Attached files

Table of Contents

As filed with the Securities and Exchange Commission on February 26, 2010

Registration No. 333-144942

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 4

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

INTCOMEX, INC.

(Exact name of Registrant as specified in its charter)

| Delaware | 5045 | 65-0893400 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

Intcomex, Inc.

3505 NW 107th Avenue

Miami, Florida 33178 (305) 477-6230

(Address including zip code, telephone number, including area code, of Registrant’s Principal Executive Offices)

Michael Shalom

Intcomex, Inc.

3505 NW 107th Avenue

Miami, Florida 33178

(305) 477-6230

(Name, address including zip code, telephone number, including area code, of agent for service)

Copies To:

| Jeffrey D. Karpf, Esq. Cleary Gottlieb Steen & Hamilton LLP One Liberty Plaza New York, New York 10006 Telephone: (212) 225-2000 Telecopy: (212) 225-3999 |

Matthew D. Bloch, Esq. Erika L. Weinberg, Esq. Weil, Gotshal & Manges LLP 767 Fifth Avenue New York, New York 10153 Telephone: (212) 310-8000 Telecopy: (212) 310-8007 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date hereof.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED FEBRUARY 26, 2010.

P R O S P E C T U S

Shares

Intcomex, Inc.

Common Stock

$ per share

This is the initial public offering of our common stock. We are selling shares of our common stock. We currently expect the initial public offering price to be between $ and $ per share.

We have granted the underwriters an option to purchase up to shares of common stock to cover over-allotments.

We have applied to have the common stock listed on the Nasdaq Global Market under the symbol “ICMX.”

An affiliate of Citigroup Global Markets Inc., one of the underwriters in this offering, is one of our principal stockholders Citigroup Venture Capital International, or CVC International. CVC International currently owns approximately % of our common stock on a fully diluted basis and will own approximately % of our common stock upon the completion of this offering (assuming the underwriters’ over-allotment option is not exercised). As a result of CVC International’s current ownership interest in us, this offering is being conducted in accordance with the applicable provisions of the Financial Industry Regulatory Authority, or the FINRA rules. These rules require, among other things, that the initial public offering price of the common stock be no higher than that recommended by a “qualified independent underwriter” (as such term is defined by the rules). UBS Securities LLC is assuming the responsibilities of acting as the qualified independent underwriter in this offering.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 12.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||

| Public offering price |

$ | $ | ||||

| Underwriting discount |

$ | $ | ||||

| Proceeds to Intcomex, Inc. (before expenses) |

$ | $ | ||||

The underwriters expect to deliver the shares to purchasers on or about , 2010 through the book-entry facilities of the Depository Trust Company.

Joint Book-Running Managers

| Citi | UBS Investment Bank | |

Co-Managers

| Raymond James | Thomas Weisel Partners LLC | |

, 2010

Table of Contents

You should rely only on the information contained in this prospectus. We have not, and the underwriters are not, authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus.

| Page | ||

| 1 | ||

| 12 | ||

| 30 | ||

| 31 | ||

| 32 | ||

| 33 | ||

| 35 | ||

| 36 | ||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

38 | |

| 62 | ||

| 82 | ||

| 88 | ||

| 100 | ||

| 103 | ||

| 105 | ||

| 109 | ||

| Certain United States Tax Consequences to Non-United States Holders |

112 | |

| 115 | ||

| 117 | ||

| 123 | ||

| 123 | ||

| 123 | ||

| 123 | ||

| 123 | ||

| F-1 | ||

Until , 2010 (25 days after the date of this prospectus), all dealers that buy, sell or trade our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

i

Table of Contents

This summary highlights selected information contained elsewhere in this prospectus. It does not contain all of the information that may be important to you. You should read the following summary together with the more detailed information regarding our company, the common stock offered and our audited and unaudited consolidated financial statements, including the notes to those statements, appearing elsewhere in this prospectus, before making an investment decision. Except as the context otherwise requires, all references in this prospectus to “Intcomex, “ “we, “ “us, “ “our,” “our company” and similar terms refer to Intcomex, Inc. together with our consolidated subsidiaries and our predecessor companies.

Our Company

We believe we are the largest pure play value-added distributor of IT products focused solely on serving Latin America and the Caribbean. We distribute computer components, peripherals, software, computer systems, accessories, networking products and digital consumer electronics to more than 50,000 customers in 40 countries. We offer single source purchasing to our customers by providing an in-stock selection of more than 6,100 products from over 173 vendors, including the world’s leading IT product manufacturers. From our headquarters and main distribution center in Miami, or our Miami Operations, we support a network of 22 sales and distribution operations in 12 Latin American and the Caribbean countries and a sales office in Brazil, or our In-country Operations.

Over the last 20 years, we have built an IT products distribution network in Latin America and the Caribbean that we believe is unmatched by any of our competitors in terms of the number of countries served through an in-country presence. We have achieved our regional market leadership position by offering our customers a wide and readily available product selection and excellent pre- and post-sale customer service, while providing our vendors with a multi-country distribution channel for their products. We believe our broad regional presence makes us more attractive to our vendors and customers, thereby enhancing our revenue growth and operating margins, and our geographic diversification reduces our operating risks.

We believe we have the broadest in-country presence of any distributor of IT products to Latin America and the Caribbean, in terms of the number of countries served through an in-country presence. From our headquarters and main distribution center in Miami, we support a network of in-country sales and distribution operations in 12 countries in Latin America and the Caribbean and a sales office in Brazil. As a result of our unique distribution platform, we have realized consistent organic revenue growth and strong operating margins. From 2001 to 2009, our revenue grew from $324.1 million to $917.2 million, representing a compound annual growth rate, or CAGR, of 13.9%, and our operating income grew from $11.2 million to $20.3 million, representing a CAGR of 7.7%. We believe these growth rates and our operating margins are higher than those of our public company competitors.

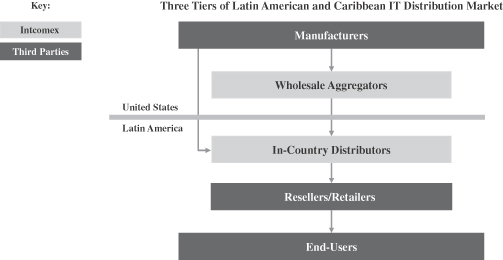

We serve the Latin American and Caribbean IT products markets using a dual distribution model:

| • | As a Miami-based wholesale aggregator, we sell primarily to: |

| - | third-party distributors, resellers and retailers of IT products based in countries in Latin America and the Caribbean where we do not have a local presence; |

| - | third-party distributors, resellers and retailers of IT products based in countries in Latin America and the Caribbean where we have a local presence but whose volumes are large enough to enable them to efficiently acquire products directly from U.S.-based wholesale aggregators; |

| - | other Miami-based exporters of IT products to Latin America and the Caribbean; and |

| - | our In-country Operations. |

1

Table of Contents

For the year ended December 31, 2009, revenue and operating income from our Miami operations (net of $230.4 million of revenue derived from sales to our In-country Operations) were $234.9 million and $3.1 million, representing 25.6% and 15.1% of our consolidated revenue and operating income, respectively. For the year ended December 31, 2008, revenue and operating income (loss) from our Miami Operations (net of $253.4 million of revenue derived from sales to our In-country Operations) were $277.2 million and $15.1 million.

| • | As an in-country distributor in 12 countries, we currently sell to over 48,000 local reseller and retailer customers, including value- added resellers (companies that sell, install and support IT products and personal computers, which we refer to as PCs), systems builders (companies that specialize in building complete computer systems by combining components from different vendors), smaller distributors and retailers. |

For the year ended December 31, 2009, revenue and operating income from our In-country Operations were $682.2 million and $17.2 million, representing 74.4% and 84.9% of our consolidated revenue and operating income, respectively. For the year ended December 31, 2008, revenue and operating income from our In-country Operations were $794.3 million and $9.9 million, respectively.

Our Strengths

We have capitalized on our strengths to achieve a leadership position in the markets we serve. Our strengths include:

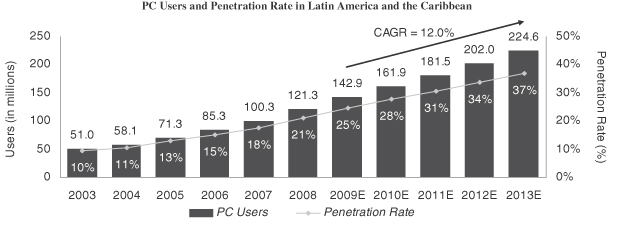

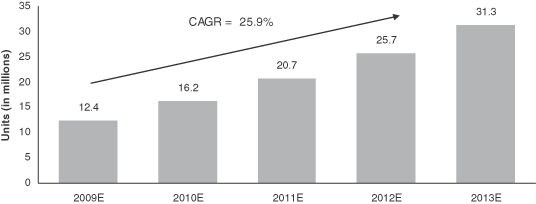

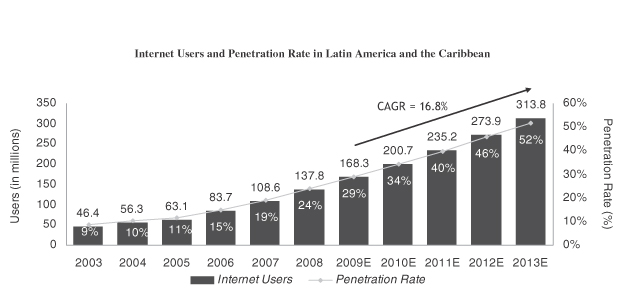

Pure play IT products distributor with leading positions in a large and growing market. We believe we are the largest pure play value-added distributor of IT products focused solely on Latin America and the Caribbean. We believe we hold the number one or number two market share position in each of the 12 countries in which we have an in-country distribution presence, except for Mexico and Colombia. We believe that we are well positioned in these markets to capitalize on the significant growth prospects driven by increasing PC and Internet penetration rates, increasing demand for notebook and netbook computers and an increasing market for PCs priced below $500. According to IDC, spending on IT products (including hardware, packaged software and services) in Latin America and the Caribbean is projected to grow from $51.9 billion in 2007 to $74.3 billion in 2013, growing at an average of 6.2% per year. This is more than twice as fast as the expected growth rate in IT spending in the United States over the same period and contrasts with a decline in IT spending in Latin America and the Caribbean from 2000 to 2006. Growth in these markets is expected to be driven primarily by increasing PC and Internet penetration rates as well as increasing demand for notebook and netbook computers. According to Pyramid Research, the Latin American and Caribbean PC penetration rate reached 24.7% in 2009 and is predicted to rise to 37.1% in 2013, which is still well below the U.S. and Canadian penetration rate of 95.5% in 2009. We expect that the higher growth in the market for PCs priced below $500 will drive a significant portion of this increase. We believe that we are well positioned in this market segment, which, according to Gartner, is expected to grow an average of 25.9% per year from 2009 to 2013. In addition, the rapid adoption of the Internet by Latin American and Caribbean consumers continues to fuel purchases of PCs. The number of Internet users is predicted by Pyramid Research to grow an average of 16.8% per year from 2009 to 2013, representing an increase in penetration rates from 29.1% to 51.8% over this period. Further, we expect to benefit from the accelerating growth in the notebook computers segment. Gartner expects notebook computer shipments to grow from 10.3 million units in 2009 to 24.5 million units in 2013, representing an average growth rate of 24.1% per year.

Unique business model creates industry-leading margins with significant barriers to entry. We operate both as a Miami-based wholesale aggregator and as an in-country distributor located in 12 countries throughout Latin America and the Caribbean. Our participation at two levels of the distribution chain (Miami and in-country), coupled with our extensive geographic footprint, creates a market presence that we believe is

2

Table of Contents

unmatched by any of our competitors and enables us to generate industry-leading margins among our public company competitors. Our dual distribution approach links a diversified set of vendors, primarily located in the United States and Asia, to a fragmented number of customers spread throughout Latin America and the Caribbean, and delivers value to both ends of the supply chain. To our vendors, we provide access to markets and customers that would be costly and inefficient for them to reach directly. For our reseller customers, we provide a cost- and time-effective source for product supply. Typically, resellers’ small order sizes prevent them from establishing direct relationships with major IT product vendors, and resellers’ limited in-stock inventory creates a need for aggregators and distributors that can provide rapid delivery of a wide variety of products. We provide resellers with broad and timely product availability, multivendor single source purchasing, technical support and local warranty service. Consequently, we are a critical component of the supply chain between most of the leading manufacturers of IT products in the United States and Asia and resellers in Latin America and the Caribbean. Over the last 20 years, we have built a broad distribution infrastructure throughout our region and gained important business experience and relationships in each of our markets. We believe that the significant time and investment required to establish an efficient regional distribution infrastructure and the valuable services we provide to both our vendors and customers create significant barriers to entry in each of our markets.

Strong revenue growth and sustainable industry-leading profitability. From our founding in 1988 to the present, we have experienced consistent sales growth. From 2001 to 2009, we achieved a CAGR in revenue of 13.9%. During this period, we also maintained consistently strong operating profitability, with a CAGR in operating income of 7.7%. In 2009, we achieved an operating income margin of 2.3%, compared to the operating margins for the most recent fiscal year of 1.1% and 1.2% of our two largest competitors, Ingram Micro and Tech Data, respectively (excluding any goodwill impairment or restructuring charges). Our unique business model, our broad geographic footprint and our focus on higher-margin components, peripherals and software have been the main contributors to our strong margins. We believe these strong margins have helped us achieve what we believe to be an industry-leading return among our public company competitors on invested capital, or ROIC, which we define as net after-tax operating profit divided by average shareholders’ equity and net debt. We have consistently achieved an ROIC in the low to mid teens, except for recent years effected by the economic crisis (7.5% in 2008 and 9.9% in 2009, excluding goodwill impairment, write-off of IPO costs and restructuring charges). Our strong ROICs have also been driven by our focus on minimizing our cash conversion cycle with centralized purchasing, efficient managing of in-country inventory levels, establishing strict customer credit policies and carefully monitoring on-going inventory and demand. Our cash conversion cycle (measuring the number of days to convert trade accounts receivable and inventory, net of accounts payable, into cash) was 30.2 days as of December 31, 2009.

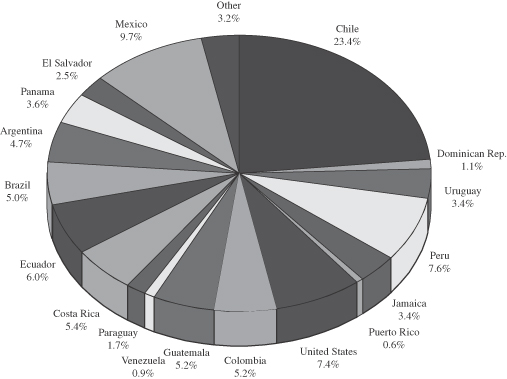

Highly diverse business across multiple geographies and customers. We believe we have the broadest in-country presence of any distributor of IT products to Latin America and the Caribbean, in terms of the number of countries served through an in-country presence. We distribute products to more than 50,000 customers in 40 countries. The diversification of our geographic presence and customer base contributes to our consistent organic revenue growth and reduces our dependence on any single country or customer. We believe our diverse geographic presence will allow us to maintain a strong pace of organic growth in our target markets, driven by attractive market share expansion opportunities as well as strong underlying market growth characteristics. We can also use our deep knowledge of local markets to assess local market conditions and adjust our market focus as necessary. Moreover, the regional expertise we have gained in our multiple local markets can be applied and transferred when we expand our distribution platform into new geographies. In 2009, no country contributed more than 10% of our revenue, except Chile (23.4%). We have also established a strong brand and a reputation for providing excellent customer service that we believe builds customer loyalty and leads to recurring revenue. In addition, we offer customers a one-stop shop for purchasing a broad selection of products, which enables us to maintain a large and diverse group of customers and attract and maintain new customers. In 2009, no single customer represented more than 2.0% of our revenue on a consolidated basis.

3

Table of Contents

Strong vendor relationships and broad portfolio of products. We distribute and market more than 6,100 products from over 173 vendors, enabling us to offer a wide variety of products, satisfy customer requirements for product availability and meet end-user demand for multi-vendor and multi-product IT configurations. The large number of resellers and retailers in the region, their relatively small size, and their geographic fragmentation make it cost effective for vendors to rely on wholesale distributors like us that can deliver a broad regional distribution channel, rather than distributing directly to numerous fragmented resellers and retailers. We provide vendors with extensive regional coverage, larger order sizes, simplified logistics, lower distribution costs than if they dealt with each of our affiliates independently, quality pre- and post-sale marketing and technical support. We also eliminate the need for our vendors to handle issues such as local duty and tax arrangements, customer credit analysis and management of numerous small accounts. Consequently, we have established long-standing relationships with most of the leading manufacturers of IT products in the United States and Asia, who we believe value our ability to provide reliable and efficient access to the numerous and growing markets across Latin America and the Caribbean. In 2009, no single vendor’s products generated more than 19.1% of our revenue.

Experienced management team with significant equity ownership. Each of our two co-founders, who today are our Chief Executive Officer and Chairman, has more than 20 years of industry experience in Latin America and the Caribbean. Our senior managers have an average tenure of over 9 years with us and each has had substantial experience working in the region. In addition, the turnover rate among our senior managers has been low. Prior to this offering, our senior managers beneficially owned approximately 27.5% of our capital stock on a fully diluted basis and will own approximately % of our capital stock following the offering. As a result of their substantial equity interest, we believe that our management has significant incentive to continue to increase our revenue and margins.

Our Strategy

We intend to achieve future growth and profitability through the following strategies:

| • | Continue to strengthen our market leadership and customer relationships through superior customer services including differentiating ourselves from competitors by emphasizing customer care and long-term customer development. |

| • | Grow and strengthen our diverse customer base by leveraging our large selection of products and our comprehensive offering of value-added services, including product training and support, credit and financing and reverse logistics (i.e., handling returns to manufacturers of defective or unwanted parts and products). |

| • | Enhance our margins by maintaining close control over our operating expenses and realizing increased economies of scale in product purchasing and working capital management. |

| • | Build upon our comprehensive in-stock selection of more than 6,100 IT products by expanding our existing product categories to include additional products or vendors and by adding new product categories or subcategories for which there is growing consumer demand. |

| • | Grow our business through extensions of our existing capabilities (including further product diversification and targeting of new markets), increasing our customer base (by distributing products directly to retailers, including small non-traditional retailers), and expanding our product offering of private label and our own branded products. |

| • | Target selective acquisitions that we believe will expand our business into new markets or improve our distribution capabilities, while growing revenues and enhancing margins. |

4

Table of Contents

Citigroup Venture Capital International

In August 2004, Citigroup Venture Capital International, or CVC International, acquired a controlling interest in us through its investment vehicle Co-Investment LLC VII (Intcomex). CVC International is a unit of Citigroup Inc. engaged in private equity investments in emerging markets. Following this offering, CVC International will own approximately % of our common stock on a fully diluted basis (approximately % if the underwriters’ overallotment option is exercised in full).

Our Corporate History and Other Information

Anthony Shalom and Michael Shalom founded our company as a small software retailer in South Florida in 1988. We were reincorporated in Delaware on August 13, 2004 in connection with the investment by CVC International. Our principal executive offices are located at 3505 NW 107th Avenue, Miami, Florida 33178. Our telephone number is (305) 477-6230. Our website is available at www.intcomex.com.

5

Table of Contents

Selected Risk Factors

We face risks in operating our business, including risks that may prevent us from achieving our business objectives or that may hurt our business, financial condition and operating results. You should consider these risks before investing in our company.

Some of the important risks to our business and of this offering include the following:

| • | Global economic downturn. Global financial markets have recently experienced an extreme economic downturn and severe disruption, including, among other things, volatility in securities prices, severely diminished liquidity and credit availability, and rating downgrades of certain investments. If this downturn were to return or worsen, there could be severely negative implications to our business that may exacerbate many other risks described below. |

| • | Highly competitive environment. The IT products distribution industry in Latin America and the Caribbean is highly competitive and very fragmented. In certain markets, we compete against large multinational public companies that are significantly better capitalized than we are and potentially have greater bargaining power with vendors than we do. In all of our in-country markets, we also compete against a substantial number of locally-based distributors, many of which have a lower cost structure than we do. We refer to Ingram Micro, Tech Data, Bell Microproducts and SYNNEX in this prospectus as our public company competitors. |

| • | Dependence on IT and telecommunications systems and maintenance of company-wide reporting system. We are dependent on a variety of IT and telecommunications systems, including systems for managing our inventories, accounts receivable, accounts payable, order processing, shipping and accounting. We are in the process of continuing to install Sentai, our company-wide ERP, management and financial reporting system and our experience with this new platform is limited. |

| • | Dependence on IT products market in Latin America and the Caribbean. Historically, the strength of our business has been driven in large part by the growth of the IT products market in Latin America and the Caribbean. If the IT products market does not grow as quickly and in the manner we expect for any reason, including as a result of economic, political, social or legal developments in Latin America and the Caribbean, we may not be able to grow our business as expected. |

| • | Fluctuations in foreign currency exchange rates. A significant portion of our revenues from in-country operations is invoiced in currencies other than the U.S. dollar, and a significant amount of our in-country operating expenses are denominated in currencies other than U.S. dollars. In markets where we invoice in local currency, the appreciation of a local currency will reduce our gross profit and gross margins in U.S. dollar terms. In markets where books and records are prepared in currencies other than the U.S. dollar, the appreciation of a local currency will increase our operating expenses and decrease our operating margins in U.S. dollar terms. Large and sustained devaluations of local currencies can make many of our products more expensive in local currencies. This could result in our customers having difficulty paying those invoices and, in turn, result in decreases in revenue. Moreover, such devaluations may adversely impact demand for our products because our customers may be unable to afford them. |

| • | Challenge of establishing and maintaining sufficient management and financial reporting systems and internal and disclosure controls and hiring, retaining and training sufficient accounting and finance personnel. We rely on a variety of management and financial reporting systems and internal and disclosure controls to enable management to capitalize on business opportunities, identify unfavorable developments and risks at an early stage and to prepare accurate and timely financial information for our investors. As our business has grown rapidly in recent years and expanded into new |

6

Table of Contents

| geographic markets, the challenge of establishing and maintaining sufficient systems and controls and hiring, retaining and training sufficient accounting and finance personnel has intensified. |

| • | Restrictions in our debt agreements. The revolving credit facility agreement between our wholly-owned subsidiary Software Brokers of America, Inc., or SBA, and Comerica Bank as well as the indenture governing our 13 ¼% Second Priority Senior Secured Notes due 2014, which we refer to as the 13 ¼% Senior Notes, impose significant operating and financial restrictions on us and SBA. |

| • | Credit exposure from customers. We extend credit for a significant portion of sales to our customers. We are subject to the risk that our customers fail to pay or delay payment for the products they purchase from us, resulting in longer payment cycles, increased collection costs, defaults exceeding our expectations and an adverse impact on the cost or availability of financing. |

| • | Receiving adequate trade credit. Our business is working capital intensive and our vendors historically have been an important source of funding our business growth through the provision of trade credit. We expect to continue to rely on trade credit from our vendors to provide a significant amount of our working capital. If our vendors fail to provide us with sufficient trade credit, including larger amounts of trade credit, in a timely manner as our business grows, we may have to rely on other sources of financing, which may not be readily available or, if available, may not be on terms acceptable or favorable to us. |

| • | Dependence on a relatively small number of vendors. A significant portion of our revenue is derived from products manufactured by a relatively small number of vendors. Due to intense competition in the IT products distribution industry, our key vendors can choose to work with other distributors and, pursuant to standard terms in our vendor agreements, may terminate their relationships with us on short notice. |

| • | Concentration of stock ownership. After this offering, our executive officers, directors and principal stockholders will continue to be able to exercise control over all matters requiring stockholder approval, including the election of directors, amendment of our amended and restated certificate of incorporation and approval of significant corporate transactions and will have significant control over our management and policies. Their interests may not be aligned with your interests as a holder of our common stock. |

For a more detailed discussion of the these and other significant risks associated with our business, our industry and investing in our common stock, you should read the section entitled “Risk Factors” beginning on page 12 of this prospectus.

7

Table of Contents

| Common stock offered by us |

shares |

| Common stock to be outstanding immediately after this offering |

shares |

| Option to purchase additional shares of common stock |

We have granted to the underwriters an option, exercisable for 30 days from the date of this prospectus, to purchase up to additional shares of common stock at the public offering price less the underwriting discount. The underwriters may exercise the option solely for the purpose of covering over-allotments, if any, in connection with this offering. To the extent the option is exercised, each underwriter must purchase a number of additional shares approximately proportionate to that underwriter’s initial purchase commitment. |

| Use of proceeds |

We intend to use a portion of the proceeds of this offering to repurchase a significant portion of the 13 1/4% Senior Notes. |

We intend to use the remainder of our proceeds from this offering for fees and expenses in connection with this offering and general corporate purposes. Pending application of the net proceeds as described above, we intend to invest the net proceeds in short-term investment grade securities.

| Dividends |

We do not anticipate paying any cash dividends in the foreseeable future. |

| Proposed Nasdaq Global Market symbol |

“ICMX.” |

8

Table of Contents

| Risk factors |

Investing in our shares involves a high degree of risk. See “Risk Factors” beginning on page 12 of this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

Except as otherwise noted, all information in this prospectus:

| • | assumes that the underwriters do not exercise their option to purchase up to additional shares from us; |

| • | assumes the exchange by the holders of the 29,357 shares of our Class B common stock, non-voting for 29,357 shares of our voting common stock prior to or simultaneously with the completion of this offering; |

| • | assumes that the initial offering price is per share, the midpoint of the range set forth on the cover of this prospectus; |

| • | assumes our receipt of net proceeds of from the offering and the application of the proceeds as described under “Use of Proceeds;” |

| • | reflects a for one split of our common stock prior to or simultaneously with the completion of this offering; |

| • | excludes 1,280 shares of common stock issuable upon exercise of outstanding stock options granted prior to this offering to certain of our officers and directors with a weighted average exercise price of $1,077 per share, 853 of which were vested as of December 31, 2009. The options were antidilutive as of December 31, 2009 as the fair value of the options was below the exercise price of the options; and |

| • | excludes restricted stock grants of 306 shares of common stock granted to certain independent, non-employee directors. |

9

Table of Contents

Summary Historical Consolidated Financial and Other Data

The following table presents summary historical consolidated financial and other data as of and for the years ended December 31, 2007, 2008 and 2009. We derived the statement of operations and other data set forth below for the years ended December 31, 2007, 2008 and 2009 and the balance sheet data as of December 31, 2008 and 2009 from our audited consolidated financial statements (together with the notes thereto) that are included elsewhere in this prospectus. We derived the balance sheet and other data as of December 31, 2007 from our audited consolidated financial statements with respect to such date and period not included in this prospectus. You should read the following summary information in conjunction with “Selected Financial Information and Other Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our audited consolidated financial statements (together with the notes thereto) that are included elsewhere in this prospectus.

| Year Ended December 31, | ||||||||||||

| 2009 | 2008 | 2007 | ||||||||||

| (in thousands, except per share data and number of shares) |

||||||||||||

| Statement of Operations Data: |

||||||||||||

| Revenue |

$ | 917,168 | $ | 1,071,551 | $ | 1,038,368 | ||||||

| Cost of revenue |

825,587 | 970,955 | 937,286 | |||||||||

| Gross profit |

91,581 | 100,596 | 101,082 | |||||||||

| Operating expenses |

71,256 | 105,723 | 73,314 | |||||||||

| Operating income |

20,325 | (5,127 | ) | 27,768 | ||||||||

| Other (income) expense |

||||||||||||

| Interest expense |

17,495 | 17,431 | 17,763 | |||||||||

| Interest income |

(514 | ) | (941 | ) | (730 | ) | ||||||

| Other (income) expense, net |

(3,563 | ) | |

(3,427 |

) |

(292 | ) | |||||

| Foreign exchange (gain) loss |

(3,130 | ) | 15,533 | (2,401 | ) | |||||||

| Total other (income) expense |

10,288 | 28,596 | 14,340 | |||||||||

| Income before taxes |

10,037 | (33,723 | ) | 13,428 | ||||||||

| Income tax provision (benefit) |

2,844 | 1,595 | 867 | |||||||||

| Net income |

$ | 7,193 | $ | (35,318 | ) | $ | 12,561 | |||||

| Net income per common share (basic and diluted) |

$ | 69.94 | $ | (345.63 | ) | $ | 122.93 | |||||

| Weighted average number of shares used in per share calculation (basic and diluted)(3) |

102,852 | (2) | 102,182 | 102,182 | ||||||||

| As of December 31, | |||||||||

| 2009 | 2008 | 2007 | |||||||

| (in thousands) | |||||||||

| Balance Sheet Data: |

|||||||||

| Cash and cash equivalents |

$ | 27,234 | $ | 22,344 | $ | 29,399 | |||

| Working capital(1) |

110,693 | 75,726 | 101,629 | ||||||

| Total assets |

308,101 | 284,068 | 363,008 | ||||||

| Long-term debt (including capital leases) |

114,982 | 105,865 | 117,224 | ||||||

| Total debt |

129,711 | 136,906 | 143,590 | ||||||

| Total shareholders’ equity |

42,734 | 14,550 | 54,101 | ||||||

| Other Data: |

|||||||||

| Cash dividends per common share |

$ | 0.00 | $ | 0.00 | $ | 0.00 | |||

10

Table of Contents

| (1) | Working capital is defined as current assets less current liabilities. |

| (2) | Weighted average number of common shares, voting and Class B common stock, non-voting used in the per share calculation for the year ended December 31, 2009 reflects the issuance of 27,175 shares of Class B common shares, non-voting to certain of our existing shareholders and their affiliates concurrently with the redemption and cancellation of our 11 3/4% Second Priority Senior Secured Notes due 2011, or our 11 3/4% Senior Notes, and the closing of the 13 1/4% Senior Notes offering on December 22, 2009. |

| (3) | Weighted average number of common shares, voting and Class B common stock, non-voting used in the per share calculation for each year reflects the issuance of 2,182 shares of Class B common stock, non-voting to the sellers of Centel in connection with the re-acquisition of Centel on June 23, 2005. |

11

Table of Contents

Any investment in our common stock involves a high degree of risk. You should carefully consider the material risks described below together with all of the other information included in this prospectus before making an investment decision. If any of the following risks actually occurs, our business, results of operations or financial condition would likely suffer. In such an event, the trading price of our common stock could decline and you could lose all or part of your investment.

Risks Relating To Our Business

The recent global economic downturn and the disruptions in the credit markets could become increasingly worse, may improve in the near future, and could cause a severe disruption in our operations and adversely affect our business and results of operations.

Global financial markets have recently experienced an extreme economic downturn and severe disruption, including, among other things, volatility in securities prices, severely diminished liquidity and credit availability, and rating downgrades of certain investments. If this downturn were to return or worsen, there could be severely negative implications to our business that may exacerbate many other risks described below.

The recent global economic downturn and the associated credit crisis could return resulting in a negative impact on financial institutions and the global financial system, which would, in turn, have a negative impact on us and our creditors. Credit insurers could drop coverage on our customers and increase premiums, deductibles and co-insurance levels on our remaining or prospective coverage. Our suppliers have tightened trade credit already, and could do so further, which could negatively impact our liquidity. We may not be able to borrow additional funds under our existing credit facilities if participating banks become insolvent or their liquidity is limited or impaired. The subsequent tightening of credit in financial markets could also result in a decrease in the demand for IT products. A global recession could adversely affect our vendors’ and customers’ ability to obtain financing for operations and result in continued severe job losses and lower consumer confidence. Certain markets could experience deflation, which would negatively impact our average selling price and revenue.

If the recent downturn in the global economy returns, it may also further intensify competition, regionally and internationally, which may negatively affect our margins. The impact may be in the form of reduced prices, lower sales or reduced sales growth, loss of market share, lower gross margins, loss of vendor rebates, extended payment terms with customers, increased bad debt risks, shorter payment terms with vendors, increased capital investment and interest costs, increased inventory losses related to obsolescence and/or excess quantities, all of which could adversely affect our results of operations and financial condition. Our vendors and customers may become insolvent and file for bankruptcy, which also would negatively impact our results of operations.

Our business requires significant levels of capital to finance accounts receivable and inventory that is not financed by trade creditors. We believe that our existing sources of liquidity, including cash resources and cash provided by operating activities, supplemented as necessary with funds available under our credit arrangements, will provide sufficient resources to meet our present and future working capital and cash requirements for at least the next 12 months. However, the capital and credit markets have been experiencing unprecedented levels of volatility and disruption. Such market conditions may affect our ability to access the capital markets or the capital we require may not be available on terms acceptable to us, or at all, due to inability of our finance partners to meet their commitments to us. We are unable to predict the likely duration and severity of disruptions to financial markets and adverse economic conditions in the U.S. and other countries and the impact these events may have on our operations and the industry in general.

12

Table of Contents

We operate in a highly competitive environment and, as a result, we may not be able to compete effectively or maintain or increase our sales, market share or margins, particularly if a prolonged global economic downturn persists.

The IT products distribution industry in Latin America and the Caribbean is highly competitive. The factors on which IT distributors compete include:

| • | price; |

| • | availability and quality of products and services; |

| • | terms and conditions of sale; |

| • | availability of credit and payment terms; |

| • | timeliness of delivery; |

| • | flexibility in tailoring specific solutions to customers’ needs; |

| • | effectiveness of marketing and sales programs; |

| • | availability of technical and product information; and |

| • | availability and effectiveness of warranty programs |

The IT products distribution industry in Latin America and the Caribbean is very fragmented. In certain markets, we compete against large multinational public companies (including Ingram Micro, Tech Data, SYNNEX and Bell Microproducts) that are significantly better capitalized than we are and potentially have greater bargaining power with vendors than we do. In addition, our main competitor in Mexico, Ingram Micro, has a significantly larger market share than we do in that country. In all of our in-country markets, we also compete against a substantial number of locally based distributors, many of which have a lower cost structure than we do, in some cases because they operate in the gray market and the local “informal” economy. Due to intense competition in our industry, we may not be able to compete effectively against our existing competitors or new entrants to the industry, or maintain or increase our sales, market share or margins.

In addition, overcapacity in our industry and price reductions by our competitors may result in a reduction of our prices and thereby a reduction of our gross margins. We may also, as a result, lose market share, need to offer customers more credit or extended payment terms or need to reduce our prices in order to remain competitive, and any of these measures may result in an increase in our required capital, financing costs, and bad debt expense in the future.

We are dependent on a variety of IT and telecommunications systems and are subject to additional risks, as we are in the process of continuing to implement our company-wide reporting system, and any disruptions in our existing systems or delays in implementing our new system could adversely impact our ability to effectively manage our business and prepare accurate and timely financial information.

We are dependent on a variety of IT and telecommunications systems, including systems for managing our inventories, accounts receivable, accounts payable, order processing, shipping and accounting. In addition, our ability to price products appropriately and the success of our expansion plans depend to a significant degree upon our IT and telecommunications systems. We are in the process of continuing to install Sentai, our company-wide ERP, management and financial reporting system. Sentai is a scalable IT system that enables simultaneous decentralized decision-making by our employees involved in sales and purchasing while permitting control of daily operating functions by our senior management. We are also using the Sentai logistics and inventory management system in order to better adapt to higher shipping volumes. The ERP system has been implemented in our Miami Operations and 11 of our 12 In-country Operations. We completed the implementation of our core ERP system in Chile and some portions of Mexico in 2009 and expect to complete the remaining areas of Mexico in early 2010.

13

Table of Contents

Our experience with this new platform is limited and each new installation requires the training of our local employees. In addition, new installations may require further modifications in order to handle the different accounting requirements in each of the countries in which we operate. Any delay in installation or temporary or long-term failure of these systems, once installed, could adversely impact our ability to effectively manage our business and prepare accurate and timely financial information. Also, our failure to adapt and upgrade our systems to keep pace with our future development and expansion could hurt our results of operations.

If the IT products market in Latin America and the Caribbean does not grow as we expect, we may not be able to maintain or increase our present growth rate and our results of operations and financial condition could be affected.

Historically, the growth of our business has been driven in large part by the growth of the IT products market in Latin America and the Caribbean. In particular, we have benefited from rapid growth in PC and Internet penetration rates. We expect that our future growth will also depend in large part on further growth in the IT market including growth in PC and Internet penetration rates and increasing demand for notebook computers, netbooks, mobile and ultra portable drives. If the IT products market does not grow as quickly and in the manner we expect for any reason, including as a result of economic, political, social or legal developments in Latin America and the Caribbean, we may not be able to maintain or grow our business as expected which could have an impact on our results of operations and financial condition.

Economic, political, social or legal developments in Latin America and the Caribbean could hurt our results of operations and financial condition.

Historically, sales to Latin America and the Caribbean have accounted for almost all of our consolidated revenues. As a result, our financial results are particularly sensitive to the performance of the economies of countries in Latin America and the Caribbean. If local, regional or worldwide developments adversely affect the economies of any of the countries in which we do business, our results of operations and financial condition could be hurt. Our results are also impacted by political and social developments in the countries in which we conduct business and changes in the laws and regulations affecting our business in those regions. Changes in local laws and regulations could, among other things, make it more difficult for us to sell our products in the affected countries, restrict or prevent our receipt of cash from our customers, result in longer payment cycles, impair our collection of accounts receivable and make it more difficult for us to repatriate capital and dividends from our foreign subsidiaries to the ultimate U.S. parent company.

The economic, political, social and legal risks we are subject to in Latin America and the Caribbean include but are not limited to:

| • | deteriorating economic, political or social conditions; |

| • | additional tariffs, import and export controls or other trade barriers that restrict our ability to sell products into countries in Latin America and the Caribbean; |

| • | changes in local tax regimes, including the imposition of significantly increased withholding or other taxes or an increase in value added tax (“VAT”) or sales tax on products we sell; |

| • | changes in laws and other regulatory requirements governing foreign capital transfers and the repatriation of capital and dividends; |

| • | increases in costs for complying with a variety of different local laws, trade customs and practices; |

| • | delays in shipping and delivering products to us or customers across borders for any reason, including more complex and time-consuming customs procedures; and |

| • | fluctuations of local currencies. |

14

Table of Contents

Any adverse economic, political, social or legal developments in the countries in which we do business could harm our results of operations and financial condition.

Fluctuations in foreign currency exchange rates could reduce our gross profit and gross margins and increase our operating expenses in U.S. dollar terms.

We periodically engage in foreign currency forward contracts when available and when doing so is not cost prohibitive. In periods when we do not, foreign currency fluctuations may adversely affect our results of operations, including our gross margins and operating margins.

A significant portion of our revenues from our In-country Operations is invoiced in currencies other than the U.S. dollar, and a significant amount of our in-country operating expenses are denominated in currencies other than U.S. dollars. In markets where we invoice in local currency, including Argentina, Chile, Colombia, Costa Rica, Guatemala, Jamaica, Mexico, Peru and Uruguay, the appreciation of a local currency could have a marginal impact on our gross profit and gross margins in U.S. dollar terms. In markets where our books and records are prepared in currencies other than the U.S. dollar, the appreciation of the local currency will increase our operating expenses and decrease our operating margins in U.S. dollar terms.

Large and sustained devaluations of local currencies, like those that occurred in Brazil in 2000 and Argentina in 2001, can make many of our products more expensive in local currencies. This could result in our customers having difficulty paying those invoices and, in turn, result in decreases in revenue. Moreover, such devaluations may adversely impact demand for our products because our customers may be unable to afford them. For example, during 2009, our foreign exchange gain amounted to $3.1 million primarily due to the appreciation of the Chilean, Colombian and Uruguayan Pesos. The Chilean Peso strengthened by 19.9%, to 519 pesos per U.S. dollar as of December 31, 2009, from 648 pesos per U.S. dollar as of December 31, 2008. The Colombian Peso strengthened by 8.3%, to 2,065 pesos per U.S. dollar as of December 31, 2009, from 2,252 pesos per U.S. dollar as of December 31, 2008. The Uruguayan Peso also strengthened by 19.8%, to 20 pesos per U.S. dollar as of December 31, 2009, from 25 pesos per U.S. dollar as of December 31, 2008. For a more detailed discussion of the effect of foreign currency fluctuations on our results of operations, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Quantitative and Qualitative Disclosures About Market Risk—Foreign exchange risk.”

We are exposed to market risk and credit exposure and loss as we engage in foreign currency exchange forward contracts to hedge foreign currency denominated payables for inventory purchases, in a currency other than the currency in which the products are sold.

We are exposed to fluctuations in foreign exchange rates and reduce our exposure to the fluctuations by sometimes using derivative financial instruments, particularly foreign currency forward contracts. We use these contracts to hedge foreign currency denominated payables for inventory purchases in the normal course of business, in a currency other than the currency in which the products are sold. Derivative financial instruments potentially subject our Company to risk. Volatile foreign currency exchange rates increase our risk related to products purchased in a currency other than the currency in which the products are sold in the normal course of business. We did not have any foreign currency forward contracts outstanding as of December 31, 2009. Our foreign currency forward contract with a notional amount of $11.8 million as of December 31, 2008, had a fair value of ($31,000).

We are exposed to market risk related to volatility in foreign currency exchange rates, including devaluation and revaluation of local currencies. The market risk related to the forward contracts is offset by changes in the valuation of the underlying foreign currencies being hedged. We are also exposed to credit loss in the event of nonperformance by our counterparties to foreign exchange forward contracts and we may not be able to adequately mitigate all foreign currency related risks. We manage our exposure to fluctuations in the value of currencies and interest rates using foreign currency forward contracts with creditworthy financial institution

15

Table of Contents

counterparties. We monitor our exposures and the creditworthiness of our financial institution counterparties. Credit exposure for derivative financial instruments is limited to the amounts, if any, by which the counterparties’ obligations under the contracts exceed our obligations to the counterparties. We manage the potential risk of credit loss through careful evaluation of counterparty credit standing, selection of counterparties from a limited group of financial institutions and other contract provisions.

We maintain a policy to protect against fluctuation in currency exchange rates, which may result in a loss. We do not use derivative financial instruments for trading or speculative purposes. The realization of any or all of these risks could have a significant adverse effect on our financial results and statement of operations.

Our management and financial reporting systems, internal and disclosure controls and finance and accounting personnel may not be sufficient to meet our management and reporting needs.

We rely on a variety of management and financial reporting systems and internal and disclosure controls to provide management with accurate and timely information about our business and operations. This information is important because it enables management to capitalize on business opportunities and identify unfavorable developments and risks at an early stage. We also rely on these management and financial reporting systems and internal and disclosure controls to enable us to prepare accurate and timely financial information for our investors.

The challenge of establishing and maintaining sufficient systems and controls and hiring, training and retaining sufficient accounting and finance personnel has intensified as our business has grown rapidly in recent years and expanded into new geographic markets. As a result, we have identified the need to expand our finance and accounting staff and enhance internal controls at both the corporate and in-country levels and enhance the training of in-country management personnel regarding internal controls and management reporting to meet our current needs. This process is ongoing. For example, although we expect Sentai, our company-wide ERP, management and financial reporting system, to enhance the control of daily operating functions by our senior management, Sentai has yet to be fully implemented in Mexico, the last operation not entirely on Sentai. The ERP system has been implemented in our Miami Operations and 11 of our 12 In-country Operations. We completed the implementation of our core ERP system in Chile and some portions of Mexico in 2009 and expect to complete the remaining areas of Mexico in early 2010.

As of the end of 2009, we determined the need to make certain enhancements to access controls within our IT systems to limit unauthorized access and user functionality in our financial reporting systems and ensure proper segregation of duties. We intend to develop additional controls that ensure authorized personnel have access only to the areas of our financial reporting systems necessary to effectively perform their particular job functions.

In 2008, we hired a new director of internal audit, vice president of human resources, a director of finance for our subsidiary in El Salvador and controllers for each of our subsidiaries in Jamaica and Mexico. In 2009, we hired a new director of finance for each of our subsidiaries in Guatemala, Chile and Colombia. In addition, we are continuously seeking to add personnel to our finance and accounting staff, institute new controls and enhance existing controls at our consolidated and subsidiary operating levels.

Although we believe our current management and financial reporting systems, internal and disclosure controls and finance and accounting personnel are sufficient to enable us to effectively manage our business, identify unfavorable developments and risks at an early stage and produce financial information in an accurate and timely manner, we cannot be sure this will be the case. For example, management identified a material weakness in one of our foreign operations control environment during 2008, which included the following: (i) a failure to perform proper management oversight of the local operations and monitor and test controls to detect the override of established controls and policies; (ii) failure to institute all elements of an effective program to detect and prevent personnel (considered to be employees performing functions under a services agreement in the

16

Table of Contents

ordinary course of business us under the laws of the jurisdiction in which the foreign entity operates) from improperly claiming tax withholding exemptions as non-employees; and (iii) failure to establish and maintain an effective control environment surrounding the payroll process and the disbursement process, including the failure to verify the existence of complete and accurate procedures to support a three-way matching process comparing the original purchase order, invoice and receipt records of the purchased products to support the approval and payment for services rendered or products purchased. This material weakness resulted in increased payroll tax and VAT in the amount estimated to be approximately $0.4 million in the second quarter of 2008.

Although management undertook corrective actions to remediate the failed controls surrounding the foreign operating entity’s purchase and receipt of products, such actions may prove to be ineffective or inadequate and may expose us to risk of misstatements in our financial statements. In such circumstances, investors and other users of our financial statement may lose confidence in the reliability of our financial information, and we could fail to comply with certain covenants in our debt agreements.

No matter how well designed and operated, a control system can provide only reasonable, not absolute, assurance that its objectives are met. Its inherent limitations include the realities that judgments in decision-making can be faulty and failures can occur due to simple mistakes. Moreover, controls can be circumvented by the acts of an individual, collusion of two or a group of people or by management’s decision to override the existing controls.

We believe that we need to continue to expand our finance and accounting staff, enhance internal controls at both the corporate and in-country levels and enhance the training of in-country management personnel regarding internal controls and management reporting to meet our future needs, as a result of our anticipated or future growth. We cannot be sure that we will be able to take all necessary actions in a timely manner to keep pace with our anticipated growth.

Although we believe our controls were effective as of yearend, if we fail to maintain sufficient management and financial reporting systems and internal and disclosure controls, hire, retain and train sufficient accounting and finance personnel, and enhance the training of in-country management personnel regarding internal controls and management reporting, our ability to prepare accurate and timely financial information could be impaired, hinder our growth and have a material adverse effect on our current or future business, results of operations and financial condition.

We could experience difficulties in staffing and managing our foreign operations, which could result in reduced revenues and difficulties in realizing our growth strategy.

We have many sales and distribution centers in multiple countries, which require us to attract managers of our business in each of those locations. In establishing and developing many of our in-country sales and distribution operations, we have relied in large part on the local market knowledge and entrepreneurial skills of a limited number of local managers in those markets. We have no employment agreements with any of our in-country managers. The loss of the services of any of these managers could adversely impact our results of operations in the market in which the manager is located. Further, it may prove difficult to find and attract new talent, including accounting and finance personnel, in our existing markets or any new markets we enter in Latin America and the Caribbean who possess the expertise required to successfully manage and operate our in-country sales and distribution operations. In 2009, we hired a new general manager and a director of finance for our operations in Colombia, each of whom we believe has the appropriate knowledge and management skills to oversee our operations. If we fail to recruit highly qualified candidates, we may experience greater difficulty realizing our growth strategy, which could hurt our results of operations.

17

Table of Contents

If we lose the services of our key executive officers, we may not succeed in implementing our business strategy.

We are currently managed by certain key executive officers, including one of our founders, Michael Shalom. These individuals have extensive experience and knowledge of our industry and the many local markets in which we operate. They also have been integral in establishing and expanding some of our most significant customer relationships and building our unique distribution platform. The loss of the services of these key executive officers could adversely affect our ability to implement our business strategy, and new members of management may not be able to successfully replace them. With the exception of an employment agreement with our Chief Financial Officer, which has expired and is under renegotiation, we have no employment agreements with any of our key executive officers.

We are exposed to increased costs associated with complying with the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”) and other corporate governance and disclosure standards. Compliance efforts could divert management time from revenue-generating activities to compliance activities. Failures to comply could cause reputational harm and additional costs to remedy shortcomings.

The Sarbanes-Oxley Act and the rules promulgated by the SEC require us to adopt various corporate governance practices and implement various internal controls. Our efforts to comply with evolving laws, regulations and standards applicable to public companies have resulted in, and are likely to continue to result in, increased expenses and a diversion of management time from revenue-generating activities to compliance activities.

In particular, Section 404 of the Sarbanes-Oxley Act (“Section 404”) requires our management to annually review and evaluate our internal controls over financial reporting and attest to the effectiveness of these controls, beginning with our fiscal year ended December 31, 2007. The Sarbanes-Oxley Act requires our independent registered public accounting firm to attest to the effectiveness of internal control over financial reporting, beginning with our fiscal year ended December 31, 2010. To date, our ongoing efforts to comply with Section 404 have required the commitment of significant financial and managerial resources. In the event that our Chief Executive Officer, Chief Financial Officer or independent registered public accounting firm determines that our controls over financial reporting are not effective as required by Section 404 at any time in the future, investor perceptions of us and our reputation may be adversely affected and we may incur significant additional costs to remedy shortcomings in our internal controls.

We may be required to recognize further impairments of our goodwill, identifiable intangible assets or other long-lived assets or to establish further valuation allowances against our deferred income tax assets, which could adversely affect our results of operations or financial condition.

In the fourth quarter of 2008, consistent with the severe decline in the global capital markets, we experienced a similar decline in the market value of our goodwill and other intangible assets. As a result, our fair value of goodwill was significantly lower than book value. We perform our impairment test of our goodwill and other intangible assets on an annual basis. As a result of this evaluation, we recognized a charge of $18.8 million against the carrying value of our goodwill for the year ended December 31, 2008. This non-cash charge materially impacted our equity and results of operations in 2008, but did not impact our ongoing business operations, liquidity or cash flow. We did not recognize a charge against the carrying value of our goodwill, identifiable intangible assets or other long-lived assets as of December 31, 2009.

As part of our 2009 impairment analysis of our goodwill, we noted that our operations in Centel reflected a fair value that exceeded its carrying value by approximately 3.4%. The fair value was determined using management’s conservative projections, giving the recent severe economic contraction in Mexico’s gross domestic product, or GDP, and our independent valuation experts’ estimate of fair value. As of December 31, 2009, we have $2.9 million of goodwill attributable to our operations in Mexico, which represents approximately

18

Table of Contents

11.2% of Centel’s carrying value and less than 1.0% of our total assets. An extended period of economic contraction could result in a further impairment to the carrying value of the goodwill attributable to our operations in Mexico.

Deferred income tax represents the tax effect of the differences between the book and tax bases of assets and liabilities. Deferred tax assets, which also include net operating loss carryforwards for entities that have generated or continue to generate operating losses, are assessed periodically by management to determine if their future benefit will be fully realized. Factors in management’s determination include the performance of the business and the feasibility of ongoing tax planning strategies. If available information indicates that it is more likely than not that the deferred income tax asset will not be realized then a valuation allowance must be established with a corresponding charge to net (loss) income. Such charges could have a material adverse effect on our results of operations or financial condition. As a result of our evaluation, we established a valuation allowance against the carrying value of our long-term deferred tax assets of $6.4 million and $4.8 million, respectively, as of December 31, 2009 and 2008.

Our future results of operations may be impacted by a prolonged weakness in the global economic environment that may result in a further impairment of any existing goodwill or goodwill recorded in the future and/or other long-lived assets or further valuation allowances on our deferred tax assets, which could adversely affect our results of operations or financial condition.

The indenture governing our 13 1/4% Senior Notes and the credit agreement governing Software Brokers of America, Inc. (“SBA”)’s Senior Secured Revolving Credit Facility imposes significant operating and financial restrictions on our Company and our subsidiaries, which may prevent us from capitalizing on business opportunities.

The indenture governing our 13 1/4% Senior Notes imposes significant operating and financial restrictions on us. These restrictive covenants limit our ability, among other things to:

| • | incur additional indebtedness or enter into sale and leaseback obligations; |

| • | pay certain dividends or make certain distributions on our capital stock or repurchase our capital stock; |

| • | make certain investments or other restricted payments; |

| • | place restrictions on the ability of subsidiaries to pay dividends or make other payments to us; |

| • | engage in transactions with shareholders or affiliates; |

| • | sell certain assets or merge with or into other companies; |

| • | guarantee indebtedness; and |

| • | create liens. |

The Senior Secured Revolving Credit Facility limits SBA’s ability, among other things, to:

| • | incur additional indebtedness; |

| • | make certain capital expenditures; |

| • | guarantee certain obligations, other than SBA’s guarantee of our 13 1/4% Senior Notes; |

| • | create or allow liens on certain assets, other than liens securing our 13 1/4% Senior Notes; |

| • | make investments, loans or advances; |

| • | pay dividends, make distributions and undertake stock and other equity interest buybacks; |

| • | make certain acquisitions; |

19

Table of Contents

| • | engage in mergers, consolidations or sales of assets; |

| • | use the proceeds of the revolving credit facility for certain purposes; |

| • | enter into transactions with affiliates on non-arm’s length transactions; |

| • | make certain payments on subordinated indebtedness; and |

| • | acquire or sell subsidiaries. |

The Senior Secured Revolving Credit Facility financial covenants require the following of SBA and the Company:

| • | maintain a consolidated total leverage ratio of not greater than 5.50 to 1.00 commencing with the quarter ending March 31, 2010 and each quarter thereafter with the quarter ending December 31, 2010, 5.00 to 1.00 for the quarters ending March 31, 2011 and June 30, 2011, 4.50 to 1.00 for the quarters ending September 30, 2011 and December 31, 2011, 4.00 to 1.00 for the quarters ending March 31, 2011 and each quarter ending thereafter; |

| • | maintain a consolidated fixed charge coverage ratio of not less than 1.00 to 1.00 commencing March 31, 2010, on a year-to-date basis through December 31, 2010, and on a rolling four-quarter basis thereafter; and |

| • | maintain consolidated net income of not less than $0 commencing with the quarter ending December 31, 2009, not less than ($500,000) for the quarter ending March 31, 2010, $0 for each of the quarters ended March 31, 2010 and each quarter thereafter with the quarter ending December 31, 2010, not less than ($500,000) for the quarter ending March 31, 2011, $0 for each of the quarters ended March 31, 2011 and each quarter thereafter with the quarter ending December 31, 2011, not less than ($500,000 for the quarter ending March 31, 2012, $0 for each of the quarters ended March 31, 2012 and each quarter thereafter. |

Our and SBA’s failure to comply with the restrictive covenants could result in an event of default, which, if not cured or waived, could result in either of us having to repay our respective borrowings before their respective due dates. If we or SBA is forced to refinance these borrowings on less favorable terms, our results of operations or financial condition could be harmed. In addition, if we are in default under any of our existing or future debt facilities, we also will not be able to borrow additional amounts under those facilities to the extent they would otherwise be available and may not be able to repay our existing indebtedness.

Our substantial debt could limit the cash flow available for our operations, which could adversely affect our business.

We have and will continue to have a substantial amount of debt, which requires significant interest and principal payments. As of December 31, 2009, we had $129.7 million of total debt outstanding (consisting of $113.3 million outstanding under our $120.0 million 13 1/4% Senior Notes, net of discount, $9.2 million outstanding under our Senior Secured Revolving Credit Facility, $6.2 million of outstanding debt of our foreign subsidiaries and $1.0 million of capital leases of SBA). Subject to the limits contained in the indenture governing our 13 1/4% Senior Notes and our other debt instruments, we may be able to incur additional debt from time to time to finance working capital, capital expenditures, investments or acquisitions, or for other purposes. If we incur additional debt, the risks related to our high level of debt could intensify. Specifically, our high level of debt could have important consequences to the holders of our common stock, including the following:

| • | limiting our ability to obtain additional financing to fund future working capital, capital expenditures, acquisitions or other general corporate requirements; |

| • | requiring a substantial portion of our cash flows to be dedicated to debt service payments instead of other purposes; |

20

Table of Contents

| • | increasing our vulnerability to general adverse economic and industry conditions; |

| • | limiting our flexibility in planning for and reacting to changes in the industry in which we compete; |

| • | placing us at a disadvantage compared to other, less leveraged competitors; and |

| • | increasing our cost of borrowing. |

We may not be able to maintain compliance with our current debt covenants or any additional covenants in the future and our failure to do so could adversely impact our liquidity.

The credit agreement governing the Senior Secured Revolving Credit Facility and the indenture governing our outstanding 13 1/4% Senior Notes contain restrictive covenants and financial covenants. Our and SBA’s failure to comply with the restrictive covenants could result in an event of default, which, if not cured or waived, could result in either of us having to repay our respective borrowings before their respective due dates. If we or SBA is forced to refinance these borrowings on less favorable terms, our results of operations or financial condition could be harmed. In addition, if we are in default under any of our existing or future debt facilities, we also will not be able to borrow additional amounts under those facilities to the extent they would otherwise be available.