Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - Astex Pharmaceuticals, Inc | a2197253zex-23_1.htm |

| EX-32.1 - EXHIBIT 32.1 - Astex Pharmaceuticals, Inc | a2197253zex-32_1.htm |

| EX-31.2 - EXHIBIT 31.2 - Astex Pharmaceuticals, Inc | a2197253zex-31_2.htm |

| EX-31.1 - EXHIBIT 31.1 - Astex Pharmaceuticals, Inc | a2197253zex-31_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the Fiscal Year Ended December 31, 2009 |

||

OR |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission file number 0-27628

SUPERGEN, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

91-1841574 (IRS Employer Identification Number) |

|

4140 Dublin Blvd., Suite 200, Dublin, CA (Address of principal executive offices) |

94568 (Zip Code) |

|

Registrant's telephone number, including area code: (925) 560-0100 |

||

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: | Name of each exchange on which registered: | |

|---|---|---|

| Common Stock, $0.001 par value per share | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý.

The aggregate market value of the voting stock held by non-affiliates of the Registrant (based on the closing sale price of the Common Stock as reported on the Nasdaq Stock Market on June 30, 2009, the last business day of the Registrant's most recently completed second fiscal quarter) was approximately $117,441,154. This determination of affiliate status is not necessarily a conclusive determination for other purposes. The number of outstanding shares of the Registrant's Common Stock as of the close of business on March 5, 2010 was 60,215,632.

DOCUMENTS INCORPORATED BY REFERENCE

Items 10, 11, 12, 13 and 14 of Part III incorporate by reference information from the definitive proxy statement for the Registrant's Annual Meeting of Stockholders to be held on June 10, 2010.

SUPERGEN, INC.

2009 ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

Special Note Regarding Forward-Looking Statements

Our disclosure and analysis in this report contain forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act, and within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements provide our current expectations or forecasts of future events. When we use the words "anticipate," "estimate," "project," "intend," "expect," "plan," "believe," "should," "likely" and similar expressions, we are making forward-looking statements. In particular, these statements include statements such as: our estimates about profitability; our forecasts regarding our revenues and research and development expenses; and our statements regarding the sufficiency of our cash to meet our operating needs. Our actual results could differ materially from those predicted in the forward-looking statements as a result of risks and uncertainties including, but not limited to, delays and risks associated with conducting and managing our clinical trials; the commercial success of Dacogen; developing products and obtaining regulatory approval; our ability to establish and maintain collaboration relationships; competition; our ability to protect our intellectual property; our expectations about the joint development program with GSK; our dependence on third party suppliers; risks associated with the hiring and loss of key personnel; adverse changes in the specific markets for our products; and our ability to launch and commercialize our products. Certain unknown or immaterial risks and uncertainties can also affect our forward-looking statements. Consequently, no forward-looking statement can be guaranteed and you should not rely on these forward-looking statements.

The forward-looking statements reflect our position as of the date of this report, and we undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. You are advised, however, to consult any further disclosures we make on related subjects in our Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, or other filings. Also note that we provide a cautionary discussion of risks and uncertainties relevant to our business under Item 1A—Risk Factors in this report. These are currently known and material risks that we believe could cause our actual results to differ materially from expected and historical results. Other unknown and immaterial risks besides those listed in this report could also adversely affect us.

We incorporated in March 1991 as a California corporation and changed our state of incorporation to Delaware in May 1997. Our executive offices are located at 4140 Dublin Blvd., Suite 200, Dublin, CA, 94568 and our telephone number at that address is (925) 560-0100. We maintain a website on the internet at www.supergen.com. This is a textual reference only. We do not incorporate the information on our website into this annual report on Form 10-K, and you should not consider any information on, or that can be accessed through, our website as part of this annual report on Form 10-K.

Overview

We are a pharmaceutical company dedicated primarily to the discovery and development of therapies to treat patients with cancer. Historically we acquired products that were developed by other companies and applied additional developmental effort to expand sales or advance these products clinically towards potential approval for marketing. In 2006, Dacogen® (decitabine) for Injection received approval for marketing in the United States, our commercial infrastructure and products were sold, and we acquired a discovery and development company to internally discover and develop our own products. These changes were implemented to mitigate the escalating risk of competitive in-licensing and maximize the return on both existing resources and our incoming royalty and milestone revenue.

Our new drug application ("NDA") for Dacogen was approved by the United States Food and Drug Administration ("FDA") in May 2006 for the treatment of patients with myelodysplastic syndromes ("MDS"). In August 2004, we had executed an agreement granting MGI PHARMA Inc.

1

("MGI") exclusive worldwide rights to the development, manufacture, commercialization and distribution of Dacogen. In July 2006, MGI executed an agreement to sublicense Dacogen to Janssen-Cilag GmbH, a Johnson & Johnson company, granting exclusive development and commercialization rights in all territories outside North America. Janssen-Cilag companies are responsible for conducting regulatory and commercial activities related to Dacogen in all territories outside North America, while MGI retains all commercialization rights and responsibility for all activities in the United States, Canada and Mexico. MGI was acquired by Eisai Corporation of North America in January 2008.

Our current primary developmental efforts revolve around the products progressing out of our acquisition of Montigen Pharmaceuticals, Inc. ("Montigen"), a small-molecule drug discovery company, in 2006. We initiated Phase I in-human clinical trials in June 2007 and initiated Phase Ib clinical trials in late 2007 for the first Montigen product, amuvatinib (MP-470), a DNA repair suppressor. In early 2009, we initiated clinical trials for a second internally developed product, SGI-1776, a PIM kinase inhibitor.

In October 2009, we entered into a Commercial License and Research Agreement with GlaxoSmithKline ("GSK"). Pursuant to the terms of this agreement, we will collaborate with GSK over a period of five years to discover and develop specific epigenetic therapeutics. At the end of the research term, or earlier if GSK elects, GSK may exercise its option to license from us the compounds that are the result of the joint research effort, in order to continue the development and ultimately commercialize and sell the resulting products worldwide. Upon execution of the agreement, we received an upfront payment of $2 million from GSK, as well as a $3 million investment in shares of our common stock, sold at a 10% premium to market price. GSK is obligated to make certain additional payments to us if and when the compounds reach specified developmental milestones, as well as payments to us if and when the compounds that GSK has licensed achieve certain regulatory milestones. The agreement further provides that, if the licensed compounds derived from the joint research team become products, GSK will pay us sales milestone payments as well as royalties on annual net sales of such products. Total potential development and commercialization milestones payable to us could exceed $375 million. The tiered royalties, into double digit magnitudes, will be paid on a country-by-country and product-by-product basis.

Strategy

We are a pharmaceutical company dedicated to the discovery and development of therapies to treat patients with cancer. Our founding strategy was to acquire rights to late stage clinical products and commercialize these products by executing selective developmental and commercialization strategies that might allow these products to come into the market and be utilized by the widest possible patient populations. The competition for late-stage compounds that can be obtained through licensure or acquisition, that have shown initial efficacy in humans, has increased significantly with most major pharmaceutical companies taking positions in this market. The acquisition of Montigen mitigates the competitive risk of in-licensure and may allow us to out-license selective products to our licensing competitors or other pharmaceutical companies. Our primary objective is to become a leading developer and seller of therapies for patients suffering from cancer. Key elements of our strategy include the following:

Discover and advance into clinical trials at least one product about every twelve to eighteen months. Our drug discovery group has been optimizing our proprietary process called CLIMB™ that allows a small team of chemists and biologists to model difficult or previously unknown cancer targets for computerized drug creation and development. The flexibility and relatively low cost of both human and developmental capital for this type of discovery and development has allowed us to transition from being just a licensee to becoming a potential licensor.

Focus on drug targets that are difficult to screen by traditional methods. Most established pharmaceutical companies use some version of a high through-put screening. However, this

2

methodology does not work well for a wide variety of complex targets. Our modeling process has demonstrated an ability to create lead candidates for these complex targets, including protein-to-protein interaction targets that might be disrupted by small molecules to be used as potential therapeutics.

Capitalize on our existing clinical expertise and regulatory development to maximize the commercial value of our products. Computer and animal models are only modestly predictive of how a product might work in humans. We have acquired significant expertise at planning, managing, and filing clinical data in both the United States and Europe. Proving the concept that a specific drug will translate into an approvable, commercially viable product in humans is a difficult task. Some drug candidates demonstrate this "proof of concept" very early in non-clinical development, while other drug candidates might need to be compared clinically to existing therapies to achieve such a proof of concept. Typically this proof of concept comes in Phase II trials where it is demonstrated that a drug candidate can destroy tumors in specific diseases through a specific process. As product candidates move from non-clinical into Phase I and Phase II clinical studies, the potential value of the drug candidates should increase as the proof of concept is achieved. Historically, products that are in Phase II trials command a higher in-licensing value than products that are still in Phase I trials. We believe our clinical and regulatory expertise facilitates efficient use of our resources to achieve appropriate proof of concept.

CLIMB Discovery Process

Traditional drug discovery processes may require five or more years before presenting a candidate suitable for the clinic. This lengthy timeline leads to high research and development costs. Utilizing our CLIMB platform, we have effectively streamlined the discovery and lead optimization process in order to get potentially life-saving therapeutics to the clinical testing stage of development faster and at a lower cost. CLIMB is SuperGen's approach to small molecule drug discovery, which merges the rapid screening of compound libraries with computational chemistry and systems biology techniques to identify drug leads that bind to target proteins.

CLIMB is an iterative and evolving process, incorporating techniques from computational design to laboratory bench biology and chemistry, to yield targeted therapeutics for use in the clinic. In traditional small molecule screening, very large physical libraries of millions of compounds may be created and screened in order to identify the few that interact selectively with a disease-related protein target. This approach has worked fairly well for simple or very well characterized targets, but is very time and cost intensive. Since CLIMB works with a virtual library of compounds and compound fragments to screen against target models, we can screen up to three million virtual compounds per day against very complex targets.

CLIMB has been used to create models and identify products that have exhibited considerable activity while physically screening as few as several hundred rationally-selected compounds. This reduces the time from target identification to clinical candidate by several years, and decreases the cost of drug development. As part of CLIMB, our software development team is actively involved in the creation of algorithms to integrate computation, biochemistry, medicinal chemistry and systems biology to improve the predictive properties of our models and streamline the drug discovery process even further.

3

Products in Research and Development

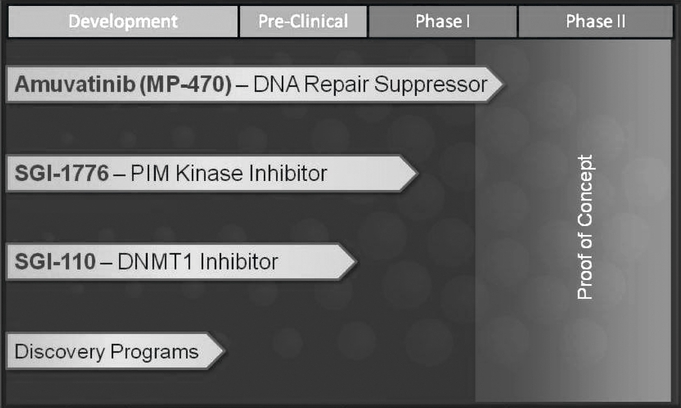

The chart below lists our current products or projects in development:

Amuvatinib (MP-470)—DNA Repair Suppressor

Amuvatinib is a multi-targeted Tyrosine Kinase Inhibitor that is specific for mutant forms of c-kit, PDGFRa, and FLT3. These protein kinase targets are involved in the growth and proliferation of cancer cells. Amuvatinib is also a suppressor of Rad51, a DNA repair protein which is involved in resistance to a variety of chemotherapy agents and radiation. We submitted an Investigational New Drug Application ("IND") to the FDA in March 2007, and initiated a first-in-human Phase I single agent amuvatinib trial in June 2007.

Amuvatinib has a wide therapeutic window and shows minimal toxicity in the expected therapeutic dose range, despite suppressing several signaling pathways within cells. We have evaluated amuvatinib as a dry powder mix and as a lipid suspension formulation in multiple Phase I studies as a single agent in healthy volunteers and in cancer patients, as well as in combination with five standard of care chemotherapy regimens in different tumor types. Across these studies, over 170 patients/healthy volunteers received at least one dose of amuvatinib. As a single agent in cancer patients, gastrointestinal toxicity was the major adverse event noted at doses up to 1500 mg/day with the dry powder formulation. In the combination trial, preliminary data indicated twelve partial responses and numerous durable stable disease per RECIST criteria, mostly with the paclitaxel/carboplatin and carboplatin/etoposide standard of care chemotherapy regimens in combination with oral amuvatinib. Tumor types demonstrating clinical benefit include neuroendocrine, non-small cell lung, small cell lung, breast and endometrial carcinoma. The safety profile of amuvatinib in combination with standard of care was consistent with historical published data for each chemotherapeutic with no apparent increase in severity or prolongation of reported events.

We completed an additional Phase I pharmacokinetic study in healthy male volunteers to determine the relative bioavailability and define the safety profile of the lipid suspension capsules

4

compared with the dry powder mix capsules. In a randomized, two-way crossover study, exposure levels of amuvatinib following administration of a single dose of the lipid suspension formulation (3 × 30 mg capsules) were higher than those observed following the administration of the single dose dry powder formulation (1 × 100 mg capsule). The relative bioavailability favored the lipid suspension formulation, adjusted for dose, with an overall increase in exposure by twofold.

We are also performing non-clinical studies with collaborators to further our understanding of the mechanisms of amuvatinib in DNA repair pathways, as well as the effects of the drug in combination studies in multiple solid tumor models. Pending full analysis of the responses in the Phase I studies and completion of the ongoing non-clinical programs, we intend to initiate one or more Phase II studies evaluating the safety and efficacy of amuvatinib lipid suspension formulation in tumor types that have demonstrated clinical benefit in the Phase I development program. The initial Phase II study is anticipated to be launched during the second half of 2010.

SGI-1776—Pim Kinase Inhibitor

Pim kinases are proteins that play a pivotal survival role in cancer cells. Over-expression of Pim kinases in cells prevents programmed cell death that normally occurs when cells malfunction and can lead to unchecked cell survival, or cancer. Our Pim kinase inhibitor, SGI-1776, is a novel, orally administered, small molecule anticancer compound that effectively blocks the pro-survival activity of Pim kinases, allowing these potentially malignant cells to self-abort. Our IND for SGI-1776 received clearance from the FDA in November 2008, and we initiated a Phase I clinical trial to evaluate the safety, tolerability, and pharmacokinetic profile of SGI-1776 in the first half of 2009. The first in-human clinical trial program has enrolled patients with solid tumors with specific emphasis on hormone and docetaxel refractory prostate cancer and refractory non-Hodgkin's lymphomas. These tumor types have been reported to over-express the Pim kinase family of proteins at a high frequency. Over-expression of Pim-1 kinase has been shown to be a marker of poor prognosis in these tumors. A second Phase I/II study is being planned in patients with refractory acute or chronic myeloid or lymphatic leukemias in which Pim kinases are also over-expressed, and correlated with poor prognosis and drug resistance. This study is anticipated to be launched during the first half of 2010.

SGI-110—DNMT1 Inhibitor

In normal cells, silencing of unnecessary genes is commonly carried out by DNA methylation through the action of DNA Methyltransferase enzymes. However, this machinery can be usurped during the process of tumorigenesis, resulting in the inactivation of tumor suppressor genes and ultimately cancer. Inhibition of DNMT-1 activity in cancer cells causes the suppressed genes to become unmethylated and re-expressed. These re-expressed tumor suppressor genes interfere with the cancer cells proliferative pathways and lead to cell death. We have developed a compound called SGI-110 which targets and blocks the mechanism by which methylation occurs, thus allowing re-expression of tumor suppressor genes in tumors. SGI-110 is currently in the pre-clinical development stage with an anticipated IND filing in 2010. The initial Phase I/II study will evaluate multiple schedules in relapsed/refractory MDS and acute myeloid leukemia (AML).

Discovery Programs

JAK2 Inhibitor

Janus kinases (JAK) are a family of non-receptor intracellular tyrosine kinases that transduce signaling from type I and II cytokine receptors, which possess no catalytic kinase activity, to the signal transducers and activators of transcription (STAT) proteins which translocate into the nucleus to initiate the growth and differentiation programs associated with the various receptor cytokine complexes. The JAK/STAT pathways play an important role in a diverse array of cellular processes, including cell survival, proliferation, differentiation and apoptosis. Activation of JAK kinases through mutation or

5

aberrant signaling has been associated with disease progression in immune disorders, myeloproliferative disorders, and cancers.

Axl Inhibitor

Axl kinase is a receptor tyrosine kinase implicated in tumorigenesis. Over-expression of Axl is associated with increased cellular transformation, cell survival, proliferation, migration, angiogenesis, and adhesion. The oncogenic potential of Axl was first discovered in chronic myelogenous leukemia (CML) and has been shown to play a role in the development of acute myelogenous leukemia (AML) and myelodysplasia. Axl kinase is an exciting target for small molecule drug discovery. A series of small molecule inhibitors were discovered and are being developed for potency and selectivity against Axl.

ETK/BMX Inhibitors

Epithelial and endothelial tyrosine kinase (ETK), also known as bone marrow X kinase (BMX), is a nonreceptor tyrosine kinase that plays a central role in the proliferation, differentiation, apoptosis, adhesion, motility, and tumorigenicity of epithelial cells. ETK has been reported to be over-expressed in several aggressive metastatic carcinomas, such as hepatocellular carcinoma, cholangiocarcinoma, and prostate cancer. ETK kinase signals downstream of several important oncogenes, including Src, focal adhension kinase, and phosphatidylinositol 3-kinase and has been shown to be vital to the tumorigenic effects of such proteins. Taken together, these findings suggest ETK is an exciting potential therapeutic target in multiple tumor types. We have designed and developed a novel class of potent small molecule inhibitors with specificity toward ETK. Initial leads from this class of inhibitors have activity against ETK at low nM concentrations in a biochemical ETK kinase assay, and show good selectivity across a diverse panel of kinases.

Products Sublicensed or Sold

Dacogen

In September 2004, we executed an agreement granting MGI exclusive worldwide rights to the development, manufacture, commercialization and distribution of Dacogen. Under the terms of the agreement, MGI made a $40 million equity investment in us and agreed to pay up to $45 million in specific regulatory and commercialization milestones. To date, we have received $32.5 million of these milestones. The Dacogen license has also created for us a royalty income stream on worldwide net sales starting at 20% and escalating to a maximum of 30%.

In July 2006, MGI executed an agreement to sublicense Dacogen to Janssen-Cilag, a Johnson & Johnson company, granting exclusive development and commercialization rights in all territories outside North America. In accordance with our license agreement with MGI, we are entitled to receive 50% of certain payments MGI receives as a result of any sublicenses. We received $5 million, or 50% of the $10 million upfront payment MGI received, and, as a result of both the original agreement with MGI and this sublicense with Janssen-Cilag, we may receive up to $17.5 million in future milestone payments as they are achieved for Dacogen globally. Janssen-Cilag is responsible for conducting regulatory and commercial activities related to Dacogen in all territories outside North America, while MGI retains all commercialization rights and responsibility for all activities in the United States, Canada and Mexico. MGI was acquired by Eisai Corporation of North America in January 2008.

Nipent

We used to sell our drug Nipent in the United States and the European Union ("EU") for the treatment of hairy cell leukemia, a type of B-lymphocytic leukemia, and it was our principal source of revenue from 1997-2006. We sold the North American rights to Nipent to Mayne Pharma ("Mayne") in August 2006, and sold the remaining worldwide rights to Nipent to Mayne in April 2007. Mayne was acquired by Hospira, Inc. in February 2007.

6

Acquisition of New Products and Technologies

We are continually reviewing new product development opportunities in an effort to enhance and create a broader product pipeline for future development.

In 2006, we completed our acquisition of Montigen, a privately held, oncology-focused drug discovery and development company headquartered in Salt Lake City, Utah. Montigen's assets included its research and development team, a proprietary drug discovery technology platform and optimization process, CLIMB, and late-stage non-clinical compounds. Pursuant to the terms of the merger agreement, we paid the Montigen stockholders a total of $17.9 million upon the closing of the transaction, consisting of $9.0 million in cash and $8.9 million in shares of SuperGen common stock. In April 2007, we paid the former Montigen stockholders a milestone payment of approximately $10.0 million, which was paid in shares of our common stock. In November 2008, we paid the former Montigen stockholders another milestone payment of approximately $5.2 million, which was paid in a combination of approximately $2.8 million in cash and 1.5 million shares of our common stock. We have an obligation to pay the Montigen stockholders an additional $6.8 million in shares of our stock, contingent upon achievement of one additional regulatory milestone.

Research and Development

Because of the stage of our development and the nature of our business, we expend significant resources on research and development activities. We expended $29.7 million in 2009, $32.7 million in 2008, and $23.4 million in 2007 on research and development activities. We conduct research internally and also through collaborations with third parties, and we intend to maintain our strong commitment to our research and development efforts in the future. Our major research and development projects are focused on our drug discovery and non-clinical activities as well as Phase I and Phase Ib clinical trials for amuvatinib and SGI-1776.

Sales and Marketing

We currently have no employees focused on sales, marketing, and sales support. Our marketing efforts are handled by our Corporate Communications and Business Development group.

Manufacturing

We currently outsource manufacturing of all our drug compounds to qualified United States and foreign suppliers. We expect to continue to outsource manufacturing in the near term. We believe our current suppliers will be able to efficiently manufacture our proprietary compounds in sufficient quantities and on a timely basis, maintaining product quality and compliance with FDA and foreign regulations. We maintain oversight of the quality of our third-party manufacturers through ongoing audits, rigorous review, control over documented operating procedures, and thorough analytical testing by qualified, contracted laboratories. We believe that our current strategy of outsourcing manufacturing is cost-effective because we avoid the high fixed costs of plant, equipment, and large manufacturing staffs.

The FDA must approve our drug manufacturing sites and deem a manufacturer acceptable under current good manufacturing practices ("GMPs") before release of active pharmaceutical ingredients ("API") and finished dosage forms for clinical testing.

We intend to continue evaluating our manufacturing requirements and may establish or acquire our own facilities to manufacture our products for distribution if doing so would be cost effective or improve control and flexibility of product supply.

7

Government Regulation: New Drug Development and Approval Process

Regulation by governmental authorities in the United States and other countries is a significant factor in the manufacture and marketing of pharmaceuticals and in our ongoing research and development activities. All of our drug products will require regulatory approval by governmental agencies prior to commercialization. In particular, human therapeutic products are subject to rigorous non-clinical testing, clinical trials, and other pre-marketing approval requirements by the FDA and regulatory authorities in other countries. In the United States, various federal, and in some cases state statutes and regulations, also govern or have an impact upon the manufacturing, safety, labeling, storage, record-keeping and marketing of such products. The lengthy process of seeking required approvals and the continuing need for compliance with applicable statutes and regulations require the expenditure of substantial resources. Regulatory approval, when and if obtained, may be limited in scope which may significantly limit the indicated uses for which a product may be marketed. Further, approved drugs, as well as their manufacturers, are subject to ongoing review and inspections which could reveal previously unknown problems with such products, which may result in restrictions on their manufacture, sale or use or in their withdrawal from the market.

The process for new drug approval has three major stages, discovery, non-clinical and clinical:

Drug discovery. In the initial stages of small molecule drug discovery, potential biological targets are identified, these targets are characterized, and then large numbers of potential compounds are screened for activity. This drug discovery process can take several years. Once a company defines a lead compound, the next steps are to conduct further preliminary studies on the mechanism of action, in vitro (test tube) screening against particular disease targets and some in vivo (animal) screening. If results are satisfactory, the compound progresses from discovery to non-clinical development.

Non-clinical testing. During the non-clinical testing stage, laboratory and animal studies are conducted to show biological activity of the compound against the disease target and the compound is evaluated for safety. These tests can take several years to complete and must be conducted in compliance with Good Laboratory Practice ("GLP") regulations. If the compound passes these hurdles, animal toxicology studies are initiated. If the results demonstrate acceptable levels of toxicity, the compound emerges from non-clinical testing and moves into the clinical phase.

Clinical testing—The Investigational New Drug Application. After appropriate animal testing is evaluated and the candidate molecule is found to have an acceptable safety profile, we may decide to expand the development programs to a clinical setting. To accomplish this in the United States an IND is submitted to the FDA. IND applications include the known chemistry of the compound, how the compound is manufactured, the results of animal studies and other previous experiments, the method by which the drug is expected to work in the human body, a proposed clinical development plan and how, where and by whom the proposed new clinical studies will be conducted. Health authorities in Europe and the rest of the world require a similar clinical trial application. If the controlling authority does not object, we may initiate human testing. All clinical trials must be conducted in accordance with globally-accepted standards of good clinical practices ("GCPs"). This means we have specific obligations to protect trial subjects and potential patients, monitor the study, collect the data and prepare a report of the study. Clinical trial applications must be updated with new information obtained during the course of the trials.

Clinical protocols must be approved by independent reviewers, referred to as Institutional Review Boards ("IRB") in the United States and Ethical Committees ("EC") in Europe. The IRB/EC is charged with providing an independent assessment of the appropriateness of the study, particularly focusing on the safety of the patients that might enroll in the study. The IRB's/EC's responsibilities continue while the study is ongoing, focusing on protecting the rights and safety of those enrolled in the study.

8

We have an obligation to provide progress reports on clinical trials at least annually to the FDA. The FDA may, at any time during a clinical trial, impose a "clinical hold" if it has serious safety concerns about a trial. If this occurs, the clinical trial cannot continue until the FDA is satisfied that it is appropriate to proceed.

Clinical Development Plan. Clinical trials are typically conducted in three sequential phases, but the phases may overlap.

- •

- Phase I clinical trials. After an IND becomes

effective, Phase I human clinical trials can begin. These trials generally involve 20 to 40 heavily pre-treated cancer patients who may have a wide variety of cancers and typically

take approximately one year to complete. These trials are designed to evaluate a drug's safety profile and may include studies to assess the optimal safe dosage range. Phase I clinical studies

may evaluate how a drug is absorbed, distributed, metabolized and excreted from the body. Phase I studies may be expanded to Phase Ib trials that test the research compound in combination with

other agents to define the combined safety and dosing parameters.

- •

- Phase II clinical trials. In Phase II

clinical trials, studies are conducted in patients who have the specific targeted disease. The primary purpose of these trials is to demonstrate preliminary efficacy of the drug in the target patient

population. These studies typically take a few years to complete. Once trial data is obtained that a specific dose and schedule is creating clinical efficacy that appears to be superior to other

treatments, advancement to Phase III can begin.

- •

- Phase III clinical trials. These trials are typically large, involving several hundred or even thousands of patients. Phase III trials typically compare an investigational agent against a control product or the standard of care, which could be a product or treatment already approved for use in that disease. The data generated in these studies are monitored regularly by clinical monitors as well as the participating physician. There are specific requirements for the reporting of any adverse reactions that may result from the use of the drug. Clinical monitors visit the sites regularly and transmit the data back to the company for analysis and ultimately for presentation to the FDA.

Marketing application. Companies have the opportunity to interact with health authorities during the course of a drug development program. Most companies take advantage of this access to gain further insights about the kind of data that will be expected in their marketing application. After completion of the clinical trial phase, a company must compile all of the chemistry, manufacturing, non-clinical and clinical data into a marketing application. In the United States, this is called an NDA; in the EU it is called a Marketing Authorization Application ("MAA"). This is a significant amount of information, often in excess of 100,000 pages, and it will be independently reviewed by these health authorities.

Both the FDA and the European Medicines Evaluation Agency ("EMEA") review these submissions for overall content and completeness before accepting them for review and may request additional information. Once an application is accepted for filing, each agency independently begins its in-depth review. In both the United States and Europe, there are specified timeframes for the completion of review. This process may be extended if an agency requests additional information or clarification regarding the data provided in the submission.

In the United States, the FDA may refer the application to an appropriate advisory committee for a recommendation as to whether the application should be approved, but the FDA is not bound by this recommendation. The review process concludes with the issuance of a "complete response" letter from the FDA. If FDA evaluations of the NDA and the manufacturing facilities are favorable, the FDA will approve the application. If the FDA's evaluation of the NDA submission or manufacturing facilities is not favorable, the FDA will reject the application in the complete response. This complete response

9

will describe specific deficiencies, and, when possible, will outline recommended actions the applicant might take to get the application ready for approval. When and if any deficiencies are corrected, and actions are completed to the FDA's satisfaction, the FDA will issue an approval letter authorizing commercialization of the drug for specific indications. The review and approval process in Europe has substantial similarities to that outlined for the United States.

Marketing approval. Once a health authority grants marketing approval for a drug, it can then be made available in that country or region. Periodic safety reports must be submitted to health authorities as a way to monitor the use of new drugs introduced to the market. Regulatory agencies around the world place great emphasis on pharmacovigilance, the process of monitoring the safety of a drug when it is released for general use, as the real world setting is very different from the controlled environment of clinical trials.

Phase IV clinical trials and post marketing studies. In addition to studies that might have been requested by health authorities as a condition of approval, clinical trials may be conducted to generate more information about the drug after initial approval of the product; including use for additional indications, the use of new dosage forms or new dosing regimens. These studies may generate approved label changes and publications that provide further information to patients and the medical community.

Fast Track. The FDA Modernization Act of 1997 specifies that the FDA can assign a fast track designation to a new drug or biologic product that is intended for the treatment of a serious or life-threatening condition and has the potential to address unmet medical needs for such a condition. Under this program, the sponsoring company may request this designation at any time during the development of the product. The FDA must determine whether the product qualifies within 60 days of receipt of the sponsoring company's request. For a product designated as fast track, the FDA has the ability to define a faster review, including allowing the sponsor to provide the NDA in discrete sections. This process is called a "rolling" NDA and is intended to accelerate the review and approval process.

Priority Review. This is a designation by the FDA for a review period of 6 months, instead of the standard 10 months defined by federal regulation.

Accelerated Approval. This is a program intended to make promising products for life-threatening diseases available on the market on the basis of preliminary evidence prior to formal demonstration of patient benefit.

Approvals in the European Union. In 1993, the EU established a system for the registration of medicinal products in the EU whereby marketing authorization may be submitted at either a centralized or decentralized level. The centralized procedure is administered by the EMEA and is mandatory for the approval of biotechnology products and is available, at the applicant's option, for other innovative products. The centralized procedure provides for the granting of a single marketing authorization that is valid in all EU member states. A mutual recognition procedure is available at the request of the applicant for all medicinal products that are not subject to the mandatory centralized procedure, under a decentralized procedure.

Approvals outside of the United States and European Union. Applications to market a new drug product must be made to virtually all countries prior to marketing. The approval procedure and the time required for approval vary from country to country and may involve additional testing and cost. There can be no assurance that approvals will be granted on a timely basis or at all. In addition, pricing approval is required in many countries and there can be no assurance that the resulting prices would be sufficient to generate an acceptable return on investment.

Off-Label Use. Drugs are approved for a specific use ("label use") that is then set forth in the document ("label") accompanying the dispensed drug. Physicians may prescribe drugs for uses that are not approved in the product's label. Such "off-label" prescribing may be used by physicians across

10

medical specialties. The FDA does not regulate the behavior of physicians in their choice of treatments but it does limit a manufacturer's communications on the subject of off-label use. Companies cannot promote FDA approved drugs for off-label uses, nor can companies promote the use of a drug before it is approved.

Other Government Regulations

As a United States-based company, in addition to laws and regulations enforced by the FDA, we are also subject to regulation by other agencies under the Occupational Safety and Health Act, the Environmental Protection Act, the Toxic Substances Control Act, the Resource Conservation and Recovery Act and other present and potential future federal, state or local laws and regulations. These agencies have specialized responsibilities to monitor the controlled use of hazardous materials such as chemicals, viruses and various radioactive compounds.

Market Exclusivity

The commercial success of a product, once it is approved for marketing, will depend primarily on a company's ability to create and sustain market share and exclusivity. Market exclusivity can be gained and maintained by a number of methods, including, but not limited to: patents, trade secrets, know-how, trademarks, branding and special market exclusivity provided by regulations.

Orphan Drug Designation

The United States, European Union, Japan and Australia have all enacted regulations to encourage the development of drugs intended to treat rare diseases. Orphan drug designation must be requested before submitting an application for marketing approval. After the granting of an orphan drug designation, the chemical identity of the therapeutic agent and its potential treatment use are disclosed publicly. If and when a product with orphan drug status receives marketing approval for the orphan indication, the product is entitled to marketing exclusivity, which means the regulatory authority may not approve any other applications to market the same drug for the same indication for seven years in the United States, ten years in Europe and Japan and four years in Australia.

Data Exclusivity and Generic Copies

There is an abbreviated regulatory review and approval process for a generic copy of an approved innovator drug product. The generic copy can be approved on the basis of an application that is usually limited to manufacturing and biologic equivalence data, by referring to the non-clinical and clinical data that were the bases of approval of the innovator product. The copy can be approved after expiration of relevant patents and any regulatory exclusivity afforded by special circumstances. A new chemical entity has 5 and 10 years of regulatory exclusivity in the United States and European Union, respectively, precluding approval of a generic copy. Additional exclusivity can be afforded in the United States by approval of a product or use that has orphan drug status (7 years), or that requires review of new clinical data (3 years), or that is an expansion of use to a pediatric population (6 months). These exclusivities are independent, and could run sequentially, effectively extending the period of regulatory exclusivity. There is no assurance that such special regulatory exclusivities are applicable for our compounds. Separate from regulatory data exclusivity is the exclusivity conferred by the Hatch Waxman Act based on patent protection of the drug. A company seeking to market a generic might, after the lapse of regulatory data exclusivity, successfully challenge the patent protection of the marketed drug, thereby shortening its exclusive marketing period.

11

Patents and Proprietary Technology

Patents are very important to us in establishing proprietary rights to the products we develop or license. The patent positions of pharmaceutical and biotechnology companies, including ours, can be uncertain and involve complex legal, scientific, and factual questions. See "Risk Factors—Our ability to protect our intellectual property rights will be critically important to the success of our business, and we may not be able to protect these rights in the United States or abroad."

We actively pursue patent protection when applicable for our proprietary products and technologies, whether they are developed in-house or acquired from third parties. We attempt to protect our intellectual property position by filing United States and foreign patent applications related to our proprietary technology, inventions and improvements that are important to the development of our business. Importantly, we are prosecuting a number of patent applications directed to various compounds in our pipeline, including those from our Discovery group. Additionally, we have been granted patents and have received patent licenses relating to our proprietary formulation technology, non-oncology and non-core technologies.

There can be no assurance that the patents granted or licensed to us will afford adequate legal protection against competitors or provide significant proprietary protection or competitive advantage. The patents granted or licensed to us could be held invalid or unenforceable by a court, or infringed or circumvented by others. In addition, third parties could also obtain patents that we would need to license or circumvent. Competitors or potential competitors may have filed patent applications or received patents, and may obtain additional patents and proprietary rights relating to proteins, small molecules, compounds, or processes that are competitive with the products we are developing.

In general, we obtain licenses from various parties we deem necessary or desirable for the development, manufacture, use, or sale of our products or product candidates. Some of our proprietary products are dependent upon compliance with other licenses and agreements. These licenses and agreements may require us to make royalty and other payments, to reasonably exploit the underlying technology of applicable patents, and to comply with regulatory filings. If we fail to comply with these and other terms in these licenses and agreements, we could lose the underlying rights to one or more of these potential products, which would adversely affect our product development and harm our business.

We also have patents, licenses to patents and pending patent applications outside of the United States, such as in Europe, Australia, Japan, Canada, China, Israel and India. Limitations on patent protection in these countries, and the differences in what constitutes patentable subject matter in these countries outside the United States, may limit the protection we have on patents issued or licensed to us outside the United States. In addition, laws of foreign countries may not protect our intellectual property to the same extent as would laws in the United States. To minimize our costs and expenses and maintain effective protection, we focus our foreign patent and licensing activities primarily in the European Union, Canada, Australia and Japan. In determining whether or not to seek a patent or to license any patent in other specific foreign countries, we weigh the relevant costs and benefits, and consider, among other things, the market potential and profitability, the scope of patent protection afforded by the law of the jurisdiction and its enforceability, and the nature of terms with any potential licensees. Failure to obtain adequate patent protection for our proprietary drugs and technology would impair our ability to be commercially competitive in these markets.

Trade Secrets and Trademarks

We also rely on trade secret protection for certain proprietary technology. To protect our trade secrets and our other confidential information, we pursue a policy of having our employees and consultants execute proprietary information agreements upon commencement of employment or consulting relationships with us. These agreements provide that all confidential information developed

12

or made known to the individual during the course of the relationship is confidential except in specified circumstances. Further, we minimize the dissemination of our trade secrets by limiting the knowledge of staff only to the specific knowledge of a trade secret to what they need to know, and protective sequestering of trade secrets behind, for example, locks and passwords.

Competition

The pharmaceutical industry in general and the oncology sector in particular is highly competitive and subject to significant and rapid technological change. There are many companies, both public and private, including well-known pharmaceutical companies that are engaged in the discovery and development of products for some of the applications that we are pursuing. Some of our competitors and probable competitors include ArQule, Array BioPharma, Astex Tx, Crystal Genomics, Exelixis, Infinity, Plexxikon, Vertex, Sanofi-Aventis, Bristol-Myers Squibb Company, Celgene, Eli Lilly & Co., GSK, Novartis AG, Pfizer, and others.

Many of our competitors have substantially greater financial, research and development, and manufacturing resources than we do and may represent substantial long-term competition for us. Some of our competitors have received regulatory approval for products or are developing or testing product candidates that compete directly with our product candidates. For example, amuvatinib faces competition from a multitude of other investigational drugs which are multi-targeted tyrosine kinase inhibitors and inhibitors of the DNA repair pathway. We also expect that there will be other inhibitors of Pim kinases that will emerge as competition for SGI-1776 as well as other investigational drugs progressing through our discovery pipeline. In addition, Dacogen faces competition from 5-aza-cytidine and other drugs in development to treat MDS.

Many of these competitors, either alone or together with their customers and partners, have significantly greater experience than we do in discovering products, undertaking non-clinical testing and clinical trials, obtaining FDA and other regulatory approvals, and manufacturing and marketing products. Accordingly, our competitors may succeed in obtaining patent protection, receiving FDA or other foreign marketing approval or commercializing products before we do. If we elect to commence commercial product sales of our product candidates, we could be at a disadvantage relative to many companies with greater marketing and manufacturing capabilities, areas in which we have limited or no experience.

Factors affecting competition in the pharmaceutical industry vary depending on the extent to which competitors are able to achieve an advantage based on superior differentiation of their products' greater institutional knowledge or depth of resources. If we are able to establish and maintain a competitive advantage based on the ability of CLIMB to discover new drug candidates more quickly and against targets not accessible by many competitors, our advantage will likely depend primarily on the ability of our CLIMB technology to make accurate predictions about the effectiveness and safety of our drug candidates as well as our ability to effectively and rapidly develop investigational drugs.

Extensive research and development efforts and rapid technological progress characterize the industry in which we compete. Although we believe that our proprietary drug discovery capabilities afford us a competitive advantage relative to other discovery and development companies competing in oncology, we expect competitive intensity in this pharmaceutical segment to continue and increase over time. Discoveries by others may render CLIMB and our current and potential products noncompetitive. Our competitive position also depends on our ability to attract and retain qualified scientific and other personnel at all our geographic locations, develop effective proprietary products, implement development plans, obtain patent protection and secure adequate capital resources.

13

Employees

As of December 31, 2009, we had 80 full-time employees. We use consultants and temporary employees to complement our staffing. Our employees are not subject to any collective bargaining agreements, and we consider our relations with employees to be good.

Executive Officers

Name

|

Age | Position

|

|||

|---|---|---|---|---|---|

James S. J. Manuso, Ph.D. |

61 | President, Chief Executive Officer and Director | |||

Mohammad Azab, M.D., M.Sc., MBA |

54 | Chief Medical Officer | |||

Michael Molkentin |

55 | Chief Financial Officer | |||

James S.J. Manuso, Ph.D., has served as our president and chief executive officer since January 1, 2004, as our chief executive officer-elect from September 2003 to December 2003 and as a director since February 2001. Dr. Manuso is co-founder and immediate past president and chief executive officer of Galenica Pharmaceuticals, Inc. Dr. Manuso co-founded and was general partner of PrimeTech Partners, a biotechnology venture management partnership, from 1998 to 2002, and co-founder and managing general partner of The Channel Group LLC, an international life sciences corporate advisory firm. He was also president of Manuso, Alexander & Associates, Inc., management consultants and financial advisors to pharmaceutical and biotechnology companies. Dr. Manuso was a vice president and director of Health Care Planning and Development for The Equitable Companies (now Group Axa), where he also served as acting medical director. He currently serves on the boards of Novelos Therapeutics, Inc. (NVLT:OB) and privately-held KineMed, Inc. Previously, he served on the boards of Merrion Pharmaceuticals Ltd. (MERR:IEX; Dublin, Ireland), Inflazyme Pharmaceuticals, Inc., Symbiontics, Inc., Quark Biotech, Inc., Galenica Pharmaceuticals, Inc., and Supratek Pharma, Inc. Dr. Manuso earned a B.A. with Honors in Economics and Chemistry from New York University, a Ph.D. in Experimental Psychophysiology from the Graduate Faculty of The New School University, a Certificate in Health Systems Management from Harvard Business School, and an Executive M.B.A. from Columbia Business School. Dr. Manuso is the author of over 30 chapters, articles and books on topics including health care cost containment and biotechnology company management. He has taught and lectured at Columbia, New York University, Georgetown, Polytechnic University, and Waseda University (Japan). He has delivered invited addresses at meetings of the American Management Association, the American Medical Association, the Securities Industry Association, the Biotechnology Industry Organization, and many other professional associations. Dr. Manuso previously served as vice president and a member of the Board of Trustees of the Greater San Francisco Bay Area Leukemia & Lymphoma Society.

Mohammad Azab, M.D., M.Sc., MBA, joined SuperGen as chief medical officer in July 2009. He possesses more than 20 years of experience in worldwide drug development, clinical research, and medical affairs, resulting in eight approved drugs, including six in oncology. Most recently, he was president and chief executive officer of Intradigm Corporation, a privately held Palo Alto, CA company developing siRNA cancer therapeutics. Previously, Dr. Azab served as executive vice president of research and development, and chief medical officer, of Vancouver, British Columbia-based QLT Inc., where he led clinical development for now-approved drugs in oncology, gastro-intestinal, and ophthalmologic indications. Prior to this, he served as oncology drug team leader at UK-based Zeneca Pharmaceuticals, now Astra Zeneca, where he held responsibilities in global clinical development and regulatory submissions. In this capacity, he managed the approval of drugs for prostate, breast, colorectal, and lung cancer indications. Before Zeneca, Dr. Azab was an international medical manager in oncology at Sanofi Pharmaceuticals, now Sanofi-Aventis, in Gentilly, France. Dr. Azab received his medical degree in 1979 from Cairo University. He practiced as a medical oncologist and received post-graduate training and degrees in oncology research and statistics from the University of Paris-Sud

14

and the University of Pierre and Marie Curie in France. He has published more than 100 medical papers and abstracts. He is an active member of the American Society of Clinical Oncology, the American Association of Cancer Research, and the European Society of Medical Oncology. Dr. Azab received an MBA, with Distinction, from the Richard Ivey School of Business, University of Western Ontario.

Michael Molkentin joined us as chief financial officer and corporate secretary in October 2003. Prior to joining us, Mr. Molkentin served as interim chief financial officer at Aradigm Corporation from May 2000 to September 2002. From January 1995 to April 2000, Mr. Molkentin served as division controller for Thermo Finnigan Corporation, a subsidiary of Thermo Electron. Mr. Molkentin served in a variety of financial management positions with technology companies, including field controller of Vanstar Corporation, controller of Republic Telcom Systems, Inc. and corporate controller of Computer Automation, Inc. Mr. Molkentin is a CPA and received a B.B.A. in accounting from Bernard M. Baruch College in New York City, New York.

Segment and Geographic Area Financial Information

We operate in one business segment—human therapeutics. We had no product revenue in 2009 or 2008. In 2007, 100% of our product revenue was from the EU.

Available Information

We are subject to the information requirements of the Securities Exchange Act of 1934 (the "Exchange Act"). Therefore, we file periodic reports, proxy statements, and other information with the Securities and Exchange Commission ("SEC"). Such reports, proxy statements, and other information may be obtained by visiting the Public Reference Room of the SEC at 100 F Street, NE, Washington, DC 20549 or by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains a website (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically.

Financial and other information about us is available on our website at www.supergen.com. We make available on our website, free of charge, copies of our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after filing such material electronically or otherwise furnishing it to the SEC. Information on our website does not constitute a part of this annual report on Form 10-K.

15

The following section lists some, but not all, of the risks and uncertainties that may have a material adverse effect on our business, financial condition and results of operations. You should carefully consider these risks in evaluating our company and business. Our business operations may be impaired if any of the following risks actually occur, and by additional risks and uncertainties that we do not know of or that we currently consider immaterial. In such case, the trading price of our common stock could decline.

This report also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements as a result of certain factors, including the risks described below and elsewhere in this report.

Risks Related to Our Financial Condition and Common Stock

If Dacogen is not commercially successful, our future revenues would be limited and our business would be harmed.

Dacogen is approved in the United States, but there is no guarantee that patients and physicians here will adopt it for use, or continue to use it for the treatment of MDS. If MGI/Eisai's sales of Dacogen decrease, as they did in the first quarter of 2009 as reported to us in the second quarter of 2009, our royalty revenue will decrease commensurately, and we cannot be assured that MGI/Eisai will expend the resources to expand sales of Dacogen. Currently, the royalty revenue we receive from MGI/Eisai is our primary source of revenue. In the past, our primary source of revenue was from sales of our product Nipent. The North American rights to Nipent were sold to Mayne/Hospira in August 2006, and the remaining worldwide rights were sold to Mayne/Hospira in April 2007. Accordingly, we are primarily dependent on Dacogen royalty revenue to fund our operations.

Dacogen is not yet approved in Europe or Japan. In July 2006, MGI/Eisai sublicensed Dacogen to Janssen-Cilag GmbH, a Johnson & Johnson company, giving Janssen-Cilag responsibility for conducting regulatory activities related to Dacogen and granting it exclusive development and commercialization rights in Europe and all territories outside North America. We received 50% of the $10 million upfront payment and, as a result of both the original agreement with MGI/Eisai and this sublicense with Janssen-Cilag GmbH, may receive up to $17.5 million in future milestone payments upon achievement of global regulatory and sales targets. However, if Dacogen is never approved in Europe or Japan, we will receive reducing, and ultimately no, royalty payments from commercial sales by Janssen-Cilag and our future revenues and business will be harmed.

Our collaborative relationship with MGI/Eisai may not produce the financial benefits that we are anticipating, which could cause our business to suffer.

We expect to record development and license revenue from payments made to us by MGI/Eisai upon the achievement of regulatory and commercialization milestones. However, we may never receive such payments because the milestones may never be achieved, either because of failure to secure regulatory approval of Dacogen in Europe or Japan or due to MGI/Eisai's or Janssen-Cilag's inability to expend the resources to grow or commence sales of Dacogen as prescribed by the license agreement. In addition, the license agreement provides that MGI/Eisai will pay us (i) a certain portion of revenues payable to MGI/Eisai as a result of MGI/Eisai sublicensing the rights to market, sell and/or distribute Dacogen, to the extent such revenues are in excess of the milestone payments already due to us under our agreement with MGI/Eisai, and (ii) a 20% royalty increasing to a maximum of 30% on annual worldwide net sales of Dacogen. We cannot guarantee that we will receive these payments, and we cannot be assured that MGI/Eisai will expend the resources to expand sales of Dacogen in North America, or that Janssen-Cilag will expend the resources to sell it in Europe and elsewhere, or that either company will be successful in doing so. Because we are heavily reliant on royalties and milestone

16

payments relating to Dacogen to fund our operations, the failure to achieve the milestones and/or receive license revenue from sales of Dacogen would cause our business to suffer.

Our collaborative relationship with GSK may not produce the financial benefits that we are anticipating, which could cause our business to suffer.

Part of our strategy is to partner or out-license selective products to other pharmaceutical companies in order to mitigate the cost of developing a drug through clinical trials to commercialization. The agreement with GSK is an example of this strategy, providing for the joint development of compounds that we will discover using our CLIMB technology, followed by the option for GSK to take one or more of the jointly developed compounds and further develop, commercialize, and sell the resulting product worldwide. The agreement provides for milestone payments to be paid to us during the development process, but the majority of the payments will not occur unless and until GSK exercises its option to license one or more compounds from us. We will expend our own cash and other resources during the joint development process, and we cannot guarantee that any successful compounds will result from our joint development efforts. Further, even if we discover and develop one or more viable compounds, we cannot guarantee that GSK will exercise its option to license any such compounds from us. If GSK chooses not to exercise its license option, we may continue to develop the compounds on our own, but the post-option exercise developmental and sales milestones described in the agreement, which we have estimated to be approximately $300 million, plus additional royalty revenues, will never be realized. If our joint development program with GSK is not successful, and if we cannot earn revenue from collaborative arrangements such as this agreement, our future revenues and business will be harmed.

We have a history of operating losses and we may incur losses for the foreseeable future.

Since inception, we have funded our research and development activities primarily from private placements and public offerings of our securities, milestone and other payments from collaborators, sales of our products, royalty revenue, and product revenues primarily from sales of Nipent. The North American rights to Nipent were sold to Mayne in August 2006 and we sold the remaining worldwide rights to Nipent to Mayne in April 2007. Our substantial research and development expenditures and limited revenues have resulted in significant net losses. We have incurred cumulative losses of $356.6 million from inception through December 31, 2009, and our products have not generated sufficient revenues to support our business during that time. We expect to continue to incur operating losses over the next few years and may never achieve sustained profitability.

Whether we achieve profitability depends primarily on the following factors:

- •

- successful sales of Dacogen in North America by MGI/Eisai;

- •

- obtaining regulatory approval in Europe and Asia and the successful commercialization of Dacogen outside of North America

by Janssen-Cilag;

- •

- delays in production of Dacogen;

- •

- the success of our joint development program with GSK and whether GSK exercises its option to further develop and

commercialize any of the compounds resulting from the joint development effort;

- •

- our ability to discover and develop additional novel therapeutics that might advance through our internal clinical

development infrastructure;

- •

- our research and development efforts, including the timing and costs of clinical trials;

- •

- our competition's ability to develop and bring to market competing products;

17

- •

- our ability to control costs and expenses associated with the discovery, development, and manufacturing of our novel

compounds, as well as general and administrative costs related to conducting our business; and

- •

- costs and expenses associated with entering into and performing under licensing, joint development, and other collaborative agreements.

Our products and product candidates, even if successfully developed and approved, may not generate sufficient or sustainable revenues to enable us to achieve or sustain profitability.

We will require additional funding to expand our product pipeline and commercialize new drugs, and if we are unable to raise the necessary capital or to do so on acceptable terms, our planned expansion and continued chances of survival could be harmed.

We will continue to spend substantial resources on expanding our product pipeline, developing future products, and conducting research and development, including clinical trials for our product candidates. Based on our currently forecasted product development activities, we anticipate that our capital resources will be adequate to fund operations and capital expenditures at least through 2011. However, if we experience unanticipated cash requirements during this period, we could require additional funds much sooner. In February 2009 we filed a $100 million shelf registration statement on Form S-3 with the SEC, which gives us the flexibility to raise funds through the sale of a variety of securities. We may raise money by the sale of our equity securities or debt, or the exercise of outstanding stock options by the holders of such options. However, given uncertain market conditions and the volatility of our stock price, we may not be able to sell our securities in public offerings or private placements at prices and/or on terms that are favorable to us, if at all. Also, the dilutive effect of additional financings could adversely affect our per share results. We may also choose to obtain funding through licensing and other contractual agreements. For example, we licensed the worldwide rights to the development, commercialization and distribution of Dacogen to MGI/Eisai. Such arrangements may require us to relinquish our rights to our technologies, products or marketing territories, or to grant licenses on terms that are not favorable to us. If we fail to obtain adequate funding in a timely manner, or at all, we will be forced to scale back our product development activities, or be forced to cease our operations.

Our equity investment in AVI exposes us to equity price risk and any impairment charge would affect our results of operations.

Our investments in marketable securities are carried at fair value with unrealized gains and losses included in accumulated other comprehensive income or loss in stockholders' equity. However, we are exposed to equity price risk on our equity investment in AVI. The public trading prices of the AVI shares have fluctuated significantly since we purchased them and could continue to do so. If the public trading prices of these shares trade below their adjusted cost basis in future periods, we may incur additional impairment charges relating to this investment, which in turn will affect our results of operations.

Currently we own 2,384,211 shares of AVI and recorded an other-than-temporary decline in value of $3.1 million related to this investment during the year ended December 31, 2008. We evaluate investments with unrealized losses to determine if the losses are other than temporary. In making these determinations, we consider the financial condition and near-term prospects of the issuers, the magnitude of the losses compared to the investments' cost, the length of time the investments have been in an unrealized loss position, and our ability and intent to hold the investments for a reasonable period of time sufficient for a recovery of fair value. It is possible that we may record another other than temporary decline in value related to AVI in the future.

18

Product Development and Regulatory Risks

Our product candidates will require significant additional development.

Most of our product candidates, including SGI-110, are in the development, rather than the clinical trial stage. However, we must significantly develop all of our product candidates before we can market them, or before they will become desirable for partnering or licensing. Although we believe that our preclinical and pilot clinical studies support further development of these product candidates, the results we have obtained to date do not necessarily indicate what results of further testing would be, including controlled human clinical testing. All of the product candidates that we are currently developing will require extensive clinical testing before we can submit any regulatory application for their commercial use.

Our product development efforts may ultimately fail.

Our product candidates are subject to the risks of failure inherent in the development of pharmaceutical products. These risks include the following:

- •

- some of our product candidates may be found to be unsafe or ineffective, or may fail to receive the necessary regulatory

clearances in a timely manner, if at all;

- •

- even if safe and effective, our product candidates may be difficult to manufacture on a large scale or may be uneconomical

to market;

- •

- the proprietary rights of third parties may preclude us from marketing such products; and

- •

- third parties may market more effective or less costly products for treatment of the same diseases.

As a result, we cannot be certain that any of our products will be successfully developed, receive required governmental approvals on a timely basis, become commercially viable or achieve market acceptance.

Before we can seek regulatory approval of any of our product candidates, we must complete clinical trials, which are expensive and have uncertain outcomes.

All of our product candidates will require the commitment of substantial resources and regulatory approval. Before obtaining regulatory approvals for the commercial sale of any of our product candidates, we must demonstrate through non-clinical testing and clinical trials that our product candidates are safe and effective for use in humans.

We have a portfolio of cancer drugs in various stages of development. We are currently conducting clinical trials on our products amuvatinib and SGI-1776, and we expect to commence new clinical trials from time to time in the course of our business as our product development work continues. Conducting clinical trials is a lengthy, time consuming and expensive process and the results are inherently uncertain. We have incurred and will continue to incur substantial expense for, and we have devoted and expect to continue to devote a significant amount of time to, non-clinical testing and clinical trials. However, regulatory authorities may not permit us to undertake any additional clinical trials for our product candidates. If we are unable to complete our clinical trials, our business will be severely harmed and the price of our stock will likely decline.

We also have ongoing research and non-clinical projects that may lead to product candidates, but we have not begun clinical trials for these projects. If we do not successfully complete our non-clinical trials, we might not be able to commence clinical trials as planned.

19

Our clinical trials may be delayed or terminated, which would prevent us from seeking necessary regulatory approvals.

Completion of clinical trials may take several years or more. The length of a clinical trial varies substantially according to the type, complexity, novelty and intended use of the product candidate. The length of time and complexity of these studies make statistical analysis difficult and regulatory approval unpredictable. The commencement and rate of completion of our clinical trials may be delayed by many factors, including:

- •

- ineffectiveness of the study compound, or perceptions by physicians that the compound is not effective for a particular

indication;

- •

- inability to manufacture sufficient quantities of compounds for use in clinical trials;

- •

- inability to obtain FDA approval of our clinical trial protocols;

- •

- slower than expected rate of patient recruitment;

- •

- inability to adequately follow patients after treatment;

- •

- difficulty in managing multiple clinical sites;

- •

- unforeseen safety issues;

- •

- lack of efficacy demonstrated during the clinical trials; or

- •

- governmental or regulatory delays.