Attached files

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C.

20549

Form 10-K

|

|

þ

|

ANNUAL REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE

FISCAL YEAR ENDED DECEMBER 31,

2009.

|

or

|

|

o

|

TRANSITION REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE

TRANSITION PERIOD FROM _____________ TO

_____________.

|

Commission

File Number: 000-51730

Thomas

Weisel Partners Group, Inc.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

20-3550472

|

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

(I.R.S.

Employer

Identification

No.)

|

One

Montgomery Street

San Francisco,

California 94104

(415) 364-2500

(Address,

including zip code, and telephone number, including area code, of registrant’s

principal executive office)

Securities

registered pursuant to Section 12(b) of the Act:

None

Securities

registered pursuant to Section 12(g) of the Act:

Common

Stock, par value $0.01 per share

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes o

No þ

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or 15(d) of the Act. Yes o

No þ

Indicate

by check mark whether the registrant (1) has filed all reports required to

be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to

such filing requirements for the past

90 days. Yes þ

No o

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the

best of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of the Annual Report on

Form 10-K or any amendment to this Annual Report on Form 10-K.

þ

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, or a non-accelerated filer. See definition of “accelerated

filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

(Check one):

|

Large

accelerated filer o

|

Accelerated

filer þ

|

Non-accelerated

filer o

|

Smaller

reporting company o

|

Indicate

by check mark whether the registrant is a shell company (as defined in

Rule 12b-2 of the Act). Yes o

No þ

The

aggregate market value of the common stock held by non-affiliates of the

registrant as of the last business day of the registrant’s most recently

completed second fiscal quarter, based upon the closing sale price of the

registrants’ common stock on June 30, 2009 as reported on The NASDAQ Stock

Market, Inc. was $162,235,551.

As of

March 10, 2010 there were 32,852,852 shares of the registrant’s common

stock outstanding, including 6,183,121 shares of TWP Acquisition Company

(Canada), Inc., a wholly-owned subsidiary of the registrant. Each exchangeable

share is exchangeable at any time into common stock of the registrant on a

one-for-one basis, entitles the holder to dividend and other rights economically

equivalent to those of the common stock, and through a voting trust, votes at

meetings of stockholders of the registrant.

DOCUMENTS

INCORPORATED BY REFERENCE

Portions

of the definitive Proxy Statement for the registrants’ Annual Meeting of

Shareholders to be held on May 20, 2010 have been incorporated by reference into

Part III of this Annual Report on Form 10-K.

|

Item

Number

|

Page

|

|||||

|

1.

|

Business

|

1

|

||||

|

1A.

|

Risk

Factors

|

8

|

||||

|

1B.

|

Unresolved Staff

Comments

|

18

|

||||

|

2.

|

Properties

|

18

|

||||

|

3.

|

Legal

Proceedings

|

19

|

||||

|

4.

|

Submission of Matters to a Vote

of Security Holders

|

19

|

||||

|

5.

|

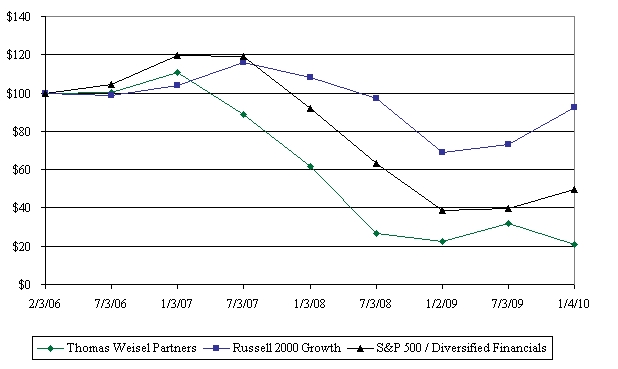

Market for Registrant’s Common

Equity, Related Shareholder Matters and Issuer Purchases of Equity

Securities

|

23

|

||||

|

6.

|

Selected Financial

Data

|

26

|

||||

|

7.

|

Management’s Discussion and

Analysis of Financial Condition and Results of Operations

|

27

|

||||

|

7A.

|

Quantitative and Qualitative

Disclosures About Market Risk

|

40

|

||||

|

8.

|

Financial Statements and

Supplementary Data

|

43

|

||||

|

9.

|

Changes in and Disagreements with

Accountants on Accounting and Financial Disclosure

|

43

|

||||

|

9A.

|

Controls and

Procedures

|

43

|

||||

|

9B.

|

Other

Information

|

43

|

||||

|

10.

|

Directors, Executive Officers,

and Corporate Governance of the Registrant

|

44

|

||||

|

11.

|

Executive

Compensation

|

44

|

||||

|

12.

|

Security Ownership of Certain

Beneficial Owners and Management and Related Shareholder

Matters

|

44

|

||||

|

13.

|

Certain Relationships and Related

Transactions, and

Director Independence

|

44

|

||||

|

14.

|

Principal Accountant Fees and

Services

|

44

|

||||

|

15.

|

Exhibits and Financial Statement

Schedules

|

44

|

||||

|

S-1

|

||||||

|

E-1

|

||||||

Special

Note Regarding Forward-Looking Statements

This

Annual Report on Form 10-K in Item 1 – “Business”,

Item 1A – “Risk Factors”, Item 7 – “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” and in other

sections includes forward-looking statements within the meaning of Section 27A

of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In some

cases, you can identify these statements by forward-looking words such as “may”,

“might”, “will”, “should”, “expect”, “plan”, “anticipate”, “believe”,

“estimate”, “predict”, “potential”, “intend” or “continue”, the negative of

these terms and other comparable terminology. These forward-looking statements,

which are subject to risks, uncertainties and assumptions about us, may include

expectations as to our future financial performance, which in some cases may be

based on our growth strategies and anticipated trends in our business. These

statements are based on our current expectations and projections about future

events. There are important factors that could cause our actual results, level

of activity, performance or achievements to differ materially from the results,

level of activity, performance or achievements expressed or implied by the

forward-looking statements. In particular, you should consider the numerous

risks outlined in Part I, Item 1A – “Risk Factors” in this Annual

Report on Form 10-K.

Although

we believe the expectations reflected in the forward-looking statements are

reasonable, we cannot guarantee future results, level of activity, performance

or achievements. Moreover, neither we nor any other person assumes

responsibility for the accuracy or completeness of any of these forward-looking

statements. You should not rely upon forward-looking statements as predictions

of future events. We are under no duty to update any of these forward-looking

statements after the date of this filing to conform our prior statements to

actual results or revised expectations, except as required by Federal securities

law.

Forward-looking

statements include, but are not limited to, the following:

|

·

|

Our

statement in Part I, Item 1 – “Business” that we believe our

efforts to reduce costs and preserve capital, while maintaining the

breadth of our coverage will lead to a significant improvement in our

financial results as capital market activity

returns.

|

|

·

|

Our

statement in Part I, Item 1 – “Competition” that we believe that

we have the capital and resources to provide our products and services and

that our product offerings are suited to our clients

needs.

|

|

·

|

Our

statements in Part I, Item 1A – “Risk

Factors” that

|

|

o

|

We

believe we may experience competitive pressures as some of our competitors

seek to obtain market share by competing on the basis of

price.

|

|

o

|

We

may grow our business through both internal expansion and through

strategic investments, acquisitions or joint

ventures.

|

|

o

|

We

intend to retain any future earnings to fund the operation and expansion

of our business, and therefore, we do not anticipate paying cash dividends

in the foreseeable future.

|

|

o

|

We

may incur significant expenses in connection with initiating new business

activities or in connection with any expansion of our underwriting,

brokerage or asset management

businesses.

|

|

o

|

We

may engage in strategic acquisitions and investments for which we may

incur significant expenses.

|

|

·

|

Our

statements in Part II, Item 7 – “Management’s Discussion and Analysis of

Financial Condition and Results of Operations”

that

|

|

o

|

We

believe the near-term investment banking opportunity in the technology and

resource sectors to be significant and that our banking platform, with a

focus on these growth sectors, will

benefit.

|

|

o

|

A

significant portion of our new hires have been in brokerage operations and

are professionals who bring incremental relationships to the firm, which

should positively impact future

revenues.

|

|

o

|

We

increased the number of our senior investment banking calling officers,

which we believe will positively impact future

results.

|

|

o

|

We

may carry out repurchases of our common stock from time to time in the

future and our Board of Directors may authorize additional repurchases in

the future, in each case for the purpose of settling obligations to

deliver common stock to employees who have received Restricted Stock Units

under our Equity Incentive Plan.

|

|

o

|

We

believe that our current level of equity capital, current cash balances,

funds anticipated to be provided by operating activities and funds

available to be drawn under temporary loan agreements, will be adequate to

meet our liquidity and regulatory capital requirements for the next 12

months.

|

Item

1. Business

Overview

We are an

investment bank focused principally on growth companies and growth investors. We

provide a combination of bulge bracket capabilities and specialized services to

this segment of the market. Our service offerings include strategic

advice on mergers and acquisitions and raising public and private equity,

independent equity research insights, asset management services and proven

brokerage transaction execution capabilities. We focus on building

and maintaining long-term strategic advisory relationships with growth companies

and take a lifecycle approach to servicing these companies. We combine our

industry knowledge base with our corporate, venture capital and professional

relationships to identify leading growth companies for our

services.

Our

executive offices are located at One Montgomery Street, San Francisco,

California. We have offices in more than 12 cities throughout North America and

Europe.

We were

formed in 1998 as Thomas Weisel Partners Group LLC and on February 7, 2006,

Thomas Weisel Partners Group, Inc. (“TWPG”), a Delaware corporation, succeeded

to the business of Thomas Weisel Partners Group LLC and completed an initial

public offering of its common stock.

We are

committed to being a premier global, growth-focused, investment bank. In January

2008, we completed our acquisition of Westwind Capital Corporation, an

independent, institutional investment bank focused on growth companies and

growth investors, particularly in the energy and mining sectors. Through the

acquisition, we expanded our coverage of growth verticals, adding energy and

mining, and significantly enhanced our global presence.

We are

exposed to volatility and trends in the general securities market, the economy

and in particular the growth sectors of the economy. The global credit crisis,

corporate consolidation and failures, lack of investor confidence and further

economic deterioration all led to a dramatic slowdown in the capital markets,

which in turn impacted the number of our investment banking transactions. During

this period, we made a concerted effort to reduce costs and preserve capital,

while maintaining the breadth of our coverage. We believe these efforts will

lead to a significant improvement in our financial results as capital market

activity returns.

Principal

Business Lines

Our

business is organized into four service offerings: investment banking,

brokerage, equity research and asset management.

Investment

Banking

Our

investment bankers provide two primary categories of services:

(i) corporate finance and (ii) strategic advisory.

Corporate Finance. Our

corporate finance practice is comprised of industry coverage groups that advise

on and structure capital raising solutions for our corporate clients through

public and private offerings of equity and debt securities, including

convertible debt. We offer a wide range of financial services designed to meet

the needs of growth companies, including initial public offerings, follow-on and

confidentially marketed offerings, equity-linked offerings, private investments

in public equity and private placements of debt and equity securities. Within

corporate finance, our capital markets group executes a variety of transactions,

both public underwritten securities offerings and private agented offerings,

assists clients with investor relations advice and introduces companies seeking

to raise capital to investors that we believe will be supportive long-term

investors. We assist the efforts of our corporate finance practice by providing

aftermarket trading support for our corporate finance clients.

Strategic

Advisory. Our strategic

advisory services include general strategic advice as well as transaction

specific advice regarding mergers and acquisitions, divestitures, spin-offs,

privatizations, special committee assignments and takeover defenses. Our

specialized advisory professionals work in conjunction with our industry

coverage groups in advising our corporate clients. We seek to become a trusted

advisor to the leading growth companies and to achieve a balance between our

buy- and sell-side assignments. Our buy- and sell-side assignments are generated

through our network of business relationships and by our reputation for quality

execution. Our strategic advisory services are also supported by our

capital markets professionals,

who provide assistance in acquisition financing and market intelligence in

connection with mergers and acquisitions transactions.

Brokerage

We

provide two principal categories of services within our brokerage operations:

(i) institutional brokerage, which comprises institutional sales, sales

trading, trading, special situations and non-deal road shows and

(ii) private client services.

Institutional Brokerage. We

provide equity and non-equity securities sales and trading services to more than

1,000 institutional investors.

Institutional Sales. Our

institutional sales professionals provide equity and non-equity securities sales

services to institutional investors and seek to develop strong relationships

with the portfolio managers they serve by developing expertise and working

closely with our equity research department. Our institutional sales

professionals focus on growth companies identified by our equity research

department and seek to develop a thorough understanding of those

companies.

Sales Trading. Our sales

traders are experienced in the industry and are knowledgeable regarding both the

markets for growth company securities and the institutional traders who buy and

sell them. Through our sales trading professionals, we connect with many large

and active buy-side trading desks in the United States, Canada and

Europe.

Trading. Our trading

professionals provide support to our institutional clients in their pursuit of

best execution, including facilitating block trades, providing electronic

trading services, committing capital and otherwise providing

liquidity.

Special Situations. Our

special situations group focuses on sourcing liquidity via overnight block

trades, reverse inquiries and quiet accumulations for investment banking,

institutional, private equity and high net worth clients in a confidential

manner and in connection with these activities engages in certain proprietary

trading activities.

Non-Deal Road Shows. We work

to leverage our industry knowledge and relationships by helping our

institutional clients maintain and build corporate contacts through coordinating

company and investor meetings that are unrelated to planned or pending

investment banking transactions, commonly referred to as non-deal road shows. We

believe these non-deal road shows underscore our high-service approach, promote

our brokerage services and are valued by our institutional brokerage clients.

Non-deal road shows present an environment for investors to further their

understanding of companies in which they have an equity position or that may be

attractive investment opportunities and for company executives to broaden

relationships with their investors and develop relationships with potential

investors.

Private Client Services. Our

private client services department offers brokerage and advisory services to

high-net-worth individuals. Our private client professionals emphasize capital

preservation and growth through prudent planning and work closely with clients

to personalize solutions that address their individual needs.

Equity

Research

Our

research analysts perform independent research to help our clients understand

the dynamics that drive the sectors and companies they cover. We seek to

differentiate ourselves through originality of perspective, depth of insight and

ability to uncover industry trends.

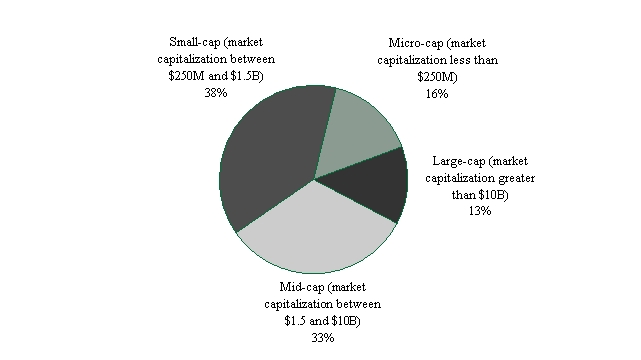

As of

December 31, 2009, our equity research professionals covered 500 companies

headquartered in 21 countries. Approximately 87% of the companies covered had

market capitalizations of $10 billion or less.

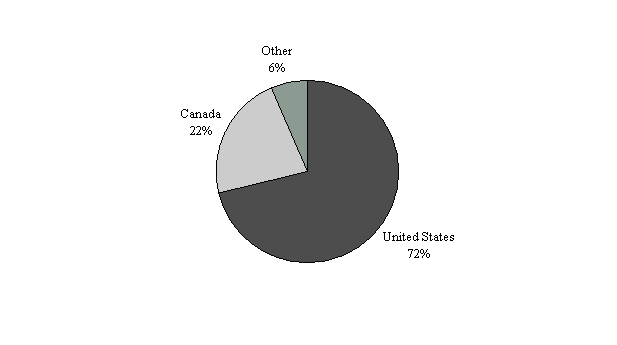

Equity

Research by Geographic Location of Company Headquarters

(as of

December 31, 2009)

Equity

Research by Market Capitalization

(as of

December 31, 2009)

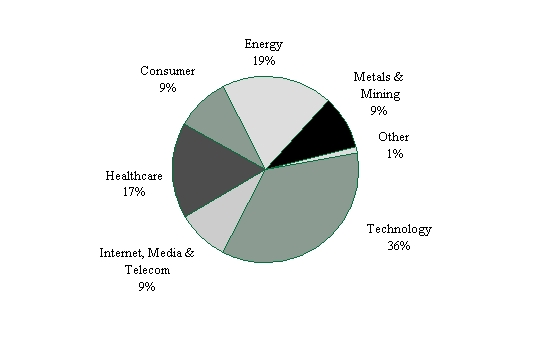

The

sectors and industry components we focus on within equity research are set forth

in the table and chart below:

|

Technology

|

Healthcare

|

Energy

|

|

Hardware

|

• Biotechnology

|

•

Alternative Energy

|

|

• Applied

Technologies

|

• Healthcare

Information Technology and

|

•

Energy Equipment & Services

|

|

• Communications

Equipment

|

Pharmaceutical

Services

|

• International

Oil & Gas

|

|

• Computer

Systems and Storage

|

• Healthcare

Services

|

•

Oil & Gas Exploration and Production

|

|

• Electronic

Supply Chain

|

• Life

Science and Medical Technology

|

|

|

• Information

& Financial Technology Services

|

• Pharmaceuticals:

Specialty

|

Metals

and Mining

|

|

• Semiconductors:

Analog & Mixed Signal

|

•

Base Metals and Uranium

|

|

|

• Semiconductors:

Processors & Components

|

Consumer

|

•

Gold and Precious Metals

|

|

• Retailing:

Hardlines

|

|

|

|

Software &

Services

|

• Retailing:

Softlines

|

Other

|

|

• Software:

Applications & Communications

|

• Sports

and Lifestyle Brands

|

•

Special Situations

|

|

• Software:

Infrastructure

|

•

Financial Services

|

|

|

•

Fertilizers / Materials

|

||

|

Internet

Media and Telecom

|

||

|

•

Internet Services

|

||

|

•

Media & Entertainment

|

||

|

• Telecom

Services

|

Equity

Research by Sector

(based on

number of companies covered as of December 31, 2009)

Our

research analysts analyze major trends, publish research on new areas of growth,

provide fundamental, company-specific coverage and work with our institutional

clients to identify and evaluate investment opportunities in publicly traded

companies. They periodically publish comprehensive “white-paper” studies of an

industry or a long-term investment theme, provide analysis and commentary on

growth companies and publish detailed primary research on investment

opportunities.

We

annually host several sector conferences targeting growth companies and

investors, including an Alternative Energy Conference, Consumer Conference,

Emerging Communications Conference, Energy Conference, Healthcare Conference,

Metals and Mining Conference and Technology and Telecom Conference. We use these

specialized events to showcase companies to institutional investors focused on

investing in these growth sectors. We believe that our conferences differentiate

us from smaller investment banks that may lack the relationships and resources

to host broadly attended industry events.

Asset

Management

Our asset

management division is divided into three principal units: (i) private

investment funds, (ii) public equity investment products and (iii) distribution

management.

Private Investment Funds. We

are currently the managing general partner of three groups of investment

funds:

|

·

|

Thomas

Weisel Global Growth Partners is a fund of funds for private primary fund

investments formed in 2000 with capital commitments of

$287.6 million. A fund for secondary private equity fund investments

with capital commitments of $130.9 million was formed in 2002, a

third fund for private equity secondary investments with capital

commitments of $54.0 million was formed in 2008 and a fourth fund for

private equity investments with capital commitments of $45.5 million was

formed in 2009.

|

|

·

|

Thomas

Weisel Healthcare Venture Partners is a healthcare venture capital fund

that invests in the emerging life sciences and medical technology sectors.

The fund was formed in 2003 with capital commitments of $121.8

million.

|

|

·

|

Thomas

Weisel Venture Partners is a venture capital fund that invests in

information technology companies, particularly in the broadly defined

software and communications industries. The fund was formed in 2000 with

capital commitments of approximately

$252.5 million.

|

As

manager of these funds, we receive management fees generally based on committed

capital or net assets of the partnerships.

We

maintain a non-managing special limited partner interest in Thomas Weisel India

Opportunity Fund, L.P. (“TWIOF”) as a result of a transaction in December 2008

under which (i) Thomas Weisel Capital Management LLC, the former investment

advisor of TWIOF, assigned its rights, responsibilities and obligations as

advisor of TWIOF to Guggenheim Partners India Management, LLC, an affiliate of

Guggenheim Partners, (ii) Guggenheim Partners India GP, LLC , an affiliate of

Guggenheim Partners, became the general partner of TWIOF and (iii) affiliates of

Guggenheim Partners acquired, directly or indirectly, assets related to the

operation of TWIOF, including assets from our India subsidiary, Thomas Weisel

International Private Limited. As a result of the transaction, neither us nor

any of our affiliates manages TWIOF but an affiliate of ours continues to

maintain an immaterial economic interest in TWIOF, consisting of an investment

of less than $0.6 million and a right to participate in a portion of the carried

interest of the fund.

Public Equity Investment

Products. We have a small/mid-cap growth public equity investment team

based in Portland, Oregon. We have provided approximately $18 million of seed

investment capital for the products they manage. This public equity investment

team also manages products through an asset management subsidiary and is

entitled to receive approximately 50% of net profits generated.

Distribution Management.

Distribution management actively manages securities distributions from private

equity and venture capital funds. We seek to enhance the returns realized by

distributions made from private equity and venture capital funds. The

distribution management services we provide include dedicated portfolio

management, execution, consolidated reporting and administrative

support.

Employees

As of

December 31, 2009, we had 453 employees, excluding those employees who have

given notice to leave or those on garden leave.

Our

professionals draw upon their experience and market expertise to provide

differentiated advice and customized services to our clients. We believe our

professionals are attracted to our company by our specialized market focus,

entrepreneurial culture and commitment to our clients. None of our employees are

represented by collective bargaining agreements. We have not experienced any

work stoppages and believe our relationship with our employees to be

satisfactory.

Competition

As an

investment bank, all aspects of our business are intensely competitive. Our

competitors are investment banking firms, other brokerage firms and financial

advisory firms. We compete with some of our competitors nationally or regionally

and with others on a product or service level. Many of our competitors have

substantially greater capital and resources than we do and offer a broader range

of financial products. We believe that the principal factors affecting

competition in our business include client relationships, reputation, the

abilities of our professionals, market focus and the relative quality and price

of our services and products.

In recent years there has been

substantial consolidation and convergence among companies in the financial

services industry. Legislative and regulatory changes in the United States

have allowed commercial

banks to enter businesses previously limited to investment banks, and a number

of large commercial banks, insurance companies and other broad-based financial

services firms have established or acquired broker-dealers or merged with other

financial institutions. This trend toward consolidation and convergence has

significantly increased the capital base and geographic reach of many of our

competitors. Many of our competitors have the ability to offer a wider range of

products and services that may enhance their competitive position. They may also

have the ability to support investment banking and securities products and

services with commercial banking, insurance and other financial services

capabilities in an effort to gain market share, which could result in pricing

pressure in our businesses.

We

experience price competition with respect to our investment banking business.

One trend, particularly in the equity underwriting business, toward multiple

book runners has increased the competitive pressure in the investment banking

industry and may lead to lower average transaction fees.

We

experience price competition with respect to our brokerage business, including

large block trades, spreads and trading commissions. The ability to execute

trades electronically and through other alternative trading systems has

increased the pricing pressure on trading commissions and spreads, as well as

affected the volume of trades being executed through traditional full-service

platforms.

We

experience competition with respect to our asset management business both in the

pursuit of investors for our investment funds and products and in the

identification and completion of investments in attractive portfolio companies

for our investment funds. We compete for individual and institutional clients on

the basis of price, the range of products we offer, the quality of our services

as well as on the basis of financial resources available to us and invested in

our products. We may be competing with other investors and corporate buyers for

the investments that we make.

Competition

is also intense for the recruitment and retention of qualified professionals.

Our ability to continue to compete effectively in our businesses will depend

upon our continued ability to attract new professionals and retain and motivate

our existing professionals.

Despite

the competition that we face, we believe our investment banking, brokerage and

research products compare favorably with those of our competitors. We believe

that we have the capital and resources to provide our products and services and

that our product offerings are suited to our clients needs. We believe that our

focus and reputation for providing these products and services to growth

companies and the relationships we have built within these communities

differentiates us from our competition.

As

compared to our competitors, we may be limited in providing our investment

banking and brokerage products and services by our regulatory

capital.

The

competitive landscape in Canada and Europe is similar to that of the United

States where we face competition from investment banking firms, other brokerage

firms and financial advisory firms, many of who have substantially greater

capital resources than us and offer a broader range of financial

products.

Regulation

Our

business, as well as the financial services industry in general, is subject to

extensive regulation in the United States, Canada and elsewhere. As a matter of

public policy, regulatory bodies in the United States, Canada and the rest of

the world are charged with safeguarding the integrity of the securities and

other financial markets and with protecting the interests of customers

participating in those markets. These regulatory bodies adopt and amend rules

(which are subject to approval by government agencies) for regulating the

industry and conduct periodic examinations of members. In the United States, the

Securities and Exchange Commission (the “SEC”) is the federal agency responsible

for the administration of the federal securities laws.

Thomas

Weisel Partners LLC (“TWP”), our wholly-owned subsidiary, is registered as a

broker-dealer with the SEC and the Financial Industry Regulatory Authority

(“FINRA”), a self-regulatory organization which is itself subject to oversight

by the SEC and which adopts and enforces rules governing the conduct, and

examines the activities of its member firms in all 50 states and the

District of Columbia. Accordingly, TWP is subject to regulation and oversight by

the SEC and FINRA. In 2007, TWP opened and registered branch offices in London,

England, Zurich, Switzerland, Chicago, Illinois, Cleveland, Ohio and Baltimore,

Maryland. In 2008, TWP opened and registered branch offices in Denver, Colorado,

Toronto, Ontario, Canada, and Calgary, Alberta, Canada. In 2009, TWP opened and

registered a branch office in Dallas, Texas. State securities regulators also

have regulatory or oversight authority over TWP. In addition, TWP and several

other wholly-owned subsidiaries of ours, including Thomas Weisel Capital

Management LLC, Thomas Weisel Asset Management LLC, TW Asset Management LLC and

Thomas Weisel Global Growth Partners LLC, are registered as investment advisers

with the SEC and therefore are subject to their regulation and oversight. TWP is

also a member of, and is subject to regulation by, the New York Stock Exchange

(“NYSE”), the American Stock Exchange and the Ontario Securities Commission. TWP

is also registered as an introducing broker with the Commodity Futures Trading

Commission and is a member of the National Futures Association.

Broker-dealers

are subject to regulations that cover all aspects of the securities business,

including sales methods, trade practices among broker-dealers, use and

safekeeping of customers’ funds and securities, capital structure,

record-keeping, the financing of customers’ purchases and the conduct and

qualifications of directors, officers and employees. We are required by the SEC

to be a member of the Securities Investors Protection Corporation (“SIPC”).

SIPC’s primary role is investor protection. As a member firm we may be assessed

fees on our revenues. The SIPC provides protection for securities and cash held

in client accounts up to $500,000 per client, with cash claims not to exceed

$100,000. This coverage does not protect against market fluctuations. As a

registered broker-dealer and member of various self-regulatory organizations,

TWP is subject to the SEC’s uniform net capital rule, Rule 15c3-1. The uniform

net capital rule specifies the minimum level of net capital a broker-dealer must

maintain. The SEC and various self-regulatory organizations impose rules that

require notification when net capital falls below certain predefined criteria

that limit the ratio of subordinated debt to equity in the regulatory capital

composition of a broker-dealer and that constrain the ability of a broker-dealer

to expand its business under certain circumstances. Additionally, the SEC’s

uniform net capital rule imposes certain requirements that may have the effect

of prohibiting a broker-dealer from distributing or withdrawing capital and

requiring prior notice to the SEC for certain withdrawals of capital. The SEC

has adopted rule amendments that establish alternative net capital requirements

for broker-dealers that are part of a consolidated supervised entity. As a

condition to its use of the alternative method, a broker-dealer’s ultimate

holding company and affiliates (referred to collectively as a consolidated

supervised entity) must consent to group-wide supervision and examination by the

SEC. If we elect to become subject to the SEC’s group-wide supervision, we will

be required to report to the SEC computations of our capital

adequacy.

Thomas

Weisel Partners Canada, Inc. (“TWPC”), our registered Canadian broker-dealer

subsidiary, is subject to regulation by the securities commissions of Ontario,

Quebec, Alberta, British Columbia, Manitoba, Saskatchewan and Nova Scotia, is a

member of the Investment Industry Regulatory Organization of Canada (“IIROC”)

and is a participating organization of the Toronto Stock Exchange and the TSX

Venture Exchange. TWPC is required by the IIROC to belong to the Canadian

Investors Protection Fund (“CIPF”), whose primary role is investor protection.

The CIPF may charge member firms assessments based on revenues and risk

premiums. The CIPF provides protection for securities and cash held in client

accounts up to CDN$1,000,000 per client with separate coverage of CDN$1,000,000

for certain types of accounts. This coverage does not protect against market

fluctuations. TWPC is subject to the minimum capital rule (By-Law No. 17 of the

IIROC) and the early warning system (By-Law No. 30 of the IIROC). The minimum

capital rule requires that every member shall have and maintain at all times

risk adjusted capital greater than zero calculated in accordance with Form 1

(Joint Regulatory Financial Questionnaire and Report) and with such requirements

as the Board of Directors of the IIROC may from time to time prescribe.

Insufficient risk adjusted capital may result in suspension from membership of

the IIROC.

Thomas

Weisel Partners International Limited, a registered U.K. broker-dealer

subsidiary, is subject to regulation by the Financial Securities Authority in

the United Kingdom. Our broker-dealer branch office in Zurich, Switzerland is

subject to the oversight of the Swiss Federal Banking Commission.

The

effort to combat money laundering and terrorist financing is a priority in

governmental policy with respect to financial institutions. The USA PATRIOT

Act of 2001 contains anti-money laundering and financial transparency laws and

mandates the implementation of various new regulations applicable to

broker-dealers and other financial services companies, including standards for

verifying client identification at account opening and obligations to monitor

client transactions and report suspicious activities. Anti-money laundering laws

outside the United States contain some similar provisions. The obligation of

financial institutions, including us, to identify their customers, watch for and

report suspicious transactions, respond to requests for information by

regulatory authorities and law enforcement agencies, and share information with

other financial institutions, has required the implementation and maintenance of

internal practices, procedures and controls which have increased, and may

continue to increase, our costs, and any failure with respect to our programs in

this area could subject us to regulatory consequences, including substantial

fines and potentially other liabilities.

In

addition to U.S. federal regulations, certain of our businesses are subject

to compliance with laws and regulations of U.S. state governments,

non-U.S. governments, their respective agencies and/or various

self-regulatory organizations or exchanges relating to the privacy of client

information. Any failure to comply with these regulations could expose us to

liability and/or reputational damage.

Additional

legislation, changes in rules promulgated by the SEC and self-regulatory

organizations or changes in the interpretation or enforcement of existing laws

and rules, either in the United States, Canada or elsewhere, may directly affect

the mode of our operations and profitability.

U.S. and

non-U.S. government agencies and self-regulatory organizations, as well as

state securities commissions in the United States, are empowered to conduct

administrative proceedings that can result in censure, fine, the issuance of

cease-and-desist orders or the suspension or expulsion of a broker-dealer or its

directors, officers or employees. Occasionally, our subsidiaries have been

subject to investigations and proceedings, and sanctions have been imposed for

infractions of various regulations relating to our

activities.

Where

You Can Find More Information

We are

required to file annual, quarterly and current reports, proxy statements and

other information required by the Exchange Act, with the SEC. You may read and

copy any document we file with the SEC at the SEC’s public reference room

located at 100 F Street, N.E., Washington, D.C. 20549, U.S.A.

Please call the SEC at 1-800-SEC-0330 for further information on the public

reference room. Our SEC filings are also available to the public from the SEC’s

internet site at http://www.sec.gov.

We

maintain a public internet site at http://www.tweisel.com and make available

free of charge through this site our Annual Reports on Form 10-K, Quarterly

Reports on Form 10-Q, Current Reports on Form 8-K, Proxy Statements and

Forms 3, 4 and 5 filed on behalf of directors and executive officers, as

well as any amendments to those reports filed or furnished pursuant to the

Exchange Act as soon as reasonably practicable after we electronically file such

material with, or furnish it to, the SEC. We also post on our website the

charters for our Board of Directors’ Audit Committee, Compensation Committee and

Corporate Governance and Nominations Committee, as well as our Corporate

Governance Guidelines, our Code of Conduct and Ethics governing our directors,

officers and employees and other related materials. In addition, we also post on

our website, under “Investment Banking – Transactions”, links to listings of our

completed investment banking transactions and our transactions in registration.

The information on our website is not part of this Annual Report.

Our

Investor Relations Department can be contacted at Thomas Weisel Partners Group,

Inc., One Montgomery Street, San Francisco, California 94104,

Attention: Investor Relations; telephone: 415-364-2500; e-mail:

investorrelations@tweisel.com.

Item

1A. Risk

Factors

We face a

variety of risks in our business, many of which are substantial and inherent in

our business and operations. The following are some of the important risk

factors that could affect our business, our industry and holders of our common

stock. These risks are not exhaustive. Other sections of this Annual Report on

Form 10-K may include additional factors which could adversely impact our

business and financial performance. Moreover, we operate in a very competitive

and rapidly changing environment. New risk factors emerge from time to time and

it is not possible for our management to predict all risk factors, nor can we

assess the impact of all factors on our business or the extent to which any

factor, or combination of factors, may cause actual results to differ materially

from those contained in any forward-looking statements.

Risks

Related to Our Business

Our

businesses have been and may continue to be adversely affected by conditions in

the global financial markets and economic conditions generally.

Our

businesses, by their nature, do not produce predictable earnings, and are

affected by changes in economic conditions generally and in particular by

conditions in the financial markets. Beginning in mid-2007, these conditions

have changed suddenly and, for a period of time in the fall of 2008 and into

2009, very negatively.

In the

fall of 2008 and into 2009, the financial services industry and the securities

markets generally experienced significant valuation declines in virtually all

asset categories. This was initially triggered by the subprime mortgage crisis,

but eventually spread to other asset classes, including equities. Financial

markets over this period have been characterized by substantially higher

volatility, a lack of liquidity and a general loss of investor confidence,

initially in financial institutions, and eventually companies in a number of

other industries and in the broader markets, including the industries in which

we specialize. While the markets have generally stabilized and improved since

the early part of 2009, asset values for many asset classes have not returned to

previous levels. Business, financial and economic conditions continue to be

negatively impacted by the events of recent years.

Market

conditions have also led to the failure or merger of a number of prominent

financial institutions with which we compete. Financial institution failures or

near-failures have resulted in further losses and have also impacted the trading

prices of shares in all financial institutions, including ours. In addition,

during 2009, the United States and many other international markets experienced

a recession. Business activity across a wide range of industries and regions,

including the sectors in which we specialize, has been greatly reduced, and many

companies were, and some continue to be, in serious difficulty.

Our

investment banking business has been and may continue to be adversely affected

by market conditions. Poor economic conditions and other adverse conditions can

adversely affect and have adversely affected investor confidence, resulting in

significant industry-wide declines in the size and number of underwritings and

of financial advisory transactions, which could have an adverse effect on our

revenues and our profit margins. In addition, reductions in the trading prices

for equity securities tend to reduce the deal value of investment banking

transactions, such as underwritings and mergers and acquisitions transactions,

which in turn may reduce the fees we earn from these transactions.

In

certain circumstances, market uncertainty or general declines in market or

economic activity may affect our brokerage businesses by decreasing levels of

overall activity or by decreasing volatility, but at other times market

uncertainty and even declining economic activity may result in higher trading

volumes or higher spreads or both.

Also,

difficult market conditions have decreased the value of certain assets under

management in our asset management and private client business, which decrease

the amount of asset-based fees we receive, and may also affect our ability to

attract additional, or retain existing, assets under management within these

businesses.

In

addition, as an investment bank focused principally on the growth sectors of the

economy, we depend significantly on transactions by venture capital-backed

companies for sources of revenues and potential business opportunities. To the

extent venture capital investment activities slow due to difficult market

conditions or otherwise, our business, financial condition, results of

operations and cash flows may be adversely affected.

Our

financial performance depends to a great extent on the economic environment in

which we operate. While the business environment has generally improved since

early 2009, there can be no assurance that these conditions will continue in the

near or long term. Accordingly, our results of operations will continue to

fluctuate and may not improve until the business environment

stabilizes.

We

focus principally on specific sectors of the economy, and deterioration in the

business environment in these sectors generally or decline in the market for

securities of companies within these sectors could materially adversely affect

our businesses.

We focus

principally on the technology, healthcare, energy and alternative energy, mining

and consumer sectors of the economy. Underwriting transactions, strategic

advisory engagements and related trading activities in our focus sectors

represent a significant portion of our businesses. Therefore, volatility in the

business environment in these sectors generally, or in the market for securities

of companies within these sectors particularly, could substantially affect our

financial results and the market value of our common stock. The business

environment for companies in these sectors can experience substantial

volatility, and our financial results may consequently be subject to significant

variations from year to year. The market for securities in each of our focus

sectors may also be subject to industry-specific risks. For example, changes in

policies by the United States Food and Drug Administration may affect the market

for securities of biotechnology and healthcare companies and volatility in the

commodities markets may affect the market for securities of energy or mining

companies that operate in the affected markets. Any future downturns in our

focus sectors could materially adversely affect our business and results of

operations.

Regulatory and legal

developments related to auction rate securities could adversely affect our

business, financial condition, operations and cash flow.

Since

February 2008, the auctions through which most auction rate securities (“ARS”)

are sold and interest rates are determined have failed, resulting in a lack of

liquidity for these securities.

We,

together with many other firms in the financial services industry, have received

inquiries from FINRA requesting information concerning purchases of ARS by our

customers. Separately, we have been named in FINRA arbitrations filed by three

retail customers who purchased ARS.

We did

not, at any time, underwrite ARS or manage the associated auctions. We acted as

agent for our customers when buying in auctions managed by underwriters.

Nevertheless, some combination of FINRA and/or our customers could seek to

compel us to purchase ARS from our customers, although we do not have sufficient

regulatory capital nor do we have cash or borrowing capacity to repurchase all

of the ARS held by those customers. We are and have been exploring potential

solutions for our Private Client Services customers and have supported the

efforts of industry participants, including particularly the efforts of those

underwriters of ARS who have entered into settlements with the SEC and other

regulators that contain “best efforts” commitments to repurchase ARS, to resolve

issues relating to the lack of liquidity for ARS. We have filed Statements of

Claims with FINRA against the various investment banks who acted as the

underwriters and auction managers of most of the ARS currently held by our

customers. Through this process, we hope to secure for our customers relief that

is the same as or equivalent to the relief that these entities have agreed to

provide to their own retail customers.

On July

23, 2009, the Staff of the Enforcement Department of FINRA advised the Company

that the Staff has made a preliminary determination to recommend disciplinary

action against the Company relating to certain activities involving ARS. The

Staff’s recommendation involves potential violations of FINRA and Municipal

Securities Rulemaking Board rules and certain anti-fraud and other provisions of

the Federal securities laws in connection with particular transactions involving

ARS. A Staff preliminary determination is neither a formal allegation nor is it

evidence of wrongdoing.

The

Company has responded to the Staff’s preliminary determination and continues to

communicate with the Staff in an effort to try to resolve the matter. Based upon

its discussions with the Staff, the Company believes that it has reached an

understanding in principle, subject to documenting that understanding in a

letter of acceptance, waiver and consent acceptable to FINRA, that would resolve

all aspects of the investigation of the Company. In light of the terms of that

agreement in principle, the Company has established in total a $4.0 million

provision for loss contingencies related to the FINRA investigation, all of

which would be paid to FINRA as a fine in connection with the resolution of all

aspects of the investigation of the Company.

There can

be no assurance, however, that the Company’s efforts to resolve these matters

will be successful or that a disciplinary proceeding will not be brought. The

Company is prepared to contest vigorously any formal disciplinary action that

would result in a censure, fine, or other sanction that could be material to its

business, financial condition, operations and cash flows. If FINRA were to

institute disciplinary action, it is possible that such action could result in a

material adverse effect on the Company’s business, financial condition,

operations and cash flows. However, the Company is unable to determine at this

time the impact of the ultimate resolution of this matter.

Our

financial results may fluctuate substantially from period to period, which may

impair our stock price.

We have

experienced, and expect to experience in the future, significant periodic

variations in our revenues and results of operations. These variations may be

attributable in part to the fact that our investment banking revenues are

typically earned upon the successful completion of a transaction, the timing of

which is uncertain and beyond our control. In most cases we receive little or no

payment for investment banking engagements that do not result in the successful

completion of a transaction. As a result, our business is highly dependent on

market conditions as well as the decisions and actions of our clients and

interested third parties. For example, a client’s acquisition transaction may be

delayed or terminated because of a failure to agree upon final terms with the

counterparty, failure to obtain necessary regulatory consents or board or

shareholder approvals, failure to secure necessary financing, adverse market

conditions or unexpected financial or other problems in the client’s or

counterparty’s business. If the parties fail to complete a transaction on which

we are advising or an offering in which we are participating, we will earn

little or no revenue from the transaction. This risk may be intensified by our

focus on growth companies, as the market for securities of many of these

companies has experienced significant variations in the number and size of

equity offerings. Recently, more companies initiating the process of an initial

public offering are simultaneously exploring merger and acquisition

opportunities. If we are not engaged as a strategic advisor in any such

dual-tracked process, our investment banking revenues would be adversely

affected in the event that an initial public offering is not

consummated.

Our

ability to retain our professionals and recruit additional professionals is

critical to the success of our business, and our failure to do so may materially

adversely affect our reputation, business and results of

operations.

Our

ability to obtain and successfully execute our business depends upon the

personal reputation, judgment, business generation capabilities and project

execution skills of our senior professionals, particularly Thomas W. Weisel, our

founder, Chairman and Chief Executive Officer, Lionel F. Conacher, our President

and Chief Operating Officer, and the other members of our Executive Committee.

Our senior professionals’ personal reputations and relationships with our

clients are a critical element in obtaining and executing client engagements. We

encounter intense competition for qualified employees from other companies in

the investment banking industry as well as from businesses outside the

investment banking industry, such as investment advisory firms, hedge funds,

private equity funds and venture capital funds. From time to time, we have

experienced losses of investment banking, brokerage, research and other

professionals, and losses of our key personnel may occur in the future. The

departure or other loss of Mr. Weisel, Mr. Conacher, any other member of our

Executive Committee or any other senior professional who manages substantial

client relationships and possesses substantial experience and expertise, could

impair our ability to secure or successfully complete engagements, protect our

market share or retain assets under management, each of which, in turn, could

materially adversely affect our business and results of operations. Certain of

our investment funds may be subject to key man provisions which, upon the

departure or other loss of some or all of the investment professionals managing

the fund, may permit the investors in the fund to dissolve the fund or may

result in a reduction of the management fees paid with respect to the investment

fund.

In

connection with our initial public offering and our conversion to corporate

form, many of our professionals received substantial amounts of common stock in

exchange for their membership interests. Ownership of, and the ability to

realize equity value from, our common stock, unlike that of membership interests

in Thomas Weisel Partners Group LLC (the predecessor to TWPG), does not depend

upon continued employment, and our professionals are not restricted from leaving

us by the potential loss of the value of their ownership interests. Similarly,

in connection with our acquisition of Westwind, many of the Westwind

professionals received substantial amounts of common stock (or shares

exchangeable for our common stock) in consideration of their ownership interests

in Westwind. Ownership of, and the ability to realize equity value from our

common stock (or shares exchangeable for our common stock), unlike that of

ownership interests in Westwind, does not depend on continued employment, and

these professionals are not restricted from leaving us by potential loss of the

value of their ownership interests. These shares of common stock (and shares

exchangeable for our common stock) are subject to certain restrictions on

transfer, and a portion are pledged to secure liquidated damages obligations to

us as set forth in the Partners’ Equity Agreement and the Westwind Capital

Corporation Shareholders’ Equity Agreement, each of which has been filed as an

exhibit to our Annual Report on Form 10-K for the fiscal year ended December 31,

2008. However, these agreements will survive for only a limited period and will

permit any professional that is party thereto to leave us without losing any of

their shares of common stock (or shares exchangeable for our common stock) if

they comply with these agreements, and, in some cases, compliance with these

agreements may also be waived. Consequently, the steps we have taken to

encourage the continued service of these individuals after our initial public

offering and after the acquisition of Westwind may not be

effective.

If any of

our professionals were to join an existing competitor or form a competing

company, some of our clients could choose to use the services of that competitor

instead of our services. The compensation arrangements, non-competition

agreements and lock-up agreements we have entered into with certain of our

professionals may not prove effective in preventing them from resigning to join

our competitors, and the non-competition agreements may not be upheld if we were

to seek to enforce our rights under these agreements.

If we are

unable to retain our professionals or recruit additional professionals, our

reputation, business, results of operations, financial condition and cash flows

may be materially adversely affected.

Pricing

and other competitive pressures may impair the revenues and profitability of our

brokerage business.

We derive

a significant portion of our revenues from our brokerage business. Along with

other brokerage firms, we have experienced intense price competition in this

business in recent years. In particular, the ability to execute trades

electronically and through other alternative trading systems has increased the

pressure on trading commissions, volume and spreads and has required us to make

investments in our brokerage business in order to compete. We expect this trend

toward alternative trading systems to continue. We believe we may experience

competitive pressures in these and other areas as some of our competitors seek

to obtain market share by competing on the basis of price. In addition, we face

pressure from our larger competitors, which may be better able to offer a

broader range of complementary products and services to brokerage clients in

order to win their trading business. As we are committed to maintaining our

comprehensive research coverage to support our brokerage business, we may be

required to make substantial investments in our research capabilities. If we are

unable to compete effectively with our competitors in these areas, brokerage

revenues may decline and our business, financial condition and results of

operations may be adversely affected.

We

face strong competition from larger firms.

The

brokerage, investment banking and asset management industries are intensely

competitive, and we expect them to remain so. We compete on the basis of a

number of factors, including client relationships, reputation, the abilities and

past performance of our professionals, market focus and the relative quality and

price of our services and products. We have experienced intense price

competition with respect to our brokerage business, including large block

trades, spreads and trading commissions, as well as competition due to the

increased use of commission sharing arrangements. Other competitive pressures in

investment banking, including the trends toward multiple book runners and

multiple financial advisors handling transactions, have continued and could

adversely affect our average fee per transaction, even during periods where the

volume and number of investment banking transactions are increasing. Competitive

factors with respect to our asset management activities include the amount of

firm capital we can invest in new products and our ability to increase assets

under management, including our ability to attract capital for new investment

funds. We believe we may continue to experience competitive pressures in these

and other areas in the future.

Many of

our competitors in the brokerage, investment banking and asset management

industries have a broader range of products and services, greater financial and

marketing resources, larger customer bases, greater name recognition, more

senior professionals to serve their clients’ needs, greater global reach and

more established relationships with clients than we have. These larger and

better capitalized competitors may be better able to respond to changes in the

brokerage, investment banking and asset management industries, to compete for

skilled professionals, to finance acquisitions, to fund internal growth and to

compete for market share generally.

The scale

of our competitors has increased over time as a result of substantial

consolidation among companies in the brokerage and investment banking

industries. In addition, a number of large commercial banks, insurance companies

and other broad-based financial services firms have established or acquired

underwriting or financial advisory practices and broker-dealers or have merged

with other financial institutions. These firms have the ability to offer a wider

range of products than we do, which may enhance their competitive position. They

also have the ability to support investment banking with commercial banking,

insurance and other financial services in an effort to gain market share, which

has resulted, and could further result, in pricing pressure in our businesses.

In particular, the ability to provide financing has become an important

advantage for some of our larger competitors and, because we do not provide such

financing, we may be unable to compete as effectively for clients in a

significant part of the brokerage and investment banking market. If we are

unable to compete effectively with our competitors, our business, financial

condition and results of operations will be adversely affected.

We

have incurred losses and may incur losses in the future.

We

recorded net losses of $203.3 million, including a goodwill impairment charge of

$92.6 million, for the year ended December 31, 2008 and $63.7 million for the

year ended December 31, 2009, and we may incur additional losses in the future.

If we are unable to finance future losses, those losses may have a significant

effect on our liquidity as well as our ability to operate.

In

addition, we may incur significant expenses in connection with initiating new

business activities or in connection with any expansion of our underwriting,

brokerage or asset management businesses. We may also engage in strategic

acquisitions and investments for which we may incur significant expenses.

Accordingly, we will need to increase our revenues at a rate greater than our

expenses to achieve and maintain profitability. If our revenues do not increase

sufficiently, or even if our revenues increase but we are unable to manage our

expenses, we will not achieve and maintain profitability in future

periods.

Our

capital markets and strategic advisory engagements are singular in nature and

may not provide for subsequent engagements.

Our

strategy is to take a lifecycle approach in providing investment banking

services to our clients, however, our investment banking clients generally

retain us on a short-term, engagement-by-engagement basis in connection with

specific capital markets or mergers and acquisitions transactions, rather than

on a recurring basis under long-term contracts. Therefore, we must seek out new

engagements when our current engagements are successfully completed or are

terminated. As a result, high activity levels in any period are not necessarily

indicative of continued high levels of activity in any subsequent period. If we

are unable to generate a substantial number of new engagements and generate fees

from the successful completion of these transactions, our business and results

of operations would likely be adversely affected.

Poor

investment performance, pricing pressure and other competitive factors may

reduce our asset management revenues or result in losses.

Asset

management revenues are primarily derived from management fees which are based

on committed capital and/or assets under management and incentive fees, which

are earned if the return of our investment funds exceeds certain threshold

returns. Our ability to maintain or increase assets under management is subject

to a number of factors, including investors’ perception of our past performance,

market or economic conditions, competition from other fund managers and our

ability to negotiate terms with major investors.

Investment

performance is one of the most important factors in retaining existing clients

and competing for new asset management and private equity business, and our

historical performance may not be indicative of future results. Poor investment

performance and other competitive factors could reduce our revenues and impair

our growth in many ways, including:

|

|

·

|

existing

clients may withdraw funds from our asset management business in favor of

better performing products;

|

|

|

·

|

our

incentive fees could decline or be eliminated

entirely;

|

|

|

·

|

firms

with which we have business relationships may terminate these

relationships with us;

|

|

|

·

|

our

capital investments in our investment funds or the seed capital we have

committed to new asset management products may diminish in value or may be

lost; and

|

|

|

·

|

our

key employees in the business may depart, whether to join a competitor or

otherwise.

|

Our

investment funds include gains and losses that have not yet been realized

through sales or other transactions. These unrealized gains and losses are

recognized in our results of operations because these investments are accounted

for in accordance with accounting principles generally accepted in the United

States of America (“GAAP”) using the fair value method. In most cases, pricing

inputs are unobservable for the investment and include situations where there is

little, if any, market activity for the investment. The inputs used in the

determination of fair value require significant management judgment or

estimation. Due to the inherent uncertainty of valuation, fair values of these

non-marketable investments may differ from the values that would have been used

had a ready market existed for these investments, which differences could be

material, and these differences may result in increased volatility in our asset

management revenues.

To the

extent our future investment performance is perceived to be poor in either

relative or absolute terms, our asset management revenues will likely be reduced

and our ability to raise new funds will likely be impaired. Even when market

conditions are generally favorable, our investment performance may be adversely

affected by our investment style and the particular investments that we

make.

The

contraction of the credit markets and the general downturn of the economy have

been major contributors to a reduction in the available investor capital pool.

This, coupled with the over-allocation of many institutional investors to the

alternative asset fund class, could make it increasingly difficult for us to

raise capital for new investment funds. Also, difficult market conditions have

decreased the value of assets under management in our asset management and

private client business, which decreases the amount of asset-based fees we

receive, and may also affect our ability to attract additional, or retain

existing assets under management within these businesses.

Increases

in capital commitments in our trading, underwriting and other businesses

increase the potential for significant losses.

The trend

in capital markets is toward larger and more frequent commitments of capital by

financial services firms in many of their activities. For example, in order to

attract clients, investment banks are increasingly committing capital to

purchase large blocks of stock from publicly-traded issuers or their significant

shareholders, instead of the more traditional marketed underwriting process, in

which marketing is typically completed before an investment bank commits capital

to purchase securities for resale. We have participated in this trend and expect

to continue to do so. As a result, we will be subject to increased risk as we

commit greater amounts of capital to facilitate primarily client-driven

business. Furthermore, we may suffer losses even when economic and market

conditions are generally favorable for others in the industry.

We may

enter into large transactions in which we commit our own capital as part of our

trading business. The number and size of these large transactions may materially

affect our results of operations in a given period. We may also incur

significant losses from our trading activities due to market fluctuations and

volatility from quarter to quarter. To the extent that we own assets, i.e., have

long positions, a downturn in the value of those assets or in those markets

could result in losses. Conversely, to the extent that we have sold assets we do

not own, i.e., have short positions, an upturn in those markets could expose us

to potentially unlimited losses as we attempt to cover our short positions by

acquiring assets in a rising market.

We also

commit capital to investment funds we sponsor and utilize our own funds as seed

capital for new products and services in our asset management business. These

investments may diminish in value or may be lost entirely if market conditions

are not favorable.

Limitations

on our access to capital could impair our liquidity and our ability to conduct

our businesses.

Liquidity,

or ready access to funds, is essential to financial services firms. Failures of

financial institutions have often been attributable in large part to

insufficient liquidity. Liquidity is of particular importance to our trading

business, and perceived liquidity issues may affect our clients’ and

counterparties’ willingness to engage in brokerage transactions with us. Our

liquidity could be impaired due to circumstances that we may be unable to

control, such as a general market disruption or an operational problem that

affects our trading clients, third parties or us. Further, our ability to sell

assets may be impaired if other market participants are seeking to sell similar

assets at the same time.

Our asset

management business is also subject to liquidity risk due to investments in

high-risk, illiquid assets. We have made substantial principal investments in

our investment funds and may make additional investments in future funds, which

often invest in securities that are not publicly traded. There is a significant

risk that we may be unable to realize our investment objectives by sale or other

disposition at attractive prices or may otherwise be unable to complete any exit

strategy. In particular, these risks could arise from changes in the financial

condition or prospects of the portfolio companies in which investments are made

and from changes in national or international economic conditions or changes in

laws, regulations, fiscal policies or political conditions of countries in which