Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2009

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-13664

THE PMI GROUP, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 3003 Oak Road Walnut Creek, California 94597 |

94-3199675 | ||

| (State of Incorporation) | (Address of principal executive offices) | (I.R.S. Employer Identification No.) |

(925) 658-7878

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $0.01 par value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definition of “large accelerated filer” and “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerate filer ¨ |

Accelerated filer x | Non-accelerated filer ¨ | Smaller Reporting Company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting stock (common stock) held by non-affiliates of the registrant as of the close of business on June 30, 2009 was approximately $121.1 million based on the closing sale price of the common stock on the New York Stock Exchange consolidated tape on that date. All executive officers and directors, and beneficial owners of 10% or more of the outstanding shares, of the registrant have been deemed, solely for the purpose of the foregoing calculation, to be “affiliates” of the registrant.

Number of shares outstanding of registrant’s common stock, as of close of business on February 26, 2010: 82,748,367.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for registrant’s Annual Meeting of Stockholders to be held on May 21, 2010 are incorporated by reference into Items 10 through 14 of Part III.

Table of Contents

| PART I | ||||

| Item 1. | 2 | |||

| 2 | ||||

| B. PMI, The Mortgage Insurance Industry and the Current Pronounced Real Estate Cycle |

3 | |||

| 4 | ||||

| 7 | ||||

| 8 | ||||

| 12 | ||||

| 13 | ||||

| 13 | ||||

| 14 | ||||

| 19 | ||||

| 21 | ||||

| 30 | ||||

| 30 | ||||

| 32 | ||||

| 38 | ||||

| 43 | ||||

| 44 | ||||

| 46 | ||||

| Item 1A. | 46 | |||

| Item 1B. | 66 | |||

| Item 2. | 66 | |||

| Item 3. | 66 | |||

| Executive Officers of Registrant | 68 | |||

| PART II | ||||

| Item 5. | Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 69 | ||

| Item 6. | 72 | |||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

74 | ||

| Item 7A. | 124 | |||

| Item 8. | 127 | |||

| Item 9A. | 191 | |||

| PART III | ||||

| Item 10. | 192 | |||

| Item 11. | 192 | |||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 192 | ||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence |

192 | ||

| Item 14. | 192 | |||

| PART IV | ||||

| Item 15. | 193 | |||

Table of Contents

Cautionary Statement Regarding Forward-Looking Statements

Statements we make or incorporate by reference in this and other documents filed with the Securities and Exchange Commission that are not historical facts, that are preceded by, followed by or include the words “believes,” “expects,” “anticipates,” “estimates” or similar expressions, or that relate to future plans, events or performance are “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements in this report include discussions of future potential trends relating to losses, claims paid, loss reserves, default inventories and cure rates of our various insurance subsidiaries, rescission and claim denial activity and the challenges thereto, persistency, premiums, new insurance written, refinance activity, the make-up of our various insurance portfolios, the impact of market and competitive conditions, rising unemployment, liquidity, capital requirements and initiatives, regulatory and contractual capital adequacy requirements, potential legislative changes, potential discretionary regulatory decisions by insurance regulators, captive reinsurance agreements, restructuring opportunities associated with our modified pool policies, fair value of certain debt instruments, the performance of our derivative contracts as well as certain securities held in our investment portfolios and potential litigation. When a forward-looking statement includes an underlying assumption, we caution that, while we believe the assumption to be reasonable and make it in good faith, assumed facts almost always vary from actual results, and the difference between assumed facts and actual results can be material. Where, in any forward-looking statement, we express an expectation or belief as to future results, there can be no assurance that the expectation or belief will result. Our actual results may differ materially from those expressed in our forward-looking statements. Forward-looking statements involve a number of risks or uncertainties including, but not limited to, the Risk Factors addressed in Item 1A below. Other risks are referred to from time to time in our periodic filings with the Securities and Exchange Commission. All of our forward-looking statements are qualified by and should be read in conjunction with our risk disclosures. Except as may be required by applicable law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

1

Table of Contents

| ITEM 1. | BUSINESS |

| A. | Overview of Operations |

Through our subsidiary, PMI Mortgage Insurance Co. (“MIC”), and its affiliated companies (collectively “PMI”), we provide residential mortgage insurance in the United States. Mortgage insurance provides loss protection to mortgage lenders and investors in the event of borrower default. By protecting lenders and investors from credit losses, we help to ensure that mortgages are available to prospective U.S. homebuyers.

Our business has undergone significant changes in the past few years, and the protracted deterioration of the U.S. economy has negatively affected our financial condition and results of operations. Our consolidated net loss was $659.3 million for the year ended December 31, 2009. Our financial condition and results of operations for 2009 are discussed on both a consolidated and segment basis in Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations (the “MD&A”), below. As a result of our significant net losses, we face a number of regulatory and other issues as discussed in C. Regulatory and Other Issues Facing PMI, below, and in the MD&A.

In 2008, we sold our Australian and Asian operations and we are not writing new business in our European and Canadian operations. As a result, we are primarily focused on our U.S. Mortgage Insurance operations. In response to changing economic and industry conditions and in order to preserve capital, PMI made a number of changes to its underwriting guidelines and customer management strategies in 2008 and 2009, all of which had the effect of limiting PMI’s new business writings in 2009. We are undertaking efforts to maintain or slightly increase insurance writings in 2010. However, we expect a variety of factors to continue to impact our new business writings in 2010. Such factors include, among others, mortgage and private mortgage insurance market conditions, PMI’s underwriting guidelines, which limit the type of new business that PMI is willing to write, and the continuation of certain customer management strategies adopted in 2009.

In 2009, we implemented a number of capital and business initiatives designed to mitigate losses and/or generate capital or capital relief. Such initiatives included:

Homeownership Preservation—In 2007, we formed PMI’s Homeownership Preservation Initiatives (“HPI”) department to develop and carry out our loss mitigation strategies. One of our strategies is to help loan servicers with their implementation of programs, including the Home Affordable Modification Program (“HAMP”), designed to assist troubled borrowers with finding solutions to avoid foreclosure and potentially cure and reinstate their loans. In 2009, loss mitigation efforts contributed to approximately $1.0 billion of workouts of delinquent risk in force.

Modified Pool Restructuring—In 2009, we restructured (including through commutation) certain modified pool policies which resulted in the acceleration of claims paid at a discount of the reserves established on such modified pool policies and the release of loss reserves, which in turn resulted in capital benefits to MIC, on both a statutory and GAAP basis.

Contribution of PMI Insurance Co., or PIC, to MIC—Effective September 30, 2009, we contributed our wholly owned subsidiary, PIC, to MIC. As of the effective date, the contribution of PIC improved MIC’s capital position and increased MIC’s excess minimum policyholders’ position.

Sale of RAM Re—In 2009, MIC sold its entire investment in RAM Re, which benefited PMI’s liquidity and capital position. MIC previously reduced its carrying value of its investment in RAM Re to zero.

We continue to focus on capital initiatives but, especially given current and expected future market conditions, there can be no assurance that we will be able to achieve further statutory capital relief or improve our capital and liquidity position. See Item 1A. Risk Factors—Capital and Liquidity Constraints.

2

Table of Contents

We divide our business into three segments—U.S. Mortgage Insurance Operations, International Operations and Corporate and Other.

U.S. Mortgage Insurance Operations. As a U.S. residential mortgage insurer, PMI offers a variety of mortgage insurance products to meet the capital and credit risk mitigation needs of its customers. PMI also owns 50% of CMG Mortgage Insurance Company, or CMG MI, a joint venture that provides mortgage insurance exclusively to credit unions.

International Operations. Our International Operations segment consists of our European and Canadian subsidiaries (“PMI Europe” and “PMI Canada”), neither of which is writing new business. PMI Europe offered mortgage insurance and mortgage credit enhancement products tailored primarily to the European mortgage markets, through 2008. PMI Canada offered residential mortgage insurance products in Canada from 2007 to 2008. Our International Operations segment also consists of the discontinued operations of our former Australian and Asian mortgage insurance subsidiaries, which we sold in 2008. Our International Operations segment did not generate significant revenues in 2009. In connection with our sale of PMI Australia, we received a note from QBE in the principal amount of approximately $187 million, with interest accruing through September 2011, when it matures. The note, which we refer to as the QBE Note, is payable by QBE. Other than revenues from the amounts due on the QBE Note in 2011, we do not expect that our International Operations segment will generate significant revenues in the future.

Corporate and Other. Our Corporate and Other segment consists of corporate debt and expenses of our holding company, The PMI Group, Inc. (“The PMI Group” or “TPG” or the “Company”), equity in earnings or losses from investments in certain limited partnerships and our discontinued contract underwriting operations. This segment also includes our investment in FGIC Corporation and its wholly-owned subsidiary, Financial Guaranty Insurance Company (“FGIC”) and our former investment in RAM Re, which we sold in the fourth quarter of 2009. FGIC is a financial guarantor and has ceased writing new business. In 2008, we reduced the carrying value of our investment in FGIC to zero.

As of December 31, 2009, our consolidated total assets were $4.6 billion, including our investment portfolio of $2.6 billion and total cash and cash equivalents of $0.7 billion. Our consolidated shareholders’ equity was $0.7 billion as of December 31, 2009. See Item 8. Financial Statements and Supplementary Data – Note 18. Business Segments, for financial information regarding our business segments.

Our website address is http://www.pmi-us.com. Information on our website does not constitute part of this report. Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports are available free of charge on our website via a hyperlink as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission. The PMI Group is a Delaware corporation founded in 1972. Our principal executive offices are located at 3003 Oak Road, Walnut Creek, California 94597-2098, and our telephone number is (925) 658-7878.

| B. | PMI, the Mortgage Insurance Industry and the Current Pronounced Real Estate Cycle |

The insurance coverage issued by PMI and other U.S. mortgage insurers has several attributes that make mortgage insurance companies more susceptible to the cyclical nature of the economy in general and the housing and labor markets in particular than many other types of insurance companies. Mortgage insurance is generally renewable at the option of the insured at the premium rate fixed when the insurance on the loan was initially issued. As a result, losses from increased claims from policies originated in a particular year cannot be offset by renewal premium increases on policies in force. In addition, we may not cancel the insurance coverage we issue except in the event of nonpayment of premiums or certain violations of PMI’s master policies. Therefore, the average life of a PMI mortgage insurance policy generally has ranged from approximately four to ten years and may span a significant portion of an economic or real estate cycle. As a result, the loss ratios, which are the ratios of an insurer’s incurred losses to premiums earned, of PMI and the mortgage insurance industry are particularly

3

Table of Contents

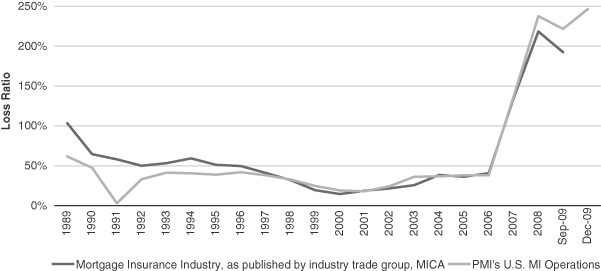

affected by the cyclical nature of the U.S. economy and housing and labor markets. The chart below shows the mortgage insurance industry’s average loss ratios between 1989 and September 30, 2009 (the most recent date for which industry data is available) and PMI’s loss ratios between 1989 and 2009.

As shown in the chart above, rising unemployment rates in the United States and ongoing weakness in U.S. credit, capital, residential mortgage, and housing markets have been reflected in our and the industry’s increasing loss ratios in recent years. For the same reason, we expect PMI to continue to experience elevated losses in 2010. These losses have reduced, and will continue to reduce, PMI’s net assets. This reduction in net assets and the prospect of continued losses have raised a number of regulatory and other issues, discussed in Section C (as well as in the MD&A) below.

| C. | Certain Regulatory and Other Issues Facing PMI |

State Regulatory Capital Adequacy Requirements. In sixteen states, if a mortgage insurer does not meet a required minimum policyholders’ position or exceeds a maximum permitted risk-to-capital ratio (generally 25 to 1), it may be prohibited from writing new business until its policyholders’ position meets the minimum or its risk-to-capital ratio falls below the limit, as applicable. In certain of those states, the applicable regulations require a mortgage insurer to immediately cease writing new business if and so long as it fails to meet the applicable capital adequacy requirements. In other states, the applicable regulator has discretion as to whether the mortgage insurer may continue writing new business. In 2009, North Carolina, Arizona and California adopted legislation giving the respective state’s insurance regulators such discretion. Thirty-four other states do not have specific capital adequacy requirements for mortgage insurers.

4

Table of Contents

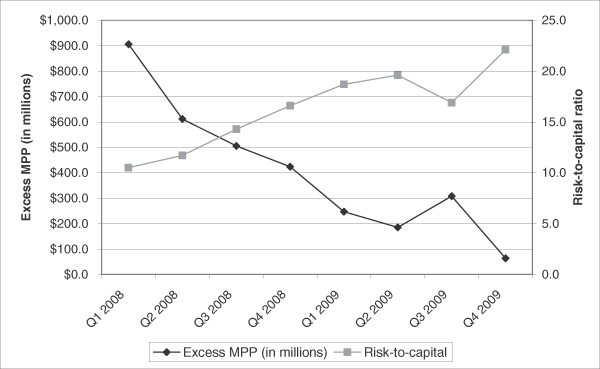

As a result of its high losses, MIC’s risk-to-capital ratio has increased and its excess minimum policyholders’ position has decreased. The graph below shows MIC’s risk-to-capital ratio and excess minimum policyholders’ position:

As of December 31, 2009, MIC’s risk-to-capital ratio was 22.1 to 1 and its excess minimum policyholders’ position was $63.9 million. Unless we raise substantial additional capital or achieve significant additional statutory capital relief in the first quarter of 2010, MIC’s excess minimum policyholders’ position will decline and risk-to-capital ratio will increase beyond levels necessary to meet regulatory capital adequacy requirements.

MIC’s principal regulator is the Arizona Department of Insurance (the “Department”). The Department notified MIC in the third quarter of 2009 of its initiation of a limited scope examination to determine, among other things, whether to exercise discretion and permit MIC to continue writing new business in the event MIC fails to maintain Arizona’s minimum policyholders’ position. On February 10, 2010, MIC received a letter from the Department waiving, until December 31, 2011, the requirement that MIC maintain the Arizona required minimum policyholders’ position to write new business. The waiver may be withdrawn by the Arizona Director of Insurance in her sole discretion at any time. Accordingly, there can be no assurance as to the period during which the waiver will remain in effect. If the Department were to withdraw the waiver and MIC fails to maintain Arizona’s minimum policyholders’ position, we would likely be required to suspend writing new business in all states. Even with the waiver from the Department, other states could require MIC to cease new business writings if we fail to maintain the applicable capital adequacy requirements. While the waiver remains in effect, the waiver letter requires that MIC, among other things, comply with certain information reporting requirements, submit to the Department for its approval MIC’s annual operating plan for calendar years 2010 and 2011, and submit to the Department for its approval any proposed material change to MIC’s then-current underwriting guidelines or operating plan. See Item 1A. Risk Factors—Unless we raise substantial additional capital or achieve significant capital relief in the first quarter of 2010, MIC will fail to meet various capital adequacy requirements and could be required to cease writing new business and could be subject to the terms of its runoff support agreement with Allstate.

5

Table of Contents

From time to time, we have discussed with certain state insurance regulators their financially hazardous condition regulations generally applicable to licensed insurance companies and those states’ interpretive positions that we are, or could be, in violation of their respective regulations. None of these states has taken any action against MIC to date. If any of those states or other states having similar financially hazardous condition regulations (which are most states) were to conclude that MIC was in a financially hazardous condition, MIC may be required to cease writing new business in that state.

PMI Mortgage Assurance Co. (“PMAC”). In the event that MIC is unable to continue to write new mortgage insurance in one or more states, we are working on a plan to enable us to write new mortgage insurance in such states by PMAC. PMAC is a subsidiary of MIC, and was formerly known as Commercial Loan Insurance Corporation, or CLIC. PMAC is currently licensed to write insurance in all states except Connecticut, Michigan and New York. In several other states, PMAC is applying to revise the line of insurance business it is authorized to transact so that it may begin writing residential mortgage guaranty insurance in those states. There is no guarantee that PMAC will be able to obtain insurance licenses in Connecticut, Michigan or New York or approval to revise its existing licenses in other impacted states. In addition, before PMAC can begin writing new business, Freddie Mac must approve PMAC as an eligible mortgage insurer. On February 12, 2010, Fannie Mae approved PMAC as a direct issuer of mortgage guaranty insurance. Fannie Mae’s approval terminates on the earlier of December 31, 2011 or the date that MIC ceases to transact new business in all jurisdictions in which it is licensed. The approval is subject to a number of detailed conditions. Among others, the approval contains limitations as to the jurisdictions, volume and types of new business PMAC may write, and restricts MIC and PMAC from taking a variety of actions, subject to enumerated exceptions, without Fannie Mae’s prior written consent, which is not to be unreasonably withheld, including engaging in certain transactions with affiliates, paying dividends or making distributions or payments of indebtedness or transferring assets outside the ordinary course of business or in excess of specified levels. Notwithstanding these restrictions, the agreement with Fannie Mae permits MIC to make dividend, interest and principal payments in connection with the issuance of certain new debt or equity instruments up to specified levels. PMAC is currently in negotiations with Freddie Mac about becoming an eligible insurer under Freddie Mac’s criteria.

Continued GSE Eligibility. Lenders purchase mortgage insurance from us to reduce losses as a result of borrower default, to obtain capital relief and, most often, to facilitate the sale of their low down payment loans to the GSEs. The GSEs purchase residential mortgages from lenders and investors as part of their mandate to provide liquidity in the secondary mortgage market. As a result of their purchases of low down payment mortgages, the GSEs are, and historically have been, two of PMI’s largest customers. The GSEs have established approval requirements for eligible mortgage insurers. In 2008, because of rating agency actions discussed under “—Financial Strength Ratings” below, in order to maintain its GSE eligibility, MIC was required to submit written remediation plans to each GSE outlining, among other things, the steps we are taking or plan to take to bolster MIC’s financial strength. To date, each of the GSEs continues to treat MIC as an eligible mortgage insurer. There can be no assurance, however, that the GSEs will continue to treat MIC as an eligible mortgage insurer. See Item 1A. Risk Factors—The exercise of certain rights reserved by the GSEs under eligibility requirements for mortgage insurers could harm our profitability and reduce our operational flexibility.

Financial Strength Ratings. Independent rating agencies have assigned our insurance subsidiaries certain insurer financial strength ratings, which are based on the rating agencies’ assessments of the financial risks associated with historical business activities and new business initiatives. In their assessments, the rating agencies model the adequacy of capital to withstand severe loss scenarios and review, among other things, corporate strategy, operational performance, available liquidity, the outlook for the relevant industry, and competitive position. The rating agencies can change or withdraw their ratings at any time.

6

Table of Contents

The insurer financial strength ratings of our insurance subsidiaries are set forth in the table below.

| Insurer Financial Strength Ratings (as of March 5, 2010) | ||||||

| Standard & Poor’s | Moody’s | Fitch | ||||

| PMI Mortgage Insurance Co. |

B+ | B2 | NR | |||

| PMI Insurance Co. |

B+ | NR | NR | |||

| PMI Europe |

B+ | NR | NR | |||

| CMG Mortgage Insurance Company |

BBB | NR | BBB | |||

| FGIC |

NR | NR | NR | |||

Ratings assigned to our holding company or its debt are set out below.

| Holding Company Ratings (as of March 5, 2010) | ||||||

| Standard & Poor’s Counterparty Credit Rating |

Moody’s Senior Unsecured Debt Rating |

Fitch Senior Unsecured Debt Rating | ||||

| The PMI Group, Inc. |

CCC+ | Caa2 | NR | |||

In 2008, and further in 2009, partially in response to MIC’s increased losses and reduced capital, Standard & Poor’s (“S&P”) and Moody’s Investors Service (“Moody’s”) each lowered its insurer financial strength rating on MIC from “AA” or equivalent to “B+” and “B2” respectively. In addition, PMI Europe and CMG MI receive capital support from MIC and are, therefore, dependent in part upon the financial strength of MIC. For a discussion of recent rating agency actions with respect to our holding company’s ratings and subsidiaries’ insurer financial strength ratings and risk factors associated with these issues, see Item 1A. Risk Factors—We have been and will continue to be negatively impacted by downgrades of MIC’s insurer financial strength ratings and —A downgrade of our senior unsecured debt ratings could increase our borrowing costs and, therefore, adversely affect our liquidity and “—Liquidity and Capital Resources—Ratings” in the MD&A.

| D. | U.S. Mortgage Insurance Operations |

Through PMI, we provide residential mortgage insurance products to mortgage lenders and investors throughout the United States. MIC is incorporated in Arizona, headquartered in Walnut Creek, California, and licensed in all 50 states, the District of Columbia, Puerto Rico, Guam, and the Virgin Islands. Under its monoline insurance licenses, MIC may only offer mortgage insurance covering first lien, one-to-four family residential mortgages.

Residential mortgage insurance protects mortgage lenders and investors in the event of borrower default, by reducing and, in some instances, eliminating the resulting credit loss to the insured institution. By mitigating losses as a result of borrower default, residential mortgage insurance facilitates the origination of “low down payment mortgages,” generally mortgages to borrowers who make down payments of less than 20% of the value of the homes. Mortgage insurance also reduces the capital that financial institutions are required to hold against insured loans and facilitates the sale of low down payment mortgage loans in the secondary mortgage market, primarily to the GSEs, or “agency market”.

PMI’s residential mortgage insurance products typically provide first loss protection on loans originated by residential mortgage lenders and sold to the GSEs and, to a lesser extent, on loans held by portfolio lenders. PMI’s current product offerings are described below. In response to changing economic and industry conditions and in order to preserve capital, PMI made a number of changes to its underwriting guidelines and customer management strategies in 2008 and 2009, all of which had the effect of limiting PMI’s new business writings in

7

Table of Contents

2009. We are undertaking efforts to maintain or slightly increase insurance writings in 2010. However, we expect a variety of factors to continue to impact our new business writings in 2010. Such factors include, among others, mortgage and private mortgage insurance market conditions, PMI’s underwriting guidelines, which limit the type of new business that PMI is willing to write, and the continuation of certain customer management strategies adopted in 2009. Section 6. Risk Management, below, discusses risk management strategies and underwriting guideline changes made by PMI. Even with the adoption of tighter underwriting guidelines and management strategies of new business writings, unless we raise substantial additional capital or achieve significant additional statutory capital relief in the first quarter of 2010, MIC will fail to satisfy regulatory capital adequacy requirements, which could require MIC to cease writing new business. See also Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Conditions and Trends Affecting our Business—U.S. Mortgage Insurance Operations, and Item 1A. Risk Factors—Capital and Liquidity Constraints, below.

| 1. | Products |

(a) Primary Mortgage Insurance

Primary insurance provides the insured with first-loss mortgage default protection on individual loans at specified coverage percentages. Our maximum obligation to an insured with respect to a claim is generally determined by multiplying the coverage percentage selected by the insured by the loss amount on the defaulted loan. The loss amount includes any unpaid loan balance, delinquent interest and certain expenses associated with the loan’s default and property foreclosure. In lieu of paying the coverage percentage of the loss amount on a defaulted loan, we generally may: (i) pay the full loss amount and take title to the mortgaged property, or (ii) in the event that the property is sold prior to settlement of the claim, pay the insured’s actual loss up to the maximum level of coverage.

Our core, primary mortgage insurance business is offered on a loan-by-loan basis to lenders through our “flow” channel. The majority of our primary insurance written is on loans sold to the GSEs. Prior to 2009, through its structured finance channel, PMI also offered and sold primary mortgage insurance products to non-agency mortgage-backed securities (“MBS”) issuers as credit enhancement covering portfolios of loans (“non-agency market”). PMI does not expect to offer structured primary mortgage insurance products in 2010.

PMI’s primary insurance in force and primary risk in force at December 31, 2009 were $113.7 billion and $27.8 billion, respectively. Primary insurance in force refers to the current principal balance of all outstanding mortgage loans with primary insurance coverage as of a given date. Primary risk in force is the aggregate dollar amount of each primary insured mortgage loan’s current principal balance multiplied by the insurance coverage percentage specified in the applicable policy. The chart below shows our U.S. primary new insurance written, or NIW, for the years ended December 31, 2009, 2008 and 2007. NIW refers to the original principal balance of all loans that receive new primary mortgage insurance coverage during a given period.

| 2009 | 2008 | 2007 | ||||||||||||||||

| (Dollars in millions) | ||||||||||||||||||

| Flow Channel |

$ | 8,993 | 100 | % | $ | 22,197 | 98 | % | $ | 37,584 | 81 | % | ||||||

| Structured Finance Channel |

1 | 0 | % | 442 | 2 | % | 8,549 | 19 | % | |||||||||

| Total Primary NIW |

$ | 8,994 | 100 | % | $ | 22,639 | 100 | % | $ | 46,133 | 100 | % | ||||||

PMI’s total primary NIW decreased substantially in 2009, principally due to PMI’s capital management strategies and changes to PMI’s underwriting guidelines that limited the types of loans PMI would insure. The size of the U.S. mortgage origination market also impacts PMI’s NIW and is influenced by many economic factors, including access to credit markets, unemployment rates, interest rates, home prices, federal and state economic stimulus programs and policies, GSE and lender-specific policies, and the availability of mortgage insurance for high-LTV loans. Increased competition from mortgage insurance programs offered by the Federal Housing Authority (FHA) has also contributed to PMI’s declining NIW. Notwithstanding these external market

8

Table of Contents

pressures, in 2009, there was substantial market demand for primary mortgage insurance products on low-down payment mortgage loans; however, due to capital constraints, PMI limited its new insurance writings. We believe that the size of the residential U.S. mortgage origination market in 2010 will be smaller than in 2009, primarily because, with interest rates expected to rise in 2010 and with borrowers faced with significant equity constraints, refinance activity is likely to decrease sharply. While the size of the mortgage origination market is expected to be smaller in 2010, purchase loan originations as a percentage of the total origination market are expected to increase. As discussed above, while we are undertaking efforts to maintain or slightly increase insurance writings, we expect a variety of factors to continue to impact such new business writings in 2010.

Primary Flow Channel.

As the GSEs have traditionally been the principal purchasers of conforming mortgage loans, mortgage lenders have typically originated such loans in conformance with GSE guidelines for sellers and servicers. These guidelines reflect the GSEs’ own charter requirements which, among other things, allow the GSEs to purchase low down payment mortgage loans only if the lender: (i) secures mortgage insurance on those loans from an eligible insurer, such as PMI; or (ii) retains a participation of not less than 10% in the mortgage; or (iii) agrees to repurchase or replace the mortgage in the event of a default under specified conditions. If the lender retains a participation in the mortgage or agrees to repurchase or replace the mortgage, banking regulations may increase the level of capital required to be held by the lender to reflect the lender’s increased obligations, which could in turn increase the lender’s cost of doing business.

Under the U.S. Department of the Treasury’s (“Treasury”) Home Affordable Refinance Program (“HARP”), announced on March 4, 2009, certain borrowers whose loans are owned or guaranteed by the GSEs and have loan-to-value ratios that have risen as a result of declines in home prices, may refinance and take advantage of lower interest rates or a more stable loan product. HARP will be in effect through June 2010. Under HARP, the GSEs will not require mortgage insurance as credit enhancement on refinances of mortgages that were originated at less than 80% LTV, but are now greater than 80% LTV. For loans that were originated with mortgage insurance, the original policies are generally expected to remain in place on the affected loans. As of December 31, 2009, PMI approved 3,594 HARP requests and, of those, 2,339 were finalized, totaling approximately $509.5 million in modified insurance in force.

The GSEs have established approval requirements for eligible mortgage insurers. The approval requirements cover substantially all areas of PMI’s mortgage insurance operations and require disclosure of certain activities and new products to the GSEs. Prior to the suspension of certain eligibility criteria in February 2008, the GSEs mandated that eligible mortgage insurers maintain at least two of the following three ratings: “AA-” by S&P or Fitch Ratings (“Fitch”), or “Aa3” by Moody’s. In response to ratings downgrades of MIC below “AA-”, the GSEs required us to submit remediation plans and each GSE has required regular updates from MIC with respect to the remediation plans. To date, each GSE has continued to treat us as an eligible mortgage insurer, although there is no assurance that they will continue to do so. See Item 1A. Risk Factors—We have been and will continue to be negatively impacted by downgrades of MIC’s insurer financial strength ratings and—The exercise of certain rights reserved by the GSEs under eligibility requirements for mortgage insurers could harm our profitability and reduce our operational flexibility. In 2009, each of the GSEs circulated among all currently approved private mortgage insurers drafts of their respective revised eligibility requirements, to which we provided comments. Generally, the changes are principally focused on capital management and GSE review and consent of a wide array of operational, fiscal and product matters. We expect that under the revised eligibility requirements, the circumstances under which the GSEs will exercise increased oversight of eligible private mortgage insurers will be more clearly defined. Because we are presently operating under remediation plans with the GSEs, the level of oversight the GSEs currently have over PMI is not expected to materially change under the revised requirements. Although the timing is uncertain, we expect that the GSEs will finalize their revised requirements in the first half of 2010.

9

Table of Contents

In September 2008, the Treasury placed the GSEs into conservatorship and appointed the Federal Housing Finance Agency (“FHFA”) as their conservator. In conservatorship, the GSEs could change their business practices with respect to the mortgage insurance industry or individual mortgage insurers, which could materially impact the quantity and level of mortgage insurance coverage required by the GSEs on residential mortgage loans or MIC’s status as an eligible mortgage insurer. Moreover, the GSEs’ business practices may be impacted by their results of operations as well as legislative or regulatory changes governing their operations. The appointment of a conservator increases the likelihood that the U.S. Congress will examine the role and purpose of the GSEs in the U.S. housing market and potentially propose structural and other changes to the GSEs. New federal legislation could reduce the level of private mortgage insurance coverage used by the GSEs as credit enhancement or eliminate the requirement altogether. See Item 1A. Risk Factors—If the role of the GSEs in the U.S. housing market is changed, or if the GSEs change other policies or practices, the amount of insurance that PMI writes could further decrease, which could result in a decrease of our future revenue.

Lenders that purchase mortgage insurance select specific coverage levels for insured loans. As a result of the GSEs’ coverage requirements, lenders generally select a coverage percentage that effectively reduces the ratio of the original loan amount to the value of the property, or LTV, to not more than 80%. In the past, the GSEs have had programs under which for certain loans lenders could choose a mortgage insurance coverage percentage that was the minimum required by the GSEs’ charters, or “charter coverage”, rather than a higher, or “standard coverage”, in exchange for a lower payment from the GSEs. The GSEs also have had programs known as “reduced coverage”, under which for certain loans lenders could choose a coverage level that was higher than charter coverage but lower than standard coverage. Effective January 1, 2010, the lender’s option to purchase reduced coverage for loans sold to Fannie Mae was eliminated, and lenders have the option of selecting charter coverage, rather than standard coverage, on a broader array of loans. Because the new option only recently went into effect, we cannot predict with any certainty whether lenders will select the lower charter coverage option on a significantly higher percentage of loans.

PMI charges higher premium rates for higher coverage, as higher coverage percentages generally result in higher amounts paid per claim. Depending on the loan, the premium payments for flow primary mortgage insurance coverage are typically borne by the insured’s customer, the mortgage borrower (“Borrower Paid MI”), and less frequently, by the insured (“Lender Paid MI”). In either case, the payment of premiums to us is generally the responsibility of the insured. PMI’s primary insurance rates are based on rates that we have filed with the various state insurance departments. To establish these rates, we utilize pricing models that allow PMI to assess risk across a spectrum of variables, including coverage percentages, loan and property attributes, and borrower risk characteristics. We also offer Lender Paid MI products, which are priced and filed in the same manner as our standard Borrower Paid MI rates. Lender Paid MI represented 8.4%, 6.2% and 20.1% of flow NIW in 2009, 2008 and 2007, respectively.

Premium payments may be paid to us on a monthly, annual or single premium basis. Monthly payment plans represented 88.3%, 94.7% and 93.5% of NIW in 2009, 2008 and 2007, respectively. As of December 31, 2009, monthly plans represented 92.4% of our U.S. primary risk in force compared to 92.8% at December 31, 2008 and 92.9% at December 31, 2007. Single premium plans represented substantially all of the remaining NIW and primary risk in force. A portion of single premium plan payments may be refundable if the insured cancels coverage, which generally occurs when the loan is repaid, the loan amortizes to a sufficiently low amount to trigger a lender permitted or legally required cancellation or the value of the property has increased sufficiently.

Primary mortgage insurance premium rates are fixed when the insurance on the loan is initially issued. As a result, losses from increased claims on policies originated in a particular year cannot be offset by renewal premium increases on policies in force. We may not cancel mortgage insurance coverage except in the event of nonpayment of premiums or certain material violations of PMI’s master policies. However, the insured or the loan’s mortgage servicer generally may cancel mortgage insurance coverage issued through our flow channel at any time. In addition, the GSEs’ guidelines generally provide that a borrower’s written request to cancel Borrower Paid MI should be honored if the borrower has a satisfactory payment record and the principal balance is not greater than 80% of the original value of the property or, in some instances, the current value of the

10

Table of Contents

property. The Homeowners Protection Act of 1998 also provides for the automatic termination of Borrower Paid MI on most loans when the LTV ratio (based upon the loan’s amortization schedule) reaches 78%, and provides for cancellation of Borrower Paid MI upon a borrower’s request when the LTV ratio (based on the original value of the property) reaches 80%, upon satisfaction of conditions set forth in the statute.

Structured Finance Channel.

PMI has offered primary mortgage insurance products through its structured finance channel, primarily to MBS issuers as credit enhancement covering portfolios of loans. While the terms varied, our structured finance products generally insured a group of pre-existing loans or loans that were to be originated in the future whose attributes were to conform to the terms of the negotiated agreement. A structured finance product can include primary insurance (first loss) and/or modified pool insurance (discussed below). We utilized risk-based pricing models to establish premium rates for our structured finance transactions business, which considered the requested structure, real estate loss scenarios, as well as loan and property attributes and borrower risk characteristics. Payment of premiums to us is generally the obligation of the insured. We do not anticipate offering structured finance products in 2010.

(b) Pool Insurance

Modified Pool Insurance. Prior to 2008, we offered modified pool insurance products, primarily to the GSEs for regulatory capital relief or the reduction of mortgage default risk. Modified pool insurance may be used in tandem with primary mortgage insurance or may be placed on loans that do not require primary insurance. The extent of coverage of modified pool products varies. Some products provide first loss protection by covering losses (up to a loan-level benefit limit) on individual loans held within the pool of insured loans up to a stated aggregate loss limit (“stop loss limit”) for the entire pool. Some modified pool products offer mezzanine-level coverage by providing for claims payments only after a predetermined cumulative claims level, or deductible, is reached. Such mezzanine-level coverage generally also includes a stop loss limit. The existence of stop-loss protection for PMI’s modified pool exposure results in a maximum loss amount equal to PMI’s modified pool risk-in-force. As of December 31, 2009, PMI had $0.8 billion of modified pool risk in force, representing 2.7% of PMI’s total risk in force. Unless otherwise noted, primary insurance statistics in this report do not include pool insurance.

As a key component of our capital relief strategy, we have been and continue to pursue opportunities to restructure our modified pool exposure (including through commutation). As the modified pool portfolio’s 2005, 2006 and 2007 book years are likely to continue to age under severe economic conditions, we recorded significant reserves in 2009 and expect to record significant additional reserves in 2010 with respect to this portfolio. The existence of stop-loss protection and the significant reserves we have recorded and expect to record provides PMI with opportunities to work with its insured customers to restructure the risk on certain modified pool policies by negotiating early, discounted claim payments. This may particularly be the case when both parties agree on the likely amount of the ultimate contract losses and where the counterparty, rather than waiting to receive future expected claim payments, prefers to receive an acceleration of claim payments for the particular pool, although at a discount of such expected future claim payments. When we restructure our modified pool contracts at a discount to the level of our associated recorded reserves, we realize a statutory capital benefit. In connection with the restructurings we completed in 2009, PMI paid the counterparties accelerated discounted claim payments of approximately $498 million (subject to certain adjustments) in the aggregate. The positive impact that these restructurings had on our loss reserves in 2009 resulted in an estimated aggregate capital benefit, on both a statutory and GAAP basis, to MIC of approximately $130 million.

Other Pool Insurance. Prior to 2002, PMI offered certain traditional pool insurance products, referred to principally as GSE Pool or Old Pool, to lenders, the GSEs and the non-agency market. As of December 31, 2009, other pool insurance represented 1.0% of PMI’s total net risk in force and 28.0% of PMI’s total net pool risk in force (including modified pool).

11

Table of Contents

(c) Joint Venture—CMG Mortgage Insurance Company

CMG Mortgage Insurance Company and its affiliates (collectively “CMG MI”) offer mortgage insurance for loans originated by credit unions. CMG MI is a joint venture, equally owned by MIC and CUNA Mutual Insurance Society (“CMIS”). CMIS is part of the CUNA Mutual Group, which provides insurance and financial services to credit unions and their members. Both MIC and CMIS provide services to CMG MI. CMG MI is a GSE-eligible mortgage insurer. As of December 31, 2009, CMG MI had $22.0 billion of primary insurance in force and $5.4 billion of primary risk in force. CMG MI’s financial results are reported in our consolidated financial statements under the equity method of accounting in accordance with U.S. generally accepted accounting principles or GAAP. CMG MI’s operating results are not included in our results shown in Part I of this Report on Form 10-K, unless otherwise noted.

Under the terms of the restated joint venture agreement effective as of June 1, 2003, CMIS has the right on September 8, 2015, or earlier under certain limited conditions, to require MIC to sell, and MIC has the right to require CMIS to purchase, MIC’s interest in CMG MI for an amount equal to the then current fair market value of MIC’s interest. MIC and CMIS have also entered into a capital support agreement, which is subject to certain limitations, for the benefit of CMG MI. Under the capital support agreement, MIC has an obligation, under specified conditions, to maintain CMG MI’s risk-to-capital ratio at or below 19.0 to 1. CMG MI’s risk-to-capital ratio as of December 31, 2009 was 17.2 to 1. See Item 1A. Risk Factors—Current market volatility combined with falling home prices and rising unemployment have materially and adversely affected our business and results of operations, and we do not expect these conditions to improve in the near future. MIC’s capital support obligation is limited to an aggregate of $37.7 million.

| 2. | Competition |

U.S. Private Mortgage Insurance Industry

The U.S. private mortgage insurance industry presently consists of seven active mortgage insurers: PMI; CMG MI; Mortgage Guaranty Insurance Corporation, or MGIC; Genworth Mortgage Insurance Corporation, an affiliate of Genworth Financial, Inc.; United Guaranty Residential Insurance Company, an affiliate of American International Group, Inc.; Radian Guaranty Inc., or Radian; and Republic Mortgage Insurance Co., an affiliate of Old Republic International. Assured Guaranty Mortgage Insurance Company, a subsidiary of Assured Guaranty Ltd., is also licensed to offer mortgage insurance in the U.S. One new private mortgage insurer, Essent US Holdings, Inc., a member of Essent Group Ltd., was recently approved as a qualified mortgage insurer by the GSEs.

U.S. and State Government Agencies

PMI and other private mortgage insurers compete with federal and state government agencies that sponsor their own mortgage insurance programs. The private mortgage insurers’ principal government competitor is the Federal Housing Administration, or FHA, and to a lesser degree, the Veterans Administration, or VA. The following table shows the relative mortgage insurance market share of FHA/VA and private mortgage insurers over the past five years.

| Federal Government and Private Mortgage Insurance Market Share (Based on NIW) |

|||||||||||||||

| Year Ended December 31, | |||||||||||||||

| 2009 | 2008 | 2007 | 2006 | 2005 | |||||||||||

| FHA/VA |

84.6 | % | 60.3 | % | 20.1 | % | 22.7 | % | 23.5 | % | |||||

| Private Mortgage Insurance |

15.4 | % | 39.7 | % | 79.9 | % | 77.3 | % | 76.5 | % | |||||

| Total |

100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100 | % | |||||

| Source: | Inside Mortgage Finance (based upon primary NIW but includes certain insurance written that we classify as pool insurance) |

12

Table of Contents

Since early 2008, the FHA has substantially increased its market share of the U.S. primary mortgage insurance business. FHA’s market share is higher as a result of private mortgage insurance companies adopting tighter underwriting guidelines limiting the types of loans they will insure and federal legislation enacted in 2008 designed to stabilize the mortgage markets by providing the FHA with greater flexibility in establishing new products and temporarily increasing the maximum loan amount that the FHA may insure, in some cases up to the GSE limits, including up to $729,750 in “high-cost” areas. The FHA is also authorized to refinance distressed mortgages in return for lenders and investors agreeing to write-down the amount of the original mortgage. The 2008 legislation had the effect of broadening the scope of loans eligible for mortgage insurance from the FHA.

While the FHA continues to view its role as providing access to underserved communities and supporting the nation’s economic recovery, on January 20, 2010 it announced a number of changes to its program which are designed to tighten FHA’s eligibility criteria and increase its premium rates. In its announcement, the FHA proposed to: increase its mortgage insurance premium; update the combination of FICO scores and down payments for new borrowers to require those with less than a 580 FICO to put down at least 10% of a property’s purchase price, rather than 3.5% for borrowers with FICO scores of 580 or higher; reduce seller concessions to 3% from 6%; and implement a series of measures aimed at strengthening lender enforcement. The future size of the FHA market share will depend in large part on whether Congress will permanently keep the FHA maximum loan limit at its current level or adopt additional increases. The recently announced changes and any future changes to the FHA program may impact demand for private mortgage insurance.

The size of the private mortgage insurance market is also influenced by GSE conforming loan limits, the maximum loan amount that the GSEs may purchase. In February 2008, Congress passed an economic stimulus package, which temporarily raised (until December 31, 2008) the GSE conforming loan limits for certain statutorily defined high cost areas to $729,750, and the American Recovery and Reinvestment Act of 2009 extended the 2008 GSE loan limits through 2009. In November 2009, the FHFA announced that the maximum conforming loan limits, including those for high cost areas, will remain unchanged in 2010. The increase to the GSE conforming loan limit could increase demand for mortgage insurance products. We and other private mortgage insurers also face competition in several states from state-supported mortgage insurance funds.

Financial Institutions and Mortgage Lenders

We and other private mortgage insurers compete with financial institutions, primarily commercial banks and thrifts, when they retain risk on all or a portion of their high LTV mortgage portfolios rather than obtain insurance for this risk. Our use of captive reinsurance with certain lenders with whom we do business (see Section 9(a)—Captive Reinsurance, below) also negatively impacts our premiums earned.

| 3. | Customers |

Our U.S. customers are primarily mortgage lenders, depository institutions, commercial banks and investors, including the GSEs. In 2009, PMI’s top ten customers generated 56.9% of PMI’s premiums earned compared to 49.4% in 2008. The beneficiary under PMI’s master policies is the owner of the insured loan. The GSEs, as major purchasers of conventional mortgage loans in the U.S., are the primary beneficiaries of PMI’s mortgage insurance coverage. In 2009, we received $74.6 million in premium revenues from Fannie Mae, which exceeded 8% of our consolidated revenues.

| 4. | Sales and Product Development |

We employ a sales force located throughout the U.S. to directly sell products and services to lenders. Our U.S. sales force is comprised entirely of PMI employees who receive compensation consisting of a base salary and incentive compensation tied to certain performance objectives. PMI’s product development and marketing department has primary responsibility for supporting our existing products and the creation of new products.

13

Table of Contents

| 5. | Business Composition |

Primary Risk in Force. The composition of PMI’s primary risk in force is summarized in the table below. The table is based on information available to PMI at the date of policy origination.

| As of December 31, | ||||||||||||||||||||

| 2009 | 2008 | 2007 | 2006 | 2005 | ||||||||||||||||

| Primary Risk in Force (In millions) |

$ | 27,794 | $ | 30,605 | $ | 30,967 | $ | 25,711 | $ | 24,971 | ||||||||||

| Loan and Borrower Characteristics as Percentages of Primary Risk in Force |

||||||||||||||||||||

| LTV: |

||||||||||||||||||||

| Above 97.0% LTV |

20.4 | % | 21.5 | % | 24.6 | % | 17.6 | % | 14.3 | % | ||||||||||

| 95.01% to 97.0% LTV |

4.0 | % | 4.1 | % | 3.8 | % | 4.6 | % | 5.3 | % | ||||||||||

| 90.01% to 95.0% LTV |

30.5 | % | 29.9 | % | 29.5 | % | 31.0 | % | 33.7 | % | ||||||||||

| 85.01% to 90% LTV |

38.1 | % | 37.5 | % | 35.0 | % | 37.9 | % | 37.4 | % | ||||||||||

| 85.00% LTV and below |

7.0 | % | 7.0 | % | 7.1 | % | 8.9 | % | 9.3 | % | ||||||||||

| Loan Type*: |

||||||||||||||||||||

| Fixed |

90.7 | % | 89.7 | % | 87.2 | % | 81.3 | % | 80.4 | % | ||||||||||

| ARMs (excluding 2/28 Hybrid ARMs) |

7.5 | % | 8.0 | % | 9.5 | % | 12.5 | % | 13.7 | % | ||||||||||

| 2/28 Hybrid ARMs |

1.8 | % | 2.3 | % | 3.3 | % | 6.2 | % | 5.9 | % | ||||||||||

| Less-than-A Quality (less than 620 FICO) |

6.8 | % | 7.1 | % | 8.1 | % | 8.0 | % | 9.3 | % | ||||||||||

| Alt-A |

17.0 | % | 18.8 | % | 22.8 | % | 19.9 | % | 17.2 | % | ||||||||||

| Interest Only |

10.9 | % | 11.8 | % | 14.2 | % | 9.9 | % | 6.2 | % | ||||||||||

| Payment Option ARMs |

3.1 | % | 3.4 | % | 3.8 | % | 4.5 | % | 3.5 | % | ||||||||||

| Property Type: |

||||||||||||||||||||

| Single-family detached |

82.0 | % | 82.1 | % | 82.8 | % | 82.7 | % | 83.8 | % | ||||||||||

| Condominium, townhouse, cooperative |

14.2 | % | 13.9 | % | 12.8 | % | 11.9 | % | 11.5 | % | ||||||||||

| Multi-family dwelling and other |

3.8 | % | 4.0 | % | 4.4 | % | 5.4 | % | 4.7 | % | ||||||||||

| Occupancy Status: |

||||||||||||||||||||

| Primary residence |

90.0 | % | 89.3 | % | 88.6 | % | 88.8 | % | 91.0 | % | ||||||||||

| Second home |

4.3 | % | 4.4 | % | 4.3 | % | 3.9 | % | 3.4 | % | ||||||||||

| Non-owner occupied |

5.7 | % | 6.3 | % | 7.1 | % | 7.3 | % | 5.6 | % | ||||||||||

| Loan Amount: |

||||||||||||||||||||

| $100,000 or less |

11.8 | % | 12.3 | % | 14.6 | % | 17.9 | % | 19.5 | % | ||||||||||

| Over $100,000 and up to $250,000 |

52.1 | % | 52.5 | % | 53.3 | % | 56.4 | % | 59.1 | % | ||||||||||

| Over $250,000 |

36.1 | % | 35.2 | % | 32.1 | % | 25.7 | % | 21.4 | % | ||||||||||

| GSE conforming loans** |

92.7 | % | 92.1 | % | 91.7 | % | 91.7 | % | 91.8 | % | ||||||||||

| Non-conforming loans** |

7.3 | % | 7.9 | % | 8.3 | % | 8.3 | % | 8.2 | % | ||||||||||

| Average primary loan size (In thousands) |

$ | 161.2 | $ | 160.2 | $ | 155.0 | $ | 142.5 | $ | 136.0 | ||||||||||

| * | Loans types are not mutually exclusive and, therefore, do not total 100%. |

| ** | GSE conforming loans have principal balances that do not exceed the maximum single-family principal balance loan limit eligible for purchase by the GSEs. Non-conforming loans have principal balances that exceed the GSE loan limits. |

| • | High LTV Loans. LTV is the ratio of the original loan amount to the value of the property. In our experience, as LTV ratios increase, the associated default and claim rates generally increase as well. In particular, “Above-97s”, mortgages with LTVs exceeding 97%, have higher default and claim rates than mortgages with lower LTVs. In 2008, we stopped insuring Above-97s, and as of February 1, 2009, we stopped insuring loans with LTVs exceeding 95%. As of December 31, 2009, Above-97s represented 20.4% of our primary risk in force, down from 21.5% of our primary risk in force as of December 31, 2008. |

14

Table of Contents

| • | Fixed, Adjustable Rate and 2/28 Hybrid Mortgages. We consider a loan an adjustable rate mortgage, or ARM, if its interest rate may be adjusted prior to the loan’s fifth anniversary. Based on our experience, the delinquency and claim rates of ARMs are generally higher than in the case of fixed rate loans. A 2/28 Hybrid ARM is a loan whose interest rate is fixed for an initial two year period and floats thereafter. PMI previously insured 2/28 Hybrid ARMs through its structured finance channel. 2/28 Hybrid ARMs have experienced higher default rates than other ARM products. As of December 31, 2009, 2/28 Hybrid ARMs represented 1.8% of our primary risk in force. |

| • | Less-than-A Quality and Alt-A Loans. We previously insured less-than-A quality loans and Alt-A loans through our primary flow and structured finance channels. We define less-than-A quality loans to include loans with FICO scores generally less than 620. We define Alt-A loans as loans where the borrower’s FICO score is 620 or higher and the borrower requests and is given the option of providing reduced documentation verifying the borrower’s income, assets, deposit information, and/or employment. The default and claim rates of less-than-A quality and Alt-A loans exceed PMI’s average rates. In 2008, we eliminated eligibility of less-than-A quality and Alt-A loans for insurance from PMI. Due primarily to commitments issued prior to elimination of Alt-A loan eligibility, we had an immaterial amount of NIW on Alt A loans for the year ended December 31, 2009, compared to 5.3% of our total primary NIW for the year ended December 31, 2008. As of December 31, 2009, less-than-A quality and Alt-A loans represented 6.8% and 17.0% of our primary risk in force, respectively, down from 7.1% and 18.8% of our primary risk in force, respectively, as of December 31, 2008. |

| • | Interest Only Loans. Interest only loans, also known as deferred amortization loans, have more exposure to declining home prices than traditional amortizing loans, in part because principal is not reduced during an initial deferral period (usually between two and ten years). The significant majority of interest only loans insured by PMI have initial deferral periods of ten years. We believe that less than one half of 1% of PMI’s primary risk in force consists of interest only loans whose initial deferral period ended in 2009. Due to the tightening of underwriting guidelines and because interest only loan originations have substantially declined in the market, NIW in 2009 was not material for interest only loans compared to 5.2% in 2008. As of December 31, 2009, interest only loans represented 10.9% of our primary risk in force, down from 11.8% of our primary risk in force as of December 31, 2008. |

| • | Payment Option ARMs. With a payment option ARM, a borrower generally has the option every month to make a payment consisting of principal and interest, interest only, or an amount established by the lender that may be less than the interest owed. Depending on prevailing interest rates and payment amounts, monthly payments may not be sufficient to fully cover interest due, in which case the shortfall is added to the principal amount of the loan in a manner known as “negative amortization.” While generally the amount of negative amortization allowed under the loan is capped, borrowers with payment option ARMs may choose not to pay all accrued interest during the early years of the loan, resulting in an increase to the principal amount owed. Typically, no later than the loan’s fifth anniversary the loan is “recast” as fully-amortizing with a loan balance equal to the principal then outstanding. Accordingly, like interest only loans, payment option ARMs have more exposure to declining home prices than amortizing loans. In addition, these loans may have interest rate risks similar to traditional ARMs. In 2008, we eliminated coverage of negatively-amortizing ARM products. As of December 31, 2009, payment option ARMs represented 3.1% of our primary risk in force, down from 3.4% of our primary risk in force as of December 31, 2008. |

| • | Layered Risk. PMI insures loans that may possess one or more of the above characteristics. For example, as of December 31, 2009: |

| • | Approximately 2.4% of PMI’s primary risk in force consists of Above-97s with FICO scores below 620. |

| • | Approximately 0.2% of PMI’s primary risk in force consists of 2/28 Hybrid ARMs that are also Above-97s. |

15

Table of Contents

| • | Approximately 0.3% of PMI’s primary risk in force consists of 2/28 Hybrid ARMs with FICO scores below 620. |

| • | Approximately 2.4% of PMI’s primary risk in force consists of Alt-A loans that are also Above-97s. |

| • | Approximately 3.1% of PMI’s primary risk in force consists of interest only loans that are also Above-97s. |

| • | Approximately 0.1% of PMI’s primary risk in force consists of interest only loans with FICO scores below 620. |

This “layering” of risk further increases the risk of borrower default.

| • | Average Primary Loan Size. As the table above shows, our average insured loan size increased each year since 2005. These increases were primarily caused by home price appreciation and a higher percentage of loans insured in geographic locations with higher average property values, such as California and Florida. As of December 31, 2009, the average primary loan sizes of PMI’s California and Florida insured loans were $295,037 and $175,965, respectively. Because our premium rates are based in part upon the size of the insured loan, higher average loan sizes favorably impact premiums written and earned. Our obligation to an insured with respect to a claim is generally determined by multiplying the stated coverage percentage by the loss amount, which includes any unpaid principal and interest. Accordingly, higher insured loan balances negatively affect our average claim sizes. In addition, we have to hold more capital against larger insured loan balances, because they represent more risk, which negatively impacts our capital position. In November 2009, the FHFA confirmed that the GSE maximum conforming loan limits will remain between $417,000 and $729,750, for high cost areas, through 2010. Because the significant majority of insurance written is on GSE conforming loans, the higher conforming loan limits may cause our average primary insured loan size to increase in 2010. |

The following table shows U.S. primary risk in force by FICO score:

| Percentage of Primary Risk in Force by FICO Score As of December 31, |

|||||||||

| 2009 | 2008 | 2007 | |||||||

| FICO Score: |

|||||||||

| Less than 575 |

1.7 | % | 1.8 | % | 2.2 | % | |||

| 575—619 |

5.0 | % | 5.2 | % | 5.9 | % | |||

| 620—679 |

29.6 | % | 30.8 | % | 33.1 | % | |||

| 680—719 |

24.6 | % | 25.1 | % | 25.1 | % | |||

| 720 and above |

38.2 | % | 36.1 | % | 32.7 | % | |||

| Unreported |

0.9 | % | 1.0 | % | 1.0 | % | |||

| Total |

100.0 | % | 100.0 | % | 100.0 | % | |||

Pool Risk in Force. The following table shows components of PMI’s net pool risk in force as of December 31 for the last five years.

| Pool Risk in Force (In millions) | |||||||||||||||

| As of December 31, | |||||||||||||||

| 2009 | 2008 | 2007 | 2006 | 2005 | |||||||||||

| Modified Pool |

$ | 772.4 | $ | 2,221.5 | $ | 2,851.9 | $ | 2,527.0 | $ | 1,809.6 | |||||

| Old Pool |

39.6 | 190.4 | 277.8 | 346.7 | 420.6 | ||||||||||

| Other Traditional Pool |

163.5 | 203.8 | 225.6 | 230.6 | 242.8 | ||||||||||

| GSE Pool |

97.6 | 106.7 | 109.0 | 112.2 | 116.0 | ||||||||||

| Total Pool Risk in Force |

$ | 1,073.1 | $ | 2,722.4 | $ | 3,464.3 | $ | 3,216.5 | $ | 2,589.0 | |||||

16

Table of Contents

Some of our modified pool products are subject to deductibles and some are not. The first table below presents data for the portion of PMI’s modified pool portfolio that is subject to deductibles. The second table presents similar data for the portion of PMI’s modified pool portfolio that is not subject to deductibles. The data in the tables below are organized by book year (the year in which the risk was written) and represent in each case the aggregate of modified pool transactions written during the applicable book year. The data presented are as of December 31, 2009.

| Modified Pool with Deductibles | ||||||||||||||||||

| 2004 and Prior | 2005 | 2006 | 2007 | 2008 | 2009 | |||||||||||||

| (Dollars in millions) | ||||||||||||||||||

| Insurance in Force |

$ | 4,877 | $ | 4,105 | $ | 8,023 | $ | 4,647 | $ | — | $ | — | ||||||

| PMI’s Claims Paid to Date, Including Restructuring |

31 | 134 | 255 | 78 | — | — | ||||||||||||

| Stop Loss Amount |

287 | 265 | 418 | 181 | — | — | ||||||||||||

| Deductible Amount |

174 | 171 | 280 | 98 | — | — | ||||||||||||

| Losses Applicable to Deductible |

69 | 59 | 45 | 10 | — | — | ||||||||||||

| Deductible Balance |

105 | 111 | 234 | 88 | — | — | ||||||||||||

| Reserves for Losses (1) |

6 | 30 | 67 | 27 | — | — | ||||||||||||

| Remaining Risk in Force (2) |

$ | 103 | $ | 64 | $ | 72 | $ | 56 | $ | — | $ | — | ||||||

| Modified Pool without Deductibles | ||||||||||||||||||

| 2004 and Prior | 2005 | 2006 | 2007 | 2008 | 2009 | |||||||||||||

| (Dollars in millions) | ||||||||||||||||||

| Insurance in Force |

$ | 2,139 | $ | 1,183 | $ | 3,853 | $ | — | $ | — | $ | — | ||||||

| Stop Loss Amount |

483 | 49 | 305 | — | — | — | ||||||||||||

| PMI’s Claims Paid to Date |

47 | 26 | 45 | — | — | — | ||||||||||||

| Stop Loss Balance |

436 | 23 | 260 | — | — | — | ||||||||||||

| Reserves for Losses (1) |

44 | 15 | 37 | — | — | — | ||||||||||||

| Remaining Risk in Force (2) |

$ | 247 | $ | 9 | $ | 223 | $ | — | $ | — | $ | — | ||||||

| (1) | Established loss reserves for delinquent modified pool loans, which represents PMI’s estimates of losses for those loans at December 31, 2009. |

| (2) | Remaining Risk in Force is net of claims paid to date and the reserves established on delinquent modified pool loans, and represents PMI’s maximum risk on its modified pool exposure. With certain pool agreements, the maximum possible loss to PMI is less than the contractual stop loss amount, primarily as a result of substantial runoff of loans subject to the agreement. |

We are experiencing accelerated and substantial loss development in our modified pool products as a result of sustained adverse market conditions and exposure to Alt-A loans in our modified pool (with deductible) portfolio. Our maximum exposure is equal to our remaining modified pool risk-in-force, which is set out in the tables above. Due to increases in pending delinquencies, average loan amounts, claim sizes, claim rates and severity, as of December 31, 2009, we established significant loss reserves with respect to modified pool (with deductibles) and we expect to record additional reserves up to the maximum loss amounts on our modified pool (with deductibles) exposure for the 2005, 2006 and 2007 book years. We do not expect to incur material losses on modified pool (with and without deductible) risk written in book years 2004 and prior. Our loss reserve balance for all pool loans increased from $261.6 million as of December 31, 2008 to $261.8 million as of December 31, 2009. Increases to loss reserves on modified pool risk were significantly offset by the modified pool restructurings and commutations we completed in 2009. (See Section 7. Defaults and Claims—Pool Claims, below.) As discussed above in Section 1(b). Products - Pool Insurance, the existence of stop-loss protection and the significant reserves we have recorded and expect to record provides PMI with opportunities to restructure its modified pool (with deductible) risk. In 2009, PMI completed modified pool restructurings which resulted in an aggregate capital benefit, on both a statutory and GAAP basis, to MIC of approximately $130 million.

17

Table of Contents

The following table shows the composition of the portion of PMI’s modified pool portfolio that is not subject to deductibles by book year based upon the effective date of coverage. We do not expect losses on our modified pool (without deductibles) exposure for any book years to reach our maximum loss limits. However, we and our industry are experiencing material losses, particularly on insurance written in 2005 and 2006, and the ultimate amount of loss on pool risk from such book years may depend on, among other things, the composition of the risk. Because modified pool stop loss limits operate across a pool of loans, we show the composition of PMI’s modified pool portfolio (without deductibles) in the table below on an insurance-in-force (“IIF”) rather than risk in force basis.

| Modified Pool (without Deductibles) by Book Year | |||||||||||||||||||||

| As of December 31, 2009 | |||||||||||||||||||||

| 2009 | 2008 | 2007 | 2006 | 2005 | 2004 & Prior |

||||||||||||||||

| Modified Pool (without Deductibles) IIF |

$ | — | $ | — | $ | — | $ | 3,853 | $ | 1,183 | $ | 2,139 | |||||||||

| Credit Score as percentages of above IIF*** |

|||||||||||||||||||||

| Less than 575 |

N/A | N/A | N/A | 8.3 | % | 0.0 | % | 0.5 | % | ||||||||||||

| 575—619 |

N/A | N/A | N/A | 18.5 | % | 0.4 | % | 1.7 | % | ||||||||||||

| 620—679 |

N/A | N/A | N/A | 44.6 | % | 20.8 | % | 33.8 | % | ||||||||||||

| 680—719 |

N/A | N/A | N/A | 19.5 | % | 29.8 | % | 27.3 | % | ||||||||||||

| 720 and above |

N/A | N/A | N/A | 9.1 | % | 47.7 | % | 28.8 | % | ||||||||||||

| Loan Type as percentages of above IIF |

|||||||||||||||||||||

| Fixed Rate |

N/A | N/A | N/A | 36.6 | % | 98.4 | % | 89.2 | % | ||||||||||||

| ARMs |

N/A | N/A | N/A | 63.4 | % | 1.6 | % | 8.5 | % | ||||||||||||

| 2/28 Hybrid ARMs |

N/A | N/A | N/A | 0.0 | % | 0.0 | % | 0.0 | % | ||||||||||||

| Specific Portfolio Characteristics* as percentages of above IIF |

|||||||||||||||||||||

| Above 97s |

N/A | N/A | N/A | 37.0 | % | 0.1 | % | 3.0 | % | ||||||||||||

| Auto States** Loans |

N/A | N/A | N/A | 16.7 | % | 4.5 | % | 6.5 | % | ||||||||||||

| California Loans |

N/A | N/A | N/A | 11.2 | % | 22.4 | % | 20.9 | % | ||||||||||||

| Florida Loans |

N/A | N/A | N/A | 9.9 | % | 7.6 | % | 7.6 | % | ||||||||||||

| Alt-A Loans |

N/A | N/A | N/A | 4.3 | % | 70.5 | % | 73.6 | % | ||||||||||||

| Interest Only Loans |

N/A | N/A | N/A | 3.2 | % | 42.7 | % | 6.6 | % | ||||||||||||

| Avg Loan Size |

N/A | N/A | N/A | $ | 153,153 | $ | 193,329 | $ | 123,289 | ||||||||||||

| Avg LTV |

N/A | N/A | N/A | 94 | % | 75 | % | 78 | % | ||||||||||||

| Avg FICO |

N/A | N/A | N/A | 648 | 718 | 693 | |||||||||||||||

| * | Specific portfolio characteristics are not necessarily mutually exclusive. |

| ** | Auto States include Michigan, Indiana, Ohio, and Illinois. |

| *** | Total may not equal 100% due to unreported FICO scores. |

| N/A | We did not write any modified pool (without deductibles) in the 2009, 2008 and 2007 book years. |

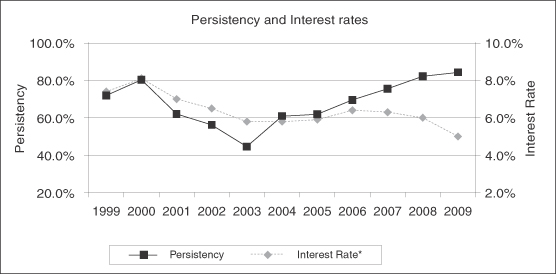

Persistency; Policy Cancellations. A significant percentage of PMI’s insurance-in-force is comprised of polices written in previous years, and our premiums earned are generated by the policies that remain in force over time. Consequently, the level of policy cancellations and resulting length of time that insurance remains in force are key determinants of PMI’s revenue and net income and, with current capital constraints, can impact our new business writings. One measure of the impact of policy cancellations on insurance in force is our persistency rate, which is based on the percentage of primary insurance in force at the beginning of a 12-month period that remains in force at the end of that period. The following graph and table show average annual mortgage interest rates and MIC’s primary portfolio persistency rates from 1999 to 2009. As shown in the table and graph, PMI’s primary persistency rate has been increasing since 2007. Typically, higher persistency rates stabilize PMI’s

18

Table of Contents

risk-in-force and premium income stream. However, because PMI must maintain sufficient capital to satisfy regulatory risk to capital metrics, higher persistency rates may further constrain PMI’s capital position and limit its ability to write new business.

| 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | |||||||||||||||||||||||

| Interest Rate* |

7.4 | % | 8.1 | % | 7.0 | % | 6.5 | % | 5.8 | % | 5.8 | % | 5.9 | % | 6.4 | % | 6.3 | % | 6.0 | % | 5.0 | % | |||||||||||

| Persistency Rate |

71.9 | % | 80.3 | % | 62.0 | % | 56.2 | % | 44.6 | % | 60.9 | % | 61.9 | % | 69.6 | % | 75.5 | % | 82.2 | % | 84.3 | % |

| * | Average annual thirty-year fixed mortgage interest rate derived from Freddie Mac data. |