Attached files

| file | filename |

|---|---|

| EX-21 - EXHIBIT 21 - SAUER DANFOSS INC | a2196918zex-21.htm |

| EX-23.1 - EXHIBIT 23.1 - SAUER DANFOSS INC | a2196918zex-23_1.htm |

| EX-32.2 - EXHIBIT 32.2 - SAUER DANFOSS INC | a2196918zex-32_2.htm |

| EX-32.1 - EXHIBIT 32.1 - SAUER DANFOSS INC | a2196918zex-32_1.htm |

| EX-31.1 - EXHIBBIT 31.1 - SAUER DANFOSS INC | a2196918zex-31_1.htm |

| EX-31.2 - EXHIBIT 31.2 - SAUER DANFOSS INC | a2196918zex-31_2.htm |

| EX-10.1(Q) - EXHIBIT 10.1(Q) - SAUER DANFOSS INC | a2196918zex-10_1q.htm |

| EX-10.1(L) - EXHIBIT 10.1(L) - SAUER DANFOSS INC | a2196918zex-10_1l.htm |

| EX-10.1(K) - EXHIBIT 10.1(K) - SAUER DANFOSS INC | a2196918zex-10_1k.htm |

| EX-10.1(X) - EXHIBIT 10.1(X) - SAUER DANFOSS INC | a2196918zex-10_1x.htm |

| EX-10.1(Y) - EXHIBIT 10.1(Y) - SAUER DANFOSS INC | a2196918zex-10_1y.htm |

| EX-10.1(AQ) - EXHIBIT 10.1(AQ) - SAUER DANFOSS INC | a2196918zex-10_1aq.htm |

QuickLinks -- Click here to rapidly navigate through this document

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2009

COMMISSION FILE NUMBER: 1-14097

SAUER-DANFOSS INC.

(Exact name of registrant as specified in its charter)

| Delaware | 36-3482074 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

2800 E. 13th Street, Ames, Iowa |

50010 |

|

| Krokamp 35, Neumünster, Germany | 24539 | |

| (Address of principal executive offices) | (Zip Code) |

(515) 239-6000

(Registrant's telephone number, including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| Common Stock, par value $0.01 per share | New York Stock Exchange | |

|---|---|---|

| (Title of each class) | (Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act of 1933. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 (the "Act"). Yes o No ý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Act during the preceding 12 months (or for such shorter periods that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K: ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act): Yes o No ý

The aggregate market value of the voting common stock of the registrant held by nonaffiliates based on the last sale price on June 30, 2009 was $69,370,059. (The registrant does not have any other authorized common equity.)

As of March 1, 2010 there were 48,389,406 shares of common stock, $0.01 par value, of the registrant outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the annual meeting of stockholders to be held June 11, 2010 are incorporated by reference into Part III.

(a) General Development of Business

Sauer-Danfoss Inc. (the Company), a U.S. Delaware corporation, and its predecessor organizations have been active in the mobile hydraulics industry since the 1960s. Sauer-Danfoss is a global leader in the development, manufacture, and marketing of advanced systems for the distribution and control of power in mobile equipment. The Company designs, manufactures, and markets hydraulic, electronic, electric, and mechanical components, as well as software and integrated systems that generate, transmit, and control power in mobile equipment. Principal products are hydrostatic transmissions, open circuit piston pumps, open circuit gear pumps and motors, low speed high torque motors, steering units, microprocessor controls, electrohydraulics, and control valves. The Company sells its products to original equipment manufacturers (OEMs) of highly engineered, off-road vehicles who use Sauer-Danfoss products to provide the hydraulic and electronic power for the propel, work, and control functions of their vehicles. The Company's products are sold primarily to the agriculture, construction, road building, turf care, material handling, and specialty vehicle markets. The Company conducts its business globally under the Sauer-Danfoss name.

In 2009 the Company completed the sale of its alternating current (AC) electric motor business which sold products into the material handling market. This resulted in total expense of approximately $14.7 million, of which $6.3 million and $8.4 million was recognized in 2009 and 2008, respectively. This expense was reported in the Controls segment. During 2009 the Company also sold the assets of its steering column business which was located in Kolding, Denmark. The loss on sale of the business of $2.7 million was reported in the Work Function segment.

In July 2009 the Company and Topcon Positioning Systems, Inc. (Topcon), the noncontrolling interest partner, agreed to terminate the joint venture they have operated since April 2001 through TSD Integrated Controls, LLC (TSD). The termination was effective September 1, 2009 but is subject to a three-year wind-down period as contemplated in the 2001 Joint Venture Agreement.

On December 22, 2009 Danfoss A/S, the majority stockholder of the Company, issued a press release announcing its intention, through its wholly owned subsidiary, Danfoss Acquisition, Inc., to commence a cash tender offer to be followed (in certain circumstances) by a statutory merger for the purpose of acquiring all the outstanding shares of Company common stock not already owned, directly or indirectly, by Danfoss A/S for a price of $10.10 per share. On January 15, 2010 Danfoss issued a press release announcing an indeterminate delay in launching its proposed tender offer. As of March 3, 2010 Danfoss had not commenced the proposed tender offer.

(b) Financial Information About Segments

The Company reports its operating segments based on its product lines of Propel, Work Function, and Controls. Propel products include hydrostatic transmissions and related products that transmit the power from the engine to the wheel to propel a vehicle. Work Function products include steering motors as well as gear pumps and motors that transmit power for the work functions of the vehicle. Products in the Controls segment include electrohydraulic controls, microprocessors, and valves that control and direct the power of a vehicle. Information about the Company's reportable segments defined by product lines is set forth in Note 17 in the Notes to Consolidated Financial Statements on pages F-37 through F-39 of this report and is incorporated herein by reference.

(c) Description of Business

Information regarding the Company's principal products, by segment, and the business in general is presented below. Information regarding sales by the Company's segments and geographic regions is set

2

forth in Note 17 in the Notes to Consolidated Financial Statements on pages F-37 through F-39, and is incorporated herein by reference. No individual customer accounted for 10 percent or more of the Company's total net sales in 2009, 2008, or 2007.

Propel Segment

Hydrostatic Transmissions

Sauer-Danfoss designs, manufactures, and markets a range of closed circuit axial and bent axis piston hydrostatic transmissions for the propulsion of mobile equipment in the Americas, Europe, and Asia-Pacific region. High-power (typically over 50 HP) and medium-power (typically 25 to 50 HP) applications for hydrostatic transmissions manufactured by the Company include construction, road building, specialty, and agricultural mobile equipment. Light-power (typically 15 to 25 HP) and bantam-power (typically under 15 HP) applications for hydrostatic transmissions manufactured by the Company include light agricultural and turf care mobile equipment. The Company manufactures these hydrostatic transmissions at its facilities in Ames, Iowa; Sullivan, Illinois; Princeton, Kentucky; Freeport, Illinois; Neumünster, Germany; Dubnica nad Váhom, Slovakia; Povazská Bystrica, Slovakia; Shanghai, China; and Osaka, Japan.

Open Circuit Piston Pumps

Sauer-Danfoss designs, manufactures, and markets open circuit piston pumps used to transform mechanical power from the engine to hydraulic power for the various functions of the vehicle. The advantages of open circuit piston pumps compared to other types of pumps, such as vane or gear pumps, are the high degree of control within the work function hydraulic system and the more efficient use of engine power. These products are designed and manufactured at facilities in Ames, Iowa and Dubnica nad Váhom, Slovakia.

Work Function Segment

Open Circuit Gear Pumps and Motors

Sauer-Danfoss designs, manufactures, and markets a broad range of high-performance standard gear pumps and motors. Gear pumps and motors are the most widely used type of mobile hydraulic pumps and motors in the industry. The Company manufactures gear pumps and motors at its Lawrence, Kansas; Bologna, Italy; and Povazská Bystrica, Slovakia facilities.

Low Speed High Torque Motors

Sauer-Danfoss designs, manufactures, and markets a complete line of geroller and gerotor motors used for both propel and work functions in all served markets. These motors are manufactured at the Company's Lawrence, Kansas; Nordborg, Denmark; and Bielany Wroclawskie, Poland facilities.

Steering Units

Sauer-Danfoss designs, manufactures, and markets hydrostatic steering units to customers throughout the world. These steering units convert steering wheel motion into hydraulic flow and pressure to provide steering motion for agricultural tractors, combines, turf care, marine, and earthmoving equipment. The Company manufactures steering units in Nordborg, Denmark; Wroclaw, Poland; and Pune, India.

3

Controls Segment

Mobile Electronics

Sauer-Danfoss designs, manufactures and markets a portfolio of electronic controls, including microprocessor-based controllers (both generic type to control any mobile machinery and specialized to control speed variability of alternating current electric motors), intelligent displays, joysticks and electronic sensors through its electronic and mechatronic operations in Minneapolis, Minnesota; Älmhult, Sweden; Kaiserslautern, Germany; Neumünster, Germany; and Nordborg, Denmark. The software to integrate all these components into systems is also developed by Sauer-Danfoss and licensed to customers to let them develop their own solutions in an easy-to-use, graphical environment. Electronic controls and software are used by OEMs to network hydrostatic transmissions and work function hydraulics of mobile equipment into comfortable, safe and efficient systems. The Company divested its alternating current (AC) electric motors and generators business in 2009.

Control Valves

Sauer-Danfoss designs, manufactures and markets a variety of spool type control valves to meet its customers' needs, ranging from very sophisticated electrohydraulic valves for highly sophisticated forestry and agricultural harvesting equipment, to very simple low-cost valves for compact utility tractors. These products are manufactured in facilities located in Caxias do Sul, Brazil; Nordborg, Denmark; Easley, South Carolina; and Pune, India.

The Company also designs, manufactures and markets a complete line of cartridge valves and hydraulic integrated circuits in facilities located in Reggio Emilia, Italy; Easley, South Carolina; and Caxias do Sul, Brazil. Aerial lift platforms and road building equipment are significant users of cartridge valves.

Major Markets and Applications

Construction and Road Building

|

Agriculture and Turf Care | Material Handling and Specialty Vehicles |

||

|---|---|---|---|---|

Chip spreaders |

Combines |

Industrial lift trucks | ||

Concrete pumps |

Commercial wide-area, |

Logging equipment | ||

Concrete saws |

walk-behind mowers |

Marine equipment | ||

Crawler dozers |

Commercial zero-turn mowers |

Mining equipment | ||

Crawler loaders |

Cotton pickers |

Oil field equipment | ||

Ditchers/trenchers |

Detasslers |

Railway maintenance vehicles | ||

Excavators |

General turf maintenance |

Rough terrain fork lifts | ||

Grinders |

equipment |

Self-propelled boom aerial lifts | ||

Landfill compactors |

Harvesters |

Self-propelled scissor aerial lifts | ||

Pavers |

Lawn and garden tractors |

Snow groomers | ||

Planers |

Seeders |

Sweepers | ||

Rollers |

Sprayers |

Tree shakers | ||

Skid steer loaders |

Tractors |

Truck and bus fan drives | ||

Transit mixers |

Windrowers |

Warehouse trucks | ||

Utility tractors |

||||

Wheel loaders |

General Characteristics

Sauer-Danfoss sells both standard and customized products, with most products being built to order. With respect to some of the most technologically demanding vehicles, such as those used in agriculture, forestry, construction, and road building, Sauer-Danfoss' engineers work closely with customers from design through manufacture of the final product. The research and design phase, which is funded by the

4

Company, can range from a few weeks to as long as four to six years for a major application. Once the design has been accepted and the customer has placed an order, the manufacturing process typically takes only a few days.

Sauer-Danfoss operates 20 manufacturing facilities in the Americas, Europe, and the Asia-Pacific region. The Company's decentralized manufacturing capabilities allow it to adapt its products to local market needs and to provide flexibility to meet customer delivery requirements. The Company sells and distributes its products directly to large OEMs and serves smaller OEMs through Company-owned sales companies or independent distributors.

In accordance with standard industry practice for the mobile equipment industry, the Company warrants its products to be free from defects in material and workmanship. The warranty period varies from one to three years, from the date of first use or date of manufacture, depending on the type of product or, in some cases, the application. The Company's warranty expense has been two percent or less of net sales in each of the past three years.

Because many of its products are designed and developed in conjunction with its customers' design teams to fit their specific needs and to minimize inventory levels, the Company primarily manufactures products to order. The Company typically machines components with long lead times according to a sales forecast and machines certain unique components for specific customers according to firm orders. Inventories at the Company's manufacturing sites consist primarily of raw materials and machined iron housings and components. Limited amounts of assembled finished units are maintained in inventory at the manufacturing sites. Some of the Company's sales locations maintain inventory that consists primarily of finished units manufactured specifically for distribution to customers in those locations.

The Company does not accept orders subject to late delivery penalties. On occasion, the Company sells its products to government agencies, including those used for military applications, but it does not design its products to meet specific government standards and usually only enters into contracts for the supply of commercial products. There are no government contracts of material value to the Company.

Raw Materials

The Company purchases iron housings and components from various U.S., European, and Asian foundries and metal suppliers. The principal materials used by the Company are iron, steel, brass, and aluminum. All materials used by the Company are generally available from a number of sources in quantities sufficient to meet current requirements. The Company has a global supplier quality program that it uses to ensure all suppliers meet the Company's quality expectations.

Patents, Trademarks, and Licenses

The Company owns or licenses rights to approximately 560 patents and trademarks relating to its business. While the Company considers its patents and trademarks important in the operation of its business and in protecting its technology from being used by competitors, its business is not dependent on any single patent or trademark or group of related patents or trademarks.

To ensure worldwide availability of the Company's design of products, the Company has, in the past, licensed its technology to unaffiliated companies in certain countries. The Company does not currently have any such license agreements in place. The Company currently has license agreements in place as part of joint ventures in which the Company participates to manufacture or distribute the Company's technology.

Seasonality

Seasonal patterns in retail demand for agricultural, construction, road building, and turf care equipment sold by the Company's customers result in variations in the volume and mix of products sold by

5

the Company during various times of the year. Historically, the Company has higher sales levels in the first half of the year. Seasonal demand must be estimated in advance, and products must be manufactured in anticipation of such demand in order to achieve efficient utilization of labor and production resources.

Working Capital

The Company has historically funded its working capital requirements through cash flow from operations and its various credit facilities. As described in Note 8 in the Notes to the Consolidated Financial Statements on page F-21 of this report, the Company has a credit facility in place which allows them to borrow up to $690 million from Danfoss A/S, the Company's majority shareholder. The Company is heavily reliant on Danfoss A/S as its primary external source of working capital financing.

Backlog

At December 31, 2009 the Company's backlog (consisting of accepted but unfilled customer orders primarily scheduled for delivery during 2010) was $509 million, a decrease of 33 percent from December 31, 2008, excluding the impact of currency fluctuation. Historically, backlog comparisons have been a good indicator of the Company's future business level, but the value of those comparisons depends on the degree to which customer ordering behavior remains constant from year to year. Customers can increase, cancel, or reschedule orders, so some customers place orders in excess of their actual needs in order to ensure that adequate quantities will be available. In such a case, the customer may ultimately cancel a portion of its order. The 33 percent decline in backlog is compared to an inflated backlog from a year ago before many of the Company's customers had started to cut orders and is not reflective of the improvement in sales the Company is seeing in 2010.

Competition

The mobile hydraulics industry is very competitive. Sauer-Danfoss competes based on technological product innovation, quality, and customer service. The Company believes that to be successful over the long term, suppliers to mobile equipment manufacturers must have the ability to capitalize on the changing needs of the industry by providing technological innovation, shorter product development times, and reduced manufacturing lead times at globally competitive price levels.

Hydrostatic Transmission Market

The closed circuit hydrostatic transmission market is highly concentrated and intensely competitive. There are a small number of manufacturers of hydrostatic transmissions with which the Company competes worldwide that are not captive suppliers of OEMs. These include Bosch Rexroth AG, Eaton Corporation, and Linde AG. In addition, the Company competes with alternative products, such as mechanical transmissions of other manufacturers.

The Company competes with a number of smaller companies that typically offer a single, specialized product on a more limited geographic basis as a component of a closed circuit hydrostatic transmission system.

In terms of global supply of closed circuit hydrostatic transmissions, the Company believes it is the world leader in terms of product range, market share, and geographic coverage. Only Bosch Rexroth AG offers similar geographic coverage.

Open Circuit Piston Pumps, Gear Pumps and Motors Market

The open circuit work function market is fragmented with a large number of suppliers of all types of products and with intensive competition on pricing at the component level. There are approximately ten major companies that compete on a global basis, including Bosch Rexroth AG, Parker-Hannifin

6

Corporation, Casappa S.p.A. and Haldex, and in Japan, Shimadzu Corporation. The supply of standard gear pumps and motors is particularly fragmented with more than 50 companies worldwide in each respective area. Most of these competitors have a limited product range and operate in a limited geographic market. The market for these products is rapidly increasing for engine cooling fan drive applications being requested for upcoming new emissions regulations.

Low Speed High Torque Motor Market

There are a limited number of competitors who can provide a complete line of low speed, high torque motors (LSHT). Competitors include Eaton Corporation, Bosch Rexroth AG, White Drive Products, Parker-Hannifin Corporation, and M+S Hydraulic. This market is highly price-competitive and is growing, providing Sauer-Danfoss opportunity to develop new products to increase market share.

Steering Unit Market

Hydrostatic steering units are provided to the market from more than ten competitors, the major ones being Eaton Corporation, Zhenjiang Hydraulic Components Manufacturing Co., Ltd., Ognibene S.p.A., Bosch Rexroth AG, M+S Hydraulic and Parker-Hannifin Corporation. Sauer-Danfoss believes it has the largest European market share for steering units and an increasing share globally. As steering systems grow and needs expand, Sauer-Danfoss is providing electronic control of steering and complete electrical steering solutions to meet the growing demands of the steering market. Today, Sauer-Danfoss believes that it leads the industry in this direction for steering technology.

Mobile Electronics Market

In the mobile electronics market, which covers both propulsion and work function systems, there are few suppliers of propulsion system controls and only three are worldwide competitors. The main competition in this area comes from major OEMs, who produce controls for their own use. In work function electrohydraulic valves and electronic controls, there is a wide range of niche suppliers in limited geographic markets. In recent years, larger companies have increasingly acquired these niche or regional suppliers and thereby have improved their ability to offer integrated systems. The Company believes it is well positioned to establish itself as a technology leader in the work function and propel segments, as there is no clearly established technology in this sector that is deemed to be an industry standard.

Control Valves Market

The control valves marketplace is fragmented with a large number of suppliers, most of which are focused on limited valve types or flow ranges. Sauer-Danfoss provides a comprehensive line of both spool valves and cartridge valves to meet the specific needs of its customers. Competitors who provide partial lines include HydraForce, Sterling Hydraulics, HUSCO International, Sun Hydraulics Corporation, Integrated Hydraulics Limited, Walvoil S.p.A., and Bosch Rexroth Oil Control S.p.A., plus many others. Complete global control valve line competitors are limited to Parker-Hannifin Corporation, Bosch Rexroth AG, and Eaton Corporation. Sauer-Danfoss believes growth in this market will be higher than historical levels related to its new product introductions and the implementation of new emissions regulations.

Research and Development

The Company's research and development expenditures during 2009, 2008, and 2007 were approximately $61.4 million, $82.9 million, and $70.6 million, respectively.

7

Environmental Matters

In all countries in which it operates, the Company is subject to environmental laws and regulations concerning emissions to air, discharge to waterways, and the generation, handling, storage, transportation, treatment, and disposal of waste materials. These laws and regulations are constantly evolving, and it is impossible to predict accurately the effect they will have on the Company in the future. The regulations are subject to varying and conflicting interpretations and implementation. In some cases, compliance can only be achieved by additional capital expenditures. The Company cannot accurately predict what capital expenditures, if any, may be required to comply with applicable environmental laws and regulations in the future; however, the Company does not currently estimate that any future capital expenditures for environmental control facilities will be material. The Company is not currently subject to any governmental remediation order, nor is the Company aware of any environmental issues that would have a materially adverse effect on the Company.

Employees

As of December 31, 2009, 2008, and 2007 the Company had approximately 6,100, 9,600, and 9,800, employees, respectively. Of its full-time employees at December 31, 2009, approximately 1,800 were located in the Americas with the remaining located in Europe and the Asia-Pacific region. From time to time, the Company also retains consultants, independent contractors, and temporary and part-time workers.

Financial Information about Geographic Areas

Information regarding the Company's net sales and long-lived assets by geographic area is set forth in Note 17 in the Notes to Consolidated Financial Statements on pages F-40 through F-42 of this report, and is incorporated herein by reference.

Available Information

The Company maintains an internet website and the address of that site is http://www.sauer-danfoss.com. The Company provides access to its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) of the Securities Exchange Act of 1934 through its internet website as soon as reasonably practicable after the Company electronically files such material with, or furnishes it to, the Securities and Exchange Commission (SEC). The SEC maintains an internet website that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of the SEC site is http://www.sec.gov.

The Company's business, financial condition, results of operations and cash flows can be affected by a number of factors, including but not limited to those set forth below and elsewhere in this annual report on Form 10-K, any one of which could cause actual results to vary materially from recent results or from anticipated future results.

Worldwide Economic Conditions

As has been widely reported, the financial markets in the U.S., Europe, and the Asia-Pacific region have been in a period of severe disruption over the last year. The turbulence has been most immediately evident in the extreme tightening of credit markets, the resulting loss of liquidity, and historic drops in stock prices. In response, governments around the world have taken unprecedented steps intended to minimize the depth and breadth of the crisis. There are indications that the economic situation may be

8

beginning to improve in 2010, however it is impossible to predict if the improvement will continue and at what rate the improvement will occur.

These economic developments in 2008 and 2009 have adversely affected the Company's business, financial condition, and results of operations in a number of ways, and they will likely continue to adversely impact the Company until the economic conditions improve. Tightening credit markets could have a material impact on the Company's customers and suppliers and their ability to finance their operations, which could result in a decrease in, or deferral of, orders for the Company's products or an increase in the Company's cost of production. A prolonged economic slowdown, recession, or depression could similarly have a material and adverse impact on the Company's business, financial condition, and results of operations.

The Company experienced a significant decline in the demand for its products during 2009 as a result of the substantial deterioration in economic conditions. Many of the Company's customers chose to delay their purchases of the Company's products. Current indications are that demand for the Company's products will increase in 2010. Customer spending on the Company's products is not discretionary, but the Company is unable to predict the level of growth expected in 2010 as customers increase their spending. Ongoing depressed demand for the Company's products could result in decreased revenues, profitability and cash flows and may impair the Company's ability to maintain operations and fund obligations to others.

Avoidance of Credit Default; Dependence on Affiliate Borrowing

As a result of the deterioration of its financial condition in early 2009 resulting from the impact of the worldwide economic downturn on its business, the Company entered into a Credit Agreement with Danfoss A/S, the Company's majority stockholder, in March 2009, to refinance and avoid default on certain credit agreements in existence at that time and to fund a significant portion of the Company's working capital and other needs. In November 2009 the Company refinanced that agreement with a new agreement with Danfoss A/S which requires repayment in April 2011.

In borrowing significant funds from Danfoss A/S, the Company is heavily dependent on Danfoss A/S for the Company's working capital and other funding needs. In light of the Company's anticipated leverage ratios over at least the near term, the Company may not be able to borrow from sources other than Danfoss A/S on reasonable terms. If Danfoss A/S were unable to borrow or otherwise generate sufficient funds to meet the Company's borrowing requirements or were to become unwilling to continue lending to the Company on favorable terms, the Company's business, results of operations, and financial position could be materially and adversely affected.

Goodwill and Long-Lived Assets Impairment

If the price of the Company's stock were to decline to the point that its market capitalization were lower than its carrying value, the Company may be required to perform interim impairment tests on goodwill or other long-lived assets. There may be other triggering events that indicate that the carrying amount of goodwill or long-lived assets may not be recoverable from future cash flows. If the Company determines that any goodwill or other long-lived asset amounts need to be written down to fair values, this could result in a charge that may be material to the Company's operating results and financial condition.

International Operations

The Company depends on the strength of the economies in various parts of the world, particularly in the U.S. and Europe. As a result of this worldwide exposure, net revenue and profitability may be harmed as a result of economic conditions in the major markets in which the Company operates, including, but not limited to, recessions, inflation and deflation, general weakness in the agriculture, construction and

9

specialty markets, changes in governmental laws and policies, government embargoes or foreign trade restrictions, duties and tariffs, import and export controls, and changes in consumer purchasing power.

Technology Change

The hydraulic industry and markets for component parts of mobile hydraulics are subject to technological change, evolving industry standards, changing customer requirements and improvements in and expansion of product offerings. Although the Company believes that it has the technological capabilities to remain competitive, technological advances or developments by competitors or others could result in the Company needing to make significant capital expenditures in order to remain competitive and to avoid material adverse effects on its business, financial conditions and results of operations.

Common Business System

The Company has implemented a common business system at the majority of its locations. Any significant problems incurred related to operation of the system may delay or stop manufacturing and hinder the Company's ability to ship product in a timely manner or affect the Company's ability to access financial information. These problems could result in the loss of customers, a decrease in revenue, or significant costs to correct the problem.

Raw Material Availability

The Company purchases raw materials and component parts from suppliers to be used in the manufacture of products. Due to the worldwide economic situation many of the raw material suppliers have reduced their output accordingly. In the past year the Company has been able to reduce its inventory levels significantly; this, accordingly, has led to a decrease in its demand for raw materials. In the event of a substantial increase in demand, difficulties in purchasing raw materials and price increases may be experienced.

Pricing and Competitive Pressures from OEM Customers

A majority of the Company's sales are directly to OEM customers. OEM customers continue to use their positions as volume purchasers in the mobile hydraulics market to obtain preferential pricing and to obtain substantial quality assurance protection from suppliers.

Currency Exchange Rates

The Company has a number of manufacturing sites throughout the world and sells products in several countries other than those where the product is manufactured. As a result, the Company has exposure to changing exchange rates between the various currencies in its customers' countries and the currencies in which the Company's manufacturing facilities are located. The Company's most significant foreign currency exposures are the euro, Japanese yen, Polish zloty, Chinese yuan and Danish kroner. Exchange rate fluctuations between these currencies and against the U.S. dollar or euro could adversely affect the Company's results of operations. The Company enters into forward contracts to reduce the impact of currency fluctuations on cash flows related to forecasted sales denominated in currencies other than the functional currency of the selling location.

Cyclicality: Risks Associated with General Economic Conditions

The capital goods industry in general, and mobile hydraulics industry in particular, are subject to economic cycles. Cyclical downturns had a material adverse effect on the demand for the Company's products in 2009, as well as in past years. Future cyclical downturns may negatively impact the Company's business, financial condition, and results of operations. Demand for the Company's products is dependent upon the general condition of the off-highway mobile equipment industry which may be affected by

10

numerous factors, including levels of construction activity, weather conditions, interest rates and access to financing. The Company's results of operations are also subject to price competition and the cost of supplies and labor, both of which are affected by general economic conditions. The Company derives substantial sales from cyclical industries, including the turf care, material handling, construction and agricultural equipment industries.

Income Tax Estimates

The Company is subject to income taxes in the U.S. and numerous non-U.S. jurisdictions. Significant judgment is required in determining the Company's worldwide provision for income taxes. In the ordinary course of business, there are many transactions and calculations where the ultimate tax determination is uncertain. The Company is periodically under audit by tax authorities. Although management believes its tax estimates are reasonable, the final outcome of tax audits and any related litigation could be materially different than that which is reflected in historical income tax provisions and accruals. If the outcome of a given tax audit or related litigation is materially different from the Company's estimates, the determination could result in material differences between the Company's originally reported income tax provision or net income (loss) and the final reported financial results.

Catastrophic Events

Unforeseen events, including war, terrorism and other international conflicts, public health issues, and natural disasters such as earthquakes, hurricanes or other adverse weather and climate conditions, whether occurring in the U.S. or abroad, could disrupt the Company's operations, disrupt the operations of suppliers or customers, or result in political or economic instability. These events could reduce demand for hydraulic and electric products and make it difficult or impossible for the Company to manufacture products, deliver products to customers, or to receive products from suppliers.

The foregoing list is not exhaustive. There can be no assurance that the Company has correctly identified and appropriately assessed all factors affecting the Company or that the publicly available and other information with respect to these matters is complete and correct. Additional risks and uncertainties not presently known to the Company or that are currently believed to be immaterial also may adversely impact the business. Should any risks or uncertainties develop into actual events, these developments could have a material adverse effect on the Company's business, financial condition, and results of operations.

11

Sauer-Danfoss Inc. conducts its manufacturing operations at 20 locations; seven in the United States, two each in Slovakia, Poland and Italy, and one each in Brazil, China, Denmark, Germany, India, Japan, and Sweden. The following table sets forth certain information relating to the Company's principal manufacturing facilities:

Location

|

Segment that Uses the Facility | Approx. Area in Sq. Ft. |

Owned/Leased | |||||

|---|---|---|---|---|---|---|---|---|

United States |

||||||||

Ames, Iowa |

Propel | 359,100 | Owned | |||||

Sullivan, Illinois |

Propel | 205,000 | Owned | |||||

Freeport, Illinois |

Propel | 197,000 | Owned | |||||

Easley, South Carolina |

Controls | 184,000 | Owned | |||||

Lawrence, Kansas |

Work Function | 157,500 | Owned | |||||

Minneapolis, Minnesota |

Controls | 75,000 | Leased | |||||

Princeton, Kentucky |

Propel | 68,000 | Owned | |||||

South America |

||||||||

Caxias do Sul, Brazil |

Controls | 90,000 | Leased | |||||

Europe |

||||||||

Nordborg, Denmark |

Work Function and Controls | 818,000 | Leased | |||||

Neumünster, Germany |

Propel and Controls | 421,500 | Owned | |||||

Povazská Bystrica, Slovakia |

Propel, Work Function and Controls | 357,000 | Owned | |||||

Dubnica nad Váhom, Slovakia |

Propel | 251,000 | Owned | |||||

Bielany Wroclawskie, Poland |

Work Function | 223,000 | Leased | |||||

Wroclaw, Poland |

Work Function | 126,000 | Owned | |||||

Bologna, Italy |

Work Function | 85,000 | Owned | |||||

Reggio Emilia, Italy |

Controls | 76,500 | Leased | |||||

Älmhult, Sweden |

Controls | 50,000 | Leased | |||||

India |

||||||||

Pune, India |

Work Function and Controls | 63,500 | Owned | |||||

Asia |

||||||||

Shanghai/Pudong, China |

Propel and Controls | 105,000 | Leased | |||||

Osaka, Japan |

Propel | 94,000 | Leased | |||||

Total |

4,006,100 | |||||||

The Company has been named as a defendant in four putative stockholder class action complaints (collectively, the Lawsuits) challenging the proposal by Danfoss Acquisition Inc. (Danfoss Acquisition), a wholly owned subsidiary of Danfoss A/S (Danfoss), to make a tender offer to purchase all of the outstanding shares of Company common stock not presently held, directly or indirectly, by Danfoss (Proposed Tender Offer). Three of the Lawsuits were filed on December 23, 2009, two in the Court of Chancery of the State of Delaware by Kenneth R. Loiselle and Laurie Forrest, respectively, and the other in the Iowa District Court for Story County by John and Michelle Freise. The two Delaware lawsuits have been consolidated into a single proceeding. The fourth Lawsuit was filed on February 10, 2010, in the Iowa District Court for Story County by Scott Crouthamel. Each of the Lawsuits was filed on behalf of the named plaintiffs and the other minority stockholders of the Company. The defendants in the Lawsuits are the Company, Danfoss, Danfoss Acquisition, the directors of the Company, Klaus Murmann (a former director and current Chairman Emeritus of the Company), David J. Anderson (a former director and former Chief Executive Officer of the Company), and Frederik Lotz (a former director of the Company

12

and the former Chief Financial Officer of Danfoss). Each Lawsuit is premised on allegations that the price offered in the Proposed Tender Offer is inadequate and that the defendants have breached their fiduciary duties to the Company's stockholders in connection with the Proposed Tender Offer. The plaintiffs seek, among other things, preliminary and permanent injunctive relief enjoining the Proposed Tender Offer, rescission of the Proposed Tender Offer, and payment of damages and costs incurred as a result of the Proposed Tender Offer. The Company believes that it has valid defenses with respect to these claims and intends to defend itself vigorously against them. The Lawsuits are all in preliminary stages, so it is not possible for the Company to predict their outcomes with any certainty. It is possible that one or more of the Lawsuits could have a materially adverse effect on the Company's results of operations, liquidity, or financial position.

From time to time, the Company is involved in other legal matters in the ordinary course of its business. The Company intends to defend itself vigorously against all such claims. It is the Company's policy to accrue for amounts related to lawsuits brought against it if it is probable that a liability has been incurred and an amount can be reasonably estimated. Although the outcome of such matters cannot be predicted with certainty and no assurances can be given with respect to such matters, the Company believes that the outcome of those ordinary-course matters in which it is currently involved will not have a materially adverse effect on its results of operations, liquidity, or financial position.

EXECUTIVE OFFICERS OF THE COMPANY

The following table sets forth certain information regarding the executive officers of the Company:

Name

|

Age | Position | Year Appointed |

||||||

|---|---|---|---|---|---|---|---|---|---|

Sven Ruder(1) |

53 | President and Chief Executive Officer | 2009 | ||||||

Jesper V. Christensen(2) |

40 | Executive Vice President and Chief Financial Officer | 2009 | ||||||

C. Kells Hall(3) |

61 | Executive Vice President and President Propel Division | 2009 | ||||||

Timothy P. Hanson(3)(4) |

59 | Vice President—Sales and Marketing | 2010 | ||||||

Wolfgang Schramm(5) |

55 | Executive Vice President and President Controls Division | 2007 | ||||||

Kenneth D. McCuskey(3) |

55 | Vice President and Chief Accounting Officer, Secretary | 2000 | ||||||

Charles M. Cohrs(3) |

47 | Treasurer | 2005 | ||||||

- (1)

- Prior

to joining the Company, Mr. Ruder was employed as President of the Motion Controls Division of Danfoss A/S, the majority stockholder of the

Company.

- (2)

- Prior

to joining the Company, Mr. Christensen was employed as Vice President, Finance, IT & HR in the Motion Controls Division of Danfoss A/S,

the majority stockholder of the Company.

- (3)

- These

executive officers have served in various capacities with the Company or its subsidiaries for more than the past five years.

- (4)

- Mr. Hanson

is filling the position of Chief Marketing Officer on an interim basis until a permanent replacement is identified. Mr. Hanson

plans to retire in August 2010.

- (5)

- Prior to joining the Company, Mr. Schramm was employed by Visteon Corporation as Executive Director Advanced Technology.

13

Item 5. Market for the Company's Common Stock, Related Stockholder Matters and Company Purchases of Common Stock.

Market and Dividend Information

The Company's Common Stock is traded on the New York Stock Exchange. As of March 1, 2010 there were 202 stockholders of record.

The Company historically paid a quarterly dividend. Quarterly dividends are subject to Board of Directors approval. On March 13, 2009 the Board of Directors voted to suspend the Company's quarterly dividend indefinitely, beginning with the dividend that would ordinarily have been declared during the first quarter of 2009.

The following table sets forth the high and low prices on the New York Stock Exchange for the Company's Common Stock since January 1, 2008, and the quarterly cash dividends declared in 2009 and 2008:

| |

1st | 2nd | 3rd | 4th | Full Year | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

2009 |

||||||||||||||||

High |

$ | 10.13 | $ | 7.08 | $ | 8.19 | $ | 12.68 | $ | 12.68 | ||||||

Low |

$ | 2.43 | $ | 2.37 | $ | 4.50 | $ | 6.71 | $ | 2.37 | ||||||

Dividends |

$ | 0.00 | $ | 0.00 | $ | 0.00 | $ | 0.00 | $ | 0.00 | ||||||

2008 |

||||||||||||||||

High |

$ | 25.41 | $ | 37.93 | $ | 35.10 | $ | 24.75 | $ | 37.93 | ||||||

Low |

$ | 17.68 | $ | 22.23 | $ | 22.63 | $ | 5.52 | $ | 5.52 | ||||||

Dividends |

$ | 0.18 | $ | 0.18 | $ | 0.18 | $ | 0.18 | $ | 0.72 | ||||||

Performance Graph

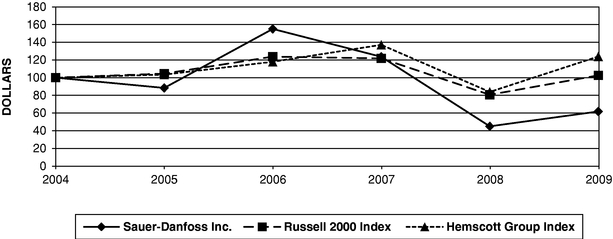

The following graph shows a comparison of the cumulative total returns from December 31, 2004 to December 31, 2009, for the Company, the Russell 2000 Index and the Hemscott, Inc.—Diversified Machinery Index ("Hemscott Group Index"). The graph assumes that $100 was invested on December 31, 2004 in the Company's common stock, the Russell 2000 Index and the Hemscott Group Index, a peer group index, and that all dividends were reinvested.

COMPARISON OF 5-YEAR CUMULATIVE TOTAL RETURN

AMONG SAUER-DANFOSS INC.,

RUSSELL 2000 INDEX AND HEMSCOTT GROUP INDEX

ASSUMES $100 INVESTED ON 12/31/04

ASSUMES DIVIDEND REINVESTMENT

FISCAL YEAR ENDING 12/31/09

14

Equity Compensation Plan Information

The following table summarizes, as of December 31, 2009, information about compensation plans under which equity securities of the Company are authorized for issuance:

Plan Category

|

Number of Securities to be Issued upon Exercise of Outstanding Options, Warrants and Rights (a) |

Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights (b) |

Number of Securities Remaining Available for Future Issuance under Equity Compensation Plans (Excluding Securities Reflected in Column(a)) (c) |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

Equity compensation plans approved by security holders |

293,803 | $ | 0.00 | 4,691,210 | ||||||

The Company does not have any equity compensation plans that were not approved by security holders. Refer to Note 13 in the Notes to the Consolidated Financial Statements on pages F-35 through F-37 of this report for a description of the equity compensation plans.

Column (a) includes performance units granted in 2008. The extent to which the performance goals established for each grant are met will determine how many shares of common stock are issued upon completion of the three-year performance period. Subsequent to December 31, 2009, the Company's Compensation Committee determined that the 2007 performance units would vest at 0.0 percent of the target levels, because the performance criteria established when such units were awarded had not been met. Therefore no amounts are included above for the 2007 performance units. The 2008 performance units are included at 100 percent of the target levels.

Column (c) includes 1,343,294 shares available for future issuance under the Company's 1998 Long-Term Incentive Plan, 3,192,559 shares available for issuance under the Company's 2006 Omnibus Incentive Plan, and 155,357 shares available for issuance under the Company's Non-Employee Director Stock Option and Restricted Stock Plan. Each of these plans permits the Company to issue common stock at times other than upon the exercise of options, warrants, or rights; for example, issuance in the form of restricted stock grants.

15

Item 6. Selected Financial Data.

| |

2009 | 2008 | 2007 | 2006 | 2005 | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

(in millions except per share) |

||||||||||||||||

Operating Data: |

|||||||||||||||||

Net sales |

$ | 1,159.0 | $ | 2,090.5 | $ | 1,972.5 | $ | 1,739.1 | $ | 1,547.8 | |||||||

Gross profit |

128.0 | 435.6 | 427.7 | 396.8 | 357.7 | ||||||||||||

Selling, general and administrative |

209.7 | 258.5 | 233.8 | 215.6 | 217.1 | ||||||||||||

Research and development |

61.4 | 82.9 | 70.6 | 61.9 | 58.7 | ||||||||||||

Impairment charges |

50.8 | 58.2 | — | 1.5 | — | ||||||||||||

Loss on sale of businesses and asset disposals |

16.4 | 9.6 | 9.4 | 1.7 | 1.4 | ||||||||||||

Total operating expenses |

338.3 | 409.2 | 313.8 | 280.7 | 277.2 | ||||||||||||

Total interest expense, net |

48.4 | 24.6 | 22.7 | 17.8 | 15.7 | ||||||||||||

Net income (loss) |

(345.8 | ) | (29.1 | ) | 47.2 | 54.0 | 34.8 | ||||||||||

Per Share Data: |

|||||||||||||||||

Income (loss) per common share, basic |

$ | (7.15 | ) | $ | (0.60 | ) | $ | 0.98 | $ | 1.13 | $ | 0.73 | |||||

Income (loss) per common share, diluted |

$ | (7.15 | ) | $ | (0.60 | ) | $ | 0.98 | $ | 1.12 | $ | 0.73 | |||||

Cash dividends declared per share |

$ | — | $ | 0.72 | $ | 0.72 | $ | 0.60 | $ | 0.48 | |||||||

Weighted average basic shares outstanding |

48.3 | 48.2 | 48.1 | 47.7 | 47.5 | ||||||||||||

Weighted average diluted shares outstanding |

48.3 | 48.2 | 48.3 | 48.2 | 47.8 | ||||||||||||

Balance Sheet Data: |

|||||||||||||||||

Inventories |

$ | 177.6 | $ | 325.5 | $ | 318.8 | $ | 272.3 | $ | 238.9 | |||||||

Property, plant and equipment, net |

513.5 | 598.4 | 562.8 | 504.0 | 450.4 | ||||||||||||

Total assets |

1,068.3 | 1,467.7 | 1,500.4 | 1,307.1 | 1,166.5 | ||||||||||||

Total debt |

533.2 | 491.4 | 444.0 | 349.6 | 332.3 | ||||||||||||

Stockholders' equity |

154.6 | 477.9 | 586.0 | 515.5 | 494.2 | ||||||||||||

Debt to total capital |

77.5 | % | 50.7 | % | 43.1 | % | 40.4 | % | 40.6 | % | |||||||

Other Data: |

|||||||||||||||||

Backlog (at year-end) |

$ | 509.5 | $ | 743.7 | $ | 921.4 | $ | 631.0 | $ | 504.2 | |||||||

Depreciation and amortization |

117.1 | 113.0 | 102.3 | 95.7 | 88.3 | ||||||||||||

Capital expenditures |

43.0 | 198.6 | 135.6 | 116.2 | 95.2 | ||||||||||||

EBITDA (1) |

(89.9 | ) | 175.6 | 212.6 | 207.6 | 172.3 | |||||||||||

Cash flows from (used in): |

|||||||||||||||||

Operating activities |

86.8 | 183.5 | 98.1 | 167.9 | 116.3 | ||||||||||||

Investing activities |

(42.2 | ) | (187.5 | ) | (122.2 | ) | (109.3 | ) | (93.3 | ) | |||||||

Financing activities |

(24.7 | ) | 4.7 | 22.1 | (45.0 | ) | (20.1 | ) | |||||||||

- (1)

- EBITDA represents net income plus net interest expense, income tax expense, depreciation and amortization, long-lived asset impairment charge and noncontrolling interest. The impairment charge is included as it will reduce depreciation in future years. EBITDA may not be comparable to similarly titled measures reported by other companies. While EBITDA should not be construed as a substitute for operating income or a better indicator of liquidity than cash flow from operating activities, which are determined in accordance with accounting principles generally accepted in the United States, it is included herein to provide additional information as management of the Company believes it provides an indication with respect to the ability of Sauer-Danfoss to meet its future debt service, capital

16

expenditures, and working capital requirements. The following table further demonstrates how EBITDA is derived from cash flows from operating activities:

| |

2009 | 2008 | 2007 | 2006 | 2005 | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Cash flows from operating activities |

$ | 86.8 | $ | 183.5 | $ | 98.1 | $ | 167.9 | $ | 116.3 | |||||||

Increase (decrease) in working capital, excluding the effects of acquisitions Accounts receivable, net |

(91.4 | ) | (71.7 | ) | 38.5 | 24.5 | 4.8 | ||||||||||

Inventories |

(153.4 | ) | 16.8 | 36.6 | 14.2 | 24.9 | |||||||||||

Prepaid and other current assets |

5.0 | 7.9 | 11.1 | 6.1 | (7.9 | ) | |||||||||||

Accounts payable |

54.2 | 14.5 | (11.0 | ) | (27.2 | ) | 13.3 | ||||||||||

Accrued liabilities |

20.7 | (23.6 | ) | 1.5 | (14.0 | ) | (17.6 | ) | |||||||||

Deferred income taxes and other |

(121.2 | ) | 9.5 | (3.7 | ) | 1.3 | 7.9 | ||||||||||

Interest expense, net |

48.4 | 24.6 | 22.7 | 17.8 | 15.7 | ||||||||||||

Tax expense |

61.0 | 14.1 | 18.8 | 17.0 | 14.9 | ||||||||||||

EBITDA |

$ | (89.9 | ) | $ | 175.6 | $ | 212.6 | $ | 207.6 | $ | 172.3 | ||||||

17

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

Safe Harbor Statement

This Management's Discussion and Analysis of Financial Condition and Results of Operations, as well as other portions of this annual report on Form 10-K, contain certain statements that constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements provide current expectations of future events based on certain assumptions and include any statement that does not directly relate to any historical or current fact. All statements regarding future performance, growth, sales and earnings projections, conditions or developments are forward-looking statements. Words such as "anticipates," "in the opinion," "believes," "intends," "expects," "may," "will," "should," "could," "plans," "forecasts," "estimates," "predicts," "projects," "potential," "continue," and similar expressions may be intended to identify forward-looking statements.

Actual future results may differ materially from those described in the forward-looking statements due to a variety of factors. Readers should bear in mind that past experience may not be a good guide to anticipating actual future results. Throughout 2009 the economies in the U.S., Europe, and Asia-Pacific suffered from the global recession and credit crisis, weakness in the housing and residential construction markets, weakness in the commercial and public-sector construction markets, job losses, and uncertainty surrounding the effects of government fiscal stimulus plans, interest rates, and crude oil prices. A prolonged downturn in the Company's business segments could adversely affect the Company's revenues and results of operations. Other factors affecting forward-looking statements include, but are not limited to, the following: specific economic conditions in the agriculture, construction, road building, turf care, material handling and specialty vehicle markets and the impact of such conditions on the Company's customers in such markets; the cyclical nature of some of the Company's businesses; the ability of the Company to win new programs and maintain existing programs with its original equipment manufacturer (OEM) customers; the highly competitive nature of the markets for the Company's products as well as pricing pressures that may result from such competitive conditions; the continued operation and viability of the Company's significant customers; the Company's execution of internal performance plans; difficulties or delays in manufacturing; the effectiveness of the Company's cost-reduction and productivity improvement efforts; competing technologies and difficulties entering new markets, both domestic and foreign; changes in the Company's product mix; future levels of indebtedness and capital spending; the ability and willingness of Danfoss A/S, the Company's majority stockholder, to lend money to the Company at sufficient levels and on terms favorable enough to enable the Company to meet its capital needs; the Company's ability to access the capital markets or traditional credit sources to supplement or replace the Company's borrowings from Danfoss A/S if the need should arise; the Company's ability over time to reduce the relative level of debt compared to equity on its balance sheet; claims, including, without limitation, warranty claims, field recall claims, product liability claims, charges or dispute resolutions; ability of suppliers to provide materials as needed and the Company's ability to recover any price increases for materials in product pricing; the Company's ability to attract and retain key technical and other personnel; labor relations; the failure of customers to make timely payment, especially in light of the current credit crisis; any inadequacy of the Company's intellectual property protection or the potential for third-party claims of infringement; global economic factors, including currency exchange rates; credit market disruptions and significant changes in capital market liquidity and funding costs affecting the Company and its customers; general economic conditions, including interest rates, the rate of inflation, and commercial and consumer confidence; energy prices; the impact of new or changed tax and other legislation and regulations in jurisdictions in which the Company and its affiliates operate; actions by the U.S. Federal Reserve Board and the central banks of other nations; actions by other regulatory agencies, including those taken in response to the global credit crisis; actions by rating agencies; changes in accounting standards; worldwide political stability; the effects of terrorist activities and resulting political or economic instability; natural catastrophes; U.S. military action overseas; and the effect of acquisitions, divestitures, restructurings, product withdrawals, and other unusual events.

18

The Company cautions the reader that this list of cautionary statements and risk factors is not exhaustive. The Company expressly disclaims any obligation or undertaking to release publicly any updates or changes to these forward-looking statements to reflect future events or circumstances.

About the Company

Sauer-Danfoss Inc. and subsidiaries (the Company) is a worldwide leader in the design, manufacture, and sale of engineered hydraulic and electronic systems and components that generate, transmit and control power in mobile equipment. The Company's products are used by original equipment manufacturers (OEMs) of mobile equipment, including construction, road building, agricultural, turf care, material handling, and specialty equipment. The Company designs, manufactures, and markets its products in the Americas, Europe, and the Asia-Pacific region, and markets its products throughout the rest of the world either directly or through distributors.

Executive Summary of 2009 Compared to 2008

The nature of the Company's operations as a global producer and supplier in the fluid power industry means the Company is impacted by changes in local economies, including currency exchange rate fluctuations. In order to gain a better understanding of the Company's base results, a financial statement user needs to understand the impact of those currency exchange rate fluctuations. The following table summarizes the change in the Company's results from operations by separately identifying changes due to currency fluctuations and the underlying change in operations from 2008 to 2009. This analysis is more consistent with how the Company's management internally evaluates results.

(in millions)

|

2008 | Currency fluctuations | Underlying change | 2009 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Net Sales |

$ | 2,090.5 | $ | (36.1 | ) | $ | (895.4 | ) | $ | 1,159.0 | ||||

Gross Profit |

435.6 | (4.2 | ) | (303.5 | ) | 127.9 | ||||||||

% of Net Sales |

20.8 | % | 11.0 | % | ||||||||||

Selling, general and administrative |

258.5 | (8.4 | ) | (40.4 | ) | 209.7 | ||||||||

Research and development |

82.9 | (2.3 | ) | (19.2 | ) | 61.4 | ||||||||

Impairment charges |

58.2 | — | (7.4 | ) | 50.8 | |||||||||

Loss on sale of businesses and asset disposals |

9.6 | 0.1 | 6.7 | 16.4 | ||||||||||

Total operating costs |

409.2 | (10.6 | ) | (60.3 | ) | 338.3 | ||||||||

Operating income (loss) |

26.4 | 6.4 | (243.2 | ) | (210.4 | ) | ||||||||

% of Net Sales |

1.3 | % | (18.2 | )% | ||||||||||

Interest expense, net |

(24.6 | ) | 1.3 | (25.1 | ) | (48.4 | ) | |||||||

Loss on early retirement of debt |

— | — | (15.8 | ) | (15.8 | ) | ||||||||

Other, net |

0.9 | 0.1 | 2.3 | 3.3 | ||||||||||

Income (loss) before income taxes |

2.7 | 7.8 | (281.8 | ) | (271.3 | ) | ||||||||

% of Net Sales |

0.1 | % | (23.4 | )% | ||||||||||

Income tax expense |

(14.0 | ) | 0.6 | (47.6 | ) | (61.0 | ) | |||||||

Net income (loss) |

(11.3 | ) | 8.4 | (329.4 | ) | (332.3 | ) | |||||||

Net income (loss) attributable to noncontrolling interest, net of tax |

(17.8 | ) | — | 4.3 | (13.5 | ) | ||||||||

Net income (loss) attributable to Sauer-Danfoss Inc. |

$ | (29.1 | ) | $ | 8.4 | $ | (325.1 | ) | $ | (345.8 | ) | |||

Net sales for the year ended December 31, 2009 decreased 43 percent compared to the year ended December 31, 2008, excluding the effects of currency. Net sales decreased in all regions and segments. Excluding the impacts of currency, sales declined 48 percent in Europe, 42 percent in the Americas and

19

27 percent in Asia-Pacific. Sales in the Work Function segment decreased by 49 percent, sales in the Controls segment were down 44 percent, followed by a reduction of 39 percent in the Propel segment.

Gross profit declined 70 percent during the year ended December 31, 2009, excluding the impact of currency. This decline was primarily driven by reduced sales volume. Other contributing factors included inventory valuation allowances of $13.8 million, accelerated depreciation of $4.0 million, and restructuring charges of $5.8 million related to the closure of the Hillsboro, Oregon; Lawrence, Kansas; and Odense, Denmark locations.

Selling, general and administrative costs decreased 16 percent during 2009 when compared to the same period in 2008, excluding the effects of currency. This decrease is primarily due to cost reduction efforts taken as a result of the economic downturn, as well as a reduction in costs of $6.6 million related to the implementation of a common business system. Offsetting these cost reductions were severance costs of $18.2 million and $4.5 million of restructuring costs related to the closure of the Hillsboro location and the exit from the electric drives business in 2009, compared to similar costs of $4.9 million in 2008. Research and development costs decreased 23 percent excluding the effects of currency due to cost reduction efforts.

The Company reported goodwill impairment charges of $50.8 million during the first quarter of 2009 related to the valves reporting unit within the Controls segment. In 2008 the Company reported impairment charges of $58.2 million, consisting of $22.9 million of goodwill impairment, and property, plant and equipment impairment of $35.3 million. The goodwill impairment related to the motors and steering reporting units within the Work Function segment and the electric drives reporting unit within the Controls segment. The impairment charges were incurred as a result of lower profitability in the reporting units than the Company had previously expected, and lower future expectations in certain end markets. The property, plant and equipment impairment related to the Work Function segment and resulted from lower earnings expectations related to the products produced within the asset group.

During the year ended December 31, 2009 the Company sold its alternating current (AC) electric motor business for the material handling market. In connection with this transaction the Company incurred charges of $6.3 million during 2009 and $8.4 million in 2008. In addition, during 2009 the Company incurred a loss of $2.7 million on the sale of its steering column business in Kolding, Denmark. These activities were part of the Company's plan to divest of product lines that do not fit the Company's long-term strategic direction. During the year ended December 31, 2008, the Propel segment recorded a gain of $1.4 million related to the sale of the LaSalle, Illinois plant.

The Company refinanced various credit agreements during 2009, which resulted in higher interest rates and an increase to interest expense of $25.1 million over 2008. This also resulted in a $15.8 million loss on early retirement of debt in 2009.

Operating Results—2009 Compared to 2008

Sales Growth by Market

The following table summarizes the Company's sales growth by market. The table and following discussion is on a comparable basis, which excludes the effects of currency fluctuations.

| |

Americas | Asia-Pacific | Europe | Total | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Agriculture/Turf Care |

(24 | )% | (24 | )% | (31 | )% | (26 | )% | |||||

Construction/Road Building |

(58 | ) | (36 | ) | (66 | ) | (57 | ) | |||||

Specialty |

(71 | ) | (15 | ) | (51 | ) | (53 | ) | |||||

Distribution |

(46 | ) | (25 | ) | (39 | ) | (39 | ) | |||||

20

Agriculture/Turf Care

Sales into the agriculture/turf care market decreased in all regions during the year ended December 31, 2009 compared to 2008. Sales into the agriculture market in the Americas remained strong during the first quarter, then declined sharply as commodity prices began a downward trend and customers focused on inventory reduction. Commodity prices began to stabilize during the fourth quarter, while the Brazilian market showed improvement during the second half of the year compared to the first and second quarters. The European agriculture market continued to decline due to falling commodity prices and the worldwide economic crisis. Turf care sales continue to suffer from depressed housing markets and reduced consumer spending. The Asia-Pacific region contributes less than 5 percent of the sales in the agriculture/turf care market, and therefore does not significantly impact the total.

Construction/Road Building

Construction /road building sales were down in all regions during the year ended December 31, 2009 compared to 2008. The sales decline was due to poor economic conditions worldwide, depressed housing and non-residential construction markets, and customers' focus on reducing inventory levels. Non-residential construction slowed rapidly in the Americas, and state government budget problems caused road building to remain at extraordinarily low levels. The Asia-Pacific region experienced strong sales in China due to government stimulus programs and strong demand for mixers. However, this was more than offset by reduced sales in Japan, which depends heavily on export markets.

Specialty

Specialty vehicles are comprised of a variety of markets including forestry, material handling, marine, waste management and waste recycling. Overall sales into the specialty vehicle market decreased 53 percent compared to 2008. Material handling sales were down across all regions due to poor economic conditions worldwide and severely depressed non-residential construction markets. Offsetting the reduced material handling sales in the Asia-Pacific region was an increase in specialty sales in China due to investments made by the Chinese government, as well as increased sales related to the carrier business for railroad construction. The divestiture of the electric drives business also had a negative impact on sales in Europe and Asia-Pacific.

Distribution

Products related to all of the above markets are sold to distributors, who then serve smaller OEMs.

21

Order Backlog

The following table shows the Company's order backlog and orders written activity for 2008 and 2009, separately identifying the impact of currency fluctuations.

| (in millions) |

2008 | Currency fluctuation |

Underlying change |

2009 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Backlog at December 31 |

$ | 743.7 | $ | 9.8 | $ | (244.0 | ) | $ | 509.5 | ||||

Orders written |

1,927.7 | (24.9 | ) | (989.5 | ) | 913.3 | |||||||

Total order backlog at the end of 2009 was $509.5 million, compared to $743.7 million at the end of 2008. On a comparable basis, excluding the impact of currency fluctuation, order backlog decreased 33 percent compared to 2008. New sales orders written for 2009 were $913.3 million, a decrease of 51 percent compared to 2008, excluding the impact of currency fluctuations. The decrease in backlog and order entry is due to the global recession.

Business Segment Results

The following discussion of operating results by reportable segment relates to information as presented in Note 17 in the Notes to Consolidated Financial Statements. Segment income is defined as the respective segment's portion of the total Company's net income, excluding net interest expense, income taxes, noncontrolling interest, and global service expenses. Propel products include hydrostatic transmissions and related products that transmit the power from the engine to the wheel to propel a vehicle. Work Function products include steering motors as well as gear pumps and motors that transmit power for the work functions of the vehicle. Controls products include electrohydraulic controls, microprocessors, electric drives and valves that control and direct the power of a vehicle.

The following table provides a summary of each segment's net sales and segment income, separately identifying the impact of currency fluctuations during the year.

| (in millions) |

2008 | Currency fluctuation |

Underlying change |

2009 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Net sales |

||||||||||||||

Propel |

$ | 1,016.6 | $ | (7.5 | ) | $ | (395.7 | ) | $ | 613.4 | ||||

Work Function |

561.4 | (14.1 | ) | (272.6 | ) | 274.7 | ||||||||

Controls |

512.5 | (14.5 | ) | (227.1 | ) | 270.9 | ||||||||

Segment income (loss) |

||||||||||||||

Propel |

$ | 156.8 | $ | 1.1 | (157.9 | ) | $ | 0.0 | ||||||

Work Function |

(65.7 | ) | 4.4 | (20.6 | ) | (81.9 | ) | |||||||

Controls |

(21.4 | ) | 2.5 | (82.2 | ) | (101.1 | ) | |||||||

Global Services and other expenses, net |

(42.4 | ) | (0.1 | ) | 18.6 | (23.9 | ) | |||||||

Propel Segment

The Propel segment experienced a 39 percent decrease in sales, excluding the effects of currency fluctuations, during 2009 due to weak global economic conditions. The Propel segment experienced an 11 percentage point decrease in operating profit margin in 2009 compared to 2008 mainly due to reduced sales volume resulting in less absorption of fixed production costs, as well as additional inventory reserves of $8.3 million and accelerated depreciation of $3.4 million due to changing the production location of a product line. Contributing to the reduction in segment income was a $12.7 million increase in severance costs over 2008, an increase in field recall costs of $6.6 million, and a loss on disposal of fixed assets of $3.1 million. Operating expenses were reduced by $19.7 million due to a focus on reducing costs and lower payroll costs as a result of headcount reductions. In addition, in 2008 the Propel segment recognized a gain on sale of a building of $1.4 million.

22

Work Function Segment

Sales in the Work Function segment decreased 49 percent in 2009 compared to 2008, excluding the effects of currency fluctuations, due to weak global economic conditions. The reduction in segment income of $20.6 million, excluding the effects of currency fluctuations, was driven by reduced sales, restructuring costs of $3.7 million related to the closure of the Lawrence, Kansas facility, $2.7 million related to the sale of the steering column business in Kolding, Denmark, and an increase in severance costs of $1.7 million over 2008 due to headcount reductions related to lower sales. Offsetting the impact of these items in the year-over-year comparison was a reduction in expedited freight costs of $8.4 million, reduced depreciation of $4.4 million due to the impairment of long-lived assets at December 31, 2008, and a reduction in total operating expenses of $18.7 million. In 2008 the Work Function segment recognized impairment charges of $17.4 million and $35.3 million, for goodwill and property, plant and equipment, respectively.

Controls Segment

Net sales in the Controls segment decreased 44 percent from 2008, excluding the effects of currency fluctuations, due to weak global economic conditions. Segment income decreased $82.2 million during 2009 due to decreased sales levels, a goodwill impairment charge of $50.8 million related to the valves reporting unit, and an increase to employee severance costs of $2.2 million compared to 2008. In addition, costs of $6.3 million related to the alternating current (AC) product line, which was sold in the second quarter of 2009, and restructuring costs of $8.7 million related to the closure of the Hillsboro, Oregon facility and the exit of the electric drives business were recognized in 2009. Excluding the restructuring and severance costs, operating expenses were reduced by $22.5 million. Also, in 2008 the Controls segment recognized goodwill impairment charges of $5.5 million.

Global Services and other expenses, net

Segment costs in Global Services and other expenses, net, relate to internal global service departments, along with the operating costs of the Company's executive office. Global services include such costs as consulting for special projects, tax and accounting fees paid to outside third parties, internal audit, certain insurance premiums, and the amortization of intangible assets from certain business combinations. Global services and other expenses decreased $18.6 million, or 44 percent excluding the impacts of currency. This was partially due to fact that 2008 costs included $1.6 million for an acquisition that was not consummated and $6.6 million associated with the implementation of a common business system. In 2009 the Company recognized a $4.4 million gain of foreign currency transactions in 2009 compared to a $1.0 million gain in 2008.

Income Taxes

The Company incurred income tax expense of $61.0 million on a loss of $271.2 million in 2009.

In 2009 the Company recorded $50.8 million for the impairment of goodwill which was not deductible for income tax purposes and therefore no tax benefit was recorded on this expense. Valuation allowances of $126.9 million were recorded as tax expense in 2009 which relates to impaired tax assets in the U.S., Italy, China and Denmark. Other non-deductible expenses and the worldwide earnings mix also impacted 2009 income tax expense.

23

Executive Summary of 2008 Compared to 2007

The following table summarizes the change in the Company's results from operations by separately identifying changes due to currency fluctuations and the underlying change in operations from 2007 to 2008. This analysis is more consistent with how the Company's management internally evaluates results.

| (in millions) |