Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark one)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

for the fiscal year ended December 31, 2009

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

for the transition period from to .

Commission File Number: 001-15713

ASIAINFO HOLDINGS, INC.

(Exact name of Registrant as specified in its charter)

| Delaware | 752506390 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

4th Floor, Zhongdian Information Tower

6 Zhongguancun South Street, Haidian District

Beijing 100086, China

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code +8610 8216 6688

Securities registered pursuant to Section 12(b) of the Act:

| Common Stock, $0.01 Par Value | The NASDAQ Stock Market LLC | |

| (Title of Each Class) | (Name of Each Exchange on Which Registered) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ |

Accelerated filer x | |

| Non-accelerated filer (Do not check if a smaller reporting company) ¨ |

Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

Based on the closing sale price of the common stock on the NASDAQ Global Market on June 30, 2009, the aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant was $548,613,203.43.

The number of shares outstanding of the registrant’s common stock, $0.01 par value, was 47,290,464 at March 2, 2010.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information is incorporated by reference to the Proxy Statement for the registrant’s 2010 Annual Meeting of Stockholders to be filed with the Securities and Exchange Commission pursuant to Regulation 14A not later than 120 days after the end of the fiscal year covered by this Form 10-K.

Table of Contents

FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2009

TABLE OF CONTENTS

Table of Contents

Cautionary Statement

Except for historical information, the statements contained in this Annual Report on Form 10-K are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. The Private Securities Litigation Reform Act of 1995, or the Reform Act, contains safe harbors regarding forward-looking statements. Forward-looking statements include management’s expectations, intentions and beliefs with respect to our growth, our future operating results, the nature of the industry in which we are engaged, our business strategies and plans for future operations, our needs for capital expenditures, capital resources and liquidity, and similar expressions concerning matters that are not historical facts. Such forward-looking statements are subject to risks and uncertainties that could cause our actual results to differ materially and adversely from those expressed in the statements. All forward-looking statements included in this report are based on information available to us on the date hereof, and we assume no obligation to update any such forward-looking statements. These cautionary statements are being made pursuant to the provisions of the Reform Act with the intention of obtaining the benefits of the safe harbor provisions of the Reform Act. Factors that could cause actual results to differ materially include, but are not limited to, those factors discussed below under Item 1A, “Risk Factors” and in other documents we file from time to time with the Securities and Exchange Commission, or the SEC.

In this report, “AsiaInfo,” the “Company,” “we,” “us,” and “our” refer to AsiaInfo Holdings, Inc. and its consolidated subsidiaries and variable interest entities, or VIEs.

| ITEM 1. | Business |

Overview

AsiaInfo is a leading provider of high-quality telecommunications software solutions and information technology, or IT, security products and services in China. In the telecommunications market, our software and services enable our customers to build, maintain, operate, manage and continuously improve their communications infrastructure. Our largest customers are the major telecommunications carriers in China and their provincial subsidiaries, such as China Mobile Communications Corporation, or China Mobile, China United Telecommunications Corporation, or China Unicom, and China Telecommunications Corporation, or China Telecom. In addition to providing customized software solutions to China’s telecommunications carriers, we also offer sophisticated IT security products and services to many small- and medium-sized companies and government agencies in China.

Our operations are organized into two divisions, AsiaInfo Technologies (China) Inc., or AsiaInfo Technologies, and Lenovo-AsiaInfo Technologies, Inc., or Lenovo-AsiaInfo. AsiaInfo Technologies encompasses our traditional telecommunications business and provides software solutions to China’s telecommunications carriers. Products and services in this division include:

| • | business operation support systems, including billing, customer relationship management and partnership relationship management applications; |

| • | business intelligence systems, including data warehousing platforms, online analytical applications and data mining applications; |

| • | service and data applications, such as mail centers, mobile device management and mobile e-commerce platforms; and |

| • | network infrastructure services, including network design and implementation, integrated network management and professional maintenance and support. |

1

Table of Contents

Lenovo-AsiaInfo provides IT security products and services tailored for small- and medium-sized companies and government agencies in China. Lenovo-AsiaInfo’s IT security applications are fixed configuration products with varying performance characteristics that offer integrated firewall, Virtual Private Network, or VPN, and denial of service protection capabilities.

For the year ended December 31, 2009, approximately 85.7% of our total revenue was contributed by AsiaInfo Technologies, while the remaining revenue was contributed by Lenovo-AsiaInfo. See note 24 to our consolidated financial statements, included in this report, for further information about our operating segments.

Recent Developments

On December 4, 2009, we executed a definitive Business Combination Agreement, or the Combination Agreement, to combine our business with the business of Linkage Technologies International Holdings Limited, or Linkage Cayman, through our acquisition of 100% of the outstanding share capital of Linkage Cayman’s wholly-owned subsidiary, Linkage Technologies Investment Limited, or Linkage Technologies. We refer to this transaction in this report as the “Combination.” Like AsiaInfo, Linkage Technologies is a leading provider of software solutions and IT services for the telecommunications industry in China. Linkage Technologies develops and implements core operating systems for all three telecommunications operators in China. In consideration for our acquisition of Linkage Technologies, we agreed to pay to Linkage Cayman $60 million in cash and to issue to Linkage Cayman 26,832,731 shares of our common stock. The consideration will be distributed by Linkage Cayman to existing shareholders of Linkage Cayman. The Combination Agreement contains representations, warranties, covenants and indemnities. Completion of the Combination is conditioned upon, among other things, the receipt of any required regulatory approvals and certain approvals by our stockholders.

We have filed a proxy statement with the SEC regarding the Combination and plan to hold a special meeting of our stockholders to approve the consideration we would pay in the Combination, to approve a change in our name following the completion of the Combination to “AsiaInfo-Linkage, Inc.,” and to adjourn or postpone the special meeting, if necessary or appropriate.

We expect to complete the Combination as soon as possible after all conditions to the Combination are satisfied or waived, which we currently expect to be in April 2010. If we complete the Combination, we expect to integrate our business with the business of Linkage Technologies following completion of the Combination.

It is possible that any of a number of factors, some of which are outside of our control, could delay or prevent us from completing the Combination on a timely basis, if at all, or from achieving the anticipated benefits of the Combination. For more information on the risks associated with the Combination, please see the discussion in Item 1A of this report, “Risk Factors.”

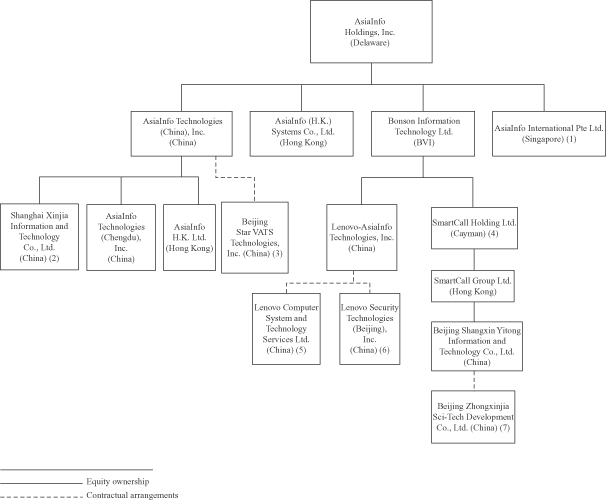

Our Corporate Structure

We commenced our operations in the United States in 1993 and moved our major operations from the United States to China in 1995. Although we are organized as a Delaware corporation, our business is conducted through a number of operating subsidiaries, most of which are organized under the laws of the People’s Republic of China, or the PRC, and are directly or indirectly wholly-owned by us. In addition to our wholly-owned subsidiaries, we operate certain businesses through domestic Chinese companies in which we hold no equity interests, but which we control through a series of contractual arrangements with those companies and their respective equity holders. Under the laws and regulations of the PRC, foreign persons and foreign companies are restricted from investing directly in certain businesses within the PRC. Certain aspects of our IT security business are subject to these restrictions on foreign investment. In order to comply with these laws and regulations, we have entered into contractual arrangements with Lenovo Computer System and Technology Services Ltd., or Lenovo Computer, and Lenovo Security Technologies (Beijing), Inc., or Lenovo Security, through which we operate the restricted businesses. Under accounting principles generally accepted in the United States of America, or US GAAP, Lenovo Computer and Lenovo Security are considered VIEs. US GAAP

2

Table of Contents

requires us to consolidate VIEs in our financial statements because our contractual arrangements related to those entities provide us with the risks and rewards associated with equity ownership, even though we do not own any of the outstanding equity interests in either of Lenovo Computer or Lenovo Security.

PRC regulations restrict direct foreign ownership of value-added telecommunications services businesses in the PRC. In order to comply with these restrictions, we have entered into various contractual arrangements to form two additional VIEs. Through Beijing Star VATS Technologies, Inc., or Star VATS, we are exploring opportunities to conduct value-added telecommunications services business in the PRC. We also acquired Beijing Zhongxinjia Sci-Tech Development Co., Ltd., or ZXJ, through which we provide outbound call services on behalf of the telecommunications operators in China.

For more information on regulations in the PRC restricting foreign ownership in certain businesses, please see the discussion below under the heading “Government Regulation—Regulation of Computer Information Security Products and Services—Foreign Ownership Restrictions and License Requirements.” For more information on certain regulatory and other risks associated with our contractual arrangements related to Lenovo Security, Lenovo Computer, Star VATS and ZXJ, please see the discussion in Item 1A of this report, “Risk Factors.”

The following diagram illustrates the current organizational structure of our company and our operating subsidiaries and affiliates. This diagram excludes legal entities in which we hold a minority interest, and which are not consolidated in our results of operations.

3

Table of Contents

| (1) | AsiaInfo Holdings, Inc. holds 70% of the share capital of AsiaInfo International Pte Ltd., or AsiaInfo Singapore, a Singapore registered company, and the remaining 30% is held by Alpha Growth International Pte Ltd. |

| (2) | AsiaInfo Technologies (China), Inc. holds 90% of the share capital of Shanghai Xinjia Information and Technology Co., Ltd., a domestic Chinese company, and the remaining 10% is held by Mr. Yao Yuan. |

| (3) | Beijing Star VATS Technologies, Inc. is a domestic Chinese company owned by certain of our employees but controlled by our subsidiary AsiaInfo Technologies (China), Inc. through a series of contractual arrangements. |

| (4) | Bonson Information Technology Ltd. holds 60% of the share capital of SmartCall Holding Ltd., or SmartCall Cayman, a Cayman Islands registered company, and the remaining 40% is held by Call Center International Limited. |

| (5) | Lenovo Computer System and Technology Services Ltd., a domestic Chinese company, is owned by the subsidiaries of one of our indirect shareholders, Lenovo Group Limited, but controlled by our subsidiary Lenovo-AsiaInfo Technologies, Inc. through a series of contractual arrangements. |

| (6) | Lenovo Security Technologies (Beijing), Inc., a domestic Chinese company, is owned by one of our indirect shareholders, Legend Holdings Limited, and two of our employees but controlled by our subsidiary Lenovo-AsiaInfo Technologies, Inc. through a series of contractual arrangements. |

| (7) | Beijing Zhongxinjia Sci-Tech Development Co., Ltd., a domestic Chinese company, is owned by two of our employees but controlled by our subsidiary Beijing Shangxin Yitong Information and Technology Co., Ltd. through a series of contractual arrangements. |

Industry Background and Market Opportunities

Telecommunications Market

Our largest customers are the three major telecommunications operators in China and their provincial subsidiaries. The recent restructuring of China’s telecommunications industry opened the fixed-line, mobile and broadband segments to all existing telecommunications operators in China, and the ensuing competition in these segments prompted each telecommunications operator to increase its IT spending on infrastructure upgrades and 3G and other next-generation technologies. We believe that increasing competition among the three operators will drive demand for telecommunications-related software and IT solutions in the long-run. We believe we are well positioned to continue capitalizing on the competition and other trends in the telecommunications industry through our market leadership, comprehensive solutions, long-standing relationships with the three PRC telecommunications operators, customer focus, and highly qualified personnel.

According to the Ministry of Industry and Information Technology of China, or MIIT, in 2009, the number of China’s mobile phone subscribers increased by 17% to 747 million while the number of China’s fixed-line phone subscribers decreased by 8% to 314 million. Additionally, the number of broadband access subscribers in China increased by 24% to 103 million in 2009. According to China Internet Network Information Center, or CINIC, the number of Internet users in China increased 29% to 384 million in 2009.

Growth in China’s telecommunications sector continues to be influenced by the country’s overall economy, in which gross domestic product, or GDP, reached RMB 33,535 billion in 2009, according to the National Statistical Bureau of China. The following table sets forth certain information relating to China’s economic growth and the telecommunications industry in China as of the dates indicated:

| As of December 31, | Year Over Year Growth Rate |

||||||||||

| 2006 | 2007 | 2008 | 2009 | (2008-2009) | |||||||

| China’s GDP (RMB billion) |

21,087 | 25,731 | 30,067 | 33,535 | 8.7 | % | |||||

4

Table of Contents

| As of December 31, | Compound Annual Growth Rate |

||||||||||||||

| 2006 | 2007 | 2008 | 2009 | (2006-2009) | |||||||||||

| Fixed-line Telephone |

|||||||||||||||

| Subscribers (in millions) |

368 | 365 | 341 | 314 | -5 | % | |||||||||

| Penetration rate |

28 | % | 28 | % | 26 | % | 24 | % | -5 | % | |||||

| Mobile Telephone |

|||||||||||||||

| Subscribers (in millions) |

461 | 547 | 641 | 747 | 17 | % | |||||||||

| Penetration rate |

35 | % | 42 | % | 49 | % | 56 | % | 17 | % | |||||

| Internet |

|||||||||||||||

| Users (in millions) |

137 | 210 | 298 | 384 | 41 | % | |||||||||

| Penetration rate |

10 | % | 16 | % | 23 | % | 29 | % | 43 | % | |||||

| Broadband |

|||||||||||||||

| Users (in millions) |

55 | 66 | 83 | 103 | 23 | % | |||||||||

| Source: | National Statistical Bureau of China, MIIT, CINIC |

IT Security Market

Through our Lenovo-AsiaInfo division, we provide IT security products and services to small- and medium-sized companies and government agencies in China. According to the International Data Corporation, or IDC, the size of China’s IT security market was $552.5 million in 2009, of which firewall and VPN products accounted for the largest portion at 43.6%. IDC estimated that the firewall and VPN market will grow at a compound annual growth rate of 9.9% from 2008 to 2013.

Our Competitive Strengths

We believe the following strengths differentiate us from our competitors and enable us to maintain a leadership position in the telecommunications software and IT security products and services industry in China.

Leading provider of telecommunications BSS/OSS solutions. We are a leading provider of business and operation support systems, or BSS/OSS, to telecommunications carriers in China, particularly to China Mobile and its provincial subsidiaries. We have deployed our industry-leading BSS/OSS solutions for 11 of China Mobile’s 31 provincial subsidiaries, and our operating analysis and decision support system platform for China Mobile’s headquarters and 15 of its provincial subsidiaries. We have constructed over 30% of China Mobile’s billing and customer relationship management, or CRM, systems and approximately 50% of its business intelligence, or BI, systems, and have developed one of the largest telecommunications billing and CRM systems in the world for China Mobile’s Zhejiang Mobile provincial subsidiary, supporting over 45 million mobile subscribers. For China Unicom, we have deployed our BSS/OSS solution for nine of its provincial subsidiaries, and our operating analysis and decision support system platform for four of its provincial subsidiaries. For China Telecom, we have deployed our BSS/OSS solution for five of its provincial subsidiaries, and our operating analysis and decision support system solution for two of its provincial subsidiaries.

Comprehensive, scalable solutions. We offer a comprehensive suite of solutions and services that cover all major telecommunications systems, including business operating support systems, service application solutions, network infrastructure solutions, and IT security. Our proprietary software allows telecommunications carriers to monitor user activity and analyze service usage data in real time, which enables service providers to increase billing accuracy, accelerate the time-to-market for new services and improve the effectiveness of marketing and targeting efforts. Most of our software products are scalable to accommodate millions of users, which allows telecommunications carriers to develop their networks incrementally as their level of business grows without the need for architecture re-engineering or large-scale system replacements. Our software products are also designed with fully documented, open architecture that allows our customers, third-party systems integrators and software developers to integrate our software with existing applications and services with minimal effort and programming overhead.

5

Table of Contents

Customer-centric and cost-effective project management capability. Our project delivery time with key customers usually lasts between three to six months, and at times may last over a year. We believe customer satisfaction is essential to preserving customer loyalty. We emphasize the importance of remaining in close contact with our customers in order to meet their needs and demands during the course of our projects. We have developed a unique project management system to achieve maximum customer satisfaction in a cost-effective manner. We believe our effective project management system distinguishes us from our competitors in China. Moreover, our strong customer service and research and development teams based in China allow us to respond quickly and efficiently to the needs of our customers.

Highly qualified personnel. In view of the specific needs of China’s market, our recruitment efforts target Chinese citizens who have information technology and professional competence and international exposure. We believe that we have been able to attract and retain qualified personnel by offering attractive compensation packages, a challenging and rewarding work environment, and the opportunity to work for a leading information technology company in China.

Our Strategy

Our goal is to lead the industry in providing high quality telecommunications software products and IT security products and services in China that help our customers achieve rapid and sustainable business growth. The key aspects of our strategy include:

Capitalizing on growth opportunities in China’s telecommunications market. We believe the recent restructuring of China’s telecommunications industry and the introduction of 3G and other next-generation technologies present significant growth opportunities for our business. We believe these market developments will lead to increased competition among the three telecommunications operators, driving demand for nationwide BSS/OSS upgrades and new system deployments throughout China. We also expect the introduction of 3G networks to intensify competition among mobile operators and drive up overall telecommunications IT spending. With our market leadership and strong commitment to customer relationships, we believe we are well positioned to continue capitalizing on the competition and other trends in the telecommunications industry. We also intend to continue to leverage our industry knowledge and research and development capabilities to offer new solutions, including upgrades and add-ons, and provide more consulting and other value-added services.

Strengthening relationships with key customers. Our customers include all three major carriers in the telecommunications industry in China. We expect our customers’ software and IT security needs to evolve as they address an increasingly competitive market, continue their modernization process and offer their customers progressively more sophisticated and innovative solutions and services. We intend to address the software and IT needs of these large telecommunications carriers and increase the sales of our products and services by implementing, among others, the following measures:

| • | Maintain high level of customer satisfaction. We aim to maintain a high level of customer satisfaction by continuing to exceed our customers’ expectations in the projects we undertake and provide quality services on an ongoing basis. |

| • | Anticipate customer needs. We plan to leverage our industry know-how and long-term customer relationships to understand our customers’ development and spending initiatives, allowing us to better coordinate our research and development and marketing efforts. |

| • | Actively identify cross-selling opportunities. Our solutions and services cover all major telecommunications systems and we believe there are substantial opportunities for us to cross-sell our wide range of products and services to our existing customer base. We will continue to leverage existing customer relationships and our ongoing projects to actively identify opportunities to market additional solutions and services to our customers. |

6

Table of Contents

Pursuing strategic acquisitions and alliances that fit within our core competencies and growth strategy. We hold a leading position in the market for BSS/OSS solutions in China, which we believe are important for the future development of the country’s telecommunications carriers. In recent years, we further strengthened our leading position in the telecommunications software solutions market through small strategic acquisitions. On December 4, 2009, we executed the Combination Agreement to combine our business with the business of Linkage Cayman through our acquisition of 100% of the outstanding share capital of Linkage Technologies, and we expect to complete the Combination in April 2010. As the market for telecommunications software solutions in China continues to expand, we intend to selectively pursue additional acquisitions to access new sectors or new clients, expand our product and service offerings and strengthen our market leadership position. We also plan to continue forging strategic alliances with complementary businesses and technologies.

Enhancing our brand. We plan to continue building awareness of AsiaInfo as a leading provider of high quality telecommunications software products and IT security products and services in China. Our goal is to make the AsiaInfo brand synonymous with superior technology, high quality customer service, trusted advice and definitive business value in our industry.

Products and Services

We leverage our core strengths in software and IT to offer product and service solutions for leading telecommunications service providers, as well as other major enterprises, in China. Our AsiaInfo Technologies division offers a specialized suite of products and services for the telecommunications industry, while our Lenovo-AsiaInfo division focuses on IT security solutions for small- and medium-sized companies and government agencies in China. We have developed core competencies in various advanced technologies that are used in our products and solutions. By utilizing technologies such as multi-tier architecture, object-oriented techniques, data mining and open application program interfaces, we are able to provide our customers with the flexibility and scalability required in a highly competitive, dynamic environment. We also closely monitor world-wide technological developments in our service and product areas. In addition, if we are able to complete the Combination with Linkage Cayman, we will acquire its products and services and plan to integrate them into our AsiaInfo Technologies business.

AsiaInfo Technologies—Software and Solutions for the Telecommunications Market

Through AsiaInfo Technologies, we provide high quality software and solutions to China’s telecommunications carriers. Our suite of innovative solutions includes business and operation support systems, network infrastructure solutions, and service application solutions. The products and services we offer to the telecommunications industry include various software product suites, most of which are designed with open architecture to facilitate further development and customization for specific purposes. We typically integrate a combination of these products, together with our services, into customized solutions to address individual customer needs.

Business and Operation Support Systems (BSS/OSS)

We are a leading provider of BSS/OSS to China’s telecommunications operators. Our core BSS/OSS offerings primarily include convergent billing solutions, CRM and BI systems. We also provide software enhancement and maintenance services for the systems we develop, as well as system integration and other value-added IT consulting and planning services.

Our BSS/OSS product suites include the following:

| • | OpenBilling Product Suite. OpenBilling is a flexible, expandable, convergent billing solution for telecommunications operators. OpenBilling supports the business of mobile operators by providing a full line of integrated solutions, including mediation, rating, billing, account balance management, as |

7

Table of Contents

| well as system monitoring and disaster recovery management. OpenBilling is designed with a multi-tier architecture, and is capable of being developed into full-service business operation support systems based on its core convergent billing function. OpenBilling is adaptable to various compatible commercial middleware, and consists of dynamic component modules that can be modified separately when a new product is introduced and updated without any system down time. It also has a unified rating engine that provides flexible pricing mechanisms, a memory database technology that supports complex rating and billing activities, and a real time accounting system that can support sophisticated business requirements. |

| • | OpenCRM Product Suite. OpenCRM is a leading CRM solution suite for telecommunications operators. OpenCRM helps operators improve customer service quality, enhance customer satisfaction and build strong customer relationships. It uses a hierarchical structure that provides flexibility for transverse development, an open architecture to permit enterprise application integration capability, and security technologies such as back-up, monitoring, auditing and emergency reporting. |

| • | OpenBOSS Product Suite. OpenBOSS is a carrier-class business operation support system solution that provides comprehensive revenue, customer, and product and service management capabilities. With a modularized design, OpenBOSS mainly consists of OpenBilling and OpenCRM solutions that can be deployed independently. |

| • | OpenBI Product Suite. OpenBI is a carrier-class operating analysis and decision support system platform and the core or our BI solution. With embedded technology such as data warehousing, online analytical process and data mining, OpenBI enables service providers to make management decisions based on analysis of customer behavior, competitive environment, business profitability and other parameters. The system is able to proactively generate business operation reports, which serve as a basis for critical management decisions. |

| • | OpenPRM Product Suite. OpenPRM is a system that calculates, manages and reconciles payment for intercarrier network access, including settlement of roaming charges between mobile operators, as well as management of agreements and settlements between operators and their business partners. The OpenPRM solution also provides support to telecommunications operators in their services to large enterprise and individual customers, as well as their relationship management with third-party sales channels. Our OpenPRM software comprises an access layer, a service layer, and a data layer. This multi-layer design provides flexibility to integrate with other systems, scalability, and high performance. OpenPRM includes a Workflow Management System, or WFMS, that monitors work activities according to defined tasks, roles, rules and processes. The WFMS is designed to improve efficiency by helping carriers reconfigure their business processes to improve service quality and flexibility. OpenPRM also includes a business-oriented architecture and communications crossing application system, which allows centralized and integrated connection among various modules. |

Network Infrastructure Solutions

Our network infrastructure solutions include network access and backbone infrastructure planning, design and implementation for telecommunications and Internet service providers. These services include technical training for our customers, as well as professional maintenance and support services. Together with these professional services, we offer comprehensive Internet Protocol, or IP, and business operation network management solutions through our NetXpert and OpenXpert product suites.

| • | AsiaInfo NetXpert. AsiaInfo NetXpert, or NetXpert, is a carrier-class data and IP network management solution. NetXpert covers network elements, such as core, aggregation and access layers of the carriers’ data and IP network, and provides comprehensive network management functions, including fault, performance, topology and resource management. NetXpert also provides traffic analysis, quality of service monitoring and routing monitoring. NetXpert is designed to help carriers reduce their costs and improve maintenance efficiency by supporting multi-vendor environments and real-time optimization. |

8

Table of Contents

| • | AsiaInfo OpenXpert. AsiaInfo OpenXpert, or OpenXpert, is an integrated telecommunications network management system. OpenXpert generates a spectrum of network managerial data that enhances overall network management and business operation management. OpenXpert also monitors the application software systems implemented on a network, such as billing, business operation, account processing, settlement, operational CRM and analytical CRM applications. OpenXpert includes a high function internal formula engine that detects the root cause of network failures and predicts which business and applications are likely to be affected. It also incorporates an integrated classification and authentication technology to control different access and user authority for network management personnel at different levels. |

Service Application Solutions

We design and provide a series of service applications that enable telecommunications operators and service providers to offer value-added services, such as Short Message Service, or SMS, mobile email, mobile entertainment and mobile e-commerce. These applications often involve licensed third-party software that we customize or integrate with our proprietary software to provide individualized solutions. Our service applications products include:

| • | AsiaInfo Mail Center. AsiaInfo Mail Center, or Mail Center, is our flagship online messaging software. Mail Center is a carrier-class messaging software product that supports electronic mail systems for all types of email service providers, from small Internet service providers to large-scale mail hosting providers with millions of mailboxes and thousands of domains. Its flexible design allows service providers to offer Web-based free email, basic email service and premium business secure email to end-users. The ability to scale both horizontally and vertically allows rapid expansion when more capacity is needed. The system is built to accommodate clustering technology and is highly fault tolerant. The wireless application protocol and SMS functions allow end-users to access emails at any time with a mobile connection. |

| • | AsiaInfo Spam Patrol. AsiaInfo Spam Patrol, or Spam Patrol, is software that offers real time anti-spam control, with advanced technology for real time recovery, intelligent upgrade capability and content filtering. |

| • | AsiaInfo Net Disk. AsiaInfo Net Disk, or Net Disk, is a network hard disk product that facilitates Internet-based file transfer, sharing and management. It provides access authentication that restricts access to authorized persons. Net Disk is an independent software that does not rely on other software but can be linked to standard database programs. In addition, Net Disk supports other value-added functions like data processing of short message folders and synchronization of mobile devices. |

| • | AsiaInfo Internet Short Messaging Gateway. AsiaInfo Internet Short Messaging Gateway, or AIISMG, is a business support platform for value-added short messaging services. AIISMG is the only one-layer short messaging gateway used by China Mobile to achieve single-point access and provincial roaming within China. AIISMG supports multiple protocols to transport short messages between different carriers and different mobile networks, including digital mobile, otherwise known as global system for mobile communications, or GSM, code division multiple access, or CDMA, personal handy-phone system, and 3G networks. AIISMG uses mainstream development tools based on the UNIX platform. It features multi-task and multi-thread concurrent processing, full parameter tuning systems, expansion capability through a modularized and distributed architecture, and a high level of system stability facilitated by disk array and system redundancy. |

| • | AsiaInfo Device Management Platform. AsiaInfo Device Management Platform, or AIDMP, enables mobile operators to manage many kinds of mobile devices using over-the-air technology and perform remote mobile device management, such as remote diagnosis and parameter setup. AIDMP can also help operators promote new services through firmware downloading and gather dynamic mobile usage information in support of marketing decision-making. |

9

Table of Contents

Lenovo-AsiaInfo—IT Security Products and Services

Lenovo-AsiaInfo provides IT security products and services to many small- and medium-sized companies and government agencies in China. Our Lenovo-AsiaInfo product and service offerings focus mainly on firewall and VPN technologies.

IT Security Products

Our firewall products provide protection against unwanted intrusion while enabling the flow of approved network traffic. Our VPN solutions are designed to enable employees and business partners to remotely access an enterprise network in a secure, cost-effective manner. Our security applications are fixed configuration products with varying performance characteristics that offer integrated firewall, VPN and related security features. We design our IT security products to maximize security and performance while using less physical space than competing products. Our security products can be deployed to provide secure Internet access and communications, both locally and from remote locations. We offer firewall and VPN solutions that protect data and communications throughout the network, including at Internet gateways, gateways to sensitive internal networks, and at client devices. Product offerings include our Power V series and our Super V series firewalls, which are designed to meet the throughput requirements of companies of all sizes. In 2007 we launched our Network Gap product, which acts as a gateway and can physically separate a local area network from a public network when security is a concern.

Our firewall products include on-Chip-SRAM to ensure high speed access of processor chips to data, include multiple IP streaming classifications, parallel streaming, security module component technology and a hardware-based fast search algorithm to achieve multi-engine parallel wire-speed filtering. Our firewall products also utilize an advanced system architecture and complete anti-attack module to rewrite internet protocol kernel and add an artificial intelligence mechanism to automatically adapt the system to a network. Our products are designed to identify and filter denial-of-service attacks by monitoring and analyzing data stream and identifying denial-of-service transport stream structure. Our firewall products also include the Lenovo Firewall Redundant Protocol to monitor the firewall service.

IT Security Services

In addition to our IT security products, we also offer various IT security services, including consulting, implementation, management and training services.

Research and Development

We are committed to researching, designing and developing information technology solutions and software products that will meet the future needs of our customers. We continuously upgrade our existing software products to enhance scalability and performance and to provide added features and functions. We had 800 employees in our research and development department as of December 31, 2009. Our principal software engineering group is located in Beijing. Our core product development teams for telecommunications software and IT security software are also located in Beijing. Approximately 77.1% of our 2009 research and development expenses were incurred by our AsiaInfo Technologies division while the remaining 22.9% was incurred by our Lenovo-AsiaInfo division.

During the fiscal years ended December 31, 2009, 2008 and 2007, we had research and product development expenses of $39.4 million, $22.7 million and $17.6 million, respectively. Our research and development team made several achievements in the development of next generation BSS/OSS, or NGBOSS, BI systems, and cloud computing during 2009.

10

Table of Contents

Achievements in NGBOSS development

In 2009, we separated the marketing, sales, service and other CRM related functions from our BSS/OSS solutions. In standard interfaces, we loosely coupled these functions with billing, accounting and provisioning. Using a centralized authentication service and unified portal, we have developed a customer-oriented system architecture. The new CRM infrastructure improves functionality, including enhanced workflow capabilities, rule engine and advanced customization. Multi-electronic channels are integrated more efficiently and collaborative work can be supported more effectively. Our NGBOSS products offer full-service support, which includes mobile, fix-line, data and value-added services, and multi-customer support for individual, family and enterprise customers. The optimized architecture of OpenCRM and OpenBilling lowers the consumption of system resources and improves system efficiency.

Achievements in BI development

In 2009, we utilized search technology and personal portal technology in BI products to improve ease of use. In addition, we developed a customer tag database in which multiple types of customer tags can be built, which allows analysis of customer behaviour. The customer tag database utilizes complex data mining technology and also allows users to customize tags. In 2009, we also further strengthened our development marketing administration platform, optimized our multi-marketing-channel system, and enhanced our rates management system, which includes rates analysis, rates pre-performance, rates mapping, and rates recommendation. We believe these developments will allow telecommunications operators in China to be more competitive.

Achievements in Cloud Computing

In 2009, we conducted targeted research designs and evaluated several key technologies regarding cloud computing, such as massive parallel process, virtualized infrastructure facilities and resources (host, network, storage) and cloud computing management platforms. Based on the concepts of platform-as-a-service and software-as-a-service, we have been studying how to make our platforms and services available externally and how to provide multiple applications to multiple users.

Customers

Our customers consist primarily of Chinese telecommunications service providers and their provincial subsidiaries, including China Mobile, China Unicom, and China Telecom. For the year ended December 31, 2009, revenue from China Mobile and its provincial subsidiaries accounted for $149.7 million, revenues from China Unicom and its provincial subsidiaries were $44.7 million and revenues from China Telecom and its provincial subsidiaries were $19.6 million, or approximately 60%, 18% and 8% of our total revenues, respectively.

Telecommunications Customers

China Mobile. China Mobile was established in July 1999 to operate mobile telecommunications networks nationwide that had previously been operated by China Telecom. China Mobile is the largest telephone service provider in China, with over 522 million wireless voice service subscribers as of December 31, 2009, and provincial subsidiaries responsible for local networks throughout China. China Mobile’s GSM network covers all of China’s cities and most of its rural areas.

China Unicom. China Unicom was established in 1994 and is China’s second largest mobile operator. China Unicom also provides a wide array of services, including long distance telephone services, local telephone services, Internet and data communications services, paging services, communications value-added services and other communications services. China Unicom merged with China Netcom and became a full-service telecommunications provider in October 2008. As of December 31, 2009, China Unicom had 145 million GSM subscribers and 103 million local access subscribers and 39 million broadband subscribers.

11

Table of Contents

China Telecom. China Telecom is China’s largest wireline telecommunications and broadband services provider, providing telecommunications and information services covering voice, data, image and multimedia. In September 2008, China Telecom bought China Unicom’s CDMA business and became a full-service telecommunications provider. As of December 31, 2009, China Telecom had 56 million CDMA subscribers, 189 million local access subscribers and 53 million broadband subscribers.

Customers in the IT Security Products and Services Market

In response to the demand for IT security products and services from small- to medium-sized companies and governmental agencies in China, Lenovo-AsiaInfo has focused on providing sophisticated IT security products and services tailored for the China market. Our customers represent a broad spectrum of organizations across diverse sectors, including financial services, technology, government and education. Our targeted customers for IT security products and services include small to medium-sized organizations that use Internet protocol-enabled information systems.

Sales and Marketing

Sales

As part of our sales strategy, we classify our market sectors and target opportunities on national and regional levels in China. This classification helps us determine our primary sales targets and prepare monthly and quarterly sales forecasts. Sales quotas are assigned to all sales personnel according to annual sales plans. We approve target projects, develop detailed sales promotion strategies and prepare reports on order forecast, technical evaluation, sales budgeting expense, schedules and competition analysis. After a report has been approved, a sales team is appointed consisting of sales personnel, system design engineers and a senior system architect.

For AsiaInfo Technologies, our division focusing on customers in the telecommunications business, we rely on our own sales force to market and sell our products and services in China. Our sales organizations are structured into three strategic customer accounts, namely China Mobile, China Unicom and China Telecom. These accounts sell our solutions and services to the respective customers and manage our long-term relationships with them. We also have direct sales personnel in regional offices in Beijing, Shanghai, Chengdu, Fuzhou, Shenyang, Hangzhou, Nanjing and Guangzhou.

For Lenovo-AsiaInfo, our division addressing the IT security products and services market, we rely on our own sales force as well as a large number of sales distributors in China. Our sales force mainly focuses on IT security solutions for the large government agencies market. We also have direct sales personnel in our headquarters in Beijing and in regional offices in various provinces.

Marketing

Both AsiaInfo Technologies and Lenovo-AsiaInfo have marketing and strategy departments, which focus on strategic planning, strategic alliance development, market analysis and software product development planning. In addition, we have a market communications department, which engages in a number of activities aimed at increasing public awareness of our products and services. Our marketing activities include:

| • | managing and maintaining our website; |

| • | producing corporate and product brochures and monthly customer newsletters; |

| • | conducting seminars and media conferences; |

| • | conducting ongoing public relations programs; and |

| • | creating and placing advertisements. |

12

Table of Contents

Competition

We operate in a highly competitive environment, both in the telecommunications software market and in the market for IT security services and solutions. In the telecommunications software market, our competitors include multinational and local companies such as Amdocs, Digital China, Huawei, and Neusoft. In addition, Linkage Technologies, which we have agreed to acquire pursuant to the Combination Agreement, historically has been our competitor in the telecommunications software market. In the IT security services and solutions market, our competitors include local companies such as Topsec and international companies such as Cisco.

We believe that we have competitive advantages in our product and service sectors due to our leading BSS/OSS solutions, comprehensive and scalable product and service offerings, customer-centric and cost effective project management capability, and established customer relationships. Our competitors, many of whom have greater financial, technical and human resources than we have, may be able to respond more quickly to new and emerging technologies and changes in customer requirements or devote greater resources to the development, promotion and sale of new products or services. It is possible that competition in the form of new competitors or alliances, joint ventures or consolidation among existing competitors may decrease our market share. Increased competition could result in lower personnel utilization rates, billing rate reductions, fewer customer engagements, reduced gross margins and loss of market share, any one of which could materially and adversely affect our profits and overall financial condition.

Government Regulation

This section sets forth a summary of the most significant PRC regulations and requirements that affect our business activities in China.

Regulation of the Software Industry

Software Copyright

The State Council of the PRC, or the State Council, promulgated the Regulations on the Protection of Computer Software, or the Software Protection Regulations, in December 2001, which became effective in January 2002. The Software Protection Regulations were promulgated, among other things, to protect the copyright of computer software in China. According to the Software Protection Regulations, computer software that is independently developed and exists in a physical form or is attached to physical goods will be protected. However, such protection does not apply to any ideas, mathematical concepts, processing and operation methods used in the development of software solutions.

Under the Software Protection Regulations, PRC citizens, legal persons and organizations enjoy copyright protection over computer software they have developed, regardless of whether the software has been published. Other developers may enjoy PRC copyright protection over computer software they have developed if such computer software was first distributed in China, or in accordance with a bilateral agreement between China and the developer’s country of citizenship or residence, or in accordance with an international treaty to which China is a party.

Under the Software Protection Regulations, owners of software copyright protection enjoy rights of publication, authorship, modification, duplication, issuance, lease, transmission on the information network, translation, licensing and transfer. Software copyright protection takes effect on the day of completion of the software’s development.

For software developed by legal persons and other organizations, software protection extends until the thirty-first day of December of the fiftieth year from the date the software solution was first published. However, the Software Protection Regulations will not protect the software unless it is published within 50 years of the completion of its development. Licensing agreements may allow others to exploit the software copyright, but exclusive licenses must be in writing. A written contract is also required to transfer any software copyright.

13

Table of Contents

Civil remedies available under the Software Protection Regulations against infringements of copyright include cessation of the infringement and elimination of its effects, an apology and compensation for losses. The administrative department of copyright may order the infringer of a software copyright to stop all infringing acts, confiscate illegal gains, confiscate and destroy infringing copies, and impose a fine on the infringer under certain circumstances. Disputes regarding infringements of software copyright may be settled through mediation, arbitration, or the PRC courts directly.

Software Copyright Registration

In February 2002, the State Copyright Administration of the PRC promulgated the Measures Concerning Registration of Computer Software Copyright Procedures, or the Registration Procedures, to implement the Software Protection Regulations and to promote the development of China’s software industry. The Registration Procedures apply to the registration of software copyrights, software copyright exclusive licensing contracts and assignment contracts. The registrant of a software copyright will either be the copyright owner or another person (whether a natural person, legal person or an organization) in whom the software copyright becomes vested through succession, assignment or inheritance.

Pursuant to the Registration Procedures, the software to be registered must (i) have been independently developed or (ii) significantly improve in its function or performance after modification from the original software with the permission of the original copyright owner. If the software being registered is developed by more than one person, the copyright owners may nominate one person to handle the copyright registration process on behalf of the other copyright owners. If the copyright owners fail to reach an agreement with respect to the registration, any of the copyright owners may apply for registration but the names of the other copyright owners must be recorded on the application.

The registrant of a software copyright and the parties to a software copyright assignment contract or exclusive licensing contract may apply to the Copyright Protection Center of the PRC for registration of such software copyright and contracts. The Copyright Protection Center of the PRC will complete its examination of an accepted application within 60 days of the date of acceptance. If an application complies with the requirements of the Software Protection Regulations and the Registration Procedures, a registration will be granted, a corresponding registration certificate will be issued and the registration will be publicly announced.

Software Products Administration

In October 2000, the MIIT issued the Measures Concerning Software Products Administration, or the Measures, to regulate software products and promote the development of the software industry in China. The Measures set forth requirements regarding who may produce software products in China, how software products may be sold, and local and imported software registration. The MIIT and other relevant departments may supervise and inspect the development, production, operation and import/export activities of software products in China.

In March 2009, the MIIT promulgated new Measures Concerning Software Products Administration, or the New Measures, which became effective in April 2009. Under the New Measures, software products operated or sold in China are not required to be registered or recorded with governmental authorities, and software products developed in China (including those developed in China on the basis of imported software) can enjoy certain favorable policies when they have been registered and recorded. The New Measures eliminated certain other requirements set forth in the original Measures.

Policies to Encourage the Development of Software and Integrated Circuit Industries

In June 2000, the State Council issued Certain Policies to Encourage the Development of Software and Integrated Circuit Industries, or the Policies, to encourage the development of the software and integrated circuit

14

Table of Contents

industries in China and to enhance the competitiveness of the PRC information technology industry in the international market. The Policies encourage the development of the software and integrated circuit industries in China through various methods, including by:

| • | Encouraging venture capital investment in the software industry and assisting software enterprises in raising capital overseas; |

| • | Providing tax incentives, including an immediate tax rebate for taxpayers who sell self-developed software products, before 2010, of the amount of the statutory value-added tax that exceeds 3% and a number of exemptions and reduced enterprise income tax rates; |

| • | Providing government support, such as government funding in the development of software technology; |

| • | Providing preferential treatment, such as credit facilities with low interest rates to enterprises that export software products; |

| • | Taking steps to ensure that the software industry has sufficient expertise; and |

| • | Implementing measures to enhance intellectual property protection in China. |

To qualify for preferential treatment, an enterprise must be recognized as a software enterprise by governmental authorities. A software enterprise is subject to annual inspection, failure of which in a given year results in loss of the relevant benefits. Certain of our subsidiaries in China have obtained the software certifications that provide tax benefits, which are discussed below in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operation, under the heading “Taxes.”

Regulation of the Telecommunications Industry

The Chinese telecommunications industry, in which our largest customers operate, is subject to extensive government regulation and control. Currently, all the major telecommunications and Internet service providers in China are primarily state owned or state controlled and their business decisions and strategies are affected by the government’s budgeting and spending plans. In addition, they are required to comply with regulations and rules promulgated from time to time by the MIIT and other ministries and government departments.

In September 2000, China published the Regulations of the People’s Republic of China on Telecommunications, or the Telecommunications Regulations. The Telecommunications Regulations were the first comprehensive set of regulations governing the conduct of telecommunications businesses in China. In particular, the Telecommunications Regulations set out in clear terms the framework for operational licensing, network interconnection, the setting of telecommunications charges and standards of telecommunications services in China. In the same month, China’s State Council approved the Administrative Measures on Internet Information Services, which provide for control and censoring of information on the Internet.

In December 2001, the Ministry of Information Industry, or MII, which was reorganized as the MIIT in June 2008, promulgated the Administrative Measures for Telecommunications Business Operating Licenses, as amended. This regulation provides for two types of telecommunications operating licenses for carriers in the PRC, namely licenses for basic services and licenses for value-added services. In February 2003, the MII issued a new classification of basic and value-added telecommunications services. The revised classification maintains the general distinction between basic telecommunications services, or BTS, and value-added telecommunications services, or VATS, and attempts to define the scope of each service. In particular, the 2003 classification delineated the differences between “Type 1” and “Type 2” value-added services. Type 1 includes online data and transaction processing, domestic multi-party communications services, domestic Internet VPN services and Internet data center services. Type 2 covers storage and retransmission (email, voice mail, facsimile), call centers, Internet access and information services.

15

Table of Contents

Under regulations introduced in December of 2001, qualified foreign investors are permitted to invest in certain sectors of China’s telecommunications industry through Sino-foreign joint ventures, including Type 2 VATS providers, although there have been few reported investments of this nature to date. These regulations, known as the Provisions on the Administration of Foreign-Invested Telecommunications Enterprises, or the Provisions, were the result of China’s accession to the World Trade Organization. Under these provisions, certain qualifying foreign investors are permitted to own up to 49% of basic telecommunications businesses in China, and up to 50% of value-added telecommunications services businesses (which include Internet service providers and Internet content providers) and wireless paging businesses.

Despite the introduction of the Provisions in 2001, PRC regulations still restrict most direct foreign ownership of VATS businesses in the PRC. We and our PRC operating subsidiaries are considered foreign persons or foreign-invested enterprises under PRC laws, and are therefore subject to foreign ownership restrictions in connection with our limited VATS Type 2 business activities. In order to comply with these restrictions, we entered into a series of contractual arrangements with certain individuals to facilitate our domestic companies Star VATS and ZXJ to conduct value-added telecommunications services business in the PRC. Star VATS obtained a License for Operating Value-Added Telecommunications Services (Type 2), issued by the MII initially in November 2004 and reissued in August 2008. At present, our product and services offerings in the VATS area are still under development. We anticipate that in the future we will offer customers various Type 2 VATS.

We anticipate that if we successfully launch our VATS products and services, all of our business related to such products and services will be conducted through Star VATS and ZXJ. Star VATS and ZXJ will receive any revenue we generate in the VATS business and will make use of the licenses and approvals that are essential to such business. We do not have any equity interest in Star VATS and ZXJ, but instead have the right to enjoy economic benefits similar to equity ownership through our contractual arrangements with Star VATS, ZXJ and their respective shareholders. For more information on the regulatory and other risks associated with our contractual arrangements related to Star VATS and ZXJ, please see the discussion below in Item 1A, “Risk Factors.”

In addition, in anticipation of China’s developing 3G telecommunications systems, in May 2008, MIIT, the Ministry of Finance, and the National Development and Reform Commission, or NDRC, jointly issued a notice, known as “The Announcement on Deepening the Reform of the Structure of the Telecommunications Sector,” which mandates further reforms to China’s telecommunications system. The regulatory authorities indicated that additional policies and measures to encourage innovation and to strengthen supervision of the telecommunications industry would be promulgated.

Regulation of Computer Information Security Products and Services

The computer information security industry in China includes products and services designed to protect the security of computer information systems, such as international inter-connection of computer information networks, commercial encryption, computer virus detection and prevention, and network hacker infringement prevention and treatment.

The State Council of China, the Ministry of Public Security and other relevant authorities have promulgated a series of regulations regarding these businesses. The Regulation of the People’s Republic of China on Protection of Computer Information Systems Security, published in February 1994, was the first law in this regard, and has formed a legal framework for the computer information security industry. The discussion below provides a description of the other primary regulations applicable to our information security solutions businesses.

Regulation of Systems Integration Involving State Secrets

In 2001, the State Secrecy Bureau of China promulgated a set of regulations, known as the Administrative Measures for Qualification of Computer Information Systems Integration Involving State Secrets, which

16

Table of Contents

expressly prohibits foreign persons or foreign-invested enterprises from engaging in systems integration businesses involving state secrets. These regulations, referred to below as the State Secrets Regulation, also provide that a company must obtain a Qualification Certificate for Computer Information System Integration Involving State Secrets in order to carry on such business.

Regulation of Commercial Encryption Businesses

The Commercial Encryption Administrative Regulation, issued in 1999, is the principal regulation governing commercial encryption businesses in China. “Commercial encryption” refers to encryption technologies and encryption products utilized for encryption protection or security authentication of information that is not related to state secrets. The Commercial Encryption Administrative Regulation also provides that encryption technology itself is a state secret; therefore, commercial encryption technology is subject to the State Secrets Regulation. As a result, foreign persons or foreign-invested enterprises are prohibited from engaging in any commercial encryption business in China. In addition, research, production, sale and use of encryption products in China are controlled by the National Encryption Administration Committee on behalf of the PRC government.

In December 2005, the State Secrecy Bureau promulgated three new regulations, which provided additional administrative measures relating to the production and sale of commercial encryption products and scientific research on commercial encryption. According to these measures, production and sale of commercial encryption products may only be undertaken by companies that are designated by China’s Encryption Administration Committee. A company producing or conducting research on commercial encryption products needs to apply for certification as a designated commercial encryption product production enterprise or research enterprise. A company selling commercial encryption products must obtain a Commercial Encryption Product Sales Permit for selling such products. A company holding such sales permit may not sell any commercial encryption products that are developed or produced outside of China.

In April 2009, the Ministry of Commerce and the Ministry of Science and Technology promulgated the Measures for the Administration of Technologies Prohibited or Restricted from Export, which provides that Internet security and encryption technology is limited from export. The technology falling under the scope of the measures must undergo confidentiality check formalities and obtain the permission of the relevant authority before export.

Foreign Ownership Restrictions and License Requirements

We and our PRC operating subsidiaries are considered foreign persons or foreign-invested enterprises under PRC laws, and are therefore subject to foreign ownership restrictions in connection with our IT security business. In order to comply with these restrictions, we entered into a series of contractual arrangements in connection with our acquisition of our IT security business in 2004. Those arrangements enable us to operate the part of that business that constitutes systems integration involving state secrets (including commercial encryption) through affiliated entities in which we do not hold a direct equity interest.

We currently operate the restricted businesses through Lenovo Security and Lenovo Computer. When we acquired the restricted business in 2004, we intended to operate the restricted business through Lenovo Security, upon Lenovo Security’s receipt of all requisite business licenses and qualifications. Pending Lenovo Security’s receipt of the requisite business licenses and qualifications, Lenovo Computer has operated the information security solutions business in accordance with certain contractual arrangements. Lenovo Security has now obtained most of the requisite business licenses and qualifications necessary to operate the IT security business, such as the Computer Information System Integration Involving State Secrets Qualification Certificate issued by the State Secrecy Bureau of China for Protection of State Secrets. Lenovo Security is in the process of applying for the remaining licenses. Since September, 2006, Lenovo Security has conducted most of our operations related to the IT security business and, consequently, generates most of our revenue derived from the IT security business. Lenovo Computer continues to perform certain previously executed contracts involving the IT security business.

17

Table of Contents

Lenovo Computer is owned by subsidiaries of one of our indirect shareholders, Lenovo Group Limited. Lenovo Security is owned by Legend Holdings Limited, the parent company and controlling shareholder of Lenovo, and by two of our employees who are PRC citizens. We do not currently have any equity interest in Lenovo Security or in Lenovo Computer, but instead enjoy the economic benefits of equity ownership in such companies through contractual arrangements among Lenovo-AsiaInfo, our wholly-owned subsidiary, and these affiliated entities and their respective shareholders. For more information on the regulatory and other risks associated with our contractual arrangements related to Lenovo Computer and Lenovo Security, please see the discussion below in Item 1A, “Risk Factors.”

Regulations affecting acquisitions of PRC companies by foreign entities

In October 2005, the PRC State Administration of Foreign Exchange, or SAFE, issued a notice, known as “Circular 75,” which sets forth a regulatory framework for acquisitions of PRC businesses involving offshore companies owned by PRC residents or passport holders, known as “round-trip” investments or acquisitions. Among other things, Circular 75 provides that if a round-trip investment in a PRC company by an offshore company controlled by PRC residents occurred prior to the issuance of Circular 75, certain PRC residents were required to submit a registration form to the local SAFE branch to register their ownership interests in the offshore company prior to March 31, 2006. Circular 75 also provides that, prior to establishing or assuming control of an offshore company for the purpose of obtaining financing for that offshore company using the assets or equity interests in an onshore enterprise in the PRC, each PRC resident or passport holder who is an ultimate controller of such offshore company, whether an individual or a legal entity, must complete the overseas investment foreign exchange registration procedures with the relevant local SAFE branch. Such PRC residents must also amend the registration form if there is a material event affecting the offshore company, such as, among other things, a change in share capital, a transfer of shares, or if such company is involved in a merger, an acquisition or a spin-off transaction or uses its assets in China to guarantee offshore obligations. In May 2007, SAFE issued guidance to its local branches with respect to the operational process for SAFE registration, known as “Circular 106,” which standardized registration under Circular 75. In the past, we have acquired a number of assets from, or equity interests in, PRC companies. However, there is substantial uncertainty as to whether we would be considered an “offshore company” for purposes of Circular 75 and, at present, it is unclear whether Circular 75 requires a company such as ours to register. We have in any event requested our stockholders who are PRC residents to make the necessary applications, filings and amendments as required under Circular 75 and other related regulations. We will attempt to comply, and attempt to ensure that all of our stockholders subject to these rules comply, with the relevant requirements. However, all of our PRC-resident stockholders may not comply with such requirements. Any failure to comply with the relevant requirements could subject us to fines or sanctions imposed by the PRC government, including restrictions on certain of our subsidiaries’ ability to pay dividends to us and our ability to increase our investment in those subsidiaries.

Circular 75, Circular 106 and related regulations are relatively new in China and it is uncertain how these regulations will be interpreted, implemented or enforced. We cannot predict how these regulations will affect our future acquisition strategies and business operations. For example, if we decide to acquire additional PRC companies, we or the owners of such companies may not be able to complete the filings and registrations, if any, required by Circular 75, Circular 106 and related regulations. Under Circular 75, failure to comply with the registration procedures set forth thereunder may result in the imposition of restrictions on the foreign exchange activities of the relevant onshore company, including the payment of dividends and other distributions to its offshore parent or affiliate and the capital inflow from the offshore entity, and may also subject relevant PRC residents to penalties under PRC foreign exchange administration regulations. Any such restrictions or penalties may restrict our ability to implement an acquisition strategy and could adversely affect our business and prospects.

In August 2006, six PRC regulatory authorities, including the PRC Ministry of Commerce, or MOFCOM, and the China Securities Regulatory Commission, or CSRC, jointly promulgated the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, or the M&A Rules, which became effective in

18

Table of Contents

September 2006 and were subsequently amended in June 2009 by MOFCOM. The M&A Rules established additional procedures and requirements that make merger and acquisition activities by foreign investors more time-consuming and complex, including, in some circumstances, advance notice to MOFCOM of any change-of-control transaction in which a foreign investor takes control of a PRC domestic enterprise. Compliance with the M&A Rules, and any related approval processes, including obtaining approval from MOFCOM, may delay or inhibit our ability to complete acquisitions of domestic PRC companies, which could affect our ability to expand our business or maintain our market share.

Furthermore, in August 2008, SAFE issued a notice, known as “Circular 142,” regulating the conversion by a foreign-invested company of foreign currency into RMB by restricting the uses for the converted RMB. Circular 142 requires that the registered capital of a foreign-invested company denominated in RMB but converted from a foreign currency may only be used pursuant to the purposes set forth in the foreign-invested company’s business scope as approved by the applicable governmental authority. Such registered capital may not be used for equity investments within the PRC. In addition, SAFE strengthened its oversight of the flow and use of the registered capital of a foreign-invested company that was denominated in RMB but converted from foreign currency. Violations of Circular 142 may result in severe penalties, including significant fines. As a result, Circular 142 may significantly limit our ability to invest in or acquire other PRC companies using the RMB-denominated capital of our PRC subsidiaries.

Certifications and Qualifications

Our products, facilities and activities must satisfy a range of criteria and conditions set by various industry bodies and governmental authorities in China in order for us to be eligible to supply our products and services. In addition, some certificates we hold are not mandatory for our business but may provide us with certain tax benefits or marketing advantages.

As of January 25, 2010, our subsidiaries or VIEs held the following certifications or qualifications, among others, that enable us to engage in certain industry or business activities:

| • | Computer Information System Integration Qualification Certificate (Level 1) issued by the Ministry of Information Industry (holders: AsiaInfo Technologies (China), Inc. and Lenovo Security Technologies (Beijing), Inc.); |