Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION - SILVERADO GOLD MINES LTD | exhibit32-2.htm |

| EX-31.1 - CERTIFICATION - SILVERADO GOLD MINES LTD | exhibit31-1.htm |

| EX-32.1 - CERTIFICATION - SILVERADO GOLD MINES LTD | exhibit32-1.htm |

| EX-31.2 - CERTIFICATION - SILVERADO GOLD MINES LTD | exhibit31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: November 30, 2009

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ____________

Commission File Number 0-12132

SILVERADO GOLD MINES

LTD.

(Exact Name of Registrant as Specified in its Charter)

| British Columbia, Canada | 98-0045034 |

| (State or Other Jurisdiction of Incorporation or | (I.R.S. Employer Identification No.) |

| Organization) | |

| 1111 West Georgia Street, Suite 1820 | |

| Vancouver, British Columbia, Canada | V6E 4M3 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant's telephone number: (800) 665-4646

Securities registered under Section 12(b) of the Act: None

Securities registered under Section 12(g) of the Act: Common Stock, no par value

| Title of each class | Name of each exchange on which registered |

| Common Stock, no par value | None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. [ ] Yes [X] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. [ ] Yes [X] No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. [X] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). [X] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). [ ] Yes [X] No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $16,269,827 as of May 31, 2009.

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. [ ] Yes [ ] No

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: 1,661,369,045 common shares, no par value, outstanding as of March 10, 2010.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) intowhich the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) under the Securities Act of 1933.

None.

1

PART 1

ITEM 1. BUSINESS.

FORWARD-LOOKING STATEMENTS

The information in this Annual Report on Form 10-K contains forward-looking statements within the meaning of applicable securities laws relating to Silverado Gold Mines Ltd. (“Silverado”, the “Company”, “we”, “our”, or “us”). These forward-looking statements represent our current expectations or beliefs including, but not limited to, statements concerning our operations, performance, and financial condition. Such forward-looking statements involve risks and uncertainties regarding the market price of gold, availability of funds, government regulations, common share prices, operating costs, capital costs, outcomes of test mining activities and other factors. Forward-looking statements are made, without limitation, in relation to operating plans, property exploration activities, including test mining activities, availability of funds, environmental reclamation, variability of quarterly results, our ability to continue growth, operating costs and permit acquisition. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “plan”, “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” or “continue,” and the negative of such terms or other comparable terminology. Statements in this annual report regarding planned mineral exploration and drilling activities and any other statements about Silverado’s future expectations, beliefs, goals, plans or prospects constitute forward-looking statements. Actual events or results may differ materially. In evaluating these statements, you should consider various factors, including the risk factors outlined in Item 1A below, and, from time to time, in other reports we file with the SEC. These factors or uncertainties materialize or should the underlying assumptions prove incorrect, actual results could differ materially from those indicated in the forward-looking statements. Given these uncertainties, readers are cautioned not to place undue reliance on any forward-looking statements.

Any forward-looking statement speaks only as of the date on which such statement is made, and we disclaim any obligation to publicly update these statements to reflect events or circumstances after the date on which such statement is made, or disclose any difference between its actual results and those reflected in these statements. New factors emerge from time to time and it is not possible for us to predict all of such factors, nor can we assess the impact of each such factor may cause actual results to differ materially from those contained in any forward-looking statements.

CAUTIONARY NOTE TO U.S. INVESTORS CONCERNING ESTIMATES OF RESERVES AND RESOURCES

The mineral estimates in this Annual Report on Form 10-K have been prepared in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). The terms “mineral reserve”, “proven mineral reserve”, “probable mineral reserve”, “measured resources”, “indicated resources” and “inferred resources” are Canadian mining terms as defined in accordance with NI 43-101. U.S. investors are cautioned that the United States Securities and Exchange Commission does not recognize these resource classifications. There is no assurance that any of our mineral resources will be converted into reserves under the disclosure standards of the United States Securities and Exchange Commission. Further, “‘inferred resources” have a great amount of uncertainty as to their existence, and economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that part or all of an “inferred resource” exists, or is economically or legally mineable.

INTRODUCTION

Silverado is engaged in the acquisition and exploration of mineral properties in the State of Alaska, through its wholly-owned subsidiary, Silverado Gold Mines Inc., and in the development of a liquid fuel derived from low-rank coal through its other wholly-owned subsidiary, Silverado Green Fuel, Inc.

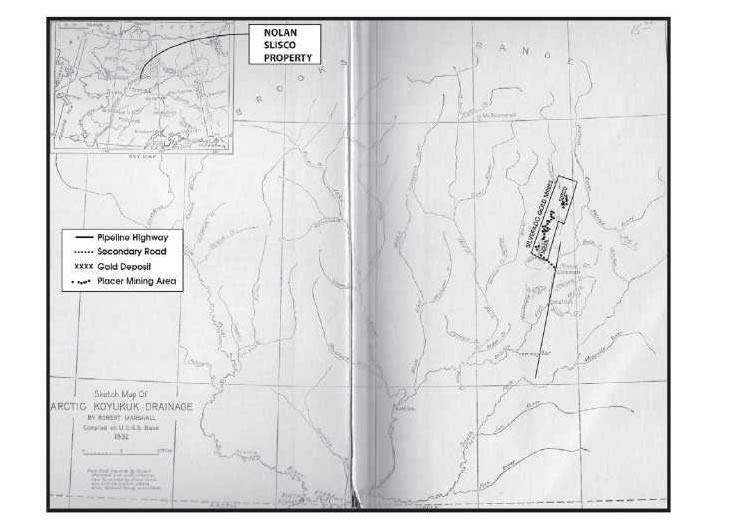

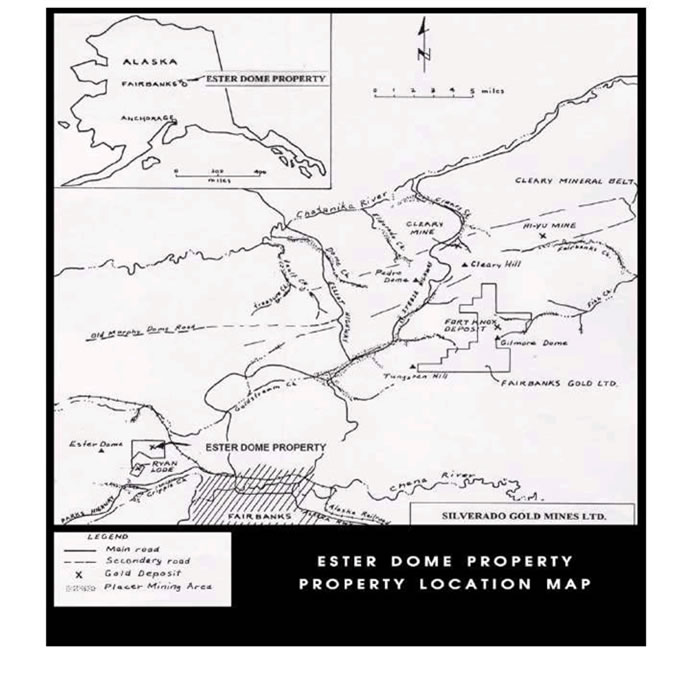

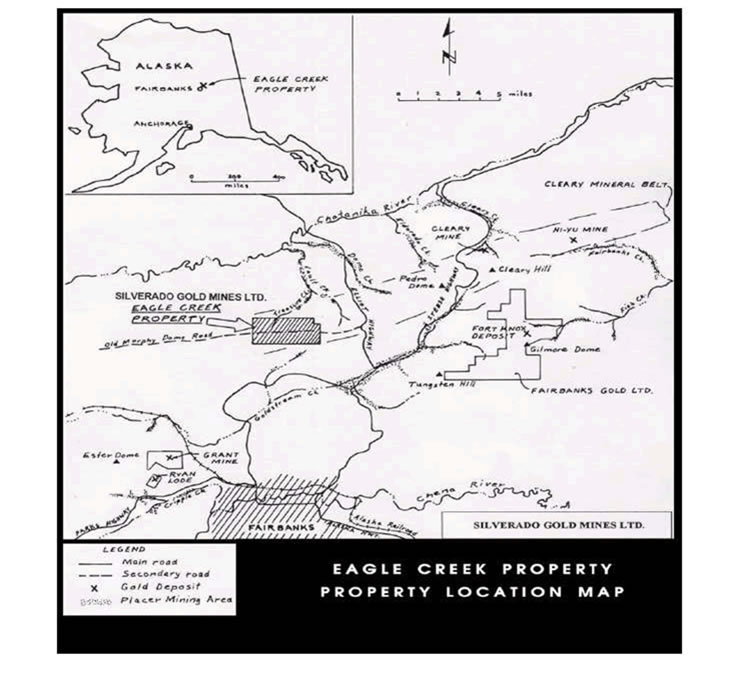

Silverado has committed over three decades of work to the exploration, development and test mining of gold properties throughout North America. In the mid-1980s, the Company decided to focus its efforts in Alaska. We have extensive experience in geological, geochemical and geophysical exploration techniques. Our mineral holdings are located in the Fairbanks Mining District and in the Koyukuk Mining District, consisting of both lode and placer mining claims. At the present time, our primary focus is the exploration and development of our Nolan Gold Project and our Hammond property located 175 miles north of Fairbanks, Alaska. We are also continuing with exploration activities on our Eagle Creek Property and our Ester Dome Project, which are both located in the Fairbanks Mining District.

2

Silverado’s cash inflow has been generated mainly from private financings, gold sale proceeds earned during the exploration stage, debentures and loans. The Company’s continuing operations are dependent upon private financings to operate our business.

Silverado has been working for eight years on the development of low-rank coal-water fuel (“Green Fuel”), a non-toxic liquid fuel product derived from sub-bituminous and lignite coal. In its finished form, the fuel is a non-toxic, non-hazardous environmentally friendly strategic (liquid) fuel. Silverado is seeking financing to enable us to proceed with the construction of a commercial demonstration facility designed to document the combustion characteristics of Green Fuel. A successful demonstration project could lead to construction of a commercial production facility to manufacture the low-rank coal-water fuel as a replacement fuel for oil fired boilers and utility generators.

CORPORATE ORGANIZATION

Silverado Gold Mines Ltd. is a corporation organized under the laws of British Columbia, Canada. The Company was originally incorporated in June 1963. Silverado operates in the United States through its wholly owned subsidiaries, Silverado Gold Mines Inc., (incorporated May 29, 1981) and Silverado Green Fuel Inc. (incorporated August 14, 2006). We filed a transition application and notice of articles with the British Columbia Registrar of Companies on April 20, 2004 in order to replace our former memorandum adopted under the British Columbia Company Act and to alter our current articles to the extent necessary to ensure compliance with the British Columbia Business Corporations Act (the “BC Business Corporations Act”). The BC Business Corporations Act came into force in British Columbia on March 29, 2004 and replaced the former British Columbia Company Act. The transition notice and notice of articles was filed under the BC Business Corporations Act that requires any British Columbia company incorporated under the former British Columbia Company Act to effect transition under the BC Business Corporations Act by filing with the British Columbia Registrar of Companies a transition application and notice of articles within two years following the coming into force of the BC Business Corporations Act.

Our exploration activities are managed and conducted by affiliated companies, Tri-Con Mining Ltd. (“Tri-Con”) and Tri-Con Mining Inc., pursuant to written operating agreements. Each of Tri-Con, and Tri-Con Mining Inc. are privately-owned corporations controlled by Garry L. Anselmo, who is our president, chief executive officer, and the chairman of our board of directors.

MINERAL EXPLORATION BUSINESS

We are a mineral exploration company with interests in properties located throughout the state of Alaska. The majority of such properties are in the early stages of exploration, and there is no assurance that a commercially viable mineral deposit exists on such properties. Effective January 1, 2009, based on completion of a preliminary feasibility study, our Nolan Gold and Antimony Lode Project has disclosed an economically viable mineral reserve. Additional resource estimates were calculated for the Nolan Gold and Antimony Project effective January 7, 2010. Refer to Item 2 section 6 for the Nolan Gold and Antimony Project Mineral Reserves and Resource Estimates. Certain definitions of geological and technical terms used in this Annual Report on Form 10-K are provided in the Glossary of Terms under Item 2. Readers and investors are cautioned that many of these terms, such as “inferred resource” and “indicated resource” are terms used and accepted by the Canadian Institute of Mining (CIM), and although these terms are recognized and required by the Canadian Securities regulations, they are not recognized by the United States Securities and Exchange Commission.

We hold interests in the following four groups of mineral properties in Alaska:

| 1. |

Nolan Gold Project; | |

| 2. |

Ester Dome Gold properties; | |

| 3. |

Hammond properties; and | |

| 4. |

Eagle Creek properties. |

A description of our operations with respect to each of these mineral properties is as follows:

1. Description of Operations at the Nolan Gold Project

1.1 Nolan Gold Project Background

The Nolan Gold Project consists of both placer-style and lode-style deposit types for exploration and development. The Nolan Placer Gold Project involves exploration and development of gold occurring in placer deposits such as stream channels or ancient remnants of placer gold deposits. The Nolan Lode Gold and Antimony Project consist of exploration work designed to locate bedrock structures or formations of bedrock which host gold and antimony mineralization. These two facets of the Nolan Gold Project complement each other, as every stone or pebble in a placer deposit is a piece of rock eroded from some near or distant bedrock formation, and each gold nugget or grain of gold in a placer deposit was originally part of a bedrock formation or structure with lode gold mineralization. Because a placer deposit originates from a lode source, the search for the Nolan lode source involves unraveling the sequences of events that caused a placer deposit to form, as well as applying various geological, geochemical and geophysical exploratory investigations.

3

The Nolan Gold Project consists of numerous mineral prospects that are in the early stages of exploration, as well as mineral prospects in the advanced stages of exploration. During the years previous to 2007, the Company focused only minimal exploration effort on finding a lode source for gold and focused mostly on the exploration and development of placer gold. During 2007-2009, the Company focused its efforts on the lode potential of the Nolan Creek property, herein referred to as the Nolan Lode Gold and Antimony Project. The project is in the advanced stages of exploration and is potentially moving toward the development stage. During September of 2008, the Company commissioned an independent mining consultant to perform a preliminary feasibility study of the Workman’s Bench lode gold and antimony deposit. The results were released to the public on January 5, 2009. The same independent consultant did another resource calculation for the 2009 drill program at Nolan Creek. These new resource calculations were disclosed to the public on January 7, 2010.

The previous (prior to 2008) bulk sampling projects of placer gold from the gravel benches along the left limit of Nolan Creek had indicated that there was an association between some of the placer gold recovered and an antimony sulfide mineral called stibnite which commonly coated the coarser and angular gold nuggets. Stibnite is a sulfide mineral, and is a common pathfinder mineral for gold exploration and consists of the elements antimony and sulfur.

1.2 Nolan Gold Project’s Exploration Approach and Focus

2007

The new exploration approach began in 2007 and involved not only looking for the lode source of the gold, but also giving economic consideration to the element antimony in addition to the gold, for exploration and development. In 2007, the Company began a new systematic and more scientific approach that combined soil and rock (surface) geochemical data and geophysical data (airborne and ground) with subsurface drill core geochemical and geological data. The data was compiled into a Geographical Information System (GIS) database. All GIS surface data acquired in the field was located with a Global Positioning System (GPS).

In 2007, the Company began focusing on the lode source of the gold and antimony in the areas referred to as Pringle Bench and Workman’s Bench. These two target areas are underlain by a quartz-gold-antimony veined zone that is part of a sheared and faulted structural zone referred to by the Company as the Solomon Shear Zone. The Company excavated eight trenches totaling 440 lineal feet of bedrock in the Pringle and Workman’s Benches and collected continuous chip samples from the bedrock that included the gold and antimony veins. The Company will continue to use the excavation of trenches to assist in exploration, especially to aid in defining drill targets, taking advantage of the historic roads and trails that allow transport of heavy equipment for exploration purposes.

In 2007, the Company acquired a tracked and mobile diamond core drill for exploration. The diamond core drill, and the 2 inch diameter (NQ) core, allow the geologist to make determination of the true width of mineralized veins and the relationship of the vein to other primary geologic structures. The diamond drill core allows for more accurate analysis of grade and interpretation of style of mineralization and timing of mineralization relative to other structures in the rock.

During 2007, the new soil and rock geochemical data and geophysical data further delineated the northeast trending structural zone, referred to by the Company as the Solomon Shear Zone, which is associated with gold and antimony mineralization. The new approach in 2007 involved the first phase of drilling, using the newly acquired diamond core. A total of 18 holes were drilled across the Solomon Shear Zone. The diamond core drilling data supported the geochemical and geophysical data. The drilling was focused on the Workman’s and Pringle Benches located on the south and north sides of Smith Creek respectively

During 2007, the Company’s exploration efforts in the Fortress area delineated gold and arsenic soil anomalies which coincide with east-west VLF-EM ground geophysical anomalies interpreted by the Company as possibly new mineralized structural trends. The Fortress area has never been drilled and is still in the earliest stages of exploration.

Exploration efforts in 2007 did not result in finding a commercially viable mineral deposit.

2008

4

During the winter of 2008, the Company excavated 570 feet of exploration tunnels into the bedrock below Workman’s Bench. During the summer of 2008, the Company began the second phase of diamond core drilling, focusing on the Workman’s Bench area, and did not drill north of Smith Creek. The Company continued with the ground (non airborne) very low frequency electromagnetic (VLF-EM) geophysical grid in the Fortress area located on the north end of the property.

The drilling under Workman’s Bench delineated 1,300 feet of gold and antimony mineralization in near vertical structures or veins that extend down dip two hundred feet and remain open at depth. The steeply dipping (near vertical) veins are much more favorable for mining and engineering purposes than lower angled subsurface structures. The 1,300 ft long and 80 to 100 ft wide zone of quartz-antimony-gold veins extends from Smith Creek southwest across Workman’s Bench and is interpreted by the Company to have been offset by a left-lateral fault at its southern extent. The interpretation of the left-lateral fault is based off of both geophysical data, and drill data, and it has possibly displaced the quartz-antimony-gold veined zone. The 1,300 ft long veined zone, located south of Smith Creek, under Workman’s Bench, requires 600 ft of infill drilling to confirm whether the zone connects with the veined zone underlying the Pringle Bench, which was drilled in 2007. The Company attempted to infill drill the area in the fall of 2008, but freezing temperatures halted that effort.

The 2007 and 2008 drill results in the Workman’s Bench area were not sufficient to define a probable reserve, but the drill results combined with the preliminary feasibility study was sufficient enough to define a probable reserve. Reserves and resources are listed in Item 2, below.

2009

During 2009 the exploration approach and focus was on advancing to the potential development stage which involved collecting baseline environmental data and performing characterization studies for permitting obligations such as the acid rock drainage study which is still ongoing. In addition, the Company performed critical upgrades to the Nolan Creek Camp facility in preparation for a crew of mining personnel to assist with the proposed bulk sampling program. Due to insufficient investment capital, the permitted 1,000 cubic yard underground bulk sample of antimony-gold ore was not initiated. Instead, planned 2010 HQ drilling will provide large enough care to conduct relevant metallurgical studies on different areas of the ore body.

During the summer of 2009 the Company drilled 20 diamond core drill holes totaling 4,992 feet under Workman’s and Pringle Benches. The drill program was focused on increasing the size of the ‘A Zone’ beyond the 2008 resource and reserve blocks. The drill results at both Workman’s and Pringle Benches were not spatially located for a reserve status but they were sufficient for an inferred resource. Refer to Item 2 below for the resource and reserve estimates.

Another goal of the summer drill program was to connect the resource blocks of the Workman’s and Pringle Bench Prospects. Drilling in the Smith Creek lowlands encountered problems that will require a larger drill in order to extract core samples and to have a contiguous resource block that connects Pringle Bench to Workman’s. However, drilling along the south end of Pringle Bench in 2009 combined with soil and geophysical anomalies has confirmed that the Main Zone of gold and antimony mineralization encountered in Workman’s and Pringle Bench are part of the same northeast trending zone.

In addition, our operations involve honoring our obligations to return the land to its natural state when possible. During 2007, we removed scrap materials and sealed the Swede Channel and Mary’s East sub surface placer exploration portals as part of our reclamation obligations with the Bureau of Land Management. During 2008, we reclaimed 27.5 acres of disturbed land as part of our continued reclamation obligations with the Bureau of Land Management. We will continue to work on our reclamation obligations with the Bureau of Land Management. During 2009 the Company took advantage of the historic trails and used the Company-owned tracked diamond core drill rig to move about without disturbing the landscape. More detailed description of our Nolan Gold Project operations is discussed in the following sections:

1.3 Nolan Gold Bulk Sampling Projects

1.3.1 2007 Placer Gold Bulk Sampling Projects

2007 Swede Channel and Mary’s East Bulk Sampling Projects

The Swede Channel and Mary’s East placer deposits represent the last bulk placer sampling projects that the Company has undertaken, and are disclosed herein as part of the background of the Company’s operations.

5

The Swede Channel Placer Gold Deposit (“Swede Channel”) is a glacial drainage perched several hundred feet above the Nolan Creek Valley. During the ice age, a glacial event caused the Swede Gulch to rapidly erode a deep, narrow water channel across earlier gold bearing river gravel deposits. Erosion and transportation caused the gold bearing gravel to be re-concentrated due to removal of the lighter gangue minerals, while much of the heavier gold, along with boulders and coarse gravel common to a high energy drainage environment, was deposited to the Swede Channel. Subsequent post glacial uplift and erosion has established the present topography including the perched Swede Channel location on the westerly flank of Smith Dome, and overlain by up to 100 feet of overburden making it an unidentifiable surface topographic expression.

The Mary’s East Placer Gold Deposit (“Mary’s East”) is located a few hundred yards northeast of the Swede Channel and directly east of Mary’s Bench Placer Gold Deposit. Unlike the gold concentrations in the Swede Channel, the placer gold in Mary’s East is concentrated in landslide material that was deposited onto a bedrock shelf during the ice age.

Swede Channel and Mary’s East 2007 Work

During the winter of 2006, Silverado re-opened the Swede portal and continued with its underground exploration and development program on the remaining sections of the Swede Channel until its completion by the middle of January 2007. A total of 8,963 loose cubic yards (“LCY”) of gravel material was stockpiled from the remaining Swede Channel.

In early January 2007, crews installed a portal into Mary’s East, and began an underground drift into the Mary’s East deposit. The Mary’s East project was completed at the end of March 2007 and 9,357 LCY of gravel material was stockpiled from this project.

The 2006-2007 winter stockpile contained 18,320 LCY (Swede Channel and Mary’s East combined) of gravel material, and was processed from June through July of 2007 at the existing sluice plant location, yielding 2,811.74 troy ounces of gold nugget gold and over 207 pounds of concentrate that contained gold particles smaller than ¼ inch in size. The fine concentrate yielded 915.06 troy ounces of gold (30% gold), which when combined with 2,811.74 troy ounces of nugget gold recovered in 2007 totals 3,726.80 troy ounces. Also, the fine concentrates yielded 65.10 troy ounces of silver or 2.15% silver which was included in gold inventory.

The Swede channel and Mary’s East portals were both sealed after completion of the underground bulk sampling projects. Both sites were reclaimed in summer 2007 as required by the Bureau of Land Management.

1.3.2 2008 Nolan Lode Gold and Antimony Bulk Sampling Project

During 2008, the Company did not explore for placer gold resources. Exploration focused on the lode potential of the Main Zone of gold-antimony veining at Workman’s Bench which required drill intercepts to be spaced close enough to define the various zones, especially the ‘A Zone’ Vein fault. The ‘A Zone’ was to be the sample target for a future 1,000 cubic yard bulk sample. The extraction of a bulk sample or samples of gold-bearing semi-massive to massive stibnite (antimony mineral) is necessary for mineral processing and metallurgical.

On November 16, 2007, Silverado began the excavation of the Workman’s Bench Portal and continued excavating 570 feet of underground workings into the bedrock below Workman’s Bench. The tunnels were finished in early February of 2008. The tunnels are interconnected and serve a multitude of purposes. The first purpose was for determining the overall width of the veined gold and antimony mineralized zone and establishing the strike and dip of the individual quartz-gold-antimony veins. The second purpose was for the collection of insitu bedrock channel samples for geochemical assays, and the third was for the collection of significantly larger (bulk) samples of the main gold and antimony vein referred to by the Company as the Zone A vein, that typically consists of massive stibnite and gold, for more accurate geochemical assays as well as for preliminary milling and processing studies of the gold and antimony.

The final purpose of the tunnels is for access and egress for future bulk sampling at depth. Depending on funding, the Company plans to collect either a 1,000 cubic yard or 2,000 cubic yard bulk sample of the main gold and antimony vein referred to by the Company as the A Zone Vein. Other potential targets for future exploration and development include the West Zone, B Zone and C Zone that parallel the main A Zone Vein.

Bulk Sample of the ‘A’ Zone Vein

Prior to 2008, the Company had not completed mineral processing or tests for mineral processing of lode mineralization in the Nolan Creek area.

6

Thomas K. Bundtzen (the “QP”), an independent and AIPG Certified Professional Geologist, served as an independent third-party qualified person to the Company for the purpose of certifying and collecting data for the Nolan Gold Project. In April 2008, the QP collected a 414 lb bulk sample of semi-massive stibnite, vein quartz, and wall rock gangue from the defined mineralized ‘A’ Zone in the Workman’s Bench underground workings. The purpose was to determine the mineralogical nature of the antimony mineralization and the source of significant gold values within the ‘A’ Zone.

The 414 lb bulk sample was sent to Hazen Research Labs Inc. in Golden, Colorado, USA in order to discover the most optimal grind for potential marketing of a stibnite product, and to identify the mineralogical nature of the gold and antimony values. Hazen Research Labs Inc. produced two reports in September of 2008. Results of the first report involve flotation and gravity separation of the gold, stibnite and other sulfides and gangue minerals. The results of the second report involve mineralogical examination. Details of the two Hazen Research Lab reports are discussed under Item 2, below.

Silverado has recently acquired a permit from the Bureau of Land Management (BLM) to collect and process a maximum 1,000 cu yd of material from the Workman’s Bench Lode for metallurgical testing. The bulk sample will be collected to determine grinding, flotation, and other processing and mineralogical characteristics of stibnite.

The QP released a detailed technical report on July 29, 2008 referred to as NI 43-101 which disclosed both placer and lode resource estimates for the Nolan Creek properties. Discussion and results of the bulk sample collected by the QP are detailed in the technical report. The July 29, 2008 report was based on information available to the QP as of July 2, 2008, and the resource estimates in the report were superseded by the QP’s November 17, 2008 revised estimates which indicated a resource of 17,000 oz of gold which has been reclassified as a reserve of 17,000 oz of gold following the release of the preliminary feasibility study, effective January 1, 2009. The more recent reserve estimates are discussed in Item 2. The most recent reserve estimates are more complete and accurate since they include data from the completion of the 2008 drill program that ended in late September of 2008. The most recent report, effective January 1, 2009 includes a feasibility study by the QP as well as additional drilling data and analysis of core samples. Readers and investors are cautioned that the 43-101 technical report in which the reserve estimates are based upon contains language and terms that may not be recognized by the US Securities and Exchange Commission.

1.3.3 2009 Nolan Lode Gold and Antimony Bulk Sampling Project

During 2009 the Company was unable to acquire the investment capital to initiate the underground 1,000 cubic yard bulk sample of gold-antimony ore from the reserve block that underlies Workman’s Bench. The Company honored permit obligations and also collected additional geotechnical and geological data which will assist in the success of the underground bulk sample. The underground tunnels and portal were inspected and appeared to be in structurally sound condition. The summer and fall drilling program added geologic and geotechnical data that will assist the bulk sampling program (See Item 2 – Description of Property, below).

1.4 Nolan Placer Gold Project Exploration

1.4.1 2007 Nolan Placer Gold Exploration

During March and April 2007, placer gold exploration focused on drilling along the left limit of Nolan Creek to explore both north and south of the Mary’s East and Swede Channel deposits. Further placer drilling was carried out within the area between the Mary’s East/Swede Channel Deposits and the Topnotch Prospect. A total of 130 reverse circulation (RC) drill holes were completed during that drilling program with a total drill footage of 6,005 feet.

The 2007 placer drilling program discovered an entirely new zone of placer gold which has been named Jack London Bench. Jack London Bench is located 200 feet north-east of and 50 feet above the Mary’s East Bench.

RC drilling is the principal exploration method used by Silverado in the identification of placer gold deposits. All placer drilling in 2007 was performed by a contractor using 6 inch diameter drill rods. Placer drill samples were collected in 5 foot intervals (industry standard).

1.4.2 2008 and 2009 Nolan Placer Gold Exploration

During 2008 and 2009, the Company did not do any field exploration work such as reverse circulation (RC) drilling or any other active exploration for placer gold. The Company focused on the Nolan Lode Gold and Antimony Project.

7

On July 29, 2008, the QP released the NI 43-101 Report ‘Estimation of Lode and Placer Mineral Resources, Nolan Creek, Wiseman B-1 Quadrangle, Koyukuk District, Northern Alaska’, which describes lode and placer mineralization in the Nolan Creek area, including the Workman’s bench area. No new information concerning sampling methods and approach for placer deposits has been generated for Nolan Creek project since that release of information. The results of Bundtzen’s resource estimates differ from the placer gold resource estimates reported by Murton’s 2007 NI 43-101 report for the Company. The difference between the Murton resource estimates and the Bundtzen estimates was due to Bundtzen having access to more data.

1.4.3 Nolan Placer Gold Exploration 2010 Work Plan

Currently the Company is focusing on the Nolan Lode Gold and Antimony Project with an emphasis on infill drilling for more accurate resource estimates in the Workman’s and Pringle Bench Areas.

However, due to the current gold prices, the Company may explore for placer gold within benches farther upslope along the left limit of Nolan Creek. More infill RC drilling is needed on Jack London Bench and other benches on the left limit of Nolan Creek. Jack London Bench is upslope of the former drift mined gold-rich channels that were sampled by Silverado in 2006 and 2007. All targets for exploration along the left limit of Nolan Creek are well above the elevation of Nolan Creek. The Nolan Creek Deep Channel is a primary consideration for exploration and development, but additional data is needed for hydrologic studies.

Based on previous RC drill data, the Company believes the best target for placer gold exploration and development is located in the Slisco Bench which is part of our Hammond Property and is discussed below.

Budget projections for this project are detailed under the section “Projected Annual Budget for 2010”

1.5 Nolan Lode Gold and Antimony Project Exploration

1.5.1 2007 Nolan Lode Gold and Antimony Project Exploration Work Summary

During 2007, exploration for a lode gold and antimony deposit on the Company’s Nolan property focused on the Nolan Creek area within the Solomon Shear Zone and the Fortress area. The Solomon Shear Zone is a five mile long gold and antimony bearing shear zone, which is a possible source of placer gold in the Nolan valley drainages, and bench deposits such as Swede Channel, Mary’s East Bench, Mary’s Bench, Eureka Bench, and Workman’s Bench.

The 2007 lode exploration program consisted of extensive ground geochemical soil surveys and ground geophysical very low frequency electromagnetic (“VLF-EM”) surveys, extensive backhoe trenching and a first phase diamond core drilling program to follow up on the significant results achieved by backhoe trenching.

A more detailed description of exploration work during 2007 is as follows:

2007 Nolan Creek Area

In May, June, and July of 2007, the Company undertook an extensive geochemical soil sampling campaign on the lower Smith Creek Dome hillside between Archibald Creek and Smith Creek (the “Hillside”), and south of Smith Creek in the lower western part of Midnight Dome. A total of 695 soil samples were collected during the campaign on a 196.85 x 98.43 foot grid. Assay results of the soil sampling campaign show a distinct arsenic and antimony anomalous trend on the eastern part of the Solomon Shear trend. Arsenic anomalies are strong indicators for the presence of gold.

Along with the soil sampling campaign, Silverado conducted an extensive VLF-EM ground geophysical survey (18.02 line miles) on the lower Smith Creek Dome hillside between Archibald Creek and Smith Creek, and south of Smith Creek in the lower western part of Midnight Dome, to identify structures such as shear zones, faults, and veins that occur within the bedrock. The VLF-EM survey identified structural trends in the Solomon Shear Zone that are overlain by arsenic, antimony, and gold in soil anomalies.

In June, July, and August of 2007 the Company undertook backhoe trenching on Pringle Bench and Workman’s Bench. This program was followed up by a first phase diamond core drilling program. Details of the 2007 exploration program are as follows:

Pringle Bench

Pringle Bench represents an area 500 feet wide by 700 feet long and consists of a series of sub parallel gold bearing antimony-quartz veins. In 2007, the Company followed up on the results achieved on Pringle Bench in 2006 and excavated six additional trenches, totaling 1296 feet, to further investigate the gold bearing antimony-quartz veins previously identified in 2006. A total of 153 combined continuous chip and select chip rock samples were collected. Continuous chip samples were collected over a defined length along the trench walls and, therefore, are representative for a specific trench interval. Continuous chip samples do contain sample material of mineralized veins if those occur within the sample interval. Select samples were collected from individual quartz and stibnite-quartz veins exposed in the trenches and, therefore, their assays represent the individual veins sampled.

8

The following table presents significant 2007 trench assay results for Pringle Bench:

| Trench G | ||||

Sample Number |

Sample Type |

Sample Length (ft) |

Au (toz/ton) |

Sb (%) |

| 07G11 | Continuous chip | 16.40 | 0.01 | 4.31 |

| 07G17 | Select chip | 0.07 | 0.05 | 24.60 |

| 07G18 | Select chip | 0.07 | 0.08 | 0.15 |

| 07G19 | Select chip | 0.16 | 0.13 | 0.04 |

| Trench H | ||||

Sample Number |

Sample Type |

Sample Length (ft) |

Au (toz/ton) |

Sb (%) |

| 07H02 | Continuous chip | 16.40 | 0.02 | 2.62 |

| 07H03 | Continuous chip | 16.40 | 5.22 | 8.74 |

| 07H06 | Continuous chip | 0.07 | 0.11 | 27.62 |

| 07H11 | Select chip | 0.03 | 0.12 | 0.03 |

| 07H12 | Continuous chip | 6.56 | 0.07 | 0.08 |

| 07H13 | Select chip | 0.03 | 0.36 | 0.80 |

| Trench I | ||||

Sample Number |

Sample Type |

Sample Length (ft) |

Au (toz/ton) |

Sb (%) |

| 07I11 | Continuous chip | 8.20 | 0.00 | 1.11 |

| 07I12 | Continuous chip | 8.20 | 0.03 | 11.06 |

| 07I13 | Select chip | 3.28 | 0.03 | 18.22 |

| 07I14 | Continuous chip | 8.20 | 0.06 | 5.07 |

| 07I15 | Select chip | 1.97 | 0.23 | 26.23 |

| 07I19 | Continuous chip | 8.20 | 0.03 | 3.16 |

| 07I20 | Select chip | 1.31 | 0.04 | 30.03 |

| 07I23 | Continuous chip | 8.20 | 0.03 | 6.02 |

| 07I24 | Select chip | 5.91 | 0.03 | 30.35 |

| 07I28 | Continuous chip | 8.20 | 0.01 | 0.88 |

| 07I29 | Select chip | 0.66 | 0.04 | 22.92 |

| 07I32 | Continuous chip | 8.20 | 0.04 | 0.51 |

| 07I33 | Select chip | 1.64 | 0.12 | 11.78 |

| 07I39 | Continuous chip | 8.20 | 0.03 | 1.76 |

| 07I45 | Continuous chip | 8.20 | 0.00 | 1.30 |

| 07I46 | Select chip | 0.16 | 0.05 | 5.90 |

| 07I58 | Continuous chip | 8.20 | 0.01 | 2.78 |

| 07I59 | Select chip | 0.16 | 0.02 | 48.07 |

| 07I65 | Continuous chip | 8.20 | 0.01 | 11.86 |

| 07I66 | Select chip | 0.26 | 0.01 | 59.52 |

| 07I72 | Continuous chip | 8.20 | 0.01 | 3.87 |

| 07I73 | Select chip | 0.10 | 0.06 | 27.59 |

| 07I75 | Continuous chip | 8.20 | 0.01 | 11.80 |

| 07I76 | Select chip | 0.13 | 0.01 | 64.76 |

| 07I78 | Select chip | 3.28 | 0.01 | 0.42 |

9

| Trench K | ||||

Sample Number |

Sample Type |

Sample Length (ft) |

Au (toz/ton) |

Sb (%) |

| 07K05 | Continuous chip | 6.56 | 0.13 | 3.75 |

| 07K06 | Select chip | 0.33 | 0.28 | 11.74 |

| Trench M | ||||

Sample Number |

Sample Type |

Sample Length (ft) |

Au (toz/ton) |

Sb (%) |

| 07M08 | Continuous chip | 6.56 | 0.03 | 13.87 |

| 07M09 | Select chip | 0.03 | 0.01 | 0.83 |

| 07M10 | Select chip | 0.33 | 0.05 | 45.09 |

| 07M11 | Select chip | 0.03 | 0.07 | 7.12 |

| 07M12 | Select chip | 0.16 | 0.13 | 32.79 |

| 07M13 | Continuous chip | 6.56 | BDL | 35.11 |

| 07M14 | Select chip | 0.07 | 0.01 | 5.34 |

| 07M15 | Select chip | 0.07 | 0.02 | 9.53 |

| 07M16 | Select chip | 0.07 | 0.03 | 9.33 |

| 07M17 | Continuous chip | 13.12 | 0.02 | 1.45 |

| 07M18 | Select chip | 0.03 | 0.07 | 4.48 |

It should be noted that Trench H revealed a 16.4 ft interval (sample number 07H03) with an erratic gold grade. The Company instructed ALS Chemex to re-assay the pulp of the specific sample which confirmed the previous gold value. The Company also decided to re-sample Trench H. Re-sampling did not reproduce the grades of the previous sampling campaign, but confirmed the presence of gold and antimony mineralization. The stibnite-quartz veins in the Nolan area are known to contain coarse gold which can result in a “nugget effect” when assayed.

Following up on the encouraging results achieved by backhoe trenching, the Company started a first phase drilling program at Pringle Bench at the end of August 2007 using its own diamond core drill rig. Eleven drill holes were drilled on Pringle Bench totaling 2,415 feet. The core drilling program was designed to check for down-dip continuity of the gold bearing antimony-quartz vein systems in the zones identified thus far. The core drilling confirmed the presence of stibnite (antimony) and quartz veins at varying depths.

2007 Workman’s Bench

Workman’s Bench is located near the confluence of Smith and Nolan Creek.

In July 2007, the Company excavated one trench in the old Workman’s Bench pit with a total length of 125 feet. This trench exposed the largest antimony veins discovered in the Nolan Creek area to that date. A total of 15 continuous chip samples were collected from Trench J.

The following table presents significant 2007 trench assay results for Workman’s Bench:

| Trench J (Workman's Bench) | ||||

Sample Number |

Sample Type |

Sample Length (ft) |

Au (toz/ton) |

Sb (%) |

| 0704WT | Continuous chip | 8.20 | 0.00 | 1.70 |

| 0710WT | Continuous chip | 8.20 | 0.00 | 30.30 |

| 0711WT | Continuous chip | 8.20 | 0.01 | 1.72 |

| 0712WT | Continuous chip | 8.20 | 0.04 | 11.70 |

| 0713WT | Continuous chip | 8.20 | 0.12 | 29.30 |

| 0714WT | Continuous chip | 8.20 | 0.02 | 2.56 |

| 0715WT | Continuous chip | 9.84 | 0.02 | 14.05 |

A first phase exploration drilling program on Workman’s Bench using the Company’s own diamond core drill rig started at the end of August 2007 and ended on October 23, 2007 due to weather conditions. Seven drill holes were drilled totaling 2,140 feet.

10

This drilling program was designed to check for down-dip continuity of the gold bearing antimony-quartz veins previously discovered. Visual observation of the drill core had identified the presence of many antimony-quartz and quartz veins. The majority of these veins were found to be contained in an 80 foot wide zone.

On November 16, 2007, we began excavation of the portal that would continue into the bedrock below Workman’s Bench located on the south side of Smith Creek near the confluence with Nolan Creek. The tunneling effort continued into 2008 and resulted in 570 feet of underground workings consisting of four interconnected tunnels referred to as Crosscut Tunnels A, B, C and D.

The QP collected a 414 lb bulk sample from mineralized zone ‘A’ for metallurgical test work from the underground workings in April 2008. The underground exposure of the mineralized zone will play an important key role for the Company in obtaining a better understanding of the nature of the structurally controlled gold and antimony mineralization in the Solomon Shear Zone. This will significantly support Silverado’s exploration strategy.

2007 Fortress Area

The Fortress area is located two miles northeast of Nolan camp and north of Smith Creek Dome. This area exposes several outcropping northwest striking quartz veins, some of which contain significant gold mineralization. The Company investigated the Fortress area in late summer 2007 and collected several quartz vein samples and confirmed anomalous gold concentrations in vein samples.

Based on the encouraging results, the Company conducted a VLF-EM ground geophysical survey (9.33 line miles) along with a ground geochemical soil survey over the central part of the Fortress area. A total of 290 soil samples were collected on a regular grid during the campaign. Interpretation of the VLF-EM survey data by the Company revealed two east-west trending fault zones that are overlain by arsenic and gold in soil anomalies. A combination of soil survey results, ground geophysical data, and surface geology suggest to Silverado that formation of northwest-trending gold-bearing quartz veins may be controlled by east-trending deformational zones.

The VLF-EM ground geophysical survey along with the ground geochemical soil survey conducted in the Fortress area, confirmed the presence of the gold-bearing antimony quartz vein system on the Saddle, as part of the Solomon Shear trend, in the southern part of the Fortress area. Interpretation of the VLF-EM survey data by the Company revealed two northeast trending deformation zones of which the southern deformation zone is overlain by antimony and arsenic in soil anomalies.

1.5.2 2008 Nolan Lode Gold and Antimony Project Exploration Work Summary

During 2008, exploration for a lode gold and antimony deposit on the Company’s Nolan property focused again on the Nolan Creek area within the Solomon Shear Zone and Fortress area. The Solomon Shear Zone is a five mile long gold and antimony bearing shear zone, which is a possible source of placer gold in the Nolan valley drainages, especially the gravel bench deposits such as Swede Channel, Mary’s East Bench, Mary’s Bench, Eureka Bench, and Workman’s and Pringle Bench. The Fortress area is a broad ridge located on the north end of the property between the Hammond River drainage and the Nolan Creek drainage. The Fortress area hosts gold-quartz-arsenopyrite veins which are associated with east-west structures termed by the Company as the Fortress trend. The Fortress veins may be the source for the gold in the Thompson Pup placer deposits. The southern end of the Fortress area is cut by the Solomon Shear Zone and contains gold and antimony mineralized quartz veins distinctly different from the Fortress trend veins.

The 2008 lode exploration program consisted of a variety of field exploration work. During early February 2008, 570 lineal ft of underground tunnels, termed Tunnels A, B, C and D were completed in the bedrock below the Workman’s Bench, crosscutting the gold and antimony veins associated with the Solomon Shear Zone. Channel samples of the bedrock were collected from the newly excavated tunnels during the winter of 2008. During April of 2008, the QP collected a 414 lb bulk sample of the gold and stibnite-rich main vein, referred to by the Company as the Zone A vein. During the early summer of 2008, additional ground geophysical very low frequency electromagnetic (VLF-EM) surveys were conducted in the Fortress area. Approximately 79,000 ft (14.9 miles) of geophysical lines were surveyed in the former area. No soil samples were collected on any of the Nolan Gold Properties. Fourteen rock samples were collected throughout the Nolan Gold Project properties.

Additional diamond core drilling continued in the summer of 2008, but focused exclusively on the Solomon Shear Zone on the south side of Smith Creek. Thirty four drill holes were drilled into the gold-bearing antimony-quartz veined zone underlying Workman’s Bench and the southwest continuation of the zone. A total of 11,597 ft was drilled into the Solomon Shear Zone. Freezing temperatures disallowed the continuation of drilling in late September while the Company was trying to drill on the north side of Smith Creek between the Pringle Bench and Workman’s Bench areas.

In addition, in June of 2008, three vertical RC holes (water test wells) were drilled a minimum of 300 ft each to test for the presence of groundwater in the area around Workman’s Bench. The well holes were drilled outside the limits of the mineralized Solomon Shear Zone, yet were proximal to the zone. According to Swan Drilling of Fairbanks Alaska, no groundwater water was encountered in any of the RC drill holes. A total of 1,000 ft was drilled by Swan Drilling. The rock chips were collected every five feet and visually inspected by geologists for possible mineralization.

11

A more detailed description of exploration work during 2008 is as follows:

2008 Nolan Creek Area

2008 Workman’s Bench

On November 16, 2007, we began the excavation of the Workman’s Bench Portal and continued excavating 570 feet of underground workings into the bedrock below Workman’s Bench. The tunnels were finished on February 2, 2008. The tunnels are interconnected and serve a multitude of purposes. The first purpose was for determining the overall width of the veined gold and antimony mineralized zone and establishing the strike and dip of the individual quartz-gold-antimony veins. The second purpose was for the collection of insitu bedrock channel samples for geochemical assays, and the third purpose was for the collection of significantly larger (bulk) samples of the main gold and antimony vein referred to by the Company as the ‘A’ Zone vein. The A zone vein typically consists of massive stibnite and gold with variable quartz and carbonate gangue minerals. The underground workings were mapped to determine the true strike and dip of the veins as well as the true width of the veins and mineralized zones. The QP collected a 414 lb bulk sample of the ‘A’ Zone Vein for more accurate geochemical assays as well as for preliminary milling and processing studies of the gold and antimony. The 414 lb sample of mostly massive stibnite with minor quartz and carbonate gangue was sent to Hazen Research Inc. Lakewood, Colorado, for the metallurgical tests. The underground tunnels will also be used for additional geotechnical studies and most importantly for access and egress of future bulk sampling efforts at depth.

During February of 2008, the Company collected 92 channel samples from the rock walls of the tunnels, and collected specific samples of the larger quartz-stibnite-gold veins. The channel samples were five feet in length. In addition, the QP collected 23 independent channel samples across 16 northeast striking steeply dipping quart-stibnite-gold veins, as well as 7 other less mineralized structures.

The following table presents assay values of significant 2008 underground channel samples and specific semi-massive and massive stibnite vein samples collected during February of 2008. The following table shows the slightly variable gold content within the stibnite rich areas, even when sampled from similar sites. The variable gold content in the massive stibnite, and stibnite-rich zones, supports the Company’s previous interpretation that there is a gold ‘nugget effect’ that makes the estimation of a lode gold to antimony ratio difficult to ascertain and is part of the reason why the Company is seeking a bulk sample on the scale of 1,000 to 2000 cubic yards or more. Also, further metallurgical work and processing studies will be carried out on a wider range of ore grade material. Refer to plan view map of the underground workings for the sample locations.

| Sample Number |

Stibnite Target Vein Zone |

Sample Location Number Or Tunnel |

True Width In feet |

Sb (%) | Au (oz/t) |

Brief Description |

| 203405 Bench Test Sample |

‘West’ Zone |

Tunnel D |

1.5 |

41.20 |

0.110 |

Semi-massive stibnite, quartz gangue |

| 203789 | ‘West’ Zone | Tunnels A and D | 1.5 | 22.48 | 0.556 | Wall rock of connecting drift |

| 203808 | A Zone | Tunnel D | 1.50 | 43.64 | 1.19 | Nearly massive stibnite with quartz |

| WBUG3 S1 | ‘A’ Zone | Site 3B | 0.42 | 52.10 | 0.676 | Massive Stibnite Vein in North Drift |

| WBUG3 S2 | ‘A’ Zone | Site 3B | 0.42 | 58.89 | 0.329 | Massive Stibnite Vein in North Drift |

| WBUG3 S3 | ‘A’ Zone | Site 3A | 0.42 | 60.90 | 0.031 | Massive Stibnite Vein in North Drift |

| WBUG3 S4 | ‘A’ Zone | Site 3B | 0.42 | 55.71 | 0.451 | Massive Stibnite Vein in North Drift |

| WBUG3 S5 | ‘A’ Zone | Site 3B | 0.42 | 11.10 | 0.444 | Semi-Massive Stibnite Vein in North Drift |

| WBUG8- S2 | ‘A’ Zone | Site 8 | 0.42 | 58.76 | 0.145 | Massive stibnite Vein in South Drift |

| 203802 | ‘A’ Zone | Tunnel C | 2.50 | 37.78 | 0.076 | Semi-Massive Stibnite Vein in South Drift |

| 203810 | ‘B’ Zone | Tunnel C | 0.5 | 41.0 | 0.696 | Nearly massive stibnite with quartz, south drift |

| 203791 | ‘B’ Zone | Tunnel A | 0.50 | 39.73 | 0.362 | Nearly massive stibnite with hanging wall north drift |

| WBUG8 S1 | ‘A’ Zone | Site 8 | 0.42 | 57.52 | 0.359 | Massive stibnite Vein in South Drift |

| WBUG5 S2 | ‘B’ Zone | Site 5 | 0.42 | 50.04 | 1.040 | Massive Stibnite Vein in North Drift |

12

A total of 34 diamond core drill holes were drilled into the gold-bearing antimony-quartz veined Solomon Shear Zone in 2008, totaling 11,597 ft of core for the season, with a core recovery of over 95%. The second phase drilling effort was focused exclusively on the portion of the Solomon Shear Zone that extends 1300 ft southwest from Smith Creek across Workman’s Bench. Details of the results of the drilling program are discussed below.

During the 2008 drilling program, a total of 627 samples were collected from the drill core. The total samples collected is significantly less than the 1,195 core samples collected during the 2007 drill program even though the drilling footage in 2007 totaled only 4,555 ft. The fewer samples collected was based off of results of 2007 when the holes were sampled from top to bottom. Drill results in both the Pringle and Workman’s Benches in 2007 indicated that the gold mineralization was associated with the sulfide-bearing (stibnite or arsenopyrite) quartz veins. Thus, only individual quartz veins or zones of closely spaced thin veins were sampled, and these samples are referred to as specific samples. The adjoining wall rock of significant veined zones was also sampled, and these are referred to as reference samples for continuity across the zones.

Four discrete gold-bearing stibnite-quartz-carbonate veined zones, were defined by the results of the two drilling programs, and these four zones are also evident in the workman’s Bench Underground exploration tunnels. The four zones are depicted in the Fig below. Currently, the ‘A’ Zone vein is the largest in width and most well defined in our downhole projections and in the exploration tunnels. The ‘A’ zone vein was subject for the bulk sample collected by the QP in April of 2008. Results of the bulk sample are listed in Bundtzen’s 43-101 report. The resource estimates for the deposit exclude the ‘C’ Zone.

The map below is a plan-view of the 570 ft of underground workings and depicts three of the four mineralized zones. The ‘West’ zone which typically skirts the west side of the ‘A’ Zone is not outlined in the figure.

13

Location of underground development and channel samples, Workman’s Bench

14

2007 and 2008 view of Workman’s bench mineralized zones, showing locations of underground workings, drill hole control, and interpreted extensions and overall widths of A, B, C and West Zones.

15

1.5.3 2009 Nolan Lode Gold and Antimony Project Exploration Work Summary

During 2009, exploration work involved drilling a total of 20 holes totaling 4,992 feet into the Solomon Shear Zone. The drill footage closely follows the recommendations made in the 43-101 technical report released to the public on January 5, 2009. Specific information for drill collars has been previously released in Silverado news releases disclosed on August 26 and September 22 of 2009.

The 2009 drill program was focused exclusively on the ‘A Zone’ mesothermal stibnite-quartz-gold vein-fault. During 2007 the drill core was sampled for the entire length of the drill hole. In 2008, the Company sampled all mineralized intervals encountered which also included the other zones formerly referred to as the West, B and C Zones. During the 2009 summer drill program core samples were collected to test the ‘A Zone’ and adjacent wall rock at Workman’s Bench, whereas at Pringle Bench some of the other gold-antimony zones were sampled in addition to the ‘A Zone’. The metal gold and metalloid antimony are the primary ore minerals but additional analyses are also done to test for the content of potential deleterious metals that could affect the value of the antimony. According to specific samples of massive stibnite that were collected at Workman’s Bench, the deleterious metal content in the antimony ore is well below the amount that could penalize the price of the ore. In 2009, the drill core that was sampled averaged over 90% recovery and is consistent with the recovery of core sampled in 2008. A total of only 73 core samples were collected from the ‘A Zone’ or adjacent wall rock and sent to the ALS Chemex Labs. The methods for analysis as well as the quality control methods are all consistent with the 2007 and 2008 drill programs and have been approved by the Company QP.

In addition to the summer drill program, additional core and surface rock samples were submitted for geochemical analysis during the fall months. The additional samples were analyzed for determination of a potential bulk minable resource which was indicated in core sample results from previous 2008 samples along the north end of the Workman’s Bench drill grid as well as the 2009 core samples collected from the southern end of the Pringle Bench drill grid. The Company geologists and the Company QP interpreted the potential for a bulk minable resource after noting low grade gold that was continuous across widths of the shear zone that are wider yet lower in grade than the more well defined mineralized vein faults. Additional samples consist of a total of 55 drill core samples that were collected from the three southern-most drill holes along Pringle Bench as well as 15 surface channel bedrock samples to check for both bulk minable potential as well as other potential mineralized structures that are oblique to the main northeast-trending Solomon Shear Zone.

More assays and more drill holes will be needed before any resource estimates can be made regarding the potential bulk minable resource. Since down hole/subsurface data is not sufficient for a definite structural geologic description, the area of potential bulk minable gold-antimony mineralization has been referred to as a deformation zone. The deformation zone consists of an abundance of smaller quartz-sulfide-gold veinlets and quartz-stibnite-gold veinlets as well as fine-grained disseminated and deformed sulfides that collectively have gold grades that average over 0.03 oz/t over much broader areas than the more well defined and higher gold-antimony grades of the vein-fault zones such as the ‘A Zone’. The bulk mineable potential was disclosed in a Silverado news release on October 27, 2009. All news releases and the data contained within are approved by the Silverado QP. Readers and investors need to take caution that a potential resource is not an economically viable resource and considerable more data is required before a resource estimate can be made by the QP.

In addition to the core and surface rock samples, the Company geologists continued their analysis of the abundance of geologic data for planning and design of a potential mine and/or a potential pilot mill that would be needed for processing of a large 1,000 cubic yard bulk sample. The characterization studies needed for permitting obligations were conducted throughout the fiscal year and are still ongoing.

2009 Workman’s Bench

The drill holes in previous years along the Solomon Shear Zone were drilled at an azimuth that was oriented southeast, but in 2009 the Company needed to test the zone in an area vertically above the previous drill campaigns. Due to the topography, the drill collars had to be placed on the southeast side of the Shear Zone and the drill azimuths were orientated northwest. A total of 9 holes totaling 2,663 feet were drilled. Eight of the nine holes intercepted the main massive stibnite-gold-quartz vein-fault referred to as the ‘A Zone’. The one hole that was not successful was the result of poor drill recovery due to a fault zone that cut across the main Solomon Shear Zone. The focus of the drill program in 2009 was to use the limited drill footage that was budgeted to define the ‘A Zone’ at the higher elevations. Also, due to the precarious topography, the drill was not situated to test the other vein-fault zones that parallel the ‘A Zone’.

The table on the following page lists some of the 2009 drill intercepts of the ‘A Zone’. None of the drilled intercepts are within the probable reserve block, and all of the drill holes are located vertically above the probable reserve block. The formerly mentioned reserve block was determined by the Company QP after completing a detailed feasibility study for the 43-101 report released on January 5, 2009. The 2009 drill intercepts of the ‘A Zone’ were not sufficiently spaced to be classified as a reserve, but they are consistent with an indicated resource according to the Company QP. Refer to the resource estimate tables under Item 2 and the summary table on the next page. Readers and investors should take caution when referring to the resource estimates in Item 2. Please take note of the cautionary statements listed with the resource estimates in Item 2.

16

2009 Pringle Bench

Exploration work along Pringle Bench involved both diamond core drilling and limited trench excavation and rock sampling. Eleven holes were drilled totaling 2,329 feet. Ten of the eleven holes intercepted the ‘A Zone’. Other gold-antimony vein zones were intercepted but the focus of the program was to check the vertical extent and nature of the ‘A Zone’ at depth. The one hole that was not successful in hitting the ‘A Zone’ was due to the abandonment of the hole before the required depth.

The table on the following page lists the widths of the intercepts and the gold and antimony content of the ‘A Zone’ quartz-gold-antimony vein fault. The new resource estimates based on the 2009 drill data can be found in Item 2 of this 10K. Please read the cautionary statements about the resource estimates that are included.

The three southern-most holes were drilled at a different azimuth to check for other mineralized structures that may be oblique to the northeast-trending gold-antimony vein fault zones. Additional samples were collected from these three holes to allow for continued averages of grade to be determined. As stated previously, the additional samples were collected to determine if there is a potential for a bulk mineable resource at the Nolan Property, but more data and more drilling will be needed before any resource estimate of this nature can be determined by the QP. The Silverado news release dated October, 27, 2009 discusses the bulk mineable potential. Investors should take caution and realize that a potential resource is not a resource estimate and will need additional work to ascertain if it is an economically viable resource.

The following table shows some examples of the types of mineralized veins found in the ‘A Zone’ in 2009. Some of the smaller veins are examples of individual veins and do not represent the entire zone which may contain more veins within it. The table does not show all of the intercepts used by the Company for resource estimates. The table is for description purposes only. Note: The ‘W’ and ‘P’ listed in the ‘Area’ column represent Workman’s and Pringle Benches respectively.

17

Area |

Drill Hole # |

Stibnite Vein Zone |

From (feet) |

To (feet) |

Width (feet) |

Sb (%) |

Au (oz/ton) |

Brief Description of Ore Veins Note: stibnite is comprised of antimony (Sb) and sulfur. The highest possible Sb content in pure stibnite is 70% |

| W | 09SH05 | ‘A Zone’ | 276.2 | 278.8 | 2.6 | 59.3% | 0.27 | 2.0 ft wide (true width) massive

stibnite with > 90% stibnite |

| W | 09SH06 | ‘A’ Zone | 214.3 | 215.1 | 0.8 | 36.2% | 0.06 | 6 inch (true thickness)

massive stibnite vein |

| W |

09SH07 |

‘A Zone’ Hanging wall |

216.2 |

217.0 |

0.8 |

<1.0% |

0.64 |

Quartz-stibnite-Au veins totaling about 4 inches in hanging wall |

| W |

09SH07 | ‘A Zone’ | 218.0 | 219.6 | 1.6 |

47.9% |

0.78 |

1.0 ft (true width) massive

stibnite-quartz-gold vein |

| W | 09SH08 | ‘A’ Zone | 278.6 | 279.7 | 1.1 | 55.4% | 0.56 | 0.8 ft (true width) Massive

stibnite-quartz-gold-vein |

| P | 09SH11 | ‘A’ zone | 29.0 | 30.2 | 1.2 | 10.3% | 0.12 | 1.0 ft (true width) Stibnite-quartz-Au vein. Zone was broken. |

| P | 09SH12 | ‘A Zone’ | 20.0 | 21.5 | 1.5 | 32.1% | 0.05 | 1.2 ft (true width) stibnite-quartz vein |

| P | 09SH14 | ‘A Zone’ | 112.0 | 113.5 | 1.5 | 50.94% | 0.03 | Massive stibnite vein with a true width of 1.0 feet |

| P | 09SH15 | ‘A Zone’ | 162.5 | 163.4 | 0.9 | 35.5% | 0.03 | 0.3 ft of massive stibnite Plus 0.6 ft of quartz-stibnite veinlets and stibnite strings

|

| P | 09SH18 | ‘A Zone’ | 74.5 | 75.5 | 1.0 | 37.7% | 5.72 | Broken stibnite-quartz-gold vein with coarse visible wire gold. |

| P | 09SH19 | ‘A Zone’ | 173.8 | 176.2 | 2.4 | 14.7% | 0.14 | 1.5 ft wide zone with 0.5 ft (true width) stibnite-quartz Vein (fragmental texture) and adjacent quartz-stibnite veinlets |

| P |

09SH20 |

‘A Zone’ |

205.0 |

206.5 |

1.5 |

2.7% |

1.69 |

3.0 inch stibnite-quartz-arsenopyrite-gold vein that is part of a 5.5 ft densely veined zone |

| P |

09SH20 |

‘A Zone’ Hanging Wall |

190.5 |

195.0 |

4.5 |

2.0% |

0.11 |

Chaotic quartz-stibnite and quartz- carbonate-gold stockwork |

18

19

20

Independent Preliminary Feasibility Study Completed by Pacific Rim Geological Consulting Inc.

During September 2008, Thomas K. Bundtzen of Pacific Rim Geological Consulting Inc. (the “QP”) was commissioned by the Company to perform a preliminary feasibility study of the Workman’s Bench Antimony and Gold Lode Deposit. Bundtzen is a third party (independent) and AIPG Certified Professional Geologist. Bundtzen is a “Qualified Person” as defined by NI 43-101 and also qualifies under the rules of the U.S. Securities and Exchange Commission. The significance of the preliminary feasibility study is that the resource estimates of the lode antimony and gold have been reclassified as a reserve and the deposit is an economically viable deposit.

The information in the report was based on data as of October 15, 2008. The report was prepared as a National Instrument 43-101 Technical Report in accordance with Form 43-101F, for the Company. Readers and investors need to take caution since the 43-101 technical report is under the guidelines of the British Columbia Securities Commission and that the United States Securities Exchange Commission does not recognize many of the terms used such as “indicated resources” and “inferred resources” and possibly other terms which are commonly used by the Canadian Institute of Mining (CIM). Readers should note that the results of the study post date the previous report by the QP released on July 29, 2008, and that the information in the recent report which includes resource estimates supersedes the July report. The results of the study were released on January 1, 2009. The report in its entirety can be found at our website www.silverado.com. Some of the pertinent items discussed in the report are as follows:

| 1. |

Data Verification by the QP and QAQC of the Company’s Sample Management. | |

| 2. |

Mineral Processing and Metallurgical Testing of Bulk Sampled Material from the Underground Workings. | |

| 3. |

Summary of Resource and Reserve Estimates of the Antimony and Gold Lode Deposits. | |

| 4. |

Methodology and Modeling Used for the Lode Resource Estimates. | |

| 5. |

Waste Rock Management Plan | |

| 6. |

Mill Design (Pilot Mill) | |

| 7. |

Modeling Used for the Lode Resource Estimates. | |

| 8. |

Project Implementation Schedule. | |

| 9. |

Conclusions and Recommendations of the QP. |

Data Verification

During numerous personal inspections of the Nolan Creek properties during 2007, 2008 and 2009, the QP observed sample collection and sample preparation practices for the Nolan Gold Projects lode-style deposits. On June 13 and 14 and September 28 and 29, 2008, the QP visited the Nolan Camp and examined all significantly mineralized core intervals acquired from the 2007 and 2008 drilling programs. A total of 124 mineralized intervals were examined. The analytical data was compared with each of the mineralized zones and confirmed the elevated antimony and gold values in the sampled areas.

The QP observed core logging and trench samples being prepared for shipment from Nolan Creek during October 22 to October 23, 2007. The QP also observed Silverado contractors preparing placer samples for separation of placer gold, the subsequent weighing of recovered gold and calculation of gold per unit volume of material. In addition, the QP has access to detailed colored photos of all drill core from the 2007-2009 drill program at Nolan Creek.

Judgments and determinations by the QP in regards to the Company’s sample preparation, analytical procedures and security of samples are discussed in the 43-101 technical reports. Any technical reports mentioned herein are included as supplemental documents that can be found on the Company Website at www.Silverado.com.

Nolan Lode Gold and Antimony Project 2010 Work Plan

The feasibility study performed by the QP and disclosed on January 5, 2009 will be a guideline for our future activities. Depending on funding and the acquisition of certain permits, the Company plans to fast track efforts toward the development stage. The Company will continue characterization studies of potential acid rock drainage issues and baseline water sampling as well as additional topographic surveys for planning and mine design.

During 2010, lode exploration work will consist of additional diamond core drilling in several key areas throughout the property, as well as more test trenching and bedrock sampling along the northeast trending Solomon Shear Zone. The primary focus will be infill drilling in the intermediate area between the Pringle Bench and Workman’s Bench, as well as more infill drilling within the area drilled in 2008 and 2009 for more accurate resource estimates of the gold and antimony mineralized veins. Additional drilling on the property will be dependent on our completion of drilling in the former key areas. The planned drilling schedule is as follows:

21

Workman’s Bench - The Company plans to infill drill a minimum of 20 holes along the portion of Solomon Shear Zone that was drilled in 2008 and 2009, for a more accurate estimate of reserves. Silverado also plans to drill a minimum of 10 deeper holes beneath the current reserve block to expand resources or potentially expand the current probable reserve block. In addition, the Project will submit additional core samples from the north end of the prospect to check for low grade gold content that has potential for a bulk mineable resource.

Pringle South – The Company plans to infill drill a minimum of 20 holes along the Solomon Shear Zone on the north side of Smith Creek in the area between the Pringle and Workman’s Benches to connect the Workman’s and Pringle Bench resource blocks. The Company plans to use a larger drill to set casing through the large boulder-rich overburden that has thwarted drill efforts in an area that is almost 600 feet in strike length. Both the extreme north and south ends of Workman’s and Pringle Bench have indicated other gold-bearing structures that are oblique to the northeast trending Solomon Shear Zone. The new and apparent gold-bearing structures and the type of gold mineralization combined with an increase in width of the zone indicate a potential for a bulk minable resource in this area.

Hillside Area - A small area of bedrock underlying the Hillside Area was drilled in 2003 with an RC drill, but the drilling locations were based on limited bedrock trenching data. Since then, geophysical surveys and geochemical soil sampling surveys have defined much better drill targets. In 2010, the Company plans to drill exploratory holes to intercept the Solomon Shear Zone in this area. The Company also plans to take advantage of the historic trails and use an excavator to dig additional test trenches for surface bedrock channel sampling and to verify drill targets.

Solomon II - The Company’s newest prospect, based on air photo interpretation and airborne EM surveys, is another structural zone that is over three miles in length and parallels the Solomon Shear Zone. Located approximately 2,000 ft east of the Solomon Shear Zone, the zone cuts across Smith Creek in an area defined by two closely spaced ephemeral creeks (gullies), an area where “old timers” previously mined stibnite. The Company believes that this is likely another structural zone similar to the Solomon Shear Zone. The northeast striking zone extends northeast from Smith Creek along the break in slope directly south of Smith Dome.

The escarpment that remains at the base of the slope represents the highest erosion and movement by glaciers in the area, and this area may be responsible for the historic placer deposits in upper Smith Creek. Depending on funding, the Company plans to build a road to allow a drill rig and other heavy equipment to access the new prospect for exploration purposes.

Fortress Area - The Company plans to do detailed mapping and sampling of the quartz-arsenopyrite veins in various outcrops along the Fortress ridgetop. No drilling is planned for the Fortress Area in 2010.

Entire 11 Square Mile Nolan Property – The Company plans to increase soil geochemistry coverage in areas that have never been subject to modern geochemical surveys to check for potential disseminated stratiform gold as well as other gold-bearing structures that may have been overlooked by placer exploration techniques.

Sample Collection, Sample Preparation, and Analytical Procedures

All primary sample preparation from both lode and placer mineral exploration programs at Nolan Creek was conducted by professional geologists employed by Silverado. All work completed on behalf of Silverado was completed by or under the supervision of a contractor of Silverado. Officers, directors, and associates of Silverado were not involved in sample preparation. Independent, off-site analytical laboratories completed additional sample preparation of samples from the lode-style deposits.

Analysis of placer samples is performed on-site by Silverado contractors. Analysis of lode-style deposit samples (core, percussion, trench, and underground channel) is performed by independent, off-site laboratories.