Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended January 2, 2010

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 01-07284

Baldor Electric Company

Exact name of registrant as specified in its charter

| Missouri | 43-0168840 | |

| State or other jurisdiction of incorporation or organization |

IRS Employer Identification No. | |

| 5711 R. S. Boreham, Jr. St | ||

| Fort Smith, Arkansas | 72901 | |

| Address of principal executive offices | Zip Code | |

479-646-4711

Registrant’s telephone number, including area code

Securities registered pursuant to section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $0.10 Par Value | New York Stock Exchange |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months. Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of voting and non-voting common stock held by non-affiliates of the registrant based on the closing price on July 4, 2009, was $979,673,409.

At January 30, 2010, there were 46,618,873 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the Annual Meeting of Shareholders to be held May 1, 2010 (the “2010 Proxy Statement”), are incorporated by reference into Part III.

Table of Contents

| Page | ||||||

| 2 | ||||||

| Item 1 |

– | 3 | ||||

| Item 1A |

– | 8 | ||||

| Item 1B |

– | 11 | ||||

| Item 2 |

– | 11 | ||||

| Item 3 |

– | 12 | ||||

| Item 4 |

– | 13 | ||||

| PART II | ||||||

| Item 5 |

– | Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 14 | |||

| Item 6 |

– | 16 | ||||

| Item 7 |

– | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

16 | |||

| Item 7A |

– | 25 | ||||

| Item 8 |

– | 25 | ||||

| Item 9 |

– | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

55 | |||

| Item 9A |

– | 55 | ||||

| Item 9B |

– | 56 | ||||

| PART III | ||||||

| Item 10 |

– | 59 | ||||

| Item 11 |

– | 60 | ||||

| Item 12 |

– | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

60 | |||

| Item 13 |

– | Certain Relationships and Related Transactions, and Director Independence |

61 | |||

| Item 14 |

– | 61 | ||||

| PART IV | ||||||

| Item 15 |

– | 62 | ||||

| 63 | ||||||

| 63 | ||||||

| 65 | ||||||

Table of Contents

This annual report, the documents incorporated by reference into this annual report, and other written reports and oral statements made time to time by Baldor and its representatives may contain statements that are forward-looking. The forward-looking statements (generally identified by words or phrases indicating a projection or future expectation such as “assume”, “believe”, “can”, “continue”, “could”, “depend”, “estimate”, “expect”, “forecast”, “future”, “if”, “intend”, “may”, “ongoing”, “pending”, “probable”, “projected”, “should”, “subject to”, “will”, “would”, or any grammatical forms of these words or other similar words) are based on our current expectations and are subject to risks and uncertainties. Accordingly, you are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements as a result of various factors, including those more fully described in “Risk Factors”. Baldor is under no duty or obligation to update any of the forward-looking statements after the date of this annual report.

Table of Contents

| Item 1. | Business |

General

We are a leading marketer, designer, and manufacturer of industrial electric motors, mechanical power transmission products, drives, and generators, currently supplying over 10,000 customers in more than 200 industries. Our products are sold to original equipment manufacturers (“OEM”) and distributors serving markets in the United States and throughout the world. We focus on providing customers with value through a combination of quality products and customer service, short lead times and total cost of ownership, which takes into account initial product cost, product life, maintenance costs and energy consumption. We estimate that the initial purchase price and lifetime maintenance costs of a typical electric motor represents approximately 2% of the total cost of owning the motor, with electricity making up the remaining cost, over its lifetime. Due to high energy prices, our customers increasingly base their purchasing decisions on the energy efficiency of our motors and other products, rather than on the purchase price alone.

On January 31, 2007, we acquired Reliance Electric Company (“Reliance”) and certain affiliates from Rockwell Automation, Inc. (“Rockwell”). Reliance was a leading manufacturer of industrial electric motors and other mechanical power transmission products sold under the Reliance® and Dodge® brand names. The acquisition extended our product offerings, provided a manufacturing base in China for the Asian markets, increased our manufacturing capabilities and flexibility, strengthened our management team, and provided strong opportunities for synergies and cost savings.

On August 29, 2008, we acquired Poulies Maska, Inc. (“Maska”) of Ste-Claire, Quebec, Canada. Maska was a designer, manufacturer and marketer of sheaves, bushings, couplings and related mechanical power transmission components. The acquisition gave us additional manufacturing plants in both Canada and China and expanded our market share of sheaves and bushings in North America.

Our Competitive Strengths

We believe that we are well positioned in the markets in which we compete based on the following competitive strengths.

| • | Excellent reputation and strong brand name preference. |

We have an excellent reputation for producing high-quality innovative products, having exceptional engineering expertise, excellent customer service, and an overall leadership position in the industry. Baldor•Reliance® was the preferred brand in 19 of 21 independent surveys of industrial electric motor users conducted over the past five years. Dodge also holds a top tier brand preference for mechanical power transmission products in the industries to which these products are sold.

| • | Emphasis on providing our customers the highest value. |

We provide value to our customers by offering a broad range of high quality products, short lead times on custom products, quick delivery for stock products and local customer service and support. We also offer the capability to design and manufacture custom products that address the special requirements of many of our customers. We believe we are well positioned relative to many of our competitors who emphasize low price.

- 3 -

Table of Contents

| • | Diversified customer base and end markets. |

Approximately one-half of our sales are to OEMs and one-half are to distributors. We believe that the different purchasing patterns among our customers in the various end markets served reduces the overall sensitivity of demand for our products in a changing economy. Also, we believe our large installed base and specification of our products by leading OEMs on original equipment creates significant replacement demand. On average, our top 20 customers in 2009 have been doing business with us for almost 20 years.

| • | Robust product development. |

Since our inception, we have introduced many innovative products, including our Super-E® branded line of premium energy efficient motors. We estimate that the initial purchase price and lifetime maintenance costs of a typical electric motor represent approximately 2% of the total cost of operation over the lifetime of the motor, with electricity making up the remaining 98% of the cost. In addition, our line of variable speed drives have been designed to be the most reliable, easy to use, and efficient drives available in the market. The Dodge brand mechanical power transmission products are also recognized for innovation. For example, customers are able to configure Dodge bearings with (i) a Grip-Tite® feature that allows it to be easily attached to standard sized shafts, (ii) an EZ-KLEEN® feature that seals the bearing in order to allow a wash-down application, and (iii) an air-handling bearing that provides ultra quiet, high-speed operation. Most recently, Dodge introduced the new MagnaGear® speed reducer that provides higher torque in a smaller package, cooler operating temperatures and greater efficiency than competitive products on the market where large gearing is required.

| • | Committed and motivated workforce. |

Our employees are highly motivated and productive. Our shared values, commitment to education and training, retention practices and the ability to participate in equity ownership through profit sharing, stock options and 401(k) plans help us keep motivated and productive employees. We are committed to an operating environment that is conducive to operational excellence and we invest regularly to make sure our plants are modern, clean and safe for our employees.

| • | Experienced management team. |

Our senior management team has significant experience in industrial manufacturing, marketing and sales under a wide range of economic conditions. The members of our senior management team have been with us on average for over 20 years and are dedicated to the success of our company.

Our Strategy

Our mission is to be the best (as determined by our customers) marketers, designers and manufacturers of industrial electric motors, mechanical power transmission products, drives and generators. Our strategies to achieve our mission include:

| • | Leverage existing customer relationships and realize cross-selling opportunities. |

Our product portfolio encompasses each level of the process that converts electrical energy to mechanical energy. This comprehensive product offering allows us to continuously strengthen our relationships with customers and enhance our ability to obtain additional business.

- 4 -

Table of Contents

| • | Continuous product development. |

We continually evaluate our products to find ways to improve performance and reduce the material content needed to meet our customers’ demands. On average, we release 250 new product lines a year and approximately 25% of our annual sales in each of the past five years were from newly developed products, defined as products developed in the prior five year period.

| • | Pursue growth opportunities. |

We believe the end markets we serve provide attractive growth opportunities. We expect to continually develop new products and enhance existing products to meet customers’ end-use applications. In addition, we intend to expand our global reach by capitalizing on high-growth regions such as China with our broad product offering, local service and support, and local manufacturing capabilities.

| • | Reduce financial leverage. |

We intend to steadily reduce our long-term debt with cash flow generated from operations.

Products

| • | Industrial Electric Motors. Our Baldor•Reliance brand motor products have a reputation of being premium products in the markets we serve. Our industrial motor product line includes both AC and DC electric motors. Our AC motors range in size from subfractional to 15,000 horsepower and our DC motors range from subfractional to 3,000 horsepower. Our motors are used in a wide variety of essential applications, including unit handling (conveyors and other material handling equipment), air handling (fans and blowers), and fluid handling (pumps). Our motors are used in many industries, including agriculture, chemical, food and beverage, machinery manufacturing, petroleum exploration and production, medical equipment, mining, paper and packaging, semiconductor manufacturing, military, and water supply. We also manufacture a full line of integral gear motors. We believe that this diversification across industries allows us to be less dependent on any particular industry or customer segment. |

Our motors are designed as both stock and custom products. Stock motors represented approximately 56% of our domestic motor sales for 2009 and are available for immediate shipment. Custom motors are built to customer specifications and are typically built and shipped within 2-4 weeks of order entry.

| • | Mechanical power transmission products. Baldor•Dodge mechanical power transmission products include mounted bearings, enclosed shaft mount, helical and worm gearing, and other mechanical power transmission components such as bushings, sheaves and conveyor pulleys. Our mechanical power transmission products are used in many applications and industries, including mining, petroleum, aggregate, unit handling, power generation, and package handling. |

| • | Drives. Baldor drives are electronic controls used to adjust the speed and torque of an electric motor to match an end application. Our drives product line ranges from fractional to 1,500 horsepower. We also make a line of drives, such as linear and rotary servo motors and motion control products, which are used to automate manual processes. Generally, our industrial drives and motion control products are used in the same industries and applications as our motors. |

| • | Generators. Our Baldor generator product line ranges from 1.3 kilowatts to 2.2 megawatts, and includes portable generators, industrial towable generators, mobile light |

- 5 -

Table of Contents

| towers, emergency and standby generators, prime power generators and peak-shaving generators. Generators are sold through distributors and, certain OEMs in a variety of industries, including agriculture, construction, equipment rental, military, municipal, and telecom. |

Manufacturing

We manufacture substantially all of the products we sell including many of the components used in our products, such as laminations, stamped steel parts, and aluminum die castings. In addition to manufacturing components, our motor manufacturing operations include machining, welding, winding, assembling, and finishing operations. Manufacturing many of our own components permits us to better manage cost, quality, and availability. Our Lean Flex Flow™ manufacturing process enables us to provide short lead times and continually reduce non value-added inputs.

The raw materials and parts necessary for our manufacturing operations are available from numerous global sources. These materials include steel, copper wire, gray iron castings, aluminum, insulating materials, electronic components, and combustion engines. Many of these materials and parts are purchased from more than one supplier. We believe alternative sources are available for such materials and parts.

Sales and Marketing

Our products are sold throughout the United States and in more than 70 countries. Our field sales organization, comprised of independent manufacturer’s representatives and factory direct sales personnel, covers more than 70 countries, including 40 locations in North America.

Custom and stock products are sold to OEMs for installation in new equipment, while independent distributors typically sell stock products as replacement components in industrial machinery that is being modernized or upgraded for improved performance.

International Sales

Our products are distributed globally, principally in Canada, Mexico, Europe, Australia, the Far East, and Latin America. We have international manufacturing facilities in Canada, England, China, and Mexico. For information concerning our foreign operations, see Note M, Foreign Operations, of the Notes to Consolidated Financial Statements, included in Item 8, Financial Statements and Supplementary Data, of this Annual Report on Form 10-K.

Competition

We face substantial competition in all markets served. Some of our competitors are larger in size or are divisions of large diversified companies having substantially greater financial resources. We focus on providing customers with value through a combination of quality products and customer service, as well as short lead times and attractive cost of ownership, which takes into account initial product cost, product life, maintenance costs and energy consumption. Our value proposition is what differentiates us from other competitors in the marketplace.

Research and Engineering

Our design and development of industrial electric motors, mechanical power transmission products, drives and generators include the development of products, which extend our product lines, the modification of existing products to meet new application requirements, and research in fields of emerging technologies. New products are typically the result of customer driven application requirements, enhancements to current product performance or the development of a complete new product solution. Additional development is performed to improve production

- 6 -

Table of Contents

methods. Costs associated with research, new product development, and product and cost improvements are expensed when incurred and amounted to approximately $31.2 million in 2009, $35.4 million in 2008, and $34.3 million in 2007.

Emerging technology development is conducted in our Advanced Technology Labs located in Cleveland, Ohio.

Intellectual Property

We rely on a combination of patents, trademarks, copyright and trade secret laws in the United States and other jurisdictions, as well as employee and third-party non-disclosure agreements, license arrangements and domain name registrations to protect our intellectual property. We sell our products under a number of registered and unregistered trademarks, which we believe are widely recognized in our industry. With the exception of our brand names, we do not believe any single patent, trademark or trade name is material to our business as a whole. Some of our trademarks include: Baldor, Baldor•Reliance, Reliance Electric, Dodge, Baldor•Dodge, Super-E, H2, Lean Flex Flow, MINT®, CST®, Torque-Arm®, Baldor•Maska® and Maska®.

Environmental Matters

We are subject to a variety of federal, state, local, foreign and provincial environmental laws and regulations including those governing discharge of chemicals into the air or water, management and disposal of hazardous substances and wastes and responsibility to investigate and clean-up contaminated sites that are or were owned, leased, operated or used by us or our predecessors. Many of our operations require environmental permits and controls to prevent and limit water and air emissions. These permits contain terms and conditions that impose limitations on our manufacturing activities, production levels and associated activities and periodically may be subject to modification, renewal and revocation by issuing authorities. Fines and penalties may be imposed for non-compliance with applicable environmental laws and regulations and the failure to have or to comply with the terms and conditions of required permits. We are also subject to the federal Occupational Health and Safety Act and similar state and foreign laws which impose requirements and standards of conduct on our operations for the health and safety of our employees. We periodically review our operations, procedures and policies for compliance with environmental and health and safety requirements. We believe that our operations generally comply with applicable environmental regulatory requirements or that any non-compliance will not result in a material liability or cost to achieve compliance.

Certain environmental laws in the United States, such as the federal Superfund law and similar state laws, impose liability for the entire cost of investigation or remediation of contaminated sites upon the current site owners, the site owners and operators at the time the contamination occurred, and upon parties who generated waste or transported or sent this waste to an off-site facility for treatment or disposal, regardless of whether the owner owned the site at the time of the release of the hazardous substances or the lawfulness of the original waste disposal activity. As a practical matter, however, the costs of investigation and remediation are generally allocated among the viable responsible parties on some form of equitable basis. There is or could be contamination at some of our current or formerly owned or operated facilities, primarily related to historical operations at those sites, for which we could be liable under applicable environmental laws. Thus far, compliance with environmental requirements and resolution of environmental claims has been accomplished without material effect on our liquidity and capital resources, competitive position or financial condition.

The Company is or may be a potentially responsible party at several judicial and administrative proceedings initiated on behalf of various state and federal regulatory agencies, or by private parties, seeking to clean up sites which have been environmentally impacted and to recover costs they have incurred or will incur as to the sites. The Company has established reserves for the sites and/or has sought insurance coverage, as appropriate. The Company believes that any environmental claims for these sites in excess of reserves, insurance proceeds and indemnified amounts will not have a material effect on its financial position or results of operations.

- 7 -

Table of Contents

Reliance is indemnified by Exxon Mobil Corporation (“Exxon”) for substantially all costs associated with environmental matters of Federal Pacific Electric Company, a non-operating subsidiary of Reliance. This indemnity has been transferred to Rockwell, and Rockwell has agreed to indemnify us with respect to costs associated with environmental claims of Federal Pacific Electric Company. The indemnification agreement covers claims for which Reliance gave notice to Exxon before December 29, 2006. We also face certain environmental claims associated with other discontinued and former operations of Reliance, including the ongoing remediation of a former Toledo-Scale manufacturing facility located in Orlando, Florida. Prior to the acquisition, Reliance began implementing a clean-up pursuant to a Consent Order with the Florida Department of Environmental Protection. Rockwell has agreed to indemnify us for these environmental matters related to the Orlando, Florida, facility.

Employees

As of January 30, 2010, we had approximately 7,250 employees, including 69 part-time employees.

Executive Officers of the Registrant

Information regarding executive officers is contained herein under Part III - Item 10.

Access to Filings on Company Website

Our Forms 10-K, 10-Q, 8-K, and amendments thereto are available on our corporate website when filed with or furnished to the SEC. These filings, along with Baldor’s Annual Reports to Shareholders, Proxy Statements, Code of Ethics for Certain Executives, and certain other corporate governance documents may be viewed online free of charge by accessing our website at www.baldor.com and selecting Investor Relations.

| Item 1A. | Risk Factors |

The most significant risk factors related to our business are as follows:

Prolonged economic weakness could adversely affect our business, financial condition and results of operation. Our results of operations are affected by the levels of business activities of our customers, which can be affected by economic conditions. Generally, our financial performance is driven by industrial spending and the strength of the economies in which we sell our products. In 2008 and 2009, general worldwide economic conditions experienced a downturn due to slower economic activity and the credit crisis. These conditions had a negative impact on our business and results of operations in 2009 and, if prolonged, could have a negative impact on our business, financial condition, and results of operations in the future.

Our future results are subject to fluctuations in the price of raw materials. The principal raw materials used to produce our industrial electric motors are steel, copper and aluminum. The prices of those raw materials are susceptible to significant fluctuations due to supply/demand trends, transportation costs, government regulations and tariffs, price controls, economic conditions and other unforeseen circumstances. If we are unable to mitigate raw materials price increases through product design improvements, price increases to our customers, and hedging transactions, our future profitability could be adversely affected.

Our financial results may be affected by competitive conditions. We operate in markets that are highly competitive. Some of our competitors are larger in size or are divisions of large diversified companies and have substantially greater financial resources. Demand for our products may be affected by our ability to respond to downward pricing pressure, to continue to provide shorter lead time and quicker delivery of our products than our competitors, and to

- 8 -

Table of Contents

respond to changes in customer order patterns. Our success depends both on our ability to continue developing new and improved products in line with technological advancements that meet the evolving requirements of our customers, and our ability to bring these products rapidly to market. New products, or refinements and improvements of existing products, may have technical failures, their introduction may be delayed, they may have higher production costs than originally expected or they may not be accepted by our customers. If we are not able to anticipate, identify, develop and market products that respond to changes in customer preferences, demand for our products could decline and our operating results would be adversely affected.

We rely on independent distributors and the loss of these distributors would adversely affect our business. In addition to our direct sales force and manufacturer sales representatives, we depend on the services of independent distributors to sell our products and provide service and aftermarket support to our customers. We are supported by an extensive distribution network with over 10,000 distributor locations worldwide. Rather than serving as passive conduits for delivery of product, our industrial distributors are active participants in the overall competitive dynamics in our industry. Industrial distributors play a significant role in determining which of our products are stocked, and therefore are readily accessible to end-users, and the price at which our products are sold. Approximately one-half of our domestic sales are generated through distributors. Most of the distributors with whom we transact business also offer products and services of our competitors to our customers. In addition, the distribution agreements we have are typically not exclusive and are cancelable by the distributor after a short notice period. Impairment of our relationship with our distributors, loss of a substantial number of these distributors, or an increase in distributors’ sales of our competitors’ products to our customers could materially reduce our sales and profits.

We are subject to the risks of doing business outside of the United States. Future growth rates and success of our business depend in part on continued growth in our non-U.S. operations. We have both sales and manufacturing operations outside the United States. Numerous risks and uncertainties affect our non-U.S. operations. These risks and uncertainties include political and economic instability, changes in local governmental laws, regulations and policies, including those related to tariffs, investments, taxation, exchange controls, employment regulations and repatriation of earnings, and enforcement of contract and intellectual property rights. International transactions may also involve increased financial and legal risks due to differing legal systems and customs, including risks of non-compliance with U.S. and local laws affecting our activities abroad. While these factors and the impact of these factors are difficult to predict, any one or more of them could adversely affect our business, financial condition or operating results. Prior to our acquisition of Reliance, Rockwell disclosed potential violations of the U.S. Foreign Corrupt Practices Act (“FCPA”) in connection with certain of Reliance’s foreign operations. We have been indemnified by Rockwell against government penalties arising from these potential violations, but this indemnification is subject to limitations and there can be no assurance that Rockwell will be able to pay on the indemnity at the time we make a claim against the indemnity. Our foreign operations may be adversely affected by the change in business practices made necessary by the FCPA. See “Item 3 – Legal Proceedings.”

We could face potential product liability claims relating to products we manufacture, which could result in us having to expend significant time and expense to defend these claims and to pay material claims or settlement amounts. We face a risk of exposure to product liability claims in the event that the use of our products is alleged to have resulted in injury or other damage. We currently maintain product liability insurance coverage for claims in excess of certain self insured limits; however, we may not be able to obtain such insurance on acceptable terms in the future, if at all, or obtain insurance that will provide adequate coverage against potential claims. Product liability claims can be expensive to defend and can divert the attention of management and other personnel for long periods of time, regardless of the ultimate outcome. An unsuccessful product liability defense could have a material adverse effect on our business, financial condition, results of operations or our ability to make payments under our debt obligations when due. In addition, we believe our business depends on the strong brand

- 9 -

Table of Contents

reputation we have developed. In the event that our reputation is damaged, we may face difficulty in maintaining our pricing positions with respect to some of our products, which would reduce our sales and profitability.

Our future results may be affected by various legal and regulatory proceedings. From time to time, we are party to legal and regulatory proceedings in the normal course of business. We have been named a defendant in lawsuits alleging personal injury as a result of exposure to asbestos. The outcome of legal proceedings could differ from our expectations since the outcomes of litigation, including regulatory matters, and our ability to collect from our insurers or on indemnities from third parties, are sometimes difficult to predict. As a result, we could be required to change current estimates of liabilities as litigation matters develop. Changes in these estimates or changes in our business as a result of legal and regulatory proceedings could have a materially adverse effect on our results of operations.

Our total assets include goodwill and other indefinite-lived intangibles. If we determine these have become impaired in the future, net income could be materially adversely affected. Goodwill represents the excess of cost over the fair market value of net assets acquired in business combinations. Indefinite-lived intangibles are comprised of trademarks. At January 2, 2010, goodwill and other indefinite-lived intangibles totaled $1.4 billion, most of which arose from our acquisition of Reliance. We review goodwill and other intangibles at least annually for impairment and any excess in carrying value over the estimated fair value is charged to the results of operations. A reduction in net income resulting from the write down or impairment of goodwill or indefinite-lived intangibles could have a material adverse effect on our financial statements.

Our future results may be affected by environmental, health and safety laws, and regulations. We are subject to various laws and regulations relating to the protection of the environment and human health and safety and have incurred and will continue to incur capital and other expenditures to comply with those regulations. Failure to comply with certain regulations could subject us to future liabilities, fines or penalties or the suspension of production. In addition, we incur, in the normal course of business, various remediation expenses related to our manufacturing sites, none of which is expected to be material. If remediation obligations were to increase beyond our expectations or if we incurred fines, penalties, or suspension of production, future results could be adversely affected. Prior to our acquisition of Reliance, Reliance had been named as a potentially responsible party at environmental clean-up sites, and may be so named in the future as well and the costs associated with these current and future sites may be significant. We have been indemnified by Rockwell against environmental liabilities relating to certain properties that had been formerly owned or operated by Reliance but this indemnification is subject to limitations and there can be no assurance that Rockwell will be able to pay on the indemnity at the time we make a claim against the indemnity.

Our operations are highly dependent on information technology infrastructure and failures could significantly affect our business. We depend heavily on our information technology infrastructure in order to achieve our business objectives. If we experience a problem that impairs this infrastructure, such as a computer virus, a problem with the functioning of an important IT application, or an intentional disruption of our IT systems by a third party, the resulting disruptions could impede our ability to record or process orders, manufacture and ship in a timely manner, or otherwise carry on our business in the ordinary course. Any such events could cause us to lose customers or revenue and could require us to incur significant expense to eliminate these problems and address related security concerns.

The inability to secure and maintain rights to intellectual property could harm our business and our customers. We own the rights to many patents, trademarks, brand names and trade names that are important to our business. The loss of patents or licenses used in principal portions of our business may have an adverse effect on our results of operations. Expenses related to enforcing our intellectual property rights could be significant. In addition,

- 10 -

Table of Contents

others may assert intellectual property infringement claims against us or our customers. We sometimes provide a limited intellectual property indemnity in connection with our terms and conditions of sale to our customers and in other types of contracts with third parties. Indemnification payments and legal costs to defend claims could have an adverse effect on our business.

Our balance sheet includes significant long-term debt. If we are unable to service our debt and meet financial covenants, we could be adversely affected. We substantially increased our leverage to finance the acquisition of Reliance. In January 2007, we borrowed $1.55 billion under a senior secured credit facility and a senior unsecured note agreement and at January 2, 2010, the amount outstanding was $1.21 billion. The increased indebtedness may reduce our flexibility to respond to changing business and economic conditions or fund capital expenditures or working capital needs because we will require additional funds to service our indebtedness. In addition, financial and other covenants related to the financing will limit our ability to incur additional indebtedness, make investments, pay dividends and engage in other transactions, and the leverage may cause potential lenders to be less willing to loan funds to us in the future. Our failure to comply with these covenants could result in an event of default that, if not waived or cured, could result in the acceleration of the due date of all our indebtedness.

| Item 1B. | Unresolved Staff Comments |

There are no unresolved written SEC staff comments regarding our periodic or current reports required by the Securities Exchange Act of 1934.

| Item 2. | Properties |

We believe that our facilities, including equipment and machinery, are in good condition, suitable for current operations, adequately maintained and insured, and capable of sufficient additional production levels. The following table contains information with respect to our properties.

| Location |

Primary Use |

Area (Sq. Ft.) |

|||||

| Fort Smith, AR |

AC motor production Distribution and service center Administration and engineering offices Aluminum die casting Drives production center |

384,901 563,789 96,980 79,330 141,726 |

|||||

| St. Louis, MO |

Metal stamping and engineering toolroom | 187,385 | |||||

| Columbus, MS |

AC motor production | 304,000 | (a | ) | |||

| Westville, OK |

AC and DC motor production | 207,250 | |||||

| Fort Mill, SC |

Held for sale | 108,000 | (e | ) | |||

| Clarksville, AR |

Subfractional and small AC and DC motors, gear motors, worm-gear speed reducers, and tachometer production | 165,735 | (a | ) | |||

| Ozark, AR |

AC motor production | 151,783 | |||||

| Athens, GA |

Small and medium AC motor production | 396,000 | (a | ) | |||

- 11 -

Table of Contents

| Gainesville, GA |

Specialty, variable speed motors and small and medium AC and DC motor production for the electrical business | 212,000 | (a | ) | |||

| Kings Mountain, NC |

Large AC, large DC, mining and hermetic motor production | 237,000 | (a | ) | |||

| Asheville, NC |

Couplings, bushings, sheaves, clutch/brake modules, sleevoil hydrodynamic bearings production | 160,000 | (a | ) | |||

| Belton, SC |

Enclosed worm and helical gearing production | 122,000 | |||||

| Clio, SC |

Conveyor pulleys Torque Arm motor mounts and bearing take-up frames production | 165,400 | |||||

| Columbus, IN |

Enclosed helical and custom gearing production | 223,000 | (a | ) | |||

| Greenville, SC |

Shaft mount and concentric gear reducers production | 237,960 | (a | ) | |||

| Marion, NC |

Mounted roller bearings production | 174,000 | |||||

| Rogersville, TN |

Mounted ball bearings and plain bearings production | 221,000 | (a | ) | |||

| Greenville, SC |

Administrative and engineering offices | 134,443 | (b | ) | |||

| Cleveland, OH |

Advanced Technology Research & Development Laboratory | 6,300 | (a | ) | |||

| Eleven other domestic locations |

Metal stamping and motor, drives, and generator production, regional sales offices | 401,424 | (c | ) | |||

| 33 foreign locations |

Sales and distribution centers, motors, electronic controls, and mechanical power transmission production | 754,588 | (d | ) | |||

| 5,835,994 | |||||||

| (a) | This property is leased. |

| (b) | Of this amount, approximately 22,943 sq. ft. is leased. |

| (c) | Of this amount, approximately 2,820 sq. ft. is leased. |

| (d) | Of this amount, approximately 477,686 sq. ft. is leased. |

| (e) | This property is held for sale and included in other current assets on the consolidated balance sheet as of January 2, 2010. |

| Item 3. | Legal Proceedings |

We are or may be a party to various lawsuits, claims and proceedings relating to the conduct of our business, including those pertaining to product liability, workers compensation, intellectual property, employment, and contract matters.

We have been named as a defendant in lawsuits alleging personal injury as a result of exposure to asbestos that was allegedly used in certain components of our products many years ago. Currently, there are hundreds of claimants in lawsuits that name us as a defendant, together with hundreds of other companies. The great bulk of the complaints, however, do not identify

- 12 -

Table of Contents

any of our products or specify which of these claimants, if any, were exposed to asbestos attributable to our products; and past experience has shown that the vast majority of the claimants will never identify any of our products. For those claimants who do show that they worked with our products, we believe we have meritorious defenses, in substantial part due to the lack of asbestos in our products, the integrity of our products, the encapsulated nature of any asbestos-containing components, and the lack of any impairing medical condition on the part of many claimants.

As a result of an internal review, Rockwell determined during the fourth quarter of 2006 that actions by a small number of employees at certain of Reliance’s operations in one jurisdiction may have violated the FCPA or other applicable laws. Reliance did business in this jurisdiction with government owned enterprises or government owned enterprises that are evolving to commercial businesses. These actions involved payments for non-business travel expenses and certain other business arrangements involving potentially improper payment mechanisms for legitimate business expenses. Special outside counsel has been engaged by Rockwell to investigate the actions and report to Rockwell’s Audit Committee. Their review is ongoing.

Rockwell voluntarily disclosed these actions to the U.S. Department of Justice (“DOJ”) and the SEC beginning in September 2006. Rockwell and Reliance implemented thorough remedial measures, and are cooperating on these issues with the DOJ and SEC. Rockwell has agreed to update the DOJ and SEC periodically regarding any further developments as the investigation continues. If violations of the FCPA occurred, Rockwell and Reliance may be subject to consequences that could include fines, penalties, other costs and business-related impacts. Rockwell and Reliance could also face similar consequences from local authorities.

Although the outcome of litigation cannot be predicted with certainty and some lawsuits, claims or proceedings may be disposed of unfavorably, we believe the disposition of matters that are pending or asserted will not have a material adverse effect on our business or financial condition. In addition, Rockwell has agreed to indemnify us for asbestos claims related to products manufactured or sold prior to the acquisition date and for any governmental penalties that may be imposed in relation to the FCPA review.

| Item 4. | Reserved |

Not applicable.

- 13 -

Table of Contents

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Ticker

Our common stock trades on the New York Stock Exchange (NYSE) with the ticker symbol BEZ.

Common Stock Price Range

As reported by the NYSE, the high and low composite sale prices per share for our common stock for each quarterly period during the past two fiscal years are listed below.

| 2009 | 2008 | |||||||||||

| HIGH | LOW | HIGH | LOW | |||||||||

| 1st quarter |

$ | 20.26 | $ | 10.21 | $ | 34.26 | $ | 24.08 | ||||

| 2nd quarter |

26.24 | 16.41 | 39.89 | 25.51 | ||||||||

| 3rd quarter |

30.58 | 20.66 | 39.90 | 30.45 | ||||||||

| 4th quarter |

30.82 | 24.97 | 30.60 | 10.71 | ||||||||

Performance Graph

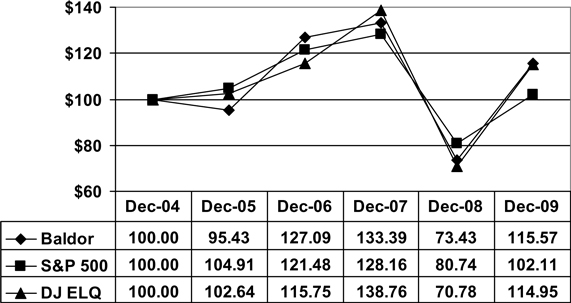

Comparison of Five-Year Cumulative Total Return

Among Baldor Electric Company, the S&P 500 Index, and the

Dow Jones US Electrical Components & Equipment Group Index

This performance graph assumes $100 invested at year-end 2004 in Baldor Electric Company, the S&P 500 Index, and the Dow Jones U.S. Electrical Components & Equipment Group Index. The compound annual growth rate is 2.9% for Baldor, 0.4% for the S&P 500 Index, and 2.8% for the Dow Jones U.S. Electrical Components & Equipment Group Index.

- 14 -

Table of Contents

Shareholders

At January 30, 2010, there were 2,002 shareholders of record.

Dividends Paid

The terms of our senior secured credit facility and the indenture for the senior unsecured notes limit our ability to increase dividends above a certain amount to the holders of our common stock. Quarterly dividend rates per share paid for fiscal years 2009, 2008, and 2007 are listed in the table below.

| 2009 | 2008 | 2007 | |||||||

| 1st quarter |

$ | 0.17 | $ | 0.17 | $ | 0.17 | |||

| 2nd quarter |

0.17 | 0.17 | 0.17 | ||||||

| 3rd quarter |

0.17 | 0.17 | 0.17 | ||||||

| 4th quarter |

0.17 | 0.17 | 0.17 | ||||||

| Year |

$ | 0.68 | $ | 0.68 | $ | 0.68 | |||

Other Equity-related Items

During the three months ended January 2, 2010, we repurchased shares of our common stock in private transactions as summarized in the table below.

ISSUER PURCHASES OF EQUITY SECURITIES

| Period |

(a) Total Number of Shares (or Units) Purchased (1) |

(b) Average Price Paid per Share (or Unit) |

(c) Total Number of Shares (or Units) Purchased as Part of Publicly Announced Plans or Programs |

(d) Maximum Number (or Approximate Dollar Value) of Shares (or Units) That May Yet Be Purchased Under the Plans or Programs | |||||

| Month #1 |

|||||||||

| Oct 4, 2009 – Oct 31, 2009 |

1,095 | $ | 29.71 | — | — | ||||

| Month #2 |

|||||||||

| Nov 1, 2009 – Nov 28, 2009 |

— | — | — | — | |||||

| Month #3 |

|||||||||

| Nov 29, 2009 – Jan 2, 2010 |

19,394 | $ | 27.65 | — | — | ||||

| Total |

20,489 | $ | 27.76 | — | — | ||||

| (1) | Consists only of shares received from trades for payment of the exercise price or tax liability on stock option exercises. |

During the fourth quarter of 2009, certain District Managers did not exercise non-qualified stock options previously granted to them under the Baldor Electric Company 1990 Stock Option Plan for District Managers (the “DM Plan”). When exercised, the exercise price paid by the District Managers equals the market value of the stock on the date of the grant. When a District Manager exercises an option, we intend to use the proceeds from these option exercises for general corporate purposes. The total amount of shares that have been granted under the DM Plan is 1.0% of the outstanding shares of our common stock. None of the transactions were registered under the Securities Act of 1933, as amended (the “Act”), in reliance upon the exemption from registration afforded by Section 4(2) of the Act. We deem this exemption to be

- 15 -

Table of Contents

appropriate given that there are a limited number of participants in the DM Plan and all parties are knowledgeable about us. In 2006, this DM Plan was effectively cancelled except with respect to then outstanding grants and no further awards have since been or will be granted from this Plan.

| Item 6. | Selected Financial Data |

Information concerning net sales, net income, net earnings per common share, dividends per common share, total assets, and long-term obligations for the years ended 1999 through 2009 is presented in the table below:

Eleven-Year Summary of Financial Data

(In thousands, except per share data)

| Per Common Share Data | |||||||||||||||||||||

| Net Sales | Net Income |

Diluted Net Earnings |

Basic Net Earnings |

Dividends | Total Assets |

Long-term Obligations | |||||||||||||||

| 2009 (c) |

$ | 1,524,072 | $ | 59,796 | $ | 1.28 | $ | 1.29 | $ | 0.68 | $ | 2,651,537 | $ | 1,156,005 | |||||||

| 2008 (b) |

1,954,679 | 99,423 | 2.15 | 2.15 | 0.68 | 2,834,159 | 1,318,578 | ||||||||||||||

| 2007 (a) |

1,824,899 | 94,102 | 2.08 | 2.11 | 0.68 | 2,821,626 | 1,355,905 | ||||||||||||||

| 2006 |

811,280 | 48,118 | 1.46 | 1.48 | 0.67 | 523,982 | 97,025 | ||||||||||||||

| 2005 |

721,569 | 43,021 | 1.28 | 1.30 | 0.62 | 507,205 | 70,025 | ||||||||||||||

| 2004 |

648,195 | 35,052 | 1.05 | 1.06 | 0.57 | 501,560 | 104,025 | ||||||||||||||

| 2003 |

561,391 | 24,779 | 0.74 | 0.75 | 0.53 | 476,955 | 79,465 | ||||||||||||||

| 2002 |

549,507 | 23,895 | 0.69 | 0.70 | 0.52 | 472,761 | 105,285 | ||||||||||||||

| 2001 |

557,459 | 22,385 | 0.65 | 0.66 | 0.52 | 457,527 | 98,673 | ||||||||||||||

| 2000 |

621,242 | 46,263 | 1.34 | 1.36 | 0.50 | 464,978 | 99,832 | ||||||||||||||

| 1999 |

585,551 | 43,723 | 1.19 | 1.21 | 0.45 | 423,941 | 56,305 | ||||||||||||||

| (a) | Includes Reliance assets acquired and liabilities assumed at January 31, 2007, and results of operations beginning February 1, 2007. |

| (b) | Includes Maska assets acquired and liabilities assumed at August 29, 2008, and results of operations beginning August 30, 2008. |

| (c) | Net income and EPS includes $21.6 million gain, after tax, on debt modification and long-term obligations include $42.2 million related to the noncash debt discount. The discount is being amortized over the remaining life of the debt. See Note G, Long-term obligations, of the Notes to the Consolidated Financial Statements. |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Overview

We are a leading marketer, designer, and manufacturer of industrial electric motors, drives, generators, and other mechanical power transmission products, currently supplying over 10,000 customers in more than 200 industries. Our products are sold to a diverse customer base consisting of original equipment manufacturers (“OEM’s”) and distributors, serving markets in the United States and throughout the world. OEM’s primarily use our products in new installations which expands our installed base and leads to future replacement product sales. Overall our domestic sales are generated equally between OEM’s and distributors. Approximately 59% of our industrial motor products and approximately 24% of our mechanical power transmission products are sold directly to OEM’s with the remainder being sold to distributors.

- 16 -

Table of Contents

Generally, our financial performance is driven by industrial spending and the strength of the economies in which we sell our products, and is also influenced by:

| • | Investments in manufacturing capacity, including upgrades, modifications, and expansions of existing manufacturing facilities, and the creation of new manufacturing facilities; |

| • | Capacity utilization; |

| • | Our customers’ needs for greater variety, timely delivery, and higher quality at a competitive cost; and |

| • | Our large installed base, which creates a significant replacement demand. |

Demand for our products is closely tied to growth trends in the economy and levels of industrial activity and capital investment. Specific drivers of demand for our products include process automation, efforts in energy conservation and productivity improvement, regulatory and safety requirements, new technologies and replacement of worn parts. Our products are typically critical parts of customers’ end-applications, and the end user’s cost associated with their failure is high. Consequently, we believe that end users of our products base their purchasing decisions on quality, reliability, efficiency and availability as well as customer service. We believe key success factors in our industry include strong reputation and brand preference, good customer service and technical support, product availability, and a strong distribution network.

Business conditions were challenging in 2009 as a result of the broad-based impact of the global economic recession. For the year ended January 2, 2010, our sales decreased 22.0%, operating profit decreased 27.1%, and diluted EPS decreased 40.5%. Sales to our domestic distributor customers decreased 21.1% as distributors aggressively reduced inventories during 2009. This destocking process substantially ended during the third quarter and incoming order rates from our distributors improved through the fourth quarter. Sales to our domestic OEM customers declined 23.2% as a result of overall declines in capital spending.

During 2009, we implemented a number of sales strategies aimed at enhancing our sales organization and gaining new customers during the economic downturn, including a bounty hunt commission strategy targeted at obtaining specifically identified new customers. Through the bounty hunt initiative, we gained over 400 new customers. As these customers’ businesses recover, we will realize additional benefits of our strategy.

Sales of our Super-E premium-efficient motor products continued to grow during 2009 ahead of the December 2010 effective date of the 2007 Energy Independence and Security Act (“EISA”). While these motors sell at a 20% to 30% price premium over standard-efficiency motors, partly because they cost more to produce, they consume less energy and result in overall decreased total cost of ownership to our customers. Once EISA takes effect in 2011, we expect premium-efficient motors to comprise approximately 50% of our total motor sales.

During the fourth quarter of 2008, we proactively began implementing cost reduction initiatives across the Company, and began accelerating integration projects related to our recent acquisitions. As a result of these initiatives, we achieved more than $92 million of cost reductions for fiscal year 2009. We expect these cost reductions to amount to approximately $115 million on an annual basis beginning in 2010. During 2009, we consolidated two of our manufacturing facilities into other existing facilities in the United States at a one-time cost of $5.0 million. These consolidations will provide annual cost savings of approximately $9.0 million. Our proactive cost reduction actions combined with continued productivity improvements resulted in sequentially improving operating margins each quarter of 2009 when compared to fourth quarter 2008 in spite of declining revenues. In addition, third and fourth quarter 2009 operating margins each improved when compared to the same periods of 2008.

- 17 -

Table of Contents

Results of Operations

2009 compared to 2008

For fiscal year 2009, we reported diluted EPS of $1.28, down 40.5% from $2.15 per diluted share in 2008. Average diluted shares outstanding was 46.8 million for 2009 compared to 46.3 million for 2008. Net income was $59.8 million for fiscal year 2009, down 39.9% from $99.4 million in 2008.

Net sales for the year decreased 22.0% to $1.52 billion compared to $1.95 billion in 2008. Sales of industrial electric motor products decreased 23.5% from 2008 and comprised 64.1% of total sales for the year compared to 65.3% for the same period last year. While overall motor product sales decreased, sales of Super-E premium-efficient motors grew 4.0% for the year and increased to 14.1% of total motor sales in 2009 compared to 10.4% in 2008. Sales of mounted bearings, gearing, and other mechanical power transmission products decreased 20.4% from 2008 and comprised 29.2% of total sales in 2009 compared to 28.6% in 2008. Our mechanical power transmission product sales are heavily weighted toward distributor customers. Consequently, inventory destocking had a significant impact on sales of these products in 2009. Sales of other products decreased 14.3% from 2008 and comprised 6.7% of total sales in 2009 compared to 6.1% in 2008. These products outperformed motors and mechanical power transmission products primarily due to growth in our generator product sales which increased 15.5% for the year. During 2009, we made organizational changes in our generator group and continued to integrate those products into our distribution network. As a result, we continue to gain new customers and expand our presence in the generator marketplace.

Gross margin was 29.0% for the year as compared to 29.6% in 2008. As a result of continued product design improvements, reduction of waste, and price improvement in certain commodities, our materials cost as a percentage of sales improved during 2009 when compared to 2008. Manufacturing costs as a percentage of sales increased in 2009 as a result of decreased sales. Our cost reduction efforts helped to partially offset the margin impact of decreased sales and production levels.

Operating margin decreased to 11.9% for the year from 12.7% in 2008. Selling and administrative expenses decreased by $64.7 million in 2009, but increased 0.5% as a percentage of sales. We realized significant cost reductions during 2009 which substantially offset the margin impact of declining sales.

Interest expense increased $4.6 million from 2008. While we benefitted from reducing our outstanding debt balance, interest rates on our variable rate debt increased as a result of the March 31, 2009 amendment of our senior secured credit facility.

Pre-tax income for 2009 decreased 33.6% from 2008. Pre-tax income for 2009 included a $35.7 million noncash gain and $7.5 million noncash debt discount amortization related to the modification of our senior secured credit facility completed March 31, 2009. The total discount of approximately $49.7 million is being amortized over the remaining term of the credit facility which matures January 31, 2014.

Our effective income tax rate was 40.9% in 2009 compared to 34.7% in 2008. Our 2009 effective income tax rate was primarily impacted by a cash dividend from a foreign subsidiary, which was utilized to repay debt and resulted in a 3.0% increase in the effective income tax rate, and an increase in the valuation allowance for certain net operating loss carryforwards of foreign subsidiaries which resulted in a 1.9% increase in the effective tax rate.

2008 compared to 2007

For fiscal year 2008, we reported diluted EPS of $2.15, up 3.4% from $2.08 per diluted share in 2007. Average diluted shares outstanding was 46.3 million for 2008 compared to 45.2 million for 2007. Net income was $99.4 million for fiscal year 2008, up 5.7% from $94.1 million in 2007.

- 18 -

Table of Contents

Net sales for 2008 increased 7.1% to $1.95 billion compared to $1.82 billion in 2007. Sales of industrial electric motor products increased 9.6% for 2008 as compared to 2007 and comprised 65.3% of total sales for 2008 compared to 64.2% for 2007. Sales of Super-E premium-efficient motors grew by 25.0% in 2008 and comprised 10.4% of total motor product sales. Sales of mounted bearings, gearing, and other mechanical power transmission products grew 11.1% during 2008 as compared to 2007 and comprised 28.6% of total sales compared to 26.5% in 2007. Sales of mechanical power transmission products in 2008 included $11.7 million from our Maska acquisition completed on August 29, 2008. Sales of other products decreased 6.0% during 2008 as compared to 2007 and comprised 6.1% of total sales compared to 9.3% in 2007.

Gross margin decreased slightly to 29.6% in 2008 as compared to 30.1% in 2007. Raw material costs were substantially higher in 2008 than in 2007. While the increased costs were partially offset by product design improvements and price increases implemented during the year, margins were negatively impacted in 2008.

Operating margin decreased to 12.7% in 2008 from 13.8% in 2007. Selling and administrative expenses increased slightly as a percentage of sales in 2008 primarily due to increased commission expense as we integrated the Reliance motor products into our sales network, and the inclusion of Maska expenses beginning August 30, 2008.

Interest expense decreased $5.7 million from 2007 to 2008 even though there was a full year of interest expense in 2008 related to the debt incurred on January 31, 2007 to fund our acquisition of Reliance, compared to eleven months of interest in 2007. Interest rates on our variable rate debt decreased in 2008 and we reduced our outstanding debt balance by a net amount of $49.4 million during the year.

Our effective income tax rate was 34.7% in 2008 compared to 36.1% in 2007. The change was primarily related to increased earnings generated outside the United States and the domestic production activities deduction.

Our Expectations for 2010

While 2009 was a very difficult year, we believe we made many decisions during the year that will benefit us in the long-term. During 2009, we achieved cost reductions that will amount to approximately $115.0 million in 2010, while continuing to invest in new products, new customers, and productivity improvements and retaining our talented and experienced workforce. We expect to maintain these cost reductions as business improves in 2010 and we believe the long-term focus of our decisions during the recession has positioned us to take advantage of opportunities as the economy recovers. Our current outlook is for a slight sales increase along with improved earnings in 2010. See “Forward-looking statements” concerning important factors that could impact actual results.

Environmental Remediation

We believe, based on our internal reviews and other factors, that any future costs relating to environmental remediation and compliance will not have a material effect on our capital expenditures, earnings, cash flows, or competitive position.

Liquidity and Capital Resources

Our primary sources of liquidity are cash flows from operations and funds available under our senior secured revolving credit facility. We expect that short-term and long-term funding requirements will continue to be met by these sources. At January 2, 2010, we had no outstanding borrowings under the revolving credit facility. We have approximately $180.2 million of borrowing capacity under the senior secured revolving credit facility which matures in 2012.

- 19 -

Table of Contents

The recent financial market conditions have not affected our ability to borrow from our revolving credit facility.

Cash flows from operations amounted to $205.7 million in 2009, $99.1 million in 2008, and $163.0 million in 2007. During 2009, our reductions in inventories, in response to declining business levels, contributed approximately $68.4 million to operating cash flows. While we aggressively reduced our inventory levels in 2009, we continue to maintain adequate inventories to serve our existing customers as well as new business. In addition to reduced inventories we had reductions in accounts receivables, and accounts payables and accrued expenses, relative to the decline in sales. These normal fluctuations contributed a net of $19.0 million to operating cash flows in 2009. Finally during 2009, we recovered $19.1 million of margin deposits on our commodity hedges that were funded during the fourth quarter of 2008.

Net cash used in investing activities was $42.3 million in 2009, $59.4 million in 2008, and $1,742.9 million in 2007. Investing activities in 2009 were primarily related to property, plant and equipment additions. Investing activities in 2008 included $23.3 million proceeds from a real estate transaction and $41.3 million (net of cash acquired) used to acquire Maska. Investing activities in 2007 included $1.8 billion (net of cash acquired) used to acquire Reliance. The Reliance acquisition was funded with proceeds from the issuance of Baldor common stock and borrowings under our senior secured credit facility and senior unsecured notes. In addition, 2007 included proceeds of $49.9 million from the divestiture of certain U.S. service centers.

Net cash used in financing activities of $161.3 million in 2009 included dividends paid to shareholders of $31.6 million, amendment fees of $7.3 million related to the March 31, 2009 amendment of our senior secured credit facility, and net debt payments of $121.8 million. Net cash used in financing activities of $64.4 million in 2008 included dividends paid to shareholders of $31.4 million and net debt reductions of $52.0 million. During 2008, we made principal payments of approximately $112.0 million on our term loan and notes payable and we had borrowings on our revolving credit facility of approximately $40.0 million and $19.1 million to fund the acquisition of Maska and margin deposits on our commodity hedges, respectively. Net cash provided by financing activities of $1.6 billion in 2007 included dividends paid to shareholders of $31.2 million, proceeds of $1.6 billion from new debt incurred and equity issued in the acquisitioin of Reliance (net of repayments and issuance costs).

We have a corporate family credit rating of BB- and senior secured debt rating of Ba3 with a stable outlook by Moody’s Investors Services, Inc. (“Moody’s”). We have a long-term issuer credit rating of B1 and senior secured debt rating of BB+ with a stable outlook by Standard & Poor’s Rating Service (“S&P”). We have senior unsecured debt ratings of B3 by Moody’s and B by S&P. Both ratings agencies recently affirmed our ratings, and Moody’s upgraded our liquidity rating from SGL-3 to SGL-2 following the successful amendment of our credit agreement on March 31, 2009. Our senior secured credit facility has a downward rating trigger that increases the margin paid on variable rate borrowings from 3.25% to 3.50% for any period during which our Moody’s corporate family rating is below BB- or our S&P long-term issuer rating is below B1. We have no downward rating triggers that would accelerate the maturity of amounts drawn under our senior secured credit facility. Also, we have no downward rating triggers under our senior unsecured notes.

Our senior secured credit facility and senior unsecured notes contain various customary covenants, which limit, among other things, indebtedness and dispositions of assets, and which require us to maintain compliance with certain quarterly financial ratios. The primary financial ratios in our credit agreement are total leverage (total debt/EBITDA, as defined) and senior secured leverage (senior secured debt/EBITDA, as defined). We have maintained compliance with all covenants and were in compliance at January 2, 2010. Our total leverage ratio and senior secured leverage ratios were 3.93x and 2.14x, respectively, at January 2, 2010. These were within our maximum covenant requirements of 5.25x and 2.75x, respectively. Our maximum covenant requirements step down to 5.00x and 2.50x, respectively at December 31, 2010. We expect to remain in compliance with these covenants in 2010.

- 20 -

Table of Contents

On March 31, 2009, we amended our senior secured credit facility. The amendment relaxed our total leverage and senior secured leverage ratio requirements to help ensure we maintain sufficient headroom under our covenants during the economic recession. In conjunction with the amendment, the margin applied to LIBOR on our variable term loan and revolver borrowings was increased to 3.25%, and a LIBOR floor of 2.00% was implemented.

The amendment of the senior secured term loan was considered a substantial modification of the debt. As a result, the senior secured term loan was recorded at fair value as of the modification date which resulted in a noncash debt discount of $49.7 million being recorded in long-term obligations on the consolidated balance sheet and a $35.7 million gain on debt modification included in income from continuing operations in the consolidated statement of income. Fees paid related to the amendment of $5.7 million along with unamortized fees related to the original agreement of $8.3 million were considered when calculating the gain. The discount is being amortized to other expense over the remaining term of the debt. Amortization amounted to $7.5 million during 2009.

The amendment did not change the borrowing capacity of the revolving credit facility; therefore, fees of $1.6 million related to the amendment were deferred and are being amortized over the remaining term of the facility agreement along with unamortized fees of $1.1 million related to the original agreement.

The table below summarizes our contractual obligations as of January 2, 2010.

| (In thousands) | Payments due by years | ||||||||||||||

| Total | 2010 | 2011-2012 | 2013-2014 | 2015 and Thereafter | |||||||||||

| Contractual Obligations: |

|||||||||||||||

| Long-term debt obligations (a) |

$ | 1,740,602 | $ | 104,754 | $ | 207,854 | $ | 759,295 | $ | 668,699 | |||||

| Operating lease obligations |

71,492 | 14,191 | 22,692 | 12,964 | 21,645 | ||||||||||

| Other Commercial Commitments: |

|||||||||||||||

| Letters of Credit |

19,772 | 19,722 | — | — | — | ||||||||||

| (a) | Includes interest on both fixed and variable rate obligations. Interest associated with variable rate obligations is based upon interest rates in effect at January 2, 2010. The contractual amounts to be paid on variable rate obligations are affected by changes in market interest rates. Future changes in market interest rates could materially affect the contractual amounts to be paid. |

Dividend Policy

Dividends paid to shareholders amounted to $0.68 per common share in 2009, 2008, and 2007. Our objective is for shareholders to receive dividends while also participating in Baldor’s growth. The terms of our credit agreement and indenture limit our ability to increase dividends in the future.

Market Risk

Market risks relating to our operations result primarily from changes in commodity prices, interest rates, concentrations of credit, and foreign exchange rates. To help maintain stable pricing for customers, we enter into various commodity hedging transactions. To manage interest rate risk on variable rate outstanding debt, we enter into various interest rate hedging transactions.

We purchase copper and aluminum, and periodically utilize commodity futures contracts for hedging purposes to reduce the effects of changing prices in these commodities. Generally, contract terms of a hedge instrument closely mirror those of the hedged item providing a high degree of risk reduction and correlation. We had derivative contracts designated as commodity cash flow hedges with a fair value of $17.4 million recorded in other current assets at January 2, 2010. A hypothetical 10% change in the fair value of open positions would not have a material effect on our results of operations.

- 21 -

Table of Contents

Our interest rate risk is primarily related to our senior secured credit facility which bears interest at variable rates. Additionally, our long-term obligations include senior unsecured notes totaling $550.0 million which bear interest at a fixed rate of 8.625%. We utilize various interest rate hedge instruments to manage future exposure to interest rate risk on a portion of the variable rate obligations. Effective March 31, 2009, we amended our senior secured credit agreement. In conjunction with the amendment, a LIBOR floor was added to the variable rate borrowings. As a result, we determined that our existing interest rate instruments were no longer expected to be highly effective and were discontinued as cash flow hedges. Details regarding the instruments as of January 2, 2010, are as follows:

| Instrument |

Notional Amount |

Maturity |

Rate Paid |

Rate Received (1) |

Fair Value (2) | |||||||

| Swap |

$250.0 million | April 30, 2012 | 5.12 | % | LIBOR | $ | (16.6) million | |||||

| Collar |

$100.0 million | April 30, 2012 | LIBOR | LIBOR; Floor 4.29%; Cap 6.50% | $ | (5.4) million | ||||||

| (1) | LIBOR is determined each reset date based on London and New York business days. |

| (2) | Fair value is an estimated amount that the Company would have paid at January 2, 2010, to terminate the agreement. |

Our financial instruments that are exposed to concentrations of credit risk consist primarily of cash equivalents and trade receivables. Cash equivalents are in high quality securities placed with major banks and financial institutions. Concentrations of credit risk with respect to receivables is limited due to our large number of customers and their dispersion across geographic areas and industries. We perform periodic credit evaluations of customers’ financial conditions and generally do not require collateral. No single customer represents more than 10% of net accounts receivable or sales for any period presented in this report. We have not experienced an increase in customer bad debts as a result of market conditions.

Foreign affiliates comprise approximately 12% of our consolidated net sales and generally conduct business in their respective local currencies. As a result, our exposure to foreign currency risk is not significant. We continue to monitor the effects of foreign currency exchange rates and will utilize foreign currency hedges where appropriate.

Critical Accounting Estimates

Our consolidated financial statements are prepared in accordance with accounting principles generally accepted in the United States (“GAAP”), which requires us to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues, expenses and the related disclosures during the periods reported. We base our assumptions, estimates and judgments on historical experience, current trends and other factors management believes to be relevant at the time our consolidated financial statements are prepared. On a regular basis, we review the accounting policies, assumptions, estimates and judgments to ensure that our financial statements are presented fairly and in accordance with GAAP. However, because future events and their effects cannot be determined with certainty, actual results could differ from our assumptions and estimates, and such differences could be material.

Our significant accounting policies are discussed in Note A, Significant Accounting Policies, of the Notes to Consolidated Financial Statements, included in Item 8, Financial Statements and Supplementary Data, of this Annual Report on Form 10-K. We believe that the following accounting estimates are the most critical to aid in fully understanding and evaluating our reported financial results, and they require our most subjective or complex judgments, resulting from the need to make estimates about the effect of matters that are inherently uncertain.

- 22 -

Table of Contents

Allowance for Doubtful Accounts: We record allowances for doubtful accounts based on customer-specific analysis, current assessments of past due balances and economic conditions, and historical experience. We have not made any material changes in the accounting methodology used to establish our allowance for doubtful accounts and do not believe there is a reasonable likelihood that there will be a material change in the assumptions used to determine the allowance. However, additional allowances for doubtful accounts may be required if there is deterioration in past due balances, if economic conditions are less favorable than anticipated, or for customer-specific circumstances, such as financial difficulty.

Inventories: We value inventories at the lower of cost or market with cost being determined principally by the last-in, first-out (LIFO) method, except for non-U.S. inventories, which are determined by the first-in, first-out (FIFO) method. The valuation of LIFO inventories is made at the end of each year based on inventory levels and costs at that time. The net realizable value of inventory is reviewed on an on-going basis with consideration given to deterioration, obsolescence, and other factors. We have not made any material changes in the accounting methodology used to value our inventories and do not believe there is a reasonable likelihood that there will be a material change in the future estimates or assumptions used to determine inventory values in the future. However, if actual conditions differ from those estimated by management, adjustments to inventory values may be required.