Attached files

| file | filename |

|---|---|

| EX-21 - SUBSIDIARIES OF THE REGISTRANT - TENNANT CO | exhibit_21.htm |

| EX-31.1 - CERTIFICATION OF CEO PURSUANT TO SECTION 302 - TENNANT CO | exhibit_31-1.htm |

| EX-23.1 - INDEPENDENT AUDITOR'S CONSENT - TENNANT CO | exhibit_23-1.htm |

| EX-32.2 - CERTIFICATION OF CFO PURSUANT TO SECTION 906 - TENNANT CO | exhibit_32-2.htm |

| EX-32.1 - CERTIFICATION OF CEO PURSUANT TO SECTION 906 - TENNANT CO | exhibit_32-1.htm |

| EX-31.2 - CERTIFICATION OF CFO PURSUANT TO SECTION 302 - TENNANT CO | exhibit_31-2.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

(Mark

One)

|

[ü]

|

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For

the fiscal year ended December 31, 2009

|

|

OR

|

|

|

[ ]

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For

the transition period from __________ to

__________.

|

Commission

File Number 001-16191

TENNANT

COMPANY

(Exact

name of registrant as specified in its charter)

|

Minnesota

|

41-0572550

|

|

|

State

or other jurisdiction of

|

(I.R.S.

Employer

|

|

|

incorporation

or organization

|

Identification

No.)

|

|

701

North Lilac Drive, P.O. Box 1452

Minneapolis,

Minnesota 55440

|

|

(Address

of principal executive offices) (Zip

Code)

|

Registrant’s

telephone number, including area code 763-540-1200

Securities

registered pursuant to Section 12(b) of the Act:

|

Name

of exchange on which registered

|

||

|

Common

Stock, par value $0.375 per share

|

New

York Stock Exchange

|

|

|

Preferred

Share Purchase Rights

|

New

York Stock Exchange

|

|

Securities registered pursuant

to Section 12(g) of the Act: None

|

||||

|

Indicate

by check mark if the registrant is a well-known seasoned issuer, as

defined by Rule 405 of the Securities Act.

|

Yes

|

ü

|

No

|

|

|

Indicate

by check mark if the registrant is not required to file reports pursuant

to Section 13 or Section 15(d) of the Act.

|

Yes

|

ü

|

No

|

|

|

Indicate

by check mark whether the registrant (1) has filed all reports required to

be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12

months

|

||||

|

(or for

such shorter period that the registrant was required to file such

reports), and (2) has been subject to such filing requirements for

the past 90 days.

|

ü

|

Yes

|

No

|

|

| Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and | ||||

| posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit | ||||

| and post such files). | Yes |

No

|

||

|

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the

best of registrant’s knowledge, in definitive proxy or information

statements incorporated by reference in Part III of this Form 10-K or any

amendment to this Form

10-K. [ü

]

|

||||

|

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See definitions of “large accelerated filer,” "accelerated filer"

and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check

one):

|

|||||

|

Large

accelerated filer

|

Accelerated

filer

|

ü | |||

|

Non-accelerated filer

|

(Do not check if a smaller reporting company) |

Smaller reporting

company

|

|||

|

Indicate

by check mark whether the registrant is a shell company (as defined in

Rule 12b-2 of the Act).

|

Yes

|

ü

|

No

|

|

|

The

aggregate market value of the voting and non-voting common equity held by

non-affiliates as of June 30, 2009, was approximately

$339,083,805.

|

||||

|

As

of February 24, 2010, there were 18,800,981 shares of Common Stock

outstanding.

|

||||

DOCUMENTS

INCORPORATED BY REFERENCE

Portions

of the registrant’s Proxy Statement for its 2010 annual meeting of shareholders

(the “2010 Proxy Statement”) are incorporated by reference in Part

III.

Tennant

Company

Form

10–K

Table of Contents

|

PART I

|

Page

|

|||||

|

Item

1

|

||||||

|

Item

1A

|

||||||

|

Item

1B

|

||||||

|

Item

2

|

||||||

|

Item

3

|

||||||

|

Item

4

|

||||||

|

PART

II

|

||||||

|

Item

5

|

||||||

|

Item

6

|

||||||

|

Item

7

|

||||||

|

Item

7A

|

||||||

|

Item

8

|

||||||

|

1

|

||||||

|

2

|

||||||

|

3

|

||||||

|

4

|

||||||

|

5

|

||||||

|

6

|

||||||

|

7

|

||||||

|

8

|

||||||

|

9

|

||||||

|

10

|

||||||

|

11

|

||||||

|

12

|

||||||

|

13

|

||||||

|

14

|

||||||

|

15

|

||||||

|

16

|

||||||

|

17

|

||||||

|

18

|

||||||

|

19

|

||||||

|

20

|

||||||

|

Item

9

|

||||||

|

Item

9A

|

||||||

|

Item

9B

|

||||||

|

PART

III

|

||||||

|

Item

10

|

||||||

|

Item

11

|

||||||

|

Item

12

|

||||||

|

Item

13

|

||||||

|

Item

14

|

||||||

|

PART

IV

|

||||||

|

Item

15

|

||||||

TENNANT

COMPANY

2009

ANNUAL

REPORT

Form

10–K

(Pursuant

to Securities Exchange Act of 1934)

PART

I

ITEM 1 – Business

General

Development of Business

Tennant

Company, a Minnesota corporation incorporated in 1909, is a world leader in

designing, manufacturing and marketing solutions that help create a cleaner,

safer world. The Company’s floor maintenance and outdoor cleaning equipment,

chemical-free cleaning technologies, specialty surface coatings and related

products are used to clean and coat surfaces in factories, office buildings,

parking lots and streets, airports, hospitals, schools, warehouses, shopping

centers and more. Customers include building service contract cleaners to whom

organizations outsource facilities maintenance, as well as end-user businesses,

healthcare facilities, schools and local, state and federal governments who

handle facilities maintenance themselves. We reach these customers through the

industry’s largest direct sales and service organization and through a strong

and well-supported network of authorized distributors worldwide.

Industry

Segments, Foreign and Domestic Operations and Export Sales

The

Company has one reportable business segment. The Company sells its products

domestically and internationally. Financial information on the Company’s

geographic areas is provided in Note 18, Segment Reporting. Nearly all of the

Company’s foreign investments in assets reside within The Netherlands,

Australia, the United Kingdom, France, Germany, Canada, Austria, Japan, Spain,

Brazil and China.

Principal

Products, Markets and Distribution

The

Company offers products and solutions mainly consisting of motorized cleaning

equipment targeted at commercial and industrial markets; parts, consumables and

service maintenance and repair; business solutions such as pay-for-use

offerings, rental and leasing programs; and technologies such as chemical-free

cleaning technologies that enhance the performance of Tennant cleaning

equipment. Adjacent products include specialty surface coatings and floor

preservation products. In 2009, the Company launched its S20, a compact sweeper,

and extended the availability of its proprietary electrically converted water

technology (“ec-water”), which cleans without chemicals, to five rider scrubber

machines. In addition, the Company licensed this technology for use in a

hand-held spray bottle for commercial and consumer cleaning applications. The

Company’s products are sold through direct and distribution channels in various

regions around the world. In North America, products are sold through a direct

sales organization and independent distributors; in Australia, Japan and many

countries principally in Western Europe, products are sold primarily through

direct sales organizations; and in more than 80 other countries, Tennant relies

on a broad network of independent distributors.

Raw

Materials and Purchased Components

The

Company has not experienced any significant or unusual problems in the

availability of raw materials or other product components. The Company has

sole-source vendors for certain components. A disruption in supply from such

vendors may disrupt the Company’s operations. However, the Company believes that

it can find alternate sources in the event there is a disruption in supply from

such vendors.

Patents

and Trademarks

The

Company applies for and is granted United States and foreign patents and

trademarks in the ordinary course of business, none of which is of material

importance in relation to the business as a whole.

Seasonality

Although

the Company’s business is not seasonal in the traditional sense, historically

revenues and earnings have been more concentrated in the fourth quarter of each

year reflecting the tendency of customers to increase capital spending during

such quarter and the Company’s efforts to close orders and reduce order

backlogs. In addition, the Company offers annual distributor rebates and sales

commissions which tend to drive sales in the fourth quarter. Typical seasonality

did not occur in the 2008 fourth quarter due to the deterioration of the

worldwide economy and global credit crisis. Typical seasonality also did not

occur during 2009. The Company’s focus and accomplishment during 2009 was to

increase sales sequentially each quarter beginning with the increase from the

2009 first quarter to the 2009 second quarter.

Working

Capital

The

Company funds operations through a combination of cash and cash equivalents and

cash flows from operations. Wherever possible, cash management is centralized

and intercompany financing is used to provide working capital to subsidiaries as

needed. In addition, credit facilities are available for additional working

capital needs or investment opportunities.

Major

Customers

The

Company sells its products to a wide variety of customers, none of which is of

material importance in relation to the business as a whole. The customer base

includes several governmental entities; however, these customers generally have

terms similar to other customers.

Backlog

The

Company processes orders within two weeks on average. Therefore, no significant

backlogs existed at December 31, 2009 or December 31, 2008.

Competition

While

there is no industry association or industry data, the Company believes, through

its own market research, that it is a world-leading manufacturer of floor

maintenance and cleaning equipment. Significant competitors exist in all key

geographic regions. However, the key competitors vary by region. The Company

competes primarily on the basis of offering a broad line of high-quality;

innovative products supported by an extensive sales and service network in major

markets.

Product

Research and Development

The

Company strives to be an industry leader in innovation and is committed to

investing in research and development. The Company’s Global Innovation Center is

dedicated to various activities including development of new products and

technologies, improvements of existing product design or manufacturing processes

and new product applications. In 2009, 2008 and 2007, the Company spent $23.0

million, $24.3 million and $23.9 million on research and development,

respectively.

Environmental

Protection

Compliance

with federal, state and local provisions regulating the discharge of materials

into the environment, or otherwise relating to the protection of the

environment, has not had, and the Company does not expect it to have, a material

effect upon the Company’s capital expenditures, earnings or competitive

position.

Employment

The

Company employed 2,786 people in worldwide operations as of December 31,

2009.

Access

to Information on the Company’s Website

The

Company makes available free of charge, through the Company’s website at

www.tennantco.com, its Annual Reports on Form 10-K, quarterly reports on Form

10-Q, current reports on Form 8-K, and amendments to those reports filed or

furnished pursuant to Section 13(a) or Section 15(d) of the Exchange Act

simultaneously when such reports are filed electronically with, or furnished to,

the Securities and Exchange Commission (“SEC”).

ITEM 1A – Risk Factors

The

following are significant factors known to us that could materially adversely

affect our business, financial condition, or operating results.

We

may encounter additional financial difficulties if the United States or other

global economies continue to experience a significant long-term economic

downturn, decreasing the demand for our products.

To the

extent that the U.S. and other global economies experience a continued

significant long-term economic downturn, our revenues could decline to the point

that we may have to take additional cost saving measures to reduce our fixed

costs to a level that is in line with a lower level of sales in order to stay in

business long-term in a depressed economic environment. Our product

sales are sensitive to declines in capital spending by our customers.

Decreased demand for our products could result in decreased revenues,

profitability and cash flows and may impair our ability to maintain our

operations and fund our obligations to others.

We

may not be able to effectively manage organizational changes which could

negatively impact our operating results or financial condition.

We are

continuing to integrate acquired companies into our business and adjust to

reduced staffing levels as a result of our workforce reduction. This

consolidation and reallocation of resources is part of our ongoing efforts to

optimize our cost structure in the current economy. Our operating

results may be negatively impacted if we are unable to manage these

organizational changes either by failing to incorporate new employees from

acquired businesses or failing to assimilate the work of the positions that are

eliminated as part of our actions to reduce headcount. In addition, if we do not

effectively manage the transition of our reduced headcount, we may not fully

realize the anticipated savings of these actions or they may negatively impact

our ability to serve our customers or meet our strategic

objectives.

We

may not be able to effectively optimize the allocation of Company resources to

our strategic objectives, which could adversely affect our operating

results.

The

decline in the global economy has constrained resources that are available to

allocate among strategic business objectives. If we are not able to

appropriately prioritize our objectives, we risk allocating our resources to

projects that do not accomplish our strategic objectives most effectively, which

could result in increased costs and could adversely impact our operating

results.

We are subject to

competitive risks associated with developing innovative products and

technologies, which generally cost more than our competitors’

products.

Our

products are sold in competitive markets throughout the world. Competition is

based on product features and design, brand recognition, reliability,

durability, technology, breadth of product offerings, price, customer

relationships, and after-sale service. Although we believe that the performance

and price characteristics of our products will provide competitive solutions for

our customers’ needs, because of our dedication to innovation and continued

investments in research and development, our products generally cost more than

our competitor’s products. We believe that customers will pay for the innovation

and quality in our products; however, in the current economic environment, it

may be difficult for us to compete with lower cost products offered by our

competitors and there can be no assurance that our customers will continue to

choose our products over products offered by our competitors. If our products,

markets and services are not competitive, we may experience a decline in sales,

pricing, and market share, which adversely impacts revenues, margin, and the

success of our operations.

We may not be

able to adequately acquire, retain and protect our proprietary intellectual

property rights which could put us at a competitive

disadvantage.

We rely

on trade secret, copyright, trademark and patent laws and contractual

protections to protect our proprietary technology and other proprietary rights.

Our competitors may attempt to copy our products or gain access to our trade

secrets. Our efforts to secure patent protection on our inventions may be

unsuccessful. Notwithstanding the precautions we take to protect our

intellectual property rights, it is possible that third parties may illegally

copy or otherwise obtain and use our proprietary technology without our consent.

Any litigation concerning infringement could result in substantial cost to us

and diversions of our resources, either of which could adversely affect our

business. In some cases, there may be no effective legal recourse against

duplication of products or services by competitors. Intellectual property rights

in foreign jurisdictions may be limited or unavailable. Patents of third parties

also have an important bearing on our ability to offer some of our products and

services. Our competitors may obtain patents related to the types of products

and services we offer or plan to offer. Any infringement by us on intellectual

property rights of others could result in litigation and adversely affect our

ability to continue to provide, or could increase the cost of providing, our

products and services.

We may encounter

difficulties as we invest in changes to our processes and computer systems that

are foundational to our ability to maintain and manage our systems

data.

We rely

on our computer systems to effectively manage our business, serve our customers

and report financial data. Our current systems are adequate for our current

business operations; however, we are in the process of standardizing our

processes and the way we utilize our computer systems with the objective that we

will improve our ability to effectively maintain and manage our systems data so

that as our business grows, our processes will be able to more efficiently

handle this growth. There are inherent risks in changing processes and systems

data and if we are not successful in our attempts to improve our data and system

processes, we may experience higher costs or an interruption in our business

which could adversely impact our ability to serve our customers and our

operating results.

We may be unable

to conduct business if we experience a significant business interruption in our

computer systems, manufacturing plants or distribution facilities for a

significant period of time.

We rely

on our computer systems, manufacturing plants and distribution facilities to

efficiently operate our business. If we experience an interruption in the

functionality in any of these items for a significant period of time, we may not

have adequate business continuity planning contingencies in place to allow us to

continue our normal business operations on a long-term basis. Significant

long-term interruption in our business could cause a decline in sales, an

increase in expenses and could adversely impact our operating

results.

We are subject to

product liability claims and product quality issues that could adversely affect

our operating results or financial condition.

Our

business exposes us to potential product liability risks that are inherent in

the design, manufacturing and distribution of our products. If products are used

incorrectly by our customers, injury may result leading to product liability

claims against us. Some of our products or product improvements may have defects

or risks that we have not yet identified that may give rise to product quality

issues, liability and warranty claims. If product liability claims are brought

against us for damages that are in excess of our insurance coverage or for

uninsured liabilities and it is determined we are liable, our business could be

adversely impacted. Any losses we suffer from any liability claims, and the

effect that any product liability litigation may have upon the reputation and

marketability of our products, may have a negative impact on our business and

operating results. We could experience a material design or manufacturing

failure in our products, a quality system failure, other safety issues, or

heightened regulatory scrutiny that could warrant a recall of some of our

products. Any unforeseen product quality problems could result in loss of market

share, reduced sales, and higher warranty expense.

We may encounter

difficulties obtaining raw materials or component parts needed to manufacture

our products and the prices of these materials are subject to

fluctuation.

Raw materials and commodity-based

components. As a manufacturer, our sales and profitability are dependent

upon availability and cost of raw materials, which are subject to price

fluctuations, and the ability to control or pass on an increase in costs of raw

materials to our customers. We purchase raw materials, such as steel, rubber,

lead and petroleum-based resins and components containing these commodities for

use in our manufacturing operations. The availability of these raw materials is

subject to market forces beyond our control. Under normal circumstances, these

materials are generally available on the open market from a variety of sources.

From time to time, however, the prices and availability of these raw materials

and components fluctuate due to global market demands, which could impair our

ability to procure necessary materials, or increase the cost of such materials.

Inflationary and other increases in the costs of these raw materials and

components have occurred in the past and may recur from time to time, and our

financial performance depends in part on our ability to incorporate changes in

costs into the selling prices for our products.

Freight

costs associated with shipping and receiving product and sales and service

vehicle fuel costs are impacted by fluctuations in the cost of oil and gas. We

do not use derivative commodity instruments to manage our exposure to changes in

commodity prices such as steel, oil, gas and lead. Any fluctuations in the

supply or prices for any of these commodities could have a material adverse

affect on our profit margins and financial condition.

Single-source supply. We

depend on many suppliers for the necessary parts to manufacture our products.

However, there are some components that are purchased from a single supplier due

to price, quality, technology or other business constraints. These components

cannot be quickly or inexpensively re-sourced to another supplier. If we are

unable to purchase on acceptable terms or experience significant delays or

quality issues in the delivery of these necessary parts or components from a

particular vendor and we need to locate a new supplier for these parts and

components, shipments for products impacted could be delayed, which could have a

material adverse affect on our business, financial condition and results of

operations.

We are subject to

a number of regulatory and legal risks associated with doing business in the

United States and international markets.

Our

business and our products are subject to a wide range of international, federal,

state and local laws, rules and regulations, including, but not limited to, data

privacy laws, anti-trust regulations, employment laws, product labeling and

regulatory requirements, and the Foreign Corrupt Practices Act and similar

anti-bribery regulations. Many of these requirements are challenging to comply

with as there are frequent changes and many inconsistencies across the various

jurisdictions. Any violation of these laws or regulations could lead to

significant fines and/or penalties could limit our ability to conduct business

in those jurisdictions and could cause us to incur additional operating and

compliance costs.

We are subject to

risks associated with changes in foreign currency exchange

rates.

We are

exposed to market risks from changes in foreign currency exchange rates. As a

result of our increasing international presence, we have experienced an increase

in transactions and balances denominated in currencies other than the U.S.

dollar. There is a direct financial impact of foreign currency exchange when

translating profits from local currencies to U.S. dollars. Our primary exposure

is to transactions denominated in the Euro, British pound, Australian and

Canadian dollar, Japanese yen, Chinese yuan and Brazilian real. Any significant

change in the value of the currencies of the countries in which we do business

against the U.S. dollar could affect our ability to sell products competitively

and control our cost structure. Because a substantial portion of our products

are manufactured in the United States, a stronger U.S. dollar generally has a

negative impact on results from operations outside the United States while a

weaker dollar generally has a positive effect. Unfavorable changes in exchange

rates between the U.S. dollar and these currencies impact the cost of our

products sold internationally and could significantly reduce our reported sales

and earnings. We periodically enter into contracts, principally forward exchange

contracts, to protect the value of certain of our foreign currency-denominated

assets and liabilities. The gains and losses on these contracts generally

approximate changes in the value of the related assets and liabilities. However,

all foreign currency exposures cannot be fully hedged, and there can be no

assurances that our future results of operations will not be adversely affected

by currency fluctuation.

ITEM 1B – Unresolved Staff Comments

None.

ITEM 2 – Properties

The

Company’s corporate offices are owned by the Company and are located in the

Minneapolis, Minnesota, metropolitan area. Manufacturing facilities are located

in the states of Minnesota, Michigan, Kentucky and in Uden, The Netherlands; the

United Kingdom; São Paulo, Brazil; and Shanghai, China. Sales offices, warehouse

and storage facilities are leased in various locations in North America, Europe,

Japan, China, Asia, Australia and Latin America. The Company’s facilities are in

good operating condition, suitable for their respective uses and adequate for

current needs. Further information regarding the Company’s property and lease

commitments is included in the Contractual Obligations section of Item 7 and in

Note 13, Commitments and Contingencies.

ITEM 3 – Legal Proceedings

There are

no material pending legal proceedings other than ordinary routine litigation

incidental to the Company’s business.

ITEM 4 – Submission of Matters to a Vote of Security

Holders

No

matters were submitted to a vote of security holders during the fourth quarter

of 2009.

PART

II

ITEM 5 – Market for Registrant’s Common Equity, Related

Shareholder Matters and Issuer Purchases of Equity Securities

STOCK

MARKET INFORMATION – Tennant common stock is traded on the New York Stock

Exchange, under the ticker symbol TNC. As of January 29, 2010, there were

approximately 500 shareholders of record and 4,400 beneficial shareholders. The

common stock price was $23.93 per share on January 29, 2010.

STOCK

SPLIT – On April 26, 2006, the Board of Directors declared a two-for-one common

stock split effective July 26, 2006. As a result of the stock split,

shareholders of record received one additional common share for every share held

at the close of business on July 12, 2006. All share and per share data has been

retroactively adjusted to reflect the stock split.

QUARTERLY

PRICE RANGE – The accompanying chart shows the quarterly price range of the

Company’s shares over the past two years:

|

First

|

Second

|

Third

|

Fourth

|

||||

|

2009

|

$7.76-16.41

|

$9.89-21.26

|

$15.79-30.79

|

$26.16-31.92

|

|||

|

2008

|

$31.88-45.41 |

$30.07-41.00

|

$24.90-40.48

|

$15.33-33.26

|

DIVIDEND

INFORMATION – Cash dividends on Tennant’s common stock have been paid for 65

consecutive years. Tennant’s annual cash dividend payout increased for the

38th

consecutive year to $0.53 per share in 2009, an increase of $0.01 per share over

2008. Dividends generally are declared each quarter. The Company announced a

quarterly cash dividend of $0.14 per share payable March 15, 2010, to

shareholders of record on February 26, 2010. Following are the anticipated

remaining record dates for 2010: June 15, 2010, September 15, 2010 and December

15, 2010.

DIVIDEND

REINVESTMENT OR DIRECT DEPOSIT OPTIONS – Shareholders have the option of

reinvesting quarterly dividends in additional shares of Company stock or having

dividends deposited directly to a bank account. The Transfer Agent should be

contacted for additional information.

TRANSFER

AGENT AND REGISTRAR – Shareholders with a change of address or questions about

their account may contact:

Wells

Fargo Bank, N.A.

Shareowner

Services

P.O. Box

64854

South St.

Paul, MN 55164-0854

(800)

468-9716

SHARE

REPURCHASES – On May 3, 2007, the Board of Directors authorized the repurchase

of 1,000,000 shares of our common stock. Share repurchases are made from time to

time in the open market or through privately negotiated transactions, primarily

to offset the dilutive effect of shares issued through our stock-based

compensation programs. In order to preserve cash, we had temporarily suspended

these repurchases effective September 2008. Our March 4, 2009 amendment to our

Credit Agreement prohibited us from conducting share repurchases during the 2009

fiscal year and limits the payment of dividends and repurchases of stock in

fiscal years after 2009 to an amount ranging from $12.0 million to $40.0 million

based on our leverage ratio after giving effect to such payments.

|

For

the Quarter Ended

December

31, 2009

|

Total

Number of Shares Purchased

(1)

|

Average

Price Paid Per Share

|

Total

Number of Shares Purchased as Part of Publicly Announced Plans or

Programs

|

Maximum

Number of Shares that May Yet Be Purchased Under the Plans or

Programs

|

|||||

|

October

1–31, 2009

|

33

|

$ 29.03

|

-

|

288,874

|

|||||

|

November

1–30, 2009

|

-

|

-

|

-

|

288,874

|

|||||

|

December

1–31, 2009

|

988

|

26.82

|

-

|

288,874

|

|||||

|

Total

|

1,021

|

$ 26.89

|

-

|

288,874

|

|||||

(1)

Includes 1,021 shares delivered or attested to in satisfaction of the exercise

price and/or tax withholding obligations by employees who exercised stock

options or restricted stock under employee stock compensation

plans.

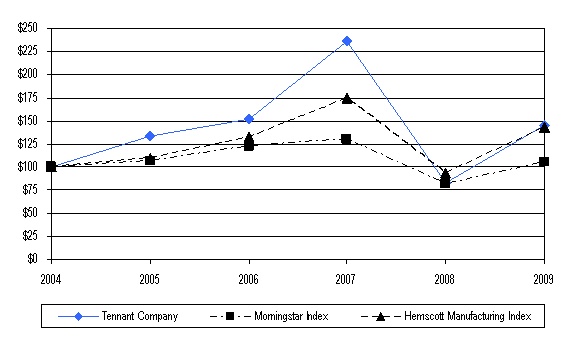

COMPARATIVE

STOCK PERFORMANCE – The following graph compares the cumulative total

shareholder return on the common stock of the Company for the last five fiscal

years with the cumulative total return over the same period on the Overall Stock

Market Performance Index (Morningstar Index) and the Industry Index (Hemscott

Group Index 62 – Industrial Goods, Manufacturing).

This

assumes an investment of $100 in the Company’s common stock, the Morningstar

Index and the Hemscott Group Index on December 31, 2004, with reinvestment of

all dividends.

COMPARISON

OF 5-YEAR CUMULATIVE TOTAL RETURN

AMONG

TENNANT COMPANY

MORNINGSTAR

INDEX AND HEMSCOTT GROUP INDEX

|

2004

|

2005

|

2006

|

2007

|

2008

|

2009

|

|||||||||||||||||||

|

Tennant

Company

|

100.00 | 134.05 | 152.19 | 235.51 | 83.28 | 146.00 | ||||||||||||||||||

|

Morningstar

Index

|

100.00 | 106.52 | 123.24 | 130.53 | 82.19 | 105.58 | ||||||||||||||||||

|

Hemscott

Manufacturing Index

|

100.00 | 110.13 | 132.56 | 174.13 | 94.15 | 143.81 | ||||||||||||||||||

ITEM 6 – Selected Financial Data

(In

thousands, except shares and per share data)

|

Years

Ended December 31

|

2009

|

2008

|

2007

|

2006

|

2005

|

|||||||||||||||

|

Year

End Financial Results

|

||||||||||||||||||||

|

Net

Sales

|

$ | 595,875 | 701,405 | 664,218 | 598,981 | 552,908 | ||||||||||||||

|

Cost

of Sales

|

$ | 349,767 | 415,155 | 385,234 | 347,402 | 318,044 | ||||||||||||||

|

Gross

Margin – %

|

41.3 | 40.8 | 42.0 | 42.0 | 42.5 | |||||||||||||||

|

Research

and Development Expense

|

$ | 22,978 | 24,296 | 23,869 | 21,939 | 19,351 | ||||||||||||||

|

%

of Net Sales

|

3.9 | 3.5 | 3.6 | 3.7 | 3.5 | |||||||||||||||

|

Selling

and Administrative Expense

|

$ | 245,623 |

(1)

|

243,385 | (2) | 200,270 | (3) | 189,676 | 180,676 | |||||||||||

|

%

of Net Sales

|

41.2 | 34.7 | 30.2 | 31.7 | 32.7 | |||||||||||||||

|

(Loss)

Profit from Operations

|

$ | (22,493 | ) (1) | 18,569 | (2) | 54,845 | (3) | 39,964 | 34,837 | |||||||||||

|

%

of Net Sales

|

(3.8 | ) | 2.6 | 8.3 | 6.7 | 6.3 | ||||||||||||||

|

Total

Other (Expense) Income, Net

|

$ | (1,827 | ) | (994 | ) | 2,867 | (3) | 3,338 | 157 | |||||||||||

|

Income

Tax Expense

|

$ | 1,921 | (1) | 6,951 | (2) | 17,845 | (3) | 13,493 | 12,058 | |||||||||||

|

%

of (Loss) Profit Before Income Taxes

|

7.9 | 39.6 | 30.9 | 31.2 | 34.5 | |||||||||||||||

|

Net

(Loss) Earnings

|

$ | (26,241 | ) (1) | 10,624 | (2) | 39,867 | (3) | 29,809 | 22,936 | |||||||||||

|

%

of Net Sales

|

(4.4 | ) | 1.5 | 6.0 | 5.0 | 4.2 | ||||||||||||||

|

Return

on beginning Shareholders’ Equity – %

|

(12.5 | ) | 4.2 | 17.4 | 15.4 | 13.2 | ||||||||||||||

|

Per

Share Data

|

||||||||||||||||||||

|

Basic

(Loss) Earnings

|

$ | (1.42 | ) (1) | 0.58 | (2) | 2.14 | (3) | 1.61 | 1.27 | |||||||||||

|

Diluted

(Loss) Earnings

|

$ | (1.42 | ) (1) | 0.57 | (2) | 2.08 | (3) | 1.57 | 1.26 | |||||||||||

|

Cash

Dividends

|

$ | 0.53 | 0.52 | 0.48 | 0.46 | 0.44 | ||||||||||||||

|

Shareholders’

Equity (ending)

|

$ | 9.83 | 11.48 | 13.65 | 12.25 | 10.50 | ||||||||||||||

|

Year-End

Financial Position

|

||||||||||||||||||||

|

Cash

and Cash Equivalents

|

$ | 18,062 | 29,285 | 33,092 | 31,021 | 41,287 | ||||||||||||||

|

Total

Current Assets

|

$ | 215,912 | 250,419 | 240,724 | 235,404 | 211,601 | ||||||||||||||

|

Property,

Plant and Equipment, Net

|

$ | 97,217 | 103,730 | 96,551 | 82,835 | 72,588 | ||||||||||||||

|

Total

Assets

|

$ | 377,726 | 456,604 | 382,070 | 354,250 | 311,472 | ||||||||||||||

|

Total

Current Liabilities

|

$ | 116,152 | 107,159 | 96,673 | 94,804 | 88,965 | ||||||||||||||

|

Total

Long-Term Liabilities

|

$ | 77,295 | 139,541 | 32,966 | 29,782 | 29,405 | ||||||||||||||

|

Shareholders’

Equity

|

$ | 184,279 | 209,904 | 252,431 | 229,664 | 193,102 | ||||||||||||||

|

Current

Ratio

|

1.9 | 2.3 | 2.5 | 2.5 | 2.4 | |||||||||||||||

|

Debt:

|

||||||||||||||||||||

|

Current

|

$ | 4,019 | 3,946 | 2,127 | 1,812 | 2,232 | ||||||||||||||

|

Long-Term

|

$ | 30,192 | 91,393 | 2,470 | 1,907 | 1,608 | ||||||||||||||

|

Debt-to-Capital

ratio

|

15.7 | 31.2 | 1.8 | 1.6 | 1.9 | |||||||||||||||

|

Cash

Flows

|

||||||||||||||||||||

|

Net

Cash Provided by Operating Activities

|

$ | 75,185 | 37,394 | 39,640 | 40,319 | 44,237 | ||||||||||||||

|

Net

Cash Used for Investing Activities

|

$ | (13,334 | ) | (101,827 | ) | (10,357 | ) | (45,959 | ) | (11,781 | ) | |||||||||

|

Net

Cash (Used for) Provided by Financing Activities

|

$ | (74,068 | ) | 62,075 | (26,679 | ) | (4,876 | ) | (8,111 | ) | ||||||||||

|

Other

Data

|

||||||||||||||||||||

|

Interest

Income

|

$ | 393 | 1,042 | 1,854 | 2,698 | 1,691 | ||||||||||||||

|

Interest

Expense

|

$ | 2,830 | 3,944 | 898 | 737 | 564 | ||||||||||||||

|

Depreciation

and Amortization

|

$ | 22,803 | 22,959 | 18,054 | 14,321 | 13,039 | ||||||||||||||

|

Purchases

of Property, Plant and Equipment

|

$ | 11,483 | 20,790 | 28,720 | 23,872 | 20,880 | ||||||||||||||

|

Proceeds

from disposals of Property, Plant and Equipment

|

$ | 311 | 808 | 7,254 | 632 | 3,049 | ||||||||||||||

|

Number

of employees at year-end

|

2,786 | 3,002 | 2,774 | 2,653 | 2,496 | |||||||||||||||

|

Diluted

Weighted Average Shares Outstanding

|

18,507,772 | 18,581,840 | 19,146,025 | 18,989,248 | 18,209,888 | |||||||||||||||

|

Closing

share price at year-end

|

$ | 26.19 | 15.40 | 44.29 | 29.00 | 26.00 | ||||||||||||||

|

Common

stock price range during year

|

$ | 7.76-31.92 | 15.33-45.41 | 27.84-49.32 | 21.71–29.88 | 17.39-26.23 | ||||||||||||||

|

Closing

Price/Earnings ratio

|

(18.4 | ) | 27.0 | 21.3 | 18.5 | 20.6 | ||||||||||||||

The

results of operations from our 2009 and 2008 acquisitions have been included in

the Consolidated Financial Statements, as well as the Selected Financial Data

presented above, since each of their respective dates of acquisition. Refer

to additional information in Note 4, Acquisitions and Divestitures.

(1) 2009 includes a goodwill impairment

charge of $43,363 pretax ($42,289 aftertax or $2.29 per diluted share), a

benefit from a revision during the first quarter of 2009 to the 2008 workforce

reduction charge of $1,328 pretax ($1,249 aftertax or $0.07 per diluted share)

and a net tax benefit, primarily from a United Kingdom business reorganization

of $1,864 aftertax (or $0.10 per diluted share). (2) 2008 includes a workforce

reduction charge and associated expenses of $14,551 pretax ($12,003 aftertax or

$0.65 per diluted share), increase in Allowance for Doubtful Accounts of $3,361

pretax ($3,038 aftertax or $0.16 per diluted share), write-off of technology

investments of $1,842 pretax ($1,246 aftertax or $0.07 per diluted share), and a

gain on sale of Centurion assets of $229 pretax ($143 aftertax or $0.01 per

diluted share). (3) 2007 includes a restructuring charge and associated expenses

of $2,507 pretax ($1,656 aftertax or $0.09 per diluted share), a one-time tax

benefit relating to a reduction in valuation reserves, net of the impact of tax

rate changes in foreign jurisdictions on deferred taxes of $3,644 aftertax (or

$0.19 per diluted share) and a gain on the sale of the Maple Grove, Minnesota

facility of $5,972 pretax ($3,720 aftertax or $0.19 per diluted

share).

ITEM 7 – Management’s Discussion and Analysis of

Financial Condition and Results of Operations

Overview

Tennant

Company is a world leader in designing, manufacturing and marketing solutions

that help create a cleaner, safer world. We provide floor maintenance and

outdoor cleaning equipment, chemical-free cleaning technologies, specialty

surface coatings and related products that are used to clean and coat surfaces

in factories, office buildings, parking lots and streets, airports, hospitals,

schools, warehouses, shopping centers and more. We sell our products through our

direct sales and service organization and a network of authorized distributors

worldwide. Geographically, our customers are primarily located in North America,

Europe, the Middle East, Africa, Asia-Pacific and Latin America. We strive to be

an innovator in our industry through our commitment to understanding our

customers’ needs and using our expertise to create innovative products and

solutions.

Net Loss

for 2009 was $26.2 million, or $1.42 loss per diluted share, compared to Net

Earnings of $10.6 million, or $0.57 per diluted share for 2008. Net Loss was

impacted by a non-cash pretax goodwill impairment charge of $43.4 million, or

$2.29 loss per diluted share, taken during the first quarter of 2009 as well as

a significant year over year decline in Net Sales due to ongoing unfavorable

global economic conditions. Net Sales totaled $595.9 million, down 15.0% from

2008 driven primarily by a decline in equipment unit sales volume. Gross Margins

increased 50 basis points to 41.3%. Benefits from commodity price deflation,

cost reductions, flexible production management and workforce reductions more

than offset the impact of lower sales and the unfavorable impact of lower

production volume through our manufacturing facilities. Selling and

Administrative Expense (“S&A Expense”) decreased 80 basis points as a

percentage of Net Sales to 33.9% compared to 34.7% in 2008 due to benefits from

our workforce reduction program, reductions in volume-related expenses, and

delays in discretionary spending to align expenses with the lower level of

sales.

Tennant

continues to invest in innovative product development, with 3.9% of Net Sales

spent on Research and Development in 2009. We launched one new product in 2009

in addition to the continued global rollout of our electrically converted water

technology (“ec-water”) on five of our rider scrubbers. Sales of new products

introduced in the past three years generated approximately 41% of our equipment

sales during 2009, exceeding our long-term goal of 30%.

In

addition, Net Loss was also impacted by a benefit from net favorable discrete

tax items, which contributed $0.03 per diluted share, and a tax benefit from a

United Kingdom business reorganization which contributed $0.10 per diluted

share.

We ended

2009 with a Debt-to-Capital ratio of 15.7%, $18.1 million in Cash and Cash

Equivalents and Shareholders’ Equity of $184.3 million. During 2009 we generated

operating cash flows of $75.2 million. Total debt was $34.2 million as of

December 31, 2009, a significant decrease from $95.3 million at the same time

last year.

Historical

Results

The

following table compares the historical results of operations for the years

ended December 31, 2009, 2008 and 2007 in dollars and as a percentage

of Net Sales (in thousands, except per share amounts):

|

2009

|

%

|

2008

|

%

|

2007

|

%

|

|||||||||||||||||||

|

Net

Sales

|

$ | 595,875 | 100.0 | $ | 701,405 | 100.0 | $ | 664,218 | 100.0 | |||||||||||||||

|

Cost

of Sales

|

349,767 | 58.7 | 415,155 | 59.2 | 385,234 | 58.0 | ||||||||||||||||||

|

Gross

Profit

|

246,108 | 41.3 | 286,250 | 40.8 | 278,984 | 42.0 | ||||||||||||||||||

|

Operating

Expense:

|

||||||||||||||||||||||||

|

Research

and Development

Expense

|

22,978 | 3.9 | 24,296 | 3.5 | 23,869 | 3.6 | ||||||||||||||||||

|

Selling

and Administrative

Expense

|

202,260 | 33.9 | 243,614 | 34.7 | 206,242 | 31.1 | ||||||||||||||||||

|

Goodwill

Impairment Charge

|

43,363 | 7.3 | - | - | - | - | ||||||||||||||||||

|

Gain

on Divestiture of Assets

|

- | - | (229 | ) | - | - | - | |||||||||||||||||

|

Gain

on Sale of Facility

|

- | - | - | - | (5,972 | ) | (0.9 | ) | ||||||||||||||||

|

Total

Operating Expenses

|

268,601 | 45.1 | 267,681 | 38.2 | 224,139 | 33.7 | ||||||||||||||||||

|

(Loss)

Profit from Operations

|

(22,493 | ) | (3.8 | ) | 18,569 | 2.6 | 54,845 | 8.3 | ||||||||||||||||

|

Other

Income (Expense):

|

||||||||||||||||||||||||

|

Interest

Income

|

393 | 0.1 | 1,042 | 0.1 | 1,854 | 0.3 | ||||||||||||||||||

|

Interest

Expense

|

(2,830 | ) | (0.5 | ) | (3,944 | ) | (0.6 | ) | (898 | ) | (0.1 | ) | ||||||||||||

|

Net

Foreign Currency Transaction

(Losses) Gains

|

(412 | ) | (0.1 | ) | 1,368 | 0.2 | 39 | - | ||||||||||||||||

|

ESOP

Income

|

990 | 0.2 | 2,219 | 0.3 | 2,568 | 0.4 | ||||||||||||||||||

|

Other

Income (Expense), Net

|

32 | - | (1,679 | ) | (0.2 | ) | (696 | ) | (0.1 | ) | ||||||||||||||

|

Total

Other (Expense) Income, Net

|

(1,827 | ) | (0.3 | ) | (994 | ) | (0.1 | ) | 2,867 | 0.4 | ||||||||||||||

|

(Loss)

Profit Before Income Taxes

|

(24,320 | ) | (4.1 | ) | 17,575 | 2.5 | 57,712 | 8.7 | ||||||||||||||||

|

Income

Tax Expense

|

1,921 | 0.3 | 6,951 | 1.0 | 17,845 | 2.7 | ||||||||||||||||||

|

Net

(Loss) Earnings

|

$ | (26,241 | ) | (4.4 | ) | $ | 10,624 | 1.5 | $ | 39,867 | 6.0 | |||||||||||||

|

Net

(Loss) Earnings per Share

|

$ | (1.42 | ) | $ | 0.57 | $ | 2.08 | |||||||||||||||||

Consolidated

Financial Results

Net Loss

for 2009 was $26.2 million, or $1.42 loss per diluted share, compared to Net

Earnings of $10.6 million, or $0.57 per diluted share for 2008. Net Loss was

impacted by:

|

§

|

A

decline in Net Sales of 15.0%, primarily due to a decrease in equipment

unit sales volume experienced during

2009.

|

|

§

|

A

50 basis point increase in Gross Margins to 41.3% due to benefits from

commodity price deflation, cost reductions, flexible production management

and workforce reductions which more than offset the decline in equipment

unit sales volume.

|

|

§

|

A

decrease in S&A Expense as a percentage of Net Sales of 80 basis

points due to benefits from our workforce reduction program, reductions in

volume-related expenses and delays in discretionary

spending.

|

|

§

|

Non-cash

pretax goodwill impairment charge of $43.4 million during the first

quarter of 2009.

|

|

§

|

A

benefit from net favorable discrete tax items contributed $0.03 per

diluted share and a tax benefit from a United Kingdom business

reorganization contributed $0.10 per diluted

share.

|

In 2008,

Net Earnings declined 73.4% to $10.6 million or $0.57 per diluted share as

compared to 2007. Net Earnings were impacted by:

|

§

|

Growth

in Net Sales of 5.6% to $701.4 million, driven by 2008 acquisitions and

increases in Other International.

|

|

§

|

A

120 basis point decline in Gross Margins to 40.8% as fixed manufacturing

costs within our plants were not fully leveraged due to a significant

equipment unit volume decline of $22.9 million experienced in the fourth

quarter of 2008.

|

|

§

|

An

increase in S&A Expense as a percentage of Net Sales of 360 basis

points due to the inclusion of $19.8 million of expenses associated with

the fourth quarter workforce reduction charge and other charges as well as

expenses incurred earlier in the year to expand international market

coverage and support new product

launches.

|

|

§

|

The

inclusion of a $2.7 million net foreign currency gain from settlement of

forward contracts related to a British pound denominated

loan.

|

|

§

|

A

net benefit from discrete tax items, primarily related to U.S. federal tax

settlements, added $0.07 per diluted

share.

|

|

§

|

A

dilutive impact to Net Earnings related to our 2008 acquisitions of $2.8

million.

|

For 2009,

we used operating profit and cash flows from operations as key indicators of

financial performance and the primary metrics for performance-based incentives.

Other key drivers we focus on to measure how effectively we utilize net assets

in the business include “Accounts Receivable Days Sales Outstanding” (DSO),

“Days Inventory on Hand” (DIOH) and capital expenditures. These key drivers are

discussed in greater depth throughout Management’s Discussion and

Analysis.

Net

Sales

In 2009,

consolidated Net Sales were $595.9 million, a decrease of 15.0% as compared to

2008. Consolidated Net Sales were $701.4 million in 2008, an increase of 5.6%

over 2007.

The

components of the consolidated Net Sales change for 2009 as compared to 2008 and

2008 compared to 2007 were as follows:

|

%

Change

|

%

Change

|

|||

|

Growth

Elements

|

from

2008

|

from

2007

|

||

|

Organic

(Decline) Growth:

|

||||

|

Volume

|

(14%)

|

(5%)

|

||

|

Price

|

1%

|

4%

|

||

|

Organic

Decline

|

(13%)

|

(1%)

|

||

|

Foreign

Currency

|

(3%)

|

2%

|

||

|

Acquisitions

|

1%

|

5%

|

||

|

Total

|

(15%)

|

6%

|

||

The 15.0%

decrease in consolidated Net Sales for 2009 from 2008 was primarily driven

by:

|

§

|

An

organic decline of 13%, which includes a decline in base business

equipment sales volume experienced in almost all geographic regions,

slightly offset by the net benefit from higher year-over-year selling

prices.

|

|

§

|

An

unfavorable direct foreign currency exchange impact of

3%.

|

The 5.6%

increase in consolidated Net Sales for 2008 from 2007 was primarily driven

by:

|

§

|

An

increase of 5% in sales volume due to our March 28, 2008 acquisition of

Sociedade Alfa Ltda. (“Alfa”), our February 29, 2008 acquisition of

Applied Sweepers, Ltd. (“Applied Sweepers”) and our February 1, 2007

acquisition of Floorep Limited

(“Floorep”).

|

|

§

|

A

favorable direct foreign currency exchange impact of

2%.

|

|

§

|

An

organic decline of 1%, which includes a decline in base business volume,

primarily within North America, partially offset by the net benefit from

price increases implemented during the

year.

|

The

following table sets forth annual Net Sales by geography and the related percent

change from the prior year (in thousands, except percentages):

|

2009

|

%

|

2008

|

%

|

2007

|

%

|

|||||||||||||||||||

|

North

America

|

$ | 345,766 | (14.0 | ) | $ | 402,174 | (3.7 | ) | $ | 417,757 | 6.8 | |||||||||||||

| Europe, Middle East and Africa |

177,829

|

(18.3 | ) | 217,594 | 18.8 | 183,188 | 17.6 | |||||||||||||||||

|

Other

International

|

72,280 | (11.5 | ) | 81,637 | 29.0 | 63,273 | 21.8 | |||||||||||||||||

|

Total

|

$ | 595,875 | (15.0 | ) | $ | 701,405 | 5.6 | 664,218 | 10.9 | |||||||||||||||

North America – In 2009, North

America Net Sales declined 14.0% to $345.8 million compared with $402.2 million

in 2008. The primary driver of the decrease in Net Sales is attributable to a

decline in equipment unit volume, during the first three quarters of 2009,

somewhat offset by benefits from slightly higher selling prices. There was no

impact from foreign currency translation during 2009.

In 2008,

North America Net Sales declined 3.7% to $402.2 million compared with $417.8

million in 2007. The primary driver of the decrease in Net Sales is attributable

to a decline in equipment unit volume, with the most significant declines

occurring in the fourth quarter as a result of the credit crisis and its impact

on an already sluggish U.S. economy. Partially offsetting these declines were

benefits from pricing actions taken during the year and a net favorable impact

from foreign currency translation. Our acquisition of Applied Sweepers

contributed approximately 1% to North America’s 2008 Net Sales.

Europe, Middle East and Africa

– Europe, Middle East and Africa (“EMEA”) Net Sales in 2009 decreased

18.3% to $177.8 million compared to 2008 Net Sales of $217.6 million.

Unfavorable direct foreign currency exchange effects decreased EMEA Net Sales by

approximately 7% in 2009. Our Applied Sweepers acquisition contributed

approximately 1% to EMEA Net Sales in 2009. EMEA’s organic sales decline of

approximately 12% was primarily due to lower equipment unit volume in most

regions due to weak economic conditions somewhat offset by higher equipment unit

volume in the UK and Italy and slightly higher selling prices.

EMEA Net

Sales in 2008 increased 18.8% to $217.6 million compared to 2007 Net Sales of

$183.2 million. Favorable direct foreign currency exchange effects increased

EMEA Net Sales by approximately 6% in 2008. Our Applied Sweepers acquisition

contributed approximately 14% to EMEA’s 2008 Net Sales. EMEA’s organic sales

were essentially flat in 2008 when compared to 2007. Pricing increases and

volume growth in emerging markets were offset by lower sales of equipment in the

mature markets within Europe. The majority of the equipment unit volume decline

occurred in the fourth quarter following the global credit crisis and a

significant slowdown in these economies.

Other International – Our

Other International markets are comprised of the following key geographic

regions: China and other Asia Pacific markets, Japan, Australia and Latin

America. Other

International Net Sales in 2009 decreased 11.5% to $72.3 million over 2008 Net

Sales of $81.6 million. Our Alfa acquisition contributed approximately 2% to

Other International Net Sales in 2009, while unfavorable direct foreign currency

exchange effects decreased Net Sales by approximately 1% in 2009. Other

International’s organic sales decline of approximately 12% was primarily due to

lower equipment unit volume in Latin America due to weak economic conditions

somewhat offset by higher equipment unit volume in Australia and

China.

Other

International Net Sales in 2008 increased 29.0% to $81.6 million over 2007 Net

Sales of $63.3 million. Growth in Net Sales was driven in part by organic

growth, resulting from expanded market coverage in Brazil and China as well as a

net benefit from pricing actions taken during the year. Our acquisitions

contributed approximately 12% to Other International’s 2008 Net Sales. Price

increases also contributed to the 2008 growth in Net Sales. Favorable direct

foreign currency exchange effects increased Net Sales in Other International

markets by approximately 3% in 2008.

Gross

Profit

Gross

Margin was 41.3% in 2009, an increase of 50 basis points as compared to 2008.

Gross Margin was unfavorably impacted by the decline in equipment unit volume as

compared to the prior year; however, this was more than offset by commodity

price deflation, cost reductions, flexible production management and savings

from workforce reductions.

Gross

Margin was 40.8% in 2008, down 120 basis points as compared to 2007. Although

benefits from pricing actions and cost reduction initiatives were able to

essentially offset higher raw material and purchased component costs during

2008, the inability to leverage the fixed manufacturing costs in our plants, due

to the significant decline in unit volume experienced in the fourth quarter,

drove a decline in margins year over year. Gross Margin was also impacted by an

unfavorable sales mix and by the inclusion of $1.2 million in expense from the

flow-through of fair market value inventory step-up from our acquisitions of

Applied Sweepers and Alfa.

Operating

Expenses

Research and Development Expense –

Research and Development Expense (“R&D Expense”) decreased $1.3

million, or 5.4%, in 2009 compared to 2008 and increased 40 basis points to 3.9%

as a percentage of Net Sales. Despite lower sales levels in 2009 investments

continued to be made in key research and development projects and

technologies.

R&D

Expense increased $0.4 million, or 1.8%, in 2008 compared to 2007 and decreased

10 basis points to 3.5% as a percentage of Net Sales.

Selling and Administrative Expense –

S&A Expense decreased by $41.4 million, or 17.0%, in 2009 compared to

2008. As a percentage of Net Sales, 2009 S&A Expense decreased 80 basis

points to 33.9%. S&A Expense benefited from decreased headcount in 2009 due

to the fourth quarter 2008 workforce reduction, decreased selling costs

associated with a lower level of sales and delays in discretionary spending,

partially offset by higher incentives as compared to the prior period due to

strong operating profit results and cash flows from operations. Favorable

foreign currency exchange was approximately $3.4 million in 2009.

S&A

Expense increased by $37.4 million, or 18.1%, in 2008 compared to 2007. The

inclusion of expense from our 2008 acquisitions of Applied Sweepers, Alfa and

Shanghai ShenTan Mechanical and Electrical Equipment Co. Ltd. (“Shanghai

ShenTan”) added $10.7 million to S&A Expense during 2008. S&A Expense

included a $14.6 million workforce reduction charge as discussed in Note 3 to

the Consolidated Financial Statements. S&A Expense was also impacted by a

significant increase in bad debt expense of $3.4 million resulting from

increased Accounts Receivable reserves due to the global credit crisis and a

write-off of $1.8 million related to technology investments that will be

replaced by new solutions. Unfavorable foreign currency exchange was

approximately $4.5 million in 2008.

Goodwill Impairment Charge

– During the first

quarter of 2009, we recorded a non-cash pretax goodwill impairment charge of

$43.4 million related to our EMEA reporting unit. All but $3.8 million of this

charge is not tax deductible.

Gain on Divestiture of Assets

– We sold assets

related to our Centurion line of sweepers during the second quarter of 2008 for

a pretax gain of $0.2 million.

Gain on Sale of Facility

– We

completed the sale of our Maple Grove, Minnesota facility during the fourth

quarter of 2007 for a net pretax gain of $6.0 million.

Total

Other Income (Expense), Net

Interest Income – Interest

Income was $0.4 million in 2009, a decrease of $0.6 million from 2008. The

decrease reflects the impact of a lower level of cash on hand during 2009 as

compared to 2008 as well as a slightly lower interest rate.

Interest

Income was $1.0 million in 2008, a decrease of $0.8 million from 2007. The

decrease between 2008 and 2007 reflects the impact of a decline in interest

rates between periods on lower average cash levels.

Interest Expense – Interest

Expense was $2.8 million in 2009 as compared to $3.9 million in 2008. This

decline is primarily due to significant repayments of debt during 2009 as

compared to 2008.

Interest

Expense was $3.9 million in 2008 as we became a net debtor during the first

quarter of 2008 borrowing against our revolving credit facility, primarily to

fund the two acquisitions that closed during the first quarter of

2008.

Net Foreign Currency Transaction

Gains (Losses) – Net Foreign Currency Transaction Gains decreased $1.8

million between 2009 and 2008 from a $1.4 million net gain in 2008 to a $0.4

million net loss during 2009. Included in the 2008 net gain of $1.4 million was

a $2.7 million net foreign currency gain from the settlement of forward

contracts related to a British pound denominated loan, partially offset by a

$0.9 million unfavorable movement in the foreign currency exchange rates related

to a deal contingent non-speculative forward contract. There were no

individually significant transactions in the 2009 activity, resulting in a net

unfavorable impact from other foreign currency fluctuations between

years.

Net

Foreign Currency Transaction Gains increased $1.3 million between 2008 and

2007. A

$2.7 million net foreign currency gain from the settlement of forward contracts

related to a British pound denominated loan was the most significant contributor

to the change between years. This gain was partially offset by the $0.9 million

unfavorable movement in the foreign currency exchange rates related to a deal

contingent non-speculative forward contract that we entered into that fixed the

cash outlay in U.S. dollars for the Alfa acquisition in the first quarter of

2008. The remaining change was due to a net favorable impact from other foreign

currency fluctuations between years.

ESOP Income – ESOP Income decreased

$1.2 million between 2009 and 2008 due to a lower average stock price. We

benefit from ESOP Income when the shares held by Tennant’s ESOP Plan are

utilized and the basis of those shares is lower than the current average stock

price. This benefit is offset in periods when the number of shares needed

exceeds the number of shares available from the ESOP as the shortfall must be

issued at the current market rate, which is generally higher than the basis of

the ESOP shares. We issued additional shares throughout 2009 as we experienced a

lower average stock price during 2009 as compared to 2008. On December 31, 2009,

the ESOP loan matured and was repaid to us, completing the twenty year term for

this plan.

ESOP

Income decreased $0.3 million between 2008 and 2007 due to a lower average stock

price. We benefit from ESOP Income when the shares held by Tennant’s ESOP Plan

are utilized and the basis of those shares is lower than the current average

stock price. This benefit is offset in periods when the number of shares needed

exceeds the number of shares available from the ESOP as the shortfall must be

issued at the current market rate, which is generally higher than the basis of

the ESOP shares. During the year ended 2008 compared to 2007, we experienced a

lower average stock price and issued additional shares during the fourth quarter

of 2008.

Other Income (Expense), Net –

The $1.7 million decrease in Other Expense, Net between 2009 and 2008 was

primarily due to a decrease in discretionary contributions to Tennant’s

charitable foundation.

Other

Expense, Net increased $1.0 million between 2008 and 2007. The increase in Other

Expense, Net was primarily due to an increase in discretionary contributions to

Tennant’s charitable foundation.

Income

Taxes

Our

effective income tax rate was 7.9%, 39.6% and 30.9% in 2009, 2008 and 2007,

respectively. The 2009 tax expense includes only a $1.1 million tax benefit

associated with the $43.4 million impairment of Goodwill recorded in the first

quarter, materially impacting the overall rate. Excluding the $1.1 million tax

benefit associated with the first quarter goodwill impairment, the 2009

effective tax rate would have been 15.7%. The 2009 tax expense also includes a

$2.3

11

million

tax benefit associated with a United Kingdom business reorganization in the

fourth quarter, also materially impacting the overall rate. Excluding the tax

benefit associated with the first quarter goodwill impairment and the fourth

quarter United Kingdom business reorganization, the 2009 effective tax rate

would have been 27.8%. The decrease in the 2009 effective tax rate excluding

these items was substantially related to changes in our operating profit by

taxing jurisdiction.

During

2008, we had a negative impact due to a correction of an immaterial error

related to reserves for uncertain tax positions covering tax years 2004 to 2006.

The change in the 2008 rate as compared to 2007 was also negatively impacted due

to the 2007 favorable one-time discrete item related to the reversal of a German

valuation allowance, as noted below.

During

2007, a favorable one-time discrete item of $3.6 million related to the reversal

of a German valuation allowance, net of the impact of tax rate changes in

foreign jurisdictions on deferred taxes, was recognized in the third quarter. It

was determined that it was now more likely than not that a tax loss carryforward

in Germany will be utilized in the future and accordingly the valuation

allowance on the related deferred tax asset was reduced to zero.

Liquidity

and Capital Resources

Liquidity – Cash and Cash

Equivalents totaled $18.1 million at December 31, 2009, as compared to $29.3

million of Cash and Cash Equivalents as of December 31, 2008. Cash and Cash

Equivalents held by our foreign subsidiaries totaled $10.1 million as of

December 31, 2009 as compared to $14.6 million of Cash and Cash Equivalents held

by our foreign subsidiaries as of December 31, 2008. Wherever possible, cash

management is centralized and intercompany financing is used to provide working

capital to subsidiaries as needed. Our current ratio was 1.9 and 2.3 as of

December 31, 2009 and 2008, based on working capital of $99.8 million and $143.3

million, respectively.

Our

Debt-to-Capital ratio was 15.7% as of December 31, 2009, compared with 31.2% as

of December 31, 2008. Our capital structure was comprised of $34.2

million of Long-Term Debt and $184.3 million of Shareholders’ Equity as of

December 31, 2009.

On July

29, 2009, we filed a shelf registration statement with the SEC to facilitate any

future issuances of debt securities, preferred stock, depository shares and

common stock up to $175.0 million. This shelf registration statement was

declared effective by the SEC on December 15, 2009.

On July

29, 2009, we entered into a Private Shelf Agreement (the “Shelf Agreement”) with

Prudential Investment Management, Inc. (“Prudential”) and Prudential affiliates

from time to time party thereto. The Shelf Agreement provides us and our

subsidiaries access to uncommitted, senior secured, debt capital with a maximum

aggregate principal amount of $80.0 million. There was no balance outstanding

under this credit facility as of December 31, 2009.

Cash Flow Summary – Cash

provided by (used in) our operating, investing and financing activities is

summarized as follows (in thousands):

|

2009

|

2008

|

2007

|

||||||||||

|

Operating

Activities

|

$ | 75,185 | $ | 37,394 | $ | 39,640 | ||||||

|

Investing

Activities:

|

||||||||||||

|

Purchases

of Property, Plant and

Equipment, Net of Disposals

|

(11,172 | ) | (19,982 | ) | (21,466 | ) | ||||||

|

Acquisitions

of Businesses, Net

of Cash Acquired

|

(2,162 | ) | (81,845 | ) | (3,141 | ) | ||||||

|

Change

in Short-Term Investments

|

- | - | 14,250 | |||||||||

|

Financing

Activities

|

(74,068 | ) | 62,075 | (26,679 | ) | |||||||

|

Effect

of Exchange Rate Changes on

Cash and Cash Equivalents

|

994 | (1,449 | ) | (533 | ) | |||||||

|

Net

Increase (Decrease) in Cash

and Cash Equivalents

|

$ | (11,223 | ) | $ | (3,807 | ) | $ | 2,071 | ||||

Operating Activities – Cash

provided by operating activities was $75.2 million in 2009, $37.4 million in

2008 and $39.6 million in 2007. In 2009, cash provided by operating activities

was driven by strong working capital management, offset somewhat by a decrease

in Employee Compensation and Benefits and Other Accrued Expenses due in part to

the cash payments in 2009 for the workforce reduction, which were accrued in

2008. Cash flow provided by operating activities was $37.8 million higher

in 2009 compared to 2008. This increase was primarily driven by a reduction in

Inventories and an increase in Income Taxes Payable and Accounts Payable, offset

by a decrease in Employee Compensation and Benefits and Other Accrued

Expenses.

In 2008,

cash provided by operating activities was driven by Net Earnings, as well as

increases in Employee Compensation and Benefits and Other Accrued Expenses and

Accounts Receivable, partially offset by a decrease in Income Taxes

Payable/Prepaid.

As

discussed previously, two metrics used by management to evaluate how effectively

we utilize our net assets are “Accounts Receivable Days Sales Outstanding” (DSO)

and “Days Inventory on Hand” (DIOH), on a FIFO basis. The metrics are calculated

on a rolling three month basis in order to more readily reflect changing trends

in the business. These metrics for the quarters ended December 31 were as

follows (in days):

|

2009

|

2008

|

2007

|

||||

|

DSO

|

67

|

77

|

61

|

|||

|

DIOH

|

87

|

101

|

83

|

DSO

decreased 10 days in 2009 compared to 2008 primarily due to our proactive

management of risk in this area by increasing focus on credit reviews and credit

limits and more aggressively pursuing collection of past due balance in light of

the more difficult economic environment.

DIOH

decreased 14 days in 2009 compared to 2008 primarily due to lower levels of

inventory as a result of inventory reduction initiatives.

Investing Activities – Net

cash used for investing activities was $13.3 million in 2009, $101.8 million in

2008 and $10.4 million in 2007. The primary use of cash in investing activities

during 2009 was net capital expenditures, which totaled $11.2

million.

Net

capital expenditures were $11.2 million during 2009 compared to $20.0 million in

2008. Net capital expenditures were $21.5 million in 2007. Capital expenditures

in 2009 included technology upgrades, tooling related to new product development

and investments in our Minnesota facilities to complete the Global Innovation

Center to support new product innovation efforts. Net capital expenditures in

2008 included upgrades to our information technology systems and related

infrastructures and investments in tooling in support of new products, as well