Attached files

his presentation contains 'forward-looking statements' within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, including without limitation those statements

regarding Minatura Gold’s ability to exploit mining concessions. The statements and

discussions contained in this presentation that are not historical facts constitute

forward-looking statements, which can be identified by the use of forward-looking

words such as "believes," "expects," "may," "intends," "anticipates," "plans,"

"estimates" and analogous or similar expressions intended to identify forward-

looking statements. Minatura Gold wishes to caution the reader of this presentation

that these forward-looking statements and estimates as to future performance,

estimates as to future valuations and other statements contained herein regarding

matters that are not historical facts, are only predictions, and that actual events or

results may differ materially. Minatura Gold cannot assure or guarantee you that any

future results described in this presentation will be achieved, and actual results could

vary materially from those reflected in such forward-looking statements. We assume

no obligation to update any forward-looking statements in order to reflect any event

or circumstance that may arise after the date of this presentation, other than as may

be required by applicable law or regulation.

Section 27A of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, including without limitation those statements

regarding Minatura Gold’s ability to exploit mining concessions. The statements and

discussions contained in this presentation that are not historical facts constitute

forward-looking statements, which can be identified by the use of forward-looking

words such as "believes," "expects," "may," "intends," "anticipates," "plans,"

"estimates" and analogous or similar expressions intended to identify forward-

looking statements. Minatura Gold wishes to caution the reader of this presentation

that these forward-looking statements and estimates as to future performance,

estimates as to future valuations and other statements contained herein regarding

matters that are not historical facts, are only predictions, and that actual events or

results may differ materially. Minatura Gold cannot assure or guarantee you that any

future results described in this presentation will be achieved, and actual results could

vary materially from those reflected in such forward-looking statements. We assume

no obligation to update any forward-looking statements in order to reflect any event

or circumstance that may arise after the date of this presentation, other than as may

be required by applicable law or regulation.

1

Minatura

Gold (MGOL.OB) is a US based public

company

company

Minatura

Gold (MGOL.OB) is a US based public

company

company

in the business of exploration, development and,

ultimately, extraction

ultimately, extraction

in the business of exploration, development and,

ultimately, extraction

ultimately, extraction

of precious metals in Colombia, South America. Minatura

is dedicated

is dedicated

of precious metals in Colombia, South America. Minatura

is dedicated

is dedicated

to achieving a high return for its investors while adhering

to the

to the

to achieving a high return for its investors while adhering

to the

to the

highest environmental standards in its projects and

creating legacy

creating legacy

highest environmental standards in its projects and

creating legacy

creating legacy

micro-economies for the communities in which Minatura

operates.

operates.

micro-economies for the communities in which Minatura

operates.

operates.

Our Mission.

2

vMinatura Gold is a mineral exploration and development company focused on gold

deposits covering 88,000 acres of property in Colombia.

deposits covering 88,000 acres of property in Colombia.

vMinatura is currently focusing on developing measured resources in four projects in the

Departments of Antioquia and Bolivar.

Departments of Antioquia and Bolivar.

vThe Anorí Project has produced strong initial data on the samples and vein

outcroppings with strong references into active and inactive underground tunnels.

outcroppings with strong references into active and inactive underground tunnels.

vThe Remedios Project is the location of Minatura’s first underground pilot mine and is

in the immediate area of the most important underground gold mine in South America.

in the immediate area of the most important underground gold mine in South America.

vThe Zaragoza Project is rapidly advancing with the commencement of a drilling

program and the engagement of MTI Holland (a division of IHC Merwede), a world

renowned alluvial mining consulting firm which is preparing a feasibility study to mine the

area and advising Minatura on the design and implementation of the dredge and gold

recovery equipment.

program and the engagement of MTI Holland (a division of IHC Merwede), a world

renowned alluvial mining consulting firm which is preparing a feasibility study to mine the

area and advising Minatura on the design and implementation of the dredge and gold

recovery equipment.

Overview.

3

vMinatura engaged Watts, Griffis & McOuat to produce its first SEC Form 7/NI 43-101

technical report on the Zaragoza Project in Q2 2010.

technical report on the Zaragoza Project in Q2 2010.

vWith the dramatic improvement in the political and economic climate in Colombia, and

the influx of foreign investments, Minatura strongly believes in a secure and stable

Colombian marketplace ready to accept substantial capital towards proving out the precious

metals reserves in our mining titles.

the influx of foreign investments, Minatura strongly believes in a secure and stable

Colombian marketplace ready to accept substantial capital towards proving out the precious

metals reserves in our mining titles.

vIn the development of its concessions, Minatura must adhere to the highest

environmental standards and develop and maintain the support of the small communities in

the environs of its operations.

environmental standards and develop and maintain the support of the small communities in

the environs of its operations.

Overview.

4

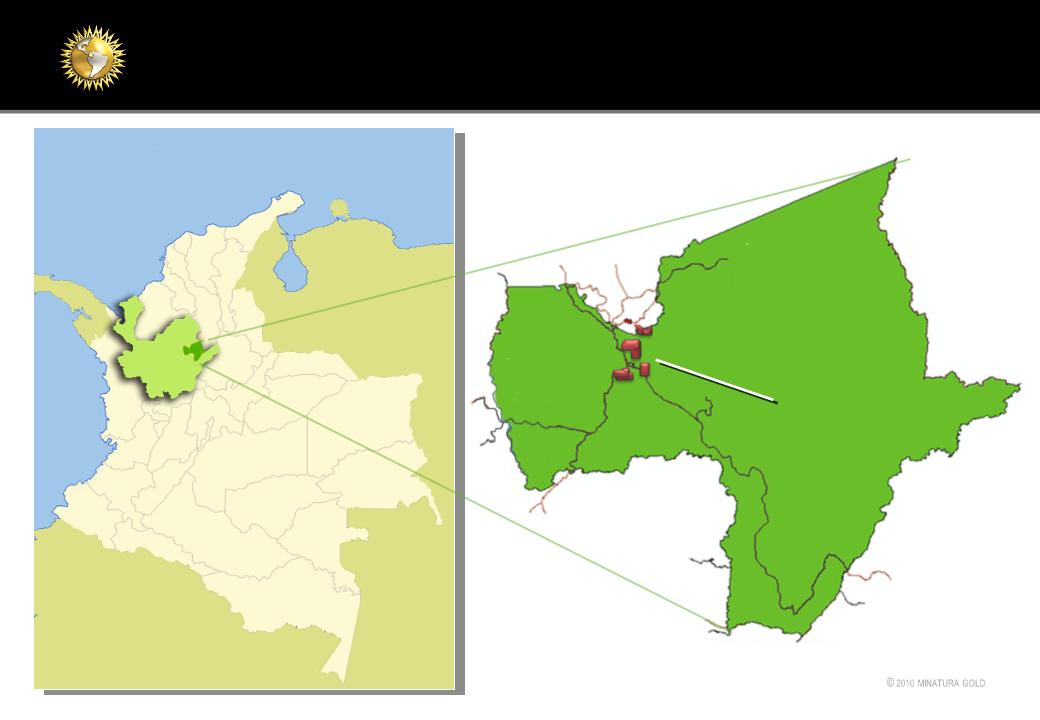

vColombia produced 40% of the

World’s gold through the end of the 19th

century.

World’s gold through the end of the 19th

century.

vDue to political instability, Colombia’s

gold deposits were not developed in the

20th century, as were other major

deposits in the World. During this time,

many advances in mining and recovery

technology occurred.

gold deposits were not developed in the

20th century, as were other major

deposits in the World. During this time,

many advances in mining and recovery

technology occurred.

Bogotá

Bogotá

Colombia's emerging market report.

5

* "Democratic Security Benefits for the Mining Sector" Boletin Dexde la Colombia Minera -Bogota,

2/10/2010

vThe Colombian government takes a pro-active role in decreasing security issues to

manageable and tolerable levels.

manageable and tolerable levels.

vCrime rates in Colombia are decreasing in comparison to the increase in neighboring

countries.

countries.

vFARC has been materially weakened, other armed forces have been demobilized and great

strides have been made in eradicating illicit drug production and smuggling operations.

strides have been made in eradicating illicit drug production and smuggling operations.

vUltimately, violent crimes targeting individuals and infrastructure have fallen over 70% in the

last 8 years.*

last 8 years.*

vIn more than the past 10 years, Colombia has demonstrated a strong trend towards

privatization in all sectors of the economy.

privatization in all sectors of the economy.

vWidespread government support for free market economy and foreign investment.

vColombian commercial and mining laws strongly support foreign investment and ownership.

vThe world’s largest alluvial gold operation, Mineros SA, is in Colombia and operates near our

Zaragoza project.

Zaragoza project.

Colombia's emerging market report.

6

vColombia contains all of the elements for a long term gold rush. Minatura has

positioned itself to capitalize on this unique opportunity with the best mineral rights and

land positioning

positioned itself to capitalize on this unique opportunity with the best mineral rights and

land positioning

vMinatura acquired strong mining rights positions over the past eight years in the most

desirable mining districts in Colombia.

desirable mining districts in Colombia.

vMinatura enjoys long-term positive relations with local communities, the Colombian

mining industry, and political leaders

mining industry, and political leaders

vMinatura employs experienced Native Colombian mining executives who have worked

in the Colombian mining industry their entire careers. These executives possess invaluable

local knowledge and in-country experience.

in the Colombian mining industry their entire careers. These executives possess invaluable

local knowledge and in-country experience.

vMinatura acquired many invaluable mineral rights concessions during a period of low

competition due to the past difficult political climate.

competition due to the past difficult political climate.

vMinatura’s qualified and knowledgeable Colombian geologists and engineers provide the

ability to move strategically in Colombia.

ability to move strategically in Colombia.

Colombia's emerging market report.

7

vRoyal Bank of Scotland recently reported that, “Colombia’s story is equally impressive but

perhaps understated, and we believe it will remain one of Latin America’s most attractive

investment opportunities over the next 5 years. We believe that in a new world of scarcer

capital and credit, Colombia stands relatively better positioned to be a winner among

Emerging Markets.”

perhaps understated, and we believe it will remain one of Latin America’s most attractive

investment opportunities over the next 5 years. We believe that in a new world of scarcer

capital and credit, Colombia stands relatively better positioned to be a winner among

Emerging Markets.”

vIntroduced in 2005, Colombia offers Legal Stability Contracts. These contracts offer

investors the opportunity to enter into a contract with the government guaranteeing that the

laws applicable to the investment at the time the investment is entered will remain in effect

for up to 20 yrs.

investors the opportunity to enter into a contract with the government guaranteeing that the

laws applicable to the investment at the time the investment is entered will remain in effect

for up to 20 yrs.

vPrudent economic policy, government investment in infrastructure, progress on

privatization, an attractive tax regime, liberalized capitol flow and investment rules have

resulted in an unprecedented investment in Colombia by foreign firms.

privatization, an attractive tax regime, liberalized capitol flow and investment rules have

resulted in an unprecedented investment in Colombia by foreign firms.

vColombia has become an FDI magnet, with annual FDI intake reaching +10.6bn in 2008

and averaging +5.6bn per year in the 2000’s. Much of this recent investment has been

generated by the mining and energy sectors.

and averaging +5.6bn per year in the 2000’s. Much of this recent investment has been

generated by the mining and energy sectors.

Source: Central Bank (Banco de Republica), calculations: UPME

* Excluding the sale of Bavaria

Foreign Direct Investment

in Colombia by sector-

2005*

2005*

Transportation

Warehousing

Warehousing

& Communications

17.7%

Oil & Gas

21.8%

Other Sectors

7.7%

Mining & Quarrying 38.3% (includes

coal)

coal)

Manufacturing

14.5%

Agriculture, Hunting,

Fishing & Fish

Farming

Farming

0.1%

Colombia's emerging market report.

8

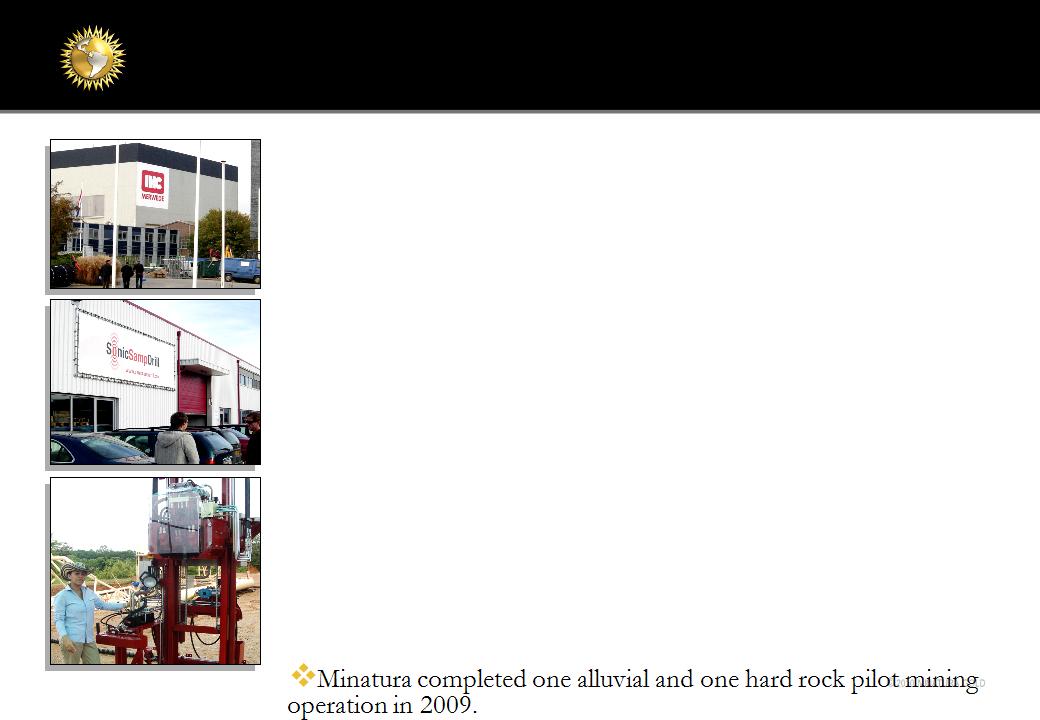

vMinatura contracted MTI Holland (a division of IHC Merwede),

the leading alluvial mining consultation firm to recommend large scale

mining equipment and recovery systems and prepare feasibility

studies.

the leading alluvial mining consultation firm to recommend large scale

mining equipment and recovery systems and prepare feasibility

studies.

vMinatura employs state of the art SonicSamp self-propelled drilling

technology to explore alluvial areas at a substantially increased rate

over traditional drilling methods.

technology to explore alluvial areas at a substantially increased rate

over traditional drilling methods.

vMinatura commenced technical analysis and drilling programs to

deliver SEC Form 7/NI 43-101 (independent geological report) in Q2

2010 on the Zaragoza Project using 6” churn drills, and SonicSamp

drills. Early samples show favorable results.

deliver SEC Form 7/NI 43-101 (independent geological report) in Q2

2010 on the Zaragoza Project using 6” churn drills, and SonicSamp

drills. Early samples show favorable results.

vMinatura engaged Watts, Griffis & McOuat to produce its first

SEC Form 7/NI 43-101 technical report on the Zaragoza Project in

Q2 2010.

SEC Form 7/NI 43-101 technical report on the Zaragoza Project in

Q2 2010.

vMinatura intends to commence additional drilling projects in 2010

on hard rock and alluvial sites.

on hard rock and alluvial sites.

vOne alluvial (Zaragoza) and four hard rock opportunities ready for

immediate exploration (Anorí, Remedios, Alacran and Nechi).

immediate exploration (Anorí, Remedios, Alacran and Nechi).

Moving Forward.

9

v The Zaragoza Project is flanked by the World’s largest alluvial gold mining project,

Mineros SA. Minatura anticipates expanding the Zaragoza Project, and expects

significant results in this historically proven area.

Mineros SA. Minatura anticipates expanding the Zaragoza Project, and expects

significant results in this historically proven area.

v 2010 will mark major advances in proven resources, and announcements of further

exploration and development of the Minatura’s mining rights.

exploration and development of the Minatura’s mining rights.

v Recently, key management positions have been filled. Minatura is strategically

planning to fill the remaining positions with top quality people in Q2 2010.

planning to fill the remaining positions with top quality people in Q2 2010.

Moving Forward.

1

0

0

Antioquia

Zarago

za

za

Antioquia

Ano

rí

rí

Antioquia

Remedios

2010 Projects.

1

1

1

Coco Hondo

Coco Hondo

Angostura

Angostura

Colombia

Colombia

Antioquia

Zaragoza

Zaragoza Project.

1

2

2

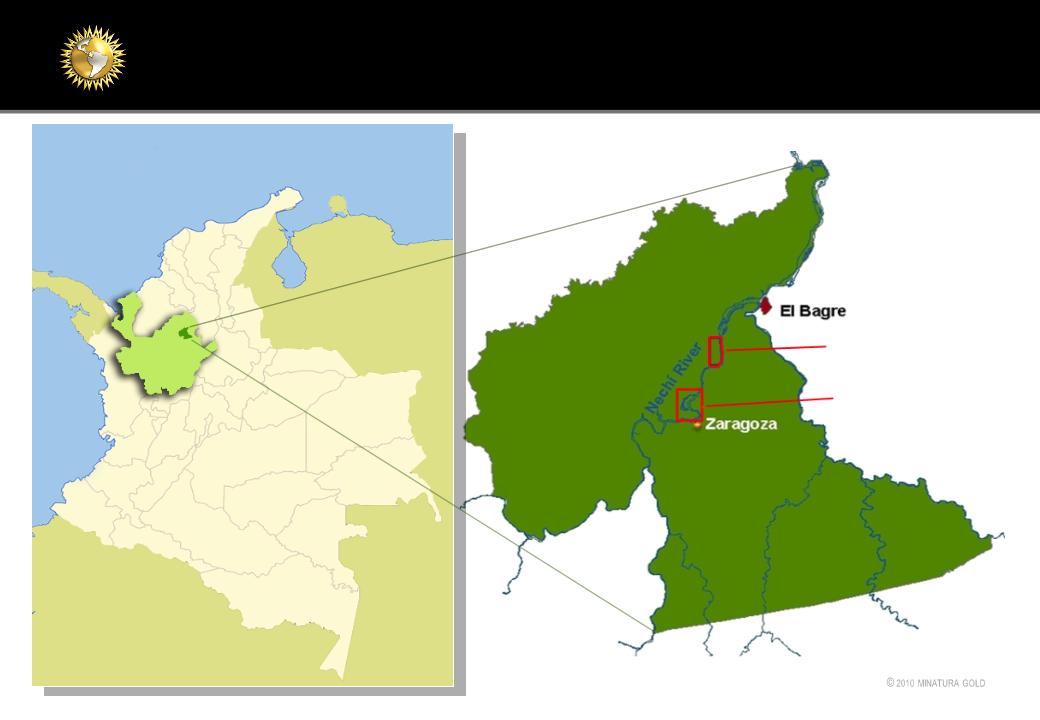

vThe Zaragoza Project consists of the Coco Hondo and Angostura Properties totaling

1,775 acres.

1,775 acres.

vThese properties are covered with gold bearing quaternary floodplain deposits straddling

the Nechi River

the Nechi River

and its banks.

vDownstream from these properties, Mineros, Colombia’s largest gold producer runs an

alluvial gold project which produces approximately 115,000 ounces of gold per year with

four bucket ladder dredges.

alluvial gold project which produces approximately 115,000 ounces of gold per year with

four bucket ladder dredges.

vAn estimated 50 million cubic meters of gravel has been dredged from the two properties

and over 700,000 ounces of gold recovered. It is anticipated that these inefficient dredges

have only recovered 50% of the gold. Preliminary test work of the tailings by Minatura has

shown grades of over 400 mg/m3.

and over 700,000 ounces of gold recovered. It is anticipated that these inefficient dredges

have only recovered 50% of the gold. Preliminary test work of the tailings by Minatura has

shown grades of over 400 mg/m3.

vMinatura is conducting a comprehensive Drilling & Sampling Program to verify previous

drill data.

drill data.

Zaragoza Project.

1

3

3

Grade mg/m3

0 - 178

179 - 451

452 - 766

767 - 1327

1328 - 6416

New drills

Trenches

Plato's Drill

Drainage

Historical Drilling

and

and

Mining Values.

Zaragoza Project.

1

4

4

vThree 6” Churn Drills

vTwo 5³/8” RotoSonic Drills.

vDrilling contract services with SonicSamp Drilling with four drill masters

vInstalling Bulk Sampling Plant for tailings processing

vLeading alluvial engineer overseeing project (John Rae)

vTest drilling showing 200 mg - 600 mg per m³

Feasibilit

y

vEngaged MTI Holland (leading alluvial consulting firm) to conduct alluvial projects

feasibility studies.

feasibility studies.

vEngaged Watts, Griffis and McOuat to prepare SEC Form 7/ NI 43-101

Geotechnical Report.

Geotechnical Report.

Drilling

Program

Program

Exploratio

n

Zaragoza Project.

1

5

5

Anorí

Anorí

Nechi River

Colombia

Colombia

Antioquia

Porche River

Contract

2,689 acres

Anorí

Anorí Project.

1

6

6

vAnorí’s historical importance as a very important

alluvial and hard rock gold mining district reaches

back to the 1830’s.

alluvial and hard rock gold mining district reaches

back to the 1830’s.

vThe most important mines in the area were La

Constancia, Santa Ana, San Benigno and El Violín.

La Constancia was one of the richest gold mines in

Colombia.

Constancia, Santa Ana, San Benigno and El Violín.

La Constancia was one of the richest gold mines in

Colombia.

vThe Anorí Project has one mining contract with

an area of 1,527 acres.

an area of 1,527 acres.

vThere are many smaller local mines that are

currently producing using antiquated technology and

limited capital investment.

currently producing using antiquated technology and

limited capital investment.

vYamana Gold is exploring an area immediately

adjacent to our concessions.

adjacent to our concessions.

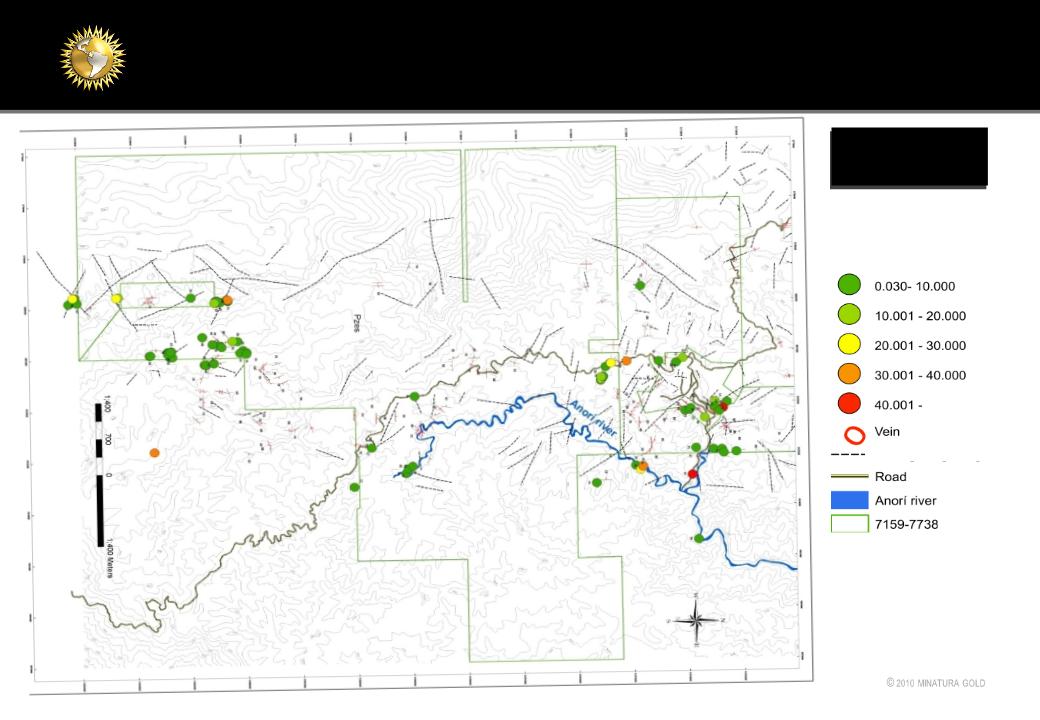

vMinatura compiled a database that geo-references

the samples and vein outcroppings as well as active

and inactive underground tunnels. The results are

strong and we will be moving to the next phase of

development.

the samples and vein outcroppings as well as active

and inactive underground tunnels. The results are

strong and we will be moving to the next phase of

development.

Anorí Project.

1

7

7

SAMPLING

S

FINDINGS

Photogeological

lineament

lineament

Gold Grade (g/ton)

Minimum: 0.03

Maximum: 112.45

150.00

Anorí Project.

1

8

8

Antioquia

Contracts

Colombia

Colombia

Remedios

Remedios

Remedios

Remedios Project.

1

8

8

vMinatura’s San Pablo hard rock mine with processing plant and surrounding mining rights

are located in the same region as well as on the same vein structure as Frontino Gold Mines,

the largest and most important hard rock gold mine in South America.

are located in the same region as well as on the same vein structure as Frontino Gold Mines,

the largest and most important hard rock gold mine in South America.

vFrontino’s operation has been active for more than 155 years, and currently produces 500

tons of ore per day.

tons of ore per day.

vMinatura owns seven mining contracts in this area. San Pablo gold mine is an operative

mine complete with a camp, laboratory, and a recovery plant capable of processing 100 tons

per day.

mine complete with a camp, laboratory, and a recovery plant capable of processing 100 tons

per day.

Remedios Project.

2

0

0

Paved Road to Mine

Remedios Airport

Mine Site: San Pablo Gold

Mine

Mine

© 2010 MINATURA GOLD

Remedios Project.

2

1

1

vMinatura’s Environmental Management Department (DGA) is implementing a

program based on the ISO 4001 Environment Management System. This model

exceeds Colombia's standards and is based on the US EPA recommendations.

program based on the ISO 4001 Environment Management System. This model

exceeds Colombia's standards and is based on the US EPA recommendations.

v The DGA supports exploration projects by conducting environmental risk and

opportunity studies, obtaining permits as required and collaborating with

development teams to incorporate sound environmental designs from the beginning.

opportunity studies, obtaining permits as required and collaborating with

development teams to incorporate sound environmental designs from the beginning.

vDGA’s other work includes a constant field presence by an Environmental

Technician, field visits by both the Forestry Engineer and director, supervision of

contractors, and reporting on activities.

Technician, field visits by both the Forestry Engineer and director, supervision of

contractors, and reporting on activities.

Minatura has approved PMAs for the Zaragoza Project and the San Pablo Gold

Mine.

Mine.

Mining With Respect.

2

2

2

Community.

vSmall communities in the mining regions of Colombia suffer from underdevelopment

and few employment opportunities. Illegal mining operations exacerbate these unfortunate

conditions by disregarding environmental standards and by exploiting local labor.

and few employment opportunities. Illegal mining operations exacerbate these unfortunate

conditions by disregarding environmental standards and by exploiting local labor.

vMinatura builds beneficial relationships with local communities to develop micro-

economies and improve the overall quality of life.

economies and improve the overall quality of life.

2

3

3

Organization.

2

4

4

History: Minatura

Gold (“MGOL”) was formed as a Nevada corporation in January

2007 as Boatatopia. It changed its name to Minatura Gold in 2009. MGOL acquired

its current assets from a consortium of US and Colombian companies in November

and December 2009.

2007 as Boatatopia. It changed its name to Minatura Gold in 2009. MGOL acquired

its current assets from a consortium of US and Colombian companies in November

and December 2009.

Capitalization: MGOL has 1,000,000,000 shares of

common stock, $.001 par value,

authorized, 10,000,000 shares of preferred stock, $.001 par value, authorized and

17,010,066 shares of common stock currently issued and outstanding. There are no

warrants or options outstanding.

authorized, 10,000,000 shares of preferred stock, $.001 par value, authorized and

17,010,066 shares of common stock currently issued and outstanding. There are no

warrants or options outstanding.

Public Market: Our Common Stock is quoted on the OTC Bulletin Board under the

symbol MGOL. On January 31, 2010, the last recorded closing price of the Common

Stock, as reported by the OTC Bulletin Board, was $8.50 per share. The range of last

sales prices over the previous 52 weeks included a high of $9.25 per share and a low of

$4.10. Volume has been low.

symbol MGOL. On January 31, 2010, the last recorded closing price of the Common

Stock, as reported by the OTC Bulletin Board, was $8.50 per share. The range of last

sales prices over the previous 52 weeks included a high of $9.25 per share and a low of

$4.10. Volume has been low.

Shareholders: 65% of our outstanding common stock is owned by Minatura

International LLC. Paul Dias’ affiliates own 65% of this company. Our next largest

shareholder of MGOL owns beneficially less than 7% of MGOL’s stock.

International LLC. Paul Dias’ affiliates own 65% of this company. Our next largest

shareholder of MGOL owns beneficially less than 7% of MGOL’s stock.

MGOL- Corporate Overview.

2

5

5

Paul R. Dias Director, CEO

Paul Dias is the original founder of the companies from which the

Company acquired its assets. A financier and venture capitalist with over

20 years of international business experience, he has worked for

numerous companies in natural resources, information technology and

alternative health sectors. Mr. Dias has been exclusively involved in the

acquisition, exploration, and development of mineral concessions in

Colombia since 2001. Mr. Dias is fluent in Spanish.

Company acquired its assets. A financier and venture capitalist with over

20 years of international business experience, he has worked for

numerous companies in natural resources, information technology and

alternative health sectors. Mr. Dias has been exclusively involved in the

acquisition, exploration, and development of mineral concessions in

Colombia since 2001. Mr. Dias is fluent in Spanish.

Tod M. Turley, Chief Operating Officer

Tod Turley joined the Company as its Chief Operating Officer in

January 2010. Previous to that, Mr. Turley served as the Chairman and

CEO of Amerivon Holdings LLC, a niche private equity investment

firm specializing in high potential growth consumer product and

services companies. Earlier, he served for 13 years as a corporate

attorney and executive with emerging growth companies. Mr. Turley

graduated from the University of Utah in 1985 with a BA in Economics

and French, and subsequently graduated from the University of

Southern California with a J.D. in 1988.

January 2010. Previous to that, Mr. Turley served as the Chairman and

CEO of Amerivon Holdings LLC, a niche private equity investment

firm specializing in high potential growth consumer product and

services companies. Earlier, he served for 13 years as a corporate

attorney and executive with emerging growth companies. Mr. Turley

graduated from the University of Utah in 1985 with a BA in Economics

and French, and subsequently graduated from the University of

Southern California with a J.D. in 1988.

MGOL Key Management.

2

6

6

MGOL Key Management.

Juan David Perez, President

Mr. Perez is a US citizen who has lived in Colombia for most of his life. He

was a consultant to business and government on numerous alluvial mining

and exploration projects in Colombia for over 30 years. From 2003 to 2008,

Mr. Perez was General Manager and a Co-founder of Promocion de

Proyectos Mineros (PPM). He was also Professor at the Faculty of Mines in

Medellin from 1984 to 2007. Mr. Perez graduated with a degree in mining

engineering from the Universidad Nacional in Colombia and completed

postgraduate studies in the UK at the University of Nottingham. Mr. Perez is

bi-lingual in English and Spanish.

was a consultant to business and government on numerous alluvial mining

and exploration projects in Colombia for over 30 years. From 2003 to 2008,

Mr. Perez was General Manager and a Co-founder of Promocion de

Proyectos Mineros (PPM). He was also Professor at the Faculty of Mines in

Medellin from 1984 to 2007. Mr. Perez graduated with a degree in mining

engineering from the Universidad Nacional in Colombia and completed

postgraduate studies in the UK at the University of Nottingham. Mr. Perez is

bi-lingual in English and Spanish.

Kelly Barker Chief Financial Officer

Mr. Barker has over 25 years as a financial executive, with his last

position as Vice President of Finance with AmPac Tire

Distribution, Inc. a national tire distributor and retailer. Previous

to that, Mr. Barker served as the Vice President/Controller of

Metromedia Technologies, Inc., a worldwide printer of large

format for the outdoor media industry. Earlier, he served for

Deloitte & Touche as a Big 4 auditor and CPA. Mr. Barker

graduated from the Brigham Young University in 1982 with a BA

in Accounting.

position as Vice President of Finance with AmPac Tire

Distribution, Inc. a national tire distributor and retailer. Previous

to that, Mr. Barker served as the Vice President/Controller of

Metromedia Technologies, Inc., a worldwide printer of large

format for the outdoor media industry. Earlier, he served for

Deloitte & Touche as a Big 4 auditor and CPA. Mr. Barker

graduated from the Brigham Young University in 1982 with a BA

in Accounting.

2

7

7

Claudia Herrera V.P. Corporate Affairs and Business Development

Claudia Herrera joined Minatura in 2008; she is an expert in Colombian mining

management, mining contracts, and administrative organization. Ms. Herrera

graduated with a degree in Economics from Universidad Nacional de Colombia

in November of 1999. Ms. Herrera continued on to Universidad Militar Nueva

Granada for her Law Degree graduating Cum Laude in October 2002. Ms.

Herrera has interfaced between the government and private sector in many

negotiations including contracts for Cerejon and Drummond. She speaks both

English and Spanish.

management, mining contracts, and administrative organization. Ms. Herrera

graduated with a degree in Economics from Universidad Nacional de Colombia

in November of 1999. Ms. Herrera continued on to Universidad Militar Nueva

Granada for her Law Degree graduating Cum Laude in October 2002. Ms.

Herrera has interfaced between the government and private sector in many

negotiations including contracts for Cerejon and Drummond. She speaks both

English and Spanish.

John A. Rae , P. Geo V.P. Alluvial Operations

John Rae brings 25 years of experience in designing and implementing process

plants and mine equipment and the management of mining projects from

grassroots exploration to commercial production for alluvial gold and platinum

mining. Mr. Rae is a professional geoscientist registered as a member of the

Association of Professional Geoscientists of Ontario, Canada, and is a graduate

of Hailbury School of Mines in Ontario. Mr. Rae worked for and continues to

associate with Watts, Griffis and McOuat, an internationally known geological

and engineering consulting group.

plants and mine equipment and the management of mining projects from

grassroots exploration to commercial production for alluvial gold and platinum

mining. Mr. Rae is a professional geoscientist registered as a member of the

Association of Professional Geoscientists of Ontario, Canada, and is a graduate

of Hailbury School of Mines in Ontario. Mr. Rae worked for and continues to

associate with Watts, Griffis and McOuat, an internationally known geological

and engineering consulting group.

MGOL Key Management.

2

8

8

MGOL Key Management.

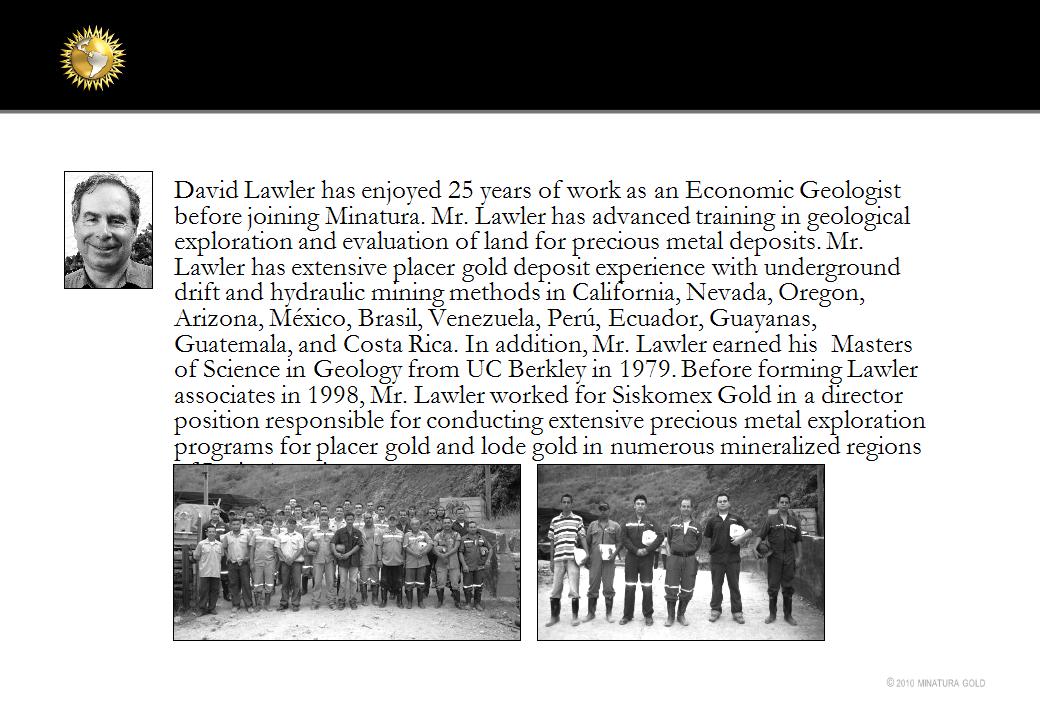

David Lawler Senior Geologist

2

9

9

www.wgm.ca

www.mtiholland.co

m

m

MTI HOLLAND

WATTS, GRIFFIS, and McOUAT

MGOL Key Consultants.

3

0

0

For further information or inquiries,

please contact us at:

Minatura

2831 St. Rose Parkway #265

Henderson, NV 89052

T/F (775) 980-1490

info@minaturagold.c

om

om