Attached files

| file | filename |

|---|---|

| EX-21 - Wonder Auto Technology, Inc | v176312_ex21.htm |

| EX-31.2 - Wonder Auto Technology, Inc | v176312_ex31-2.htm |

| EX-23.1 - Wonder Auto Technology, Inc | v176312_ex23-1.htm |

| EX-32.1 - Wonder Auto Technology, Inc | v176312_ex32-1.htm |

| EX-32.2 - Wonder Auto Technology, Inc | v176312_ex32-2.htm |

| EX-31.1 - Wonder Auto Technology, Inc | v176312_ex31-1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

(Mark

One)

x ANNUAL REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the

fiscal year ended: December 31,

2009

o TRANSITION REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the

transition period from ____________ to _____________

Commission

File No. 001-33648

WONDER

AUTO TECHNOLOGY, INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

88-0495105

|

|

|

(State

or other jurisdiction of incorporation or

organization)

|

(I.R.S.

Employer Identification

No.)

|

No.

16 Yulu Street

Taihe

District, Jinzhou City

Liaoning

Province 121013

People’s

Republic of China

(Address

of principal executive offices)

(86)

416-2661186

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

|

Common

Stock, par value $0.0001 per share

|

NASDAQ

Global Market

|

Securities

registered pursuant to Section 12(g) of the Exchange Act: None

|

Indicate

by check mark if the registrant is a well-known seasoned issuer, as

defined in Rule 405 of the Securities Act.

|

Yes

¨

No x

|

|

Indicate

by check mark if the registrant is not required to file reports pursuant

to Section 13 or Section 15(d) of the Act.

|

Yes

¨

No x

|

|

Indicate

by check mark whether the registrant (1) has filed all reports required to

be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to

such filing requirements for the past 90 days.

|

Yes

x No ¨

|

|

Indicate

by check mark whether the registrant has submitted electronically and

posted on its corporate Website, if any, every Interactive Data File

required to be submitted and posted pursuant to Rule 405 of Regulation S-T

(§ 232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such

files).

|

Yes

o No ¨

|

|

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the

best of registrant’s knowledge, in definitive proxy or information

statements incorporated by reference in Part III of this Form 10-K or any

amendment to this Form 10-K.

|

¨

|

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act.

|

Large

Accelerated Filer o

|

Accelerated

Filer x

|

|

|

Non-Accelerated

Filer o

(Do not check if a smaller reporting company)

|

Smaller

reporting company o

|

|

Indicate

by check mark whether registrant is a shell company (as defined in Rule

12b-2 of the Act).

|

Yes

o No x

|

As of

June 30, 2009 (the last business day of the registrant’s most recently completed

second fiscal quarter), the aggregate market value of the shares of the

registrant’s common stock held by non-affiliates (based upon the closing sale

price of such shares as reported on the NASDAQ Global Market) was approximately

$273 million. Shares of the registrant’s common stock held by each

executive officer and director and by each person who owns 10% or more of the

outstanding common stock have been excluded from the calculation in that such

persons may be deemed to be affiliates of the registrant. This determination of

affiliate status is not necessarily a conclusive determination for other

purposes.

There

were a total of 33,859,994 shares of the registrant’s common stock outstanding

as of March 4, 2010.

DOCUMENTS

INCORPORATED BY REFERENCE

Portions

of the registrant’s Definitive Proxy Statement for its 2010 Annual Meeting of

Stockholder to be filed with the Commission within 120 days after the close of

the registrant’s fiscal year are incorporated by reference into Part III of this

Annual Report on Form 10-K.

WONDER

AUTO TECHNOLOGY, INC.

Annual

Report on FORM 10-K

For the Fiscal

Year Ended December 31, 2009

TABLE

OF CONTENTS

|

PART

I

|

||

|

Item

1.

|

Business.

|

1

|

|

Item

1A.

|

Risk

Factors.

|

10

|

|

Item

1B.

|

Unresolved

Staff Comments.

|

26

|

|

Item

2.

|

Properties.

|

26

|

|

Item

3.

|

Legal

Proceedings.

|

27

|

|

Item

4.

|

Reserved.

|

27

|

|

PART

II

|

||

|

Item

5.

|

Market

for Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities.

|

28

|

|

Item

6.

|

Selected

Financial Data.

|

30

|

|

Item

7.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations.

|

31

|

|

Item

7A.

|

Quantitative

and Qualitative Disclosures About Market Risk.

|

46

|

|

Item

8.

|

Financial

Statements and Supplementary Data.

|

47

|

|

Item

9.

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosure.

|

48

|

|

Item

9A.

|

Controls

and Procedures.

|

48

|

|

Item

9B.

|

Other

Information.

|

50

|

|

PART

III

|

||

|

Item

10.

|

Directors,

Executive Officers and Corporate Governance.

|

50

|

|

Item

11.

|

Executive

Compensation.

|

50

|

|

Item

12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters.

|

50

|

|

Item

13.

|

Certain

Relationships and Related Transactions, and Director

Independence.

|

51

|

|

Item

14.

|

Principal

Accounting Fees and Services.

|

51

|

|

PART

IV

|

||

|

Item

15.

|

Exhibits,

Financial Statement Schedules.

|

51

|

Special

Note Regarding Forward Looking Statements

In

addition to historical information, this report contains forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We

use words such as “believe,” “expect,” “anticipate,” “project,” “target,”

“plan,” “optimistic,” “intend,” “aim,” “will” or similar expressions which are

intended to identify forward-looking statements. Such statements include, among

others, those concerning market and industry segment growth and demand and

acceptance of new and existing products; any projections of sales, earnings,

revenue, margins or other financial items; any statements of the plans,

strategies and objectives of management for future operations; any statements

regarding future economic conditions or performance; uncertainties related to

conducting business in China, as well as all assumptions, expectations,

predictions, intentions or beliefs about future events. You are cautioned that

any such forward-looking statements are not guarantees of future performance and

involve risks and uncertainties, as well as assumptions, which, if they were to

ever materialize or prove incorrect, could cause the results of the Company to

differ materially from those expressed or implied by such forward-looking

statements. Such risks and uncertainties, among others, include:

|

|

·

|

The

effects of the global economic

crisis;

|

|

|

·

|

The

effects of contraction in automotive sales and

production;

|

|

|

·

|

Escalating

pricing pressures from our

customers;

|

|

|

·

|

Our

ability to accurately project market demand for our

products;

|

|

|

·

|

Our

ability to require additional

capital;

|

|

|

·

|

Risks

associated with future investments or

acquisitions;

|

|

|

·

|

Interruption

in our production processes;

|

|

|

·

|

Our

ability to attract new

customers;

|

|

|

·

|

Our

ability to employ and retain qualified

employees;

|

|

|

·

|

Competition

and competitive factors in the markets in which we

compete;

|

|

|

·

|

General

economic and business conditions in China and in the local economies in

which we regularly conduct business, which can affect demand for the

Company’s products and services;

|

|

|

·

|

Changes

in laws, rules and regulations governing the business community in China

in general and the automobile industry in particular;

and

|

|

|

·

|

The

risks identified in Item 1A. “Risk Factors” included

herein.

|

All

statements other than statements of historical fact are statements that could be

deemed forward-looking statements. We assume no obligation and do not

intend to update these forward-looking statements, except as required by

law.

Use

of Terms

Except as

otherwise indicated by the context, references in this report to:

|

|

·

|

“Company,”

“WATG,” “we,” “us” and “our” are references to the combined business of

Wonder Auto Technology, Inc., a Nevada corporation, and its subsidiaries

on a consolidated basis;

|

|

|

·

|

“Friend

Birch” are references to Friend Birch Limited, a Hong Kong company and a

direct, wholly owned subsidiary of the

Company;

|

|

|

·

|

“Fuxin

Huirui” are references to Fuxin Huirui Mechanical Co., Ltd., a corporation

incorporated in the People’s Republic of China and an indirect, wholly

owned subsidiary of the Company;

|

|

|

·

|

“Jinan

Worldwide” are references to Jinan Worldwide Auto Accessories Co., Ltd., a

corporation incorporated in the People’s Republic of China and an

indirect, wholly owned subsidiary of the

Company;

|

|

|

·

|

“Jinzhou

Dongwoo” are references to Jinzhou Dongwoo Precision Co., Ltd., a

corporation incorporated in the People’s Republic of China and an

indirect, 50% owned subsidiary of the

Company;

|

1

|

|

·

|

“Jinzhou

Equipment” are references to Jinzhou Wonder Auto Electrical Equipment Co.,

Ltd., a corporation incorporated in the People’s Republic of China and an

indirect, wholly owned subsidiary of the

Company;

|

|

|

·

|

“Jinzhou

Halla” are references to Jinzhou Halla Electrical Equipment Co., Ltd., a

corporation incorporated in the People’s Republic of China and an

indirect, wholly owned subsidiary of the

Company;

|

|

|

·

|

“Jinzhou

Hanhua” are references to Jinzhou Hanhua Electrical System Co., Ltd., a

corporation incorporated in the People’s Republic of China and an

indirect, 50% owned subsidiary of the

Company;

|

|

|

·

|

“Jinzhou Jiade” are references to

Jinzhou Jiade Machinery Co., Ltd., a corporation incorporated in the

People’s Republic of China and an indirect, wholly owned subsidiary of the

Company;

|

|

|

·

|

“Jinzhou

Karham” are references to Jinzhou Karham Electrical Equipment Co., Ltd., a

corporation incorporated in the People’s Republic of China and an

indirect, 65% owned subsidiary of the

Company;

|

|

|

·

|

“Jinzhou

Lida” are references to Jinzhou Lida Auto Parts Co., Ltd., a corporation

incorporated in the People’s Republic of China and an indirect, 50% owned

subsidiary of the Company;

|

|

|

·

|

“Jinzhou

Motor” are references to Jinzhou Wonder Motor Co., Ltd., a corporation

incorporated in the People’s Republic of China and an indirect, wholly

owned subsidiary of the Company;

|

|

|

·

|

“Jinzhou

Wanyou” are references to Jinzhou Wanyou Mechanical Parts Co., Ltd., a

corporation incorporated in the People’s Republic of China and an

indirect, wholly owned subsidiary of the

Company;

|

|

|

·

|

“Wonder

Auto” are references to Wonder Auto Limited, a British Virgin Islands

company and a direct, wholly owned subsidiary of the

Company;

|

|

|

·

|

“SEC”

are references to the United States Securities and Exchange

Commission;

|

|

|

·

|

“Securities

Act” are references to Securities Act of 1933, as amended, and “Exchange

Act” are to the Securities Exchange Act of 1934, as

amended.

|

|

|

·

|

“China”

and “PRC” are references to People’s Republic of

China;

|

|

|

·

|

“RMB”

are references to Renminbi, the legal currency of China;

and

|

|

|

·

|

“U.S.

dollar,” “$” and “US$” are references to the legal currency of the United

States.

|

2

PART

I

|

ITEM

1.

|

BUSINESS.

|

Overview

We are a

leading manufacturer of automotive electric parts, suspension products and

engine components in China. Our core products include alternators, starters,

engine valves and tappets, and rods and shafts for use in shock absorber

systems. We have been producing alternators and starters in China since 1997.

According to the China Association of Automobile Manufacturers, or CAAM, in 2008

we ranked second and third in sales revenue in the Chinese market for automobile

alternators and starters, respectively. Our subsidiary Jinan Worldwide, which we

acquired in October 2008, has been producing engine valves and tappets for over

50 years, and we believe we are now one of the largest manufacturers of engine

valves and tappets in China in terms of sales volume as a result of the

acquisition.

Our

products are used in a wide range of passenger and commercial automobiles, and

we are especially focused on the fast-growing small-to-medium engine passenger

vehicle market. We sell our products primarily within China to well-known

domestic and international automobile original equipment manufacturers, or OEMs,

engine manufacturers and automotive parts suppliers. We are increasingly

exporting our products to international markets. Our customers include SAIC GM

Wuling Automobile Co., Ltd., Beijing Hyundai Motor Company, Shenyang Aerospace

Mitsubishi Motors Engine Co., Ltd., Harbin Dongan Automotive Engine Co., Ltd.,

Shanghai Volkswagen Co., Ltd., BYD Company Limited, Tianjin Toyota Co., Ltd.,

Chery Automobile Co., Ltd., Dongfeng Yueda Kia Motors Co., Ltd., Geely

Automobile Co., Ltd., Tianjin FAW Xiali Automobile Co., Ltd., and a major North

American automobile OEM. Most of our customers subject us to a rigorous product

qualification process to ensure that our products meet their quality standards.

We believe that the complex and stringent requirements of each customer’s

qualification process acts as a barrier to entry for many new market

entrants.

Our

strategically-located manufacturing facilities in Jinzhou and Jinan, China house

our high-quality manufacturing, testing and research and development

capabilities. We currently have four alternator assembly lines, four starter

assembly lines, twenty engine valves production lines, five tappets production

lines and three rods and shafts production lines. Our current annual production

capacity is approximately 2.6 million units of alternators,

2.4 million units of starters, 27 million units of engine valves and

tappets, and 20 million units of rods and shafts, assuming two work shifts

per day with eight hours each.

We

actively pursue acquisition prospects and other strategic opportunities and have

completed the following transactions since the beginning of fiscal year

2009:

|

|

·

|

On

September 22, 2009, we acquired 100% of the equity interest in Friend

Birch Limited, a Hong Kong company, thereby indirectly acquiring its

wholly owned Chinese subsidiaries, Jinzhou Jiade Machinery Co., Ltd. and

Jinzhou Lida Auto Parts Co., Ltd., which are engaged in designing,

manufacturing and selling gas spring shafts and other thin mechanical

shafts products, automotive springs and gas spring. As part of

the transaction, we also acquired all proprietary technology of Friend

Birch Limited’s rods and shafts technology center in

Brazil.

|

|

|

·

|

On

November 4, 2009, we entered into a joint venture agreement with Korea

Teawon Dianzhuang Corporation, a Korean company, pursuant to which we

agreed to establish a joint venture company named Jinzhou Wonder Teawon

Co., Ltd. (“Jinzhou Teawon”), which will primarily engage in the

manufacture of solenoid switches for automotive starters, alternator

collector rings, starter communicators and other automobile

parts. Under the joint venture agreement, we will acquire 75%

of Jinzhou Teawon.

|

|

|

·

|

On

January 18, 2010, through two separate transactions, we acquired an

aggregate of 38.36% of equity interest in Applaud Group Limited which is a

British Virgin Islands corporation and has no assets other than its

ownership of 52.2% of equity interest in Jinheng Automotive Safety

Technology Holdings Limited (“Jinheng Holding”). As a result of

the acquisition of an aggregate of 38.36% of Applaud, we will become the

largest shareholder of Applaud and, thereby, owner of 20.02% of Jinheng

Holdings. Jinheng Holdings is a high-tech automotive parts supplier that

is primarily engaged in developing, manufacturing and selling components

of automotive passive safety restraint systems (airbag and seatbelt),

automotive engine electronic injection management systems, and components

of diesel engines. Jinheng Holdings is listed on the Main Board of Hong

Kong Stock Exchange. Our CEO and chairman, Qingjie Zhao, is an executive

director of Jinheng Holdings.

|

1

History

and Corporate Structure

We were

incorporated on June 8, 2000 in the State of Nevada as “MGCC Investment

Strategies Inc.” Until our reverse acquisition of Wonder Auto on June

22, 2006, our business strategy and ownership changed several times. On June 22,

2006, we acquired all of the capital stock of Wonder Auto in exchange for shares

of our capital stock. This share exchange transaction resulted in a change of

the ownership control of the Company. On August 25, 2006, we amended our

Articles of Incorporation and changed our name into “Wonder Auto Technology,

Inc.” As a result of the Wonder Auto acquisition, our business became the

business of our indirect, wholly-owned Chinese subsidiaries: (1) Jinzhou Halla,

(2) Jinzhou Dongwoo, (3) Jinzhou Wanyou, (4) Jinzhou Hanhua, (5) Jinzhou Karham,

(6) Jinzhou Motor, (7) Jinzhou Equipment, (8) Fuxin Huirui, (9) Jinan Worldwide;

(10) Jinzhou Jiade and (11) Jinzhou Lida.

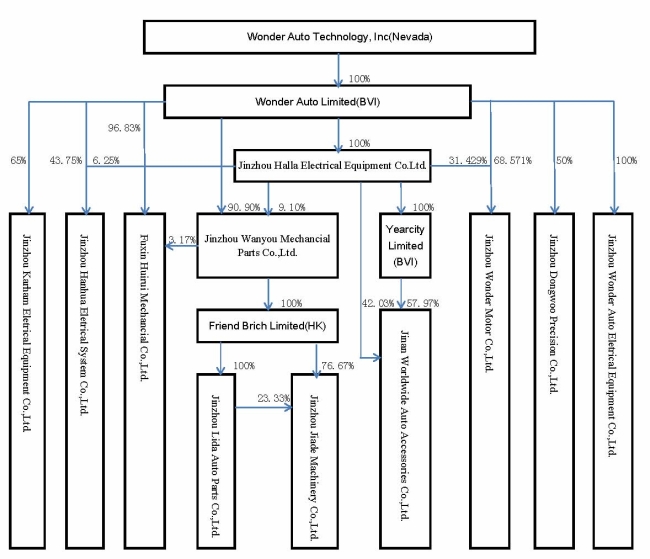

We

conduct our operations in China through our PRC subsidiaries. The following

chart reflects our organizational structure as of the date of this annual

report.

Segment

Information

Our

business operations can be categorized into four segments based on the type of

products which we manufacture and sell, specifically, (i) alternators, (ii)

starters, (iii) rods and shafts and (iv) engine valves and

tappets.

2

Our

alternator product line offerings are available in seven series based on

different sizes and output rates and come in over 230 models. Our starter

product line offerings primarily consist of planetary type starters which are

small and lightweight and come in ten series with approximately 150 models based

on their size and power output. We manufacture and sell both alternators and

starters using largely the same facilities, personnel and other resources in

Jinzhou Halla. Approximately 35.2% and 32.7% of our 2009 sales

revenue were derived from the sale of our alternator and starter

products.

Our

subsidiary Jinzhou Wanyou manufacturers our rod and shaft product line, which is

targeted primarily to international market outside China and accounts for

approximately 10.1% of our sales revenue in 2009. Our product offerings were

expanded to include engine valves and tappets as a result of our acquisition of

Jinan Worldwide in 2008. Sales of our engine valves and tappets

accounted for 22.0% of our sales revenue in 2009.

For

financial information relating to our business segments, see Item 7,

“Management’s Discussion and Analysis of Financial Condition and Results of

Operations” and Note 24 to the consolidated financial statements appearing

elsewhere in this annual report. For a discussion of the risks attendant to our

foreign operations and of any dependence on one or more of the Company’s

segments upon such foreign operations, please see Item 1A, “Risk

Factors.”

Our

Products and Markets

Our

current products include automotive electrical parts, specifically, alternators

and starters; rods and shafts; and engine valves and tappets.

The

following table set forth sales information about our product mix in each of the

last three years.

(All

amounts, other than percentage, in thousands of U.S. dollars)

|

Year Ended December 31,

|

||||||||||||||||||||||||

|

2009

|

2008

|

2007

|

||||||||||||||||||||||

|

Product

|

Revenue

|

Percent of

Revenue

|

Revenue

|

Percent of

Revenue

|

Revenue

|

Percent of

Revenue

|

||||||||||||||||||

|

Alternators

|

$ | 74,250 | 35.2 | % | $ | 63,256 | 44.8 | % | $ | 59,790 | 58.6 | % | ||||||||||||

|

Starters

|

68,946 | 32.7 | % | 52,138 | 36.9 | % | 35,014 | 34.3 | % | |||||||||||||||

|

Rods

and Shafts

|

21,247 | 10.1 | % | 18,106 | 12.8 | % | 7,280 | 7.1 | % | |||||||||||||||

|

Engine

Valves and Tappets

|

46,581 | 22.0 | % | 7,690 | 5.5 | % | - | - | % | |||||||||||||||

|

Total

|

$ | 211,024 | 100 | % | $ | 141,190 | 100 | % | $ | 102,084 | 100 | % | ||||||||||||

Alternators

Our

alternators are manufactured by Jinzhou Halla. An alternator is part of a car

engine’s electrical system which is connected to the engine belt of a vehicle

and converts mechanical energy into electricity to recharge the

battery. The battery, in turn, provides power to all electrical

devices in the vehicle, such as the radio, power steering, headlights and

windshield wipers. We have developed, manufactured and sold seven series of

alternators, which are represented by different sizes and output rates, in over

230 models. Our alternators’ current electrical current flows range in size and

output from 35A to 120A. Larger alternators, as determined by their diameters,

have more electrical field coils and can produce stronger currents. Our

alternators have dual integrated fans and built-in integrated circuit

regulators. Our alternators are designed to produce high outputs while remaining

small and lightweight. The size and weight parameters result in the improved

cooling performance of integrated fans and higher output from the integrated

circuit regulators.

Starters

Our

starters are manufactured by Jinzhou Halla. A starter is part of a car engine’s

starting system, along with the starter solenoid. At ignition, the starter

solenoid is activated and provides power for the starter. The starter then spins

the engine a few revolutions to begin the internal combustion process. The

starters produced by our Company are known as planetary type starters. These

starters are small and lightweight due to their high speed motors combined with

speed reduction systems. We produce ten series of starters in terms of diameters

(ø) from ø67 to ø100, which produce between 0.85kW to 5.5kW of

power.

3

Rods

and Shafts

Our rods

and shafts are manufactured by Jinzhou Wanyou. Our rod and shaft products are

mainly used in shock absorber which is a key part in a vehicle’s suspension

system. A shock absorber rod is the stem in the shock absorber providing full

support of a vehicle’s suspension system. Jinzhou Wanyou currently produces 15

series of rods and shafts in terms of diameters from ø8 to ø28 with over 2,000

models.

Engine

Valves and Tappets

Our

engine valves and tappets are manufactured by Jinan Worldwide. Engine valves and

tappets are used in internal combustion engines to control and facilitate the

engine’s air intake and exhaust functions. Our engine valves and tappets are

critical to optimizing the engine’s power output and fuel

consumption. At present, Jinan Worldwide produces 5 series of engine

valves and tappets in term of applications with over 200 models.

We strive

to produce high quality products and have established a quality control system

to ensure that we achieve this goal. We have obtained the ISO9002, QS9000, and

TS 16949 certificates for our quality management system.

Our

Industry

Overview

of Chinese Automobile Industry

China

experienced significant economic growth in 2009 and has overtaken the U.S. as

the world’s largest automobile market despite challenging global economic

conditions that have had a significant negative impact on the global automobile

industry. According to CAAM, China’s automobile production and sales volumes

were 13.8 million and 13.6 million units in 2009, representing a 48.3% and 46.2%

growth rate over 2008, respectively. Sales of passenger cars in China, including

sedans, multipurpose vehicles and sport-utility vehicles, were 10.3 million

units in 2009, up 7.3% year-over-year. The automobile vehicle population

exceeded 186 million units in 2009 according to the Chinese State Minister of

Public Security. The passenger vehicles population increased by 9.6 million

units, up to 42.4 million units, representing a 29.3% growth rate over

2008.

Most of

our products are manufactured for use in passenger automobiles with small to

medium engines, with displacements of 2.0 liters or below. Automobiles with

these engine displacements produce lower emissions, tend to be more fuel

efficient, more environmentally friendly and less expensive. Sales of small- to

medium-engine passenger cars with displacements of 2.0 liters or below in China

were approximately 9.45 million units in 2009, representing 91.5% of the

total sales of passenger car market in China.

We

believe growth in China’s automobile industry will primarily be driven by the

following factors:

China’s

Macroeconomic Growth. China’s economy has

experienced significant growth since the early 1980s. According to the National

Bureau of Statistics of China, the gross domestic product, or GDP, in China was

RMB 33.54 trillion in 2009, representing an 8.7% growth as compared to 2008.

According to a report

published by the Organization for Economic Co-operation and Development (OECD)

in November 2009, China’s GDP growth in 2010 is expected to reach approximately

10%, as compared to an expected approximate 3.4% increase in global GDP. We

believe that a continued increase in China’s GDP will generate greater Chinese

consumer purchasing power for durable goods such as automobiles.

Low Per

Capita Rate of Vehicle Ownership. According to the

CAAM, in 2009, the passenger vehicle ownership rate in China was approximately

25 passenger vehicles per 1,000 inhabitants, and even lower in remote areas in

China. According to Japan Automobile Manufacturers Association statistics, the

average passenger vehicle ownership rate in the United States was more than 450

passenger vehicles per 1,000 inhabitants and the world average passenger vehicle

ownership rate was over 100 passenger vehicles per 1,000 inhabitants in 2007. We

believe that sales of automobiles in China will experience continued growth,

given the significantly lower penetration rate of automobiles in China and

rising income levels in China.

4

Increasing

Urbanization and Rising Income Levels. Overall

population growth and a trend towards urbanization have led to significant

growth in China’s urban population since 1978. According to the National Bureau

of Statistics of China, the urbanization rate in China grew at a CAGR of 2.8% in

the period from 2004 to 2008, while annual disposable income per capita of urban

residents grew at a CAGR of 13.8% in the same period. We expect a growing and

increasingly affluent urban population will result in greater need for more

efficient and individualized means of transportation, resulting in rising car

ownership.

Growth

of Highway Infrastructure. According to the

National Bureau of Statistics of China, the total length of highways in China

increased from 1.2 million kilometers in 1996 to 3.7 million

kilometers in 2008, representing a CAGR of 10.0%. The growth in the total length

of expressways in China has been even faster, with the total length having

increased from 3,400 kilometers in 1996 to 65,000 kilometers in 2009,

representing a CAGR of 25.5%. We believe the continued growth of China’s

highways and related transportation infrastructure is likely to make automobile

transportation easier and more efficient resulting in a growing demand for

automobiles.

Favorable

Government Policies. The Chinese government has

adopted a number of measures and initiatives intended to stimulate the growth

and development of China’s automobile industry. The following are selected

government initiatives that we believe are likely to have a favorable impact on

China’s automobile industry:

|

|

·

|

On

September 1, 2008, a measure was adopted by the PRC tax authority to

reduce the consumption tax rates assessed on low-emission vehicles, which

is a primary market for our

products.

|

|

|

·

|

In

November 2008, China’s State Council announced a RMB 4 trillion

(approximately $585.7 billion) economic stimulus package which increases

PRC government investment and spending on infrastructure projects,

particularly roads, railways and

airports.

|

|

|

·

|

On

January 1, 2009, the Chinese State Tax Bureau implemented a new fuel

tax which replaces six other fees imposed on vehicle owners and provides

favorable tax treatment to low-emission

vehicles.

|

|

|

·

|

On

January 14, 2009, the Chinese government announced a stimulus package

of RMB 10 billion (approximately $1.5 billion) to specifically bolster

China’s automobile industry, including investment in the development of

alternative energy vehicles and

parts.

|

|

|

·

|

On

January 20, 2009, the Chinese State Tax Bureau reduced the sales tax

imposed on sales of small engine vehicles with displacements of 1.6 liters

or below by 50%.

|

|

|

·

|

The

Chinese Ministry of Financing approved and granted RMB 5 billion

(approximately $732.1 million) for the “Cars to the Countryside” program,

which is a government subsidy program that became effective on

March 1, 2009. Under this program, individuals in rural areas who

purchase minibuses with engine sizes of 1.3 liters or below between

March 1, 2009 and December 31, 2009 will be entitled to a 10%

subsidy of the full price of a

vehicle.

|

|

|

·

|

On

December 9, 2009, the Chinese State Council announced that the purchase

tax for automobiles with displacement of 1.6 liters or less will be 7.5%

until December 31, 2010.

|

|

|

·

|

On

January 18, 2010, the Chinese State Tax Bureau and the State Finance

Ministry jointly announced a new stimulus package to encourage people to

abandon the use of old vehicles for new vehicles, which will combine

subsidies for old vehicles with a purchase tax deduction for new

vehicles.

|

We expect

the above government measures and initiatives will accelerate the demand for

automobiles, particularly low-displacement automobiles, in China.

Overview

of Chinese Automobile Parts Industry

While the

Chinese automobile parts industry experienced rapid growth over the past several

years, starting in 2009, the Chinese automotive parts industry grew at a

considerably slower pace than in past years as the global economic crisis took

effect. The number of automobiles in China reached 186 million at the

end of 2009, up 9.83% from 2008. According to Sinomind Consulting, a China based

automobile market research and management consulting company, China’s sales of

automobile parts reached $136.5 billion in 2008, up 23.9% from $110.2 billion in

2007. According to the United States Department of Commerce, China became the

second largest exporter of automobile parts into the United States in 2007,

overtaking Germany and following Japan.

5

We

believe that growth in China’s auto parts industry will continue due to several

important factors. First, the continued growth of Chinese automobile

industry will lay a solid foundation for the growth in the OEM automobile parts

industry. Second, increased levels of car ownership by Chinese

residents will lead to the growth of the replacement parts

market. Finally, as Chinese and international automotive

manufacturers implement cost savings plans, we expect them to source components

directly from low cost manufacturing regions, such as China.

Our

Intellectual Property

Our goal

is to utilize our intellectual property to provide us with a competitive

advantage. We currently own 64 patents issued in China relating to our products.

Additionally, Jinzhou Halla has registered the trademark for the logo “ ” ,and Jinan Worldwide has registered the trademark for

the logo “

” ,and Jinan Worldwide has registered the trademark for

the logo “ ”, “

”, “ ”, “

”, “ ”, “

”, “ ”, “

”, “ ”, “

”, “ ”, and “

”, and “ ” with the Trademark office of the State Administration for

Industry and Commerce of China.

” with the Trademark office of the State Administration for

Industry and Commerce of China.

” ,and Jinan Worldwide has registered the trademark for

the logo “

” ,and Jinan Worldwide has registered the trademark for

the logo “ ”, “

”, “ ”, “

”, “ ”, “

”, “ ”, “

”, “ ”, “

”, “ ”, and “

”, and “ ” with the Trademark office of the State Administration for

Industry and Commerce of China.

” with the Trademark office of the State Administration for

Industry and Commerce of China.We cannot

give any assurance that the protection afforded our intellectual property will

be adequate. It may be possible for third parties to obtain and use, without our

consent, intellectual property that we own or are licensed to use. Unauthorized

use of our intellectual property by third parties, and the expenses incurred in

protecting our intellectual property rights, may adversely affect our business.

See Item 1A, “Risk Factors – Risks Related to our Business – Failure to

adequately protect our intellectual property rights may undermine our

competitive position, and litigation to protect our intellectual property rights

may be costly.” We may also be subject to litigation involving claims of patent

infringement or violation of other intellectual property rights of third

parties. See Item 1A, “Risk Factors – Risks Related to our Business – We may be

exposed to infringement or misappropriation claims by third parties, which, if

determined adversely against us, could disrupt our business and subject us to

significant liability to third parties.”

Sales

and Marketing

We market

our products directly to our customers though our sales department which, as of

December 31, 2009, consisted of approximately 141 employees. Each member of our

sales department receives one month of training in both the business and

technical aspects that they will need to perform their job functions. In

addition, we periodically provide continuing educational training for our sales

personnel. Members of our sales department generate sales leads by contacting

auto manufacturers directly and by attending industry trade shows and

exhibitions. Since we have established our status as one of the leading

suppliers of alternators, starters, rods and shafts, and engine valves and

tappets, our customers may also contact us for new projects. Although most of

our business is developed by direct personal contact and referrals from our

customers, we also advertise our products in industry trade journals and other

industry media.

In order

to attract international customers, we also attend international trade shows,

such as the automobile shows in Frankfurt and Las Vegas, to raise our brand

recognition and promote our products to the international market. We

started selling our products directly to foreign customers in 2003. Our overseas

sales accounted for approximately 10.7% of our total sales revenue in

2009.

In

addition to our sales and marketing department which performs customer service

functions, we also employ outside representatives whose primary function is to

understand our customers’ needs and promote services that best meet their

requirements. These representatives also help our customers resolve installation

problems and provide general customer service. As of December 31, 2009, we had

twelve representatives stationed at different major customers, including one

Mexican representative.

Raw

Materials

The raw

materials we use to produce our starters and alternators fall into four general

categories: metal parts, semiconductors, chemicals, and packaging materials. The

main raw materials we use to produce our rods, shafts, engine valves and tappets

are iron and steel. The prices of these raw materials are determined based upon

prevailing market conditions, supply and demand. Supply and demand for these raw

materials is generally affected by the cyclical nature of the automobile

industry and the auto parts industry. Supply and demand is also affected by

macroeconomic conditions, including consumer disposable income and spending

patterns.

6

We

purchase the majority of our raw materials and components from suppliers located

in China, including Jiangsu Senyuan Special Steel Co., Ltd., Yingkou Die-Casting

Products Co., Ltd., Tianjin Jingda Rea Special Enamelled Wire Co., Ltd.,

Zhejiang Huanfang Auto Electrical Appliance Co. Ltd., Zhejiang Yuhuan Solenoid

Co., Ltd., and Jinzhou Hirvon Auto Electronics Co., Ltd. In

situations where we procure raw materials from our subsidiaries, we purchase

such materials at cost with no additional mark-up and account for such

transactions through intercompany cost allocations.

A portion

of our raw materials and components are made to our technical specifications,

and the remainder of our raw materials and components are non-customized. We

consider the raw materials and components that are made to our technical

specifications to be proprietary to us, and we have entered into agreements with

some of our suppliers which prohibit them from supplying to other third parties

these raw materials and components. We believe that in most instances, raw

materials and components made to our technical specifications can be obtained

from multiple supply sources. We generally have not experienced any difficulties

in obtaining our requirements for raw materials.

Even

though multiple supply sources are available to us, our practice has been to

utilize limited vendors for certain types of raw materials and components needed

in our business based on our past relationship with particular vendors and their

abilities to deliver to us high quality raw materials and components on

favorable terms. Over the past years, we have been making efforts to diversify

our supply channels in order to increase our bargaining power with suppliers. In

2009, our top

five suppliers accounted for approximately 32% of our total cost of

sales, decreased from approximately 59% in 2008.

We

utilize local suppliers in close proximity to us, typically within 300

kilometers of our manufacturing facilities, in order to closely supervise their

activities, monitor quality, provide technical training and collaborate on

technical improvements. If geographically proximate suppliers continue to be

able to provide high quality raw materials and components to us, we intend to

continue to source our raw materials and components from them to take advantage

of lower shipping costs and favorable quality control capabilities.

Our

suppliers must meet our quality standards and delivery requirements consistently

to remain on our approved supplier list. If a supplier furnishes suboptimal

materials and components to us or is repeatedly late in deliveries, we remove

them from our approved supplier list.

We

typically purchase the raw materials that we use to produce our products from

our suppliers on credit. Credit terms usually permit payment up to 90

days following the delivery of the raw materials. When we purchase raw materials

from Chinese suppliers, we are able to pay in RMB. When we purchase raw

materials from foreign suppliers, we usually pay in U.S. dollars. Our account

payables above six months accounted for 1.75%, 1.85% and 3.7% of our total

account payables in 2007, 2008 and 2009, respectively.

In 2009,

our three biggest suppliers were Jiangsu Senyuan Special Steel Co., Ltd.,

Yingkou Die-Casting Products Co., Ltd. and Tianjin Jingda Rea Special Enameled

Wire Co. Ltd., which accounted for approximately

7.1%, 6.7% and 6.6% of our total purchases, respectively. No suppliers

accounted for more than 10% of our total cost of sales in 2009.

Our

Major Customers

Large

automobile manufacturers and automotive engine suppliers are our primary and

most desirable customers. Our major customers include, among others,

Beijing Hyundai Mobis Auto Parts, Harbin Dongan Automotive Engine Co., Ltd.,

Shenyang Aerospace Mitsubishi Motors Engine Co., Ltd., Weichai Engine Logistic

Co., Ltd., Mianyang Xinchen Engine Co., Ltd., Shanghai GM Wuling Automotive Co.,

Ltd., Guangxi Yuchai Machinery Holdings Company, Jiangsu Mobis Auto Parts

Company, Magneti Marelli Suspension System (Brazil). As we continue to increase

sales in the domestic market, we also intend to grow our overseas sales. We

focus on maintaining long-term relationships with our customers. We have enjoyed

recurring orders from most of our customers for periods of four to ten years.

Our typical sales contract has a one-year term and is usually

renewable.

We

continued our efforts in diversifying our client base without lowering our total

sales revenue. In 2009, our top three customers accounted for approximately

29.9% of our total sales revenue as compared to approximately 34.9% in

2008. In 2009, our two biggest customers Beijing Hyundai Mobis Auto

Parts Co., Ltd., and Harbin Dongan Automotive Engine Co., Ltd. accounted for

approximately13.9% and 10.8% of our total sales revenue, respectively. No other

customers accounted for more than 10% of our sales revenue in 2009. We plan to

further diversify our customer base in 2010 to enhance

profitability.

7

Research

and Development

We

believe that the development of new products and production methods is important

to our success. We currently operate four research and development centers, each

performing different research and development activities. Three of our research

and development centers are located at our principal business headquarters in

Jinzhou, China, focusing on the enhancement of current products, and the

development and testing of new alternator, starter and electric motor products.

The other research and development center is located in Jinan, China, focusing

on the development and testing of new engine valve and tappet products. As of

December 31, 2009, our research and development personnel consisted of

approximately 163 employees.

We are

often invited by our customers to jointly develop new components tailored to our

customers’ specific requirements. In 2009, we had 35 joint development programs

used in various models of sedans. Our OEM customers that we conduct joint

development projects with include FAW sedans, Chery Automobile, South Korea

Doosan and Shanghai GM Wuling. During the past several years, upon the

successful completion of most joint development project, we were engaged as the

supplier for the jointly developed products.

We

believe that our development period is shorter than many other industry

participants due to our dedicated research and development resources and our

close proximity to our customers. Many of our major competitors are foreign

joint ventures who generally conduct their primary research and development

activities in their home countries. We believe that our China-based research and

development operations provide us with an advantage over these competitors since

we are within geographic proximity to our customers and our research and

development personnel are able to communicate directly with our customers in

Chinese and quickly respond to their product requirements.

For the

fiscal years ended December 31, 2007, 2008 and 2009, our research and

development expenses for new products development, representing salaries of

personnel and other costs incurred for research and development of potential new

products, were $534,503, $1.2 million and $3.0 million, representing

approximately 0.5%, 0.9% and 1.4% of our total sales revenue in 2007, 2008

and 2009, respectively. The amount incurred for purchase of

equipments for research and development were approximately $2.4 million,

$2.2 million and $704,616, representing approximately 3.0%, 1.5% and 0.3%

of our total sales revenue in 2007, 2008 and 2009, respectively.

Backlog

Our

backlog of orders was approximately $58 million as of December 31, 2009 compared

to approximately $12.3 million at December 31, 2008. We anticipate that

substantially all of the backlog at the end of 2009 will be delivered during

2010. In the opinion of management, the amount of backlog is not indicative of

trends in our business.

Regulation

Because

our operating subsidiaries are located in the PRC, we are regulated by the

national and local laws of the PRC.

There is

no private ownership of land in China. Upon payment of a land grant fee, land

use rights can be obtained from the government for a period up to 70 years in

the case of industrial land and are typically renewable. We have received the

necessary land use rights certificate for the 453,900 square feet of land

located at No. 16 Yulu Street, Jinzhou High Technology Industrial Park, Jinzhou,

China and the 179,500 square feet of land located at West Bo Hai Street, Open

Economic Zone, Jinzhou, China. We were granted land use rights from the Chinese

government for 1,842,000 square feet of land located at New Century Avenue,

Changqing District, Jinan High Technology Industrial Park, Shangdong, China. The

land use rights have a 50-year term and will expire on January 27, 2055. This

site houses our office building, a research and development center, as well as

our production facilities.

We are

also subject to China’s foreign currency regulations. The PRC government has

controlled Renminbi reserves primarily through direct regulation of the

conversion of Renminbi into other foreign currencies. Although foreign

currencies, which are required for “current account” transactions, can be bought

freely at authorized PRC banks, the proper procedural requirements prescribed by

PRC law must be met. At the same time, PRC companies are also required to sell

their foreign exchange earnings to authorized PRC banks, and the purchase of

foreign currencies for capital account transactions still requires prior

approval of the PRC government.

8

We do not

face any significant government regulations in connection with the production of

our products. We do not require any special government permits to produce our

products other than those permits that are required for all corporations in

China.

Our

Competition

The

automobile parts market in China is very competitive. We compete based upon the

price and quality of our products, product availability and customer service.

There are approximately 10 major competitors in this market trying to sell the

same products that we sell to the same group of target customers. Our primary

competitors are located in China and include Shanghai Valeo Automotive

Electrical Systems Co. Ltd., Hubei Shendian Auto Motor Co., Ltd. and Zhongqi

Changdian Co., Ltd.

With

China’s entry into the WTO and China’s agreement to lift its protections to

infant industries, we believe that competition will increase in the China auto

parts industry segment. Our primary international competitors include VALEO

(France), BOSCH (German), RAMY (U.S.), Mitsubishi Motor (Japan) and Denso

(Japan). Some of our competitors have greater financial resources,

larger staff, and more established market recognition in both domestic Chinese

and international markets than we have.

Environmental

Compliance

Our

manufacturing facilities are subject to various pollution control regulations

with respect to noise and air pollution and the disposal of waste and hazardous

materials. We are also subject to periodic inspections by local environmental

protection authorities. We believe we are in material compliance with the

relevant PRC environmental laws and regulations. We are not currently subject to

any pending actions alleging any violations of applicable PRC environmental

laws.

Our

Employees

As

of December 31,

2009, we employed 3,766 full-time employees. The following table sets forth the

number of our full-time employees by function.

|

Function

|

Number of Employees

|

|

|

Manufacturing

and engineering

|

3,180

|

|

|

General

and administration

|

282

|

|

|

Marketing

and sales

|

141

|

|

|

Research

and development

|

163

|

As

required by applicable Chinese law, we have entered into employment contracts

with all of our officers, managers and employees. We believe that we maintain a

satisfactory working relationship with our employees, and we have not

experienced any significant labor disputes or any difficulty in recruiting staff

for our operations.

Our

employees in China participate in a state pension scheme organized by Chinese

municipal and provincial governments. We are required to contribute to the

scheme at the rates of 30.6% to 45.0% of the employees’

salaries and wages. The compensation expenses related to this scheme

was approximately $3.2 million, $1.2 million and $681,944 for the fiscal years

2009, 2008 and 2007, respectively.

In

addition, we are required by Chinese law to cover employees in China with

various types of social insurance. We have purchased social insurance

for all of our employees.

9

Available

Information

Our

Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on

Form 8-K, including exhibits, and amendments to those reports filed or furnished

pursuant to Sections 13(a) and 15(d) of the Exchange Act, are available free of

charge on our website at www.watg.cn as soon

as reasonably practicable after such reports are electronically filed with, or

furnished to, the SEC. Copies of these reports may also be obtained free of

charge by sending written requests to Investor Relation, Wonder Auto Technology,

Inc., No. 16 Yulu Street, Taihe District, Jinzhou City, Liaoning, People’s

Republic of China, 121013. The information posted on our web site is not

incorporated into this Annual Report.

|

ITEM

1A.

|

RISK

FACTORS.

|

RISKS

RELATED TO OUR BUSINESS

The

global economic crisis could further impair the automotive industry thereby

limiting demand for our products and affecting the overall availability and cost

of external financing for our operations.

The

continuation or intensification of the recent global economic crisis and turmoil

in the global financial markets may adversely impact our business, the

businesses of our customers and our potential sources of capital financing. Our

automotive parts are primarily sold to automakers, engine manufacturers and auto

parts suppliers. The recent global economic crisis harmed most industries and

has been particularly detrimental to the automotive industry. Since virtually

all of our sales are made to auto industry participants, our sales and business

operations are dependent on the financial health of the automotive industry and

could suffer if our customers experience, or continue to experience, a downturn

in their business. In addition, the lack of availability of credit could lead to

a further weakening of the Chinese and global economies and make capital

financing of our operations more expensive for us or impossible altogether.

Presently, it is unclear whether and to what extent the economic stimulus

measures and other actions taken or contemplated by the Chinese government and

other governments throughout the world will mitigate the effects of the crisis

on the automotive industry and other industries that affect our business. These

conditions have not presently impaired our ability to access credit markets and

finance our operations. However, the impact of the current crisis on our ability

to obtain capital financing in the future, and the cost and terms of the

financing, is unclear. Furthermore, deteriorating economic conditions including

business layoffs, downsizing, industry slowdowns and other similar factors that

affect our customers could have further negative consequences for the automotive

industry and result in lower sales, price reductions in our products and

declining profit margins. The economic situation also could harm our current or

future lenders or customers, causing them to fail to meet their obligations to

us. No assurances can be given that the effects of the current crisis will not

damage on our business, financial condition and results of

operations.

A

contraction in automotive sales and production could have a material adverse

affect on our results of operations and liquidity and on the viability of our

supply base.

Automotive

sales and production are highly cyclical and depend, among other things, on

general economic conditions and consumer spending and preferences (which can be

affected by a number of issues including fuel costs and the availability of

consumer financing). As the volume of automotive production fluctuates, the

demand for our products also fluctuates. The global automotive sales and

production deteriorated substantially in the second half of 2008 and are not

expected to rebound significantly in the near term. While the China automotive

sales and production maintained modest growth momentum in 2008 and continued to

grow in 2009, the growth rate was down from previous years. A contraction in

automotive sales and production could harm our results of operations and

liquidity. In addition, our suppliers would also be subject to many of the same

consequences which could pressure their results of operations and liquidity.

Depending on an individual supplier’s financial condition and access to capital,

its viability could be challenged which could impact its ability to perform as

we expect and consequently our ability to meet our own commitments.

Escalating

pricing pressures from our customers may adversely affect our

business.

Pricing

pressure in the automotive supply industry has been substantial and is likely to

continue. Many vehicle manufacturers seek price reductions in both the initial

bidding process and during the term of the contract. Price reductions have

impacted our sales and profit margins and are expected to do so in the future.

If we are not able to offset continued price reductions through improved

operating efficiencies and reduced expenditures, those price reductions may have

a material adverse effect on our results of operations.

10

If

we fail to accurately project market demand for our products, our business

expansion plan could be jeopardized and our financial condition and results of

operations will suffer.

If actual

customer orders are less than our projected market demand, we will likely suffer

overcapacity problems and may have to leave capacity idle, which may reduce our

overall profitability and hurt our financial condition and results of

operations. Even though our business increasingly has included more

international sales, we derive most of our sales revenue from sales of our

products in China. The continued development of our business depends, in large

part, on continued growth in the automotive industry, especially in China.

Although China’s automotive industry has grown rapidly in the past, it may not

continue to grow at the same growth rate in the future or at all. However, the

developments in our industry are, to a large extent, outside of our control and

any reduced demand for automotive parts products and services, any other

downturn or other adverse changes in China’s automotive industry could severely

harm our business.

Our

business is capital intensive and our growth strategy may require additional

capital which may not be available on favorable terms or at all.

We

believe that our current cash and cash flow from operations are sufficient to

meet our present and reasonably anticipated cash needs. We may, however, require

additional cash resources due to changed business conditions, implementation of

our strategy to expand our manufacturing capacity or other investments or

acquisitions we may decide to pursue. If our own financial resources are

insufficient to satisfy our capital requirements, we may seek to sell additional

equity or debt securities or obtain additional credit facilities. The sale of

additional equity securities could result in dilution to our stockholders. The

incurrence of indebtedness would result in increased debt service obligations

and could require us to agree to operating and financial covenants that would

restrict our operations. Given the current global economic crisis, financing may

not be available in amounts or on terms acceptable to us, if at all. Any failure

by us to raise additional funds on terms favorable to us, or at all, could limit

our ability to expand our business operations and could harm our overall

business prospects.

Due

to our rapid growth in recent years, our past results may not be indicative of

our future performance so evaluating our business and prospects may be

difficult.

Our

business has grown and evolved rapidly in recent years as demonstrated by our

growth in annual sales revenue from approximately $48.1 million in 2005 to

$211.0 million in 2009. We may not be able to achieve similar growth in future

periods, and our historical operating results may not provide a meaningful basis

for evaluating our business, financial performance and prospects. Moreover, our

ability to achieve satisfactory manufacturing results at higher volumes is

unproven. Therefore, you should not rely on our past results or our historical

rate of growth as an indication of our future performance.

We

face risks associated with future investments or acquisitions.

An

important element of our growth strategy is to invest in or acquire businesses

that will enable us, among other things, to expand the products we offer to our

existing target customer base, lower our costs for raw materials and components

and capitalize on opportunities to expand into new markets. We recently acquired

controlling interests in several complementary businesses, including Friend

Birch Limited and its subsidiaries which we expect to contribute to our future

growth. In the future, we may be unable to identify other suitable investment or

acquisition candidates or may be unable to make these investments or

acquisitions on commercially reasonable terms, if at all.

If we

complete an investment or acquisition, we may not realize the anticipated

benefits from the transaction. Integrating an acquired business is distracting

and time consuming, as well as a potentially expensive process. We are currently

in the process of integrating our operations with the operations of recently

acquired companies. The successful integration of these companies and any other

acquired businesses require us to:

|

|

·

|

integrate

and retain key management, sales, research and development, production and

other personnel;

|

|

|

·

|

incorporate

the acquired products or capabilities into our offerings from an

engineering, sales and marketing

perspective;

|

|

|

·

|

coordinate

research and development efforts;

|

|

|

·

|

integrate

and support pre-existing supplier, distribution and customer

relationships; and

|

11

|

|

·

|

consolidate

duplicate facilities and functions and combine back office accounting,

order processing and support

functions.

|

Acquisitions

involve a number of risks and present financial, managerial and operational

challenges, including:

|

|

·

|

Our

ability to successfully commercialize our strategic

investments;

|

|

|

·

|

increased

expenses, including travel, legal, administrative and compensation

expenses resulting from newly hired

employees;

|

|

|

·

|

increased

costs to integrate personnel, customer base and business practices of the

acquired company with our own;

|

|

|

·

|

adverse

effects on our reported operating results due to possible write-down of

goodwill associated with

acquisitions;

|

|

|

·

|

potential

disputes with sellers of acquired businesses, technologies, services,

products and potential liabilities;

|

|

|

·

|

potential

liabilities as a result of assumption of liabilities of acquired

companies; and

|

|

|

·

|

dilution

to our earnings per share if we issue common stock in any

acquisition.

|

Moreover,

geographic distance between business operations, the compatibility of the

technologies and operations being integrated and the disparate corporate

cultures being combined also present significant challenges. Acquired businesses

are likely to have different standards, controls, contracts, procedures and

policies, making it more difficult to implement and harmonize company-wide

financial, accounting, billing, information and other systems. Our focus on

integrating operations may also distract attention from our day-to-day business

and may disrupt key research and development, marketing or sales efforts.

Performance problems with an acquired business, technology, product or service

could also have a material adverse impact on our reputation as a whole. Any

acquired business, technology, product or service could significantly

under-perform relative to our expectations. In addition, although we have

conducted due diligence with respect to our recently acquired companies, there

may still be unidentified issues and hidden liabilities, which could have a

material adverse effect on our business, liquidity, financial condition and

results of operations. For instance, in connection with our acquisition of Jinan

Worldwide, a previously state-owned enterprise, the local Chinese government

may, among other things, require us fulfill obligations of the prior owner of

Jinan Worldwide to contribute additional capital of approximately RMB 330

million into Jinan Worldwide by May 2010 and achieve certain performance targets

with respect to Jinan Worldwide. If we cannot overcome these challenges, we may

not realize actual benefits from past and future acquisitions, which will impair

our overall business results.

Our

acquisition strategy also depends on our ability to obtain necessary government

approvals. See “–Risks Related to Doing Business in China – We may be unable to

complete a business combination transaction efficiently or on favorable terms

due to complicated merger and acquisition regulations which became effective on

September 8, 2006.”

We

may not be able to realize the potential financial or strategic benefits of

strategic investment in Jinheng Holding, which could hurt our ability to grow

our business and harm our financial condition.

As part

of our growth strategy, we will continue to explore and make strategic

investments in business that is complementary or additive to our core business

and product offerings. For instance, on January 18, 2010, through two

separate transactions, we made a strategic investment in which we acquired an

aggregate of 38.36% of equity interest in Applaud Group Limited, and, thereby,

owner of 20.02% of Jinheng Holding, which manufactures airbag safety devices for

automobiles. We expect to utilize our strategic investment in Jinheng

Holding to further strengthen and broaden our research and development

expertise, expand customer base and improve value-added services. However, the

success of the strategic investment depends on various factors over which we may

have limited or no control. Mergers and acquisitions and strategic investments

are inherently subject to significant risks. For instance, the commercial

aspects and goals of our strategic investment may not materialize as desired or

yield the commercial benefits sought. Moreover, regardless of whether

the commercial aspects and goals of the strategic investment prove to be

positive, an strategic investment in another company comes with the typical

investment risks, such as the partial or total loss of investment in the worst

case. Our inability to pinpoint and make favorable strategic

investments, from both a commercial and investment perspective and our inability

to effectively manage the associated risks could materially and adversely affect

our business, financial condition and results of operations. In the case of

Jinheng Holding, our strategic investment may decline in value and/or may not

meet our desired objectives. If we do not successfully manage the risks

associated with this and other acquisitions and strategic investments, our

business, financial condition and results of operations could be materially and

adversely affected.

12

If

we fail to comply with covenants in our loan agreements, our lenders may allege

a breach of a covenant and seek to accelerate the loan or exercise other

remedies, which could strain our cash flow and harm our business, liquidity and

financial condition.

In

connection with loans made to us by several commercial lenders, we have entered

into loan agreements which impose upon us certain financial and operating

covenants. The financial covenants require us to satisfy certain financial

metrics and maintain financial ratios deemed appropriate by our lenders. The

operating covenants often require us to take certain actions, such as keeping

current on our debt payments, delivering reports to our lenders and so forth, or

refraining from taking actions without the lender’s consent or at all, such as

incurring additional debt, making capital expenditures, paying dividends or

distributions or acquiring other business or assets. Even though we strive to

comply with our covenants, we have failed in the past, and may fail in the

future, to do so and our lenders may notify us of such non-compliance and seek

to accelerate a loan or exercise other remedies. For instance, under our loan

agreement with DEG - Deutsche Investitions - und Entwicklungsgesellschaft mbH,

or DEG, dated November 24, 2006, we agreed not to make certain acquisitions

without prior consent of DEG. For some of our recent acquisitions, we did not

obtain prior approval from DEG, but instead have subsequently informed DEG about

the acquisitions. We have not received from DEG any written notice of

non-compliance or breach as we believe our subsequent notices have remedied any

problems. However, we cannot assure you that DEG will not, in the future, send a

notice of breach to us and require acceleration of the loan, in which case we

currently believe we have adequate cash to meet the payment obligation. If, in

the future, we fail to comply with our loan agreement covenants, and we receive

a notice of non-compliance or default, we will attempt to cure any

non-compliance and/or negotiate appropriate waivers with our lenders. If we

cannot cure any non-compliance or obtain a waiver, our lenders may declare us to

be in default, which would give them the right to accelerate our outstanding

indebtedness. If any larger amount of our indebtedness is accelerated as a

result of a default, we may be forced to repay our loans earlier than expected,

which would have a material adverse effect on our business, liquidity and

financial condition.

Any

interruption in our production processes could impair our financial performance

and negatively affect our brand.

We

manufacture or assemble our products primarily at our facilities in Jinzhou and

Jinan, China. Our manufacturing operations are complicated and integrated,

involving the coordination of raw material and component sourcing from third

parties, internal production processes and external distribution processes.

While these operations are modified on a regular basis in an effort to improve

manufacturing and distribution efficiency and flexibility, we may experience

difficulties in coordinating the various aspects of our manufacturing processes,

thereby causing downtime and delays. We have also been steadily increasing our

production capacity and have limited experience operating at these higher

production volume levels. In addition, we may encounter interruption in our

manufacturing processes due to a catastrophic loss or events beyond our control,

such as fires, explosions, labor disturbances or violent weather conditions. Any

interruptions in our production or capabilities at our facilities could result

in our inability to produce our products, which would reduce our sales revenue

and earnings for the affected period. If there is a stoppage in production at

any of our facilities, even if only temporary, or delays in delivery times to

our customers, our business and reputation could be severely affected. Any

significant delays in deliveries to our customers could lead to increased