b), the plan of distribution must provide for all of such claims to be paid in full or make provision for payments to be made in full, as applicable, if there are sufficient assets. If there are insufficient assets to provide for all such claims, the plan must provide that such claims and obligations be paid or provided for according to their priority and, among claims of equal priority, ratably to the extent of legally available assets. These claims must be paid or provided for before we make any distribution of our remaining assets to our stockholders. We cannot assure you those funds will be sufficient to pay or provide for all creditors’ claims. Although we will seek to execute agreements with all vendors and service providers that we engage and prospective target businesses with which we negotiate, in which they will waive any right, title, interest or claim of any kind they may have in or to any monies held in the trust account for the benefit of our public stockholders, there is no guarantee that they will execute such agreements. There is no guarantee that, even if such third parties entered into such waiver agreements with us, they would not challenge the enforceability of these waivers and bring claims against the trust account. In addition, there is no guarantee that such entities will agree to waive any claims they may have in the future as a result of, or arising out of, any negotiations, contracts or agreements with us and will not seek recourse against the trust account for any reason. A court could also conclude that such agreements are not legally enforceable. As a result, if we liquidate, the per-share distribution from the trust account could be less than $9.96 due to claims or potential claims of creditors. We will distribute to all of our public stockholders, in proportion to their respective equity interests, an aggregate sum equal to the amount then on deposit in the trust account, including the deferred underwriting discounts and commissions and interest earned on the trust account, net of taxes previously paid or payable thereon and net of amounts previously released to us, plus any remaining net assets (subject to our obligations under Delaware law to provide for claims of creditors as described below).

5

Table of Contents

Our sponsors’ affiliates, Brooklyn NY Holdings LLC and Perella Weinberg Partners Group LP, and our sponsors have agreed that they will be jointly and severally liable to ensure that the claims of prospective target businesses, vendors for services rendered or products sold to us, or of third parties including lenders, with whom we entered into contractual relationships following the consummation of our initial public offering will not reduce the proceeds in the trust account available for payment to public stockholders or require the return or disgorgement of payments made from the trust account to public stockholders, but only if such prospective target business, vendor or third party does not execute a valid and enforceable waiver. Accordingly, if a claim brought by a prospective target business, vendor or third party did not exceed the amount of funds available to us outside of the trust account or available to be released to us from interest earned on the trust account balance, Brooklyn NY Holdings LLC, Perella Weinberg Partners Group LP and our sponsors would not have any obligation to indemnify such claims as they would be paid from such available funds. Even if a claim exceeded such amounts, there will be no liability (1) as to claimed amounts owed to such a prospective target business, vendor or third party who executed a valid and enforceable waiver or (2) as to any claims under our indemnity of the underwriters of our initial public offering against certain liabilities, including liabilities under the Securities Act of 1933, as amended (the “Securities Act”). Based upon representations from Brooklyn NY Holdings LLC, Perella Weinberg Partners Group LP and our sponsors that they are accredited investors (as such term is defined in Regulation D under the Securities Act) and that they have sufficient funds available to them to satisfy their indemnification obligations, we believe they will be able to satisfy any indemnification obligations that may arise given the limited nature of the obligations. We will enforce our rights under the indemnification arrangements against them. However, we cannot assure you that Brooklyn NY Holdings LLC, Perella Weinberg Partners Group LP and our sponsors will be able to satisfy their obligations to us under these indemnification arrangements. On December 7, 2009, our sponsors entered into an agreement whereby PWPA and an affiliate will acquire 100% of the issued and outstanding membership units of BNYH BPW and will assume 100% of the interests, rights and obligations under BNYH BPW’s operating agreement on the date that we consummate our initial business combination. In addition to customary indemnification provisions, PWPA has also agreed that, effective as of December 7, 2009, if BPW is required to liquidate or dissolve prior to its initial business combination, PWPA will indemnify BNYH BPW against certain losses arising pursuant to the Letter Agreement, dated as of February 26, 2008, by and among BPW, Citigroup Global Markets, Inc., BNYH BPW and Brooklyn NY Holdings LLC. Further, PWPA has agreed to indemnify certain affiliates of BNYH BPW for any losses incurred as a result of the execution by BPW of any documents relating to its initial business combination and/or the negotiation or consummation of any actual or potential initial business combination after December 8, 2009.

We will promptly notify the account agent to begin liquidating the trust’s assets and anticipate it will take no more than ten business days to effectuate such distribution. The underwriters have agreed to waive their rights to their deferred underwriting discounts and commissions held in the trust account in the event we do not consummate our initial business combination within the required time period, and in such event such amounts will be included within the funds held in the trust account that will be available for distribution to the public stockholders.

Our founders have waived their rights to participate in any liquidation distribution with respect to their founders’ common stock. There will be no distribution from the trust account with respect to our warrants, which will expire worthless. We will pay the costs of liquidation from our remaining assets outside of the trust account. If such funds are insufficient, our sponsors have agreed to advance us the funds necessary to complete such liquidation (currently anticipated to be no more than approximately $15,000) and have agreed not to seek repayment of such expenses.

If we are unable to consummate an initial business combination and we have expended all of the net proceeds of our initial public offering and the private placements described herein, other than the proceeds which were deposited in the trust account, we expect that the initial per-share liquidation price (without taking into account any interest earned on the trust account) will be approximately $9.96, or $0.04 less than the per-unit offering price of $10.00. The proceeds deposited in the trust account could, however, become subject to claims of our creditors that are in preference to the claims of our stockholders. In addition, if we are forced to file a

6

Table of Contents

bankruptcy case or an involuntary bankruptcy case is filed against us that is not dismissed, the proceeds held in the trust account could be subject to applicable bankruptcy law, and may be included in our bankruptcy estate and subject to the claims of third parties with priority over the claims of our stockholders. Therefore, we cannot assure you that the actual per-share liquidation price will not be less than approximately $9.96.

Under the Delaware General Corporation Law, stockholders may be held liable for claims by third parties against a corporation to the extent of distributions received by them in a dissolution. If the corporation complies with certain procedures set forth in Section 280 of the Delaware General Corporation Law intended to ensure that it makes reasonable provision for all claims against it, including a 60-day notice period during which any third-party claims can be brought against the corporation, a 90-day period during which the corporation may reject any claims brought, and an additional 150-day waiting period before any liquidating distributions are made to stockholders, any liability of stockholders with respect to a liquidating distribution is limited to the lesser of such stockholder’s pro rata share of the claim or the amount distributed to the stockholder, and any liability of the stockholder would be barred after the third anniversary of the dissolution. However, we do not intend to comply with those procedures since, as stated above, it is our intention to make liquidating distributions to our stockholders as soon as reasonably possible after April 26, 2010 (or up to August 26, 2010 if extended pursuant to a subsequent stockholder vote) in the event our initial business combination has not been consummated. As such, our stockholders could potentially be liable for any claims to the extent of distributions received by them (but no more) and any liability of our stockholders may extend beyond the third anniversary of such date. Because we will not be complying with Section 280, Section 281(b) of the Delaware General Corporation Law requires us to adopt a plan that will provide for our payment, based on facts known to us at such time, of (i) all existing claims, including all contingent, conditional, or unmatured contractual claims known to us, (ii) all pending claims and (iii) all claims that may be potentially brought against us within the subsequent ten years. Accordingly, we would be required to provide for any claims of creditors known to us at that time or those that we believe could be potentially brought against us within the subsequent ten years prior to our distributing the funds in the trust account to our public stockholders. As a result, if we liquidate, the per-share distribution from the trust account could be less than $9.96 due to claims or potential claims of creditors. However, because we are a blank check company, rather than an operating company, and our operations are limited to searching for prospective target businesses to acquire, the only likely claims to arise would be from third parties, including lenders, with whom we entered into contractual relationships following the consummation of our initial public offering, vendors and service providers that we engage after the consummation of our initial public offering (such as accountants, lawyers, investment bankers, etc.) and potential target businesses and, as discussed above, we will seek to have all such third parties, vendors and service providers and prospective target businesses execute agreements with us waiving any right, title, interest or claim of any kind they may have in or to any monies held in the trust account.

Our public stockholders will be entitled to receive funds from the trust account only in the event of the expiration of our corporate existence and our liquidation or if they sought to convert their respective shares into cash as described above. In no other circumstances will a stockholder have any right or interest of any kind to or in the trust account.

Employees

We currently have four executive officers. These individuals are not obligated to devote any specific number of hours to our matters but they intend to devote only as much of time as they deem necessary to our affairs. In March 2009, the Company entered into an agreement for consulting services with Douglas McGovern. Services under this agreement require monthly payments of up to $13,500 (and Mr. McGovern is entitled to a bonus upon completion of an initial business combination) and extends through the earlier of April 26, 2010 (or August 26, 2010, if further extended) or completion of a business combination. Mr. McGovern was formerly an employee of Brooklyn NY Holdings LLC. Approximately $127,715 was incurred under this agreement through December 31, 2009.

7

Table of Contents

Available Information

We are required to file Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q with the Securities and Exchange Commission, which we refer to throughout this Annual Report as the SEC, on a regular basis, and are required to disclose certain material events (e.g., changes in corporate control; acquisitions or dispositions of a significant amount of assets other than in the ordinary course of business and bankruptcy) in a Current Report on Form 8-K. The public may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet website that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. The SEC’s Internet website is located at http://www.sec.gov.

8

Table of Contents

| ITEM 1A. | RISK FACTORS |

In addition to the other information included in this Annual Report, the following risk factors should be considered in evaluating our business and future prospects. The risk factors described below are not necessarily exhaustive and you are encouraged to perform your own investigation with respect to our company and our business. You should also read the other information included in this Annual Report, including our financial statements and the related notes.

Risks Related to Our Business

We are a recently formed development stage company with no operating history and no revenues, and you have no basis on which to evaluate our ability to achieve our business objective.

We are a recently formed development stage company with no operating results. Because we lack an operating history, you have no basis upon which to evaluate our ability to achieve our business objective of completing our initial business combination with one or more target businesses. If we expend all of the $100,000 in proceeds from our initial public offering not held in trust and interest income earned of up to $4.0 million, subject to adjustment, on the balance of the trust account that may be released to us to fund our working capital requirements in seeking our initial business combination, but fail to complete such a combination, we will never generate any operating revenues.

Failure to complete the merger may result in our liquidation.

Our certificate of incorporation requires us to complete the merger, or another business combination, by April 26, 2010 (unless extended by subsequent stockholder vote). If we fail to complete the merger or another business combination during this time period, our corporate existence will automatically cease, except for the purposes of winding up our affairs and liquidating. If we liquidate before completing the merger or another business combination, there will be no distribution with respect to the warrants, which will expire worthless. In such event, we expect that the per share liquidation distribution for holders of our common stock would be approximately $9.96 because of the expenses of our initial public offering, our general and administrative expenses and the costs incurred in seeking the merger or another business combination. In addition, we may suffer other adverse consequences if the merger is not completed, including that our business may have been adversely impacted by the failure to pursue other beneficial opportunities due to the focus on the merger, without realizing any of the anticipated benefits of the merger.

You will not be entitled to protections normally afforded to investors of blank check companies.

Since the net proceeds of our initial public offering are intended to be used to complete an initial business combination with a target business, we may be deemed to be a “blank check” company under the United States securities laws. However, since our securities are listed on the NYSE Amex, a national securities exchange, and we had net tangible assets in excess of $6.75 million upon the consummation of our initial public offering and filed a Current Report on Form 8-K, including an audited balance sheet demonstrating this fact, we are exempt from rules promulgated by the SEC to protect investors in blank check companies such as Rule 419. Accordingly, investors will not be afforded the benefits or protections of those rules. Because we are not subject to Rule 419, our units were immediately tradable, we are entitled to withdraw a certain amount of interest earned on the funds held in the trust account prior to the completion of our initial business combination and we have a longer period of time to complete our initial business combination than we would if we were subject to such rule.

9

Table of Contents

We have at least six months longer than most other blank check companies to effect an initial business combination and therefore the net proceeds of our initial public offering being held in the trust account may remain in the trust account for a longer period of time than other blank check or special purpose acquisition company offerings before they are released to you.

The period of time we have to complete an initial business combination is longer than blank check companies subject to Rule 419, which have 18 months to complete an initial business combination, or other special purpose acquisition companies, which typically have 18 or 24 months to complete an initial business combination. As a result, if we do not complete an initial business combination, the net proceeds of our initial public offering being held in the trust account will remain in trust for a longer period of time than blank check companies subject to Rule 419 or other special purpose acquisition company offerings before they are released to you.

If third parties bring claims against us, the proceeds held in trust could be reduced and the per-share liquidation price received by stockholders may be less than approximately $9.96 per share.

Our placing of funds in trust may not protect those funds from third party claims against us. Although we will seek to execute agreements with all vendors and service providers we engage, and prospective target businesses we negotiate with, in which they will waive any right, title, interest or claim of any kind they may have in or to any monies held in the trust account for the benefit of our public stockholders, there is no guarantee that they will execute such agreements. Furthermore, there is no guarantee that, even if such third parties entered into such agreements with us, they will not challenge the enforceability of these waivers and bring claims against the trust account. Nor is there any guarantee that such entities will agree to waive any claims they may have in the future as a result of, or arising out of, any negotiations, contracts or agreements with us and will not seek recourse against the trust account for any reason. There is also no guarantee that a court would uphold the validity of such agreements. Further, we could be subject to claims from parties not in contract with us who have not executed a waiver, such as a third party claiming tortious interference as a result of our initial business combination. Accordingly, the proceeds held in trust could be subject to claims which could take priority over those of our public stockholders and, as a result, the per-share liquidation price could be less than $9.96 due to claims of such creditors. Brooklyn NY Holdings LLC, Perella Weinberg Partners Group LP and our sponsors have agreed that they will be jointly and severally liable to ensure that the claims of prospective target businesses, vendors for services rendered or products sold to us, or of third parties, including lenders, with whom we entered into contractual relationships following the consummation of our initial public offering, will not reduce the proceeds in the trust account available for payment to public stockholders or require the return or disgorgement of payments made from the trust account to public stockholders, but only if such prospective target business, vendor or third party does not execute a valid and enforceable waiver. Accordingly, if a claim brought by a prospective target business, vendor or third party did not exceed the amount of funds available to us outside of the trust account or available to be released to us from interest earned on the trust account balance, Brooklyn NY Holdings LLC, Perella Weinberg Partners Group LP and our sponsors would not have any obligation to indemnify such claims as they would be paid from such available funds. Even if a claim exceeded such amounts, there will be no liability (1) as to claimed amounts owed to such a prospective target business, vendor or third party who executed a valid and enforceable waiver or (2) as to any claims under our indemnity of the underwriters of our initial public offering against certain liabilities, including liabilities under the Securities Act. Based upon representations from Brooklyn NY Holdings LLC, Perella Weinberg Partners Group LP and our sponsors as to their accredited investor status (as such term is defined in Regulation D under the Securities Act) and that they have sufficient funds available to them to satisfy their indemnification obligations, we believe they will be able to satisfy any indemnification obligations that may arise given the limited nature of the obligations. We will enforce our rights under the indemnification arrangements against them. However, in the event Brooklyn NY Holdings LLC, Perella Weinberg Partners Group LP and our sponsors have liability to us under these indemnification arrangements, we cannot assure you that they will be able to satisfy their obligations. On December 7, 2009, our sponsors entered into an agreement whereby PWPA and an affiliate will acquire 100% of the issued and outstanding membership units of BNYH BPW and will assume 100% of the interests, rights and

10

Table of Contents

obligations under BNYH BPW’s operating agreement on the date that we consummate our initial business combination. In addition to customary indemnification provisions, PWPA has also agreed that, effective as of December 7, 2009, if BPW is required to liquidate or dissolve prior to its initial business combination, PWPA will indemnify BNYH BPW against certain losses arising pursuant to the Letter Agreement, dated as of February 26, 2008, by and among BPW, Citigroup Global Markets, Inc., BNYH BPW and Brooklyn NY Holdings LLC. Further, PWPA has agreed to indemnify certain affiliates of BNYH BPW for any losses incurred as a result of the execution by BPW of any documents relating to its initial business combination and/or the negotiation or consummation of any actual or potential initial business combination after December 8, 2009.

Additionally, if we are forced to file a bankruptcy case or an involuntary bankruptcy case is filed against us which is not dismissed, the proceeds held in the trust account could be subject to applicable bankruptcy law, and may be included in our bankruptcy estate and subject to the claims of third parties with priority over the claims of our stockholders. To the extent any bankruptcy claims deplete the trust account, we cannot assure you we will be able to return to our public stockholders at least $9.96 per share.

Our stockholders may be held liable for claims by third parties against us to the extent of distributions received by them.

If we are unable to consummate our initial business combination by April 26, 2010 (or up to August 26, 2010 if extended pursuant to a subsequent stockholder vote), our corporate existence will automatically cease except for the purposes of winding up our affairs and liquidating pursuant to Section 278 of the Delaware General Corporation Law, in which case we will as promptly as practicable thereafter adopt a plan of distribution in accordance with Section 281(b) of the Delaware General Corporation Law. Section 278 provides that our existence will continue for at least three years after its expiration for the purpose of prosecuting and defending suits, whether civil, criminal or administrative, by or against us, and of enabling us gradually to settle and close our business, to dispose of and convey our property, to discharge our liabilities and to distribute to our stockholders any remaining assets, but not for the purpose of continuing the business for which we were organized. Our existence will continue automatically even beyond the three-year period for the purpose of completing the prosecution or defense of suits begun prior to the expiration of the three-year period, until such time as any judgments, orders or decrees resulting from such suits are fully executed. Section 281(b) will require us to pay or make reasonable provision for all then-existing claims and obligations, including all contingent, conditional, or unmatured contractual claims known to us, and to make such provision as will be reasonably likely to be sufficient to provide compensation for any then-pending claims and for claims that have not been made known to us or that have not arisen but that, based on facts known to us at the time, are likely to arise or to become known to us within ten years after the date of dissolution. Payment or reasonable provision for payment of claims will be made in the discretion of the board of directors based on the nature of the claim and other factors deemed relevant by the board of directors. Claims may be satisfied by direct negotiation and payment, purchase of insurance to cover the claims, setting aside money as a reserve for future claims, or otherwise as determined by the board of directors in its discretion. Accordingly, we would be required to provide for any creditors known to us at that time or those that we believe could be potentially brought against us within the subsequent ten years prior to distributing the funds held in the trust account to stockholders. However, because we are a blank check company, rather than an operating company, and our operations will be limited to searching for prospective target businesses to acquire, the only likely claims to arise would be from third parties, including lenders, with whom we entered into contractual relationships following the consummation of our initial public offering, vendors and service providers that we engage after the consummation of our initial public offering (such as accountants, lawyers, investment bankers, etc.) and potential target businesses. We will seek to have all such third parties, vendors and service providers and prospective target businesses execute agreements with us waiving any right, title, interest or claim of any kind they may have in or to any monies held in the trust account. Accordingly, we believe the claims that could be made against us should be limited, thereby lessening the likelihood that any claim would result in any liability extending to the trust. However, we cannot assure you that we will properly assess all claims that may be potentially brought against us. As such, our stockholders could potentially be liable for any claims to the extent of distributions received by them (but no more) and any liability

11

Table of Contents

of our stockholders may extend well beyond the third anniversary of the date of distribution. Accordingly, we cannot assure you that third parties will not seek to recover from our stockholders amounts owed to them by us.

If we are forced to file a bankruptcy case or an involuntary bankruptcy case is filed against us which is not dismissed, any distributions received by stockholders could be viewed under applicable debtor/creditor and/or bankruptcy laws as either a “preferential transfer” or a “fraudulent conveyance.” As a result, a bankruptcy court could seek to recover all amounts received by our stockholders. Furthermore, because we intend to distribute the proceeds held in the trust account to our public stockholders promptly after our liquidation in the event our initial business combination has not been consummated by April 26, 2010 (or up to August 26, 2010 if extended pursuant to a stockholder vote), this may be viewed or interpreted as giving preference to our public stockholders over any potential creditors with respect to access to or distributions from our assets. Furthermore, our board of directors may be viewed as having breached its fiduciary duties to our creditors and/or having acted in bad faith, and thereby exposing itself and us to claims of punitive damages, by paying public stockholders from the trust account prior to addressing the claims of creditors. We cannot assure you that claims will not be brought against us for these reasons.

Compliance with the Sarbanes-Oxley Act of 2002 will require substantial financial and management resources and may increase the time and costs of completing an acquisition.

Section 404 of the Sarbanes-Oxley Act of 2002 requires that we evaluate and report on our system of internal controls and requires that we have such system of internal controls audited beginning with our Annual Report on Form 10-K for the year ending December 31, 2009. If we fail to maintain the adequacy of our internal controls, we could be subject to regulatory scrutiny, civil or criminal penalties and/or stockholder litigation. Any inability to provide reliable financial reports could harm our business. Section 404 of the Sarbanes-Oxley Act also requires that our independent registered public accounting firm report on management’s evaluation of our system of internal controls. A target company may not be in compliance with the provisions of the Sarbanes- Oxley Act regarding adequacy of their internal controls. The development of the internal controls of any such entity to achieve compliance with the Sarbanes-Oxley Act may increase the time and costs necessary to complete any such acquisition. Furthermore, any failure to implement required new or improved controls, or difficulties encountered in the implementation of adequate controls over our financial processes and reporting in the future, could harm our operating results or cause us to fail to meet our reporting obligations. Inferior internal controls could also cause investors to lose confidence in our reported financial information, which could have a negative effect on the trading price of our securities.

Risks Related to the Talbots Transaction

The completion of the merger is subject to a number of conditions that are outside our control, including a financing condition.

The completion of the merger is subject to a number of conditions including, but not limited to:

| • | Talbots’ receipt of financing in such principal amount that, together with the net proceeds of amounts in our trust account and other available cash, it will have all necessary funds to consummate the transactions contemplated by the merger agreement, including the repayment in full of all amounts due or outstanding in respect of (i) all financing agreements between AEON (U.S.A.), Inc., or AEON, and Talbots, (ii) the Support Letter (Financial), dated as of April 9, 2009, from AEON to Talbots, and the Letter of Support, dated as of April 9, 2009, from AEON to Talbots and (iii) all Third Party Credit Facilities (as defined in the agreement by and among us, Talbots, AEON and AEON Co., LTD in Appendix D to the definitive proxy materials filed in connection with the transaction), to pay related fees and expenses and to have, immediately following the consummation of the transactions contemplated by the merger agreement, cash on hand or available to be borrowed under one or more bank credit facilities in an amount sufficient to fund ordinary course working capital and other general corporate purposes, |

12

Table of Contents

| • | the successful completion of the warrant exchange offer, which will not be completed unless holders of at least 90% of the warrants issued in our initial public offering participate in the exchange offer and the other conditions to the warrant exchange offer are satisfied, and |

| • | the continued effectiveness of, and performance of the parties under, certain agreements including an agreement by and among us, Talbots, AEON and AEON Co., LTD and an agreement with our sponsors. Notwithstanding certain contractual rights of us and Talbots under these agreements, neither we nor Talbots controls AEON or our sponsors. |

The completion of the merger is also subject to a number of other conditions, including, certain governmental approvals and the absence of a material adverse effect upon Talbots.

The merger agreement limits our ability to pursue alternatives to the merger.

The merger agreement restricts our ability to pursue alternatives to the merger, including our agreement not to solicit other offers. These restrictions could prevent us from engaging in a transaction that may be more beneficial to our stockholders and warrantholders than the merger.

The shares of Talbots common stock to be received by our stockholders and the shares of Talbots common stock to be issued to our warrantholders in the warrant exchange offer, and issuable upon the exercise of Talbots warrants, as a result of the merger will have different rights from the shares of our common stock.

Upon the completion of the merger, our stockholders will become Talbots stockholders and their rights as stockholders will be governed by the organizational documents of Talbots. The rights associated with our common stock are different from the rights associated with Talbots common stock and the rights associated with Talbots warrants are different from the rights associated with our warrants.

The GE Capital credit facility combined with cash flows from operations may not be sufficient to support operations.

As a specialty retailer dependent upon consumer discretionary spending, Talbots has been adversely affected by recent economic conditions, which have substantially impacted sales, margins, cash flows, liquidity, results of operations and financial condition. While the funding received through the completion of the merger and related credit facility with GE Capital are expected to eliminate approaching debt maturities and assist in the recapitalization of Talbots, it does not provide assurance that the current economic environment will improve in the near future or that Talbots will generate positive cash flows from operations. The GE Capital credit facility allows for a maximum borrowing of $200 million, $40 million of which is not available until after the completion of the merger. Going forward, Talbots’ ability to operate profitably and to generate positive cash flows is dependent upon many factors, including improvement in economic conditions and consumer spending and Talbots’ ability to successfully execute its long term financial plan and strategic initiatives. In the event cash flows are not sufficient to support operations, it is uncertain whether the credit facility will be able to provide levels of cash in the amounts or at the time needed. As such, the merger and refinancing does not provide assurance that Talbots’ cash flows from operations will be sufficient to support itself without additional financing or credit availability. There can be no assurance that these alternatives, if needed, would be successfully implemented, in which case it could materially adversely affect the company, its liquidity and results of operations.

Our warrantholders may not receive all consideration in the form elected.

The number of Talbots warrants to be paid to holders of our warrants in the warrant exchange offer is fixed, with 17,500,000 of our warrants (equal to 50% of our warrants held by public warrantholders) to be exchanged for Talbots warrants and all remaining warrants that participate in the warrant exchange offer to be exchanged for shares of Talbots common stock. Therefore, elections will be subject to proration if holders of our warrants, in

13

Table of Contents

the aggregate, elect to receive more than the maximum amount of consideration to be paid in the form of Talbots common stock or Talbots warrants, as the case may be. Accordingly, some of the consideration warrantholders receive in the offer may differ from the type of consideration selected and such difference may be significant. In addition, instead of receiving any fractional shares of Talbots common stock or fractional Talbots warrants to which our warrantholders otherwise would be entitled, tendering warrantholders will receive an amount in cash (without interest) equal to such holder’s respective proportionate interest in the proceeds from the sale or sales in the open market by the exchange agent for the warrant exchange offer, on behalf of all such holders, of the aggregate fractional shares of Talbots common stock and/or fractional Talbots warrants issued pursuant to the warrant exchange offer.

The liquidity of the warrants that are not exchanged will be reduced.

In connection with the completion of the warrant exchange offer and the merger, we will make the appropriate filings to delist our warrants from trading on the NYSE Amex. The warrants that are not validly tendered in the warrant exchange offer, if any, will cease to be eligible for trading on any public market. The ability to sell unexchanged warrants will become more limited and could cease to exist due to the reduction in the amount of the warrants outstanding upon completion of the warrant exchange offer and the delisting of the warrants from the NYSE Amex. A more limited trading market might adversely affect the liquidity, market price and price volatility of these securities. If a market for unexchanged warrants develops, these securities may trade at a discount to the price at which the securities would trade if the amount outstanding were not reduced and the securities were not delisted from trading on the NYSE Amex, depending on the market for similar securities and other factors. However, there can be no assurance that an active market in the unexchanged warrants will exist, develop or be maintained or as to the prices at which the unexchanged warrants may be traded.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

| ITEM 2. | PROPERTIES |

We currently maintain our executive offices at 750 Washington Boulevard, Stamford, Connecticut 06901. The cost for this space is included in the $10,000 per month fee that Perella Weinberg Partners Group LP charges us for general and administrative services. We consider our current office space adequate for our current operations.

| ITEM 3. | LEGAL PROCEEDINGS |

As of December 31, 2009, there was no material litigation, arbitration or governmental proceeding pending against us or any members of our management team in their capacity as such, and we and the members of our management team have not been subject to any such proceeding.

On January 12, 2010, a class action and derivative complaint was filed against us, our Vice Chairman, two of our officers (collectively, the “BPW Defendants”), and other entities and persons. The plaintiff, who purports to assert claims on behalf of all public shareholders of Talbots, challenges a series of transactions announced on December 8, 2009, including the proposed transaction in which Talbots will acquire us. Along with his complaint, the plaintiff filed a motion for a preliminary injunction to prevent the consummation of the transactions. Specifically, the complaint alleges that the proposed transactions are dilutive and unfair to the Talbots public shareholders and invalid under the Talbots bylaws and Delaware statutory law, and it asserts claims for breaches of fiduciary duties and claims for aiding and abetting those breaches. Only the aiding and abetting claim is asserted against the BPW Defendants. On February 5, 2010, the BPW Defendants filed a motion to dismiss. A briefing schedule for this motion has not yet been set. On March 6, 2010, the parties filed a joint

14

Table of Contents

stipulation in which the plaintiff withdrew, without prejudice, his motion for a preliminary injunction. His damage claims, however, remain outstanding, and we will continue to vigorously defend against them. We cannot accurately predict the likelihood of a favorable or unfavorable outcome or quantify the amount or range of potential financial impact, if any. Accordingly, no adjustment has been made in the accompanying financial statements because of this claim.

| ITEM 4. | RESERVED |

15

Table of Contents

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Price Range of Common Stock

Our units, common stock and warrants are listed on the NYSE Amex under the symbols “BPW.U,” “BPW” and “BPW.WS,” respectively.

The following table includes the high and low sales prices for our units, common stock and warrants for the periods presented.

| Units | Common Stock | Warrants | ||||||||||

| High | Low | High | Low | High | Low | |||||||

| 2009 |

||||||||||||

| First Quarter |

9.64 | 9.05 | 9.52 | 8.95 | 0.19 | 0.06 | ||||||

| Second Quarter |

9.84 | 9.35 | 9.58 | 9.35 | 0.24 | 0.06 | ||||||

| Third Quarter |

10.89 | 9.55 | 9.82 | 9.55 | 0.58 | 0.10 | ||||||

| Fourth Quarter |

11.50 | 8.90 | 10.75 | 9.77 | 1.01 | 0.30 | ||||||

Holders

As of December 31, 2009, there were six holders of record of our units, one holder of record of our common stock and one holder of record of our warrants.

Dividends

We have not paid any cash dividends on our common stock to date and do not intend to pay cash dividends prior to the completion of our initial business combination.

Sale of Unregistered Securities

On October 31, 2007, we issued an aggregate of 10,781,250 founders’ units to our sponsors for $25,000 in cash, at a purchase price of $0.002 per founders’ unit. Such issuance was made pursuant to the exemption from registration contained in Section 4(2) of the Securities Act as they were sold to sophisticated, accredited, wealthy individuals and entities. On November 14, 2007, the sponsors committed to purchase 7,000,000 sponsors’ warrants at a purchase price of $1.00 per sponsors’ warrant in a private placement simultaneously with our initial public offering. On November 16, 2007, the sponsors transferred at cost an aggregate of 377,001 of these founders’ units and committed to transfer at cost an aggregate of 149,466 sponsors’ warrants to our independent directors. On February 19, 2008, the independent directors returned an aggregate of 97,251 founders’ units to the sponsors, and the sponsors returned an aggregate of 3,170,956 founders’ units to us which we have cancelled. Also on February 19, 2008, the sponsors committed to purchase an additional 1,600,000 sponsors’ warrants (for a total of 8,600,000 sponsors’ warrants) from us simultaneously with our initial public offering and the sponsors committed to transfer an additional 105 sponsors’ warrants (for a total of 149,571 sponsors’ warrants) to our independent directors. On February 26, 2008, the independent directors returned an aggregate of an additional 8,823 founders’ units to the sponsors, and the sponsors returned an aggregate of an additional 507,353 founders’ units to us which we have cancelled. On December 8, 2009, the founders agreed to surrender an aggregate of 1,852,941 shares of common stock upon closing of the Talbots transaction.

The founders’ units included an aggregate of 926,470 units subject to forfeiture by these stockholders to the extent that the underwriters’ over-allotment is not exercised in full so that they collectively own 15% of the issued and outstanding shares of common stock after our initial public offering. As the underwriters did not

16

Table of Contents

exercise their over-allotment option, these units were forfeited on March 27, 2008. The founders’ units consist of one share of our common stock and one warrant to purchase one share of our common stock at an exercise price of $10.00 per share. The founders’ warrants will become exercisable on the later of February 26, 2009 or our consummation of our initial business combination, in each case, if and only when (x) the last sales price of our common stock equals or exceeds $12.25 per share for any 20 trading days within any 30-trading day period beginning 90 days after our initial business combination and (y) there is an effective registration statement covering the shares of common stock issuable upon exercise of the founders’ warrants. The founders’ warrants will expire on February 26, 2014. The founders’ units may not be sold or transferred until one year after the consummation of our initial business combination.

We also consummated the simultaneous private sale of 8,600,000 sponsors’ warrants at a price of $1.00 per warrant (for an aggregate purchase price of $8,600,000), exercisable for one share of our common stock at a price of $7.50 per share . The sponsors’ warrants were purchased by the sponsors and the issuances were made pursuant to the exemption from registration contained in Section 4(2) of the Securities Act. The sponsors’ warrants will become exercisable on the later of February 26, 2009 or our consummation of our initial business combination and will expire on February 26, 2014. The sponsors’ warrants may not be sold or transferred until we consummate our initial business combination.

No underwriting discounts or commissions were paid with respect to such sales.

The founders have agreed to elect to exchange in the exchange offer all of their warrants to purchase shares of BPW common stock for shares of Talbots common stock, at an exchange ratio of one warrant to purchase shares of BPW common stock for one-tenth of the stock consideration received for each share of BPW common stock based on the ultimately applicable exchange ratio in the merger, subject to the proration procedures described under the heading “Risk Factors—Our warrantholders may not receive all consideration in the form elected.”

Use of Proceeds from First Registered Offering

On March 3, 2008, we consumated our initial public offering of 35,000,000 units with each unit consisting of one share of our common stock and one warrant, each to purchase one share of our common stock at an exercise price of $7.50 per share. The units from the initial public offering were sold at an offering price of $10.00 per unit, generating total gross proceeds of $350 million. Citigroup Global Markets Inc. acted as bookrunning manager of the initial public offering and as representative of the following underwriters: Citigroup Global Markets Inc., UBS Securities LLC, Piper Jaffray & Co., Sandler O’Neill & Partners, L.P., Ladenburg Thalmann & Co. Inc., Maxim Group LLC and I-Bankers Securities, Inc. The securities sold in our initial public offering were registered under the Securities Act of 1933 on a registration statement on Form S-1 (No. 333-147439). The SEC declared the registration statement effective on February 26, 2008.

We paid a total of $9.1 million in underwriting discounts and commissions and $1,149,069 for other costs and expenses related to our initial public offering. After deducting the underwriting discounts and commissions and the initial public offering expenses, the total net proceeds to us from our initial public offering were $348,650,000, which was deposited into the trust account and the remaining proceeds of approximately $100,000 became available to be used to provide for business, legal and accounting due diligence on prospective business combinations and continuing general and administrative expenses. The net proceeds deposited into the trust account remain on deposit in the trust account and have earned approximately $3.7 million in interest of which approximately $1.2 million has been disbursed for income taxes and approximately $2 million for working capital purposes through December 31, 2009.

Repurchase of Securities

None.

17

Table of Contents

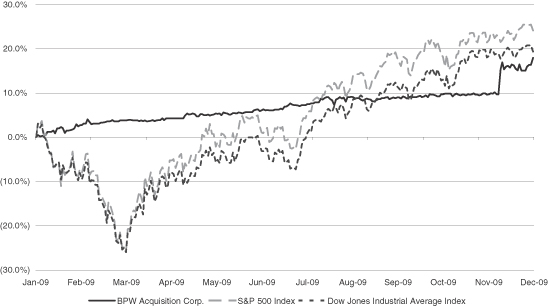

Stock Price Performance Graph

The graph below compares the cumulative total return of our common stock from January 1, 2009 through December 31, 2009 with the comparable cumulative return of two indices, the S&P 500 Index and the Dow Jones Industrial Average Index. The graph plots the growth in value of an initial investment of $100 in each of our common stock, the Dow Jones Industrial Average Index and the S&P 500 Index over the indicated time periods, and assuming reinvestment of all dividends, if any, paid on the securities. We have not paid any cash dividends and, therefore, the cumulative total return calculation for us is based solely upon stock price appreciation and not upon reinvestment of cash dividends. The stock price performance shown on the graph is not necessarily indicative of future price performance.

18

Table of Contents

| ITEM 6. | SELECTED FINANCIAL DATA |

The following table sets forth selected historical financial information derived from our audited financial statements included elsewhere in this Annual Report for the fiscal year ended December 31, 2009 and 2008 and for the periods from October 12, 2007 (inception) to December 31, 2007 and 2009. You should read the following selected financial data in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements and the related notes appearing elsewhere in this Annual Report.

| Year ended December 31, 2009 |

Year ended December 31, 2008 |

Period from October 12, 2007 to December 31, 2007 |

Period from October 12, 2007 to December 31, 2009 |

|||||||||||||

| Statement of Operations Data: |

||||||||||||||||

| Net sales |

$ | — | $ | — | $ | — | $ | — | ||||||||

| Loss from operations |

(1,679,729 | ) | (469,442 | ) | (1,138 | ) | (2,150,309 | ) | ||||||||

| Interest and dividend income |

329,371 | 3,393,450 | 1,044 | 3,723,865 | ||||||||||||

| Net income (loss) |

(891,358 | ) | 1,929,908 | (94 | ) | 1,038,456 | ||||||||||

| Net income (loss) per share – basic (excludes shares subject to possible redemption) |

($0.03 | ) | $ | 0.07 | $ | (0.00 | ) | $ | 0.04 | |||||||

| Net income (loss) per share – diluted (excludes shares subject to possible redemption) |

($0.03 | ) | $ | 0.06 | $ | (0.00 | ) | $ | 0.03 | |||||||

| Balance Sheet Data: |

|||||

| December 31, | |||||

| 2009 | 2008 | ||||

| Cash |

111,503 | $ | 31,848 | ||

| Cash equivalent held in Trust Account |

349,198,387 | 350,530,373 | |||

| Total assets |

349,958,096 | 350,769,031 | |||

| Deferred underwriters’ fee |

7,700,000 | 10,010,000 | |||

| Common stock subject to redemption |

122,009,990 | 122,009,990 | |||

| Stockholders’ equity |

219,704,397 | 218,285,755 | |||

19

Table of Contents

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Overview

We are a blank check company, formed on October 12, 2007, to effect a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or other similar business combination with one or more operating businesses in the financial services or business services industries. We intend to effect such initial business combination using cash from the proceeds of our recently completed initial public offering and the private placements of the sponsors’ warrants, our capital stock, debt or a combination of cash, stock and debt.