Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2009

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 0-8082

LHC GROUP, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 71-0918189 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

420 West Pinhook Rd, Suite A

Lafayette, Louisiana 70503

(Address of principal executive offices)

(337) 233-1307

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Common Stock, par value $.01 per share | NASDAQ Global Select Market | |

| (Title of each class) | (Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Exchange Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by checkmark whether the registrant has submitted electronically and posted on its corporate Web site, in any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

As of June 30, 2009, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $354.3 million based on the closing sale price as reported on the NASDAQ Global Select Market. For purposes of this determination shares beneficially owned by officers, directors and ten percent shareholders have been excluded, which does not constitute a determination that such persons are affiliates.

There were 18,597,579 shares of common stock, $.01 par value, issued and outstanding as of March 8, 2010.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Annual Report to stockholders for the fiscal year ended December 31, 2009 are incorporated by reference in Part II of this Annual Report on Form 10-K. Portions of the Registrant’s Proxy Statement for its 2010 Annual Meeting of Stockholders are incorporated by reference in Part III of this Annual Report on Form 10-K.

Table of Contents

TABLE OF CONTENTS

2

Table of Contents

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K and the information incorporated by reference herein, contain certain statements and information that may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”). Forward-looking statements relate to future plans and strategies, anticipated events or trends, future financial performance and expectations and beliefs concerning matters that are not historical facts or that necessarily depend upon future events. The words “may,” “will,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “believe,” “foresee,” “estimate,” “predict,” “potential,” “intend” and similar expressions are intended to identify forward-looking statements. Specifically, this Annual Report on Form 10-K contains, among others, forward-looking statements about:

| • | our expectations regarding financial condition or results of operations for periods after December 31, 2009; |

| • | our critical accounting policies; |

| • | our business strategies and our ability to grow our business; |

| • | our participation in the Medicare and Medicaid programs; |

| • | the reimbursement levels of Medicare and other third-party payors; |

| • | the prompt receipt of payments from Medicare and other third-party payors; |

| • | our future sources of and needs for liquidity and capital resources; |

| • | the effect of any changes in market rates on our operating and cash flows; |

| • | our ability to obtain financing; |

| • | our ability to make payments as they become due; |

| • | the outcomes of various routine and non-routine governmental reviews, audits and investigations; |

| • | our expansion strategy, the successful integration of recent acquisitions and, if necessary, the ability to relocate or restructure our current facilities; |

| • | the value of our propriety technology; |

| • | the impact of legal proceedings; |

| • | our insurance coverage; |

| • | the costs of medical supplies; |

| • | our competitors and our competitive advantages; |

| • | our ability to attract and retain valuable employees; |

| • | the price of our stock; |

| • | our compliance with environmental, health and safety laws and regulations; |

| • | our compliance with health care laws and regulations; |

3

Table of Contents

| • | our compliance with Securities and Exchange Commission laws and regulations and Sarbanes-Oxley requirements; |

| • | the impact of federal and state government regulation on our business; and |

| • | the impact of changes in or future interpretations of fraud, anti-kickback or other laws. |

The forward-looking statements included in this report reflect our current views and assumptions only as of the date this report is filed with the Securities and Exchange Commission. Except as required by law, we assume no responsibility and do not intend to release updates or revisions to forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise. The occurrence of any of the events described in Part I, Item 1A, Risk Factors in this Annual Report on Form 10-K or incorporated by reference into this Annual Report on Form 10-K, and other events that we have not predicted or assessed could have a material adverse effect on our earnings, financial condition and business, and any such forward-looking statements should not be relied on as a prediction of future events. Many factors, beyond our ability to control or predict could cause actual results or achievements to materially differ from any future results or achievements expressed in or implied by our forward-looking statements.

We qualify all of our forward-looking statements by these cautionary statements. In addition, with respect to all of our forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

You should read this Annual Report on Form 10-K, the information incorporated by reference into this Annual Report on Form 10-K and the documents filed as exhibits to this Annual Report on Form 10-K completely and with the understanding that our actual future results or achievements may differ materially from what we expect or anticipate.

Unless otherwise indicated, “LHC Group,” “we,” “us,” “our” and “the Company” refer to LHC Group, Inc. and its consolidated subsidiaries.

| Item 1. | Business. |

Overview

We provide post-acute health care services to patients through our home nursing agencies, hospices and long-term acute care hospitals (“LTACHs”). Through our wholly and majority owned subsidiaries, equity joint ventures and controlled affiliates, we currently operate in Alabama, Arkansas, Florida, Georgia, Kentucky, Louisiana, Maryland, Mississippi, Missouri, North Carolina, Ohio, Oklahoma, Oregon, Tennessee, Texas, Virginia, West Virginia, and Washington. We operate in two segments: home-based services and facility-based services. As of December 31, 2009, we owned and operated 264 home-based service locations, with 230 home nursing agency locations, 21 hospices, two diabetes management companies, three specialty agencies and four private duty agencies. As of December 31, 2009, we also managed the operations of four home nursing agencies in which we do not have an ownership interest. Our facility-based services included five long-term acute care hospitals with eight locations, a pharmacy, one medical equipment location and a family health center. We also managed the operations of one inpatient rehabilitation facility and an LTACH in which we have no ownership interest.

We provide home-based post-acute health care services through our home nursing agencies and hospices. Our home nursing locations offer a wide range of services, including skilled nursing, medically-oriented social services and physical, occupational and speech therapy. The nurses, home health aides and therapists in our home nursing agencies work closely with patients and their families to design and implement individualized treatments in accordance with a physician-prescribed plan of care. Our hospices provide end-of-life care to patients with terminal illnesses through interdisciplinary teams of physicians, nurses, home health aides, counselors and volunteers. Of the 264 home-based services locations, 139 are wholly-owned by us, 113 are majority-owned or controlled by us through joint ventures, eight are operated through license lease arrangements, and we manage the operations of four home nursing agencies in which we have no ownership interest.

Our LTACH locations, seven of which are located within host hospitals, provide services primarily to patients with complex medical conditions who have transitioned out of a hospital intensive care unit but whose conditions

4

Table of Contents

remain too severe for treatment in a non-acute setting. As of December 31, 2009, our hospitals had 188 licensed beds. Of our 13 facility-based services locations, four are wholly-owned by us and seven are majority-owned or controlled by us through joint ventures and we manage the operations of two locations in which we have no ownership.

Our net service revenue by segment for the years ended December 31, 2009, 2008 and 2007 was as follows (amounts in thousands):

| Year Ended December 31, | |||||||||

| 2009 | 2008 | 2007 | |||||||

| Home-Based Services | $ | 469,470 | $ | 326,041 | $ | 244,107 | |||

| Facility-Based Services | 62,510 | 56,550 | 52,910 | ||||||

| Consolidated Net Service Revenue | $ | 531,980 | $ | 382,591 | $ | 297,017 | |||

Our founders began operations in September 1994 as St. Landry Home Health, Inc. in Palmetto, Louisiana. After several years of expansion, our founders reorganized their business and began operating as Louisiana Healthcare Group, Inc. in June 2000. In March 2001, Louisiana Healthcare Group, Inc. reorganized and became a wholly owned subsidiary of The Healthcare Group, Inc., a Louisiana business corporation. In December 2002, The Healthcare Group, Inc. merged into LHC Group, LLC, a Louisiana limited liability company, with LHC Group, LLC being the surviving entity. In January 2005, LHC Group, LLC established a wholly owned Delaware subsidiary, LHC Group, Inc. and on February 9, 2005, LHC Group, LLC merged into LHC Group, Inc., a Delaware corporation. Our principal executive offices are located at 420 West Pinhook Road, Suite A, Lafayette, Louisiana, 70503. Our telephone number is (337) 233-1307. Our website is www.lhcgroup.com; information contained on our website is not part of or incorporated by reference into this Annual Report on Form 10-K.

5

Table of Contents

Industry and Market Opportunity

According to Centers for Disease Control and Prevention (“CDC”), approximately 86% of the Medicare population has one chronic condition, 66% have two or more chronic conditions, and 40% have three or more chronic conditions. Chronic diseases, such as asthma, cancer, diabetes and heart disease, are the leading causes of death and disability in the United States and account for the vast majority of healthcare spending. They affect the quality of life for 133 million Americans and are responsible for seven out of every ten deaths in the U.S. – killing more than 1.7 million Americans every year. Chronic diseases are also the primary driver of healthcare costs – accounting for more than 75 cents of every dollar we spend on healthcare in this country, as reported by the CDC. In 2007, this amounted to $1.65 trillion of the $2.2 trillion spent on healthcare.

According to a study conducted by Avalere Health in 2009, Medicare patients with diabetes, chronic obstructive pulmonary disease, or congestive heart failure that used home healthcare within 3 months of being discharged from a hospital cost the program $1.7 billion less and had 24,000 fewer re-hospitalizations than similar patients that used other forms of post-acute care over a two-year period. The analysis also found that if cumulated to the full set of Medicare beneficiaries in the study group that utilized other forms of post-acute care, the program would have saved an additional $1.7 billion. About 8.9% of Medicare fee-for-service beneficiaries currently use home health services. Based on this Avalere report and the ever rising costs of treating chronic illness, we believe there is a significant opportunity for home health to serve an expanded role in the treatment of chronic disease.

In addition to the opportunity for home care to serve an expanded role in the treatment of chronic disease, we believe there is significant opportunity for growth in the home care industry that will be driven by:

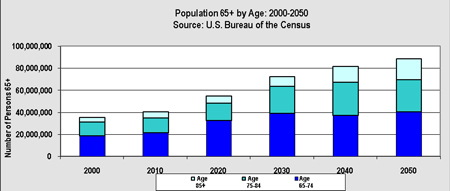

| • | a U.S. population that is getting older and living longer. According to the U.S. Bureau of the Census, the population 65 and older will increase from 35 million people in 2000 to a projected to 88.5 million in 2050. |

| • | patient preference for less restrictive care settings; |

| • | incentives for general acute care hospitals to discharge patients into less intensive treatment settings as quickly as medically appropriate; |

| • | higher incidences of chronic conditions and disease; and |

| • | a continued movement of institutionalized people into home- and community-based care. |

We also believe our post-acute service provides valuable alternatives to an underserved, rural patient population. According to the National Rural Health Association (“NRHA”), rural areas have a higher percentage of residents over the age of 65, who accounted for 18.0% of the total population in rural markets compared to 15.0% in urban

6

Table of Contents

markets. Additionally, according to NRHA, rural areas typically do not offer the range of post-acute health care services that are available in urban or suburban markets. As such, patients in rural markets face challenges in accessing health care in a convenient and appropriate setting. For example, NRHA estimates that although approximately 25% of Americans live in rural areas, less than 10% of the nation’s physicians practice in rural areas. According to NRHA, individuals in rural areas may also have difficulty reaching health care facilities due to greater travel time or a lack of public transportation. The economic characteristics and population dispersion of rural markets also make these markets less attractive to health maintenance organizations and other managed care payors. Government studies cited by NRHA have shown rural residents also tend to have more health complications than urban residents. Additionally, NRHA has noted that residents in rural areas are less likely to use preventive screening services and have a higher prevalence of disabilities, heart disease, cancer, diabetes and other chronic conditions when compared to urban residents. At December 31, 2009, 50% of our patient population lives in rural areas as designated by the Core Based Statistical Area (“CBSA”) population classification by the U.S. Office of Management and Budget (“OMB”).

We believe we are well positioned to build and maintain long-term relationships with local hospitals, physicians and other health care providers and to become the highest quality post-acute provider in our markets. In our experience, because most rural areas have the population size to support only one or two general acute care hospitals, the local hospital often plays a significant role in rural market health care delivery systems. Rural patients who require home nursing frequently receive care from a small home care agency or an agency that, while owned and run by the hospital, is not an area of focus for that hospital. Similarly, patients in these markets who require services typically offered by long-term acute care hospitals are more likely to remain in the community hospital because it is often the only local facility equipped to deal with severe, complex medical conditions. By entering these markets through affiliations with local hospitals, competition for the services we provide is minimal.

Business Strategy

Our objective is to become the leading provider of post-acute services to Medicare beneficiaries in the United States. To achieve this objective, we intend to:

Drive internal growth in existing markets. We intend to drive internal growth in our current markets by increasing the number of health care providers in each market from whom we receive referrals and by expanding the breadth of our services. We intend to achieve this growth by: (1) continuing to educate health care providers about the benefits of our services; (2) reinforcing the position of our agencies and facilities as community assets; (3) maintaining our emphasis on high-quality medical care for our patients; and (4) providing a superior work environment for our employees.

Achieve margin improvement through the active management of costs. The majority of our net service revenue is generated under Medicare prospective payment systems (“PPS”) through which we are paid pre-determined rates based upon the clinical condition and severity of the patients in our care. Because our profitability in a fixed payment system depends upon our ability to manage the costs of providing care, we continue to pursue initiatives to improve our margins and net income.

Expand into new markets. We intend to continue expanding into new markets by developing de novo locations and by acquiring existing Medicare-certified home nursing agencies in attractive markets throughout the United States. We will continue our unique strategy of partnering with non-profit hospitals in home health services, as these ventures provide significant return on investment. We also plan to look to acquire larger freestanding agencies that can serve as growth platforms in markets we do not currently serve, in order to support our growth into new states.

Pursue strategic acquisitions. We will continue to identify and evaluate opportunities for strategic acquisitions in new and existing markets that will enhance our market position, increase our referral base and expand the breadth of services we offer.

Develop joint ventures. We endeavor to joint venture with hospitals to provide post-acute services, such as home health and hospice services in communities served by hospitals already operating Medicare- certified home health agencies.

7

Table of Contents

Services

We provide post-acute care services in the United States by providing quality cost-effective health care services to patients within the comfort and privacy of their home or place of residence. Our services can be broadly classified into two principal categories: (1) home-based services offered through our home nursing agencies and hospices; and (2) facility-based services offered through our long-term acute care hospitals and inpatient rehabilitation facility.

Home-Based Services

Home Nursing. Our registered and licensed practical nurses provide a variety of medically necessary services to homebound patients who are suffering from acute or chronic illness, recovering from injury or surgery, or who otherwise require care, teaching or monitoring. These services include wound care and dressing changes, cardiac rehabilitation, infusion therapy, pain management, pharmaceutical administration, skilled observation and assessment and patient education. We have also designed guidelines to treat chronic diseases and conditions, including diabetes, hypertension, arthritis, Alzheimer’s disease, low vision, spinal stenosis, Parkinson’s disease, osteoporosis, complex wound care and chronic pain. Our home health aides provide assistance with daily living activities such as light housekeeping, simple meal preparation, medication management, bathing and walking. Through our medical social workers, we counsel patients and their families with regard to financial, personal and social concerns that arise from a patient’s health-related problems. We provide skilled nursing, ventilator and tracheotomy services, extended care specialties, medication administration and management and patient and family assistance and education. We also provide management services to third-party home nursing agencies, often as an interim solution until proper state and regulatory approvals for an acquisition can be obtained.

Our physical, occupational and speech therapists provide therapy services to patients in their home. Our therapists coordinate multi-disciplinary treatment plans with physicians, nurses and social workers to restore basic mobility skills such as getting out of bed and walking safely with crutches or a walker. As part of the treatment and rehabilitation process, a therapist will stretch and strengthen muscles, test balance and coordination abilities and teach home exercise programs. Our therapists assist patients and their families with improving and maintaining a patient’s ability to perform functional activities of daily living, such as the ability to dress, cook, clean and manage other activities safely in the home environment. Our speech and language therapists provide corrective and rehabilitative treatment to patients who suffer from physical or cognitive deficits or disorders that create difficulty with verbal communication or swallowing.

All of our home nursing agencies offer 24-hour personal emergency response and support services through Philips Lifeline (“Lifeline”) for qualified patients who require close medical monitoring but who want to maintain an independent lifestyle. These services consist principally of a communicator that connects to the telephone line in the subscriber’s home and a personal help button that is worn or carried by the individual subscriber, which when activated, initiates a telephone call from the subscriber’s communicator to Lifeline’s central monitoring facilities. Lifeline’s trained personnel identify the nature and extent of the subscriber’s particular need and notify the subscriber’s family members, neighbors and/or emergency personnel, as needed. We believe our use of the Lifeline system increases patient satisfaction and loyalty by providing our patients a point of contact between scheduled nursing visits. As a result, we provide a more complete regimen of care management than our competitors in the markets in which we operate by offering this service to qualified patients as part of their home health plan of care.

Hospice. Our Medicare-certified hospice operations provide a full range of hospice services designed to meet the individual physical, spiritual and psychosocial needs of terminally ill patients and their families. Our hospice services are primarily provided in a patient’s home but can also be provided in a nursing home, assisted living facility or hospital. Key services provided include pain and symptom management accompanied by palliative medication, emotional and spiritual support, spiritual counseling and family bereavement counseling, inpatient and respite care, homemaker services, dietary counseling and social worker visits for up to 13 months after a patient’s death.

Facility-Based Services

Long-term Acute Care Hospitals. Our LTACHs treat patients with severe medical conditions who require a high-level of care and frequent monitoring by physicians and other clinical personnel. Patients who receive our services in an LTACH are too medically unstable to be treated in a non-acute setting. Examples of these medical conditions include respiratory failure, neuromuscular disorders, cardiac disorders, non-healing wounds, renal disorders, cancer, head and neck injuries and mental disorders. These impairments often are associated with accidents, strokes, heart attacks and other serious medical conditions. We also treat patients diagnosed with musculoskeletal impairments that restrict their ability to perform normal activities of daily living. As part of our facility-based services, we operate an institutional pharmacy, which focuses on providing a full array of services to our long-term acute care hospitals and inpatient rehabilitation facility.

8

Table of Contents

Rehabilitation Services. In our facilities and through our contractual relationships, we provide physical, occupational and speech rehabilitation services. We also provide certain specialized services such as hand therapy or sports performance enhancement to treat sports and work related injuries, musculoskeletal disorders, chronic or acute pain and orthopedic conditions. Our patients are often diagnosed with musculoskeletal impairments that restrict their ability to perform normal activities of daily living. These impairments are often associated with accidents, sports injuries, strokes, heart attacks and other medical conditions. Our rehabilitation services are designed to help these patients minimize physical and cognitive impairments and maximize functional ability. We also design services to prevent short-term disabilities from becoming chronic conditions. Our rehabilitation services are provided by our physical, occupational and respiratory therapists and speech-language pathologists. We also provide management services to one inpatient rehabilitation facility and operate one health and wellness center.

Operations

Financial information relating to the home- and facility- based segments of our business is found in Note 11 to the Consolidated Financial Statements included in this Annual Report on Form 10-K. All of our operations are based in the United States.

Home-Based Services

Each of our home nursing agencies is staffed with experienced clinical home health professionals who provide a wide range of patient care services. Our home nursing agencies are managed by a Director of Nursing or Branch Manager who is also a licensed registered nurse. Our Directors of Nursing and Branch Managers are overseen by State Directors who report to Division Vice Presidents. The Senior Vice President of Home Health Operations is accountable for the oversight of the Division Vice Presidents and directly reports to the Chief Operating Officer of the Company. Our patient care operating model for our home nursing agencies is structured on a base model that requires a Medicare patient minimum census of 50 patients. At the base model level, one registered nurse is responsible for all aspects of the management of each patient’s plan of care. A home nursing agency based on this model is staffed with an office manager, a field-registered nurse, a field-licensed professional nurse and a home health aide. We also contract with local community therapists and other clinicians, as appropriate, to provide additional required services. As the size and patient census of a particular home nursing agency grows, these staffing patterns are increased appropriately.

Our home nursing agencies use our Service Value Point system, a proprietary clinical resource allocation model and cost management system. The system is a quantitative tool that assigns a target level of resource units to a group of patients based upon their initial assessment and estimated skilled nursing and therapy needs. The Service Value Point system allows the Director of Nursing or Branch Manager to allocate adequate resources throughout the group of patients assigned to his or her care, rather than focusing on the profitability of an individual patient.

Patient care is handled at the home nursing agency level. Functions that are centralized into the home office include payroll, accounting, financial reporting, billing, collections, regulatory and legal compliance, risk management, pharmacy, information technology and general clinical oversight accomplished by periodic on-site surveys. Each of our home nursing agencies is licensed and certified by the state and federal governments, and 119 agencies are accredited by the Joint Commission, a nationwide commission that establishes standards relating to the physical plant, administration, quality of patient care and operation of medical staffs of hospitals. Those not yet accredited are working towards achieving this accreditation, a process which can take up to six months. By the end of 2010, we expect to have an additional 219 agencies accredited by the Joint Commission.

Facility-Based Services

Long-Term Acute Care Hospitals. Each of our LTACH locations is managed by a Hospital Administrator, while the clinical operations are directed by a Director of Nursing who is a licensed registered nurse. The individual Hospital Administrators are responsible for managing the day-to-day operating activities of the hospital within appropriate budgetary constraints. Each Hospital Administrator reports to the Senior Vice President of Facility-Based Services. Each Director of Nursing reports directly to his or her respective hospital administrator as well as indirectly to our Director of Clinical Services responsible for the oversight of the quality of patient care services. The medical management of each patient is overseen by a Medical Director who is responsible for ensuring the appropriateness of admissions, as well as leading weekly patient care conferences.

9

Table of Contents

Our facility-based services follow a clinical approach under which each patient is discussed in weekly, multidisciplinary team meetings. In these meetings, patient progress is assessed, compared to goals and future goals are set. We believe that this model results in higher quality care, predictable discharge patterns and the avoidance of unnecessary delays.

All coding, medical records, human resources, case management, utilization review and medical staff credentialing are provided at the hospital level. Centralized functions that are provided by the home office include payroll, accounting, financial reporting, billing, collections, regulatory and legal compliance, risk management, pharmacy, information technology and general clinical oversight accomplished by periodic on-site surveys.

Rehabilitation Services. Our rehabilitation services are overseen by an administrator, who is a licensed physical therapist.

As with our LTACHs, all coding, medical records, human resources, charge/data entry, front end collections and marketing for our rehabilitation centers are provided at the individual center level. Centralized functions provided by the home office include payroll, accounting, financial reporting, billing, collections, regulatory and legal compliance, risk management, information technology and general clinical oversight accomplished by periodic on-site surveys.

Joint Ventures

As of December 31, 2009, we had 63 joint venture agreements for 120 of our agencies.

| Type of Services |

||

| Home Nursing Agencies |

105 | |

| Hospice |

8 | |

| LTACH |

7 | |

| 120 |

Our joint ventures are structured either as equity joint ventures or agency leasing arrangements, as permitted by applicable state laws and subject to business considerations. As of December 31, 2009, we had 63 equity joint ventures and four agency leasing arrangements. Of the 63 equity joint ventures, we have joint ventured with 55 hospitals, with physicians on four and with other parties on the remaining four. With respect to our four joint ventures with physicians, three involve the ownership and operation of LTACHs and one involves the ownership of a rural home nursing agency.

Equity Joint Ventures

As of December 31, 2009, we have 63 equity joint ventures for the ownership and operation of home nursing agencies, hospices, and LTACHs. Our equity joint ventures are structured as limited liability companies in which we own a majority equity interest and our partners own a minority equity interest ranging from 1% to 49%. At the time of formation, we and our partners each contribute capital to the equity joint venture in the form of cash or property. We believe that the amount contributed by each party to the equity joint venture represents their pro rata portion of the fair market value of the equity joint venture. None of our partners are required to make or influence referrals to our equity joint ventures. In fact, each of our hospital joint venture partners must follow the same Medicare discharge planning regulations, which, among other things, requires them to offer each Medicare patient a list of available Medicare-certified home nursing agency options and to allow the patient to choose his or her own provider.

We serve as the manager for our equity joint ventures and oversee their day-to-day operations. From a governance perspective, our equity joint ventures are either manager-managed or board managed. In our manager-managed joint ventures, we are designated as the manager, and, in our board managed joint ventures, we hold a majority of the votes required to take action. We possess a majority of the total votes available to be cast by the members of the management committee. However, in three of these joint ventures where we have partnered with not-for-profit hospitals, the hospital controls a majority

10

Table of Contents

of the total management committee votes. In such instances we possess the right to withdraw from the equity joint venture at any time upon notice to our partner in exchange for the receipt of a payment in an amount calculated in accordance with a predetermined fair market value formula. The members of our equity joint ventures participate in profits and losses in proportion to their equity interests. Distributions from our equity joint ventures are made pro-rata based on percentage ownership interests and are not based on referrals made to the equity joint venture by any of the members.

The 63 equity joint ventures individually contribute between 0.1% and 6.0% of our total net service revenue and only two of the equity joint ventures account for greater than 5.0% of our total net service revenue for the 12 months ended December 31, 2009. Extended Care Hospital of Lafayette, LLC, a LTACH in which we own 87.3% of the membership interests, contributed 5.0% to net service revenue, for the year ended December 31, 2009. Mississippi HomeCare of Jackson, LLC, in which we have a 66.67% ownership interest, contributed 6.0% to our consolidated net service revenue for the year ended December 31, 2009. This joint venture was converted from a license lease arrangement (discussed below) to an equity joint venture in October 2007.

Several of our equity joint ventures include a buy/sell option that grants to us and our joint venture partners the right to require the other joint venture party to either purchase all of the exercising member’s membership interests or sell to the exercising member all of the non-exercising member’s membership interests, at the non-exercising member’s option, within 30 days of the receipt of notice of the exercise of the buy/sell option. In some instances, the purchase price under these buy/sell provisions is based on a multiple of the historical or future earnings before income taxes, depreciation and amortization of the equity joint venture at the time the buy/sell option is exercised. In other instances, the buy/sell purchase price will be negotiated by the partners but will be subject to a fair market valuation process.

License Leasing Agreements

As of December 31, 2009, we have four agreements to lease, through our wholly-owned subsidiaries, the right to use the home health licenses necessary to operate five of our home nursing agencies and three hospice agencies. These leases are entered into in instances when state law would otherwise prohibit the alienation and sale of home nursing agencies. The table below details the monthly fees and termination dates of the leasing agreements. Two of the agreements are based on net quarterly projections with a cap of $160,000 per year.

| 2009 Current Monthly Fee |

Increase in Monthly Fee |

Initial Term Dates | ||

| Based on net quarterly projections with a cap of $160,000. | None |

2010 with a 5 year automatic renewal | ||

| $16,000 | 5% increase every three years | 2017 with a 2 year automatic renewal | ||

| $5,000 | Renegotiated after five years (2013) | 2017 with a 5 year automatic renewal |

In all four leasing arrangements, we have a right of first refusal in the event that the lessor intends to sell the leased agency to a third party.

Management Services Agreements

As of December 31, 2009, we have six management services agreements under which we manage the operations of four home nursing agencies, an inpatient rehabilitation facility and one LTACH, which we entered into in 2009. We currently have no ownership interest in the agencies and facilities subject to these management services agreements. As described in the agreements we provide billing, management and other consulting services suited to and designed for the efficient operation of the applicable home nursing agency, inpatient rehabilitation facility or LTACH. We are responsible for the costs associated with the locations and personnel required for the provision of services. We are compensated through one arrangement based on a percentage of cash collections, a flat fee on another arrangement and reimbursed for operating expenses and compensated based on a percentage of operating net income for the remaining two arrangements. The term of these arrangements is typically five years, with an option to renew for an additional five-year term. The termination dates for our management services agreements range from August 31, 2010 to August 31, 2014.

We record management services revenue as services are provided in accordance with the various management services agreements.

11

Table of Contents

Competition

The home health care market is highly fragmented. According to MedPac, there were approximately 10,000 Medicare-certified home nursing agencies in the United States in 2009, of which approximately 32% were hospital-based or not-for-profit, freestanding agencies. MedPAC estimates that 19% of these home nursing agencies are located in rural markets. Although there are a small number of public home nursing companies with significant home nursing operations, they generally do not compete with us in the rural markets that we currently serve. As we expand into new markets, we may encounter public companies that have greater resources or greater access to capital. Competition in our markets comes primarily from small local and regional providers. These providers include facility- and hospital-based providers, visiting nurse associations and nurse registries. We are unaware of any competitor offering our breadth of services and focusing on the needs of rural markets.

We have also entered into various joint ventures with nonprofit hospitals for the ownership and management of home nursing agencies and LTACHs. We are unaware of any competitor with this type of ownership mix.

Although several public and private national and regional companies own or manage long-term acute care hospitals, they generally do not operate in the rural markets that we serve. Generally, the competition in our markets comes from local health care providers. We believe our principal competitive advantages over these local providers are our diverse service offerings, our collaborative approach to working with health care providers, our focus on rural markets and our patient-oriented operating model.

Quality Control

In March 2008, we established the LHC Group Quality Council (“The Council”). The Council is responsible for formulating quality of care indicators, identifying performance improvement priorities, and facilitating best-practices for quality care. As part of this council, we adopted the Plan, Do, Check, Act methodology. We also set forth a quality platform for home care that reviews the following:

| • | performance improvement audits; |

| • | joint commission; |

| • | state and regulatory surveys; |

| • | home health compare; and |

| • | patient perception of care. |

The Council also has the responsibility to ensure that the infrastructure of the quality initiatives throughout the Company is appropriate, to oversee and evaluate the effectiveness of the quality plans and initiatives and to recommend appropriate quality and performance improvement initiatives.

In 2009, we established the Clinical Quality Committee of the Board of Directors (“The Committee”). The Committee is responsible for advising the Company’s clinical leadership, monitoring the performance of our locations based on internal and external benchmarks, overseeing and evaluating the effectiveness of the performance improvement and quality plans, facilitating best-practices based on internal and external comparisons and fostering enhanced awareness of clinical performance by the Board of Directors.

We have approximately 48 Performance Improvement Coordinators and 20 Performance Improvement Assistants that are all trained using a performance improvement specific orientation program and mentorship.

As part of our ongoing quality control, internal auditing and monitoring programs, we conduct internal regulatory audits and mock surveys at each of our agencies and facilities at least once a year. If an agency or facility does not achieve a satisfactory rating, we require that it prepare and implement a plan of correction. We then follow-up to verify that all deficiencies identified in the initial audit and survey have been corrected.

As required under the Medicare conditions of participation, we have a continuous quality improvement program, which involves:

| • | ongoing education of staff and quarterly continuous quality improvement meetings at each of our agencies and facilities and at our home office; |

12

Table of Contents

| • | monthly comprehensive audits of patient charts performed at each of our agencies and facilities; |

| • | at least annually, a comprehensive audit of patient charts performed on each of our agencies and facilities by our home office staff; |

| • | review of Home Health Compare scores; |

| • | assessment of patient’s perception of care using Press Ganey exit survey; and |

| • | assessment of infection control practices and risk events. |

If an agency or facility fails to achieve a satisfactory rating on a patient chart audit, we require that it prepare and implement a plan of correction.

We continually expand and refine our quality improvement programs. Specific written policies, procedures, training and educational materials and programs, as well as auditing and monitoring activities, have been prepared and implemented to address the functional and operational aspects of our business. Our programs also address specific problem areas identified through regulatory interpretation and enforcement activities. We believe our consistent focus on continuous quality improvement programs provide us with a competitive advantage in the market.

Compliance

We have established and maintain a comprehensive corporate compliance program that is designed to assist all of our employees to meet or exceed applicable standards established by federal and state laws and regulations and industry practice. Although we first established our corporate compliance program in 1996, in 2009 we redesigned and enhanced several aspects of our corporate compliance program. Our 2009 redesign and enhancement involved several initiatives to further our goal of fostering and maintaining the highest standards of compliance, ethics, integrity and professionalism in every aspect of our business dealings.

The purpose of our corporate compliance program is to focus on compliance with applicable legal and regulatory requirements; the requirements of the Medicare and Medicaid programs and other government healthcare programs; industry standards; our Code of Conduct and Ethics; and our policies and procedures that support and enhance overall compliance within our company. The primary focus of our corporate compliance program is on regulations related to the federal False Claims Act, Stark Law, Anti-Kickback Law, billing and overall adherence to health care regulations.

To ensure the independence of our compliance department staff, the following measures have been implemented:

| • | our Chief Compliance Officer reports has direct oversight by the Audit Committee of our Board of Directors; |

| • | the compliance department has its own operating budget; and |

| • | the compliance department has the authority to independently investigate any compliance or ethical concerns, including, when deemed necessary, the authority to interview any company personnel, access any company property (including electronic communications) and engage counsel to assist in any investigation. |

Among other activities, our compliance department staff is responsible for the following activities:

| • | drafting and revising company policies and procedures related to compliance and ethics issues; |

| • | reviewing, making recommended revisions to, disseminating and tracking attestations to our Code of Conduct and Ethics; |

| • | measuring compliance with our policies and procedures, Code of Conduct and Ethics and legal and regulatory requirements related to the Medicare and Medicaid programs and other government healthcare programs, laws and regulations; |

| • | developing and providing compliance-related training and education to all of our employees and, as appropriate, directors, contractors and other representatives and agents, including, new-hire compliance training for all new employees, annual compliance training for all employees, sales compliance training to all members of our sales team, billing compliance training to all members of our billing and revenue cycle team and other job-specific and role-based compliance training of certain employees; |

13

Table of Contents

| • | performing an annual company-wide risk assessment; |

| • | implementing an annual compliance auditing and monitoring work plan and performing and following up on various risk-based auditing and monitoring activities, including both clinical and non-clinical auditing and monitoring activities at the corporate level and at the local agency/facility level; |

| • | developing, implementing and overseeing our Health Insurance Portability and Accountability Act of 1996 (“HIPAA”) privacy compliance program; |

| • | monitoring, responding to and overseeing the resolution of issues and concerns raised through our anonymous compliance hotline; |

| • | monitoring, responding to and resolving all compliance and ethics-related issues and concerns raised through any other form of communication; and |

| • | ensuring that we take appropriate corrective and disciplinary action when noncompliant or improper conduct is identified. |

Our Chief Compliance Officer is a member of and meets with and provides a weekly report on our compliance initiatives, investigations and other activities to our Senior Management team. We have also developed a corporate compliance committee that is chaired by our Chief Compliance Officer and also includes our Chief Executive Officer, Chief Operating Officer, Chief Financial Officer, General Counsel, Chief Corporate Development Officer, Chief Administrative Officer, Senior Counsel of Legislative and Regulatory Affairs, VP of Quality and Performance Improvement, VP of Corporate Education, Associate General Counsel, Director of Revenue Cycle, Director of Internal Audit and Director of Financial Reporting. Our corporate compliance committee meets on a quarterly basis or as called by the Chief Compliance Officer to establish the agenda for compliance initiatives and review the status of compliance initiatives, investigations and other activities, as well as the operations of our Compliance Department. Our Chief Compliance Officer also meets with and provides a quarterly report on our compliance initiatives, investigations and other activities to the Audit Committee of our Board of Directors.

All employees are required to report incidents, issues or other concerns that they believe in good faith may be in violation of our Code of Conduct and Ethics, our policies and procedures, applicable legal and regulatory requirements or the requirements of the Medicare and Medicaid programs and other government healthcare programs. All employees are encouraged to either contact our Chief Compliance Officer directly or to contact our 24-hour toll-free compliance hotline when they have questions or concerns about any compliance or ethics issues. All reports to our compliance hotline are kept confidential to the extent allowed by law, and employees have the option to remain anonymous. In cases reported to our compliance hotline that involve a compliance or ethics issue or any possible violation of law or regulation, the matter is referred to the compliance department for investigation. Retaliation against employees in connection with reporting compliance or ethical concerns is considered a serious violation of our Code of Conduct and Ethics, and, if it occurs, it will result in discipline, up to and including termination of employment.

We continually expand and refine our compliance and ethics programs. We promote a culture of compliance, ethics, integrity and professionalism within our company through persistent messages from our senior leadership concerning the necessity of strict compliance with legal requirements and company policies and procedures. We believe our consistent focus on our compliance and ethics programs provide us with a competitive advantage in the markets we serve.

Technology and Intellectual Property

Our Service Value Point system is a proprietary information system that assists us in, among other things, monitoring use and other cost factors, supporting our health care management techniques, internal benchmarking, clinical analysis, outcomes monitoring and claims generation, revenue cycle management and revenue reporting. We were notified by the U.S. Patent and Trademark Office that the patent for our Service Value Points system was finalized during 2009. This proprietary home nursing clinical resource and cost management system is a quantitative tool that assigns a target level of resource units to each patient based upon his or her initial assessment and estimated skilled nursing and therapy needs. We designed this system to empower our direct care employees to make appropriate day-to-day clinical care decisions while also allowing us to manage the quality and delivery of care across our system and to monitor the cost of providing that care both on a patient-specific and agency-specific basis.

In addition to our Service Value Point system, our business is substantially dependent on non-proprietary software. We utilize a third-party software information system for billing and maintaining patient claim receivables

14

Table of Contents

for our LTACHs. Our various home nursing agency databases primarily utilize one billing and patient claim system. We have kept certain acquisitions on their legacy system where we determined it was more advantageous to do so and where we obtained expertise on the legacy system in the acquisition. Three such legacy systems are also utilized in our operations. By using these systems and the expertise obtained we maintain accuracy, reliability and efficiency of processing and management reporting.

Technology plays a key role in our organization’s ability to expand operations and maintain effective managerial control. The software we use is based on client-server technology and is highly scalable. We believe our software and systems are flexible, easy-to-use and allow us to accommodate growth without difficulty. We believe that building and enhancing our information and software systems provides us with a competitive advantage that allows us to grow our business in a more cost-efficient manner and results in better patient care.

We continue to implement, evaluate and refine our point of care (“POC”) roll out strategy and will be conducting beta tests on POC throughout 2010. We currently have 28 locations on POC. Compared to 5 years ago when 30%-40% of home health agencies and 5% of hospices utilized POC, today 65% of home health agencies and 30% of hospices utilize POC. POC tools now have predictive and disease management capabilities built in. Today, 55% of all Americans have broadband access at home, which is up from 47% in 2007, according to a July Pew Internet & American Life Project report. The study also found that 38% of rural Americans now have broadband at home, an increase of 23% from 2007. $7.2 billion of the $787 billion federal stimulus package is set aside to expand the reach of broadband to rural areas. This supports the increasing ability for real time transfer of information from the field to the office and presents a more compelling quality and efficiency return on investment.

Reimbursement

Medicare

The federal government’s Medicare program, governed by the Social Security Act of 1965, reimburses health care providers for services furnished to Medicare beneficiaries. These beneficiaries generally include persons age 65 and older and those who are chronically disabled. The program is primarily administered by the Department of Health and Human Services (“HHS”) and the Centers for Medicare & Medicaid Services (“CMS”). Medicare payments accounted for 81.7%, 83.2% and 81.7% of our net service revenue for the years ended December 31, 2009, 2008 and 2007, respectively. Medicare reimburses us based upon the setting in which we provide our services or the Medicare category in which those services fall.

Home Nursing. The Medicare home nursing benefit is available to patients who need care following discharge from a hospital, as well as patients who suffer from chronic conditions that require ongoing but intermittent care. The services received need not be rehabilitative or of a finite duration; however, patients who require full-time skilled nursing for an extended period of time generally do not qualify for Medicare home nursing benefits. As a condition of coverage under Medicare, beneficiaries must: (1) be homebound in that they are unable to leave their home without considerable effort; (2) require intermittent skilled nursing, physical therapy, or speech therapy services that are covered by Medicare; and (3) receive treatment under a plan of care that is established and periodically reviewed by a physician. Qualifying patients also may receive reimbursement for occupational therapy, medical social services and home health aide services if these additional services are part of a plan of care prescribed by a physician.

We receive a standard prospective Medicare payment for delivering care over a base 60-day period, referred to as an episode of care. There is no limit to the number of episodes a beneficiary may receive as long as he or she remains eligible. Most patients complete treatment within one payment episode. The base episode payment, established through federal legislation, is a flat rate that is adjusted upward or downward based upon differences in the expected resource needs of individual patients as indicated by clinical severity, functional severity and service utilization. The magnitude of the adjustment is determined by each patient’s categorization into one of 153 payment groups, known as home health resource groups and the costliness of care for patients in each group relative to the average patient. Our payment is further adjusted for differences in local prices using the hospital wage index. We bill and are reimbursed for services in two stages: an initial request for advance payment when the episode commences and a final claim when it is completed. We submit all Medicare claims through the Medicare Administrative Contractors for the federal government. We receive 60% of the estimated payment for a patient’s initial episode up-front (after the initial assessment is completed and upon initial billing) and the remaining 40% upon completion of the episode and after all final treatment orders are signed by the physician. In the event of subsequent episodes, reimbursement timing is 50% up-front and 50% upon completion of the episode.

15

Table of Contents

Final payments may reflect one of four retroactive adjustments to ensure the adequacy and effectiveness of the total reimbursement: (1) an outlier payment if the patient’s care was unusually costly; (2) a low utilization adjustment if the number of visits was fewer than five; (3) a partial payment if the patient transferred to another provider before completing the episode; or (4) a payment adjustment based upon the level of therapy services required in the population base. Because such adjustments are determined upon the completion date of the episode, retroactive adjustments could impact our financial results up to 60 days in advance of the effective date and recognition of the change.

We verify a patient’s eligibility for home health benefits at the time of admission. Through the verification process we are able to determine the payor source and eligibility for reimbursement of each patient. Accordingly, we do not have any material reimbursement amounts that are pending approval based on the eligibility of a patient to receive reimbursement from the applicable payor program. Further, we provide only limited services to patients who are ineligible for reimbursement from a third party payor. Therefore, we do not have any material reimbursement from patients who are self-pay.

The base payment rate for Medicare home nursing in 2009 was $2,272 per 60-day episode. Since the inception of the prospective payment system in October 2000, the base episode payment rate has varied due to both the impact of annual market-basket based increases and Medicare-related legislation. Home health payment rates are updated annually by either the full home health market basket percentage, or by the home health market basket percentage as adjusted by Congress. CMS establishes the home health market basket index, which measures inflation in the prices of an appropriate mix of goods and services included in home health services.

The Office of Inspector General (“OIG”) of HHS has a responsibility to report both to the Secretary of HHS and to Congress any program or management problems related to programs such as Medicare. The OIG’s duties are carried out through a nationwide network of audits, investigations and inspections. The OIG has recently undertaken a study with respect to Medicare reimbursement for home health services. No estimate can be made at this time regarding the impact, if any, of the OIG’s findings.

Hospice. In order for a Medicare beneficiary to qualify for the Medicare hospice benefit, two physicians must certify that, in the best judgment of the physician or medical director, the beneficiary has less than six months to live, assuming the beneficiary’s disease runs its normal course. In addition, the Medicare beneficiary must affirmatively elect hospice care and waive any rights to other Medicare benefits related to his or her terminal illness. For each benefit period, a physician must recertify that the Medicare beneficiary’s life expectancy is six months or less in order for the beneficiary to continue to qualify for and to receive the Medicare hospice benefit. The first two benefit periods are measured at 90-day intervals and subsequent benefit periods are measured at 60-day intervals. A Medicare beneficiary may revoke his or her election at any time and resume receiving traditional Medicare benefits. There is no limit on how long a Medicare beneficiary can receive hospice benefits and services, provided that the beneficiary continues to meet Medicare hospice eligibility criteria.

Medicare reimburses for hospice care using a prospective payment system. Under that system, we receive one of four predetermined daily or hourly rates based upon the level of care we furnish to the beneficiary. These rates are subject to annual adjustments based on inflation and geographic wage considerations. Our base Medicare rates depend upon which of the following four levels of care we provide:

| • | Routine Care. This level of care includes care that is not classified under any of the other levels of care, such as the work of social workers or home health aides. |

| • | General Inpatient Care. This level of care is available for pain control or acute or chronic symptom management that cannot be managed in a setting other than an inpatient Medicare certified facility, such as a hospital, skilled nursing facility or hospice inpatient facility. |

| • | Continuous Home Care. This level of care is provided when a patient is experiencing a medical crisis and requires nursing services to achieve palliation and symptom control. For services to qualify for this level of care, the agency must provide a minimum of eight hours of care within a 24-hour period. |

| • | Respite Care. This level of care is provided on a short-term, inpatient basis to give temporary relief to the person who regularly provides care to the patient. |

Medicare limits the reimbursement we may receive for inpatient care services of hospice patients. Under the “80-20 rule,” if the number of inpatient care days furnished by us to Medicare beneficiaries exceeds 20% of the total days of hospice care furnished by us to Medicare beneficiaries, Medicare payments to us for inpatient care days exceeding the inpatient cap will be reduced to the routine home care rate. This determination is made annually based

16

Table of Contents

on the 12-month period beginning on November 1st each year. This limit is computed on a program-by-program basis. Our hospices have not exceeded the cap on inpatient care services during 2008 or 2007. We have not received notification that any of our hospices have exceeded the cap on inpatient care services during 2009.

Our Medicare hospice reimbursement is also subject to a cap amount calculated by the Medicare fiscal intermediary at the end of the hospice cap period, which runs from November 1st through October 31st of the following year. We have not received notification that any of our hospices have exceeded the cap on per beneficiary limits during 2009.

The two caps include an inpatient cap and overall payment cap, detailed below:

| • | Inpatient Cap. This cap limits the number of days of inpatient care (both respite and general) under a provider number to 20% of the total number of days of hospice care (both inpatient and in-home) furnished to all patients served. The daily payment rate for any inpatient days of service in excess of the cap amount is calculated at the routine home care rate, with excess amounts due back to Medicare; and |

| • | Overall Payment Cap. This cap is calculated by the Medicare fiscal intermediary at the end of each hospice cap period to determine the maximum allowable payments per provider number. On a monthly and quarterly basis, we estimate our potential cap exposure using information available for both inpatient day limits as well as per beneficiary cap amounts. The total cap amount for each provider is calculated by multiplying the number of beneficiaries electing hospice care from September 28, 2008 to September 27, 2009 by a statutory amount that is indexed for inflation. The per beneficiary cap amount was $23,014 for the twelve-month period ended October 31, 2009 and $22,386 for the twelve month period ended October 31, 2008. There will be a cap liability if actual payments per the Provider Statistical and Reimbursement report for the period of November 1, 2008 to October 31, 2009 exceed the beneficiary cap amount. |

Long-term Acute Care Hospitals. All Medicare payments to our LTACHs are made in accordance with a prospective payment system specifically applicable to long term acute care hospitals, referred to as “LTACH-PPS.” Proposed rules specifically related to LTACHs are generally published in January, finalized in May and effective on July 1st of each year. Additionally, LTACHs are subject to annual updates to the rules related to the inpatient prospective payment system, or “IPPS,” that are typically proposed in May, finalized in August and effective on October 1st of each year. In the annual payment rate update for the 2009 fiscal year, CMS consolidated the two historical annual updates into one annual update. The final rule adopted a 15-month rate update for fiscal year 2009 and moves the LTACH-PPS from a July-June update cycle to an October-September cycle. Beginning fiscal year 2010 the LTACH rate year will begin October 1, coinciding with the start of the federal fiscal year.

August 2004 Final Rule. On August 11, 2004, CMS published final regulations applicable to LTACHs that are operated as “hospital within hospitals” or as “satellites.” We collectively refer to hospital within hospitals and satellites as “HwHs,” and we refer to the CMS final regulations as the “final regulations.” HwHs are separate hospitals located in space leased from, and located in or on the same campus of, another hospital. We refer to such other hospitals as “host” hospitals. Effective for hospital cost reporting periods beginning on or after October 1, 2004, subject to certain exceptions, the final regulations provide lower rates of reimbursement to HwHs for those Medicare patients admitted from their host hospitals that are in excess of a specified percentage threshold. For HwHs opened after October 1, 2004, the Medicare admissions threshold has been established at 25% except for HwHs located in rural areas or co-located with “MSA dominant” hospitals or single urban hospitals where the percentage is no more than 50%, nor less than 25%. For HwHs that met specified criteria and were in existence as of October 1, 2004, the Medicare admissions thresholds were to have been phased in over a four year period starting with hospital cost reporting periods that began on or after October 1, 2004. However, as described below, many of these changes have been postponed for a three year period by the Medicare, Medicaid, and SCHIP Extension Act of 2007, or “SCHIP Extension Act,” and further clarified in the American Recovery and Reinvestment Act of 2009, or “ARRA.”

May 2007 Final Rule. On May 11, 2007, CMS published its annual payment rate update for the 2008 LTACH-PPS rate year, or “RY 2008” (affecting discharges and cost reporting periods beginning on or after July 1, 2007 and before July 1, 2008). The May 2007 final rule made several changes to LTACH-PPS payment methodologies and amounts during RY 2008 although, as described below, many of these changes have been postponed for a three year period by the SCHIP Extension Act.

17

Table of Contents

For cost reporting periods beginning on or after July 1, 2007, the May 2007 final rule expanded the Medicare HWH admissions threshold to apply to Medicare patients admitted from any individual hospital. Previously, the admissions threshold was applicable only to Medicare HWH admissions from hospitals co-located with an LTACH or satellite of an LTACH. Under the May 2007 final rule, free-standing LTACHs and grandfathered HwHs would be subject to the Medicare admission thresholds, as well as HwHs and satellites that admit Medicare patients from non-co-located hospitals. To the extent that any LTACH’s or LTACH satellite facility’s discharges that are admitted from an individual hospital (regardless of whether the referring hospital is co-located with the LTACH or LTACH satellite) exceed the applicable percentage threshold during a particular cost reporting period, the payment rate for those discharges would be subject to a downward payment adjustment. Cases admitted in excess of the applicable threshold would be reimbursed at a rate comparable to that under general acute care IPPS, which is generally lower than LTACH-PPS rates. Cases that reach outlier status in the discharging hospital would not count toward the limit and would be paid under LTACH-PPS. CMS estimated the impact of the expansion of the Medicare admission thresholds would result in a reduction of 2.2% of the aggregate payments to all LTACHs in RY 2008.

The applicable percentage threshold is generally 25% after the completion of the phase-in period described below. The percentage threshold for LTACH discharges from a referring hospital that is an MSA dominant hospital or a single urban hospital is the percentage of total Medicare discharges in the MSA that are from the referring hospital, but no less than 25% nor more than 50%. For Medicare discharges from LTACHs or LTACH satellites located in rural areas, as defined by the Office of Management and Budget, the percentage threshold is 50% from any individual referring hospital. The expanded 25% rule is being phased in over a three year period. The three year transition period starts with cost reporting periods beginning on or after July 1, 2007 and before July 1, 2008, when the threshold is the lesser of 75% or the percentage of the LTACH’s or LTACH satellite’s admissions discharged from the referring hospital during its cost reporting period beginning on or after July 1, 2004 and before July 1, 2005, or “RY 2005.” For cost reporting periods beginning on or after July 1, 2008 and before July 1, 2009, the threshold is the lesser of 50% or the percentage of the LTACH’s or LTACH satellite’s admissions from the referring hospital, during its RY 2005 cost reporting period. For cost reporting periods beginning on or after July 1, 2009, all LTACHs will be subject to the 25% threshold (or applicable threshold for rural, urban-single, or MSA dominant hospitals). The SCHIP Extension Act, as amended by the ARRA, postponed the application of the percentage threshold to all free-standing and grandfathered HwHs for a three year period commencing on an LTACH’s first cost reporting period on or after July 1, 2007. However, the SCHIP Extension Act did not postpone the application of the percentage threshold, or the transition period stated above, to those Medicare patients discharged from an LTACH HWH or HWH satellite that were admitted from a non-co-located hospital. The SCHIP Extension Act only postpones the expansion of the admission threshold in the May 2007 final rule to free-standing LTACHs and grandfathered HwHs.

The May 2007 final rule further revised the payment adjustment formula for short stay outlier, or “SSO” cases. Beginning with discharges on or after July 1, 2007, for cases with a length of stay that is less than the average length of stay plus one standard deviation for the same DRG under IPPS, referred to as the so-called “IPPS comparable threshold,” the rule effectively lowers the LTACH payment to a rate based on the general acute care hospital IPPS. SSO cases with covered lengths of stay that exceed the IPPS comparable threshold would continue to be paid under the SSO payment policy described above under the May 2006 final rule. Cases with a covered length of stay less than or equal to the IPPS comparable threshold and less than five-sixths of the geometric average length of stay for that LTC-DRG would be paid at an amount comparable to the IPPS per diem. The SCHIP Extension Act also postponed, for the three year period beginning on December 29, 2007, the SSO policy changes made in the May 2007 final rule.

The May 2007 final rule increased the standard federal rate by 0.71% for RY 2008. As a result, the federal rate for RY 2008 is equal to $38,356.45, compared to $38,086.04 for RY 2007. Subsequently, the SCHIP Extension Act eliminated the update to the standard federal rate that occurred for RY 2008 effective April 1, 2008. This adjustment to the standard federal rate was applied prospectively on April 1, 2008 and reduced the federal rate back to $38,086.04. In a technical correction to the May 2007 final rule, CMS increased the fixed-loss amount for high cost outlier in RY 2008 to $20,738, compared to $14,887 in RY 2007. CMS projected an estimated 0.4% decrease in LTACH payments in RY 2008 due to this change in the fixed-loss amount and the overall impact of the May 2007 final rule to be a 1.2% decrease in total estimated LTACH-PPS payments for RY 2008.

The May 2007 final rule provided that beginning with the annual payment rate updates to the LTC-DRG classifications and relative weights for the fiscal year 2008, or “FY 2008” (affecting discharges beginning on or after October 1, 2007 and before September 30, 2008), annual updates to the LTC-DRG classification and relative weights are to have a budget neutral impact. Under the May 2007 final rule, future LTC-DRG reclassification and recalibrations, by themselves, should neither increase nor decrease the estimated aggregated LTACH-PPS payments.

18

Table of Contents

The May 2007 final rule is complex and the SCHIP Extension Act postponed the implementation of certain portions of the May 2007 final rule. While we cannot predict the ultimate long-term impact of LTACH-PPS because the payment system remains subject to significant change, if the May 2007 final rule becomes effective as currently written, after the expiration of the applicable provisions of the SCHIP Extension Act, our future net operating revenues and profitability could be adversely affected.

August 2007 Final Rule. On August 22, 2007, CMS published the IPPS final rule for FY 2008, which created a new patient classification system with categories referred to as MS-DRGs and MS-LTC-DRGs, respectively, for hospitals reimbursed under IPPS and LTACH-PPS. Beginning with discharges on or after October 1, 2007, the new classification categories take into account the severity of the patient’s condition. CMS assigned proposed relative weights to each MS-DRG and MS-LTC-DRG to reflect their relative use of medical care resources.

The August 2007 final rule published a budget neutral update to the MS-LTC-DRG classification and relative weights. In the preamble to the IPPS final rule for FY 2008 CMS restated that it intends to continue to update the LTC-DRG weights annually in the IPPS rulemaking and those weights would be modified by a budget neutrality adjustment factor to ensure that estimated aggregate LTACH payments after reweighting are equal to estimated aggregate LTACH payments before reweighting.

Medicare, Medicaid, and SCHIP Extension Act of 2007. On December 29, 2007, President Bush signed into law the SCHIP Extension Act. Among other changes in the federal health care programs, the SCHIP Extension Act makes significant changes to Medicare policy for LTACHs including a new statutory definition of an LTACH, a report to Congress on new LTACH patient criteria, relief from certain LTACH-PPS payment policies for three years, a three year moratorium on the establishment and classification of new LTACHs and LTACH beds, elimination of the payment update for the last quarter of RY 2008 and new medical necessity reviews by Medicare contractors through at least October 1, 2010.

The SCHIP Extension Act precludes the Secretary from implementing, during the three year moratorium period, the provisions added by the May 2007 final rule that extended the 25% rule to free-standing LTACHs and grandfathered HwHs. The SCHIP Extension Act also modifies, during the moratorium, the effect of the 25% rule for non-grandfathered LTACH HwHs, non-grandfathered satellites and grandfathered LTACH HwHs, as it applies to admissions from co-located hospitals. For HwHs and satellite facilities, the applicable percentage threshold is set at 50% and not phased in to the 25% level. For those HwHs and satellite facilities located in rural areas and those which receive referrals from MSA dominant hospitals or single urban hospitals, the percentage threshold is set at no more than 75%. The ARRA, as discussed below further revises the SCHIP Extension Act to postpone the percentage limitations established in the SCHIP Extension Act to the three cost reporting periods beginning on or after July 1, 2007 for freestanding LTACHs, grandfathered HwHs and grandfathered satellites and on or after October 1, 2007 for non-grandfathered LTACH HwHs and non-grandfathered satellites.