Attached files

| file | filename |

|---|---|

| EX-10.9 - COMPX INTERNATIONAL INC. - 10K FOR PERIOD ENDING 12-31-2009 EXHIBIT 10.9 - COMPX INTERNATIONAL INC | cix10k12312009_exh109.htm |

| EX-23.1 - COMPX INTERNATIONAL INC. - 10K FOR PERIOD ENDING 12-31-2009 EXHIBIT 23.1 - COMPX INTERNATIONAL INC | cix110k12312009_exh231.htm |

| EX-31.2 - COMPX INTERNATIONAL INC. - 10K FOR PERIOD ENDING 12-31-2009 EXHIBIT 31.2 - COMPX INTERNATIONAL INC | cix110k12312009_exh312.htm |

| EX-21.1 - COMPX INTERNATIONAL INC. - 10K FOR PERIOD ENDING 12-31-2009 EXHIBIT 21.1 - COMPX INTERNATIONAL INC | cix110k12312009_exh211.htm |

| EX-32.1 - COMPX INTERNATIONAL INC. - 10K FOR PERIOD ENDING 12-31-2009 EXHIBIT 32.1 - COMPX INTERNATIONAL INC | cix110k12312009_exh321.htm |

| EX-10.13 - COMPX INTERNATIONAL INC. - 10K FOR PERIOD ENDING 12-31-2009 EXHIBIT 10.13 - COMPX INTERNATIONAL INC | cix110k12312009_exh1013.htm |

| EX-31.1 - COMPX INTERNATIONAL INC. - 10K FOR PERIOD ENDING 12-31-2009 EXHIBIT 31.1 - COMPX INTERNATIONAL INC | cix110k12312009_exh311.htm |

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE

ACT OF 1934 – For the fiscal year ended December 31, 2009

Commission

file number 1-13905

|

COMPX

INTERNATIONAL INC.

|

|

(Exact

name of Registrant as specified in its

charter)

|

|

Delaware

|

57-0981653

|

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

(IRS

Employer

Identification

No.)

|

|

|

5430

LBJ Freeway, Suite 1700,

Three

Lincoln Centre, Dallas, Texas

|

75240-2697

|

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

|

|

Registrant’s

telephone number, including area code

|

(972)

448-1400

|

|

|

Securities

registered pursuant to Section 12(b) of the Act:

|

||

|

Title of each class

|

Name

of each exchange

on which registered

|

|

|

Class

A common stock

($.01

par value per share)

|

New

York Stock Exchange

|

|

|

Securities

registered pursuant to Section 12(g) of the

Act: None.

|

||

Indicate

by check mark:

If the

Registrant is a well-known seasoned issuer, as defined in Rule 405 of the

Securities Act. Yes £ No

S

If the

Registrant is not required to file reports pursuant to Section 13 or Section

15(d) of the Act. Yes £ No

S

Whether

the Registrant (1) has filed all reports required to be filed by Section 13 or

15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or

for such shorter period that the Registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90

days. Yes S No

£

Whether

the registrant has submitted electronically and posted on its corporate website,

if any, every Interactive Data File required to be submitted and posted pursuant

to Rule 405 of Regulation S-T during the preceding 12 months (or for such

shorter period that the registration was required to submit and post such file).

* Yes £ No

£

* The

registrant has not yet been phased into the interactive data

requirements.

- 1

-

If

disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not

contained herein, and will not be contained, to the best of Registrant's

knowledge, in definitive proxy or information statements incorporated by

reference in Part III of this Form 10-K or any amendment to this Form 10-K.

S

Whether

the registrant is a large accelerated filer, an accelerated filer or a

non-accelerated filer (as defined in Rule 12b-2 of the Act). Large

accelerated filer £ Accelerated

filer £ Non-accelerated

filer S Smaller

reporting company £

Whether

the Registrant is a shell Company (as defined in Rule 12b-2 of the Exchange

Act). Yes £ No

S

The

aggregate market value of the 1.3 million shares of voting stock held by

nonaffiliates of CompX International Inc. as of June 30, 2009 (the last business

day of the Registrant’s most recently completed second fiscal quarter)

approximated $7.9 million.

As of

February 25, 2010, 2,370,307 shares of Class A common stock were

outstanding.

Documents incorporated by

reference

The

information required by Part III is incorporated by reference from the

Registrant's definitive proxy statement to be filed with the Commission pursuant

to Regulation 14A not later than 120 days after the end of the fiscal year

covered by this report.

- 2

-

PART

I

ITEM

1. BUSINESS

General

CompX

International Inc. (NYSE:CIX), incorporated in Delaware in 1993, is a leading

manufacturer of security products, precision ball bearing slides and ergonomic

computer support systems used in the office furniture, transportation, postal,

tool storage, appliance and a variety of other industries. We are

also a leading manufacturer of stainless steel exhaust systems, gauges, and

throttle controls for the performance marine industry. Our products are

principally designed for use in medium to high-end product applications, where

design, quality and durability are valued by our customers.

At

December 31, 2009, (i) NL Industries, Inc. (NYSE: NL) owned 87% of our

outstanding common stock; (ii) Valhi, Inc. (NYSE: VHI) holds approximately 83%

of NL’s outstanding common stock; and (iii) subsidiaries of Contran Corporation

hold approximately 93% of Valhi's outstanding common stock. Substantially all of

Contran's outstanding voting stock is held by trusts established for the benefit

of certain children and grandchildren of Harold C. Simmons, (for which Mr.

Simmons is sole trustee) or is held by Mr. Simmons or other persons or related

companies to Mr. Simmons. Consequently, Mr. Simmons may be deemed to

control each of these companies and us.

Our

corporate offices are located at Three Lincoln Centre, 5430 LBJ Freeway, Suite

1700, Dallas, Texas 75240. Our telephone number is (972)

448-1400. We maintain a website at www.compx.com.

Unless

otherwise indicated, references in this report to “we,” “us,” or “our” refer to

CompX International Inc. and its subsidiaries taken as a whole.

Forward-Looking

Statements

This

Annual Report contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. Statements in this Annual

Report on Form 10-K that are not historical in nature are forward-looking in

nature about our future, and are not statements of historical fact. Such

statements are found in this report, including, but not limited to, statements

found in Item 1 – "Business," Item 1A – “Risk Factors,” Item 3 - "Legal

Proceedings," Item 7 - "Management’s Discussion and Analysis of Financial

Condition and Results of Operations" and Item 7A - "Quantitative and Qualitative

Disclosures About Market Risk." These statements are forward-looking statements

that represent our beliefs and assumptions based on currently available

information. In some cases you can identify these forward-looking

statements by the use of words such as "believes," "intends," "may,"

"should," "could," "anticipates," "expects" or comparable

terminology or by discussions of strategies or trends. Although we

believe the expectations reflected in forward-looking statements are reasonable,

we do not know if these expectations will be correct. Forward-looking

statements by their nature involve substantial risks and uncertainties that

could significantly impact expected results. Actual future results

could differ materially from those predicted. Among the factors that

could cause actual future results to differ materially from those described

herein are the risks and uncertainties discussed in this Annual Report and those

described from time to time in our other filings with the SEC including, but not

limited to, the following:

|

·

|

Future

supply and demand for our products,

|

|

·

|

Changes

in our raw material and other operating costs (such as steel and energy

costs),

|

|

·

|

General

global economic and political conditions (such as changes in the level of

gross domestic product in various regions of the

world),

|

- 3

-

|

·

|

Demand

for office furniture,

|

|

·

|

Service

industry employment levels,

|

|

·

|

Demand

for high performance marine

components,

|

|

·

|

Competitive

products and prices, including competition from low-cost manufacturing

sources (such as China),

|

|

·

|

Substitute

products,

|

|

·

|

Customer

and competitor strategies,

|

|

·

|

The

introduction of trade barriers,

|

|

·

|

The

impact of pricing and production

decisions,

|

|

·

|

Fluctuations

in the value of the U.S. dollar relative to other currencies (such as the

Canadian dollar and New Taiwan

dollar),

|

|

·

|

Potential

difficulties in integrating completed or future

acquisitions,

|

|

·

|

Decisions

to sell operating assets other than in the ordinary course of

business,

|

|

·

|

Uncertainties

associated with the development of new product

features,

|

|

·

|

Environmental

matters (such as those requiring emission and discharge standards for

existing and new facilities),

|

|

·

|

Our

ability to comply with covenants contained in our revolving bank credit

facility,

|

|

·

|

The

ultimate outcome of income tax audits, tax settlement initiatives or other

tax matters,

|

|

·

|

The

impact of current or future government

regulations,

|

|

·

|

Current

and future litigation,

|

|

·

|

Possible

disruption of our business or increases in the cost of doing business

resulting from terrorist activities or global conflicts;

and

|

|

·

|

Operating

interruptions (including, but not limited to labor disputes, hazardous

chemical leaks, natural disasters, fires, explosions, unscheduled or

unplanned downtime and transportation

interruptions).

|

Should

one or more of these risks materialize or if the consequences worsen, or if the

underlying assumptions prove incorrect, actual results could differ materially

from those currently forecasted or expected. We disclaim any

intention or obligation to update or revise any forward-looking statement

whether as a result of changes in information, future events or

otherwise.

Industry

Overview

We

manufacture engineered components that are sold to a variety of industries

including office furniture, recreational transportation (including performance

boats), mailboxes, toolboxes, appliances, banking equipment, vending equipment,

computers and related equipment. Approximately 34% of our total sales

in 2009 are to the office furniture manufacturing industry, compared to 33% in

2008 and 32% in 2007. We believe that our emphasis on new product

features and sales of our products to additional markets has resulted in our

potential for higher rates of earnings growth and diversification of

risk. See also Item 6 – "Selected Financial Data" and Item 7 –

"Management's Discussion and Analysis of Financial Condition and Results of

Operations."

Business

Segments

We

currently have three operating business segments – Security Products, Furniture

Components and Marine Components. For additional information

regarding our segments, see “Part II – Item 7. Management’s Discussion and

Analysis of Financial Condition and Results of Operations” and Note 2 to our

Consolidated Financial Statements.

- 4

-

Manufacturing,

Operations, and Products

Security Products. Our Security

Products segment, with a manufacturing facility in South Carolina and one in

Illinois shared with Marine Components, manufactures locking mechanisms and

other security products for sale to the postal, transportation, office and

institutional furniture, toolbox, banking, vending, general cabinetry and other

industries. We believe we are a North American market leader in the

manufacture and sale of cabinet locks and other locking

mechanisms. Our security products are used in a variety of

applications including ignition systems, mailboxes, toolboxes, vending and

gaming machines, parking meters, electrical circuit panels, storage

compartments, office furniture and medical cabinet security. These products

include:

|

·

|

disc

tumbler locks which provide moderate security and generally represent the

lowest cost lock to produce;

|

|

·

|

pin

tumbler locking mechanisms which are more costly to produce and are used

in applications requiring higher levels of security, including our KeSet high security

system, which allows the user to change the keying on a single lock 64

times without removing the lock from its enclosure;

and

|

|

·

|

our

innovative eLock electronic locks which provide stand alone or networked

security and audit trail capability for drug storage and other valuables

through the use of a proximity card, magnetic stripe or keypad

credentials.

|

A

substantial portion of our Security Products’ sales consist of products with

specialized adaptations to an individual manufacturer’s specifications, some of

which are listed above. We also have a standardized product line

suitable for many customers, which is offered through a North American

distribution network to lock distributors and smaller original equipment

manufacturers (“OEMs”) via our STOCK LOCKS distribution

program.

Furniture

Components. Our Furniture Components segment, with facilities

in Canada, Michigan and Taiwan, manufactures a complete line of precision ball

bearing slides and ergonomic computer support systems for use in applications

such as computer related equipment, appliances, tool storage cabinets, imaging

equipment, file cabinets, desk drawers, automated teller machines and other

applications. These products include:

|

·

|

our

patented Integrated

Slide Lock which allows a file cabinet manufacturer to reduce the

possibility of multiple drawers being opened at the same

time;

|

|

·

|

our

patented adjustable Ball

Lock which reduces the risk of heavily-filled drawers, such as auto

mechanic toolboxes, from opening while in

movement;

|

|

·

|

our

Self-Closing

Slide, which is designed to assist in closing a drawer and is used

in applications such as bottom mount

freezers;

|

|

·

|

articulating

computer keyboard support arms (designed to attach to desks in the

workplace and home office environments to alleviate possible user strains

and stress and maximize usable workspace), along with our patented LeverLock keyboard arm,

which is designed to make ergonomic adjustments to the keyboard arm

easier;

|

|

·

|

CPU

storage devices which minimize adverse effects of dust and moisture on

desktop computers; and

|

|

·

|

complementary

accessories, such as ergonomic wrist rest aids, mouse pad supports and

flat screen computer monitor support

arms.

|

Marine Components. Our Marine

Components segment, with a facility in Wisconsin and a facility in Illinois

shared with Security Products, manufactures and distributes marine instruments,

hardware and accessories for performance boats. Our specialty marine

component products are high performance components designed to operate within

precise tolerances in the highly corrosive marine environment. These

products include:

- 5

-

|

·

|

original

equipment and aftermarket stainless steel exhaust headers, exhaust pipes,

mufflers and other exhaust

components;

|

|

·

|

high

performance gauges such as GPS speedometers and

tachometers;

|

|

·

|

controls,

throttles, steering wheels and other billet accessories;

and

|

|

·

|

dash

panels, LED lighting, rigging and other

accessories.

|

Our

business segments operated six manufacturing facilities at December 31, 2009

including one facility in Grayslake, Illinois that houses operations relating to

Security Products and Marine Components. For additional information,

see also “Item 2 – Properties”, including information regarding leased and

distribution-only facilities.

|

Security Products

|

Furniture Components

|

Marine Components

|

||

|

Mauldin,

SC

Grayslake,

IL

|

Kitchener,

Ontario

Byron

Center, MI

Taipei,

Taiwan

|

Neenah,

WI

Grayslake,

IL

|

Raw

Materials

Our

primary raw materials are:

|

·

|

zinc,

copper and brass (used in the Security Products segment for the

manufacture of locking mechanisms);

|

|

·

|

coiled

steel (used in the Furniture Components segment for the manufacture of

precision ball bearing slides and ergonomic computer support

systems);

|

|

·

|

stainless

steel (used in the Marine Components segment for the manufacture of

exhaust headers and pipes and other components;

and

|

|

·

|

plastic

resins (used primarily in the Furniture Components segment for injection

molded plastics employed in the manufacturing of ergonomic computer

support systems).

|

These raw

materials are purchased from several suppliers and are readily available from

numerous sources and accounted for approximately 18% of our total cost of sales

for 2009.

We

occasionally enter into raw material arrangements to mitigate the short-term

impact of future increases in raw materials that are affected by commodity

markets. While these arrangements do not necessarily commit us to a

minimum volume of purchases, they generally provide for stated unit prices based

upon achievement of specified purchase volumes. We utilize purchase

arrangements to stabilize our commodity related raw material prices provided we

meet the specified minimum monthly purchase quantities. Commodity related raw

materials purchased outside of these arrangements are sometimes subject to

unanticipated and sudden price increases. We generally seek to mitigate the

impact of fluctuations in raw material costs on our margins through improvements

in production efficiencies or other operating cost reductions. In the

event we are unable to offset raw material cost increases with other cost

reductions, it may be difficult to recover those cost increases through

increased product selling prices or raw material surcharges due to the

competitive nature of the markets served by our

products. Consequently, overall operating margins can be affected by

commodity related raw material cost pressures. Commodity market

prices are cyclical, reflecting overall economic trends and specific

developments in consuming industries.

- 6

-

Patents

and Trademarks

We hold a

number of patents relating to our component products, certain of which are

believed to be important to us and our continuing business

activity. Patents generally have a term of 20 years, and our patents

have remaining terms ranging from less than one year to 15 years at December 31,

2009. Our major trademarks and brand names include:

|

Furniture

Components

|

Security

Products

|

Marine

Components

|

||

|

CompX

Precision Slides®

|

CompX

Security Products®

|

Custom

Marine®

|

||

|

CompX

Waterloo®

|

National

Cabinet Lock®

|

Livorsi

Marine®

|

||

|

CompX

ErgonomX®

|

Fort

Lock®

|

CMI

Industrial Mufflers™

|

||

|

CompX

DurISLide®

|

Timberline®

|

Custom

Marine Stainless

|

||

|

Dynaslide®

|

Chicago

Lock®

|

Exhaust™

|

||

|

Waterloo

Furniture

|

STOCK

LOCKS®

|

The

#1 Choice in

|

||

|

Components

Limited®

|

KeSet®

|

Performance

Boating®

|

||

|

TuBar®

|

Mega

Rim™

|

|||

|

ACE

II®

|

Race

Rim™

|

|||

|

CompX

eLock®

|

CompX

Marine™

|

|||

|

Lockview®

Software

|

Sales, Marketing

and Distribution.

We sell

components directly to large OEM customers through our factory-based sales and

marketing professionals and with engineers working in concert with field

salespeople and independent manufacturers' representatives. We select

manufacturers' representatives based on special skills in certain markets or

relationships with current or potential customers.

A

significant portion of our sales are also made through

distributors. We have a significant market share of cabinet lock

sales as a result of the locksmith distribution channel. We support

our distributor sales with a line of standardized products used by the largest

segments of the marketplace. These products are packaged and merchandised for

easy availability and handling by distributors and end users. Due to

our success with the STOCK

LOCKS inventory program within the Security Products segment, similar

programs have been implemented for distributor sales of ergonomic computer

support systems within the Furniture Components segment.

In 2009,

our ten largest customers accounted for approximately 39% of our total sales;

however, no one customer accounted for sales of 10% or more in

2009. Of the 39% of total sales, 18% (7 customers) was related to

Security Products sales and 21% (7 customers) was related to Furniture

Components sales, including 4 customers for which we sell both Security Products

and Furniture Components. Overall, our customer base is diverse and

the loss of any single customer would not have a material adverse effect on our

operations.

Competition

The

markets in which we participate are highly competitive. We compete

primarily on the basis of product design, including ergonomic and aesthetic

factors, product quality and durability, price, on-time delivery, service and

technical support. We focus our efforts on the middle and high-end

segments of the market, where product design, quality, durability and service

are valued by the customer. Our Marine Components segment competes

with small domestic manufacturers and is minimally affected by foreign

competitors. Our Security Products and Furniture Components segments

compete against a number of domestic and foreign manufacturers.

- 7

-

International

Operations

We have

substantial operations and assets located outside the United States, principally

Furniture Component operations in Canada and Taiwan. The majority of

our 2009 non-U.S. sales are to customers located in Canada. These

operations are subject to, among other things, currency exchange rate

fluctuations. Our results of operations have in the past been both

favorably and unfavorably affected by fluctuations in currency exchange

rates. Political and economic uncertainties in certain of the

countries in which we operate may expose us to risk of loss. We do

not believe that there is currently any likelihood of material loss through

political or economic instability, seizure, nationalization or similar

event. We cannot predict, however, whether events of this type in the

future could have a material effect on our operations. See Item 7 -

"Management's Discussion and Analysis of Financial Condition and Results of

Operations," Item 7A – "Quantitative and Qualitative Disclosures About Market

Risk" and Note 1 to the Consolidated Financial Statements.

Regulatory

and Environmental Matters

Our

operations are subject to federal, state, local and foreign laws and regulations

relating to the use, storage, handling, generation, transportation, treatment,

emission, discharge, disposal, remediation of and exposure to hazardous and

non-hazardous substances, materials and wastes ("Environmental

Laws"). Our operations also are subject to federal, state, local and

foreign laws and regulations relating to worker health and safety. We

believe that we are in substantial compliance with all such laws and

regulations. To date, the costs of maintaining compliance with such

laws and regulations have not significantly impacted our results. We

currently do not anticipate any significant costs or expenses relating to such

matters; however, it is possible future laws and regulations may require us to

incur significant additional expenditures.

Employees

As of

December 31, 2009, we employed the following number of people:

|

United

States

|

528

|

|

Canada(1)

|

211

|

|

Taiwan

|

76

|

|

Total

|

815

|

(1) Approximately

77% of our Canadian employees are represented by a labor union covered by a

collective bargaining agreement that expires in January 2012 which provides for

wage increases from 0% to 1% over the term of the contract.

We

believe our labor relations are good at all of our facilities.

Available

Information

Our

fiscal year end is always the Sunday closest to December 31, and our operations

are reported on a 52 or 53-week fiscal year. We furnish our

stockholders with annual reports containing audited financial

statements. In addition, we file annual, quarterly and current

reports, proxy and information statements and other information with the

SEC. We also make our annual report on Form 10-K, quarterly reports

on Form 10-Q, current reports on Form 8-K and all related amendments, available

free of charge through our website at www.compx.com as soon

as reasonably practical after they have been filed with the SEC. We

also provide to anyone, without charge, copies of the documents upon written

request. Requests should be directed to the attention of the

Corporate Secretary at our address on the cover page of this Form

10-K.

- 8

-

Additional

information, including our Audit Committee Charter, our Code of Business Conduct

and Ethics and our Corporate Governance Guidelines, can also be found on our

website. Information contained on our website is not a part of this

Annual Report.

The

general public may read and copy any materials we file with the SEC at the SEC’s

Public Reference Room at 100 F. Street, NE, Washington, DC 20549. The

public may obtain information on the operation of the Public Reference Room by

calling the SEC at 1-800-SEC-0330. We are an electronic

filer. The SEC maintains an Internet website at www.sec.gov that

contains reports, proxy and information statements and other information

regarding issuers that file electronically with the SEC, including

us.

Item

1A. RISK

FACTORS

Listed

below are certain risk factors associated with us and our

businesses. In addition to the potential effect of these risk factors

discussed below, any risk factor which could result in reduced earnings or

operating losses, or reduced liquidity, could in turn adversely affect our

ability to service our liabilities or pay dividends on our common stock or

adversely affect the quoted market prices for our securities.

Many of the markets in which we

operate are mature and highly competitive resulting in pricing pressure and the

need to continuously reduce costs.

Many of

the markets we serve are highly competitive, with a number of competitors

offering similar products. We focus our efforts on the middle and

high-end segment of the market where we feel that we can compete due to the

importance of product design, quality and durability to the

customer. However, our ability to effectively compete is impacted by

a number of factors. The occurrence of any of these factors could

result in reduced earnings or operating losses.

|

·

|

Competitors

may be able to drive down prices for our products because their costs are

lower than our costs, especially those sourced from

Asia.

|

|

·

|

Competitors'

financial, technological and other resources may be greater than our

resources, which may enable them to more effectively withstand changes in

market conditions.

|

|

·

|

Competitors

may be able to respond more quickly than we can to new or emerging

technologies and changes in customer

requirements.

|

|

·

|

Consolidation

of our competitors or customers in any of the markets in which we compete

may result in reduced demand for our

products.

|

|

·

|

New

competitors could emerge by modifying their existing production facilities

to manufacture products that compete with our

products.

|

|

·

|

Our

ability to sustain a cost structure that enables us to be

cost-competitive.

|

|

·

|

Our

ability to adjust costs relative to our

pricing.

|

|

·

|

Customers

may no longer value our product design, quality or durability over lower

cost products of our competitors.

|

Sales for certain precision slides

and ergonomic products are concentrated in the office furniture industry, which

has periodically experienced significant reductions in demand that could result

in reduced earnings or operating losses.

Sales of

our products to the office furniture manufacturing industry accounted for

approximately 34%, 33% and 32% for 2009, 2008 and 2007, respectively, of our net

sales. The future growth, if any, of the office furniture industry

will be affected by a variety of macroeconomic factors, such as service industry

employment levels, corporate cash flows and non-residential commercial

construction, as well as industry factors such as corporate reengineering and

restructuring, technology demands, ergonomic, health and safety concerns and

corporate relocations. There can be no assurance that current or future economic

or industry trends will not materially and adversely affect our

business.

- 9

-

Our

failure to enter into new markets with our current businesses would result in

the continued significant impact of fluctuations in demand within the office

furniture manufacturing industry on our operating results.

In an

effort to reduce our dependence on the office furniture market for certain

products and to increase our participation in other markets, we have been

devoting resources to identify new customers and develop new applications for

those products in markets outside of the office furniture industry, such as home

appliances, toolboxes and server racks. Developing these new

applications for our products involves substantial risk and uncertainties due to

our limited experience with customers and applications in these markets as well

as facing competitors who are already established in these

markets. We may not be successful in developing new customers or

applications for our products outside of the office furniture

industry. Significant time may be required to develop new

applications and uncertainty exists as to the extent to which we will face

competition in this regard.

Our development of innovative

features for current products is critical to sustaining and growing our

sales.

Historically,

our ability to provide value-added custom engineered products that address

requirements of technology and space utilization has been a key element of our

success. We spend a significant amount of time and effort to refine,

improve and adapt our existing products for new customers and

applications. Since expenditures for these types of activities are

not considered research and development expense under accounting principles

generally accepted in the United States of America, the amount of our research

and development expenditures, which is not significant, is not indicative of the

overall effort involved in the development of new product

features. The introduction of new product features requires the

coordination of the design, manufacturing and marketing of the new product

features with current and potential customers. The ability to

coordinate these activities with current and potential customers may be affected

by factors beyond our control. While we will continue to emphasize

the introduction of innovative new product features that target

customer-specific opportunities, there can be no assurance that any new product

features we introduce will achieve the same degree of success that we have

achieved with our existing products. Introduction of new product

features typically requires us to increase production volume on a timely basis

while maintaining product quality. Manufacturers often encounter

difficulties in increasing production volumes, including delays, quality control

problems and shortages of qualified personnel or raw materials. As we

attempt to introduce new product features in the future, there can be no

assurance that we will be able to increase production volume without

encountering these or other problems, which might negatively impact our

financial condition or results of operations.

Recent

and future acquisitions could subject us to a number of operational

risks.

A key

component of our strategy is to grow and diversify our business through

acquisitions. Our ability to successfully execute this component of

our strategy entails a number of risks, including:

|

·

|

the

identification of suitable growth

opportunities;

|

|

·

|

an

inaccurate assessment of acquired liabilities that were undisclosed or not

properly disclosed;

|

|

·

|

the

entry into markets in which we may have limited or no

experience;

|

|

·

|

the

diversion of management’s attention from our core

businesses;

|

|

·

|

the

potential loss of key employees or customers of the acquired

businesses;

|

|

·

|

difficulties

in realizing projected efficiencies, synergies and cost savings;

and

|

|

·

|

an

increase in our indebtedness and a limitation in our ability to access

additional capital when needed.

|

- 10

-

Higher

costs of our raw materials may decrease our liquidity.

Certain

of the raw materials used in our products are commodities that are subject to

significant fluctuations in price in response to world-wide supply and

demand. Coiled steel is the major raw material used in the

manufacture of precision ball bearing slides and ergonomic computer support

systems. Plastic resins for injection molded plastics are also an

integral material for ergonomic computer support systems. Zinc is a

principal raw material used in the manufacture of security

products. Stainless steel tubing is the major raw material used in

the manufacture of marine exhaust systems. These raw materials are

purchased from several suppliers and are generally readily available from

numerous sources. We occasionally enter into raw material supply

arrangements to mitigate the short-term impact of future increases in raw

material costs. Materials purchased outside of these arrangements are

sometimes subject to unanticipated and sudden price increases. Should

our vendors not be able to meet their contractual obligations or should we be

otherwise unable to obtain necessary raw materials, we may incur higher costs

for raw materials or may be required to reduce production levels, either of

which may decrease our liquidity as we may be unable to offset the higher costs

with increased selling prices for our products.

Negative

worldwide economic conditions could continue to result in a decrease in our

sales and an increase in our operating costs, which could continue to adversely

affect our business and operating results.

If the

current worldwide economic downturn continues, many of our direct and indirect

customers may continue to delay or reduce their purchases of the components we

manufacture or products that utilize our components. In addition, many of our

customers rely on credit financing for their working capital needs. If the

negative conditions in the global credit markets continue to prevent our

customers' access to credit, product orders may continue to decrease which could

result in lower sales. Likewise, if our suppliers continue to face challenges in

obtaining credit, in selling their products or otherwise in operating their

businesses, they may become unable to continue to offer the materials we use to

manufacture our products. These actions could continue to result in reductions

in our sales, increased price competition and increased operating costs, which

could adversely affect our business, results of operations and financial

condition.

Negative

global economic conditions increase the risk that we could suffer unrecoverable

losses on our customers' accounts receivable which would adversely affect our

financial results.

We extend

credit and payment terms to some of our customers. Although we have an ongoing

process of evaluating our customers' financial condition, we could suffer

significant losses if a customer fails and is unable to pay us. A significant

loss of an accounts receivable would have a negative impact on our financial

results.

Global

climate change legislation could negatively impact our financial results or

limit our ability to operate our businesses.

We

operate production facilities in several countries (the United States, Canada,

and Taiwan), and we believe all of our worldwide production facilities are in

substantial compliance with applicable environmental laws. In many of the

countries in which we operate, legislation has been passed, or proposed

legislation is being considered, to limit green house gases through various

means, including emissions permits and/or energy taxes. To date the

climate change legislation in effect in the various countries in which we

operate has not had a material adverse effect on our financial results.

However, if green house gas legislation were to be enacted in one or more

countries, it could negatively impact our future results from operations through

increased costs of production, particularly as it relates to our energy

requirements. If such increased costs of production were to materialize, we may

be unable to pass price increases onto our customers to compensate for increased

production costs, which may decrease our liquidity, operating income and results

of operations.

- 11

-

ITEM

1B. UNRESOLVED STAFF

COMMENTS

None.

ITEM

2. PROPERTIES

Our

principal executive offices are located in approximately 1,000 square feet

of leased space at 5430 LBJ Freeway, Dallas,

Texas 75240. The following table sets forth the location,

size, business operating segment and general product types produced for each of

our operating facilities.

|

Facility Name

|

Business

Segment

|

Location

|

Size

(square

feet)

|

Products Produced

|

|||

|

Owned Facilities:

|

|||||||

|

Waterloo(1)

|

FC

|

Kitchener,

Ontario

|

276,000 |

Slides/ergonomic

products

|

|||

|

Durislide(1)

|

FC

|

Byron

Center, MI

|

143,000 |

Slides

|

|||

|

National

(1)

|

SP

|

Mauldin,

SC

|

198,000 |

Security

products

|

|||

|

Dynaslide(2)

|

FC

|

Taipei,

Taiwan

|

45,500 |

Slides

|

|||

|

Custom(2)

|

MC

|

Neenah,

WI

|

95,000 |

Specialty

marine products

|

|||

|

Fort,

Timberline and Livorsi(1)

|

SP/MC

|

Grayslake,

IL

|

120,000 |

Security

products/specialty marine products

|

|||

|

Leased Facilities:

|

|||||||

|

Dynaslide

|

FC

|

Taipei,

Taiwan

|

36,000 |

Slides

|

|||

|

Dynaslide

|

FC

|

Taipei,

Taiwan

|

22,000 |

Slides

|

|||

|

Distribution

Center

|

SP/FC/MC

|

Rancho

Cucamonga, CA

|

12,000 |

Product

distribution

|

|||

FC –

Furniture Components business segment

SP –

Security Products business segment

MC –

Marine Components business segment

(1) ISO-9001

registered facilities

(2) ISO-9002

registered facilities

We

believe all of our facilities are well maintained and satisfactory for their

intended purposes.

ITEM

3. LEGAL

PROCEEDINGS

We are

involved, from time to time, in various environmental, contractual, product

liability, patent (or intellectual property) and other claims and disputes

incidental to our business. See Note 12 to the Consolidated Financial

Statements. While we currently believe that the disposition of all

claims and disputes, individually or in the aggregate, should not have a

material adverse effect on our consolidated financial condition, results of

operations or liquidity, we expect to incur costs defending against such claims

during the short-term that are likely to be material.

ITEM

4. RESERVED

- 12

-

PART

II

ITEM

5. MARKET

FOR REGISTRANT'S COMMON EQUITY AND RELATED STOCKHOLDER

MATTERS

Common Stock and

Dividends. Our Class A common stock is listed and traded on the New York

Stock Exchange (symbol: CIX). As of February 25, 2010, there were

approximately 15 holders of record of CompX Class A common stock. The

following table sets forth the high and low closing sales prices per share for

our Class A common stock for the periods indicated, according to Bloomberg, and

dividends paid during each period. On February 25, 2010, the closing

price per share of our Class A common stock was $8.26.

|

High

|

Low

|

Dividends

paid

|

||||||||||

|

Year

ended December 31, 2008

|

||||||||||||

|

First

Quarter

|

$ | 14.62 | $ | 8.07 | $ | .125 | ||||||

|

Second

Quarter

|

9.20 | 5.01 | .125 | |||||||||

|

Third

Quarter

|

7.70 | 5.02 | .125 | |||||||||

|

Fourth

Quarter

|

7.53 | 4.76 | .125 | |||||||||

|

Year

ended December 31, 2009

|

||||||||||||

|

First

Quarter

|

$ | 5.82 | $ | 4.70 | $ | .125 | ||||||

|

Second

Quarter

|

6.53 | 4.82 | .125 | |||||||||

|

Third

Quarter

|

8.03 | 5.50 | .125 | |||||||||

|

Fourth

Quarter

|

8.00 | 6.80 | .125 | |||||||||

|

January 1, 2010 through

February 25, 2010

|

$ | 8.26 | $ | 7.19 | $ | - | ||||||

We paid

regular quarterly dividends of $.125 per share during 2008 and

2009. In February of 2010, our board of directors declared a first

quarter 2010 dividend of $.125 per share, to be paid on March 23, 2010 to CompX

shareholders of record as of March 10, 2010. However, declaration and

payment of future dividends and the amount thereof, if any, is discretionary and

is dependent upon our results of operations, financial condition, cash

requirements for our businesses, contractual requirements and restrictions and

other factors deemed relevant by our board of directors. The amount

and timing of past dividends is not necessarily indicative of the amount or

timing of any future dividends which we might pay. In this regard,

our revolving bank credit facility places certain restrictions on the payment of

dividends. We are limited to (i) a $.125 per share quarterly

dividend, not to exceed $8.0 million in any calendar year, plus (ii) $20.0

million plus 50% of net income since September 30, 2008 over the term of the

credit facility.

- 13

-

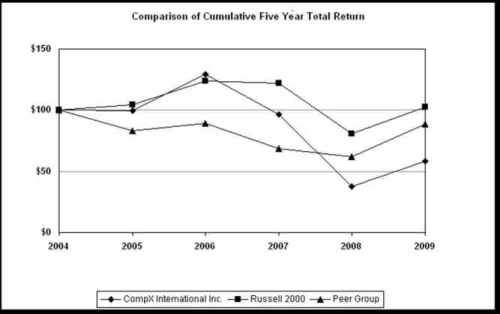

Performance

Graph. Set forth below is a line graph comparing the yearly

change in our cumulative total stockholder returns on our Class A common stock

against the cumulative total return of the Russell 2000 Index and an index of a

self-selected peer group of companies for the period from December 31, 2004

through December 31, 2009. The peer group index is comprised of The

Eastern Company and Leggett & Platt Inc. The graph shows the

value at December 31 of each year assuming an original investment of $100 at

December 31, 2004 and reinvestment of dividends.

|

December

31,

|

||||||||||||||||||||||||

|

2004

|

2005

|

2006

|

2007

|

2008

|

2009

|

|||||||||||||||||||

|

CompX

International Inc.

|

$ | 100 | $ | 99 | $ | 129 | $ | 97 | $ | 38 | $ | 58 | ||||||||||||

|

Russell

2000 Index

|

100 | 105 | 124 | 122 | 81 | 103 | ||||||||||||||||||

|

Peer

Group

|

100 | 83 | 90 | 68 | 62 | 89 | ||||||||||||||||||

Equity

compensation plan information. We have an equity compensation

plan, approved by our stockholders, which provides for the discretionary grant

to our employees and directors of, among other things, options to purchase our

Class A common stock and stock awards. As of December 31, 2009, there

were 81,000 options outstanding to purchase an equivalent number of shares of

our Class A common stock, and approximately 922,820 shares of our Class A common

stock were available for future grant or issuance. We do not have any

equity compensation plans that were not approved by our

stockholders. See Note 8 to the Consolidated Financial

Statements.

Treasury Stock

Purchases. Our board of directors

has previously authorized the repurchase of our Class A common stock in open

market transactions, including block purchases, or in privately-negotiated

transactions at unspecified prices and over an unspecified period of time, which

may include transactions with our affiliates. We may repurchase our

common stock from time to time as market conditions permit. The stock

repurchase program does not include specific price targets or timetables and may

be suspended at any time. Depending on market conditions, we may

terminate the program prior to its completion. We will use cash on

hand to acquire the shares. Repurchased shares will be added to our

treasury and cancelled. We did not purchase any shares of our common stock

during the fourth quarter of 2009. See Note 8 to the Consolidated Financial

Statements.

- 14

-

ITEM

6. SELECTED

FINANCIAL DATA

The

following selected financial data should be read in conjunction with our

Consolidated Financial Statements and Item 7 - "Management's Discussion and

Analysis of Financial Condition and Results of Operations."

Our

fiscal year end is always the Sunday closest to December 31, and our operations

are reported on a 52 or 53-week fiscal year. 2009 was a 53-week year,

all other years shown are 52-week years.

|

Years ended December 31,

|

||||||||||||||||||||

|

2005

|

2006

|

2007

|

2008

|

2009

|

||||||||||||||||

|

($

in millions, except per share data)

|

||||||||||||||||||||

|

Statements

of Operations Data:

|

||||||||||||||||||||

|

Net

sales

|

$ | 186.3 | $ | 190.1 | $ | 177.7 | $ | 165.5 | $ | 116.1 | ||||||||||

|

Gross

margin

|

43.8 | 46.5 | 45.2 | 40.3 | 23.8 | |||||||||||||||

|

Operating

income (loss)

|

19.1 | 20.3 | 15.6 | 6.2 | (1) | (4.0 | ) | |||||||||||||

|

Provision

(benefit) for income

taxes

|

18.6 | 9.7 | 6.9 | 7.2 | (3.1 | ) | ||||||||||||||

|

Income

(loss) from continuing operations

|

$ | 0.9 | $ | 11.7 | $ | 9.0 | $ | (3.1 | ) | $ | (2.0 | ) | ||||||||

|

Discontinued

operations

|

(0.5 | ) | - | - | - | - | ||||||||||||||

|

Net

income (loss)

|

$ | 0.4 | $ | 11.7 | $ | 9.0 | $ | (3.1 | ) | $ | (2.0 | ) | ||||||||

|

Diluted

Earnings Per Share Data:

|

||||||||||||||||||||

|

Income

(loss) from:

|

||||||||||||||||||||

|

Continuing

operations

|

$ | .06 | $ | .76 | $ | .61 | $ | (.25 | ) | $ | (.16 | ) | ||||||||

|

Discontinued

operations

|

(.03 | ) | - | - | - | - | ||||||||||||||

| $ | .03 | $ | .76 | $ | .61 | $ | (.25 | ) | $ | (.16 | ) | |||||||||

|

Cash

dividends

|

$ | .50 | $ | .50 | $ | .50 | $ | .50 | $ | .50 | ||||||||||

|

Weighted

average common shares outstanding

|

15.2 | 15.3 | 14.8 | 12.4 | 12.4 | |||||||||||||||

|

Balance

Sheet Data (at year end):

|

||||||||||||||||||||

|

Cash

and other current assets

|

$ | 80.8 | $ | 76.2 | $ | 68.2 | $ | 59.5 | $ | 55.1 | ||||||||||

|

Total

assets

|

188.6 | 192.0 | 187.7 | 163.4 | 154.0 | |||||||||||||||

|

Current

liabilities

|

20.3 | 17.8 | 18.9 | 17.0 | 14.6 | |||||||||||||||

|

Long-term

debt and note payable to affiliate, including current

maturities

|

1.6 | - | 50.0 | 43.0 | 42.2 | |||||||||||||||

|

Stockholders'

equity

|

150.1 | 153.7 | 104.1 | 91.3 | 85.0 | |||||||||||||||

|

Statements

of Cash Flow Data:

|

||||||||||||||||||||

|

Cash

provided by (used in):

|

||||||||||||||||||||

|

Operating

activities

|

$ | 20.0 | $ | 27.4 | $ | 11.9 | $ | 15.7 | $ | 15.3 | ||||||||||

|

Investing

activities

|

(3.7 | ) | (19.3 | ) | (12.4 | ) | (5.1 | ) | (2.1 | ) | ||||||||||

|

Financing

activities

|

(7.2 | ) | (8.8 | ) | (11.7 | ) | (14.2 | ) | (7.1 | ) | ||||||||||

(1)

Includes a $9.9 million goodwill impairment charge related to our Marine

Components Segment. See Note 4 to our Consolidated Financial

Statements.

- 15

-

ITEM

7. MANAGEMENT'S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

Business

Overview

We are a

leading manufacturer of engineered components utilized in a variety of

applications and industries. Through our Security Products Segment we

manufacture mechanical and electrical cabinet locks and other locking mechanisms

used in postal, office and institutional furniture, transportation, vending,

tool storage and other general cabinetry applications. Our Furniture

Components Segment manufacturers precision ball bearing slides and ergonomic

computer support systems used in office and institutional furniture, home

appliances, tool storage and a variety of other applications. We also

manufacture stainless steel exhaust systems, gauges and throttle controls for

the performance boat industry through our Marine Components

Segment.

The

economic slow down that had negatively affected our 2008 results became even

more severe in 2009, resulting in a 30% decrease in sales from

2008. In response, we quickly reduced costs to the extent possible

while continuing to focus on gaining new customers, expanding into new markets

and enhancing the product offerings in each of our segments.

Operating

Income Overview

We

reported an operating loss of $4.0 million in 2009 compared to operating income

of $6.2 million in 2008 and $15.6 million in 2007. Our 2008 results

include a $9.9 million goodwill impairment charge related to our Marine

Components unit. See Note 4 to the Consolidated Financial

Statements.

The 2008

goodwill impairment charge had no impact on our liquidity, cash flows from

operating activities, or debt covenant compliance, and does not have any impact

on future operations. In an effort to provide investors with

additional information regarding our results of operations as determined by

accounting principles generally accepted in the United States of America

(“GAAP”), we have disclosed below our operating income, excluding the impact of

the goodwill impairment charge, which is a non-GAAP measure that is used by our

management to assess the performance of our operations. We believe

the disclosure of operating income, exclusive of the goodwill impairment charge,

provides useful information to investors because it allows investors to analyze

the performance of our operations in the same way that our management assesses

performance.

|

Year

Ended

December 31, 2008

|

||||

|

(Dollars

in thousands)

|

||||

|

Operating

income (GAAP)

|

$ | 6,186 | ||

|

Goodwill

impairment charge

|

9,881 | |||

|

Operating

income excluding goodwill impairment charge

(Non-GAAP)

|

$ | 16,067 | ||

We

reported an operating loss of $4.0 million in 2009 compared to operating income

of $16.1 million in 2008, excluding the 2008 goodwill impairment

charge. The change in operating income is primarily due

to

|

·

|

the

negative effects of lower order rates from our customers as a result of

unfavorable economic conditions in North

America,

|

|

·

|

reduced

coverage of overhead and fixed manufacturing costs from the resulting

under-utilization of production

capacity,

|

|

·

|

legal

expense associated with certain patent related litigation,

and

|

|

·

|

a

write-down on assets held for sale.

|

- 16

-

These

items were partially offset by the positive effects of cost reductions

implemented in response to lower sales.

Excluding

the goodwill impairment charge, our operating income was $16.1 million in 2008

compared to $15.6 million in 2007, although 2007 operating income was impacted

by $2.7 million in facility consolidation costs. The change in

operating income compared to 2007, excluding the 2008 goodwill impairment

charge, was primarily the net result of lower order rates from many of our

customers due to unfavorable economic conditions in North America and increased

raw material costs, offset by the favorable comparative impact of facility

consolidation costs incurred in 2007, the continuation of cost reductions

throughout 2008 and a $1.3 million favorable comparative impact in foreign

currency transaction gains and losses.

Results

of Operations - 2009 Compared to 2008 and 2008 Compared to 2007

|

Years ended December 31,

|

%Change

|

|||||||||||||||||||

|

2007

|

2008

|

2009

|

2007-08 | 2008-09 | ||||||||||||||||

|

(Dollars

in millions)

|

||||||||||||||||||||

|

Net

sales

|

$ | 177.7 | $ | 165.5 | $ | 116.1 | (7 | %) | (30 | %) | ||||||||||

|

Cost

of goods sold

|

132.5 | 125.2 | 92.3 | (6 | %) | (26 | %) | |||||||||||||

|

Gross

margin

|

45.2 | 40.3 | 23.8 | (11 | %) | (41 | %) | |||||||||||||

|

Operating

costs and expenses

|

29.6 | 24.2 | 22.5 | (18 | %) | (7 | %) | |||||||||||||

|

Goodwill

impairment

|

- | 9.9 | - |

n.m.

|

n.m.

|

|||||||||||||||

|

Legal

expenses

|

- | - | 4.6 | - |

n.m.

|

|||||||||||||||

|

Asset

held for sale write-down

|

- | - | 0.7 | - |

n.m.

|

|||||||||||||||

|

Operating

income (loss)

|

$ | 15.6 | $ | 6.2 | $ | (4.0 | ) | (60 | %) | (165 | %) | |||||||||

|

Percent

of net sales:

|

||||||||||||||||||||

|

Cost

of goods sold

|

75 | % | 76 | % | 80 | % | ||||||||||||||

|

Gross

margin

|

25 | % | 24 | % | 20 | % | ||||||||||||||

|

Operating

costs and expenses

|

17 | % | 15 | % | 19 | % | ||||||||||||||

|

Goodwill

impairment

|

- | 6 | % | - | ||||||||||||||||

|

Legal

expenses

|

- | - | 4 | % | ||||||||||||||||

|

Asset held

for sale write-down

|

- | - | 1 | % | ||||||||||||||||

|

Operating

income (loss)

|

9 | % | 4 | % | (3 | %) | ||||||||||||||

|

n.m.

- not meaningful

|

||||||||||||||||||||

Net Sales. Net

sales decreased approximately $49.4 million in 2009 as compared to 2008

principally due to lower order rates from our customers resulting from

unfavorable economic conditions in North America. Our Furniture

Components, Security Products and Marine Components segments accounted for

approximately 57%, 32% and 11%, respectively, of the total decrease in sales

year over year. Furniture Components sales was a greater percentage of the total

decrease due to Furniture Components’ greater reliance on sales to a small

number of original equipment manufacturers in a few markets such as office

furniture, tool storage and appliances that were more severely impacted by the

economic slow down compared to the greater diversification of Security Products

customers and markets which more closely matched the overall decline in the

economy. The Marine Segment accounted for a smaller percentage of the

total decrease due to the smaller sales volume associated with that

segment.

Net sales

decreased in 2008 as compared to 2007 principally due to lower order rates from

many of our customers resulting from unfavorable economic conditions in North

America, offset in part by the effect of sales price increases for certain

products to mitigate the effect of higher raw material costs. Our Furniture

Components, Marine Components, and Security Products segments accounted for

approximately 41%, 35%, and 24%, respectively, of the total decrease in sales

year over year.

- 17

-

Costs of Goods Sold and Gross

Margin. Cost of goods sold decreased from 2008 to 2009

primarily due to decreased sales volumes. As a percentage of sales,

gross margin decreased in 2009 from the prior year. The decrease in

gross margin percentage is primarily due to reduced coverage of overhead and

fixed manufacturing costs from lower sales volume and the related

under-utilization of capacity, partially offset by a net $4.8 million in fixed

manufacturing cost reductions implemented in response to lower

sales.

Cost of

goods sold decreased from 2007 to 2008 primarily due to decreased sales

volumes. As a percentage of sales, gross margin decreased slightly in

2008 from the prior year. The slight decrease in gross margin

percentage was due to the net impact of a number of factors including lower

facility utilization rates relating to the decrease in sales, lower depreciation

expense resulting from lower capital requirements relating to lower sales and

minor increases in variable production costs not fully offset by price

increases.

Operating Costs and

Expenses. Operating costs and expenses consists primarily of

salaries, commissions and advertising expenses directly related to product sales

and administrative costs relating to business unit and corporate management

activities. While operating cost and expenses were reduced by $1.7

million from 2008 to 2009 in response to lower sales, it increased as a

percentage of net sales due to the significant reduction in sales

volumes.

As a

percentage of net sales, operating costs and expenses decreased from 2007 to

2008 primarily as a result of $2.7 million of costs recorded in 2007 related to

the consolidation of three of our northern Illinois facilities into one facility

(see Note 9 to the Consolidated Financial Statements) and a $1.8 million

favorable change in currency gains and losses.

Goodwill

Impairment. In 2008, we recorded a goodwill impairment charge

of $9.9 million for our Marine Components reporting unit. See Note 4

to the Consolidated Financial Statements.

Legal Expenses. In

2009, we recorded $4.6 million of patent litigation expenses relating to

Furniture Components. See Note 12 to the Consolidated Financial

Statements.

Assets Held for Sale

Write-down. In 2009, we recorded a write-down on assets held

for sale of $717,000 relating to certain facilities held for sale that are no

longer in use. See Note 9 to the Consolidated Financial

Statements.

Operating

Income. Excluding the 2008 goodwill impairment charge

discussed above, the comparison of operating income for 2009 to 2008 was

primarily impacted by:

|

·

|

a

negative impact of approximately $21.2 million relating to lower order

rates from many of our customers resulting from unfavorable economic

conditions in North America,

|

|

·

|

approximately

$4.6 million of patent litigation expenses relating to Furniture

Components, and

|

|

·

|

a

write-down on assets held for sale of approximately

$717,000.

|

The above

decreases were primarily offset by:

|

·

|

a

$3.8 million reduction in fixed manufacturing expenses (excluding

depreciation) in response to the lower sales

volume,

|

|

·

|

a

$1.7 million reduction in lower operating costs and expenses in response

to the lower sales volume, and

|

|

·

|

$900,000

in lower depreciation expense in 2009 due to a reduction in capital

expenditures for shorter lived assets over the last several years in

response to lower sales.

|

- 18

-

Excluding

the 2008 goodwill impairment charge, the comparison of operating income for 2008

to 2007 was primarily impacted by:

|

·

|

a

negative impact of approximately $5.4 million relating to lower order

rates from many of our customers resulting from unfavorable economic

conditions in North America, and

|

|

·

|

increased

raw material costs that we were not able to fully recover through sales

price increases by approximately $1.0 million due to the competitive

nature of the markets we serve.

|

The above

decreases were primarily offset by:

|

·

|

the

one-time $2.7 million of facility consolidation costs incurred in

2007,

|

|

·

|

$1.8

million in lower depreciation expense in 2008 due to a reduction in

capital expenditures for shorter lived assets over the last several years

in response to lower sales, and

|

|

·

|

the

$1.3 million favorable effect on operating income of changes in foreign

currency exchange rates.

|

Currency. Our

Furniture Components segment has substantial operations and assets located

outside the United States (in Canada and Taiwan). The majority of

sales generated from our non-U.S. operations are denominated in the U.S. dollar

with the remainder denominated in other currencies, principally the Canadian

dollar and the New Taiwan dollar. Most raw materials, labor and other

production costs for our non-U.S. operations are denominated primarily in local

currencies. Consequently, the translated U.S. dollar values of our

non-U.S. sales and operating results are subject to currency exchange rate

fluctuations which may favorably or unfavorably impact reported earnings and may

affect comparability of period-to-period operating results. In

addition to the impact of the translation of sales and expenses over time, our

non-U.S. operations also generate currency transaction gains and losses which

primarily relate to the difference between the currency exchange rates in effect

when non-local currency sales or operating costs are initially

accrued and when such amounts are settled with the non-local

currency.

Overall,

fluctuations in currency exchange rates had the following effects on our

Furniture Component segment’s net sales and operating

income:

|

Impact of changes in currency exchange

rates - 2008 vs 2009 (in thousands)

|

||||||||||||||||||||

|

Transaction

gains/(losses)

|

Translation

gain/loss-

impact

of rate

|

Total

currency impact

|

||||||||||||||||||

|

2008

|

2009

|

Change

|

changes

|

2008 vs 2009

|

||||||||||||||||

|

Impact

on:

|

||||||||||||||||||||

|

Net

Sales

|

$ | - | $ | - | $ | - | $ | (848 | ) | $ | (848 | ) | ||||||||

|

Operating

income

|

679 | (236 | ) | (915 | ) | 907 | (8 | ) | ||||||||||||

|

Impact of changes in currency exchange rates -

2007 vs 2008 (in thousands)

|

||||||||||||||||||||

|

Transaction gains/(losses)

|

Translation

gain/loss-

impact

of rate

|

Total

currency impact

|

||||||||||||||||||

|

2007

|

2008

|

Change

|

changes

|

2007 vs 2008

|

||||||||||||||||

|

Impact

on:

|

||||||||||||||||||||

|

Net

Sales

|

$ | - | $ | - | $ | - | $ | 406 | $ | 406 | ||||||||||

|

Operating

income

|

(1,085 | ) | 679 | 1,764 | (460 | ) | 1,304 | |||||||||||||

- 19

-

The net

impact on operations of changes in currency rates from 2008 to 2009 was not

significant. The positive impact on operating income for the 2007

versus 2008 comparison is due to transactional currency exchange gains in 2008

as compared to losses in 2007 which were a function of the timing of currency

exchange rate changes and the settlement of non-local currency receivables and

payables.

General

Our

profitability primarily depends on our ability to utilize our production

capacity effectively, which is affected by, among other things, the demand for

our products and our ability to control our manufacturing costs, primarily

comprised of labor costs and materials. The materials used in our

products consist of purchased components and raw materials some of which are

subject to fluctuations in the commodity markets such as zinc, copper, plastic

resin, coiled steel and stainless steel. Total material costs represent

approximately 44% of our cost of sales in 2009, with commodity related raw

materials accounting for approximately 18% of our cost of

sales. During 2007 and most of 2008, worldwide raw material costs

increased significantly and then declined in 2009. We occasionally

enter into commodity related raw material supply arrangements to mitigate the

short-term impact of future increases in commodity related raw material

costs. While these arrangements do not necessarily commit us to a

minimum volume of purchases, they generally provide for stated unit prices based

upon achievement of specified volume purchase levels. This allows us to

stabilize commodity related raw material purchase prices to a certain extent,

provided the specified minimum monthly purchase quantities are met. We enter

into such arrangements for zinc and coiled steel. While commodity

related raw material purchase prices stabilized to a certain extent in 2009, it

is uncertain whether the current prices will remain near the current levels

during 2010. Materials purchased on the spot market are sometimes

subject to unanticipated and sudden price increases. We generally

seek to mitigate the impact of fluctuations in raw material costs on our margins

through improvements in production efficiencies or other operating cost

reductions. In the event we are unable to offset raw material cost

increases with other cost reductions, it may be difficult to recover those cost

increases through increased product selling prices or raw material surcharges

due to the competitive nature of the markets served by our

products. Consequently, overall operating margins may be affected by

raw material cost pressures.

Other

non-operating income, net

As

summarized in Note 10 to the Consolidated Financial Statements, “other

non-operating income, net” primarily includes interest

income. Interest income decreased approximately $350,000 in 2009

compared to 2008 and decreased $900,000 in 2008 compared to 2007 due to lower

interest rates on lower invested cash balances.

Interest expense

Interest

expense decreased approximately $1.3 million in 2009 compared to 2008 as the

result of a lower interest rate on the outstanding principal amount of our note

payable to affiliate (5.05% at December 31, 2008 as compared to 1.25% at

December 31, 2009). Interest expense increased approximately $1.6

million in 2008 compared to 2007 as a result of financing the October 2007

repurchase and/or cancellation of a net 2.7 million shares of our Class A common

stock from an affiliate with a promissory note. See Note 11 to the

Consolidated Financial Statements. We expect 2010 interest expense to

be comparable to 2009.

Provision

for income taxes

As a

member of the Contran Tax Group, we compute our provision for income taxes on a

separate company basis, using the tax elections made by Contran. One

such election is whether to claim a deduction or a tax credit against U.S.

taxable income with respect to foreign income taxes paid. Consistent with

elections of the Contran Tax Group, in the last three years we did not claim a

credit with respect to foreign income taxes paid but instead we claimed a tax

deduction for related withholding taxes. This resulted in an increase

in our effective income tax rate.

- 20

-

Excluding

the 2008 goodwill impairment charge, our effective income tax rate increased

from 51% in 2008 to 61% in 2009 and increased from 44% in 2007 to 51% in 2008.

The increases in our effective income tax rates over the three year period are

primarily due to a higher percentage of our results being sourced from Canada

and as noted above, the taxes on these results are not claimed as a credit on

our U.S. tax return. We currently expect our effective income tax

rate for 2010 will be lower than our effective rate for 2009.

Segment

Results

The key

performance indicator for our segments is the level of their operating income

(see discussion below). For additional information regarding our

segments refer to Note 2 to the Consolidated Financial Statements.

|

Years ended December 31,

|

% Change

|

|||||||||||||||||||

|

2007

|

2008

|

2009

|

2007 – 2008 | 2008 – 2009 | ||||||||||||||||

|

(In

millions)

|

||||||||||||||||||||

|

Net

sales:

|

||||||||||||||||||||

|

Security

Products

|

$ | 80.1 | $ | 77.1 | $ | 61.4 | (4 | %) | (20 | %) | ||||||||||

|

Furniture

Components

|

81.3 | 76.4 | 48.2 | (6 | %) | (37 | %) | |||||||||||||

|

Marine

Components

|