Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - PACIFICORP /OR/ | exhibit23-1.htm |

| EX-12.2 - STATEMENTS OF COMPUTATION OF RATIO - PACIFICORP /OR/ | exhibit12-2.htm |

| EX-31.1 - SECTION 302 CEO CERTIFICATION - PACIFICORP /OR/ | exhibit31-1.htm |

| EX-31.2 - SECTION 302 CFO CERTIFICATION - PACIFICORP /OR/ | exhibit31-2.htm |

| EX-32.2 - SECTION 906 CFO CERTIFICATION - PACIFICORP /OR/ | exhibit32-2.htm |

| EX-12.1 - STATEMENTS OF COMPUTATION OF RATIO - PACIFICORP /OR/ | exhibit12-1.htm |

| EX-32.1 - SECTION 906 CEO CERTIFICATION - PACIFICORP /OR/ | exhibit32-1.htm |

| EX-10.1 - SUMMARY OF KEY TERMS OF COMPENSATION - PACIFICORP /OR/ | exhibit10-1.htm |

| EX-10.10 - AMENDMENT NO. 1 TO THE PACIFICORP EXECUTIVE VOLUNTARY DEFERRED COMPENSATION PLAN - PACIFICORP /OR/ | exhibit10-10.htm |

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X]

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange

Act of 1934

For the

fiscal year ended December 31, 2009

or

[ ]

Transition Report Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

For

the transition period from _____ to _____

|

Commission

|

Exact

name of registrant as specified in its charter;

|

IRS

Employer

|

||

|

File

Number

|

State

or other jurisdiction of incorporation or

organization

|

Identification No.

|

||

|

1-5152

|

PACIFICORP

|

93-0246090

|

||

|

(An

Oregon Corporation)

|

||||

|

825

N.E. Multnomah Street

|

||||

|

Portland,

Oregon 97232

|

||||

|

503-813-5000

|

||||

Securities

registered pursuant to Section 12(b) of the Act: None

Securities

registered pursuant to Section 12(g) of the Act:

Title of each

Class

5%

Preferred Stock (Cumulative; $100 Stated Value)

Serial

Preferred Stock (Cumulative; $100 Stated Value)

No Par

Serial Preferred Stock (Cumulative; $100 Stated Value)

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act.

Yes T No o

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act.

Yes o No T

Indicate

by check mark whether the registrant (1) has filed all reports required to

be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the

Registrant was required to file such reports), and (2) has been subject to

such filing requirements for the past 90 days.

Yes T No o

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period

that the registrant was required to submit and post such files).

Yes ¨ No ¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the

best of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any

amendment to this Form 10-K. T

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

|

Large

accelerated filer o

|

Accelerated

filer o

|

Non-accelerated

filer T

|

Smaller

reporting company o

|

Indicate

by check mark whether the registrant is a shell company (as defined in

Rule 12b-2 of the Exchange Act).

Yes o No T

As of

January, 31, 2010, there were 357,060,915 shares of common stock

outstanding. All shares of outstanding common stock are indirectly owned by

MidAmerican Energy Holdings Company, 666 Grand Avenue, Des Moines,

Iowa.

TABLE OF

CONTENTS

|

PART

I

|

||

|

PART

II

|

||

|

PART

III

|

||

|

PART

IV

|

||

Forward-Looking

Statements

This

report contains statements that do not directly or exclusively relate to

historical facts. These statements are “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933 and Section 21E

of the Securities Exchange Act of 1934, as amended. Forward-looking statements

can typically be identified by the use of forward-looking words, such as “may,”

“could,” “project,” “believe,” “anticipate,” “expect,” “estimate,” “continue,”

“intend,” “potential,” “plan,” “forecast” and similar terms. These statements

are based upon PacifiCorp’s current intentions, assumptions, expectations and

beliefs and are subject to risks, uncertainties and other important factors.

Many of these factors are outside PacifiCorp’s control and could cause actual

results to differ materially from those expressed or implied by PacifiCorp’s

forward-looking statements. These factors include, among others:

|

|

·

|

general

economic, political and business conditions in the jurisdictions in which

PacifiCorp’s facilities operate;

|

|

|

·

|

changes

in federal, state and local governmental, legislative or regulatory

requirements, including those pertaining to income taxes, affecting

PacifiCorp or the electric utility

industry;

|

|

|

·

|

changes

in, and compliance with, environmental laws, regulations, decisions and

policies that could, among other items, increase operating and capital

costs, reduce plant output or delay plant

construction;

|

|

|

·

|

the

outcome of general rate cases and other proceedings conducted by

regulatory commissions or other governmental and legal

bodies;

|

|

|

·

|

changes

in economic, industry or weather conditions, as well as demographic

trends, that could affect customer growth and usage or supply of

electricity or PacifiCorp’s ability to obtain long-term contracts with

customers;

|

|

|

·

|

a

high degree of variance between actual and forecasted load and prices that

could impact the hedging strategy and costs to balance electricity and

load supply;

|

|

|

·

|

hydroelectric

conditions, as well as the cost, feasibility and eventual outcome of

hydroelectric relicensing proceedings, that could have a significant

impact on electric capacity and cost and PacifiCorp’s ability to generate

electricity;

|

|

|

·

|

changes

in prices, availability and demand for both purchases and sales of

wholesale electricity, coal, natural gas, other fuel sources and fuel

transportation that could have a significant impact on generation capacity

and energy costs;

|

|

|

·

|

the

financial condition and creditworthiness of PacifiCorp’s significant

customers and suppliers;

|

|

|

·

|

changes

in business strategy or development

plans;

|

|

|

·

|

availability,

terms and deployment of capital, including reductions in demand for

investment-grade commercial paper, debt securities and other sources of

debt financing and volatility in the London Interbank Offered Rate, the

base interest rate for PacifiCorp’s credit

facilities;

|

|

|

·

|

changes

in PacifiCorp’s credit ratings;

|

|

|

·

|

performance

of PacifiCorp’s generating facilities, including unscheduled outages or

repairs;

|

|

|

·

|

the

impact of derivative contracts used to mitigate or manage volume, price

and interest rate risk, including increased collateral requirements, and

changes in the commodity prices, interest rates and other conditions that

affect the fair value of derivative

contracts;

|

|

|

·

|

increases

in employee healthcare costs and the potential impact of federal

healthcare reform legislation;

|

|

|

·

|

the

impact of investment performance and changes in interest rates,

legislation, healthcare cost trends, mortality and morbidity on pension

and other postretirement benefits expense and funding

requirements;

|

|

|

·

|

unanticipated

construction delays, changes in costs, receipt of required permits and

authorizations, ability to fund capital projects and other factors that

could affect future generating facilities and infrastructure

additions;

|

|

|

·

|

the

impact of new accounting pronouncements or changes in current accounting

estimates and assumptions on consolidated financial

results;

|

|

|

·

|

other

risks or unforeseen events, including litigation, wars, the effects of

terrorism, embargoes and other catastrophic events;

and

|

1

|

|

·

|

other

business or investment considerations that may be disclosed from time to

time in PacifiCorp’s filings with the United States Securities and

Exchange Commission (“SEC”) or in other publicly disseminated written

documents.

|

Further

details of the potential risks and uncertainties affecting PacifiCorp are

described in Item 1A and other discussions contained in this

Form 10-K. PacifiCorp undertakes no obligation to publicly update or revise

any forward-looking statements, whether as a result of new information, future

events or otherwise. The foregoing review of factors should not be construed as

exclusive.

2

PART I

|

Item 1.

|

Business

|

General

PacifiCorp,

which includes PacifiCorp and its subsidiaries, is a United States regulated

electric company serving 1.7 million retail customers, including

residential, commercial, industrial and other customers in portions of the

states of Utah, Oregon, Wyoming, Washington, Idaho and California. PacifiCorp

owns, or has interests in, 78 thermal, hydroelectric, wind-powered and

geothermal generating facilities, with a net owned capacity of

10,483 megawatts (“MW”). PacifiCorp also owns, or has interests in,

electric transmission and distribution assets, and transmits electricity through

approximately 15,900 miles of transmission lines. PacifiCorp also buys and

sells electricity on the wholesale market with public and private utilities,

energy marketing companies and incorporated municipalities as a result of excess

electricity generation or other system balancing activities. PacifiCorp is

subject to comprehensive state and federal regulation. PacifiCorp’s subsidiaries

support its electric utility operations by providing coal mining facilities and

services and environmental remediation services. PacifiCorp is an indirect

subsidiary of MidAmerican Energy Holdings Company (“MEHC”), a holding company

based in Des Moines, Iowa, that owns subsidiaries principally engaged in energy

businesses. MEHC is a consolidated subsidiary of Berkshire Hathaway Inc.

(“Berkshire Hathaway”). MEHC controls substantially all of PacifiCorp’s voting

securities, which include both common and preferred stock.

PacifiCorp’s

principal executive offices are located at 825 N.E. Multnomah Street,

Suite 2000, Portland, Oregon 97232, and its telephone number is

(503) 813-5000. PacifiCorp was initially incorporated in 1910 under the

laws of the state of Maine under the name Pacific Power & Light Company. In

1984, Pacific Power & Light Company changed its name to PacifiCorp. In 1989,

it merged with Utah Power and Light Company, a Utah corporation, in a

transaction wherein both corporations merged into a newly-formed Oregon

corporation. The resulting Oregon corporation was re-named PacifiCorp, which is

the operating entity today.

Berkshire

Hathaway Equity Commitment

On

March 1, 2006, MEHC and Berkshire Hathaway entered into an Equity

Commitment Agreement (the “Berkshire Equity Commitment”) pursuant to which

Berkshire Hathaway has agreed to purchase up to $3.5 billion of MEHC’s

common equity upon any requests authorized from time to time by MEHC’s Board of

Directors. The proceeds of any such equity contribution shall only be used by

MEHC for the purpose of (a) paying when due MEHC’s debt obligations and

(b) funding the general corporate purposes and capital requirements of

MEHC’s regulated subsidiaries, including PacifiCorp. Berkshire Hathaway will

have up to 180 days to fund any such request in increments of at least

$250 million pursuant to one or more drawings authorized by MEHC’s Board of

Directors. The funding of each drawing will be made by means of a cash equity

contribution to MEHC in exchange for additional shares of MEHC’s common stock.

PacifiCorp has no right to make or to cause MEHC to make any equity contribution

requests. The Berkshire Equity Commitment expires on February 28,

2011.

Operations

PacifiCorp

delivers electricity to customers in Utah, Wyoming and Idaho under the trade

name Rocky Mountain Power and to customers in Oregon, Washington and California

under the trade name Pacific Power. PacifiCorp’s electric generation, commercial

and trading, and coal mining functions are operated under the trade name

PacifiCorp Energy. As a vertically integrated electric utility, PacifiCorp owns

or has contracts for fuel sources, such as coal and natural gas, and uses these

fuel sources, as well as water resources, wind and geothermal to generate

electricity at its generating facilities. This electricity, together with

electricity purchased on the wholesale market, is then transmitted via a grid of

transmission lines throughout PacifiCorp’s six-state service area and the

Western United States. The electricity is then transformed to lower voltages and

delivered to customers through PacifiCorp’s distribution system.

PacifiCorp’s

primary goal is to provide safe, reliable electricity to its customers at a

reasonable cost. In return, PacifiCorp expects that all prudently incurred costs

to provide such service will be included as allowable costs for state ratemaking

purposes, and PacifiCorp will be allowed an opportunity to earn a reasonable

return on its investments.

3

PacifiCorp

seeks to manage growth in its customer demand through the construction and

purchase of new cost-effective, environmentally prudent and efficient sources of

power supply and through demand response and energy efficiency programs. During

2009, PacifiCorp placed in service 265 MW of wind-powered generating

facilities to help meet future retail load growth, achieve renewable generation

targets and replace expiring wholesale supply contracts.

Employees

As of

December 31, 2009, PacifiCorp, together with its subsidiaries, had

6,447 employees, 60% of which were covered by union contracts, principally

with the International Brotherhood of Electrical Workers, the Utility Workers

Union of America, the International Brotherhood of Boilermakers and the United

Mine Workers of America.

Service

Territories

PacifiCorp’s

combined service territory covers approximately 136,000 square miles and

includes diverse regional economies ranging from rural, agricultural and mining

areas to urban, manufacturing and government service centers. No single segment

of the economy dominates the service territory, which helps mitigate

PacifiCorp’s exposure to economic fluctuations. In the eastern portion of the

service territory, mainly consisting of Utah, Wyoming and southeastern Idaho,

the principal industries are manufacturing, recreation, agriculture and mining

or extraction of natural resources. In the western portion of the service

territory, mainly consisting of Oregon, southern Washington and northern

California, the principal industries are agriculture and manufacturing, with

forest products, food processing, technology and primary metals being the

largest industrial sectors.

PacifiCorp

receives authorization from state public utility commissions to serve areas

within each state. This authorization is perpetual until withdrawn. In addition,

PacifiCorp has received franchises that permit it to provide electric service to

customers inside incorporated areas within the states. The average term of these

franchises is approximately 30 years, although their terms range from five

years to indefinite. PacifiCorp must renew franchises as they expire.

Governmental agencies have the right to challenge PacifiCorp’s right to serve in

a specific area and can condemn PacifiCorp’s property under certain

circumstances. However, PacifiCorp vigorously challenges attempts from

individuals and governmental agencies to undertake forced takeover of portions

of its service territory.

Except

for Oregon and Washington, PacifiCorp has an exclusive right to serve customers

within its service territories, and in turn, has the obligation to provide

electric service to those customers. Under Oregon law, PacifiCorp has the

exclusive right and obligation to provide electric distribution services to all

customers within its allocated service territory; however, nonresidential

customers have the right to choose alternative electricity service suppliers.

The impact of these programs on PacifiCorp’s consolidated financial results has

not been material. In Washington, state law does not provide for exclusive

service territory allocation. PacifiCorp’s service territory in Washington is

surrounded by other public utilities with whom PacifiCorp has from time to time

entered into service area agreements under the jurisdiction of the Washington

Utilities and Transportation Commission (“WUTC”).

The

percentages of electricity sold to retail customers by jurisdiction were as

follows for the years ended December 31:

|

2009

|

2008

|

2007

|

||||||||||

|

Utah

|

42 | % | 42 | % | 42 | % | ||||||

|

Oregon

|

25 | 26 | 26 | |||||||||

|

Wyoming

|

17 | 17 | 16 | |||||||||

|

Washington

|

8 | 7 | 8 | |||||||||

|

Idaho

|

6 | 6 | 6 | |||||||||

|

California

|

2 | 2 | 2 | |||||||||

| 100 | % | 100 | % | 100 | % | |||||||

4

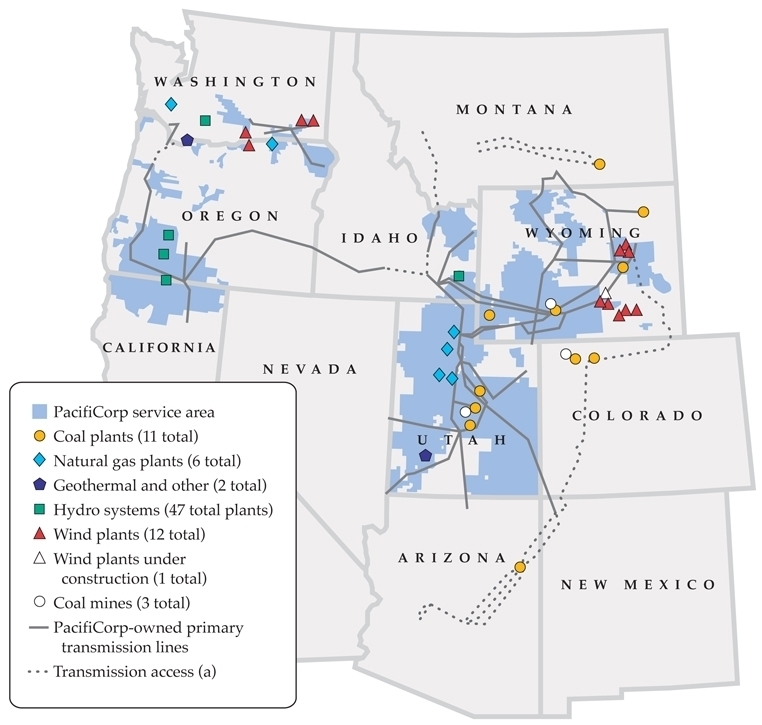

The

following map highlights PacifiCorp’s retail service territory, generating

facility locations and PacifiCorp’s primary transmission lines as of

December 31, 2009. PacifiCorp’s generating facilities are interconnected

through PacifiCorp’s own transmission lines or by contract through transmission

lines owned by others.

|

(a)

|

Access

to other entities’ transmission lines through wheeling

arrangements.

|

5

Customers

Retail

sales volumes depend on factors such as economic conditions, including the

timing of recovery from the current economic recession, population growth,

consumer trends, voluntary and mandated conservation efforts, weather,

technology and price changes.

Electricity

sold to retail and wholesale customers and the average number of retail

customers, by class of customer, were as follows for the years ended December

31:

|

2009

|

2008

|

2007

|

||||||||||||||||||||||

|

Gigawatt hours

(“GWh”) sold:

|

||||||||||||||||||||||||

|

Residential

|

15,999 | 24 | % | 16,222 | 24 | % | 15,975 | 24 | % | |||||||||||||||

|

Commercial

|

16,194 | 25 | 16,055 | 24 | 15,951 | 24 | ||||||||||||||||||

|

Industrial

|

19,934 | 31 | 21,495 | 32 | 20,892 | 31 | ||||||||||||||||||

|

Other

|

583 | 1 | 590 | 1 | 572 | 1 | ||||||||||||||||||

|

Total

retail

|

52,710 | 81 | 54,362 | 81 | 53,390 | 80 | ||||||||||||||||||

|

Wholesale

|

12,349 | 19 | 12,345 | 19 | 13,724 | 20 | ||||||||||||||||||

|

Total

GWh sold

|

65,059 | 100 | % | 66,707 | 100 | % | 67,114 | 100 | % | |||||||||||||||

|

Average

number of retail customers (in thousands):

|

||||||||||||||||||||||||

|

Residential

|

1,467 | 85 | % | 1,458 | 86 | % | 1,441 | 86 | % | |||||||||||||||

|

Commercial

|

214 | 13 | 210 | 12 | 205 | 12 | ||||||||||||||||||

|

Industrial

|

34 | 2 | 34 | 2 | 34 | 2 | ||||||||||||||||||

|

Other

|

4 | - | 4 | - | 4 | - | ||||||||||||||||||

|

Total

|

1,719 | 100 | % | 1,706 | 100 | % | 1,684 | 100 | % | |||||||||||||||

|

Retail

customers:

|

||||||||||||||||||||||||

|

Average

usage per customer (kilowatt hours)

|

30,672 | 31,863 | 31,712 | |||||||||||||||||||||

|

Average

revenue per customer

|

$ | 2,047 | $ | 2,021 | $ | 1,931 | ||||||||||||||||||

|

Revenue

per kilowatt hour

|

6.7 | ¢ | 6.3 | ¢ | 6.1 | ¢ | ||||||||||||||||||

Customer

Usage and

Seasonality

In

addition to the variations in weather from year to year, fluctuations in

economic conditions within the service territory and elsewhere can impact

customer usage, particularly for industrial and wholesale customers. Beginning

in the fourth quarter of 2008, certain customer usage levels began to decline

due to the effects of the economic conditions in the United States. The

declining usage trend continued in 2009, resulting in lower retail demand than

in 2008.

Peak

customer demand is typically highest in the summer across PacifiCorp’s service

territory when air conditioning and irrigation systems are heavily used. The

service territory also has a winter peak, which is primarily due to heating

requirements in the western portion of PacifiCorp’s service territory. Peak

demand represents the highest demand on a given day and at a given hour. During

the year ended December 31, 2009, PacifiCorp’s peak demand was

9,420 MW in the summer and 9,336 MW in the winter.

6

Power

and Fuel Supply

The

percentage of PacifiCorp’s energy requirements by resource varies from year to

year and is subject to numerous operational and economic factors such as planned

and unplanned outages; fuel commodity prices; fuel transportation costs;

weather; environmental considerations; transmission constraints; and wholesale

market prices of electricity. When factors for one generation resource are

unfavorable, PacifiCorp must place more reliance on other energy sources. For

example, PacifiCorp can generate more electricity using its low cost

hydroelectric and wind-powered generating facilities when factors associated

with these facilities are favorable. When hydroelectric and wind resources are

less favorable, PacifiCorp must increase its reliance on more expensive

generation or purchased electricity. PacifiCorp manages certain risks relating

to its supply of electricity and fuel requirements by entering into various

contracts, which may be derivatives, including forwards, futures, options, swaps

and other agreements. Refer to Item 7A in this Form 10-K for a discussion

of commodity price risk and derivative contracts.

7

PacifiCorp’s

portfolio of generating facilities was comprised of the following as of

December 31, 2009:

|

Location

|

Energy

Source

|

Installed

|

Facility

Net Capacity

(MW)

(1)

|

Net

Owned Generating Capacity (MW) (1)

|

|||||||||||

|

COAL:

|

|||||||||||||||

|

Jim

Bridger

|

Rock

Springs, WY

|

Coal

|

1974-1979 | 2,117 | 1,411 | ||||||||||

|

Hunter

Nos. 1, 2 and 3

|

Castle

Dale, UT

|

Coal

|

1978-1983 | 1,320 | 1,122 | ||||||||||

|

Huntington

|

Huntington,

UT

|

Coal

|

1974-1977 | 895 | 895 | ||||||||||

|

Dave

Johnston

|

Glenrock,

WY

|

Coal

|

1959-1972 | 762 | 762 | ||||||||||

|

Naughton

|

Kemmerer,

WY

|

Coal

|

1963-1971 | 700 | 700 | ||||||||||

|

Cholla

No. 4

|

Joseph

City, AZ

|

Coal

|

1981 | 395 | 395 | ||||||||||

|

Wyodak

|

Gillette,

WY

|

Coal

|

1978 | 335 | 268 | ||||||||||

|

Carbon

|

Castle

Gate, UT

|

Coal

|

1954-1957 | 172 | 172 | ||||||||||

|

Craig

Nos. 1 and 2

|

Craig,

CO

|

Coal

|

1979-1980 | 856 | 165 | ||||||||||

|

Colstrip

Nos. 3 and 4

|

Colstrip,

MT

|

Coal

|

1984-1986 | 1,480 | 148 | ||||||||||

|

Hayden Nos. 1 and 2

|

Hayden,

CO

|

Coal

|

1965-1976 | 446 | 78 | ||||||||||

| 9,478 | 6,116 | ||||||||||||||

|

NATURAL

GAS:

|

|||||||||||||||

|

Lake Side

|

Vineyard,

UT

|

Natural gas/steam

|

2007 | 558 | 558 | ||||||||||

|

Currant

Creek

|

Mona,

UT

|

Natural gas/steam

|

2005-2006 | 550 | 550 | ||||||||||

|

Chehalis

|

Chehalis,

WA

|

Natural

gas/steam

|

2003 | 520 | 520 | ||||||||||

|

Hermiston

|

Hermiston,

OR

|

Natural gas/steam

|

1996 | 474 | 237 | ||||||||||

|

Gadsby

Steam

|

Salt

Lake City, UT

|

Natural

gas

|

1951-1955 | 231 | 231 | ||||||||||

|

Gadsby

Peakers

|

Salt

Lake City, UT

|

Natural

gas

|

2002 | 122 | 122 | ||||||||||

|

Little

Mountain

|

Ogden,

UT

|

Natural

gas

|

1971 | 14 | 14 | ||||||||||

| 2,469 | 2,232 | ||||||||||||||

|

HYDROELECTRIC: (2)

|

|||||||||||||||

|

Lewis River System (3)

|

WA

|

Hydroelectric

|

1931-1958 | 578 | 578 | ||||||||||

|

North Umpqua River System (4)

|

OR

|

Hydroelectric

|

1950-1956 | 200 | 200 | ||||||||||

|

Klamath River System (5)

|

CA,

OR

|

Hydroelectric

|

1903-1962 | 170 | 170 | ||||||||||

|

Bear River System (6)

|

ID,

UT

|

Hydroelectric

|

1908-1984 | 105 | 105 | ||||||||||

|

Rogue River System (7)

|

OR

|

Hydroelectric

|

1912-1957 | 52 | 52 | ||||||||||

|

Minor hydroelectric facilities

|

Various

|

Hydroelectric

|

1895-1986 | 53 | 53 | ||||||||||

| 1,158 | 1,158 | ||||||||||||||

|

WIND: (2)

|

|||||||||||||||

|

Marengo

|

Dayton,

WA

|

Wind

|

2007 | 140 | 140 | ||||||||||

|

Leaning

Juniper 1

|

Arlington,

OR

|

Wind

|

2006 | 101 | 101 | ||||||||||

|

High

Plains

|

McFadden,

WY

|

Wind

|

2009 | 99 | 99 | ||||||||||

|

Rolling

Hills

|

Glenrock,

WY

|

Wind

|

2009 | 99 | 99 | ||||||||||

|

Glenrock

|

Glenrock,

WY

|

Wind

|

2008 | 99 | 99 | ||||||||||

|

Seven

Mile Hill

|

Medicine

Bow, WY

|

Wind

|

2008 | 99 | 99 | ||||||||||

|

Goodnoe

Hills

|

Goldendale,

WA

|

Wind

|

2008 | 94 | 94 | ||||||||||

|

Marengo

II

|

Dayton,

WA

|

Wind

|

2008 | 70 | 70 | ||||||||||

|

Foote

Creek

|

Arlington,

WY

|

Wind

|

1999 | 41 | 33 | ||||||||||

|

Glenrock

III

|

Glenrock,

WY

|

Wind

|

2009 | 39 | 39 | ||||||||||

|

McFadden

Ridge I

|

McFadden,

WY

|

Wind

|

2009 | 28 | 28 | ||||||||||

|

Seven

Mile Hill II

|

Medicine

Bow, WY

|

Wind

|

2008 | 20 | 20 | ||||||||||

| 929 | 921 | ||||||||||||||

|

OTHER: (2)

|

|||||||||||||||

|

Blundell

|

Milford,

UT

|

Geothermal

|

1984, 2007 | 34 | 34 | ||||||||||

|

Camas

Co-Gen

|

Camas,

WA

|

Black

liquor

|

1996 | 22 | 22 | ||||||||||

| 56 | 56 | ||||||||||||||

|

Total

available generating capacity

|

14,090 | 10,483 | |||||||||||||

8

|

(1)

|

Facility

net capacity (MW) represents the total capability of a generating unit as

demonstrated by actual operating or test experience, less power generated

and used for auxiliaries and other station uses, and is determined using

average annual temperatures. Net owned generating capacity (MW)

indicates current legal ownership. For wind-powered generating facilities,

nominal ratings are used in place of facility net capacity. A wind turbine

generator’s nominal rating is the manufacturer’s contractually specified

capability (in MW) under specified conditions.

|

|

(2)

|

All

or some of the renewable energy attributes associated with generation from

these generating facilities may be: (a) used in future years to

comply with renewable portfolio standards (“RPS”) or other regulatory

requirements or (b) sold to third parties in the form of renewable

energy credits or other environmental commodities.

|

|

(3)

|

The

license for these facilities is valid through

May 2058.

|

|

(4)

|

The

license for these facilities is valid through

October 2038.

|

|

(5)

|

The

license for these facilities was valid through February 2006 and it

currently operates on annual licenses. Refer to Note 13 of Notes to

Consolidated Financial Statements in Item 8 of this Form 10-K for an

update regarding hydroelectric relicensing for the Klamath River

system.

|

|

(6)

|

The

license is valid through March 2024 for Cutler and through

November 2033 for the Grace, Oneida and Soda hydroelectric generating

facilities.

|

|

(7)

|

The

license is valid through December 2018 for Prospect No. 3 and

through March 2038 for the Prospect Nos. 1, 2 and 4

hydroelectric generating

facilities.

|

The

percentages of PacifiCorp’s total energy supplied by energy source were as

follows for the years ended December 31:

|

2009

|

2008

|

2007

|

||||||||||

|

Coal

|

63 | % | 65 | % | 64 | % | ||||||

|

Natural

gas

|

12 | 12 | 11 | |||||||||

|

Hydroelectric

|

5 | 5 | 5 | |||||||||

|

Other

(1)

|

4 | 2 | 1 | |||||||||

|

Total

energy generated

|

84 | 84 | 81 | |||||||||

|

Energy

purchased – long-term contracts

|

6 | 5 | 5 | |||||||||

|

Energy

purchased – short-term contracts and other

|

10 | 11 | 14 | |||||||||

| 100 | % | 100 | % | 100 | % | |||||||

|

(1)

|

All

or some of the renewable energy attributes associated with generation from

these generating facilities may be: (a) used in future years to

comply with RPS or other regulatory requirements or (b) sold to third

parties in the form of renewable energy credits or other environmental

commodities.

|

Coal

Coal-fired

generating facilities account for 58% of PacifiCorp’s total net owned generating

capacity. PacifiCorp owns coal mines that support its coal-fired generating

facilities. These mines supplied 31% of PacifiCorp’s total coal requirements

during each of the years ended December 31, 2009, 2008 and 2007. The

remaining coal requirements are acquired through long- and short-term

third-party contracts. PacifiCorp’s mines are located adjacent to many of its

coal-fired generating facilities, which significantly reduces overall

transportation costs included in fuel expense. Most of PacifiCorp’s coal

reserves are held pursuant to leases from the federal government through the

Bureau of Land Management and from certain states and private parties. The

leases generally have multi-year terms that may be renewed or extended only with

the consent of the lessor and require payment of rents and royalties. In

addition, federal and state regulations require that comprehensive environmental

protection and reclamation standards be met during the course of mining

operations and upon completion of mining activities.

9

Coal

reserve estimates are subject to adjustment as a result of the development of

additional engineering and geological data, new mining technology and changes in

regulation and economic factors affecting the utilization of such reserves.

Recoverable coal reserves as of December 31, 2009, based on PacifiCorp’s

most recent engineering studies, were as follows

(in millions):

|

Location

|

Plant Served

|

Mining Method

|

Recoverable Tons

|

|||||

|

Craig, CO

|

Craig

|

Surface

|

46 | (1) | ||||

|

Huntington & Castle Dale, UT

|

Huntington and Hunter

|

Underground

|

30 | (2) | ||||

|

Rock Springs, WY

|

Jim Bridger

|

Surface

|

83 | (3) | ||||

|

Rock Springs, WY

|

Jim Bridger

|

Underground

|

50 | (3) | ||||

| 209 | ||||||||

|

(1)

|

These

coal reserves are leased and mined by Trapper Mining, Inc., a Delaware

non-stock corporation operated on a cooperative basis, in which PacifiCorp

has an ownership interest of 21%. The amount included above represents

only PacifiCorp’s 21% interest in the coal reserves.

|

|

(2)

|

These

coal reserves are leased by PacifiCorp and mined by a wholly owned

subsidiary of PacifiCorp.

|

|

(3)

|

These

coal reserves are leased and mined by Bridger Coal Company, a joint

venture between Pacific Minerals, Inc. (“PMI”) and a subsidiary

of Idaho Power Company. PMI, a wholly owned subsidiary of PacifiCorp, has

a two-thirds interest in the joint venture. The amount included above

represents only PacifiCorp’s two-thirds interest in the coal

reserves.

|

Recoverability

by surface mining methods typically ranges from 90% to 95%. Recoverability by

underground mining techniques ranges from 50% to 70%. To meet applicable

standards, PacifiCorp blends coal mined at its owned mines with contracted coal

and utilizes emission reduction technologies for controlling sulfur dioxide and

other emissions. For fuel needs at PacifiCorp's coal-fired generating facilities

in excess of coal reserves available, PacifiCorp believes it will be able to

purchase coal under both long- and short-term contracts to supply its remaining

coal-fired generating facilities with coal over their currently expected useful

lives.

During

the year ended December 31, 2009, PacifiCorp-owned coal-fired generating

facilities held sufficient sulfur dioxide emission allowances to comply with the

United States Environmental Protection Agency (the “EPA”) Title IV

requirements.

Natural Gas

PacifiCorp’s

natural gas-fired generating facilities account for 21% of PacifiCorp’s

total net owned generating capacity. PacifiCorp uses natural gas as fuel for its

combined- and simple-cycle natural gas-fired generating facilities. Oil and

natural gas are also used for igniter fuel and to fuel generation for

transmission support and standby purposes. In determining whether to dispatch

its natural gas-fired generating facilities, PacifiCorp considers, among other

factors, its operational requirements to balance electricity supply and demand

and the current spark spread. Spark spread is the difference between the

wholesale market price of electricity at any given hour and the cost to convert

natural gas to electricity.

PacifiCorp

manages its natural gas supply requirements by entering into forward commitments

for physical delivery of natural gas. PacifiCorp also manages its exposure to

increases in natural gas supply costs through forward commitments for the

purchase of forecasted physical natural gas requirements at fixed prices and

financial swap contracts that settle in cash based on the difference between a

fixed price that PacifiCorp pays and a floating market-based price that

PacifiCorp receives. As of December 31, 2009, PacifiCorp had economically

hedged 53% of its forecasted physical exposure and 95% of its forecasted

financial exposure for 2010. For 2011, PacifiCorp has currently hedged 26% of

its forecasted physical exposure and 87% of its forecasted financial

exposure.

10

Hydroelectric

Hydroelectric

generating facilities account for 11% of PacifiCorp’s total net owned generating

capacity. The amount of electricity PacifiCorp is able to generate from its

hydroelectric facilities depends on a number of factors, including snowpack in

the mountains upstream of its hydroelectric facilities, reservoir storage,

precipitation in its watersheds, generating unit availability and restrictions

imposed by oversight bodies due to competing water management

objectives.

PacifiCorp

operates the majority of its hydroelectric generating portfolio under long-term

licenses from the Federal Energy Regulatory Commission (the “FERC”) with

terms of 30 to 50 years, while some are licensed under the Oregon

Hydroelectric Act. PacifiCorp expects to incur ongoing operating and maintenance

expense and capital expenditures associated with the terms of its renewed

hydroelectric licenses and settlement agreements, including natural resource

enhancements. PacifiCorp’s Klamath hydroelectric system is currently operating

under annual licenses. Substantially all of PacifiCorp’s remaining hydroelectric

generating facilities are operating under licenses that expire between 2030 and

2058. As of December 31, 2009 and 2008, PacifiCorp had $67 million and

$57 million, respectively, in costs related to the relicensing of the

Klamath hydroelectric system included in construction work-in-progress within

property, plant and equipment, net on the Consolidated Balance Sheets. For a

further discussion of PacifiCorp’s hydroelectric relicensing and decommissioning

activities, refer to “Hydroelectric Relicensing – Klamath River

Hydroelectric Facilities” and “Hydroelectric Decommissioning – Condit

Hydroelectric Facility – White Salmon River, Washington”

below.

Wind

and Other Renewable Resources

PacifiCorp

is pursuing additional renewable resources as viable, economic and

environmentally prudent means of supplying electricity. Renewable resources have

low to no emissions, require little or no fossil fuel and are complemented by

PacifiCorp’s other generating facilities and wholesale transactions.

PacifiCorp’s wind-powered generating facilities are eligible for federal

renewable electricity production tax credits (“PTCs”) for 10 years from the

date that the facilities were placed in service. In February 2009,

legislation was passed extending the date by which such facilities must be

placed in service to be eligible for PTCs to December 31,

2012.

Wholesale

Activities

PacifiCorp

purchases electricity in the wholesale markets as needed to serve its retail

load and long-term wholesale sales obligations and for system balancing

requirements. PacifiCorp also purchases electricity in the wholesale markets

when it is more economical than generating it at its own facilities. Many of

PacifiCorp’s purchased electricity contracts have fixed-price components, which

provide some protection against price volatility. PacifiCorp sells electricity

into the wholesale market arising from imbalances between generation and retail

load obligations and to optimize the utilization of generation

assets.

11

Transmission

and Distribution

PacifiCorp’s

electric transmission system is part of the Western Interconnection, the

regional grid in the West. The Western Interconnection includes the

interconnected transmission systems of 14 western states, two Canadian

provinces and parts of Mexico that make up the Western Electricity Coordinating

Council (the “WECC”). The map under “Service Territories” above shows

PacifiCorp’s primary transmission system. PacifiCorp operates one balancing

authority area in the western portion of its service territory and one balancing

authority area in the eastern portion of its service territory. A balancing

authority area is a geographic area with electric transmission systems that

control generation to maintain schedules with other balancing authority areas

and ensure reliable operations. In operating the balancing authority areas,

PacifiCorp is responsible for continuously balancing electric supply and demand

by dispatching generating resources and interchange transactions so that

generation internal to the balancing authority area, plus net imported power,

matches customer loads. PacifiCorp also schedules deliveries of energy over its

transmission system in accordance with FERC requirements.

As of

December 31, 2009, PacifiCorp owned, or participated in, an electric

transmission system consisting of approximately:

|

Nominal Voltage

|

||||

|

(in kilovolts)

|

||||

|

Transmission Lines

|

Miles

(1)

|

|||

|

500

|

700

|

|||

|

345

|

2,100

|

|||

|

230

|

3,400

|

|||

|

161

|

300

|

|||

|

138

|

2,200

|

|||

|

46

to 115

|

7,200

|

|||

|

15,900

|

|

(1)

|

Includes

PacifiCorp’s share of jointly owned

lines.

|

PacifiCorp’s

electric transmission and distribution system included approximately

900 substations as of December 31, 2009. PacifiCorp’s transmission

system, together with contractual rights on other transmission systems, enables

PacifiCorp to integrate and access generating resources to meet its customer

load requirements.

PacifiCorp’s

Energy Gateway Transmission Expansion Program represents plans to build

approximately 2,000 miles of new high-voltage transmission lines, with an

estimated cost exceeding $6 billion, primarily in Wyoming, Utah, Idaho, Oregon

and the desert Southwest. The plan includes several transmission line segments

that will: (a) address customer load growth; (b) improve system reliability; (c)

reduce transmission system constraints; (d) provide access to diverse resource

areas, including renewable resources; and (e) improve the flow of electricity

throughout PacifiCorp’s six-state service area and the Western United States.

Proposed transmission line segments are re-evaluated to ensure maximum benefits

and timing before committing to move forward with permitting and construction.

The first major transmission segments associated with this plan are expected to

be placed in service during 2010, with other segments placed in service through

2019, depending on siting, permitting and construction schedules.

Substantially

all of PacifiCorp’s generating facilities and reservoirs are managed on a

coordinated basis to obtain maximum load-carrying capability and efficiency.

Portions of PacifiCorp’s transmission and distribution systems are

located:

|

·

|

On

property owned or leased by

PacifiCorp;

|

|

·

|

Under

or over streets, alleys, highways and other public places, the public

domain and national forests and state lands under franchises, easements or

other rights that are generally subject to

termination;

|

|

·

|

Under

or over private property as a result of easements obtained primarily from

the record holder of title; or

|

|

·

|

Under

or over Native American reservations under grant of easement by the United

States Secretary of Interior or lease by Native American

tribes.

|

It is

possible that some of the easements, and the property over which the easements

were granted, may have title defects or may be subject to mortgages or liens

existing at the time the easements were acquired.

12

Future

Generation and Conservation

Integrated

Resource Plan

As

required by certain state regulations, PacifiCorp uses an Integrated Resource

Plan (“IRP”) to develop a long-term view of prudent future actions required to

help ensure that PacifiCorp continues to provide reliable and cost-effective

electric service to its customers. The IRP process identifies the amount and

timing of PacifiCorp’s expected future resource needs and an associated optimal

future resource mix that accounts for planning uncertainty, risks, reliability

impacts, state energy policies and other factors. The IRP is a coordinated

effort with stakeholders in each of the six states where PacifiCorp operates.

PacifiCorp files its IRP on a biennial basis, and for four of its six state

jurisdictions, receives a formal notification as to whether the IRP meets the

commission’s IRP standards and guidelines. In May 2009, PacifiCorp filed

its 2008 IRP with each of its state commissions. During 2009, PacifiCorp

received orders from states of Washington and Idaho acknowledging that the IRP

met their applicable standards and guidelines. In February 2010, the Oregon

Public Utility Commission (“OPUC”) issued an order acknowledging the 2008 IRP.

Acknowledgment of the 2008 IRP by the Utah Public Service Commission (“UPSC”) is

pending.

Requests

for Proposals

PacifiCorp

has issued a series of separate Requests for Proposals (“RFPs”), each of which

focuses on a specific category of resources consistent with the IRP. The IRP and

the RFPs provide for the identification and staged procurement of resources in

future years to achieve a balance of load requirements and resources. As

required by applicable laws and regulations, PacifiCorp files draft RFPs with

the UPSC, the OPUC and the WUTC prior to issuance to the market. Approval by the

UPSC, the OPUC or the WUTC may be required depending on the nature of the

RFPs.

In

August 2009, under PacifiCorp’s 2008R-1 renewable resources RFP (approved

by the OPUC in September 2008), PacifiCorp executed a power purchase

agreement to purchase the entire output of the proposed 200-MW Top of the World

wind-powered generating facility located in Wyoming. The generation of the

energy and associated renewable energy credits under this agreement are expected

to commence in December 2010 and continue for a period of 20 years.

PacifiCorp’s 2009R renewable resources RFP (approved by the OPUC with

modification in July 2009) seeks additional cost-effective renewable

generation projects with no single resource greater than 300 MW, combined

total resources of no more than 400 MW and on-line dates no later than

December 31, 2012. As a result of the 2009R renewable resources RFP,

PacifiCorp’s 111-MW Dunlap Ranch I wind-powered generating facility located

in Wyoming was selected and construction has commenced. Negotiations were also

initiated with the remaining final shortlist bidder under the 2009R renewable

resources RFP.

In

October 2009, PacifiCorp filed a request for approval with the UPSC to

re-issue the All Source RFP, which was previously suspended in April 2009.

In October 2009 and November 2009, respectively, the UPSC and the OPUC

approved resumption of the All Source RFP. The All Source RFP seeks up to

1,500 MW on a system wide basis from projects with in-service dates from

2014 through 2016. In December 2009, the All Source RFP was issued to the

market.

13

Demand-side

Management

PacifiCorp

has provided a comprehensive set of demand-side management (“DSM”) programs to

its customers since the 1970s. The programs are designed to reduce energy

consumption and more effectively manage when energy is used, including

management of seasonal peak loads. Current programs offer services to customers

such as energy engineering audits and information on how to improve the

efficiency of their homes and businesses. To assist customers in investing in

energy efficiency, PacifiCorp offers rebates or incentives encouraging the

purchase and installation of high-efficiency equipment such as lighting, heating

and cooling equipment, weatherization, motors, process equipment and systems, as

well as incentives for efficient construction. Incentives are also paid to

solicit participation in load management programs by residential, business and

agricultural customers through programs, such as PacifiCorp’s residential and

small commercial air conditioner load control program and irrigation equipment

load control programs. Subject to random prudence reviews, state regulations

allow for contemporaneous recovery of costs incurred for the DSM programs

through state-specific energy efficiency service charges paid by retail electric

customers. In addition to these DSM programs, PacifiCorp has load curtailment

contracts with a number of large industrial customers that deliver up to

342 MW of load reduction when needed. Recovery for the costs associated

with the large industrial load management program is determined through

PacifiCorp’s general rate case process. In 2009, $106 million was expended on

the DSM programs in PacifiCorp’s six-state service area, resulting in an

estimated 457,000 megawatt hours (“MWh”) of first-year energy savings and

441 MW of peak load management. Total demand-side load available for

control in 2009, including both load management from the large industrial

curtailment contracts and DSM programs, was 783 MW.

General

Regulation

PacifiCorp

is subject to comprehensive governmental regulation, which significantly

influences its operating environment, prices charged to customers, capital

structure, costs and ability to recover costs.

State

Regulation

PacifiCorp

pursues a regulatory program in all states, with the objective of keeping rates

closely aligned to ongoing costs. Historically, state utility commissions have

established rates on a cost-of-service basis, which are designed to allow a

utility an opportunity to recover its costs of providing services and to earn a

reasonable return on its investments. A utility’s cost of service generally

reflects its allowed operating expenses, including energy costs, operation and

maintenance expense, depreciation expense and income and other tax expense,

reduced by wholesale electric sales and other revenue. State utility commissions

may adjust rates pursuant to a review of (a) the utility’s revenue and

expenses during a defined test period and (b) the utility’s level of

investment. State utility commissions typically have the authority to review and

change rates on their own initiative. States may also initiate reviews at the

request of a utility, utility customer, a governmental agency or a

representative of a group of customers. The utility and such parties, however,

may agree with one another not to request a review of or changes to rates for a

specified period of time.

14

In

addition to recovery through general rates, PacifiCorp also achieves recovery of

certain costs through various adjustment mechanisms as summarized below. Refer

to “Liquidity and Capital Resources” in Item 7 of this Form 10-K for

additional information regarding regulatory matters, including the status of

current filings with the various state commissions.

|

State

Regulator

|

Base

Rate Test Period

|

Adjustment

Mechanism

|

||

|

Utah

Public Service Commission

|

Forecasted

or historical with known and measurable changes (1)

|

PacifiCorp

has requested approval of an energy cost adjustment mechanism (“ECAM”) to

recover the difference between base net power costs set during a general

rate case and actual net power costs.

A

recovery mechanism is available for a single capital investment project

that in total exceeds 1% of existing rate

base when a general rate case has occurred within the preceding

18 months.

|

||

|

Oregon

Public Utility Commission

|

Forecasted

|

Annual

transition adjustment mechanism (“TAM”), a mechanism for annual rate

adjustments for forecasted net variable power costs; no true-up to actual

net variable power costs.

|

||

|

Renewable

adjustment clause (“RAC”) to recover the revenue requirement of new

renewable resources and associated transmission that are not reflected in

general rates.

|

||||

|

Annual

true-up of taxes authorized to be collected in rates compared to taxes

paid by PacifiCorp, as defined by Oregon statute and administrative rules

under Oregon Senate Bill 408 (“SB 408”).

|

||||

|

Wyoming

Public Service Commission (“WPSC”)

|

Forecasted

or historical with known and measurable changes (1)

|

Power

cost adjustment mechanism (“PCAM”) based on forecasted net power costs,

later trued-up to actual net power costs, subject to dead bands and

customer sharing.

|

||

|

Washington

Utilities and Transportation Commission

|

Historical

with known and measurable changes

|

Deferral

mechanism of costs for up to 24 months of new base load generation

resources and eligible renewable resources that qualify under the state’s

emissions performance standard and are not reflected in general

rates.

|

||

|

Idaho

Public Utilities Commission (“IPUC”)

|

Historical

with known and measurable changes

|

ECAM

to recover the difference between base net power costs set during a

general rate case and actual net power costs, subject to customer sharing

and other adjustments.

|

||

|

California

Public Utilities Commission (“CPUC”)

|

Forecasted

|

Post

test-year adjustment mechanism for major capital additions (“PTAM –

capital additions”), a mechanism that allows for rate adjustments outside

of the context of a traditional rate case for the revenue requirement

associated with capital additions exceeding $50 million on a total-company

basis. Filed as eligible capital additions are placed into

service.

|

||

|

Energy

cost adjustment clause (“ECAC”) that allows for an annual update to actual

and forecasted net variable power costs.

|

||||

|

Post

test-year adjustment mechanism for attrition (“PTAM – attrition”), a

mechanism that allows for an annual adjustment to costs other than net

variable power costs.

|

|

(1)

|

PacifiCorp

has relied on both historical test periods with known and measurable

adjustments and forecasted test periods. The WPSC has not issued a final

ruling on its preference between historical or forecasted test

periods.

|

PacifiCorp’s

energy efficiency program costs are collected through separately established

rates that are adjusted periodically based on actual and expected costs, as

approved by the respective state utility commission.

15

Federal

Regulation

The FERC

is an independent agency with broad authority to implement provisions of the

Federal Power Act, the Energy Policy Act and other federal statutes. The FERC

regulates rates for interstate sales of electricity in wholesale markets;

transmission of electric power, including pricing and expansion of transmission

systems; electric system reliability; utility holding companies; accounting;

securities issuances; and other matters, including construction and operation of

hydroelectric projects. The FERC also has the enforcement authority to assess

civil penalties of up to $1 million per day per violation of rules,

regulations and orders issued under the Federal Power Act. PacifiCorp has

implemented programs that facilitate compliance with the FERC regulations

described below, including having instituted compliance monitoring

procedures.

Wholesale

Electricity and Capacity

The FERC

regulates PacifiCorp’s rates charged to wholesale customers for electricity and

transmission capacity and related services. Most of PacifiCorp’s wholesale

electric sales and purchases take place under market-based pricing allowed by

the FERC and are therefore subject to market volatility.

The FERC

conducts a triennial review of PacifiCorp’s market-based pricing authority.

PacifiCorp must demonstrate the lack of market power in order to charge

market-based rates for sales of wholesale electricity and electric generation

capacity in its balancing authority areas. PacifiCorp’s next triennial filing is

due in June 2010. Under the FERC’s market-based rules, PacifiCorp must also file

a notice of change in status when there is a significant change in the

conditions that the FERC relied upon in granting market-based pricing authority.

PacifiCorp is currently authorized to sell at market-based rates.

Transmission

PacifiCorp’s

wholesale transmission services are regulated by the FERC under cost-based

regulation subject to PacifiCorp’s Open Access Transmission Tariff (“OATT”). In

accordance with its OATT, PacifiCorp offers several transmission services to

wholesale customers:

|

·

|

Network

transmission service (guaranteed service that integrates generating

resources to serve retail loads);

|

|

·

|

Long-

and short-term firm point-to-point transmission service (guaranteed

service with fixed delivery and receipt points);

and

|

|

·

|

Non-firm

point-to-point service (“as available” service with fixed delivery and

receipt points).

|

These

services are offered on a non-discriminatory basis, which means that all

potential customers are provided an equal opportunity to access the transmission

system. PacifiCorp’s transmission business is managed and operated independently

from its commercial and trading business, in accordance with the FERC Standards

of Conduct.

For

retail customers, transmission costs are not separated from, but rather are

“bundled” with, generation and distribution costs in rates approved by state

regulatory commissions.

16

FERC

Order No. 890 – Preventing Undue Discrimination and Preference in Transmission

Service (“Order No. 890”)

In

February 2007, the FERC adopted a final rule in Order No. 890 designed

to strengthen the pro forma OATT by providing greater specificity and increasing

transparency. The most significant revisions to the pro forma OATT relate to the

development of more consistent methodologies for calculating available transfer

capability, changes to the transmission planning process, changes to the pricing

of certain generator and energy imbalances to encourage efficient scheduling

behavior and changes regarding long-term point-to-point transmission service,

including the addition of conditional firm long-term point-to-point transmission

service and generation re-dispatch. The FERC has issued rules through a set of

subsequent orders clarifying Order No. 890. As a transmission provider with

an OATT on file with the FERC, PacifiCorp is required to comply with the

requirements of the new rule. PacifiCorp made its first compliance filing

amending its OATT in July 2007. The FERC has continued to issue rules

through a set of subsequent orders clarifying Order No. 890. In response to

these various orders, PacifiCorp has made several required compliance

filings.

FERC

Reliability Standards

The FERC

has approved an extensive number of reliability standards developed by the North

American Electric Reliability Corporation (the “NERC”) and the WECC,

including critical infrastructure protection standards and regional standard

variations. PacifiCorp must comply with all applicable standards. Compliance,

enforcement and monitoring oversight of these standards is carried out by the

FERC and the WECC. During 2007, the WECC audited PacifiCorp’s compliance

with several of the approved reliability standards, and in November 2008,

the FERC assumed control of certain aspects of the WECC’s audit. In

May 2009, PacifiCorp received a notice of alleged violation and proposed

sanctions related to the portions of the WECC’s 2007 audit that remained

with the WECC. In July 2009, PacifiCorp reached a settlement in principle

with the WECC. The results of the settlement will not have a material impact on

PacifiCorp’s consolidated financial results. Refer to Note 13 of Notes to

Consolidated Financial Statements included in Item 8 of this Form 10-K

for additional information regarding certain aspects of the WECC’s

2007 audit currently under the FERC’s authority.

Hydroelectric

Relicensing – Klamath River Hydroelectric Facilities

PacifiCorp’s

Klamath hydroelectric system is the only hydroelectric generating facility for

which PacifiCorp is engaged in the relicensing process with the FERC. PacifiCorp

also has requested the FERC to allow decommissioning of certain hydroelectric

systems. Most of PacifiCorp’s hydroelectric generating facilities are licensed

by the FERC as major systems under the Federal Power Act, and certain of these

systems are licensed under the Oregon Hydroelectric Act. Refer to

Note 13 of Notes to Consolidated Financial Statements in Item 8 of

this Form 10-K for an update regarding hydroelectric relicensing for

PacifiCorp’s Klamath hydroelectric system.

Hydroelectric

Decommissioning – Condit Hydroelectric Facility – White Salmon River,

Washington

In

September 1999, a settlement agreement to remove the 14-MW Condit

hydroelectric facility was signed by PacifiCorp, state and federal agencies and

non-governmental organizations. Under the original settlement agreement, removal

was expected to begin in October 2006, with a total cost to decommission

not to exceed $17 million, excluding inflation. In early

February 2005, the parties agreed to modify the settlement agreement so

that removal would not begin until October 2008, with a total cost to

decommission not to exceed $21 million, excluding inflation. The settlement

agreement is contingent upon receiving a FERC surrender order and other

regulatory approvals that are not materially inconsistent with the amended

settlement agreement. PacifiCorp is in the process of acquiring all necessary

permits within the terms and conditions of the amended settlement agreement.

Given the ongoing permitting process and the time needed for system removal and

to evaluate impacts on natural resources, decommissioning is now expected to

begin no earlier than October 2010. In March 2008, the United States Army

Corps of Engineers requested PacifiCorp complete an additional study of expected

decommissioning impacts on aquatic resources. In January 2009, the study

work was completed and the results were provided to the United States Army Corps

of Engineers and the Washington Department of Ecology. In January 2010, the

Washington Department of Ecology released the Final Second Supplemental

Environmental Impact Statement which formally considered this additional

information. Absent further information requests, the Washington Department of

Ecology is expected to complete the Clean Water Act 401 certification

process within the second quarter of 2010. Remaining permitting includes a

404 permit from the United States Army Corps of Engineers and a surrender

order from the FERC.

17

Northwest

Refund Case

For a

discussion of the Northwest Refund case, refer to Note 13 of Notes to

Consolidated Financial Statements in Item 8 of this

Form 10-K.

United

States Mine Safety

PacifiCorp’s

mining operations are regulated by the federal Mine Safety and Health

Administration (“MSHA”), which administers federal mine safety and health laws,

regulations and state regulatory agencies. The Mine Improvement and New

Emergency Response Act of 2006 (“MINER Act”), enacted in

June 2006, amended previous mine safety and health laws to improve mine

safety and health and accident preparedness. PacifiCorp is required to develop a

written emergency response plan specific to each underground mine it operates.

These plans must be reviewed by MSHA every six months. It also requires every

mine to have at least two rescue teams located within one hour, and it limits

the legal liability of rescue team members and the companies that employ them.

The MINER Act also increases civil and criminal penalties for violations of

federal mine safety standards and gives MSHA the ability to institute a civil

action for relief, including a temporary or permanent injunction, restraining

order or other appropriate order against a mine operator who fails to pay the

penalties or fines.

Environmental

Laws and Regulation

PacifiCorp

is subject to federal, state and local laws and regulations regarding air and

water quality, renewable portfolio standards, climate change, hazardous and

solid waste disposal, protected species and other environmental matters that

have the potential to impact PacifiCorp’s current and future operations. In

addition to imposing continuing compliance obligations, these laws and

regulations provide authority to levy substantial penalties for noncompliance

including fines, injunctive relief and other sanctions. These laws and

regulations are administered by the EPA and various other state, local and

international agencies. All such laws and regulations are subject to a range of

interpretation, which may ultimately be resolved by the courts. Environmental

laws and regulations continue to evolve, and PacifiCorp is unable to predict the

impact of the changing laws and regulations on its operations and consolidated

financial results. PacifiCorp believes it is in material compliance with all

applicable laws and regulations.

Refer to

“Liquidity and Capital Resources” in Item 7 of this Form 10-K for

additional information regarding environmental laws and regulation and

PacifiCorp’s forecasted environmental-related capital expenditures.

18

|

Item 1A.

|

Risk

Factors

|

We are

subject to numerous risks, including, but not limited to, those set forth below.

Careful consideration of these risks, together with all of the other information

included in this Form 10-K and the other public information filed by us, should

be made before making an investment decision. Additional risks and uncertainties

not presently known or that are currently deemed immaterial may also impair our

business operations.

Our Corporate and Financial

Structure Risks

We

have a substantial amount of debt, which could adversely affect our ability to

obtain future financing and limit our expenditures.

As of

December 31, 2009, we had $6.372 billion in total debt securities

outstanding. Our principal financing agreements contain restrictive covenants

that limit our ability to borrow funds, and any issuance of debt securities

requires prior authorization from certain of our state regulatory commissions.

We expect that we may need to supplement cash generated from operations and

availability under committed credit facilities with new issuances of long-term

debt. However, if market conditions are not favorable for the issuance of

long-term debt, or if an issuance of long-term debt would exceed contractual or

regulatory limits, we may postpone planned capital expenditures, or take other

actions, to the extent those expenditures are not fully covered by cash from

operations, borrowings under committed credit facilities or equity contributions

from MEHC.

A

downgrade in our credit ratings could negatively affect our access to capital,

increase the cost of borrowing or raise energy transaction credit support

requirements.

Our debt

securities and preferred stock are rated investment grade by various rating

agencies. We cannot assure that our debt securities and preferred stock will

continue to be rated investment grade in the future. Although none of our

outstanding debt has rating-downgrade triggers that would accelerate a repayment

obligation, a credit rating downgrade would increase our borrowing costs and

commitment fees on our revolving credit agreements and other financing

arrangements, perhaps significantly. In addition, we would likely be required to

pay a higher interest rate in future financings, and the potential pool of

investors and funding sources would likely decrease. Further, access to the

commercial paper market, the principal source of short-term borrowings, could be

significantly limited resulting in higher interest costs.

Most of

our large customers, suppliers and counterparties require sufficient

creditworthiness in order to enter into transactions, particularly in the

wholesale energy markets. If our credit ratings were to decline, especially

below investment grade, financing costs and borrowing would likely increase

because certain counterparties may require collateral in the form of cash, a

letter of credit or some other security for existing transactions, as well as a

condition to further transactions with us.

MEHC

could exercise control over us in a manner that would benefit MEHC to the

detriment of our creditors and preferred stockholders.

MEHC,

through its subsidiary, owns all of our common stock and has control over all

decisions requiring shareholder approval, including the election of our

directors. In circumstances involving a conflict of interest between MEHC and

our creditors and preferred stockholders, MEHC could exercise its control in a

manner that would benefit MEHC to the detriment of our creditors and preferred

stockholders.

19

Our Business

Risks

We

are subject to extensive regulations and legislation that affect our operations

and costs. These regulations and laws are complex, dynamic and subject to

change.

We are

subject to numerous regulations and laws enforced by regulatory agencies. These

regulatory agencies include, among others, the FERC, the WECC, the EPA and the

public utility commissions in Utah, Oregon, Wyoming, Washington, Idaho and

California.

Regulations

affect almost every aspect of our business and limit our ability to

independently make and implement management decisions regarding, among other

items, constructing, acquiring or disposing of operating assets; business

combinations; setting rates charged to customers; establishing capital

structures and issuing debt or equity securities; engaging in transactions

between our subsidiaries and affiliates; and paying dividends. Regulations are

subject to ongoing policy initiatives, and we cannot predict the future course

of changes in regulatory laws, regulations and orders, or the ultimate effect

that regulatory changes may have on us. However, such changes could adversely

affect our consolidated financial results through higher capital expenditures

and operating costs and an overall change in how we operate our business. For

example, such changes could result in, but are not limited to, increased retail

competition within our service territories; new environmental requirements,

including the implementation of RPS and greenhouse gas (“GHG”) emission

reduction goals; the issuance of stricter air quality standards and the

implementation of energy efficiency mandates; the acquisition by a municipality

of our distribution facilities (by a vote in favor of a public utility district