Attached files

| file | filename |

|---|---|

| EX-31.2 - CERTIFICATION - DIVX INC | dex312.htm |

| EX-32.2 - CERTIFICATION - DIVX INC | dex322.htm |

| EX-32.1 - CERTIFICATION - DIVX INC | dex321.htm |

| EX-23.1 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - DIVX INC | dex231.htm |

| EX-31.1 - CERTIFICATION - DIVX INC | dex311.htm |

| EX-10.26 - LETTER AGREEMENT - DIVX INC | dex1026.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2009.

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission file number: 001-33029

DivX, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 33-0921758 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 4780 Eastgate Mall, San Diego, California | 92121 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (858) 882-0600

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $0.001 par value |

The Nasdaq Stock Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ¨ Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ |

Accelerated filer x | |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) |

Smaller reporting company ¨ | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

The aggregate market value of the common stock of the registrant as of June 30, 2009 held by non-affiliates was $148,272,805, based upon the closing price of the common stock reported on the NASDAQ Global Select Market on such date. Shares of common stock held by each officer and director (and/or his/her affiliates) and by each person who owns 10 percent or more of the outstanding common stock have been excluded from this calculation because these persons may be considered affiliates. The determination of affiliate status for purposes of this calculation is not necessarily a conclusive determination for other purposes.

The number of shares of common stock outstanding as of March 1, 2010, was 32,822,820.

Documents Incorporated by Reference:

| Document |

Part of Form 10-K | |

| Proxy Statement for the 2010 Annual Meeting of Stockholders |

Part III |

Table of Contents

FORM 10-K

INDEX

| PART I. |

||||

| ITEM 1. |

1 | |||

| ITEM 1A. |

14 | |||

| ITEM 1B. |

35 | |||

| ITEM 2. |

35 | |||

| ITEM 3. |

35 | |||

| ITEM 4. |

36 | |||

| PART II. |

||||

| ITEM 5. |

Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities | 37 | ||

| ITEM 6. |

39 | |||

| ITEM 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

39 | ||

| ITEM 7A. |

63 | |||

| ITEM 8. |

64 | |||

| ITEM 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

64 | ||

| ITEM 9A. |

65 | |||

| ITEM 9B. |

67 | |||

| PART III. |

||||

| ITEM 10. |

68 | |||

| ITEM 11. |

68 | |||

| ITEM 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 68 | ||

| ITEM 13. |

68 | |||

| ITEM 14. |

68 | |||

| PART IV. |

||||

| ITEM 15. |

69 | |||

| 72 | ||||

| F-1 | ||||

| F-39 | ||||

Table of Contents

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K, or Annual Report, contains forward-looking statements that are based on our management’s beliefs and assumptions and on information currently available to our management. The forward-looking statements are contained principally in Item 1—“Business,” Item 1A—“Risk Factors,” Item 7—“Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and Item 7A—Quantitative and Qualitative Disclosures About Market Risk.” Forward-looking statements include information concerning our possible or assumed future results of operations, business strategies, financing plans, competitive position, industry environment, potential growth opportunities and the effects of competition. Forward-looking statements include all statements that are not historical facts and can be identified by terms such as “anticipates,” “believes,” “could,” “seeks,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” or similar expressions and the negatives of those statements.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. We discuss certain of these risks in greater detail in Item 1A—“Risk Factors.” Given these uncertainties, you should not place undue reliance on these forward-looking statements. Also, forward-looking statements represent our management’s beliefs and assumptions only as of the date of this Annual Report. You should read this Annual Report and the documents that we reference herein and have filed as exhibits with the Securities and Exchange Commission, or SEC, completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

Table of Contents

PART I

DivX overview

We were incorporated in Delaware in May 2000 with the purpose of making media better through the use of technology. We believe that media is undergoing a profound transformation that will change how individuals and entities obtain information, communicate and express ideas. We believe that there are opportunities within this transformation—opportunities to generate tremendous value by meeting the needs of users of new media and, more importantly, opportunities to influence the evolution and development of media. Our successes to date have been the result of creating value with and for a broad community of constituents including software vendors, consumer hardware device manufacturers, content creators and consumers. Like the evolving markets in which we operate, DivX is open and dynamic.

Our goal is to create products and provide services that improve the way consumers experience media. The first step toward this goal was to build and release a high-quality video compression-decompression software library, or codec, to enable distribution of content across the Internet and through recordable media. As a result, we created the DivX codec. Since the creation of the first DivX codec, DivX codecs have been actively sought out and downloaded by consumers hundreds of millions of times. These downloads include those for which we receive revenue as well as free downloads, such as limited-time trial versions, and downloads provided as upgrades or support to existing end users of our products. After the significant grass-roots adoption of our codecs, the next step toward our goal was to license similar technology to consumer hardware device manufacturers and to certify their products to ensure the interoperable support of DivX-encoded content. We are entitled to receive a royalty and/or license fee for DivX Certified devices shipped by our customers. In addition to licensing revenue from such licensees, we also generate revenue from software licensing, advertising and content distribution.

One aspect of our long term vision is to allow content creators to have the ability to capture their content in the DivX format using any device or software of their choosing and to allow consumers of such content to playback and interact with the content on any device or platform. We bring together consumers of DivX content with content creators both large and small through the development and licensing of media distribution platforms and services.

In January 2009, we released the latest version of our codec, DivX Plus. DivX Plus technology offers consumers and consumer electronics manufacturers an enhanced version of our codecs for certain implementations, including for high definition and mobile content.

In recent years we completed two strategic transactions to complement our organic growth. In November 2007, we acquired MainConcept GmbH, or MainConcept, a leading provider of an H.264 codec solution and a wide range of other high-quality video codecs and technologies for the broadcast, film, consumer electronics and computer software markets. MainConcept solutions are optimized for various platforms including PCs, set-top boxes, portable media players and mobile phones.

In August 2009 we acquired substantially all of the assets of AnySource Media, LLC, or AnySource, technology company developing software and service platforms for Internet-enabled consumer electronics devices. We believe the AnySource transaction will help us meet our goal of expanding our business model to encompass licensing and other revenue opportunities relating to Internet-enabled consumer electronics devices.

Our next steps, which we have begun working toward, are to bring together the millions of DivX consumers with content creators both large and small to build communities around media, including through the development and licensing of media distribution platforms and services for Internet and consumer electronics devices. We are optimistic about the future and believe our opportunities are only beginning to be realized.

1

Table of Contents

The DivX codec solution

The DivX codecs have been developed as a solution to address the opportunity created by the transformation of content. Specifically, we have built the technological platform and galvanized the community necessary to enable a digital media ecosystem of consumers, content creators, software vendors, hardware device manufacturers and advertisers, allowing each participant in this ecosystem to benefit from the participation of the other participants.

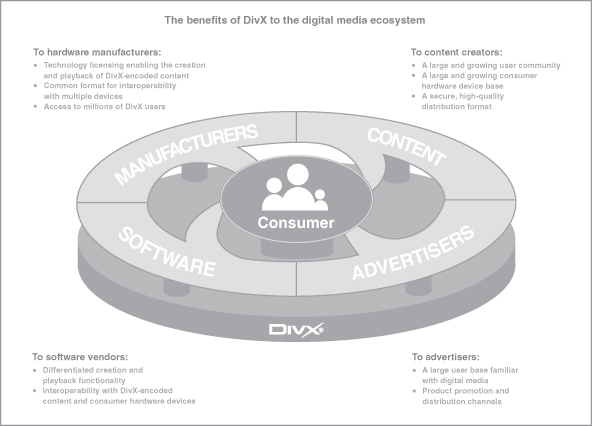

The following illustration depicts how DivX provides the foundation and connection for the participants in the digital media ecosystem, all of whom ultimately work to benefit the consumer:

Specifically, our codec ecosystem offers the following benefits to these various participants in the content industry:

To content consumers, the DivX ecosystem provides a high-quality, interoperable digital media format supported by dozens of software products and thousands of models of consumer hardware devices. This allows consumers to access a diverse range of content from large and small content creators and to play back this content when, where and how they want. Moreover, the widespread availability of consumer hardware devices, software and services within the DivX ecosystem makes creating and sharing content easier and more fun for the community of DivX users.

To content creators, the DivX ecosystem provides the ability to cost-effectively and securely create and distribute high-quality content to a large market of consumers and to deliver that content when, where and how consumers want it. The DivX ecosystem gives content creators access to DivX Certified consumer hardware devices as well as millions of digital video savvy consumers who have demonstrated their willingness and ability to seek out high-quality content distributed via the Internet.

2

Table of Contents

To digital media software vendors, the DivX ecosystem allows software vendors to provide easy-to-use products for the creation and playback of content that is interoperable with other DivX Certified devices. By doing so, software vendors can differentiate their products by adding DivX media creation and playback functionality, thus providing useful products that compete with generic operating system bundles.

To consumer hardware device manufacturers, the DivX ecosystem provides the ability to offer recording and playback devices that are interoperable with an array of other DivX Certified devices in a high-quality, secure digital media format that consumers want and use. Manufacturers can thus avoid the cost of supporting many different incompatible formats, allowing them to remain competitive in the face of significant price pressures. Use of DivX technologies and association with the DivX brand enables manufacturers to participate in new content business models from content services provided by others in the DivX ecosystem.

To advertisers, the DivX ecosystem provides access to a large and engaged group of DivX users. This may enable advertisers to communicate with consumers to inform them about available products and services.

Our strategy

Our strategy is to improve the way in which consumers experience media by leveraging the vibrant DivX ecosystem and advances in media technologies. Key elements of this strategy include:

Develop a content and services platform for Internet-enabled devices. We believe that Internet TV will transform the landscape for media distribution and advertising. Based in part on the assets we acquired as a result of our acquisition of AnySource, we are developing DivX TV, a technology designed to enable consumers to stream Internet video directly to an Internet-connected digital television or other Internet-connected consumer electronics devices. We believe that this technology will improve the way consumers experience media and will provide us with new opportunities to provide products and services.

Grow our core licensing business. We believe that our software and consumer hardware partners are integral to our success. In hardware, we are building on the initial success of licensing DivX technologies for implementation in DVD players by growing our licensing business into the emerging categories of Blu-ray players, digital televisions, mobile devices, set-top boxes and other consumer electronics devices. In software, we plan to enhance the value of the DivX technologies to our existing software partners by adding new features to the DivX media format and to increase partnerships across the software market.

Provide content platforms and content-related services that are valued by DivX users. There are millions of DivX users around the world, and we intend to work independently, and with other parties focused on media to develop products and services that enhance the media experience for these users.

Expand the DivX ecosystem through partnerships with the community of diverse content creators. We believe the active engagement of content creators in the DivX ecosystem is essential to realizing the full potential of the digital media transformation. We plan to continue to develop relationships with premium, mid-tier and individual content creators. We intend to partner with creators based not only on the economic potential of their content, but also on the potential for DivX to enhance the value of their content through the power of our platform and community. We also plan to support our content partners in their efforts to distribute their content in the DivX format through their own various digital distribution channels.

Strengthen the DivX brand. We intend to continue building upon the strength of the DivX brand. We plan to ensure that in the future the DivX brand continues to be associated only with those products and services that offer high-quality media experiences. We may also invest in activities beyond our products that are consistent with the DivX vision of better media.

3

Table of Contents

Pursue selected complementary acquisitions, investments and strategic alliances. When the opportunity presents itself, we intend to pursue selected acquisitions, investments or strategic alliances that complement and further our mission to make media better and improve the media experience for consumers. Our primary objectives in these transactions would be to acquire complementary technologies and platforms and expand the consumer and content aspects of our ecosystem. Once we have accomplished such acquisitions, we will spend time and resources integrating them into our businesses.

Our strengths

We believe that the following key strengths uniquely position DivX to continue to enhance and enrich the digital media content experience:

Our demonstrated history of success, innovation and ecosystem creation. We have a history of technology leadership on which we will continue to build. The success of DivX has been driven by the grassroots adoption of our technologies by millions of consumers, due in large part to the strength of our technology. We also have a demonstrated ability to build technologies that support an ecosystem of diverse participants that gain value from their participation.

Our large installed base. DivX technologies and products have been adopted by millions of users who have sought them out and chosen to download them. This success encouraged consumer hardware device manufacturers to build support for DivX technologies into their products. Hundreds of consumer hardware device manufacturers and dozens of integrated circuit manufacturers have incorporated DivX technologies into thousands of models of consumer hardware devices that have shipped into the market. We believe our large user and consumer hardware installed base places us in a strong position to benefit from the transformation of the content industry and growing digital content distribution. The DivX media platform installed base represents a large addressable market for content creators interested in commercial digital distribution of their content.

The DivX brand. The DivX logo appears on products that incorporate DivX technology and indicates to consumers that the product meets our strict standards of interoperability and delivers a high-quality DivX media experience. We believe that consumers recognize the value of the DivX logo, and that this increases the value of the DivX brand to all other participants in the DivX ecosystem.

Our neutral media technology platforms for software, hardware and content. Our technology platforms for the creation, distribution and consumption of media content are not tied exclusively to any specific consumer hardware device manufacturer, software vendor or content provider. We license our technologies to a wide array of companies. We believe our neutral platforms allow us to bring a diverse set of powerful interests together in the DivX ecosystem.

Our ability to understand and partner with various constituents of the digital media industry. We have a demonstrated ability to work with industries that have very different goals. We are as comfortable working within the explosiveness of the Internet industry as we are within the planned and deliberate environment of the consumer hardware industry. We believe this ability will serve us well as we work to add even more diverse participants and industries to the DivX ecosystem.

How we derive revenue

We have four revenue streams. Three of these revenue streams emanate from our technologies, including technology licensing to manufacturers of consumer hardware devices, licenses to independent software vendors and consumers, and services we provide related to digital content distribution over the Internet. Additionally, we derive revenues from advertising and distributing third-party products.

Technology licensing-consumer hardware devices. Our technology licensing revenues from consumer hardware device manufacturers comprise the majority of our total revenues and are derived primarily from royalties and/or

4

Table of Contents

license fees received from original equipment manufacturers, although related revenues are derived from other members of the consumer hardware device supply chain. We license our technologies to original equipment manufacturers, allowing them to build support of DivX technologies into their consumer hardware devices. Our original equipment manufacturer licensees pay us a fee based on the quantity of DivX Certified devices they sell. Our license agreements with original equipment manufacturers typically range from one to two years, and may include the payment of initial fees, volume-based royalties and minimum guaranteed volume levels. Because royalties are generated by the shipment volumes of our consumer hardware device customers, and because sales by consumer hardware device manufacturers are highly seasonal, we typically expect revenues relating to consumer hardware devices to be highly seasonal, with our second quarter revenues in any given calendar year being generally lower than any other quarter in that calendar year.

To ensure high-quality support of the DivX media format in finished consumer electronic products, we also license our technologies to those companies who create the major components in those products. These companies include integrated circuit manufacturers who supply integrated circuits, and original design manufacturers who create reference designs, for DVD players, Blu-ray players, digital televisions, mobile phones, and the other consumer hardware devices distributed by our licensee original equipment manufacturers. In 2009, Samsung Corporation, Ltd. and Sony Corporation accounted for 13% and 12%, respectively, of our total net revenues. In 2008 and 2007, LG Electronics, Inc. accounted for 11% and 10% respectively, of our total net revenues.

To ensure that our licensees’ products conform to our quality standards, we employ a rigorous certification program. Integrated circuit manufacturers, original design manufacturers and original equipment manufacturers are required to have their devices tested and certified prior to distribution. Only DivX Certified devices are permitted to display our logo as evidence that they conform to our standards of high quality.

In the years 2009, 2008 and 2007, we derived 70%, 66% and 70% respectively, of our total net revenues from licensing our technology to original equipment manufacturers, original design manufacturers and integrated circuit manufacturers.

Technology licensing—software. We license our technologies to independent software vendors that incorporate our technologies into software applications for computers and other consumer hardware devices. An independent software vendor typically pays us an initial license fee, in addition to per-unit royalties based on the number of products sold that include our technology. Since our acquisition of MainConcept in November 2007, we also have generated revenues associated with MainConcept’s licensing agreements in areas complementary to our pre-existing revenue streams, including through MainConcept’s focus on the professional video sector. We also license our technologies directly to consumers through several software bundles. We make certain software bundles available free of charge from our website. These bundles incorporate a version of our codec technology, and allow consumers to play and create content in the DivX format. We also make available from our website an enhanced version of the free software bundle, including additional features that increase the quality and control of DivX media playback and creation. This enhanced version is available free of charge for a limited trial period, which is generally 15 days. At the end of the trial period, our users are invited to purchase a license to one or more components of the enhanced bundle by making a one time payment to us. If they choose not to do so, they still enjoy playback and creation functionality equivalent to our free software bundle.

In the years 2009, 2008 and 2007 we derived 22%, 14% and 8% respectively, of our total net revenues from licensing our technology to independent software vendors and licensing our software directly to consumers.

Advertising and third-party product distribution. We derive revenue from advertisements or third party software applications that we embed in or include with the software packages we offer to consumers. In March 2009, we entered into a promotion and distribution agreement with Google. Pursuant to this agreement, we distribute Google products, including the Google Chrome web browser with our software products and Google pays us fees based on successful activations of these products. Pursuant to the terms of the agreement with Google, this

5

Table of Contents

agreement expires on February 28, 2011, or upon the achievement of a maximum distribution commitment. Revenues earned under this agreement accounted for approximately 8% of our total net revenues in 2009. From November 2007 through November 2008, we had agreed with Yahoo! to include and distribute the Yahoo! Toolbar software product with our software products. Yahoo! paid us fees based on the number of downloads or activations of the included software by consumers.

In the years 2009, 2008 and 2007, we derived 8%, 19% and 21% respectively, of our total net revenues from the inclusion of advertisements and third party software applications in our software products.

Content distribution and related services. We derive revenue by acting as an application service provider for third party owners of digital video content by making available our online video delivery system to content providers in return for a revenue share of the download-for-rental or sales revenue generated from the content provider’s customer using our delivery system. We also provide encoding, content storage and distribution services to content providers. The content partner delivers a video-on-demand movie through its website using our Open Video System. We earn a certain percentage of each transaction with the end consumer renting or purchasing such content based on a pre-negotiated revenue share with the content provider. We also encode the content of certain customers into the DivX format and charge certain of these customers for this service or receive an up-front license fee from certain content partners who use our software to encode their own content.

We record revenue related to content distribution arrangements with consumer hardware original equipment manufacturers, or OEMs, who pay us a fee for each copy of DivX-encoded content that is encoded on physical media and bundled with their consumer hardware products.

In the years 2009, 2008 and 2007 we derived 0%, 1% and 1% respectively, of our total net revenues from providing content distribution services to third parties.

Geographic information.

We are a global company with a broad, geographically diverse market presence. For the years 2009, 2008 and 2007, our revenues outside the United States comprised 84%, 75% and 78% respectively, of our total net revenues.

A large number of our consumer hardware device manufacturers are located in Asia. Fees received pursuant to licenses to these consumer hardware device manufacturers accounted for 70%, 62% and 59% of our total net revenues for 2009, 2008 and 2007 respectively. Revenues from customers located in Japan, Korea and Singapore comprised approximately 33%, 25% and 6%, respectively, of our total net revenues in 2009, 25%, 15% and 11% respectively, of our total net revenues in 2008, and 23%,19%, and 8%, respectively, of our total net revenues in 2007.

Domestic revenues comprised approximately 16%, 25% and 22% of our total net revenues in 2009, 2008, and 2007, respectively.

Technologies

Our digital media ecosystem utilizes a series of technologies designed for commercial and consumer users. These technologies enable users to compress, secure, distribute and view digital video and otherwise participate in our digital media ecosystem. The following is a description of the core technologies that form the basis for our digital media ecosystem.

DivX media format. Our DivX media format comprises our DivX video compression technology, DivX file containers with their advanced media features and digital rights management, or DRM.

6

Table of Contents

DivX video compression technology. Our DivX video compression technology reduces the size of high-quality video to a level that can be efficiently distributed over broadband networks. In addition, the newest version of our video compression technology, the DivX Plus Codec, was designed to offer even more efficient compression for certain source files. Both technologies utilize a mixture of video compression tools, including some from the MPEG-4 standard, and are capable of producing high-quality video using only a fraction of the amount of data required by a standard-size DVD or Blu-ray disc. As a result, DivX technology enables a user to store a full- length standard definition movie on a one giga-bite USB drive. DivX technology is designed to offer a balance of compression, complexity and speed. Our technology offers superior visual quality at a high level of compression. The computational efficiencies of our technology make it suitable for integration into low-cost consumer hardware devices and its speed makes it useful in both consumer and professional content creation and editing environments. DivX video technology can be used on video sources with sizes ranging from high definition quality video to video resolutions suitable for a mobile environment.

DivX file containers. Our DivX file containers are designed to hold multimedia data and metadata. The original version of our container is based on the Resource Interchange File Format, which by design gives it some compatibility with other Resource Interchange File Format based file formats such as the Audio Video Interleave file container. Our newest file container is a proprietary implementation built on MKV standards, which by design gives it some compatibility with other MKV-based files.

DivX advanced media features. DivX advanced media features enable DivX users to create enhanced digital media files, including features in the files themselves that are normally associated with the physical media or playback device used, such as DVD-like menus, user-selected multiple-language audio tracks, subtitles, and metadata that allow the content creator to add descriptive information such as title, author and video specifications.

Digital rights management. We have developed a digital rights management, or DRM, that encrypts and manages the playback of protected DivX content on personal computers and consumer hardware devices. When implemented, it ensures that digital video is delivered in a secure manner and used in accordance with rules defined by its publisher. Our digital rights management technology is designed to require minimal system resources, allowing it to be implemented on low-cost consumer hardware devices.

Products and services

Our technologies are incorporated into several software product bundles that we offer directly to consumers, as well as software development kits that we license to hardware and software companies. We also offer certification services to software and hardware companies, and operate a digital media distribution system in which we act as an application service provider to third party content owners.

Consumer software

In addition to the third-party consumer software products that our technologies power, we offer several programs to consumers directly. We have released numerous versions of these programs and are currently working on additional updates and improvements to our DivX consumer software programs. Our consumer software programs currently include the following:

DivX for Windows bundle. Our DivX for Windows bundle includes our DivX community codecs, DivX Player and DivX Web Player. The bundle also includes free trial versions of the Windows versions of the DivX Converter and the DivX Pro video codecs.

DivX Pro for Windows bundle. Like our DivX for Windows bundle, the DivX Pro for Windows bundle includes our DivX Player, and DivX Web Player. However, instead of our DivX community codecs, this bundle includes our DivX Pro video codecs and additionally includes the DivX Converter application.

7

Table of Contents

DivX for Mac bundle. Our DivX for Mac bundle includes Mac OS versions of our DivX community codec, DivX Player and DivX Web Player. The bundle also includes free trial versions of the Mac OS versions of the DivX Converter and the DivX Pro video codec. The DivX for Mac software bundle does not yet support the advanced media features of the DivX format.

DivX Pro for Mac bundle. Our DivX Pro for Mac bundle includes all of the components of the DivX for Mac bundle as well as Mac OS versions of the DivX Converter application and the DivX Pro video codec.

DivX Mobile Player. Our DivX Mobile Player is available for certain mobile handsets, and allows users to playback DivX videos on their handsets from a variety of sources, including side-loading from memory cards or downloading from the Internet, including DivX’s own mobile portal.

DivX Author. Our DivX Author application is available for the Windows OS and allows users to combine and edit multiple videos into a single DivX video, add the advanced features of the DivX format to enhance digital media files, and create slideshows with videos, photos and music.

Technology licensing for independent software vendors and consumer hardware device manufacturers

Software development kits. We typically make our technologies available to partners via software development kits. For hardware licensees, we have “decode” and “encode” software development kits that enable hardware partners to build DivX playback and recording support, respectively, into their products. For software licensees, we offer several software development kits that allow software vendors to build DivX playback and creation support into their products.

Certification Programs. The DivX Certification Program certifies hardware devices and software applications for the creation and playback of DivX video. DivX Certified hardware devices support playback of DivX video, while DivX Certified software applications support the conversion of digital video into the high-quality, highly-compressed DivX media format.

Integrated circuit manufacturers, original design manufacturers, original equipment manufacturers and software vendors are required to have their products certified prior to being marketed as DivX Certified products. For example, integrated circuit manufacturers typically receive a software development kit and certification kit from us, which they use to design an integrated circuit that will meet our standards to be DivX Certified. Manufacturers may distribute those integrated circuits to DivX-licensed original equipment manufacturers and original design manufacturers for inclusion in DivX Certified devices only after those integrated circuits are DivX Certified. Similarly, original design manufacturers, original equipment manufacturers and software vendors must have their products certified prior to being marketed as DivX Certified products.

Our DivX Certified programs currently include the following certification levels:

DivX Plus HD Certified

Devices certified pursuant to the DivX Plus HD certification level ensure device compatibility with files generated using the DivX Plus codec. DivX Plus technology offers enhancements over prior versions of our codecs for certain implementations, including for high definition and mobile content. While files generated using the DivX Plus HD codec will not play back on DivX Home Theater Certified devices, devices certified under the DivX Plus profiles will play DivX video generated with existing DivX codecs as well as the newer DivX Plus HD technology. Devices that are DivX Plus HD Certified for decode play high definition DivX video in 720p and/or 1080p resolution as well as high definition DivX video in the MKV format, support advanced playback features, play DivX formatted Hollywood content as well as standard definition and mobile resolution DivX video.

8

Table of Contents

DivX Ultra Certified

The DivX Ultra Certified Program is a premium certification level that additionally certifies hardware devices and software applications for the creation and playback of high-quality DivX video with advanced features such as motion menus, subtitles, chapter points and alternate audio tracks. DivX Ultra Certified software applications support the conversion of digital video into the high-quality, highly-compressed DivX media format as well as the creation of video with advanced features. Devices that are DivX Ultra Certified for decode support advanced playback features and play DivX formatted Hollywood content as well as DivX content in standard definition and mobile resolution content.

DivX HD Certified

The DivX HD Certified program is a premium certification level that certifies hardware devices and software applications for the creation and playback of high definition video in the DivX format. Devices that are DivX HD Certified for decode play high definition DivX video, Hollywood content purchased in the DivX format, as well as standard definition and mobile resolution DivX videos.

DivX Mobile Theater Certified and DivX Mobile Certified

The DivX Mobile Theater Certified and DivX Mobile Certified programs were developed to allow consumers to create and playback DivX video. Devices that are DivX Mobile Theater Certified for decode can play Hollywood content in the DivX format as well as DivX videos in mobile resolution. Devices that are DivX Mobile Certified for decode can play mobile resolution DivX videos.

DivX Home Theater

The DivX Home Theater Certified program enables the creation and playback of standard definition DivX video. Devices that are DivX Home Theater Certified for decode playback standard definition Hollywood content in the DivX format as well as standard definition and mobile resolution DivX videos.

DivX Certified Recorder/Encoder

The DivX Certified Recorder/Encoder program certifies hardware devices to record video directly in the DivX media format. DivX Certified Recorder/Encoder devices create DivX video that is compatible with all DivX Certified, DivX Plus, and DivX Ultra Certified products.

Open Video System

Our Open Video System, or OVS, is a complete hosted service that allows content creators to deliver high-quality DivX video content over the Internet. We use our OVS to provide content and service providers with encoding services, content storage and distribution services, and use of our DivX media format and digital rights management technology. Using the OVS, a content service provider can launch its own web store and sell content online.

DivX Mobile Media

DivX Mobile Media is a mobile media platform service that allows users to enjoy video content in the DivX format from a variety of sources.

Sales and marketing

Our sales and marketing team markets our technologies to a wide range of integrated circuit manufacturers, original design manufacturers, original equipment manufacturers, retailers, operators and software developers on a worldwide basis. In addition, members of this team market our products to various consumer segments at industry tradeshows such as CES and IFA, and engage in partner and retailer training, product marketing, sales

9

Table of Contents

support and partner co-marketing programs. Members of our sales and marketing team also focus on content and distribution partnerships, co-marketing transactions, advertising partnerships, brand and product marketing, electronic software distribution, business operations and marketing programs. As of December 31, 2009, our sales and marketing team included 106 full-time and part-time employees based in 11 countries.

Product development

We incurred product development costs of approximately $20.6 million, $20.2 million and $18.7 million in 2009, 2008 and 2007 respectively, representing 29%, 21% and 22% respectively, of total net revenues. Our product development team is based out of our headquarters in San Diego, California and following our transactions with AnySource in August 2009 and MainConcept in November 2007, includes team members in Malvern, Pennsylvania, Aachen, Germany and Tomsk, Russia. As of December 31, 2009, our product development team consisted of 191 full-time and part-time employees dedicated to product development and product management, 154 of which were engineers and 19 of which were product managers (with the other 18 filling other related roles).

Our product development team focuses on building our technologies into products that meet the needs of our consumers. This team identifies, investigates and analyzes new long-term opportunities, shapes our technology strategy and provides support for internally developed and externally acquired technologies. Our product development team builds the platform technologies upon which our products are based and conducts our applied research in developing and improving technologies to compress, secure and distribute digital video.

Competition

We face significant competition in the digital media markets in which we operate. We believe that our most significant competitive threat comes from companies that have the collective financial, technical and other resources to develop the technologies, services, products, and partnerships necessary to create a digital media ecosystem that can compete with the DivX ecosystem. Those potential competitors currently include Adobe Systems, Apple Computer, Google, Microsoft, and Yahoo!.

We also compete with companies that offer products or services that compete with specific aspects of our digital media ecosystem. For example, our digital rights management technology competes with technologies from companies such as Apple Computer, ContentGuard, Intertrust Technologies, Microsoft, Nagra Audio, NDS Group and 4C Entity, as well as the internal development efforts of certain of our licensees. Similarly, content distribution providers, such as Amazon.com, Apple Computer, Sonic Solutions, Google, Joost, MovieLink, MySpace.com, a subsidiary of News Corporation, Netflix, Yahoo!, YouTube, a subsidiary of Google, Hulu, LLC, and subscription entertainment services and cable and satellite providers compete with our content distribution services. In addition, we compete with companies such as Yahoo!, VUDU, Inc., Boxee, Inc. and Rovi Corporation and with internally developed proprietary solutions developed by hardware device manufacturers and integrated circuit manufacturers in our development and marketing of technologies to enable the next generation of Internet-enabled consumer electronics devices.

Our proprietary video compression technologies also compete with other video compression technologies, including other implementations of MPEG-4 or implementations of H.264/AVC. In addition, a number of companies such as Adobe Systems, Apple Computer, Ateme, Google, Microsoft, and RealNetworks offer video formats that compete with our proprietary video format.

We also face competition from subscription entertainment services, cable and satellite providers, DVDs and other emerging technologies and products related to content distribution. Our content distribution platforms and services face significant competition from services, such as peer-to-peer and content aggregator services, which allow consumers to directly access an expansive array of content without securing licenses from content providers.

10

Table of Contents

Some of our current or future competitors may have significantly greater financial, technical, marketing and other resources than we do, may enjoy greater brand recognition than we do, or may have more experience or advantages than we have in the markets in which they compete. For example, companies such as Amazon.com, Apple Computer, Google, Microsoft, Sony, Yahoo! and Adobe Systems may have competitive advantages over us because of their greater size and resources and the strength of their respective brand names. In addition, some of our current or potential competitors, such as Apple Computer, Dolby Laboratories, Microsoft and Sony, may be able to offer integrated system solutions in certain markets for entertainment technologies, including audio, video and rights management technologies related to personal computers or the Internet, which could make competing products and technologies that we develop unnecessary. By offering an integrated system solution, these potential competitors also may be able to offer competing products and technologies at lower prices than our products and technologies. Further, many of the consumer hardware and software products that include our technologies also include technologies developed by our competitors. As a result, we must continue to invest significant resources in product development in order to enhance our technologies and our existing products and introduce new high-quality technologies and products to meet the wide variety of such competitive pressures.

Significant Customers

A small number of customers account for a significant percentage of our total net revenues. In 2009, Samsung Corporation, Ltd. and Sony Corporation accounted for 13% and 12%, respectively, of our total net revenues. In 2008, Yahoo! Inc. and LG Electronics, Inc. accounted for 19% and 11%, respectively, of our total net revenues. In 2007, Google, Inc. and LG Electronics, Inc. accounted for 19% and 10%, respectively, of our total net revenues.

Intellectual property

To protect our proprietary rights, we rely on a combination of trademark, copyright, patent, trade secret and other intellectual property laws; employment, confidentiality and invention assignment agreements with our employees and contractors; and confidentiality agreements and protective contractual provisions with our partners, licensees and other third parties.

Trademarks. As of December 31, 2009, we had over 100 trademark registrations and over 90 pending trademark applications in more than 40 countries, including the U.S., for a variety of word marks, logos and slogans. Our trademarks are an integral part of our licensing program. Licensees are allowed to place our trademarks on their products to inform customers that their products incorporate our technology and meet our quality specifications only if such products have been DivX Certified. We also require that our licensees adhere to detailed branding guidelines to ensure that usage of our trademarks and logos are consistent and uphold our image. Our trademarks include, among others, DivX, DivX Certified, DivX Ultra, DivX Plus HD, DivX TV, and DivX Connected.

Copyrights. We have a significant amount of copyright-protected materials, including among other things, software, codecs and textual material. As an additional layer of protection to the common law copyrights we own in our software and other materials, we have also obtained U.S. copyright registrations on more than 20 software products as of December 31, 2009.

Patents. Patents provide important protections to certain of our technologies. As of December 31, 2009, we had six issued U.S. patents and two issued foreign patents. We also hold an exclusive license to one additional U.S. patent. Assuming that all of the appropriate maintenance, renewal, annuity or other governmental fees are paid, we expect that our patents and the patent to which we hold an exclusive license would expire between 2019 and 2027, excluding any additional term for patent term adjustments or patent term extensions. We are in the process of applying for additional patent coverage for various aspects of our technology, including technologies for digital rights management, digital media formats, mobile content delivery, connected devices and video encoding and decoding. As a result, as of December 31, 2009, we had dozens of U.S. and international patent applications on file relating to various aspects of our technology.

11

Table of Contents

Other proprietary rights. Many of our consumer hardware licensees and other partners have contractually recognized our proprietary rights in the file identifiers that identify video content files as encoded using our codec. For instance, a video file encoded using our codec may be identified with a “DIVX” code that can be read and recognized by a consumer hardware device or PC video player. Such consumer hardware licensees and partners have also contractually agreed to limit playback of such “DIVX”-identified files to devices that incorporate our technologies. These contractual agreements enable us to differentiate DivX devices and video files from non-DivX devices and video files.

In addition, we also seek to maintain certain intellectual property and proprietary know-how as trade secrets, and generally require our partners to execute non-disclosure agreements prior to any substantive discussions or disclosures of our technology.

MPEG LA technology licenses. We have entered into a license agreement with MPEG LA, effective January 2000, under its MPEG-4 Part 2 Visual Patent Portfolio. Under this license agreement, we have a royalty-bearing, worldwide, non-exclusive sublicense of certain patents licensed to MPEG LA relating to MPEG-4 technology. One version of our video codec incorporates technologies implementing a portion of the MPEG-4 video standard. Our license agreement with MPEG LA will expire on December 31, 2013, unless the agreement is earlier terminated. We may terminate the license agreement for any reason by providing 30 days prior written notice to MPEG LA. Upon expiration, the license agreement may be renewed by MPEG LA for successive five year periods upon notice of renewal to us. We have also entered into a license agreement with MPEG LA, effective August 2002, under its MPEG-4 Part 10, or AVC, Patent Portfolio. Under this license agreement, we have a royalty-bearing, worldwide, non-exclusive sublicense of certain patents licensed to MPEG LA relating to H.264 technology. The newest version of our video codec, the DivX Plus codec, incorporates technologies implementing a portion of the AVC video standard. Our license agreement with MPEG LA with respect to this technology will expire on December 31, 2010, unless the agreement is earlier terminated. We may terminate the license agreement for any reason by providing 30 days prior written notice to MPEG LA. Upon expiration, the license agreement may be renewed by MPEG LA for successive five year periods upon notice of renewal to us. For the years 2009, 2008, and 2007 we expensed $7.4 million, $2.0 million, and $2.0 million respectively, related to these MPEG LA license agreements. We also expect to incur expenses of approximately $7.4 million in 2010 under these MPEG LA license agreements.

Government regulation

We are subject to a number of foreign and domestic laws and regulations that affect companies that import or export software and technology, including encryption technology, such as the U.S. export control regulations as administered by the U.S. Department of Commerce.

We are also subject to a number of foreign and domestic laws that affect companies conducting business on the Internet. In addition, because of the increasing popularity of the Internet and the growth of online services, laws relating to user privacy, freedom of expression, content, advertising, information security and intellectual property rights are being debated and considered for adoption by many countries throughout the world.

In the U.S., online service providers have been subject to claims of defamation, libel, invasion of privacy and other data protection claims, tort, unlawful activity, copyright or trademark infringement, or other theories based on the nature and content of the materials searched and the ads posted or the content generated by users. In addition, several other federal laws could have an impact on our business. For example, the Digital Millennium Copyright Act has provisions that limit, but do not eliminate, our liability for hosting or linking to third-party websites that include materials that infringe copyrights or other rights, so long as we comply with the statutory requirements of this act. The Children’s Online Privacy Protection Act restricts the ability of online services to collect information from minors, and the Protection of Children from Sexual Predators Act of 1998 requires online service providers to report evidence of violations of federal child pornography laws under certain circumstances.

12

Table of Contents

In addition, the application of existing laws regulating or requiring licenses for certain businesses of our advertisers can be unclear. Existing or new legislation could expose us to substantial liability and restrict our ability to deliver services to our users. We also face risks from legislation that could be passed in the future.

We may be further subject to international laws associated with data protection and other aspects of our business in Europe and elsewhere and the interpretation and application of data protection laws is still uncertain and in flux. In addition, because our services are accessible worldwide, foreign jurisdictions may claim that we are required to comply with their laws.

Employees

As of December 31, 2009, we employed 343 full-time and part-time employees. None of our employees is subject to any collective bargaining agreements. We consider our relationship with our employees to be good.

Executive Officers of the Registrant

Our executive officers serve at the discretion of the Board. The names of our executive officers and their ages, titles, and biographies as of December 31, 2009 are set forth below:

| Name |

Age | Position | ||

| Kevin Hell |

45 | CEO, Director | ||

| Dan L. Halvorson |

44 | CFO and EVP Operations | ||

| David J. Richter |

41 | EVP, Business & Legal Affairs and General Counsel |

Kevin Hell has served as our CEO and a Director since October 2007. From July 2007 to October 2007, Mr. Hell served as our Acting CEO. Between 2002 and 2007, Mr. Hell held a number of management positions within the Company including Chief Marketing Officer and Managing Director, Chief Operating Officer, the Company’s CXO for Partners and Licensing, and President. Mr. Hell is currently responsible for our corporate strategy and overall strategic direction. From July 2001 to May 2002, Mr. Hell served as Senior Vice President of Product Management in the Solutions Group of Palm, a handheld solutions company. From May 1999 to May 2001, Mr. Hell was Vice President of the Connected Home division and Vice President of Corporate Strategy at Gateway Computer, a personal computer manufacturing company. From May 1991 to May 1999, Mr. Hell worked in the Los Angeles office of the Boston Consulting Group, a management consulting firm. Mr. Hell received an M.B.A. from The Wharton School, and a master’s degree in Aeronautics and Astronautics and a B.S. in Mechanical Engineering from Stanford University.

Dan L. Halvorson has served as our Executive Vice President and Chief Financial Officer since July 2007. Mr. Halvorson was promoted to Chief Financial Officer and Executive Vice President Operations in November 2009. From June 2007 to July 2007, Mr. Halvorson served as our Chief Financial Officer and Senior Vice President. Mr. Halvorson is responsible for investor relations, financial and administrative aspects of our strategic and tactical goals, and for management of several operations teams including oversight for MainConcept, the commercial licensing business for DivX, with international operations in Germany and Russia. Mr. Halvorson has served in many senior finance and accounting roles at a number of public companies including various roles from 2000 to 2007 at Novatel Wireless where he was promoted to Chief Financial Officer and Chief Accounting Officer in early 2004. From 1998 to 2000, he was Director of Finance at Dura Pharmaceuticals, which was acquired by Elan in 2000. He was also Director of Finance at Alliance Pharmaceuticals from 1996 to 1998. Previous to his public company roles, Mr. Halvorson spent eight years in public accounting at Deloitte & Touche and PriceWaterhouseCoopers, serving both public and private client companies. Mr. Halvorson is a Certified Public Accountant and holds a Bachelor of Science from San Diego State University.

David J. Richter has served as our Executive Vice President, Business & Legal Affairs and General Counsel since January 2010. Mr. Richter served as our Executive Vice President, Business &Legal Affairs from March 2009 until

13

Table of Contents

January 2010 and prior to that, he served as Executive Vice President, Corporate Development and Legal since July 2007. From June 2007 to July 2007, Mr. Richter served as our General Counsel and Senior Vice President Corporate Development. From April 2006 to June 2007, Mr. Richter served as our General Counsel, Legal and Corporate Development. From May 2004 to April 2006, Mr. Richter served as our General Counsel and, in addition, from January 2005 through April 2006, as our Senior Vice President, Corporate Development. Mr. Richter is responsible for the following teams: legal, business and corporate development, and software product development efforts. Previously, Mr. Richter worked at Maveron, a venture capital firm, as a Principal from January 2002 through March 2004 and as Director, Business Development from July 2000 through December 2001. Mr. Richter received a J.D. from Yale Law School and a B.A. in Government from Cornell University.

Available Information

Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, or the Exchange Act, are available free of charge on our website (www.divx.com) as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC.

Before you decide to invest or maintain an interest in our common stock, you should consider carefully the risks described below, together with the other information contained in this Annual Report on Form 10-K. We believe the risks described below are the risks that are material to us as of the date of this Annual Report on Form 10-K. If any of the following risks comes to fruition, our business, financial condition, results of operations and future growth prospects would likely be materially and adversely affected. In these circumstances, the market price of our common stock could decline and you may lose all or part of your investment.

Risks Related to our Business

Our business and prospects depend on the strength of our brand, and if we do not maintain and strengthen our brand, we may be unable to maintain or expand our business.

Maintaining and strengthening the “DivX” brand is critical to maintaining and expanding our business, as well as to our ability to enter into new markets for our technologies and products. If we fail to promote and maintain the DivX brand successfully, our ability to sustain and expand our business and enter into new markets will suffer. Maintaining and strengthening our brand will depend heavily on our ability to continue to develop and provide innovative and high-quality technologies and products for consumers, content owners, consumer hardware device manufacturers and software vendors. Moreover, because we engage in relatively little direct brand advertising, the promotion of our brand depends, among other things, upon hardware device manufacturing partners displaying our trademarks on their products. If these partners choose for any reason not to display our trademarks on their products, or if our partners use our trademarks incorrectly or in an unauthorized manner, the strength of our brand may be diluted or our ability to maintain or increase our brand awareness may be harmed. In addition, if we fail to maintain high-quality standards for products that incorporate our technologies through the quality-control certification process that we require of our licensees, or if we take other steps to commercialize our products and services that our customers or potential customers reject, the strength of our brand could be adversely affected. Further, unauthorized third parties may use our brand in ways that may dilute or undermine its strength.

We expect the market for DVD players to decline as new products are introduced into the market. To the extent that sales of DVD players decline, or alternative technologies in which we do not participate replace DVDs as a dominant medium for consumer video entertainment, our licensing revenue will be adversely affected.

Growth in our revenue over the past several years has been the result, in large part, of the rapid growth in sales of red-laser DVD players incorporating our technologies. For years 2009, 2008 and 2007, we derived approximately

14

Table of Contents

70%, 66% and 70%, respectively, of our total net revenues from technology licensing to consumer hardware device manufacturers, a majority of which are derived from sales of red-laser DVD players incorporating our technologies. However, as the markets for DVD players mature, we expect sales of red-laser DVD players to decline. To the extent that sales of red-laser DVD players decline, our licensing revenue will be adversely affected. In addition, if new technologies are developed for use with DVDs or new technologies are developed that substantially compete with or replace red-laser DVDs as a dominant medium for consumer video entertainment such as the Blu-ray Disc, and if we are unable to develop and successfully market technologies that are incorporated into or compatible with such new technologies, our ability to generate revenues will be adversely affected.

If we are unable to penetrate existing consumer electronics markets or adapt or develop technologies and products for new markets, our business prospects could be limited.

We expect that our future success will depend, in part, upon our ability to successfully penetrate existing markets for digital media technologies, including:

| • | DVD players and recorders; |

| • | MP3 devices; |

| • | Blu-ray players; |

| • | portable media players; |

| • | digital still cameras; |

| • | digital camcorders; |

| • | mobile handsets; |

| • | digital media software applications; |

| • | digital TVs; |

| • | home media centers; |

| • | set-top boxes; |

| • | multi-media storage devices; and |

| • | video game consoles. |

To date, we have penetrated only some of these markets, including the markets for DVD players, Blu-ray players, portable media players, digital still cameras, digital TVs, mobile handsets, digital media software applications, set-top boxes, multi-media storage devices and video game consoles. Our success depends upon our ability to further penetrate these markets, some of which we have only penetrated to a limited extent, and to successfully penetrate those markets in which we currently have no presence. Demand for our technologies in any of these developing markets may not grow or develop, and a sufficiently broad base of consumers and professionals may not adopt or continue to use our technologies. In addition, our ability to generate revenue from these markets may be limited to the extent that service providers in these markets choose to provide competitive technologies and entertainment at little or no cost. Because of our limited experience in certain of these markets, we may not be able to adequately adapt our business and our technologies to the needs of consumers and licensees in these markets.

We face significant competition in various markets, and if we are unable to compete successfully, our ability to generate revenues from our business will suffer.

We face significant competition in the digital media markets in which we operate. We believe that our most significant competitive threat comes from companies that have the collective financial, technical and other

15

Table of Contents

resources to develop the technologies, services, products and partnerships necessary to create a digital media ecosystem that can compete with the DivX ecosystem. Those potential competitors currently include Adobe Systems, Apple Computer, Google, Microsoft, and Yahoo!.

We also compete with companies that offer products or services that compete with specific aspects of our digital media ecosystem. For example, our digital rights management technology competes with technologies from companies such as Apple Computer, ContentGuard, Intertrust Technologies, Microsoft, Nagra Audio, NDS Group and 4C Entity, as well as the internal development efforts of certain of our licensees. Similarly, content distribution providers, such as Amazon.com, Apple Computer, Google, Joost, MovieLink, a subsidiary of Blockbuster Inc., MySpace.com, a subsidiary of News Corporation, Netflix, Yahoo!, YouTube, a subsidiary of Google, Hulu, LLC and subscription entertainment services and cable and satellite providers compete with our content distribution services. In addition, we compete with companies such as Yahoo!, VUDU, Inc., Boxee, Inc. and Rovi Corporation and with internally developed proprietary solutions developed by hardware device manufacturers and integrated circuit manufacturers in our development and marketing of technologies to enable the next generation of Internet-enabled consumer electronics devices.

Our proprietary technologies also compete with other video compression technologies, including other implementations of MPEG-4 or implementations of H.264/AVC. In addition, a number of companies such as Adobe Systems, Apple Computer, Ateme, Google, Microsoft, and RealNetworks offer video formats that compete with our proprietary video format.

We also face competition from subscription entertainment services, cable and satellite providers, DVDs and other emerging technologies and products related to content distribution. Our content distribution platforms and services face significant competition from services, such as peer-to-peer and content aggregator services, which allow consumers to directly access an expansive array of content without securing licenses from content providers.

Some of our current or future competitors may have significantly greater financial, technical, marketing and other resources than we do, may enjoy greater brand recognition than we do, or may have more experience or advantages than we have in the markets in which they compete. For example, companies such as Amazon.com, Apple Computer, Google, Microsoft, Sony, Yahoo! and Adobe Systems may have competitive advantages over us because of their greater size and resources and the strength of their respective brand names. In addition, some of our current or potential competitors, such as Apple Computer, Dolby Laboratories, Microsoft and Sony, may be able to offer integrated system solutions in certain markets for entertainment technologies, including audio, video and rights management technologies related to personal computers or the Internet, which could make competing products and technologies that we develop unnecessary. By offering an integrated system solution, these potential competitors also may be able to offer competing products and technologies at lower prices than our products and technologies. Further, many of the consumer hardware and software products that include our technologies also include technologies developed by our competitors. As a result, we must continue to invest significant resources in product development in order to enhance our technologies and our existing products and introduce new high- quality technologies and products to meet the wide variety of such competitive pressures. Our ability to generate revenues from our business will suffer if we fail to do so successfully.

We are dependent on the sale by our licensees of consumer hardware and software products that incorporate our technologies. Our top 10 licensees by revenue accounted for approximately 58% of our total net revenues during the year 2009, and a reduction in revenues from those licensees or a loss of one or more of our key licensees would adversely affect our licensing revenue.

We derive most of our revenue from the licensing of our technologies to consumer hardware device manufacturers, software vendors and consumers. We derived 92%, 80% and 78% of our total net revenues from licensing our technology during years 2009, 2008 and 2007, respectively. One or a small number of our licensees generally represents a significant percentage of our technology licensing revenues. For example, in 2009,

16

Table of Contents

Samsung and Sony accounted for approximately 13% and 12% of our total net revenues, respectively, and our top 10 licensees by revenue accounted for approximately 58% of our total net revenues. Our technology licensing revenues are particularly dependent upon our relationships with consumer hardware device manufacturers. We cannot control consumer hardware device manufacturers’ and software developers’ product development or commercialization efforts or predict their success. Our license agreements typically require manufacturers of consumer hardware devices and software vendors to pay us a specified royalty for every shipped consumer hardware or software product that incorporates our technologies, but many of these agreements do not require these manufacturers to guarantee us a minimum royalty in any given period. Accordingly, if our licensees sell fewer products incorporating our technologies, or otherwise face significant economic difficulties, our licensing revenues will be adversely affected. Additionally, certain of our license agreements provide for specific royalties based on our estimations of the volumes of certain units consumer hardware device manufacturers are likely to ship during a given term; if our estimates are too low, the actual per-unit revenues received may be lower than expected. Also, certain of our OEM partners have sought to enter into a site license with us, pursuant to which the OEM partner pays a flat royalty fee for use of certain of our technology. If we underestimate the use of our technology by one of our site license partners, the flat royalty rate that we charge may be too low and our revenues may be adversely affected. Our license agreements are generally for two years or less in duration, and a significant number of these agreements expire in any given quarter. Upon expiration of their license agreements, manufacturers and software developers may not renew their agreements or may elect not to enter into new agreements with us on terms as favorable as our current agreements.

Revenues under our promotion and distribution agreement with Google, entered into in March 2009, represented approximately 8% of our total net revenues in 2009. A termination of our promotion and distribution agreement with Google or our failure to renew or replace this agreement would significantly decrease our revenues.

In March 2009, we entered into a promotion and distribution agreement with Google pursuant to which we distribute Google products, including among others the Google Chrome web browser, with our software products, and Google pays us fees based on successful activations of these products. Since March 2009, we have relied on this relationship with Google for a significant portion of our revenue. Revenue derived from the agreement represented approximately 8% of our total net revenues in 2009. If Google’s products do not prove to be as popular among consumers as we anticipate, if our products decline in popularity among consumers, or if Google’s products reach market saturation, we may experience a decrease in revenue under our agreement with Google. In addition, our ability to continue to generate revenues under the agreement is limited by a cap on the total amounts payable by Google under the agreement, after which Google is relieved of further obligations to pay us for successful activations or otherwise. If we meet this cap, our revenues in subsequent periods may decrease. This agreement expires upon the earlier of February 28, 2011 or the date upon which we reach the cap on the total amounts payable by Google to us under the agreement, and Google is under no obligation to renew this agreement. If, upon the expiration of our agreement with Google, we fail to enter into a new agreement with Google or a similar partner on substantially the same or more favorable terms, our future revenues will significantly decrease.

The success of our business depends in part on the availability of premium video content in the DivX format.

To date, only five Hollywood motion picture studios have agreed to make certain video content available in the DivX media format. If we, and/or our consumer electronics partners or retail partners, fail to implement certain technological safeguards mandated under those deals, such format approval agreements may be suspended or terminated, either of which could negatively impact our business. The implementation of these changes could potentially be viewed negatively by consumers and as a result our business could suffer. Additionally, the distribution of such DivX-formatted video content is dependent on third party retailers’ willingness to enter into distribution deals with one or more of our studio partners and DivX and ultimately upon the willingness of consumers to purchase such content from such third party retailers. Finally, our business success depends upon our ability to reach agreement with other major motion picture studios to make their content available in the

17

Table of Contents

DivX media format. In the event that we fail to reach agreement with such studios, the DivX format may become less compelling to consumers and to retailers and potentially to consumer electronics licensees of DivX.

The success of our business depends on the interoperability of our technologies with consumer hardware devices.

To be successful we design our digital media platform to interoperate effectively with a variety of consumer hardware devices, including personal computers, DVD players and recorders, Blu-ray players, digital still cameras, digital camcorders, portable media players, digital TVs, home media centers, set-top boxes, video game consoles, MP3 devices, multi-media storage devices and mobile handsets. We depend on significant cooperation with manufacturers of these devices and the components integrated into these devices, as well as software providers that create the operating systems for such devices, to incorporate our technologies into their product offerings and ensure consistent playback of DivX-encoded files. Currently, a limited number of devices are designed to support our technologies. If we are unsuccessful in causing component manufacturers, device manufacturers and software providers to integrate our technologies into their product offerings, our technologies may become less accessible to consumers, which would adversely affect our revenue potential.

If we fail to develop and deliver innovative technologies and products in response to changes in our industry, including changes in consumer tastes or trends, our revenues could decline.