Attached files

| file | filename |

|---|---|

| 8-K - COPANO ENERGY, L.L.C. FORM 8-K - Copano Energy, L.L.C. | form8-k.htm |

Copano

Energy

March

Investor Presentation

NASDAQ: CPNO

NASDAQ: CPNO

March

8, 2010

Copano

Energy

2

Disclaimer

Statements made by

representatives of Copano Energy, L.L.C. (“Copano”) during this

presentation will include “forward-looking statements,” as defined in the federal securities laws.

All statements that address activities, events or developments that Copano believes will or may

occur in the future are forward-looking statements. Underlying these statements are assumptions

made by Copano’s management based on their experience and perceptions of historical trends,

current conditions, expected future developments and other factors management believes are

appropriate under the circumstances.

presentation will include “forward-looking statements,” as defined in the federal securities laws.

All statements that address activities, events or developments that Copano believes will or may

occur in the future are forward-looking statements. Underlying these statements are assumptions

made by Copano’s management based on their experience and perceptions of historical trends,

current conditions, expected future developments and other factors management believes are

appropriate under the circumstances.

Whether

future results and developments will conform to Copano’s expectations is subject

to a

number of risks and uncertainties, many of which are beyond Copano’s control. If one or more of

these risks or uncertainties materializes, or if underlying assumptions prove incorrect, then

Copano’s actual results may differ materially from those implied or expressed by forward-looking

statements made during this presentation. These risks and uncertainties include the volatility of

prices and market demand for natural gas and natural gas liquids; Copano’s ability to complete

any pending acquisitions and integrate any acquired assets or operations; Copano’s ability to

continue to obtain new sources of natural gas supply; the ability of key producers to continue to

drill and successfully complete and attach new natural gas supplies; Copano’s ability to retain key

customers; the availability of local, intrastate and interstate transportation systems and other

facilities to transport natural gas and natural gas liquids; Copano’s ability to access sources of

liquidity when needed and to obtain additional financing, if necessary, on acceptable terms; the

effectiveness of Copano’s hedging program; unanticipated environmental or other liability;

general economic conditions; the effects of government regulations and policies; and other

financial, operational and legal risks and uncertainties detailed from time to time in the Risk

Factors sections of Copano’s annual and quarterly reports filed with the Securities and Exchange

Commission.

number of risks and uncertainties, many of which are beyond Copano’s control. If one or more of

these risks or uncertainties materializes, or if underlying assumptions prove incorrect, then

Copano’s actual results may differ materially from those implied or expressed by forward-looking

statements made during this presentation. These risks and uncertainties include the volatility of

prices and market demand for natural gas and natural gas liquids; Copano’s ability to complete

any pending acquisitions and integrate any acquired assets or operations; Copano’s ability to

continue to obtain new sources of natural gas supply; the ability of key producers to continue to

drill and successfully complete and attach new natural gas supplies; Copano’s ability to retain key

customers; the availability of local, intrastate and interstate transportation systems and other

facilities to transport natural gas and natural gas liquids; Copano’s ability to access sources of

liquidity when needed and to obtain additional financing, if necessary, on acceptable terms; the

effectiveness of Copano’s hedging program; unanticipated environmental or other liability;

general economic conditions; the effects of government regulations and policies; and other

financial, operational and legal risks and uncertainties detailed from time to time in the Risk

Factors sections of Copano’s annual and quarterly reports filed with the Securities and Exchange

Commission.

Copano

undertakes no obligation to update any forward-looking statements, whether as a

result

of new information or future events.

of new information or future events.

Copano

Energy

3

Introduction to

Copano

• Independent

midstream company founded in 1992

– Best in class

service to customers

– Entrepreneurial

approach

– Focus on long-term

accretive growth

• Provides midstream

services in multiple producing areas

through three operating segments

through three operating segments

– Texas

• South Texas

conventional and Eagle Ford Shale

• North Texas Barnett

Shale Combo play

– Central and Eastern

Oklahoma

• Conventional, Hunton

De-Watering play and Woodford Shale

– Rocky

Mountains

• Powder River

Basin

Copano

Energy

4

Key

Metrics

• Service throughput

volumes

approximate 2 Bcf/d

of natural gas(1)

• Approximately 6,700

miles of active pipelines

• 7 natural gas

processing plants with over 1.1 Bcf/d of combined

processing capacity

processing capacity

• One NGL

fractionation facility with total capacity of 22,000 Bbls/d

(in-service expected end of Q1 2010)

(in-service expected end of Q1 2010)

• Equity market cap:

$1.5 billion(2)

• Enterprise value:

$2.3 billion(2)

(1) Based

on 4Q 2009 results. Includes

unconsolidated affiliates.

(2) As

of March 4, 2010. Reflects

March 2010 equity offering.

Copano

Energy

5

Copano’s LLC

Structure

|

Characteristic

|

Typical

MLP

|

Copano

Energy

|

Typical

Corporation |

|

Non-Taxable

Entity |

|

|

|

|

Tax Shield

on

Distributions |

|

|

|

|

Tax

Reporting

|

|

|

|

|

General

Partner

|

|

|

|

|

Incentive

Distribution Rights |

|

|

|

|

Voting

Rights

|

|

|

|

Schedule

K-1

Schedule

K-1

Form

1099

Copano

Energy

6

Agenda

2010

Regional

Outlook

Outlook

Commodity

Prices and

Margin

Sensitivities

Prices and

Margin

Sensitivities

Financing

and

Commodity Risk

Management

Commodity Risk

Management

Distribution

Outlook and

Conclusions

Outlook and

Conclusions

Copano

Energy

7

• Overall focus was

maintaining liquidity and watching costs - enabled

Copano to maintain distributions

Copano to maintain distributions

– 2009 total

distributable cash flow coverage averaged 107% - all

quarters in excess of 100% coverage

quarters in excess of 100% coverage

• Copano’s hedging

strategy supported 2009 cash flow

– Option-focused and

product-specific

– Strategy protects

downside, without the loss of upside

• Volumes - 2009 vs.

2008

– 2009 total service

throughput volumes(1)

declined 4%

• Most significant

declines seen in lower-margin third-party volumes in Texas

and Woodford Shale gas in Oklahoma

and Woodford Shale gas in Oklahoma

– NGL volumes(1) increased by

9%

• Volumes stabilized

as NGL pricing strengthened in 2009 relative to lows in

late 2008/early 2009

late 2008/early 2009

2009

Review

(1) Includes

unconsolidated affiliates.

Copano

Energy

8

• North

Texas

– Significant drilling

and development activity in the Barnett

Shale Combo play

Shale Combo play

• South

Texas

– Ramp up of Eagle

Ford Shale directed drilling

• Oklahoma

– Moderate drilling

activity behind both the Hunton De-Watering

and Woodford Shale plays

and Woodford Shale plays

• Rocky

Mountains

– Minimal new

drilling; flat volumes

2010

Outlook

Copano

Energy

9

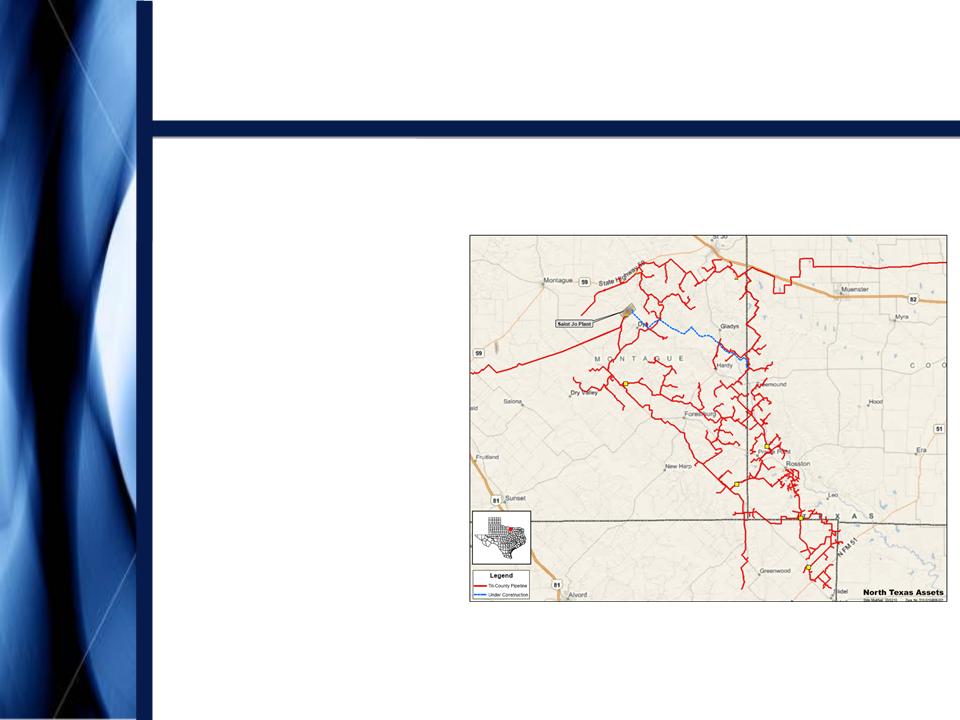

North

Texas Outlook

• 9 rigs running in

the

area with as many as 3

more anticipated later

this year

area with as many as 3

more anticipated later

this year

• Drilling economics

are

driven by associated

crude oil production

driven by associated

crude oil production

• Production from

this

area requires a full slate

of midstream services

area requires a full slate

of midstream services

• Based on

producer

drilling schedule, expect

steady increase in plant

inlet volumes in 2010

drilling schedule, expect

steady increase in plant

inlet volumes in 2010

Copano

Energy

10

North

Texas Recent Developments

• Recently executed

key producer

contract

contract

– Long-term gathering,

treating and

processing agreement

processing agreement

– Fee-for-service

contract

• No incremental

hedging costs

– Highly rated

producer

• Additional 50 MMcf/d

of compression

expected in service 4Q 2010, bringing

total plant capacity to 100 MMcf/d

expected in service 4Q 2010, bringing

total plant capacity to 100 MMcf/d

• Approximately $30

million in expansion

capex for 2010 (compression and

pipelines)

capex for 2010 (compression and

pipelines)

• $25 - $30 million in

fee-based cash flow

expected by year-end 2010 on an

annualized basis

expected by year-end 2010 on an

annualized basis

Copano

Energy

11

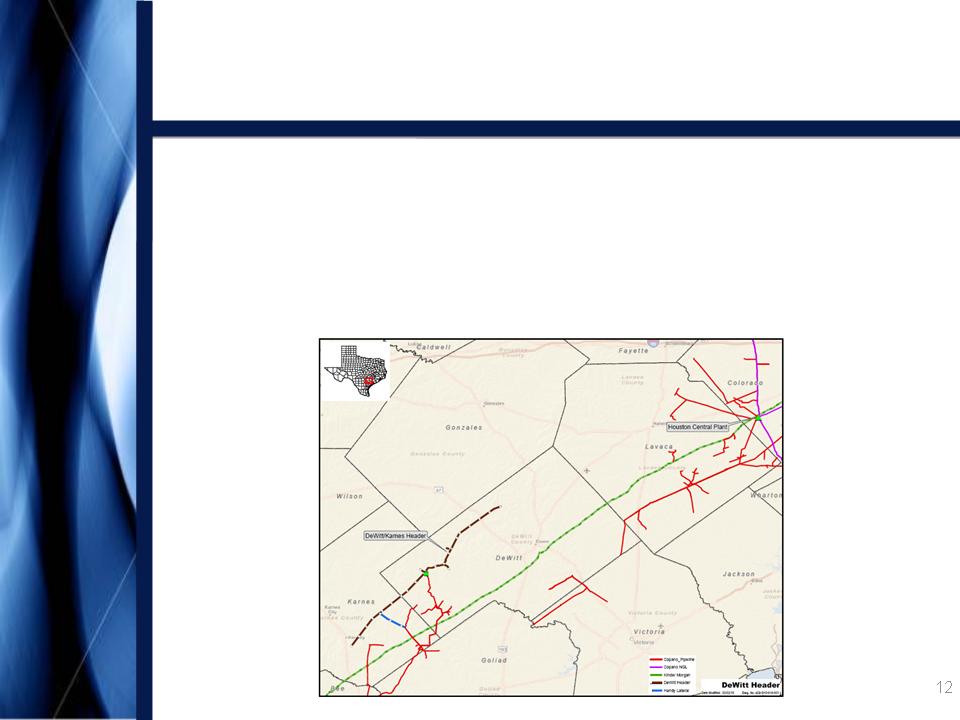

South

Texas Outlook

• In 4Q 2009,

announced plans for a joint venture with Kinder

Morgan to provide gathering, transportation and processing

services to gas producers in the Eagle Ford Shale. Producer

decisions to commit have been delayed by:

Morgan to provide gathering, transportation and processing

services to gas producers in the Eagle Ford Shale. Producer

decisions to commit have been delayed by:

– Gas quality

variability

– Desire to seek

capital partners (in case of small to mid-sized

producers)

producers)

• Connected a third

Eagle Ford Shale well in 1Q 2010, which IP’d

at 17 MMcf/d

at 17 MMcf/d

• 1Q 2010 pipeline

throughput volumes are expected to be higher

compared to 4Q 2009 due to recently connected Eagle Ford wells

and other drilling behind legacy systems

compared to 4Q 2009 due to recently connected Eagle Ford wells

and other drilling behind legacy systems

Copano

Energy

DeWitt-Karnes

Pipeline

• Recently announced

DeWitt-Karnes pipeline

– Targets rich Eagle

Ford Shale gas

– 38 miles of 24” pipe

- expected to be in service July 2010

– Anticipated 2010

capex - approximately $45 million

• Complements Houston

Central fractionation project

Copano

Energy

13

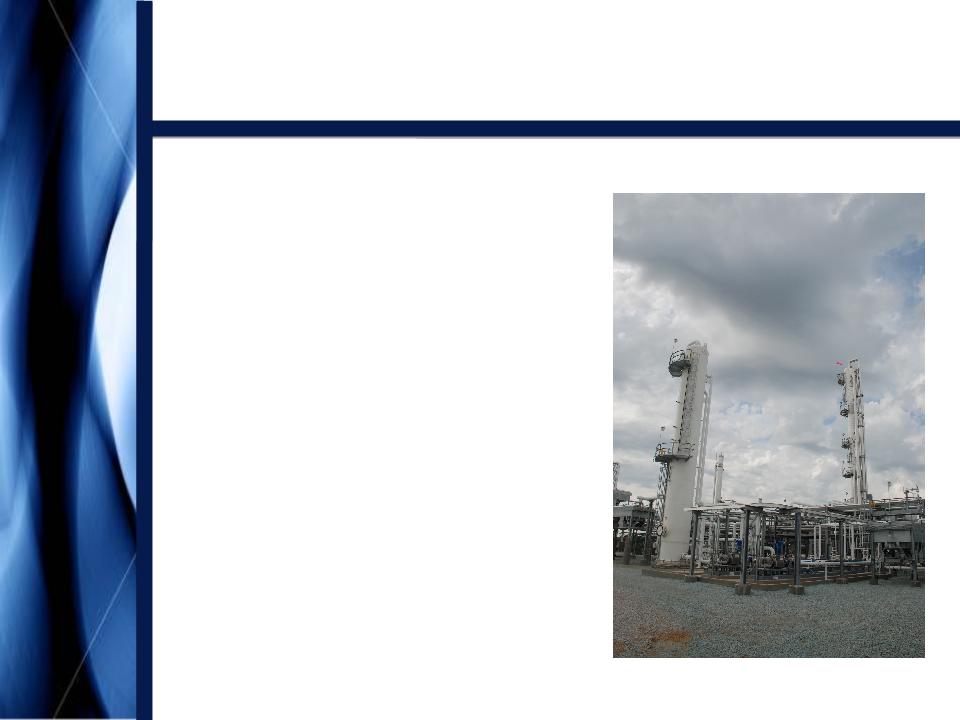

Texas

Fractionation Strategy

• Responding to NGL

transportation

and fractionation constraints along

the Texas Gulf Coast, Copano will

re-start its fractionator at Houston

Central

and fractionation constraints along

the Texas Gulf Coast, Copano will

re-start its fractionator at Houston

Central

• Utilizing Houston

Central’s

fractionation unit and extensive

tailgate NGL pipelines, Copano

plans to produce purity products

by April 1, 2010

fractionation unit and extensive

tailgate NGL pipelines, Copano

plans to produce purity products

by April 1, 2010

– Total capacity of

22,000 Bbls/d

– Approximate cost of

$15 million

– Estimated fee-based

cash flow

between $8 and $10 million on an

annualized basis

between $8 and $10 million on an

annualized basis

Copano

Energy

14

• Rich gas (primarily

Hunton De-Watering play)

– Drilling activity

remains steady

– 2 rigs currently

running in the Hunton and 8 rigs in other rich

gas areas

gas areas

– Attractive

processing upgrade and low geologic risk

– 1Q 2010 volumes

expected to be flat to slightly up vs. 4Q 2009

– Burbank processing

plant expected in service 2Q 2010 (10

MMcf/d capacity)

MMcf/d capacity)

• Lean gas (primarily

Woodford Shale and coalbed methane)

– Drilling activity

slightly increasing due to current commodity

prices and long-term price outlook

prices and long-term price outlook

– 8 rigs currently

running

– 1Q 2010 volumes

expected to be slightly up from 4Q 2009

Oklahoma

Outlook

Copano

Energy

Oklahoma Rich Gas

vs. Lean Gas

(1) Full

value prior to deduction of Copano’s margin. Excludes

value of condensate and crude oil recovered by the

producer at the wellhead.

producer at the wellhead.

(2) Implied

NGL prices are based on a six-year historical regression analysis.

(3) Assumes

9 GPM gas with a Btu factor of 1.375 processed at Copano’s cryogenic plant, and

field fuel of 6.25%.

(4) Assumes

unprocessed gas with a Btu factor of 1.0 and field fuel of 6%.

15

Prices

as of 3/2/10

Copano

Energy

16

Rocky

Mountains Outlook

• Drilling and

dewatering will be driven by commodity prices

and

producer economics

producer economics

• 1Q 2010 volumes

expected to be flat vs. 4Q 2009

• For Bighorn, 130

previously drilled wells can be connected with

minimal capital expenditures

minimal capital expenditures

– An additional 70

drilled wells can be connected with moderate capital

expenditures

expenditures

• 2010 Adjusted EBTIDA

expected to be flat vs. 2009

– Forward pricing

curve indicates drilling and dewatering activity should

resume this year and if this occurs, 2014 Adjusted EBITDA could

double from current levels

resume this year and if this occurs, 2014 Adjusted EBITDA could

double from current levels

Copano

Energy

17

Commodity Prices and

Margin

Sensitivities

Sensitivities

Commodity

Prices and

Margin

Sensitivities

Prices and

Margin

Sensitivities

Distribution

Outlook and

Conclusions

Outlook and

Conclusions

Financing

and

Commodity Risk

Management

Commodity Risk

Management

2010

Regional

Outlook

Outlook

Copano

Energy

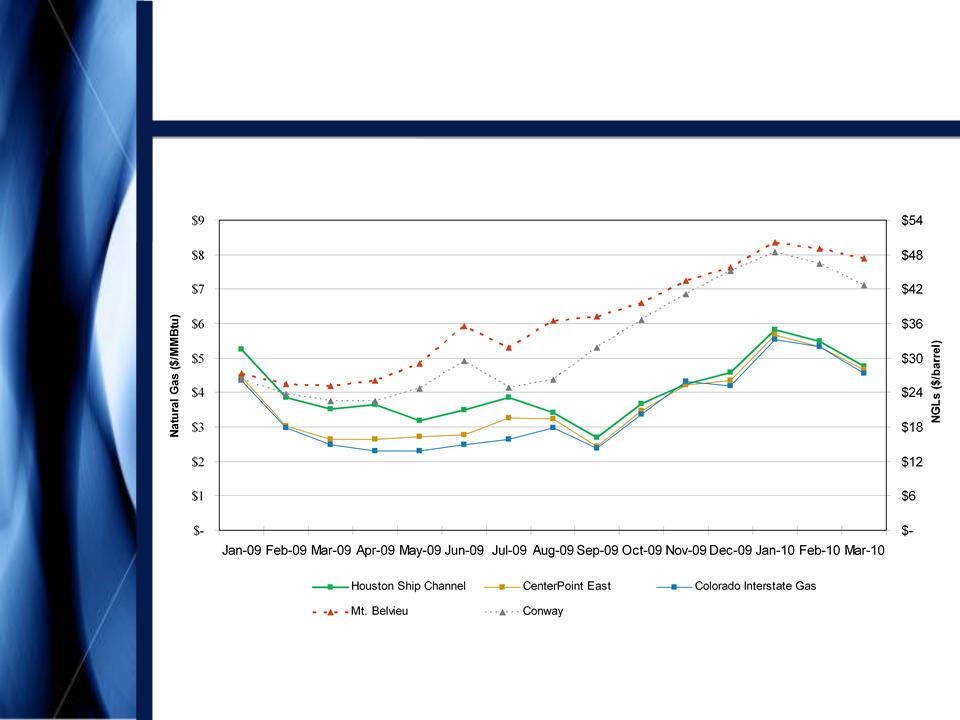

Historical Commodity

Prices

18

(1) NGL

prices are month-to-date through March 2, 2010.

(2) NGL

prices for Jan-09 through Dec-09 are calculated based on the weighted-average

product mix for the period

indicated. NGL prices for Jan-10 through Mar-10 are calculated based on the fourth quarter 2009 product mix.

indicated. NGL prices for Jan-10 through Mar-10 are calculated based on the fourth quarter 2009 product mix.

(1)

(2)

(2)

Copano

Energy

19

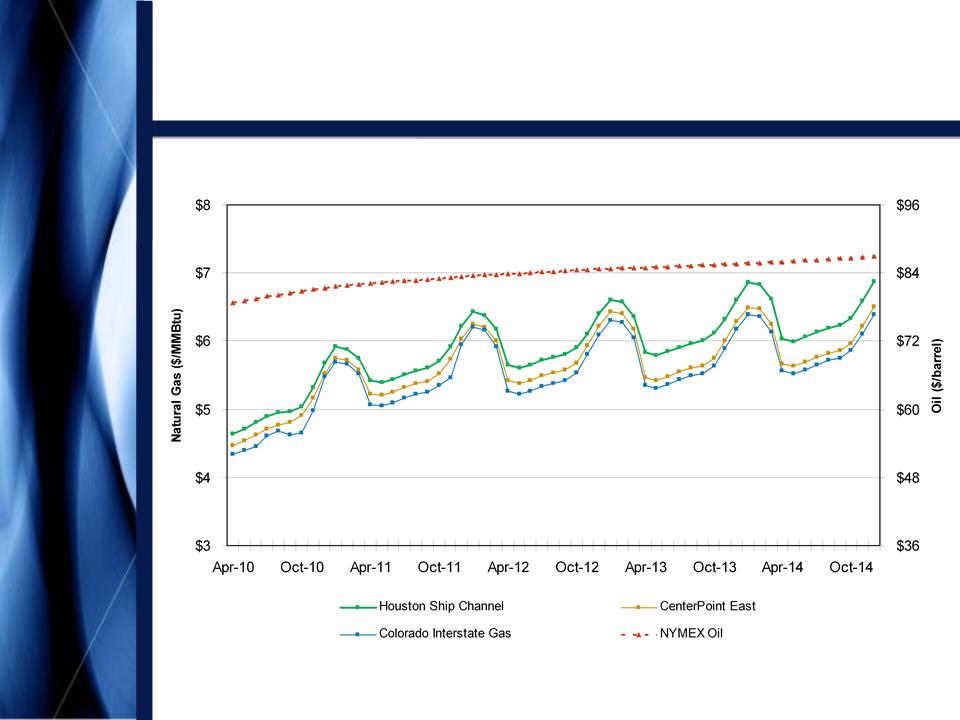

Note:

Forward prices as of March 2, 2010

Forward

Commodity Prices

Copano

Energy

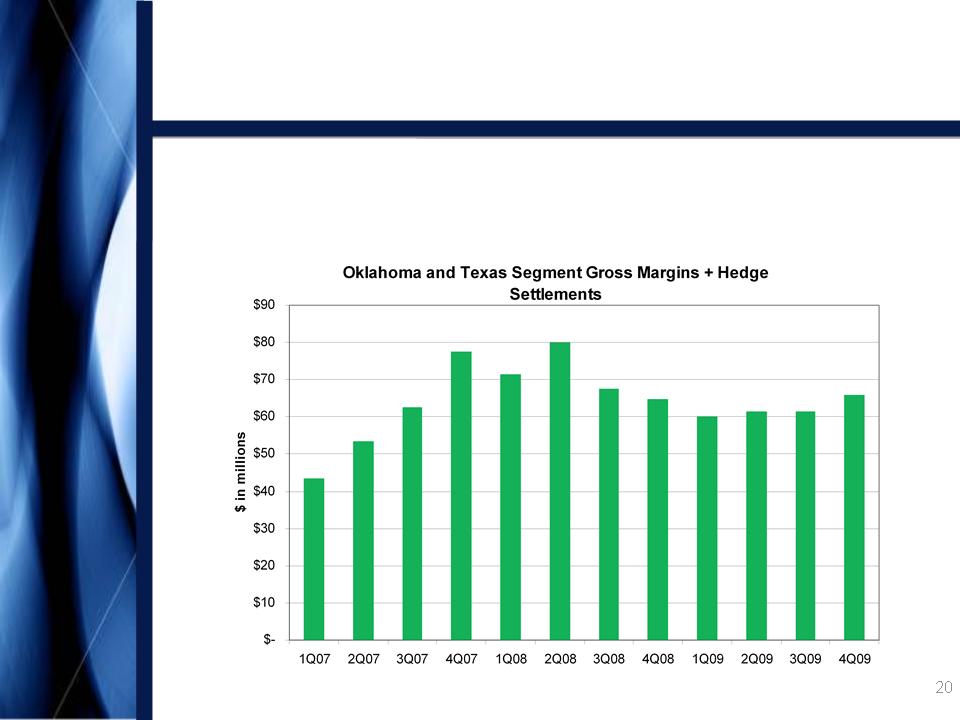

Combined

Commodity-Sensitive Segment Margins

and Hedging Settlements

and Hedging Settlements

• Copano’s hedge

portfolio supports cash flow stability based on

combined segment gross margins and cash hedging settlements

combined segment gross margins and cash hedging settlements

Copano

Energy

21

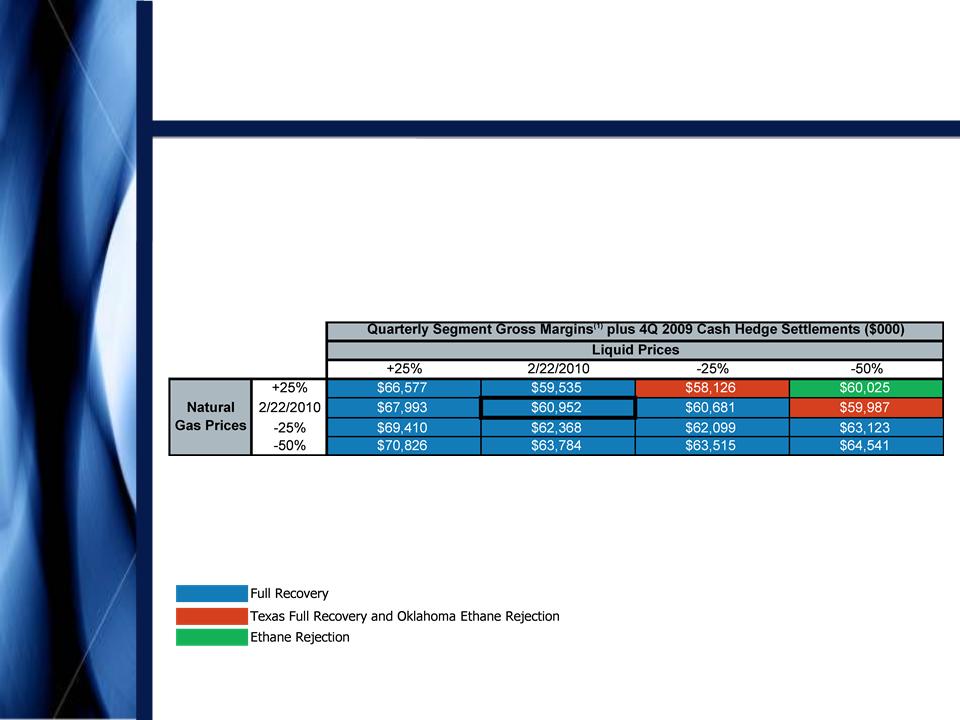

Commodity-Related

Margin

Sensitivities

Sensitivities

Note: Please

see Appendix for definitions of processing modes and additional

details.

• Matrix reflects 4Q

2009 wellhead and plant inlet volumes,

adjusted using Copano’s 2009 planning model

adjusted using Copano’s 2009 planning model

(1) Consists

of Texas and Oklahoma Segment gross margins.

Copano

Energy

22

Combined

Commodity-Sensitive Segment Margins

and Hedging Settlements

and Hedging Settlements

Note:

Weighted

average NGL prices are based on Copano product mix for period

indicated.

(1) Does

not include non-cash expenses included in Corporate and Other for purposes of

calculating Total Segment

Gross Margin. See Appendix for reconciliation of Total Segment Gross Margin.

Gross Margin. See Appendix for reconciliation of Total Segment Gross Margin.

(2) Reflects

prices as of March 2, 2010.

Copano

Energy

23

Financing and

Commodity Risk

Management

Management

Financing

and

Commodity Risk

Management

Commodity Risk

Management

Distribution

Outlook and

Conclusions

Outlook and

Conclusions

Commodity

Prices and

Margin

Sensitivities

Prices and

Margin

Sensitivities

2010

Regional

Outlook

Outlook

Copano

Energy

24

2010

Expansion Capex

• Copano has

approximately $130 million(1) in approved

expansion capital projects for 2010. Major areas of focus

include:

expansion capital projects for 2010. Major areas of focus

include:

– Eagle Ford Shale and

Houston Central processing plant in

south Texas

south Texas

• DeWitt-Karnes

pipeline - recently upsized project from $20 million

to $45 million

to $45 million

– Saint Jo processing

plant and pipelines in north Texas

– Additional pipeline

and processing capacity in Oklahoma

– Expect capital to be

invested at a multiple of approximately 5x

• Financing to be

consistent with Copano’s historical policy -

balance of debt and equity

balance of debt and equity

(1) Includes

Copano’s net share for unconsolidated affiliates. Does not

include future potential acquisitions.

Copano

Energy

25

Recent

Equity Offering

• On March 3, 2010

Copano sold 6.475 million common units

in a public offering

in a public offering

– Approximately $143

million in net proceeds (excluding

greenshoe)

greenshoe)

– Proceeds used to

reduce revolver borrowings, which ultimately

will fund expansion capex

will fund expansion capex

– Demonstrated

commitment to raising capital and maintaining

liquidity

liquidity

• Enhances liquidity

available to fund expansion capex and

balance sheet

balance sheet

– At December 31,

2009, as adjusted for offering

• Total liquidity of

approximately $309 million

• Total debt to

defined EBTIDA(1)

reduced to 3.7x (compared to

4.4x prior to offering)

4.4x prior to offering)

(1) See

Appendix for reconciliation of defined EBITDA, which is referred to in our

credit facility as “Consolidated

EBITDA.”

EBITDA.”

Copano

Energy

26

Hedging

Strategy

• Option-based,

product-specific

• 2010 price exposed

volumes are well hedged

– Between 70% and 80%

of propane, butane, natural gasoline

and condensate price exposure is hedged

and condensate price exposure is hedged

– Approximately 40% of

ethane price exposure is hedged

– Expect $32 - $34

million of non-cash amortization expense in

2010 related to option component of hedge portfolio

2010 related to option component of hedge portfolio

• January 2010 -

announced addition of ethane and propane

hedges for 2012 (net cost of approximately $7.3 million)

hedges for 2012 (net cost of approximately $7.3 million)

– 2010 focus - adding

to 2012 hedging positions

Copano

Energy

27

Distribution Outlook

and

Conclusions

Conclusions

Distribution

Outlook and

Conclusions

Outlook and

Conclusions

Financing

and

Commodity Risk

Management

Commodity Risk

Management

Commodity

Prices and

Margin

Sensitivities

Prices and

Margin

Sensitivities

2010

Regional

Outlook

Outlook

Copano

Energy

28

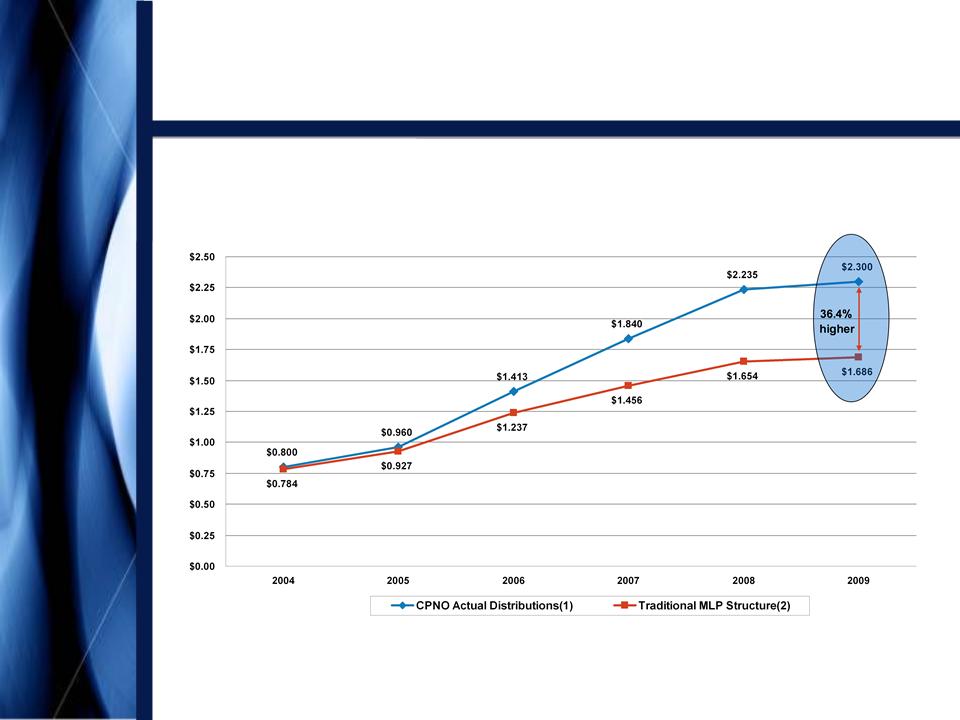

Distribution Track

Record

• On January 13, 2010,

Copano announced a cash distribution for

the fourth quarter of 2009 of $0.575 per common unit

the fourth quarter of 2009 of $0.575 per common unit

(3)(4)

(1) All

pre-1Q 2007 distributions are adjusted to reflect Copano’s 3/30/07 two-for-one

unit split.

(2) Assumes

generic MLP splits with 10%, 25% & 50% increases in distributable cash flow

to LP units resulting in

incremental 13%, 23% and 48% increases in the percentage of total distributable cash flow applicable to the GP.

incremental 13%, 23% and 48% increases in the percentage of total distributable cash flow applicable to the GP.

(3) Actual

$0.10 distribution per unit was for the period from November 15, 2004 through

December 31, 2004.

(4) 4Q

2004 annualized.

Copano

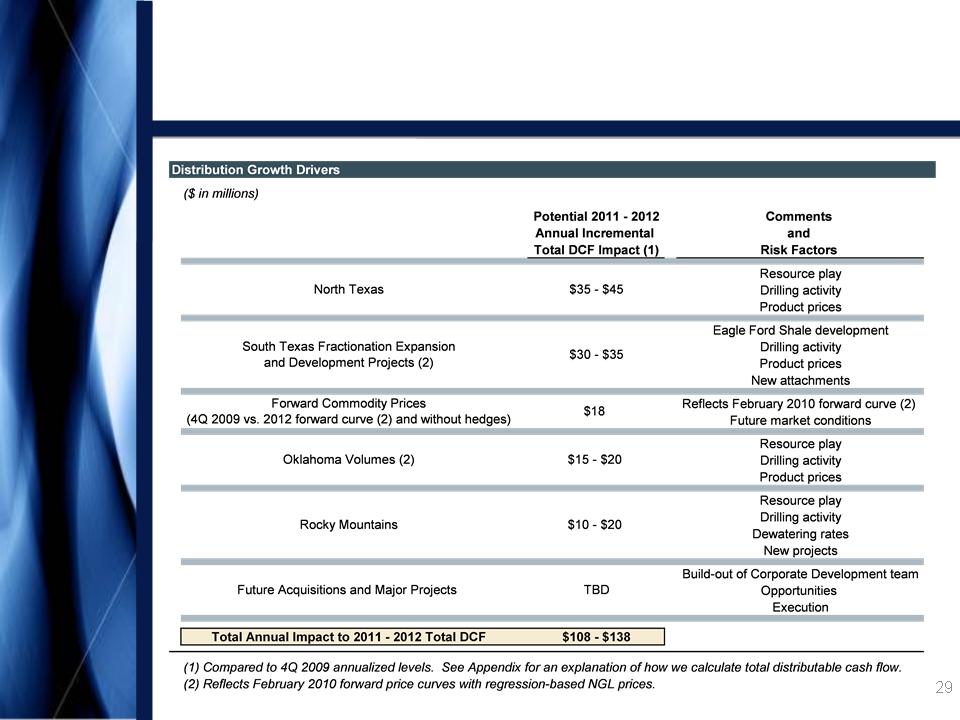

Energy

Distribution

Outlook

Copano

Energy

• Goal: to become a

diversified midstream company with

scale and stability of cash flows, above-average returns on

invested capital and “investment-grade quality distributions”

scale and stability of cash flows, above-average returns on

invested capital and “investment-grade quality distributions”

• Key tenets of growth

strategy:

– Execute on organic

growth opportunities around existing

assets

assets

– Explore

opportunities beyond traditional gathering and

processing

processing

• Be more proactive in

seeking assets and opportunities

– Reduce sensitivity

of cash flows to commodity price

fluctuations

fluctuations

• Hedging

program

• Contracts - increase

fee-for-service component

30

Growth

Strategy

Copano

Energy

31

Appendix

Copano

Energy

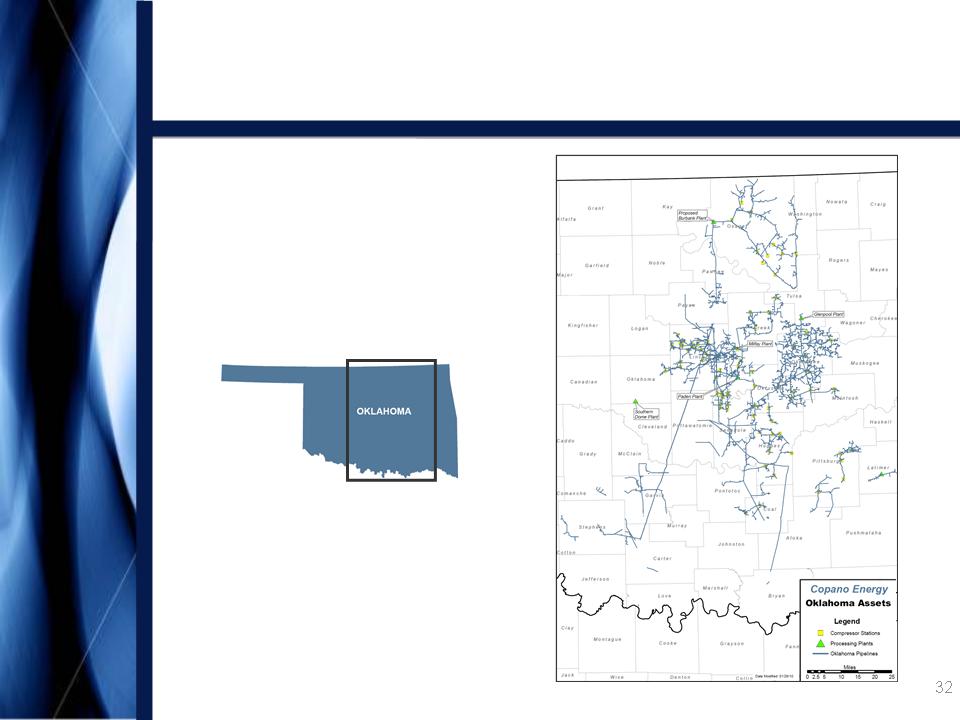

Oklahoma

Assets

Appendix

Copano

Energy

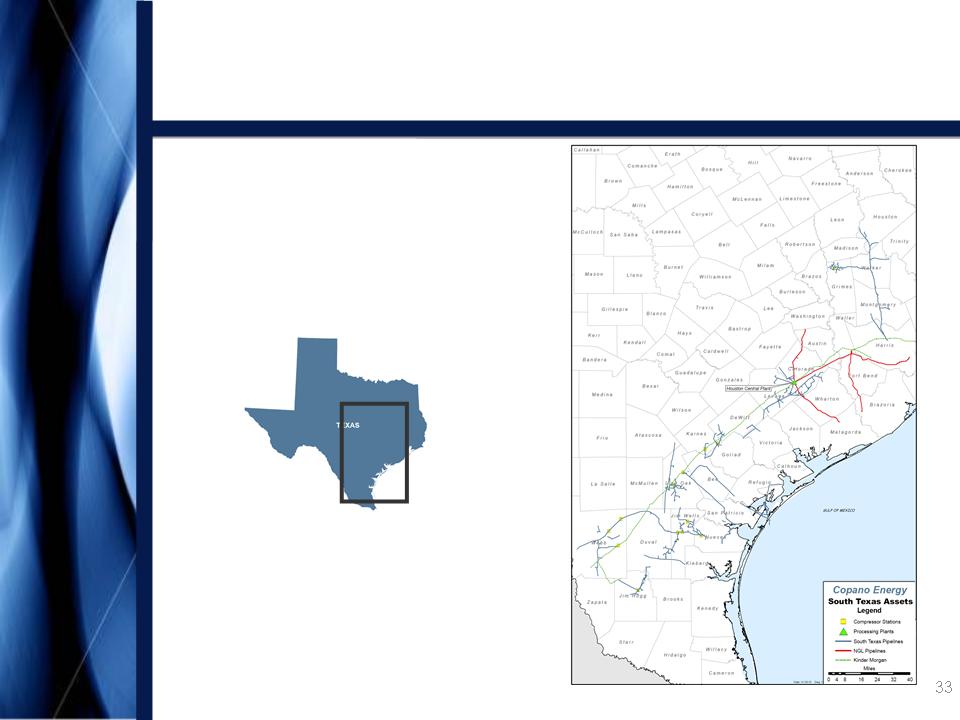

South

Texas Assets

Appendix

Copano

Energy

34

North

Texas Assets

Appendix

Copano

Energy

Rocky

Mountains Assets

Appendix

Copano

Energy

36

Processing

Modes

• Full

Recovery

• Ethane

Rejection

• Conditioning

Mode

→ Texas and Oklahoma -

If the value of

recovered NGLs exceeds the fuel and gas

shrinkage costs of recovering NGLs

recovered NGLs exceeds the fuel and gas

shrinkage costs of recovering NGLs

→ Texas - If the value

of recovered NGLs is less

than the fuel and gas shrinkage cost of

recovering NGLs (available at Houston

Central plant and at Saint Jo plant in North

Texas)

than the fuel and gas shrinkage cost of

recovering NGLs (available at Houston

Central plant and at Saint Jo plant in North

Texas)

→ Texas and Oklahoma -

If the value of ethane

is less than the fuel and shrinkage costs to

recover ethane (in Oklahoma, ethane

rejection at Paden plant is limited by nitrogen

rejection facilities)

is less than the fuel and shrinkage costs to

recover ethane (in Oklahoma, ethane

rejection at Paden plant is limited by nitrogen

rejection facilities)

Appendix

Copano

Energy

37

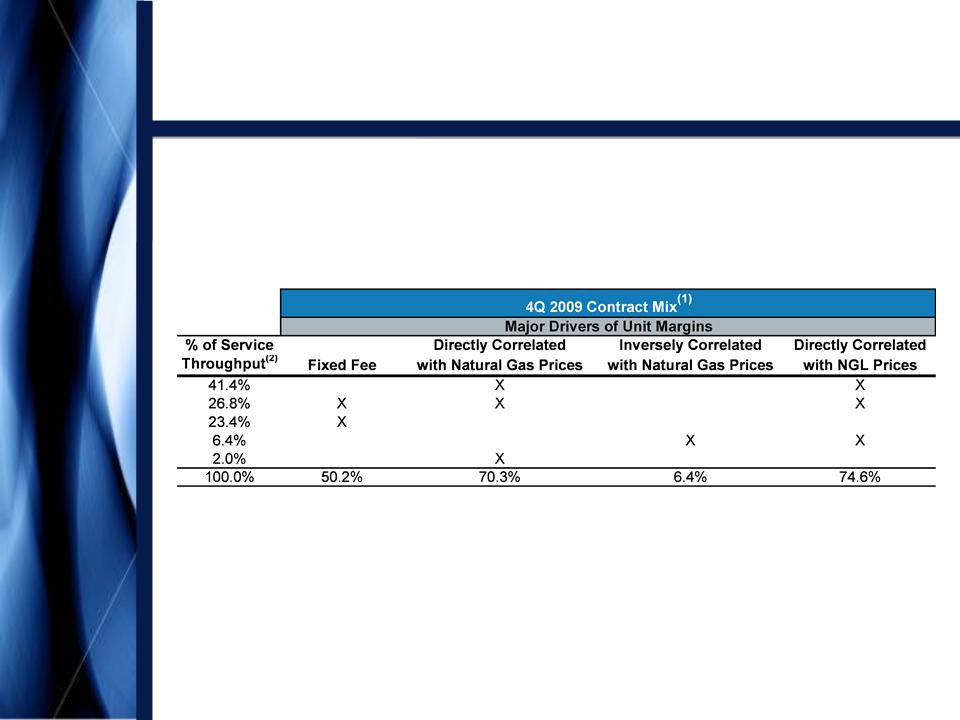

Oklahoma Contract

Mix

(1) Source:

Copano Energy internal financial planning models for consolidated

subsidiaries.

(2) Excludes

12,639 MMBtu/d service throughput for Southern Dome, a majority-owned

affiliate.

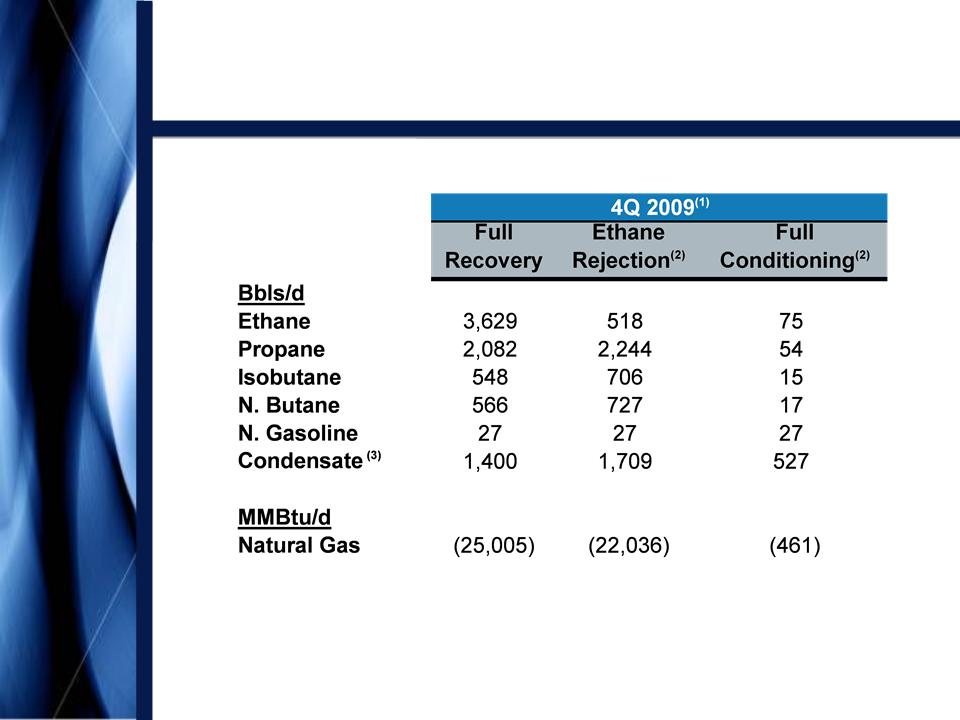

Appendix

Copano

Energy

38

Oklahoma Net

Commodity

Exposure

Exposure

Note: See

explanation of processing modes in this Appendix. Values

reflect rounding.

(1) Source: Copano

Energy internal financial planning models for consolidated

subsidiaries.

(2) Ethane

rejection at Paden plant is limited by nitrogen rejection

facilities.

(3) Reflects

impact of producer delivery point allocations, offset by field condensate

collection and stabilization.

Appendix

Copano

Energy

39

Oklahoma Commodity

Price

Sensitivities

Sensitivities

• Oklahoma segment

gross margins excluding hedge

settlements

settlements

– Matrix reflects 4Q

2009 volumes, adjusted using Copano’s

2009 planning model

2009 planning model

Appendix

Copano

Energy

40

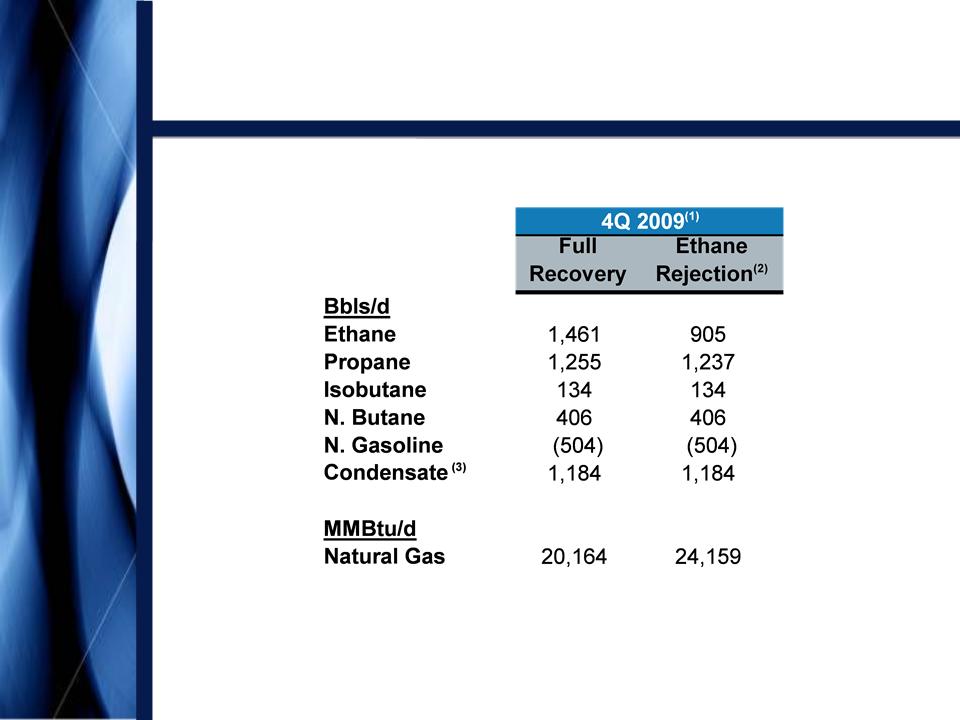

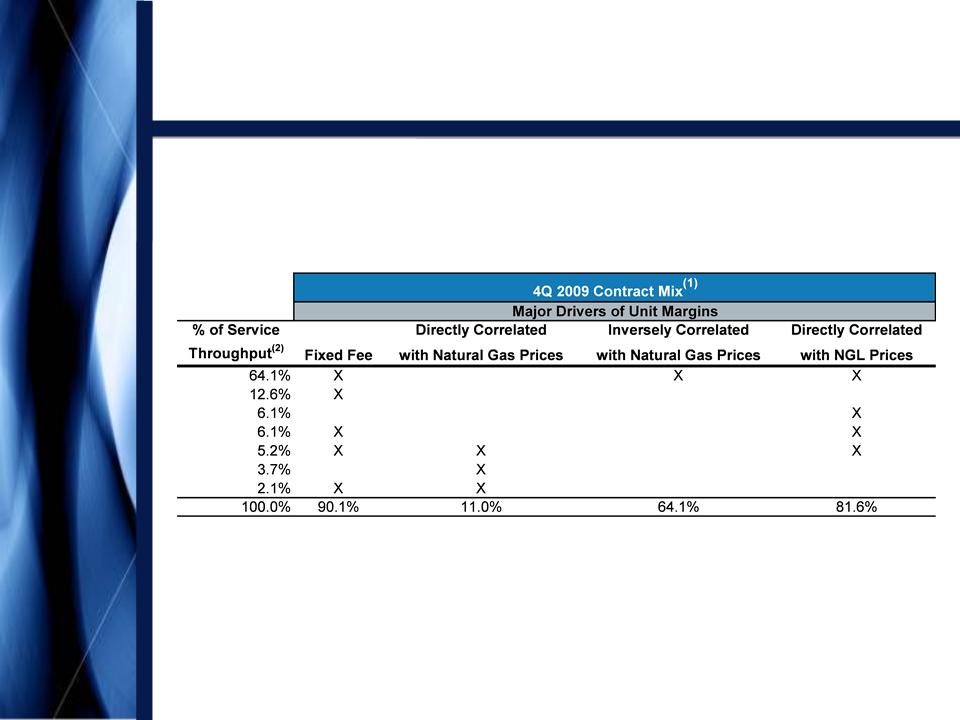

Texas

Contract Mix

Appendix

(1) Source: Copano

Energy internal financial planning models for consolidated

subsidiaries.

(2) Excludes

66,764 MMBtu/d service throughput for Webb Duval, a majority-owned

affiliate.

Copano

Energy

41

Texas

Net Commodity Exposure

Note: See

explanation of processing modes in this Appendix.

(1) Source: Copano

Energy internal financial planning models for consolidated subsidiaries. Based on

4Q 2009

daily wellhead/plant inlet volumes.

daily wellhead/plant inlet volumes.

(2) Fractionation

at Houston Central processing plant permits significant reductions in ethane

recoveries in ethane

rejection mode and full ethane rejection in conditioning mode. To optimize profitability, plant operations can

also be adjusted to partial recovery mode.

rejection mode and full ethane rejection in conditioning mode. To optimize profitability, plant operations can

also be adjusted to partial recovery mode.

(3) At

the Houston Central processing plant, pentanes+ may be sold as

condensate.

Appendix

Copano

Energy

42

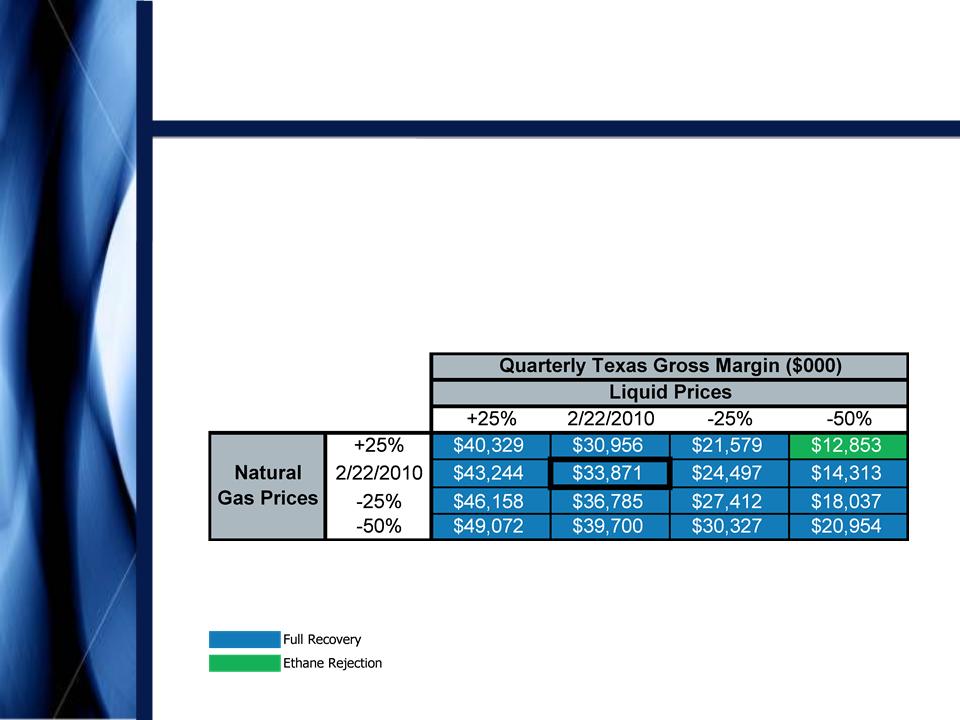

Texas

Commodity Price

Sensitivities

Sensitivities

• Texas segment gross

margins excluding hedge settlements

– Matrix reflects 4Q

2009 volumes and operating conditions,

adjusted using Copano’s 2009 planning model

adjusted using Copano’s 2009 planning model

Appendix

Copano

Energy

43

Rocky

Mountains Sensitivities

Appendix

Note: See this

Appendix for reconciliation of Adjusted EBITDA. Values

reflect rounding.

(1) Impact

on Adjusted EBITDA based on Copano’s interest in the unconsolidated

affiliate.

• 4Q 2009

– Adjusted EBITDA

volume sensitivity (positive or negative impact)

• Consolidated

(producer services): 10,000 MMBtu/d = $26,000

• Unconsolidated

affiliates:

§ Bighorn: 10,000

MMBtu/d = $227,000(1)

§ Fort Union: 10,000

MMBtu/d = $70,000(1)

Copano

Energy

Hedging

Impact

of Commodity Price Sensitivities

of Commodity Price Sensitivities

• Commodity hedging

program supplements cash flow in 2010

through 2012 during less favorable commodity price periods

through 2012 during less favorable commodity price periods

Appendix

Copano

Energy

45

Liquidity and Debt

Facilities

• At December 31,

2009:

– Cash: $45

million

– $550 million

revolving credit facility

• Approximately $122

million available (limited by debt covenants) -

availability increased to approximately $264 million pro forma for March

2010 equity offering

availability increased to approximately $264 million pro forma for March

2010 equity offering

• Remaining term:

approximately 2.8 years

• LIBOR + 175

bps

– $582 million senior

notes

• $332,665,000 8 ⅛%

due 2016

• $249,525,000 7 ¾%

due 2018

• Weighted average

rate: 7.96%

• Weighted average

maturity: 7.1 years

Appendix

Note: See

slide titled “Recent Equity Offering” for adjusts related to March 2010 equity

offering.

Copano

Energy

• Senior Secured

Revolving Credit Facility

– $550 million

facility with $100 million accordion

– Maintenance

tests:

• 5x total debt to

defined EBITDA(1)

limitation

§ 4.39x at December

31, 2009 (3.67x pro forma for March 2010 equity

offering)

offering)

• Minimum required

interest coverage 2.5x defined EBITDA

§ 3.59x at December

31, 2009

• Defined EBITDA adds

back hedge amortization and other non-cash

expenses

expenses

– Following an

acquisition, Copano may increase total debt to defined

EBITDA limitation to 5.5x for three quarters

EBITDA limitation to 5.5x for three quarters

• Senior

Notes

– Incurrence

tests:

• Minimum defined

EBITDA to interest test of 2.00x for debt incurrence

• Minimum defined

EBITDA to interest test of 1.75x for restricted payments

• Defined EBITDA is

similar to that for credit facility

46

Key

Debt Terms and Covenants

(1) See

this Appendix for reconciliation of defined EBITDA, which is referred to in our

credit facility as

“Consolidated EBITDA.”

“Consolidated EBITDA.”

Appendix

Copano

Energy

47

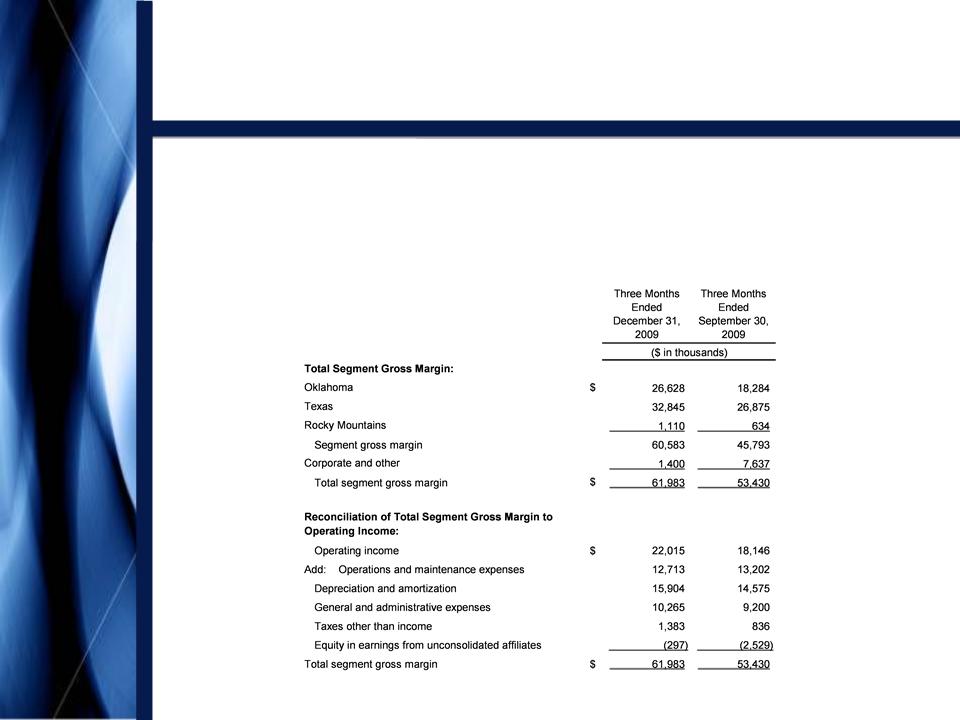

Reconciliation of

Non-GAAP

Financial Measures

Financial Measures

Segment

Gross Margin and Total Segment Gross Margin

• We define segment

gross margin, with respect to a Copano operating segment, as segment revenue

less cost of sales. Cost of

sales includes the following:

cost of natural gas and NGLs purchased from third parties, cost of natural gas and NGLs purchased from affiliates, cost of crude oil purchased from third

parties, costs paid to third parties to transport volumes and costs paid to affiliates to transport volumes. Total segment gross margin is the sum of the

operating segment gross margins and the results of Copano’s risk management activities that are included in Corporate and other. We view total segment

gross margin as an important performance measure of the core profitability of our operations. Segment gross margin allows Copano’s senior management

to compare volume and price performance of the segments and to more easily identify operational or other issues within a segment. The GAAP measure

most directly comparable to total segment gross margin is operating income.

cost of natural gas and NGLs purchased from third parties, cost of natural gas and NGLs purchased from affiliates, cost of crude oil purchased from third

parties, costs paid to third parties to transport volumes and costs paid to affiliates to transport volumes. Total segment gross margin is the sum of the

operating segment gross margins and the results of Copano’s risk management activities that are included in Corporate and other. We view total segment

gross margin as an important performance measure of the core profitability of our operations. Segment gross margin allows Copano’s senior management

to compare volume and price performance of the segments and to more easily identify operational or other issues within a segment. The GAAP measure

most directly comparable to total segment gross margin is operating income.

• The following table

presents total segment gross margin and a reconciliation of total segment gross

margin to the GAAP financial measure of operating

income:

income:

Appendix

Copano

Energy

48

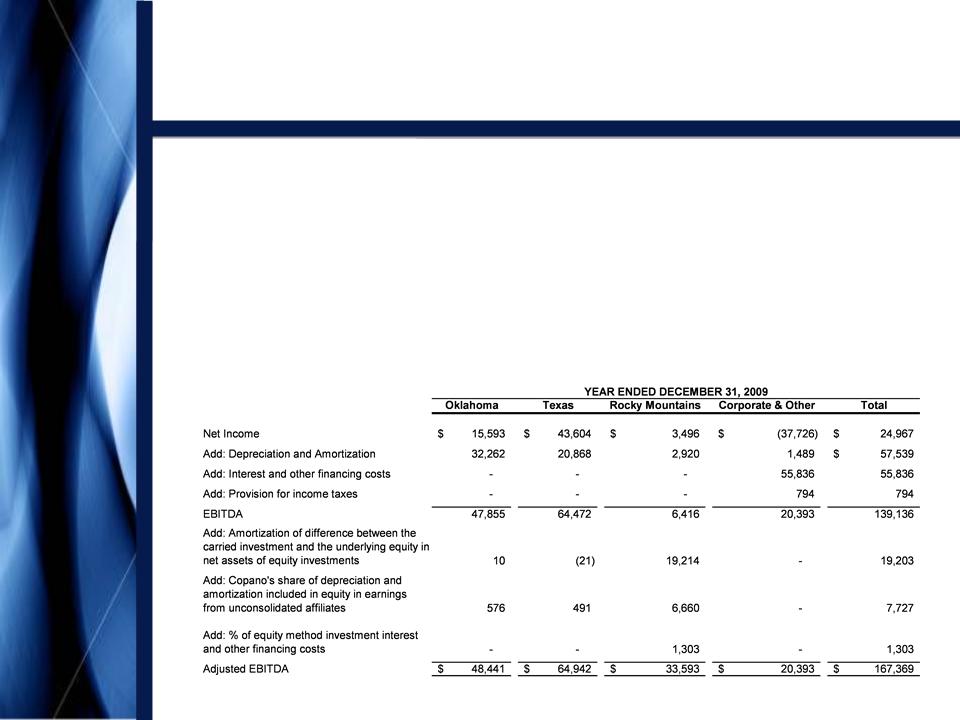

Reconciliation of

Non-GAAP

Financial Measures

Financial Measures

Adjusted

EBITDA

• We define EBITDA as

net income (loss) plus interest expense, provision for income taxes and

depreciation and amortization expense. Because a portion of

our net income (loss) is attributable to equity in earnings (loss) from our equity investees (which include Bighorn, Fort Union, Webb Duval and Southern

Dome), our management also calculates Adjusted EBITDA to reflect the depreciation and amortization expense embedded in equity in earnings (loss) from

unconsolidated affiliates. Specifically, our management determines Adjusted EBITDA by adding to EBITDA (i) the amortization expense attributable to the

difference between our carried investment in each unconsolidated affiliate and the underlying equity in its net assets, (ii) the portion of each unconsolidated

affiliate’s depreciation and amortization expense, which is proportional to our ownership interest in that unconsolidated affiliate and (iii) the portion of each

unconsolidated affiliate’s interest and other financing costs, which is proportional to our ownership interest in that unconsolidated affiliate.

our net income (loss) is attributable to equity in earnings (loss) from our equity investees (which include Bighorn, Fort Union, Webb Duval and Southern

Dome), our management also calculates Adjusted EBITDA to reflect the depreciation and amortization expense embedded in equity in earnings (loss) from

unconsolidated affiliates. Specifically, our management determines Adjusted EBITDA by adding to EBITDA (i) the amortization expense attributable to the

difference between our carried investment in each unconsolidated affiliate and the underlying equity in its net assets, (ii) the portion of each unconsolidated

affiliate’s depreciation and amortization expense, which is proportional to our ownership interest in that unconsolidated affiliate and (iii) the portion of each

unconsolidated affiliate’s interest and other financing costs, which is proportional to our ownership interest in that unconsolidated affiliate.

• External users of our

financial statements such as investors, commercial banks and research analysts

use EBITDA or Adjusted EBITDA, and our

management uses Adjusted EBITDA, as a supplemental financial measure to assess:

management uses Adjusted EBITDA, as a supplemental financial measure to assess:

– The financial

performance of our assets without regard to financing methods, capital structure

or historical cost basis;

– The ability of our

assets to generate cash sufficient to pay interest costs and support our

indebtedness;

– Our operating

performance and return on capital as compared to those of other companies in the

midstream energy sector, without regard to

financing or capital structure; and

financing or capital structure; and

– The viability of

acquisitions and capital expenditure projects and the overall rates of return on

alternative investment opportunities.

• The following table

presents a reconciliation of the portion of our EBITDA and Adjusted EBITDA

attributable to each of our segments to the GAAP financial

measure of net income (loss):

measure of net income (loss):

Appendix

Copano

Energy

49

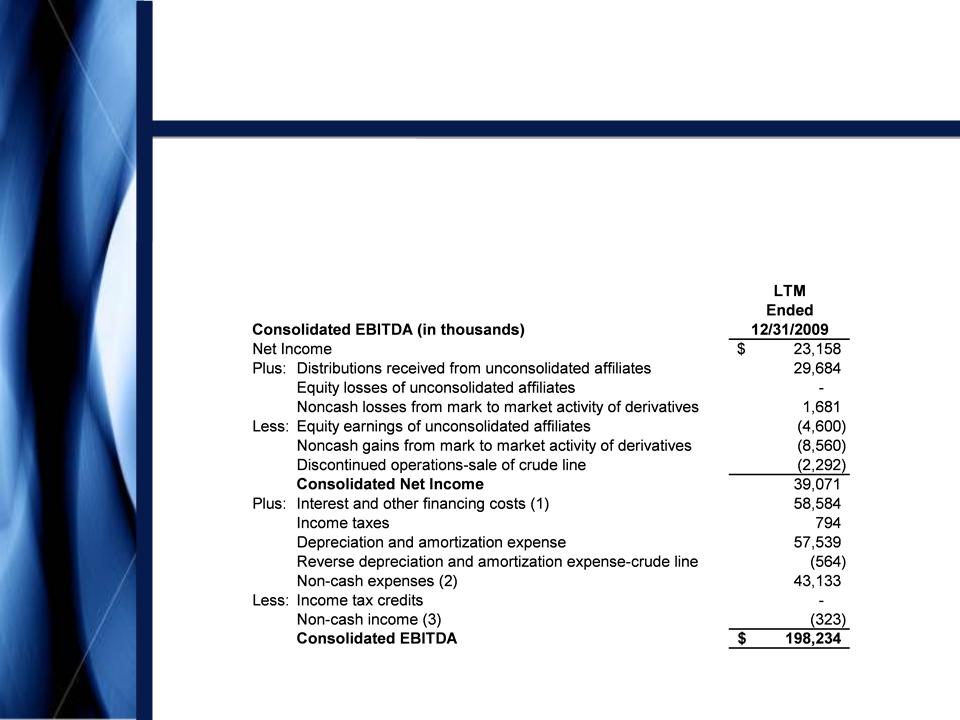

Reconciliation of

Non-GAAP

Financial Measures

Financial Measures

Consolidated

EBITDA

§ EBITDA is also a

financial measure that, with negotiated pro forma adjustments relating to

acquisitions completed during the

period, is reported to our lenders as Consolidated EBITDA and is used to compute our financial covenants under our senior

secured revolving credit facility.

period, is reported to our lenders as Consolidated EBITDA and is used to compute our financial covenants under our senior

secured revolving credit facility.

§ The following table

presents a reconciliation of the non-GAAP financial measure of Consolidated

EBITDA to the GAAP

financial measure of net income (loss):

financial measure of net income (loss):

Appendix

Copano

Energy

50

Definitions of

Non-GAAP

Financial Measures

Financial Measures

Total

Distributable Cash Flow

§ We define total

distributable cash flow as net income plus: (i) depreciation, amortization and

impairment expense (including

amortization expense relating to the option component of our risk management portfolio); (ii) cash distributions received from

investments in unconsolidated affiliates and equity losses from such unconsolidated affiliates; (iii) provision for deferred

income taxes; (iv) the subtraction of maintenance capital expenditures; (v) the subtraction of equity in earnings from

unconsolidated affiliates and (vi) the addition of losses or subtraction of gains relating to other miscellaneous non-cash

amounts affecting net income for the period, such as equity-based compensation, mark-to-market changes in derivative

instruments, and our line fill contributions to third-party pipelines and gas imbalances. Maintenance capital expenditures are

capital expenditures employed to replace partially or fully depreciated assets to maintain the existing operating capacity of

our assets and to extend their useful lives, or other capital expenditures that are incurred in maintaining existing system

volumes and related cash flows.

amortization expense relating to the option component of our risk management portfolio); (ii) cash distributions received from

investments in unconsolidated affiliates and equity losses from such unconsolidated affiliates; (iii) provision for deferred

income taxes; (iv) the subtraction of maintenance capital expenditures; (v) the subtraction of equity in earnings from

unconsolidated affiliates and (vi) the addition of losses or subtraction of gains relating to other miscellaneous non-cash

amounts affecting net income for the period, such as equity-based compensation, mark-to-market changes in derivative

instruments, and our line fill contributions to third-party pipelines and gas imbalances. Maintenance capital expenditures are

capital expenditures employed to replace partially or fully depreciated assets to maintain the existing operating capacity of

our assets and to extend their useful lives, or other capital expenditures that are incurred in maintaining existing system

volumes and related cash flows.

§ Total distributable

cash flow is a significant performance metric used by senior management to

compare basic cash flows

generated by us (prior to the establishment of any retained cash reserves by our Board of Directors) to the cash distributions

we expect to pay our unitholders, and it also correlates with the metrics of our existing debt covenants. Using total

distributable cash flow, management can quickly compute the coverage ratio of estimated cash flows to planned cash

distributions. Total distributable cash flow is also an important non-GAAP financial measure for our unitholders because it

serves as an indicator of our success in providing a cash return on investment — specifically, whether or not we are

generating cash flow at a level that can sustain or support an increase in our quarterly distribution rates. Total distributable

cash flow is also used by industry analysts with respect to publicly traded partnerships and limited liability companies

because the market value of such entities’ equity securities is significantly influenced by the amount of cash they can

distribute to unitholders.

generated by us (prior to the establishment of any retained cash reserves by our Board of Directors) to the cash distributions

we expect to pay our unitholders, and it also correlates with the metrics of our existing debt covenants. Using total

distributable cash flow, management can quickly compute the coverage ratio of estimated cash flows to planned cash

distributions. Total distributable cash flow is also an important non-GAAP financial measure for our unitholders because it

serves as an indicator of our success in providing a cash return on investment — specifically, whether or not we are

generating cash flow at a level that can sustain or support an increase in our quarterly distribution rates. Total distributable

cash flow is also used by industry analysts with respect to publicly traded partnerships and limited liability companies

because the market value of such entities’ equity securities is significantly influenced by the amount of cash they can

distribute to unitholders.

Appendix

Copano

Energy

NASDAQ:

CPNO

March

2010