Attached files

| file | filename |

|---|---|

| EX-16.1 - STOCK PURCHASE AGREEMENT - Adaptive Medias, Inc. | ex16-1.htm |

United

States

Securities

and Exchange Commission

Washington,

D.C. 20549

FORM

8-K/A

Current

Report Pursuant to

Section 13

or 15(d) of the Securities Exchange Act of 1934

March 5,

2010

(Date

of Report)

Fashion

Net, Inc.

(Exact

name of registrant as specified in its charter)

|

Nevada

(State

of incorporation)

|

333-153826

(Commission

File Number)

|

26-0685980

(IRS

Employer Identification No.)

|

|

222

Columbus Ave, Suite 410,

San Francisco, CA

(Address

of principal executive offices)

|

94133

(Zip

Code)

|

|

|

510 552 2811

(Registrant’s

telephone number, including area

code)

|

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions:

o Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

o Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

o Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

o Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

1

|

Item

1.01 Entry into a Material Definitive Agreement

|

|

Item

2.01 Completion of Acquisition or Disposition of Assets

|

|

Item 5.01

Changes in Control of Registrant

|

|

Item 5.02

Departure of Directors or Certain Officers; Election of Directors;

Appointment of Certain Officers; Compensatory Arrangements of Certain

Officers

|

|

SIGNATURES

|

Forward

Looking Statements

This

report contains certain forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended. These include statements about our

expectations, beliefs, intentions or strategies for the future, which we

indicate by words or phrases such as "anticipate," "expect," "intend," "plan,"

"will," "we believe," "our company believes," "management believes" and similar

language. These forward-looking statements are based on our current

expectations and are subject to certain risks, uncertainties and assumptions,

including those set forth in the discussion under Part 1, Item 1 “Description of

Business" and Part 1, Item 6 "Management's Discussion and Analysis", including

under the heading “– Risk Factors” under Part 1, Item 6. Our actual

results may differ materially from results anticipated in these forward-looking

statements. We base our forward-looking statements on information

currently available to us, and we assume no obligation to update them. In

addition, our historical financial performance is not necessarily indicative of

the results that may be expected in the future and we believe that such

comparisons cannot be relied upon as indicators of future

performance.

SECTION

1—REGISTRANT’S BUSINESS AND OPERATIONS

Item

1.01 Entry into a Material Definitive Agreement

This

Current Report on Form 8-K/A amends the Current Report on Form 8-K filed on

February 1, 2010 by Fashion Net, Inc. (the “Company”) with the Securities and

Exchange Commission (the “Change of Control 8-K”) regarding the acquisition of

10,000,000 shares of the Company’s common stock by Kasian Franks directly from

Evelyn Meadows, former Chief Executive Officer of the Company. Mr.

Franks acquired control of the Company by purchasing approximately 98.3% of the

issued and outstanding shares of common stock of the Registrant from Ms. Meadows

through a Stock Purchase Agreement executed on January 15, 2010 and approved by

the Company. A copy of the Stock Purchase Agreement is attached

hereto as Exhibit 2.1

SECTION

2 – FINANCIAL INFORMATION

Item

2.01 Completion of Acquisition or Disposition of Assets

This

Current Report on Form 8-K/A amends the Current Report on Form 8-K filed on

February 1, 2010 by Fashion Net, Inc. (the “Company”) with the Securities and

Exchange Commission (the “Change of Control 8-K”) regarding the acquisition of

10,000,000 shares of the Company’s common stock by Kasian Franks directly from

Evelyn Meadows, former Chief Executive Officer of the Company. Mr.

Franks acquired control of the Company by purchasing approximately 98.3% of the

issued and outstanding shares of common stock of the Registrant from Ms.

Meadows.

2

Subsequent

to the closing of the Stock Purchase Agreement, on March 4, 2010, Mr. Franks

voluntarily cancelled 9,000,000 of his shares. He remains the

majority shareholder of the Company. As the majority shareholder, CEO and

Director of the Company, Mr. Franks has determined that it is in the best

interest of the Company to change the direction of its operating business to

align with Mr. Franks’ experience and expertise. As part of the

change of direction, the Company plans to amend the Articles of Incorporation of

the Company to change its name to “Mimvi, Inc.” This name change has been

approved by the Board of Directors of the Company and the name change approval

process has begun. A detailed description of the new operations of

the Company is described herein.

As used

in this annual report, the terms “we”, “us”, “our”, and “Mimvi” mean Fashion

Net, Inc., unless otherwise indicated.

General Description of

Business

Mimvi is

a technology company that develops advanced algorithms and technology for

personalized search, recommendation and discovery services to the consumer and

enterprise.

Consumers

generally know what they want in terms of Internet content but do not

necessarily know how or where to find it. At best, consumers today are forced to

spend their personal time and energy to find and organize the Internet and

mobile content they desire.

During

the last fifteen to twenty years, standard search engine technology has been

able to provide a valuable but partial solution toward helping consumers find

content they are looking for. During the next fifteen to twenty years, new kinds

of search companies will arise that provide value beyond today’s commoditized

and limited search results. Mimvi leads this new revolution in search,

recommendation and discovery with its overall personalization technology

platform.

Our

personalization technology automates the organization of content. In detail, not

only does it automate the process of search, but importantly, the process of

personalization, recommendation and discovery of content. Behind our technology

is a unique, powerful and proprietary set of algorithms. These algorithms are

optimized for various categories of content such as mobile apps and online

video.

Our

personalization technology platform applies to all content. However, we focus

our technology in the area of search, recommendation and discovery results for

mobile apps, entertainment and educational videos of all kinds, including music

videos. We focus our technology on a search, recommendation and discovery

consumer destination Internet site for all of the world’s up and coming mobile

apps including those that exist on the Apple iPhone, Google Android, Symbian and

Microsoft Windows Mobile platforms.

The

fierce competitive landscape of mobile apps has left open the huge opportunity

for our technology to automatically organize and recommend mobile apps for all

mobile platforms in an unbiased way. Our technology unites mobile apps from

leading competitors on a search and recommendation website for the consumer and

advertiser. Although this is something that today’s major players in the mobile

space refuse to do, it remains as one of our more rewarding execution

paths.

3

As an

explosion of video continues on the Internet, our strategy includes an

understanding that video experiences are inherently passive. This means that the

consumer should not be forced to endlessly enter queries searching for video

content. Video content should be passively recommended to the consumer, similar

to a TV-like experience. This is especially true when it comes to video content

related to Music, Travel, Comedy, Education and Health.

Transactions,

revenue and profit that occur on our personalization platform are composed of

recommended products, merchandise and advertisements from large companies to

small individuals. Our own personalization technology and algorithms are used to

create contextual and relevant matches between the content it organizes and the

products, merchandise and services from advertisers large and

small.

Business

Overview

Mobile

applications are the new “websites” and mobile devices are the new “browsers”.

Our technology excels at helping people search for and find personalized mobile

apps such as iPhone apps, Google Android apps, Windows Mobile apps, Symbian apps

and many others.

A

multi-billion dollar revenue difference exists that favors leading search

engines over leading social networks. Our business combines the value of search

engines and social networks to provide the world’s largest personalized search

and recommendation engine for mobile applications and videos.

We have

developed cognitive computing technology which is the basis for its personalized

search and recommendation platform. This technology mimics the way humans

process information. Using this technology to analyze information, searches on

search engines and similar tastes found on social networks around the world, our

business provides powerful personalized search, discovery, recommendation

algorithms and additional technology platforms. This technology is currently

applied to automatically organize the world’s mobile apps and videos for

consumers and enterprises such as Google, Apple, Baidu, NetFlix and

Amazon.

While

standard search algorithms require a lot of active work on the users part, our

cognitive computing algorithms are designed to automate the search, discovery

and recommendation process with personalization technology. This works

especially well when users want to passively, similar to watching TV, interact

with content on the Internet or within the enterprise.

Our

technology platforms enable addictive and exhilarating consumer web experiences.

These consumer web experiences are defined by simplicity and power. The world’s

general social networks and search engines have commoditized information making

it ripe for the application of our technology. The value in this information

comes from it being intelligently organized.

Our

strategists understand that consumers need services that simplify their daily

routines as opposed to making them more complex. This strategy wrapped around a

platinum class of advanced search algorithms and technology provides relevant

search results without having to actively search for apps, entertainment and

product recommendations. Powerful automated discoveries add to a higher quality

of life that can inspire and be shared with family and friends. By achieving

this, the Company’s product becomes a part of the consumer’s daily

lives.

Our

company is led by top-notch strategists and engineers in the areas of

entertainment technology, as indicated in Item 5.01 of this Form

8-K/A.

4

Services and

Products

Our

products branch from its personalization technology platform. These products

include:

Specialized

Web Content Aggregation Systems

We have

developed technology that algorithmically targets, aggregates and monitors

mobile application marketplaces from Apple, Google and many other mobile

platform providers. In addition, web content from video content storage sites

such as YouTube, Vimeo, Hulu, VEVO, and DailyMotion. Our technology ‘talks’ to

sites like these to determine what content is available to better organize for

the consumer. The technology does not store content but rather data related to

the content that can be used to provide better search, recommendation and

discovery into these content storage sites.

Our

specialized content aggregation systems target, aggregates and monitors iPhone

apps, Android apps and other mobile app sites and marketplaces such as those

provided by Apple, Google and other mobile carries and platforms. Our technology

generates data that enables advanced search, recommendation and discovery of all

mobile apps found on the web and on mobile operating systems.

Advanced

Personalization, Recommendation, Automated Discovery and Matching

Platforms

Our

personalization platforms consist of algorithms that contextually match content

such as mobile apps, videos and websites to consumer demand. These algorithms

gather and generate context surround this content to provide advanced search,

recommendation and discovery. Mimvi algorithms are based on vector space

methods. Combining these methods results in the Mimvi personalized search,

recommendation, discovery and matching platforms.

Vector

Space Search Indexing Technology

The

individual algorithmic component of vector space indexing enables the Company to

generate context vectors of context for content such as individual videos,

mobile apps and websites. These vectors can be compared with other vectors for

advanced contextual matching of mobile apps, videos and websites.

Vertical

& Specialized Search Engines for Video and Mobile Apps

Using the

above mentioned methods and platforms, our technology includes vertical search

and specialized search interfaces that focus on specific content providing a

more targeted search result set for mobile apps, videos and

websites.

Algorithm

Development Services

We offer

vector space algorithm development for customized solutions applied to mobile

platforms, consumer websites and enterprise partners.

5

Powerful

Application Programming Interfaces (APIs) for Partners & Third

Parities

All of

our technology platforms come enabled with APIs for efficient access and

development of third party applications. This results in a broad ecosystem of

close partners that benefit from our technology.

Simplified

Scalable Consumer Web Offerings

Our

technology’s core is its ability to offer consumer web destination sites. These

enable the consumer with simple and transparent access to powerful personalized

search, recommendation and discovery interfaces.

Algorithms,

Technology & IP

Personalized

Search & Recommendation Platforms that Index Mobile

Applications

Similar

to a major search or recommendation engine, Mimvi intends to be the leading

personalized search, discovery and recommendation destination consumer site for

Mobile Applications. Today’s “mobile apps” are like yesterday’s

“websites”.

6

Mobile

apps are being produced at an unprecedented rate and they need to be organized

and personalized with simplicity and power. But they need more than yesterday’s

search technology. Our personalized search, discovery and recommendation

algorithm for mobile applications utilizes cognitive computing algorithms

combining information from the mobile web, major search engines and social

networks. This algorithm powers our leading search and recommendation engine

along with social components for mobile applications available to consumers

worldwide.

7

Technology

for Videos

There is

a continued explosion in video content on the Internet. It’s difficult to find

what you’re looking for and the content is largely unorganized. Our algorithms

for automated video organization combine information from the web, major search

engines, video search engines and social networks. The algorithms automatically

organize and recommend personalized video search results to consumers in the

area of travel, music, health, education, comedy, mobile apps, and video games

as well as many other areas. Our initial focus will include destination video

websites both for music and comedy. Our technology will be available to movie

resellers and distributers.

Sales and

Marketing

General

Technology Strategy

Our

technology platform consists of using advanced specialized aggregation, search

and recommendation technology. The technology considers the UI (User Interface)

and UX (User Experience) integral to any technology consumer web or mobile

application. This also includes specific technology applications in these

areas:

|

·

|

Specialized

Web Aggregation Systems

|

|

·

|

Advanced

Personalization, Recommendation, Automated Discovery and

Matching

|

|

·

|

Vector

Space Search Indexing Technology

|

|

·

|

Vertical

& Specialized Search Engines for Mobile

Apps

|

|

·

|

Cognitive

Computing Algorithm Development

|

|

·

|

Powerful

APIs

|

|

·

|

Simplified

Scalable Consumer Web Offerings

|

We are

currently in the process of patenting all methods and applications developed.

Concurrently, we adheres to a solid release schedule with the first series of

releases, which include search and recommendation for mobile apps and a

surrounding a TV-like channel consumption of entertainment content based on

search and automated discovery experiences. The following diagram illustrates

the release schedule, which is on track for a commercial grade release during

the first quarter of 2010.

8

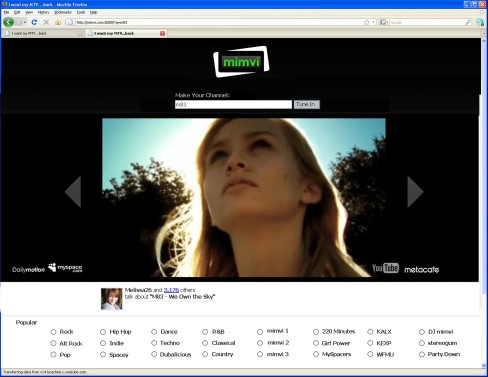

Screenshot

of the current Mimvi automated video discovery channel:

Our

products and services continue to be built with the consumer web and social

networking mobile generation in mind. Additional releases from the

Company include providing users and developers with an array of easy to use

tools to create and share applications. Our products and services are tightly

integrated with revenue approaches that stick to the theme of purchasing search

results or keywords surrounding automated content driven channel experiences.

Our products and services are being developed to be fully iPhone, iPod Touch,

Google Android, Symbian and Windows Mobile compatible. Our company reflects a

passion for the human desire to search and discover, and the belief that soon

everything on the Web will need to be consumed based on simple, powerful

personalized search and automated discovery experiences.

9

Transaction

Platforms

Our

algorithms are coupled with relevant advertising platforms that display

personalized mobile apps, products, services, virtual goods and merchandise. The

platform is available to large and small advertisers. The Company’s advertising

marketplace and transaction platform support mobile payments, micropayments and

standard payment processing methods.

Transactions

can be enabled on our partner sites. Our technology platforms and algorithms can

be used to power other partner sites with the goal of revenue sharing on any

resulting transactions where search or recommendation results are powered by our

technology.

Our

revenue goals relate to creating high-value around keywords and content that can

be exchanged via our Transaction Platform. Our focus is to achieve this with

high user retention by offering a series of entertainment search, automated

discovery and personalization experiences that are more simple and powerful than

any other service.

Consumer

spending habits have been redefined by recent changes in the world’s economy. We

understand this and consider this difficulty a clear opportunity based on a deep

experience with the mobile space, consumer web and enterprise. Companies must

move beyond basic unique visitor counts and instead into query counts, visitor

retention and multi-path transaction conversion. We funnel these into the

following revenue streams:

|

·

|

Micro-transactions

|

|

·

|

Mobile-enabled

Transactions

|

|

·

|

Marketplaces

for Keywords (something only a query-focused platform can benefit

from)

|

|

·

|

App

Marketplaces (based on Mimvi search and automated discovery

APIs)

|

|

·

|

API

Results Distribution

|

|

·

|

Revenue

Sharing & Equity Positioning Based on Mimvi-powered Ecosystem

Partners

|

|

·

|

Tiered

subscriptions connected to advanced search and automated discovery

experiences

|

|

·

|

Lead

generation

|

|

·

|

Advertising

|

|

·

|

Enterprise

Licensing & Consulting

|

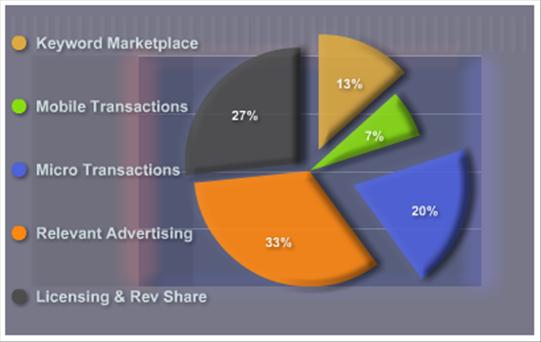

Hedged

Mimvi revenue models can be segmented in the following divisions:

10

In the

era of this new web economy, personalized search and automated discoveries are

more important than ever in converting consumers into paying customers. Whether

the sector is music, movies or books, customers are always looking for guidance

and suggestions as to what mobile apps and purchases might best suit their

desires.

Personalization,

recommendation and discoveries have become one of the primary driving factors

behind sales. Besides buying things to fulfill direct necessities or desires,

customers like to browse to find complementary purchases. Consequently, the

higher the degree to which mobile app or content is personalized, the higher the

sales volume will be.

More

importantly, this is not a linear relationship. As the accuracy of discoveries

and personalization improve, there is a potential for an exponential growth in

sales. Good personalization technology increases sales, which produces even

further personalization and additional sales. A small improvement in the ability

to personalize or recommend content leads to a large boost in

revenue.

International

Applications

Along

with the US and UK, countries such as China represent a significant opportunity

for our Company’s search and recommendation technology platforms. Our strategy

includes leveraging its language-independent approaches to provide superior

personalized search and discovery services to mobile apps and content in China,

particularly video content. Other international efforts include countries such

as Japan, France, India, Russia and many more.

Market

Demand

The

market demand for mobile apps is clear. Market demand for simplicity, power and

choice on the Internet is greater than ever before. Content on the Internet is

increasing exponentially. Today’s media and technology companies have

commoditized content and search results and consumers are not getting what they

are looking for.

Many

leading media and search technology companies believe that providing access to

limited media and choice is enough. As a result, today’s content and search

experiences are complex and require the consumer to work hard to connect with

what they truly need and want.

This has

created a great demand for simple and powerful content, search and automated

discovery experiences, which are filled with choice based on leveraging

commoditized content and search results from a variety of sources.

We

recognize that on the Internet there is a large market demand for powerful

Internet experiences defined by the consumer, not a company. New Internet

content experiences relate to vertical and specialized search, automated

discovery and personalization platforms connecting people to mobile apps,

millions of videos, images, and hidden knowledge with unprecedented ease and

refreshing simplicity.

11

We fills

this demand by specializing in delivering new, simple, powerful search and

automated discovery experiences with immediate satisfaction to the consumer on

any device and in any location. This is done with any content based on new

technology, algorithms and, more importantly, consumer strategy. Reducing steps,

increasing power and choice is where our Company excels.

Creating

the new roadways to meet consumer demand is part of the Mimvi technology

experience.

Logistics and

Inventory

We use

the Internet to manage its logistics. This includes its consumer web destination

sites. We own and operate several network operations centers and server farms

along with cloud computing centers in partnership with Amazon and Rackspace,

Inc. These are located San Francisco CA, Berkeley CA, New York NY and Nagoya

Japan.

Competition

Major

Competitors

Our

primary competitors include Google, Apple, Baidu, Amazon and NetFlix. Many have

the opportunity to qualify as competitors to the Mimvi experience. As

competitors, we consider leading search engines, social networks and companies

that have used entertainment content to capture the attention and loyalty of

consumers in a limited way. Companies that have used entertainment as a

foundation to introduce new hardware and expanded search experiences remain

competitive to our Company.

Our

competitors such as Google, Apple, Baidu, VEVO, Amazon, NetFlix and many others

have clearly benefited from offering platforms founded on entertainment content

combined with search experiences.

We

recognize the importance of competing not only on the battlegrounds of consumer

acquisition but also in revenue potential based on new hybrid revenue models for

a new economy.

Our

Competitive Advantages

Our

primary competitive advantage is based on its proprietary set of search and

discovery algorithms based on cognitive computing approaches along with a team

and strategy that has a proven track record of success at executing

commercial-grade platforms that excite consumers, enterprises and academic

institutions. At its core, our technology applies to automated intelligence

acquisition in any data domain and for any device. We are in constant pursuit of

patents related to all aspects of its cognitive computing technology, platform

and applications.

We

understand the power of combining search technology with entertainment content

and how this has proved successful for companies such as Apple, Baidu, NetFlix

and Google.

Our team

has a high-level of prescience when it comes to understanding what excites the

consumer and investors. This includes, but is not limited to, its current

strategy of initially applying cognitive computing technology to enable the

world’s largest search and discovery engine to help people find mobile apps.

Mobile apps are the new "websites" and mobile devices are the new "browsers". In

1996 there were 100,000+ websites, today there are 180,000+ mobile apps which

are exponentially increasing at a higher rate on varying platforms including the

iPhone, Google Android, Windows Mobile, Symbian and Nokia app

stores.

12

In

addition, based on the experience of our team and its technology, we intend to

apply a competitive approach to enabling consumers to search and automatically

discover videos in the area of entertainment and general exploration in an

extremely simple way similar to watching TV.

Our

competitive advantages also include its ability to cross-pollinate user traffic,

consumer attention and revenue between its search and discovery

properties.

Top-notch

strategists and engineers in the areas of entertainment technology lead the

Company. Most notably these are from companies and organizations such as

Lawrence Berkeley National Laboratory, SeeqPod, Inc. (responsible for 50M

uniques and 250M monthly queries), TiVo and UC Berkeley. The history of our team

includes strategy and execution that have resulted in platinum enterprise and

consumer web offerings, which include being winners of the 2008 R&D100

Award, also known as the “Oscars of Invention”, given by Steven Chu, US Energy

Secretary and Lawrence Berkeley National Laboratory for biomimetic search engine

technology.

Kasian

Franks, former founder, CEO and CVO of SeeqPod, Inc., which generated 250

million searches per month and 50 million unique visitors per month, founded

Mimvi, Inc. in 2010. The technology team and advisors continue to evolve

breakthroughs for the consumer, as was done among genomic scientists at the U.S.

Department of Energy's Lawrence Berkeley National Laboratory. Currently,

versions of Mimvi search and automated discovery offerings are ready for launch.

Full-scale commercial releases will commence during the first quarter of

2010.

Our

technology platforms enable addictive and exhilarating consumer web experiences.

The Company’s consumer web experiences are defined by simplicity and power. The

world’s general social networks and search engines have commoditized information

making it ripe for the application of our technology. The value in this

information comes from it being intelligently organized. Intelligent

organization is where the Company shines.

Business

Development

Acquiring

high quality traffic remains as a high priority for our team. High quality

traffic can be defined by revenue potential. Traffic acquisition methods are not

new to our strategy and engineering teams. Our team has a proven track record of

execution on this front. A focus within the enterprise on both traffic

acquisition and customer acquisition is key as shown in the forecast in the

chart above. This is due to our unique growth strategy of cross-pollination from

the enterprise to the consumer market and vice-versa. We also focus on

cross-pollination to and from product offerings that spawn from the overall

platform.

Organic

traffic and customer growth come from reducing clicks, steps and work both for

the consumer and customer while maintaining extremely powerful technology behind

the scenes.

In

addition, we maintain its own automated lead generation system based on its

advanced crawling platform. This, in turn, leads to a virtuous cycle of traffic

acquisition with a healthy user adoption curve.

We have a

focus on consumer loyalty and retention. Consumer loyalty connects directly to

putting the consumer first, ahead of the technology or out-dated media

distribution strategies.

13

Partnerships

Mimvi

currently has in the pipeline are structured to secure revenue, traffic and

loyal customers. Larger diversified partners will continue to have a substantial

and sustained impact on our growth.

Regulatory

Matters

Mimvi

complies with all regulatory and environmental laws and state and federal

regulation related to its operations.

Legal

Proceedings

The

Company is not a party to any material legal proceedings.

Employees

The

company currently has no employees except for Kasian Franks. Mr.

Franks has hired certain technology consultants and the Company intends to

eventually convert those consultants into employees in the next six months.

These consultants include an Engineering & Design Team, a Media Content

Team, and a Corporate Strategy & Business Development Team.

Description of

Properties

The

Company subleases space from Capital Group Communications (CGC) on a month to

month basis. The Company provides technology services to CGC in lieu

of rent. The offices are located at:

Mimvi,

Inc.

222

Columbus Ave.

San

Francisco, CA 94133

Direct:

510 552 2811

Office:

510 332 4612

Fax: 510

215 7474

Email:

contact@mimvi.com

Web:

http://www.mimvi.com

Additionally,

we use the Internet to manage its logistics. This includes its consumer web

destination sites. We own and operate several network operations centers and

server farms along with cloud computing centers in partnership with Amazon and

Rackspace, Inc. These are located San Francisco CA, Berkeley CA, New York NY and

Nagoya Japan.

Intellectual Properties

& Licenses

Mimvi is

in the process of filing multiple patents supporting its algorithms, technology

platforms and unique user experience frameworks.

14

Risk

factors

Before

you invest in our common stock, you should be aware that there are risks, as

described below. You should carefully consider these risk factors

together with all of the other information included in this prospectus before

you decide to purchase shares of our common stock. Any of the following risks

could adversely affect our business, financial condition and results of

operations. We have incurred substantial losses from inception while realizing

limited revenues and we may never generate substantial revenues or be profitable

in the future.

(1)

Our failure to file timely reports may subject us to shareholder

litigation, which may materially and adversely affect our

business.

Our failure to file our

reports in a timely manner may subject us to shareholder litigation, which may

divert the attention of our management and force us to expend resources to

defend against such claims. Any litigation may have a material and adverse

effect on our business and future results of operations.

(2)

We have a limited operating history, which may make it difficult for you

to evaluate our business and prospects.

We began operations in

January, 2010. Accordingly, we have a very limited operating history for our

current operations upon which you can evaluate the viability and sustainability

of our business and its acceptance by advertisers and consumers. It is also

difficult to evaluate the viability of our use of audiovisual advertising

displays in restaurants, audio stores and electronic store malls and other

out-of-home commercial locations as a business model because we do not have

sufficient experience to address the risks frequently encountered by early stage

companies using new forms of advertising media and entering new and rapidly

evolving markets. These circumstances may make it difficult for you to evaluate

our business and prospects.

(3) We derive

a portion of our revenues from the provision of advertising services, and

advertising is particularly sensitive to changes in economic conditions and

advertising trends.

Demand for advertising on or

through our products, and the resulting advertising spending by our clients, is

particularly sensitive to changes in general economic conditions and advertising

spending typically decreases during periods of economic downturn. Advertisers

may reduce the money they spend to advertise for a number of reasons, including

a general decline in economic conditions, a decision to shift advertising

expenditures to other available advertising media, or a decline in

advertising spending in general.

A decrease in demand for

advertising media in general and for our advertising services in particular

would materially and adversely affect our ability to generate revenue from our

advertising services, and our financial condition and results of

operations.

(4) Our

quarterly operating results are difficult to predict and may fluctuate

significantly from period to period in the future.

Our quarterly operating

results are difficult to predict and may fluctuate significantly from period to

period based on the seasonality of consumer spending trends in general. As a

result, you may not be able to rely on period to period comparisons of our

operating results as an indication of our future performance. If our revenues

for a particular quarter are lower than we expect, we may be unable to reduce

our operating expenses for that quarter by a corresponding amount, which would

harm our operating results for that quarter relative to our operating results

from other quarters.

15

(5) Our future

acquisitions may expose us to potential risks and have an adverse effect on our

ability to manage our business.

Selective acquisitions will

form a part of our strategy to further expand our business. If we are presented

with appropriate opportunities, we may acquire additional businesses, services

or products that are complementary to our core business. Our integration of the

acquired entities into our business may not be successful and may not enable us

to expand into new advertising platforms as well as we expect. This would

significantly affect the expected benefits of these acquisitions. Moreover, the

integration of any future acquisitions will require significant attention from

our management.

The

diversion of our management’s attention and any difficulties encountered in any

integration process could have an adverse effect on our ability to manage our

business. In addition, we may face challenges trying to integrate new

operations, services and personnel with our existing operations. Future

acquisitions may also expose us to other potential risks, including risks

associated with unforeseen or hidden liabilities, the diversion of resources

from our existing businesses and technologies, our inability to generate

sufficient revenue to offset the costs, expenses of acquisitions and potential

loss of, or harm to, relationships with employees and advertising clients as a

result of our integration of new businesses. In addition, we cannot assure you

that we will be able to realize the benefits we anticipate from acquiring other

companies or that we will not incur costs, including those relating to

intangibles or goodwill, in excess of our projected costs for these

transactions. The occurrence of any of these events could have a material and

adverse effect on our ability to manage our business, our financial condition

and our results of operations.

(6)

There may be unknown risks inherent in our acquisitions of companies which

could result in a material adverse effect on our business.

We will

conduct due diligence with respect to any acquisition we undertake we may not be

aware of all of the risks associated with any of the acquisitions. Any discovery

of adverse information concerning any of these acquisitions could have a

material adverse effect on our business, financial condition and results of

operations. While we may be entitled to seek indemnification in certain

circumstances, successfully asserting indemnification or enforcing such

indemnification could be costly and time consuming or may not be successful at

all.

(7) Failure to manage

our growth could strain our management, operational and other resources and we

may not be able to achieve anticipated levels of growth in the new networks and

media platforms we hope to operate, either of which could materially and

adversely affect our business and growth potential.

We have been expanding, and

plan to continue to expand, our operations. We must continue to expand our

operations to meet what we believe are the demands of our Company. This

expansion has resulted, and will continue to result, in substantial demands on

our management resources. To manage our growth, we must develop and improve our

existing administrative and operational systems and, our financial and

management controls and further expand, train and manage our work force. As we

continue this effort, we may incur substantial costs and expend substantial

resources in connection with any such expansion due to, among other things,

different technology standards, legal considerations and cultural differences.

We may not be able to manage our current or future international operations

effectively and efficiently or compete effectively in such markets. We cannot

assure you that we will be able to efficiently or effectively manage the growth

of our operations, recruit top talent and train our personnel. Any failure to

efficiently manage our expansion may materially and adversely affect our

business and future growth.

16

As we

continue to expand into new networks and new media platforms, we expect the

percentage of revenues derived from our commercial location network to decline.

However, the new advertising networks and media platforms we pursue may not

present the same opportunities for growth that we have experienced with our

commercial location network and, accordingly, we cannot assure you that the

level of growth of our networks will not decline over time. Moreover, we expect

the level of growth of our commercial location network to decrease as many of

the more desirable locations have already been leased by us or our

competitors.

(8)

If our future

technologies contain design or performance defects, our reputation and business

may be harmed and we may need to expend significant resources to address

liability.

Technology as complex as ours

may contain design and/or performance defects which are not detectable even

after extensive internal testing. Such defects may become apparent only

after widespread commercial use. Any design or performance defects in our

products or technology could have a material and adverse effect on our

reputation and business.

(9) We depend on the

leadership and services of Kasian Franks who is our founder,

chairman, chief executive officer and our largest shareholder, and our business

and growth prospects may be severely disrupted if we lose his

services.

Our future success is

dependent upon the continued service of Kasian Franks our chief executive officer,

director and our largest shareholder. We rely on his industry expertise and

experience in our business operations, and in particular, his business vision,

management skills, and working relationships with our employees and partners. We

do not maintain key-man life insurance for Mr. Franks. If he is

unable or unwilling to continue in his present position or if he joins a

competitor or forms a competing company, we may not be able to replace him

easily or at all. As a result, our business and growth prospects may be severely

disrupted if we lose his services.

(10) We may need

additional capital and we may not be able to obtain it, which could adversely

affect our liquidity and financial position.

We believe that our current

cash and cash equivalents and cash flow from operations will not be sufficient

to meet our anticipated cash needs including for working capital and capital

expenditures, for the foreseeable future. We will require additional cash

resources due to changed business conditions or other future developments. We

may seek to sell additional equity or debt securities or obtain a credit

facility. The sale of convertible debt securities or additional equity

securities could result in additional dilution to our shareholders. The

incurrence of indebtedness would result in increased debt service obligations

and could result in operating and financing covenants that would restrict our

operations and liquidity.

Our ability to obtain

additional capital on acceptable terms is subject to a variety of uncertainties,

including: investors’ perception of, and demand for securities in this Industry;

·conditions of the U.S. and other capital markets in which we may seek to

raise funds; our future results of operations, financial condition and cash

flows.

17

We cannot assure you that

financing will be available in amounts or on terms acceptable to us, if at all.

Any failure by us to raise additional funds on terms favorable to us could have

a material adverse effect on our liquidity and financial

condition.

(11) We may be subject

to intellectual property infringement claims, which may force us to incur

substantial legal expenses and, if determined adversely against us, may

materially disrupt our business.

We cannot be certain that our

technology or other aspects of our business do not or will not infringe upon

patents, copyrights or other intellectual property rights held by third parties.

Although we are not aware of any such claims, we may become subject to legal

proceedings and claims from time to time relating to the intellectual property

of others in the ordinary course of our business. If we are found to have

violated the intellectual property rights of others, we may be enjoined from

using such intellectual property, and

We may incur licensing fees

or be forced to develop alternatives. In addition, we may incur substantial

expenses in defending against these third party infringement claims, regardless

of their merit. Successful infringement or licensing claims against us may

result in substantial monetary liabilities, which may materially and adversely

disrupt our business.

(12) Unauthorized use

of our intellectual property by third parties, and the expenses incurred in

protecting our intellectual property rights, may adversely affect our

business.

We regard our trade secrets

and other intellectual property as critical to our success. Unauthorized use of

the intellectual property used in our business may adversely affect our business

and reputation.

We have historically relied

on a combination of trademark and copyright law, trade secret protection and

restrictions on disclosure to protect our intellectual property rights. We enter

into confidentiality and invention assignment agreements with all our employees.

We cannot assure you that these confidentiality agreements will not be breached,

that we will have adequate remedies for any breach, or that our proprietary

technology will not otherwise become known to, or be independently developed by,

third parties. Additionally, e cannot assure

you that any of our trademark applications will ultimately proceed to

registration or will result in registration with scope adequate for our

business. Some of our applications or registration may be successfully

challenged or invalidated by others. If our trademark applications are not

successful, we may have to use different marks for affected services or

technologies, or enter into arrangements with any third parties who may have

prior registrations, applications or rights, which might not be available on

commercially reasonable terms, if at all.

In

addition, policing unauthorized use of our proprietary technology, trademarks

and other intellectual property is difficult and expensive, and litigation may

be necessary in the future to enforce our intellectual property rights. Future

litigation could result in substantial costs and diversion of our resources, and

could disrupt our business, as well as have a material adverse effect on our

financial condition and results of operations.

(13) We face

significant competition, and if we do not compete successfully against new and

existing competitors, we may lose our market share, and our profitability may be

adversely affected.

18

Increased

competition could reduce our operating margins and profitability and result in a

loss of market share. Some of our existing and potential competitors may have

competitive advantages, such as significantly greater financial, marketing or

other resources, or exclusive arrangements, and others may successfully mimic

and adopt our business model. Moreover, increased competition will provide a

wider range of media and advertising service alternatives, which could lead to

lower prices and decreased revenues, gross margins and profits. We cannot assure

you that we will be able to successfully compete against new or existing

competitors.

(14)

We do not maintain any business liability disruption or litigation

insurance coverage for our operations, and any business liability, disruption or

litigation we experience might result in our incurring substantial costs and the

diversion of resources.

We do not have any business

liability, disruption or litigation insurance coverage for our operations. Any

business disruption or litigation may result in our incurring substantial costs

and the diversion of resources.

(15)

There may be deficiencies with our internal controls that require

improvements, and we will be exposed to potential risks from legislation

requiring companies to evaluate controls under Section 404 of the

Sarbanes-Oxley Act of 2002 in the event we become a fully reporting

company.

While we believe that we

currently have adequate internal control procedures in place, we are still

exposed to potential risks from legislation requiring companies to evaluate

controls under Section 404 of the Sarbanes-Oxley Act of 2002. Under the

supervision and with the participation of our management, we have evaluated our

internal controls systems in order to allow management to report on, and our

registered independent public accounting firm to attest to, our internal

controls, as required by Section 404 of the Sarbanes-Oxley Act. We have

performed the system and process evaluation and testing required in an effort to

comply with the management certification and auditor attestation requirements of

Section 404. As a result, we have incurred additional expenses and a

diversion of management’s time. If we are not able to meet the requirements of

Section 404 in a timely manner or with adequate compliance, we might be

subject to sanctions or investigation by regulatory authorities, such as the

SEC.

(16) Our business operations

may be affected by legislative or regulatory changes.

There are

no existing local laws or regulations that specifically define or regulate our

business. Changes in laws and regulations or the enactment of new laws and

regulations governing placement or content of our products, the industry or

otherwise affecting our business in Hong Kong may materially and adversely

affect our business prospects and results of operations. We are not certain how

the local and Federal governments will implement any regulation or how it may

affect our ability to compete in the industry and marketplace.

Risks Associated with this

Offering

(17)

Our shares are listed for trading on the OTC Bulletin Board, and our

shares will likely be classified as a “penny stock” as that term is generally

defined in the Securities Exchange Act of 1934 to mean equity securities with a

price less than $5.00. Our shares will be subject to rules that

impose sales practice and disclosure requirements on broker-dealers who engage

in certain transactions involving a penny stock.

19

We will

be subject to the penny stock rules adopted by the Securities and Exchange

Commission that require brokers to provide extensive disclosure to its customers

prior to executing trades in penny stocks. These disclosure requirements may

cause a reduction in the trading activity of our common stock, which in all

likelihood would make it difficult for our stockholders to sell their

securities.

Under the

penny stock regulations, a broker-dealer selling a penny stock to anyone other

than an established customer or accredited investor must make a special

suitability determination regarding the purchaser and must receive the

purchaser’s written consent to the transaction prior to the sale, unless the

broker-dealer is otherwise exempt. Generally, an individual with a net worth in

excess of $1,000,000, or annual income exceeding $200,000 individually, or

$300,000 together with his or her spouse, is considered an accredited investor.

In addition, under the penny stock regulations the broker-dealer is required

to:

|

·

|

Deliver,

prior to any transaction involving a penny stock, a disclosure schedule

prepared by the Securities and Exchange Commission relating to the penny

stock market, unless the broker-dealer or the transaction is otherwise

exempt;

|

|

·

|

Disclose

commissions payable to the broker-dealer and our registered

representatives and current bid and offer quotations for the

securities;

|

|

·

|

Send

monthly statements disclosing recent price information pertaining to the

penny stock held in a customer’s account, the account’s value and

information regarding the limited market in penny

stocks;

|

|

·

|

Make

a special written determination that the penny stock is a suitable

investment for the purchaser and receive the purchaser’s written agreement

to the transaction, prior to conducting any penny stock transaction in the

customer’s account.

|

Because

of these regulations, broker-dealers may encounter difficulties in their attempt

to sell shares of our common stock, which may affect the ability of selling

stockholders or other holders to sell their shares in the secondary market and

have the effect of reducing the level of trading activity in the secondary

market. These additional sales practice and disclosure requirements could impede

the sale of our securities. In addition, the liquidity for our securities may be

decreased, with a corresponding decrease in the price of our securities. Our

shares in all probability will be subject to such penny stock rules and our

stockholders will, in all likelihood, find it difficult to sell their

securities.

(18)

There has been no independent valuation of the stock, which means that the

stock may be worth less than the purchase price.

The per

share purchase price has been determined by us without independent valuation of

the shares. We established the offering price based on management’s estimate of

the value of the shares. This valuation is highly speculative and

arbitrary. There is no relation to the market value, book value, or any other

established criteria. We did not obtain an independent appraisal opinion on the

valuation of the shares. The shares may have a value significantly less than the

offering price and the shares may never obtain a value equal to or greater than

the offering price.

(19)

Investors may never receive cash distributions which could result in an

investor receiving little or no return on his or her investment.

20

Distributions

are payable at the sole discretion of our board of directors. We do not know the

amount of cash that we will generate, if any, once we have more productive

operations. Cash distributions are not assured, and we may never be in a

position to make distributions.

Participating

market maker or be approved for a quotation on the OTCBB, in which case, there

will be no liquidity for the shares of our shareholders.

(20)

Even If A Market Develops For Our Shares, Our Shares May Be Thinly

Traded With Wide Share Price Fluctuations, Low Share Prices And Minimal

Liquidity.

If a

market for our shares develops, the share price may be volatile with wide

fluctuations in response to several factors, including: potential investors’

anticipated feeling regarding our results of operations; ·increased competition;

our ability or inability to generate future revenues; and market perception of

the future of development of wood product manufacturing.

In

addition, if our shares are quoted on the OTCBB, our share price may be affected

by factors that are unrelated or disproportionate to our operating performance.

Our share price might be affected by general economic, political, and market

conditions, such as recessions, interest rates, or international currency

fluctuations. In addition, even if our stock is approved for quotation by a

market maker through the OTCBB, stocks traded over this quotation system are

usually thinly traded, highly volatile and not followed by analysts. These

factors, which are not under our control, may have a material effect on our

share price.

(21)

We Anticipate The Need To Sell Additional Authorized Shares In The Future.

This Will Result In A Dilution To Our Existing Shareholders And A

Corresponding Reduction In Their Percentage Ownership In Asian

Trends.

We may

seek additional funds through the sale of our common stock. This will result in

a dilution effect to our shareholders whereby their percentage ownership

interest in Asian Trends is reduced. The magnitude of this dilution effect will

be determined by the number of shares we will have to issue in the future to

obtain the funds required. The sale of additional stock to new

shareholders will reduce the ownership position of the current shareholders.

The price of each share outstanding common share may decrease in the event

we sell additional shares.

(22) Since Our Securities Are

Subject To Penny Stock Rules, You May Have Difficulty Reselling Your

Shares.

Our

shares are "penny

stocks" and are covered by Section 15(d) of the Securities Exchange Act

of 1934 which imposes additional sales practice requirements on broker/dealers

who sell Asian Trends Media Holdings, Inc.’s securities including the delivery

of a standardized disclosure document; disclosure and confirmation of quotation

prices; disclosure of compensation the broker/dealer receives; and, furnishing

monthly account statements. For sales of our securities, the broker/dealer must

make a special suitability determination and receive from its customer a written

agreement prior to making a sale. The imposition of the foregoing additional

sales practices could adversely affect a shareholder's ability to dispose of his

stock.

21

Kasian Franks (the “Buyer”) acquired control of

Fashion Net, Inc. (the “Registrant”) on January 15, 2010. The Buyer acquired

control by purchasing approximately 98.3% of the issued and outstanding shares

of common stock of the Registrant directly from Evelyn Meadows, former Chief

Executive Officer of the Registrant (see below).

Each

share of common stock is entitled to one vote on all matters upon which such

shares can vote. All shares of common stock are equal to each other with respect

to the election of directors and cumulative voting is not permitted. There are

no preemptive rights. In the event of liquidation or dissolution, holders of

common stock are entitled to receive, pro rata, the assets remaining, after

creditors, and holders of any class of stock having liquidation rights senior to

holders of shares of common stock, have been paid in full. All shares of common

stock are entitled to such dividends as the board of directors of the Registrant

(the “Board of

Directors”) may declare from time to time. There are no provisions in the

articles of incorporation or bylaws that would delay, defer or prevent a change

of control. The Registrant does not have any other classes of issued and

outstanding capital stock.

Pursuant

to Item 5.01(a)(8) of Current Report on Form 8-K, the information contained

in Items 1, 2 and 3 of Part I; Items 5, 6, 7 and 8 of Part II; and

Item 13 of Part III of the Registrant’s Annual Report on Form 10-K for

the fiscal year ended December 31, 2008, is hereby incorporated by reference

into this Current Report on Form 8-K under Item 5.01 hereof.

Security

Ownership of Certain Beneficial Owners and Management

The

following table sets forth certain information, as of January 22, 2010,

concerning shares of common stock of the Registrant, the only class of its

securities that are issued and outstanding, held by (1) each shareholder

known by the Registrant to own beneficially more than five percent of the common

stock, (2) each director of the Registrant, (3) each executive officer

of the Registrant, and (4) all directors and executive officers of the

Registrant as a group:

|

Amount

and

|

||||||||

|

Nature

of

|

Percentage | |||||||

|

Beneficial

|

of

Common

|

|||||||

|

Name

and Address of Beneficial Owner (1)

|

Ownership

|

Stock(3)

|

||||||

|

Kasian

Franks (2)

|

1,000,000

|

85.5%

|

||||||

|

All

directors and executive officers as a group (1 person)

|

1,000,000

|

85.5%

|

||||||

|

(1)

|

Unless

otherwise indicated in the footnotes to the table, each shareholder shown

on the table has sole voting and investment power with respect to the

shares beneficially owned by him or it.

|

|

|

(2)

|

Mr.

Franks is the Chief Executive Officer, Secretary and Director of the

Registrant.

|

|

(3)

|

Based

on 10,170,000 shares of Common Stock

outstanding.

|

Change

in Control Arrangements

With the

completion of the Transaction, there are currently no arrangements that would

result in a change in control of the Registrant.

22

Item

5.02 Departure of Directors or Certain Officers; Election of Directors;

Appointment of Certain Officers, Directors, Executive Officers, Promoters and

Control Persons

Kasian

Franks Director, Chairman of the Board, Chief Executive Officer, and

Secretary

Executive

Compensation

Shown on

the table below is information on the annual and long-term compensation for

services rendered to the Registrant in all capacities, for the fiscal years

ended December 31, 2008 and December 31, 2009, paid by the Registrant to all

individuals serving as the Registrant’s chief executive officer or acting in a

similar capacity. During the last completed fiscal year, the Registrant did not

pay aggregate compensation to any executive officer in an amount greater than

$100,000.

|

Annual

Compensation

|

Long

Term Compensation

|

||||||||||||||||||||||||||||||||

|

Restricted

|

LTIP

|

||||||||||||||||||||||||||||||||

|

Other

Annual

|

Stock

|

Options/

|

payouts

|

All

Other

|

|||||||||||||||||||||||||||||

|

Name

|

Title

|

Year

|

Salary

|

Bonus

|

Compensation

|

Awarded

|

SARs

(#)

|

($)

|

Compensation

|

||||||||||||||||||||||||

|

Evelyn

Meadows

|

Former

President

|

2009

|

$

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

|||||||||||||||||||||||

|

CEO,

CFO

|

2008

|

$

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

||||||||||||||||||||||||

|

Chairman

|

|||||||||||||||||||||||||||||||||

|

Kasian

Franks

|

Current

|

2009

|

$

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

|||||||||||||||||||||||

|

CEO,

CFO

|

2008

|

$

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

||||||||||||||||||||||||

|

Secretary

|

|||||||||||||||||||||||||||||||||

Director

Compensation

The

directors of the Registrant have not received compensation for their services as

directors nor have they been reimbursed for expenses incurred in attending board

meetings.

Certain

Relationships and Related Transactions

There

have not been any transactions, or proposed transactions, during the last two

years, to which the Registrant was or is to be a party, in which any director or

executive officer of the Registrant, any nominee for election as a director, any

security holder owning beneficially more than five percent of the common stock

of the Registrant, or any member of the immediate family of the aforementioned

persons had or is to have a direct or indirect material interest.

The

Company’s common stock is listed on the Over the Counter Bulletin Board ("OTC:

BB") under the symbol “FNNI.OB”.

23

Approximate

Number of Equity Security Holders

On March

3, 2010 the Company's common stock had a closing price quotation of

$0. As of March 3, 2010, there were approximately 25 certificate

holders of record of the Company’s common stock.

Dividends

We have

not declared or paid cash dividends on our common stock.

Recent

Sales of Unregistered Securities

There

have been no recent sales of unregistered securities.

Description

of Registrant’s Securities to be Registered

The

company is not registering any securities at this time.

Indemnification

of Officers and Directors

Our

Articles of Incorporation, as amended, Bylaws and Nevada law contain provisions

relating to the indemnification of officers and directors. Generally, they

provide that we may indemnify any person who was or is a party to any

threatened, pending, or completed action, suit or proceeding, whether civil,

criminal, administrative or investigative, except for an action by or in right

of our company, by reason of the fact that he is or was a director, officer,

employee or agent of our company. It must be shown that he acted in good faith

and in a manner, which he reasonably believed to be in, or not opposed to our

best interests. Generally, no indemnification may be made where the person has

been determined to be negligent or guilty of misconduct in the performance of

his duty to our company.

Insofar

as indemnification for liabilities arising under the Securities Act may be

permitted to directors, officers or persons controlling our company pursuant to

the foregoing provisions, or otherwise, we have been informed that in the

opinion of the SEC such indemnification is against public policy as expressed in

the Securities Act and is therefore unenforceable. In the event that a claim for

indemnification against such liabilities (other than the payment by us of

expenses incurred or paid by a director, officer or controlling person of our

company in the successful defense of any action, suit or proceeding) is asserted

by such director, officer or controlling person in connection with the

securities being registered, we will, unless in the opinion of our counsel the

matter has been settled by controlling precedent, submit to a court of

appropriate jurisdiction the question whether such indemnification by us is

against public policy as expressed in the Securities Act and will be governed by

the final adjudication of the matter.

24

Item 5.02

Departure of Directors or Certain Officers; Election of Directors; Appointment

of Certain Officers; Compensatory Arrangements of Certain Officers

On

January 15, 2010 Kasian Franks was appointed as a member of the Board of

Directors.

Mr.

Franks worked as software engineer and product developer specializing in pattern

matching algorithms and tools for companies and organizations such as Sun

Microsystems, Oracle, Motorola, Tivo, mPower, and X-Mine. Franks worked at the

U.S. Department of Energy’s Lawrence Berkeley National Laboratory (LBNL), Life

Sciences Division, as a Genomic Research Scientist from 2002-2005, where, along

with Raf Podowski, and Connie Myers, he developed the technology behind SeeqPod.

Franks began to study biomimetics along with pattern matching in data and

nature. This led to 5 patents in the area of search and discovery. Later he went

on to start SeeqPod Inc. a music search, discovery and pattern matching company

in which the U.S. Department of Energy, along with Lawrence Berkeley National

Laboratory, holds a 5% stake. Under Steven Chu and Lawerence Berkeley National

Lab, Franks and SeeqPod won the 2008 R&D 100 award for biomimetic search

engines. A number of record companies have attempted to sue SeeqPod, including

Warner Music Group, Elektra Records, Rhino Records, and most recently EMI and

Capitol Records.

Mr. Franks

does not hold any other directorships with reporting companies in the United

States. There are no family relationships between Mr. Franks and the

directors, executive officers, or persons nominated or chosen by the Registrant

to become directors or executive officers. During the last two years, there have

been no transactions, or proposed transactions, to which the Registrant was or

is to be a party, in which Mr. Franks (or any member of his immediate family)

had or is to have a direct or indirect material interest.

Mr.

Franks has not, during the last five years, been convicted in a criminal

proceeding (excluding traffic violations or similar misdemeanors). Mr. Franks,

as the previous CEO of SeeqPod, Inc., filed for Chapter 7 bankruptcy protection

in February of 2009. This was in direct response to multi billion dollar

lawsuits launched by Warner Music Group, BMI, EMI, Capital Records and Electra

Records against the SeeqPod as a result of the search engine technology they

developed. The afore mentioned record companies claimed that

Seeqpod’s technology infringed on copyrighted content that existed on the

Internet and further claimed that Seeqpod posed a substantial threat to their

businesses. The Chapter 7 bankruptcy is ongoing and has not been

finalized. Other than the above mentioned Chapter 7 bankruptcy, Mr.

Franks has not, during the last five years, been a party to a civil proceeding

of a judicial or administrative body of competent jurisdiction and, as a result

of such proceeding, was or is subject to a judgment, decree or final order

enjoining future violations of, or prohibiting or mandating activities subject

to, federal or state securities laws, or finding any violation with respect to

such laws. Other than the above mentioned Chapter 7 Bankruptcy, Mr. Franks has

not, during the last five years, been a party of any bankruptcy petition filed

by or against any business of which he was a general partner or executive

officer either at the time of the bankruptcy or within two years prior to that

time.

Departure

of Evelyn Meadows as President, Chief Executive Officer, Chief Financial

Officer, Secretary, and Treasurer

Evelyn

Meadows resigned as the President, Chief Executive Officer, Chief Financial

Officer, Secretary, and Treasurer of the Registrant as of January 15,

2010.

25

Appointment

of Kasian Franks as Chairman of the Board, Chief Executive Officer, Chief

Financial Officer and Secretary

On

January 15, 2010, the Registrant appointed Kasian Franks as its Chairman, Chief

Executive Officer, Chief Financial Officer and Secretary. There are no

employment agreements between the Registrant and Kasian

Franks. Information about Mr. Franks is set forth above under

“Appointment of Kasian Franks to the Board of Directors.”

Other

consultants and Advisors

Consultants &

Advisors

Eric

Stoppenhagen

Eric

Stoppenhagen, through his consulting company, Venor, Inc., focuses on financial

management of small to medium businesses desiring to go public or that are

public. He provides temporary CFO services helping with transaction advisory,

security filings, and corporate governance requirements. Mr. Stoppenhagen has

more than 10 years of financial experience, having served in an executive

capacity for several public and private companies; including President of

Trestle Holdings, Inc., CFO of AuraSource, Inc., President of Landbank Group,

Inc., and CFO of Jardinier Corporation. Mr. Stoppenhagen is a Certified Public

Accountant. He holds a Juris Doctorate and Masters of Business Administration

both from George Washington University. Additionally, he holds a Bachelor of

Science in Finance and a Bachelor of Science in Accounting both from

Indiana University.

Raf

Podowski

Raf is a

consultant and member of Mimvi Advisory Board and has a Ph.D., Bioinformatics

from Karolinska Institute, Sweden. He also has an M.S., Engineering Physics from

Rensselaer Polytechnic Institute. Raf has worked in senior research capacity

with Oracle and AstraZeneca and has authored numerous research

papers.

Mike

Muldoon

Mike

Muldoon has over 18 years experience delivering multi-tiered software systems.

Mike has a proven team leadership record, managing development efforts from

whiteboard to release and maintenance and has worked with mPower (acquired by

Morningstar), Blue Shield of California, USDA, GE. Mike has published papers on

Internet security and maintains a B.S. in Computer Science from Ohio State

University

26

Caleb

Pate

As media,

content and music Industry Strategist for Mimvi, Caleb Pate is also founder of

Pacific Radio Fire Records and a member of the American Society of Composers and

Producers (ASCAP). Caleb maintains a world-wide deal with Zomba/BMG Music

Publishing and is member of the band Seventeen Evergreen with forthcoming

UK/European releases of full-length albums licensed for the UK and Japanese

markets. Their songs have been featured in recent Summit Entertainment film

'Bandslam' with Vanessa Hudgens as well as various BBC and ITV television

programs. Appearances on BBC Radio One, BBC Six Music and XFM. Caleb has