Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2009

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 000-30939

ACTIVE POWER, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 74-2961657 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 2128 W. Braker Lane, BK 12, Austin, Texas | 78758 | |

| (Address of principal executive offices) | (Zip Code) | |

(512) 836-6464

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Class |

Name of Exchange on Which Registered | |

| Common Stock, $0.001 per share | The Nasdaq Stock Market LLC | |

| (Nasdaq Global Market) |

Securities registered pursuant to Section 12(g) of the Act:

Preferred Share Purchase Rights

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes þ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. ¨ Yes þ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. þ Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ¨ Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one)

| Large accelerated filer ¨ | Accelerated filer þ | Non-accelerated filer ¨ | Smaller reporting company ¨ |

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) ¨ Yes þ No

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, based upon the closing sale price of its common stock on the last day of registrant’s most recently completed second fiscal quarter, June 30, 2009, as reported on The Nasdaq Stock Market, was approximately $56.6 million (affiliates being, for these purposes only, directors and executive officers).

As of March 3, 2010, the registrant had 79,710,373 shares of Common Stock outstanding.

Documents Incorporated by Reference

Certain information required by Part III of Form 10-K is incorporated by reference to the registrant’s proxy statement for the 2010 Annual Meeting of Stockholders, which will be filed with the Securities and Exchange Commission within 120 days after the close of the Registrant’s fiscal year ended December 31, 2009.

Table of Contents

Active Power, Inc.

Unless otherwise indicated, “we,” “us,” “our,” and “Active Power” mean Active Power, Inc., including our predecessor Texas corporation and our subsidiary companies. References in this report to “$” or “dollars” are to United States of America currency.

i

Table of Contents

Special Note Regarding Forward-Looking Statements

This report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements about historical or current facts, including, without limitation, statements about our business strategy, plans and objectives of management and our future prospects, are forward-looking statements. Although we believe that the expectations reflected in such forward-looking statements are reasonable, such forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from these expectations. Such risks and uncertainties include, without limitation, the following:

| • | strategic relationships with third parties, including suppliers and channel partners; |

| • | customer demand for our products; |

| • | customer adoption of new products; |

| • | growth and future operating results; |

| • | developments in our markets; |

| • | expansion of our product offerings and sales channels; |

| • | customer benefits attributable to our products; |

| • | technologies and operations; |

| • | industry trends; and |

| • | future economic, business and regulatory conditions. |

You can identify these statements by forward-looking words such as “may,” “will,” “expect,” “intend,” “anticipate,” “believe,” “estimate,” “continue” and other similar words. You should read statements that contain these words carefully because they discuss our future expectations, make projections of our future results of operations or financial condition, or state other “forward-looking” information. We believe that it is important to communicate our future expectations to our investors. However, there may be events in the future that we are not able to accurately predict or control. The factors listed in the section captioned “Risk Factors” in Item 1A of this report, as well as any cautionary language in this report, provide examples of risks, uncertainties and events that may cause our actual results to differ materially from the expectations we described in our forward-looking statements.

ii

Table of Contents

PART I.

| ITEM 1. | Business. |

Overview

Active Power is a manufacturer and provider of efficient, reliable and green continuous power solutions incorporating uninterruptible power supply (UPS) systems that ensure business continuity for enterprises in the event of power disturbances. Our products and solutions are designed to deliver continuous clean power, protecting customers from voltage fluctuations such as surges and sags and frequency fluctuations and to provide ride-through, or temporary, power to bridge the gap between a power outage and the restoration of utility power. Our target customers are global enterprises requiring “power insurance” because they have zero tolerance for downtime in their mission critical operations. The UPS products we manufacture use kinetic energy to provide short-term power as a cleaner alternative to electro-chemical battery-based energy. These products are highly reliable, energy and space efficient and significantly reduce client electricity expenses.

As of December 31, 2009, we have shipped more than 2,400 flywheels in UPS system installations, delivering more than 600 megawatts of power to customers in 44 countries around the world. We are headquartered in Austin, Texas, with international offices in the United Kingdom, Germany and Japan.

Our patented flywheel-based UPS systems store kinetic energy by constantly spinning a compact steel wheel (“flywheel”) driven from utility power in a low friction environment. When the utility power used to spin the flywheel fluctuates or is interrupted, the flywheel’s inertia causes it to continue spinning. The resulting kinetic energy of the spinning flywheel generates electricity known as “bridging power” for short periods, until either utility power is restored or a backup electric generator starts and takes over generating longer-term power in the case of an extended electrical outage. We believe our flywheel products provide many competitive advantages over conventional battery-based UPS systems, including substantial space savings, higher power densities, “green” energy storage, and higher power efficiencies up to 98%. This high energy efficiency reduces operating costs and provides customers a total lower cost of ownership. We offer our flywheel products with load capabilities from 130kVA to 8,400kVA. We typically target higher power applications of 200kVA and above, largely because the majority of customers in this market segment have backup generators. Our flywheel-based UPS systems are marketed under the brand name CleanSource®.

Our continuous power systems, which incorporate our UPS products with switchgear and a generator to provide complete short and long-term protection in the event of a power disturbance, are marketed under the brand name PowerHouseTM. PowerHouse can be deployed in either a 20-foot or 40-foot-long ISO container depending upon the customer’s power load requirements. These systems are specifically designed to handle the demands of high-tech facilities requiring the highest power integrity available while maximizing up time, useable floor space and operational efficiency. Designed to offer a highly flexible architecture to a customer’s constantly changing environment, our systems are offered in four standard modular power configurations, enabling sizing for infrastructure on demand. These systems are highly differentiated as they offer flexibility in placement, space savings, fast deployment time after receipt of order, high energy efficiency, and prompt capital deployment to meet current demands. They also deliver significant value to customers as the entire system is integrated and tested prior to delivery for a repeatable simple solution.

We believe a number of underlying macroeconomic trends place Active Power in a strong position to be one of the leading providers of critical power protection. These trends include:

| • | Ever-increasing demands placed on the public utility infrastructure; |

| • | An inadequate investment in global utility infrastructure; |

| • | Rising costs of energy worldwide; |

| • | Increasing business costs of downtime; |

| • | A rapidly expanding need for data centers that provide reliable, efficient power; and |

| • | An increasing demand for economically green solutions. |

1

Table of Contents

We have evolved significantly since our founding in 1992 as an engineering business focused on research, development and invention. The technological foundation of Active Power has yielded more than 100 worldwide patents and a highly differentiated, cost-efficient product platform. In 2005, Active Power’s board of directors brought in a new management team which set into motion a commercialization strategy focused on:

| • | building the Active Power brand in the marketplace; |

| • | expanding our distribution channels; |

| • | creating innovative solutions; and |

| • | focusing on operating and product cost reduction. |

As a result of this strategy, we have been successful in improving our operating and financial performance, broadening our global footprint, diversifying our customer base, broadening our sales channels and partners and moving higher up the customer value chain with innovative developments of our core underlying product technology. This is most recently illustrated by our newest product offering, PowerHouse, a containerized, portable, complete continuous power solution.

We sell our products to a wide array of commercial and industrial customers across a variety of vertical markets, including data centers, manufacturing, technology, broadcast and communications, financial, utilities, healthcare, government and airports. Sales to Caterpillar, Inc. represented 31%, 40% and 24% of our total revenue in 2007, 2008 and 2009, respectively. One of our U.S. based IT customers accounted for 12% of our total revenue in 2009. No other customer represented more than 10% of our total revenue in 2009. We have expanded our global sales channels and direct sales force, selling in all major geographic regions of the world, but particularly in North America, Europe and Asia. Our revenue derived from customers outside of the United States was $15.2 million, $16.9 million and $12.4 million, which represented 45%, 39% and 31% of our total revenue in 2007, 2008 and 2009, respectively.

The Global UPS Market

According to a 2008 report on the world UPS market by IMS Research the global UPS market was estimated to be almost $8 billion in 2008. IMS Research projects the market will increase to almost $9 billion during 2010 and is expected to grow to more than $10 billion by 2012 with a compound annual growth rate of 8.3%.

UPS products can be classified into single phase and three phase systems. Single phase applications are typically for homes or very small businesses with low power requirements. Active Power is engaged in the higher power three phase market and does not offer any systems in the lower power single phase range. The market for three phase systems is typically stratified by kVA (kilo-Volt-Amps or power level) and by geography. Active Power has refined its focus on customers in the 100 kVA and higher category. In 2008, this category of the UPS market was estimated to be $2.1 billion of the global market and is forecasted to be $3.3 billion of the total market opportunity in 2012 according to the 2008 IMS Research report. This is one of the fastest growing segments of the UPS market according to IMS Research.

2

Table of Contents

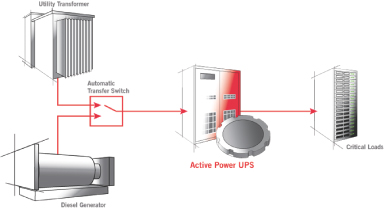

UPS products serve two primary functions. First, they are continuously operating when utility power is being provided. They also perform a power “conditioning” function where they regulate incoming utility power via an automatic transfer switch and compensate for fluctuations in voltage and frequency, in order to provide clean continuous output power to the end application. Second, if there is any interruption in the utility source, the UPS will provide temporary, or bridging, power until either utility power is restored, or an alternative generating source, such as a diesel or gas generator, begins to provide power. This functionality of the UPS in the context of a continuous power application is illustrated below:

UPS Market Drivers

There are several market dynamics fueling the growth of the UPS market and the need for energy efficient, reliable and green backup power. These include:

| • | Increasing unreliability of utility infrastructure |

| • | A lack of global investment over a sustained period in underlying infrastructure has failed to keep up with increased demands for energy and resulted in increased disruption and poor supply quality from the grid. |

| • | More frequent power outages and disturbances |

| • | Increase in data growth and storage requirements |

| • | Increase in the amount of enterprise data growth, which will require more IT equipment, more power, more space and more cooling |

| • | Increased use of social networking sites, Web-based applications, cloud computing, and similar technologies that are increasing data storage requirements |

| • | Increase in global energy consumption |

| • | Data growth requires data centers to invest in more IT equipment, more power and more space. |

| • | High density computing applications continue to grow where people are requiring more computing power in the same or less physical space. |

| • | Rapid industrialization of highly populated world regions is increasing global energy demand. |

| • | An increasing cost to produce and consume electricity due to rapid depletion of finite fossil fuel sources, instability in oil-producing regions, and a preference for green energy sources |

| • | Customers focused on convenience and improving margins |

| • | Organizations want full turnkey solutions from one supplier rather than having to engage with multiple vendors to build a complete power solution. |

| • | Industry shift towards energy efficiency and reducing electricity costs |

3

Table of Contents

| • | Increasing economic impact of power interruption to users |

| • | The financial cost of power interruption through loss of products, manufacturing down time, and computer processing interruptions |

| • | Reputational cost of power interruption to underlying businesses |

| • | Increasing concern over environmental impact |

| • | Global warming |

| • | Carbon footprint of businesses and individuals |

| • | Tax incentives and rebates for deploying energy efficient products |

Within the UPS market, we believe a majority of customers are using UPS products to protect their data center and IT applications. The competitive dynamics of the data center market, in particular, provide an excellent platform to successfully market our highly efficient systems.

We believe that the UPS market opportunity remains relatively intact despite the recent global economic situation. The managed data center sector remains sound as a result of recurring cash flows and the stability of operating results they provide, along with increasing customer demand growing faster than available data center supply, particularly for collocation hosting. Improvement in credit availability and business confidences is allowing corporations to resume capital spending and to scale their IT infrastructure, which we believe should lead to higher demand for UPS and continuous power solutions.

Given the rapidly increasing cost and consumption of energy, there is a significant requirement to improve the efficiency of the infrastructure in the data center. According to a December 2008 article entitled “Tomorrow’s Data Center” in Information Week Analytics, the national average usage rate for electricity in the United States has jumped 44% since 2004. We also believe that the market is already predisposed to the use of battery-free alternatives since battery-based solutions are less space efficient, have higher replacement cycles and are less reliable. This is particularly true as customer applications increase in absolute size, specifically above one megawatt, where we believe a majority of the applications are already using battery-free solutions. In general, the savings associated with our higher efficiency products are magnified in larger customer applications based upon the space and power efficiencies and extended operating temperature range of the Active Power system.

With the expansion of our product range to encompass a complete continuous power solution, including our PowerHouse business, we believe the potential available market opportunity for our company increases from $2.1 billion to approximately $6 billion. This increase is due to the fact we are now moving into different product market segments with all of the additional components used in the assembly of PowerHouse – switchgear, automatic transfer switch, diesel generator, container integration and professional services.

Our Solutions

We believe our key areas of product differentiation and our market focus align very well with the market drivers described above. We believe the core differentiators in Active Power’s solutions are that they are

| • | intelligently efficient; |

| • | inherently reliable; and |

| • | economically green. |

Intelligently Efficient.

Energy Efficient. Our UPS systems are up to 98% energy efficient, as compared to 88% efficiency for conventional battery-based UPS systems, at similar loading levels. Our flywheel UPS loses only 2% of incoming power compared with as much as a 12% power loss for conventional battery-based UPS systems to protect the

4

Table of Contents

same mission critical load. This results in an average utility savings for our customers of approximately 83% as compared to conventional systems. Greater efficiency reduces a customer’s energy consumption when operating the UPS system, resulting in a decrease in energy expenses. This savings is magnified as the volume and cost of energy increases.

Space Efficient. Our UPS systems are also extremely power-dense, meaning we can provide, on average, twice the power in the same physical space as compared to a conventional battery-based UPS system. This space efficiency allows customers to dedicate space to revenue generating operations and/or equipment, to use less space for their UPS needs or to increase the amount of backup power they can fit into their existing facility. This allows them to take advantage of higher-power computing applications without needing to invest in new infrastructure.

Flexible Operations. Our systems have a 20-year design life and can operate in temperatures of up to 40 degrees Centigrade (104 degrees Fahrenheit), compared to 24 degrees Centigrade (76 degrees Fahrenheit) for conventional battery-based UPS systems. Our systems can be deployed virtually anywhere due to the minimal requirements the system has in terms of heating or cooling.

Modular Design. Active Power UPS systems are designed around a 300kVA module which can be paralleled with other modules to make a larger UPS system. This modularity allows customers to purchase their UPS systems as expandable systems to be upgraded in the field when additional power is needed. We believe that this capability provides customers with an easy path to expansion and the benefits of just-in-time capital deployment.

Inherently Reliable. We believe that the Active Power system is more reliable than conventional or chemical-based solutions available in the market today. We can measure the reliability of our UPS products, including the short-term energy storage devices, providing our customers with a much better indicator of system reliability compared to our competitors. Our competitors quote product reliability measures that exclude the failure rate of their short-term energy storage devices due to the inherent limitations of lead-acid batteries. In comparison to conventional UPS systems that use chemical energy storage technology, the Active Power solution is a precision-engineered mechanical system that delivers predictable, consistent backup power performance. Using aircraft quality steel to harness kinetic energy, our systems deliver peace of mind throughout the course of the product’s 20-year plus useful life. By December 31, 2009, we had shipped more than 2,400 flywheels that can be found in UPS installations around the world with more than 63 million hours of reliable run time. We believe, based on an independent study by Massachusetts-based MTechnology, Inc., in February 2008 entitled “System Reliability of CleanSource UPS versus Double Conversion UPS,” that Active Power flywheel UPS system is generally seven times less likely to fail versus a conventional battery-based UPS system.

Economically Green. We believe that we offer a unique distinction among UPS providers. When a customer selects an Active Power solution, they become part of the growing global movement to reduce industrial impact on the environment. Because of our higher efficiency, the end user saves on energy consumption, our ability to function in higher temperatures means less air conditioning required to dissipate energy losses, and the elimination of battery maintenance, replacement and disposal, all resulting in savings on operational expenses. We call it economically green because unlike many other products that are considered “green,” our solution will improve a customer’s bottom line with reduced energy expenses and a lower total cost of ownership. In addition, there are no environmentally hazardous disposal concerns as compared with battery-based lead and acid materials used in competitive technologies. A green choice delivered at an overall economic advantage to the end user makes for a very compelling offering in today’s marketplace. All of this adds up to a solution delivered with a much lower total cost of ownership for customers that we believe can yield up to 60% cost savings over a system’s life.

Strategy

Active Power’s current commercialization plan is supported by the following primary business strategies:

| • | Building brand |

| • | Expand distribution |

5

Table of Contents

| • | Create innovative solutions |

| • | Build service capabilities |

| • | Reduce Cost |

Building Brand. Customers seeking continuous power products and solutions often prefer direct engagement with the manufacturer for products and services. Brand awareness is therefore an important element and necessary for sales success to these mission-critical customers, especially in high power applications at 200 kVA and above. As we continue to pursue a multi-tiered and multi-geographical distribution strategy, we must have a recognizable brand. We have increased our marketing efforts to build awareness of both our company and our products and we continue to gain awareness and recognition as an efficient, reliable, and green power solution provider. We are building our brand identity through the expansion of traditional and nontraditional public relations programs, conference presentations, industry awards, white paper and case studies and key sales wins. Building the Active Power name in our addressable markets will be critical to future growth and success in the industry.

Expand Distribution. We now bring products to market through diversified sales channels including sales sold directly by Active Power, manufacturer’s representatives, international distributors, original equipment manufacturer (OEM) partners and strategic IT partners. In the past, most of our revenues were generated through our OEM channel and as recently as 2005, OEM sales were the majority of our revenues. In 2002, 93% of our business was non-Active Power branded sales. In 2009, Active Power branded product sales had increased and made up 76% of total sales. We believe the diversification of our sales channels provides us greater market penetration opportunities while minimizing the adverse impact that any one channel or partner may have on our overall business.

Our OEM channel historically has produced lower margin sales than sales we make directly and, more dramatically, it provides decreased opportunities for us to sell additional products and services. Our OEM partners historically were able to leverage their own brand equity and client relationships to help accelerate the adoption of our products. While our OEM channel is still strategically important to our business, use of other sales channels has helped us build the Active Power brand and increased our opportunity to interact directly with clients in a consultative selling environment, which yields better product pricing, better profitability, longer-term sales and service opportunities and enhanced customer relationships.

To help further expand our distribution channels and increase our brand awareness globally, during 2009, we established a strategic IT partner channel that includes relationships with leading technology companies including Hewlett Packard (HP) and Sun Microsystems. These partners are already selling technology solutions to many of the same end users that we have traditionally targeted for UPS solutions sales. Through these new partners, we can introduce Active Power, and our PowerHouse product in particular, to their customers for projects to which we may not otherwise have been exposed. In 2009, approximately half of our PowerHouse sales were derived from our strategic IT partners.

Create Innovative Solutions. The global UPS market has been dominated by a handful of providers delivering essentially the same product platform for over a decade – a static double-conversion UPS with lead-acid batteries for short-term energy storage. Today, Active Power brings a differentiated solution that provides clients with significant economic advantages compared to competitive systems, including: energy efficiency, space efficiency, 20-year plus useful life, improved system reliability and lower operating and maintenance costs. Our high efficiency UPS systems reduce utility power costs in an environment of increasing electricity usage and rising kilowatt-hour energy costs. Similarly, our space efficient design reduces precious data center floor space by as much as a factor of four for the same power requirement. This improved performance at a lower cost coupled with high reliability and the fact our products are economically green delivers distinct rewards to the end user and to the environment.

Leveraging the unique product advantages of our UPS systems, and in particular their ability to provide more backup power in less physical space, we have developed a containerized continuous power system that we

6

Table of Contents

call PowerHouse. PowerHouse is a complete continuous power system in a streamlined, space saving containerized unit with all critical power infrastructure components in one package: generator, switch gear, UPS, monitoring/control systems, optional cooling systems and comprehensive maintenance. The solution, which allows customers to get their entire continuous power solution from one vendor provides a competitive advantage for a variety of applications, including: facility infrastructure expansion, disaster recovery, temporary or portable critical power needs, event support or support for a containerized datacenter product such as those sold by our IT channel partners We believe PowerHouse is a differentiated solution that allows customers to deploy their capital more efficiently to meet their current demands, compared to building out power and cooling infrastructure to support capacity planned to grow over many years. It also enables clients to maximize the efficient use of their data center space by utilizing higher cost interior space for revenue-generating or critical computing activities and less costly space to house their power and cooling infrastructure. The Active Power flywheel UPS system is well suited to be housed in an ISO (International Organization for Standardization) container because of its small footprint, high efficiency and wide operating temperature range.

Build Service Capabilities. We have focused on building our local service capabilities to provide assessment, implementation and life cycle support services to customers buying our UPS and continuous power solutions. As a result of this focus, our service revenue has grown from $1.7 million in 2004 to $7.5 million in 2009. Providing our clients, including our channel partners, with consultative and long-term services is integral to our strategy of selling directly and delivering overall solutions while building long-term customer relationships. Broadening our product portfolio to offer new and value added services also affords us the opportunity to sell more products to individual clients, increases the chances for follow-on or repeat orders, and grows our revenue and contribution margin.

Reduce Cost. We have deployed a number of cost reduction programs to improve product and operating costs while delivering high quality and reliability in our products. In addition to these cost reduction efforts, we have worked to streamline our product line to simplify our offerings and leverage the modular nature of our products to build multi-megawatt systems. As a result, we have experienced improved efficiencies in the overall manufacturing process, supply chain improvements, and service delivery with lower overall operating expenses.

Competitive Landscape

Active Power competes in two primary product areas: UPS systems and continuous power solutions.

UPS Systems. CleanSource UPS competes primarily with conventional battery-based UPS manufacturers such as Emerson/Liebert, Eaton/Powerware and APC/MGE on a global basis. In addition, we compete with rotary UPS providers such as Piller, Eurodiesel and Hitec, particularly in Europe. We are largely competing against these same competitors in applications of above one megawatt; however, there is greater market acceptance of battery-free solutions compared to battery-based solutions in this power range, making this an ideal segment for our CleanSource UPS products. Our primary basis of competition in this segment is product differentiation and our advantage in space and power efficiencies. We also offer CleanSource DC, a battery replacement option for companies with existing UPS and batteries who desire to upgrade to a battery-free technology. Pentadyne Energy Corp. and Vycon are two of our U.S.-based competitors in this market.

Continuous Power Solutions. Continuous power solutions are a growing sector of our business that enable us to leverage the strengths and key benefits of our flagship product, CleanSource UPS. PowerHouse is the brand name for our prepackaged continuous power systems which are delivered in a 20- or 40-foot ISO quality shipping container for fast deployment to space constrained operations, and disaster recovery applications or to accompany a modular data center product. There are a variety of competitors with similar capabilities including system integrators and value added service providers who may procure required system components and assemble custom solutions. We believe that Active Power is one of only a few UPS manufacturers in the world also offering pre-packaged standard systems for quick delivery globally. The power density advantages we enjoy with our UPS products allow us to offer higher backup power levels within the physical constraints of the

7

Table of Contents

containerized space compared to our competitors, which we believe is a barrier to entry for them and will lead to higher revenues from turnkey systems for Active Power in the future. Also, our product’s ability to operate in temperatures of up to 40 degrees Centigrade in non-air conditioned environments (such as a modular container) acts as a competitive barrier to entry for battery UPS systems which must have sufficient air conditioning to operate properly. Since early 2008, we have entered into agreements to jointly market and sell PowerHouse and related services in conjunction with Sun Microsystems and Hewlett Packard. Active Power will support the modular or containerized data center products of each of these partners. We believe our ability to jointly market and leverage the activities of our mutual sales channels increases the revenue potential of PowerHouse for Active Power in future periods.

Many of our current competitors have longer operating histories, greater financial, technical, marketing and other resources, broader name and brand recognition, and a larger installed base of customers and service infrastructure than we do. As a result, these competitors may have greater credibility with our existing and potential customers. They also may be able to adopt more aggressive pricing policies and devote greater resources to the development, promotion and sale of their products than we can, which would allow them to respond more quickly to new or emerging technologies or changes in customer requirements. In addition, some of our current competitors have established supplier or joint development relationships with our current or potential customers and channel partners. These competitors may be able to leverage their existing relationships to discourage these customers from purchasing products from us or to persuade them to replace our products with their products. Increased competition could decrease our prices, reduce our sales, lower our margins or decrease our market share. These and other competitive pressures could prevent us from competing successfully against current or future competitors and could materially harm our business.

Products and Services

Foundational Technology

Active Power introduced the world’s first integrated flywheel UPS system, which integrates UPS power electronics with flywheel energy storage technology. The flywheel stores kinetic energy, energy produced by motion, by constantly spinning a compact rotor in a low friction environment. When short-term backup power is required due to utility power fluctuations or losses, the rotor’s inertia allows it to continue spinning and the resulting kinetic energy is converted to electricity.

The UPS draws upon the stored kinetic energy of the spinning flywheel to generate electricity to the load until the utility power returns, or in the event of a longer interruption, the generator comes online as a power source. The flywheel immediately supports the critical load upon loss of utility power. Within seconds of an extended outage occurring, the UPS signals the generator to start via the automatic transfer switch. The generator then carries the load until utility is restored.

8

Table of Contents

CleanSource Products

We market all of our flywheel-based products that are sold as stand-alone products under the brand name CleanSource ®. CleanSource DC is a battery-free replacement for lead acid batteries used for bridging power. Using our flywheel energy storage technology, CleanSource DC is a stand-alone direct current (DC) product compatible with all major brands of UPS systems and is sold and used in conjunction with a third-party UPS system. It is available in power configurations ranging from 250kVA up to 2 megawatts. From this initial product that we first sold in 1997, we developed CleanSource UPS, a battery-free UPS system that integrates normal UPS electronics and our flywheel energy storage system into one compact cabinet. We currently offer CleanSource UPS products in power configurations ranging from 130kVA up to 2.4 megawatts, with the ability to parallel these products to provide more than 8 megawatts of load protection. Combining CleanSource UPS with a generator provides customers with complete short- and long-term protection in the event of a power disturbance. UPS products, branded by Active Power or our OEM partners, represent a majority of our current revenues and represented 63%, 67% and 60% of our total revenue for the years ended December 31, 2007, 2008 and 2009, respectively.

PowerHouse Systems

For customers looking for a complete, integrated continuous power system, we package our CleanSource UPS along with a generator, switch gear, monitoring and control software, our generator starting module (known as GenSTART), optional cooling system and a comprehensive maintenance package all into a containerized product offering we call PowerHouse. PowerHouse can be deployed in either a 20-foot or 40-foot-long ISO container depending upon the customer’s power load requirements. These systems are specifically designed to handle the demands of high-tech facilities requiring the highest power integrity available while maximizing up time, useable floor space and operational efficiency. Designed to offer a highly flexible architecture to a customer’s constantly changing environment, our systems are offered in four standard modular power configurations, enabling sizing for infrastructure on demand. These systems are highly differentiated as they offer flexibility in placement, space savings, fast deployment time after receipt of order, high energy efficiency, and prompt capital deployment to meet current demands. They also deliver significant value to customers as the entire system is integrated and tested prior to delivery for a repeatable simple solution. PowerHouse revenues, a new revenue source in 2009, represented 15% of total revenue in 2009.

GenSTART

GenSTART is a battery-free, starting modular system designed to ensure that a customer’s diesel generator will start. Diesel failure is a common cause of UPS system failure when there is a power disturbance. This unique and patented product takes energy from the flywheel of the CleanSource UPS and provides 1725 cold cranking amps to the generator set starting motor, so the customer can be assured starting power is available when it is most critical – at start-up. GenSTART is sold in conjunction with our CleanSource UPS system and is also a critical component in our PowerHouse solution. It can also be sold independently of our UPS product and works with third-party UPS systems.

Service

We deliver worldwide customer support through our technical services division that offers clients assessment, implementation and lifecycle support services for all Active Power systems. Building a portfolio of services to work with clients through the lifecycle of their power assessment design and implementation process is a key element of our service growth strategy. We offer the following services to our customers:

| • | Infrastructure Needs Assessment. We work locally through our global network of mission critical infrastructure engineers and project managers to assess the power and cooling needs of a client’s facility. |

| • | Vetting and Validation. Our teams of experienced application engineers use comprehensive assessments to vet and validate the most optimal solution that complements a client’s business continuity plan. |

9

Table of Contents

| • | Alignment with Business Objectives. Through continuous communication, our teams ensure the solution accurately aligns with the original needs assessment and a client’s short-term and projected future business objectives. |

| • | System Design. We design client solutions to ensure all components are optimized, with a particular focus on reliability, efficiency and cost effectiveness in determining the correct match and interoperability between components. |

| • | Deployment. Our experienced group of project managers will work with a client to develop a timely deployment schedule with the least impact on day-to-day business. We ensure expectations are clearly defined through the deployment phase. |

| • | Start-Up & Commissioning. Once the system is deployed, our team takes the system through a rigorous commissioning process to ensure the system is working to specification. Our engineers work closely with the client’s team to make certain they are educated and trained on the successful operation of the system. |

| • | Service, Support & Monitoring. Clients can choose from a variety of comprehensive service and support offerings, tiered to match an organization’s internal capabilities and requirements. We offer four tiers of maintenance programs specifically designed to deliver on both the long-term preventive maintenance requirements for the system and a client’s need for support. Level of support is at the client’s discretion. Ensuring a reliable and efficient operation requires accurate monitoring, which we offer as a hands-off remote monitoring service in our center, locally at the client’s facility, or as a combination of both. |

Distribution Strategy

We bring products to market through several distribution methods and partners:

| • | Sales made directly by Active Power; |

| • | Manufacturer’s representatives; |

| • | Distributors; |

| • | OEM partners; and |

| • | Strategic IT partners |

Sales made directly by Active Power. Our direct sales teams are located in the Americas, Europe and Asia markets. We have adopted a strategy of native geographic expansion, meaning we will place local offices in the markets we identify for direct selling activities rather than having personnel travel from the United States to sell into foreign markets. Our direct sales teams have been successful in securing and establishing local presence and brand awareness, large customer orders and developing the foundation for the long-term client relationships we seek to build.

Manufacturer’s Representatives. We have both exclusive and non-exclusive relationships in place with a group of manufacturer’s representatives primarily in North America. An exclusive representative has been granted exclusive rights to sell Active Power products in a specific geographic territory. In exchange, the representative has agreed to sell a specific volume of our products and not sell any competitive products, all in exchange for compensation at a specified rate that is tied to the profitability of the underlying sales. We also maintain a group of non-exclusive representatives who have each been designated a territory in which to sell our products on a non-exclusive basis for a lower specified commission rate. The manufacturer’s representative channel remains integral to the distribution of our products in North America and increases our geographic sales coverage without the necessity of adding direct sales personnel. Products are marketed and sold under the Active Power brand through this channel.

10

Table of Contents

International Distributors. In certain overseas markets, we have elected to recruit and retain specific international distributors to market our products and services into the designated geographic market. The distributor buys products from us and resells them to the end user, often with other products or services. Distributors may also perform service and warranty work for us under contract. This strategy has proved fruitful for the company in markets where we do not choose to deploy direct sales resources.

OEM Partners. OEM partners are our longest standing method of distribution and remain key to our overall business strategy. We continue to invest in this important distribution channel and look forward to improved performance in this channel in 2010. Our primary OEM partner and largest single customer is Caterpillar, Inc. (Caterpillar). Caterpillar markets Active Power manufactured products under the Caterpillar brand name “CAT UPS” and as a complement to its electric power product lines of diesel engines and switchgear. Caterpillar is a global market leader in new generator sales and has the largest installed base of existing standby generators in the world. By offering the CAT UPS with a standby generator and switchgear, Caterpillar can transform a standby power system into a continuous power system. We believe this total solution gives both Caterpillar and Active Power significant competitive advantages in the power quality market. In 2008, we signed a three-year distribution agreement with Caterpillar to continue this important relationship that dates back to 1999. Our sales to Caterpillar represented 31%, 40% and 24% of our total revenue for the years ended December 31, 2007, 2008 and 2009, respectively.

Strategic IT Partners. We have entered into a number of agreements since 2007 with leading global organizations in the data center market who have the ability to collaborate with Active Power on new sales opportunities. These relationships help us expand potential opportunities to market our products and services through all of our distribution channels. Some of the major partnerships we have entered into include the following:

| • | Hewlett Packard (HP). We are a member of HP’s Data Center Solution Builders Program. This program is designed to develop and deliver new technologies and products and services that are targeted towards energy conservation and other operational improvements in data center design or operation. The program allows Active Power to promote its PowerHouse solution jointly with HP on a global basis and to support the power infrastructure requirements of HP’s Performance Optimized Data Center products. We saw encouraging early results from this channel in 2009 and look forward to it growing in 2010. We have also entered into a Master Services Agreement with HP that allows HP to purchase any of our products, including CleanSource UPS and PowerHouse, for their own use or to resell our products to their customers. |

| • | Sun Microsystems, Inc. We have entered into a strategic relationship with Sun whereby we jointly market and promote our PowerHouse and CleanSource UPS products and their Sun Modular Datacenter product on a global basis. We have also entered into global supply and service agreements with Sun to allow Sun to purchase any of our products and services and resell them to Sun’s customers on a global basis. |

Vertical Markets and Key Customers

We continue to develop client relationships by selling directly and through our various strategic partner channels. We are focused on recruiting new representatives and distributors, but also helping those who have been with us for several years to become even more productive. Direct sales through our own employees and our manufacturer’s representatives and distribution channels have increased our end user interaction and allowed us to respond to customer needs more quickly. Our Active Power branded sales channels contributed 68%, 59%, and 76% of our total revenue during 2007, 2008 and 2009, respectively.

11

Table of Contents

Active Power has experienced success in several key vertical markets. The distinct advantages of our products are gaining awareness and have been adopted by organizations within the following key vertical selling segments:

| • | Data Center |

| • | Healthcare |

| • | Industrial |

| • | Broadcast |

| • | Financial |

| • | Airports |

The following table provides a representative sample of customers that use our flywheel products and includes customers to whom such products have been sold directly or by our OEM partners:

| Industry |

Representative Customers | |||

| Data Center |

• Northrop Grumman • SAS • DataCave • Profitability.net • Tesco PLC |

• Terramark Worldwide • Cegeka Datacenters NV • Databank • Sun Microsystems • CyrusOne | ||

| Industrial |

• Corning • Erdemir • Mozaik Printing • Chevron • Pemex Refinacion |

• Sarah Lee • Goodyear Tire and Rubber • Fuji Electric Group • EverGreen Solar • Freescale Semiconductor | ||

| Broadcast |

• KY3 Studio • KATV-TV (ABC) • WGTE-TV (PBS) • WTVF-TV (CBS) |

• Christian Television Network • Univision • WAVY-TV (NBC) • KBTX-TV (CBS) | ||

| Financial |

• Barclay’s PLC • Dubai Stock Exchange • MBNA |

• Royal Bank of Scotland • Andrews Federal Credit Union | ||

| Healthcare |

• Banner Health • Busan Paik Hospital Korea • Community Health Network |

• Mercy Hospital • Banner Estrella • Cardiology Research Hospital Monzino | ||

| Airports |

• Presov Airport • Suvarnabhumi Airport (Bangkok) • Kosice Airport |

• Ciudad Real Airport • Sharjah International Airport | ||

Marketing

Since 2005, we have developed and implemented a marketing strategy to build awareness of our brand name, technology and solutions in order to attract and influence potential customers. We now employ a broad mix of programs to accomplish these goals including market research, product and strategy updates with industry analysts, public relations activities, advertising, direct marketing and relationship marketing programs, seminars, customer events, user group meetings, trade shows and speaking engagements. Our marketing organization also produces marketing materials in support of sales to prospective customers that include Web properties, brochures, data sheets, white papers, presentations, sales tools, events and demonstration capabilities and supporting material for our distributors, representatives and our OEM channels.

12

Table of Contents

Intellectual Property and Assets

We rely upon a combination of patents, trademarks, confidentiality agreements and other contractual restrictions with employees and third parties to establish and protect our proprietary rights. We have filed dozens of applications before the U.S. Patent and Trademark Office, of which 46 have been issued as patents. Additionally, we have made a concerted effort to obtain patent protection abroad for our technology by continuing to file patent applications and receive patents in Europe and Asia. Our patent strategy is critical for preserving our rights in and to the intellectual property embedded in our CleanSource and PowerHouse product lines and in newer technologies. As a manufactured, tangible device that is sold, rather than licensed, our products do not qualify for copyright or trade secret protection. To enforce ownership of such technology, we principally rely on the protection obtained through the patents we own and unfair competition laws. We intend to aggressively protect our patents, which would include bringing legal actions if we deem it advisable. We currently hold more than 100 worldwide patents for the technology utilized in the products we deliver to the marketplace.

We own the registered trademarks ACTIVE POWER, CLEANSOURCE and COOLAIR in the United States and abroad. The ACTIVE POWER logo, CSVIEW, PowerHouse and MEGAWATT CLASS UPS are trademarks of Active Power. All other trademarks, service marks or trade names referred to in this report are the property of their respective owners.

Research and Development

We believe research and development efforts are essential to our ability to successfully deliver innovative products that address the current and emerging customer, particularly as the power management/quality market evolves. Our research and development team works closely with our marketing and sales teams, IT channel partners and OEMs to define product requirements that address specific market needs. Our research and development expenses were $5.7 million, $5.1 million and $4.2 million in 2007, 2008 and 2009, respectively. We anticipate our research and development expenditures in 2010 will remain at similar levels to 2009 and will decrease as a percentage of sales in the future as our revenues grow. This is consistent with our strategy to focus on the three-phase market for which a core platform now exists. As of December 31, 2009, our research, development and engineering teams consisted of 19 engineers and technicians.

Manufacturing

We manufacture our products at our headquarters in Austin, Texas. We are an ISO 9001:2008 quality certified operation which attests to the quality in product and process used to manufacture and deliver products and services to our clients. We source the majority of our components from contract manufacturers to enhance our ability to scale our operations and minimize cost. This approach allows us to respond quickly to customer orders while maintaining high quality standards and optimizing inventory.

Our internal manufacturing process consists of the fabrication of certain critical components within the flywheel energy storage system and the assembly, functional testing and quality control of our finished products. We also test components, parts and subassemblies obtained from suppliers for quality control purposes.

We have entered into long-term agreements with some of our key suppliers, but we currently purchase most of our components on a purchase order basis. Although we use standard parts and components for our products where possible, we currently purchase the flywheel rotor from Canton Drop Forge Inc., a single source supplier. Although we and our rotor supplier currently maintain buffer stocks to avoid potential supply disruptions, we have recently taken further proactive steps to mitigate this risk by identifying potential alternate suppliers. Lead times for ordering materials and components vary significantly and depend on factors such as specific supplier requirements, contract terms, production time required and current market demand for such components or commodities.

13

Table of Contents

In 2001, our manufacturing facility was expanded significantly to support projected sales volume; however, much of that capacity was never utilized due to an economic downturn and lower revenue levels than previously projected. This capacity is still currently underutilized even though we have increased production significantly since the expansion and increased our revenue levels. We have actively reduced our manufacturing overhead and costs since 2007 and subleased a portion of the facility that we were not using. We believe our current workforce, facilities and inventory levels will be sufficient to handle our near-term projected sales demand. Over time, we will need to hire additional manufacturing personnel to address anticipated sales volume increases, but we do not anticipate further material capital investments in the near term.

Employees

As of December 31, 2009, we had 149 total employees in the following areas:

| • | 19 in research and development; |

| • | 66 in manufacturing, sourcing and service; |

| • | 46 in sales and marketing; and |

| • | 18 in administration, information technology and finance. |

None of our employees are represented by a labor union. We have not experienced any work stoppages and consider our relations with our employees to be good.

Seasonality

Our business has experienced seasonal customer buying patterns for a number of years. In recent years, both the UPS industry generally and our business experienced relatively weaker demand in the first calendar quarter of the year and a sequential decrease in revenue from the prior quarter. We believe this pattern, which we attribute to annual capital budgeting procedures will continue. We also anticipate demand for our products in Europe and Africa may decline in the summer months as compared to other regions because of reduced corporate buying patterns during the vacation season.

Where You Can Find Other Information

Active Power is a Delaware corporation originally founded in 1992 as a Texas corporation. We file annual, quarterly, current and other reports, proxy statements and other information with the Securities and Exchange Commission (SEC) pursuant to the Securities Exchange Act of 1934, as amended, or the Exchange Act. You may read and copy any materials the company files with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the SEC’s Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and other information statements, and other information regarding issuers, including Active Power, that file electronically with the SEC. The address of that site is www.sec.gov.

We maintain a Web site at www.activepower.com. We make available free of charge through this site our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. This information can be found under the heading “Financial Reports” in the “Investor Relations” subsection of the “About Us” section of our Web site. The Web site and the information contained therein or connected thereto are not intended to be incorporated in this Annual Report on Form 10-K.

14

Table of Contents

| ITEM 1A. | Risk Factors |

You should carefully consider the risks described below before making a decision to invest in our common stock or in evaluating Active Power and our business. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not currently known to us, or that we currently view as immaterial, may also impair our business operations. The actual occurrence of any of the following risks could materially harm our business, financial condition and results of operations. In that case, the trading price of our common stock could decline. This report is qualified in its entirety by these risk factors.

This Form 10-K also contains forward-looking statements that involve risks and uncertainties. Our results could materially differ from those anticipated these forward-looking statements as a result of certain factors, including the risks described below and elsewhere. See “Special Note Regarding Forward-Looking Statements.”

We have incurred significant losses and anticipate losses for at least the next year.

We have incurred operating losses since our inception and expect to continue to incur losses for at least the next year. As of December 31, 2009, we had an accumulated deficit of $249.9 million. To date, we have funded our operations principally through the public and private sales of our stock, from product and service revenue and from development funding. We will need to generate significant additional revenue in order to achieve profitability, and we cannot assure you that we will ever realize such revenue levels or achieve profitability. We also expect to incur product development, sales and marketing and administrative expenses in excess of our product revenue after costs, and, as a result, we expect to continue to incur losses for at least the next year.

Our increased emphasis on a direct sales model and our transaction and customer concentration may affect our ability to accurately predict the timing of revenues and to meet short-term expectations of operating results.

Our increased emphasis on a direct sales model since 2005 has increased the effort and time required by us to complete sales to customers. Further, a larger portion of our quarterly revenue is derived from relatively few large transactions with relatively few customers. For example, in 2009, our three largest customers contributed 42% of our revenue, and in the fourth quarter of 2009, our three largest customers contributed 60% of our revenue. Our shift to the direct sales model, or any delay in completing these large sales transactions or reduction in the number of customers or large transactions, may result in significant fluctuations in our quarterly revenue. Further, we use anticipated revenues to establish our operating budgets and a large portion of our expenses, particularly rent and salaries, are fixed in the short term. As a result, any shortfall or delay in revenue could result in increased losses and would likely cause our operating results to be below public expectations. The occurrence of any of these events would likely materially adversely affect our results of operations and likely cause the market price of our common stock to decline.

Our business may be affected by general economic conditions and uncertainty that may cause customers to defer or cancel sales commitments previously made to us.

Recent economic difficulties in the Unites States credit markets and certain international markets have led to an economic recession and lower capital spending and credit availability in some or all of the markets in which we operate. A recession or even the risk of a potential recession or uneven economic growth conditions may be sufficient reason for customers to delay, defer or cancel purchase decisions, including decisions previously made. This risk is magnified for capital goods purchases such as the UPS products we supply. Although we believe that the higher operating efficiency and lower total cost of ownership would support customers using and purchasing our equipment, and our efforts to broaden the number of different markets in which we sell will help mitigate economic risk from any one country or market vertical, any customer delays or cancellation in sales orders could materially adversely affect our level of revenues and operating results. Should our financial results not meet the expectations of public market analysts or investors, the market price of our stock would most likely decline.

15

Table of Contents

Our financial results may vary significantly from quarter to quarter.

Our product revenue, operating expenses and quarterly operating results have varied in the past and may fluctuate significantly from quarter to quarter in the future due to a variety of factors, many of which are outside of our control. As a result you should not rely on our operating results during any particular quarter as an indication of our future performance in any quarterly period or fiscal year. These factors include, among others:

| • | timing of orders from our customers and the possibility that customers may change their order requirements with little or no notice to us; |

| • | rate of adoption of our flywheel-based energy storage system as an alternative to lead-acid batteries and our continuous power solution, PowerHouse; |

| • | ongoing need for short-term power outage protection in traditional UPS systems; |

| • | deferral of customer orders in anticipation of new products from us or other providers of power quality systems; |

| • | limited visibility into customer spending plans; |

| • | timing of deferred revenue components associated with large orders; |

| • | timing and execution of new product introductions; |

| • | new product releases, licensing or pricing decisions by our competitors; |

| • | commodity and raw material component prices; |

| • | lack of order backlog; |

| • | loss of a significant customer or distributor; |

| • | impact of changes to our product distribution strategy and pricing policies; |

| • | impact of changes to the product distribution strategy and pricing policies of our distributors; |

| • | changes in the mix of domestic and international sales; |

| • | rate of growth of the markets for our products; and |

| • | other risks described below. |

The market for power quality products is evolving and it is difficult to predict its potential size or future growth rate. Most of the organizations that may purchase our products have invested substantial resources in their existing power systems and, as a result, have been reluctant or slow to adopt a new technological approach, particularly during a period of reduced capital expenditures. Moreover, our current products are alternatives to existing UPS and battery-based systems and may never be accepted by our customers or may be made obsolete by other advances in power quality technologies.

Significant portions of our expenses are not variable in the short term and cannot be quickly reduced to respond to decreases in revenue. Therefore, if our revenue is below our expectations, our operating results are likely to be adversely and disproportionately affected. In addition, we may change our prices, modify our distribution strategy and policies, accelerate our investment in research and development, sales or marketing efforts in response to competitive pressures or to pursue new market opportunities. Any one of these activities may further limit our ability to adjust spending in response to revenue fluctuations. We use forecasted revenue to establish our expense budget. Because most of our expenses are fixed in the short term or incurred in advance of anticipated revenue, any shortfall in revenue may result in significant losses.

16

Table of Contents

We derive a substantial portion of our revenues from international markets and plan to continue to expand such efforts, which subjects us to additional business risks including increased logistical and financial complexity, managing internal controls and processes, political instability and currency fluctuations.

The percentage of our product revenue derived from customers located outside of the United States was 45%, 39% and 31% in 2007, 2008 and 2009, respectively. Our international operations are subject to a number of risks, including:

| • | foreign laws and business practices that favor local competition; |

| • | dependence on local channel partners; |

| • | compliance with multiple, conflicting and changing government laws and regulations; |

| • | longer sales cycles; |

| • | difficulties in managing and staffing foreign operations; |

| • | foreign currency exchange rate fluctuations and the associated effects on product demand and timing of payment; |

| • | political and economic stability, particularly in the Middle East and North Africa; |

| • | greater difficulty in the contracting and shipping process and in accounts receivable collection including longer collection periods; |

| • | greater difficulty in hiring qualified technical sales and application engineers; and |

| • | difficulties with financial reporting in foreign countries. |

To date, the majority of our sales to international customers and purchases of components from international suppliers have been denominated in U.S. dollars. We have generally benefited from the decline in value of the U.S. dollar relative to foreign currencies over the last several years, which has made our products more price competitive in foreign markets. However, the value of the dollar will likely fluctuate, and an increase in the value of the U.S. dollar relative to foreign currencies could make our products more expensive for our international customers to purchase, thus rendering our products less competitive. As we increase direct sales in foreign markets, we are making more sales that are denominated in other currencies, primarily Euro and British pounds. Those sales in currencies other than U.S. dollars can result in translation gains and losses. Currently, we do not engage in hedging activities for our international operations to offset this currency risk. However, we may engage in hedging activities in the future.

We are subject to risks relating to product concentration and lack of revenue diversification.

We derive a substantial portion of our revenue from a limited number of products, particularly our 250-900 kVA product family. We expect these products to continue to account for a large percentage of our revenues in the near term. Continued market acceptance of these products is therefore critical to our future success. Our future success will also depend in part on our ability to reduce our dependence on these few products by developing and introducing new products and product or feature enhancements in a timely manner. Specifically, our ability to capture significant market share depends on our ability to develop and market extensions to our existing UPS product line at higher and lower power range offerings and as containerized solutions. Even if we are able to develop and commercially introduce new products and enhancements, they may not achieve market acceptance, which would substantially impair our revenue, profitability and overall financial prospects. Successful product development and market acceptance of our existing and future products depend on a number of factors, including:

| • | changing requirements of customers; |

| • | accurate prediction of market and technical requirements; |

17

Table of Contents

| • | timely completion and introduction of new designs; |

| • | quality, price and performance of our products; |

| • | availability, quality, price and performance of competing products and technologies; |

| • | our customer service and support capabilities and responsiveness; |

| • | successful development of our relationships with existing and potential customers; and |

| • | changes in technology, industry standards or end-user preferences. |

We must expand our distribution channels and manage our existing and new product distribution relationships to continue to grow our business.

The future growth of our business will depend in part on our ability to expand our existing relationships with distributors, to identify and develop additional channels for the distribution and sale of our products and to manage these relationships. As part of our growth strategy, we may expand our relationships with distributors and develop relationships with new distributors. We will also look to identify and develop new relationships with additional parties that could serve as outlets for our products, or that could provide additional opportunities for our existing sales channels, such as the recent relationships that we have developed with Sun Microsystems and Hewlett Packard. Our inability to successfully execute this strategy, and to integrate and manage our existing OEM channel partners and our new distributors and manufacturer’s representatives could impede our future growth.

We must continue to hire and retain skilled personnel.

We believe our future success will depend in large part upon our ability to attract, motivate and retain highly skilled managerial, engineering and sales and product marketing personnel. There is a limited supply of skilled employees in the power quality marketplace. A decline in our stock price can result in a substantial number of “underwater” stock options, whereby the exercise price of the option is greater than the current market value of our common stock. As a result, the financial attractiveness of the stock options may become substantially diminished, which may cause certain of our employees to seek employment elsewhere as a result of this decreased financial incentive, or impair our ability to recruit new employees. Our efforts to attract and retain highly skilled employees could be harmed by our past or any future workforce reductions. Our failure to attract and retain the highly trained technical personnel who are essential to our product development, marketing, sales, service and support teams may limit the rate at which we can develop new products or generate revenue. If we are unable to retain the personnel we currently employ, or if we are unable to quickly replace departing employees, our operations and new product development may suffer.

We are significantly dependent on our relationship with Caterpillar, our primary OEM customer. If this relationship is unsuccessful, for whatever reason, our business and financial prospects would likely suffer.

Caterpillar and its dealer network is our primary OEM customer and our largest single customer for our flywheel-based products. Caterpillar and its dealer network accounted for 31%, 40% and 24% of our revenue during 2007, 2008 and 2009, respectively. If our relationship with Caterpillar is not successful, or if Caterpillar’s distribution of the CAT UPS product is not successful or suffers a material change, our business and financial prospects would likely suffer. Pursuant to our distribution agreement with Caterpillar, they are an OEM distributor of our CleanSource UPS product which is then marketed to Caterpillar’s dealer network under the brand name CAT UPS. Caterpillar is not obligated to purchase any minimum quantity of CleanSource UPS units from us.

18

Table of Contents

A significant increase in sales of our PowerHouse product may materially increase the amount of liquidity required to fund the Company’s operations.

A significant increase in sales of our PowerHouse product may materially increase the amount of liquidity required to fund out operations. The amount of time between the receipt of payment from our customers and our expenditures for raw materials, manufacturer and shipment of products (the sales cycle) for sales of our standard UPS product can be as short as 45 days, and is typically 60 days. However, this cash cycle on a PowerHouse sale can be as much as 210 days, depending on customer payment terms. We intend to mitigate the financial impact of this longer cash cycle by requiring customer deposits and periodic payments where possible from our customers. This is not always commercially feasible, and in order to increase our PowerHouse sales, we may be required to make larger investments in inventory and receivables to fund these sales opportunities. These larger investments may require us to obtain additional sources of working capital, debt or equity financing in order to fund this business. If we are unsuccessful at obtaining additional sources of working capital, we may be required to curtail our level of PowerHouse sales or we may lose potential customers, both of which may cause our financial results to not meet the expectations of public market analysts or investors and adversely impact our results of operations.

We have underutilized manufacturing capacity and have no experience manufacturing our products in large quantities.

In 2001, we leased and equipped a 127,000 square foot facility used for manufacturing and testing of our three-phase product line, including our DC and UPS products. To be financially successful, and to fully utilize the capacity of this facility and allocate its associated overhead, we must achieve significantly higher sales volumes. We must accomplish this while also preserving the quality levels we achieved when manufacturing these products in more limited quantities. To date, we have not been successful at increasing our sales volume to a level that fully utilizes the capacity of the facility and we may never increase our sales volume to necessary levels. During 2007, we subleased approximately 31,000 feet of our manufacturing facility to help lower our operating costs and to take advantage of surplus space that we leased but were not using. If we do not reach these necessary sales volume levels, or if we cannot sell our products at our suggested prices, our ability to reach profitability will be materially limited.

Achieving the necessary production levels presents a number of technological and engineering challenges for us. We have not previously manufactured our products in high volume. We do not know whether or when we will be able to develop efficient, low-cost manufacturing capability and processes that will enable us to meet the quality, price, engineering, design and product standards or production volumes required to successfully manufacture large quantities of our products. Even if we are successful in developing our manufacturing capability and processes, we do not know whether we will do so in time to meet our product commercialization schedule or to satisfy the requirements of our customers.

We must build quality products to ensure acceptance of our products.