Attached files

Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark one) | ||

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2009 |

||

or |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

Commission File Number 0-15006

CELLDEX THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 13-3191702 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

119 Fourth Avenue, Needham, Massachusetts 02494

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: (781) 433-0771

Securities registered pursuant to Section 12(b) of the Act:

| Title of Class: | Name of Each Exchange on Which Registered: | |

|---|---|---|

| Common Stock, par value $.001 | NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this Chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller Reporting Company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

The aggregate market value of the registrant's common stock held by non-affiliates as of June 30, 2009 was $100.8 million. Exclusion of shares held by any person should not be construed to indicate that such person possesses the power, direct or indirect, to direct or cause the actions of the management or policies of the registrant, or that such person is controlled by or under common control with the registrant.

The number of shares of common stock outstanding at February 25, 2010 was 31,711,124 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive Proxy Statement for our 2010 Annual Meeting of Stockholders are incorporated by reference into Part III of this Report.

CELLDEX THERAPEUTICS, INC.

ANNUAL REPORT ON FORM 10-K

YEAR ENDED DECEMBER 31, 2009

i

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995: This report on Form 10-K contains forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements with respect to our beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates, intentions and future performance, and involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause our actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. All statements other than statements of historical fact are statements that could be forward-looking statements. You can identify these forward-looking statements through our use of words such as "may," "will," "can," "anticipate," "assume," "should," "indicate," "would," "believe," "contemplate," "expect," "seek," "estimate," "continue," "plan," "point to," "project," "predict," "could," "intend," "target," "potential" and other similar words and expressions of the future.

There are a number of important factors that could cause the actual results to differ materially from those expressed in any forward-looking statement made by us. These factors include, but are not limited to:

- •

- our ability to successfully complete product research and further development, including animal, preclinical and clinical

studies, and commercialization of CDX-110, CDX-011, CDX-1307, CDX-1401, CDX-1135, and other products and the growth of the markets for those

product candidates;

- •

- our ability to raise sufficient capital on terms acceptable to us, or at all;

- •

- the cost, timing, scope and results of ongoing safety and efficacy trials of CDX-110, CDX-011,

CDX-1307, CDX-1401, CDX-1135, and other preclinical and clinical testing;

- •

- our ability to adapt our APC Targeting Technology™ to develop new, safe and effective vaccines against

oncology and infectious disease indications;

- •

- the ability to negotiate strategic partnerships or other disposition transactions for our non-core programs;

- •

- our ability to manage multiple clinical trials for a variety of product candidates at different stages of development;

- •

- the strategies and business plans of our partners, such as Pfizer's plans for CDX-110, GlaxoSmithKline's plans

with respect to Rotarix® and Vaccine Technologies' plans concerning the CholeraGarde® (Peru-15) and ETEC E. coli vaccines, which are not within our control, and our

ability to maintain strong, mutually beneficial relationships with those partners;

- •

- our ability to successfully integrate our and CuraGen's business without causing delays in the research and development

necessary to select drug development candidates and/or delays in clinical trials, and to operate the combined business efficiently;

- •

- our ability to develop technological capabilities and expand our focus to broader markets for vaccines;

- •

- the availability, cost, delivery and quality of clinical and commercial grade materials produced by our own manufacturing

facility or supplied by contract manufacturers and partners;

- •

- the timing, cost and uncertainty of obtaining regulatory approvals for product candidates;

- •

- our ability to develop and commercialize products before competitors that are superior to the alternatives developed by such competitors;

ii

- •

- the validity of our patents and our ability to avoid intellectual property litigation, which can be costly and divert

management time and attention; and

- •

- the factors listed under "Risk Factors" in this annual report on Form 10-K.

All forward-looking statements are expressly qualified in their entirety by this cautionary notice. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date of this report or the date of the document incorporated by reference into this report. We have no obligation, and expressly disclaim any obligation, to update, revise or correct any of the forward-looking statements, whether as a result of new information, future events or otherwise. We have expressed our expectations, beliefs and projections in good faith and we believe they have a reasonable basis. However, we cannot assure you that our expectations, beliefs or projections will result or be achieved or accomplished.

iii

General

As used herein, the terms "we," "us," "our," the "Company", or "Celldex" refer to Celldex Therapeutics, Inc. and its direct and indirect subsidiaries: Celldex Research Corporation ("Celldex Research") and Celldex Therapeutics, Ltd. ("Celldex Ltd."). Our principal activity since our inception has been research and product development conducted on our own behalf, as well as through joint development programs with several pharmaceutical companies and other collaborators.

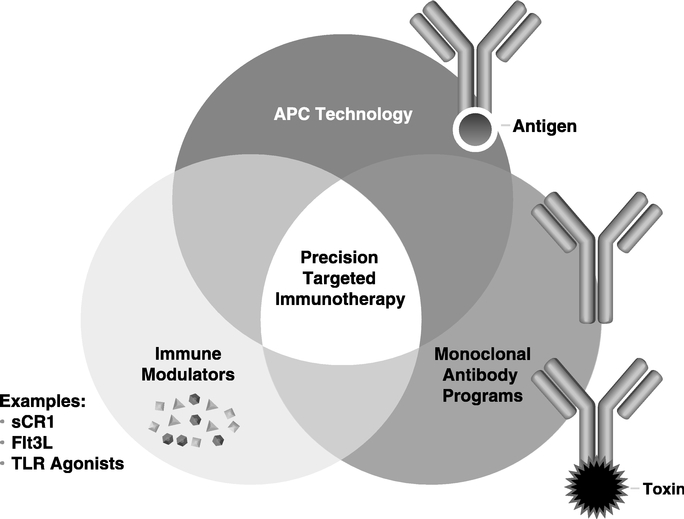

We are an integrated biopharmaceutical company that applies our comprehensive Precision Targeted Immunotherapy Platform to generate a pipeline of candidates to treat cancer and other difficult-to-treat diseases. Our immunotherapy platform includes a complementary portfolio of monoclonal antibodies, antibody-targeted vaccines, antibody-drug conjugates and immunomodulators to create novel disease-specific drug candidates.

Our strategy is to develop and demonstrate proof-of-concept for our product candidates before leveraging their value through partnerships or, in appropriate situations, continuing late stage development through commercialization ourselves. Demonstrating proof-of-concept for a product candidate generally involves bringing it through Phase 1 clinical trials and one or more Phase 2 clinical trials so that we are able to demonstrate, based on human trials, good safety data for the product candidate and some data indicating its effectiveness. We thus leverage the value of our technology portfolio through corporate, governmental and non-governmental partnerships. This approach allows us to maximize the overall value of our technology and product portfolio while best ensuring the expeditious development of each individual product.

Our current collaborations include the commercialization of an oral human rotavirus vaccine and the development of oncology and infectious disease vaccines. Our product candidates address large market opportunities for which we believe current therapies are inadequate or non-existent.

AVANT Merger

On March 7, 2008, AVANT Immunotherapeutics, Inc. ("AVANT") merged with Celldex Research (formerly known as Celldex Therapeutics, Inc.), a privately-held company, (the "AVANT Merger"). Effective October 1, 2008, we changed our name from AVANT Immunotherapeutics, Inc. to Celldex Therapeutics, Inc.

The AVANT Merger was accounted for using the purchase method of accounting and was treated as an acquisition by Celldex Research of AVANT even though AVANT was the issuer of common stock and the surviving legal entity in the transaction. Because Celldex Research was determined to be the acquirer for accounting purposes, the historical financial statements of Celldex Research became our historical financial as of the closing of the AVANT Merger. Accordingly, our financial statements prior to the AVANT Merger reflect the financial position, results of operations and cash flows of Celldex Research, which during the historical periods presented in the accompanying consolidated financial statements, was then majority-owned by Medarex, Inc. ("Medarex"). Following the AVANT Merger, the financial statements reflect the financial position, results of operation and cash flows of the combined companies. The results of operations of AVANT are included in our results of operations beginning March 8, 2008.

Acquisition of CuraGen Corporation ("CuraGen")

On October 1, 2009, CuraGen, then a publicly-traded company, merged with a wholly-owned subsidiary of Celldex (the "CuraGen Merger"). In connection with the CuraGen Merger, effective

1

October 1, 2009, we (i) issued 15,722,713 shares of our common stock, or 0.2739 shares, in exchange for each share of outstanding CuraGen common stock, plus cash in lieu of fractional shares (the "CuraGen Exchange Ratio"), (ii) assumed all of the CuraGen stock options outstanding under the CuraGen 2007 Stock Plan (the "CuraGen 2007 Options"), and (iii) assumed the obligations of the $12.5 million in CuraGen 4% convertible subordinated debt due in February 2011 (the "CuraGen Debt"). The CuraGen 2007 Options are exercisable into 931,315 shares of our common stock after applying the CuraGen Exchange Ratio.

In connection with the consummation of the CuraGen Merger, effective October 1, 2009, Celldex, CuraGen, and The Bank of New York Mellon (formerly the Bank of New York) (the "Trustee") amended the CuraGen Debt to provide that the CuraGen Debt shall be convertible into 353,563 shares of Celldex common stock at the rate of 28.27823 shares of Celldex common stock per $1,000 principal amount of notes, or $35.36 per share.

Based on the closing price of our common stock on October 1, 2009 of $5.43, the fair value of the shares issued in the CuraGen Merger was $85.4 million. We have applied acquisition accounting as of October 1, 2009. Accordingly, the results of operations of CuraGen have been included in our results of operations beginning October 1, 2009.

On December 31, 2009, we completed the merger of our CuraGen subsidiary with and into Celldex pursuant to a short-form merger effected under Delaware law. As a result, the separate corporate existence of CuraGen has ceased and we have succeeded to all rights, privileges, powers and franchises of CuraGen.

We are a Delaware corporation organized in 1983. Our web site is located at http://www.celldextherapeutics.com. On our web site, investors can obtain a copy of our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and other reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act of 1934, as amended, as soon as reasonably practicable after we file such material electronically with, or furnishes it to, the Securities and Exchange Commission ("SEC"). None of the information posted on our website is incorporated by reference into this Annual Report.

Research and Development Activities

Our goal is to become a leading developer of innovative products that we call Precision Targeted Immunotherapeutics which are designed to address major unmet health care needs. Most of our products are derived from a set of complementary technologies (collectively known as our Precision Targeted Immunotherapy Platform). This platform includes monoclonal antibodies, antibody-targeted vaccines, antibody-drug conjugates and immunomodulators to create novel disease-specific drugs. We are using our Precision Targeted Immunotherapy Platform to develop targeted immunotherapies that prevent or treat specific forms of cancer, autoimmune disorders and disease caused by infectious organisms.

2

The following table includes the programs that we currently believe are material to our business:

Product (generic)

|

Indication/Field | Partner | Status | ||||

|---|---|---|---|---|---|---|---|

CLINICAL |

|||||||

CDX-110 |

Glioblastoma multiforme | Pfizer (PF-4948568) | Phase 2b | ||||

CDX-011 |

Metastatic melanoma and breast cancer | — | Phase 2 | ||||

CDX-1307 |

Colorectal, bladder, pancreas, ovarian and breast tumors | — | Phase 1 | ||||

CDX-1401 |

Multiple solid tumors | — | Phase 1/2 | ||||

CDX-1135 |

Renal disease | — | Phase 1/2 | ||||

PRECLINICAL |

|||||||

CDX-301 |

Cancer, autoimmune disease and transplant | — | Preclinical | ||||

CDX-1127 |

Immuno-modulation, multiple tumors | — | Preclinical | ||||

CDX-014 |

Renal and ovarian cancer | — | Preclinical | ||||

CDX-1189 |

Renal disease | — | Preclinical | ||||

MARKETED PRODUCTS |

|||||||

Rotarix® |

Rotavirus infection | GlaxoSmithKline | Marketed | ||||

Using our expertise in immunology, we are building business franchises in major disease areas: oncology, inflammatory and infectious diseases. Each of our business franchises addresses large market opportunities for which current therapies are inadequate or non-existent. We have pursued some of these opportunities independently in a highly focused manner. In other cases, we have leveraged the financial support and development capabilities of corporate and public sector partners to bring our development projects to fruition. The research we have pursued over the past several years has matured into what we believe is an exciting portfolio of product candidates.

Our success has depended and will continue to depend upon many factors, including our ability, and that of our licensees and collaborators, to successfully develop, obtain regulatory approval for and commercialize our product candidates. Commercial sales are currently only being generated from Rotarix®. We have had no commercial revenues from sales of our human therapeutic or other human vaccine products and we have had a history of operating losses. It is possible that we may not be able to successfully develop, obtain regulatory approval for or commercialize our product candidates, and we are subject to a number of risks that you should be aware of before investing in us. These risks are described more fully in "Item 1A. Risk Factors."

3

Development Strategy

Precision Targeted Immunotherapy Platform:

We believe there is tremendous untapped potential in immunotherapy that can be exploited through the right combination of therapeutic agents. Our industry has traditionally taken biologics that mediate effective cancer regression in mice and expected similar results in humans. There are many explanations why this strategy often does not succeed, but the most important is that immunotherapy has difficulties when following standard drug development. The mechanism of action is complex, activity is generally not dependent on highest tolerated dose, and patient response is highly variable. Our new understanding of the immune system, cancer's effect on immune mediated mechanisms, and the impact of conventional therapies on the immune system provides a new rationale for combining therapies that may lead to significant clinical responses. The concept of Precision Targeted Immunotherapy is to exploit this knowledge and the availability of good products that may not be sufficiently effective to be commercialized as a monotherapy, but which we believe may be very effective in combination approaches. Our goal is to develop products that maximize the efficacy of immunotherapy regimens through combinations of therapeutic agents. This includes:

Therapeutic Antibody Programs: These programs are based on the well validated approach to using antibodies that target to cancer and other diseases directly, or through interfering with critical interactions between the patient and the disease. Our antibody programs include antibody-drug conjugates (ADCs) that are designed to deliver potent cytotoxic molecules to cancer cells, and

4

traditional unmodified antibody approaches. Our current programs are based on fully human sequence antibodies to minimize patient reactivity against the drug. In addition, we have access through a Research and Commercialization Agreement with Medarex (now a subsidiary of Bristol-Myers Squibb) to the UltiMAb® Technology for generating fully human monoclonal antibodies. Under this agreement, we can exercise up to ten separate licenses to develop and commercialize therapeutic antibody products, either alone or through collaboration with our licensing partners.

Our APC Targeting Technology™: This is a new class of vaccines based on our proprietary antibody-targeted vaccine technology that is used to generate an immune response against cancer or other diseases. Our APC Targeting Technology™ uses human monoclonal antibodies linked to disease associated antigens to efficiently deliver the attached antigens to immune cells known as antigen presenting cells, or APCs. This technology has been designed to allow us to take advantage of many important characteristics of human monoclonal antibodies, including their long circulating half-life, well known safety profile, and standardized manufacturing procedures. We believe that our APC Targeting Technology™ provides significant manufacturing, regulatory and other practical advantages over patient specific and other immune-based treatments and can substantially reduce the dosage and cost currently required in conventional immunotherapies. Preclinical studies have demonstrated that APC Targeting Technology™ is more effective than conventional non-targeted vaccines. We have developed several proprietary monoclonal antibodies that can independently be developed to generate new product opportunities. Our CDX-1307 and CDX-1401 programs are in clinical development with the APC technology.

Immune System Modulators: Immune system modulators include drugs that activate or suppress specific parts of the immune system. Currently we are combining our APC technology product candidates with molecules known as Toll-Like Receptor (TLR) agonists that can activate patients' innate and adaptive immunity. We are also developing an immune cell growth factor called FMS-like tyrosine kinase 3 ligand (FLT3-L or CDX-301) designed to expand immune cells and stem cells. In addition, we are investigating the activity of a complement inhibitor (CDX-1135) that suppresses inflammatory reactions. These agents further support our Precision Targeted Immunotherapy Platform.

Our strategy is to utilize our expertise to design and develop targeted immunotherapeutics that have significant and growing market potential; to establish governmental and corporate alliances to fund development; and to commercialize our products either through corporate partners or, in appropriate circumstances, through our own direct selling efforts. Our goal is to demonstrate clinical proof-of-concept for each product, and then seek partners to help see those products which we cannot develop ourselves through to commercialization. This approach allows us to maximize the overall value of our technology and product portfolios while best ensuring the expeditious development of each individual product. Implementation of this strategy is exemplified by our lead programs which are discussed in the following sections.

Factors that may significantly harm our commercial success, and ultimately the market price of our common stock, include but are not limited to, announcements of technological innovations or new commercial products by our competitors, disclosure of unsuccessful results of clinical testing or regulatory proceedings and governmental approvals, adverse developments in patent or other proprietary rights, public concern about the safety of products developed by us and general economic and market conditions. See "Item 1A. Risk Factors."

Clinical Development Programs

CDX-110

Our lead clinical development program, CDX-110, is a peptide-based immunotherapy that targets the tumor specific molecule called EGFRvIII, a functional variant of the naturally expressed epidermal growth factor receptor ("EGFR"), a protein which has been well validated as a target for cancer

5

therapy. Unlike EGFR, EGFRvIII is not present in normal tissues, and has been shown to be a transforming oncogene that can directly contribute to the cancer cell growth. EGFRvIII is commonly present in glioblastoma multiforme, or GBM, the most common and aggressive form of brain cancer, and has also been observed in various other cancers such as breast, ovarian, prostate, colorectal, and head & neck cancer.

In April 2008, we and Pfizer Inc. ("Pfizer") entered into a License and Development Agreement (the "Pfizer Agreement") under which Pfizer was granted an exclusive worldwide license to CDX-110. The Pfizer Agreement also gives Pfizer exclusive rights to the use of EGFRvIII vaccines in other potential indications. Pfizer funds all development costs for these programs. We and Pfizer are currently pursuing the development of CDX-110 for GBM therapy and plan to expand the clinical development into other cancers through additional clinical studies. The Food and Drug Administration ("FDA") has granted orphan drug designation for CDX-110 for the treatment of EGFRvIII expressing GBM as well as fast track designation.

Initial clinical development of EGFRvIII immunotherapy was led by collaborating investigators at the Brain Center at Duke Comprehensive Cancer Center in Durham, North Carolina and at M.D. Anderson Cancer Center in Houston, Texas. The results from the Phase 1 (VICTORI) and Phase 2a (ACTIVATE) studies, which enrolled 16 and 21 patients, respectively, have demonstrated a significant increase in the time to disease progression (greater than 113%) in the patients who were vaccinated, and also in overall survival rates (greater than 100%), both relative to appropriately matched historical controls. An extension of the Phase 2a program (ACT II) at the same two institutions has enrolled 23 additional GBM patients treated in combination with temozolomide (the current standard of care). Preliminary results from this study (ACT II) currently estimates median overall survival to be 23.6 months, although the median has not yet been reached, while the survival of a matched historical control group was 15.0 months with a p value = 0.0237. Overall time to progression in the ACT II study was 15.2 months compared with 6.3 months for the historical control group.

We initiated a Phase 2b/3 randomized study (ACT III) of CDX-110 combined with standard of care, temozolomide, versus standard of care alone in patients with GBM in over 30 sites throughout the United States. In December 2008, we announced an amendment to convert the ACT III study to a single-arm Phase 2 clinical trial in which all patients will receive CDX-110 in combination with temozolomide. The decision, which followed the recommendation of the Independent Data Monitoring Committee, was based on the observation that the majority of patients randomized to the control (standard of care) arm withdrew from this open-label study after being randomized to the control arm. Patients participating on the control arm of the study were offered the option to receive treatment with CDX-110. Under this amendment, the ACT III study provided for a multi-center, non-randomized dataset for CDX-110 in patients with newly diagnosed GBM. These data will provide important additional information that can be used to better design the future development of CDX-110. Enrollment in ACT III is complete with a total of over 60 patients enrolled and we expect to present updated results during 2010.

CDX-011

CDX-011 (formerly CR011-vcMMAE) is an antibody-drug conjugate (ADC) that consists of a fully-human monoclonal antibody, CR011, linked to a potent cell-killing drug, monomethyl-auristatin E (MMAE). The CR011 antibody specifically targets glycoprotein NMB or (GPNMB) that is expressed in a variety of human cancers including breast cancer and melanoma. The ADC technology, comprised of MMAE and a stable linker system for attaching it to CR011, was licensed from Seattle Genetics, Inc. The ADC is designed to be stable in the bloodstream. Following intravenous administration, CDX-011 targets and binds to GPNMB, and upon internalization into the targeted cell, CDX-011 is designed to release MMAE from CR011 to produce a cell-killing effect. We acquired the rights to CDX-011 in connection with the CuraGen Merger.

6

Treatment of Breast Cancer: In June 2008, an open-label, multi-center Phase 1/2 study was initiated of CDX-011 administered intravenously once every three weeks to patients with locally advanced or metastatic breast cancer who have received prior therapy (median of seven prior regimens). The study began with a bridging phase to confirm the maximum tolerated dose ("MTD") and has expanded into a Phase 2 open-label, multi-center study.

The study confirmed the safety of CDX-011 at the pre-defined maximum dose level (1.88 mg/kg) in 6 patients. An additional 28 patients were enrolled as an expanded Phase 2 cohort (for a total of 34 treated patients at 1.88 mg/kg, the Phase 2 dose) to evaluate the progression-free survival ("PFS") rate at 12 weeks. As previously seen in melanoma patients, the 1.88 mg/kg dose was well tolerated in this patient population with the most common adverse events of rash, alopecia, and fatigue. The primary activity endpoint, which called for at least 5 of 25 (20%) patients in the Phase 2 study portion to be progression-free at twelve weeks, has been met. To date, 9 of 26 (35%) evaluable patients are without progression of disease at twelve weeks.

In addition, at the Phase 2 dose level, 4 of 32 (13%) evaluable patients achieved confirmed or unconfirmed Partial Responses ("PR") while 15 of 25 (60%) evaluable patients with measurable disease experienced some reduction in tumor size. GPNMB expression was identified in 10 of 14 (71%) of analyzed tumor samples and treatment with CDX-011 was associated with improved outcomes in all activity parameters in patients whose tumors expressed GPNMB. Notably, in patients who received the Phase 2 dose and whose tumors expressed GPNMB, 2 of 7 (29%) had confirmed PR, 5 of 7 (71%) had decreases in tumor size, and all 7 achieved at least stable disease with duration from 17.3 to 26.9 weeks. The median PFS in all patients was 9.1 weeks, but in patients whose tumors expressed GPNMB, median PFS was 18.3 weeks, compared to median PFS of 5.9 weeks for patients whose tumors did not express GPNMB. In patients with triple negative disease, 5 of 7 (71%) analyzed samples expressed GPNMB, 7 of 9 (78%) evaluable patients had tumor shrinkage, and the median PFS for these patients was 17.9 weeks.

We expect to initiate a randomized Phase 2b controlled study in patients with advanced breast cancer that express GPNMB in the second half of 2010.

Treatment of Metastatic Melanoma Cancer: In June 2006, a Phase 1/2 open-label, multi-center, dose escalation study was initiated to evaluate the safety, tolerability and pharmacokinetics of CDX-011 for patients with un-resectable Stage III or Stage IV melanoma who have failed no more than one prior line of cytotoxic therapy. During the Phase 1 portion of the study, doses of CDX-011 between 0.03 mg/kg to 2.63 mg/kg were evaluated and generally well tolerated, with rash and neutropenia emerging at higher doses. The MTD was determined to be 1.88 mg/kg administered intravenously (IV) once every three weeks.

In June 2009, CuraGen announced results for the 36 patients who were treated in the Phase 2 portion of the study. Of the patients enrolled, 94% had Stage IV disease of which two-thirds were classified as M1c, the poorest risk group. The study successfully met its primary activity endpoint, with 5 objective responses (1 unconfirmed) observed in 34 evaluable patients, and median duration of response of 5.3 months. The median overall PFS was 4.4 months. Tumor shrinkage was observed in 58% of patients, and 20 patients had best response of stable disease. Dermatologic adverse events consisting of rash, alopecia, and pruritus were the most common toxicities in this study. Other adverse events included fatigue, diarrhea, musculoskeletal pain, anorexia and nausea. Grade 3 or 4 neutropenia was observed in 5 patients. The absence of rash in the first cycle of treatment predicted a worse PFS. Additionally, in a subset of patients with tumor biopsies, high levels of tumor expression of GPNMB appeared to correlate with favorable outcome.

Enrollment has been completed in the Phase 1 portion of the melanoma trial to evaluate more frequent dosing schedules of CDX-011, including a weekly and a two out of every three-week regimen, to explore if more frequent administration can provide additional activity in patients with metastatic

7

melanoma. A dose of 1.0 mg/kg given once every week has been identified as the MTD in a weekly schedule, and a dose of 1.5mg/kg was being explored in the two out of three week schedule. Although median duration of follow-up was only 6 weeks, objective responses have thus far been observed in 3 of 11 evaluable patients treated with weekly CDX011 (1 confirmed) and 1 confirmed response in 8 evaluable patients treated with CDX-011 two out of every three weeks. We expect to present updated results during the first half of 2010.

CDX-1307

Our lead APC Targeting Technology™ product candidate, CDX-1307, is in development for the treatment of epithelial tumors such as colorectal, pancreatic, bladder, ovarian and breast cancers. CDX-1307 targets the beta chain of human chorionic gonadotropin, known as hCG-Beta, which is an antigen often found in epithelial tumors. The presence of hCG-Beta in these cancers correlates with a poor clinical outcome, suggesting that this molecule may contribute to tumor growth. Normal adult tissues have minimal expression of hCG-Beta; therefore, targeted immune responses are not expected to generate significant side effects.

Enrollment is complete in our two Phase 1 studies at multiple centers designed to explore safety and dose/effect relationships via two administration routes—intradermal (ID), a traditional vaccine route that allows efficient access to local dermal dendritic cells and intravenous (IV), a novel systemic approach to vaccination that might target a much larger population of dendritic cells. The Phase 1 studies investigated the safety and immunogenicity of CDX-1307 alone and in combination with adjuvants, including GM-CSF (known to increase mannose receptor expression on dendritic cells) and Toll-Like Receptor ("TLR") agonists (poly-ICLC or Hiltonol™ and R848 or resiquimod). Patients with an assortment of different tumor types that are known to express hCG-Beta were enrolled with retrospective analysis for hCG-Beta expression. An escalating four dose regimen was utilized with the possibility of retreatment if patients demonstrate tumor regression or stable disease.

The Phase 1 studies enrolled over 80 patients with heavily pretreated, advanced-stage breast, colon, bladder and pancreatic cancer, with an average of 4.6 prior therapies across the treatment population. All patient cohorts demonstrated a favorable safety profile with no dose limiting toxicity to date. The combination of CDX-1307 with TLR agonists significantly enhanced immune responses against hCG-Beta, providing humoral responses in 88% of patients and cellular immune responses in 57% of patients analyzed to date. Immune responses occurred even in the presence of high circulating levels of hCG-Beta, suggesting that the CDX-1307 can overcome antigen tolerance in advanced and heavily pretreated cancers. Nine patients in the studies experienced disease stabilization from 2.3 months to 11.4 months following the initiation of CDX-1307 vaccination. Two of these patients have received multiple courses of CDX-1307 and continue treatment with stable disease at 6.4 and 11.4 months. These data provide the basis for advancing CDX-1307 into a front-line patient population selected for hCG-Beta expressing cancers.

We expect to initiate a randomized Phase 2b controlled study in patients with newly diagnosed invasive bladder cancer in the second quarter of 2010. Patient's whose bladder cancer expresses hCG-Beta are predicted to have more aggressive disease and shorter survival. In this study we plan to select only patients with confirmed hCG-Beta expression using a specific diagnostic assay.

CDX-1401

CDX-1401 is a fusion protein consisting of a fully human monoclonal antibody with specificity for the dendritic cell receptor, DEC-205, linked to the NY-ESO-1 tumor antigen. In humans, NY-ESO-1 has been detected in 20 - 30% of cancers, thus representing a broad opportunity. This product is intended to selectively deliver the NY-ESO-1 antigen to APCs for generating robust immune responses against cancer cells expressing NY-ESO-1. Unlike CDX-1307, which targets the mannose receptor

8

expressing dendritic cells, CDX-1401 is the first APC product targeting DEC-205 expressing dendritic cells. We are developing CDX-1401 for the treatment of malignant melanoma and a variety of solid tumors which express the proprietary cancer antigen NY-ESO-1, which we licensed from the Ludwig Institute for Cancer Research in 2006. We believe that preclinical studies have shown that CDX-1401 is effective for activation of human T-cell responses against NY-ESO-1.

In September 2009, we initiated enrollment in a dose-escalating Phase 1/2 clinical trial aimed at determining the optimal dose for further development based on the safety, tolerability, and immunogenicity of the CDX-1401 vaccine. The trial will evaluate three different doses of the vaccine in combination with resiquimod, an activator of TLR 7 and 8. We expect to enroll approximately 36 patients with solid tumor cancers at multiple clinical sites in the United States.

CDX-1135

CDX-1135 is a molecule that inhibits a part of the immune system called the complement system. The complement system is a series of proteins that are important initiators of the body's acute inflammatory response against disease, infection and injury. Excessive complement activation also plays a role in some persistent inflammatory conditions. CDX-1135 is a soluble form of naturally occurring Complement Receptor 1 that inhibits the activation of the complement cascade in animal models and in human clinical trials. We believe that regulating the complement system could have therapeutic and prophylactic applications in several acute and chronic conditions, including organ transplantation, multiple sclerosis, rheumatoid arthritis, age-related macular degeneration ("AMD"), atypical Hemolytic Uremic Syndrome ("aHUS"), Paroxysmal Nocturnal Hemaglobinuria ("PNH"), Dense Deposit Disease ("DDD") in kidneys, and myasthenia gravis. We are currently defining the most appropriate clinical development path for CDX-1135 and are focusing on rare disease conditions of unregulated complement activation as the fastest route to FDA approval.

Preclinical Development Programs

CDX-301

CDX-301 is a FMS-like tyrosine kinase 3 ligand (Flt3L) that we licensed from Amgen in March 2009. CDX-301 is a growth factor for stem cells and immune cells called dendritic cells. Based on previous experience with this molecule, we believe that CDX-301 has considerable opportunity in various transplant settings as a stem cell mobilizing agent. In addition, CDX-301 is an immune modulating molecule that increases the numbers and activity of specific types of immune cells. We believe CDX-301 has significant opportunity for synergistic development in combination with proprietary molecules in our portfolio. We expect to file an Investigational New Drug ("IND") application for CDX-301 before the end of 2010.

CDX-1127

We have entered into a License Agreement with the University of Southampton, UK, to develop human antibodies to CD27, a potentially important target for immunotherapy of various cancers. In preclinical models, antibodies to CD27 alone have been shown to mediate anti-tumor effects, and may be particularly effective in combination with other immunotherapies. CD27 is a critical molecule in the activation pathway of lymphocytes. It is downstream from CD40, and may provide a novel way to regulate the immune responses. Engaging CD27 with the appropriate monoclonal antibody has proven highly effective at promoting anti-cancer immunity in mouse models. We are evaluating new human monoclonal antibodies in preclinical models.

9

CDX-014

CDX-014 (formerly CR014-vcMMAE) is a fully-human monoclonal ADC that targets TIM-1, an immunomudulatory protein that appears to down regulate immune response to tumors. The antibody, CDX-014, is linked to a potent chemotherapeutic, monomethyl auristatin E (MMAE), using Seattle Genetics' proprietary technology. The ADC is designed to be stable in the bloodstream, but to release MMAE upon internalization into TIM-1-expressing tumor cells, resulting in a targeted cell-killing effect. CDX-014 has shown potent activity in preclinical models of ovarian and renal cancer. We acquired the rights to CDX-014 in connection with the CuraGen Merger.

CDX-1189

We are developing therapeutic human antibodies to a signaling molecule known as CD89 or Fca receptor type I (FcaRI). CD89 is expressed by some white blood cells and leukemic cell lines, and has been shown to be important in controlling inflammation and tumor growth in animal models. We have proprietary, fully human antibodies to CD89 in preclinical development. Depending upon the specific antibody used, anti-CD89 antibodies can either be activating and thus stimulate immune responses, or down-regulating and act as an anti-inflammatory agent.

Partnerships

We have entered into collaborative partnership agreements with pharmaceutical and other companies and organizations that provide financial and other resources, including capabilities in research, development, manufacturing, and sales and marketing, to support our research and development programs. We depend on these relationships and may enter into more of them in the future. Some of our partners have substantial responsibility to commercialize a product and to make decisions about the amount and timing of resources that are devoted to developing and commercializing a product. As a result, we do not have complete control over how resources are used toward some of our products.

Some of our partnership agreements relate to products in the early stages of research and development. Others require us and our collaborators to jointly decide on the feasibility of developing a particular product using our technologies. In either case, these agreements may terminate without benefit to us if the underlying products are not fully developed. If we fail to meet our obligations under these agreements, they could terminate and we might need to enter into relationships with other collaborators and to spend additional time, money, and other valuable resources in the process.

We cannot predict whether our collaborators will continue their development efforts or, if they do, whether their efforts will achieve success. Many of our collaborators face the same kinds of risks and uncertainties in their business that we face. A delay or setback to a collaborator will, at a minimum, delay the commercialization of any affected products, and may ultimately prevent it. Moreover, any collaborator could breach its agreement with us or otherwise not use best efforts to promote our products. A collaborator may choose to pursue alternative technologies or products that compete with our technologies or products. In either case, if a collaborator failed to successfully develop one of our products, we would need to find another collaborator. Our ability to do so would depend upon our legal right to do so at the time and whether the product remained commercially viable.

GlaxoSmithKline plc ("Glaxo") and Paul Royalty Fund II, L.P. ("PRF")

Rotavirus is a major cause of diarrhea and vomiting in infants and children. In 1997, we licensed our oral rotavirus strain to Glaxo and Glaxo assumed responsibility for all subsequent clinical trials and all other development activities. Glaxo gained approval for its rotavirus vaccine, Rotarix®, in Mexico in July 2004, which represented the first in a series of worldwide approvals and commercial launches for the product leading up to the approval in Europe in 2006 and in the U.S. in 2008. We licensed-in our

10

rotavirus strain in 1995 and owe a license fee of 30% to Cincinnati Children's Hospital Medical Center ("CCH") on net royalties received from Glaxo. We are obligated to maintain a license with CCH with respect to the Glaxo agreement. The term of the Glaxo agreement is through the expiration of the last of the relevant patents covered by the agreement, although Glaxo may terminate the agreement upon 90 days prior written notice.

In May 2005, we entered into an agreement whereby an affiliate of PRF purchased an interest in the milestone payments and net royalties that we will receive on the development and worldwide sales of Rotarix®. We have received a total of $60 million in milestone payments under the PRF agreement. No additional milestone payments are due from PRF under the agreement.

Royalty rates on Rotarix® escalate from 7% to 10% based on net product sales in countries that have valid patent protection. These royalty rates are discounted by 30% for "non-patent" countries (primarily international markets). In September 2006, we received notice from Glaxo that Glaxo would begin paying royalties on sales of Rotarix® vaccine at the lower of the two royalty rates under their 1997 license agreement. Glaxo's decision to pay the lower royalty rate (which is 70% of the full rate) is based upon Glaxo's assertion that Rotarix® is not covered by the patents Glaxo licensed from us in Australia and certain European countries. We are currently evaluating the basis for Glaxo's action and our potential remedies. If Glaxo's position stands, the royalties to which PRF is entitled will no longer be limited by a $27.5 million annual threshold, which we projected may have been reached in later years as sales of Rotarix® increased. Irrespective of Glaxo's position, we will still retain approximately 65% of the royalties on worldwide sales of Rotarix® once PRF receives 2.45 times the aggregate cash payments of $60 million it made to us, though the potential amount of such residual royalties will be lower if Glaxo's position stands.

Pfizer Inc.

Pfizer License and Development Agreement: In April 2008, we and Pfizer entered into the Pfizer Agreement under which Pfizer was granted an exclusive worldwide license to a therapeutic cancer vaccine candidate, CDX-110, in Phase 2 development for the treatment of glioblastoma multiforme. The Pfizer Agreement also gives Pfizer exclusive rights to the use of EGFRvIII vaccines in other potential indications. Under the Pfizer Agreement, Pfizer made an upfront payment to us of $40 million and made a $10 million equity investment in us. Pfizer will fund all development costs for these programs. We are also eligible to receive potential milestone payments exceeding $390 million for the successful development and commercialization of CDX-110 and additional EGFRvIII vaccine products, as well as royalties on any product sales. The Pfizer Agreement became effective after clearance under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 (as amended) on May 19, 2008. In connection with the Pfizer Agreement, we paid a total of $6.9 million in sublicense fees to Duke University and Thomas Jefferson University.

Pfizer Animal Health Agreement: We entered into a licensing agreement in December 2000 with Pfizer's Animal Health Division whereby Pfizer has licensed our technology for the development of animal health and food safety vaccines. Under the agreement, we may receive additional milestone payments of up to $3 million based upon attainment of specified milestones. We may receive royalty payments on eventual product sales. The term of this agreement is through the expiration of the last of the patents covered by the agreement. We have no obligation to incur any research and development costs in connection with this agreement.

Rockefeller University ("Rockefeller")

We are providing research and development support to Rockefeller on the development of their vaccine, DCVax-001, which we refer to as CDX-2401, aimed at providing protection from infection with HIV, the virus known to cause AIDS. Rockefeller's program is in a Bill & Melinda Gates Foundation

11

funded partnership called the Grand Challenges initiative. Preclinical studies and manufacturing development are in progress and our collaborators plan to file an IND for Phase 1 clinical studies in the first half of 2010. Rockefeller pays us on a time and materials basis.

Vaccine Technologies, Inc. ("VTI")

In January 2009, we entered into a license agreement with VTI under which we granted a worldwide exclusive license to VTI to develop and commercialize our CholeraGarde® and ETEC vaccine programs. We may receive milestones payments and royalties with respect to development and commercialization of the technology licensed to VTI.

TopoTarget A/S ("TopoTarget")

In connection with the CuraGen Merger, we assumed the rights under the April 2008 agreement ("TopoTarget Agreement") between CuraGen and TopoTarget whereby we could receive up to $6 million in either potential commercial milestone payments related to future net sales of Belinostat or 10% of any sublicense income received by TopoTarget ("TopoTarget Payments"). Under the TopoTarget Agreement, CuraGen sold back its Belinostat rights to TopoTarget and received $25 million in cash, 5 million shares of TopoTarget common stock (sold by CuraGen in 2008 for net proceeds of $12 million) and the right to receive the TopoTarget Payments. In addition, TopoTarget assumed all financial and operational responsibility for the clinical development of Belinostat under the TopoTarget Agreement. In February 2010, TopoTarget entered into a co-development and commercialization agreement for Belinostat with Spectrum Pharmaceuticals, Inc. resulting in our receipt of $3 million of the TopoTarget Payments.

Research Collaboration and Licensing Agreements

We have entered into licensing agreements with several universities and research organizations. Under the terms of these agreements, we have received licenses or options to license technology, specified patents or patent applications. Our licensing and development collaboration agreements generally provide for royalty payments equal to specified percentages of product sales, annual license maintenance fees and continuing patent prosecution costs. In addition, we have committed to make potential future milestone payments to third parties of up to approximately $116 million as part of our various collaborations including licensing and development programs. Payments under these agreements generally become due and payable only upon achievement of certain developmental, regulatory and/or commercial milestones.

Medarex, Inc., a subsidiary of Bristol-Myers Squibb ("Medarex")

We and Medarex, a former related party, have entered into the following agreements, each of which was approved by a majority of its independent directors who did not have an interest in the transaction. These agreements include:

- •

- An Assignment and License Agreement, as amended, ("Assignment and License Agreement") that provides for the assignment of

certain patent and other intellectual property rights and a license to certain Medarex technology; and

- •

- A Research and Commercialization Agreement, as amended, ("Research and Commercialization Agreement") that provides us with certain rights to obtain exclusive commercial licenses to proprietary monoclonal antibodies raised against certain antigens.

Under the terms of the Assignment and License Agreement and Research and Commercialization Agreement, we may be required to pay milestone and royalty payments to Medarex with respect to the development of any products containing such licensed antibodies.

12

In October 2007, we and Medarex entered into a settlement and mutual release agreement which settled disputed amounts we owed Medarex. We issued to Medarex 351,692 shares of our common stock equal in value to $3.0 million, based on the per share price of $8.64 set on the second trading day prior to the closing date of the AVANT Merger and exchanged releases. At December 31, 2008, we owed Medarex an additional $3.0 million related to a Master Services Agreement, which we paid Medarex in October 2009.

Rockefeller University ("Rockefeller")

In November 2005, we and Rockefeller entered into a license agreement for the exclusive worldwide rights to human DEC-205 receptor, with the right to sublicense the technology. The license grant is exclusive except that Rockefeller may use and permit other nonprofit organizations to use the human DEC-205 receptor patent rights for educational and research purposes. We may be required to pay milestone and royalty payments to Rockefeller with respect to development and commercialization of the human DEC-205 receptor. We may also be required to pay royalties on any product sales.

Duke University Brain Tumor Cancer Center ("Duke")

In September 2006, we and Duke entered into a license agreement that gave us access and reference to the clinical data generated by Duke and its collaborators in order for us to generate our own filing with the FDA relating to the CDX-110 product. We may be required to pay milestone and royalty payments to Duke with respect to development and commercialization of the CDX-110 product. In connection with the Pfizer Agreement, we determined that $2.4 million was payable to Duke as a sublicense fee. As provided for under the Duke license, we paid 50% of this amount to Duke in the form of 81,512 shares of our common stock in October 2008.

Ludwig Institute for Cancer Research ("Ludwig")

In October 2006, we and Ludwig entered into an agreement for the nonexclusive rights to six cancer tumor targets for use in combination with our APC Targeting Technology. The term of the agreement is for ten years. We may be required to pay milestone and royalty payments to Ludwig with respect to development and commercialization of the technology licensed from Ludwig.

Alteris Therapeutics, Inc. ("Alteris")

In October 2005, we completed the acquisition of the assets of Alteris, including the EGFRvIII molecule that we licensed to Pfizer under the Pfizer Agreement. We may be required to pay Alteris up to $5.0 million upon obtaining the first approval for commercial sale of a product containing EGFRvIII, including CDX-110.

Thomas Jefferson University ("TJU")

In February 2003, we entered into three exclusive license agreements with TJU. Under these licenses, we may be required to pay milestone and royalty payments to TJU with respect to development and commercialization of the technology licensed from TJU. In connection with the Pfizer Agreement, we amended our licenses with TJU to add additional sublicensing rights and paid $4.5 million in sublicense fees to TJU in 2008.

3M Company

In June 2008, we and 3M Company entered into a license agreement for the exclusive worldwide rights to access 3M Company's proprietary Immune Response Modifier, Resiquimod™, (and additional Toll-Like Receptor 7/8 agonists ("TLR")) for clinical study with our proprietary APC Targeting Technology, for use as vaccine adjuvants, with the right to sublicense the technology. We may be

13

required to pay milestone and royalty payments to 3M Company with respect to development and commercialization of the technology licensed from 3M Company.

University of Southampton, UK ("Southampton")

In November 2008, we entered into a license agreement with Southampton to develop human antibodies towards CD27, a potentially important target for immunotherapy of various cancers. CD27 is a critical molecule in the activation pathway of lymphocytes, is downstream from CD40, and may provide a novel way to regulate the immune responses. In preclinical models, antibodies to CD27 have been shown to mediate anti-tumor effects alone, and may be particularly effective in combination with our other immunotherapies. We may be required to pay milestone and royalty payments to Southampton with respect to development and commercialization of the technology licensed from Southampton.

Amgen Inc. ("Amgen")

In March 2009, we entered into a license agreement with Amgen to expand our Precision Targeted Immunotherapy Platform by acquiring exclusive rights to CDX-301 and CD40 ligand (CD40L). CDX-301 and CD40L are immune modulating molecules that increase the numbers and activity of immune cells that control immune responses. We may be required to pay milestone and royalty payments to Amgen with respect to development and commercialization of this technology licensed from Amgen.

Amgen Fremont (formerly Abgenix)

In connection with the CuraGen Merger, we assumed the license agreement between CuraGen and Amgen Fremont (successor in-interest to Abgenix) to develop fully-human monoclonal antibody therapeutics. In May 2009, an amendment to the license agreement ("Amgen Amendment") was entered into related to CuraGen's exclusive rights to develop and commercialize CDX-011 and 11 other licensed antigens. Under the Amgen Amendment, CuraGen and Amgen Fremont agreed to modify the terms of their existing cross-license of antigens whereby the amended license would be fully paid-up and royalty-free (except for any potentially required payments by CuraGen to the original licensor of CDX-011).

Seattle Genetics, Inc. ("Seattle Genetics")

In connection with the CuraGen Merger, we assumed the license agreement between CuraGen and Seattle Genetics whereby CuraGen acquired the rights to proprietary antibody-drug conjugate ("ADC") technology for use with its their proprietary antibodies for the potential treatment of cancer. We may be required to pay milestone and royalty payments to Seattle Genetics with respect to development and commercialization of the ADC technology.

Competition

The biotechnology and pharmaceutical industries are intensely competitive and subject to rapid and significant technological change. Many of the products that we are attempting to develop and commercialize will be competing with existing therapies. In addition, a number of companies are pursuing the development of pharmaceuticals that target the same diseases and conditions that we are targeting. We face competition from pharmaceutical and biotechnology companies both in the United States and abroad. Our competitors may utilize discovery technologies and techniques or partner with collaborators in order to develop products more rapidly or successfully than us or our collaborators are able to do. Many of our competitors, particularly large pharmaceutical companies, have substantially greater financial, technical and human resources than we do. In addition, academic institutions,

14

government agencies and other public and private organizations conducting research may seek patent protection with respect to potentially competitive products or technologies and may establish exclusive collaborative or licensing relationships with our competitors.

We face intense competition in our development activities. We face competition from many companies in the United States and abroad, including a number of large pharmaceutical companies, firms specialized in the development and production of vaccines, adjuvants and vaccine and immunotherapeutic delivery systems and major universities and research institutions. These competitors include Alexion, Anadys, Antigenics, Baxter, BioSante, Crucell, Dendreon, Eli Lilly, Emergent, Genitope, GlaxoSmithKline, Idera, Intercell, Immunogen, Maxygen, Merck, NeoPharm, Northwest Biotherapeutics, Novavax, Pfizer, Roche, Sanofi-Aventis, Seattle Genetics, and Vical. We are aware that Dendreon is in late stage clinical trials for therapeutic vaccines for the treatment of prostate cancer which may compete with CDX-1307 and CDX-1401. In addition, companies such as Eli Lilly with its approved product Erbitux™ for the treatment of colorectal cancer, and Roche with its product Herceptin® for the treatment of metastatic breast cancer, have already commercialized antibody-based products that may compete with CDX-1307, CDX-1401 and CDX-110. Various other companies are developing or commercializing products in areas that we have targeted for product development. Some of these products use therapeutic approaches that may compete directly with our product candidates. Many of these companies and institutions, either alone or together with their partners, have substantially greater financial resources and larger research and development staffs than we do. These companies may succeed in obtaining approvals from the FDA and foreign regulatory authorities for their products sooner than we do for our products.

We are aware of a number of competitive products currently available in the marketplace or under development that are used for the prevention and treatment of the diseases that we have targeted for product development. Various companies are currently marketing or developing biopharmaceutical products that may compete with our product candidates that target colorectal cancer. Product candidates we may develop are also subject to competition in the treatment of colorectal cancer from a number of products already approved and on the market, including the following chemotherapy products: AstraZeneca PLC's Tomudex®, Hoffman-LaRoche's Xeloda® (capecitabine), Immunex Corporation's Leucovorin® calcium, ImClone Systems' Erbitux™, Pfizer, Inc.'s Camptosar® (irinotecan) and Aduracil® (5-FU), Sanofi-Synthelabo Group's Eloxatin™ (oxaliplatin), Genentech's anti-VEGF antibody, Avastin™, GlaxoSmithKline's Eniluracil™, and Titan Pharmaceuticals' CeaVac™, in the treatment of patients with advanced-stage colorectal cancer. In addition, we are aware that other companies such as Cell Genesys and Dendreon may be developing additional cancer vaccines that could potentially compete with other of our product candidates. We may also face competition from Medarex and Bristol-Myers Squibb, which are developing a therapeutic vaccine for the treatment of melanoma using Medarex's MDX-010 product candidate. We also face competition from a number of companies working in the fields of anti-angiogenesis and specific active immunotherapy for the treatment of solid tumor cancers. We expect that competition among specific active immunotherapy and anti-angiogenesis products approved for sale will be based on various factors, including product efficacy, safety, reliability, availability, price and patent position.

We are aware of specific companies that are developing antibody drug conjugates (ADCs) for use in the treatment of cancer. Trastuzumab-DM1 (T-DM1) is a first-in-class HER2 antibody drug conjugate comprised of Genentech's (a Member of the Roche Group) trastuzumab antibody linked to ImmunoGen's cell-killing agent, DM1. T-DM1 combines anti-HER2 activity and targeted intracellular delivery of the potent anti-microtubule agent, DM1 (a maytansine derivative). A Phase 3 clinical trial evaluating T-DM1 for second-line HER2-positive metastatic breast cancer is planned and may be competitive with our developmental program in the breast cancer indication. Other ADCs are in development by our collaborator of the MMAE technology, Seattle Genetics, using monomethylaurastatin derivatives as the cell-killing agent in hematologic cancers and other cancers.

15

Marketed products that are used in the treatment of melanoma include dacarbazine, temozolamide, and interleukin-2. In addition, several other pharmaceutical and biotechnology companies are engaged in research and development for the treatment of melanoma. Many more products are on the market or in development for the treatment of metastatic breast cancer. How CDX-011 will compete with these other commercial and development stage products in metastatic melanoma and breast cancer is not clear at this time.

We also face competition from pharmaceutical and biotechnology companies, academic institutions, government agencies and private research organizations in recruiting and retaining highly qualified scientific personnel and consultants and in the development and acquisition of technologies. Moreover, technology controlled by third parties that may be advantageous to our business may be acquired or licensed by our competitors, thereby preventing us from obtaining technology on commercially reasonable terms, if at all. We will also compete for the services of third parties that may have already developed or acquired internal biotechnology capabilities or made commercial arrangements with other biopharmaceutical companies to target the diseases on which we have focused both in the U.S. and outside of the U.S.

Our competitive position will also depend upon our ability to attract and retain qualified personnel, obtain patent protection or otherwise develop proprietary products or processes and secure sufficient capital resources for the often lengthy period between technological conception and commercial sales. We will require substantial capital resources to complete development of some or all of our products, obtain the necessary regulatory approvals and successfully manufacture and market our products. In order to secure capital resources, we anticipate having to sell additional capital stock, which would dilute existing stockholders. We may also attempt to obtain funds through research grants and agreements with commercial collaborators. However, these types of fundings are uncertain because they are at the discretion of the organizations and companies that control the funds. As a result, we may not receive any funds from grants or collaborations. Alternatively, we may borrow funds from commercial lenders, likely at high interest rates, which would increase the risk of any investment in us.

Manufacturing

We have no experience in large scale manufacturing and we have relied upon collaborators or contractors to manufacture some of our proposed products for both clinical and commercial purposes to date. We have established our own manufacturing facility in Fall River, Massachusetts, to produce antibodies, vaccines and other products that we may develop at scale for clinical trials. In order for us to establish a commercial manufacturing facility, we will require substantial additional funds and will be required to hire and retain significant additional personnel and comply with the extensive cGMP regulations of the FDA applicable to such facility. The commercial manufacturing facility would also need to be licensed for the production of antibodies, vaccines and other products by the FDA. We intend to establish manufacturing arrangements with manufacturers that comply with the FDA's requirements and other regulatory standards, although there can be no assurance that we will be able to do so.

While we believe that there is currently sufficient capacity worldwide for the production of our potential products by our collaborators or through contract manufacturers, establishing long-term relationships with contract manufacturers and securing multiple sources for the necessary quantities of clinical and commercial materials required can be a challenge. Qualifying the initial source of clinical and ultimately commercial material is a time consuming and expensive process due to the highly regulated nature of the pharmaceutical/biotech industry. These costs are hopefully mitigated in the economies of scale realized in commercial manufacture and product sale. The key difficulty in qualifying more than one source for each product is the duplicated time and expense in doing so without the potential to mitigate these costs if the secondary source is never utilized.

16

In connection with the Pfizer Agreement, the manufacture of CDX-110 is the responsibility of Pfizer. To date, we have utilized contract manufacturers for the manufacture of clinical trial supplies of CDX-011 and CDX-1135. Manufacture of the rotavirus vaccine is the responsibility of Glaxo, which has received from us a world-wide exclusive license to commercialize this vaccine. The two clinical lots of CDX-1307 used in our completed Phase 1 clinical trials of CDX-1307 were manufactured by contract manufacturers. In 2009, we completed the manufacture of additional quantities of CDX-1307 in our Fall River facility to meet planned Phase 2 clinical material requirements. We have also manufactured in our Fall River facility CDX-1401 clinical materials for our Phase 1/2 clinical trial currently enrolling and CDX-2401 clinical materials for a Rockefeller-sponsored Phase 1 clinical trial expected to begin in the first half of 2010.

The manufacturing processes for our other vaccine and immunotherapeutic delivery systems and vaccines utilize known technologies. We believe that the products we currently have under development can be scaled up to permit manufacture in commercial quantities. However, there can be no assurance that we will not encounter difficulties in scaling up the manufacturing processes.

Use of third party manufacturers limits our control over and ability to monitor the manufacturing process. As a result, we may not be able to detect a variety of problems that may arise and may face additional costs in the process of interfacing with and monitoring the progress of our contract manufacturers. If third party manufacturers fail to meet our manufacturing needs in an acceptable manner, we would face delays and additional costs while we develop internal manufacturing capabilities or find alternative third party manufacturers. It may not be possible to have multiple third party manufacturers ready to supply us with needed material at all or without incurring significant costs.

Marketing

Under the terms of existing and future partnership agreements, we rely and expect to continue to rely on the efforts of our collaborators, including Glaxo, Pfizer, VTI, and TopoTarget/Spectrum for the sale and marketing of our products. There can be no assurance that our collaborators will develop and market vaccine products incorporating our technologies, or, if marketed, that such efforts will be successful. The failure of our collaborators to successfully market products would harm our business.

We have retained, and in the future intend to retain, marketing rights to some of our product candidates, including vaccine and immunotherapeutic delivery systems and vaccine candidates, in selected geographic areas and for specified indications. We intend to seek marketing and distribution agreements and/or co-promotion agreements for the distribution of our products in these geographic areas and for these indications. We believe that these arrangements could enable us to generate greater financial return than might be obtained from early stage licensing and collaboration agreements. We have no marketing and sales staff and limited experience relating to marketing and distribution of commercial products, including vaccines. If we determine in the future to engage in direct marketing of our products, we will be required to recruit an experienced marketing group, develop a supporting distribution capability and incur significant additional expenditures. There can be no assurance that we will be able to establish a successful marketing force. We may choose or find it necessary to enter into strategic partnerships on uncertain, but potentially unfavorable, terms to sell, market and distribute our products. Any delay in the marketing or distribution of our products, whether it results from problems with internal capabilities or with a collaborative relationship, could harm the value of an investment in us.

17

Patents, Licenses and Proprietary Rights

In general, our intellectual property strategy is to protect our technology by filing patent applications and obtaining patent rights covering our own technology, both in the United States and in foreign countries that we consider important to our business. In addition, we have acquired and will seek to acquire as needed or desired, exclusive rights of others through assignment or license to complement our portfolio of patent rights. We also rely on trade secrets, unpatented know-how and technological expertise and innovation to develop and maintain our competitive position.

Patents

The successful development and marketing of products by us will depend in part on our ability to create and maintain intellectual property, including patent rights. We are the owner or exclusive licensee to proprietary patent positions in the areas of vaccine technologies, antibody technologies and complement inhibitor technology. Although we continue to pursue patent protection for our products, no assurance can be given that any pending application will issue as a patent, that any issued patent will have a scope that will be of commercial benefit, or that we will be able to successfully enforce our patent position against infringers. We routinely review our patent portfolio and adjusts its strategies for prosecution and maintenance of individual cases according to a number of factors including program priorities, stage of development, and patent term.

We own or license rights under more than 400 granted patents and national and regional patent applications around the world covering inventions relating to our business. The key patents owned by us or licensed to us that we consider important to our business include the following (the indicated and estimated patent expiry dates do not include any possible Patent Term Extensions or Supplementary Protection Certificates, if these may be secured in due course):

- •

- Patents for the technology used in CDX-110 have expiration dates through 2014 in the United States and from

2010 to 2015 in the United Kingdom, Germany and France. A pending patent application in Japan is currently under appeal. We also have rights under patent applications around the world relating to uses

of CDX-110 which are currently pending. If issued and maintained to full term in a form which covers commercial use of CDX-110, the latter filings could potentially provide

additional patent protection for the relevant use in the relevant territories to 2026.

- •

- Our patent portfolio for CDX-011 includes pending patent applications in the US, Europe and Japan. If issued

and maintained to full term in due course, these would have estimated patent expiry dates in 2025. In addition, patent rights relating to the toxin and conjugation technology used in

CDX-011 have been licensed from Seattle Genetics.

- •

- US patents and worldwide pending patent applications for the technology used in CDX-1307 have current or

estimated expiration dates (subject to issue in the case of pending applications) that range from 2021 to 2024.

- •

- We have a pending international patent application relating to the technology used in CDX-1401 which, if

issued in the main designated territories and maintained to full term in due course, would have estimated patent expiry dates in 2028.

- •

- Patents for the technology used in CDX-301 have current expiration dates that range from 2016 in the major

European territories to 2020 in the US.

- •

- We have licensed pending patent applications in the US, Europe and Japan relating to the technology used in CDX-1127. If issued and maintained to full term in due course, these would have estimated patent expiry dates in 2027. Further filings are also under preparation.

18

- •

- Our patent portfolio for CDX-014 includes pending patent applications in the US, Europe and Japan. If issued

and maintained to full term in due course, these would have estimated patent expiry dates in 2024.

- •

- Patents for the technology used in CDX-1135 have expiration dates that range from 2013 to 2016.

- •

- Our US patent and worldwide pending patent applications for the technology used in CDX-1189 have current or

estimated expiration dates (subject to issue in the case of pending applications) in 2022.

- •

- Patents for the technology used in the cholera and typhoid vaccines expire between 2013 and 2016. Our patent portfolio for

ETEC includes pending patent applications around the world which, if issued and maintained to full term in due course, would have estimated patent expiry dates in 2028.

- •

- Licensed patents for our rotavirus strain that we licensed to Glaxo have expiration dates in 2011 and 2012.

There can be no assurance that patent applications owned by or licensed to us will result in granted patents or that, if granted, the resultant patents will afford protection against competitors with similar technology. It is also possible that third parties may obtain patents or other proprietary rights that may be necessary or useful to us. In cases where third parties are first to invent a particular product or technology, it is possible that those parties will obtain patents that will be sufficiently broad to prevent us from using important technology or from further developing or commercializing important vaccine and immunotherapeutic systems and vaccine candidates. If licenses from third parties are necessary but cannot be obtained, commercialization of the covered products might be delayed or prevented. Even if these licenses can be obtained, they would probably require us to pay ongoing royalties and other costs, which could be substantial.

Although a patent has a statutory presumption of validity in the United States, the issuance of a patent is not conclusive as to validity or as to the enforceable scope of the patent claims. The validity or enforceability of a patent after its issuance by the Patent and Trademark Office can be challenged in litigation. As a business that uses a substantial amount of intellectual property, we face a heightened risk of intellectual property litigation. If the outcome of the litigation is adverse to the owner of the patent, third parties may then be able to use the invention covered by the patent without authorization or payment. There can be no assurance that our issued patents or any patents subsequently issued to or licensed by us will not be successfully challenged in the future. In addition, there can be no assurance that our patents will not be infringed or that the coverage of our patents will not be successfully avoided by competitors through design innovation.