Attached files

| file | filename |

|---|---|

| EX-31.2 - CHANCERY RESOURCES, INC. | v177437_ex31-2.htm |

| EX-32.1 - CHANCERY RESOURCES, INC. | v177437_ex32-1.htm |

| EX-31.1 - CHANCERY RESOURCES, INC. | v177437_ex31-1.htm |

| EX-32.2 - CHANCERY RESOURCES, INC. | v177437_ex32-2.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

(Mark

One)

x ANNUAL REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the

fiscal year ended November

30, 2009

o TRANSITION REPORT UNDER

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the

transition period from [ ] to

[ ]

Commission

file number 000-51163

CHANCERY RESOURCES,

INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

26-4567259

|

|

(State

or other jurisdiction of incorporation or organization)

|

(I.R.S.

Employer Identification No.)

|

|

4400 Westgrove Drive, Suite 104, Dallas,

Texas

|

75001

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

|

Registrant's

telephone number, including area code:

|

972-655-9870

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of Each Class

|

Name

of Each Exchange On Which Registered

|

|

N/A

|

N/A

|

Securities

registered pursuant to Section 12(g) of the Act:

Common

Stock, Par Value $0.00001

(Title

of class)

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 the Securities Act.

Yes ¨ No

x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act

Yes

¨

No x

Indicate

by check mark whether the registrant: (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports) and (2) has been subject to such filing requirements for

the last 90 days. Yes x No

¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K (§229.405 of this chapter) is not contained herein, and will not

be contained, to the best of registrant's knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this Form 10-K

or any amendment to this Form 10-K. ¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

definition of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

|

Large

accelerated filer ¨

|

Accelerated

filer

¨

|

|

Non-accelerated

filer ¨

|

Smaller

reporting company x

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act).

Yes ¨ No

x

The

aggregate market value of Common Stock held by non-affiliates of the Registrant

on February 24, 2010was $322,500

based on a $0.01 closing price for the Common Stock on February 24, 2010.

For purposes of this computation, all executive officers and directors have been

deemed to be affiliates. Such determination should not be deemed to be an

admission that such executive officers and directors are, in fact, affiliates of

the Registrant.

Indicate

the number of shares outstanding of each of the registrant’s classes of common

stock as of the latest practicable date. 32,250,000

as of February 23, 2010

DOCUMENTS

INCORPORATED BY REFERENCE

None.

TABLE

OF CONTENTS

|

Item

1.

|

Business

|

3

|

|

Item

1A.

|

Risk

Factors

|

10

|

|

Item

1B.

|

Unresolved

Staff Comments

|

14

|

|

Item

2.

|

Properties

|

14

|

|

Item

3.

|

Legal

Proceedings

|

14

|

|

Item

4.

|

Submission

of Matters to a Vote of Security Holders

|

14

|

|

Item

5.

|

Market

for Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities

|

14

|

|

Item

6.

|

Selected

Financial Data

|

15

|

|

Item

7.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

15

|

|

Item

7A.

|

Quantitative

and Qualitative Disclosures About Market Risk

|

20

|

|

Item

8.

|

Financial

Statements and Supplementary Data

|

20

|

|

Item

9.

|

Changes

in and Disagreements With Accountants on Accounting and Financial

Disclosure

|

22

|

|

Item

9A(T).

|

Controls

and Procedures

|

22

|

|

Item

9B.

|

Other

Information

|

22

|

|

Item

10.

|

Directors,

Executive Officers and Corporate Governance

|

23

|

|

Item

11.

|

Executive

Compensation

|

25

|

|

Item

12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

27

|

|

Item

13.

|

Certain

Relationships and Related Transactions, and Director

Independence

|

29

|

|

Item

14.

|

Principal

Accounting Fees and Services

|

29

|

|

Item

15.

|

Exhibits,

Financial Statement Schedules

|

31

|

2

PART

I

Item

1. Business

This

annual report contains forward-looking statements. These statements relate to

future events or our future financial performance. In some cases, you can

identify forward-looking statements by terminology such as “may”, “should”,

“expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”,

“potential” or “continue” or the negative of these terms or other comparable

terminology. These statements are only predictions and involve known and unknown

risks, uncertainties and other factors, including the risks in the section

entitled “Risk Factors” that may cause our or our industry’s actual results,

levels of activity, performance or achievements to be materially different from

any future results, levels of activity, performance or achievements expressed or

implied by these forward-looking statements.

Although

we believe that the expectations reflected in the forward-looking statements are

reasonable, we cannot guarantee future results, levels of activity, performance

or achievements. Except as required by applicable law, including the securities

laws of the United States, we do not intend to update any of the forward-looking

statements to conform these statements to actual results.

Our

financial statements are stated in United States Dollars (US$) and are prepared

in accordance with United States Generally Accepted Accounting

Principles.

In this

annual report, unless otherwise specified, all dollar amounts are expressed in

United States dollars and all references to “common shares” refer to the common

shares in our capital stock.

As used

in this current report and unless otherwise indicated, the terms "we", "us",

"our", “Company”, and “Chancery” mean Chancery Resources, Inc. and our wholly

owned subsidiaries Chancery Mining Canada Ltd. and Minera Chancery Columbia,

unless otherwise indicated.

General

Overview and Business Development over the Last Three Years

We were

incorporated in the State of Nevada on September 12, 2006. We are an exploration

stage corporation. An exploration stage corporation is one that is engaged in

the search from mineral deposits or reserves which are not in either the

development or production stage.

We

maintain our statutory registered agent's office at The Corporation Trust

Company of Nevada, 6100 Neil Road, Suite 500, Reno, Nevada 89511 and our

business office and mailing address is 4400 Westgrove Drive, Suite 106, Dallas,

Texas 75001. Our telephone number is 972-655-9870.

Since

October 2006, we held the rights to nine Mineral Titles Online cells referred to

as the Hunter property, through Geoffrey Gachallan, a former director and

officer of our company, who held the property for us in trust. On September 9,

2008, our rights to the claim expired.

On March

19, 2008, we entered into a mining acquisition agreement with Altos de Amador

S.A., wherein we have agreed to purchase a 100% interest in certain mineral

claims in Valparaiso, Antioquia, Colombia, known as the El Cafetal

Mine.

As

consideration for the purchase, we have agreed to pay to Altos de Amador

$270,000 cash, to be provided as follows:

|

|

(a)

|

$50,000 to be provided on signing

of the acquisition agreement

(paid);

|

|

|

(b)

|

$70,000 to be provided within 30

days of signing the acquisition agreement (paid);

and

|

|

|

(c)

|

$150,000 to be provided within 90

days of signing the acquisition

agreement.

|

3

In

addition, we have agreed to split profits from mining operations – 60% to our

company and 40% to the vendor until such time as we have paid $210,000 of the

purchase price, after which, profits shall be split 90% to our company and 10%

to the vendor. We have the right to acquire the vendor’s 10% profit interest at

any time for $370,000.

Effective

April 4, 2008, we entered into an amending agreement with Altos de Amador

wherein the terms of profit split have been amended so that, upon commencement

of mining operations, all profits from the sale of ore shall be split 60% to our

company and 40% to the vendor. Upon our company having paid a further $210,000,

in addition to the funds payable pursuant to the terms of the mining acquisition

agreement, such profits shall then be split 90% to our company and 10% to the

vendor. Our company will have the right to acquire the vendor’s 10% profit

interest at any time upon payment of an additional $370,000. There are currently

some governmental requirements that need to be fulfilled for the El Cafetal

mining title. These requirements include the present title owner amending a PTO

report to comply with certain specifications and paying certain annual

governmental fees, all of which are currently being completed.

To date,

we have not made the final $150,000 payment as required by the mining

acquisition agreement. We plan to hold such payment until the above title

requirements have been complied with and or alternatively to pay the outstanding

governmental fees due on the El Cafetal mine and deduct these amounts from the

final $150,000 payment. As our initial mining

acquisition agreement with Altos de Amador is no longer in good standing due to

certain misrepresentation on warranties and representations made on Altos de

Amador’s side, we have signed a Mining Acquisition Agreement on April 14

th

, 2009

directly with the owners of the property, Inversiones Midas Limitada, to

continue negotiations, which has a final payment of $150,000 minus

payments to the outstanding governmental fees due on the El Cafetal mine with no

timeframe period for payment.

Effective

April 14, 2009, we entered into an agreement with Inversiones Midas wherein the

terms of profit split so that, upon commencement of mining operations, all

profits from the sale of ore shall be split 60% to our company and 40% to the

vendor. Upon our company having paid a further 720 million Colombian pesos

(estimated value of land and equipment), Inversiones Midas agrees to give and

transfer 50% ownership of the Mining title, in addition to the funds payable

pursuant to the terms of the mining acquisition agreement, such profits shall

then be split 90% to our company and 10% to the vendor. Our company will have

the right to acquire the vendor’s 10% profit interest at any time upon payment

of additional 780 million Colombian pesos, and then the remaining 50% of the

Title ownership will be transferred to our company.

On

October 16, 2008, Rafael A. Pinedo and Jeffrey Fanning were appointed as

directors of our company.

Subsequent

to such appointments, on October 16, 2008, Juan Restrepo Gutierrez resigned as

president and a director of our company and Rafael A. Pinedo was appointed

president. Mr. Restrepo remains as chief executive officer, chief financial

officer, secretary and treasurer. In addition, Mr. Fanning was appointed vice

president of exploration. Our board of directors now consists of Rafael A.

Pinedo and Jeffery Fanning.

On

November 4, 2008, our board of directors designated 40,000,000 shares of our

preferred stock as the Series A Preferred Stock. Each share of Series A

Preferred Stock is convertible into shares of our common stock on the basis of

one (1) share of Series A Preferred Stock for one-fifth (1/5) of one share of

our Common Stock;

On

November 6, 2008, we entered into a consulting agreement with Rafael Pinedo, our

President. The term of the agreement is for a period of one year and in

consideration for the services to be provided we have agreed to issue 1,000,000

restricted shares of our common stock to Mr. Pinedo.

On

November 6, 2008, we entered into a mineral property acquisition agreement with

CB Resources Ltd., BNP Resources LLC and Rafael Pinedo to acquire certain

mineral property interests known as the HCL Property (the HCL Property is

comprised in part by our formerly owned Hunter Property). The closing of the

transactions contemplated in the mineral property acquisition agreement occurred

on November 6, 2008. In accordance with the closing of the mineral property

acquisition agreement, we agreed to issue 1,000,000 restricted shares of our

common stock to CB Resources Ltd., 25,000,000 restricted shares of our Series A

Preferred Stock to Rafael Pinedo and 6,000,000 restricted shares of our Series A

Preferred Stock to BNP Resources LLC. Due to land ownership restrictions under

British Columbia laws, we entered into a trust agreement with CB Resources Ltd.,

wherein CB Resources Ltd. agreed to hold the mineral property interests in trust

for our company.

On

November 12, 2008, we incorporated a wholly owned subsidiary pursuant to the

laws of the Province of British Columbia under the name Chancery Mining Canada

Ltd.

On

January 19, 2009, we acquired through our wholly owned subsidiary, Chancery

Mining Canada Ltd., an undivided one hundred percent (100%) interest in certain

mineral interests located in British Columbia, Canada known as the Fiddler Creek

Property.

4

The

Fiddler Creek Property is comprised of 25 mineral claims, totaling 465.74

hectares located within the Omineca Mining Division in northwestern British

Columbia. The acquired block of claims counts with records of a past producer

“Fiddler Creek,” which describes the geology of the Property as an area that is

underlain by argillites of the Jurassic to Cretaceous Bowser Lake Group, in

which auriferous quartz veins are probable sources for placer gold along Fiddler

Creek (BC Minfile 103I206). The deposit types that historically predominate in

the Fiddler-Doreen area are Silver, Gold, Lead and Zinc. Geophysical, soil, rock

and core samples will be analyzed soon; an exploration program recommended by a

qualified geology person will be released when finalized.

On

January 30, 2009, we incorporated a wholly owned subsidiary pursuant to the laws

of Columbia under the name Minera Chancery Colombia.

On July

24, 2009, Chancery Resources, Inc. (the "Company") received a NI 43-101 Canadian

Compliant Geological report on the El Cafetal Property as prepared and submitted

by James R. Reeves, Reg., P.Geo., in his capacity as a geological consultant to

the Company. Technical Report was formatted on Canadian National Instrument

43-101 ("NI 43-101"), which is a mineral resource classification scheme that

provides strict guidelines for the public disclosure of scientific and technical

information relating to mineral properties.

On August 3rd, 2009, Vincent Higgins

was appointed as independent director of our company. Subsequent to such

appointment, on August 4, 2009, Juan Restrepo Gutierrez resigned as chief

executive officer and remains as chief operations officer, secretary and

director of our company and Rafael A. Pinedo was appointed chief executive and

ratified as president.

Mr.

Higgins, age 43, is a recognized international leader in training, leadership

development, and multicultural team building. He founded the

Institute for Effective Leadership. Mr. Higgins served as the Director of the

Lumen Institute, Dallas, Texas and founded the Dallas

branch. Trilingual: English, Spanish, and Italian. Extensive

experience in operations and growth of international non-profit organizations

including institutional fundraising and networking. Obtained undergraduate

degree in Physics, Summa Cum Laude at the University of Dallas, TX. Doctoral

track in High Energy Physics, at Purdue University, West Lafayette, Indiana and

degrees in Philosophy and Theology at the Pontifical University Regina

Apostolorum, in Rome, Italy.

There are

no family relationships with any of our directors and officers.

October

16th, 2009,

the Company dismissed Manning Elliott, as its independent registered public

accounting firm and, on October 16th, 2009,

engaged Malone & Bailey, PC, from Houston Texas as its new independent

registered public accounting firm.

Other

than as set out herein, we have not been involved in any bankruptcy,

receivership or similar proceedings, nor have we been a party to any material

reclassification, merger, consolidation or purchase or sale of a significant

amount of assets not in the ordinary course of our business.

Our

Current Business

We are an

exploration stage mining company engaged in the exploration of minerals on our

properties.

Our

current operational focus is to conduct exploration activities on our HCL

Property, to complete the terms of the mining acquisition agreement with Altos

de Amador S.A. for the El Cafetal Mine and to conduct exploration activities on

our Fiddler Creek Property.

HCL

Property

General

Information

The HCL

Property is a mining claim located in Merritt, British Columbia, Canada, and

totals 415.04 hectares or 1,026 acres approximately.

The

following is a list of tenure numbers, claim, and expiration date of our

claims:

|

Tenure Number

|

Claim Name

|

No. MTO Cells

|

Expiration Date

|

|||

|

592560

|

|

HCL

|

|

20

|

|

10/04/2010

|

A cell is

an area, which appears electronically on the British Columbia Internet Minerals

Titles Online Grid and was formerly called a claim. A claim is a grant from the

Crown of the available land within the cells to the holder to remove and sell

minerals. The online grid is the geographical basis for the cell. Formerly, the

claim was established by sticking stakes in the ground to define the area and

then recording the staking information. The staking system is now antiquated in

British Columbia and has been replaced with the online grid. The claim is

registered in the name of the CB Resources Ltd. who has agreed to hold the claim

in trust on behalf of Chancery Resources. As October 06, 2008, it’s not yet been

determined whether there are proven or probable reserves on the

property.

There are

no native land claims that affect title to the property.

Location

and Access

The HCL

mineral claim is comprised of 20 contiguous cells totaling 415.0483 hectares.

The center of the property is located at the latitude 50o 2' 14" N and the

longitude is 120o 47' 1" W. The claim is motor vehicle accessible from the Town

of Merritt, B.C. by traveling 19 miles east along Highway #5 beyond the Village

of Quilchena, B.C. to the Minnie Lake cut-off and then for 18 miles south by

gravel ranch roads to the mineral claim.

5

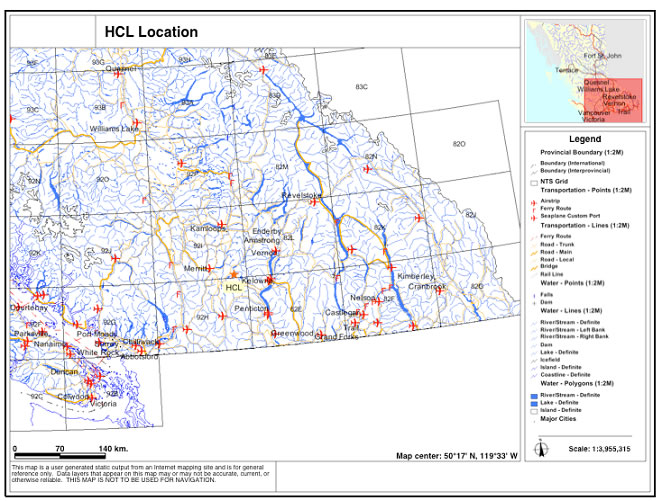

Below is

map of the HCL Claim:

Physiography

The Town

of Merritt, British Columbia which lies 37 miles by road northwest of the HCL

mineral claim offers much of the necessary infrastructure required to base and

carry-out an exploration program (accommodations, communications, equipment and

supplies). Merritt B.C. is highway accessible from Vancouver, B.C. in a few

hours by traveling over the Coquihalla (toll section) highway, in the time it

takes to travel 200 miles. The overnight Greyhound bus service is a popular way

to send-in samples and to receive additional equipment and supplies. The claim

area ranges in elevation from 2,850 feet to 3,400 feet mean sea level. The

physiographic setting of the property can be described as rounded, open range,

plateau terrain that has been surficially altered both by the erosional and the

depositional (drift cover) effects of glaciation. Thickness of drift cover in

the valleys may vary considerably. Fresh water lakes and streams are abundant in

the area.

6

Below is

a map of the HCL Property location:

Location,

History and Land Tenure

The

geology of the HCL mineral claim may be described as being underlain by units of

the Nicola Group. Some or all of these units may be found to host economic

mineralization. The property geological setting offers good underlying

possibilities and all overburden areas should be checked if a field program is

undertaken. The deposit types that historically predominate in the general area

are, as the larger target, as a porphyry-type base metal (copper-gold-palladium

or copper-molybdenum) occurrence with peripheral base and precious metal

occurrences as veins and/or contact zones of mineralization. The most prolific

host in this area is the Nicola Group andesitic tuffs that are often skarned or

altered. Any occurrences of Princeton Group sediments, i.e. shales, sanstone,

etc. should be checked thoroughly for coal occurrences and possibly coal-bed

methane gas possibilities.

Requirements

for Title

Title to

the property has already been granted CB Resources Ltd., who holds the claim in

trust for our company. To obtain a Free Miner's Certificate, which is required

to hold a mining claim in British Columbia, Section 8(1) of the B.C. Mineral

Tenure Act (MTA) stipulates that a corporation must be registered under the

British Columbia Business Corporations Act. Section 8(2) of the MTA stipulates

that an individual applicant must either be a resident of Canada or be

authorized to work in Canada. As the corporation is not registered in British

Columbia the claim is held in trust for the Company by CB Resources Ltd., a

corporation registered under the British Columbia Business Corporations Act. The

mineral title claim has been registered with the Government of British

Columbia.

7

Fiddler Creek

Property

General

Information

The

Fiddler Creek Property is comprised of 25 mineral claims, totaling 465.74

hectares located within the Omineca Mining Division in northwestern British

Columbia. The acquired block of claims counts with records of a past producer

“Fiddler Creek,” which describes the geology of the Property as an area that is

underlain by argillites of the Jurassic to Cretaceous Bowser Lake Group, in

which auriferous quartz veins are probable sources for placer gold along Fiddler

Creek (BC Minfile 103I206). The deposit types that historically predominate in

the Fiddler-Doreen area are Silver, Gold, Lead and Zinc. Geophysical, soil, rock

and core samples will be analyzed soon; an exploration program recommended by a

qualify geology person will be released when finalized.

The

following is a list of tenure number, claim name, and expiration date of our

claims:

|

Tenure Number

|

Claim Name

|

No. MTO Cells

|

Expiration Date

|

|||

|

597810

|

|

Fiddler

Creek

|

|

25

|

|

01/19/2011

|

Below is

a map of the Fiddler Creek Property:

8

Climate and Local

Resources

The

climate in the area is temperate with significant coastal influence coming from

the west up the Skeena valley as well as from the southwest up the Kitimat

valley. The northern location allows for long hours of daylight during the

summer, while significant snowfall occurs during winter season, which limits

fieldwork. Field season is comprised between June and early

September.

The

closest airport is the Terrace airport, which receives daily flights from

Vancouver and serves as a transportation hub for the area. The Canadian National

Railway and Yellowhead Highway (Highway 16) go through Terrace along the Skeena

River and connect the interior of B.C. to the ocean ports of Prince Rupert and

Kitimat.

El Cafetal

Mine

General

Information

The El

Cafetal Mine is located in the River basin of the Honda stream, on the Eastern

flank of the Western Mountain range, in the municipality of Valparaiso,

Antioquia, Colombia.

The

property covers an area of 135 hectares. The geology of the zone includes

sedimentary rocks and basaltic lava and Andesite of Tertiary age with several

veins and veins with different thicknesses and sulfide concentrations up to

80%.

The

mineralization consists of several veins with thicknesses between 0.15 and 1.1

m, composed by quartz, pyrite and partly free gold fitted in andesite lava, the

strips of 0.15 m of thickness with great sulfide concentrations are common

mainly pyrite up to an 80% with intermediate zones of rock with scattered

sulfides, in the endorsements the salband are common to conform a mineralized

zone up to 1.1 m.

We

recently completed preliminary sampling and chemical analyses on the El Cafatel

property. Our management is awaiting the results from the preliminary sampling

program and will update shareholders in the near future.

9

Competition

We are a

mineral resource exploration company. We compete with other mineral resource

exploration companies for financing and for the acquisition of new mineral

properties. Many of the mineral resource exploration companies with whom we

compete have greater financial and technical resources than those available to

us. Accordingly, these competitors may be able to spend greater amounts on

acquisitions of mineral properties of merit, on exploration of their mineral

properties and on development of their mineral properties. In addition, they may

be able to afford more geological expertise in the targeting and exploration of

mineral properties. This competition could result in competitors having mineral

properties of greater quality and interest to prospective investors who may

finance additional exploration. This competition could adversely impact on our

ability to finance further exploration and to achieve the financing necessary

for us to develop our mineral properties.

Compliance

with Government Regulation

We are

committed to complying with and are, to our knowledge, in compliance with, all

governmental and environmental regulations applicable to our company and our

properties. Permits from a variety of regulatory authorities are required for

many aspects of mine operation and reclamation. We cannot predict the extent to

which these requirements will affect our company or our properties if we

identify the existence of minerals in commercially exploitable quantities. In

addition, future legislation and regulation could cause additional expense,

capital expenditure, restrictions and delays in the exploration of our

properties.

Subsidiaries

Other

than Chancery Mining Canada Ltd. and Minera Chancery Colombia, we do not have

any other subsidiaries.

Research

and Development Expenditures

We have

incurred $Nil in research and development expenditures over the last fiscal

year.

Employees

Currently,

we have two employees. We do not expect any material changes in the number of

employees over the next 12 month period.

We engage

contractors from time to time to consult with us on specific corporate affairs

or to perform specific tasks in connection with our exploration

programs.

Intellectual

Property

We do not

own, either legally or beneficially, any patent or trademark.

Item

1A. Risk Factors

Legal

Proceedings.

We know

of no material, existing or pending legal proceedings against our company, nor

are we involved as a plaintiff in any material proceeding or pending litigation.

There are no proceedings in which any of our directors, officers or affiliates,

or any registered or beneficial shareholder, is an adverse party or has a

material interest adverse to our interest.

Risk

Factors

Much of

the information included in this quarterly report includes or is based upon

estimates, projections or other "forward looking statements". Such forward

looking statements include any projections or estimates made by us and our

management in connection with our business operations. While these

forward-looking statements, and any assumptions upon which they are based, are

made in good faith and reflect our current judgment regarding the direction of

our business, actual results will almost always vary, sometimes materially, from

any estimates, predictions, projections, assumptions or other future performance

suggested herein.

Such

estimates, projections or other "forward looking statements" involve various

risks and uncertainties as outlined below. We caution the reader that important

factors in some cases have affected and, in the future, could materially affect

actual results and cause actual results to differ materially from the results

expressed in any such estimates, projections or other "forward looking

statements".

Our

common shares are considered speculative during the development of our new

business operations. Prospective investors should consider carefully the risk

factors set out below.

Risks

Associated With Mining

All

of our properties are in the exploration stage. There is no assurance that we

can establish the existence of any mineral resource on any of our properties in

commercially exploitable quantities. Until we can do so, we cannot earn any

revenues from operations and if we do not do so we will lose all of the funds

that we expend on exploration. If we do not discover any mineral resource in a

commercially exploitable quantity, our business could fail.

Despite

exploration work on our mineral properties, we have not established that any of

them contain any mineral reserve, nor can there be any assurance that we will be

able to do so. If we do not, our business could fail.

A mineral

reserve is defined by the Securities and Exchange Commission in its Industry

Guide 7 (which can be viewed over the Internet at http://www.sec.gov/divisions/corpfin/forms/industry.htm#secguide7)

as that part of a mineral deposit which could be economically and legally

extracted or produced at the time of the reserve determination. The probability

of an individual prospect ever having a "reserve" that meets the requirements of

the Securities and Exchange Commission's Industry Guide 7 is extremely remote;

in all probability our mineral resource property does not contain any 'reserve'

and any funds that we spend on exploration will probably be lost.

10

Even if

we do eventually discover a mineral reserve on one or more of our properties,

there can be no assurance that we will be able to develop our properties into

producing mines and extract those resources. Both mineral exploration and

development involve a high degree of risk and few properties which are explored

are ultimately developed into producing mines.

The

commercial viability of an established mineral deposit will depend on a number

of factors including, by way of example, the size, grade and other attributes of

the mineral deposit, the proximity of the resource to infrastructure such as a

smelter, roads and a point for shipping, government regulation and market

prices. Most of these factors will be beyond our control, and any of them could

increase costs and make extraction of any identified mineral resource

unprofitable.

Mineral

operations are subject to applicable law and government regulation. Even if we

discover a mineral resource in a commercially exploitable quantity, these laws

and regulations could restrict or prohibit the exploitation of that mineral

resource. If we cannot exploit any mineral resource that we might discover on

our properties, our business may fail.

Both

mineral exploration and extraction require permits from various foreign,

federal, state, provincial and local governmental authorities and are governed

by laws and regulations, including those with respect to prospecting, mine

development, mineral production, transport, export, taxation, labour standards,

occupational health, waste disposal, toxic substances, land use, environmental

protection, mine safety and other matters. There can be no assurance that we

will be able to obtain or maintain any of the permits required for the continued

exploration of our mineral properties or for the construction and operation of a

mine on our properties at economically viable costs. If we cannot accomplish

these objectives, our business could fail.

We

believe that we are in compliance with all material laws and regulations that

currently apply to our activities but there can be no assurance that we can

continue to remain in compliance. Current laws and regulations could be amended

and we might not be able to comply with them, as amended. Further, there can be

no assurance that we will be able to obtain or maintain all permits necessary

for our future operations, or that we will be able to obtain them on reasonable

terms. To the extent such approvals are required and are not obtained, we may be

delayed or prohibited from proceeding with planned exploration or development of

our mineral properties.

If

we establish the existence of a mineral resource on any of our properties in a

commercially exploitable quantity, we will require additional capital in order

to develop the property into a producing mine. If we cannot raise this

additional capital, we will not be able to exploit the resource, and our

business could fail.

If we do

discover mineral resources in commercially exploitable quantities on any of our

properties, we will be required to expend substantial sums of money to establish

the extent of the resource, develop processes to extract it and develop

extraction and processing facilities and infrastructure. Although we may derive

substantial benefits from the discovery of a major deposit, there can be no

assurance that such a resource will be large enough to justify commercial

operations, nor can there be any assurance that we will be able to raise the

funds required for development on a timely basis. If we cannot raise the

necessary capital or complete the necessary facilities and infrastructure, our

business may fail.

Mineral

exploration and development is subject to extraordinary operating risks. We do

not currently insure against these risks. In the event of a cave-in or similar

occurrence, our liability may exceed our resources, which would have an adverse

impact on our company.

Mineral

exploration, development and production involves many risks which even a

combination of experience, knowledge and careful evaluation may not be able to

overcome. Our operations will be subject to all the hazards and risks inherent

in the exploration for mineral resources and, if we discover a mineral resource

in commercially exploitable quantity, our operations could be subject to all of

the hazards and risks inherent in the development and production of resources,

including liability for pollution, cave-ins or similar hazards against which we

cannot insure or against which we may elect not to insure. Any such event could

result in work stoppages and damage to property, including damage to the

environment. We do not currently maintain any insurance coverage against these

operating hazards. The payment of any liabilities that arise from any such

occurrence would have a material adverse impact on our company.

Mineral

prices are subject to dramatic and unpredictable fluctuations.

We expect

to derive revenues, if any, either from the sale of our mineral resource

properties or from the extraction and sale of precious and base metals such as

gold, silver and copper. The price of those commodities has fluctuated widely in

recent years, and is affected by numerous factors beyond our control, including

international, economic and political trends, expectations of inflation,

currency exchange fluctuations, interest rates, global or regional consumptive

patterns, speculative activities and increased production due to new extraction

developments and improved extraction and production methods. The effect of these

factors on the price of base and precious metals, and therefore the economic

viability of any of our exploration properties and projects, cannot accurately

be predicted.

11

The

mining industry is highly competitive and there is no assurance that we will

continue to be successful in acquiring mineral claims. If we cannot continue to

acquire properties to explore for mineral resources, we may be required to

reduce or cease operations.

The

mineral exploration, development, and production industry is largely

un-integrated. We compete with other exploration companies looking for mineral

resource properties. While we compete with other exploration companies in the

effort to locate and acquire mineral resource properties, we will not compete

with them for the removal or sales of mineral products from our properties if we

should eventually discover the presence of them in quantities sufficient to make

production economically feasible. Readily available markets exist worldwide for

the sale of mineral products. Therefore, we will likely be able to sell any

mineral products that we identify and produce.

In

identifying and acquiring mineral resource properties, we compete with many

companies possessing greater financial resources and technical facilities. This

competition could adversely affect our ability to acquire suitable prospects for

exploration in the future. Accordingly, there can be no assurance that we will

acquire any interest in additional mineral resource properties that might yield

reserves or result in commercial mining operations.

Risks

Related To Our Company

We

have a limited operating history on which to base an evaluation of our business

and prospects.

We have

been in the business of exploring mineral resource properties since September

2006 and we have not yet located any mineral reserve. As a result, we have never

had any revenues from our operations. In addition, our operating history has

been restricted to the acquisition and exploration of our mineral properties and

this does not provide a meaningful basis for an evaluation of our prospects if

we ever determine that we have a mineral reserve and commence the construction

and operation of a mine. We have no way to evaluate the likelihood of whether

our mineral properties contain any mineral reserve or, if they do that we will

be able to build or operate a mine successfully. We anticipate that we will

continue to incur operating costs without realizing any revenues during the

period when we are exploring our properties. We therefore expect to continue to

incur significant losses into the foreseeable future. We recognize that if we

are unable to generate significant revenues from mining operations and any

dispositions of our properties, we will not be able to earn profits or continue

operations. At this early stage of our operation, we also expect to face the

risks, uncertainties, expenses and difficulties frequently encountered by

companies at the start up stage of their business development. We cannot be sure

that we will be successful in addressing these risks and uncertainties and our

failure to do so could have a materially adverse effect on our financial

condition. There is no history upon which to base any assumption as to the

likelihood that we will prove successful and we can provide investors with no

assurance that we will generate any operating revenues or ever achieve

profitable operations.

The

fact that we have not earned any operating revenues since our incorporation

raises substantial doubt about our ability to continue to explore our mineral

properties as a going concern.

We have

not generated any revenue from operations since our incorporation and we

anticipate that we will continue to incur operating expenses without revenues

unless and until we are able to identify a mineral resource in a commercially

exploitable quantity on one or more of our mineral properties and we build and

operate a mine. We had cash in the amount of $323 as of November 30, 2009. At

November 30, 2009, we had working capital deficit of $378,907. We incurred a net

loss of $275,883 for the year ended November 30, 2009 and $1,562,110 since

inception on September 12, 2006. We estimate our average monthly operating

expenses to be approximately $7,800 to $9,500, including mineral property costs,

management services and administrative costs. Should the results of our planned

exploration require us to increase our current operating budget, we may have to

raise additional funds to meet our currently budgeted operating requirements for

the next 12 months. As we cannot assure a lender that we will be able to

successfully explore and develop our mineral properties, we will probably find

it difficult to raise debt financing from traditional lending sources. We have

traditionally raised our operating capital from sales of equity and debt

securities, but there can be no assurance that we will continue to be able to do

so. If we cannot raise the money that we need to continue exploration of our

mineral properties, we may be forced to delay, scale back, or eliminate our

exploration activities. If any of these were to occur, there is a substantial

risk that our business would fail.

These

circumstances lead our independent registered public accounting firm, in their

report dated February 26, 2010, to comment about our company’s ability to

continue as a going concern. Management has plans to seek additional capital

through a private placement and public offering of its capital stock. These

conditions raise substantial doubt about our company’s ability to continue as a

going concern. Although there are no assurances that management’s plans will be

realized, management believes that our company will be able to continue

operations in the future. The consolidated financial statements do not include

any adjustments relating to the recoverability and classification of recorded

assets, or the amounts of and classification of liabilities that might be

necessary in the event our company cannot continue in existence.” We continue to

experience net operating losses.

12

Risks

Associated with Our Common Stock

Trading

on the OTC Bulletin Board may be volatile and sporadic, which could depress the

market price of our common stock and make it difficult for our stockholders to

resell their shares.

Our

common stock is quoted on the OTC Bulletin Board service of the Financial

Industry Regulatory Authority. Trading in stock quoted on the OTC Bulletin Board

is often thin and characterized by wide fluctuations in trading prices, due to

many factors that may have little to do with our operations or business

prospects. This volatility could depress the market price of our common stock

for reasons unrelated to operating performance. Moreover, the OTC Bulletin Board

is not a stock exchange, and trading of securities on the OTC Bulletin Board is

often more sporadic than the trading of securities listed on a quotation system

like NASDAQ or a stock exchange like Amex. Accordingly, shareholders may have

difficulty reselling any of their shares.

Our

stock is a penny stock. Trading of our stock may be restricted by the SEC’s

penny stock regulations and FINRA’s sales practice requirements, which may limit

a stockholder’s ability to buy and sell our stock.

Our stock

is a penny stock. The Securities and Exchange Commission has adopted Rule 15g-9

which generally defines “penny stock” to be any equity security that has a

market price (as defined) less than $5.00 per share or an exercise price of less

than $5.00 per share, subject to certain exceptions. Our securities are covered

by the penny stock rules, which impose additional sales practice requirements on

broker-dealers who sell to persons other than established customers and

“accredited investors”. The term “accredited investor” refers generally to

institutions with assets in excess of $5,000,000 or individuals with a net worth

in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly

with their spouse. The penny stock rules require a broker-dealer, prior to a

transaction in a penny stock not otherwise exempt from the rules, to deliver a

standardized risk disclosure document in a form prepared by the SEC which

provides information about penny stocks and the nature and level of risks in the

penny stock market. The broker-dealer also must provide the customer with

current bid and offer quotations for the penny stock, the compensation of the

broker-dealer and its salesperson in the transaction and monthly account

statements showing the market value of each penny stock held in the customer’s

account. The bid and offer quotations, and the broker-dealer and salesperson

compensation information, must be given to the customer orally or in writing

prior to effecting the transaction and must be given to the customer in writing

before or with the customer’s confirmation. In addition, the penny stock rules

require that prior to a transaction in a penny stock not otherwise exempt from

these rules, the broker-dealer must make a special written determination that

the penny stock is a suitable investment for the purchaser and receive the

purchaser’s written agreement to the transaction. These disclosure requirements

may have the effect of reducing the level of trading activity in the secondary

market for the stock that is subject to these penny stock rules. Consequently,

these penny stock rules may affect the ability of broker-dealers to trade our

securities. We believe that the penny stock rules discourage investor interest

in, and limit the marketability of, our common stock.

In

addition to the “penny stock” rules promulgated by the Securities and Exchange

Commission, the Financial Industry Regulatory Authority has adopted rules that

require that in recommending an investment to a customer, a broker-dealer must

have reasonable grounds for believing that the investment is suitable for that

customer. Prior to recommending speculative low priced securities to their

non-institutional customers, broker-dealers must make reasonable efforts to

obtain information about the customer’s financial status, tax status, investment

objectives and other information. Under interpretations of these rules, the

Financial Industry Regulatory Authority believes that there is a high

probability that speculative low-priced securities will not be suitable for at

least some customers. The Financial Industry Regulatory Authority ’ requirements

make it more difficult for broker-dealers to recommend that their customers buy

our common stock, which may limit your ability to buy and sell our

stock.

Other

Risks

Trends,

Risks and Uncertainties

We have

sought to identify what we believe to be the most significant risks to our

business, but we cannot predict whether, or to what extent, any of such risks

may be realized nor can we guarantee that we have identified all possible risks

that might arise. Investors should carefully consider all of such risk factors

before making an investment decision with respect to our common

stock.

13

Item

1B. Unresolved Staff Comments

None.

Item

2. Properties

Executive

Offices

As of the

date of this current report, our executive and administrative offices are

located at 4400 Westgrove Drive, Suite 106, Dallas, Texas 75001. We lease

approximately 1,350 square feet at a cost of $1860 per month. We believe these

facilities are adequate for our current needs and that alternate facilities on

similar terms would be readily available if needed. We also keep an

administration and geology office on the 3rd Floor, 422 Richards Street

Vancouver, B.C. V6B2Z3.

Mineral

Properties

As of the

date of this annual report on Form 10-K, we hold or have the rights to acquire

the following properties: El Cafetal Mine, the HCL Property and the Fiddler

Creek Property. For detailed descriptions of these properties, please see the

section entitled “Business” above.

Item

3. Legal Proceedings

We know

of no material, existing or pending legal proceedings against us, nor are we

involved as a plaintiff in any material proceeding or pending litigation. There

are no proceedings in which any of our directors, officers or affiliates, or any

registered or beneficial shareholder, is an adverse party or has a material

interest adverse to our company.

Item

4. Submission of Matters to a Vote of Security

Holders

None.

PART

II

Item

5. Market for Registrant’s Common Equity, Related

Stockholder Matters and Issuer Purchases of Equity Securities

Our

common shares are quoted on the Over-the-Counter Bulletin Board under the symbol

“CCRY.” The following quotations, obtained from Yahoo Finance, reflect the high

and low bids for our common shares based on inter-dealer prices, without retail

mark-up, mark-down or commission and may not represent actual

transactions.

The high

and low bid prices of our common stock for the periods indicated below are as

follows:

|

National Association of

Securities Dealers OTC Bulletin Board (1)

|

||||||||

|

Quarter

Ended

|

High

|

Low

|

||||||

|

November

30, 2009

|

$ | 0.004 | $ | 0.004 | ||||

|

August

31, 2009

|

$ | 0.008 | $ | 0.008 | ||||

|

May

31, 2009

|

$ | 0.009 | $ | 0.009 | ||||

|

February

29, 2009

|

$ | 0.004 | $ | 0.004 | ||||

|

November

30, 2008

|

$ | 0.19 | $ | 0.19 | ||||

|

August

31, 2008

|

$ | 0.40 | $ | 0.40 | ||||

|

May

31, 2008

|

$ | 0.75 | $ | 0.75 | ||||

|

February

28, 2008

|

$ | 0.02 | $ | 0.02 | ||||

14

|

National Association of Securities Dealers OTC Bulletin Board (1)

|

||||||||

|

Quarter Ended

|

High

|

Low

|

||||||

|

November

30, 2008

|

$ | 0.01 | $ | 0.008 | ||||

|

August

31, 2008

|

$ | 0.01 | $ | 0.007 | ) | |||

(1)

Over-the-counter market quotations reflect inter-dealer prices without retail

mark-up, mark-down or commission, and may not represent actual

transactions.

(2) No

trades occurred during this period.

Our

common shares are issued in registered form. Empire Stock Transfer Inc., 7251

West Lake Mead Boulevard, Suite 300, Las Vegas, Nevada 89128-8351 (Telephone:

(775) 562-4091; Facsimile: (775) 974-1444 is the registrar and

transfer agent for our common shares.

On March

12, 2010, the shareholders' list showed 32 registered shareholders, 32,250,000

common shares and no Series A Preferred Shares outstanding.

Dividend

Policy

We have

not paid any cash dividends on our common stock and have no present intention of

paying any dividends on the shares of our common stock. Our current policy is to

retain earnings, if any, for use in our operations and in the development of our

business. Our future dividend policy will be determined from time to time by our

board of directors.

Equity

Compensation Plan Information

On

February 9, 2009, our directors approved the adoption of the 2009 Stock Option

Plan which permits our company to issue up to 6,450,000 shares of our common

stock to directors, officers, employees and consultants of our

company.

Recent

Sales of Unregistered Securities; Use of Proceeds from Registered

Securities

We did

not sell any equity securities which were not registered under the Securities

Act during the year ended November 30, 2008 that were not otherwise disclosed on

our quarterly reports on Form 10-Q or our current reports on Form 8-K filed

during the year ended November 30, 2008.

Purchase

of Equity Securities by the Issuer and Affiliated Purchasers

We did

not purchase any of our shares of common stock or other securities during our

fourth quarter of our fiscal year ended November 30, 2008.

Item

6. Selected Financial Data

As a

“smaller reporting company”, we are not required to provide the information

required by this Item.

Item

7. Management’s Discussion and Analysis of Financial

Condition and Results of Operations

Plan

of Operation

Management

plans to continue exploration of the El Cafetal property at the same time that

the Company undertakes efforts to place the property into production. As we

intend to continue exploration at the El Cafetal Project for the foreseeable

future, we are moving forward with our plans to make improvements to the

property, which will include recondition of current equipments and acquisition

of some new parts and materials. The Company recently completed preliminary

sampling and chemical analyses on the El Cafatel property. The Company also

intends to begin exploration of the HCL and Fiddler Creek property as fieldwork

season 20010 starts for more detailed sampling and mapping of the area. Our

ultimate objective is to become a producer of gold, silver and possibly other

associated base metals. We are unable at this time to predict when, if ever,

that objective will be achieved.

Purchase

of Significant Equipment

We do not

intend to purchase any significant equipment over the next twelve

months.

15

Personnel

Plan

We do not

expect any material changes in the number of employees over the next 12 month

period (although we may enter into employment or consulting agreements with our

officers or directors). We do and will continue to outsource contract employment

as needed.

Off-Balance

Sheet Arrangements

There are

no off-balance sheet arrangements that have or are reasonably likely to have a

current or future effect on our financial condition, changes in financial

condition, revenues or expenses, results of operations, liquidity, capital

expenditures or capital resources that is material to investors.

Our

principal capital resources have been through the subscription and issuance of

common stock, although we have also used stockholder loans and advances from

related parties.

Results

of Operations for the Years Ended November 30, 2009 and 2008

The

following summary of our results of operations should be read in conjunction

with our audited financial statements for the years ended November 30, 2009 and

2008.

Our

operating results for the years ended November 30, 2009 and 2008 are summarized

as follows:

|

Year

Ended

|

||||||||

|

November

30

|

||||||||

|

2009

|

2008

|

|||||||

|

Revenue

|

$ | Nil | $ | Nil | ||||

|

Total

Expenses

|

$ | 267,348 | $ | 1,224,237 | ||||

|

Net

Loss

|

$ | 275,883 | $ | 1,224,237 | ||||

Revenues

We have

not earned any revenues since our inception and we do not anticipate earning

revenues in the near future.

Expenses

Our

expenses for the year ended November 30, 2009 and November 30, 2008 are outlined

in the table below:

|

Year

Ended

|

||||||||

|

November

30

|

||||||||

|

2009

|

2008

|

|||||||

|

General

and administrative

|

$ | 62,392 | $ | 83,263 | ||||

|

Consulting

fees

|

$ | 184,809 | $ | 10,000 | ||||

|

Management

services

|

$ | - | $ | 5,500 | ||||

|

Impairment

of mineral property costs

|

$ | 444 | $ | 1,116,930 | ||||

|

Mineral

property costs

|

$ | 13,703 | $ | 6,000 | ||||

|

Rent

|

$ | 6,000 | $ | 2,544 | ||||

16

The

decrease in operating expenses for the year ended November 30, 2009, compared to

the same period in fiscal 2008, was mainly due to a decrease in general and

administrative expenses of $62,392 (2008: $83,263), a decrease in management

services $Nil (2008:$5,500); an impairment of mineral property costs of $444

(2008: $1,116,930), an increase in consulting fees of $184,809 (2008:

$10,000); an increase in rent $6,000 (2008: $2,544) and an increase

in mineral property costs of $13,703 (2008: $6,000).

Liquidity

and Financial Condition

As of

November 30, 2009, our total assets were $323 and our total liabilities were

$379,230 and we had a working capital deficit of $378,907. Our financial

statements report a net loss of $1,562,110 for the year ended November 30, 2009,

and a net loss of $1,286,227 for the period from September 12, 2006 (date of

inception) to November 30, 2008.

We have

suffered recurring losses from operations. The continuation of our company is

dependent upon our company attaining and maintaining profitable operations and

raising additional capital as needed. In this regard we have raised additional

capital through equity offerings and loan transactions.

|

Cash Flows

|

||||||||

|

At

|

At

|

|||||||

|

November

|

November

|

|||||||

|

30, 2009

|

30, 2008

|

|||||||

|

Net

Cash (Used in) Operating Activities

|

$ | (39,733 | ) | $ | (85,141 | ) | ||

|

Net

Cash Provided by (Used In) Investing Activities

|

$ | (444 | ) | $ | (50,000 | ) | ||

|

Net

Cash Provided by Financing Activities

|

$ | 39,018 | $ | 38,248 | ||||

|

Increase

In Cash During The Period

|

$ | (1,315 | ) | $ | (96,893 | ) | ||

We had a

working capital deficit of $378,907 as of November 30, 2009 compared to working

capital deficit of $107,754 as of November 30, 2008.

Our

principal sources of funds have been from sales of our common stock and short

term loans.

Contractual

Obligations

As a

“smaller reporting company”, we are not required to provide tabular disclosure

obligations.

Going

Concern

We have

not yet achieved profitable operations and are dependent on our ability to raise

capital from stockholders or other sources to meet our obligations and repay our

liabilities arising from normal business operations when they become due, in

their report on our audited financial statements for the year ended November 30,

2009, our independent auditors included an explanatory paragraph regarding

concerns about our ability to continue as a going concern. Our financial

statements contain additional note disclosure describing the circumstances that

lead to this disclosure by our independent auditors.

Critical

Accounting Policies

The

discussion and analysis of our financial condition and results of operations are

based upon our consolidated financial statements, which have been prepared in

accordance with the accounting principles generally accepted in the United

States of America. Preparing financial statements requires management to make

estimates and assumptions that affect the reported amounts of assets,

liabilities, revenue, and expenses. These estimates and assumptions are affected

by management’s application of accounting policies. We believe that

understanding the basis and nature of the estimates and assumptions involved

with the following aspects of our financial statements is critical to an

understanding of our financial statements.

17

Mineral

Property Costs

The

Company has been in the exploration stage since its inception and has not yet

realized any revenues from its planned operations. It is primarily engaged in

the acquisition and exploration of mining properties. Mineral property

exploration costs are expensed as incurred. Mineral property acquisition costs

are initially capitalized when incurred using the guidance in EITF 04-02,

“Whether Mineral Rights Are Tangible or Intangible Assets”. The Company assesses

the carrying costs for impairment under SFAS No. 144, “Accounting for Impairment

or Disposal of Long Lived Assets” at each fiscal quarter end. When it has been

determined that a mineral property can be economically developed as a result of

establishing proven and probable reserves, the costs then incurred to develop

such property, are capitalized. Such costs will be amortized using the

units-of-production method over the estimated life of the probable reserve. If

mineral properties are subsequently abandoned or impaired, any capitalized costs

will be charged to operations.

Long-lived

Assets

In

accordance with SFAS No. 144, “Accounting for the Impairment or Disposal of

Long-Lived Assets”, the Company tests long-lived assets or asset groups for

recoverability when events or changes in circumstances indicate that their

carrying amount may not be recoverable. Circumstances which could trigger a

review include, but are not limited to: significant decreases in the market

price of the asset; significant adverse changes in the business climate or legal

factors; accumulation of costs significantly in excess of the amount originally

expected for the acquisition or construction of the asset; current period cash

flow or operating losses combined with a history of losses or a forecast of

continuing losses associated with the use of the asset; and current expectation

that the asset will more likely than not be sold or disposed significantly

before the end of its estimated useful life. Recoverability is assessed based on

the carrying amount of the asset and its fair value which is generally

determined based on the sum of the undiscounted cash flows expected to result

from the use and the eventual disposal of the asset, as well as specific

appraisal in certain instances. An impairment loss is recognized when the

carrying amount is not recoverable and exceeds fair value.

Financial

Instruments

The fair

values of financial instruments, which include cash, accounts payable and

accrued liabilities, amounts due to a related party and loans payable, were

estimated to approximate their carrying values due to the immediate or

short-term maturity of these financial instruments. The Company’s operations are

in Canada, which results in exposure to market risks from changes in foreign

currency rates. The financial risk is the risk to the Company’s operations that

arise from fluctuations in foreign exchange rates and the degree of volatility

of these rates. Currently, the Company does not use derivative instruments to

reduce its exposure to foreign currency risk.

Income

Taxes

The

Company accounts for income taxes using the asset and liability method in

accordance with SFAS No. 109, “Accounting for Income Taxes”. The asset and

liability method provides that deferred tax assets and liabilities are

recognized for the expected future tax consequences of temporary differences

between the financial reporting and tax bases of assets and liabilities, and for

operating loss and tax credit carry-forwards. Deferred tax assets and

liabilities are measured using the currently enacted tax rates and laws that

will be in effect when the differences are expected to reverse. The Company

records a valuation allowance to reduce deferred tax assets to the amount that

is believed more likely than not to be realized.

18

Stock-based

Compensation

The

Company records stock-based compensation in accordance with SFAS No. 123R,

“Share Based Payments”, using the fair value method. All transactions in which

goods or services are the consideration received for the issuance of equity

instruments are accounted for based on the fair value of the consideration

received or the fair value of the equity instrument issued, whichever is more

reliably measurable.

19

Recent

Accounting Pronouncements

In May

2008, the Financial Accounting Standards Board (“FASB”) issued SFAS No. 163,

“Accounting for Financial Guarantee Insurance Contracts – An interpretation of

FASB Statement No. 60”. SFAS No. 163 requires that an insurance enterprise

recognize a claim liability prior to an event of default when there is evidence

that credit deterioration has occurred in an insured financial obligation. It

also clarifies how Statement 60 applies to financial guarantee insurance

contracts, including the recognition and measurement to be used to account for

premium revenue and claim liabilities, and requires expanded disclosures about

financial guarantee insurance contracts. It is effective for financial

statements issued for fiscal years beginning after December 15, 2008, except for

some disclosures about the insurance enterprise’s risk-management activities.

SFAS No. 163 requires that disclosures about the risk-management activities of

the insurance enterprise be effective for the first period beginning after

issuance. Except for those disclosures, earlier application is not permitted.

The adoption of this statement is not expected to have a material effect on the

Company’s financial statements.

In May

2008, the FASB issued SFAS No. 162, “The Hierarchy of Generally Accepted

Accounting Principles”. SFAS No. 162 identifies the sources of accounting

principles and the framework for selecting the principles to be used in the

preparation of financial statements of nongovernmental entities that are

presented in conformity with generally accepted accounting principles in the

United States. It is effective 60 days following the SEC’s approval of the

Public Company Accounting Oversight Board amendments to AU Section 411, “The

Meaning of Present Fairly in Conformity With Generally Accepted Accounting

Principles”. The adoption of this statement is not expected to have a material

effect on the Company’s financial statements.

In March

2008, the FASB issued SFAS No. 161, “Disclosures about Derivative Instruments

and Hedging Activities – an amendment to FASB Statement No. 133”. SFAS No. 161

is intended to improve financial standards for derivative instruments and

hedging activities by requiring enhanced disclosures to enable investors to

better understand their effects on an entity's financial position, financial

performance, and cash flows. Entities are required to provide enhanced

disclosures about: (a) how and why an entity uses derivative instruments; (b)

how derivative instruments and related hedged items are accounted for under SFAS

No. 133 and its related interpretations; and (c) how derivative instruments and

related hedged items affect an entity’s financial position, financial

performance, and cash flows. SFAS No. 161 is effective for financial statements

issued for fiscal years beginning after November 15, 2008, with early adoption

encouraged. The adoption of this statement is not expected to have a material

effect on the Company's financial statements.

In

December 2007, the FASB issued SFAS No. 141 (revised 2007), “Business

Combinations”. SFAS No. 141 (revised 2007) establishes principles and

requirements for how the acquirer of a business recognizes and measures in its

financial statements the identifiable assets acquired, the liabilities assumed,

and any non-controlling interest in the acquiree. The statement also provides

guidance for recognizing and measuring the goodwill acquired in the business

combination and determines what information to disclose to enable users of the

financial statements to evaluate the nature and financial effects of the

business combination. SFAS No. 141 (revised 2007) applies prospectively to

business combinations for which the acquisition date is on or after the

beginning of the first annual reporting period beginning on or after December

15, 2008. The adoption of this statement is not expected to have a material

effect on the Company's financial statements.

In

December 2007, the FASB issued SFAS No. 160, “Non-controlling Interests in

Consolidated Financial Statements Liabilities – an Amendment of ARB No. 51”.

This statement amends ARB 51 to establish accounting and reporting standards for

the Non-controlling interest in a subsidiary and for the deconsolidation of a

subsidiary. This statement is effective for fiscal years, and interim periods

within those fiscal years, beginning on or after December 15, 2008, and earlier

adoption is prohibited. The adoption of this statement is not expected to have a

material effect on the Company’s financial statements.

Item

7A. Quantitative and Qualitative Disclosures About Market

Risk

As a

“smaller reporting company”, we are not required to provide the information

required by this Item.

Item

8. Financial Statements and Supplementary

Data

20

Chancery

Resources, Inc.

(An

Exploration Stage Company)

November

30, 2008

|

Index

|

|

|

Report

of Independent Registered Public Accounting Firm

|

F–1

|

|

Consolidated

Balance Sheets

|

F–2

|

|

Consolidated

Statements of Operations

|

F–3

|

|

Consolidated

Statements of Cash Flows

|

F–4

|

|

Statement

of Stockholders’ Equity (Deficit)

|

F–5

|

|

Notes

to the Consolidated Financial Statements

|

F–6

|

21

To the

Directors and Stockholders

Chancery

Resources, Inc.

(An

Exploration Stage Company)

Letter:

We have

audited the accompanying balance sheets of Chancery Resources, Inc. (An

Exploration Stage Company) as of November 30, 2009 and 2008, and the related

statements of operations, cash flows and stockholders’ equity (deficit) for the

years then ended and accumulated from September 12, 2006 (Date of Inception) to

November 30, 2009. These financial statements are the responsibility of the

Company's management. Our responsibility is to express an opinion on these

financial statements based on our audits.

We

conducted our audits in accordance with the standards of the Public Company

Accounting Oversight Board (United States). Those standards require that we plan

and perform the audits to obtain reasonable assurance about whether the

financial statements are free of material misstatement. An audit includes

examining, on a test basis, evidence supporting the amounts and disclosures in

the financial statements. The Company is not required to have, nor were we

engaged to perform, an audit of its internal control over financial reporting.

An audit includes consideration of internal control over financial reporting as

a basis for designing audit procedures that are appropriate in the

circumstances, but not for the purpose of expressing an opinion on the

effectiveness of internal control over financial reporting. Accordingly, we

express no such opinion. An audit also includes assessing the accounting

principles used and significant estimates made by management, as well as

evaluating the overall financial statement presentation. We believe that our

audits provide a reasonable basis for our opinion.

In our

opinion, the financial statements referred to above present fairly, in all