Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - International Coal Group, Inc. | frm8-k.htm |

Simmons

& Company Energy Conference

and

UBS

Energy/Utility Conference

March

2, 2010

Ben

Hatfield

President

& Chief Executive Officer

Forward-Looking

Statements

n Statements in this

presentation that are not historical facts are forward-looking statements within

the “safe harbor” provision of the Private

Securities Litigation Reform Act of 1995 and may involve a number of risks and uncertainties. We have used the words “anticipate,” “believe,”

“could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project” and similar terms and phrases, including references to assumptions, to

identify forward-looking statements. These forward-looking statements are made based on expectations and beliefs concerning future events

affecting us and are subject to various risks, uncertainties and factors relating to our operations and business environment, all of which are difficult

to predict and many of which are beyond our control, that could cause our actual results to differ materially from those matters expressed in or

implied by these forward-looking statements. The following factors are among those that may cause actual results to differ materially from our

forward-looking statements: our ability to successfully refinance our outstanding indebtedness and reduce our leverage; market demand for coal,

electricity and steel; availability of qualified workers; future economic or capital market conditions; weather conditions or catastrophic weather-

related damage; our production capabilities; consummation of financing, acquisition or disposition transactions and the effect thereof on our

business; a significant number of conversions of our 9.00% Convertible Senior Notes due 2012 prior to maturity; our plans and objectives for future

operations and expansion or consolidation; our relationships with, and other conditions affecting, our customers; availability and costs of key

supplies or commodities, such as diesel fuel, steel, explosives and tires; availability and costs of capital equipment; prices of fuels which compete

with or impact coal usage, such as oil and natural gas; timing of reductions or increases in customer coal inventories; long-term coal supply

arrangements; reductions and/or deferrals of purchases by major customers; risks in or related to coal mining operations, including risks related to

third-party suppliers and carriers operating at our mines or complexes; unexpected maintenance and equipment failure; environmental, safety and

other laws and regulations, including those directly affecting our coal mining and production, and those affecting our customers’ coal usage; ability

to obtain and maintain all necessary governmental permits and authorizations; competition among coal and other energy producers in the United

States and internationally; railroad, barge, trucking and other transportation availability, performance and costs; employee benefits costs and labor

relations issues; replacement of our reserves; our assumptions concerning economically recoverable coal reserve estimates; availability and costs

of credit, surety bonds and letters of credit; title defects or loss of leasehold interests in our properties which could result in unanticipated costs or

inability to mine these properties; future legislation and changes in regulations or governmental policies or changes in interpretations or

enforcement thereof, including with respect to safety enhancements and environmental initiatives relating to global warming or climate change;

impairment of the value of our long-lived and deferred tax assets; our liquidity, including our ability to adhere to financial covenants related to our

borrowing arrangements; adequacy and sufficiency of our internal controls; and legal and administrative proceedings, settlements, investigations

and claims and the availability of related insurance coverage.

Securities Litigation Reform Act of 1995 and may involve a number of risks and uncertainties. We have used the words “anticipate,” “believe,”

“could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project” and similar terms and phrases, including references to assumptions, to

identify forward-looking statements. These forward-looking statements are made based on expectations and beliefs concerning future events

affecting us and are subject to various risks, uncertainties and factors relating to our operations and business environment, all of which are difficult

to predict and many of which are beyond our control, that could cause our actual results to differ materially from those matters expressed in or

implied by these forward-looking statements. The following factors are among those that may cause actual results to differ materially from our

forward-looking statements: our ability to successfully refinance our outstanding indebtedness and reduce our leverage; market demand for coal,

electricity and steel; availability of qualified workers; future economic or capital market conditions; weather conditions or catastrophic weather-

related damage; our production capabilities; consummation of financing, acquisition or disposition transactions and the effect thereof on our

business; a significant number of conversions of our 9.00% Convertible Senior Notes due 2012 prior to maturity; our plans and objectives for future

operations and expansion or consolidation; our relationships with, and other conditions affecting, our customers; availability and costs of key

supplies or commodities, such as diesel fuel, steel, explosives and tires; availability and costs of capital equipment; prices of fuels which compete

with or impact coal usage, such as oil and natural gas; timing of reductions or increases in customer coal inventories; long-term coal supply

arrangements; reductions and/or deferrals of purchases by major customers; risks in or related to coal mining operations, including risks related to

third-party suppliers and carriers operating at our mines or complexes; unexpected maintenance and equipment failure; environmental, safety and

other laws and regulations, including those directly affecting our coal mining and production, and those affecting our customers’ coal usage; ability

to obtain and maintain all necessary governmental permits and authorizations; competition among coal and other energy producers in the United

States and internationally; railroad, barge, trucking and other transportation availability, performance and costs; employee benefits costs and labor

relations issues; replacement of our reserves; our assumptions concerning economically recoverable coal reserve estimates; availability and costs

of credit, surety bonds and letters of credit; title defects or loss of leasehold interests in our properties which could result in unanticipated costs or

inability to mine these properties; future legislation and changes in regulations or governmental policies or changes in interpretations or

enforcement thereof, including with respect to safety enhancements and environmental initiatives relating to global warming or climate change;

impairment of the value of our long-lived and deferred tax assets; our liquidity, including our ability to adhere to financial covenants related to our

borrowing arrangements; adequacy and sufficiency of our internal controls; and legal and administrative proceedings, settlements, investigations

and claims and the availability of related insurance coverage.

n You should keep in

mind that any forward-looking statement made by us in this presentation or

elsewhere speaks only as of the date on which the

statements

were made. See also the “Risk Factors” in our 2009 Annual Report on Form 10-K

and subsequent filings with the SEC which are

currently available on our website at www.intlcoal.com. New risks and uncertainties arise from time to time, and it is impossible for us to predict

these events or how they may affect us or our anticipated results. In light of these risks and uncertainties, you should keep in mind that any forward

-looking statement made in this presentation might not occur. All data presented herein is as of December 31, 2009 unless otherwise noted.

currently available on our website at www.intlcoal.com. New risks and uncertainties arise from time to time, and it is impossible for us to predict

these events or how they may affect us or our anticipated results. In light of these risks and uncertainties, you should keep in mind that any forward

-looking statement made in this presentation might not occur. All data presented herein is as of December 31, 2009 unless otherwise noted.

2

ICG

Highlights

n Strong operating

presence in 3 of 4 largest US coal-producing

regions - Central Appalachia, Northern Appalachia & Illinois Basin

regions - Central Appalachia, Northern Appalachia & Illinois Basin

n Extensive coal

reserve holdings with 66% ownership

n Planned production

growth is primarily from permitted underground

mines with less exposure to environmental issues

mines with less exposure to environmental issues

n Strong sales

position with growing met coal portfolio

n 100% union-free

workforce

n Solid balance sheet

with minimal long-term legacy liabilities

Summary

Statistics

Market

capitalization1:

$780.4 million

Coal

reserves:

1.1

billion tons

Reserve

life:

Approximately

67 yrs

Employees:

2,600

2009 tons sold: 16.8

million

2009 tons

produced: 16.3

million

1Market capitalization

is based on 179.0 million shares outstanding and a stock price of $4.36 as of

February 26, 2010

3

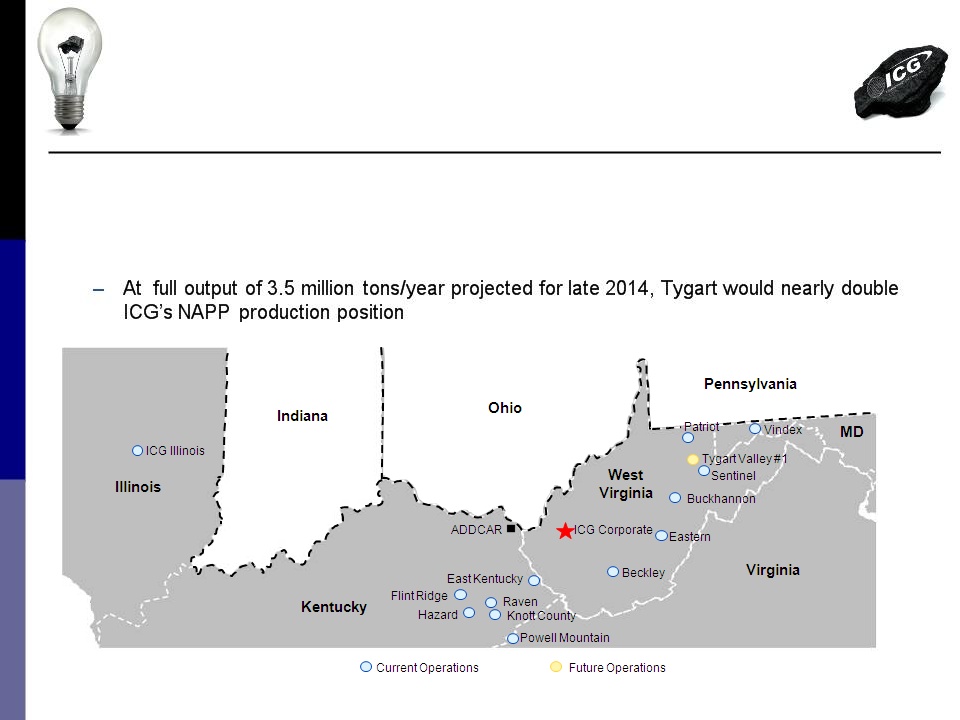

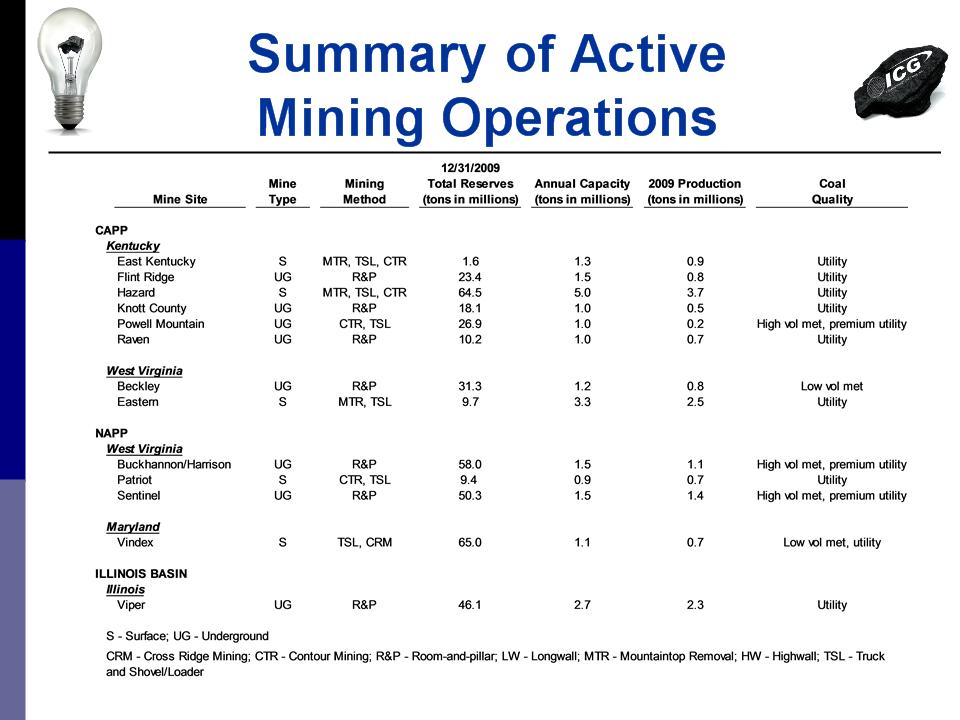

§ 13 active mining

complexes - 8 in Central Appalachia, 4 in Northern Appalachia, and 1 in

Illinois Basin

Illinois Basin

§ Construction of

flagship Tygart project is expected to resume in 2011 with initial

production

in late 2012

in late 2012

Operating

Strength

and Diversity

and Diversity

4

Production

Growth Matched

to

Market Demand

1 Management’s estimate

as of February 26, 2010

1

1

5

Significant

Idle Production

Capacity

Available

§ Additional to

current production and planned developments, nearly 3 million annual tons

of

production capacity can be activated promptly in response to rising market demand

production capacity can be activated promptly in response to rising market demand

– Operations

representing approximately 2.15 million tons/year are held in “hot idle”

status

and require only moderate equipment investment for restart

and require only moderate equipment investment for restart

– Another 0.75 million

tons/year of production capacity are essentially permitted and

available for development within a 6-12 month timeframe

available for development within a 6-12 month timeframe

§ These production

sources are generally higher cost mines that were either idled or

development

-deferred in response to the weaker market of 2009

-deferred in response to the weaker market of 2009

6

Tygart

Represents World Class

Production Opportunity

Production Opportunity

§ Tygart #1 is the

first of 3 or more mining

complexes planned for ICG’s 186 million ton

Hillman property in Northern WV

complexes planned for ICG’s 186 million ton

Hillman property in Northern WV

– High Btu, low- to

medium-sulfur steam and

premium high volatile met quality coal

premium high volatile met quality coal

– Anticipating low

costs due to longwall

mining, owned property, and favorable

geology

mining, owned property, and favorable

geology

§ Projected to produce

up to 3.5 million tons

per year at full output (50% met/50% steam)

per year at full output (50% met/50% steam)

– Startup in late

2012; full output mid-2014

– Targets a 40-50

million ton reserve area

§ Tygart expected to

be one of ICG’s highest

margin operations due to low cost structure

and premium met/thermal marketability

margin operations due to low cost structure

and premium met/thermal marketability

§ Favorable geographic

position relative to

Atlantic terminals and NE customer base

Atlantic terminals and NE customer base

7

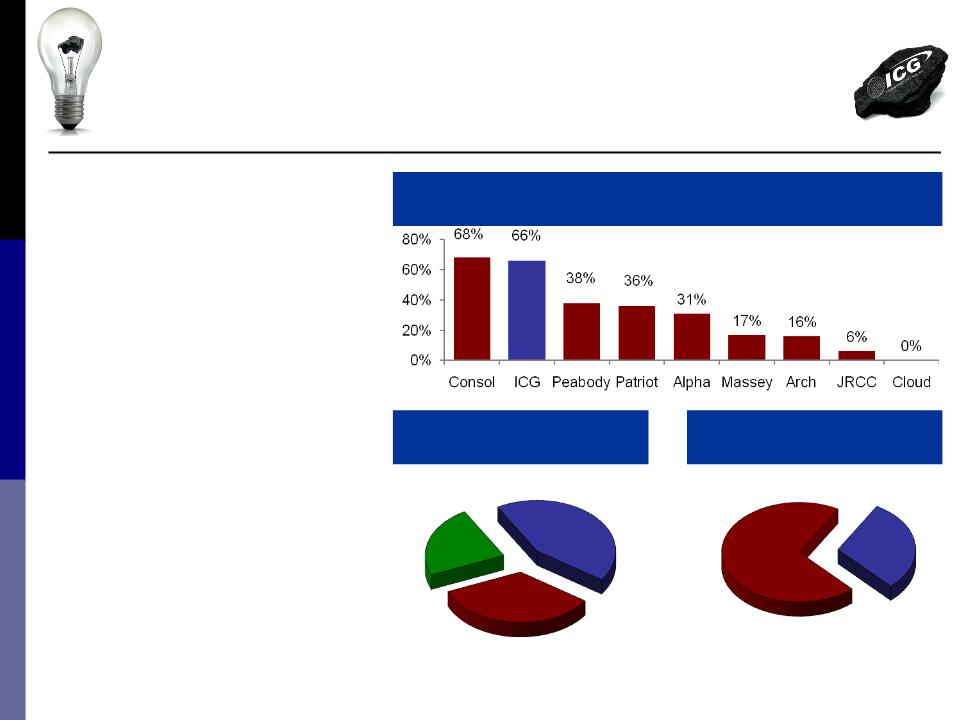

Excellent

Reserve Position

§ ICG owns a larger

portion of its

reserves than nearly all other

public producers

reserves than nearly all other

public producers

– Met reserves 71%

owned

– Thermal reserves 64%

owned

§ ICG controls 1.1

billion tons of

high-quality reserves that are

primarily high-BTU low-sulfur

thermal and premium met coals

high-quality reserves that are

primarily high-BTU low-sulfur

thermal and premium met coals

%

Ownership of Total Reserves

Geographic

Distribution

of

Reserves

30%

Met Quality

325

million tons

70%

Steam Quality

765

million tons

Reserves

by Type

34%

IL Basin

371

million tons

23%

CAPP

256

million tons

43%

NAPP

463

million tons

8

Production

Shift Towards Underground

Mitigates Regulatory Risks

Mitigates Regulatory Risks

n Nearly all ICG

growth is comprised of new or

expanding underground mining operations (rather

than surface mines)

expanding underground mining operations (rather

than surface mines)

– Incremental deep

mine growth totaling 1.7

million TPY by 2011 is planned at Illinois,

Vindex, Beckley, Eastern & KY operations

million TPY by 2011 is planned at Illinois,

Vindex, Beckley, Eastern & KY operations

– The largest

component of anticipated deep

mine growth is the 3.5 million TPY Tygart #1

complex in NAPP

mine growth is the 3.5 million TPY Tygart #1

complex in NAPP

• Production ramp up

is projected for 2012-2014

n Underground mining

operations generally have

fewer regulatory hurdles than surface mines

fewer regulatory hurdles than surface mines

n Reduced risk of

regulatory permitting obstacles

Production

by Mining Method

10%

Surface

104

million tons

90%

Underground

986

million tons

Reserves

by Method

9

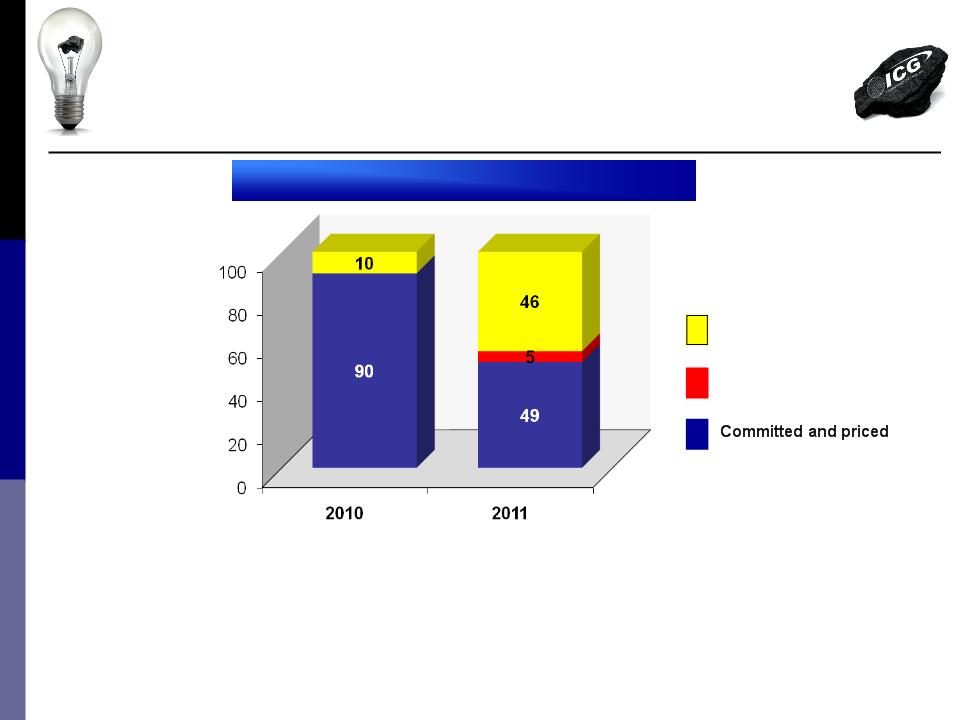

Projected

Sales 16.7 -

17.3 16.5 -

18.0

(tons in millions)

(tons in millions)

Total

Price Per Ton $63.00-$64.50 $65.00-$70.00

Metallurgical

Uncommitted 1.0 2.6

(tons in millions)

(tons in millions)

Committed

Tonnage1

1 Management’s

estimate as of February 26, 2010

Favorable

Sales Position

%

of

Sales

Sales

Uncommitted

Committed

and not priced

10

Metallurgical

Portfolio

Expanding Rapidly

Expanding Rapidly

Metallurgical

Sales Growth1

Key

drivers of met growth:

n Projected production

increase at met mines

during 2009-2011 of nearly 700,000 tons/year

during 2009-2011 of nearly 700,000 tons/year

– Added 3rd section at Beckley

(LV)

– Higher productivity

at Sentinel (HV)

– New

low volatile met Bismark mine is

being developed at Vindex; startup

projected for Q3 2010

being developed at Vindex; startup

projected for Q3 2010

n Sentinel met sales

projected to increase from

14% in 2009 to 60% in 2010

14% in 2009 to 60% in 2010

– Completion of legacy

utility contracts

– Increased market

demand for Sentinel

quality

quality

n Increase in met

blend sales expected from

Powell Mountain (HV/PCI) and existing Vindex

mines (LV)

Powell Mountain (HV/PCI) and existing Vindex

mines (LV)

11

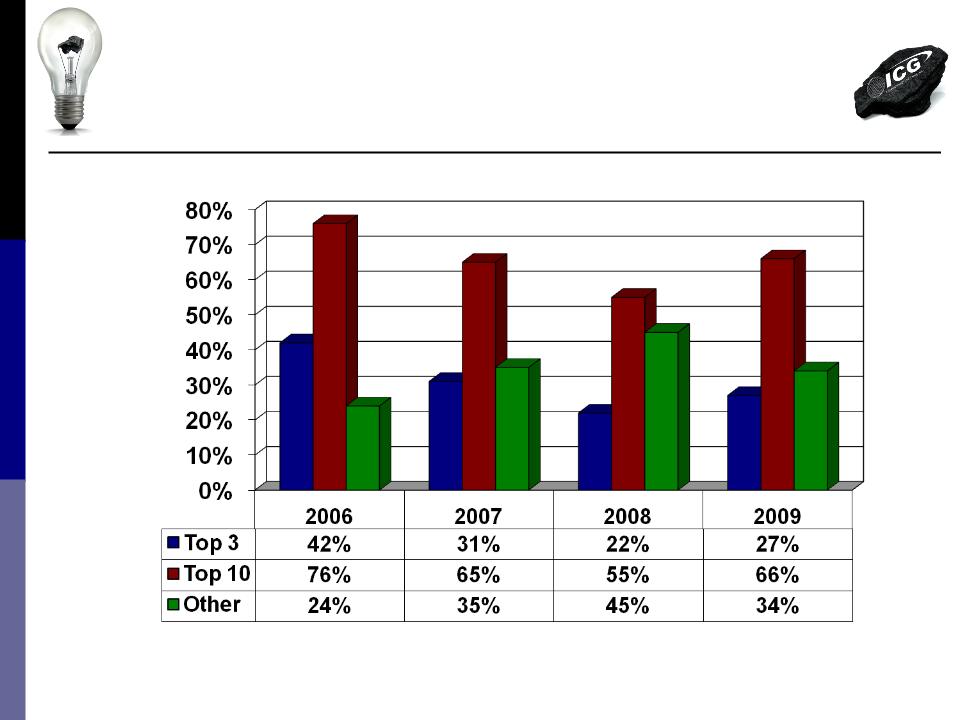

Increasingly

Diversified

Customer Base

Customer Base

12

ICG

Legacy Liabilities

Total: $144

million

Total

Legacy Liabilities1

1 Source:

Company Annual Reports as of December 31, 2008; legacy liabilities include post

retirement benefits, black lung liabilities, reclamation liabilities,

workers compensation and Coal Act liabilities; Alpha pro forma for Foundation

workers compensation and Coal Act liabilities; Alpha pro forma for Foundation

($ in

millions)

Lowest

Legacy Liabilities

Among

Peer Group

13

New

ABL Credit Facility

n New ABL credit

facility closed on February 22, 2010

n Replaces the $100

million credit facility set to expire in June

of 2011

of 2011

n New facility

provides:

– $125 million in

borrowing capacity, an increase of $25 million

– $125 million in

Letter of Credit capacity, an increase of $45 million

– Eliminates maximum

leverage and minimum interest coverage ratio

requirements

requirements

– Provides for

increased capital spending limits

– Secured by real and

personal property of the Company

– Term runs through

February 2014

14

Coal

Market Outlook

l Current Market

Conditions

l Review of Key

Indicator Trends

l Market

Outlook

15

Current

Market Conditions

n Coal market

sentiment continues to improve

– Natural gas prices

seem to have stabilized in a range of $4.50 to $5.50

n Most key indicators

trending favorably

– Steel capacity

utilization continues on a steady, upward trajectory

– Metallurgical export

demand continues to grow

– Utility inventories

are dropping faster than expected

– Coal output

continues to be restrained

– Over-the-counter

thermal prices continue to improve

n However, areas of

uncertainty temper optimism

– Continued mixed

signals for sustained economic recovery

– Rail service has

been difficult since late January

– Some concern that

Chinese demand is slowing

– Natural gas rig

count seems to be recovering prematurely

n Despite concerns,

overall outlook is much improved

16

Quick

Review of

Key Indicators

Key Indicators

n Prompt-month OTC

coal price trends

n EIA coal production

data

n Natural gas

storage

n Blast furnace

utilization

17

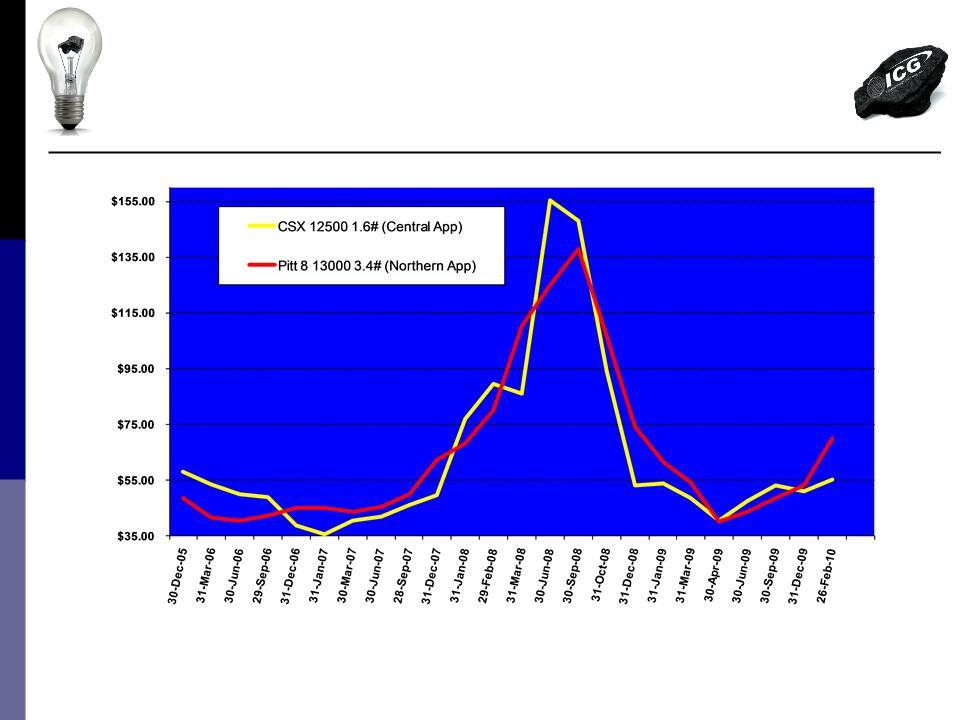

Prompt-Month

OTC

Coal Price Trends

Per ICAP-United, Inc.

Coal Price Trends

Per ICAP-United, Inc.

18

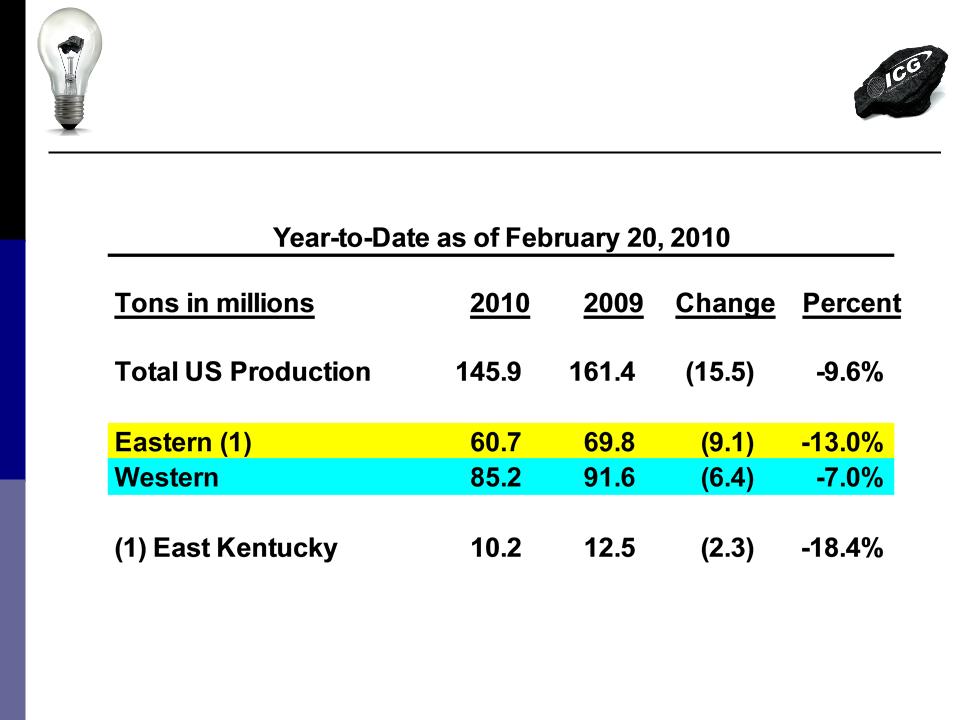

EIA

Coal Production Data

19

Natural

Gas Storage - Now

(Per EIA - week ending 2/05/10)

(Per EIA - week ending 2/05/10)

At

or above 5-Year

Range

Range

Working

Gas in Underground Storage Compared with 5-Year Range

Well

within

5-Year

Range

20

US

Iron And Raw Steel Output

% Capacity Utilization

% Capacity Utilization

Source:

Steelfacts, including AISI and US Dept. of Commerce

21

Short-term Market Outlook

n Thermal coal outlook

improving - early signs of “inventory

stress” are beginning to appear

stress” are beginning to appear

– Utilities that

require high quality coals are feeling the met cross-over impact

– Nationwide utility

inventories have dropped by nearly 40 million tons

– Rail carriers

struggling with weather delays; expect transport issues to

continue into April, which would constrain 1st quarter shipments

continue into April, which would constrain 1st quarter shipments

n Rising metallurgical

demand is expected to continue

attracting higher quality coals from the thermal market

attracting higher quality coals from the thermal market

– Broadly based

speculation is that benchmark hard coking coal settlements

will land in the $200 to $240 range (fob vessel, metric tonne basis)

will land in the $200 to $240 range (fob vessel, metric tonne basis)

– 2009 benchmark was

$129

n US coal production

is expected to decrease through the first

quarter of 2010 and then begin to stabilize

quarter of 2010 and then begin to stabilize

22

Long-term

Market Outlook

n Cold winter weather

is forecast to extend into March

– Natural gas storage

could be near normal by end of withdrawal season

– Coal utilization

should be enhanced and inventory surplus significantly

reduced

reduced

n Strengthening US

economic recovery should boost demand

n Thermal coal

production is expected to remain suppressed

– Producers will be

reluctant to increase production without strong and

sustained price signals

sustained price signals

– Permit and

regulatory issues could begin impacting production in late 2010

– New capital will

generally favor metallurgical projects

n Utilities are

expected to return to the spot market mid-2010

as burns improve

as burns improve

23

Summary

n Well-positioned to

benefit from anticipated market improvement

with strong and diverse operating assets

with strong and diverse operating assets

– Nearly 3 million

tons of idle production capacity available for opportunistic

startup

– Prominent shift from

surface mining to underground production is expected to

mitigate risk of regulatory delays

mitigate risk of regulatory delays

– Flagship Tygart #1

Complex is expected to resume construction in 2011

– Reserves of 1.1

billion tons include 325 million tons of met coal and are 66% owned

n Favorable sales

outlook and growing met coal portfolio

– Having 90% of 2010

sales priced provides near term protection from weak thermal

markets while the 46% open 2011 position allows upside in a rising market

markets while the 46% open 2011 position allows upside in a rising market

– Met sales are

increasing by 250% in 2010 just as prices sharply escalate in response

to strong Asian demand

to strong Asian demand

n As the market

rebalances in 2010 and global stimulus efforts

take hold, increasing demand for low-cost electricity and steel

products should bode well for coal

take hold, increasing demand for low-cost electricity and steel

products should bode well for coal

24

Updated

Guidance Summary

(Management Estimate as of February 26, 2010 )

(Management Estimate as of February 26, 2010 )

|

2010

Guidance

|

|

|

Tons

Sold

|

16.7-17.3

million tons

|

|

Metallurgical

Tons Sold

|

2.4

million tons

|

|

Tons

Produced

|

16.0-16.4

million tons

|

|

Average

Selling Price

|

$63.00-$64.50/ton

|

|

• CAPP

Selling Price

|

$70.50-$72.50/ton

|

|

• NAPP

Selling Price

|

$60.50-$63.50/ton

|

|

• Illinois

Basin Selling Price

|

$36.25-$36.75/ton

|

|

Cash

Costs

|

$49.50-$51.50/ton

|

|

EBITDA

|

$170-$200

million

|

|

CapEx

|

$90-$100

million

|

|

|

|

|

2011

Guidance

|

|

|

Tons

Produced and Sold

|

16.5-18.0

million tons

|

|

Metallurgical

Tons Sold

|

2.7

million tons

|

|

Average

Selling Price

|

$65.00-$70.00/ton

|

25

Appendices

26

27

Peer

Group

Cost

and Margin Comparisons

28

Peer

Group Cost Per Ton

Appalachian Production (2007-2009)

Appalachian Production (2007-2009)

29

Peer

Group Cost Per Ton

Illinois Basin Production (2007-2009)

Illinois Basin Production (2007-2009)

30

Peer

Group Margin Comparison

Margin Per Ton in Dollars (2007-2009)

Margin Per Ton in Dollars (2007-2009)

Note: Margin

comparison reflects Eastern US production only.

31