Attached files

Exhibit 3.2

CERTIFICATE OF DESIGNATIONS OF

THE SERIES A 10% CONVERTIBLE PREFERRED STOCK

(Par Value $0.01)

OF

RUTH’S HOSPITALITY GROUP, INC.

Pursuant to Section 151 of the

General Corporation Law of the State of Delaware

Ruth’s Hospitality Group, Inc., a corporation organized and existing under the General Corporation Law of the State of Delaware (the “Company”), in accordance with the provisions of Section 151 thereof, DOES HEREBY CERTIFY:

That pursuant to the authority conferred upon the Board of Directors of the Company (the “Board”) in accordance with the Amended and Restated Certificate of Incorporation of the Company and the Restated Bylaws of the Company, the Board on December 18, 2009 adopted the following resolution creating a series of Preferred Stock, par value $0.01 per share, of the Company designated as Series A 10% Convertible Preferred Stock:

RESOLVED, that pursuant to the authority vested in the Board in accordance with the Amended and Restated Certificate of Incorporation of the Company and out of the Preferred Stock, par value $0.01 per share, authorized therein, the Board hereby authorizes, designates and creates a series of 25,000 shares of Preferred Stock, and states that the designation and amount thereof and the voting powers, preferences and relative, participating, optional and other special rights of the shares of such series, and the qualifications, limitations or restrictions thereof be, and hereby are, as follows:

Section 1. Designation.

The designation of the series of Preferred Stock created by this resolution shall be “Series A 10% Convertible Preferred Stock” (the “Series A Preferred Stock”). Each share of the Series A Preferred Stock shall be identical in all respects to every other share of the Series A Preferred Stock. The Series A Preferred Stock shall be perpetual, subject to the provisions of Section 6.

Section 2. Number of Shares.

The authorized number of shares of Series A Preferred Stock shall be 25,000. Such number of shares may be increased or decreased by resolution of the Board; provided, that no decrease shall reduce the number of shares of Series A Preferred Stock to a number less than the number of shares then outstanding or may be required to be issued pursuant to Section 4. Shares of Series A Preferred Stock that are redeemed, purchased or otherwise acquired by the Company, or converted into Common Stock or another series of Preferred Stock, shall revert to authorized but unissued shares of Preferred Stock.

Section 3. Definitions. As used herein with respect to the Series A Preferred Stock:

(a) “Accumulated Dividends” shall mean with respect to any share of Series A Preferred Stock, as of any date, the aggregate accumulated and unpaid dividends on such share for Dividend Periods ending on or prior to such date.

(b) “Affiliate” of any Person shall mean any other Person directly or indirectly controlling or controlled by or under direct or indirect common control with such Person. For purposes of this definition, “control” when used with respect to any Person has the meaning specified in Rule 12b-2 under the Exchange Act; and the terms “controlling” and “controlled” have meanings correlative to the foregoing.

(c) “Board” shall mean the Board of Directors of the Company.

(d) “Business Day” shall mean a day that is a Monday, Tuesday, Wednesday, Thursday or Friday and is not a day on which banking institutions in New York, New York generally are authorized or obligated by law, regulation or executive order to close.

(e) “Bylaws” shall mean the Restated By-Laws of the Company in effect on the date hereof, as may be amended from time to time.

(f) “Capital Stock” shall mean any and all shares, interests, rights to purchase, warrants, options, participations or other equivalents of or interests in (in each case however designated) Common Stock, Preferred Stock or other equity interests issued by the Company, any Subsidiary of the Company or any other Person, as applicable.

(g) “Certificate of Designations” shall mean this Certificate of Designations relating to the Series A Preferred Stock, as it may be amended from time to time.

(h) “Certificate of Incorporation” shall mean the Amended and Restated Certificate of Incorporation of the Company.

(i) “Change of Control” shall mean the occurrence of any of the following:

(1) any Person other than one or more Permitted Holders shall Beneficially Own, directly or indirectly, through a purchase, merger or other acquisition transaction or series of transactions, shares of the Company’s Capital Stock entitling such Person to exercise 50% or more of the Total Voting Power of Voting Stock of the Company (for purposes of this clause (1), “Person” shall include any syndicate or group that would be deemed to be a “person” under Section 13(d)(3) of the Exchange Act);

(2) the Company (i) merges or consolidates with or into any other Person or another Person merges with or into the Company or (ii) engages in any recapitalization, reclassification or other transaction in which all or substantially all of the Common Stock is exchanged for or converted into cash, securities or other property, in each case; provided, that the stockholders of the Company immediately prior to the consummation of such transaction (including a series of related transactions) shall own less than 50% of the Voting Stock (or have the right to appoint less than 50% of the members of the Board) of the surviving person (or the parent of the surviving person where the surviving person is wholly owned by the parent person) immediately following the consummation of such transaction (including a series of related transactions); or

(3) the Company conveys, sells, transfers or leases all or substantially all of the Company’s consolidated assets to another Person in one or a series of transactions.

2

(j) “Close of Business” shall mean 5:00 p.m., New York City time, on any Business Day.

(k) “Closing Price” shall mean the price per share of the final trade of the Common Stock, other Capital Stock or similar equity interest, as applicable, on the applicable Trading Day (or the last trade of the Capital Stock or similar equity interest preceding the applicable Trading Day if no trades of such securities were made on the applicable Trading Day) on the principal national securities exchange or over-the-counter securities market on which the Common Stock, other Capital Stock or similar equity interest is listed or admitted to trading; provided that if the Capital Stock is not so listed or traded, the Closing Price shall be equal to the fair market value, as reasonably determined in good faith by the Board.

(l) “Common Stock” shall mean the common stock, par value $0.01 per share, of the Company.

(m) “Company” shall mean Ruth’s Hospitality Group, Inc., a Delaware corporation.

(n) “Conversion Price” shall mean $1,000 divided by the Conversion Rate in effect on the date of determination.

(o) “Conversion Rate” shall mean 344.828, subject to adjustment as set forth in Section 8.

(p) “Conversion Shares” shall have the meaning ascribed to it in Section 7(a).

(q) “Credit Agreement” means the First Amended and Restated Credit Facility dated February 19, 2008, as amended, among the Company, Wells Fargo Bank, National Association, as administrative agent, and various lenders, as the same may be amended, restated, supplemented, modified, renewed, refunded, replaced or refinanced from time to time in one or more agreements.

(r) “Current Market Price” shall mean the average Closing Price for the ten (10) consecutive Business Days immediately preceding, but not including, the date as of which the Current Market Price is to be determined.

(s) “Current Market Value” shall mean the average consolidated closing bid price of the Common Stock for the ten (10) consecutive Business Days immediately preceding, but not including, the date as of which the Current Market Value is to be determined.

(t) “Distributed Property” shall have the meaning ascribed to it in Section 8(c).

(u) “Dividend Payment Date” shall mean January 1, April 1, July 1 and October 1 of each year, commencing on April 1, 2010; provided, that if any such Dividend Payment Date would otherwise occur on a day that is not a Business Day, such Dividend Payment Date shall instead be (and any dividend payable on Series A Preferred Stock on such Dividend Payment Date shall instead be payable on) the immediately succeeding Business Day.

(v) “Dividend Period” shall mean the period commencing on and including a Dividend Payment Date (other than the initial Dividend Period, which shall commence on and include the Original Issue Date of the Series A Preferred Stock) and shall end on and include the calendar day immediately preceding the next Dividend Payment Date.

(w) “Dividend Rate” shall mean 10% per annum.

3

(x) “Exchange Act” shall mean the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

(y) “Exchange Property” shall have the meaning ascribed to it in Section 10(a).

(z) “Excluded Issuance” shall mean, any issuances of (1) Capital Stock to any employee, officer or director of the Company pursuant to a stock option, incentive compensation, stock purchase or similar plan outstanding as of the Original Issue Date or, subsequent to the Original Issue Date, approved by the Board or a duly authorized committee of the Board, (2) Capital Stock by the Company pursuant to any merger, joint venture, partnership, consolidation, dissolution, liquidation, tender offer, recapitalization, reorganization, share exchange, business combination or similar transaction or any other direct or indirect acquisition by the Company approved by the Board, whereby the Company’s Capital Stock comprises, in whole or in part, the consideration paid by the Company in such transaction, (3) securities pursuant to a broadly-marketed underwritten public offering, to be offered and sold to the public at an issue price of not less than 95% of the Closing Price of the Common Stock immediately prior to the pricing of such offering, (4) Capital Stock by the Company pursuant to options, warrants, notes or other rights to acquire Capital Stock of the Company outstanding on the Original Issue Date or issued pursuant to an Excluded Issuance under clauses (1) and (2) above, and (5) Common Stock issued by the Company upon conversion of the Series A Preferred Stock.

(aa) “Expiration Date” shall have the meaning ascribed to it in Section 8(d).

(bb) “Internal Reorganization Event” shall have the meaning ascribed to it in Section 10(d).

(cc) “Junior Stock” shall mean the Common Stock and any other class or series of Capital Stock of the Company that ranks junior to the Series A Preferred Stock (1) as to the payment of dividends or (2) as to the distribution of assets on any liquidation, dissolution or winding up of the Company, or both.

(dd) “Liquidation Preference” shall mean, on any specific date, with respect to any share of Series A Preferred Stock, (1) $1,000 plus (2) the Accumulated Dividends with respect to such share.

(ee) “Notice of Change of Control” shall have the meaning ascribed to it in Section 6(c).

(ff) “Original Issue Date” shall mean February 12, 2010.

(gg) “Parity Stock” shall mean any class or series of Capital Stock of the Company (other than the Series A Preferred Stock) that ranks equally with the Series A Preferred Stock both (1) in the priority of payment of dividends and (2) in the distribution of assets upon any liquidation, dissolution or winding up of the Company (in each case, without regard to whether dividends accrue cumulatively or non-cumulatively).

(hh) “Pending COC Event” shall mean the earlier of (1) the date on which the Board (A) publicly recommends that the stockholders tender their shares to any Person who has publicly announced a tender or exchange offer which, if consummated, would result in a Change of Control, or (B) fails to recommend that stockholders reject such an offer within 10 business days after the commencement of such tender or exchange offer or in the alternative fails to make a “stop-look-and-listen” communication to the stockholders of the Company within such time period, (2) the execution by the Company of a definitive agreement which if consummated will result in a Change of Control, or (3) the public announcement by the Company that it recommends any transaction that, if consummated, would result in a Change of Control.

4

(ii) “Permitted Holders” shall mean, collectively, (1) BRS Coinvestor III, L.P., a Delaware limited partnership (“Co-Invest Fund”), (2) Bruckmann, Rosser, Sherrill & Co. III, L.P., a Delaware limited partnership (“BRS”), (3) any general partner of BRS or BRS Co-Invest Fund and (4) any of their commonly controlled or commonly managed investment funds.

(jj) “Person” shall mean any individual, company, partnership, limited liability company, joint venture, association, joint stock company, trust, unincorporated organization, government or agency or political subdivision thereof or any other entity.

(kk) “Preferred Director” shall have the meaning ascribed to it in Section 9(b).

(ll) “Preferred Stock” shall mean any and all series of preferred stock of the Company, including the Series A Preferred Stock.

(mm) “Purchase Agreement” shall mean the Securities Purchase Agreement by and among the Company, BRS and Co-Invest Fund, dated as of December 22, 2009.

(nn) “Record Date” shall mean, with respect to any dividend, distribution or other transaction or event in which the holders of Common Stock (or other applicable security) have the right to receive any cash, securities or other property or in which the Common Stock (or other applicable security) is exchanged for or converted into any combination of cash, securities or other property, the date fixed for determination of stockholders entitled to receive such cash, securities or other property (whether such date is fixed by the Board or by statute, contract, this Certificate of Designations or otherwise).

(oo) “Redemption Amount” shall have the meaning ascribed to it in Section 6(a).

(pp) “Reorganization Event” shall have the meaning ascribed to it in Section 10(a).

(qq) “Series A Parity Payment Date” shall have the meaning ascribed to it in Section 4(c)(3).

(rr) “Series A Preferred Stock” shall have the meaning ascribed to it in Section 1.

(ss) “Spin-Off” shall have the meaning ascribed to it in Section 8(c).

(tt) “Subsidiary” shall mean any company, partnership, limited liability company, joint venture, joint stock company, trust, unincorporated organization or other entity for which the Company owns, directly or indirectly, at least 50% of the Voting Stock of such entity.

(uu) “Total Voting Power” means the total number of votes that may be cast in the election of directors of the Company if all Voting Stock treated as outstanding pursuant to this definition were present and voted at a meeting held for such purpose. The percentage of the Total Voting Power Beneficially Owned by any Person is the percentage of the Total Voting Power that is represented by the total number of votes that may be cast in the election of directors of the Company by Voting Stock Beneficially Owned by such Person. In calculating such percentage, the Voting Stock Beneficially Owned by any Person that are not outstanding but are subject to issuance upon exercise or exchange of rights of conversion or any options, warrants or other rights Beneficially Owned by such Person shall be deemed to be outstanding for the purpose of computing the percentage of the Total Voting Power represented by Voting Stock Beneficially Owned by such Person, but shall not be deemed to be outstanding for the purpose of computing the percentage of the Total Voting Power represented by Voting Stock Beneficially Owned by any other Person. Any Person shall be deemed to “Beneficially Own,” to have “Beneficial Ownership” of, or to be “Beneficially Owning” any securities (which securities shall

5

also be deemed “Beneficially Owned” by such Person) that such Person is deemed to “beneficially own” within the meaning of Rules 13d-3 and 13d-5 under the Exchange Act; provided, that any Person shall be deemed to Beneficially Own any securities that such Person has the right to acquire, whether or not such right is exercisable immediately.

(vv) “Trading Day” shall mean any Business Day on which the Common Stock is traded, or able to be traded, on the principal national securities exchange or over-the-counter securities market on which the Common Stock is listed or admitted to trading.

(ww) “Trigger Event” shall have the meaning ascribed to it in Section 8(c).

(xx) “Voting Stock” shall mean, with respect to the Company or any other Person, Capital Stock of the class or classes pursuant to which the holders thereof have the general voting power under ordinary circumstances (determined without regard to any classification of directors) to elect one or more members of the board of directors or other governing body thereof (it being understood that the Series A Preferred Stock shall be considered Voting Stock for all purposes under this Certificate of Designations).

Section 4. Dividends.

(a) Rate. Holders of the Series A Preferred Stock shall be entitled to receive, on each share of Series A Preferred Stock, when, as and if declared by the Board, out of funds legally available therefor, dividends with respect to each Dividend Period (1) in an amount equal to the Dividend Rate on the then applicable Liquidation Preference and (2) in the event a cash dividend or other distribution in cash has been declared on the Common Stock during such Dividend Period, an additional amount in cash equal to the product of (A) the quotient of (i) the Liquidation Preference in effect on the Record Date for such dividend or other distribution divided by (ii) the Conversion Price in effect on the Record Date for such dividend or other distribution, multiplied by (B) the cash amount per share distributed or to be distributed in respect of the Common Stock. Dividends payable at the Dividend Rate on the then applicable Liquidation Preference shall accrue daily and begin to accrue and be cumulative from the Original Issue Date, whether or not the Company has funds legally available for such dividends or such dividends are declared. Dividends that are payable on the Series A Preferred Stock on any Dividend Payment Date shall be payable to holders of record of the Series A Preferred Stock as they appear on the stock register of the Company on the record date for such dividend, which record date shall be the date that is 15 days prior to the applicable Dividend Payment Date; provided, that dividends on account of arrears for any past Dividend Period may be declared and paid at any time, without reference to any regular Dividend Payment Date, to the holders of record of the Series A Preferred Stock on any date as may be fixed by the Board, which date is not more than 30 days prior to the payment of such dividends. Notwithstanding anything to the contrary set forth above, unless and until such dividends are declared by the Board, there shall be no obligation to pay such dividends; provided, however, that such dividends shall compound on each Dividend Payment Date if not otherwise paid in cash on such date and shall be added to the then applicable Liquidation Preference. Dividends payable at the Dividend Rate on the Series A Preferred Stock shall be computed on the basis of a 365-day year and the actual number of days elapsed.

(b) Partial Payment of Dividends. All dividends paid with respect to shares of Series A Preferred Stock pursuant to Section 4(a) above shall be paid pro rata to the holders of record of the Series A Preferred Stock entitled thereto.

6

(c) Priority. Without the vote or consent of the holders of at least a majority of the shares of Series A Preferred Stock then outstanding pursuant to Section 9(c) hereof, so long as any shares of Series A Preferred Stock are outstanding:

(1) no dividends shall be declared by the Board or paid or funds set apart for the payment of dividends or other distributions on any Junior Stock for any period;

(2) no payment in cash or otherwise on account of the purchase, redemption, retirement or other acquisition of Junior Stock shall be made, and no sum shall be set aside for or applied by the Company to any Junior Stock (either pursuant to any applicable sinking fund requirement or otherwise); provided that the foregoing limitations shall not apply to redemptions, purchases or other acquisitions of shares of Common Stock or other Junior Stock by the Company in accordance with the provisions of any employee benefit plan or other equity agreement with the employees, officers and directors of the Company that has been approved by the Board, so long as such redemptions, purchases or other acquisitions do not exceed an aggregate of one percent (1%) of the outstanding shares of Common Stock in any twelve month period;

(3) no dividends shall be declared by the Board or paid or funds set apart for the payment of dividends or other distributions on any Parity Stock for any period unless (A) full Accumulated Dividends have been paid or set apart for payment on the Series A Preferred Stock for all Dividend Periods terminating on or prior to the date of payment of such dividends or distributions on such Parity Stock (the “Series A Parity Payment Date”) and (B) an amount equal to accrued and unpaid dividends on the Series A Preferred Stock from and including the immediately preceding Dividend Payment Date to but excluding the Series A Parity Payment Date have been paid or set apart for payment on the Series A Preferred Stock; and

(4) no payment in cash or otherwise on account of the purchase, redemption, retirement or other acquisition of Parity Stock shall be made, and no sum shall be set aside for or applied by the Company to any Parity Stock (either pursuant to any applicable sinking fund requirement or otherwise).

Section 5. Liquidation Rights.

(a) Voluntary or Involuntary Liquidation. In the event of any liquidation, dissolution or winding up of the affairs of the Company, whether voluntary or involuntary, holders of the Series A Preferred Stock shall be entitled to receive for each share of Series A Preferred Stock, out of the assets of the Company or proceeds thereof (whether capital or surplus) available for distribution to stockholders of the Company, and after satisfaction of all liabilities and obligations to creditors of the Company, on par with each share of Parity Stock but before any distribution of such assets or proceeds is made to or set aside for the holders of Junior Stock, an amount equal to the greater of (1) the sum of (A) the then applicable Liquidation Preference per share of the Series A Preferred Stock plus (B) an amount per share equal to accrued but unpaid dividends not previously added to the Liquidation Preference from and including the immediately preceding Dividend Payment Date to but excluding the date fixed for such liquidation, dissolution or winding up of the Company and (2) the proportionate amount of all cash, securities and other property (such securities or other property having a value equal to its fair market value as reasonably determined in good faith by the Board) to be distributed in respect of the Common Stock that such holder would have been entitled to had it converted such Series A Preferred Stock into Common Stock immediately prior to the date fixed for such liquidation, dissolution or winding up of the Company. To the extent such amount is paid in full to all holders of Series A Preferred Stock, the holders of other Capital Stock of the Company shall be entitled to receive all remaining assets of the Company (or proceeds thereof) according to their respective rights and preferences.

(b) Partial Payment. If in connection with any distribution described in Section 5(a) above the assets of the Company or proceeds thereof are not sufficient to pay the then applicable Liquidation Preferences in full to all holders of Series A Preferred Stock and all holders of Parity Stock, the amounts

7

paid to the holders of Series A Preferred Stock and to the holders of all such other Parity Stock shall be paid pro rata in accordance with the respective aggregate Liquidation Preferences of the holders of Series A Preferred Stock and the holders of all such other Parity Stock.

(c) Merger, Consolidation and Sale of Assets Not Liquidation. For purposes of this Section 5, the merger or consolidation of the Company with any other corporation or other entity, including a merger or consolidation in which the holders of Series A Preferred Stock receive cash, securities or other property for their shares, or the sale, lease or exchange (for cash, securities or other property) of all or substantially all of the assets of the Company, shall not constitute a liquidation, dissolution or winding up of the Company, but instead shall be subject to the provisions of Section 10.

Section 6. Redemption.

(a) Redemption at the Option of the Company. The Series A Preferred Stock may be called for redemption, in whole or in part, at the option of the Company, at any time on or after the fifth (5th) anniversary of the date on which the Company issues the first share of Series A Preferred Stock, upon giving of notice of redemption as provided below, at a redemption price per share in cash equal to the sum of (1) the then applicable Liquidation Preference per share of the Series A Preferred Stock plus (2) an amount per share equal to accrued but unpaid dividends not previously added to the Liquidation Preference from and including the immediately preceding Dividend Payment Date to but excluding the date of redemption (the “Redemption Amount”); provided, however, that the Company shall not be permitted to redeem less than all of the outstanding shares of Series A Preferred Stock if such partial redemption would result in the Permitted Holders holding more than 0% and less than 5% of the Total Voting Power of the Company.

Notice of every redemption of outstanding shares of Series A Preferred Stock pursuant to this Section 6(a) shall be given by first class mail, postage prepaid, addressed to the holders of record of the shares to be redeemed at their respective last addresses appearing on the books of the Company. Such mailing shall be made at least 30 days and not more than 60 days before the date fixed for redemption. Any notice mailed as provided in this Section 6(a) shall be conclusively presumed to have been duly given, whether or not the holder receives such notice, but failure duly to give such notice by mail, or any defect in such notice or in the mailing thereof, to any holder of shares of Series A Preferred Stock designated for redemption shall not affect the validity of the proceedings for the redemption of any other shares of Series A Preferred Stock. Each notice of redemption given to a holder shall state: (1) the redemption date; (2) the number of shares of Series A Preferred Stock to be redeemed and, if less than all the shares held by such holder are to be redeemed, the number of such shares to be redeemed from such holder; (3) the Redemption Amount; and (4) the place or places where certificates for such shares are to be surrendered for payment of the redemption price.

(b) Redemption at the Option of the Holder. At any time on or after the seventh (7th) anniversary of the date on which the Company issues the first share of Series A Preferred Stock, each holder of Series A Preferred Stock shall have the right to require the Company to repurchase all or any part of such holder’s Series A Preferred Stock at a purchase price per share in cash equal to the Redemption Amount.

The right of redemption provided in this Section 6(b) may be exercised by a holder of Series A Preferred Stock by (1) providing written notice to the Company stating the holder’s determination to redeem its shares of Series A Preferred Stock and the address to which payment for such shares is to be sent and (2) tendering the certificate or certificates representing the shares to be redeemed.

8

(c) Redemption Upon a Change of Control. Within ten (10) days after a Pending COC Event and at least twenty (20) days prior to the Company effecting a Change of Control, the Company shall notify each holder of Series A Preferred Stock in writing of the Pending COC Event or the Change of Control. Such notice (the “Notice of Change of Control”) shall set forth in reasonable detail all material terms and conditions of the Pending COC Event or the Change of Control. Each holder of Series A Preferred Stock may elect (by delivery of written notice to the Company within ten (10) days of receipt of the Notice of Change of Control) to require the Company, as part of the proposed Change of Control and contemporaneously with the consummation thereof, to repurchase all or any part of such holder’s Series A Preferred Stock at a purchase price per share in cash equal to the Redemption Amount; provided that in any case, the Company shall not be required to purchase any shares of Series A Preferred Stock until the consummation of such Pending COC Event or Change of Control.

(d) Partial Redemption. In case of any redemption of part of the shares of Series A Preferred Stock at the time outstanding, the shares to be redeemed shall be selected pro rata. If fewer than all the shares represented by any certificate are redeemed, a new certificate shall be issued representing the unredeemed shares without charge to the holder thereof.

(e) Effectiveness of Redemption. If notice of redemption has been duly given and if on or before the redemption date specified in the notice all funds necessary for the redemption have been deposited by the Company, in trust for the pro rata benefit of the holders of the shares called for redemption, with a bank or trust company doing business in the Borough of Manhattan, The City of New York, and having a capital and surplus of at least $5.0 billion and selected by the Board, so as to be and continue to be available solely therefor, then, notwithstanding that any certificate for any share so called for redemption has not been surrendered for cancellation, on and after the redemption date dividends shall cease to accrue on all shares so called for redemption, all shares so called for redemption shall no longer be deemed outstanding and all rights with respect to such shares shall forthwith on such redemption date cease and terminate, except only the right of the holders thereof to receive the amount payable on such redemption from such bank or trust company, without interest (it being understood that notwithstanding the foregoing, any share so called for redemption may be converted pursuant to Section 7 prior to the redemption date). Any funds unclaimed at the end of three (3) years from the redemption date shall, to the extent permitted by law, be released to the Company, after which time the holders of the shares shall look only to the Company for payment of the Redemption Amount of such shares.

Section 7. Conversion.

(a) Permissive Conversion. Each share of Series A Preferred Stock may be converted on any date, from time to time, at the option of the holder thereof, into the number of shares of Common Stock equal to the quotient of (1) the sum of (A) the then applicable Liquidation Preference plus (B) an amount per share equal to accrued but unpaid dividends not previously added to the Liquidation Preference on such share of Series A Preferred Stock from and including the immediately preceding Dividend Payment Date to but excluding the conversion date divided by (2) the Conversion Price in effect at such time (such number of shares of Common Stock, the “Conversion Shares”).

The right of conversion attaching to any shares of Series A Preferred Stock may be exercised by the holders thereof by delivering the shares to be converted to the office of the Company, accompanied by a duly signed and completed notice of conversion in form reasonably satisfactory to the Company. The conversion date shall be the date on which the shares of Series A Preferred Stock and the duly signed and completed notice of conversion are received by the Company. The Person entitled to receive the Common Stock issuable upon such conversion shall be treated for all purposes as the record holder or holders of such Common Stock as of such conversion date, and such Person or Persons shall cease to be a record holder of the Series A Preferred Stock on that date. As promptly as practicable on or after the

9

conversion date (and in any event no later than three Trading Days thereafter), the Company shall issue the number of whole shares of Common Stock issuable upon conversion, with any fractional shares (after aggregating all Series A Preferred Stock being converted on such date) rounded down to the nearest whole share. Such delivery shall be made, at the option of the applicable holder, in certificated form or by book-entry. Any such certificate or certificates shall be delivered by the Company to the appropriate holder on a book-entry basis or by mailing certificates evidencing the shares to the holders at their respective addresses as set forth in the conversion notice. From and after the date of conversion, the shares of Series A Preferred Stock converted on such date will no longer be deemed to be outstanding, and all rights of the holder thereof as a holder of Series A Preferred Stock (except the right to receive from the Company the Common Stock and any other property receivable upon conversion) shall cease and terminate with respect to such shares.

(b) Automatic Conversion. If, at any time after the second anniversary of the date on which the Company issues the first share of Series A Preferred Stock, the Closing Price equals or exceeds 225% of the then applicable Conversion Price for a period of 20 Trading Days over any consecutive 30 Trading Day period occurring completely after the second anniversary of the date on which the Company issues the first share of Series A Preferred Stock, then upon the fifteenth (15th) day following receipt of written notice from the Company of automatic conversion sent in accordance with Section 7(c) and Section 12 hereof, the Series A Preferred Stock shall automatically be converted into shares of Common Stock to the extent specified in the notice from the Company (i.e., in whole or in part, at the option of the Company) without any action on the part of the holder, with each share of Series A Preferred Stock being converted into the then applicable number of Conversion Shares.

(c) Notice of Automatic Conversion. Notice of the automatic conversion of shares of Series A Preferred Stock pursuant to Section 7(b) shall be given by first class mail, postage prepaid, addressed to the holders of record of the shares to be converted at their respective last addresses appearing on the books of the Company. Any notice mailed as provided in this Section 7(c) shall be conclusively presumed to have been duly given, whether or not the holder receives such notice, but failure to duly give such notice by mail, or any defect in such notice or in the mailing thereof, to any holder of shares of Series A Preferred Stock designated for conversion shall not affect the validity of the proceedings for the conversion of any other shares of Series A Preferred Stock. Each notice of conversion given to a holder shall state: (1) the conversion date; (2) the number of shares of the Series A Preferred Stock to be converted and, if less than all the shares held by such holder are to be converted, the number of such holder’s shares to be converted; (3) the Conversion Shares to be received by such holder; and (4) the place or places where certificates for such shares of Series A Preferred Stock are to be surrendered for conversion.

(d) Partial Conversion. In case of any conversion of part of the shares of Series A Preferred Stock at the time outstanding, the shares to be converted shall be selected pro rata. If fewer than all the shares represented by any certificate are converted, a new certificate shall be issued representing the shares that were not converted without charge to the holder thereof.

(e) Common Stock Reserved for Issuance. The Company shall at all times reserve and keep available out of its authorized and unissued Common Stock, solely for issuance upon the conversion of the Series A Preferred Stock, such number of shares of Common Stock as shall from time to time be issuable upon the conversion of all the shares of Series A Preferred Stock then outstanding. Any shares of Common Stock issued upon conversion of Series A Preferred Stock shall be (1) duly authorized, validly issued and fully paid and nonassessable, (2) shall rank pari passu with the other shares of Common Stock outstanding from time to time and (3) shall be approved for listing on the principal national securities exchange or over-the-counter securities market on which the Common Stock is listed or admitted to trading.

10

(f) Taxes. The Company shall pay any and all transfer taxes that may be payable in respect of the issue or delivery of shares of Common Stock on conversion of Series A Preferred Stock. The Company shall not, however, be required to pay any tax which may be payable in respect of any transfer involved in the issue and delivery of shares of Common Stock in a name other than that in which the Series A Preferred Stock so converted were registered, and no such issue or delivery shall be made unless and until the Person requesting such issue has paid to the Company the amount of any such tax, or has established to the satisfaction of the Company that such tax has been paid.

Section 8. Dilution Adjustments.

The Conversion Rate shall be adjusted from time to time (successively and for each event described) by the Company as follows:

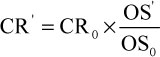

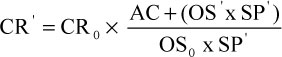

(a) If the Company shall, at any time or from time to time while any of the Series A Preferred Stock is outstanding, issue shares of Common Stock as a dividend or distribution on shares of Common Stock, to the extent the holders of the Series A Preferred Stock are not entitled to receive such dividend or distribution, or if the Company effects a share split or share combination in respect of the Common Stock, then the Conversion Rate shall be adjusted based on the following formula:

Where

| CR0 |

= | the Conversion Rate in effect immediately prior to the Close of Business on the Record Date for such dividend or distribution, or the Close of Business on the effective date of such share split or share combination, as applicable; | ||

| CR' |

= | the new Conversion Rate in effect immediately after the Close of Business on the Record Date for such dividend or distribution, or the Close of Business on the effective date of such share split or share combination, as applicable; | ||

| OS0 |

= | the number of shares of Common Stock outstanding immediately prior to the Close of Business on the Record Date for such dividend or distribution, or the Close of Business on the effective date of such share split or share combination, as applicable; and | ||

| OS' |

= | the number of shares of Common Stock outstanding immediately after such dividend or distribution, or the Close of Business on the effective date of such share split or share combination, as applicable. | ||

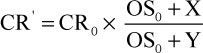

(b) Except as otherwise provided for by Section 8(c) and except for Excluded Issuances, if the Company shall, at any time or from time to time while any of the Series A Preferred Stock is outstanding, issue or distribute any options, rights or warrants entitling the holder to subscribe for or purchase shares of Common Stock at a price per share less than the Closing Price of the Common Stock on the Trading Day immediately preceding the date of issuance or the Record Date of such distribution, to

11

the extent the holders of the Series A Preferred Stock are not entitled to subscribe for or purchase such shares of Common Stock, the Conversion Rate shall be adjusted based on the following formula:

Where

| CR0 |

= | the Conversion Rate in effect immediately prior to the Close of Business on the date of such issuance or the Record Date for such distribution; | ||

| CR' |

= | the new Conversion Rate in effect immediately after the Close of Business on the date of such issuance or the Record Date for such distribution; | ||

| OS0 |

= | the number of shares of Common Stock outstanding immediately prior to the Close of Business on the date of such issuance or the Record Date for such distribution; | ||

| X |

= | the total number of shares of Common Stock issuable pursuant to such options, rights or warrants; and | ||

| Y |

= | the number of shares of Common Stock equal to the aggregate price payable to exercise such options, rights or warrants divided by the average Closing Price over the 10 consecutive Trading Day period ending on the Record Date. | ||

To the extent that shares of Common Stock are not delivered pursuant to any such options, rights or warrants upon the expiration or termination of such options, rights or warrants, the Conversion Rate shall be readjusted to the Conversion Rate which would then be in effect had the adjustments made upon the issuance or distribution of such options, rights or warrants been made on the basis of the delivery of only the number of shares of Common Stock actually delivered.

In determining the aggregate price payable to exercise such options, rights or warrants, there shall be taken into account any amount payable on exercise thereof, with the value of such consideration, if other than cash, to be determined in good faith by the Board.

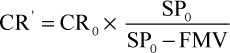

(c) If the Company, at any time or from time to time while any of the Series A Preferred Stock is outstanding, shall, by dividend or otherwise, distribute to all or substantially all holders of its Common Stock shares of any class of Capital Stock of the Company (other than Common Stock as covered by Section 8(a)), evidences of its indebtedness, assets, property or rights or warrants to acquire Capital Stock or other securities, but excluding (1) dividends, distributions or issuances as to which an adjustment under Section 8(a) or Section 8(b) shall apply, (2) dividends or distributions paid exclusively in cash (which shall be payable to the holders of the Series A Preferred Stock to the extent set forth in Section 4(a)) and (3) Spin-Offs to which the provision set forth below in this Section 8(c) shall apply (any of such shares of Capital Stock, indebtedness, assets, property or rights or warrants to acquire Capital Stock or other securities, hereinafter in this Section 8(c) called the “Distributed Property”), to the extent

12

the holders of the Series A Preferred Stock are not entitled to participate in any such distribution, then, in each such case the Conversion Rate shall be adjusted based on the following formula:

Where

| CR0 |

= | the Conversion Rate in effect immediately prior to the Close of Business on the Record Date for such distribution; | ||

| CR' |

= | the new Conversion Rate in effect immediately after the Close of Business on the Record Date for such distribution; | ||

| SP0 |

= | the Current Market Price of the Common Stock on the Record Date for such distribution; and | ||

| FMV |

= | the fair market value (as determined in good faith by the Board) of the portion of Distributed Property with respect to each outstanding share of Common Stock on the Record Date for such distribution. | ||

Notwithstanding the foregoing, if the then fair market value (as so determined) of the portion of the Distributed Property so distributed applicable to one share of Common Stock is equal to or greater than SP0 as set forth above, then in lieu of the foregoing adjustment, the Company shall distribute to each holder of Series A Preferred Stock on the date such Distributed Property is distributed to holders of Common Stock, but without requiring such holder to convert its shares of Series A Preferred Stock, the amount of Distributed Property such holder would have received per share of Series A Preferred Stock had such holder owned a number of shares of Common Stock equal to the Conversion Rate on the Record Date fixed for determination of stockholders entitled to receive such distribution. If the Board determines the fair market value of any distribution for purposes of this Section 8(c) by reference to the actual or when issued trading market for any securities, it shall in doing so consider the prices in such market over the same period used in computing the Current Market Price of the Common Stock for purposes of calculating SP0 in the formula in this Section 8(c).

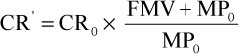

With respect to an adjustment pursuant to this Section 8(c) where there has been a payment of a dividend or other distribution on the Common Stock consisting of shares of Capital Stock of any class or series, or similar equity interest, of or relating to a Subsidiary or other business unit of the Company (a “Spin-Off”), to the extent the holders of the Series A Preferred Stock are not entitled to participate in any such Spin-Off, the Conversion Rate in effect immediately before the Close of Business on the 10th Trading Day immediately following, and including, the effective date of the Spin-Off shall be increased based on the following formula:

13

Where

| CR0 |

= | the Conversion Rate in effect immediately prior to the Close of Business on the 10th Trading Day immediately following, and including, the effective date of the Spin-Off; | ||

| CR' |

= | the new Conversion Rate in effect from and after the Close of Business on the 10th Trading Day immediately following, and including, the effective date of the Spin-Off; | ||

| FMV |

= | the average of the Closing Prices of the Capital Stock or similar equity interest distributed to holders of Common Stock applicable to one share of Common Stock over the 10 consecutive Trading Day period immediately following, and including, the effective date of the Spin-Off; and | ||

| MP0 |

= | the average Closing Price of the Common Stock over the 10 consecutive Trading Day period immediately following, and including, the effective date of the Spin-Off. | ||

Such adjustment shall occur on the 10th Trading Day immediately following, and including, the effective date of the Spin-Off.

For purposes of this Section 8(c), Section 8(a) and Section 8(b) hereof, any dividend or distribution to which this Section 8(c) is applicable that also includes shares of Common Stock, or rights or warrants to subscribe for or purchase shares of Common Stock to which Section 8(a) or Section 8(b) hereof applies (or both), shall be deemed instead to be (1) a dividend or distribution of the evidences of indebtedness, assets or shares of Capital Stock other than such shares of Common Stock or rights or warrants to which Section 8(a) or Section 8(b) hereof applies (and any Conversion Rate adjustment required by this Section 8(c) with respect to such dividend or distribution shall then be made) immediately followed by (2) a dividend or distribution of such shares of Common Stock or such options, rights or warrants to which Section 8(a) or Section 8(b) hereof applies (and any further Conversion Rate adjustment required by Section 8(a) and Section 8(b) hereof with respect to such dividend or distribution shall then be made), except (A) “the Close of Business on the Record Date of such dividend or distribution” shall be substituted for “such dividend or distribution, or the Close of Business on the effective date of such share split or share combination, as applicable,” “after the Close of Business on the Record Date for such dividend or distribution, or the Close of Business on the effective date of such share split or share combination, as applicable” and “the Close of Business on the date of such issuance or the Record Date for such distribution” within the meaning of Section 8(a) and Section 8(b) hereof and (B) for the avoidance of doubt any shares of Common Stock included in such dividend or distribution shall not be deemed “outstanding immediately prior to the Close of Business on the Record Date or the Close of Business on the effective date” within the meaning of Section 8(a) hereof.

If the Company shall, at any time or from time to time while any of the Series A Preferred Stock is outstanding, distribute options, rights or warrants to all or substantially all holders of Common Stock entitling the holders thereof to subscribe for, purchase or convert into shares of Capital Stock (either initially or under certain circumstances), which options, rights or warrants, until the occurrence of a specified event or events (“Trigger Event”): (x) are deemed to be transferred with such shares of Common Stock; (y) are not exercisable; and (z) are also issued in respect of future issuances of Common Stock, then such options, rights or warrants shall be deemed not to have been distributed for purposes of this Section 8(c) (and no adjustment to the Conversion Rate under this Section 8(c) shall be required), until the occurrence of the earliest Trigger Event and a distribution or deemed distribution under the terms of such options, rights or warrants at which time an appropriate adjustment (if any is required) to the

14

Conversion Rate shall be made in the same manner as provided for under this Section 8(c). If any such options, rights or warrants are subject to events, upon the occurrence of which such options, rights or warrants become exercisable to purchase different securities, evidences of indebtedness or other assets, then the date of the occurrence of any and each such event shall be deemed to be the date of distribution and Record Date with respect to new options, rights or warrants for purposes of this Section 8(c) (and a termination or expiration of the existing rights or warrants without exercise by any of the holders thereof). In addition, in the event of any distribution (or deemed distribution) of options, rights or warrants (of the type described in the preceding sentence) with respect thereto that was counted for purposes of calculating a distribution amount for which an adjustment to the Conversion Rate under this Section 8(c) was made, (1) in the case of any such options, rights or warrants that shall all have been redeemed or repurchased without exercise by any holders thereof, the Conversion Rate shall be readjusted upon such final redemption or repurchase to give effect to such distribution or Trigger Event, as the case may be, as though it were a distribution under this Section 8(c), equal to the per share redemption or repurchase price received by a holder or holders of Common Stock with respect to such options, rights or warrants (assuming such holder had retained such options, rights or warrants), made to all holders of Common Stock as of the date of such redemption or repurchase, and (2) in the case of such options, rights or warrants that shall have expired or been terminated without exercise by any holders thereof, the Conversion Rate shall be readjusted as if such options, rights or warrants had not been issued.

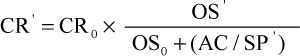

(d) If the Company or any of its Subsidiaries makes a payment of cash or other consideration in respect of a tender offer or exchange offer for all or any portion of the Common Stock, where such cash and the value of any such other consideration included in the payment per share of Common Stock validly tendered or exchanged exceeds the Closing Price of the Common Stock on the Trading Day next succeeding the last date (the “Expiration Date”) on which tenders or exchanges may be made pursuant to such tender or exchange offer (as it may be amended), the Conversion Rate shall be increased based on the following formula:

Where

| CR0 |

= | the Conversion Rate in effect immediately prior to the Close of Business on the Expiration Date; | ||

| CR' |

= | the new Conversion Rate in effect immediately after the Close of Business on the Expiration Date; | ||

| AC |

= | the aggregate value of all cash and any other consideration (as determined in good faith by the Board) paid or payable for shares purchased in such tender or exchange offer; | ||

| OS0 |

= | the number of shares of Common Stock outstanding immediately prior to the date such tender or exchange offer expires; | ||

| OS' |

= | the number of shares of Common Stock outstanding immediately after the date such tender or exchange offer expires (after giving effect to such tender offer or exchange offer); and | ||

| SP' |

= | the average Closing Price of the Common Stock over the ten consecutive Trading Days ending on the Trading Day succeeding the Expiration Date. | ||

15

If the Company or any Subsidiary is obligated to purchase shares of Common Stock pursuant to any such tender or exchange offer, but the Company or such Subsidiary is permanently prevented by applicable law from effecting any such purchases or all or any portion of such purchases are rescinded, then the Conversion Rate shall again be adjusted to be the Conversion Rate that would then be in effect if such tender or exchange offer had not been made or had only been made in respect of the purchases that were effected.

(e) If the Company, at any time or from time to time while any of the Series A Preferred Stock is outstanding, shall issue shares of Common Stock for a consideration per share less than the Current Market Price of the Common Stock, or, if the Common Stock is listed on the Nasdaq Stock Market, less than the Current Market Value of the Common Stock, on the date the Company fixes the offering price of such additional shares, the Conversion Rate shall be increased based on the following formula:

Where

| CR0 |

= | the Conversion Rate in effect immediately prior to the issuance of such additional shares of Common Stock; | ||

| CR' |

= | the new Conversion Rate in effect immediately after the issuance of such additional shares of Common Stock; | ||

| AC |

= | the aggregate consideration paid or payable for such additional shares of Common Stock; | ||

| OS0 |

= | the number of shares of Common Stock outstanding immediately prior to the issuance of such additional shares of Common Stock; | ||

| OS' |

= | the number of shares of Common Stock outstanding immediately after the issuance of such additional shares of Common Stock; and | ||

| SP' |

= | the Closing Price of the Common Stock on the date of issuance of such additional shares of Common Stock. | ||

The adjustment shall become effective immediately after such issuance.

This Section 8(e) does not apply to: (a) dividends, distributions or issuances as to which an adjustment under Sections 8(a), 8(b) or 8(c) shall apply, or any shares of Common Stock issued upon the exercise of rights, options, warrants or other securities so distributed; and (b) Excluded Issuances.

16

(f) Upon the occurrence of each adjustment of the Conversion Rate pursuant to this Section 8, the Company at its expense shall, as promptly as reasonably practicable but in any event not later than thirty (30) days thereafter, compute such adjustment in accordance with the terms hereof and furnish or make available to each holder of Series A Preferred Stock a certificate setting forth such adjustment (including the kind and amount of securities, cash or other property into which the Series A Preferred Stock is convertible) and showing in detail the facts upon which such adjustment is based. The Company shall, as promptly as reasonably practicable after the written request at any time of any holder of Series A Preferred Stock (but in any event not later than thirty (30) days thereafter), furnish or cause to be furnished to such holder a certificate setting forth the Conversion Rate then in effect or, if applicable, the amount of other securities, cash or property that then would be received upon the conversion of a share of Series A Preferred Stock.

Section 9. Voting Rights of the Series A Preferred Stock.

(a) General. The holders of shares of Series A Preferred Stock shall be entitled to vote with the holders of the Common Stock on all matters submitted to a vote of stockholders of the Company, except as otherwise provided herein or by applicable law. Each holder of shares of Series A Preferred Stock shall be entitled to the number of votes equal to the product (rounded down to the nearest number of whole shares) of one times the largest number of whole shares of Common Stock into which all shares of Series A Preferred Stock held of record by such holder could then be converted pursuant to Section 7 at the record date for the determination of the stockholders entitled to vote on such matters or, if no such record date is established, at the date such vote is taken or any written consent of stockholders is first executed. In any case in which the holders of shares of Series A Preferred Stock shall be entitled to vote as a separate series to the exclusion of the holders of the Common Stock, each holder of shares of Series A Preferred Stock shall be entitled to one vote for each share of Series A Preferred Stock held at the Record Date for the determination of the stockholders entitled to vote on such matters or, if no such Record Date is established, at the date such vote is taken or any written consent of shareholders is first executed. The holders of shares of Series A Preferred Stock shall be entitled to notice of any stockholders’ meeting in accordance with the Bylaws.

(b) Election of Directors.

(1) Effective as of the date on which the Company issues the first share of Series A Preferred Stock, the number of directors constituting the Board shall be increased by one person, to seven (7) persons (such additional director, the “Preferred Director”). For so long as the Permitted Holders Beneficially Own shares of Series A Preferred Stock representing at least 5% of the Total Voting Power of the Company, (A) the Permitted Holders, voting as a separate class to the exclusion of the holders of Common Stock, shall be entitled to elect the Preferred Director, provided that such Preferred Director is a current employee (and remains a current employee) of BRS Management LP, and (B) the Company shall not, without the consent of the Permitted Holders, increase the size of the Board to more than eight (8) persons.

(2) Term. The Preferred Director shall serve until the next annual meeting of the stockholders of the Company and until his or her successor is elected and qualifies in accordance with this Section 9(b) and the Bylaws, unless the Preferred Director is earlier removed in accordance with the Certificate of Incorporation or Bylaws, resigns, ceases to be an employee of BRS Management LP or is otherwise unable to serve. In the event the Preferred Director is removed, resigns or is unable to serve as a member of the Board, the Permitted Holders, voting as a separate class to the exclusion of the holders of Common Stock, shall have the right to fill such vacancy. The Preferred Director may only be elected to the Board by the Permitted Holders in accordance with this Section 9(b), and such director’s seat shall otherwise remain vacant.

17

(3) Removal. At such time as the Permitted Holders Beneficially Own shares of Series A Preferred Stock representing less than 5% of the Total Voting Power of the Company, the Permitted Holders shall, except as otherwise set forth in the Purchase Agreement, automatically and immediately, without any further action on the part of the stockholders or the Board, lose the right to elect the Preferred Director. Subject to the right of the Permitted Holders to remove the Preferred Director, no loss of the right to elect the Preferred Director shall have the effect of shortening the term of the incumbent Preferred Director.

(4) Non-Limitation of Voting Rights. For the avoidance of doubt, the right of the Series A Preferred Stock to vote for the election of the Preferred Director shall be in addition to the right of the holders of the Series A Preferred Stock to vote together with the holders of Common Stock for the election of the other members of the Board.

(c) Class Voting Rights as to Particular Matters. So long as any shares of Series A Preferred Stock are outstanding, the Company shall not, either directly or indirectly by amendment, merger, consolidation or otherwise, do any of the following without (in addition to any other vote or consent of stockholders required by law or by the Certificate of Incorporation) the vote or consent of the holders of at least a majority of the shares of Series A Preferred Stock then outstanding, given in person or by proxy, either in writing without a meeting or by vote at any meeting called for the purpose:

(1) amend the Certificate of Incorporation or Bylaws in a manner that would adversely affect the relative rights, preferences, privileges or voting powers of the Series A Preferred Stock;

(2) amend, alter or change the relative rights, preferences, privileges or voting powers of the Series A Preferred Stock;

(3) declare or pay any dividend or distribution on or in respect of Common Stock, other Junior Stock or Parity Stock (other than a dividend payable solely in Junior Stock);

(4) purchase, redeem or otherwise acquire for consideration, directly or indirectly, any Common Stock, other Junior Stock or Parity Stock or capital stock of any of the Company’s Subsidiaries (except as necessary to effect (A) a reclassification of Junior Stock for or into other Junior Stock, (B) a reclassification of Parity Stock for or into other Parity Stock with the same or lesser aggregate liquidation preference, (C) a reclassification of Parity Stock into Junior Stock, (D) the exchange or conversion of one share of Junior Stock for or into another share of Junior Stock, (E) the exchange or conversion of one share of Parity Stock for or into another share of Parity Stock with the same or lesser per share liquidation amount, (F) the exchange or conversion of one share of Parity Stock into Junior Stock and (G) redemptions, purchases or other acquisitions of shares of Common Stock or other Junior Stock by the Company in accordance with the provisions of any employee benefit plan or other equity agreement with the employees, officers and directors of the Company that has been approved by the Board, so long as such redemptions, purchases or other acquisitions do not exceed an aggregate of one percent (1%) of the outstanding shares of Common Stock in any twelve month period); and

(5) authorize, issue, or reclassify into, Parity Stock (including additional shares of the Series A Preferred Stock), Capital Stock that would rank senior to the Series A Preferred Stock or debt securities that are convertible into Capital Stock by their terms.

(d) Except as set forth herein, in the Certificate of Incorporation or as otherwise required by law, holders of shares of Series A Preferred Stock shall have no special voting rights and their consent shall not be required (except to the extent they are entitled to vote with holders of Common Stock as set forth herein) for taking any corporate action.

18

Section 10. Reorganization Events.

(a) In the event of:

(1) any consolidation or merger of the Company with or into another Person or of another Person with or into the Company;

(2) any sale, transfer, lease or conveyance to another Person of all or substantially all of the assets of the Company in one or a series of transactions; or

(3) any statutory share exchange of the Company with another Person (other than in connection with a consolidation or merger),

in each case in which holders of Common Stock would be entitled to receive cash, securities or other property for their shares of Common Stock (any such event specified in this Section 10(a), a “Reorganization Event”), each share of Series A Preferred Stock outstanding immediately prior to such Reorganization Event shall remain outstanding but shall thereafter (subject to prior redemption, including pursuant to Section 6(a), or conversion), without the consent of the holder thereof, become convertible into the cash, securities and other property that the holder would have received in such Reorganization Event had such holder owned a number of shares of Common Stock equal to the Conversion Rate on the Record Date fixed for determination of stockholders entitled to receive such cash, securities or other property (such cash, securities and other property having a value equal to its fair market value as reasonably determined in good faith by the Board and referenced to herein as the “Exchange Property”); provided, however, that in the case of a Reorganization Event in the form of a consolidation or merger, the surviving corporation shall exchange in such transaction for each share of Series A Preferred Stock outstanding immediately prior to such Reorganization Event, preferred shares of the surviving corporation with substantially the same terms and conditions as the Series A Preferred Stock, which terms are no less beneficial to the holders thereof, except that such preferred shares shall, upon conversion, be converted into, in lieu of the Common Stock, the Exchange Property. Any consideration to be paid to or received by holders of Common Stock pursuant to any employment, consulting, severance, non-competition or other similar arrangement approved by the Board or a duly authorized committee of the Board, shall not be considered to be “Exchange Property” for purposes of the foregoing provision, regardless of whether such consideration is paid in connection with, or conditioned upon the completion of, the Reorganization Event.

(b) In the event that holders of the shares of the Common Stock have the opportunity to elect the form of consideration to be received in the Reorganization Event, the “Exchange Property” that holders of the Series A Preferred Stock shall be entitled to receive shall be determined by the holders of a majority of the outstanding shares of Series A Preferred Stock, who shall make such determination from among the choices made available to the holders of the Common Stock.

(c) The above provisions of this Section 10 shall similarly apply to successive Reorganization Events.

(d) Notwithstanding anything to the contrary in this Section 10, Section 10(a) shall not apply in the case of, and a Reorganization Event shall not be deemed to be, a merger, consolidation, reorganization or statutory share exchange (1) among the Company and its direct and indirect wholly owned Subsidiaries to the extent such merger, consolidation, reorganization or statutory share exchange

19

does not change or effect the outstanding classes of Capital Stock of the Company or (2) between the Company and any Person for the sole purpose of changing the domicile of the Company (an “Internal Reorganization Event”). Without limiting the rights of the holders of the Series A Preferred Stock set forth in Section 9(c)(2), the Company shall not effectuate an Internal Reorganization Event unless (A) the Series A Preferred Stock shall be outstanding as a class of preferred stock of the surviving company having the same rights, terms, preferences, liquidation preference and accrued and unpaid dividends as the Series A Preferred Stock in effect immediately prior to such Internal Reorganization Event, as adjusted for such Internal Reorganization Event pursuant to this Certificate of Designations after giving effect to any such Internal Reorganization Event and (B) no holder of the Series A Preferred Stock recognizes taxable income as a result of such Internal Reorganization Event. The Company (or any successor) shall, within twenty (20) days of the occurrence of any Internal Reorganization Event, provide written notice to the holders of the Series A Preferred Stock of the occurrence of such event. Assuming compliance with Section 9(c)(2) hereof, failure to deliver such notice shall not affect the operation of this Section 10(d) or the validity of any Internal Reorganization Event.

Section 11. Record Holders.

To the fullest extent permitted by applicable law, the Company may deem and treat the record holder of any share of the Series A Preferred Stock as the true and lawful owner thereof for all purposes, and the Company shall not be affected by any notice to the contrary.

Section 12. Notices.

(a) General. All notices or communications in respect of the Series A Preferred Stock shall be sufficiently given if given in writing and delivered in person or by first class mail, postage prepaid, or if given in such other manner as may be permitted in this Certificate of Designations, in the Certificate of Incorporation or the Bylaws or by applicable law or regulation, and shall be deemed received (1) three (3) Business Days after being sent by certified or registered mail, return receipt requested, postage prepaid. (2) one (1) Business Day after being deposited with a next-day courier or (3) upon confirmation of receipt, if made by facsimile. Notwithstanding the foregoing, if the Series A Preferred Stock is issued in book-entry form through The Depository Trust Company or any similar facility, such notices may be given to the holders of the Series A Preferred Stock in any manner permitted by such facility and such notice shall be deemed to be received by the holders on the date such notice is appropriately given to such facility.

(b) Notice of Certain Events. The Company shall to the extent not included in the Exchange Act reports of the Company, provide reasonable written notice to each holder of the Series A Preferred Stock of any event that is reasonably likely to result in (1) a Reorganization Event, (2) an event the occurrence of which would result in an adjustment to the Conversion Rate, (3) the voluntary or involuntary liquidation, dissolution or winding up of the affairs of the Company or (4) a Change of Control.

Section 13. Replacement Certificates.

The Company shall replace any mutilated certificate at the holder’s expense upon surrender of that certificate to the Company. The Company shall replace certificates that become destroyed, stolen or lost at the holder’s expense upon delivery to the Company of reasonably satisfactory evidence that the certificate has been destroyed, stolen or lost, together with any indemnity that may be required by the Company.

20

Section 14. Other Rights.

The shares of Series A Preferred Stock shall not have any rights, preferences, privileges or voting powers or relative, participating, optional or other special rights, or qualifications, limitations or restrictions thereof, other than as set forth herein or in the Certificate of Incorporation or as provided by applicable law and regulation.

Section 15. Descriptive Headings and Governing Law.

The descriptive headings of the several Sections and paragraphs of this Certificate of Designations are inserted for convenience only and do not constitute a part of this Certificate of Designations.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

21

IN WITNESS WHEREOF, Ruth’s Hospitality Group, Inc. has caused this Certificate of Designations to be signed and duly authorized as of the date first above written.

| RUTH’S HOSPITALITY GROUP, INC. | ||

| By: | /s/ Robert M. Vincent | |

| Name: | Robert M. Vincent | |

| Title: | Executive Vice President and Chief Financial Officer | |