Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - Assertio Therapeutics, Inc | a2197080zex-32_1.htm |

| EX-23.1 - EXHIBIT 23.1 - Assertio Therapeutics, Inc | a2197080zex-23_1.htm |

| EX-32.2 - EXHIBIT 32.2 - Assertio Therapeutics, Inc | a2197080zex-32_2.htm |

| EX-31.2 - EXHIBIT 31.2 - Assertio Therapeutics, Inc | a2197080zex-31_2.htm |

| EX-31.1 - EXHIBIT 31.1 - Assertio Therapeutics, Inc | a2197080zex-31_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark One) | ||

ý |

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

|

For the fiscal year ended December 31, 2009 |

||

OR |

||

o |

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

|

For the transition period from: to |

||

Commission File Number: 001-13111

DEPOMED, INC.

(Exact Name of Registrant as Specified in its Charter)

| California | 94-3229046 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

1360 O'Brien Drive, Menlo Park, California |

94025 |

|

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (650) 462-5900

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

|---|---|---|

| Common Stock, no par value | The NASDAQ Stock Market LLC |

Securities

registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer, as defined in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant based upon the closing price of Common Stock on the Nasdaq Stock Market on June 30, 2009 was approximately $143,091,000. Shares of Common Stock held by each officer and director and by each person who owned 10% or more of the outstanding Common Stock as of June 30, 2009 have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares outstanding of the registrant's Common Stock, no par value, as of March 5, 2010 was 52,330,443.

Documents Incorporated by Reference

Portions of the registrant's Proxy Statement, which will be filed with the Securities and Exchange Commission pursuant to Regulation 14A in connection with the registrant's 2010 Annual Meeting of Shareholders, expected to be held on or about May 20, 2010, are incorporated by reference in Part III of this Form 10-K.

DEPOMED, INC.

2009 FORM 10-K REPORT

TABLE OF CONTENTS

2

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Statements made in this Annual Report on Form 10-K that are not statements of historical fact are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the Securities Act), and Section 21E of the Securities Exchange Act of 1934, as amended. We have based these forward-looking statements on our current expectations and projections about future events. Our actual results could differ materially from those discussed in, or implied by, these forward-looking statements. Forward-looking statements are identified by words such as "believe," "anticipate," "expect," "intend," "plan," "will," "may" and other similar expressions. In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances are forward-looking statements. Forward-looking statements include, but are not necessarily limited to, those relating to:

- •

- regulatory filings and approval of DM-1796 for postherpetic neuralgia;

- •

- the commercial success and market acceptance of DM-1796 if it is approved for marketing in the United States,

and the efforts of Abbott Laboratories' subsidiary, Solvay Pharmaceuticals, Inc. (Solvay), with respect to the commercialization of DM-1796;

- •

- results and timing of our clinical trials, including the results of our Serada™ Phase 3 trial for

menopausal hot flashes;

- •

- the commercial success and market acceptance of Serada if we receive approval to market Serada in the United States;

- •

- the commercial success of GLUMETZA® (metformin hydrochloride extended release tablets) in the United States,

and the efforts of Santarus, Inc. (Santarus) with respect to the commercialization of GLUMETZA;

- •

- the results of our ongoing litigation against Lupin Limited (Lupin) related to Lupin's abbreviated New Drug Application

(ANDA) to market generic GLUMETZA in the United States;

- •

- the results of our research and development efforts;

- •

- submission, acceptance and approval of regulatory filings;

- •

- our need for, and ability to raise additional capital;

- •

- our collaborative partners' compliance or non-compliance with their obligations under our agreements with

them; and

- •

- our plans to develop other product candidates.

Factors that could cause actual results or conditions to differ from those anticipated by these and other forward-looking statements include those more fully described in the "ITEM 1A. RISK FACTORS" section and elsewhere in this Annual Report on Form 10-K. We disclaim any intent to update or revise these forward-looking statements to reflect new events or circumstances.

The address of our Internet website is http://www.depomed.com. We make available, free of charge through our website or upon written request, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other periodic SEC reports, along with amendments to all of those reports, as soon as reasonably practicable after we file the reports with the SEC.

Unless the context indicates otherwise, "Depomed", "the Company", "we", "our" and "us" refer to Depomed, Inc. Depomed was incorporated in the State of California on August 7, 1995. Our principal executive offices are located at 1360 O'Brien Drive, Menlo Park, California 94025, and our telephone number is (650) 462-5900.

Depomed®, Proquin®, and AcuForm® are registered trademarks of Depomed. SeradaTM is a trademark of Depomed. GLUMETZA® is a registered trademark of Biovail Laboratories, s.r.l. exclusively licensed in the United States to Depomed. All other trademarks and trade names referenced in this Annual Report on Form 10-K are the property of their respective owners.

3

COMPANY OVERVIEW

Depomed is a specialty pharmaceutical company focused on the development and commercialization of differentiated products that address large and growing markets and are based on proprietary oral drug delivery technologies. In 2009, we completed Phase 3 clinical trials for two product candidates. In October 2009, we announced that DM-1796, an extended release formulation of gabapentin for the treatment of postherpetic neuralgia that we have licensed to Abbott Laboratories' subsidiary, Solvay Pharmaceuticals, Inc. (Solvay) met its Phase 3 clinical trial primary endpoint with statistical significance. We anticipate a New Drug Application (NDA) for DM-1796 will be filed with the FDA in March 2010. Also in October 2009, we announced the results of Breeze 1 and Breeze 2, our Phase 3 clinical trials for Serada, our proprietary extended release formulation of gabapentin for the treatment of menopausal hot flashes. The higher dose formulation of Serada evaluated in the studies met five of eight co-primary endpoints across the two studies, while the lower dose formulation evaluated met four of eight co-primary endpoints. In December 2009, we met with the FDA to discuss the results of the Breeze 1 and Breeze 2 studies and any additional clinical development that may be required to obtain approval to market Serada in the United States. Based on guidance from the meeting with the FDA, we expect to initiate one additional Phase 3 trial for Serada by the end of April 2010.

We seek to optimize the use and value of our product candidates and drug delivery technologies in three ways. First, we are seeking to assemble a number of pharmaceutical products that can be highly differentiated from immediate release versions of the compounds upon which they are based and may be promoted together within a specialty pharmaceutical field, such as women's health care providers. Our development of Serada, and our retention of co-promotion rights within the obstetrics/gynecology field in our commercialization arrangements with Covidien, Ltd. (Covidien) and Santarus, Inc. (Santarus), are examples of this aspect of our business strategy. Second, we out-license product candidates after we have increased their value through our formulation and clinical development efforts. Our DM-1796 license and development arrangement with Solvay is an example of this strategy. Third, we enter into collaborative partnerships with other companies where the unique capabilities of our technology can provide superior value to a partner's product candidate, resulting in greater value for Depomed than traditional fee-for-service arrangements. Our license and development arrangement with Covidien and our license agreement with Merck & Co., Inc. (Merck) are examples of this strategy.

We have developed two products which have been approved by the FDA and are currently marketed. GLUMETZA is a once-daily treatment for adults with type 2 diabetes that we commercialize in the United States with Santarus. Proquin® XR (ciprofloxacin hydrochloride) is a once-daily treatment for uncomplicated urinary tract infections.

4

The following table summarizes our product pipeline and marketed products.

| Product Pipeline | ||||

Product |

Indication |

Status |

||

|---|---|---|---|---|

| DM-1796 | Postherpetic neuralgia | Phase 3 study completed. New Drug Application expected to be submitted to the FDA by March 2010. Licensed to Solvay in the United States, Mexico and Canada. |

||

SeradaTM |

Menopausal hot flashes |

Phase 3 studies completed (Breeze 1 and Breeze 2). One additional Phase 3 study (Breeze 3) expected to be initiated in Q2 2010. |

||

DM-3458 |

Gastroesophageal reflux disease |

Proof of concept studies completed. |

||

DM-1992 |

Parkinson's disease |

Phase 1 study completed. Second Phase 1 study expected to be initiated in 2010. |

||

Marketed Products |

||||

GLUMETZA® |

Type 2 diabetes |

Currently sold in the United States and Canada. Co-promoted in the United States with Santarus. Canadian rights held by Biovail. Korean rights held by LG Life Sciences. |

||

Proquin® XR |

Uncomplicated urinary tract infections |

Currently sold in the United States. European rights held by Rottapharm/Madaus. |

||

SIGNIFICANT DEVELOPMENTS DURING 2009

Among the significant developments in our business during 2009 were the following:

- •

- In January 2009, our license agreement with Solvay related to DM-1796 became effective after clearance of the

transaction under the HSR Antitrust Improvements Act of 1976. Pursuant to the agreement, Solvay paid us a $25.0 million upfront fee in February 2009.

- •

- In February 2009 and in March 2009, we completed enrollment of our Breeze 1 and Breeze 2 Phase 3 clinical trials

for Serada for the treatment of menopausal hot flashes.

- •

- In February 2009, we dosed the first patient in a Phase 1 clinical trial for our DM-1992 program in

Parkinson's disease.

- •

- In June 2009, we completed enrollment of our Phase 3 clinical trial for DM-1796 for the treatment of

postherpetic neuralgia.

- •

- In May 2009, Shay Weisbrich was appointed as our Vice President, Marketing.

- •

- In July 2009, we entered into a non-exclusive license agreement with Merck granting Merck a license to certain

patents related to our metformin extended release technology to be used in developing fixed dose combinations of sitagliptin and extended release metformin. Pursuant to the agreement, Merck paid us a

$10.0 million upfront fee in July 2009.

- •

- In August 2009, we announced the results of our Phase 1 clinical trial for our DM-1992 program in Parkinson's disease.

5

- •

- In October 2009, we delivered the first formulation under our agreement with Covidien, which triggered a

$0.5 million milestone payment to us.

- •

- In October 2009, we announced the primary endpoint of reducing pain was met with statistical significance in our

Phase 3 clinical trial for DM-1796 for the treatment of postherpetic neuralgia.

- •

- In October 2009, we announced the results of Breeze 1 and Breeze 2, our Phase 3 clinical trials for Serada for the

treatment of menopausal hot flashes. The higher dose formulation of Serada (1800mg) evaluated in the studies met five of eight co-primary endpoints across the two studies, while the lower

dose formulation (1200mg) evaluated met four of eight co-primary endpoints.

- •

- In November 2009, William Callahan was appointed as our Vice President, Operations.

- •

- In December 2009, we met with the FDA to discuss the results of the Breeze 1 and Breeze 2 studies and any additional

clinical development that may be required to obtain approval to market Serada in the United States. Based on guidance from the FDA meeting, we plan to conduct one additional Phase 3 clinical

trial for the 1800mg formulation of Serada.

- •

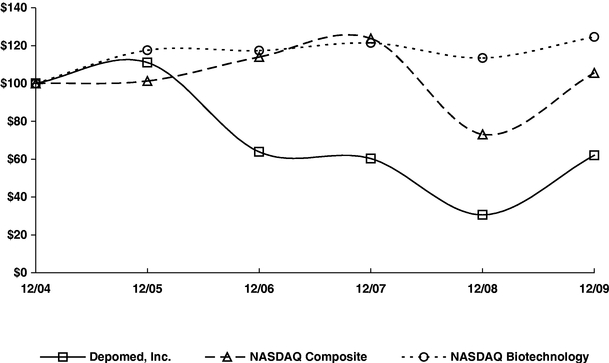

- Total revenues for the year ended December 31, 2009 were $57.7 million, as compared to $34.8 million

for the year ended December 31, 2008. Revenue for the year ended December 31, 2009 included recognition of $10.0 million associated with our license agreement with Merck. Revenue

for the year ended December 31, 2008 included recognition of $6.3 million in previously deferred GLUMETZA product sales.

- •

- Operating expenses for the year ended December 31, 2009 were $74.5 million, compared to operating expenses

of $46.2 million for the year ended December 31, 2008. Operating expenses for 2008 included a $7.5 million gain on litigation related to the IVAX settlement, which had the effect

of reducing operating expenses.

- •

- Cash, cash equivalents and marketable securities were $81.8 million as of December 31, 2009, compared to $82.1 million as of December 31, 2008.

RECENT PRODUCT DEVELOPMENTS AND TRANSACTIONS

DM-1796 for Postherpetic Neuralgia

General

DM-1796 is our internally developed, extended release formulation of the compound gabapentin. Gabapentin is marketed by Pfizer Inc. for adjunctive therapy for epileptic seizures and postherpetic pain under the trade name Neurontin. It is also marketed by a number of other companies as a generic, immediate release drug.

In November 2008, we entered into an Exclusive License Agreement with Solvay Pharmaceuticals, Inc. granting Solvay exclusive rights to develop and commercialize DM-1796 in the United States, Canada and Mexico for pain indications.

Postherpetic Neuralgia. Postherpetic neuralgia, or PHN, is a persistent pain condition caused by nerve damage during a shingles, or herpes zoster, viral infection. There are an estimated 600,000 to 1 million cases of shingles each year, according to the Centers for Disease Control and Prevention. The incidence of PHN increases in elderly shingles patients, in whom the incidence of PHN in shingles patients 50 to 69 years old is 50 percent and increases to 75 percent in patients over 70 years old, according to WWMR, Inc., a pharmaceutical market research firm. Pain associated with PHN reportedly can be so severe that patients are unable to resume normal activities for months. Since there is no cure for PHN, treatments are focused on relieving pain.

6

Target Market

Approximately 2.6 million people are estimated to have suffered from moderate to severe neuropathic pain in 2004. The overall neuropathic pain market is expected to reach $5 billion in 2010, according to Datamonitor.

Clinical Program

2008/2009 Postherpetic Neuralgia Study.

Study Design. In March 2008, we initiated dosing of the first patient in a Phase 3 clinical trial for DM-1796 for PHN. The study was a randomized, double-blind, placebo-controlled study of approximately 450 PHN patients. Patients in the study were randomized into two treatment arms: placebo, or 1800mg of DM-1796 dosed once daily. The study was conducted at sites in the United States, Russia and Argentina. In June 2009, the study was fully enrolled.

The primary objective of the study was to assess the efficacy of DM-1796 in reducing the pain associated with PHN, measured from baseline pain scores to the end of a ten-week treatment period on the basis of the Likert pain scale. Secondary objectives were also evaluated, including assessments of sleep interference and quality of life.

In October 2009, we announced that the primary endpoint was met with statistical significance.

Efficacy. DM-1796 demonstrated a statistically significant reduction in pain associated with postherpetic neuralgia versus placebo using the baseline observation carried forward (BOCF) method required by FDA. The primary efficacy outcome observed in the study is set forth in the table below.

Treatment Group

|

Reduction in pain score at 10 weeks | |

|---|---|---|

| 1800mg | -2.1 (p = 0.0125) | |

| placebo | -1.6 |

Safety. DM-1796 was generally well tolerated in the study. The most common side effects observed in the study were somnolence and dizziness. The incidence of those side effects in each of the treatment groups for each study is set forth in the table below.

Treatment Group

|

Somnolence (%) | Dizziness (%) | ||

|---|---|---|---|---|

| 1800mg | 5 | 11 | ||

| placebo | 3 | 2 |

2006/2007 Postherpetic Neuralgia Study. In May 2006, we initiated a Phase 3 clinical trial for DM-1796 for the treatment of PHN. The study was a randomized, double-blind, placebo-controlled study of approximately 400 PHN patients. The study was fully enrolled in early March 2007. Patients in the study were randomized into three treatment arms: placebo, a total daily dose of 1800mg of DM-1796 dosed once daily, and a total daily dose of 1800mg of DM 1796 dosed twice daily.

The primary objective of the study was to assess the efficacy of DM-1796 in reducing the pain associated with PHN, measured from baseline pain scores to the end of a ten-week treatment period on the basis of the Likert pain scale. Secondary objectives include an assessment of changes from baseline in sleep interference, and additional patient and clinician assessments of pain and quality of life.

In July 2007, we announced the primary endpoint was not achieved with statistical significance for either active treatment regimen, as compared to placebo, over the ten-week treatment period. The mean reductions in average daily pain scores from baseline to end of study were 1.83 (once-daily), 1.72 (twice-daily) and 1.43 (placebo). However, statistical significance relative to placebo was achieved in

7

each of the first seven weeks for the once-daily treatment arm and in each of the first four weeks for the twice-daily treatment arm.

The secondary endpoints of sleep interference, Clinical Global Impression of Change (CGIC), a scale used by physicians for overall assessment of patient improvement, and Patient Global Impression of Change (PGIC), a scale used by patients to report their overall assessment of change, were all statistically significant for the once-daily treatment compared to placebo over the ten week study period. Sleep interference scores were reduced by 2.01 points with DM-1796 compared to -1.39 with placebo (p=0.014). Physicians reported that 48.0% of patients taking Gabapentin once-daily were "very much improved" or "much improved" compared to 27.1% of the patients who received placebo (p<0.001), as measured by the CGIC. Similar results were observed for the PGIC in the once-daily and placebo arms (p=0.009).

Phase 2 Postherpetic Neuralgia Study. We conducted a randomized, double-blind, placebo-controlled Phase 2 trial of 158 PHN patients, and reported the results of the study in January 2006. Patients were randomized into three treatment groups for four weeks of treatment: placebo, an 1800mg total daily dose of DM-1796 given once daily, and an 1800mg total daily dose of DM-1796 given twice daily. The primary objective of the study was to assess the relative efficacy of DM-1796 once-daily, twice-daily, and placebo in reducing PHN patients' average daily pain scores from baseline to the end of a four-week treatment period on the basis of the Likert pain scale, and 11-point numerical rating scale used to assess pain intensity. Secondary objectives included assessments of changes from baseline in sleep interference, and additional patient and clinician assessments of pain.

Reductions in average daily pain scores were statistically significant with twice-daily DM-1796 from week two to the end of treatment based on the Likert pain scale. Clinically significant improvements in the score were observed with mean change from baseline to study end of -2.24 compared to -1.29 for placebo (p= 0.014). The secondary endpoint of sleep interference was also statistically significantly different, with sleep interference scores reduced by -2.28 with DM-1796 compared to -1.16 with placebo (p=0.006).

For once-daily DM-1796, there was an improvement in pain that did not reach statistical significance, with a reduction in mean daily pain score of -1.93 with DM-1796 compared to -1.29 with placebo (p= 0.089). Sleep Interference Scores were reduced by -1.94 compared to -1.16 with placebo (p=0.048).

There were no serious adverse events associated with DM-1796. The most common side effects observed were dizziness (22% in the once-daily arm, 11% in the twice-daily arm, and 10% in the placebo arm), and somnolence (9% in the once-daily arm, 8% in the twice-daily arm, and 8% in the placebo arm).

Collaboration and Licensing Arrangements

Solvay Pharmaceuticals, Inc. In November 2008, we entered into an exclusive license agreement with Solvay Pharmaceuticals, Inc. granting Solvay exclusive rights to develop and commercialize DM-1796 in the United States, Canada and Mexico for pain indications. The agreement became effective in January 2009, upon clearance of the transaction under the Hart-Scott-Rodino (HSR) Antitrust Improvements Act of 1976.

Pursuant to the agreement, Solvay Pharmaceuticals paid us a $25 million upfront fee in February 2009. We are also eligible to receive aggregate milestone payments of up to $70 million for acceptance and FDA approval of the New Drug Application for DM-1796 for PHN, and up to $300 million in potential sales milestone payments. Solvay will pay us royalties of 14 to 20 percent of net product sales, depending on the level of net product sales.

8

We were responsible for completion of the Phase 3 clinical trial for DM-1796 in PHN, and are responsible for certain other regulatory support activities through NDA approval. Solvay will be responsible for NDA filing and has the option to develop DM-1796 in further pain indications other than PHN. If Solvay elects to develop DM-1796 in fibromyalgia, we have a right of first negotiation for co-promotion rights in the obstetrics/gynecology field upon fibromyalgia indication regulatory approval.

We are responsible for the manufacture of DM-1796 for up to four years from the effective date of the License Agreement, pursuant to a supply agreement to be entered into by Depomed and Solvay in 2010. The License Agreement will expire with the last to expire of our patents covering DM-1796, subject to early termination in certain circumstances.

Abbott Laboratories (Abbott) acquired the pharmaceutical business of Solvay in a transaction that closed in February 2010. Accordingly, Abbott is now responsible for our DM-1796 license arrangement, through its subsidiary, Solvay Pharmaceuticals, Inc.

Serada™ for Menopausal Hot Flashes

General

We have an exclusive sublicense from PharmaNova, under United States Patent No. 6,310,098, held by the University of Rochester, to develop and commercialize in the United States a product that contains gabapentin as its active pharmaceutical ingredient, and is indicated for the treatment of menopausal hot flashes. We believe that Serada is an excellent non-hormonal product candidate for this indication, because our clinical study and numerous academic studies have demonstrated that gabapentin may be effective in treating hot flashes, and gabapentin has a long history of use in other indications.

Hot Flashes

A hot flash is a sudden flushing and sensation of heat caused by dilation of skin capillaries. Hot flashes are often associated with menopausal endocrine imbalance. The occurrence and frequency of hot flashes are unpredictable. Symptoms often associated with hot flashes include sweating, irritability and frustration.

Hot flashes can begin early in menopause and are most common during the first few years after menopause begins. There are over 40 million postmenopausal women more than 55 years old and about 2 million women enter menopause every year in the United States. Approximately 80% of those women suffer from hot flashes.

Current Treatments; Target Market

Currently, the leading prescription drug product for the treatment of hot flashes associated with menopause is hormone replacement therapy, or HRT, which involves the administration of the hormone estrogen, either alone or in combination with the hormone progestin. In 2001, the HRT market represented more than $2 billion and in excess of 90 million prescriptions. In 2003, the Women's Health Initiative released the results of a clinical study that revealed an increased risk of blood clots, stroke, and breast cancer associated with HRT. Subsequently, in 2003, the HRT market decreased by more than $850 million and 34 million prescriptions relative to 2001. HRT prescriptions have declined to approximately 32 million prescriptions in 2008.

Existing non-hormonal pharmaceutical alternatives to HRT for the treatment of hot flashes include off-label administration of anti-depressants. There is also a considerable market for dietary and herbal supplements for the treatment of hot flashes, although we are not aware of any clinical study demonstrating the safety and efficacy of any such treatment.

9

Clinical Program

Phase 3 Study-Breeze 3 Clinical Trial. In December 2009, the Company met with the FDA regarding Serada for the treatment of menopausal hot flashes. Based on guidance reflected in the meeting minutes, Depomed plans to conduct a single additional pivotal Phase 3 trial evaluating Serada for the treatment of menopausal hot flashes. The company expects to initiate the trial, which will be known as Breeze 3, by the end of April 2010 and expects to complete the trial by the end of the first quarter of 2011. The FDA has agreed to review the proposed Breeze 3 study protocol under the FDA's Special Protocol Assessment (SPA) process.

Study Design. Breeze 3 will be a randomized, double-blind, placebo-controlled study of up to 600 patients. Patients will be randomized into one of two treatment arms, with patients receiving either placebo or a total dose of 1800mg of Serada dosed 600mg in the morning and 1200mg in the evening. The co-primary efficacy endpoints in the study will be reductions in the mean frequency of moderate-to-severe hot flashes, and the average severity of hot flashes, measured after four and 12 weeks of stable treatment. As in the prior Breeze 1 trial, the treatment duration of the study will be 24 weeks, to address the FDA's view that an effective drug should also show statistically significant persistence of efficacy at 24 weeks. The trial will also include a responder analysis to assess the clinical meaningfulness of any reduction in the frequency of hot flashes in the active arm relative to the placebo arm.

Modifications to the design of Breeze 3 relative to Breeze 1 and 2 include: (i) a single active arm rather than two arms, and therefore a required statistical p value of .05 rather than .025 to achieve statistical significance; (ii) up to 65% more patients in the active treatment arm than in Breeze 1 and 2 (iii) a two-week run in period to prior to randomization, rather than one week, which is designed to reduce the regression to the mean observed in Breeze 1 and 2, resulting in a more stable baseline, and thereby potentially reducing the placebo effect; and (iv) an alternative statistical analysis method, known as a non-parametric analysis, that is designed to reduce the influence significant outliers can have on the achievement of efficacy endpoints.

Phase 3 Study-Breeze 1 and 2 Clinical Trials.

Study Design. We recently completed our Breeze 1 and 2 clinical trials evaluating Serada in menopausal hot flashes. Each trial was a Phase 3 randomized, double-blind, placebo-controlled study of approximately 540 patients. In September 2008, we enrolled and dosed the first patient in Breeze 1, and in October 2008, we enrolled and dosed the first patient in Breeze 2. In each study, patients were randomized into three treatment arms: (i) placebo; (ii) 1200mg of Serada dosed once daily; or (iii) a total dose of 1800mg of Serada dosed 600mg in the morning and 1200mg in the evening. We completed enrollment in Breeze 1 in February 2009, and completed enrollment in Breeze 2 in March 2009.

The treatment duration of the Breeze 1 study was six months, with primary efficacy endpoints assessed at 4 and 12 weeks. Persistence of efficacy was assessed at 6 months as one of the secondary endpoints. The treatment duration in the second study, Breeze 2, was three months, with assessment of efficacy at 4 and 12 weeks only.

The primary efficacy endpoints in both studies were reductions in the mean frequency of moderate to severe hot flashes, and the average severity of hot flashes. Various secondary efficacy endpoints were measured as well.

10

Efficacy. As set forth in the table below, in the higher dose treatment arm of the two doses evaluated, the 1800mg dose achieved positive results at 4 weeks. All four co-primary endpoints of the 1800mg dose at 4 weeks demonstrated significant reductions in frequency and severity in both clinical trials. Of the other four co-primary endpoints of the 1800mg dose at 12 weeks, one endpoint was positive (p=0.0026) while the other three endpoints did not achieve statistical significance.

In the lower dose treatment arm, the 1200mg dose at 4 weeks achieved statistical significance in three of the four co-primary endpoints. The Frequency of hot flashes were significantly reduced in both clinical trials (p-values of 0.0024 and 0.0117) at four weeks. Severity was significantly reduced in only one trial (p=0.0016). Of the other four co-primary endpoints of the 1200mg dose at 12 weeks, one endpoint was positive (p=0.0024) while the other three endpoints did not achieve statistical significance.

Both patients' and clinicians' impression of overall improvement in the higher dose treatment arm was highly statistically significant relative to placebo in both studies.

The primary efficacy outcomes observed in the studies are set forth in the tables below.

| Breeze 1 | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Frequency (# per day) | Severity (average per incident) | ||||||||||

Treatment Group

|

Baseline | 4 weeks | 12 weeks | Baseline | 4 weeks | 12 weeks | ||||||

| 1800mg | 11.1 | 3.8 (p £ 0.0001) | 3.7 (p = 0.2) | 2.5 | 1.8 (p £ 0.0001) | 1.7 (p = 0.0468) | ||||||

| 1200mg | 11.3 | 4.5 (p = 0.0117) | 3.8 (p = 0.183) | 2.5 | 1.9 (p = 0.0016) | 1.7 (p = 0.0433) | ||||||

| placebo | 11.3 | 5.4 | 4.3 | 2.5 | 2.1 | 1.8 | ||||||

| Breeze 2 | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Frequency (# per day) | Severity (average per incident) | ||||||||||

Treatment Group

|

Baseline | 4 weeks | 12 weeks | Baseline | 4 weeks | 12 weeks | ||||||

| 1800mg | 11.2 | 4.1 (p = 0.004) | 3.7 (p = 0.028) | 2.5 | 1.8 (p = 0.0003) | 1.6 (p = 0.0026) | ||||||

| 1200mg | 12.0 | 4.7 (p = 0.0024) | 3.9 (p = 0.0024) | 2.5 | 1.9 (p = 0.06) | 1.7 (p = 0.028) | ||||||

| placebo | 11.2 | 5.7 | 5.0 | 2.5 | 2.0 | 1.9 | ||||||

Safety. Serada was generally well tolerated in the study. The most common side effects observed in the study were headache, somnolence, dizziness and nausea. The incidence of those side effects in each of the treatment groups for each study are set forth in the tables below:

| Breeze 1 | ||||||||

|---|---|---|---|---|---|---|---|---|

Treatment Group

|

Somnolence (%) | Dizziness (%) | Headache (%) | Nausea (%) | ||||

| 1800mg | 19 | 19 | 9 | 9 | ||||

| 1200mg | 13 | 24 | 9 | 7 | ||||

| placebo | 2 | 3 | 6 | 4 | ||||

| Breeze 2 | ||||||||

|---|---|---|---|---|---|---|---|---|

Treatment Group

|

Somnolence (%) | Dizziness (%) | Headache (%) | Nausea (%) | ||||

| 1800mg | 8 | 19 | 7 | 7 | ||||

| 1200mg | 7 | 17 | 5 | 3 | ||||

| placebo | 3 | 3 | 8 | 2 | ||||

11

Withdrawals due to adverse events in each of the treatment groups for each study are set forth in the tables below:

| Breeze 1 | ||||

|---|---|---|---|---|

Treatment Group

|

Somnolence (%) | Dizziness (%) | ||

| 1800mg | 2 | 1 | ||

| 1200mg | 3 | 3 | ||

| placebo | 0 | 0 | ||

| Breeze 2 | ||||

|---|---|---|---|---|

Treatment Group

|

Somnolence (%) | Dizziness (%) | ||

| 1800mg | 2 | 3 | ||

| 1200mg | 0.5 | 3 | ||

| placebo | 0.5 | 0 | ||

Phase 2 Study. In June 2007, we randomized the first patient in a Phase 2 double-blind, placebo-controlled, multi-center trial evaluating Serada for the treatment of women with moderate-to-severe menopausal hot flashes. The 124 patient study was fully enrolled in September 2007. In February 2008, we announced positive results of our Phase 2 trial for Serada for moderate-to-severe menopausal hot flashes.

Study Design. The study included 124 menopausal women (approximately 30 per group) with recurrent, moderate to severe hot flashes and was conducted at eight sites in the United States. The total study treatment duration after screening and baseline was 13 weeks. The primary objective of the study was to investigate the relationship between blood plasma concentrations of gabapentin observed in menopausal women after administration of Serada and the frequency of hot flashes in those women. The plasma concentration data (pharmacokinetics) and the hot flash frequency and severity data (pharmacodynamics) are being used to construct a PK/PD dose response model designed to identify the dosing regimen to utilize in the Phase 3 program.

In order to facilitate the generation of an optimal dose response model, patients in each of the three active treatment arms remained on a stable Serada dose for five weeks at an initial dose, followed by five weeks on a stable, incrementally higher dose, as follows.

| Treatment Group | Weeks 2 – 6 | Weeks 8 – 12 | ||

|---|---|---|---|---|

| A ("1800mg group") | 600mg PM | 600mg AM + 1200mg PM | ||

| B ("2400mg group") | 600mg AM + 600mg PM | 600mg AM + 1800mg PM | ||

| C ("3000mg group") | 1200mg PM | 1200mg AM + 1800mg PM | ||

| D ("placebo group") | placebo | placebo |

Each stable dosing regimen was preceded by a one-week titration period

Efficacy. Serada demonstrated a reduction in the mean frequency of moderate to severe hot flashes, and in the mean total daily severity of hot flashes, in all active treatment groups. Statistical significance relative to placebo from baseline to the end of the study was observed in the 1800mg and 2400mg treatment groups with regard to frequency, and statistical significance was observed in the 1800mg treatment group with regard to severity. The severity of hot flashes is based on a mean daily composite score, where a moderate hot flash is assigned a score of "2" and a severe hot flash is

12

assigned a score of "3". The primary efficacy outcomes observed in the study are set forth in the table below.

| |

Mean Daily Frequency (#) | Mean Total Daily Severity Score | ||||||

|---|---|---|---|---|---|---|---|---|

Treatment Group

|

Baseline | End of treatment | Baseline | End of treatment | ||||

| 1800mg | 10.1 | 2.7 (p = 0.016) | 24.0 | 6.9 (p = 0.044) | ||||

| 2400mg | 11.8 | 3.0 (p = 0.03) | 29.6 | 6.8 (p = 0.041) | ||||

| 3000mg | 11.4 | 3.9 (p = 0.229) | 27.8 | 10.2 (p = 0.426) | ||||

| placebo | 10.6 | 5.1 | 26.7 | 12.2 | ||||

Safety. Serada was generally well tolerated in the study, with one, two, one and three patients, respectively, withdrawing due to adverse events from the placebo, 1800mg, 2400mg and 3000mg groups. The most common side effects observed in the study were headache, somnolence, dizziness and nausea. The incidence of those side effects in each of the treatment groups is set forth in the table below.

Treatment Group

|

Somnolence (%) | Dizziness (%) | Headache (%) | Nausea (%) | ||||

|---|---|---|---|---|---|---|---|---|

| 1800mg | 16 | 10 | 32 | 16 | ||||

| 2400mg | 16 | 39 | 32 | 3 | ||||

| 3000mg | 16 | 9 | 25 | 3 | ||||

| placebo | 3 | 10 | 10 | 7 |

Collaboration and License Arrangements

PharmaNova. In October 2006, we entered into a sublicense agreement with PharmaNova, Inc. Pursuant to the agreement, PharmaNova has granted us an exclusive sublicense, under United States Patent No. 6,310,098, held by the University of Rochester, to develop and commercialize in the United States a product that contains gabapentin as its active pharmaceutical ingredient, and is indicated for the treatment of hot flashes associated with menopause.

We paid PharmaNova an upfront license fee of $0.5 million upon signing of the agreement and paid an additional $0.5 million upon dosing of the first patient in our Phase 3 trials for the product. We are required to pay PharmaNova $1.0 million upon submission to the FDA of a NDA for the product, and $2.0 million upon FDA approval of an NDA. The agreement provides for royalty payments to PharmaNova on net sales of the product, and for milestone payments upon achievement of annual net sales in excess of certain thresholds. We also paid PharmaNova consultancy fees of $0.3 million over approximately ten months beginning in November 2006.

DM-3458 for Gastroesophageal Reflux Disease

General

Gastroesophageal reflux disease, or GERD, is a disorder of the digestive system caused by the failure of the lower esophageal sphincter muscle, or LES, to close properly, which permits stomach contents to leak back into the esophagus. When stomach contents pass through the LES into the esophagus, stomach acid causes the burning sensation in the chest or throat known as heartburn. Heartburn that occurs more than twice a week may be GERD. Other symptoms of GERD can include acid indigestion, bad breath, chest pain, hoarseness in the morning, and trouble swallowing. According to the NIDDK, 20% of the US population suffers from GERD.

GERD Treatments; Target Market

Treatments for GERD include: antacids designed to neutralize stomach acid, such as Alka-Seltzer, Mylanta and Rolaids, among others; foaming agents, such as Gaviscon, that cover stomach contents

13

with foam in order to prevent reflux; H2 blockers, such as cimetidine (Tagamet HB), famotidine (Pepcid AC) and ranitidine (Zantac), among others; proton pump inhibitors, or PPIs, such as omeprazole (Prilosec), lansoprazole (Prevacid), and esomperzole (Nexium), among others; and drugs known as prokinetics that are designed to strengthen the LES and accelerate stomach emptying. GERD treatments are often taken in combination.

The US market for GERD treatments was in excess of $14 billion in 2008, according to IMS Health, Inc., a pharmaceutical market research firm.

Clinical Program

In 2006, we conducted a Phase 1 study designed to provide us with insight into our formulation strategy, and in 2007, we conducted a proof-of-concept study related to our DM-3458 program. No additional DM-3458 clinical studies are currently planned, as we are awaiting the results of our efforts to enter into a development and commercialization partnership for the product candidate.

DM-1992 for Parkinson's Disease

General

Parkinson's disease is a chronic degenerative disorder that affects nearly one million Americans, with significant prevalence growth expected over the next 25 years due to aging population demographics. Nearly 5 million people worldwide are estimated to have Parkinson's. While the average age at onset is 60, disease onset starts by age 40 in an estimated 5 to 10 percent of patients, and people as young as 30 can also be affected.

Parkinson's Treatments; Target Market

Current therapies are effective in addressing only the mild/moderate motor symptoms of the disease and have significant long-term side effects. Levodopa/carbidopa is the common treatment of Parkinson's but currently has limitations with inconsistent efficacy and inconvenient dosing since it absorbed in the upper GI tract. Levodopa/carbidopa is available as a generic (brand name Sinemet) and had $270 million in sales in the United States in 2006.

Clinical Program

In July 2008, The Michael J. Fox Foundation awarded the Company a preclinical development grant to support the DM-1992 program. DM-1992 is our investigative novel gastric retentive extended-release formulation of levodopa/carbidopa.

In January 2009, we initiated a Phase 1 pharmacokinetic study in Parkinson's patients designed to provide us with insight into our formulation strategy for the DM-1992 program. The Phase 1 trial in DM-1992 was a randomized, open-label crossover study that enrolled 18 patients with stable Parkinson's disease at two leading neurology centers in Russia. The objective of the study was to compare the pharmacokinetics of two distinct formulations of DM-1992 and a generic version of Sinemet CR sustained-release levodopa/carbidopa, as well as the safety and tolerability of the formulations. Patients in the trial received a single dose of each of the three treatments being studied. A dose of the first treatment was administered at the beginning of the study, followed by a dose of a second treatment after 7 to 14 days, and a dose of the third treatment after another 7 to 14 days. Blood samples were drawn during the 24 hour period following administration of each treatment. Patients remained on any anti-Parkinson's therapy other than levodopa/carbidopa during the trial.

In August 2009, we completed the Phase 1 study. In the study, DM-1992 extended coverage above levodopa's efficacious threshold and extended the time to peak levodopa concentration relative to currently available sustained release levodopa/carbidopa formulations. One of our formulations tested

14

in the study extended the median time at which levodopa blood levels stayed above the efficacious threshold of 300 ng/mL to approximately nine hours, compared to approximately seven hours for the generic version of Sinemet CR tested in the study. The time to median peak levodopa blood levels in the study was extended to four hours, compared to 2.8 hours for the comparator.

We anticipate commencing a second Phase 1 study in 2010.

OTHER RESEARCH AND DEVELOPMENT AND COLLABORATIVE PROGRAMS

Merck & Co., Inc. In July 2009, we entered into a non-exclusive license agreement with Merck & Co., Inc. granting Merck a license to certain patents related to our metformin extended release technology to be used in developing fixed dose combinations of sitagliptin and extended release metformin.

Under terms of the agreement, Merck received a non-exclusive license as well as other rights to certain of our patents directed to metformin extended release technology. In exchange, we received a $10.0 million upfront fee in the third quarter of 2009. We are also eligible to receive a milestone payment upon filing of the New Drug Application for the therapeutic candidate, as well as modest royalties on any net product sales for an agreed-upon period. Merck will also be granted a right of reference to the New Drug Application covering our GLUMETZA product in Merck's regulatory filings covering fixed dose combinations of sitagliptin and extended release metformin. We have no development obligations under the agreement.

Covidien. In November 2008, we entered into a license agreement with Mallinckrodt, Inc., a subsidiary of Covidien, Ltd. (Covidien) granting Covidien worldwide rights to utilize the Company's Acuform® technology for the exclusive development of four products containing acetaminophen in combination with opiates. In 2008, Covidien paid us a total of $5.5 million in upfront fees, representing a $4.0 million upfront license fee and a $1.5 million upfront payment for formulation work to be performed by Depomed under the agreement. Under the agreement, we may also receive certain developmental milestone payments, if achieved, and is also entitled to receive royalties on sales of the products.

In October 2009, we completed and delivered the first formulation for Covidien, which triggered a $0.5 million milestone payment to us from Covidien in October 2009. In December 2009, Covidien paid us an additional $0.5 million milestone payment, which is related to the second formulation. The second formulation is not complete and we expect to provide formulation work during the first half of 2010 to complete this formulation.

RESEARCH AND DEVELOPMENT EXPENSES

Our research and development expenses were $34.3 million in 2009, $27.3 million in 2008 and $23.3 million in 2007.

MARKETED PRODUCTS

GLUMETZA

General

The 500mg strength of GLUMETZA is our internally developed once-daily metformin product for type 2 diabetes. The FDA approved GLUMETZA for marketing in the United States in June 2005. At that time, a subsidiary of Biovail Corporation (Biovail) held US and Canadian marketing rights to GLUMETZA pursuant to a license agreement we entered into with the Biovail subsidiary in 2002. We reacquired the US rights to GLUMETZA from Biovail in December 2005.

15

In June 2006, we entered into a promotion arrangement with King Pharmaceuticals (King) related to GLUMETZA under which we and King jointly commercialized GLUMETZA in the United States. GLUMETZA was launched in the United States in September 2006. In October 2007, we terminated our promotion agreement with King related to GLUMETZA, and King paid us $29.7 million in termination and other fees. King ended promotion of GLUMETZA in December 2007.

In July 2008, we entered into a promotion agreement with Santarus granting Santarus exclusive rights to promote GLUMETZA in the United States. Santarus began promotion of GLUMETZA in October 2008.

In connection with the restructuring of our GLUMETZA agreements with Biovail in December 2005, we also acquired the exclusive US license to a 1000mg strength of GLUMETZA utilizing proprietary Biovail drug delivery technology. In December 2007, the FDA approved the 1000mg formulation for marketing in the United States, and we began selling the 1000mg GLUMETZA in June 2008.

The 500mg and 1000mg GLUMETZA have also been approved for marketing in Canada, where they are marketed by Biovail.

Diabetes

Diabetes is a disease in which levels of glucose, a type of sugar found in the blood, are above normal. Diabetic patients do not produce insulin, a hormone produced in the pancreas, or do not properly use insulin, making it difficult for the body to convert food into energy. Type 2 diabetes is the most common form of diabetes, accounting for 90 to 95 percent of all diabetes cases, according to the National Institute of Diabetes and Digestive and Kidney Diseases of the National Institutes of Health, or the NIDDK.

The body breaks down food into glucose, and delivers glucose to cells through the bloodstream. Cells use insulin to help process blood glucose into energy. In the case of type 2 diabetes, cells fail to use insulin properly or the pancreas cannot make as much insulin as the body requires. That causes the amount of glucose in the blood to increase, while starving cells of energy. Over time, high blood glucose levels damage nerves and blood vessels, which can lead to complications such as heart disease, stroke, blindness, kidney disease, nerve problems, gum infections, and amputation.

Target Market

According to the American Diabetes Association (ADA), 23.6 million people in the United States have diabetes. Of those, 17.9 million are diagnosed. The ADA estimates that the number of diagnosed diabetics in the United States is increasing by approximately one million per year. Among adults with diagnosed diabetes, 57 percent take oral medication only, and 12 percent take both insulin and oral medication, according to the 2001-2003 National Health Interview Survey of the Centers for Disease Control and Prevention. In 2008, the metformin market in the United States was approximately $1.4 billion in retail sales.

GLUMETZA Collaboration, Commercialization and Licensing Arrangements

Santarus, Inc. In July 2008, we entered into a promotion agreement with Santarus granting Santarus exclusive rights to promote GLUMETZA in the United States. Santarus paid us a $12.0 million upfront fee, and based on the achievement of specified levels of annual GLUMETZA net product sales, Santarus may be required to pay us additional one-time sales milestones, totaling up to $16.0 million.

Santarus began promotion of GLUMETZA in October 2008. Under the promotion agreement, Santarus is required to meet certain minimum promotion obligations during the term of the agreement,

16

and required to make certain minimum marketing, advertising, medical affairs and other commercial support expenditures. We continue to record revenue from the sales of GLUMETZA product and pay Santarus a promotion fee equal to 80% of the gross margin earned from net sales of GLUMETZA product in the United States. The promotion fee will be reduced to 75% of gross margin beginning in the fourth quarter of 2010.

Santarus is responsible for all costs associated with its sales force and for all other marketing expenses associated with its promotion of GLUMETZA. We are responsible for overseeing product manufacturing and supply. A joint commercialization committee has been formed to oversee and guide the strategic direction of the GLUMETZA alliance.

Pursuant to the terms of the promotion agreement, we retain the option to co-promote GLUMETZA product in the future to obstetricians and gynecologists. The promotion agreement will continue in effect until the expiration of the last-to-expire patent or patent application with a valid claim in the territory covering a GLUMETZA product, unless terminated sooner.

Publicis Selling Solutions. In February 2008, we entered into a professional detailing services agreement with Publicis Selling Services pursuant to which approximately 33 part-time Publicis sales representatives detailed GLUMETZA to physicians. The arrangement with Publicis ended in September 2008.

King Pharmaceuticals. In June 2006, we entered into a promotion agreement with King Pharmaceuticals pursuant to which we granted King the co-exclusive right to promote GLUMETZA in the United States. Under the agreement, King was required to promote GLUMETZA to physicians in the United States through its sales force, to deliver a minimum number of annual detail calls to potential GLUMETZA prescribers, and to maintain a sales force of a minimum size. In consideration for its promotion of GLUMETZA, King received a promotion fee equal to fifty percent of gross margin of GLUMETZA product sales. Out-of-pocket marketing expenses were shared with King at an agreed-upon ratio, in which Depomed's share was lower than King's.

In October 2007, we and King terminated the promotion agreement. Pursuant to the termination agreement, King paid us $29.7 million in termination and other fees, and fulfilled its GLUMETZA promotion obligations through December 31, 2007.

Biovail. We licensed US and Canadian rights to GLUMETZA to Biovail in 2002. In 2005, we received a $25.0 million license fee payment from Biovail under our original license agreement following FDA approval of GLUMETZA. In December 2005, we and Biovail entered into an amended and restated license agreement relating to GLUMETZA. The amended and restated license agreement supersedes our April 27, 2004 amended license and development agreement with Biovail.

Pursuant to the amended and restated license agreement, Biovail has an exclusive license in Canada to manufacture and market the 500mg GLUMETZA, and we receive royalties of six percent of Canadian net sales of the 500mg GLUMETZA. We also receive payments from Biovail equal to one percent of Canadian net sales of the 1000mg GLUMETZA. The royalty payable by Biovail on net sales of the 500mg GLUMETZA was increased to ten percent for the period from June 30, 2007 to December 28, 2007, and returned to six percent when we obtained regulatory approval in the United States of the 1000mg formulation of GLUMETZA.

In December 2005, we also entered into a manufacturing transfer agreement and a supply agreement with Biovail related to the 1000mg GLUMETZA. Under those agreements, we received an exclusive license to market the 1000mg GLUMETZA in the United States, and an exclusive license to the "GLUMETZA" trademark in the United States for the purpose of marketing GLUMETZA. We purchase the 1000mg GLUMETZA exclusively from Biovail under the supply agreement, subject to back-up manufacturing rights in our favor. If we exercise our back-up manufacturing rights,

17

compensation to Biovail will change from a supply-based arrangement to royalties of six percent of net sales of the 1000mg GLUMETZA in the United States (or, if less, thirty percent of royalties and other similar payments from our licensees) under the manufacturing transfer agreement.

We also pay Biovail royalties of one percent of net sales of the 500mg GLUMETZA in the United States (or, if less, five percent of royalties and other similar payments from our licensees).

LG Life Sciences. In August 2004, we entered into a license and distribution agreement granting LG Life Sciences an exclusive license to our 500mg extended-release formulation of metformin in the Republic of Korea. LG Life Sciences launched the product, known as Novamet GR, in Korea in 2006.

We received a $0.6 million upfront license fee from LG in connection with entering into the agreement. In November 2006, we amended the agreement to provide for a $0.5 million milestone payment from LG with respect to LG's approval to market Novamet GR in the Republic of Korea, rather than a $0.7 million payment, as reflected in the original agreement. We received the $0.5 million payment in November 2006, net of applicable Korean withholding taxes, and commenced negotiations to further amend the agreement to formally grant LG a license to manufacture Novamet GR in exchange for royalties on net sales of Novamet GR in Korea, and to remove the provisions of the original agreement providing for the supply of Novamet GR tablets by us to LG. In January 2007, we completed our negotiations with LG, and entered into an amended license agreement implementing the provisions.

Proquin® XR

General

Proquin XR is a once-daily formulation of the antibiotic ciprofloxacin for uncomplicated urinary tract infections. We developed Proquin XR, and the FDA approved it for marketing in the United States in May 2005. Esprit Pharma (Esprit) licensed marketing rights to Proquin XR in the United States in July 2005, and launched the product in the United States in November 2005. We terminated our agreement with Esprit in July 2007 related to Proquin XR and relaunched Proquin XR with Watson in September 2007. Our agreement with Watson terminated on December 31, 2009. We are seeking to divest Proquin XR in the United States.

Proquin XR Collaboration and Licensing Arrangements

Watson Pharma. In July 2007, following the termination of our Proquin XR licensing arrangement with Esprit Pharma described below, we entered into a promotion agreement with Watson Pharma, a subsidiary of Watson Pharmaceuticals, granting Watson a co-exclusive right to promote Proquin XR to the urology specialty and long-term care facilities in the United States. In September 2007, we amended the agreement to also grant Watson a co-exclusive right to promote Proquin XR to the ob/gyn specialty. Under the agreement, Watson was required to deliver a minimum number of annual sales detail calls and maintain a sales force of a minimum size, and received a promotion fee equal to an agreed upon portion of gross margin attributable to the urology and ob/gyn specialties and long-term care facilities above an agreed upon baseline level. We began selling Proquin XR in September 2007 and Watson began promotion in October 2007.

In February 2009, we amended the agreement with Watson and were no longer obligated to pay Watson a promotion fee beginning in the first quarter of 2009, and Watson performed a specified number of physician details in the first quarter of 2009.

Under the provisions of the agreement, Watson elected to terminate the agreement early, and the promotion agreement terminated effective December 31, 2009.

18

Esprit Pharma. In July 2005, we entered into an exclusive license and marketing agreement with Esprit Pharma, Inc. pursuant to which we granted Esprit exclusive US marketing and distribution rights to Proquin XR. The agreement obligated Esprit to pay us $50.0 million in license fees; $30.0 million, which was paid in 2005, and two $10.0 million installments in July 2006 and in July 2007. The agreement also provided for royalty payments to us of 15 percent to 25 percent of Proquin XR net sales, based on escalating net sales, subject to minimum royalty obligations of $4.6 million in 2006, $5.0 million in 2007, and in subsequent years, the minimum royalty was to increase in line with annual increases in the consumer price index beginning in 2008. We also had a supply agreement with Esprit under which we provided Esprit with commercial quantities of Proquin XR.

In July 2006, we amended the license agreement with Esprit to, among other matters, extend to December 2006 the due date on the $10.0 million license fee payment to Depomed that had been due in July 2006, to credit royalties paid to us for sales made in the fourth quarter of 2005 of Proquin XR against Esprit's $4.6 million minimum royalty obligation in 2006, and to establish a joint marketing team to periodically review and discuss all aspects of the commercialization of Proquin XR.

In December 2006, we delivered a notice to Esprit regarding alleged breaches by Esprit of the license agreement. The alleged breaches related to Esprit's failure to make a $10.0 million license fee payment due to the Company in December 2006, and to use commercially reasonable efforts to market Proquin XR. In connection with the notice, we filed a demand for binding arbitration. Subsequent to the delivery of the notice and demand for arbitration, Esprit paid us the $10.0 million license fee payment in December 2006 and we withdrew without prejudice the notice and demand for arbitration. We also agreed to commence, in January 2007, discussions with Esprit toward a mutually agreeable, long-term restructuring of the license agreement.

In July 2007, we entered into a termination and assignment agreement with Esprit terminating the exclusive license and marketing agreement, and the related supply and co-promotion agreements. Upon entering into the termination and assignment agreement, the marketing and distribution rights in the United States for Proquin XR were transferred back to us and Esprit paid us $17.5 million, representing (i) a $10.0 million payment in respect of the final license payment that would have been due to us in July 2007 under the exclusive license and marketing agreement; (ii) a $2.5 million payment in respect to a pro-rated portion minimum royalties for 2007; and (iii) a $5.0 million termination fee. The termination and assignment agreement removed Esprit's future minimum royalty obligations to us. Under the termination and assignment agreement, Esprit remains responsible for all returns and rebates associated with Proquin XR product distributed by Esprit.

Rottapharm/Madaus. In November 2005, we entered into a distribution and supply agreement for Proquin XR in Europe with a privately owned specialty pharmaceutical company, Madaus S.r.l., that was acquired by Rottapharm (Rottapharm) in June 2007. Under the terms of the agreement, we granted an exclusive right to Rottapharm for the commercialization of Proquin XR in Europe and agreed to supply Rottapharm with commercial quantities of Proquin XR tablets in bulk form. In March 2006, Rottapharm filed a Marketing Authorization Application for Proquin XR with the Medical Products Agency in Sweden. In July 2008, the Medical Products Agency in Sweden approved the Marketing Authorization.

In April 2009, we and Rottapharm entered into an amended and restated license agreement for Proquin XR in Europe, which amended the parties' distribution and supply agreement originally entered into in November 2005 and subsequently amended in November 2006. Under the amended and restated license agreement, we will no longer be obligated to supply commercial quantities of Proquin XR tablets in bulk form to Rottapharm as contemplated under the distribution and supply agreement, and we will now receive royalties on net sales of Proquin XR in Europe sold by Rottapharm. We are obligated to provide regulatory and manufacturing support and consultation for up to an agreed upon

19

number of hours per month through December 31, 2010 as reasonably requested by Rottapham. The term of the amended and restated license agreement is through July 2023.

OUR DRUG DELIVERY TECHNOLOGIES

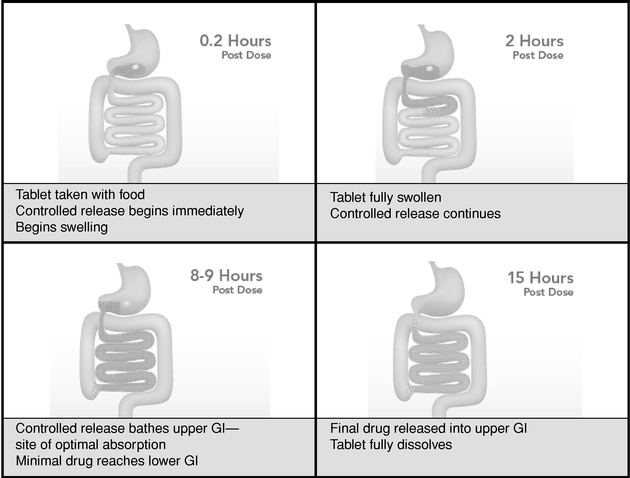

The AcuForm technology is based on our proprietary oral drug delivery technologies and is designed to include formulations of drug-containing polymeric tablets that allow multi-hour delivery of an incorporated drug. Although our formulations are proprietary, the polymers utilized in the AcuForm technology are commonly used in the food and drug industries and are included in the list of inert substances approved by the FDA for use in oral pharmaceuticals. By using different formulations of the polymers, we believe that the AcuForm technology is able to provide continuous, controlled delivery of drugs of varying molecular complexity and solubility. With the use of different polymers and polymers of varying molecular weight, our AcuForm tablet technology can deliver drugs by diffusion, tablet erosion, or from a bi-layer matrix. In addition, our technology allows for the delivery of more than one drug from a single tablet. If taken with a meal, these polymeric tablets remain in the stomach for an extended period of time to provide continuous, controlled delivery of an incorporated drug.

The AcuForm technology's design is based in part on principles of human gastric emptying and gastrointestinal transit. Following a meal, liquids and small particles flow continuously from the stomach into the intestine, leaving behind the larger undigested particles until the digestive process is complete. As a result, drugs in liquid or dissolved form or those consisting of small particles tend to empty rapidly from the stomach and continue into the small intestine and on into the large intestine, often before the drug has time to act locally or to be absorbed in the stomach and/or upper small intestine. The drug-containing polymeric tablets of the AcuForm technology are formulated into easily swallowed shapes and are designed to swell upon ingestion. The tablets attain a size after ingestion sufficient to be retained in the stomach for multiple hours during the digestive process while delivering the drug content at a controlled rate. After drug delivery is complete, the polymeric tablet dissolves and becomes a watery gel, which is safely eliminated through the intestine sight unseen.

20

The following graphic demonstrates the operation of the AcuForm technology.

The AcuForm technology is designed to address certain limitations of drug delivery and to provide for orally-administered, conveniently-dosed, cost-effective drug therapy that provides continuous, controlled-delivery of a drug over a multi-hour period. We believe that the AcuForm technology can provide one or more of the following advantages over conventional methods of drug administration:

- •

- Greater Patient and Caregiver Convenience. We believe that

the AcuForm technology may offer once-daily or reduced frequency dosing for certain drugs that are currently required to be administered several times daily. Less frequent dosing promotes

compliance with dosing regimens. Patient noncompliance with dosing regimens has been associated with increased costs of medical therapies by prolonging treatment duration, increasing the likelihood of

secondary or tertiary disease manifestation and contributing to over-utilization of medical personnel and facilities. By improving patient compliance, providers and third-party payors may

reduce unnecessary expenditures and improve therapeutic outcomes.

- •

- Enhanced Safety and Efficacy through Controlled Delivery. We believe that the AcuForm technology may improve the ratio of therapeutic effect to toxicity by decreasing the initial peak concentrations of a drug associated with toxicity, while maintaining levels of the drug at therapeutic, subtoxic concentrations for an extended period of time. Many drugs demonstrate optimal efficacy when concentrations are maintained at therapeutic levels over an extended period of time. When a drug is administered intermittently, the therapeutic concentration is often exceeded for some period after which concentrations fall below therapeutic levels. Excessively high concentrations are a major cause of side effects and subtherapeutic concentrations are ineffective.

21

- •

- Proprietary Reformulation of Generic Products. We believe

that the AcuForm technology may offer the potential to produce improved formulations of off-patent drugs. These proprietary formulations may be differentiated from existing generic

products by virtue of reduced dosing requirements, improved efficacy, decreased toxicity or additional indications.

- •

- More Efficient Gastrointestinal Drug Absorption. We

believe that the AcuForm technology can be used for improved oral administration of drugs that are inadequately absorbed when delivered as conventional tablets or capsules. Many drugs are primarily

absorbed in the stomach, duodenum or upper small intestine regions, through which drugs administered in conventional oral dosage forms transit quickly. In contrast, the AcuForm technology is designed

to be retained in the stomach, allowing for constant multi-hour flow of drugs to these regions of the gastrointestinal tract. Accordingly, for such drugs, we believe that the AcuForm

technology offers a significantly enhanced opportunity for increased absorption. Unlike some insoluble drug delivery systems, the polymer comprising the AcuForm technology dissolves at the end of its

useful life and is passed through the gastrointestinal tract and eliminated.

- •

- Gastric Delivery for Local Therapy and Absorption. We

believe that the AcuForm technology can be used to deliver drugs which can efficiently eradicate gastrointestinal-dwelling microorganisms, such as H.

pylori, the bacterium which is a cause of most peptic ulcers.

- •

- Rational Drug Combinations. We believe that the AcuForm technology may allow for rational combinations of drugs with different biological half-lives. Physicians frequently prescribe multiple drugs for treatment of a single medical condition. Single product combinations have not been considered feasible because the different biological half-lives of these combination drugs would result in an overdosage of one drug and/or an underdosage of the other. By appropriately incorporating different drugs into an AcuForm technology we believe that we can provide for the release of each incorporated drug continuously at a rate and duration (dose) appropriately adjusted for the specific biological half-lives of the drugs. We believe that future rational drug combination products using the AcuForm technology have the potential to simplify drug administration, increase patient compliance, and reduce medical costs.

COMPETITION

GLUMETZA. GLUMETZA competes against immediate release metformin, which is marketed primarily by generic manufacturers. GLUMETZA also competes against both branded and generic extended-release versions of metformin, such as Bristol-Myers Squibb's Glucophage XR and Shinogi/Sciele Pharma's Fortamet. Generic extended-release metformin manufacturers include Barr Pharmaceuticals, Inc., ANDRX Corporation, Mylan Laboratories, Inc., Watson Pharmaceuticals, Inc. and Teva Pharmaceutical Industries, Ltd., among others.

GLUMETZA also competes against oral type 2 diabetes medications other than metformin, such as Takeda's Actos (pioglitazone hydrochloride), GlaxoSmithKline's Avandia (risiglitazon), Pfizer's Glucotrol (sulfonylurea) and Merck's Januvia (sitagliptin), among others.

SeradaTM for Menopausal Hot Flashes. If approved, Serada for hot flashes will compete against HRT, such as Pfizer's Premarin (estrogens) and Prempro (a combination of estrogens and a progestin) products, and anti-depressant medications prescribed off-label. Pfizer's anti-depressant drug candidate, Pristiq, is in pre-registration and Pfizer's Aprela (estrogens) is in Phase 3 clinical trials for the treatment of hot flashes. We are aware that Pfizer has non-exclusively licensed from the University of Rochester rights to develop a hot flash product containing pregabalin under the same patent we have sublicensed exclusive rights to develop a menopausal hot flash product containing gabapentin. Accordingly, Pfizer may develop a competing hot flash product. Bionovo's Menerba completed Phase 2 clinical trials and is expected to commence Phase 3 clinical trials in 2010 for the treatment of hot flashes.

22

DM-1796 for Neuropathic Pain. Gabapentin is currently marketed by Pfizer as Neurontin and by several generic manufacturers for adjunctive therapy for epileptic seizures and for postherpetic pain. In addition, Pfizer's product, Lyrica™ (pregabalin), has been approved for marketing in the United States and the European Union for the treatment of postherpetic neuralgia, diabetic neuropathy, partial seizures and fibromyalgia.

If approved, DM-1796 will compete against other neuropathic pain treatments, such as anti-depressants, other anti-convulsants, local anesthetics used as regional nerve blockers, anti-arrythmics and opiods. We are also aware of at least one company that is developing a product of gabapentin for the neuropathic pain market. To our knowledge, we are the only company currently in clinical trials with a sustained release formulation of gabapentin for the United States market.

DM-3458 for GERD. Any GERD product we develop will compete against the antacids, foaming agents, H2 blockers, proton pump inhibitors and prokinetics described above under "GERD Treatments; Target Market".

DM-1992 for Parkinson's Disease. If approved, DM-1992 will compete against Sinemet, a combination of levodopa and carbidopa product for treatment of Parkinson's disease and syndrome sold by Merck as well as generic Sinemet sold by various generic manufacturers.

Drug Delivery Technologies. Other companies that have oral drug delivery technologies competitive with the AcuForm technology include Elan Corporation, Bristol-Myers Squibb, Teva Pharmaceutical Industries, Ltd , ALZA Corporation (a subsidiary of Johnson & Johnson), SkyePharma plc, Biovail Corporation, Flamel Technologies S.A., Ranbaxy Laboratories, Ltd., and Intec Pharma, all of which develop oral tablet products designed to release the incorporated drugs over time. Each of these companies has patented technologies with attributes different from ours, and in some cases with different sites of delivery to the gastrointestinal tract.

General. We believe that we compete favorably in the markets described above on the basis of the safety and efficacy of our products and product candidates, and in some cases on the basis of the price of our products. However, competition in pharmaceutical products and drug delivery technologies is intense, and we expect competition to increase. There may be other companies developing products competitive with ours of which we are unaware. Competing product or technologies developed in the future may prove superior to our products or technologies, either generally or in particular market segments. These developments could make our products or technologies noncompetitive or obsolete.

Most of our principal competitors have substantially greater financial, sales, marketing, personnel and research and development resources than we do. In addition, many of our potential collaborative partners have devoted, and continue to devote, significant resources to the development of their own products and drug delivery technologies.

23

PATENTS AND PROPRIETARY RIGHTS

Our material issued United States patents and the products and product candidates they cover are as follows:

United States Patent No. |

Expiration Date | Product(s) and Product Candidate(s) Covered |

|||

|---|---|---|---|---|---|

| 6,340,475 | September 19, 2016 | Glumetza 500mg | |||

| Proquin XR | |||||

| DM-1796 | |||||

| Serada | |||||

6,635,280 |

September 19, 2016 |

Glumetza 500mg |

|||

| Proquin XR | |||||

| DM-1796 | |||||

| Serada | |||||

6,723,340 |

October 25, 2021 |

Glumetza 500mg |

|||

| DM-1796 | |||||

| Serada | |||||

6,488,962 |

June 20, 2020 |

Glumetza 500mg |

|||

| Glumetza 1000mg | |||||

| Proquin XR | |||||

| DM-1796 | |||||

| Serada | |||||

5,972,389 |

September 19, 2016 |

Proquin XR |

|||

7,438,927 |

February 26, 2024 |

DM-1796 |

|||

| Serada | |||||

6,310,098 |

(1) |

July 21, 2020 |

Serada |

||

- (1)

- We have an exclusive sublicense from PharmaNova, under United States Patent No. 6,310,098, held by the University of Rochester, to develop and commercialize in the United States a product that contains gabapentin as its active pharmaceutical ingredient, and is indicated for the treatment of menopausal hot flashes.