Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 for the fiscal year ended December 31, 2009 |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 for the transition period from to |

Commission File Number 0-28551

Nutrisystem, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 23-3012204 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 300 Welsh Road, Building 1, Suite 100 Horsham, Pennsylvania |

19044 | |

| (Address of principal executive offices) |

(Zip Code) | |

Registrant’s telephone number, including area code: (215) 706-5300

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $.001 par value | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in the definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by checkmark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company (as defined in Exchange Act Rule 12b-2).

Large Accelerated Filer ¨ Accelerated Filer x Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by checkmark whether the registrant is a shell company (as defined by Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2009, was $424,173,764. Such aggregate market value was computed by reference to the closing price of the common stock as reported on the NASDAQ Global Select Market on June 30, 2009 (the last business day of the registrant’s most recently completed fiscal second quarter).

Number of shares outstanding of the registrant’s common stock, $0.001 par value, as of February 25, 2010: 30,943,884 shares

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement to be filed with the Securities and Exchange Commission for Nutrisystem, Inc.’s annual meeting of stockholders are incorporated by reference into Part III of this Form 10-K.

Table of Contents

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

Nutrisystem®, Nutrisystem® Flex® and Nutrisystem® Select® are registered trademarks of Nutrisystem, Inc. or its subsidiaries. Other service marks, trademarks and trade names of Nutrisystem, Inc. or its subsidiaries may be used in this Annual Report on From 10-K (the “Annual Report”). All other service marks, trademarks and trade names referred to in the Annual Report are the property of their respective owners. Solely for convenience, any trademarks referred to in the Annual Report may appear without the ® or TM symbol, but such references are not intended to indicate, in any way, that we or the owner of such trademark, as applicable, will not assert, to the fullest extent under applicable law, our or its rights, or the right of the applicable licensor, to these trademarks.

INDUSTRY AND MARKET DATA

The market data and other statistical information used throughout this Annual Report are based on independent industry publications, government publications and other published independent sources. Some data is also based on our good faith estimates, which are derived from other relevant statistical information, as well as the independent sources listed above. Although we believe these sources are reliable, we have not independently verified the information.

2

Table of Contents

Nutrisystem, Inc.

3

Table of Contents

Special Note Regarding Forward-Looking Statements

Except for the historical information contained herein, this Annual Report (“Report”) on Form 10-K contains certain forward-looking statements that involve substantial risks and uncertainties. Words such as “may,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “continue,” or similar words are intended to identify forward-looking statements, although not all forward-looking statements contain these words. Our actual results, performance or achievements could differ materially from the results expressed in, or implied by, these forward-looking statements. Factors that could cause or contribute to such differences include those set forth in “Risk Factors.” Accordingly, there is no assurance that the results in the forward-looking statements will be achieved.

| ITEM 1. | BUSINESS |

Overview

We are a leading provider of a weight management system based on a low-calorie, portion-controlled, prepared meal program. Typically, our customers purchase monthly food packages containing a 28-day supply of breakfasts, lunches, dinners and desserts, which they supplement with fresh dairy, fruit, salad, vegetables and low-glycemic carbohydrate items. Most of our customers order on an auto-delivery basis (“Auto-Delivery”), in which we send a month’s food supply on an ongoing basis until notified by the customer to stop our shipments. Our basic Auto-Delivery program is currently priced between $300 and $330 per shipment, or about $11 to $12 per day for a full 28 days of Nutrisystem food. Our food for the Core program is shelf-stable at room temperature and will last for up to two years, making it relatively inexpensive to ship and store. We also expanded our product offerings in 2008 and 2009 to incorporate a new fresh-frozen line of menu items.

Our program is based on the following cornerstones that represent who we are to our customers:

Results. We believe our program enables our customers to lose weight successfully. The Nutrisystem program is based on 35 years of nutrition research and the science of the low Glycemic Index, and offers over 150 low-calorie, portion-controlled items that are high in fiber, heart healthy and contain “good” carbohydrates and zero trans fats. The Glycemic Index is a measure of the quality of carbohydrates in foods. Foods on the lower end of the index are generally considered “good” carbohydrates.

Convenience. We sell our weight management programs primarily through a direct-to-consumer sales and distribution approach using the Internet and telephone. Our customers can order 24 hours a day, seven days a week on our website, www.nutrisystem.com, and the food is shipped directly to the customer’s door.

Simplicity. We provide a comprehensive weight management program, consisting of a pre-packaged food program and counseling. Our customers can either choose our pre-selected favorites food package or customize their monthly food orders for their specific tastes. There are no center visits, no measuring foods and no counting calories.

Value. Our basic Auto-Delivery program is currently priced at about $11 to $12 per day for a full 28 days of Nutrisystem food. We do not charge membership fees.

Anonymity. The direct-to-consumer approach using the Internet provides the privacy that our customers value. We provide online and telephone counseling and support to our customers using our trained weight loss coaches, diet counselors and other nutrition and dietary staff resulting in no need to travel for a face-to-face meeting.

4

Table of Contents

Competitive Strengths

We believe that our system offers consumers a sensible approach to losing weight without the use of faddish, unhealthy or unrealistic weight loss methods. We intend to capitalize on the following competitive strengths to grow:

Product Efficacy. We believe our customers are very satisfied with our products and believe they have lost weight while using our program. Our customer surveys found that customers lost an average of 1.0 to 2.0 pounds per week and tended to stay on the program for 10 to 11 weeks (including the one free week most customers obtain with their initial order). We believe these surveys indicate overall satisfaction with our program and a potential willingness to refer our program to others.

Strong Brand Recognition. We believe that our brand is generally well recognized in the weight management industry. Our company and our predecessors have been in the weight management industry for more than 35 years, and we estimate that our company and our predecessors have spent hundreds of millions of dollars in advertising over that time period.

Low Cost, Highly Scalable Model. Unlike traditional commercial weight loss programs, which primarily sell through franchisee and company-owned centers, we generate revenue in our direct channel through the Internet and telephone (including the redemption of prepaid program cards). Our method of distribution removes the fixed costs and capital investment associated with diet centers. We also minimize fixed costs and capital investments in food procurement and fulfillment: we outsource the production of our food products to a number of vendors and we currently outsource 100% of our fulfillment operations to a third party provider.

Superior Consumer Value Proposition. Our goal is to offer our customers a complete weight management program that is convenient, private and cost-effective. Our customers place their orders through the Internet or over the phone and have their food delivered directly to their homes. This affords our customers the convenience and anonymity that other diets which rely on weight-loss centers cannot ensure. Additionally, we provide our customers with a month of food, including breakfast, lunch, dinner and dessert, each day, which removes the confusion of reading nutrition labels, measuring portions or counting calories, carbohydrates or points. At a cost of as little as $11 per day, we believe our weight management program offers our customers significant value and is priced below those of our competitors. In addition, we do not charge a membership fee, whereas many of our competitors do.

Our Industry

Weight management is a challenge for a significant portion of the U.S., as well as the global population. According to the World Health Organization (“WHO”), in 2005 approximately 1.6 billion adults (age 15 and above) globally were overweight and at least 400 million of them were obese. According to the CDC National Center for Health Statistics, as of 2006, one-third of the U.S. population, or approximately 134 million adults, are either overweight or obese.

Nutrisystem is currently operating primarily in the U.S. and Canada. Gallup surveys indicate that approximately 42%, or an estimated 96 million, of the people in the U.S. were dieting during 2008. Of those people, approximately 56 million were attempting to lose weight and 40 million were attempting to maintain their weight. Approximately 8% participated in commercial weight loss programs and 56% conducted some form of self-directed diet. We believe the Nutrisystem program is well positioned to attract both types of dieters.

According to the U.S. Department of Health and Human Services, overweight or obese individuals are increasingly at risk for diseases such as diabetes, heart disease, certain types of cancer, stroke, arthritis, breathing problems and depression. However, there is evidence that weight loss may reduce the risk of developing these diseases.

5

Table of Contents

In addition to the health risks, there are also cultural implications for those who are overweight or obese. U.S. consumers are inundated with imagery in media, fashion and entertainment that depicts the thin body as the ideal body type. Despite the high percentage of overweight or obese individuals in the U.S., the popularity of dieting appears to indicate consumers’ desire to be thin.

Competition

The weight loss industry is very competitive and consists of pharmaceutical products and weight loss programs, as well as a wide variety of diet foods and meal replacement bars and shakes, appetite suppressants and nutritional supplements. The weight loss market is served by a diverse array of competitors. Potential customers seeking to manage their weight can turn to traditional center-based competitors such as Weight Watchers and Jenny Craig, online diet-oriented sites, self-administered products such as the over-the-counter drug Alli and other medically supervised programs.

We believe that the principal competitive factors in the weight loss market are:

| • | the availability, convenience and effectiveness of the weight reduction program; |

| • | brand recognition and trustworthiness; |

| • | media spending; |

| • | new products; |

| • | program pricing; and |

| • | the ability to attract and retain customers through promotion and personal referral. |

Based on these factors, we believe that we can compete effectively in the weight management industry. We, however, have no control over how successful competitors will be in addressing these factors. By providing a well-recognized food-based program using the direct channel, we believe that we have a competitive advantage in our market.

Our Products and Services

For more than 35 years, the Nutrisystem name has been recognized as a leader in the weight loss industry. We provide a comprehensive weight management program, consisting primarily of a pre-packaged food program, online tools and counseling. Trained counselors are available 24 hours per day, seven days per week, to answer questions and make recommendations to help each customer achieve his or her weight loss goal. Customers support, encourage and share information with each other through hosted chat rooms and bulletin boards. These services are complemented with relevant information on diet, nutrition and exercise, which is provided on our community website and emailed to our customers bi-weekly. Additionally, online weight management tools are available and include the interactive Mindset Makeover guide, an innovative approach to behavior modification that we offer to our customers free of charge and that is compliant with research standards and co-authored by a national and international leader in the field of obesity research. This is an insightful and motivational behavior modification guide that walks clients through the program and can act as an interactive tool for our counselors to use in order to better facilitate communication and, ultimately, weight loss success for our clients.

Our Nutrisystem program consists of over 150 low calorie, portion-controlled items that are designed to rank low on the Glycemic Index, thereby providing dieters with a balanced intake of “good” carbohydrates, proteins and fats. The Glycemic Index is a measure of the quality of carbohydrates in foods. Foods on the lower end of the index are generally considered “good” carbohydrates. Our program is perfectly portioned for weight loss and balanced to meet national dietary guidelines for Americans. We have also worked to reduce the sodium content of our meal program to an average of 1800mg per day and will continue to actively work to lower the sodium content of our food even further without sacrificing flavor.

6

Table of Contents

In April 2009, we launched the marketing of our Nutrisystem D program, a low glycemic program specifically designed for those with type 2 diabetes who need to lose weight. Results from a clinical study conducted at the Temple University School of Medicine and published in the Journal of Postgraduate Medicine show that a pre-packaged, portion controlled meal plan helped overweight individuals with type 2 diabetes lose up to 16 times more weight and experience greater reductions in their A1C levels as compared to those in the control group. This weight loss was also associated with reductions in blood pressure, cholesterol and waist circumference. This research study was funded by Nutrisystem.

During 2009, we also began offering our program at Costco Wholesale Corporation’s warehouse club outlets (“Costco”) through the use of prepaid program cards. Expanding further in the retail area, we now also offer the Nutrisystem program in large retailers such as Walmart, Sam’s Club and Walgreens. Each retailer offers its unique promotional package and pricing through the use of prepaid cards. In each case, customers redeem the prepaid card online at our website and then the product is shipped to the customer. Currently, Costco has continued to perform in accordance with our expectations, while the other retailers that offer our program have struggled to meet our expectations. We expect to discontinue offering our program at underperforming retailers by the second quarter of 2010 but will continue to evaluate other major retailers that may provide us with additional opportunities to offer our program.

In December 2009, we launched Nutrisystem Jumpstart, a program for men and women designed to help those who are looking to jumpstart their way to a healthier lifestyle. Nutrisystem Jumpstart showcased our 50 new foods and provided customers with extra tools and support to help them reach their weight-loss goals.

In October 2009, we announced the introduction of the Nutrisystem program in Japan. Under our license agreement with House Foods International, the “Nutrisystem J Diet” was launched and the program will be exclusively marketed at the House Foods ecommerce site. The Nutrisystem J Diet features nutritionally balanced pre-packaged foods and beverages delivered directly to the home and supported by personalized weight loss nutrition counseling. The new diet is a 14-day program consisting of two meals per day (meal menu plus light menu) and beverages. The initial package will include a shaker and support kit.

In November 2008, we entered into an agreement with Schwan’s Home Service, a provider of fine frozen foods, for the development and distribution of frozen foods under the Nutrisystem brand. The program, which includes frozen foods (“Nutrisystem Select”), will enhance Nutrisystem’s tradition of effective weight loss and weight management. The full national launch of Nutrisystem Select took place in the first quarter of 2009. The program provides customers with premium fresh-frozen foods that complement Nutrisystem’s prepared food weight loss programs and still adheres to Nutrisystem’s nutritional guidelines. When a customer orders Nutrisystem Select, three separate shipments are delivered. The first shipment will be sent directly to the customer and will contain Nutrisystem’s standard shelf-stable food. The second and third shipments will contain the fresh-frozen foods and will be delivered right to the customer’s home by Schwan’s Home Service.

In July 2008, we acquired certain assets of Power Chow, LLC (d/b/a NuKitchen) (“NuKitchen”), a provider of premium, fresh prepared meals designed to promote weight management and healthy living. NuKitchen provides a full menu of fresh, restaurant-quality prepared meals delivered daily to customers.

In 2008, we also introduced the Flex program (“Nutrisystem Flex”), which is a 28-day program consisting of 20 days of food, our “weekends off” program, which provides a less restrictive option to meet the needs and lifestyle of an important segment of dieting consumers. Nutrisystem Flex includes a Recipe Book (Nutrisystem, My Way) and a Dining Out Guide to help consumers make healthy choices and stay within the program guidelines on their “flex” days.

Typically, our customers purchase monthly food packages of shelf-stable food containing 28 breakfasts, lunches, dinners and desserts, which they supplement with fresh dairy, fruit, salad, vegetables and low-glycemic carbohydrate items. In certain instances, depending on the promotional offers available, customers can receive

7

Table of Contents

more than the typical 28 days of food. Most customers order through our Auto-Delivery feature. Our program is currently priced for as little as $11 per day. The food is shelf-stable at room temperature, making it relatively inexpensive to ship and store. On our website, customers can order food 24 hours a day, seven days a week.

The features of our weight loss program address many of the most common limitations of traditional weight loss programs, including high initiation and recurring membership fees, the inconvenience of traveling to weight loss centers for scheduled appointments and lack of privacy. In addition, our prepared meals provide our customers with a structured program in which they do not have to weigh or measure foods or count calories, carbohydrates or points.

Our food items have accounted for 99% of our revenues for each of the years ended December 31, 2009, 2008 and 2007, respectively. No other product or service has accounted for more than 1% of consolidated revenue in any of the last three years. In January 2008, we expanded operations into Canada and in October 2009, we announced our Nutrisystem J Diet in Japan. Approximately 98% of our revenues for both the years ended December 31, 2009 and 2008 were generated in the United States.

Marketing

Marketing is a core competency that drives sales and builds the Nutrisystem brand. We have strong expertise in all facets of both offline and online marketing and utilize 360-degree, integrated marketing to drive profitable revenue in an efficient, effective way.

Offline Marketing. We believe Nutrisystem is one of the leading and most efficient offline direct response advertisers in the industry. We deploy a hybrid of proven direct response techniques to: 1) build brand equity and awareness; 2) encourage qualified customers to call or visit our website; and 3) deliver profitable sales. We track response to each advertisement through unique toll-free numbers and URLs and we deploy multi-channel campaigns to target new customers that include Internet, television, print, direct mail and telemarketing efforts. To reactivate lapsed customers and upsell to those already on our program, we utilize a combination of direct mail and telemarketing efforts which complements our other media advertising.

Online Marketing. Our online marketing strategy focuses on driving high-volume, cost-effective, qualified leads to our website with an emphasis on increasing both front-end and back-end conversion through constant testing and optimization. We are continually exploring new online opportunities as the market evolves, but focus the majority of our efforts on search optimization (paid and natural), affiliate management, portal relationships, large ad networks, strategic partnerships, targeted display media and internal/external email campaigns.

Public Relations. The consumer and business media outreach programs accentuate Nutrisystem as a leader and innovator in the weight loss category. Our public relations strategically complement offline and online marketing to increase top-of-mind awareness for Nutrisystem, as well as to foster positive word-of-mouth, in order to enhance purchase consideration of our product. The Nutrisystem brand, our marketing and product innovations, as well as celebrities who have lost weight on our program are regularly featured in top-tier media outlets such as: The Today Show, USA TODAY, People Magazine, Larry King Live, Access Hollywood, E! News and Forbes.com. We typically compensate our spokespersons based on their initial weight loss on our program and maintenance of the weight loss over time.

Ecommerce

As a leading ecommerce company and brand, we constantly strive to employ the latest tools and technology in order to drive increased performance of online customer conversion, retention and reactivation. We utilize our ecommerce platform to drive a highly-customizable and personalized user experience, as well as to effectively and efficiently manage day-to-day ecommerce business operations. In addition, we combine internal resources with external agencies in the development of our website information architecture, user interface and user

8

Table of Contents

experience. In order to optimize the key online business drivers, we continually perform usability testing and are constantly optimizing our website using a variety of sophisticated third party testing tools. Finally, we measure our online interaction with customers, along with broader website performance, via web analytics platforms and tools.

Sales and Counseling

A majority of our direct business sales occur on our website. The remaining sales are by telephone, and our call center processes virtually all of them. Our weight loss program is also sold through QVC, a television home shopping network, which represented 5% of our revenue in 2009.

As of December 31, 2009 we employed approximately 95 weight loss counselors and 274 sales agents. Staffing levels for counselors and sales agents are largely a function of the volume of revenue and orders. Sales agents are responsible for in-bound sales calls and will initiate out-bound sales calls to our leads and other targeted potential customers. Counselors initiate some out-bound sales calls but primarily focus on in-bound calls and email. Counselors also handle online web conversations from new visitors and appointments with existing customers. Sales agents and counselors are available 24 hours per day, seven days a week. Sales agents are paid primarily on commission while counselors receive an hourly wage.

We seek to hire counselors with backgrounds in psychology, sociology, nutrition, dietetics or other health-related fields and with suitable temperaments to speak with our customers. Counselors are trained in our meal plan, our Internet chat service, email, motivational techniques and customer service problem solving. Sales agents are well-versed in explaining our program and working with our customers to determine the program that would best fit their needs in helping them reach their weight loss goals.

Customer Service

As of December 31, 2009, we employed approximately 114 customer service representatives. Customer service representatives are trained to handle in-bound calls and email from customers who have questions or problems with an order after the sale transaction is completed. Typical customer inquiries relate to the arrival date of their order shipment, reporting of missing or damaged items and credits and exchanges. For email inquiries, we have a software system that scans the customer’s email message for key words and automatically supplies the representative with a form response that is reviewed, edited and sent back to the customer. Customer service representatives are available from 8 a.m. to midnight E.T., Monday through Friday, and 8:30 a.m. to 5 p.m., E.T., on Saturday and Sunday. Customer service representatives are paid an hourly wage.

Fulfillment

We operate an integrated order receipt, billing, picking, shipping and delivery tracking system comprised of proprietary and third party components. This system integrates the front end, or website customer interface, with order processing and shipping, and allows Internet customers to access shippers’ order tracking numbers online. Our computer-assisted picking system allows for virtually paperless order picking in all warehouse facilities.

We operate an integrated network of distribution facilities that consist of two outsourced facilities. In 2008 and 2009, we undertook a complete review of our entire supply chain management function which enabled detailed studies on product cost improvements, vendor productivity, warehouse efficiencies and key cost center opportunities. This effort resulted in improvement in our inventory management and allowed for the reduction of our outsourced distribution facilities down to two – one located in Chambersburg, Pennsylvania and the other in Sparks, Nevada. While 100% of our fulfillment operations are currently outsourced to a third party provider, during 2009, more than 85% of our fulfillment was handled by this outsourced provider.

We have entered into a service agreement with our outside fulfillment provider, which provides for storage, handling and other services, pricing and minimum space commitments. The current contract expires on

9

Table of Contents

December 17, 2014, but may be terminated sooner upon 180 days written notice. There are other outside fulfillment providers that could be utilized if needed and we are continually evaluating the need for secondary fulfillment services.

We continue to partner with our fulfillment provider to reduce the warehouse order turn-around time for processing and shipping orders. In 2009, approximately 99% of all direct customer orders were shipped within two business days of the date the order was received. In addition, we can ship to approximately 99% of the domestic population within five business days using standard ground transportation. This past year, we made capital investments in new material handling equipment and a new warehouse management system to target improvements in productivity, cost, quality and service.

Direct customers are not charged for their orders until the ordered product is shipped. We do not charge customers for shipping and handling on Auto-Delivery food orders provided customers take receipt of their second order. If a customer cancels before receipt of a second order or postpones his or her second order for more than 30 days, the customer will be charged for shipping and the difference in pricing for an Auto-Delivery order versus a non Auto-Delivery order.

Product Development

All of our foods and supplements are currently outsourced from more than 25 manufacturers or vendors. We have entered into supply agreements with many of these food vendors. The majority of these agreements provide for annual pricing, annual purchase obligations, as well as exclusivity in the production of certain products, with terms of five years or less. One agreement also provides for certain rebates to us if certain volume thresholds are exceeded. All of these contracts may be terminated by us upon written notice, generally between 30 and 180 days. We anticipate meeting all annual purchase obligations.

In 2009, approximately 19% and 18%, respectively, of inventory purchases were from two suppliers. We have supply arrangements with these two vendors that require us to make certain minimum purchases. In 2008, these vendors supplied 19% and 15% of total purchases and in 2007 these vendors supplied 24% and 11% of total purchases.

Our product development department primarily creates ideas and concepts based on customer feedback, market trends, nutrition and food technology breakthroughs and retail grocery trends. This starts at the laboratory level to determine if the product can meet our stringent demands (i.e. shelf-stable, glycemic friendly, etc.) and is then outsourced to our food manufacturers who further develop the new product based on our specifications. All new foods are created to enhance the variety of our current program or to support the efforts of creating a new program. Also, new foods are presented to us by food manufacturers to determine if they are compatible with our program. Most of our foods are created from market research and customer requests, as well as recommendations from our manufacturers. All of our new foods are evaluated for nutrition, compliance with our program, taste (by using testing panels) and cost considerations. The number of SKUs we introduce each year varies depending on whether we are introducing a new program or simply updating an existing program.

Our Customers

Based on our customer data, our typical customer is female, approximately 48 years of age and weighs 188 lbs. Men comprised approximately 28% of our new customers in 2009 compared to 32% in 2008 and 31% in 2007. We believe that, on average, our customers want to lose approximately 44 lbs. over a period of time. Based on our customer surveys, we believe our typical customers tend to stay on our program for 10 to 11 weeks (including the one free week most customers obtain with their initial order), lose 1.0 to 2.0 pounds per week and have tried other popular diet programs. We believe that these surveys indicate a willingness to refer our program to others and that our customers value the following Nutrisystem program attributes:

| • | effective weight loss; |

10

Table of Contents

| • | direct delivery to their door; |

| • | easy to follow and stay on the program; |

| • | food can be easily prepared in minutes; |

| • | wide variety of food; and |

| • | they do not feel hungry while on the program. |

Information Systems

Our ecommerce and community websites, both of which are based primarily on third party software customized to meet our business needs, are each hosted in a top tier, co-location facility. These facilities provide redundant network connections, an uninterruptible power supply, physical and fire security and diesel generated power back up for the equipment upon which our website relies. Our servers and our network are monitored 24 hours a day, seven days a week.

We use a variety of security techniques to protect our confidential customer data. When our customers place an order or access their account information, we secure that transaction by using the best available encryption technologies, including secure sockets layer, or SSL. Our customer data is protected against unauthorized access by security measures that meet or exceed all payment card industry and government guidelines. We employ a variety of industry leading technology providers including VeriSign, CyberSource and SecureWorks to further ensure the security of our credit card transactions and the safety of our customers’ personal information.

Intellectual Property

We own numerous domestic and international trademarks and other proprietary rights that are important to our business. Depending upon the jurisdiction, trademarks are valid as long as they are used in the regular course of trade and/or their registrations are properly maintained. We believe the protection of our trademarks, copyrights, patents, domain names, trade dress, and trade secrets is important to our success. We aggressively protect our intellectual property rights by relying on a combination of watch services and trademark, copyright, patent, trade dress and trade secret laws, and through the domain name dispute resolution system.

Employees

As of December 31, 2009, we had approximately 612 administrative, sales, counseling and customer service personnel, 27 employees dedicated to fulfillment and 41 employees in marketing. None of our employees is represented by a labor union, and we consider relations with our employees to be good.

Seasonality

Typically in the weight loss industry, revenue is strongest in the first quarter and lowest in the fourth calendar quarter. We believe our business experiences seasonality, driven by the predisposition of dieters to initiate a diet and the placement of our advertising based on the price and availability of certain media.

Available Information

All periodic and current reports, registration statements, code of conduct and other material that the Company is required to file with the Securities and Exchange Commission (“SEC”), including the Company’s annual report on Form 10-K, quarterly reports on Form10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) of the Securities Exchange Act of 1934 (the “1934 Act Reports”), are available free of charge through the Company’s investor relations page at www.nutrisystem.com. Such documents are available as soon as reasonably practicable after electronic filing of the material with the

11

Table of Contents

SEC. The Company’s Internet website and the information contained therein or connected thereto are not intended to be incorporated into this Annual Report on Form 10-K.

The public may also read and copy any materials filed by the Company with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site, www.sec.gov, which contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

Executive Officers of the Company

The Company’s executive officers and their respective ages and positions as of December 31, 2009 are as follows:

| Name |

Age | Position | ||

| Joseph M. Redling |

51 | Chairman, President and Chief Executive Officer | ||

| David D. Clark |

45 | Executive Vice President, Chief Financial Officer, Treasurer and Secretary | ||

| Chris Terrill |

42 | Executive Vice President, E-Commerce and Chief Marketing Officer | ||

| Scott A. Falconer |

50 | Executive Vice President, Operations | ||

Joseph M. Redling has served as our President since September 2007, as our Chief Executive Officer since May 2008 and as member of our Board since April 2008. In November 2008, Mr. Redling became Chairman of our Board. Prior to becoming Chief Executive Officer, Mr. Redling had served as our Chief Operating Officer since September 2007. Before joining us, Mr. Redling held a number of executive positions at AOL, Inc., a global web services company, including Chief Marketing Officer, President of AOL Access, President of AOL Paid Services and Customer Management and Chief Executive Officer of AOL International from September 2001 through March 2007.

David D. Clark has served as our Chief Financial Officer, Treasurer and Secretary since November 2007 and in July 2008, the Board promoted Mr. Clark from the position of Senior Vice President, which he held since November 2007, to Executive Vice President. Prior to joining us, Mr. Clark was Chief Financial Officer of Claymont Steel Holdings, Inc., a manufacturer of steel plate, from November 2006 through October 2007. Prior to that, Mr. Clark was Chief Financial Officer of SunCom Wireless Holdings, a publicly traded provider of digital wireless communications services, from its founding in 1997 through February 2006 and held the additional position of Executive Vice President from 2000 through February 2006 and Senior Vice President from 1997 through 2000.

Chris Terrill has served as our Executive Vice President, E-Commerce and Chief Marketing Officer since June 2009. Prior to becoming Chief Marketing Officer, Mr. Terrill had served as our Senior Vice President, E-Commerce since January 2007. Prior to joining us, Mr. Terrill was Vice President of Product and Marketing at Blockbuster.com, the online division of Blockbuster, Inc., from December 2005 to July 2006. Before joining Blockbuster, Mr. Terrill spent six years with Match.com, including his last roles as Vice President of New Brands and Verticals, where he was responsible for the creation of Chemistry.com.

Scott A. Falconer has served as our Executive Vice President, Operations since June 2009. Prior to that, Mr. Falconer served as our Executive Vice President, Customer Management and Product Development since May 2008. Prior to joining us, Mr. Falconer held a number of positions at AOL, Inc., a global web services company, including Executive Vice President, AOL Mobile, Executive Vice President, Member Services and Chief Operating Officer, Member Services from 2002 through 2007.

12

Table of Contents

| ITEM 1A. | RISK FACTORS |

You should consider carefully the following risks and uncertainties when reading this Annual Report on Form 10-K. If any of the events described below actually occurs, the Company’s business, financial condition and operating results could be materially adversely affected.

Risks Related to Our Business

Our future growth and profitability will depend in large part upon the effectiveness and efficiency of our marketing expenditures and our ability to select the right markets and media in which to advertise.

Our marketing expenditures were $147.0 million, $175.0 million and $178.7 million in 2009, 2008 and 2007, respectively. Our future growth and profitability will depend in large part upon the effectiveness and efficiency of our marketing expenditures, including our ability to:

| • | create greater awareness of our brand and our program; |

| • | identify the most effective and efficient level of spending in each market, media and specific media vehicle; |

| • | determine the appropriate creative message and media mix for advertising, marketing and promotional expenditures; |

| • | effectively manage marketing costs (including creative and media) in order to maintain acceptable customer acquisition costs; |

| • | acquire cost-effective national television advertising; |

| • | select the right market, media and specific media vehicle in which to advertise; and |

| • | convert consumer inquiries into actual orders. |

Our planned marketing expenditures may not result in increased revenue or generate sufficient levels of brand name and program awareness. We may not be able to manage our marketing expenditures on a cost-effective basis whereby our customer acquisition cost may exceed the contribution profit generated from each additional customer.

Our sales can be adversely impacted by the health and stability of the general economy.

Unfavorable changes in general economic conditions, such as a recession or prolonged economic slowdown, may reduce the demand for our products and otherwise adversely affect our sales. For example, economic forces, including general economic conditions, demographic trends, consumer confidence in the economy, changes in disposable consumer income and/or reductions in discretionary spending, may cause consumers to defer purchases of our program which could adversely affect our revenue, gross margins, and/or our overall financial condition and operating results.

We rely on third parties to provide us with adequate food supply and certain fulfillment, Internet, networking and call center services, the loss of any of which could cause our revenue, earnings or reputation to suffer.

Food Manufacturers. We rely solely on third party manufacturers to supply all of the food and other products we sell. In 2009, approximately 19% and 18%, respectively, of inventory purchases were from two suppliers. If we are unable to obtain sufficient quantity, quality and variety of food and other products in a timely and low-cost manner from our manufacturers, we will be unable to fulfill our customers’ orders in a timely manner, which may cause us to lose revenue and market share or incur higher costs, as well as damage the value of the Nutrisystem brand.

13

Table of Contents

Freight and Fulfillment. In 2009, more than 95% of our orders were shipped by one third party, United Parcel Service, or UPS, and more than 85% of our order fulfillment was handled by another third party, Ozburn-Hessey Logistics, or OHL. Should UPS or OHL be unable to service our needs for even a short duration, our revenue and business could be harmed. Additionally, the cost and time associated with replacing OHL or UPS on short notice would add to our costs. Any replacement fulfillment provider would also require startup time, which could cause us to lose sales and market share.

Internet, Networking and Call Center. Our business also depends on a number of third parties for Internet access, networking and call center services, and we have limited control over these third parties. Should our network connections go down, our ability to fulfill orders would be delayed. Further, if our website or call center becomes unavailable for a noticeable period of time due to Internet or communication failures, our business could be adversely affected, including harm to our brand and loss of sales.

Therefore, we are dependent on maintaining good relationships with these third parties. The services we require from these parties may be disrupted by a number of factors associated with their businesses, including the following:

| • | labor disruptions; |

| • | delivery problems; |

| • | financial condition of operations; |

| • | internal inefficiencies; |

| • | equipment failure; |

| • | natural or man-made disasters; and |

| • | with respect to our food suppliers, shortages of ingredients or United States Department of Agriculture (“USDA”) and United States Food and Drug Administration (“FDA”) compliance issues. |

We are dependent on the QVC Shopping Network for a percentage of revenue.

In 2009, sales of our products through our relationship with the QVC Shopping Network accounted for 5% of our revenue. For 2010, we have a one-year contractual agreement with QVC with an automatic extension unless either party decides not to extend the agreement and a minimum level of sales has not been achieved for the year. Under the QVC agreement, QVC controls when and how often our products and services are offered on-air, and we are not guaranteed any minimum level of sales or transactions. QVC has the exclusive right in the United States, its possessions and territories, the United Kingdom and Germany to promote our products using home shopping television programs other than our own infomercials during the contract term and on a non-exclusive basis for two years thereafter. If QVC elects not to renew the agreement or reduces airtime for promoting our products, our operating profits will suffer and we will be prohibited from selling our products through competitors of QVC for six months after the termination of the agreement.

We may be subject to claims that our personnel are unqualified to provide proper weight loss advice.

Some of our counselors for our weight management program do not have extensive training or certification in nutrition, diet or health fields and have only undergone the training they receive from us. We may be subject to claims from our customers alleging that our personnel lack the qualifications necessary to provide proper advice regarding weight loss and related topics. We may also be subject to claims that our personnel have provided inappropriate advice or have inappropriately referred or failed to refer customers to health care providers for matters other than weight loss. Such claims could result in damage to our reputation and divert management’s attention from our business, which would adversely affect our business.

14

Table of Contents

We may be subject to health-related claims from our customers.

Our weight loss program does not include medical treatment or medical advice, and we do not engage physicians or nurses to monitor the progress of our customers. Many people who are overweight suffer from other physical conditions, and our target consumers could be considered a high-risk population. A customer who experiences health problems could allege or bring a lawsuit against us on the basis that those problems were caused or worsened by participating in our weight management program. For example, our predecessor businesses suffered substantial losses due to health-related claims and related publicity. Currently, we are neither subject to any such allegations nor have we been named in any such litigation. However, if we were, we would defend ourselves against such claims. Defending ourselves against such claims, regardless of their merit and ultimate outcome, would likely be lengthy and costly, and adversely affect our results of operations. Further, our general liability insurance may not cover claims of these types.

The weight management industry is highly competitive. If any of our competitors or a new entrant into the market with significant resources pursues a weight management program similar to ours, our business could be significantly affected.

Competition is intense in the weight management industry and we must remain competitive in the areas of program efficacy, price, taste, customer service and brand recognition. Some of our competitors are significantly larger than we are and have substantially greater resources. Our business could be adversely affected if someone with significant resources decided to imitate our weight management program. For example, if a major supplier of pre-packaged foods decided to enter this market and made a substantial investment of resources in advertising and training diet counselors, our business could be significantly affected. Any increased competition from new entrants into our industry or any increased success by existing competition could result in reductions in our sales or prices, or both, which could have an adverse effect on our business and results of operations.

New weight loss products or services may put us at a competitive disadvantage.

On an ongoing basis, many existing and potential providers of weight loss solutions, including many pharmaceutical firms with significantly greater financial and operating resources than we have, are developing new products and services. The creation of a weight loss solution, such as a drug therapy, that is perceived to be safe, effective and “easier” than a portion-controlled meal plan would put us at a disadvantage in the marketplace and our results of operations could be negatively affected.

If we pursue competitive advertising, we may be subject to litigation from our competitors.

If we pursue competitive advertising, our competitors may pursue litigation regardless of its merit and chances of success. Competitive advertising may include advertising that directly or indirectly mentions a competitor or a competitor’s weight loss program in comparison to our program. Defending such litigation may be lengthy and costly, strain our resources and divert management’s attention from their core responsibilities, which would have a negative impact on our business.

Our business is subject to online security risks, including security breaches and identity theft.

To succeed, online commerce and communications must provide a secure transmission of confidential information over public networks. Currently, a significant number of our customers authorize us to bill their credit cards directly for all fees charged by us. We rely on third party software products to secure our credit card transactions. Although we have developed systems and processes that are designed to protect consumer information and prevent fraudulent payment transactions and other security breaches, failure to prevent or mitigate such fraud or breaches may adversely affect our operating results.

We may experience fluctuations in our operating results which may cause our stock price to be volatile.

In view of the rapidly evolving nature of our business and the seasonality inherent in the weight loss industry, our operating results may fluctuate significantly. The market price of our common stock is subject to

15

Table of Contents

fluctuations in response to our operating results, general trends in the weight loss industry, announcements by our competitors, our ability to meet or exceed securities analysts’ expectations, recommendations by securities analysts, the condition of the financial markets and other factors. These fluctuations, as well as general economic and market conditions, may adversely affect the market price of our common stock and cause it to fluctuate significantly.

Expansion into international markets may expose us to economic, political and social risks in the countries in which we operate.

In January 2008, we expanded operations into Canada and entered Japan, through a partner, in October 2009. This expansion may be costly as we will be required to divert management time and resources and it could require us to adapt our program to conform to local cultures. We may not be successful in expanding into particular international markets and this expansion could expose our financial results to additional risks in the countries in which we operate. Financial results could be adversely affected by changes in foreign currency rates, changes in worldwide economic conditions, changes in trade policies or tariffs and political unrest.

Future acquisitions and the pursuit of new business opportunities present risks, and we may be unable to achieve the financial and strategic goals of any acquisition or new business.

A component of our growth strategy may be to acquire existing businesses or pursue other business opportunities in the market for weight management and fitness products and services. Even if we succeed in acquiring or building such businesses, we will face a number of risks and uncertainties, including:

| • | difficulties in integrating newly acquired or newly started businesses into existing operations, which may result in increasing operating costs that would adversely affect our operating income and earnings; |

| • | the risk that our current and planned facilities, information systems, personnel and controls will not be adequate to support our future operations; |

| • | diversion of management time and capital resources from our existing businesses, which could adversely affect their performance and our operating results; |

| • | dependence on key management personnel of acquired or newly started businesses and the risk that we will be unable to integrate or retain such personnel; |

| • | the risk that the new products or services we may introduce or begin offering, whether as a result of internal expansion or business acquisitions, will not gain acceptance among consumers and existing customers; |

| • | the risk that new efforts may have a detrimental effect on our brand; |

| • | the risk that we will face competition from established or larger competitors in the new markets we may enter, which could adversely affect the financial performance of any businesses we might acquire or start; and |

| • | the risk that the anticipated benefits of any acquisition or of the commencement of any new business may not be realized, in which event we will not be able to achieve any return on our investment in that new business. |

If we do not continue to receive referrals from existing customers, our customer acquisition cost may increase.

We rely on word-of-mouth advertising for a portion of our new customers. If our brand suffers or the number of customers acquired through referrals drops due to other circumstances, our costs associated with acquiring new customers and generating revenue will increase, which will, in turn, have an adverse affect on our profitability.

16

Table of Contents

We use spokespersons to promote our products. If these spokespersons suffer adverse publicity, our revenue could be adversely affected.

Our marketing strategy depends in part on celebrity spokespersons, as well as customer spokespersons, to promote our weight management program. Any of these spokespersons may become the subject of adverse news reports, negative publicity or otherwise be alienated from a segment of our customer base, whether weight loss related or not. If so, such events may reduce the effectiveness of his or her endorsement and, in turn, adversely affect our revenue and results of operations.

If we cannot protect and enforce our trademarks and other intellectual property rights, our brand and our business will suffer.

We believe that our trademarks and other proprietary rights are important to our success and competitive position. The actions we take to establish and protect our trademarks and other proprietary rights may prove to be inadequate to prevent imitation of our products or services or to prevent others from claiming violations of their trademarks and proprietary rights by us. In addition, others may develop similar trademarks or other intellectual property independently or assert rights in our trademarks and other proprietary rights. If so, third parties may seek to block or limit sales of our products and services based on allegations that use of some of our marks or other intellectual property constitutes a violation of their intellectual property rights. If we cannot protect our trademarks and other intellectual property rights, or if our trademarks or other intellectual property rights infringe upon the rights of third parties, the value of our brand may decline, which would adversely affect our results of operations.

We are dependent on our key executive officers for future success.

Our future success depends to a significant degree on the skills, experience and efforts of our key executive officers. The loss of the services of any of these individuals could harm our business. We have not obtained life insurance on any key executive officers. If any key executive officers left us or were seriously injured and became unable to work, the business could be harmed.

Provisions in our certificate of incorporation may deter or delay an acquisition of us or prevent a change in control, even if an acquisition or a change of control would be beneficial to our stockholders.

Provisions of our certificate of incorporation (as amended) may have the effect of deterring unsolicited takeovers or delaying or preventing a third party from acquiring control of us, even if our stockholders might otherwise receive a premium for their shares over then current market prices. In addition, these provisions may limit the ability of stockholders to approve transactions that they may deem to be in their best interests.

Our certificate of incorporation (as amended) permits our Board of Directors to issue preferred stock without stockholder approval upon such terms as the Board of Directors may determine. The rights of the holders of our common stock will be junior to, and may be adversely affected by, the rights of the holders of any preferred stock that may be issued in the future. The issuance of preferred stock could have the effect of making it more difficult for a third party to acquire, or of discouraging a third party from acquiring, a majority of our outstanding common stock. The issuance of a substantial number of preferred shares could adversely affect the price of our common stock.

Risks Related to Our Industry

Changes in consumer preferences could negatively impact our operating results.

Our program features pre-packaged food selections, which we believe offer convenience and value to our customers. Our continued success depends, to a large degree, upon the continued popularity of our program

17

Table of Contents

versus various other weight loss, weight management and fitness regimens, such as low carbohydrate diets, appetite suppressants and diets featured in the published media. Changes in consumer tastes and preferences away from our pre-packaged food and support and counseling services, and any failure to provide innovative responses to these changes, may have a materially adverse impact on our business, financial condition, operating results, cash flows and prospects.

The weight loss industry is subject to adverse publicity, which could harm our business.

The weight loss industry receives adverse publicity from time to time, and the occurrence of such publicity could harm us, even if the adverse publicity is not directly related to us. In the early 1990s, our predecessor businesses were subject to extremely damaging adverse publicity relating to a large number of lawsuits alleging that the Nutrisystem weight loss program in use at that time led to gall bladder disease. This publicity was a factor that contributed to the bankruptcy of our predecessor businesses in 1993. More recently, our predecessor businesses were severely impacted by significant litigation and damaging publicity related to their customers’ use of fen-phen as an appetite suppressant, which the FDA ordered withdrawn from the market in September 1997. The significant decline in business resulting from the fen-phen problems caused our predecessor businesses to close all of their company-owned weight loss centers.

Congressional hearings about practices in the weight loss industry have also resulted in adverse publicity and a consequent decline in the revenue of weight loss businesses. Future research reports or publicity that is perceived as unfavorable or that question certain weight loss programs, products or methods could result in a decline in our revenue. Because of our dependence on consumer perceptions, adverse publicity associated with illness or other undesirable effects resulting from the consumption of our products or similar products by competitors, whether or not accurate, could also damage customer confidence in our weight loss program and result in a decline in revenue. Adverse publicity could arise even if the unfavorable effects associated with weight loss products or services resulted from the user’s failure to use such products or services appropriately.

Our industry is subject to governmental regulation that could increase in severity and hurt results of operations.

Our industry is subject to federal, state and other governmental regulation. For example, some advertising practices in the weight loss industry have led to investigations from time to time by the Federal Trade Commission, or FTC, and other governmental agencies. Many companies in the weight loss industry, including our predecessor businesses, have entered into consent decrees with the FTC relating to weight loss claims and other advertising practices. We continue to be subject to these consent decrees, which restrict how we advertise the successes our customers have achieved in losing weight through the program and require us to include the phrase “results not typical” in advertisements. In October 2009, the FTC published its revised Guides concerning the Use of Endorsements and Testimonials in Advertising. Regulation of advertising practices in the weight loss industry may increase in scope or severity in the future, which could have a material adverse impact on our business.

Other aspects of our industry are also subject to government regulation. For example, food manufacturers are subject to rigorous inspection and other requirements of the USDA and FDA, and companies operating in foreign markets must comply with those countries’ requirements for proper labeling, controls on hygiene, food preparation and other matters. If federal, state, local or foreign regulation of our industry increases for any reason, then we may be required to incur significant expenses, as well as modify our operations to comply with new regulatory requirements, which could harm our operating results. Additionally, remedies available in any potential administrative or regulatory actions may include requiring us to refund amounts paid by all affected customers or pay other damages, which could be substantial.

The sale of ingested products involves product liability and other risks.

Like other distributors of products that are ingested, we face an inherent risk of exposure to product liability claims if the use of our products results in illness or injury. The foods that we resell in the U.S. are subject to

18

Table of Contents

laws and regulations, including those administered by the USDA and FDA that establish manufacturing practices and quality standards for food products. Product liability claims could have a material adverse effect on our business as existing insurance coverage may not be adequate. Distributors of weight loss food products, vitamins, nutritional supplements and minerals, including our predecessor businesses, have been named as defendants in product liability lawsuits from time to time. The successful assertion or settlement of an uninsured claim, a significant number of insured claims or a claim exceeding the limits of our insurance coverage would harm us by adding costs to the business and by diverting the attention of senior management from the operation of the business. We may also be subject to claims that our products contain contaminants, are improperly labeled, include inadequate instructions as to use or inadequate warnings covering interactions with other substances. Product liability litigation, even if not meritorious, is very expensive and could also entail adverse publicity for us and reduce our revenue. In addition, the products we distribute, or certain components of those products, may be subject to product recalls or other deficiencies. Any negative publicity associated with these actions would adversely affect our brand and may result in decreased subscriptions and product sales and, as a result, lower revenues and profits.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

| ITEM 2. | PROPERTIES |

We currently lease three locations in Horsham, Pennsylvania. The three Horsham locations total approximately 166,143 square feet of office space at a combined 2009 rent of $2.3 million. One lease in Horsham expires in 2010, the second in 2011 and the third in 2018. In October 2009, we signed a fourth lease in Fort Washington, Pennsylvania with approximately 119,767 square feet of office space which we do not yet occupy but intend to consolidate all of our administrative and call center operations into this space. This lease expires in 2022. We have additional fulfillment capacity in Chambersburg, Pennsylvania and Sparks, Nevada through an outsourced provider. We have no lease obligations to any of our outsourced fulfillment providers; however, we are subject to minimum space commitments which we may reduce over a specified period of time. Management believes the outsourced fulfillment capacity is adequate to meet our needs for the foreseeable future.

19

Table of Contents

| ITEM 3. | LEGAL PROCEEDINGS |

Commencing on October 9, 2007, several putative class actions were filed in the United States District Court for the Eastern District of Pennsylvania naming Nutrisystem, Inc. and certain of its officers and directors as defendants and alleging violations of Sections 10(b) and 20(a) of the Securities Exchange Act of 1934. The complaints purported to bring claims on behalf of a class of persons who purchased the Company’s common stock between February 14, 2007 and October 3, 2007 or October 4, 2007. The complaints alleged that the defendants issued various materially false and misleading statements relating to the Company’s projected performance that had the effect of artificially inflating the market price of its securities. These actions were consolidated in December 2007 under docket number 07-4215. On January 3, 2008, the Court appointed lead plaintiffs and lead counsel pursuant to the requirements of the Private Securities Litigation Reform Act of 1995, and a consolidated amended complaint was filed on March 7, 2008. The consolidated amended complaint raises the same claims but alleges a class period of February 14, 2007 through February 19, 2008. The defendants filed a motion to dismiss on May 6, 2008. The motion has been fully briefed, and oral argument was held on November 24, 2008. On August 31, 2009, the Court granted defendants’ motion to dismiss. On September 29, 2009, plaintiff filed a notice of appeal, and the dismissal is currently on appeal. The Company believes the claims are without merit and intends to defend the litigation vigorously.

Commencing on October 30, 2007, two shareholder derivative suits were filed in the United States District Court for the Eastern District of Pennsylvania. These suits, which were nominally brought on behalf of Nutrisystem, Inc., name certain of its officers and a majority of the current Board of Directors as defendants. The federal complaints allege violations of Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 and claims for breach of fiduciary duty, waste, and unjust enrichment against all defendants and insider selling against certain defendants. The complaints are based on many of the same allegations as the putative class action described above but add contentions regarding the Company’s buyback program. The two federal actions were consolidated in December 2007 under docket number 07-4565, and an amended complaint was filed on March 14, 2008 naming a majority of the current Board of Directors as defendants and certain current and former officers. Defendants filed a motion to dismiss on May 13, 2008. The plaintiffs’ opposition was filed on July 14, 2008, and defendants’ reply was filed on August 13, 2008. The motion has been fully briefed, and oral argument was held on November 24, 2008. On October 26, 2009, the Court granted defendants’ motion to dismiss.

A shareholder derivative action was also filed in the Common Pleas Court of Montgomery County, Pennsylvania, in November 2007. Like the federal derivative action, the state court action is nominally brought on behalf of the Company and names a majority of the current Board of Directors as defendants. This action has been stayed. The Company believes that the claims are without merit and intends to defend the litigation vigorously.

The Company received in November 2007 correspondence from an attorney purporting to represent a Nutrisystem shareholder. This correspondence requested that the Company’s Board of Directors appoint a special litigation committee to investigate unspecified breaches of fiduciary duty. The disinterested and independent board members met to discuss this issue and responded to the attorney’s correspondence. Following receipt of additional correspondence from the same attorney in February 2008, the Board of Directors was considering its response when the shareholder represented by this attorney commenced a derivative lawsuit in the Court of Common Pleas of Montgomery County, Pennsylvania in the name of the Company against the entire Board of Directors at that time and certain current and former officers. The Board of Directors responded to the attorney’s correspondence. The parties have reached an agreement to stay this matter pending the disposition of the anticipated motion to dismiss the federal securities putative class action complaint. The Company believes that the claims are without merit and intends to defend the litigation vigorously.

On March 28, 2008, a former Nutrisystem, Inc. sales representative filed a putative collective action complaint in the United States District Court for the Eastern District of Pennsylvania, docket no. 08-1508, alleging that the Company unlawfully failed to pay overtime in violation of the Fair Labor Standards Act. The

20

Table of Contents

complaint purported to bring claims on behalf of a class of current and former sales representatives who were compensated by the Company pursuant to a commission-based compensation plan, rather than on an hourly basis. The plaintiff filed an amended complaint on May 28, 2008, adding a state-law class claim under the Pennsylvania Minimum Wage Act, alleging that the Company’s compensation plan also violated state law. On June 11, 2008, the Company answered the amended complaint and moved to dismiss the plaintiff’s state-law class claim. On June 11, 2008, the plaintiff filed a motion to proceed as a collective action and sent class members notice under the Fair Labor Standards Act claim. On July 25, 2008, the Court granted the Company’s motion to dismiss with respect to the state law claim. On September 26, 2008, the Court granted plaintiff’s motion to proceed as a collective action and facilitate notice. On October 8, 2008, the Court entered a Stipulation and Order approving proposed notice of a collective action lawsuit. On October 14, 2008, plaintiff’s counsel mailed notice to potential class members. Including plaintiff, fifty-four former sales representatives and fourteen current sales representatives have opted-in to this litigation. On March 9, 2009, the Company filed a motion for summary judgment on plaintiffs’ claims. On June 22, 2009, plaintiffs filed their response in opposition to the Company’s motion for summary judgment and cross-motion for summary judgment. On July 6, 2009, the Company filed its reply in further support of its motion for summary judgment. Thereafter, on July 22, 2009, plaintiffs filed their reply in further support of their cross-motion for summary judgment. The Court heard oral argument on the cross-motions for summary judgment on July 24, 2009. On July 31, 2009, the Court entered an Order granting the Company’s motion for summary judgment and denying plaintiffs’ cross-motion for summary judgment. On September 10, 2009, plaintiffs filed an appeal of the Court’s Order granting the Company’s motion for summary judgment and denying plaintiffs’ cross-motion for summary judgment. On January 4, 2010, plaintiffs filed their brief in support of their appeal. On January 7, 2010, several employee rights organizations filed an amicus curiae brief in this matter. On January 21, 2010, the U.S. Department of Labor filed an amicus curiae brief in this matter. The Company believes that the claims are without merit and intends to defend the litigation vigorously.

The Company is also involved in other various claims and routine litigation matters. In the opinion of management, after consultation with legal counsel, the outcome of such matters is not anticipated to have a material adverse effect on the Company’s consolidated financial position, results of operations or cash flows in future years.

21

Table of Contents

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Information

The Company’s common stock has been traded on the NASDAQ Stock Market since June 22, 2005, under the symbol “NTRI.” The following table sets forth, for the periods indicated, the high and low sale prices for the Company’s common stock as reported on the NASDAQ Stock Market.

| High | Low | |||||

| 2010 First Quarter (through February 25, 2010) |

$ | 31.90 | $ | 19.26 | ||

| 2009 First Quarter |

$ | 16.80 | $ | 10.28 | ||

| 2009 Second Quarter |

15.92 | 13.20 | ||||

| 2009 Third Quarter |

18.25 | 13.25 | ||||

| 2009 Fourth Quarter |

33.54 | 14.58 | ||||

| 2008 First Quarter |

$ | 30.62 | $ | 12.55 | ||

| 2008 Second Quarter |

22.25 | 13.64 | ||||

| 2008 Third Quarter |

22.68 | 12.94 | ||||

| 2008 Fourth Quarter |

18.30 | 10.01 | ||||

Holders

As of February 25, 2010, the Company had approximately 244 record holders of its common stock.

Dividends

Prior to 2008, we had not declared or paid any dividend since inception. We have paid a quarterly dividend of $0.175 per share beginning with the second quarter of 2008. The declaration and payment of dividends in the future will be determined by the Company’s Board of Directors in light of conditions then existing, including the Company’s earnings, financial condition, capital requirements and other factors. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity, Capital Resources and Other Financial Data.”

Securities Authorized for Issuance Under Equity Compensation Plans

The information under the heading “Equity Compensation Plan Information” to be filed in the Company’s definitive proxy statement for the 2010 annual meeting of stockholders is incorporated by reference.

22

Table of Contents

Issuer Purchases of Equity Securities

The following table provides information relating to our purchases of our common stock during the quarter ended December 31, 2009:

| Period |

Total Number of Shares Purchased (1)(2) |

Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs (1) |

Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs (1) | |||||

| October 1 – October 31, 2009 |

— | — | — | $ | 113,831,389 | ||||

| November 1 – November 30, 2009 |

— | — | — | $ | 113,831,389 | ||||

| December 1 – December 31, 2009 |

— | — | — | $ | 113,831,389 | ||||

| (1) | In August 2006, we announced that our Board of Directors authorized the repurchase of up to $50 million of our outstanding shares of common stock in open-market transactions on the NASDAQ National Market. Additionally, in February 2007, a repurchase program of up to $200 million of outstanding shares of common stock was authorized and, in October 2007, an additional $100 million of outstanding shares of common stock was authorized. The timing and actual number of shares repurchased depend on a variety of factors including price, corporate and regulatory requirements, alternative investment opportunities and other market conditions. The stock repurchase programs from 2007 had an expiration date of March 31, 2009, but were extended by our Board of Directors until March 31, 2011. These programs also may be limited or terminated at any time without prior notice. |

| (2) | For the period October 1, 2009 through December 31, 2009, does not include 4,470 shares surrendered by employees to the Company for payment of the minimum tax withholding obligations upon the vesting of shares of restricted common stock. |

23

Table of Contents

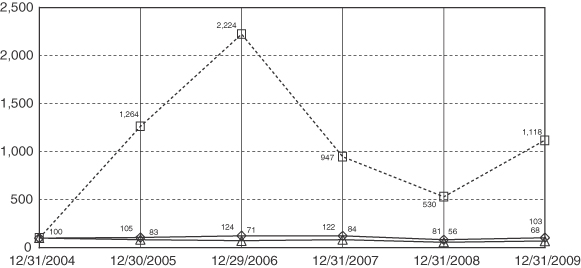

STOCK PRICE PERFORMANCE GRAPH