Attached files

| file | filename |

|---|---|

| EX-31.1 - China Water Group, Inc. | v176464_ex31-1.htm |

| EX-31.2 - China Water Group, Inc. | v176464_ex31-2.htm |

| EX-32.2 - China Water Group, Inc. | v176464_ex32-2.htm |

| EX-21.1 - China Water Group, Inc. | v176464_ex21-1.htm |

| EX-32.1 - China Water Group, Inc. | v176464_ex32-1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

10-K/A-2

(Mark

One)

|

x

|

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE

ACT OF 1934

|

For the

fiscal year ended: December 31, 2008

|

¨

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE

ACT OF 1934

|

Commission File No.:

000-26175

CHINA

WATER GROUP, INC.

(Exact

Name of Registrant as Specified in Its Charter)

|

Nevada

|

88-0409151

|

|

|

(State

or Other Jurisdiction of Incorporation

or

Organization)

|

(I.R.S.

Employer Identification No.)

|

SUITE

7A01, BAICHENG BUILDING

584

YINGBIN ROAD

DASHI,

PANYU DISTRICT

GUANGZHOU,

GUANGDONG, CHINA

(Address

of Principal Executive Offices)

(86-20)

3479 9768

(Registrant’s

Telephone Number, Including Area Code)

Securities

registered pursuant to Section 12(b) of the Act: None

Securities

registered pursuant to Section 12(g) of the Act: Common Stock, par

value $0.001

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes ¨ No

x

Indicate by check mark if the

registrant is not required to file reports pursuant to Section 13 or 15(d) of

the Act. Yes ¨ No

x

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes ¨ No

x

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K (s 229.405) is not contained herein, and will not be contained,

to the best of registrant’s knowledge, in definitive proxy or information

statements incorporated by reference in Part III of this Form 10-K or any

amendment to this Form 10-K. x

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer or a smaller reporting company

filer. See the definitions of “large accelerated filer,” “accelerated

filer” and “smaller reporting company” in Rule 12b-2 of the Exchange

Act.

Large

accelerated filer o Accelerated

filer o Non-accelerated

Filer o Smaller

reporting company x

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Act).

Yes No x

Yes No x

Aggregate

market value of the voting stock held by non-affiliates of the registrant,

computed by reference to the closing price as of the last business day of the

registrant’s most recently completed second fiscal quarter, June 30, 2008,

was $2,787,669. The registrant has no non-voting common stock.

As of

November 20, 2009, there were 139,383,450 shares of our common stock issued and

outstanding.

INDEX

TO FORM 10-K ANNUAL REPORT

|

Page

|

||

|

PART

I

|

4

|

|

|

|

||

|

Item

1.

|

Business

|

4

|

|

Item

1A.

|

Risk

Factors

|

21

|

|

Item

1B.

|

Unresolved

Staff Comments

|

26

|

|

Item

2.

|

Properties

|

26

|

|

Item

3.

|

Legal

Proceedings

|

28

|

|

Item

4.

|

Submission

of Matters to a Vote of Security Holders

|

28

|

|

PART

II

|

28

|

|

|

Item

5.

|

Market

for Registrant’s Common Equity, Related Stockholder Matters and

Issuer Purchases of Equity Securities

|

28

|

|

Item

6.

|

Selected

Financial Data

|

29

|

|

Item

7.

|

Management’s

Discussion and Analysis of Financial Condition and Results

of Operations

|

29

|

|

Item

7A.

|

Quantitative

and Qualitative Disclosures about Market Risk

|

37

|

|

Item

8.

|

Financial

Statements and Supplementary Data

|

37

|

|

Item

9.

|

Changes in and

Disagreements with Accountants on Accounting and Financial

Disclosure

|

37

|

|

Item

9A(T)

|

Controls

and Procedures

|

37

|

|

Item

9B

|

Other

Information

|

44

|

|

PART

III

|

45

|

|

|

Item

10.

|

Directors,

Executive Officers and Corporate Governance

|

45

|

|

Item

11.

|

Executive

Compensation

|

46

|

|

Item

12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

48

|

|

Item

13.

|

Certain

Relationships and Related Transactions, and Director

Independence

|

50

|

|

Item

14.

|

Principal

Accountant Fees and Services

|

51

|

|

PART

IV

|

51

|

|

|

Item

15.

|

Exhibits

and Financial Statement Schedules

|

51

|

|

Signatures

|

54

|

|

|

Financial

Statements

|

F-1

|

2

EXPLANATORY

NOTE

We, China

Water Group, Inc., are filing this Amendment to our Annual Report on Form 10-K

for the year ended December 31, 2008 During calendar 2010, as

an initial step to become current in our filing obligations under the

Securities Exchange Act of 1934, as amended. We will endeavor to file additional

periodic reports to become current in our filings as expeditiously as the

limited size of our staff allows. Except where a date after April 2009 is

specifically mentioned, this report is written as though it had been prepared

during the first four months of calendar 2009. We are filing this amendment in

response to comments received from the staff of the Securities and Exchange

Commission.

Unless

otherwise indicated, all references to our company include our wholly and

majority owned subsidiaries.

All of

our sales and nearly all our expenses are denominated in renminbi (“RMB”), the

national currency of the People’s Republic of China (the “PRC”). For SEC

reporting purposes, the balance sheet items are translated into US dollars using

the exchange rate at the respective balance sheet dates. The capital and various

reserves are translated at historical exchange rates prevailing at the time

of the transactions while income and expenses items are translated at the

average exchange rate for the period. All exchange differences are recorded

within equity.

Statements

contained in this Annual Report on Form 10-K, which are not historical facts,

are forward-looking statements, as the term is defined in the Private Securities

Litigation Reform Act of 1995. Such forward-looking statements, whether

expressed or implied, are subject to risks and uncertainties which can

cause actual results to differ materially from those currently anticipated, due

to a number of factors, which include, but are not limited to:

|

|

·

|

Competition

within our industry;

|

|

|

·

|

Seasonality

of our sales;

|

|

|

·

|

Success

of our acquired businesses;

|

|

|

·

|

Our

relationships with our major

customers;

|

|

|

·

|

The

popularity of our products;

|

|

|

·

|

Relationships

with suppliers and cost of

supplies;

|

|

|

·

|

Financial

and economic conditions in Asia, Japan, Europe and the

U.S.;

|

|

|

·

|

Anticipated

effective tax rates in future

years;

|

|

|

·

|

Regulatory

requirements affecting our

business;

|

|

|

·

|

Currency

exchange rate fluctuations;

|

|

|

·

|

Our

future financing needs; and

|

|

|

·

|

Our

ability to attract additional investment capital on attractive

terms.

|

Forward-looking

statements also include the assumptions underlying or relating to any of the

foregoing or other such statements. When used in this report, the words “may,”

“will,” “should,” “could,” “expect,” “plan,” “anticipate,” “believe,”

“estimate,” “predict,” “continue,” and similar expressions are generally

intended to identify forward-looking statements.

Readers

are cautioned not to place undue reliance on these forward-looking statements,

which reflect management’s opinions only as of the date hereof. We undertake no

obligation to revise or publicly release the results of any revision to these

forward-looking statements. Readers should carefully review the factors

described in the Section of this report entitled “Risk Factors” and other

documents we file from time to time with the Securities and Exchange Commission

(‘SEC’), including the Quarterly Reports on Form 10-Q to be filed by us in the

fiscal year 2009.

3

Part

I

Item

1. Description of Business.

We are

a bottled water company based in the PRC. We also continue to operate

various waste water treatment facilities. Through our majority-owned

subsidiaries, we were engaged in the design, construction, implementation and

management of industrial and municipal waste water treatment facilities

throughout the PRC. We are now seeking to dispose of those

operations. We also provide high quality bottled water in China

by using 9000-Year Old Glacier Spring Water. Our bottled water has been

marketed in many big cities in China such as Shanghai, Beijing, Guangzhou,

Chengdu and others.

We also

previously provide turn-key waste water treatment engineering design and

contracting. From 2000 through 2008, we completed the following turn-key

projects: Yongji Development Zone Wastewater Treatment Plant (Phase 1),

Guangdong Nanhai City Jinsha Town Wastewater Treatment Plant, Guangdong Sanshui

Baini Wastewater Treatment Plant and Guangzhou Yantang Wastewater Treatment

Plant, Tianjin City Meichang Town Wastewater Treatment Plant,Yongji Development

Zone Wastewater Treatment Plant (Phase 2), China Environment Industrial Park

Wastewater Treatment Plant, Huangzhuang Industrial Park Wastewater Treatment

Plant and Tian Jin WuQing No.1 Waste Water Treatment Factory. We have left

this business and no longer provide turn-key waste water services.

We hold

28.8%and 11.2%, respectively, of the equity interest in the following two water

treatment facilities operated through build, operate and transfer (“BOT”)

arrangements with the PRC government: (i) Tian Jin Shi Sheng Water

Treatment Company Limited (“TianJin”), which commissioned water treatment in

November 2003 and has a daily treatment capacity of approximately 10,000 tons;

and (ii) Xin Le Sheng Mei Water Purifying Company Limited (“XinLe”), which

also commissioned water treatment in November 2003 and has a daily

treatment capacity of 40,000 tons. We have been retained as the manager to

manage both TianJing and XinLe. The fees from XinLe and TianJing did not

represent a significant portion of our revenue during 2008.

We also

developed a BOT water treatment facility project in Hai Yang City under our

subsidiary Hai Yang City Sheng Shi Environment Protection Company Limited

(“HaiYang”) with capacity of 20,000 tons per day. We began construction of this

project in April 2004 and completed the project and commenced water treatment in

June 2005. We also developed another BOT water treatment facility project in

Beijing under our subsidiary Bei Jing Hao Tai Shi Yuan Water Purifying Company

Limited (“Beijing HaoTai”) with planned capacity of 20,000 tons per day. We

began construction of this project in July 2004 completed approximately 90% till

December, 2006. We retained a 90% interest in this facility until we disposed of

it in December 2006 for a total consideration of US$1,442,567, and realized a

gain of $44,872. In July 2005, we

started construction of a BOT water treatment facility project for the Handan

Fengfeng Mining Area in the Hebei Province under our subsidiary Han Dan Cheng

Sheng Water Affairs Company Limited (“HanDan”) with capacity of 33,000 tons per

day. The project was completed in December 2007. The fees from these projects

are expected to increase our net sales in the future. We are in the process of

discontinuing our waste water engineering operations to concentrate on our

bottled water operations and the presentation of our financial statements

reflects that these assets relate to our “discontinued

division”.

4

Our

predecessor in interest, Discovery Investments, Inc. (“Discovery”) was

incorporated on September 10, 1996, under the laws of the State of Nevada

to engage in any lawful corporate activity. Discovery had been in the

development stage and was not active until October 26, 1999.

On

December 10, 1999, Discovery entered into a Plan and Agreement of

Reorganization (the “Plan”) with LLO-Gas, Inc. and John Castellucci. On

October 26, 1999, LLO-Gas had acquired certain ARCO facilities and a

so-called card lock facility and commenced operations. LLO-Gas was incorporated

in July 1998 under the laws of the State of Delaware. On December 20, 1999,

there was a closing under the Plan and LLO-Gas, Inc. became a wholly-owned

subsidiary of Discovery and there was a change of control of Discovery. Between

December 20, 1999 and August 10, 2000, differences of opinion as to

matters of fact and as to matters of law had arisen by and between certain of

the shareholders of Discovery, who were shareholders prior to the closing, and

between Discovery, John Castellucci and LLO-Gas, Inc.

On

June 7, 2000, LLO-Gas, Inc. filed a Voluntary Petition under Chapter 11 of

the Bankruptcy Code in the United States Bankruptcy Court, Central District of

California, San Fernando Valley Division, case number SV 00-15398-AG. On

December 1, 2000, the United States Bankruptcy Court converted the pending

matter into a Chapter 7 liquidation. Said Chapter 7 effected LLO-Gas, Inc. and

not Discovery.

On

August 10, 2000, Discovery entered into a Mutual Rescission Agreement and

Mutual Release with John Castellucci which provided, inter alia, that Discovery

consented and agreed to rescind said Plan with John Castellucci consenting and

agreeing to the rescission. The parties mutually agreed to forego all rights and

benefits provided to each other thereunder.

On

August 9, 2001, Discovery filed a voluntary petition under Chapter 11 of

the Bankruptcy Code in the United States Bankruptcy Court, District of Nevada,

Case Number BK-S-01-18156-RCJ. On September 24, 2001, the Bankruptcy Court

confirmed the Disclosure Statement and Plan of Reorganization submitted by

Discovery and Discovery was thereafter released from Bankruptcy.

On

April 29, 2002, Discovery entered into a Plan and Agreement of

Reorganization with Bycom Media Inc., an Ontario, Canada corporation (“Bycom”).

Pursuant to this agreement, Discovery acquired all the outstanding shares of

Bycom for 4,800,000 shares of Common Stock. On October 5, 2002, Bycom

became a wholly-owned subsidiary of Discovery and there was a change of

control.

Bycom was

engaged in multimedia applications for internet-based business. Utilizing

business search tools and databases, Bycom intended to be able to locate and

access global business information for a fee, or was to act as an “out-source

provider” of information. Bycom currently is an inactive, wholly owned

subsidiary of the Company.

On

September 4, 2002, Discovery completed a transaction set out in a Plan and

Agreement of Reorganization dated June 13, 2002, pursuant to which

Discovery acquired all of the outstanding shares of Cavio Corporation, a

Washington corporation, (“Cavio”) in exchange for 14 million share of

Discovery common stock. Due to poor market conditions and Discovery’s inability

to seek adequate financing from third parties to properly finance the operations

of Cavio, on December 2, 2002 Discovery’s board of directors approved,

subject to receiving the approval of a majority of the shareholders, to unwind

the acquisition of Cavio in cancellation of the shares of common stock

issued.

On

December 2, 2002, Discovery unanimously approved the disposition of its

interest in Cavio and thereafter received the consent of a majority of the

outstanding shares of the company’s common stock. Discovery determined the

effective date for the divestiture to be June 30, 2003.

5

For the

two years prior to a reverse acquisition in September 2004, we had not generated

significant revenues and were considered a development stage company as defined

in Statement of Financial Accounting Standards No. 7. We were seeking

business opportunities or potential business acquisitions. Pursuant to a

securities purchase agreement and plan of reorganization dated September 9,

2004, as amended, between our company, Evergreen Asset Group Limited, an

International Business Company organized under the laws of the British Virgin

Islands (“Evergreen” or “EGAG”), and the stockholders of Evergreen, we

acquired 100% of the issued and outstanding shares of Evergreen’s capital stock.

We issued 83,500,000 shares of our common stock in exchange for all the 300

issued and outstanding shares of Evergreen capital stock which had an estimated

value of $4.24 million at the time of such issuance, valued based on the fair

market value of the net assets of Evergreen. Since the stockholders of Evergreen

acquired approximately 83.5% of our outstanding shares and the Evergreen

management team and board of directors became the management team and board of

directors of our company, according to FASB Statement No. 141 -

“ Business Combinations

”, this acquisition has been treated as a recapitalization for accounting

purposes, in a manner similar to reverse acquisition accounting. In accounting

for this transaction:

|

|

•

|

Evergreen

is deemed to be the purchaser and surviving company for accounting

purposes. Accordingly, its net assets are included in the balance sheet at

their historical book values and the results of operations of Evergreen

have been presented for the comparative prior

period;

|

|

|

•

|

Control

of the net assets and business of our company was acquired effective

October 15, 2004. This transaction has been accounted for as a

purchase of the assets and liabilities of our company by Evergreen. The

historical cost of the net liabilities assumed was

$0.00.

|

As a

result of the transaction described above we changed our name from Discovery

Investments, Inc. to China Evergreen Environmental Corporation.

Due to

the reverse acquisition mentioned above, EGAG, pursuant to a group

reorganization which was completed in July 2004, acquired 90% equity interests

in each of XinXingmei, XianYang, HaiYang and BeijingHaoTai for cash

consideration of RMB12,601,000 (approximately $1,521,860), RMB18,000,000

(approximately $2,173,913), RMB2,700,000 (approximately $326,087) and

RMB1,800,000 (approximately $217,391), respectively, all of which are domestic

incorporated companies established in the PRC with limited

liability.

In March

2003, GDXS entered into a BOT agreement with Xian Yang City Environment

Protection Bureau. The BOT agreement was later transferred to Xian Yang Bai

Sheng Water Purifying Company Limited (“XianYang”), after XianYang was

incorporated. The construction of the wastewater plant of XianYang started in

the beginning of 2004. Due to the group reorganization in July 2004, 90% of

GDXS’s interest in XianYang was transferred to EGAG. In October 2004, EGAG

entered into a tri-party framework agreement with True Global Limited (“TGL”),

an independent party and Guang Dong Xin Sheng Environmental Protection Company

Limited (“GDXS”) for the disposal of its 90% interest in XianYang to TGL at a

total consideration of $13,246,377. A gain on disposal of $5,220,299 was

recorded in 2004 for the disposal of our entire 90% attributable interest in

XianYang to TGL.The gain represents the difference between the disposal proceeds

and our attributable share of net assets of XianYang at the date of

disposal.

6

In April

2005, we conducted a private placement of 20 investment units, at $25,000 per

unit, for gross proceeds of $500,000. Each unit consisted of (a) one 12%

convertible debenture in the original principal amount of $25,000, convertible

into shares of our common stock at the rate of the lesser of (i) $0.20 per

share or (ii) a 10% discount to the price per share of common stock (or

conversion price per share of common stock) of the next private placement

conducted by us prior to any conversion of the debenture, and (b) 125,000

detachable warrants to purchase one share each of our common stock at an

exercise price of $0.20 per share, expiring ten years from their date of

issuance. The debentures were due and payable August 1, 2005. The

debenture holders, however, extended the payment period to September 30,

2005. We granted the investors limited registration rights for the common shares

underlying their debentures and warrants. Westminster Securities Corporation

acted as placement agent for this offering on our behalf. All the debenture

holders have converted the debentures into 3,703,701 shares of our common stock

on October 1, 2005.

On

September 14, 2005, we closed the private placement sale to accredited investors

of units consisting of shares of our common stock and warrants to purchase

shares of our common stock for aggregate gross proceeds of $4.83 million.

Pursuant to the subscription agreements entered into with the investors, we

issued to the investors 161 units at a price of $30,000 per unit. Each unit

consisted of 200,000 shares of our common stock, priced at $0.15 per share, and

warrants to purchase 200,000 shares of our common stock over a five-year period

at an exercise price of $0.20 per share. Pursuant to the terms of the

subscription agreements, we granted the investors limited registration rights

for all common shares comprising the units, including the common shares issuable

on exercise of the warrants.

On

November 7, 2006, China Evergreen Environmental Corporation changed its name to

China Water Group, Inc. to reflect its focus on China’s water treatment and

supply needs and on build-operate-transfer(BOT), Transfer-operate-transfer(TOT),

and turnkey wastewater treatment facilities in China, at the same time, bottled

water is considered.

On

December 29, 2007, we entered into an Equity Transfer Agreement, pursuant to

which we transferred a 58% out of our 90% interest in our subsidiary Guangdong

Xinxingmei Water Affairs Co, Ltd. (“GXWA”) to Wenning Pu, a 10% minority

sharehoulder of GXWA for RBM7,308,600 (approximately $1,000,000). After the

transaction, our ownership of GXWA was reduced from 90% to 32% and

Wenning Pu’s ownership of GXWA was increased from 10% to 68%. The proceeds of

the sale will be used for our working capital.

On

December 31, 2007, China Water Group Inc. signed a contract with Fortune Luck

Global International Limited to acquire 90 percent of the equity interest of Aba

Xinchen Dagu Glacier Spring Co., Limited through its subsidiary Guangzhou

Xinchen Water Company. The consideration for the acquisition is $13.45 million

dollars, of which $7.5 million will be paid in cash, and the remaining $5.95

million will be paid in our common stock. As of November

20,2009, we have paid a total of $ 7.5 million cash, but hadn’t

issued any shares towards the purchase price. Acquiring this asset has allowed

us to enter the bottled water business with our own high quality water

source.

On

December 30, 2008, we entered into an Equity Transfer Agreement, pursuant to

which China Water Group Inc transferred 100% interest in Evergreen Asset Group

Limited to Whole Treasure Investment Ltd. , a BVI company.

The proceeds of the sale will be used for our working capital , mainly to

develop the bottled water market and trademark building.

Our

Corporate headquarters is located in Guangzhou, Guangdong,

China

7

Our

Business

General

We are a

PRC based waste water engineering company and are engaged

in repositioning ourselves to be a bottled water production, sales

and marketing company . Through our majority-owned subsidiaries, we have

been engaged in the design, construction, implementation and management of

industrial and municipal waste water treatment facilities throughout the

PRC. Starting 2009 we will reposition our business focus

to bottled water production, sales and distribution in the

PRC.

Our waste

water engineering business was originally established in 1999 by our Chairman,

Mr. Chong Liang Pu, with a focus on developing innovative biochemical

technologies and processes for waste water treatment. We have the exclusive

rights to MHA biological treatment processes technologies (“MHA”) and GM

Bio-carriers. Both are the subject of patents owned by our Chairman,

Mr. Pu, and we have acquired the exclusive rights pursuant to a license

agreement with Mr. Pu. Both technologies were developed to improve the

efficiency and effectiveness of waste water treatment processes and reduce the

initial investment and on-going operating cost of waste water treatment

facilities.

We have

applied biotechnological processes to waste water treatment and have developed

relationships with the PRC environmental authorities at both national and

provincial levels throughout the PRC. Since 2000, we have successfully completed

the design and construction of over 15 waste water facilities across China with

total daily capacity of over 130,000 tons (inclusive of five BOT waste

water treatment facilities with daily capacity of 123,000 tons). Our customers

include municipal governments, food processing and beverage companies and

industrial companies.

As a

result of these achievements, we have been recognized as a “Key Enterprise in

Environmental Industry in the PRC” by the General Bureau of Environmental

Protection of China and are viewed as a “High-Tech Enterprise” by the Bureau of

Science and Technology of Guangzhou, PRC.

BOTTLED

WATER OPERATIONS

In 2007

we entered into an agreement with Fortune Luck Global

International Limited to secure a high quality source of natural drinking

water from the Dagu

glacier. During the calendar years 2007 and 2008 we conducted a

limited test market of bottled water in Guangzhou.Management was

satisfied with the results and intends to expand this business to make it the

main business of the Company in the future. At the beginning of 2008, we started

developing the bottled water business. The Company established

development and branding strategies for the bottled water business, managed to

set up four regional sales centers in the cities of Shanghai , Beijing, Chengdu

and Guangzhou, as part of the strategy to promote our products in China’s major

cities. The May 12th

earthquake in Sichuan, however, had a severe impact on our marketing efforts, as

the earthquake damaged the roads between Aba, where our production is located,

and Chengdu. The roads did not reopen until November 2008. Our agreement with

Fortune Luck Global has been filed as an exhibit to this

report.

8

The Global Industry for Bottled

Water.

According

to Datamonitor, the global bottled water market reached a value of $61.0 billion

in 2006 and is forecasted to have a value of $86.4 billion in 2011, an increase

of 41.6%. In 2006, global volume of bottled water was 115.4 billion liters and

is expected to be 174.2 billion liters in 2011, an increase of 51.0%. On a

consumption per capita basis, United Arab Emirates holds the leading position

with 260 liters of bottled water consumption per capita in 2007, followed by

Mexico and Italy. The global average consumption per capita is 29 liters, but

China consumes only approximately 14 liters of bottled water per capita. If

China's consumption per capita grew to the global average of 29 liters, it would

represent a 110% increase (or an additional 20 billion liters) in consumption of

bottled water. If China's consumption per capita grew to the average

consumption per capita of the top 10 countries, it would represent over a 1,000%

increase (or an additional 184 billion liters) in consumption of bottled

water.

The Chinese Bottled Water

Industry.

In China,

water resources per capita are only 28% of the world average. Compounding the

lack of water resources, the State Environment Protection Administration of

China estimated in 2007 that tap water in one-half of China's major cities was

polluted by industrial chemicals and agriculture fertilizers. A large amount of

wastewater is directly discharged into water bodies, and industrial wastewater

treatment has not been completely established, resulting in serious water

pollution problems. Safe drinking water is a priority in China, and given the

lack of wastewater treatment plants, the drinking water issues are not likely to

be solved in the near future.China's bottled water industry started to grow as

drinking water quality in China began to deteriorate. The market grew at a

compound rate of around 37% yearly from 1994 to 2005. According to the Beverage

Marketing Corporation, China was the fastest growing consumer of

bottled water in the world with a 17.5% compounded annual growth rate

from 2002 to 2007, double the next fastest growing country, the United States.

Although China was the fastest growing and third largest consumer of bottled

water, it represented less than one-half of the world's per capita average of

liters consumed and only 11% of the per capita average of liters consumed of the

top 20 countries.

Industry

Background

Waste Water Treatment Markets in the

PRC . The waste water treatment business is in a developmental stage in

China. Following decades of rapid industrialization and urbanization resulting

from PRC’s breakneck economic expansion, demands for urban and industrial waste

water treatment are immense. In 2002, total volume of municipal and industrial

waste water produced reached 23 billion and 26 billion tons, respectively, of

which only approximately 25% was treated in some form. The PRC government, which

views environmental issues as a priority policy, has targeted a 90% treatment

ratio by 2030. This targeted growth, combined with a policy of privatizing all

existing government facilities, is resulting in extraordinarily high levels of

expansion in an industry that did not effectively exist until the

1980s.

In order

to promote investment in the waste water treatment industry, the central

government has created incentives such as tax relief and higher throughput fees

which can improve the profitability of certain municipal projects.

Under the

tax regulations in the PRC, companies providing water purification are exempted

from business tax on the collection of waste water treatment fees. The PRC

government also gives tax relief in the form of reduction in or exemption from

value-added tax and income tax to encourage treated water to be reused in

residential, agricultural, commercial and industrial sectors.

The PRC

government introduced a policy in relation to water supply tariff management

methods for the water-resource system which became effective in January 2004.

The new policy prescribes a water tariff approach, comprising of water

production costs, expenses, profit, and tax. Pertinent pricing is expected to be

in accord with local market demand.

9

Before

the 1990s, water tariffs were extremely low, and there were no wastewater

discharge fees. People were more concerned with water quality than with the

price and quantity they used. As citizens now pay closer attention to water

quality, they expect higher prices to accompany water quality improvements.

Therefore, water tariff and wastewater treatment throughput fees, especially in

the cities, are rising to levels that potentially allow our business to operate

profitably.

Fresh Water Markets . Before

2003, the facilities for fresh water supply in the PRC were owned and operated

by the agencies of local governments. As industrial, economic and population

growth and chronic pollution have placed intense demands on the water supply in

China, the fresh water supply has had serious shortages. Similar to the waste

water treatment industry, the PRC government has opened up the fresh water

supply business to private sector and international operators.

Bottled Water Markets . The

bottled water industry in PRC is in the stage of rapid and continuous growth and

development. Globally, according to recently published data from consultancy

firm Beverage Marketing Corporation (BMC), from 2002 to 200 PRC was the fastest

growing country in the world in terms of consumption of bottled water, showing a

compound annual growth rate of 17.5%, doubling the next fastest growing country,

the United States. With the growth in demand and addition of new industry

participants offering new and varied bottled water products, management believes

that the Chinese bottled water industry is posed for significant

growth.

Our

Business Waste Water Related Activities

There are

different types and quantities of pollutants in water due to the environment,

conditions and purpose for which the water is used. Municipal water has organic

matters including nitrogen and phosphorus. The composition of such municipal

wastewater is relatively stable. In contrast, pollutants in water discharged

from industries include organic pollutants, inorganic matters, metal ions and

salt ion. We adopt varying treatment processes for different industrial

wastewater.

We

provided turn-key engineering, equipment and chemical sales for industrial and

municipal waste water treatment facilities in the PRC. We also invest in, manage

and operate our own water treatment facilities through BOT arrangements in the

PRC.

The

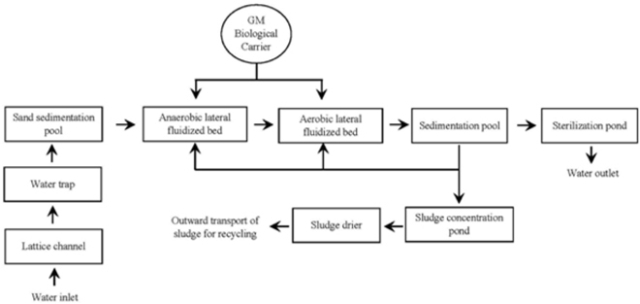

following chart describes the waste water treatment process that we

service:

10

Turn-Key Waste Water Engineering.

We provide turn-key waste water treatment engineering services to both

public and private sectors. Our public sector clients include municipal

governments at the city, district and town levels. Our private sector clients

include heavy industries, such as steel, car manufacturing, electronic; light

industries, such as chemical, food and beverage, paper, printing and breweries;

and others, including hospitals and the pharmaceutical industry. The industrial

wastewater qualities differ due to the different industrial products and

manufacturing processes.

These

contracts are awarded either by public tender or by direct contract. A typical

turn-key waste water treatment project can be classified into three phases;

(1) survey and design, (2) construction and equipment installation,

and (3) operation and management services. However, commencing

in 2007, we discontinued initiating new turn-key projects.

From 2000

to 2007, we completed the following turn-key projects: Yongji Development Zone

Wastewater Treatment Plant (Phase 1), Guangdong Nanhai City Jinsha Town

Wastewater Treatment Plant, Guangdong Sanshui Baini Wastewater Treatment Plant

and Guangzhou Yantang Wastewater Treatment Plant, Tianjin City Meichang Town

Wastewater Treatment Plant,Yongji Development Zone Wastewater Treatment Plant

(Phase 2), China Environment Industrial Park Wastewater Treatment Plant

,Huangzhuang Industrial Park Wastewater Treatment Plant and Tian Jin WuQing No.1

Waste Water Treatment Factory.

We

financed our turn-key projects through progressive payments from our customers

as stipulated in the agreements for these projects.

Investment in BOT Waste Water

Treatment Facilities. We also invest in waste water treatment facilities

through BOT arrangements. BOT projects provide us with a stable income source

under a long-term (usually 20-30 year) contract granted by municipal governments

to build and operate waste water plants. BOT project land is typically

contributed by the municipal government with the operator providing investment

and daily management. After the contract period, the project is transferred to

the local government. After we secure a contract for a BOT project from a

municipal government and the financing for such project is in place, we will

proceed to construct the facility. After the completion of construction and

testing and commissioning, we will operate the waste water treatment facility

for a period of 20-25 years as stipulated in the BOT contract.

11

The

following table sets forth the BOT projects which we have

completed:

|

BOT Projects

|

Cost of

Investment

|

Capacity/

Per Day

|

Operation

Period

|

Date of

commencement of

operation

|

|||||

|

Waste

water treatment

plant of TianJing |

$ | 1.09 million |

10,000

tons

|

20

years

|

November

2003

|

||||

|

Waste

water treatment

plant of XinLe |

$ | 4.11 million |

40,000

tons

|

22

years

|

October

2003

|

||||

|

Waste

water treatment

plant of HaiYang |

$ | 3.62 million |

20,000

tons

|

22

years

|

June

2005

|

||||

|

Waste

water treatment

plant of HanDan |

$ | 3.53 million |

33,000

tons

|

22

years

|

December

2007

|

||||

As of

December 31, 2008, the waste water treatment plants of TianJin, XinLe and

HaiYang were operational and have been providing waste water treatment services.

The HanDan waste water treatment plant began to operate during January

2008.

We have

been financing the BOT projects of TianJing, XinLe and HaiYang through capital

injectionsand funds generated from our operations. We will finance the remaining

capital expenditure of HanDan of approximately $2 million through funds

generated from our operations.

Our

Production Process

Waste Water treatment Though the

chemicals used for treating municipal and industrial wastewater qualities are

different due to the different sources of wastewater for municipal wastewater

treatment and different industrial product and manufacturing process for

industrial wastewater treatment, the treatment processes are largely

similar.

During

the wastewater treatment process, the wastewater is first collected by a

pipeline network system and then transported to a sand sedimentation pool. The

wastewater will then go through the MHA waste water treatment process, which is

a natural, chemical-free, biological and mineral-based process that facilitates

the rapid growth of bacteria in order to improve the efficiency of degrading the

micro-organism materials in the wastewater and for more efficient operation and

reduced energy consumption. After the MHA waste water treatment process, the

wastewater is then transported to the sedimentation pool to remove the fine

particles in the wastewater. The wastewater will then be sterilized in the

sterilization pool and be transported to the water outlet.

Bottled

Water Raw water flows into

water processing workshop through the stainless steel pipe, after sand

filtration, carbon filtration, membrane filtration and ozone sterilizing,

the water will be bring into containers. Then the wter will be poured

into PET bottle automatically by aseptic operation. Then these

products will be packed and transported to the market.

Our

Project Management Process

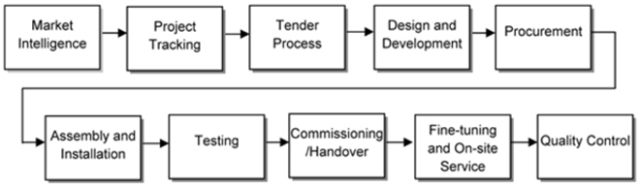

The

following is the flow chart of our project management process for both turn-key

wastewater engineering projects and BOT projects:

12

Market Intelligence . The

starting point for all our projects was market intelligence so that our

management was able to decide which projects they wished to secure for the

benefit of the company. Our marketing personnel were in charge of market

information on potential projects on a regular and ad-hoc basis. Our management

was able to identify and decide on projects which we might potentially bid

for.

Project Tracking . Based on

the information gathered through market intelligence and the subsequent

comprehensive analysis conducted on such information, our

management decided which projects to pursue. We carried

out internal evaluations which consist of three steps: initial evaluation,

revaluation and valuation by professionals. We also engaged external advisors to

carry out external evaluation. We then embarked on determining what

the tender rules and conditions are and the capital requirements and

technologies used for the project. Project tracking allowed us to plan ahead and

make the necessary cost planning.

Tender Process . Once we

decided to proceed to tender for a particular project, we formed a tender

committee comprising marketing personnel and technical personnel, who were

responsible for compiling the tender documents to be submitted for tender within

the stipulated deadline. The tender committee compiled internal costing and

budgetary estimates of labor and material costs based on quotations from the

relevant suppliers and factor in a suitable profit margin in determining our

tender pricing.

Design and Development. After

signing of the contract, we appointed a project team to be responsible for the

execution of the project, including an ad-hoc research and development team to

handle the design and development of that particular project. The research and

development team followed our overall guidelines to analyze, assess and

determine the design and specifications of a system which ensured that all of

our customers’ requirements were met. The design and development process

included collection of information, site survey, key design concept, design

specification, individual design, evaluation, revaluation and issue for

construction. In addition to our own design and development capabilities, we

have also entered into collaboration arrangements with other parties to test our

equipment to ensure its suitability and effectiveness.

Procurement. After the

necessary design and analysis, the specifications of the system were confirmed,

and our procurement department proceeded to purchase all the materials and

equipment required or appoint appropriate sub-contractors to carry out certain

parts of the project.

Construction . The

construction process included sub-contracting and site supervision. During

construction, we sent site representatives to control and supervise the

construction.

13

Assembly and Installation .

We will carried out assembly and installation of equipment and/or system and

coordinate the assembly and installation fully with the construction process to

ensure all equipment and/or system were properly assembled and installed. We

sent technical staff to assist and guide the assembly and

installation.

Testing . After the equipment

and/or system was assembled and installed, we tested the system in accordance

with industrial and national rules and regulations formulated by the relevant

PRC authorities.

Commissioning and Fine-Tuning

. For turn-key projects, should the system pass all tests, we proceeded

to hand over the system to our customers. 5%-10% of the total contract value was

be treated as retention monies during the warranty period of up to 12 months

requirement. Our technical personnel carried out fine-tuning and on-site

services. After successful commissioning of the entire system, the retention

monies were paid by our customers to us after the warranty period of up to 12

months. For BOT projects, the plant started operation after passing all

tests. The technical team carried out fine-tuning and on-site services. The

operation team followed the operational guidelines and monitor the quality of

treated water.

Competition

We

believe our main competitor in waste water treatment business was Beijing

Capital Co., Ltd. (“Beijing Capital”), a subsidiary of Capital Group, which has

identified investment, development, operation and management in the PRC water

industry as its core business. Beijing Capital provides environment management

services. We also competed with many other regional environmental and water

treatment companies. We believe that we compete primarily on the basis of

contract pricing and capital. Though many of our competitors offer similar but

less cost-effective services, they may have greater financial resources and

hence be able to secure contracts with reduced operating margins but more

competitive pricing. However, we believed that as a result of our cost

efficiency through our patented technologies, we were able to offer much more

competitive pricing. In addition, having access to the capital markets in the

United States through our public listing helped us to

differentiate ourselves from our competitors. Another area of competition

came from local protectionism where local governments wish to protect local

environmental businesses. In order for us to overcome this kind of competition,

we relied on our financial and technical resources.

We

believe our main competitor in bottled water business is Evian, a French bottled

water company which entered China more than 10 years ago and occupied the

biggest share of the Chinese market for branded bottled water . Several other

local brands of high level bottled water companies recently entered the

market and have relatively small market shares. We believe that

acquiring a 90% equity interest in a high quality water source within China will

give us a competitive advantage in the bottled water business as we seek to

expand this business.

Our

Competitive Strengths

Key

elements of our competitive strengths include:

Capital Resources On one hand, the

threshold of capital requirements for entering the waste water treatment segment

and the initial capital investment of waste water treatment facilities and

projects, especially BOT projects, is relatively high. On the other hand, the

bottled water business requires capital to build a marketing network and brand

image in the targeted market. We believe we are capable of obtaining

sufficient capital resources to fund our operation of an expanded bottled water

business. We also believe that additional capital will be available

to us on a time to time basis as we dispose of our remaining waste water

treatment facilities..

14

We place

great emphasis on high quality bottled water marketing and brand

building also concentrate more on technical research and development, and

typically set up research and development teams for specific projects to handle

the design, development and improvement of such projects.

We

are building our bottled water market network in China’s principal

cities such as Beijing, Shanghai, Guangzhou and Chengdu, and have developed more

than 300 distribution channels to sell our 9000-Year Old Glacier Spring Water,

mainly luxury hotels, restaurants, chain stores and supermarkets, chambers of

commerce, beauty parlors and other outlets.

Customers,

Sales and Marketing

Many of

our principal customers in our waste water treatment business were local

governments, food and beverage processing companies and industrial companies

that used our technologies to treat their waste water. In our bottled

water business, the main customers are the retail stores our wholesale

distributors and our ultimate customers are middle class, and wealthy

families, large companies and government offices as they are more

sensitive to and will pay a premium for food and water that is perceived to be

safer.

In 2008,

the Group’s major customer was Hai Yang City Zoning and Construction

Management Bureau, an independent third party, which, accounted for

approximately 79% of the Group’s total revenue of 2008. Revenue from Hai Yang

City Zoning and Construction Management Bureau was for the BOT wastewater

treatment services of Haiyang City Wastewater Treatment Plant.

Research

and Development

Waste Water treatment Our

research and development efforts were directed toward enhancing our existing

technology and products and developing our next generation of technology. We are

no longer engaged in Research and Development with respect to waste water

treatment.

Bottled Water Given high market

demand for bottled water, we have established an R&D department responsible

for expanding product lines and putting in market a series of products to meet

different demands of market segments so as to increase the market

coverage.

Quality

Control

In

connection with our waste water treatment business, our quality control

department was headed by Luo Huizhong, who has more than 15 years of relevant

experience. Mr. Luo has been a chief engineer at several companies, and Vice

general engineer of our company, and he is familiar with resource allocation,

quality control and environmental facility management control. We no

longer have a quality control department for waste water treatment.

15

Quality Control during production for bottled water

. We have

established at the factory a department

and laboratory facilities to ensure the high quality of our

products. Specific proceedures include testing at each stage such as water

source, water treatment, bottling, packaging, and finished products to ensure

our products are meeting all healthy water standards and the expectations of our

customers.

Cooperative

Partners and Suppliers for Waste Water Treatment

We

outsourced the design and construction of our subsystems to a number of

cooperative partners and key suppliers and maintain close relationships with

them. Our cooperative partners include North-Eastern Environmental Protection

Design Institute, Guangdong Province Environmental Protection Design Institute,

and the 20 th Group

of China Railway Company. We have signed cooperative agreements with these

cooperative partners. North-Eastern Environmental Protection Design Institute

provides technical support in the design of waste water treatment facilities and

preparation for the tendering of projects, 20 th Group

of China Railway Company evaluates all documents and information required for

tendering while Guangdong Province Environmental Protection Design Institute

evaluates feasibility and acceptability of the blue prints of the facilities.

Compensation for our cooperative partners were based on amount of work

done.

North-Eastern

Environmental Protection Design Institute was established in 1961 in the city of

Changchun. The institute focuses on design of, research in and provision of

consultancy services for municipal infrastructure construction works including

water supply, waste water treatment, waste treatment, energy supply,

construction of road and bridges, public transport and reforestation of cities

etc. The institute also provides other services in relation to civil

construction works for municipal projects like feasibility studies for projects,

evaluation of projects, project management and project supervision.

The

Guangdong Province Environmental Protection Design Institute was established in

1990. Over the years, the institute has gained experiences in the design,

management, treatment and turn-key engineering of waste water, air pollution,

noise pollution and waste residue. The institute has achieved remarkable results

especially in waste water treatment for the printing and dyeing, electroplating,

brewing, pharmaceutical, chemical and food & beverages

industries.

The 20

th

Group of China Railway is a large-scale construction company in the PRC.

The history of the 20 th Group

of China Railway dated back to the year 1949. The company has enormous

experience in the construction of railway systems in the PRC and related

infrastructure including road construction, water supply, energy supply, waste

water treatment, urban and rural planning, municipal projects etc. The company

is also involved in many large scale construction projects

overseas.

There are

three main types of equipment for our waste water treatment and potable water

projects: (i) electrical equipment which includes various types of sewage

pumps, slush pumps and other water pumps, separators, sludge scrapers, mixers,

air compressors, filters, dehydrators, blow fans, etc; (ii) automated

control systems and electrical parts; and (iii) various test, analysis,

detection and monitoring instruments. All purchases from foreign companies are

made through their authorized dealers/agents in the PRC. We adhere closely to

the principles of total quality management. Our customers, suppliers and

employees are encouraged to provide feedback and suggestions for improvements in

products and services.

The

following table sets forth our major suppliers of equipment and materials in

waste water treatment:

16

|

Component, Raw Materials and

Equipment

|

Our Major Suppliers

|

|

|

Waste

water treatment analytical instruments

|

Hach

Company

|

|

|

Blow

fan systems

|

HV-Turbo

A/S

|

|

|

Sewage

pumps, slush pumps, other water pumps and mixers

|

Nanjing

Airs Pump Industry Group

|

|

|

PLC

automated control systems

|

Mitsubishi

Electric

|

|

|

Electrical

parts

|

Schneider

Electric Low Voltage (Tianjin) Co.

|

|

|

Automated

systems

|

GuangZhou

SaiDi Automated Engineering

Company

|

The

following table sets forth our major suppliers of equipment and materials in

bottled water:

|

Component, Raw Materials

and Equipment

|

Our Major Suppliers

|

|

|

Bottle

blowing machine

|

Fogang

Guozhu Blowing Equipment Co., Ltd

|

|

|

Racking

machine

|

Jiangsu

XinMeixin Water Purifying Equipment Co.,Ltd

|

|

|

Air

compressor

|

Nanjing Hengda Compressor

Co.,Ltd

|

|

|

Packing

machinery

|

Jiangsu

XinMeichen Packing Machinery Co.,Ltd

|

|

|

Water

treating equipment

|

Zhejiang

Deqing Water Treating Co.,Ltd

|

|

|

Bottle

base, top

|

Yibing PuLaisi Packing Material

Co.,Ltd

|

|

|

Bottle

bag, label

|

Guangzhou

Rongshun Packing Co.,Ltd

|

We have entered into a

50-year exclusive contract to use the glacier spring water at Aba area with Aba

Municipal Government of Sichuan province. According to the contract, during the

first 10 years, we have the right to exclude any competitor for the water

source. Currently, we have established a bottling facility in the area,

primarily for 350 ML and 500 ML bottled water. A 3L facility is under

construction with expected completion in January, 2010. Our current

production capacity is 120 tons per day. We intend to increase the

capacity to 200 tons per day in the future. In addition to Aba, we are in the

process of exploring new water sources.

17

Intellectual

Property

Waste Water treatment We

seek to protect our intellectual property by way of our license rights to

patents on proprietary features of our advanced bio-chemical treatment

technology and processing systems for waste water treatment and by challenging

third parties that we believe infringe on our licensed patents. We have obtained

the exclusive right to use two patents owned by our Chairman, Mr. Pu, for

our MHA and GM Bio-carriers technologies. We also protect our intellectual

property rights with nondisclosure and confidentiality agreements with

employees, consultants and key customers.

Specifically,

we have registered the following patents with the State Intellectual Property

Office of the PRC:

|

|

•

|

MHA

biological treatment process technology (PRC Patent No. ZL 01 1 07637.2)

applied on March 14, 2001, declared effective on March 3, 2004

with a duration of 20 years from the date of application;

and

|

|

|

•

|

GM

Bio carriers (PRC Patent No. ZL 01 1 07624.0) applied on March 8,

2001, declared effective on September 10, 2003 with a duration of 20

years from the date of application.

|

Bottled

water We are the only bottled water company in

China that has registered with the State Industrial and Commercial

Bureau our “9000-year” trade mark

Employees

As of

December 31, 2008, we had 58 employees, of whom 27 were in bottled water

operations of whom 18 were engaged in sales, marketing and services, the others

in accounting and administration. We also had 31 employees in our waste water

treatment. 5 were engaged in sales, marketing and service, 5 in research,

development and engineering, 10 in finance and administration and

11 in operations. None of our employees is represented by a

collective bargaining agreement, and we believe that we have satisfactory

relations with our employees.

Environmental

Regulation

One of

our core values is protecting the environment in which we operate and the

environment in which our equipment operates. Compliance with laws and

regulations regarding the discharge of materials into the environment, or

otherwise relating to the protection of the environment, has not had any

material effect on our capital expenditures, earnings or competitive position.

We do not anticipate any material capital expenditures for environmental control

facilities in 2009.

Regulation

The PRC’s

numerous ongoing water reforms are moving toward a user-pay, market-driven

sector. Legislation serves as the basis to regulate and enforce these reforms.

The Water Resource Law, amended and put into effect on October 1, 2002,

significantly changes water resource management systems, water resource

protection, water conservation, and legal responsibilities.

Environmental

Laws and Regulations

In the

PRC, environmental laws and regulations are stipulated and implemented through

legislation and through administrative authorities at various levels of

government. Current environmental laws and regulations can be classified into

two categories: environmental management and environmental pollution prevention

and control. All environmental laws and regulations are stipulated on the

basis of the Environmental Protection Law (EPL). EPL, effective in December

1989, sets the framework for environmental management and pollution control

legislation in the PRC.

18

Environmental Management Law and

Regulations. The

PRC’s environmental management measures include environmental impact assessment

(EIA), the Three Synchronies Policy, permitting requirements, and reporting

requirements. Each of these is described below:

|

|

1.

|

Environmental impact

assessment . The 1989 Environmental Impact Assessment Law was

revised in October 2002. These revisions became effective in September

2003 and apply to all construction projects that may negatively impact the

environment. An EIA must be prepared during the project feasibility stage

to assess the project’s environmental impact. EIA approval is necessary to

secure a construction and operating

permit.

|

|

|

2.

|

Three Synchronies Policy

. Article 26 of the EPL defines the Three Synchronies Policy as the

installation of pollution prevention and control facilities in a

construction project to be undertaken concurrently with the main

construction phase. The pollution prevention and control facilities are to

be installed and commissioned only after they are inspected and approved

by the Environmental Protection Bureau

(EPB).

|

|

|

3.

|

Permitting requirements

. Pollution discharges in the PRC are subject to registration and

permitting requirements. The EPL defines requirements for pollution

discharge registration and permits. Pollution discharges must be

registered with the relevant environmental authority. A pollution

discharge permit is issued after registration. The Management Regulation

on the Registration of Discharged Pollutants, issued by the State

Environmental Protection Administration (SEPA), effective Oct. 1, 1992,

details requirements for pollution discharge registration. At the state

level, the Department of Pollution Control under SEPA implements pollution

discharge registration and permitting policies. Pollution control

departments under local EPBs are in charge of the registration procedures

and issue a pollution discharge

permit.

|

|

|

4.

|

Reporting requirements.

According to Article 31 of the EPL, any organization that causes or

has a potential to cause an accident resulting in environmental pollution

must promptly take measures to prevent and control the pollution hazard

and notify the relevant authorities. In addition, enterprises and

institutions that have a greater likelihood to cause severe pollution

accidents must adopt effective pollution prevention

measures.

|

Environmental Pollution Law and

Regulation .

Environmental pollution prevention and control measures in the PRC apply

to various environmental media, including water, water supply, wastewater

discharge, air emissions, hazardous waste management, noise, and soil and

groundwater. In November 2004, the management rules regarding environmental

pollution prevention facilities operation permit was enacted and it set forth

the requirements for getting a permit and how the facilities must be

operated.

The

following is a summary of environmental pollution laws and regulations regarding

water, water supply and waste water discharge in the PRC:

Three

laws apply to the water sector:

|

|

1.

|

The

Water Resources Law emphasizes the uniform management of river basins and

the macro-management of water distribution and consumption. In addition,

the law identifies a water quality management

system.

|

19

|

|

2.

|

The

1984 Water Pollution Prevention and Control Law (WPL) applies to

discharges to rivers, lakes, canals, reservoirs, and groundwater. The WPL

contains sections pertaining to water quality and discharge standards,

pollution prevention, surface water, and groundwater. Amendments in 1996

introduced further controls on river basins, including requirements for

cities and towns to establish central sewage treatment plants and to set

treatment fees, mass-loading controls, provisions for strengthening the

supervision and management of water pollution, and non-point-source

pollution controls.

|

|

|

3.

|

The

Implementation Regulation of Water Pollution Prevention and Control Law

was enacted on March 20, 2000. This law regulates the supervision and

management of surface and ground water pollution, prevention, and control

measures.

|

Water supply. In urban areas,

water is usually supplied by the municipal water utility companies, which are

responsible for ensuring that water quality complies with the National Drinking

Water Standard (GB5749-85). A groundwater abstraction permit is required if any

company intends to use groundwater directly. In the northern part of the PRC,

however, the use of groundwater is strictly controlled because of significant

water shortages and ground settlement issues. Users must apply to provincial or

higher level administrative committees for a groundwater abstraction

permit.

Wastewater discharge. Two

types of wastewater discharge systems are defined in the PRC: (1) polluted

wastewater discharges (typically industrial and domestic wastewater) and

(2) non-polluted wastewater discharges (for example, storm water). Separate

drainage systems for polluted and non-polluted discharges are required for a

facility in which a municipal sewer system is available.

Bottled

water sales For a company to sell bottled water products, the company must

obtain a State issued certificate for water source, and meets the State QA

standard and State requirements of the Food Safety Law and Drinking Natural

Mineral Water Standard. We have obtained the necessary certificates

and believe that we meet all standards.

Environmental

Enforcement

In the

PRC, methods of enforcing environmental legislation include discharge fees,

surcharge fees, fines, and administrative sanctions. Pollutant discharge

activity is subject to a discharge permit, which must be registered and obtained

before the pollutants are generated.

In major

pollution control areas, such as Shanghai and Beijing, mass-loading targets are

established and allocated to major emission facilities by the local EPB. In some

pilot locations, emission quotas can be traded among facilities.

In areas

with significant pollution problems, such as those impacted by sulfur dioxide

emissions, acid rain, and water quality deterioration, specific discharge

limitations are adopted to prevent further degradation.

There are

specific items within the Constitution of the People’s Republic of China and the

PRC Criminal Law to strengthen the enforcement of environmental legislation by

disciplinary sanction, civil liability, and even criminal liability.

Disciplinary sanctions may come in the form of a warning, a fine, a requirement

to install environmental protection equipment, or a requirement to cease

operations. Criminal liability can also be passed on to the legal representative

of an enterprise if the polluting activity caused severe damage to property,

health, or interests of the state or its citizens. In these cases, the

individual deemed responsible may be prosecuted. Civil liability also exists and

is aimed at activities that may result in civil disputes. Generally, the dispute

may be settled through financial compensation by the facility that caused the

damage.

20

Currently,

the industry of waste water treatment is facing more intense competition. The

industry itself requires large investment in capital coupled with low rates of

return over long periods. We have determined that we lack the available capital

resources and support to expand our business in waste water treatment.

Management believes it is in the shareholders’ interest to switch our business

line from waste water treatment to bottled water mining, distribution and sales

as there is currently no premium national bottled glacier water brand in the PRC

creating a market opportunity for the Company.

Our

transition from a waste water treatment company with a BOT model to a premium

bottled water production, distribution and marketing company will occur over

several years as our BOT operations are disposed of fromtime to time as

opportunities present themselves to us and our capital resources and efforts are

devoted to expanding bottled water operations.

Item

1A. Risk Factors.

You

should carefully consider the risks described below, which constitute the

material risks facing us. If any of the following risks actually

occur, our business could be harmed. You should also refer to the other

information about us contained in this Form 10-K, including our financial

statements and related notes.

Risks

Related to Our Business

We are dependent

on economic conditions in the PRC’s as

all of our business is conducted

in the PRC. All of our business operations are conducted in the PRC and

all of our customers are also located in the PRC. We operate our new bottled

water business internally in the PRC. Accordingly, any significant

slowdown in the PRC economy may cause the waste water treatment industry to

reduce expenditure or delay the building of new facilities or projects for waste

water treatment. This may in turn lead to a decline in the demand for our BOT

products and services, and may reduce our profitability and the return on your

investment. Also, a general economic slowdown has is currently

underway may reduce demand for premium bottled water and limit the growth of

those operations.

Failure to retain

services of key personnel will affect our operations

and results . Our success to date has been largely due to the

contributions of our executive officers. The continued success of our business

is very much dependent on the goodwill that they have developed in the industry

over the past several years.

Our

continued success is dependent, to a large extent, on our ability to retain the

services of our executive officers. The loss of any of our executive officers’

services due to resignation, retirement, illness or otherwise without suitable

replacement or the inability to attract and retain qualified personnel would

affect our operations and may reduce our profitability and the return on your

investment.

We may not be

able to protect our processes, technologies and systems against claims

by

other parties. Although we have two registered patents in respect of the

processes, technologies and systems we use frequently in our systems, we have

not purchased or applied for any patents other than these as we are of the view

that it may not be cost-effective to do so. For such other processes,

technologies and systems for which we have not applied for or purchased or been

licensed to use patents, we may have no legal recourse to protect our rights in

the event that they are replicated by other parties. If our competitors are able

to replicate our processes, technologies and systems at lower costs, we may lose

our competitive edge and our profitability may be reduced.

21

We may face

claims for infringement of third-party intellectual property rights . We

may face claims from third parties in respect of the infringement of any

intellectual property rights owned by such third parties. There is no assurance

that third parties will not assert claims to our processes, technologies and

systems. In such an event, we may need to acquire licenses to, or to contest the

validity of, issued or pending patents or claims of third parties. There can be

no assurance that any license acquired under such patents would be made

available to us on acceptable terms, if at all, or that we would prevail in any

such contest. In addition, we would incur substantial costs and spend

substantial amounts of time in defending ourselves in or contesting suits

brought against us for alleged infringement of another party’s patent rights. As

such, our operations and business may be adversely affected by such civil

actions.

We rely

on trade secrets, technology and know-how, which we seek to protect, in part, by

confidentiality provisions in contracts with our customers and our employees.

There can be no assurance that these agreements will not be breached, or that we

will have adequate remedies for any breach, or that other parties may not obtain

knowledge of our trade secrets and processes, technology and systems. Should

these events occur, our business would be affected and hence, our profitability,

may be reduced.

We may require

additional funding for our future growth. Our future growth will depend,

to a large extent, on our ability to establish our bottled water products

through advertising and to develop a manufacturing and distribution