Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2009

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 0-33489

ZYMOGENETICS, INC.

(exact name of registrant as specified in its charter)

| Washington | 91-1144498 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

|

1201 Eastlake Avenue East, Seattle, WA 98102 (Address of principal executive offices) | ||

Registrant’s telephone number, including area code (206) 442-6600

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, no par value | The NASDAQ Stock Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark whether the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨. No x.

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨. No x.

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days.

Yes x. No ¨.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ¨ No ¨.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendments to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ |

Accelerated filer x | Non-accelerated filer ¨ |

Smaller reporting company ¨ | |||||||

| (Do not check if a smaller reporting company) | ||||||||||

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ¨ No x.

The aggregate market value of the common equity held by non-affiliates computed by reference to the price at which the common equity was last sold as of June 30, 2009 was: $173,248,521.

Common stock outstanding at February 19, 2010: 85,477,565 shares.

DOCUMENTS INCORPORATED BY REFERENCE

| (1) | Portions of the Company’s definitive Proxy Statement for the annual meeting of shareholders to be held on June 17, 2010 are incorporated by reference in Part III. |

Table of Contents

ZYMOGENETICS, INC.

ANNUAL REPORT ON FORM 10-K

For the Year Ended December 31, 2009

| Page No. | ||||

| PART I | ||||

| Item 1. |

2 | |||

| Item 1A. |

24 | |||

| Item 1B. |

45 | |||

| Item 2. |

45 | |||

| Item 3. |

46 | |||

| Item 4. |

46 | |||

| PART II | ||||

| Item 5. |

Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities | 47 | ||

| Item 6. |

49 | |||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 50 | ||

| Item 7A. |

61 | |||

| Item 8. |

62 | |||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 91 | ||

| Item 9A. |

91 | |||

| Item 9B. |

92 | |||

| PART III | ||||

| Item 10. |

92 | |||

| Item 11. |

92 | |||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters | 92 | ||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

93 | ||

| Item 14. |

93 | |||

| PART IV | ||||

| Item 15. |

94 | |||

| 99 | ||||

1

Table of Contents

This Annual Report on Form 10-K contains, in addition to historical information, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. This Act provides a “safe harbor” for forward-looking statements to encourage companies to provide prospective information about themselves. All statements other than statements of historical fact, including statements regarding company and industry prospects and future results of operations, financial position and cash flows, made in this Annual Report on Form 10-K are forward-looking. We use words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “future,” “intend,” “may,” “potential,” “seek,” “should,” “target” and similar expressions, including negatives, to identify forward-looking statements. Forward-looking statements reflect management’s current expectations, plans or projections and are inherently uncertain. Our actual results could differ significantly from the results discussed in the forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Factors that could cause or contribute to such differences include those discussed in “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” as well as those discussed elsewhere in this Annual Report on Form 10-K. We undertake no obligation to publicly release any revisions to these forward-looking statements that may be made to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Readers are urged, however, to review the information provided in reports that we file from time to time with the Securities and Exchange Commission or otherwise make public.

Overview

We are a biopharmaceutical company focused on the development and commercialization of therapeutic proteins for the treatment of human diseases. In 2009, through a series of strategic initiatives and workforce and cost reductions, we restructured our organization and are now focused on developing and commercializing a limited number of products, which we believe have substantial therapeutic and commercial potential and in which we retain a significant ownership position. Our current portfolio includes one commercial product, RECOTHROM® Thrombin, topical (Recombinant), and three immunology product candidates.

Commercial Product

RECOTHROM. We have developed and are marketing RECOTHROM in the United States for use as a topical hemostat to control moderate bleeding during surgical procedures. Our product, which is a recombinant version of the human blood-clotting protein thrombin, provides an effective and safe alternative to other thrombin products marketed in the United States in forms derived from bovine (cattle) plasma or human plasma. We hold worldwide rights to RECOTHROM, except for Canada, where Bayer Schering Pharma AG is responsible for commercializing the product.

Immunology Product Candidates

PEG-IFN-lambda. Pegylated Interferon-lambda (PEG-IFN-lambda) is being studied in collaboration with Bristol-Myers Squibb Company in a Phase 2 clinical trial for treatment of hepatitis C virus infection. In November 2009, we presented final results from an open-label Phase 1b study in patients with hepatitis C. We hold co-development rights to PEG-IFN-lambda in the United States and Europe and the option to co-promote and share profits on product sales in the United States. Bristol-Myers Squibb is responsible for commercializing the product outside the United States, for which we will receive milestones and royalties on sales.

IL-21. Interleukin-21 (IL-21) is currently being tested in an open-label Phase 2 clinical trial as a potential immunotherapy treatment for metastatic melanoma. In May 2009, we presented interim results from this study, with final results expected to be available in 2010. In addition, we presented results from an open-label Phase 2 study in renal cell carcinoma in May 2009. We hold worldwide rights to IL-21.

2

Table of Contents

IL-31 mAb. Interleukin-31 monoclonal antibody (IL-31 mAb) is currently in preclinical development as a potential treatment for atopic dermatitis. We hold worldwide rights to IL-31 mAb and expect to begin clinical testing for this candidate in 2011.

Our goal is to substantially increase the value of our company by advancing our products and candidates to key value inflection points associated with the achievement of development and/or commercial milestones. We intend to continue to build the market for RECOTHROM in the United States, which we expect will provide net cash flows that we may use to fund the further development of our immunology product candidates. Where appropriate, we intend to enter into strategic collaborations for the commercialization of our immunology product candidates, which we believe will enable us to maximize long-term value of these assets, while leveraging our internal resources and accessing complementary technologies, infrastructure and expertise. For example, we established the PEG-IFN-lambda collaboration with Bristol-Myers Squibb in January 2009, which provided substantial near-term cash and long-term commercial value retention.

We have out-licensed several product candidates previously identified through our discovery research efforts to third parties, including atacicept, FGF-18, IL-22RA mAb and IL-17RC soluble receptor to Merck Serono SA and IL-20 mAb and IL-21 mAb to Novo Nordisk A/S. These candidates are either outside our core area of interest or require levels of capital investment that we could not justify considering our available financial resources. We are not actively involved in the development of these product candidates. We are, however, eligible to receive milestone payments and royalties and, thus, we consider these product candidates to be important assets that could result in the generation of substantial value over the long term.

We intend to maintain strong patent protection for our asset portfolio. We file detailed patent applications with respect to our discoveries covering multiple patentable inventions, typically including composition of matter, method of making and method of use claims. We have issued patents or pending applications covering RECOTHROM and all of our internal product candidates. In total, we have more than 340 unexpired issued or allowed U.S. patents and over 180 U.S. patent applications pending. Outside of the United States, we have more than 790 issued or allowed foreign patents.

We were incorporated in the state of Washington in 1981. From 1988 to 2000, we were a wholly owned subsidiary of Novo Nordisk, one of the world’s largest producers of therapeutic proteins. In November 2000, as part of a restructuring by Novo Nordisk, we became an independent company. In February 2002, we completed our initial public offering. In addition to RECOTHROM, we have contributed to the discovery or development of seven recombinant protein products currently on the market. Our principal executive offices are located at 1201 Eastlake Avenue East, Seattle, Washington, 98102. Our telephone number is (206) 442-6600. Our website is www.zymogenetics.com. At the Investor Relations section of this website, we make available free of charge our annual report on Form 10-K, our annual proxy statement, our quarterly reports on Form 10-Q, any current reports on Form 8-K, and any amendments to these reports, as soon as reasonably practicable after we electronically file them with, or furnish them to, the Securities and Exchange Commission (SEC). The information on our website is not a part of, and is not incorporated into, this annual report on Form 10-K. In addition to our website, the SEC maintains an Internet site at www.sec.gov that contains reports, proxy and information statements, and other information regarding us and other issuers that file electronically with the SEC.

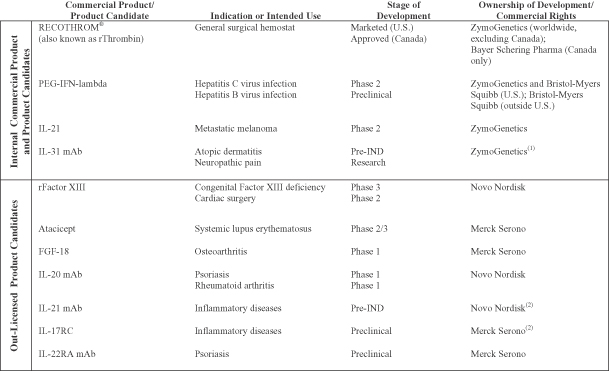

Commercial Product and Product Pipeline

Our current focus is the continued commercialization of our first product, RECOTHROM, and the development of three product candidates: PEG-IFN-lambda in partnership with Bristol-Myers Squibb, IL-21, and IL-31 mAb. We have out-licensed several product candidates that are outside of our core areas of interest or for which we could not justify the required capital investment. We are eligible to receive milestone payments and royalties related to these assets. The following table summarizes our commercial product and product candidates that are being internally developed or co-developed, as well as out-licensed product candidates.

3

Table of Contents

| (1) | Subject to certain opt-in rights granted to Merck Serono. |

| (2) | Subject to certain opt-in rights granted to ZymoGenetics. |

In the preceding table, “Research” refers to the stage in which we analyze the biology and therapeutic potential of proteins using a variety of laboratory methods. “Preclinical” refers to the stage in which safety, pharmacology and proof of efficacy in non-human animal models of specific human disease are evaluated. “Pre-IND” refers to the stage in which investigational new drug enabling preclinical toxicology studies are performed and materials in support of the investigational new drug (IND) and clinical studies are manufactured. “Phase 1” refers to clinical trials designed primarily to determine safety and pharmacokinetics in healthy volunteers or a limited patient population. “Phase 1b” refers to clinical trials designed to demonstrate biomarker or clinical outcome that could be considered for proof of concept in a limited patient population. “Phase 2” refers to clinical trials designed to evaluate preliminary efficacy, further characterize safety and optimize dosing in a limited patient population. “Phase 2/3” refers to large-scale clinical trials designed to establish safety and confirm efficacy in comparison to standard therapies or placebo in a patient population large enough to generate statistically significant results. “Phase 3” refers to clinical trials in a broad patient population with the intention of generating statistical evidence of efficacy and safety to support product approval.

Commercial Product

RECOTHROM®

RECOTHROM Thrombin, topical (Recombinant) was approved by the U.S. Food and Drug Administration (FDA) on January 17, 2008 for use as a general aid to control diffuse (non-arterial) bleeding during surgery. Net RECOTHROM sales in the United States totaled $8.8 million and $28.2 million during the years ended December 31, 2008 and December 31, 2009, respectively. RECOTHROM is available in a 5,000 international unit (IU) vial, a 20,000 IU vial and a 20,000 IU vial co-packaged with a spray applicator kit. Three wholesalers, AmerisourceBergen Corporation, Cardinal Health, Inc. and McKesson Corporation, accounted for approximately 90% of U.S. sales in 2009. If any of these wholesalers ceased distributing RECOTHROM, other wholesalers already distributing RECOTHROM would likely absorb the incremental sales volume with minimal interruption to the business or we would sell directly to hospitals.

4

Table of Contents

Thrombin is a specific blood-clotting enzyme that converts fibrinogen to fibrin, the primary protein contained in newly formed blood clots. Thrombin also promotes clot formation by activating Factor XIII, which cross-links the fibrin molecules and strengthens the newly forming clot. Topical thrombin is widely used to stop diffuse (non-arterial) bleeding occurring during surgical procedures, when control of bleeding by standard surgical techniques, such as direct pressure, ligation, or cautery, is ineffective or impractical. Minimizing bleeding during surgical procedures is important to maintain visibility in the operating field, limit the use of transfused blood products and reduce peri- and post-operative complications. Thrombin is generally sold as a lyophilized powder stored at room temperature, which is dissolved in saline and absorbed onto a surgical sponge, embedded onto a hemostatic pad or sprayed directly for topical application to wounds. Currently, there are three types of topical thrombin available in the United States: bovine (cattle) plasma-derived (Thrombin-JMI® marketed by King Pharmaceuticals), human-plasma derived (Evithrom® marketed by Ethicon, Inc. and the thrombin contained in GELFOAM Plus hemostasis kit marketed by Baxter Healthcare Corporation) and recombinant human thrombin (RECOTHROM marketed by ZymoGenetics). The thrombin market, based on the combined sales to hospitals of RECOTHROM, Thrombin-JMI, Evithrom and GELFOAM Plus, was estimated at $228 million in 2009, with full-year RECOTHROM sales representing approximately 13% market share.

We believe that there are several important advantages to recombinant human thrombin. Some patients may experience allergic reactions to plasma-derived products. Patients could also develop antibodies to bovine plasma-derived thrombin or to bovine Factor V or other protein impurities in the bovine plasma-derived product. In some cases, these antibodies can cross-react with analogous human proteins, creating a bleeding condition that can be difficult to manage and which has been fatal in patients who develop the most severe cases. Use of bovine plasma-derived thrombin in patients with pre-existing antibodies to bovine clotting factors may increase these risks and is, therefore, contraindicated. The package insert for bovine plasma-derived thrombin contains a black box warning, the most serious form of warning the FDA can require for approved products, describing these potential risks. In addition, all human plasma-derived products carry an FDA-mandated warning addressing a potential risk of transmitting infectious and other diseases, including HIV, hepatitis, parvovirus, Creutzfeldt-Jakob disease (CJD) and variant CJD. RECOTHROM, which is human thrombin produced using recombinant DNA technology, is inherently free from these potential risks and its package insert does not have a black box warning or any other warnings associated with the risk of transmitting blood-borne pathogens or infectious diseases.

In August 2009, we submitted a Citizen Petition to the FDA requesting that the FDA remove Thrombin-JMI Thrombin, topical (bovine origin) from the market in the interest of patient safety. The Citizen Petition was prompted by reports of serious or fatal bleeding-related adverse events in surgical patients exposed to bovine thrombin. In January 2010, we received an interim response from the FDA indicating that additional time was needed for the agency to reach a decision and provide a final response to the Citizen Petition. We can provide no assurance that the petition will be granted or that Thrombin-JMI will be removed from the market.

Prior to launch, we established the supply chain for RECOTHROM, from sourcing of critical raw materials and manufacturing to distribution to end customers, and built commercial inventories to satisfy expected market demand and provide what we believe are sufficient levels of safety stock. We have developed a patent-protected two-step process for the manufacture of recombinant thrombin. First, recombinant human prethrombin-1 is produced in mammalian cells. Then, using an enzyme activation step, prethrombin-1 is converted to recombinant human thrombin. The commercial-scale manufacturing process was developed in collaboration with Abbott Laboratories, our commercial manufacturer of the RECOTHROM bulk drug substance.

In December 2009, we announced a restructuring of our U.S. co-promotion agreement with Bayer HealthCare LLC and our license and collaboration agreement with Bayer Schering Pharma AG. Effective December 31, 2009 we ended the co-promotion with Bayer HealthCare such that Bayer HealthCare will no longer participate in the sales and marketing of RECOTHROM in the United States. We are currently in the process of increasing the size of our sales organization and intend to have the additional sales personnel fully trained and in the field by the end of first quarter of 2010. Outside the United States, we regained all rights to RECOTHROM, except for Canada, where the product was approved in December 2009. Bayer Schering Pharma

5

Table of Contents

will market and sell RECOTHROM in Canada and pay us royalties on net sales. Also, in December 2009, Bayer Schering Pharma withdrew the Marketing Authorization Application (MAA) to the European Medicines Agency (EMEA) for approval to market RECOTHROM in Europe. The application was withdrawn in response to indications from the European regulatory authorities that approval would require additional clinical trial data.

Clinical Trials. In September 2006, we completed a pivotal Phase 3 clinical study designed to evaluate the comparative efficacy of RECOTHROM and bovine thrombin, both administered with an absorbable gelatin sponge. The randomized, double-blind study was conducted at 34 sites in the United States and enrolled 411 patients in four surgical settings: spinal surgery, liver resection, peripheral artery bypass and arteriovenous graft construction. Both the primary and secondary endpoints of the study were met. RECOTHROM was shown to have comparable efficacy to bovine thrombin, as measured by the overall percentage of patients achieving hemostasis within 10 minutes. Both treatments were well tolerated and exhibited similar adverse event profiles. RECOTHROM also demonstrated a superior immunogenicity profile to bovine thrombin, based on a significantly lower incidence of post-treatment anti-product antibody development. The study was not powered to detect differences in clinical outcomes based on differences in antibody formation.

In 2007, we completed an open-label, non-comparative Phase 2 clinical study designed to evaluate safety and immunogenicity of RECOTHROM administered using a spray device in patients with burns undergoing autologous skin grafting. The study results demonstrated a safety and immunogenicity profile similar to that observed in the pivotal Phase 3 study.

In 2008, we completed an open-label Phase 3b study designed to evaluate the safety and immunogenicity of RECOTHROM in subjects at increased risk for having anti-bovine thrombin product antibodies as a result of prior surgical history. The study enrolled 205 subjects, 16% of whom had pre-existing antibodies to bovine thrombin. The study results demonstrated that no patients developed antibodies against RECOTHROM. Following a 29-day period after topical RECOTHROM application during a single spinal or vascular surgical procedure, the immunogenicity profile of RECOTHROM did not differ among subjects with or without pre-existing antibodies to bovine thrombin. RECOTHROM was well tolerated and observed adverse events were consistent with those commonly seen in post-surgical settings.

Adverse events observed in clinical trials with RECOTHROM were consistent with those commonly observed in surgical patients. In pooled results from completed clinical trials involving 583 patients exposed to RECOTHROM, the most common adverse events were incision site pain, procedural pain, and nausea. Of the 552 patients for whom complete immunogenicity observations were available, only 5 patients (0.9%) developed specific anti-product antibodies, and none of these antibodies were found to neutralize native human thrombin.

As part of our post-marketing approval commitments, we are conducting an open-label Phase 4 clinical study to evaluate the safety and immunogenicity of re-exposure to RECOTHROM in approximately 30 subjects previously treated with RECOTHROM. We expect to complete patient enrollment in the re-exposure Phase 4 study in 2011. In addition, pursuant to the Pediatric Research Equity Act, we are conducting an open-label Phase 4 clinical study to evaluate the safety of RECOTHROM as an aid to hemostasis in a pediatric population. We completed patient enrollment in the pediatric study in December 2009 and expect to report study results in 2010.

In November 2008, we borrowed $25 million under a $100 million financing arrangement with Deerfield Management. The draw entitles Deerfield to a royalty equal to 2% of RECOTHROM net sales in the United States until repayment, which is due by June 27, 2014. No further draws on the remaining $75 million available for borrowing under the facility were taken prior to expiration of the facility in February 2010.

We own issued U.S. and foreign patents directed to a genetically engineered thrombin precursor termed “prethrombin-1”, methods of producing recombinant human thrombin from prethrombin-1, formulations, and methods of activation and therapeutic use of the protein.

6

Table of Contents

Product Candidates

PEG-IFN-lambda

Interferon-lambda 1 (IFN-lambda 1, also known as IL-29) is a type III interferon that belongs to the 4-helical-bundle cytokine family. Native IFN-lambda 1 is generated in response to a viral infection and exhibits broad cellular anti-viral activity similar to type I interferons, such as interferon-alpha. However, IFN-lambda 1 signals through a receptor that is distinct from the type I interferon receptor and that has a more selective expression pattern compared to the widely expressed receptor for type I interferons. The difference in the receptor tissue distribution suggests that IFN-lambda 1 may serve as an alternative to interferon-alpha based therapy for viral infection by providing comparable antiviral activity with potentially fewer side effects.

In vitro studies have shown that IFN-lambda 1 has antiviral activity against human hepatitis C virus (HCV) in HCV preclinical models. Additionally, we have demonstrated that IFN-lambda 1 induces antiviral gene expression similar to interferon-alpha in primary human hepatocytes. Combined with the significant expression of the receptor for IFN-lambda 1 in liver samples from HCV positive individuals, these data provided the rationale for selecting HCV infection as our first clinical indication. Recent clinical studies have also demonstrated the importance of type III interferons in controlling HCV infection. Correlative data from these studies showed that patients with certain genotypes who had poor response to the current standard of care regimen of interferon-alpha plus ribavirin also produced lesser amounts of endogenous type III interferon, thus illustrating the importance of type III interferons in controlling the viral replication pathway.

Chronic infection with HCV is a leading cause of cirrhosis, liver failure, and hepatocellular carcinoma worldwide. It is estimated that there are over 170 million people worldwide infected with hepatitis C virus. In the United States, an estimated 4.0 million people have been exposed to HCV, and approximately 3.2 million have chronic HCV infection. HCV is associated with an estimated 8,000-10,000 deaths per year and is the main indication for liver transplantation in the United States. The current standard of care for chronic HCV infection involves treatment with the combination of pegylated interferon-alpha and ribavirin. Standard of care therapy has been associated with a number of significant side effects, including flu-like symptoms, anorexia, depression, hemolytic anemia and myelosuppression, which continue to be treatment-limiting factors. With a response rate to the current standard treatment for the most common form of HCV (genotype 1) in the United States of approximately 40%, there remains a need for better tolerated and more effective therapy for HCV infection. Our product candidate, PEG-IFN-lambda, is a pegylated version of the IFN-lambda 1 protein, produced using recombinant DNA technology. Pegylation extends the in vivo half-life of the protein, allowing for convenient dose scheduling, such as once per week.

In January 2009, we entered into an exclusive global collaboration with Bristol-Myers Squibb Company for PEG-IFN-lambda. Under the terms of the collaboration, we will co-develop PEG-IFN-lambda in the United States and Europe with Bristol-Myers Squibb and share development costs. We will have the option to co-promote PEG-IFN-lambda and to share profits on product sales in the United States, while receiving royalties on sales in the rest of the world. We may opt out of the co-development, co-promotion and profit sharing arrangement in the United States, in which case we would no longer be obligated to co-fund development or commercialization activities, and we would receive royalties on worldwide product sales.

In 2007, we completed a randomized, placebo-controlled, dose-escalation Phase 1a clinical trial in healthy volunteers to evaluate the safety, tolerability and pharmacokinetics of a single dose of PEG-IFN-lambda administered subcutaneously. The study enrolled 20 subjects who were randomized to four dose levels of PEG-IFN-lambda, ranging from 0.5 to 7.5 mcg/kg, or placebo. The results from this study demonstrated that administration of a single dose of PEG-IFN-lambda was associated with dose-related pharmacokinetic and pharmacodynamic effects, with evidence of biological activity, including up-regulation of interferon response markers, being observed at dose levels of 1.5 mcg/kg and above. No fever or hematologic effects, which are typically seen with interferon-alpha, were observed at all tested dose levels in this study.

7

Table of Contents

In 2009, we completed a Phase 1b study to evaluate the safety and antiviral effect of repeat dosing of PEG-IFN-lambda administered subcutaneously for four weeks as a single agent or in combination with ribavirin in genotype 1 HCV patients. Final study results were presented in November 2009 at the American Association for the Study of the Liver Diseases (AASLD) annual meeting. A total of 56 patients were enrolled in this three-part study. In Part 1, a total of 24 relapsed HCV patients were enrolled in 4 cohorts, consisting of 6 patients each. PEG-IFN-lambda was administered as a single agent weekly or bi-weekly at dose levels of 1.5 or 3.0 mcg/kg. In Part 2, a total of 25 relapsed HCV patients were treated in 4 cohorts, consisting of 6 or 7 patients each. PEG-IFN-lambda was administered weekly at dose levels of 0.5, 0.75, 1.5, or 2.25 mcg/kg in combination with ribavirin. In Part 3, a total of 7 previously untreated HCV patients were enrolled in a single cohort receiving 1.5 mcg/kg of PEG-IFN-lambda in combination with ribavirin. The results from this study demonstrated anti-viral activity of PEG-IFN-lambda at all dose levels tested in both relapsed and previously untreated HCV patients. A majority of patients across all treatment arms achieved a greater than 2 log reduction in HCV RNA measured by a test that identifies the presence of hepatitis C virus in patient’s blood. Minimal constitutional symptoms or hematologic effects were observed with PEG-IFN-lambda given as a single agent or in combination with ribavirin. The majority of adverse events and laboratory changes were mild or moderate. Dose-limiting elevations in liver enzymes, with or without an increase in bilirubin, were dose-dependent and reversible.

In October 2009, in collaboration with our partner Bristol-Myers Squibb, we initiated a two-part, randomized, controlled Phase 2 study of PEG-IFN-lambda administered subcutaneously for up to 48 weeks in combination with ribavirin in treatment-naïve patients with chronic genotype 1, 2, 3, or 4 HCV infection (the “EMERGE” study). The EMERGE study will evaluate the safety, tolerability and antiviral efficacy of PEG-IFN-lambda and ribavirin compared to PEGASYS® (PEG-IFN alfa-2a) and ribavirin. The primary efficacy endpoint of the study is the proportion of patients who achieve complete early virologic response (cEVR), defined as undetectable levels of HCV RNA after 12 weeks of treatment. A secondary efficacy endpoint is the proportion of patients who achieve sustained virologic response (SVR), defined as undetectable levels of HCV RNA 24 weeks after completed treatment. Part A of the EMERGE study is an open-label study that will explore four fixed doses of PEG-IFN-lambda compared to standard dose of PEGASYS in approximately 55 patients. Up to four doses of PEG-IFN-lambda will be selected from Part A for testing in the second part of the study. Part B of the study will be conducted as a randomized, blinded study and is designed to enroll up to 600 patients. We began enrolling patients in Part A of the study in October 2009 and expect to begin Part B in 2010.

We own issued patents for IFN-lambda 1 polypeptides, polynucleotides, expression vectors, cells, methods of treating a hepatitis infection, and a method of producing IFN-lambda 1, as well as patents on all known related molecules in the type III interferon family. We have filed patent applications for IFN-lambda 1 polypeptides, IFN-lambda 1 fusion proteins, antibodies, methods of expressing and purifying IFN-lambda 1, methods of using IFN-lambda 1 alone and in combination with other therapeutic agents to treat various viral diseases, cancers and autoimmune disorders. We will continue to file patent applications as new inventions are made. As part of our agreement with Bristol-Myers Squibb, we have assigned to Bristol-Myers Squibb a one-half ownership interest in each core patent relating to PEG-IFN-lambda filed outside the United States and a security interest in each core patent relating to PEG-IFN-lambda filed in the United States.

IL-21

IL-21 is a cytokine that activates several types of immune cells thought to be critical in eliminating cancerous or virally infected cells from the body. More specifically, IL-21 enhances the activity of mature natural killer (NK) cells; it has multiple effects on cytotoxic T lymphocyte cells (CTL), including increased activation and proliferation, extended longevity in circulation and improved ability to kill cancerous cells; and it enhances B-cell antibody production.

Preclinical studies have indicated that our recombinant version of IL-21 is an effective therapy in a number of animal models of cancer. In an animal model of metastatic melanoma, IL-21 was associated with significant

8

Table of Contents

anti-tumor activity. Animals in this model develop aggressive metastases to the lung, which can be readily measured. Treatment with IL-21 led to a significant reduction in the number of lung metastases relative to controls. IL-21 also was found to have potent inhibitory activity in other animal models of cancer. These models demonstrated that the in vivo effects of IL-21 were mediated through the activation of CTL and NK cells, which contribute to rejection of the tumors in the animal models. Moreover, this led to establishment of immunological memory, which protected animals from re-challenge with the parent tumor.

We believe that IL-21 could represent a potentially better tolerated and more efficacious immunotherapeutic agent than other cancer immunotherapies, such as interleukin-2 (IL-2) and interferon-alpha. In clinical practice, IL-2 produces durable responses in a very small percentage of patients with metastatic melanoma and metastatic renal cell carcinoma. Accompanying this relatively low level of efficacy are significant toxicities, including vascular leak syndrome and the release of pro-inflammatory cytokines, which profoundly limit the utility of IL-2 in treating disease. These side effects can be so severe that many patients are either hospitalized or stop the therapy before completion of the treatment program. Although somewhat better tolerated, interferon-alpha therapy is associated with significant chronic toxicities limiting its administration and produces a lower overall response rate with fewer complete responses compared to IL-2.

We own worldwide rights to our product candidate, recombinant human IL-21 protein. We had previously out-licensed rights to the IL-21 protein outside North America to Novo Nordisk and entered into a collaborative data sharing and cross-licensing agreement with them. In January 2009, subsequent to a strategic decision by Novo Nordisk to exit all of its oncology development programs, we reacquired rights to the IL-21 protein outside North America. Simultaneously, we and Novo Nordisk terminated a collaborative data sharing and cross-license agreement and a manufacturing agreement, under which Novo Nordisk was supplying clinical materials. As part of this termination, we acquired rights to all patent applications and data generated by Novo Nordisk as well as clinical product manufactured by Novo Nordisk. The reacquisition agreements did not require any upfront payment to Novo Nordisk. However, we will owe milestone payments and royalties to Novo Nordisk upon commercialization of IL-21 outside North America.

Metastatic Melanoma. We are pursuing metastatic melanoma as the lead indication for IL-21. There are an estimated 69,000 new cases of melanoma per year in the United States, with over 8,650 deaths per year attributed to this disease. Metastatic melanoma is essentially an incurable cancer with no established standard of care. Because of poor prognosis of overall survival for patients with advanced stages of metastatic melanoma, with a median of six to nine months, there is a significant unmet need for the development of therapies that can prolong overall survival. Several drugs have previously failed in late-stage clinical trials of metastatic melanoma. Most recently, Nexavar® (a product marketed by Bayer HealthCare AG and Onyx Pharmaceuticals, Inc.) failed to meet its endpoint of improved overall survival in a Phase 3 trial and a Phase 3 trial of elesclomol (Synta Pharmaceuticals Corp.) was suspended due to safety concerns. In October 2005, the FDA granted IL-21 orphan drug status for the treatment of melanoma patients with advanced or aggressive disease.

We are developing IL-21 as a single-agent treatment for metastatic melanoma. In 2007, we initiated an open-label Phase 2 clinical trial of IL-21 in previously untreated patients with metastatic or recurrent melanoma. The study, which is being conducted by the National Cancer Institute of Canada (NCIC), is designed to evaluate two dose levels of IL-21 at 30 and 50 mcg/kg. The interim results from 24 patients, presented at the World Congress on Melanoma annual meeting in May 2009, showed IL-21 to be biologically active, with 7 patients, or 29%, having a partial response and 8 patients, or 33%, having stable disease. Administered at a dose of 30 mcg/kg during three 5- day cycles, IL-21 was well tolerated. The most common adverse events were mild or moderate fatigue and rash. The 50 mcg/kg dose of IL-21 was poorly tolerated, with severe adverse events including neutropenia and skin rash. In August 2009, we completed study enrollment. A total of 30 patients received IL-21 at a dose of 30 mcg/kg and 10 patients received IL-21 at a dose of 50 mcg/kg. Final results from the study are expected to be available in 2010. In collaboration with the NCIC, we expect to initiate a larger randomized study versus DTIC (dacarbazine) in the first half of 2010. The study will evaluate safety and efficacy of IL-21 versus DTIC as first-line therapy in metastatic melanoma.

9

Table of Contents

Metastatic Renal Cell Carcinoma. In 2009, we completed an open-label Phase 2 clinical trial of IL-21 in combination with the tyrosine kinase inhibitor Nexavar in patients with advanced renal cell carcinoma. The study was designed to evaluate the safety, pharmacokinetics and anti-tumor activity of the combination therapy at the IL-21 maximum tolerated dose, previously established at 30 mcg/kg. The final study results were presented at the American Society of Clinical Oncology (ASCO) meeting in May 2009. The results indicated that the combination of IL-21 with Nexavar was well tolerated, with side effects that were manageable in an outpatient setting. The combination therapy was associated with anti-tumor activity both in terms of tumor response and duration of disease control, measured by progression-free survival (PFS). An independent data review completed for 33 patients showed an overall response rate of 21%, with 7 patients having a partial response. Median PFS was 5.7 months. No further investigation of IL-21 in renal cell carcinoma is planned at this time based on an evaluation of the competitive landscape and commercial opportunity.

B-cell Lymphoma. We have explored the use of IL-21 in combination with monoclonal antibodies, such as Rituxan® (a product marketed by Genentech, Inc. and Biogen Idec Inc.), an anti-CD20 antibody, that functions via antibody-dependent cellular cytotoxicity, a process enhanced by IL-21. In 2008, we completed an open-label Phase 1 clinical trial of IL-21 in combination with Rituxan in patients with relapsed low-grade B-cell lymphoma. The final study results, which were presented at the ASCO annual meeting in 2008, demonstrated that the combination of IL-21 at 100 mcg/kg with Rituxan was well tolerated and provided evidence of anti-tumor activity in this heavily pre-treated population, including one confirmed complete response, and three partial responses. No further investigation of IL-21 in B-cell lymphoma is planned.

We own issued patents for IL-21 polypeptides, polynucleotides and methods of using IL-21 to stimulate immune responses, particularly in tumor-bearing subjects as well as to the cell lines and methods of producing the recombinant IL-21 clinical product. We have filed patent applications for pharmaceutical compositions, IL-21 fusion proteins and other methods of using IL-21 for the treatment of disease. We have additional patent applications relating to IL-21 directed to methods for expressing and purifying recombinant IL-21; methods of treating specific cancers and viral diseases; combination therapies for IL-21 and monoclonal antibodies and IL-21 and tyrosine kinase inhibitors; and antagonist IL-21 ligands. We will continue to file patent applications as new inventions are made.

IL-31 mAb

Interleukin-31 (IL-31) is a cytokine derived from T cells. Analysis of IL-31 and IL-31 receptor levels in human and murine disease tissues suggests that IL-31 could play a role in atopic dermatitis (AD) and neuropathic pain. Transgenic animals over-expressing the IL-31 gene develop a severe type of dermatitis that resembles human AD, characterized by a destructive chronic scratching behavior in response to IL-31 mediated itch. Itch is a characteristic of human AD and the scratch response to itch is thought to be a major contributor to the severity of skin damage and disease. Treatment of animals in a murine model of spontaneous AD with a neutralizing antibody against IL-31 results in the reduction of scratching behavior. In addition, data shows that elevated levels of IL-31 mRNA and protein in skin correlate with both mouse and human AD, and that elevated circulating levels of IL-31 in serum correlate with severity of AD in patients. Analysis of peripheral blood T cells from human atopic dermatitis patients provides an association between IL-31 and skin-homing T cells, suggesting that skin diseases, such as AD, may be a promising therapeutic area for inhibition of IL-31.

Atopic dermatitis is a relapsing, chronic, inflammatory skin disorder that affects over 50 million people in the United States, major European countries and Japan. The disease has a high prevalence in children, with as many as 85% of cases developing AD before age 5. Some patients suffer from the disease into adulthood. AD typically resolves over time, but the disease becomes severe for those patients that do not go into remission, representing approximately 10% of the total affected population. Severe AD patients suffer from intense itching resulting in psychological problems, significant sleep loss and skin disfigurement. Current therapies on the market, such as topical corticosteroids, topical calcineurin inhibitors and antihistamines, are not effective for patients with severe disease, have safety concerns with long-term use, and do not target the disease mechanism. We believe that an inhibitor of IL-31 may be an effective therapy for treatment of these severely affected AD patients.

10

Table of Contents

Our product candidate is an IL-31 monoclonal antibody (IL-31 mAb) that has been shown to neutralize the activity of IL-31 in preclinical settings in a highly specific manner. IL-31 mAb is currently in the pre-IND development stage as a potential treatment for AD. We are in the process of manufacturing sufficient quantities of drug to supply toxicology studies, which are expected to begin in 2010, and Phase 1 clinical trials, which we intend to initiate in 2011. We own worldwide rights to IL-31, including protein products that target IL-31 such as monoclonal antibodies, subject to certain opt-in rights held by Merck Serono.

We have issued patents to IL-31 and IL-31 antibodies. We also have filed several patent applications relating to IL-31 and IL-31 antagonists, compositions and uses in disease on a worldwide basis, which cover protein products that target IL-31, including monoclonal antibodies, and therapeutic uses and will continue to file new patent applications as new inventions are made.

Out-licensed Product Candidates

Atacicept (formerly known as TACI-Ig)

Atacicept is a soluble form of the TACI receptor, a member of the tumor necrosis factor receptor family of proteins. Atacicept binds to and inhibits the activity of two ligands, BLyS and APRIL, which are implicated in B-cell survival, maturation and antibody production. We believe that atacicept could represent a more specific immunosuppressive agent for the treatment of autoimmune diseases.

Until August 2008, atacicept was developed jointly by us and Merck Serono SA pursuant to a collaborative development and marketing agreement established in 2001. In 2008, we converted this agreement to a worldwide royalty-bearing license, granting Merck Serono exclusive worldwide development and commercialization rights for atacicept.

Merck Serono is conducting a randomized, double-blind, placebo-controlled Phase 2/3 clinical trial of atacicept in patients with general systemic lupus erythematosus (SLE). In 2008, Merck Serono discontinued a Phase 2/3 study in patients with lupus nephritis. The study was discontinued due to the observation of the increased risk of severe infection, possibly resulting from significant underlying disease activity and the concomitant use of several immunosuppressive agents. In order to obtain regulatory approval in SLE, Merck Serono will need to complete additional studies of atacicept in patients with SLE.

Merck Serono is conducting three Phase 2 studies investigating atacicept in rheumatoid arthritis (RA): one in RA patients with inadequate response to TNF inhibitor therapy, another in RA patients who have not previously received TNF inhibitor therapy, and a third to evaluate the safety and efficacy of atacicept in combination with Rituxan. Preliminary results of the two single-agent atacicept Phase 2 studies confirmed the biological effect of atacicept on immunoglobulin and autoantibody production and no new safety signals were observed. However, the studies did not meet the pre-specified level of disease control activity to support moving directly into Phase 3 clinical testing. Following completion of further exploratory analysis, Merck Serono decided not to initiate further studies of atacicept in RA patients.

In September 2009, Merck Serono voluntarily discontinued two studies investigating atacicept in multiple sclerosis (MS) based upon a recommendation from an Independent Data Monitoring Committee (IDMC). In one of the MS studies, the IDMC observed an increase in MS disease activity in the atacicept treatment arms compared to the placebo arm. No comparable issues have been identified in the Phase 2/3 clinical trial in SLE or in the Phase 2 clinical trials in RA.

IL-21 monoclonal antibody (IL-21 mAb)

IL-21 mAb is a fully human monoclonal antibody we developed as an inhibitor of IL-21. IL-21 is a T-cell derived cytokine that exerts multiple effects on both T-cell and B-cell responses, which can be beneficial in fighting cancer or infections. In some situations, over expression of IL-21 can lead to autoimmune or

11

Table of Contents

inflammatory disease. In particular, IL-21 is a key regulator of two types of T cells: Th17 cells and T follicular helper (TFH) cells. Th17 cells are known to be involved in inflammation. By blocking IL-21 with IL-21 mAb, inflammation may be reduced in a number of diseases that share this pathway, such as psoriasis, Crohn’s disease and rheumatoid arthritis. TFH cells are specialized types of T cells that promote antibody responses from B cells. Blocking IL-21’s effect on B cells may have an impact on human diseases that are driven by antibody responses, such as systemic lupus erythematous (SLE). Murine models of psoriasis, Crohn’s disease (colitis), rheumatoid arthritis and SLE have demonstrated that inhibition of IL-21 leads to significant reductions in disease scores and pathology.

We and Novo Nordisk A/S have been parties to a license agreement for IL-21 since 2001, pursuant to which Novo Nordisk had certain rights to IL-21 outside North America, including monoclonal antibodies targeting IL-21. In December 2009, we and Novo Nordisk amended this license agreement, giving Novo Nordisk worldwide rights to IL-21 mAb and certain other embodiments of IL-21. Under the agreement, we have a right to co-promote the IL-21 mAb product in the United States and receive increased royalties on net sales in the United States if we contribute to Phase 3 clinical development costs. This license does not affect our IL-21 Phase 2 development candidate, which is recombinant human IL-21 protein and as to which we maintain worldwide rights.

IL-21 mAb is currently in the pre-IND stage. We expect to complete the transfer of IL-21 mAb technology and information to Novo Nordisk in 2010, which will enable them to begin clinical testing.

Other Out-licensed Product Candidates

rFactor XIII. rFactor XIII is a recombinant version of a human protein that is involved in blood clotting, and is being developed for the treatment of bleeding disorders. Novo Nordisk acquired rights to this protein from us in October 2004 after we completed several Phase 1 clinical trials in healthy volunteers and in patients with congenital Factor XIII deficiency. Novo Nordisk is conducting a Phase 3 study of rFactor XIII in patients with congenital Factor XIII deficiency and a Phase 2 study in patients undergoing cardiac surgery.

Fibroblast growth factor-18 (FGF-18). FGF-18 is a member of the fibroblast growth factor family of proteins. Our preclinical data suggest that FGF-18 may be useful for healing cartilage damaged by injury or disease. We out-licensed this protein to Merck Serono in October 2004 in conjunction with the strategic alliance. Merck Serono is conducting a Phase 1 clinical trial of FGF-18 for the treatment of osteoarthritis.

IL-17 receptor C (IL-17RC) soluble receptor. IL-17RC is a soluble receptor that binds to both IL-17A and IL-17F, the two most closely related cytokines in the IL-17 family. Both cytokines are highly expressed in a variety of inflammatory and autoimmune diseases, including rheumatoid arthritis, inflammatory bowel disease, multiple sclerosis and transplant rejection. We hypothesize that use of IL-17RC soluble receptor to neutralize the pro-inflammatory properties of IL-17A and IL-17F could have a beneficial therapeutic effect in any or all of these diseases. In August 2008, as part of the restructuring of our relationship, Merck Serono acquired an exclusive development and commercialization license to IL-17RC soluble receptor worldwide, subject to certain opt-in rights that we hold. The product candidate is currently in preclinical development.

IL-20 monoclonal antibody (IL-20 mAb). IL-20 is a member of the IL-10 cytokine family. In September 2001, Novo Nordisk licensed the rights to IL-20 outside North America pursuant to the option and license agreement. In March 2004, they licensed the rights to IL-20 in North America under a separate agreement. Our preclinical data suggest that IL-20 may play an important role in the regulation of skin inflammation and the pathology of psoriasis, as well as other inflammation diseases. Novo Nordisk is currently conducting Phase 1 clinical trials in psoriasis and rheumatoid arthritis patients.

IL-22 receptor subunit alpha monoclonal antibody (IL-22RA mAb). IL-22RA is a cytokine receptor that binds to both IL-20 and IL-22 cytokines and may be a potential target for the treatment of psoriasis. We

12

Table of Contents

out-licensed rights to IL-22RA monoclonal antibodies and to IL-22RA as a target to Merck Serono in October 2004 as part of the strategic alliance. The IL-22RA mAb product candidate is currently in preclinical development by Merck Serono.

Out-licensed Commercial Products

In addition to RECOTHROM, we have contributed to the discovery or development of seven recombinant protein products marketed by other companies.

Augment™ Bone Graft (formerly GEM-OS1TM)/Augment™ Injectable Bone Graft (formerly GEM-OS2TM). Augment Bone Graft/Augment Injectable Bone Graft is a combination of platelet-derived growth factor (PDGF-BB) and a synthetic bone matrix. PDGF-BB is a growth factor that stimulates the growth of a variety of cell types, including bone forming cells. We cloned the gene that codes for platelet-derived growth factor, which we have out-licensed to BioMimetic Therapeutics, Inc. In November 2009, BioMimetic received approval to market Augment Bone Graft as an alternative to the use of autograft in foot and ankle fusion indications in Canada. In addition, BioMimetic completed submission of a modular Product Market Approval (PMA) to the U.S. FDA in February 2010.

Cleactor™ (tPA analog). Cleactor is a modified form of the protein tissue plasminogen activator, marketed in Japan by Eisai for the treatment of myocardial infarction, or heart attacks. In collaboration with Eisai, we developed this modified protein, which has enhanced properties that allow it to be given as a single injection.

GEM 21S® (platelet-derived growth factor). GEM 21S is a combination of a platelet-derived growth factor with a synthetic bone matrix, developed by BioMimetic Therapeutics, Inc. and marketed by Osteohealth Company, a division of Luitpold Pharmaceuticals, Inc. for the treatment of bone loss and gum tissue recession associated with advanced periodontal disease. We cloned the gene that codes for platelet-derived growth factor, the active agent in GEM 21S.

GlucaGen® (glucagon). GlucaGen is a protein therapeutic marketed by Novo Nordisk, Bedford Laboratories and Eisai Co., Ltd. (Eisai) for use as an aid for gastrointestinal motility inhibition and for the treatment of severe hypoglycemia in diabetic patients treated with insulin. In collaboration with Novo Nordisk, we developed a process for the production of this protein that is currently used by Novo Nordisk in the manufacture of GlucaGen.

Insulin and insulin analogs. Insulin and insulin analogs manufactured using recombinant DNA technology are marketed by Novo Nordisk worldwide for the treatment of diabetes. In collaboration with Novo Nordisk, we developed a process for the production of recombinant human insulin in yeast that is used by Novo Nordisk.

NovoSeven® (recombinant Factor VIIa). Factor VIIa is a protein involved in the generation of blood clots, and NovoSeven is marketed worldwide by Novo Nordisk for the treatment of patients with hemophilia and certain other coagulation deficiencies. We cloned the gene that codes for human Factor VII and developed the process for the production of activated recombinant human Factor VII, or recombinant Factor VIIa, which led to the establishment of the manufacturing process that Novo Nordisk currently uses to produce this protein.

Regranex® (platelet-derived growth factor). Regranex, until recently a product of Ethicon, Inc., a Johnson & Johnson Company, is a growth factor approved for the treatment of non-healing diabetic ulcers. In December 2008, One Equity Partners LLC announced the acquisition of Regranex from Ethicon Inc., which will be marketed and distributed by Systagenix Wound Management, a company created by One Equity Partners LLC. We cloned the gene that codes for platelet-derived growth factor and demonstrated the importance of this protein in stimulating wound healing.

13

Table of Contents

We have earned royalties on sales of some of these products. In the aggregate, from sales of these products and other technology licenses, we earned royalties of $1.3 million, $6.3 million, and $6.3 million for the years ended December 31, 2009, 2008, and 2007, respectively.

Commercialization

To commercialize RECOTHROM in the United States, we established our own dedicated commercial operations team with sales and sales operations, marketing, and supply chain and inventory management functions. We believe that the thrombin market, with its concentrated customer base, can be addressed with a relatively small sales force and that our recombinant technology gives us a competitive advantage in the current market.

In June 2007, we entered into a co-promotion agreement with Bayer HealthCare LLC, under which Bayer HealthCare provided sales people and medical liaisons to support RECOTHROM commercialization in the United States. During 2008 and 2009, the combined sales force worked to convert larger bovine thrombin accounts to RECOTHROM, by focusing on key surgeons, clinical pharmacists, operating room nurses and Pharmacy and Therapeutics (P&T) committee members within each account. Three wholesalers, AmerisourceBergen Corporation, Cardinal Health, Inc. and McKesson Corporation, accounted for approximately 90% of U.S. sales in 2009. If any of these wholesalers ceased distributing RECOTHROM, other wholesalers already distributing RECOTHROM would likely absorb the incremental sales volume with minimal interruption to the business or we would sell directly to hospitals.

In December 2009, we amended the U.S. co-promotion whereby Bayer HealthCare will no longer participate in the sales and marketing of RECOTHROM in the United States. We are currently in the process of increasing the size of our sales organization and intend to have the additional sales personnel fully trained and in the field by the end of first quarter 2010.

With our other product candidates, we intend, where appropriate, to enter into strategic collaborations for the commercialization of these candidates. We believe that this approach will enable us to maximize the long-term value of these assets.

Research and Development

In 2009, through a series of strategic initiatives and workforce and cost reductions, we restructured our organization to focus on developing and commercializing a smaller number of product candidates, which we believe have substantial therapeutic and commercial potential and in which we retain a significant ownership position. As part of these changes, we discontinued ongoing immunology and oncology discovery research programs, while retaining the research and development capabilities necessary to support the ongoing development programs for our product candidates.

Our research and development infrastructure draws upon a broad range of skills and technologies, including scientific computing, molecular and cellular biology, animal models of human disease, protein chemistry, antibody generation and engineering, pharmacology and toxicology, clinical development, medical and regulatory affairs, drug formulation, process development and protein manufacturing methods. We believe that this comprehensive approach enables us to effectively and efficiently develop our pipeline of therapeutic proteins.

We have a development organization with the skills and expertise to design and implement clinical trials for multiple product candidates and to file license applications with the FDA and other regulatory agencies. Our in-house development resources include a clinical development group responsible for designing, conducting and analyzing clinical trials. The group includes clinical research, clinical operations, biometrics, medical writing and drug safety. Our preclinical development group provides support in the areas of bioanalytical research and

14

Table of Contents

development, pharmacology (including pharmacogenomics), toxicology, pathology and pharmacokinetics. Our regulatory affairs group develops regulatory strategies and manages communications and submissions to regulatory agencies.

For additional details for research and development activities, refer to the Operating Expenses section under “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations Overview”.

Manufacturing

RECOTHROM®

We have established a RECOTHROM commercial supply chain, which relies on several single-source vendors. We have entered into a long-term manufacturing agreement with Abbott Laboratories for commercial-scale production of bulk recombinant human thrombin (rThrombin), the active drug substance in RECOTHROM. Under the agreement, Abbott manufactures rThrombin using the two-step process developed by ZymoGenetics, according to specifications developed and agreed upon by both companies. First, recombinant human prethrombin-1 is produced in mammalian cells. Then, using an enzyme activation step, prethrombin-1 is converted to rThrombin. Abbott has committed to annually supply up to a maximum amount, which we believe is sufficient to meet our projected market demand and provide adequate safety stock. We have agreed to purchase annual minimum amounts from Abbott. The agreement terminates in 2018. We have also entered into a manufacturing services agreement with Patheon Italia S.p.A. for fill and finish of rThrombin, which expires in December 2013, and are currently negotiating with an additional fill and finish supplier located in the United States. In addition, we have entered into agreements with two vendors for the final packaging of RECOTHROM and with Cardinal Health SPS, Inc. for third party logistics services. Furthermore, we have entered into agreements with several suppliers of critical raw materials, manufacturing aids, and components for RECOTHROM, some of which are located outside the United States.

Under the terms of the amended license and collaboration agreement, we agreed to supply vials of rThrombin approved for sale in the United States to Bayer Schering Pharma for sale in Canada throughout the term of the agreement.

PEG-IFN-lambda

We manufactured initial clinical supplies of PEG-IFN-lambda in our pilot-scale GMP manufacturing facility, using a high-yield internally developed E. coli process and believe we have adequate supply of product to support clinical development though Phase 2. Under the terms of our co-development and co-promotion agreement with Bristol-Myers Squibb, they will be responsible for all future manufacturing of PEG-IFN-lambda, including product for Phase 3 clinical trials and commercial sale.

IL-21

Our initial clinical supply of IL-21, which is made in E. coli, was manufactured by a third party using a process we developed. Subsequently, Novo Nordisk manufactured clinical materials for Phase 2 and initial Phase 3 development under a manufacturing agreement established in 2007. In January 2009, Novo Nordisk terminated the agreement and we acquired all rights to the manufacturing processes and obtained the existing supply of the product. We will need to identify and enter into an agreement with a third-party contract manufacturer for commercial supply of IL-21.

IL-31 mAb

Our initial supplies of IL-31 mAb product for toxicology studies and Phase 1 clinical trials are currently being manufactured by a third-party contractor.

15

Table of Contents

Manufacturing Changes

In 2009, we discontinued operation of our pilot-scale GMP manufacturing facility that was used to supply materials for toxicology studies and early-stage clinical trials. Going forward, we intend to rely on collaborative partners or third-party contractors for production of all preclinical, clinical and commercial supplies.

Collaborative Relationships

Bristol-Myers Squibb Co-Development and Co-Promotion Agreement for PEG-IFN-lambda

In January 2009, we entered into a co-development/co-promotion and license agreement with Bristol-Myers Squibb Company that covers all members of the type III interferon family, including interferon-lambda 1. Under the terms of the agreement, we are obligated to work exclusively with Bristol-Myers Squibb to develop biopharmaceutical products based on the type III interferon family. Currently, the companies intend to only develop PEG-IFN-lambda, a pegylated version of interferon-lambda 1, which is in development as a treatment for hepatitis C.

As part of the co-development/co-promotion and license agreement, Bristol-Myers Squibb receives an exclusive worldwide license to the core patents relating to the type III interferon family and a co-ownership interest in all core patents relating to the type III interferon family filed outside of the United States. In addition, Bristol-Myers Squibb receives a non-exclusive license to other intellectual property rights relating to the licensed products. We will be responsible for funding the first $100 million of development costs in the United States and Europe, which we expect to incur during Phase 1b and Phase 2 clinical testing, and 20% of all further development costs in the United States and Europe.

In return, during 2009 we have received:

| • | $105 million in license fees; and |

| • | $95 million in milestone payments related to initiation of Phase 2 activities. |

In addition, we may receive:

| • | Additional payments of up to $335 million based on pre-defined development and regulatory milestones for hepatitis C, up to $287 million in development and regulatory milestones for other potential indications, and up to $285 million based on pre-defined annual sales milestones; |

| • | 40% of the profits from the co-commercialization of any type III interferon family product within the United States. We will also be responsible for 40% of any loss from the co-commercialization of any product within the United States, provided that a portion of our share of losses incurred through the initial launch phase will be deferred, and deferred losses will subsequently be deducted from milestones, royalties and our share of profits; and |

| • | Royalties on product sales outside the United States. |

The research and development activities are governed by a steering committee made up of an equal number of representatives from each company. Bristol-Myers Squibb is responsible for all future manufacturing of PEG-IFN-lambda, including product for Phase 3 clinical trials and commercial sale.

We have the right to co-promote or co-fund PEG-IFN-lambda in the United States, and must exercise this right within 30 days after acceptance by the FDA of a Biologics License Application (BLA) filing, in which case we will share any profits or losses in the United States. In certain circumstances, we may opt out of co-promotion while retaining the option to co-fund and share product profits and losses. We have the right to discontinue co-promotion and co-funding in the United States, in which case we would be eligible to receive royalties on product sales in the United States. Under certain restricted circumstances, Bristol-Myers Squibb may terminate our right to co-promote in the United States, provided that, in certain of these circumstances, we will retain the

16

Table of Contents

option to co-fund and share product profits and losses. If Bristol-Myers Squibb terminates our co-promotion right and we do not have the option to co-fund or choose not to exercise that option, we would receive royalties on product sales instead of sharing profits and losses in the United States.

Royalties on sales vary based on annual sales volume and the degree of patent protection provided by the licensed intellectual property. Royalty payments may be reduced if Bristol-Myers Squibb is required to license additional intellectual property from one or more third parties in order to commercialize a product or, in certain circumstances, if product sales suffer from direct competition. Royalty obligations under the agreement continue on a country-by-country basis until the date on which no valid patent claims relating to a product exist or, if the product is not covered by a valid patent claim, eleven years after the date of first sale of the product in that country.

The term of the agreement began on February 26, 2009 and will continue for as long as a type III interferon product is the subject of an active development project or there is an obligation to pay royalties under the agreement.

Bayer License and Collaboration Agreement for rThrombin and U.S. Co-Promotion Agreement for RECOTHROM®

In June 2007, we executed a license and collaboration agreement with Bayer Schering Pharma AG and a U.S. co-promotion agreement with Bayer HealthCare LLC. Under the terms of the license and collaboration agreement, Bayer Schering Pharma was responsible for developing and commercializing rThrombin outside of the United States. Under the co-promotion agreement, Bayer HealthCare agreed to contribute sales people and medical science liaisons for the first three years following the launch of RECOTHROM in the United States. Through December 31, 2009, we received an initial milestone of $30.0 million upon signing of the agreements, an additional $40.0 million upon the U.S. approval of rThrombin, and $6.5 million upon the initial filings for approval in Canada, Europe and Asia.

In December 2009, we executed amendments to both agreements. Pursuant to the amended license and collaboration agreement, Bayer Schering Pharma will develop and commercialize the initial presentations of rThrombin in Canada, where it received marketing approval in December 2009, but will return all other rights to RECOTHROM outside the United States and Canada to us. As part of the agreement, we will also supply vials of rThrombin approved for sales in the United States to Bayer Schering Pharma for sale in Canada for the term of the license. Pursuant to the amended co-promotion agreement, Bayer HealthCare’s active role in promoting RECOTHROM in the United States ceased as of December 31, 2009, but they are entitled to commissions on sales in the United States for up to two years subject to an aggregate maximum amount of $12 million.

Merck Serono Development and Marketing Agreement for Atacicept

In August 2001, we entered into a collaborative development and marketing agreement with Ares Trading S.A., a wholly owned subsidiary of Serono S.A., focused on product candidates derived from two cellular receptors (designated TACI and BCMA) that are involved in the regulation of the human immune system. Following the acquisition of Serono by Merck KGaA in 2007, Serono’s rights under this agreement have been held by Merck Serono S.A. Pursuant to the collaborative development and marketing agreement, the parties had been co-developing atacicept in autoimmune diseases and cancer. In August 2008, we entered into an amended and restated development and marketing agreement, providing Merck Serono with exclusive worldwide rights to develop, market and sell products developed under the agreement, for which we will be entitled to receive milestone fees and royalties on worldwide net sales.

We granted Merck Serono an exclusive license to our intellectual property relating to TACI, BCMA and certain other related technologies to make, use, have made, sell, offer to sell and import products based on TACI and BCMA. Merck Serono is required to pay royalties on sales, which vary based on annual sales volume and the

17

Table of Contents

degree of patent protection provided by the licensed intellectual property. Royalty payments may be reduced if Merck Serono is required to license additional intellectual property from one or more third parties in order to commercialize a product or, in certain circumstances, if product sales suffer from direct competition. Royalty obligations under the agreement continue on a country-by-country basis until the date on which no valid patent claims relating to a product exist or, if the product is not covered by a valid patent claim, 15 years from the date of first sale of the product in that country.

The agreement will continue for as long as a TACI or BCMA product is the subject of an active development project or there is an obligation to pay royalties under the agreement. The agreement provides for an initial fee and milestone payments to be paid by Merck Serono in connection with the development and approval of products, up to an aggregate of $52.5 million of which $15.5 million has been received to date.

Novo Nordisk License Agreements for IL-21

As a result of a series of agreements, we now have worldwide development and commercialization rights for products based on our intellectual property to IL-21 protein and Novo Nordisk has development and commercialization rights for products based on our intellectual property to other embodiments of IL-21, including antibodies to IL-21.

In 2001, Novo Nordisk initially licensed the rights under our intellectual property to various embodiments of IL-21 in territories outside of North America. In 2005, we entered into a collaborative data sharing and cross-license agreement with Novo Nordisk to develop and execute a joint global clinical development plan for the IL-21 protein to achieve regulatory approval of a common product in the companies’ respective territories. In January 2007, the parties also entered into a manufacturing agreement whereby Novo Nordisk agreed to supply us with IL-21 protein for use in clinical trials. In January 2009, the parties restructured their relationship as it relates to IL-21. As part of the restructuring, the parties:

| • | Amended and restated the license agreement to no longer cover the IL-21 protein. However, Novo Nordisk continued to be responsible for developing other embodiments of IL-21, including antibodies to IL-21, outside North America. |

| • | Entered into a license and transfer agreement pursuant to which we received an exclusive license outside North America to the intellectual property rights that Novo Nordisk developed relating to the IL-21 protein, and are obligated to make milestone payments based on approval and sales and pay single-digit royalties on sales of any resulting products outside North America. In addition, we will pay Novo Nordisk a portion of any third-party license fees above a specified threshold. |

| • | Terminated the collaborative data sharing and cross-license agreement. However, our exclusive license in North America to the intellectual property rights that Novo Nordisk developed relating to the IL-21 protein survived termination. |

| • | Terminated the manufacturing agreements and Novo Nordisk transferred to us all manufacturing processes developed and its existing stock of IL-21 protein. |

In December 2009, the parties further amended and restated the license agreement to provide Novo Nordisk worldwide rights to embodiments of IL-21 (other than IL-21 protein), including antibodies to IL-21. Novo Nordisk is obligated to make milestone payments based on the achievement of development milestones and royalties on sales of any resulting products. In addition, we will have a right to co-promote the IL-21 mAb product in the United States and receive double-digit royalties on net sales in the United States if we contribute to Phase 3 clinical development costs directed to achieving regulatory approval in the United States or European Union. We must make an election to contribute to Phase 3 clinical development costs within 90 days following receipt of data from the Phase 2b studies, in which case we will pay a one-time fee of $10 million and 15% of Phase 3 clinical development costs. Royalty obligations under the agreement continue on a country-by-country basis until the date on which no valid patent claims relating to a product exist or, if the product is not covered by

18

Table of Contents

a valid patent claim, 10 years from the date of first sale of the product in that country. Royalty payments may be reduced if Novo Nordisk is required to license additional intellectual property from one or more third parties in order to commercialize a product or, in certain circumstances, if product sales suffer from direct competition.

Merck Serono Strategic Alliance Agreement

In October 2004, we executed a strategic alliance agreement with Serono S.A. to research, develop and commercialize product candidates, including protein and antibody therapeutics, based on a specific portfolio of our proprietary genes. Following the acquisition of Serono in 2007 by Merck KGaA, Serono’s rights under this agreement have been held by Merck Serono SA, an affiliate of Merck KGaA. In August 2008, we amended the strategic alliance agreement, while retaining the original five-year term, which expired in October 2009.