Attached files

| file | filename |

|---|---|

| EX-32.1 - SECTION 906 CERTIFICATION - GOLDEN CENTURY RESOURCES Ltd | exhibit32-1.htm |

| EX-31.1 - SECTION 302 CERTIFICATION - GOLDEN CENTURY RESOURCES Ltd | exhibit31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-Q /A

Amendment No. 3

[ x ] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2009

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE EXCHANGE ACT

For the transition period from _________ to ________

Commission File No. 000-52842

GOLDEN CENTURY RESOURCES

LIMITED

(Exact name of registrant as specified in its

charter)

| Delaware | 98-0466250 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

Suite 400, 2711 Centervill Road, Wilmintong, Delaware,

19808

(Address of principal executive offices) (zip code)

(302) 295-4937

(Registrant’s telephone number,

including area code)

Golden Century Technologies Corporation

(Former name, former address and former fiscal year, if changed

since last report)

Copy of communications to:

Clark Wilson LLP

Karen

Richardson, Esq.

Suite 800 - 885 West Georgia Street

Vancouver, British

Columbia, Canada V6C 3H1

Telephone: 604-687-5700

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Yes[ x ] No[ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer," "accelerated filer,” and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [ x ] |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company

(as defined in Rule 12b-2 of the Exchange Act).

Yes[ ] No[ x ]

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PRECEDING FIVE YEARS

Check whether the registrant filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Exchange Act after distribution of securities under a plan confirmed by a court. Yes[ ] No[ ]

APPLICABLE ONLY TO CORPORATE ISSUERS

State the number of shares outstanding of each of the issuer's classes of common equity as of the latest practicable date: As of November 9, 2009, there were 14,818,000 shares of common stock, par value $0.0001 outstanding.

Explanatory Note: This Amendment No. 3 on Form 10-Q/A constitutes an amendment to our quarterly report on Form 10-Q for the quarter ended September 30, 2009 that was originally filed with the Securities and Exchange Commission on November 16, 2009 and amended on February 17 and 24, 2010. This Amendment is being filed solely for the purpose of reflecting the changes in the restated financial statements filed on February 24, 2010 relating to an error related to the accounting for a refundable deposit and an error in recording fully vested common shares as issued when they had not yet been issued.

As required by Rule 12b-15 under the Securities Exchange Act of 1934, new certifications of our principal executive officer and principal financial officer are being filed as exhibits to this Amendment.

Except for the matters described above, this amendment does not change any previously reported financial results, modify or update disclosures in the Form 10-Q, or reflect events occurring after the date of the original filing or the Amendments of the Form 10-Q.

ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

CAUTIONARY NOTICE REGARDING FORWARD LOOKING STATEMENTS

This report contains forward-looking statements. Forward-looking statements deal with our current plans, intentions, beliefs and expectations and are statements of future economic performance. Statements containing terms like "believes", "does not believe", "plans", "expects", "intends", "estimates", "anticipates", and other phrases of similar meaning are considered to imply uncertainty and are forward-looking statements.

Forward-looking statements involve known and unknown risks and uncertainties that may cause our actual results in future periods to differ materially from what is currently anticipated. We make cautionary statements throughout this report and the documents we have incorporated by reference, including those stated under the heading "Risk Factors". You should read these cautionary statements as being applicable to all related forward-looking statements wherever they appear in this report, the materials referred to in this report, and the materials incorporated by reference into this report.

We cannot guarantee our future results, levels of activity, performance or achievements. Neither we nor any other person assumes responsibility for the accuracy and completeness of these forward-looking statements. We are under no duty to update any of the forward-looking statements after the date of this report.

Where we say "we", "us", "our" or "the Company", we mean Golden Century Resources Limited.

OVERVIEW

We are a Delaware Corporation established on July 1, 2005. On September 8, 2009, we completed a merger with our subsidiary, Golden Century Resources Limited, a Delaware corporation which was incorporated solely to effect a change in our name. As a result, we have changed our name from “Golden Century Technologies Corporation” to “Golden Century Resources Limited”.

We are engaged in the production, distribution and sale of medical supplies in Mainland China, Hong Kong, Macau, Taiwan and Middle East. Our principal business is to supply the Flushable Colostomy and Ostomy Pouch Liners (the “Liners) to Colo-Majic Liners, Inc. (the “Colo-Majic”) for its existing North American market and to manufacture, market and distribute the Liners in the People of Republic of China, Hong Kong, Macau, Taiwan and Middle East.

On October 30, 2005, we entered into an Agreement of Cooperation with Colo-Majic. Pursuant to the agreement, we will manufacture and supply 3,000,000 or more liners every eighteen months. The agreement is for a term of five years.

On September 28, 2006, we entered into a Licensing Agreement with Colo-Majic. Pursuant to the agreement, Colo-Majic grants to us a license to manufacture, develop and distribute the Liner product in the mainland of the People’s Republic of China, excluding Hong Kong, Macau and Taiwan.

On January 15, 2007, we entered into a Licensing Agreement Amendment with Colo-Majic adding additional Territories of Hong Kong, Taiwan, Macau and Middle East for the existing Licensing, Production and Distribution Agreement dated September 28, 2006.

On January 16, 2007, we entered into a Distribution Agreement with T-Ray Science, Inc. (“T-Ray”), a Delaware corporation, regarding granting non-exclusive distribution right to T-Ray to promote, sell and distribute the Flushable Colostomy and Ostomy Pouch Liners in the territories of Middle East including the United Arab Emirates, Israel, Saudi Arabia, Iran, Egypt and Turkey. On January 16, 2007, On January 16, 2008, the above mentioned Distribution Agreement expired. We decided to not renew the Distribution Agreement with T-Ray cause the minimum target for the first year of the Agreement, 1000 boxes of Liners, was not met.

- 2 -

On August 12, 2009, the Company entered into a Letter of Intent with JinXin Copper Holding Limited (“JinXin”), a British Virgin Island corporation that owns 62% of Nanjiang Long Du Mining Industrial Limited Corporation (“Long Du”). Long Du is incorporated in Sichuan Province in the People’s Republic of China and owns a prospecting permit of the Yang Tan Gold Mine (“Yang Tan”). Pursuant to the Letter of Intent, we agreed to acquire all the rights to Yang Tan owned by JinXin. On August 15, 2009, the Company paid $500,000 to JinXin, and subsequently paid a further $500,000 on December 18, 2009, to be used only for expenses relating to the application for the government exploitation permit for Yang Tan. The amount is fully refundable to the Company if the exploitation permit application for the Yang Tan Gold Mine is not successful , anytime before the execution of the Definitive Agreement. Upon closing, the Company will issue from treasury and deliver to JinXin a yet to be determined amount of common shares of the Company’s capital stock, and pay any additional consideration that is agreed to be paid as part of the consideration in the Definitive Agreement as described in the Letter of Intent. Mining operations will be another principal business of the Company going forward. We expect the closing to take place on or before the end of this year.

We have not at any time been able to generate sufficient revenue from sales of our products or services to sustain ongoing operations. From inception on July 1, 2005 to September 30, 2009, we have generated total revenues of only $251,731 but as of September 30, 2009, we have incurred total operating expenses of $1,646,769 and an accumulated deficit of $1,442,960 since inception. We may continue to incur significant additional operating losses as our operations continue. Operating losses may fluctuate from quarter to quarter as a result of differences in the timing of expenses incurred and revenue recognized.

Our capital requirements relating to the manufacturing and marketing of our products have been, and will continue to be, significant. We are dependent on the proceeds of future financing in order to continue in business and to develop and commercialize proposed products. We anticipate requiring approximately $750,000 to $1,500,000 in additional financing for the next twelve months. There can be no assurance that we will be able to raise the substantial additional capital resources necessary to permit us to pursue our business plan. We have no current arrangements with respect to, or sources of, additional financing and there can be no assurance that any such financing will be available to us on commercially reasonable terms, or at all. Any inability to obtain additional financing will have a material adverse effect on us, such as requiring us to significantly curtail or cease operations. In that case, investors may lose their entire investments.

Our strategic operating priorities for the balance of 2009 focus primarily on our goal of increasing revenues by December 31, 2009. We intend to achieve this revenue growth on several fronts as follows:

We intend to promote the Colo-Majic®Flushable Colostomy and Ostomy Pouch Liners throughout Mainland of China, Hong Kong, Macau and Taiwan;

We intend to promote Colo-Majic®Flushable Colostomy and Ostomy Pouch Liners to the Middle East through T-Ray Science, Inc., with whom we have signed an agreement that allows T-Ray to promote, sell and distribute the Liners in the Middle East. This agreement is attached as an exhibit to this form.; and,

We intend to continue to expand our revenue sources outside Colo-Majic. We intend to continue to pursue opportunities with other health care products.

Product Overview

PRODUCT

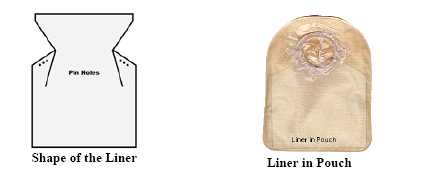

Colo-Majic® Flushable Colostomy and Ostomy Pouch Liner, it is designed to be used with the exiting pouch systems that are regularly used for colostomy and ostomy patients worldwide. Currently, the pouches are used, washed between uses and then thrown away. By using the Liners, patients can remove and flush the liner and install a new liner into the pouch. This increases the number of times the pouch can be used and reduces costs, since the liners are much less expensive than the pouches.

- 3 -

The Liners are inexpensive, light to carry, easy to apply, safe and clean.

The Liners are flushable. All pouches are disposable but not flushable. The pouches are not flushable because they have to be made from materials with a certain thickness to provide a strong hold capability. Also, they have to have a mechanism for sticking to the skin. These design requirements make them un-flushable. The Liners, however, are completely flushable, which puts the waste in the septic/sewage treatment system, which is healthier for both the patients and the public.

The curved-inward shape of the Liners on both sides cuts off the excessive material that otherwise would affect the connection tightness when applying on the inter-locking rims of the pouch components, as it is very precise in engineering and requires a snug fit at all times. That is to say, using a regular rectangular-shaped liner, for example, would have too much material to fit in between the inter-locking rims. The curved sealing lines on both sides, however, are designed to create two small areas where several pin holes can be punched to let the gas, but not the contents, travel through.

The Liners increase the number of times a pouch can be used and fully takes advantages of the existing merits of the pouch system, for example, the hold capability, comfort of wear and the seamless connection of the two pieces of the pouch system, which are the wafer and the pouch.

Competition

We face competition from several companies that manufacture and market pouch products in China, including ConvaTec (a Bristol-Myers Squibb Company), Cololplast China Company, Hollister Corporation and emerging companies in China, such as the Si Tai Li Company. However, as far as we are aware, not a single company is manufacturing a pouch liner product or a product similar to the Liners. Compared to the pouches alone, we believe the Liner products have a very competitive edge in costs for the consumers.

Customers

There are basically three groups of customers: hospitals and clinics, pharmacies, and the colostomy and/or ostomy patients.

As part of the regular hospital and clinic routine practice, hospitals, clinics and pharmacies maintain supplies of pouch systems for colostomy and ostomy patients and the health conscious populations buy the Liner products for at-home use on daily basis.

Intellectual Property

PATENTS

- 4 -

We have been granted a license by Mr. Douglas Wolrich, the inventor of the Liners, to manufacture, distribute, market and sell the Flushable Colostomy and Ostomy Pouch liner in China. The patent number in China is ZL 95 1 93664.6 and it expires on April 21, 2015.

TRADE MARKS

Mr. Douglas Wolrich, the inventor, holds 100% interest in the trademark of Colo-Majic® for the Flushable Colostomy and Ostomy Pouch liner. We have the rights to use the trademark in connection with our exercise of the rights under our agreement with Mr. Wolrich.

DOMAIN NAMES

We hold a 100% interest in the domain name of www.gc-hightech.com.

LICENSING AGREEMENT

Pursuant to the agreement between the Company and Colo-Majic dated September 28, 2006, Mr. Douglas Wolrich grants the Company the license and the sole exclusive and assignable right to use or cause to be used the Liner product in any manner and for any purpose to in any manner develop, maintain, manufacture, transport, distribute, market, sell, lease and/or license or sub-license the Liner product and to sell the same to the general public throughout China. The Company acknowledged that the within grant of the License is limited only to the purposes stated and does not constitute a grant of any right of ownership of intellectual property of the Liner product. This license expires on April 21, 2015. This license will continue until April 21, 2015 as long as the terms and conditions of this Licensing Agreement are being met.

Description of Property

Our executive and head office is located at Suite 1200, 1000 N. West Street, Wilmington, Delaware. No debt has accrued on account of rent payments owed. We feel that this space is adequate for our needs at this time, and we feel that we will be able to locate adequate space in the future, if needed, on commercially reasonable terms.

Research and Development

To date, we have not undergone any research and development.

Quantitative and Qualitative Disclosures about Market Risk

As at September 30, 2009, we have not entered into or acquired financial instruments that have a material market risk. We have no financial instruments for trading or other purposes or derivative or other financial instruments with off balance sheet risk. All financial assets and liabilities are due within the next twelve months and are classified as current assets or liabilities in the balance sheets provided with this report. The fair value of all financial instruments at September 30, 2009 approximate their carrying values.

Employees

As of September 30, 2009, we have two full time employees, our president and treasurer, Mr. David Cheng Lee and our Secretary, Ms. Hong Yang. Mr. David Cheng Lee handles all the responsiblities in the area of business development and corporate administration. Ms. Hong Yang handles some responsibilities in the area of corporate administration.

As of August 1, 2005, we had engaged two independent consultants in the areas of assisting us for overseas production and marketing management, business development in China and the consulting agreements were terminated on July 31, 2009.

- 5 -

On July 1, 2009, the Company entered into an agreement with Acme Group Consultants Limited for services to the Company at $3,000 per month for a period of six months .

On July 1, 2009, the Company entered into an agreement with Mr. Au for services to the Company at $3,000 per month for a period of six months .

On August 8, 2009, the Company entered into an agreement with a consultant for services for a period of 12 months commencing on the effective date. In consideration for the provision of the consulting services, the Company will issue the consultant 1,419,300 restricted shares of common stock with a fair value of $1,135,440. As at September 30, 2009, the amount was charged to operations as stock-based compensation and recorded the obligation to issue shares as accrued liability.

Results of Operations

We believe that our limited history of revenue generation make the prediction of future results of operations difficult, and, accordingly, our operating results should not be relied upon as an indication of future performance.

Results of Operations for the Three Months ended September 30, 2009 Compared to Three Months ended September 30, 2008, and for the Period from July 1, 2005 (Date of Inception) to September 30, 2009

Since our inception on July 1, 2005 to September 30, 2009, we have only generated revenues of $251,731. For the three months ended September 30, 2009 we incurred a net loss of $1,231,219 compared to a net loss of $26,181 for the three months ended September 30, 2008. Most of the increase in the net loss is the result of stock-based compensation charged for consulting services fees at the fair value of $1,135,440 for Universe Crown Consultants Limited during the period. From July 1, 2005 (Date of Inception) to September 30, 2009, we incurred a net loss of $1,442,960. Our net loss per share was $0.08 for the three months ended September 30, 2009, nil for the three months ended September 30, 2008 and nil for the period from July 1, 2005 (Date of Inception) to September 30, 2009.

Our total operating expenses were $1,231,219 for the three months ended September 30, 2009, compared to $26,181 for the same period ended September 30, 2008, an increase of approximately $1,205,038 resulting mainly from increases of stock-based compensation charged for consulting services fees at the fair value of $1,135,440 for Universe Crown Consultants Limited and professional fees relating to the change of control of the Company. From July 1, 2005 (Date of Inception) to September 30, 2009, we incurred total operating expenses of $1,646,769.

Our consulting fees of $41,250 for the three months ended September 30, 2009 consisted of amounts paid to four independent consultants and two full time employees, compared to $15,750 consisted of amounts paid to two independent consultants for the same period ended September 30, 2008, an increase of approximately $25,500 resulting from an addition of two more consultants and two more full time employees. From July 1, 2005 (Date of Inception) to September 30, 2009, our consulting fees were $305,709.

Our general and administrative fees for the three months ended September 30, 2009 were $42,537, compared to $10,431 for the same period ended September 30, 2008. Our general and administrative expenses consist of marketing and promotion, professional fees, meals and entertainment, rent, office maintenance, communication expenses (cellular, internet, fax, telephone, office supplies, courier and postage costs, web development and office supplies. The increase of approximately $32,106 primarily resulting from an increase of professional fees including legal, accounting and auditing fees relating to the change of control of the Company. From July 1, 2005 (Date of Inception) to September 30, 2009, we incurred general and administrative expenses of $170,164.

- 6 -

Liquidity and Capital Resources

Working Capital and Operations

As of September 30, 2009, we had a working capital deficit of $873,310, our deficit accumulated during the development stage was $1,442,960. For the period ended September 30, 2009, we had cash of $16,041. Our capital requirements relating to the manufacturing and marketing of our products have been, and will continue to be, significant. We are dependent on the proceeds of future financing in order to continue in business and to develop and commercialize proposed products. We anticipate requiring approximately $750,000 to $1,500,000 in additional financing for the next twelve months. There can be no assurance that we will be able to raise the substantial additional capital resources necessary to permit us to pursue our business plan. We have no current arrangements with respect to, or sources of, additional financing and there can be no assurance that any such financing will be available to us on commercially reasonable terms, or at all. Any inability to obtain additional financing will have a material adverse effect on us, such as requiring us to significantly curtail or cease operations. In that case, investors may lose their entire investments.

Audit Committee

The functions of the audit committee are currently carried out by our board of directors. Our board of directors have determined that we do not have a director that is an audit committee financial expert carrying out the duties of the audit committee. Our board of directors have determined that the cost of hiring a financial expert to act as a director of our company and to be a member of the audit committee or otherwise perform audit committee functions outweighs the benefits of having a financial expert on the audit committee.

Certain Relationships and Related Party Transactions

We have not entered into any transactions with our officers, directors, persons nominated for these positions, beneficial owners of 5% or more of our common stock, or family members of these persons wherein the amount involved in the transaction or a series of similar transactions exceeded $60,000.

Critical Accounting Policies

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. An accounting policy is considered to be critical if it requires an accounting estimate to be made based on assumptions about matters that are highly uncertain at the time the estimate is made, and if different estimates that reasonably could have been used, or changes in the accounting estimates that are reasonably likely to occur periodically, could materially impact the financial statements. Financial Reporting Release No. 60 requires all companies to include a discussion of critical accounting policies or methods used in the preparation of financial statements. Note 2 to the financial statements, includes a summary of the significant accounting policies and methods used in the preparation of our financial statements. The following is a brief discussion of the more significant accounting policies and methods used by us.

Stock based Compensation

In accordance with ASC 718, Compensation – Stock Based Compensation, the Company accounts for share-based payments using the fair value method. The Company has not issued any stock options since its inception. Common shares issued to third parties for non-cash consideration are valued based on the fair market value of the services provided or the fair market value of the common stock on the measurement date, whichever is more readily determinable.

- 7 -

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

Going Concern Statement

Due to the uncertainty of our ability to meet our current operating and capital expenses, in their report on our audited financial statements for the period ended June 30, 2009 , our independent registered public accounting firm included an explanatory paragraph regarding concerns about our ability to continue as a going concern. Our audited financial statements contained additional note disclosures describing the circumstances that led to this disclosure by our independent auditors.

There is substantial doubt about our ability to continue as a going concern as the continuation of our business is dependent upon obtaining further financing, successful and sufficient market acceptance of our software products, the continuing successful development of our computerized vision systems and, finally, achieving a profitable level of operations. The issuance of additional equity securities by us could result in a significant dilution in the equity interests of our current stockholders. Obtaining commercial loans, assuming those loans would be available, will increase our liabilities and future cash commitments.

There are no assurances that we will be able to obtain further funds required for our continued operations. We are pursuing various financing alternatives to meet our immediate and long-term financial requirements. There can be no assurance that additional financing will be available to us when needed or, if available, that it can be obtained on commercially reasonable terms. If we are not able to obtain the additional financing on a timely basis, we will not be able to proceed with our expansion program and may not be able to meet our other obligations as they become due.

- 8 -

PART II - OTHER INFORMATION

ITEM 1 A: RISK FACTORS

An investment in our common stock involves a number of very significant risks. You should carefully consider the following material risks and uncertainties in addition to other information in this prospectus in evaluating our company and its business before purchasing shares of our company’s common stock. Our business, operating results and financial condition could be seriously harmed due to any of the following material risks. You could lose all or part of your investment due to any of these material risks.

RISKS RELATED TO OUR COMPANY

We have a limited operating history and have only earned nominal revenue since inception. We have no suitable business history to which investors can refer in determining whether to invest in our company and we can provide no assurances that we will ever earn sufficient revenue to earn a profit. We may ever have a profitable business and investors may lose all of their investment in our company.

We have a very limited operating history and we face all of the risks and uncertainties encountered by development stage companies. Therefore, our prospects must be considered in light of the risks, expenses and difficulties associated with any development stage company. Due to our limited history, predictions of our future performance are very difficult. As of September 30, 2009, we have only generated revenues of $251,731, which was from our only customer and represented 100% of our total revenue. As at September 30, 2009, we had an accumulated deficit of $1,442,960 since inception. We anticipate continuing to incur significant losses in the foreseeable future as our operating expenses continue to increase. There can be no assurance that we will ever operate profitably with our current products and strategy. We cannot assure you that we will continue to generate revenues from our operations or ever achieve profitability. We may never generate enough revenue to become profitable and we may have to cease operations, in which case investors will likely lose all of their investment in our company.

Our independent auditors have expressed substantial doubt about our ability to continue as a going concern, which may hinder our ability to obtain future financing. Furthermore, it indicates that we may go out of business.

In their report dated September 26, 2009, our independent auditors have expressed substantial doubt about our ability to continue as a going concern. Our ability to continue as a going concern is an issue raised as a result of recurring losses from operations. We continue to experience net operating losses. Our ability to continue as a going concern is subject to our ability to obtain necessary funding from outside sources, including obtaining additional funding from the sale of our securities and to successfully carry out our business plan. Our continued net operating losses increase the difficulty in meeting such goals and there can be no assurances that our methods will prove successful. Because of our continued operating losses and the substantial doubt about our abilities to continue as a going concern, investors may not want to invest in our company and we may be unable to obtain the financing we need to continue. Also, these factors indicate that any investment into our company is very risky and that we may go out of business.

We have only one customer and generate no significant revenues and have only limited marketing experience to develop customers.

- 9 -

We have not entered into any agreements to sell our products to any customers in China, as yet. We do not believe that we will generate significant revenues in the immediate future. We will not generate any meaningful revenues unless we obtain sales contracts with a significant number of distributors or general hospitals/clinics or pharmacy chains. There can be no assurance that we will ever be able to obtain contracts with a significant number of customers to generate meaningful revenues or achieve profitable operations.

We have only limited experience in developing and commercializing the Liners, and there is limited information available concerning the potential performance or market acceptance of the Liners in China. There can be no assurance that unanticipated expenses or problems will not occur which would result in material delays in commercialization of our products or that our efforts will result in successful commercialization.

Our future is dependent upon our ability to obtain financing. If we do not obtain such financing, we may have to cease our operations and investors could lose their entire investment.

Our future is dependent upon our ability to obtain financing. There is no assurance that we will operate profitably or will generate positive cash flow in the future. We believe that we will require additional financing in order to proceed beyond the first three months of our business plan and to pay the fees and expenses necessary to become and operate as a public company. Although we plan to obtain additional financing, we currently do not have any arrangements for further financing. We may not be able to obtain additional equity or debt financing on acceptable terms when we need it. Even if financing is available it may not be available on terms that are favorable to us or in sufficient amounts to satisfy our requirements.

Our capital requirements relating to the manufacturing and marketing of our products have been, and will continue to be, significant. We are dependent on the proceeds of future financing in order to continue in business and to develop and commercialize proposed products. We anticipate requiring approximately $750,000 to $1,500,000 in additional financing for the next twelve months. There can be no assurance that we will be able to raise the substantial additional capital resources necessary to permit us to pursue our business plan. We have no current arrangements with respect to, or sources of, additional financing and there can be no assurance that any such financing will be available to us on commercially reasonable terms, or at all. Any inability to obtain additional financing will have a material adverse effect on us, such as requiring us to significantly curtail or cease operations. In that case, you may lose your entire investment.

The continued growth of our business will require additional funding from time to time which would be used for general corporate purposes. General corporate purposes may include acquisitions, investments, repayment of debt, capital expenditures, repurchase of our capital stock and any other purposes that we may specify in any prospectus supplement. Obtaining additional funding would be subject to a number of factors including market conditions, operational performance and investor sentiment. These factors may make the timing, amount, terms and conditions of additional funding unattractive, or unavailable, to us. If we do not obtain the financing we need, our business could fail and investors could lose their entire investment.

The terms of any future financing may adversely affect your interest as stockholder and dilute your interest in our company, which may reduce the value of your investment.

We will require additional financing in the future. We may be required to incur indebtedness or issue equity securities, the terms of which may adversely affect your interests in the Company. For example, the issuance of additional indebtedness may be senior in right of payment to your shares upon our liquidation. In addition, indebtedness may be under terms that make the operation of our business more difficult because the lender’s consent will be required before we take certain actions. Similarly the terms of certain securities we issue may be senior in right of payment of dividends to your common stock and may contain superior rights and other rights as compared to your common stock. Further, any further issuance of our securities may dilute your interest in our company, which may reduce the value of your investment.

We could lose our competitive advantages if we are not able to protect any intellectual property rights against infringement, and any related litigation could be time-consuming and costly.

- 10 -

Although the Liner product has been patented in the People’s Republic of China by the inventor and we have a license to that patent, we may not be able to completely protect our proprietary rights against possible infringement, which could cause us to lose our competitive advantage and negatively impact our business and operations. Our efforts to protect our intellectual property rights could be time-consuming and costly and we still might not be successful in protecting them. The potential expense and loss of competitiveness related to our intellectual property could cause our business to remain unprofitable and eventually cause us to go out of business.

We may face regulatory difficulties for our products, which may cause us to slow down or cease our operations

The manufacturing and sale of the health care products of the Liners in the People’s Republic of China are subject to potential regulations of the federal Food and Drug Administration and provincial Food and Drug Administration. The bureaucracy and corruption that are often seen in bureaucratic procedures in China may have adverse effects on our operation and financial conditions.

Although we have two independent consultants who are working on the required licenses and authorizations on behalf of our company, we have no assurance that we will get theses licenses and authorizations successfully.

The uncertain nature of the business legal environment in the People’s Republic of China and our industry may prove to make our company vulnerable to local government agencies who have persistent bureaucratic power over manufacturers, distributors, retailers and other parties who may wish to do business with us. If companies are prevented from doing business with us in China, then we will go out of business and investors will lose all of their investment in our company.

Our Bylaws contain limitations on the liability of our directors and officers, which may discourage suits against directors and executive officers for breaches of fiduciary duties

Our Bylaws contain provisions limiting the liability of our directors for monetary damages to the fullest extent permissible under Delaware law. This is intended to eliminate the personal liability of a director for monetary damages on an action brought for breach of a director’s duties to us or to our stockholders except in certain limited circumstances. In addition, our Bylaws contain provisions requiring us to indemnify our directors, officers, employees and agents serving at our request, against expenses, judgments (including derivative actions), fines and amounts paid in settlement. This indemnification is limited to actions taken in good faith in the reasonable belief that the conduct was lawful and in, or not opposed to our best interests. Our Bylaws provide for the indemnification of directors and officers in connection with civil, criminal, administrative or investigative proceedings when acting in their capacities as agents for us. These provisions may reduce the likelihood of derivative litigation against directors and executive officers and may discourage investors or management from suing directors or executive officers for breaches of their fiduciary duties, even though such an action, if successful, might otherwise benefit our stockholders and directors and officers.

If we are unable to hire and retain the qualified personnel, our business will likely be adversely affected and we could be forced to cease operations.

Our future success will also depend on our ability to attract, retain and motivate highly qualified personnel, especially sales, marketing and customer support employees, in the future. Because of the rapid growth of the economy in China, competition for qualified personnel is intense. We cannot assure you that we will be able to retain our key personnel or that we will be able to attract, assimilate or retain qualified personnel in the future. Our inability to hire and retain qualified personnel or the loss of the services of our key personnel could have a material adverse effect upon our business, financial condition and results of operations. If these effects are significant, they may cause us to go out of business.

- 11 -

RISKS RELATING TO OUR BUSINESS

Our success depends upon the development of China’s health care products industry and if that industry stagnates, we may go out of business.

China is currently the world’s most populous country and one of the largest producers and consumers of health care products. The health care industry in China has been under tight state and provincial government controls until recent years, when the government controls appear to have become less cumbersome. However, the health care industry in China is stagnating, especially where it concerns research, development and the production of supplies and devices arguably due to immature regulatory policies, local protectionist activities and a shortage of state and provincial funding. Despite the Chinese government’s continued emphasis on industry self-sufficiency, the industry continues to be impeded by inadequate research and development facilities, a lack of innovative product lines due to long history of practice of free-copying of foreign intellectual properties and a lack of financial and political incentives to attract talented persons into the industry. Since we will rely on the local facilities and our subsidiary to manufacture and market the products, and since our potential customer are mainly hospitals and clinics and pharmacies chains, which are largely state owned, our ability to increase sales and revenues may be delayed and hindered by any of these factors and we may go out of business.

RISKS RELATING TO MINING

We do not yet hold any rights to any mineral properties. There is no assurance that we will obtain the rights to the Yang Tan Gold Mine, the only property that we intend to explore at present. If we do obtain the rights in the Yang Tan Gold Mine, there is no assurance that we will establish the existence of any mineral resource there in commercially exploitable quantities. If we do not do so, we will lose all of the funds that we spend on exploration and our share price likely will decline substantially.

We have not obtained the rights to explore the Yang Tan Gold Mine. We have not established that there are commercially viable mineral reserves on that property. There can be no assurance that we ever will be able to obtained the rights to explore the Yang Tan Gold Mine or discover commercially viable mineral reserves there. If we do not, we will lose all of the funds that we spend on exploration and our share price likely will decline substantially.

A mineral reserve is defined by the Securities and Exchange Commission in its Industry Guide 7 (which can be viewed over the Internet at http://www.sec.gov/divisions/corpfin/forms/industry.htm#secguide7) as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. The probability of an individual prospect ever having a “reserve” that meets the requirements of the Securities and Exchange Commission’s Industry Guide 7 is extremely remote. If we do obtain the rights to explore the Yang Tan Gold Mine, in all probability it will not contain a ‘reserve’ and any funds that we spend on exploration will probably be lost.

The commercial viability of any potential mineral reserve depends on a number of factors including, by way of example, the size, grade and other attributes of the mineral deposit, the proximity of the resource to infrastructure such as a smelter, roads and a point for shipping, government regulation and market prices. Most of these factors are beyond the control of the company and any of them could increase costs and make extraction of any identified mineral resource unprofitable.

Mineral operations are subject to applicable law and government regulation. Even if we obtain the rights to a mineral property discover a mineral resource in a commercially exploitable quantity, these laws and regulations could restrict or prohibit the exploitation of that mineral resource. If we cannot exploit any mineral resource that we might discover on our properties, our business may fail.

Both mineral exploration and extraction require permits from governmental authorities and are governed by laws and regulations, including those with respect to prospecting, mine development, mineral production, transport, export, taxation, labour standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. There can be no assurance that we will be able to obtain or maintain any of the permits required for the continued exploration of our mineral properties or for the construction and operation of a mine on our properties at economically viable costs. If we cannot accomplish these objectives, our business could fail. We can give no assurance that we can remain in compliance with all government regulations and requirements. Current laws and regulations could be amended and we might not be able to comply with them, as amended. Further, there can be no assurance that we will be able to obtain or maintain all permits necessary for our future operations, or that we will be able to obtain them on reasonable terms. To the extent such approvals are required and are not obtained, we may be delayed or prohibited from proceeding with the planned exploration of any mineral properties to which we may acquire rights to explore.

RISKS RELATING TO THE PEOPLE’S REPUBLIC OF CHINA

The Economic Policies of the People’s Republic of Change Could Affect our Business. If the economic policies of China hamper our ability to carry on business and earn revenues, we may be forced to abandon our business plan and may have to cease our operations.

Substantially all of our revenue will be derived from operations in the People’s Republic of China. Accordingly, our results of operations and prospects are subject, to a significant extent, to the economic, political and legal developments in the People’s Republic of China. Our operating results and financial condition may be adversely affected by the government control over capital investments or changes in tax regulations.

- 12 -

The economy of the People’s Republic of China has been changing from a planned economy to a more market-oriented economy. In recent years, the Chinese government has implemented measures emphasizing the utilization of market forces for economic reform and the reduction of state ownership of productive assets, and the establishment of corporate governance in business enterprises; however, a substantial portion of productive assets in the People’s Republic of China are still owned by the Chinese government. In addition, the Chinese government continues to play a significant role in regulating industry development by imposing industrial policies. It also exercises significant control over the People’s Republic of China’s economic growth through the allocation of resources, the control of payment of foreign currency-denominated obligations, the setting of monetary policy and the provision of preferential treatment to particular industries or companies.

Capital outflow policies in the People’s Republic of China may hamper our ability to expand our business and/or operations internationally. The People’s Republic of China has adopted currency and capital transfer regulations. These regulations may require us to comply with complex regulations for the movement of capital. Although our management believes that it is currently in compliance with these regulations, should these regulations or the interpretation of them by courts or regulatory agencies change, we may not be able to remit income earned and proceeds received in connection with any off-shore operations or from other financial or strategic transactions the Company may consummate in the future.

Fluctuation of the Renminbi could materially affect our financial condition and results of operations.

Fluctuation of the Renminbi Yuan, the currency of the People’s Republic of China, could materially affect our financial condition and results of operations. The value of the Renminbi Yuan fluctuates and is subject to changes in the People’s Republic of China’s political and economic conditions. Since 1994, the conversion of the Renminbi Yuan into foreign currencies, including United States dollars, is pegged against the inter-bank foreign exchange market rates or current exchange rates of a basket of currencies on the world financial markets. As of September 30, 2009, the exchange rate between the Renminbi Yuan and the United States dollar was one Renminbi Yuan to $0.14639 United States dollar.

We may face obstacles from the communist system and Political, Judicial and/or Ministerial Corruption in the People’s Republic of China and may have to cease operations.

Foreign companies conducting operations in the People’s Republic of China face significant political, economic and legal risks. The Communist regime in the People’s Republic of China, including a cumbersome bureaucracy, may hinder Western investment. We may have difficulty establishing adequate management, legal and financial controls in the People’s Republic of China and may have to cease operations.

Another obstacle to foreign investment in the People’s Republic of China is corruption. We may face judicial and ministerial corruption in the People’s Republic of China. There is no assurance that we will be able to obtain recourse, if desired, through the People’s Republic of China’s poorly developed and sometimes corrupt judicial systems. In addition, many of the regulatory and business authorities with whom we normally conduct our business, are state employees or affiliated state-enterprise employees. These officials may engage in corrupt activities which may negatively impact our ability to conduct business.

RISKS ASSOCIATED WITH OUR COMMON STOCK

Trading on the OTC Bulletin Board may be volatile and sporadic, which could depress the market price of our common stock and make it difficult for our stockholders to resell their shares.

Our common stock is quoted on the OTC Bulletin Board service of the Financial Industry Regulatory Authority (“FINRA”). Trading in stock quoted on the OTC Bulletin Board is often thin and characterized by wide fluctuations in trading prices due to many factors that may have little to do with our operations or business prospects. This volatility could depress the market price of our common stock for reasons unrelated to operating performance. Moreover, the OTC Bulletin Board is not a stock exchange, and trading of securities on the OTC Bulletin Board is often more sporadic than the trading of securities listed on a quotation system like Nasdaq or a stock exchange like the American Stock Exchange. Accordingly, our shareholders may have difficulty reselling any of their shares.

Our stock is a penny stock. Trading of our stock may be restricted by the SEC’s penny stock regulations and the FINRA’s sales practice requirements, which may limit a stockholder’s ability to buy and sell our stock.

Our stock is a penny stock. The Securities and Exchange Commission has adopted Rule 15g-9 which generally defines “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and “accredited investors”. The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or

- 13 -

in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in, and limit the marketability of, our common stock.

Please read this prospectus carefully. You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. You should not assume that the information provided by the prospectus is accurate as of any date other than the date on the front of this prospectus.

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

On August 15, 2009, we issued 625,000 restricted common shares at the price of $0.80 per share to one investor, Hou Yu Zhen. We relied on Regulation S, promulgated under Securities Act, as amended, for registration exemption of the issuance because Ms. Hou is a non-US resident.

ITEM 6. EXHIBITS

| Exhibit | |

| Number | Description |

| 3.1(1) | Certificate of Incorporation |

| 3.2(1) | Bylaws |

| 10.1(1) | Consulting Agreement dated August 1, 2005 between Golden Century Technologies Corporation and Mr. Mo You Yu |

- 14 -

| Exhibit | |

| Number | Description |

| 10.2(1) | Consulting Agreement dated August 1, 2005 between Golden Century Technologies Corporation and Ms. Li Yang |

| 10.3(1) | Production Agreement dated October 31, 2005 between Golden Century Technologies Corporation and Colo-Majic Liners, Inc. |

| 10.4(1) | Amendment Consulting Agreement dated August 1, 2006 between Golden Century Technologies Corporation and Mr. Mo You Yu |

| 10.5(1) | Amendment Consulting Agreement dated August 1, 2006 between Golden Century Technologies Corporation and Ms. Li Yang |

| 10.6 (1) | Licensing Agreement dated September 28, 2006 between Golden Century Technologies Corporation and Colo-Majic Liners, Inc. |

| 10.8(2) | Licensing, Production and Distribution Agreement Amendment dated January 15, 2008 between Golden Century Technologies Corporation and Colo-Majic Liners, Inc. |

| 10.7(2) | Distribution Agreement dated January 16, 2008 between Golden Century Technologies Corporation and T- Ray Science, Inc. |

| 31.1 | |

| 32.1 | |

| (5) | Form 8K filed with SEC on July 1, 2009 regarding Changes in Control of Registrant and Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers: Compensatory Arrangements of Certain Officers |

| (5) | Form 8K filed with SEC on August 12, 1009 regarding Entry into a Material Definitive Agreement |

| (5) | Form 8K filed with SEC on Octboer 8, 2009 regarding Amendments to Articles of Incorporation or Bylaws; |

| (1) |

Exhibit already on file - exhibit to our Form SB-2 registration statement filed December 22, 2006. |

| (2) |

Exhibit already on file - exhibit to our Form 8-K filed January 18, 2008. |

SIGNATURES

In accordance with Section 13 of the Securities Exchange Act of 1934, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Golden Century Resources Limited | |

| (Registrant) | |

| /s/ David Lee | |

| Date: February 26, 2010 | David Cheng Lee |

| President and Director | |

| Director | |

| (Principal Executive Officer, Principal Financial Officer) |