Attached files

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-K

|

x

|

ANNUAL REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For

the fiscal year ended December 31, 2009

or

|

¨

|

TRANSITION REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For

the transition period from

to

Commission

File Number: 0-26640

POOL

CORPORATION

(Exact

name of Registrant as specified in its charter)

|

Delaware

|

36-3943363

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

(I.R.S.

Employer

Identification

No.)

|

|

109

Northpark Boulevard, Covington, Louisiana

|

70433-5001

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

985-892-5521

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

Name

of each exchange on which registered

|

|

Common

Stock, par value $0.001 per share

|

NASDAQ

Global Select Market

|

Securities

registered pursuant to Section 12(g) of the Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. YES x NO ¨

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or 15(d) of the Act. YES ¨ NO x

Indicate

by check mark whether the registrant (1) has filed all reports required to

be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the Registrant

was required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days.

YES x NO ¨

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulations S-T during the

preceding 12 months (or for such shorter period that the registrant was required

to submit and post such files). YES ¨ NO ¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein and will not be contained, to the best of

the Registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. ¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

Large

accelerated filer x Accelerated

filer ¨

Non-accelerated

filer ¨

(Do not check if a smaller reporting

company) Smaller

reporting company ¨

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Act). YES ¨ NOx

The

aggregate market value of voting and non-voting common equity held by

non-affiliates of the Registrant based on the closing sales price of the

Registrant’s common stock as of June 30, 2009 was

$776,671,055.

As of

February 22, 2010, the Registrant had 49,164,271 shares of common

stock outstanding.

Documents

Incorporated by Reference

Portions

of the Registrant’s Proxy Statement to be mailed to stockholders on or about

March 26, 2010 for the

Annual

Meeting to be held on May 4, 2010, are incorporated by reference in

Part III of this Form 10-K.

POOL

CORPORATION

TABLE

OF CONTENTS

|

Page

|

||

|

PART

I.

|

||

|

Item

1.

|

1

|

|

|

Item

1A.

|

8

|

|

|

Item

1B.

|

11

|

|

|

Item

2.

|

12

|

|

|

Item

3.

|

14

|

|

|

PART

II.

|

||

|

Item

5.

|

14

|

|

|

Item

6.

|

16

|

|

|

Item

7.

|

17

|

|

|

Item

7A.

|

37

|

|

|

Item

8.

|

38

|

|

|

Item

9.

|

67

|

|

|

Item

9A.

|

67

|

|

|

Item

9B.

|

70

|

|

|

PART III.

|

||

|

Item

10.

|

70

|

|

|

Item

11.

|

70

|

|

|

Item

12.

|

70

|

|

|

Item

13.

|

70

|

|

|

Item

14.

|

70

|

|

|

PART

IV.

|

||

|

Item

15.

|

71

|

|

|

72

|

||

Item

1. Business

General

Based on

industry data, Pool Corporation (the Company, which may be

referred to as POOL, we, us

or our) is the

world’s largest wholesale distributor of swimming pool supplies, equipment and

related leisure products and one of the top three distributors of landscape and

irrigation products in the United States. The Company was

incorporated in the State of Delaware in 1993 and has grown from a regional

distributor to a multi-national, multi-network distribution

company.

Our

industry is highly fragmented, and as such, we add considerable value to the

industry by purchasing products from a large number of manufacturers and then

distributing the products and offering a range of services to our customer base

on conditions that are more favorable than these customers could obtain on their

own.

As of

December 31, 2009 we operated 287 sales centers in North America and Europe

through our three distribution networks: SCP Distributors LLC (SCP), Superior

Pool Products LLC (Superior) and Horizon Distributors, Inc.

(Horizon). Superior and Horizon are both wholly owned subsidiaries of

SCP, which is wholly owned by Pool Corporation.

Our

Industry

We

believe that the swimming pool industry is relatively young, with room for

continued growth from increased penetration of new pools. Of the

approximately 70 million homes in the United States that have the economic

capacity and the yard space to have a swimming pool, approximately 13% own a

pool. Higher rates of new home construction from 1996 to 2005 have

added to the market expansion opportunity for pool ownership, particularly in

larger pool markets.

We

believe favorable demographic and socioeconomic trends have and will continue to

positively impact the long-term prospects of our industry. These

favorable trends include the following:

|

·

|

long-term

growth in housing units in warmer markets due to the population migration

towards the south, which contributes to the growing installed base of

pools that homeowners must

maintain;

|

|

·

|

increased

homeowner spending on outdoor living spaces for relaxation and

entertainment; and

|

|

·

|

consumers

bundling the purchase of a swimming pool and other products, with new

irrigation systems and landscaping often being key components to both pool

installations and remodels.

|

The

irrigation and landscape industry has many characteristics in common with the

pool industry, and we believe that it benefits from the same favorable

demographic and socioeconomic trends and will realize long-term growth rates

similar to the pool industry.

Approximately

70% of consumer spending in the pool industry is derived from the maintenance of

existing swimming pools. Maintaining proper chemical balance and the

related upkeep and repair of swimming pool equipment, such as pumps, heaters,

filters and safety equipment creates a non-discretionary demand for pool

chemicals, equipment and other related parts and supplies. We also

believe cosmetic considerations such as a pool’s appearance and the overall look

of backyard environments create an ongoing demand for other maintenance related

goods and certain discretionary products.

We believe

that the recurring nature of the maintenance and repair market has helped

maintain a relatively consistent rate of industry growth historically, and has

helped cushion the negative impact on revenues in periods when unfavorable

economic conditions and softness in the housing market adversely impact pool

construction activities such as 2006 through 2009.

1

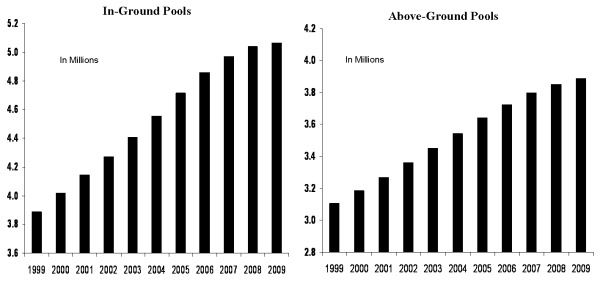

The table

below reflects growth in the domestic installed base of in-ground and

above-ground swimming pools over the past 11 years (based on Company estimates

and information from 2007 P.K. Data, Inc. reports):

The

replacement and refurbish market includes major swimming pool repairs and

currently accounts for approximately 20% of consumer spending in the pool

industry. This activity is more sensitive to economic factors that

impact consumer spending compared to the maintenance and minor repair

market. New swimming pool construction comprises the bulk of the

remaining consumer spending in the pool industry. The demand for new pools

is driven by the perceived benefits of pool ownership including relaxation,

entertainment, family activity, exercise and convenience. The

industry competes for new pool sales against other discretionary consumer

purchases such as kitchen and bathroom remodeling, boats, motorcycles,

recreational vehicles and vacations.

The

landscape and irrigation distribution business is split between residential and

commercial markets, with the majority of sales related to the residential

market. Landscape and irrigation maintenance activities account for

40% of total spending in the irrigation industry, with the remaining 60% of

spending related to irrigation construction and other discretionary related

products. As such, our irrigation business is more heavily weighted

towards the sale of discretionary related products compared to our pool

business.

General economic

conditions (as commonly measured by Gross Domestic Product or GDP), the

availability of consumer credit and certain trends in the

housing market affect our industry, particularly new pool and irrigation system

starts. Positive GDP trends may have a favorable impact on

industry starts, while negative trends may be unfavorable for industry

starts. We believe there is a direct correlation between industry

starts and the rate of housing turnover and home appreciation over time, with

higher rates of home turnover and appreciation having a positive impact on

starts over time. We also believe that homeowners’ access to consumer

credit, particularly as facilitated by mortgage-backed financing markets, is a

critical enabling factor in the purchase of new swimming pools and irrigation

systems.

The

continuing adverse economic trends that began in 2006 and worsened through 2009

have negatively impacted our industry and our performance. Specific

issues included a slowdown in the domestic housing market, with lower housing

turnover, a sharp drop in new home construction, home value deflation in many

markets and a significant tightening of consumer and commercial

credit. The downturn in the real estate and credit markets that began

in 2006 was compounded by the overall deterioration in general economic

conditions in late 2008 and throughout 2009. These trends resulted in

significant decreases in new construction activities, and we estimate that pool

construction has declined approximately 80% since 2005. Pool

refurbishment and replacement activities were also significantly impacted as

consumers began to defer discretionary purchases as the economy

worsened. The impact of these trends was more severe in 2007 and 2008

in some of the largest pool markets including California, Florida and Arizona,

with a more recent adverse impact in Texas and other states.

Since

irrigation is more heavily weighted towards new construction activities, this

has resulted in a greater impact on our Horizon business as new home and

commercial construction rates have fallen. We have consolidated

several facilities and significantly reduced operating costs related to our

Horizon network, and we expect these measures will mitigate the greater rate of

earnings decline for our irrigation business.

2

We are

encouraged by indications that the downward economic trends of the past several

years are moderating, which is evidenced by the fact that the level of sales

declines in the major pool markets first impacted by the negative external

trends diminished as 2009 progressed. The landscape and irrigation

markets that we participate in have not yet shown improvement as these markets

tend to lag the trends in the corresponding pool markets by up to a

year.

We

believe there is potential for significant sales recovery over the next several

years, driven by both the aging of the installed base of in-ground pools and

pent-up demand for replacement and retrofit activity that consumers have

deferred due to recent market conditions. We also anticipate that new

pool and irrigation construction activities will gradually begin to return to

more normalized levels, but we expect the replacement

and refurbish market will rebound before the new construction market and believe

it may be 2011 before there is growth in new construction

activities. We expect that sales levels should once again benefit

from long-term industry growth dynamics and that over the long-term the industry

will return to an annual growth rate of approximately 2% to 6% when the overall

economy does rebound and the real estate and credit markets revert to

normal.

Our

industry is seasonal and weather is one of the principal external factors that

affect our business. Peak industry activity occurs during the warmest

months of the year, typically April through September. Unseasonable

warming or cooling trends can delay or accelerate the start or end of the pool

and landscape season, impacting our maintenance and repair

sales. These impacts at the shoulders of the season are generally

more pronounced in northern markets. Weather also impacts our sales

of construction and installation products to the extent that above average

precipitation, late spring thaws in northern markets and other extreme weather

conditions delay, interrupt or cancel current or planned construction and

installation activities.

The

industry is also affected by other factors including, but not limited to,

consumer attitudes toward pool and landscape products for environmental or

safety reasons.

Business

Strategy and Growth

Our

mission is to provide exceptional value to our customers and suppliers, in order

to provide exceptional return to our shareholders while providing exceptional

opportunities to our employees. Our three core strategies are to

promote the growth of our industry, to promote the growth of our customers’

businesses and to continuously strive to operate more effectively.

We

promote the growth of the industry through various advertising and promotional

programs intended to raise consumer awareness of the benefits and affordability

of pool ownership, the ease of pool maintenance and the many ways in which a

pool and the surrounding spaces may be enjoyed beyond swimming. These

programs include media advertising, industry-oriented website development such

as www.swimmingpool.com™

and public relations campaigns. We use these programs as tools to

educate consumers and lead prospective pool owners to our

customers.

We

promote the growth of our customers’ businesses by offering comprehensive

support programs that include promotional tools and marketing support to help

our customers generate increased sales. Our uniquely tailored

programs include such features as customer lead generation, personalized

websites, brochures, marketing campaigns and business development

training. As a customer service, we also provide certain retail store

customers assistance with everything from site selection to store layout and

design to business management system implementation. These benefits

and other exclusive services are offered through our retail brand licensing

program called The Backyard Place®, which is one of

our key growth initiatives. In return for these services, customers

make commitments to meet minimum purchase levels, stock a minimum of nine

specific product categories and operate within The Backyard Place® guidelines

(including weekend hour requirements)

. We launched The Backyard Place® program in 2006

and we currently have over 120 agreements with retail store

customers. Our total sales to these customers grew 15% in 2009

compared to 2008.

In

addition to our efforts aimed at industry and customer growth, we strive to

operate more effectively by continuously focusing on improvements in our

operations such as product sourcing, procurement and logistics initiatives,

adoption of enhanced business practices and improved working capital

management. We have increased our product breadth (as described

in the “Customers and Products” section below) and expanded our sales center

networks through acquisitions, new sales center openings and expansions of

existing sales centers. Historically, acquisitions have been an

important source of sales growth.

3

Since

2005, we have opened 18 new sales centers (net of subsequent closings and

consolidations of new sales centers) and successfully completed 9 acquisitions

consisting of 74 sales centers (net of sales center closings and consolidations

within one year of acquisition). Given the current challenging

external environment, we did not open any new sales centers in 2009 and expect

to open only two new sales centers in 2010. We plan to continue to

selectively expand our domestic swimming pool distribution networks and to take

advantage of opportunities to further expand our domestic irrigation and

international swimming pool distribution networks via both acquisitions and new

sales center openings. We plan to make strategic acquisitions to

further penetrate existing markets and expand into both new geographic markets

and new product categories. For additional discussion of our recent

acquisitions, see Note 2 of “Notes to Consolidated Financial Statements,”

included in Item 8 of this Form 10-K.

Based

upon industry data, we believe our industry grew at a 2% to 6% annual rate for

the period between 2000 and 2005 but contracted each year between 2006 and

2009. Historically, our sales growth has exceeded the industry’s

growth rates and allowed us to increase market share. We believe that

our high service levels and expanded product offerings have also enabled us to

gain market share during the past four years as our industry

contracted. Going forward, we expect to realize sales growth higher

than the industry average due to increases in market share and further expansion

of our product offerings.

We

estimate that pricing inflation has averaged 1% to 3% annually in our industry

over the past 10 years. In 2010, we do not expect industry price

increases after experiencing above average inflationary increases in product

costs in 2008 and 2009. We generally pass industry price increases

through the supply chain and make strategic volume inventory purchases ahead of

vendor price increases. Based on the volume inventory purchases we

made ahead of vendor price increases in the second half of 2008, we realized a

favorable impact to gross margin in the first half of 2009. Since

there were no similar late season vendor price increases in 2009, we expect

tough gross margin comparisons to 2009 in the first half of 2010.

Customers

and Products

We serve

roughly 70,000 customers, none of which account for more than 1% of our

sales. We primarily serve five types of customers:

|

·

|

swimming

pool remodelers and builders;

|

|

·

|

retail

swimming pool stores;

|

|

·

|

swimming

pool repair and service businesses;

|

|

·

|

landscape

construction and maintenance contractors;

and

|

|

·

|

golf

courses.

|

The

majority of these customers are small, family owned businesses with relatively

limited capital resources. The current economic environment has had

the greatest impact on swimming pool remodelers and builders and landscape

construction companies. We have seen a modest contraction in our

customer base in these segments over the last three years.

We

conduct our operations through over 280 sales centers in North America and

Europe. Our primary markets, which have the highest concentration of swimming

pools, are California, Florida, Texas and Arizona, representing approximately

51% of our net sales in 2009. We use a combination of local and

international sales and marketing personnel to promote the growth of our

business and develop and strengthen our customers’ businesses. Our

sales and marketing personnel focus on developing customer programs and

promotional activities, creating and enhancing sales management tools and

providing product and market expertise. Our local sales personnel

work from the sales centers and are charged with understanding and meeting our

customers’ specific needs.

We offer

our customers more than 100,000 national brand and Pool Corporation branded

products. We believe that our selection of pool equipment, supplies,

chemicals, replacement parts, irrigation and landscape products and

complementary products is the most comprehensive in the industry. The

products we sell can be categorized as follows:

|

·

|

maintenance

products such as chemicals, supplies and pool

accessories;

|

|

·

|

repair

and replacement parts for cleaners, filters, heaters, pumps and

lights;

|

|

·

|

packaged

pool kits including walls, liners, braces and coping for in-ground and

above-ground pools;

|

4

|

·

|

pool

equipment and components for new pool construction and the remodeling of

existing pools;

|

|

·

|

irrigation

and landscape products, including professional lawn care equipment;

and

|

|

·

|

complementary

products, which consists of a number of product categories and

includes:

|

|

–

|

building

materials used for pool installations and remodeling, such as concrete,

plumbing and electrical components and pool surface and decking materials;

and

|

|

–

|

other

discretionary recreational and related outdoor lifestyle products that

enhance consumers’ use and enjoyment of outdoor living spaces, such as

pool toys and games, spas and

grills.

|

We track and monitor the

majority of our sales by various product lines and product categories, primarily

for consideration in incentive plan programs and to provide support for sales

and marketing efforts. We currently have over 300 product lines and

over 40 product categories. Based on our 2009 product

classifications, sales for our pool and spa chemicals product category as a

percentage of total net sales was 17% in 2009, 14% in 2008 and 12% in

2007. We attribute this growth to increases in our market share, a

shift in product mix resulting from the decline in construction related products

and chemical price increases. No other product category accounted for

10% or more of total net sales in any of the last three fiscal

years.

We

categorize our maintenance, repair and replacement products into the following

two groupings:

|

·

|

maintenance

and minor repair (non-discretionary);

and

|

|

·

|

major

repair and refurbishment (partially

discretionary).

|

Maintenance

and minor repair products are primarily non-discretionary in nature, meaning

that these items must be purchased by end users to maintain existing swimming

pools and landscaped areas. In 2009, the sale of maintenance and

minor repair products accounted for approximately 70% of our sales and gross

profits while approximately 30% of sales and gross profits were derived from the

replacement, construction and installation (equipment, materials, plumbing,

electrical, etc.) of pools and landscaping. This reflects a shift

toward more sales of maintenance and minor repair products due to the

significant declines in new pool construction over the past four

years. Historically, just over 50% of our total sales and gross

profits were related to maintenance and repair products.

With our

acquisition of National Pool Tile (NPT) in 2008, our focus in 2009 included

expanding the number of sales center locations that offer NPT’s tile and

composite pool finish products. Another recent example of our product

initiatives is the expansion of our replacement parts offerings. This

includes the continued expansion of our Pool Corporation branded products, which

has contributed to our improvement of gross margin.

Complementary product sales have also been an important factor in our historical base business sales growth, but have declined over the past several years since the majority of these products are related to construction activities or are discretionary by nature. We continue to identify other product categories that could become part of our complementary product offerings in the future. We typically introduce two to three categories each year in certain markets. We then evaluate the performance of these test categories and focus on those which we believe exhibit long-term growth potential. We intend to continue to expand our complementary products initiative by increasing the number of locations which offer complementary products, increasing the number of complementary products offered at certain locations and continuing a modest broadening of the product offerings on a company-wide basis.

Operating

Strategy

We

operate three distribution networks: the SCP network, the

Superior network and the Horizon network. The SCP network

consists of 168 sales centers, including 12 sales centers in Europe, the

Superior network consists of 62 sales centers and the Horizon network consists

of 57 sales centers. We distribute swimming pool supplies, equipment

and related leisure products through our SCP and Superior networks, and we

distribute irrigation and landscape products through our Horizon

network.

5

We

adopted the strategy of operating two distinct distribution networks within the

swimming pool marketplace primarily for two reasons:

|

1.

|

To

offer our customers a choice of different distributors, featuring

distinctive product selections and service personnel;

and

|

|

|

2.

|

To

increase the level of customer service and operational efficiency provided

by the sales centers in each network by promoting healthy competition

between the two networks.

|

We

evaluate our sales centers based upon their performance relative to

predetermined standards that include both financial and operational

measures. Our corporate support groups provide our field operations

with various services including customer and vendor related programs,

information systems support and expert resources to help them achieve their

goals. We believe our incentive programs and feedback tools, along

with the competitive nature of our internal networks, stimulate and enhance

employee performance.

Distribution

Our sales

centers are located near customer concentrations, typically in industrial,

commercial or mixed-use zones. Customers may pick up products at any

sales center location, or products may be delivered via our trucks or third

party carriers.

Our sales

centers maintain well-stocked inventories to meet customers’ immediate

needs. We utilize warehouse management technology to optimize

receiving, inventory control, picking, packing and shipping

functions.

We also

operate 10 centralized shipping locations that redistribute products we purchase

in bulk quantities to our sales centers or directly to customers.

Purchasing

and Suppliers

We enjoy

good relationships with our suppliers, who generally offer competitive pricing,

return policies and promotional allowances. It is customary in our

industry for manufacturers to seasonally offer extended payment terms to

qualifying purchasers such as POOL. These terms are typically available to us

for pre-season or early season purchases.

We

initiated a preferred vendor program in 1999 which encourages our buyers to

purchase products from a smaller number of vendors. We work closely

with these vendors to develop programs and services to better meet the needs of

our customers and to concentrate our purchasing activities. These

practices, together with a more comprehensive service offering, have resulted in

improved margins at the sales center level.

We

regularly evaluate supplier relationships and consider alternate sourcing to

assure competitive cost, service and quality standards. Our largest

suppliers include Pentair Corporation, Hayward Pool Products, Inc. and Zodiac

Pool Systems, Inc., which accounted for approximately 16%, 10% and 8%,

respectively, of the cost of products we sold in 2009.

Competition

Based on

industry knowledge and available data, management believes we are the largest

wholesale distributor of swimming pool and related backyard products and the

only truly national wholesale distributor focused on the swimming pool industry

in the United States. We are also one of the top three distributors

of landscape and irrigation products in the United States, and we compete

against one national wholesale distributor of these products. We face

intense competition from many regional and local distributors in our markets and

to a lesser extent, mass-market retailers and large pool supply retailers with

their own internal distribution networks.

Some

geographic markets we serve, particularly our four largest, higher density

markets in California, Florida, Texas and Arizona, are more competitive than

others. Barriers to entry in our industry are relatively low. We

compete with other distributors for rights to distribute brand-name

products. If we lose or are unable to obtain these rights, we might

be materially and adversely affected. We believe that the size of our operations

allows us to compete favorably for such distribution rights.

6

We

believe that the principal competitive factors in swimming pool and landscape

supply distribution are:

|

·

|

the

breadth and availability of products

offered;

|

|

·

|

the quality and level of customer

service;

|

|

·

|

the breadth and depth of sales and marketing

programs;

|

|

·

|

consistency and stability of business relationships with

customers;

|

|

·

|

competitive product pricing; and

|

|

·

|

access to commercial credit to finance business working

capital.

|

We

believe that we generally compete favorably with respect to each of these

factors.

Seasonality

and Weather

For a

discussion regarding seasonality and weather, see Item 7, “Management’s

Discussion and Analysis of Financial Condition and Results of Operations -

Seasonality and Quarterly Fluctuations,” of this Form 10-K.

Environmental,

Health and Safety Regulations

Our

business is subject to regulation under local fire codes and international,

federal, state and local environmental and health and safety requirements,

including regulation by the Environmental Protection Agency, the Consumer

Product Safety Commission, the Department of Transportation, the Occupational

Safety and Health Administration, the National Fire Protection Agency and the

International Maritime Organization. Most of these requirements govern the

packaging, labeling, handling, transportation, storage and sale of chemicals and

fertilizers. We store certain types of chemicals and/or fertilizers at each of

our sales centers and the storage of these items is strictly regulated by local

fire codes. In addition, we sell algaecides and pest control products that are

regulated as pesticides under the Federal Insecticide, Fungicide and Rodenticide

Act and various state pesticide laws. These laws are primarily related to

labeling, annual registration and licensing.

Employees

We

employed approximately 3,200 people at December 31, 2009. Given the seasonal

nature of our business, our peak employment period is the summer and depending

on expected sales levels, we add 200 to 500 employees to our work

force to meet seasonal demand.

Intellectual

Property

We

maintain both domestic and foreign registered trademarks primarily for our

private label products that are important to our current and future business

operations. We also own rights to several Internet domain names.

Geographic

Areas

Net sales

by geographic region were as follows for the past three fiscal years (in

thousands):

|

Year

Ended December 31,

|

||||||||

|

2009

|

2008

|

2007

|

||||||

|

United

States

|

$

|

1,393,513

|

$

|

1,626,869

|

$

|

1,774,771

|

||

|

International

|

146,281

|

156,814

|

153,596

|

|||||

|

$

|

1,539,794

|

$

|

1,783,683

|

$

|

1,928,367

|

|||

Net

property and equipment by geographic region was as follows (in

thousands):

|

December

31,

|

||||||||

|

2009

|

2008

|

2007

|

||||||

|

United

States

|

$

|

27,840

|

$

|

28,931

|

$

|

30,505

|

||

|

International

|

3,592

|

4,117

|

3,718

|

|||||

|

$

|

31,432

|

$

|

33,048

|

$

|

34,223

|

|||

7

Available

Information

Our

annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on

Form 8-K and amendments to those reports filed or furnished pursuant to Section

13(a) or 15(d) of the Securities Exchange Act of 1934 are available free of

charge on our website at www.poolcorp.com as soon as reasonably practical after

we electronically file such reports with, or furnish them to, the Securities and

Exchange Commission.

Additionally,

we have adopted a Code of Business Conduct and Ethics, applicable to all

employees, officers and directors, which is available free of charge on our

website.

Cautionary

Statement for Purposes of the "Safe Harbor" Provisions of the Private Securities

Litigation Reform Act of 1995

Our

disclosure and analysis in this report contains forward-looking information that

involves risks and uncertainties. Our forward-looking statements express our

current expectations or forecasts of possible future results or events,

including projections of future performance, statements of management’s plans

and objectives, future contracts, and forecasts of trends and other matters.

Forward-looking statements speak only as of the date of this filing, and we

undertake no obligation to update or revise such statements to reflect new

circumstances or unanticipated events as they occur. You can identify these

statements by the fact that they do not relate strictly to historic or current

facts and often use words such as “anticipate”, “estimate”, “expect”, “believe,”

“will likely result,” “outlook,” “project” and other words and expressions of

similar meaning. No assurance can be given that the results in any

forward-looking statements will be achieved and actual results could be affected

by one or more factors, which could cause them to differ materially. For these

statements, we claim the protection of the safe harbor for forward-looking

statements contained in the Private Securities Litigation Reform

Act.

Risk

Factors

Certain

factors that may affect our business and could cause actual results to differ

materially from those expressed in any forward-looking statements include the

following:

The

demand for our swimming pool and related outdoor lifestyle products has been and

may continue to be adversely affected by unfavorable economic

conditions.

In

economic downturns, the demand for swimming pool or leisure related products may

decline as discretionary consumer spending, the growth rate of pool eligible

households and swimming pool construction decline. Although maintenance

products and repair and replacement equipment that must be purchased by pool

owners to maintain existing swimming pools currently account for approximately

90% of our net sales and gross profits, the growth of this portion of our

business depends on the expansion of the installed pool base and could also be

adversely affected by decreases in construction activities similar to the trends

between late 2006 and 2009. A weakening economy may also cause deferrals

of discretionary replacement and refurbish activity. In addition,

even in generally favorable economic conditions, severe and/or prolonged

downturns in the housing market could have a material adverse impact on our

financial performance. Such downturns expose us to certain additional

risks, including but not limited to the risk of customer closures or

bankruptcies, which could shrink our potential customer base and inhibit our

ability to collect on those customers’ receivables.

We

believe that homeowners’ access to consumer credit, particularly as facilitated

by mortgage-backed financing markets, is a critical enabling factor in the

purchase of new pool and irrigation systems. The recent unfavorable

economic conditions and downturn in the housing market have resulted in

significant tightening of credit markets, which has limited the ability of

consumers to access financing for new swimming pool and irrigation

systems. If these trends continue or worsen, many consumers will

likely not be able to obtain financing for pool and irrigation projects, which

could negatively impact our sales of construction related products.

8

We

are susceptible to adverse weather conditions.

Weather

is one of the principal external factors affecting our business. For

example, unseasonably late warming trends in the spring or early cooling trends

in the fall can shorten the length of the pool season. Also,

unseasonably cool weather or extraordinary rainfall during the peak season can

decrease swimming pool use, installation and maintenance, as well as landscape

installations and maintenance. These weather conditions adversely affect sales

of our products. Drought conditions or water management initiatives may lead to

municipal ordinances related to water use restrictions, which could result in

decreased pool and irrigation system installations and negatively impact our

sales. While warmer weather conditions favorably impact our sales,

global warming trends and other significant climate changes can create more

variability in the short-term or lead to other unfavorable weather conditions

that could adversely impact our sales or operations. For a discussion

regarding seasonality and weather, see Item 7, “Management’s Discussion and

Analysis of Financial Condition and Results of Operations - Seasonality and

Quarterly Fluctuations,” of this Form 10-K.

Our

distribution business is highly dependent on our ability to maintain favorable

relationships with suppliers.

As a

distribution company, maintaining favorable relationships with our suppliers is

critical to the success of our business. We believe that we add

considerable value to the swimming pool supply chain and landscape supply chain

by purchasing products from a large number of manufacturers and distributing the

products to a highly fragmented customer base on conditions that are more

favorable than these customers could obtain on their own. We believe

that we currently enjoy good relationships with our suppliers, who generally

offer us competitive pricing, return policies and promotional

allowances. However, our inability to maintain favorable

relationships with our suppliers could have an adverse effect on our

business.

Our

largest suppliers are Pentair Corporation, Hayward Pool Products, Inc. and

Zodiac Pool Systems, Inc., which accounted for approximately 16%, 10% and 8%,

respectively, of the costs of products we sold in 2009. A decision by

several suppliers, acting in concert, to sell their products directly to retail

customers and other end-users of their products, bypassing distribution

companies like ours, would have an adverse effect on our

business. Additionally, the loss of a single significant supplier due

to financial failure or a decision to sell exclusively to other distributors,

retail customers or end user consumers could also adversely affect our

business. We dedicate significant resources to promote the benefits

and affordability of pool ownership, which we believe greatly benefits our

swimming pool customers and suppliers.

We

face intense competition both from within our industry and from other leisure

product alternatives.

We face

competition from both inside and outside of our industry. Within our

industry, we compete against various regional and local distributors and, to a

lesser extent, mass market retailers and large pool or landscape supply

retailers. Outside of our industry, we compete with sellers of other

leisure product alternatives, such as boats and motor homes, and with other

companies who rely on discretionary homeowner expenditures, such as home

remodelers. New competitors may emerge as there are low barriers to

entry in our industry. Some geographic markets that we serve,

particularly our four largest, higher density markets in California, Florida,

Texas and Arizona, representing approximately 51% of our net sales in 2009, also

tend to be more competitive than others.

More

aggressive competition by mass merchants and large pool or landscape supply

retailers could adversely affect our sales.

Mass market

retailers today carry a limited range of, and devote a limited amount of

shelf space to, merchandise and products targeted to our

industry. Historically, mass market retailers

have generally expanded by adding new stores and product breadth, but their

product offering of pool and landscape related products has remained relatively

constant. Should mass market retailers increase their focus on the

pool or professional landscape industries, or increase the breadth of their pool

and landscape related product offerings, they may become a more significant

competitor for direct and end-use customers which could have an adverse

impact on our business. We may face additional competitive pressures

if large pool or landscape supply retailers look to expand their customer base

to compete more directly within the distribution channel.

9

We

depend on key personnel.

We

consider our employees to be the foundation for our growth and success. As such,

our future success depends in large part on our ability to attract, retain and

motivate qualified personnel, including our executive officers and key

management personnel. If we are unable to attract and retain key personnel, our

operating results could be adversely affected.

Past

growth may not be indicative of future growth.

Historically,

we have experienced substantial sales growth through acquisitions, market share

gains and new sales center openings that have increased our size, scope and

geographic distribution. During the past five fiscal years, we have opened 18

new sales centers (net of subsequent closings and consolidations of new sales

centers) and have completed 9 acquisitions. These acquisitions have added 74

sales centers (net of sales center closings and consolidations within one year

of acquisition) to our distribution networks. Between 2007 and 2009, we also

closed or consolidated 12 existing sales centers. While we contemplate continued

growth through acquisitions and internal expansion, no assurance can be made as

to our ability to:

|

·

|

penetrate

new markets;

|

|

·

|

identify

appropriate acquisition candidates;

|

|

·

|

complete

acquisitions on satisfactory terms and successfully integrate acquired

businesses;

|

|

·

|

obtain

financing;

|

|

·

|

generate

sufficient cash flows to support expansion plans and general operating

activities;

|

|

·

|

maintain

favorable supplier arrangements and relationships;

and

|

|

·

|

identify

and divest assets which do not continue to create value consistent with

our objectives.

|

If we do

not manage these potential difficulties successfully, our operating results

could be adversely affected.

The

growth of our business depends on effective marketing programs.

The

growth of our business depends on the expansion of the installed pool base.

Thus, an important part of our strategy is to promote the growth of the pool

industry through our extensive advertising and promotional programs that attempt

to raise consumer awareness regarding the benefits and affordability of pool

ownership, the ease of pool maintenance and the many ways in which a pool may be

enjoyed beyond swimming. These programs include media advertising, website

development such as www.swimmingpool.com™

and public relations campaigns. We believe these programs benefit the entire

supply chain from our suppliers to our customers.

We also

promote the growth of our customers’ businesses through comprehensive support

programs that offer promotional tools and marketing support to help generate

increased sales for our customers. Our programs include such features as

personalized websites, brochures, marketing campaigns and business development

training. We also provide certain retail store customers with assistance in site

selection, store layout and design and business management system

implementation. Our inability to sufficiently develop effective advertising,

marketing and promotional programs to succeed in a weakened economic environment

and an increasingly competitive marketplace, in which we (and our entire supply

chain) also compete with other luxury product alternatives, could have a

material adverse effect on our business.

Our

business is highly seasonal.

In 2009,

approximately 67% of our net sales and over 100% of our operating income were

generated in the second and third quarters of the year, which represent the peak

months of swimming pool use, installation, remodeling and repair. Our sales are

substantially lower during the first and fourth quarters of the year, when we

may incur net losses.

The

nature of our business subjects us to compliance with environmental, health,

transportation and safety regulations.

We are

subject to regulation under federal, state and local environmental, health,

transportation and safety requirements, which govern such things as packaging,

labeling, handling, transportation, storage and sale of chemicals and

fertilizers. For example, we sell algaecides and pest control products that are

regulated as pesticides under the Federal Insecticide, Fungicide and Rodenticide

Act and various state pesticide laws. These laws are primarily related to

labeling, annual registration and licensing.

10

Failure

to comply with these laws and regulations may result in the assessment of

administrative, civil and criminal penalties or the imposition of injunctive

relief. Moreover, compliance with such laws and regulations in the future could

prove to be costly, and there can be no assurance that we will not incur such

costs in material amounts. These laws and regulations have changed substantially

and rapidly over the last 20 years and we anticipate that there will be

continuing changes. The clear trend in environmental, health, transportation and

safety regulation is to place more restrictions and limitations on activities

that impact the environment, such as the use and handling of chemical

substances. Increasingly, strict restrictions and limitations have resulted in

higher operating costs for us and it is possible that the costs of compliance

with such laws and regulations will continue to increase. We will attempt to

anticipate future regulatory requirements that might be imposed and we will plan

accordingly to remain in compliance with changing regulations and to minimize

the costs of such compliance.

We

store chemicals, fertilizers and other combustible materials that involve fire,

safety and casualty risks.

We store

chemicals and fertilizers, including certain combustible, oxidizing compounds,

at our sales centers. A fire, explosion or flood affecting one of our facilities

could give rise to fire, safety and casualty losses and related liability

claims. We maintain what we believe is prudent insurance protection. However, we

cannot guarantee that our insurance coverage will be adequate to cover future

claims that may arise or that we will be able to maintain adequate insurance in

the future at rates we consider reasonable. Successful claims for which we are

not fully insured may adversely affect our working capital and profitability. In

addition, changes in the insurance industry have generally led to higher

insurance costs and decreased availability of coverage.

We

conduct business internationally, which exposes us to additional

risks.

Our

international operations expose us to certain additional risks,

including:

|

·

|

difficulty

in staffing international subsidiary

operations;

|

|

·

|

different

political and regulatory

conditions;

|

|

·

|

currency

fluctuations;

|

|

·

|

adverse

tax consequences; and

|

|

·

|

dependence

on other economies.

|

We source

certain products we sell, including our Pool Corporation branded products, from

Asia and other international sources. There is a greater risk that we may not be

able to access products in a timely and efficient manner, and we may also be

subject to certain trade restrictions that prevent us from obtaining products.

Fluctuations in other factors relating to international trade, such as tariffs,

currency exchange rates, transportation costs and inflation are additional risks

for our international operations.

A

terrorist attack or the threat of a terrorist attack could have a material

adverse effect on our business.

Discretionary

spending on leisure product offerings such as ours is generally adversely

affected during times of economic or political uncertainty. The potential for

terrorist attacks, the national and international responses to terrorist

attacks, and other acts of war or hostility could create these types of

uncertainties and negatively impact our business for the short or long-term in

ways that cannot presently be predicted.

None.

11

We lease

the POOL corporate offices, which consist of approximately 50,000 square feet of

office space in Covington, Louisiana, from an entity in which we have a 50%

ownership interest. We own three sales center facilities in Florida and one in

Texas. We lease all of our other properties and the majority of our leases have

three to seven year terms. As of December 31, 2009, we had 18 leases with

remaining terms longer than seven years that expire between 2017 and 2027. Most

of our leases contain renewal options, some of which involve rent increases. In

addition to minimum rental payments, which are set at competitive rates, certain

leases require reimbursement for taxes, maintenance and insurance.

Our sales

centers range in size from approximately 2,000 square feet to 100,000 square

feet and generally consist of warehouse, counter, display and office space. Our

centralized shipping locations (CSLs) range in size from 16,000 square feet to

78,000 square feet.

We

believe that our facilities are well maintained, suitable for our business and

occupy sufficient space to meet our operating needs. As part of our normal

business, we regularly evaluate sales center performance and site suitability

and may relocate a sales center or consolidate two locations if a sales center

is redundant in a market, under performing or otherwise deemed unsuitable. We do

not believe that any single lease is material to our operations.

The table

below summarizes the changes in our sales centers during the year ended

December 31, 2009:

|

Network

|

12/31/08

|

New

Locations

|

Consolidated

&

Closed

Locations (1)

|

Acquired

Locations

(2)

|

Converted

Locations (3)

|

12/31/09

|

||||||

|

SCP

|

146

|

-

|

(1

|

)

|

-

|

2

|

147

|

|||||

|

Superior

|

60

|

-

|

(3

|

)

|

7

|

(2

|

)

|

62

|

||||

|

Horizon

|

61

|

-

|

(4

|

)

|

-

|

-

|

57

|

|||||

|

Total

Domestic

|

267

|

-

|

(8

|

)

|

7

|

-

|

266

|

|||||

|

SCP

International

|

21

|

-

|

-

|

-

|

-

|

21

|

||||||

|

Total

|

288

|

-

|

(8

|

)

|

7

|

-

|

287

|

|

(1)

|

Consolidated

sales centers are those locations where we expect to transfer the majority

of the existing business to our nearby sales center locations. During

2009, we consolidated seven sales centers and closed one sales

center.

|

|

(2)

|

We

added 10 sales centers through our acquisition of General Pool & Spa

Supply (GPS) in October 2009. We have consolidated three of

these locations with existing sales

centers.

|

|

(3)

|

In

2009, we converted two existing sales centers in Florida from our Superior

network to our SCP network.

|

12

The table

below identifies the number of sales centers in each state or country by

distribution network as of December 31, 2009:

|

Location

|

SCP

|

Superior

|

Horizon

|

Total

|

|||

|

United

States

|

|||||||

|

California

|

24

|

21

|

20

|

65

|

|||

|

Florida

|

31

|

6

|

-

|

37

|

|||

|

Texas

|

16

|

4

|

11

|

31

|

|||

|

Arizona

|

6

|

4

|

10

|

20

|

|||

|

Georgia

|

7

|

2

|

-

|

9

|

|||

|

Tennessee

|

4

|

3

|

-

|

7

|

|||

|

Washington

|

1

|

-

|

6

|

7

|

|||

|

Alabama

|

4

|

2

|

-

|

6

|

|||

|

Nevada

|

2

|

2

|

2

|

6

|

|||

|

New

York

|

6

|

-

|

-

|

6

|

|||

|

Louisiana

|

5

|

-

|

-

|

5

|

|||

|

New

Jersey

|

3

|

2

|

-

|

5

|

|||

|

Ohio

|

2

|

3

|

-

|

5

|

|||

|

Pennsylvania

|

4

|

1

|

-

|

5

|

|||

|

Colorado

|

1

|

1

|

2

|

4

|

|||

|

Illinois

|

3

|

1

|

-

|

4

|

|||

|

Indiana

|

2

|

2

|

-

|

4

|

|||

|

Missouri

|

3

|

1

|

-

|

4

|

|||

|

North

Carolina

|

3

|

1

|

-

|

4

|

|||

|

Oklahoma

|

2

|

1

|

-

|

3

|

|||

|

Oregon

|

-

|

-

|

3

|

3

|

|||

|

South

Carolina

|

2

|

1

|

-

|

3

|

|||

|

Virginia

|

2

|

1

|

-

|

3

|

|||

|

Arkansas

|

2

|

-

|

-

|

2

|

|||

|

Idaho

|

-

|

-

|

2

|

2

|

|||

|

Massachusetts

|

2

|

-

|

-

|

2

|

|||

|

Michigan

|

2

|

-

|

-

|

2

|

|||

|

Minnesota

|

1

|

1

|

-

|

2

|

|||

|

Connecticut

|

1

|

-

|

-

|

1

|

|||

|

Iowa

|

1

|

-

|

-

|

1

|

|||

|

Kansas

|

1

|

-

|

-

|

1

|

|||

|

Kentucky

|

-

|

1

|

-

|

1

|

|||

|

Maryland

|

1

|

-

|

-

|

1

|

|||

|

Mississippi

|

1

|

-

|

-

|

1

|

|||

|

Nebraska

|

1

|

-

|

-

|

1

|

|||

|

New

Mexico

|

1

|

-

|

-

|

1

|

|||

|

Utah

|

-

|

-

|

1

|

1

|

|||

|

Wisconsin

|

-

|

1

|

-

|

1

|

|||

|

Total

United States

|

147

|

62

|

57

|

266

|

|||

|

International

|

|||||||

|

Canada

|

8

|

-

|

-

|

8

|

|||

|

France

|

5

|

-

|

-

|

5

|

|||

|

Portugal

|

3

|

-

|

-

|

3

|

|||

|

United

Kingdom

|

2

|

-

|

-

|

2

|

|||

|

Italy

|

1

|

-

|

-

|

1

|

|||

|

Spain

|

1

|

-

|

-

|

1

|

|||

|

Mexico

|

1

|

-

|

-

|

1

|

|||

|

Total

International

|

21

|

-

|

-

|

21

|

|||

|

Total

|

168

|

62

|

57

|

287

|

|||

13

From time

to time, we are subject to various claims and litigation arising in the ordinary

course of business, including product liability, personal injury, commercial,

contract and employment matters. While the outcome of any litigation is

inherently unpredictable, we do not believe, based on currently available facts,

that the ultimate resolution of any of these matters will have a material

adverse impact on our financial condition, results of operations or cash

flows.

Item

5. Market

for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases

of Equity Securities

Our

common stock is traded on the NASDAQ Global Select Market under the symbol

“POOL”. On February 19, 2010, there were approximately

11,831 holders of record of our common stock. The table below sets

forth the high and low sales prices of our common stock as well as dividends

declared for each quarter during the last two fiscal years.

|

Dividends

|

||||||||||

|

High

|

Low

|

Declared

|

||||||||

|

Fiscal

2009

|

||||||||||

|

First

Quarter

|

$

|

19.00

|

$

|

11.39

|

$

|

0.13

|

||||

|

Second

Quarter

|

18.47

|

13.58

|

0.13

|

|||||||

|

Third

Quarter

|

24.57

|

15.79

|

0.13

|

|||||||

|

Fourth

Quarter

|

23.62

|

17.75

|

0.13

|

|||||||

|

Fiscal

2008

|

||||||||||

|

First

Quarter

|

$

|

24.64

|

$

|

17.99

|

$

|

0.12

|

||||

|

Second

Quarter

|

22.43

|

17.76

|

0.13

|

|||||||

|

Third

Quarter

|

25.87

|

16.65

|

0.13

|

|||||||

|

Fourth

Quarter

|

23.39

|

13.36

|

0.13

|

|||||||

We

initiated quarterly dividend payments to our shareholders in the second quarter

of 2004 and we have continued payments in each subsequent quarter. Our Board of

Directors (our Board) has increased the dividend amount five times including in

the fourth quarter of 2004 and annually in the second quarter of 2005 through

2008. Future dividend payments will be at the discretion of our Board, after

considering various factors, including our earnings, capital requirements,

financial position, contractual restrictions and other relevant business

considerations. We cannot assure shareholders or potential investors that

dividends will be declared or paid any time in the future if our Board

determines that there is a better use of those funds.

Stock

Performance Graph

The

information included under the caption “Stock Performance Graph” in this

Item 5 of this Annual Report on Form 10-K is not deemed to be

“soliciting material” or to be “filed” with the SEC or subject to Regulation 14A

or 14C under the Securities Exchange Act of 1934 (the 1934 Act) or to the

liabilities of Section 18 of the 1934 Act, and will not be deemed to

be incorporated by reference into any filing under the Securities Act of 1933 or

the 1934 Act, except to the extent we specifically incorporate it by

reference into such a filing.

The graph

below compares the total stockholder return on our common stock for the last

five fiscal years with the total return on the NASDAQ US Index and the S&P

MidCap 400 Index for the same period, in each case assuming the investment of

$100 on December 31, 2004 and the reinvestment of all dividends. We believe the

S&P MidCap 400 Index includes companies with capitalization comparable to

ours. Additionally, we chose the S&P MidCap 400 Index for comparison, as

opposed to an industry index, because we do not believe that we can reasonably

identify a peer group or a published industry or line-of-business index that

contains companies in a similar line of business.

14

|

Base

|

INDEXED

RETURNS

|

|||||

|

Period

|

Years

Ending

|

|||||

|

Company

/ Index

|

12/31/04

|

12/31/05

|

12/31/06

|

12/31/07

|

12/31/08

|

12/31/09

|

|

Pool

Corporation

|

100

|

117.77

|

125.16

|

64.33

|

59.80

|

65.41

|

|

S&P

MidCap 400 Index

|

100

|

112.56

|

124.17

|

134.08

|

85.50

|

117.46

|

|

NASDAQ

US Index

|

100

|

101.33

|

114.01

|

123.71

|

73.11

|

105.61

|

Purchases

of Equity Securities

The table

below summarizes the repurchases of our common stock in the fourth quarter of

2009.

|

|

|

|||||||||

|

|

||||||||||

|

Period

|

Total

number of shares

purchased(1) |

Average

price paid per

share |

Total

number of shares purchased as

part of publicly |

Maximum

approximate dollar value that

may yet be |

||||||

|

October

1-31, 2009

|

-

|

$

|

-

|

-

|

$

|

52,987,067

|

||||

|

November

1-30, 2009

|

-

|

$

|

-

|

-

|

$

|

52,987,067

|

||||

|

December

1-31, 2009

|

-

|

$

|

-

|

-

|

$

|

52,987,067

|

||||

|

Total

|

-

|

$

|

-

|

-

|

||||||

|

(1)

|

These

shares may include shares of our common stock surrendered to us by

employees in order to satisfy tax withholding obligations in connection

with certain exercises of employee stock options and/or the exercise price

of such options granted under our share-based compensation

plans. There were no shares surrendered for this purpose in the

fourth quarter of 2009.

|

|

(2)

|

In

July 2002, our Board authorized $50.0 million for the repurchase of

shares of our common stock in the open market. In August 2004, November

2005 and August 2006, our Board increased the authorization for the

repurchase of shares of our common stock in the open market to a total of

$50.0 million from the amounts remaining at each of those dates. In

November 2006 and August 2007, our Board increased the authorization for

the repurchase of shares of our common stock in the open market to a total

of $100.0 million from the amounts remaining at each of those

dates.

|

|

(3)

|

In

2009, we did not purchase any shares under our Board authorized

plan. As of February 22, 2010, $53.0 million of the authorized

amount remained available.

|

15

The table

below sets forth selected financial data from the Consolidated Financial

Statements. You should read this information in conjunction with the discussions

in Item 7 of this Form 10-K and with the Consolidated Financial Statements and

accompanying Notes in Item 8 of this Form 10-K.

|

Year

Ended December 31, (1)

|

||||||||||||||||

|

(in

thousands, except per share data)

|

2009(2)

|

2008

|

2007

|

2006

|

2005(3)

|

|||||||||||

|

Statement

of Income Data

|

||||||||||||||||

|

Net

sales

|

$

|

1,539,794

|

$

|

1,783,683

|

$

|

1,928,367

|

$

|

1,909,762

|

$

|

1,552,659

|

||||||

|

Operating

income

|

88,440

|

115,476

|

133,774

|

167,382

|

135,363

|

|||||||||||

|

Net

income

|

19,202

|

56,956

|

69,394

|

95,024

|

80,455

|

|||||||||||

|

Earnings

per share:

|

||||||||||||||||

|

Basic

|

$

|

0.39

|

$

|

1.19

|

$

|

1.42

|

$

|

1.83

|

$

|

1.53

|

||||||

|

Diluted

|

$

|

0.39

|

$

|

1.17

|

(4)

|

$

|

1.37

|

$

|

1.74

|

$

|

1.44

|

(4)

|

||||

|

Cash

dividends declared

|

||||||||||||||||

|

per

common share

|

$

|

0.52

|

$

|

0.51

|

$

|

0.465

|

$

|

0.405

|

$

|

0.34

|

||||||

|

Balance Sheet Data(5)

|

||||||||||||||||

|

Working

capital

|

$

|

230,804

|

$

|

294,552

|

$

|

250,849

|

$

|

227,631

|

$

|

193,525

|

||||||

|

Total

assets

|

743,099

|

830,906

|

814,854

|

774,562

|

740,850

|

|||||||||||

|

Total

long-term debt,

|

||||||||||||||||

|

including

current portion

|

248,700

|

307,000

|

282,525

|

191,157

|

129,100

|

|||||||||||

|

Stockholders'

equity(6)

|

252,187

|

241,734

|

208,791

|

277,684

|

281,724

|

|||||||||||

|

Other

|

||||||||||||||||

|

Base

business sales change(7)

|

(15

|

)%

|

(9

|

)%

|

(1

|

)%

|

10

|

%

|

14

|

%

|

||||||

|

Number

of sales centers

|

287

|

288

|

281

|

274

|

246

|

|||||||||||

|

(1)

|

During

the years 2005 to 2009, we successfully completed 9 acquisitions

consisting of 74 sales centers. For information about our recent

acquisitions, see Note 2 of “Notes to Consolidated Financial

Statements,” included in Item 8 of this Form 10-K. Our results

were negatively impacted between 2007 and 2009 due to the adverse external

market conditions, which included downturns in the housing market and

overall economy that led to significant declines in pool and irrigation

construction activities and deferred discretionary replacement purchases

by consumers.

|

|

(2)

|

The

2009 net income and earnings per share amounts include the impact of a

$26.5 million equity loss that we recognized in September 2009

related to our pro rata share of Latham Acquisition Corporation’s (LAC)

non-cash goodwill and other intangible asset impairment

charge. The impact of this impairment charge was a $0.54 per