Attached files

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

(Mark One)

þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2009

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission File No. 001-11155

WESTMORELAND COAL COMPANY

(Exact name of registrant as specified in its charter)

Delaware | 23-1128670 |

(State or other jurisdiction of | (I.R.S. Employer Identification No.) |

|

|

2 North Cascade Avenue, 2nd Floor Colorado Springs, CO (Address of principal executive offices) | 80903 (Zip Code) |

Registrant’s telephone number, including area code:

(719) 442-2600

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class |

| Name of Exchange on Which Registered |

|

|

|

Common Stock, par value $2.50 per share |

| NYSE AMEX |

Depositary Shares, each representing one-quarter of a share of Series A Convertible Exchangeable Preferred Stock |

|

|

Preferred Stock Purchase Rights |

|

|

Securities registered pursuant to Section 12(g) of the Act:

Series A Convertible Exchangeable Preferred Stock, par value $1.00 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-T (§ 232.405) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this 10-K or any amendment to this Form 10-K. ¨

1

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Accelerated filer | þ |

Non-accelerated filer | ¨ | Smaller reporting company | ¨ |

(Do not check if a small reporting company.) |

| ||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

The aggregate market value of voting common stock held by non-affiliates as of June 30, 2009 was $69,181,468.

There were 10,541,556 shares outstanding of the registrant's common stock, $2.50 par value per share (the registrant's only class of common stock), as of March 1, 2010.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement to be used by the Company in connection with its 2010 Annual Meeting of Stockholders scheduled to be held on May 20, 2010 are incorporated by reference into Part III of this Annual Report on Form 10-K.

2

Item |

| Page |

| PART I |

|

4 | Reserved | [ ] |

| PART II |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations | ||

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | ||

| PART III |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | ||

Certain Relationships and Related Transactions, and Director Independence | ||

| PART IV |

|

3

Cautionary Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K contains “forward-looking statements.” Forward-looking statements can be identified by words such as “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects” and similar references to future periods. Examples of forward-looking statements include, but are not limited to, statements we make regarding our expected increase in tons of coal to be delivered, the amount of our coal that will be subject to purchase contracts through 2019, an expected decrease in heritage health benefit expenses, cash payments and administrative costs, a reduction in cash receipts and the impact on our revenues due to a change in the rate charged by our ROVA plant, an expected decrease in pension expenses, an expected increase in our required pension plan contributions, an expected increase in our depreciation expense, anticipated capital investments and how such investments will be funded, an expected increase in our restricted investments and bond collateral, an expected reduction in our repayment obligations, and our expectation that our cash from operations and available borrowing capacity will be sufficient to meet our working capital and bonding requirements, planned capital expenditures and debt payments for the foreseeable future.

Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements. We caution you therefore against relying on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. Important factors that could cause actual results to differ materially from those in the forward-looking statements include political, economic, business, competitive, market, weather and regulatory conditions and the following:

·

changes in our postretirement medical benefit and pension obligations;

·

inability to expand or continue current coal operations due to limitations in obtaining bonding capacity for new mining permits;

·

our ability to maintain compliance with debt covenant and waiver agreement requirements or obtain waivers from our lenders in cases of non-compliance with our debt covenants;

·

the inability of our subsidiaries to pay dividends to us due to restrictions in our debt arrangements or reductions in planned coal deliveries;

·

the structure of ROVA’s contracts with its lenders, coal suppliers and the power purchaser, which could dramatically affect the overall profitability of ROVA;

·

the effect of prolonged maintenance or unplanned outages at our operations or those of our major power generating customers;

·

future legislation and changes in regulations, governmental policies and taxes, including those aimed at reducing emissions of elements such as mercury, sulfur dioxides, nitrogen oxides, particulate matter or greenhouse gases; and

·

the other factors that are described in “Risk Factors” herein.

Any forward-looking statements made by us in this Annual Report on Form 10-K speaks only as of the date on which it was made. Factors or events that could cause our actual results to differ may emerge from time-to-time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future developments or otherwise, except as may be required by law.

4

PART I |

The words “we,” “our,” “the Company,” or “Westmoreland,” as used in this report refer to Westmoreland Coal Company and its applicable subsidiary or subsidiaries.

Overview

Westmoreland Coal Company began mining in Westmoreland County, Pennsylvania in 1854 as a Pennsylvania corporation. In 1910, we incorporated in Delaware and continued our focus on underground coal operations in Pennsylvania and the Appalachian Basin. We moved our headquarters from Philadelphia, Pennsylvania to Colorado Springs, Colorado in 1995 and fully divested ourselves of all Eastern coal operations.

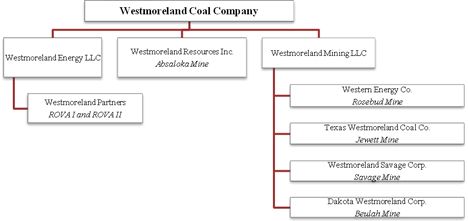

Today, Westmoreland Coal Company is an energy company employing 1,109 employees whose operations include five surface coal mines in Montana, North Dakota and Texas and two coal-fired power generating units with a total capacity of 230 megawatts in North Carolina. We sold 24.3 million tons of coal in 2009. Our two principal operating segments are our coal segment and our power segment. Our two non-operating segments are heritage and corporate. Our heritage segment primarily includes the costs of benefits we provide to former mining operation employees and our corporate segment consists primarily of corporate and business development expenses. We incorporate by reference the information about the operating results of each of our segments for the years ended December 31, 2009, 2008 and 2007 contained in Note 18 — Segment Information to our consolidated financial statements. The following chart provides an overview of the operating subsidiaries that make up our coal and power segments:

Coal Segment

General

Our coal segment is focused on niche coal markets where we take advantage of long-term coal contracts and rail transportation advantages. Approximately, two-thirds of our coal production is mine mouth, governed by long-term coal contracts with the neighboring power plant, while approximately the other third of coal production is sold in the open market where we take advantage of being the closest coal producer to our core open market customers via rail transportation. Currently, two-thirds of our produced coal is non-compliance sub-bituminous coal from the Northern Powder River Basin, while the remaining third is lignite. We project that over 50% of our contracted tons in 2010 will still be under contract in 2019. In addition, in 2010, we will be one of only three U.S. coal companies operating on Indian reservations, allowing us to enter into transactions to monetize Indian Coal Tax Credits.

In 2009, we sold 24.3 million tons of coal compared to 29.3 million in 2008. Our decrease in tons sold resulted from reduced demand for coal due to the global economic downturn, reduced electricity demands principally caused by adverse weather conditions and unscheduled customer shutdowns at our Rosebud and Beulah Mines.

5

The following table provides summary information regarding our principal mining operations as of December 31, 2009:

Mining Operation | Prior Operator | Manner of Transport | Machinery | Tons Sold | Total Cost of Property, Plant and Equipment ($ in millions) | Employees/ Labor Relations(1) | Coal Seam | ||

2007 | 2008 | 2009 | |||||||

MONTANA | |||||||||

Rosebud | Entech, Inc., a subsidiary of Montana Power, Purchased 2001 | Conveyor belt BNSF Rail Truck | 4 draglines Loadout facility | 12,583 | 13,026 | 10,332 | $131.9 | 389 employees; 303 represented by Local 400 of the IUOE | Rosebud |

Absaloka | Washington Group International, Inc. as contract operator, Ended contract in 2007 | Burlington Northern Santa Fe, or BNSF Rail Truck | 1 dragline Loadout facility | 7,347 | 6,418 | 5,911 | $131.1 | 171 employees; 133 represented by Local 400 of the IUOE | Rosebud-McKay |

Savage | Knife River Corporation, a subsidiary of MDU Resources Group, Inc., Purchased 2001 | Truck | 1 dragline | 354 | 359 | 344 | $4.4 | 11 employees; 9 represented by Local 400 of the IUOE | Pust |

TEXAS | |||||||||

Jewett | Entech, Inc., a subsidiary of Montana Power, Purchased 2001 | Conveyor belt | 4 draglines | 6,781 | 6,494 | 5,080 | $33.3 | 344 employees | Wilcox Group |

NORTH DAKOTA | |||||||||

Beulah | Knife River Corporation, a subsidiary of MDU Resources Group, Inc., Purchased 2001 | Conveyor belt BNSF Rail | 2 draglines Loadout facility | 2,946 | 3,046 | 2,585 | $54.9 | 153 employees; 122 represented by Local 1101 of the UMWA | Schoolhouse Beulah-Zap |

TOTALS | |||||||||

| 30,011 | 29,343 | 24,252 | $ 355.6 | 1,068 |

| |||

(1) 567 employees, or approximately 51% of our total employees, are represented by collective bargaining agreements. The labor agreement at the Savage Mines expires during 2010.

Properties

We had an estimated 425.1 million tons of proven and probable coal reserves as of December 31, 2009. Montana, Texas, and North Dakota each use a permitting process approved by the Office of Surface Mining. Our mines have chosen to permit coal reserves on an incremental basis and currently have sufficient permitted coal to meet production, given the current rates of mining and demand, for the periods shown in the table below. We secure all of our final reclamation obligations by bonds as required by the respective state agencies. We perform contemporaneous reclamation activities at each mine in the normal course of operations and coal production.

Our mines control coal reserves and deposits through long-term leases. Coal reserves are that part of a mineral deposit that can be economically and legally extracted at the time of the reserve determination. Coal deposits do not qualify as reserves until we conduct a final comprehensive economic evaluation and conclude it is legally and economically feasible to mine the coal. We base our estimate of the economic recoverability of our reserves upon a comparison of potential reserves to reserves currently in production in a similar geologic setting to determine an estimated mining cost. We compare these estimated mining costs to existing market prices for the anticipated quality of coal. We only include reserves expected to be economically mined in our reserve estimates.

Our engineers and geologists prepare our reserve estimates. We periodically engage independent mining and geological consultants to review the models and procedures we use in preparing our internal estimates of coal reserves according to standard classifications of reliability. Total recoverable reserve estimates change over time to reflect mining activity, analysis of new engineering and geological data, information obtained from our ongoing drilling program, changes in reserve holdings and other factors. We compile data from individual drill holes in a database from which the depth, thickness and the quality of the coal are determined. We classify reserves as either proven or probable based on the density result of the drill pattern.

6

The following table provides information about our mines as of December 31, 2009:

| Absaloka | Rosebud | Jewett | Beulah | Savage |

Owned by | Westmoreland Resources, Inc. | Western Energy Company | Texas Westmoreland Coal Co. | Dakota Westmoreland Corporation | Westmoreland Savage Corporation |

Location | Big Horn County, MT | Rosebud and Treasure Counties, MT | Leon, Freestone and Limestone Counties, TX | Mercer and Oliver Counties, ND | Richland County, MT |

Coal reserves (thousands of tons)(1) Proven | 77,486 | 212,515 | 49,966 - | 44,549 | 13,605 |

Permitted reserves | 75,098 | 127,824 | 49,966 | 26,873 | 1,129 |

2009 production | 5,859 | 10,105 | 5,092 | 2,587 | 343 |

Estimated life of permitted reserves(2) | 2020 | 2019 | 2022 | 2015 | 2013 |

Lessor | Crow Tribe | Federal Govt; State of MT; Great Northern Properties | Private parties; State of Texas | Private parties; State of ND; Federal Govt | Federal Govt; Private parties |

Lease term | Through exhaustion | Varies | Varies | 2009-2019 | Varies |

Current production capacity (thousands of tons) | 7,500 | 13,300 | 7,000 | 3,400 | 400 |

Coal type | Sub-bituminous | Sub-bituminous | Lignite | Lignite | Lignite |

Major customers | Xcel Energy, Western Fuels Assoc., Midwest Energy, Rocky Mountain Power | Colstrip 1&2 owners, Colstrip 3&4 owners, Minnesota Power | NRG Texas Power LLC | Otter Tail, MDU, Minnkota, Northwestern Public Service | MDU, Sidney Sugars |

Delivery method | Rail/Truck | Truck / Rail / Conveyor | Conveyor | Conveyor / Rail | Truck |

Approx. heat content (BTU/lb.)(3) | 8,647 | 8,553 | 6,572 | 7,002 | 6,553 |

Approx. sulfur content (%)(4) | 0.68 | 0.64 | 0.79 | 0.76 | 0.55 |

Year current complex opened | 1974 | 1968 | 1985 | 1963 | 1958 |

Total tons mined since inception (thousands of tons) | 167,136 | 419,677 | 179,092 | 99,356 | 14,141 |

(1)

Reserves are defined by SEC Industry Guide 7 as that part of a mineral deposit, which could be economically and legally extracted or produced at the time of the reserve determination. Proven and probable coal reserves are defined by SEC Industry Guide 7 as follows:

Proven (Measured) Reserves — Reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so close and the geographic character is so well defined that size, shape, depth and mineral content of reserves are well-established.

Probable (Indicated) Reserves — Reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven (measured) reserves, is high enough to assume continuity between points of observation.

(2)

Approximate year in which permitted reserves would be exhausted, based on current mine plan and production rates. Our Jewett Mine’s permit is expected to be renewed in 2010, but effectively covers all of the Mine’s reserves for the entire life of the mine. The Absaloka Mine permits expire in 2013 and 2014.

(3)

Approximate heat content applies to the coal mined in 2009.

(4)

Approximate sulfur content applies to the tons mined in 2009.

7

We lease all our coal properties except at the Jewett Mine, where we control some reserves through fee ownership. We are a party to coal leases with the federal government, state governments, and private parties at our Rosebud, Beulah, Savage and Jewett Mines. Each of the federal and state government leases continue indefinitely provided there is diligent development of the property and continued operation of the related mines. Federal statute generally sets production royalties on Federal leases at 12.5% of the gross proceeds of coal mined and sold for surface mines. At the Beulah and Savage Mines, we have received reductions in the Federal royalty rate due to the quality of the lignite coal mined. Our private leases run for an average term of twenty years and have options for renewal. We believe that we have satisfied all lease conditions in order to retain the properties and keep the leases in force.

We are a party to two leases with the Crow Tribe covering 18,406 acres of land at our Absaloka Mine. In 2008, WRI entered into a series of transactions, including the formation of Absaloka Coal, LLC with an unaffiliated investor, in order to take advantage of certain available tax credits for the production of coal on the Crow Tribe leased land. The tax credit is equal to $2.21 per ton in 2010 and increases annually to $2.30 per ton in 2012. We received a private letter ruling from the IRS providing that the Indian Coal Tax Credits are available to us. As part of such transaction, WRI subleased its leases with the Crow Tribe to Absaloka Coal, LLC, granting it the right to mine specified quantities of coal through September 2013, with WRI as contract miner. We will pay to the Crow Tribe 33% of the expected payments we will receive from the investor. WRI fully encumbered all of its property by a first lien under the revolving credit facility with First Interstate Bank and a second lien under the Note Purchase Agreement with Tontine Associates. In addition, Westmoreland Mining LLC fully encumbered all of its property at our Rosebud, Beulah and Savage mines pursuant to our June 2008 fixed rate term debt and revolving debt.

Customers

We sell almost all of the coal that we produce (over 99% in 2009) to plants that generate electricity. In 2009, approximately 60% of our total revenues were derived from coal sales to four power plants: Limestone Generating Station (19% of our 2009 revenues), Colstrip Units 3&4 (18%), Colstrip Units 1&2 (12%) and Sherburne County Station (11%). More than 80% of our tons are sold under contracts with remaining supply obligation terms of three years or more. We provide transportation for our mine-mouth customers, but sell coal plus lignite on a Free On Board, or FOB, basis to our other customers. Our coal revenues include amounts earned by our coal sales company from sales of coal produced by mines other than ours. In 2009, 2008, and 2007, such amounts were $0.8 million, $1.2 million, and $4.1 million, respectively.

Rosebud. The Rosebud Mine has two contracts with the adjacent Colstrip Station power generating facility. Effective January 1, 2010, a new cost-plus agreement commenced with Colstrip Units 1&2 with a projected term through at least 2019 and expected tons of 3.0 million per year. A second agreement at Units 3&4 covers approximately 7.0 million tons per year and is set to expire at the end of 2019. This contract is also cost-plus, but with specific return on capital investment provisions. The Rosebud Mine also has a 1.5 to 2.5 million ton per year fixed price contract with Minnesota Power’s Boswell Station that expires on December 31, 2010. We do not expect to renew this contract at the Rosebud Mine at this time due to the poor economics of the contract.

Absaloka. The Absaloka Mine operates primarily in the open market and has several contracts with various parties that totaled roughly 6.0 million tons in 2009 and decline to zero by the end of 2014. More than 3.0 million tons expired at the end of 2009 under three separate agreements, which we successfully renegotiated during the year. Approximately 80% of all tons sold were to the rail-served Sherburne County Station under several contracts.

Savage. The Savage Mine supplies approximately 0.3 million tons per year to the local Lewis & Clark Station under an agreement that expires at the end of 2012. Prices under this agreement are based upon certain actual mine costs and certain inflation indices for such items as diesel fuel.

Jewett. The Jewett Mine has a cost-plus agreement with NRG Texas Power’s adjacent Limestone Generating Station, which commenced January 1, 2008, replacing various prior agreements in place since 1985. NRG Texas Power is obligated to pay all mine costs of production plus a margin and the mine’s capital and reclamation expenditures. The agreement has a term through 2018, which may be extended by NRG Texas Power for up to an additional ten years or until the mine’s reserves are exhausted. NRG has the option to determine volumes to be delivered, which currently average approximately 4.5 million tons per year and to terminate the agreement at its discretion.

Beulah. The Beulah Mine supplies approximately 2.5 million tons per year to the adjacent Coyote Station under an agreement that expires in May 2016. It also supplies approximately 0.5 million tons per year to the rail-served Heskett Station under an agreement that expires during 2011. Prices under these agreements are based upon certain actual mine costs and certain inflation indices for such items as diesel fuel.

8

Competition

While the coal industry is intensely competitive, we focus on niche coal markets where we take advantage of long-term coal contracts with neighboring power plants and rail transportation advantages. For our coal sold into the open market, we compete with many other suppliers of coal to provide fuel to power plants. Additionally, coal competes for electrical power generation with other fuels such as nuclear energy, natural gas, hydropower, petroleum and wind. Costs and other factors such as safety, environmental and regulatory considerations relating to these alternative fuels affect the overall demand for coal as a fuel.

We believe that our mines have a competitive advantage based on three factors:

·

all of our mines are the most economic suppliers to each of their respective principal customers, a result of a transportation advantage over our competitors in that market;

·

nearly all of the power plants we supply were specifically designed to use our coal; and

·

the plants we supply are among the lowest cost producers of electric power in their respective regions and are among the cleaner producers of power from solid fossil fuels.

As a result of the foregoing, we believe that our current customers are more likely to be dispatched to produce power and to continue purchasing coal extracted from our mines.

The principal customers of the Rosebud, Jewett, and Beulah Mines are located adjacent to the mines; the coal for these customers can generally be delivered by conveyor belt instead of more expensive means such as truck or rail. The customers of the Savage Mine are located approximately 20 to 25 miles from the mine so that coal can be transported most economically by truck.

The Absaloka Mine faces a different competitive situation. The Absaloka Mine sells its coal in the rail market to utilities located in the northern tier of the United States that are served by BNSF. These utilities may purchase coal from us or from other producers, and we compete with other producers on the basis of price and quality, with the purchasers also taking into account the cost of transporting the coal to their plants. The Absaloka Mine enjoys an approximately 300-mile rail advantage over its principal competitors from the Southern Powder River Basin in supplying customers located in the northern tier. Rail rates have increased over the last several years by 50 to 100%, which increases our competitive advantage. We also believe that the next most economic suppliers to Absaloka’s northern tier customers could be our other mines.

Material Effects of Regulation

We are subject to extensive regulation with respect to environmental and other matters by federal, state and local authorities. Federal laws to which we are subject include the Surface Mining Control and Reclamation Act of 1977, or SMCRA, the Clean Air Act, the Clean Water Act, the Toxic Substances Control Act, the Endangered Species Act, the Comprehensive Environmental Response, Compensation and Liability Act, the Emergency Planning and Community Right to Know Act and the Resource Conservation and Recovery Act. These laws are administered and enforced by the United States Environmental Protection Agency, or EPA, and/or other authorized federal or state agencies. Any non-compliance with these laws and regulations could subject us to material administrative, civil or criminal penalties or other liabilities, including suspension or termination of operations. In addition, we may be required to make large and unanticipated capital expenditures to comply with applicable laws. Our reclamation obligations under applicable environmental laws will be substantial. Our coal sales agreements contain government impositions provisions that allow the pass-through of compliance costs in some circumstances. The following summarizes certain legal and regulatory matters that we believe may significantly affect us.

Surface Mining Control and Reclamation Act. SMCRA establishes minimum national operational, reclamation and closure standards for all surface coal mines. SMCRA requires that comprehensive environmental protection and reclamation standards be met during the course of and following completion of coal mining activities. Permits for all coal mining operations must be obtained from the Federal Office of Surface Mining Reclamation and Enforcement, or OSM, or, where state regulatory agencies have adopted federally approved state programs under SMCRA, the appropriate state regulatory authority. States that operate federally approved state programs may impose standards that are more stringent than the requirements of SMCRA and OSM’s regulations and in many instances have done so. Permitting under SMCRA has generally become more difficult in recent years, which adversely affect the cost and availability of coal purchased by ROVA, especially in light of significant permitting issues affecting the Central Appalachia region.

Clean Air Act and Related Regulations. The federal Clean Air Act and similar state laws and regulations affect coal mining, coal handling and processing and energy production primarily through permitting and/or emissions control requirements. For example, regulations relating to fugitive dust and coal combustion emissions could restrict our ability to develop new mines or require us to modify our operations. The Clean Air Act also extensively regulates the air emissions of coal fired electric

9

power generating plants such as ROVA and plants operated by our coal customers. Coal contains impurities, such as sulfur, mercury and other constituents, many of which are released into the air when coal is burned. The Clean Air Act and similar legislation regulate these emissions and therefore affect demand for our coal. In particular, our mines do not produce “compliance coal” for purposes of the Clean Air Act. Compliance coal is coal containing 1.2 pounds or less of sulfur dioxide per million British thermal unit, or Btu. This restricts our ability to sell coal to power plants that do not utilize sulfur dioxide emission controls and otherwise leads to a price discount based, in part, on the market price for sulfur dioxide emission allowances under the Clean Air Act. Our coal also contains about twice the ash content of our primary competitors, which can translate into a cost disadvantage where post-combustion coal ash must be land filled.

While new regulations under the Clean Air Act or similar statutes could increase market prices for sulfur dioxide emission allowances and therefore the price discount applied to our coal, they could also cause power plants to retrofit sulfur dioxide emission controls, therefore expanding our market potential. Higher costs for complying with coal ash regulations could also result in a higher price discount for our open market coal.

We are at particular risk of changes in applicable environmental laws with respect to the Jewett Mine, whose customer, the NRG Texas Power-Limestone Station, blends our lignite with compliance coal from Wyoming. Tightened nitrogen oxide and new mercury emission standards could result in an increased blend of the Wyoming coal to reduce emissions. Further, increased market prices for sulfur dioxide emissions and increased coal ash costs could also favor an increased blend of the lower ash Wyoming compliance coal. In such a case, NRG Texas Power has the option to increase its purchases of other coal, reduce purchases of our coal and to terminate our contract. If NRG terminates the contact, sales of lignite would end and the Jewett Mine would commence final reclamation activities. NRG would pay for all reclamation work plus a margin.

Bonding Requirements. Federal and state laws require mine operators to assure, usually through the use of surety bonds, payment of certain long-term obligations, including the costs of mine closure and the costs of reclaiming the mined land. The costs of these bonds have fluctuated in recent years, and the market terms of surety bonds have generally become more unfavorable to mine operators. Surety providers are requiring greater percentages of collateral to secure a bond, which has required us to provide increasing quantities of cash to collateralize bonds to allow us to continue mining. These changes in the terms of the bonds have been accompanied, at times, by a decrease in the number of companies willing to issue surety bonds. As of December 31, 2009, we have posted an aggregate of $227.4 million in surety bonds for reclamation purposes.

Resource Conservation and Recovery Act. We may generate wastes, including ‘‘solid’’ wastes and ‘‘hazardous’’ wastes that are subject to the federal Resource Conservation and Recovery Act, or RCRA, and comparable state statutes, although certain mining and mineral beneficiation wastes and certain wastes derived from the combustion of coal currently are exempt from regulation as hazardous wastes under RCRA. The EPA has limited the disposal options for certain wastes that are designated as hazardous wastes under RCRA. Furthermore, it is possible that certain wastes generated by our operations that currently are exempt from regulation as hazardous wastes may in the future be designated as hazardous wastes, and therefore be subject to more rigorous and costly management, disposal and clean-up requirements.

Comprehensive Environmental Response, Compensation, and Liability Act. Under the Comprehensive Environmental Response, Compensation, and Liability Act, also known as CERCLA or Superfund, and similar state laws, responsibility for the entire cost of cleanup of a contaminated site, as well as natural resource damages, can be imposed upon current or former site owners or operators, or upon any party who released one or more designated ‘‘hazardous substances’’ at the site, regardless of the lawfulness of the original activities that led to the contamination. CERCLA also authorizes the EPA and, in some cases, third parties to take actions in response to threats to public health or the environment and to seek to recover from the potentially responsible parties the costs of such action. In the course of our operations we may have generated and may generate wastes that fall within CERCLA’s definition of hazardous substances. We may also be an owner or operator of facilities at which hazardous substances have been released by previous owners or operators. We may be responsible under CERCLA for all or part of the costs of cleaning up facilities at which such substances have been released and for natural resource damages. We have not, to our knowledge, been identified as a potentially responsible party under CERCLA, nor are we aware of any prior owners or operators of our properties that have been so identified with respect to their ownership or operation of those properties. We also must comply with reporting requirements under the Emergency Planning and Community Right-to-Know Act and the Toxic Substances Control Act.

Climate Change Legislation and Regulations. Numerous proposals for federal and state legislation have been made relating to greenhouse gas, or GHG, emissions (including carbon dioxide) and such legislation could result in the creation of substantial additional costs in the form of taxes or required acquisition or trading of emission allowances. Many of the federal and state climate change legislative proposals use a “cap and trade” policy structure, in which GHG emissions from a broad cross-section of the economy would be subject to an overall cap. Under the proposals, the cap would become more stringent with the passage of time. The proposals establish mechanisms for GHG sources such as power plants to obtain “allowances” or permits to emit GHGs during the course of a year. The sources may use the allowances to cover their own emissions or sell them to other sources that do not hold enough emissions for their own operations.

10

In addition, the EPA has issued a notice of finding and determination that emissions of carbon dioxide, methane and other GHGs present an endangerment to human health and the environment, which allows the EPA to begin regulating emissions of GHGs under existing provisions of the federal Clean Air Act. The EPA has begun to implement GHG-related reporting and permitting rules.

The impact of GHG-related legislation and regulations, including a “cap and trade” structure, on us will depend on a number of factors, including whether GHG sources in multiple sectors of the economy are regulated, the overall GHG emissions cap level, the degree to which GHG offsets are allowed, the allocation of emission allowances to specific sources and the indirect impact of carbon regulation on coal prices. We may not recover the costs related to compliance with regulatory requirements imposed on us from our customer due to limitations in our agreements.

Passage of additional state or federal laws or regulations regarding GHG emissions or other actions to limit carbon dioxide emissions could result in fuel switching from coal to other fuel sources by electricity generators and thereby reduce demand for our coal. In addition, political and regulatory uncertainty over future emissions controls have been cited as major factors in decisions by power companies to postpone new coal-fired power plants. If these or similar measures, such as controls on methane emissions from coal mines, are ultimately imposed by federal or state governments or pursuant to international treaties, our operating costs may be materially and adversely affected. Also, alternative sources of power, including wind, solar, nuclear and natural gas, could become more attractive than coal in order to reduce carbon emissions, which could result in a reduction in the demand for coal and, therefore, our revenues. Similarly, some of our customers, in particular smaller, older power plants, could be at risk of significant reduction in coal burn or closure as a result of imposed carbon costs. The imposition of a carbon tax or similar regulation could, in certain situations, lead to the shutdown of coal-fired power plants, which would materially and adversely affect our coal and power plant revenues.

Power Segment

General

We own two coal-fired power-generating units in Weldon, North Carolina with a total capacity of 230 megawatts, which we refer to collectively as ROVA. ROVA, which commenced operations in 1994, was built as a Public Utility Regulatory Policies Act co-generation facility with long-term power purchase agreements with Dominion Virginia Power. While we initially structured the project as a joint venture where we owned a 50% interest in the partnership that owned ROVA, we acquired the other 50 percent partnership interest in ROVA in June 2006, bringing our ownership interest in the ROVA project to 100 percent. ROVA has been reclassified as an Electric Wholesale Generator, a Federal Energy Regulatory Commission classification created by the Energy Policy Act of 1992. Westmoreland Partners has fully encumbered all power plant property pursuant to the Second Amended and Restated Loan Agreement with Prudential Investment Management, Inc.

The following table shows megawatt hours produced and average annual capacity factors achieved at ROVA for the last three years:

Year | Megawatt Hours | Capacity Factor |

2009 | 1,486,000 | 81% |

2008 | 1,641,000 | 89% |

2007 | 1,590,000 | 86% |

Coal Supply

ROVA purchases coal under long-term contracts from coal suppliers with identified reserves located in Central Appalachia, which contracts expire in 2014 and 2015.

Customer

ROVA supplies power to Dominion Virginia Power under long-term contracts, which expire in 2019 and 2020. We can extend, by mutual consent, the contracts with Dominion Virginia Power for five-year terms at mutually agreeable pricing. In 2009, the sale of power to Dominion Virginia Power accounted for approximately 18% of our consolidated revenues.

Material Effects of Regulation

For a thorough discussion of the extensive regulation with respect to environmental and other matters by federal, state and local authorities affecting our power segment, see Item 1 under “Coal Segment -Material Effects of Regulation.”

11

With respect to our power segment, ROVA is among the newer and cleaner coal-fired power plants in the United States. It is exempted under Title IV of the Clean Air Act, but may opt-in to receive allocations of sulfur dioxide emission allowances. The plant is among the lowest coal-fired emitters of mercury in the country. We are evaluating whether ROVA could be a net consumer or seller of sulfur dioxide allowances, nitrogen oxide credits and mercury allowances under new and pending regulations. However, we currently expect an increase in costs associated with nitrogen oxide allowances at ROVA. With regard to coal ash regulations, ROVA both remarkets and landfills its combustion waste. Landfills are lined and meet strict North Carolina Department of Solid Waste regulations. Should ROVA incur additional costs of regulatory compliance, it is unlikely that we will be able to pass through these costs under our agreements with Dominion Virginia Electric.

An important factor relating to the impact of GHG-related legislation and regulations on our power segment will be our ability to recover the costs incurred to comply with any regulatory requirements that are ultimately imposed. We may not recover the costs related to compliance with regulatory requirements imposed on us due to limitations in our power purchase agreements. If we are unable to pass through such costs incurred by ROVA to Dominion Virginia Power or recoup them in another manner such as through allowances, it could have a material adverse effect on our results of operations at ROVA.

Heritage Segment

Our heritage segment costs consist primarily of payments for medical benefits to our retired workers, workers’ compensation benefits, black lung benefits and combined benefit fund premiums. These collective heritage obligations are funded by distributions from our operating subsidiaries.

Management has been working over the past several years to reduce our heritage obligations. In 2009, we changed our health provider network for our retiree population, resulting in substantial savings and corresponding reduction in heritage liability. Additionally, in September 2009, we eliminated postretirement medical benefits for our non-represented retiree population. Lastly, in December 2009, we entered into an agreement with the United Mine Workers of America to modernize the method by which prescription drugs are provided to retirees of our former operations. Under the agreement, we will utilize a new system of distribution and administration, along with drug formularies, to enable us to continue to provide prescription drug benefits to retirees, but at a lower cost. These modifications are expected to become effective around April 15, 2010. Management’s collective efforts to reduce our heritage obligations have resulted, as of the end of fiscal year 2009, in substantial reductions in our postretirement medical benefit obligation.

We will continue to explore ways to further reduce or eliminate other portions of our benefits costs incurred as a consequence of our former operations.

Corporate Segment

The corporate segment consists primarily of costs for our corporate and business development expenses. In addition, the corporate segment contains our captive insurance company.

We have elected to retain some of the risks associated with operating our company through a wholly owned, consolidated insurance subsidiary, Westmoreland Risk Management Ltd., or WRM. WRM, a Bermuda corporation, provides our primary layer of property and casualty insurance. By using this insurance subsidiary, we have reduced the cost of our property and casualty insurance premiums and retained some economic benefits due to our excellent loss record. We reduce our major exposure by insuring for losses in excess of our retained limits with a number of third-party insurance companies.

Except for the assets of WRM, all of our assets are located in the United States. We had no export sales and derived no revenues from outside the United States during the five-year period ended December 31, 2009.

Available Information

We file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission. You may access and read our filings without charge through the SEC’s website, at www.sec.gov. You may also read and copy any document we file at the SEC’s Public Reference Room located at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the Public Reference Room.

We also make our public reports available through our website, www.westmoreland.com, as soon as practicable after we file or furnish them with the SEC. You may also request copies of the documents, at no cost, by telephone at (719) 442-2600 or by mail at Westmoreland Coal Company, 2 North Cascade Avenue, 2nd Floor, Colorado Springs, Colorado, 80903. The information on our website is not part of this Annual Report on Form 10-K.

12

This report, including Management’s Discussion and Analysis of Financial Condition and Results of Operation, contains forward-looking statements that may be materially affected by numerous risk factors, including those summarized below.

Risk Factors Relating to our Operations

We may not generate sufficient cash flow to pay our operating expenses, meet our debt service costs and pay our heritage and corporate costs, and we may not be able to obtain additional sources of liquidity to meet these needs.

We are a holding company that conducts our operations through our subsidiaries. Certain costs that we incur are direct obligations of ours such as significant heritage health benefit costs, and we rely on dividends from our subsidiaries to meet these holding company obligations. Our Westmoreland Mining LLC subsidiary, which owns the Rosebud, Jewett, Beulah and Savage Mines, and our Westmoreland Partners subsidiary, which owns ROVA, are subject to credit facilities that require the maintenance of reserve accounts and limit the ability of those subsidiaries to dividend funds to us based on changes in reserve account balances and the subsidiaries’ operating results. Accordingly, these subsidiaries may not be able to pay dividends to us in the amounts and in the time required for us to pay our heritage health benefit costs and corporate expenses. Ultimately, if our subsidiaries’ operating cash flows are insufficient to support their operations and provide dividends to us in the amounts and time required to pay our expenses, and we are unable to obtain external financing at sufficient levels to pay such obligations, we will be unable to meet our obligations as they come due.

As a result of Westmoreland Resources Inc., or WRI, which owns the Absaloka Mine, renewed revolving line of credit and an increase in its term debt, anticipated reductions in our heritage medical obligations and the conclusion of customer shutdowns, we anticipate that our cash from operations and available borrowing capacity will be sufficient to meet our working capital and bonding requirements, planned capital expenditures and debt payments for the foreseeable future, although by a small margin. However, our expectations in this regard are subject to numerous risks and uncertainties, and may not be realized. Because of the uncertainties surrounding the 2010 forecast assumptions and anticipated non-compliance with certain debt covenants, the report from our independent registered public accounting firm on our consolidated financial statements for the year ended December 31, 2009, includes an explanatory paragraph that summarizes the salient facts or conditions that raise substantial doubt about our ability to continue as a going concern.

We have a significant amount of debt, which imposes restrictions on us and may limit our flexibility, and a decline in our operating performance may materially affect our ability to meet our future financial commitments and liquidity needs.

As of December 31, 2009, our total gross indebtedness, excluding debt discounts, was approximately $259.9 million, the principal components of which are: $148.8 million of Westmoreland Mining LLC term and other debt; $55.6 million of ROVA term debt; $38.3 million under WRI’s revolving line of credit and term and other debt; and $17.2 million of convertible notes. We may incur additional indebtedness in the future, including indebtedness under our three existing revolving credit facilities.

A substantial portion of our subsidiaries’ cash flows must be used to pay principal and interest on our indebtedness and is not available to fund working capital, capital expenditures, bonding requirements, heritage costs or other general corporate uses. In addition, the degree to which we are leveraged could have other important consequences, including: increasing our vulnerability to general adverse economic and industry conditions; limiting our ability to obtain additional financing to fund future working capital, capital expenditures or equipment leases or other general corporate requirements; limiting our ability to grow our business; and limiting our flexibility in planning for, or reacting to, changes in our business and in the industry.

If our operating performance fails to improve as anticipated, or if we do not have sufficient cash flows and capital resources to meet our debt service obligations, we may be forced to seek additional capital or seek to restructure or refinance our indebtedness. If we are unable to obtain new or restructured financing, we could be forced to sell our assets or those of our subsidiaries under unfavorable circumstances to make up for any shortfall in our payment obligations. Our existing credit facilities limit our ability to sell assets and restrict the use of the proceeds from any such sale. Therefore, even if forced to do so, we may not be able to sell assets quickly enough or for sufficient amounts to enable us to meet our debt obligations. In addition, our liquidity could be adversely affected if one or more lenders under our subsidiaries’ revolving credit agreements become unwilling or unable to fund amounts under those facilities when requested.

If we fail to comply with certain covenants in our various debt arrangements, it could negatively affect our liquidity and ability to finance our operations.

13

Our lending arrangements contain, among other conditions, events of default and various affirmative and negative covenants. In 2009, WML did not comply with a leverage ratio covenant in its debt agreement and obtained a waiver from its lenders for defaults through March 31, 2010, subject to certain conditions. At September 30, 2009, WRI was unable to comply with its net worth covenant contained in its business loan agreement. WRI obtained a waiver from its lenders for the quarter ended September 30, 2009. The agreement was subsequently amended to extend the net worth requirement from September 30, 2009 to April 30, 2010. We currently anticipate that we will not be able to meet the WRI net worth covenant requirement by April 30, 2010. Should we not meet the conditions of the waivers, the lenders may require the payment of additional fees, require prepayment of a portion of indebtedness to them, accelerate the amortization schedule for the indebtedness and or increase the interest rates they charge on our outstanding indebtedness. Should we be unable to meet future debt-related covenants, we will be required to seek a waiver of such covenant to avoid an event of default. Covenant waivers and modifications may be expensive to obtain, or, potentially, unavailable. If we are unable to obtain covenant waivers and our lenders accelerate our debt, we could attempt to refinance or repay the debt with the proceeds from sales of assets. Sales of assets undertaken in response to such immediate needs may be made at potentially unfavorable prices, or asset sales may not be sufficient to refinance or repay the debt, and we may be unable to complete such transactions in a timely manner, on favorable terms, or at all.

Continuing unfavorable economic conditions could have a material adverse effect on our results of operations.

Economic conditions in the United States and throughout much of the world experienced a sudden, sharp economic downturn in 2008 and 2009. While the markets have shown improvements in recent months, continuing turmoil in the financial markets could make it more difficult for us to access capital, sell assets, refinance our existing indebtedness, obtain waivers for covenant violations from our lenders if necessary, obtain future bonding capacity required to expand our operations, enter into agreements for new indebtedness, or obtain funding through the issuance of our securities.

Our dependence on a small group of customers could adversely affect our revenues if such customers reduce or suspend their coal purchases or if they become unable to pay for our coal.

In 2009, approximately 60% of our total revenues were derived from coal sales to four power plants: Limestone Generating Station (19% of our 2009 revenues), Colstrip Units 3&4 (18%), Colstrip Units 1&2 (12%) and Sherburne County Station (11%). Interruption in the purchases of coal by our operations of our principal customers could significantly affect our revenues. During 2009, unscheduled power plant outages occurred after planned maintenance outages at power plants served by our Rosebud and Beulah Mines resulting in lost revenues of approximately $47.5 million. Unscheduled maintenance outages at our customers' power plants, unseasonably moderate weather, or increases in the production of alternative clean-energy generation such as wind power could cause our customers to reduce their purchases. In addition, new environmental regulations could compel our customer of the Jewett Mine to purchase more compliance coal, reducing or eliminating our sales to them. Four of our five mines are dedicated to supplying customers located adjacent to or near the mines, and these mines may have difficulty identifying alternative purchasers of their coal if their existing customers suspend or terminate their purchases. The reduction in the sale of our coal would adversely affect our operating results. In addition, if any of our major customers became unable to pay for contracted amounts of coal, our results of operation and liquidity would be adversely affected.

If our assumptions regarding our future expenses related to employee benefit plans are incorrect, then expenditures for these benefits could be materially different than we have assumed.

We provide various postretirement medical benefits, black lung and worker’s compensation benefits to current and former employees and their dependents. We calculate the total accumulated benefit obligations according to the guidance provided by Generally Accepted Accounting Principles, or GAAP. We estimate the present value of our postretirement medical, black lung and worker’s compensation benefit obligations to be $190.2 million, $14.7 million and $11.2 million, respectively, at December 31, 2009. We have estimated these unfunded obligations based on actuarial assumptions described in the notes to our consolidated financial statements. If our assumptions do not materialize as expected, cash expenditures and costs that we incur could be materially different.

Inaccuracies in our estimates of our coal reserves could result in decreased profitability from lower than expected revenues or higher than expected costs.

Our future performance depends on, among other things, the accuracy of our estimates of our proven and probable coal reserves. Our reserve estimates are prepared by our engineers and geologists and are updated periodically. There are numerous factors and assumptions inherent in estimating the quantities and qualities of, and costs to mine, coal reserves, including many factors beyond our control, including the following:

·

quality of the coal;

14

·

geological and mining conditions, which may not be fully identified by available exploration data and/or may differ from our experiences in areas where we currently mine;

·

the percentage of coal ultimately recoverable;

·

the assumed effects of regulation, including the issuance of required permits, taxes, including severance and excise taxes and royalties, and other payments to governmental agencies;

·

assumptions concerning the timing for the development of the reserves; and

·

assumptions concerning equipment and productivity, future coal prices, operating costs, including for critical supplies such as fuel, tires and explosives, capital expenditures and development and reclamation costs.

As a result, estimates of the quantities and qualities of economically recoverable coal attributable to any particular group of properties, classifications of reserves based on risk of recovery, estimated cost of production, and estimates of future net cash flows expected from these properties may vary materially due to changes in the above factors and assumptions. Any inaccuracy in our estimates related to our reserves could result in decreased profitability from lower than expected revenues and/or higher than expected costs.

If the assumptions underlying our reclamation and mine closure obligations are materially inaccurate, we could be required to expend greater amounts than anticipated.

The Surface Mining Control and Reclamation Act of 1977, or SMCRA, establishes operational, reclamation and closure standards for all aspects of surface mining as well as most aspects of deep mining. We calculated the total estimated reclamation and mine-closing liabilities according to the guidance provided by GAAP and current industry practice. Estimates of our total reclamation and mine-closing liabilities are based upon permit requirements and our engineering expertise related to these requirements. If our estimates are incorrect, we could be required in future periods to spend more or less on reclamation and mine-closing activities than we currently estimate. Likewise, if our customers, some of whom are contractually obligated to pay certain reclamation costs, default on the unfunded portion of their contractual obligations to pay for reclamation, we could be forced to make these expenditures ourselves and the cost of reclamation could exceed any amount we might recover in litigation.

We estimate that our gross reclamation and mine-closing liabilities, which are based upon projected mine lives, current mine plans, permit requirements and our experience, were $244.6 million (on a present value basis) at December 31, 2009. Of these December 31, 2009 liabilities, our customers have assumed $82.2 million by contract. In addition, we held final reclamation deposits, received from customers, of approximately $73.1 million at December 31, 2009 to provide for these obligations. We estimate that our obligation for final reclamation that was not the contractual responsibility of others or covered by offsetting reclamation deposits was $89.3 million at December 31, 2009. This $89.3 million must be recovered in the price of coal sold. Responsibility for the final reclamation amounts may change in certain circumstances.

In addition, we are currently in a dispute with our coal buyers that own the Colstrip Units 3&4 at Rosebud regarding reclamation costs. The buyers assert that they were charged for base reclamation work in Area C of the Rosebud Mine when those charges were actually for final reclamation, which would be our responsibility under the terms of the coal supply agreement. The refund of $21.0 million sought by the buyers includes $17.0 million in alleged overpayments for final reclamation work plus $4.0 million in interest. If the buyers prevail and all of the challenged work is determined to be final reclamation rather than base reclamation, we could be required to refund in cash the overpayment with interest, which would materially affect our ability to use cash to obtain bonding for future mining, restrict cash dividends from the mine to the holding company and could cause a potential breach of a Westmoreland Mining loan covenant.

After discussions with the Colstrip Unit 3&4 buyers in the fourth quarter of 2009 and first quarter of 2010, we have determined that a settlement agreement would be reached. As a result, we recorded $6.5 million to Other current liabilities and reduced Revenues by the same amount for this claim. In addition, Cost of sales was reduced by $1.7 million and a corresponding $1.7 million recorded in Other current assets for prepaid production taxes and royalties.

If the cost of obtaining new reclamation bonds and renewing existing reclamation bonds continues to increase or if we are unable to obtain additional bonding capacity, our operating results could be negatively affected.

Federal and state laws require that we provide bonds to secure our obligations to reclaim lands used for mining. We must post a bond before we obtain a permit to mine any new area. These bonds are typically renewable on a yearly basis and have become increasingly expensive. Bonding companies are requiring that applicants collateralize increasing portions of their obligations to the bonding company. In 2009, we paid approximately $4.1 million in premiums for reclamation bonds and were required to use $3.2 million in cash to collateralize 21% of the face amount of the new bonds obtained in 2009. We anticipate that, as we permit additional areas for our mines in 2010 and 2011, our bonding requirements will increase significantly and our collateral requirements will increase as well. Any capital that we provide to collateralize our obligations to our bonding

15

companies is not available to support our other business activities. If the cost of our reclamation bonds continues to increase, our results of operations could be negatively affected. Additionally, if we are unable to obtain additional bonding capacity due to cash flow constraints, we will be unable to begin mining operations in newly permitted areas. Our inability to begin operations in new areas will hamper our ability to efficiently meet our current customer contract deliveries, expand operations, and increase revenues.

Our coal mining operations are subject to external conditions that could disrupt operations and negatively affect our profitability.

Our coal mining operations are all surface mines. These mines are subject to conditions or events beyond our control that could disrupt operations, affect production, and increase the cost of mining at particular mines for varying lengths of time. These conditions or events include: unplanned equipment failures, which could interrupt production and require us to expend significant sums to repair our equipment, which is integral to the mining of coal; geological conditions such as variations in the quality of the coal produced from a particular seam, variations in the thickness of coal seams and variations in the amounts of rock and other natural materials that overlie the coal that we are mining; and weather conditions. For example, in our recent past, we have endured: a major blizzard at the Beulah Mine, which interrupted operations; a fire on the trestle at the Beulah Mine that interrupted rail shipment of our coal; and an unanticipated replacement of boom suspension ropes on one of our draglines that caused a multi-week interruption of mining. Major disruptions in operations at any of our mines over a lengthy period could adversely affect the profitability of our mines.

Should our Private Letter Ruling pertaining to our Indian Coal Tax Credit, or ICTC, be audited by the IRS, the transaction may be cancelled and we may be required to return payments received from the third party.

Our mining subsidiary at our Absaloka Mine entered into a series of transactions, including the formation of a limited liability company with an unaffiliated investor, in order to take advantage of certain available tax credits for the production of coal on Indian lands. We requested and have received a private letter ruling, or PLR, from the IRS providing that the ICTCs will be available under the specific scenario described in the PLR. Even though we have received the PLR, there are certain issues that may be raised by the IRS in a subsequent audit of tax returns of the members of the limited liability company. In the unlikely event that a subsequent audit disqualifies the tax credits as approved in the PLR or disallows the allocations of the tax credits, we could be required to either return to the investor previously received payments under the notes, and the transaction would effectively be cancelled or retain the previously received payments under the notes, but the transaction would effectively be cancelled from the date of the disallowance. We will pay to the Crow Tribe 33% of the expected ICTC payments we will receive from the investor. The Crow Tribe is only required to reimburse us under very limited circumstances. As a result, in the unlikely event that the IRS disallows or disqualifies the tax credit, we would be unable to recoup payments already paid to the Crow Tribe.

Our future success depends upon our ability to continue acquiring and developing coal reserves that are economically recoverable and to raise the capital necessary to fund our expansion.

Our recoverable reserves will decline as we produce coal. We have not yet applied for the permits required or developed the mines necessary to use all of the coal deposits under our mineral rights. Furthermore, we may not be able to mine all of our coal deposits as efficiently as we do at our current operations. Our future success depends upon our conducting successful exploration and development activities and acquiring properties containing economically recoverable coal deposits. In addition, we must also generate enough capital, either through our operations or through outside financing, to mine these additional reserves and to acquire new reserves. Our current strategy includes increasing our coal reserves through acquisitions of other mineral rights, leases, or producing properties and continuing to use our existing properties. Our ability to further expand our operations may be dependent on our ability to obtain sufficient working capital, either through cash flows generated from operations, or financing activities, or both. As mines become depleted, replacement reserves may not be available when required or, if available, may not be capable of being mined at costs comparable to those characteristic of the depleting mines. These factors could have a material adverse affect on our mining operations and costs, and our customers’ ability to use the coal we mine.

Union represented labor creates an increased risk of work stoppages and higher labor costs.

At December 31, 2009, approximately 51% of our total workforce was represented by either the International Union of Operating Engineers Local 400 or the United Mine Workers of America. Our unionized workforce is spread out amongst four of our surface mines. As a majority of our workforce is unionized, there may be an increased risk of strikes and other labor disputes, as well as higher labor costs. In March 2009, during negotiation over a collective bargaining agreement, our employees at the Rosebud Mine imposed a sixteen-day work stoppage. On April 6, 2009, we entered into a new four-year agreement with the union, and the Rosebud Mine resumed full operation. The impact on our operations was minimal as we continued to make most of our scheduled coal deliveries. If our Jewett Mine operations were to become unionized, we could be subject to additional risk of work stoppages, other labor disputes and higher labor costs, which could adversely affect the stability of production and our results of operations.

16

Legislation has been proposed to Congress to enact a law allowing workers to choose union representation solely by signing election cards (“Card Check”), which would eliminate the use of secret ballots to elect union representation. While the impact is uncertain, if Card Check legislation is enacted into law, it will be administratively easier for unions to unionize coal mines and may lead to more coal mines becoming unionized.

Our revenues could be affected by unscheduled outages at ROVA or if the scheduled maintenance outages at ROVA last longer than anticipated.

Unplanned outages of generating units and extensions of scheduled outages due to mechanical failures or other problems occur from time-to-time and are an inherent risk of our business. Unplanned outages typically increase our operation and maintenance expenses and may reduce our revenues as a result of selling fewer megawatt hours. While we maintain insurance, the proceeds of such insurance may not be adequate to cover our lost revenues, increased expenses or liquidated damages payments should we experience equipment breakdown. As our facilities were brought online in the mid 1990s, they require periodic upgrading and improvement. Any unexpected failure, including failure associated with breakdowns, forced outages or any unanticipated capital expenditures could result in reduced profitability. In September 2009, we were forced to keep the larger ROVA plant offline for a significant period of time following a scheduled major turbine outage due to unanticipated mechanical issues that arose. In 2010, we have a major scheduled turbine outage for our smaller ROVA plant, which could result in unscheduled maintenance issues.

The profitability of ROVA could be severely affected beginning in 2014 due to differences in the termination dates of our coal supply agreements and power purchase agreements.

We entered into a ROVA Coal Supply Agreement for our larger plant on June 21, 1993, and a ROVA Coal Supply Agreement for our smaller plant on December 1, 1993, which provide for ROVA’s coal needs for a twenty-year period, terminating on May 29, 2014 and June 1, 2015, respectively. We also entered into power purchase agreements with Dominion Virginia Power that provide for the sale of power for a twenty-five year term through May 29, 2019, for our larger ROVA plant and June 1, 2020, for the smaller ROVA plant. The coal supply agreements provide for coal at a price per ton that is less than today’s open market price for Central Appalachia coal. Upon the termination of the coal supply agreements beginning in 2014, we will be required to renegotiate our current contract or find a substitute supply of coal, likely at a cost per ton far greater than the price we are paying today. However, the power purchase agreements do not provide for a price increase related to an increase in the cost per ton of delivered coal and Dominion Virginia Power’s payment for power after 2014 will not escalate with our increased coal costs. Due to the change in the economics of ROVA at such time, it is projected that ROVA will begin incurring losses in 2014 and may be unable to pay its debt and other obligations as they become due. Should ROVA renegotiate its future coal supply contracts prior to 2014 in a manner that results in higher coal prices, the incurrence of losses and an inability to pay obligations could be accelerated.

Permitting issues in Central Appalachia could put ROVA’s coal supply at risk.

ROVA purchases coal under long-term contracts from coal suppliers with identified reserves located in Central Appalachia. While our coal supply has been relatively stable since the inception of the contracts, potential permitting issues pertaining to the reserves identified as our source of coal in our coal contracts could prove problematic in the coming years. Should regulatory/legal action prevent our coal supplier from continuing to mine the reserves identified as our source of coal or to mine other reserves that could be identified as potential sources of coal, we could be forced to find an alternative source of coal at higher prices. While the cost of cover for substitute coal should be covered by our coal contracts, we would be forced to initially incur the higher costs to secure a coal supply to provide for the continued operations at ROVA. In addition, should issues arise under our coal contracts relating to the cost of cover, the coal suppliers’ guarantee or any other issue, we could be forced to incur significant legal expenses and, potentially, may never recoup our incremental coal or related legal costs.

Risk Factors Relating to the Coal and Power Industries

The recent downturn in the domestic and international financial markets, and the risk of prolonged global recessionary conditions, could adversely affect our financial condition and results of operations.

Because we sell substantially all of our coal to electric utilities, our business and results of operations remain closely linked to demand for electricity. The recent downturn in the domestic and international financial markets has created economic uncertainty and raised the risk of prolonged global recessionary conditions. Historically, global demand for basic inputs, including electricity production, has decreased during periods of economic downturn. If the recent downturn in the domestic and international financial markets decreases global demand for electricity production, our financial condition and results of operations could be adversely affected.

17

Increased consolidation and competition in the U.S. coal industry may adversely affect our revenues and profitability.

During the last several years, the U.S. coal industry has experienced increased consolidation. Consequently, many of our competitors in the domestic coal industry are major coal producers who have significantly greater financial resources than we do. The intense competition among coal producers may impact our ability to retain or attract customers and may therefore adversely affect our future revenues and profitability.

Any change in consumption patterns by utilities away from the use of coal could affect our ability to sell the coal we produce or the prices that we receive.

Some power plants are fueled by natural gas because of the relatively cheaper construction costs of such plants compared to coal-fired plants and because natural gas is a cleaner burning fuel. The domestic electric utility industry accounts for approximately 90% of domestic coal consumption. The amount of coal consumed by the domestic electric utility industry is affected primarily by the overall demand for electricity, environmental and other governmental regulations, and the price and availability of competing fuels for power plants such as nuclear, natural gas and fuel oil as well as alternative sources of energy. A decrease in coal consumption by the domestic electric utility industry could adversely affect the price of coal, which could negatively impact our results of operations and reduce our cash available for distribution.

Extensive government regulations impose significant costs on our mining operations, and future regulations could increase those costs or limit our ability to produce and sell coal.

The coal mining industry is subject to increasingly strict regulation by federal, state and local authorities with respect to matters such as:

·

limitations on land use;

·

employee health and safety;

·

mandated benefits for retired coal miners;

·

mine permitting and licensing requirements;

·

reclamation and restoration of mining properties after mining is completed;

·

air quality standards;

·

water pollution;

·

construction and permitting of facilities required for mining operations, including valley fills and other structures, including those constructed in water bodies and wetlands;

·

protection of human health, plant life and wildlife;

·

discharge of materials into the environment; and

·

effects of mining on groundwater quality and availability.

The costs, liabilities and requirements associated with these and other regulations may be costly and time-consuming and may delay commencement or continuation of exploration or production operations. Failure to comply with these regulations may result in the assessment of administrative, civil and criminal penalties, the imposition of cleanup and site restoration costs and liens, the issuance of injunctions to limit or cease operations, the suspension or revocation of permits and other enforcement measures that could have the effect of limiting production from our operations. We may also incur costs and liabilities resulting from claims for damages to property or injury to persons arising from our operations. We must compensate employees for work-related injuries. If we do not make adequate provision for our workers’ compensation liabilities, it could harm our future operating results. If we are pursued for these sanctions, costs and liabilities, our mining operations and, as a result, our profitability could be adversely affected.

The possibility exists that new legislation and/or regulations and orders may be adopted that may materially adversely affect our mining operations, our cost structure and/or our customers’ ability to use coal. New legislation or administrative regulations (or new judicial interpretations or administrative enforcement of existing laws and regulations), including proposals related to the protection of the environment that would further regulate and tax the coal industry, may also require us or our customers to change operations significantly or incur increased costs. These regulations, if proposed and enacted in the future, could have a material adverse effect on our financial condition and results of operations.

Extensive environmental laws and regulations affect the end-users of coal and could reduce the demand for coal as a fuel source and cause the volume of our sales to decline. These laws and regulations could also impose costs on ROVA that it would be unable to pass through to its customer.

18