Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2009

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 0-50167

INFINITY PROPERTY AND CASUALTY CORPORATION

(Exact name of registrant as specified in its charter)

| OHIO | 03-0483872 | |

| (State of other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 3700 COLONNADE PARKWAY BIRMINGHAM, ALABAMA |

35243 | |

| (Address of principal executive offices) | (Zip Code) | |

(205) 870-4000

(Registrant’s telephone number, including area code)

| Securities registered pursuant to Section 12(b) of the Act: |

Name of each exchange on which registered: | |

| Common Stock, no par value | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

(Title of class)

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Act from their obligations under those Sections.

Table of Contents

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ¨ Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ¨ Yes x No

As of June 30, 2009, the aggregate market value of the voting Common Stock held by non-affiliates of the registrant was $489,807,527 based on the last sale price of Common Stock on that date as reported by The NASDAQ Global Select Market.

As of February 12, 2010, there were 13,418,699 shares of the registrant’s Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s proxy statement for the annual meeting of shareholders to be held on May 26, 2010, are incorporated by reference in Part III hereof.

Table of Contents

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

INDEX TO ANNUAL REPORT

ON FORM 10-K

| Page | ||||||

| Part I | ||||||

| Item 1 - | 1 | |||||

| 1 | ||||||

| 2 | ||||||

| Item 1A - | 9 | |||||

| Item 1B - | 12 | |||||

| Item 2 - | 12 | |||||

| Item 3 - | 12 | |||||

| Item 4 - | 12 | |||||

| Part II | ||||||

| Item 5 - | 13 | |||||

| Item 6 - | 16 | |||||

| Item 7 - | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

17 | ||||

| Item 7A - | 49 | |||||

| Item 8 - | 49 | |||||

| Item 9 - | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

49 | ||||

| Item 9A - | 50 | |||||

| Item 9B - | 52 | |||||

| Part III | ||||||

| Item 10 - | 52 | |||||

| Item 11 - | 52 | |||||

| Item 12 - | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

52 | ||||

| Item 13 - | Certain Relationships and Related Transactions, and Director Independence |

52 | ||||

| Item 14 - | 52 | |||||

| Part IV | ||||||

| Item 15 - | 89 | |||||

Table of Contents

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains certain statements that may be deemed to be “forward-looking statements” that anticipate results based on our estimates, assumptions and plans that are subject to uncertainty. These statements are made subject to the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. All statements in this report not dealing with historical results or current facts are forward-looking and are based on estimates, assumptions, and projections. Statements which include the words “believes,” “seeks,” “expects,” “may,” “should,” “intends,” “likely,” “targets,” “plans,” “anticipates,” “estimates” or the negative version of those words and similar statements of a future or forward-looking nature identify forward-looking statements. Examples of such forward-looking statements include statements relating to expectations concerning market conditions, premium, growth, earnings, investment performance, expected losses, rate changes and loss experience.

Actual results could differ materially from those expected by Infinity depending on: changes in economic conditions and financial markets (including interest rates), the adequacy or accuracy of Infinity’s pricing methodologies, actions of competitors, the approval of requested form and rate changes, judicial and regulatory developments affecting the automobile insurance industry, the outcome of pending or new litigation against Infinity, weather conditions (including the severity and frequency of storms, hurricanes, snowfalls, hail and winter conditions), earthquakes and other natural catastrophes, changes in driving patterns and loss trends. Infinity undertakes no obligation to publicly update or revise any of the forward-looking statements. For a more detailed discussion of some of the foregoing risks and uncertainties which could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” contained in Item 1A.

PART I

Business

Infinity Property and Casualty Corporation (“Infinity” or the “Company”) is a holding company that, through subsidiaries, provides personal automobile insurance with a concentration on nonstandard auto insurance. Infinity is headquartered in Birmingham, Alabama. The Company employed approximately 1,780 persons at December 31, 2009.

Infinity files its Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other reports as required with the United States Securities and Exchange Commission (“SEC”). Any of these documents may be read and copied at the SEC’s Public Reference Room at 100 F Street NE, Washington, D.C. 20549. Information regarding the operation of the SEC Public Reference Room may be obtained by calling 1-800-SEC-0330. Infinity’s filed documents may also be accessed via the SEC Internet site at: http://www.sec.gov. All of Infinity’s SEC filings, news releases and other information may also be accessed free of charge on Infinity’s Internet site at: http://www.ipacc.com. Information on Infinity’s website is not part of this Form 10-K.

Please see Note 1 to the Consolidated Financial Statements for additional information regarding the history and organization of Infinity. References to Infinity, unless the context requires otherwise, include the combined operations of its subsidiaries (collectively the “NSA Group”) and the in-force personal insurance business assumed through a reinsurance contract (“the Assumed Agency Business”) from Great American Insurance Company (“GAI”). Unless indicated otherwise, the financial information herein is presented on a GAAP basis. Schedules may not foot due to rounding.

The Personal Automobile Market

Personal auto insurance is the largest line of property and casualty insurance, accounting for approximately 37% of the estimated $432 billion of annual industry premium. Personal auto insurance is comprised of preferred, standard and nonstandard risks. Nonstandard auto insurance is intended for drivers who, due to factors such as their driving record, age or vehicle type, represent a higher than normal risk. As a result, customers who purchase nonstandard auto insurance generally pay a higher premium for similar coverage than the drivers qualifying for standard or preferred policies. While there is no established industry-recognized distinction between nonstandard risks and all other personal auto risks, Infinity believes that nonstandard auto risks generally constitute between 15% and 20% of the personal automobile insurance market, with this range fluctuating according to competitive conditions in the market. Independent agents sell approximately one-third of all personal automobile insurance. The remainder is sold by captive agents or directly by insurance companies to their customers. Infinity believes that, relative to the standard and preferred auto insurance market, a disproportionately larger portion of nonstandard auto insurance is sold through independent agents.

1

Table of Contents

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

Business

The personal auto insurance industry is cyclical, characterized by periods of price competition and excess capacity followed by periods of high premium rates and shortages of underwriting capacity. Over the past several years, the cycle has been “soft”, marked by aggressive competition for independent agents’ business through increased sales and commission incentives. Infinity observed that, during this soft cycle, some competitors were reducing their overall rates with larger rate reductions in certain segments of the business. The personal automobile component of the Consumer Price Index (“CPI”) reflects this trend as it indicates personal automobile insurance rates have increased just 0.5%, 0.8% and 1.0% during 2007, 2006 and 2005, respectively, after increasing 3.4% and 4.5% during 2004 and 2003, respectively. However, the market is showing signs of hardening, as Infinity observed a few competitors increasing rates and tightening underwriting standards beginning in 2008 and continuing into 2009. Industry rates increased 4.0% during that year and another 4.7% in 2009. Infinity’s average rate adjustments on its personal auto business were (0.3)%, (2.6)%, 3.5%, 0.8% and 2.2% for 2009, 2008, 2007, 2006 and 2005, respectively.

The personal auto insurance industry is highly competitive and, except for regulatory considerations, there are relatively few barriers to entry. Infinity generally competes with other insurers on the basis of price, coverage offered, claims handling, customer service, agent commission, geographic coverage and financial strength ratings. Infinity competes with both large national writers and smaller regional companies. In 2008, the five largest automobile insurance companies accounted for approximately 50% of the industry’s net written premium and the largest ten accounted for approximately 68% (2009 industry data is not available). Approximately 332 insurance groups compete in the personal auto insurance industry according to A.M. Best. Some of these groups specialize in nonstandard auto insurance while others insure a broad spectrum of personal auto insurance risks.

Infinity is organized along functional responsibilities with the following centralized departments: product management, marketing, claims, customer service, accounting, treasury, human resources and information technology resources. Frequent executive team meetings, which include the Chief Executive Officer, the Chief Financial Officer, the Chief Legal Officer, the Chief Marketing Officer, the Chief Product Management Officer and the Chief Claims Officer, allow for sharing of information among functional departments and for setting policies and making key strategic decisions.

In recent years, Infinity has made efforts to improve service levels and more consistently and cost effectively manage its operations. The company consolidated certain customer service, centralized claims and information technology back-office operations and opened a bilingual customer service call center to improve its service capabilities.

Infinity estimates that approximately 97% of its personal auto business is nonstandard auto insurance. Based on data published by A.M. Best, Infinity believes that it is the fourth largest provider of nonstandard auto coverage through independent agents in the United States. Infinity also writes standard and preferred personal auto insurance, monoline commercial auto insurance and classic collector automobile insurance.

2

Table of Contents

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

Business

Summarized historical financial data for Infinity is presented below (in thousands):

| Twelve months ended December 31, | |||||||||

| 2009 | 2008 | 2007 | |||||||

| Gross written premium |

$ | 848,812 | $ | 896,899 | $ | 1,019,119 | |||

| Net written premium |

843,869 | 892,090 | 1,014,262 | ||||||

| Net earnings |

70,594 | 19,257 | 71,944 | ||||||

| As of December 31, | ||||||

| 2009 | 2008 | |||||

| Total assets |

$ | 1,803,671 | $ | 1,742,232 | ||

| Total liabilities |

1,185,511 | 1,216,901 | ||||

| Total shareholders’ equity |

618,160 | 525,331 | ||||

Infinity has a history of favorable underwriting results. The following table compares Infinity’s statutory combined ratio in past years with those of the private passenger auto industry. The statutory combined ratio is the sum of the loss ratio (the ratio of losses and loss adjustment expenses (“LAE”) to net earned premium) and the expense ratio (when calculated on a statutory accounting basis, the ratio of underwriting expenses to net written premium). When the combined ratio is under 100%, underwriting results are generally considered profitable; when the ratio is over 100%, underwriting results are generally considered unprofitable. Infinity has consistently performed better than the industry as shown below:

| 2009 | 2008 | 2007 | 2006 | 2005 | 2005-2009 | 2000-2009 | |||||||||||||||

| Infinity |

87.2 | % | 91.2 | % | 91.8 | % | 88.7 | % | 90.0 | % | 89.9 | % | 94.6 | % | |||||||

| Industry (a) |

99.9 | % | 100.2 | % | 98.3 | % | 95.5 | % | 95.1 | % | 97.8 | % | 99.9 | % | |||||||

| Percentage points better than industry |

12.7 | % | 9.0 | % | 6.5 | % | 6.8 | % | 5.1 | % | 7.9 | % | 5.3 | % |

| (a) | Private passenger auto industry combined ratios for 2000 through 2008 were obtained from A.M. Best. A.M. Best data were not available for 2009. The industry combined ratio for 2009 is an estimate based on data obtained from Conning Research and Consulting. |

Products

Personal Automobile is Infinity’s primary insurance product. It provides coverage to individuals for liability to others for bodily injury and property damage and for physical damage to an insured’s own vehicle from collision and various other perils. In addition, many states require policies to provide for first party personal injury protection, frequently referred to as no-fault coverage. Infinity offers three primary products to individual drivers: the Low-Cost product, which offers the most restricted coverage, the Value-Added product, which offers broader coverage and higher limits, and the Premier product, which offers the broadest coverage and is designed for standard and preferred risk drivers. For the year ended December 31, 2009, Infinity’s mix of personal automobile written premium was 12% Low-Cost, 85% Value-Added and 3% Premier.

Commercial Vehicle provides coverage to businesses for liability to others for bodily injury and property damage and for physical damage to vehicles from collision and various other perils. Infinity offers monoline commercial automobile insurance to businesses with fleets of 12 or fewer vehicles. Businesses that are involved in what Infinity considers to be hazardous operations or interstate commerce are generally avoided.

Classic Collector provides protection for classic collectible automobiles. Infinity’s Classic Collector program provides coverage to individuals with classic or antique automobiles for liability to others for bodily injury and property damage and for physical damage to an insured’s own vehicle from collision and various other perils.

3

Table of Contents

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

Business

Infinity’s three product groups contributed the following percentages of total gross written premium:

| Twelve months ended December 31, | |||||||||

| 2009 | 2008 | 2007 | |||||||

| Personal Automobile |

92 | % | 93 | % | 94 | % | |||

| Commercial Vehicle |

6 | % | 5 | % | 4 | % | |||

| Classic Collector |

2 | % | 2 | % | 2 | % | |||

| Total |

100 | % | 100 | % | 100 | % | |||

Distribution and Marketing

Infinity distributes its products primarily through a network of over 12,600 independent agencies and brokers (with approximately 16,000 locations). In 2009, four independent agencies each accounted for between 2% and 3% of Infinity’s gross written premium, two other agencies each accounted for between 1% and 2% of the Company’s gross written premium and 14.0% of the agency force produced 80% of Infinity’s gross written premium. In California, Infinity’s largest state by premium volume, 43% of gross written premium (which represents 23.5% countrywide) was produced by forty independent agents and brokers.

Infinity also fosters agent relationships by providing them with access to Infinity’s Internet web-based software applications along with programs and services designed to strengthen and expand their marketing, sales and service capabilities. Infinity’s Internet-based software applications provide many of its agents with real-time underwriting, claims and policy information. Infinity believes the array of services that it offers to its agents adds significant value to the agents’ businesses. For example, “Providing Agents Service and Support Program” is Infinity’s incentive-based program through which agents receive assistance in critical areas such as training, advertising and promotion. In 2009, Infinity spent $10.8 million on co-op advertising and promotions.

Strategic partnerships are another mode of distribution for Infinity. These are relationships with non-affiliated property and casualty insurers that have their own captive agency forces. These companies usually provide standard and preferred auto coverage through one of their own companies while utilizing Infinity’s companies for their nonstandard risks. Infinity believes these relationships are mutually beneficial because its partners gain access to Infinity’s nonstandard auto expertise, and Infinity gains access to a new distribution channel.

Infinity is licensed to write insurance in all 50 states and the District of Columbia, but is committed to growth in targeted urban areas (“Urban Zones”) identified within selected Focus States that management believes offer the greatest opportunity for premium growth and profitability. Infinity classifies the states in which it operates into three categories:

| • | “Focus States” – Infinity has identified Urban Zones in these states which include: Arizona, California, Florida, Georgia, Illinois, Nevada, Pennsylvania and Texas. |

| • | “Maintenance States” – Infinity is maintaining its writings in these states which include: Alabama, Colorado, Connecticut, Missouri, Ohio, South Carolina, and Tennessee. Infinity believes each state offers the Company an opportunity for underwriting profit. |

| • | “Other States” – Includes all remaining states. |

Infinity further classifies the Focus States into two categories:

| • | “Urban Zones” – include the following urban areas: |

| • | Arizona – Phoenix and Tucson |

| • | California – Bay Area, Los Angeles, Sacramento, San Diego, and San Joaquin Valley |

| • | Florida – Jacksonville, Miami, Orlando, Sarasota and Tampa |

| • | Georgia – Atlanta |

| • | Illinois – Chicago |

| • | Nevada – Las Vegas |

| • | Pennsylvania – Allentown and Philadelphia |

| • | Texas – Dallas, Fort Worth, Houston and San Antonio |

4

Table of Contents

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

Business

| • | “Non-Urban Zones” – include all remaining areas in the Focus States outside of a designated Urban Zone. |

Infinity continually evaluates its market opportunities; thus the Focus States, Urban Zones, Maintenance States and Other States may change over time. In the table below, Infinity has restated 2008 and 2007 premium to be consistent with the 2009 classification of Urban Zones, Focus States, Maintenance States and Other States.

5

Table of Contents

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

Business

Total gross written premium among the three state categories are as follows:

| Twelve months ended December, 31 | |||||||||

| 2009 | 2008 | 2007 | |||||||

| Personal Auto Insurance |

|||||||||

| Focus States: |

|||||||||

| California |

|||||||||

| Urban Zones |

53 | % | 50 | % | 51 | % | |||

| Non-Urban Zones |

1 | % | 1 | % | 2 | % | |||

| Florida |

|||||||||

| Urban Zones |

8 | % | 9 | % | 8 | % | |||

| Non-Urban Zones |

4 | % | 5 | % | 6 | % | |||

| Texas |

|||||||||

| Urban Zones |

5 | % | 5 | % | 4 | % | |||

| Non-Urban Zones |

1 | % | 1 | % | 1 | % | |||

| Pennsylvania |

|||||||||

| Urban Zones |

4 | % | 3 | % | 3 | % | |||

| Non-Urban Zones |

2 | % | 2 | % | 2 | % | |||

| Arizona |

|||||||||

| Urban Zones |

3 | % | 3 | % | 4 | % | |||

| Non-Urban Zones |

* | * | * | ||||||

| Nevada |

|||||||||

| Urban Zones |

3 | % | 3 | % | 2 | % | |||

| Non-Urban Zones |

* | * | * | ||||||

| Georgia |

|||||||||

| Urban Zones |

2 | % | 3 | % | 3 | % | |||

| Non-Urban Zones |

2 | % | 3 | % | 3 | % | |||

| Illinois |

|||||||||

| Urban Zones |

1 | % | * | * | |||||

| Non-Urban Zones |

* | * | * | ||||||

| Total Focus States |

88 | % | 87 | % | 86 | % | |||

| Maintenance States |

4 | % | 5 | % | 7 | % | |||

| Other States |

* | * | * | ||||||

| Subtotal |

92 | % | 93 | % | 94 | % | |||

| Commercial Vehicle |

6 | % | 5 | % | 4 | % | |||

| Classic Collector |

2 | % | 2 | % | 2 | % | |||

| Other |

* | * | * | ||||||

| Total All States and All Lines |

100 | % | 100 | % | 100 | % | |||

| Total $ (in thousands) - All States and All Lines(1) |

848,816 | 896,902 | 1,019,011 | ||||||

| (1) | 2009 and 2008 exclude less than $(0.1) million each of premium written on behalf of other companies. 2007 excludes $0.1 million of premium written on behalf of other companies. |

| * | denotes less than one percent |

6

Table of Contents

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

Business

Infinity’s distribution and marketing efforts are implemented with a focus on maintaining a low-cost structure. Controlling expenses allows Infinity to price competitively and achieve better underwriting returns. Over the five years ended 2008, years for which industry data are available from A.M. Best, Infinity’s statutory ratio of underwriting expenses to premium written has averaged 21.5%, which is 5.1 points better than the independent agency segment of the private passenger automobile industry average of 26.7% for the same period.

Claims Handling

Infinity strives for accuracy, consistency and fairness in its claim resolutions. Infinity’s claims organization employs approximately 840 people and has 33 field locations and provides a 24-hour, seven days per week toll-free service for its customers to report claims. Infinity predominantly uses its own local adjusters and appraisers, who typically respond to claims within 24 hours of a report. Included in the 33 field locations are 11 claims service centers, which allow customers to conveniently bring in their vehicles for damage appraisal.

Infinity is committed to the field handling of claims in Urban Zones and believes it provides, when compared to alternative methods, better service to its customers and better control of the claim resolution process. Infinity opens claims branch offices in the Urban Zones where the volume of business will support them. Customer interactions can occur with generalists (initial and continuing adjusters) and specialists (staff appraisers, field casualty representatives and special investigators) based on local market volume, density and performance.

In addition to the use of field claims handling, Infinity uses two centralized claims call centers, one in Birmingham, Alabama and another in McAllen, Texas, to receive initial reports of losses and to adjust simple property damage claims.

Ratings

A.M. Best has assigned Infinity’s insurance company subsidiaries a group financial strength rating of “A” (Excellent). According to A.M. Best, “A” ratings are assigned to insurers that, in A.M. Best’s opinion, “have an excellent ability to meet their ongoing insurance obligations”. A.M. Best bases its ratings on factors that concern policyholders and not upon factors concerning investor protection.

Regulatory Environment

Infinity’s insurance company subsidiaries are subject to regulation and supervision by insurance departments of the jurisdictions in which they are domiciled or licensed to transact business. State insurance departments have broad administrative power relating to licensing insurers and agents, regulating premium rates and policy forms, establishing reserve and investment requirements, prescribing statutory accounting methods and the form and content of statutory financial reports, and regulating methods and processes of how an insurer conducts its business. Recent examples of the latter include the establishment in California of auto rating factor and rate approval regulations, proscription on credit based insurance scoring, prohibition of certain business practices with auto body repair shops, and attempts to set uniform auto body repair shop parts and labor rates.

Under state insolvency and guaranty laws, regulated insurers can be assessed or required to contribute to state guaranty funds to cover policyholder losses resulting from insurer insolvencies. Insurers are also required by many states, as a condition of doing business in the state, to participate in various assigned risk pools, reinsurance facilities or underwriting associations, which provide various insurance coverages to individuals who otherwise are unable to purchase that coverage in the voluntary market. Participation in these involuntary plans is generally in proportion to voluntary writings of related lines of business in that state. The underwriting results of these plans traditionally have been unprofitable. The amount of premium Infinity might be required to assume in a given state in connection with an involuntary plan may be reduced because of credits Infinity may receive for nonstandard policies that it voluntarily writes. Many states also have laws and regulations that limit an insurer’s ability to exit a market. For example, certain states limit an automobile insurer’s ability to cancel and non-renew policies.

State insurance departments that have jurisdiction over Infinity’s insurance subsidiaries may conduct routine, on-site visits and examinations of the companies’ affairs. At December 31, 2009, Infinity’s insurance subsidiaries were involved in a rating and underwriting examination in California, Infinity’s largest state. As of February 26, 2010 this examination has not been completed. These examinations have from time to time given rise to, and are likely to give rise to in the future, regulatory orders requiring remedial, injunctive or other action on the part of an insurance subsidiary or the assessment of substantial

7

Table of Contents

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

Business

fines or other penalties against Infinity’s insurance subsidiaries. Every five years, Infinity’s insurance subsidiaries are subject to a financial examination by the states in which the subsidiaries are domiciled. During 2007, the states’ examinations of the 2002 through 2006 statutory financial statements were completed with no financial adjustments required.

The insurance laws of the states of domicile of Infinity’s insurance subsidiaries contain provisions to the effect that the acquisition or change of control of a domestic insurer or of any entity that controls a domestic insurer cannot be consummated without the prior approval of the relevant insurance regulator. In addition, certain state insurance laws contain provisions that require pre-acquisition notification to state agencies of a change in control with respect to a non-domestic insurance company licensed to do business in that state. Such approval requirements may deter, delay or prevent certain transactions affecting the ownership of Infinity’s common stock.

Infinity is a holding company with no business operations of its own. Consequently, Infinity’s ability to pay dividends to shareholders and meet its debt payment obligations is largely dependent on dividends or other distributions from its insurance company subsidiaries, current investments and cash held. State insurance laws restrict the ability of Infinity’s insurance company subsidiaries to declare shareholder dividends. These subsidiaries may not make an “extraordinary dividend” until thirty days after the applicable commissioner of insurance has received notice of the intended dividend and has either not objected or has approved the payment of the extraordinary dividend within the 30-day period. An extraordinary dividend is defined as any dividend or distribution that, together with other distributions made within the preceding twelve months, exceeds the greater of 10% of the insurer’s surplus as of the preceding December 31st, or the insurer’s net income for the twelve-month period ending the preceding December 31st, in each case determined in accordance with statutory accounting practices. In addition, an insurer’s remaining surplus after payment of a cash dividend to shareholder affiliates must be both reasonable in relation to its outstanding liabilities and adequate to its financial needs.

If a shareholder dividend does not rise to the statutory level of an extraordinary dividend, then it is an “ordinary dividend.” While an insurance company’s ability to pay an ordinary dividend does not require the approval of a state insurance department, the company must, by law, file a 10-day notice of ordinary dividend with the appropriate insurance departments. Insurance companies that fail to notify an insurance department of the payment of an ordinary dividend are assessed administrative fines.

The ordinary dividend capacity and payment activity of Infinity’s insurance companies for the two most recent years as well as the dividend capacity for the upcoming year are shown in the following table (in thousands):

| 2010 | 2009 | 2008 | |||||||

| Maximum ordinary dividends available to Infinity (a), (c) |

$ | 107,000 | $ | 43,000 | $ | 79,001 | |||

| Dividends paid from subsidiaries to parent (b) |

— | $ | 90,000 | $ | 70,000 | ||||

| (a) | The majority of dividends paid by Infinity’s insurance companies to Infinity prior to December 21, 2010 will require an extraordinary dividend as those dividends, together with other distributions made within the preceding twelve months, will exceed the ordinary dividend capacity. |

| (b) | 2009 includes a $60 million extraordinary dividend for which Infinity received regulatory approval. |

| (c) | The dividend capacity for 2010 increased as a result of an increase in statutory income due to an increase in redundancy of loss reserves and a reduction in other-than-temporary impairment charges in 2009 as compared to 2008. |

State insurance laws require Infinity’s insurance companies to maintain specified levels of statutory capital and surplus. Generally, the net admitted assets of insurance companies that, subject to other applicable insurance laws and regulations, are available for transfer to the parent company cannot include the net admitted assets required to meet the minimum statutory surplus requirements of the states where the companies are licensed. In addition, for competitive reasons, Infinity’s insurance company subsidiaries need to maintain adequate financial strength ratings from independent rating agencies. Both of these factors may limit the ability of Infinity’s insurance subsidiaries to declare and pay dividends.

8

Table of Contents

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

Risk Factors

Infinity’s business operations face a number of risks. These risks should be read and considered with other information provided in this report.

The economic slowdown has disproportionately impacted Infinity’s targeted consumers and could continue to adversely affect the Company’s premium revenue and profitability.

The current downturn in the general economy- characterized by high levels of unemployment and falling consumer confidence- has adversely affected insurance buying behavior. We believe these economic factors have disproportionately affected consumers of nonstandard automobile insurance. Customers have chosen not to purchase coverage, to let coverage lapse on renewal or to opt for liability coverage only. These conditions may continue to adversely affect Infinity’s premium revenue and profitability.

Because of the significant concentration of Infinity’s business in California, Infinity’s profitability may be adversely affected by negative developments in the California insurance market and economic environment.

California, Infinity’s largest market, generated approximately 57% of Infinity’s gross written premium in 2009. Infinity’s California business also generates substantial underwriting profit. Consequently, Infinity’s revenues and profitability are affected by the dynamic nature of regulatory, legal, competitive and economic conditions in that state, including rising unemployment. Examples of potentially adverse regulatory or judicial developments or proposed legislation in California include laws aimed at curtailing unlawful immigration, restricting the use of territory as a rate factor, limiting the after-tax rate of return allowed an insurer, and restricting the type of compensation paid to independent brokers. These developments could negatively affect premium revenue or make it more expensive or less profitable for Infinity to conduct business in the state.

Infinity relies upon a limited number of independent agents to generate a substantial portion of its business. If Infinity is unable to retain or increase the level of business that these independent agents place with Infinity or increase the level of business generated by other agents, the Company’s revenues would be negatively affected.

Approximately 14.0% of the Company’s 12,600 independent agents accounted for approximately 80% of Infinity’s gross written premium in 2009. Infinity must compete with other insurance carriers for the business of these agents in an increasingly competitive marketplace. Some competitors offer superior systems to quote and process business, a larger variety of products, lower prices for insurance coverage, higher commissions or more attractive cash and non-cash incentives.

Infinity is vulnerable to a reduction in the amount of business written through the independent agent distribution channel.

Reliance on the independent agency as its primary distribution channel makes Infinity vulnerable to the growing popularity of directly to the consumer distribution channels, particularly the Internet. Approximately two-thirds of all personal automobile insurance sold in the United States is sold direct or through captive agents (agents employed by one company or selling only one company’s products) and approximately one-third is sold by independent agents. A material reduction in the amount of business generated through the independent agency channel could negatively impact Infinity’s revenues and growth opportunities.

Legal, regulatory and legislative challenges to established practices in the areas of underwriting, claims handling and compensation issues are continually emerging and could adversely impact Infinity’s operating results or established methods of doing business.

As automobile insurance industry practices and regulatory, judicial and consumer conditions change, challenges to prevailing industry practices continue to emerge. Examples of recent challenges to Infinity and industry practices relate to:

| • | the use of an applicant’s credit, territory, occupation and other rating factors in making risk selection and pricing decisions; |

9

Table of Contents

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

Risk Factors

| • | the use of automated databases to assist in the adjustment of bodily injury and physical damage claims; and |

| • | the manner in which brokers are compensated and provided incentives. |

Some of these practices are the subject of ongoing litigation (See Note 15 of the Consolidated Financial Statements, “Legal Proceedings”). How or when these issues will ultimately be resolved is uncertain. The resolutions could, however, adversely impact Infinity’s operating results or its methods of doing business.

The failure to maintain or to further develop reliable and efficient information and technology systems would be disruptive to Infinity’s operations and diminish its ability to compete successfully.

Infinity is highly dependent on efficient and uninterrupted performance of its information technology and business systems. These systems quote, process and service Infinity’s business, and perform actuarial functions necessary for pricing and product development. These systems must also be able to undergo periodic modifications and improvements without interruptions or untimely delays in service. This capability is crucial to meeting growing customer demands for user friendly, online capabilities and convenient, quality service. The Company is undergoing fundamental changes and improvements to its claims and policy services platform. A failure or delay to achieve these improvements could interrupt certain processes or degrade business operations and would place Infinity at a competitive disadvantage.

Profitability may be affected if Infinity fails to accurately price the risks it underwrites.

Infinity’s profitability depends on its ability to set premium rates accurately. Pricing with accuracy is complicated by inflationary pressures on medical care, auto parts and repair services costs. It is also dependent on the availability of sufficient, reliable data on which to project both severity and frequency trends and timely recognition of changes in loss cost trends. This process poses more of a challenge in markets where Infinity has less pricing experience.

Consequently, Infinity could under-price risks, which could negatively affect its profit margins, or overprice risks, which could reduce sales volume and competitiveness. Either scenario could adversely affect profitability.

The inability to recruit, develop and retain key personnel could prevent Infinity from implementing its business strategy and negatively affect future growth and profitability.

Successful implementation of Infinity’s business strategy will depend, in part, upon the continued services of its Chief Executive Officer, James Gober. Infinity’s future success will also depend on its ability to retain executives and key personnel, as well as attract new talent. The highly competitive nature of the industry, along with the advantages that larger, better known firms possess in the recruiting process, poses a challenge. The loss of any of the executive officers or key personnel, or the inability to attract and retain new talent, could prevent Infinity from fully implementing its business strategy and negatively affect future growth and profitability.

Extra-contractual losses arising from bad faith claims could materially reduce Infinity’s profitability.

In California, Florida, and other states where Infinity has substantial operations, the judicial climate, case law or statutory framework are often viewed as unfavorable toward an insurer in litigation brought against it by policyholders and third-party claimants. This tends to increase Infinity’s exposure to extra-contractual losses, or monetary damages beyond policy limits, in what are known as “bad faith” claims, for which reinsurance may be unavailable. Such claims have in the past, and may in the future, result in losses to Infinity that materially reduce the Company’s profitability.

Infinity’s goodwill may be at risk for impairment if actual results regarding growth and profitability vary from Infinity’s estimates.

At December 31, 2009, Infinity had $75.3 million, or approximately $5.58 per share, of goodwill. In accordance with the Goodwill topic of the FASB Accounting Standards Codification, Infinity performs impairment test procedures for goodwill on an annual basis. These procedures require Infinity to calculate the fair value of goodwill, compare the result to its carrying value and record the amount of any shortfall as an impairment charge.

Infinity uses a variety of methods to test goodwill for impairment, including estimates of future discounted cash flows and comparisons of the market value of Infinity to its major competitors as well as the overall market. Infinity’s cash flow projections rely on assumptions that are subject to uncertainty, including premium growth, loss and loss adjustment expense ratios, interest rates and capital requirements. If actual results differ significantly from these assumptions, the fair value of

10

Table of Contents

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

Risk Factors

Infinity’s goodwill could fall below its carrying value and the Company could be required to record an impairment charge.

At September 30, 2009, test results indicated that the fair value of Infinity’s goodwill exceeded its carrying value and no impairment charge was required at that date. Additionally, there was no indication of impairment at December 31, 2009.

11

Table of Contents

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

Unresolved Staff Comments

None.

Properties

Infinity’s insurance subsidiaries lease approximately 870,355 square feet of office and warehouse space in numerous cities throughout the United States, of which approximately 266,533 square feet is subleased or available for sublease. All of these leases expire within ten years. The most significant leased office spaces are located in Birmingham, Alabama (Infinity’s Colonnade Park corporate headquarters); suburban Atlanta, Georgia and suburban Los Angeles, California. See Note 16 – Commitments and Contingencies of the Notes to Consolidated Financial Statements for further information about leases. Infinity owns a 33,515 square foot building in McAllen, Texas.

Leases on approximately 310,100 square feet will expire in 2010. The Company plans to replace approximately 60,253 square feet as the remaining space is no longer needed for ongoing operations.

Infinity has made an offer to purchase the 111,602 square foot Liberty Park facility that it currently leases in Birmingham, Alabama for $16.1 million. This offer has been accepted but is contingent upon due diligence by Infinity and successful entry into a definitive sales contract. Infinity intends to use current funds to complete the purchase in the first half of 2010.

Legal Proceedings

See Note 15 – Legal Proceedings of the Notes to Consolidated Financial Statements for a discussion of the Company’s material Legal Proceedings.

Submission of Matters to a Vote of Security Holders

None.

12

Table of Contents

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

PART II

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Infinity had 70 registered holders of record and an estimated 3,845 total holders at February 12, 2010. Infinity’s common stock is listed and traded on the NASDAQ Global Select Market under the symbol IPCC. The stock prices in the following table are over-the-counter market quotations that reflect transactions between dealers; retail markups and commissions are not reflected. These prices may not represent actual transactions. The Company’s closing per-share stock price on February 12, 2010 was $37.00. See Note 17 – Additional Information of the Notes to Consolidated Financial Statements for information about restriction on transfer of funds and assets of subsidiaries.

Infinity Quarterly High and Low Stock Prices and Dividends Paid by Quarter

| For the quarter ended: |

High | Low | Close | Dividends Declared and Paid Per Share |

Return to Shareholders (excluding dividends) (a) |

Return to Shareholders (including dividends) (b) |

||||||||||||

| March 31, 2008 |

$ | 42.99 | $ | 35.47 | $ | 41.60 | $ | 0.11 | 15.1 | % | 15.4 | % | ||||||

| June 30, 2008 |

45.00 | 38.01 | 41.52 | 0.11 | (0.2 | )% | 0.1 | % | ||||||||||

| September 30, 2008 |

52.82 | 39.51 | 41.20 | 0.11 | (0.8 | )% | (0.5 | )% | ||||||||||

| December 31, 2008 |

48.66 | 32.98 | 46.73 | 0.11 | 13.4 | % | 13.7 | % | ||||||||||

| March 31, 2009 |

$ | 47.54 | $ | 30.78 | $ | 33.93 | $ | 0.12 | (27.4 | )% | (27.1 | )% | ||||||

| June 30, 2009 |

39.54 | 31.59 | 36.46 | 0.12 | 7.5 | % | 7.8 | % | ||||||||||

| September 30, 2009 |

45.66 | 35.76 | 42.48 | 0.12 | 16.5 | % | 16.8 | % | ||||||||||

| December 31, 2009 |

43.49 | 38.20 | 40.64 | 0.12 | (4.3 | )% | (4.0 | )% | ||||||||||

| For the twelve months ended: |

||||||||||||||||||

| December 31, 2008 |

52.82 | 32.98 | 46.73 | 0.44 | 29.3 | % | 30.6 | % | ||||||||||

| December 31, 2009 |

47.54 | 30.78 | 40.64 | 0.48 | (13.0 | )% | (12.0 | )% | ||||||||||

| (a) | Calculated as the difference between Infinity’s share price at the end and the beginning of the periods presented by the share price at the beginning of the period presented. |

| (b) | Calculated by dividing the sum of (i) the amount of dividends, assuming dividend reinvestment during the period presented and (ii) the difference between Infinity’s share price at the end and the beginning of the periods presented by the share price at the beginning of the period presented. |

The information required under the heading “Equity Compensation Plan Information” is provided under Item 12 herein.

During the fiscal year ended December 31, 2009, no equity securities of the Company were sold by the Company that were not registered under the Securities Act of 1933, as amended.

The following table presents information with respect to purchases of common stock of the Company made during the three months ended December 31, 2009 by the Company or any “affiliated purchaser” of the Company as defined in Rule 10b-18(a)(3) under the Exchange Act.

13

Table of Contents

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

Issuer Purchases of Equity Securities

| Period |

Total Number of Shares Purchased |

Average Price Paid per Share (a) |

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs(b) |

Maximum Number (or Approximate Dollar Value) that May Yet Be Purchased Under the Plans or Programs(b) | ||||||

| October 1, 2009 – October 31, 2009 |

5,000 | $ | 41.55 | 5,000 | $ | 49,412,704 | ||||

| November 1, 2009 – November 30, 2009 |

45,900 | 39.64 | 45,900 | 42,616,631 | ||||||

| December 1, 2009 – December 31, 2009 |

59,800 | 40.03 | 59,800 | 40,220,916 | ||||||

| Total |

110,700 | $ | 39.94 | 110,700 | $ | 40,220,916 | ||||

| (a) | Average price paid per share excludes commissions. |

| (b) | In October 2006, the Company announced that the Board of Directors approved a share repurchase program whereby the Company may repurchase up to an aggregate of $100 million of its outstanding shares. On July 24, 2008, the Board of Directors approved an additional $74.3 million to be added to the current remaining share repurchase authority, bringing the total share repurchase authority as of that date to $100 million. Effective August 6, 2009, Infinity’s Board of Directors increased this authority by $28.8 million to $50.0 million as of that date, modified the authority to include the repurchase of Infinity’s debt and extended the date to execute this program to December 31, 2010. In addition to $25.0 million in shares repurchased during 2009, Infinity repurchased approximately $5.0 million of debt. |

14

Table of Contents

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

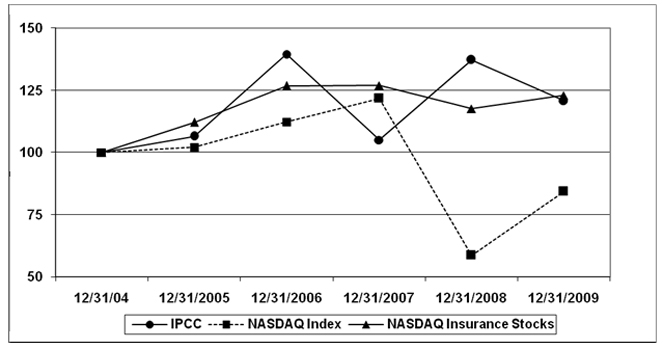

The following graph shows the percentage change in cumulative total shareholder return on Infinity’s common stock over the five years ending December 31, 2009 measured by dividing the sum of (A) the cumulative amount of dividends, assuming dividend reinvestment during the periods presented and (B) the difference between Infinity’s share price at the end and the beginning of the periods presented by the share price at the beginning of the periods presented. The graph demonstrates cumulative total returns for Infinity, the Center for Research in Security Prices (“CRSP”) Total Return Index for NASDAQ U.S. Index, and the CRSP Total Return Index for the NASDAQ Insurance Stocks (SIC 6330-6339 U.S. Fire, Marine and Casualty Insurance Company) from December 31, 2004 through December 31, 2009.

Cumulative Total Return

Cumulative Total Return as of December 31, 2009

(Assumes a $100 investment at the close of trading on December 31, 2004)

| 12/31/04 | 12/31/05 | 12/31/06 | 12/31/07 | 12/31/08 | 12/31/09 | |||||||

| IPCC |

100.00 | 106.474 | 139.487 | 105.003 | 137.180 | 120.814 | ||||||

| NASDAQ U.S. Index |

100.00 | 102.135 | 112.187 | 121.681 | 58.639 | 84.282 | ||||||

| NASDAQ Insurance Stocks |

100.00 | 112.076 | 126.722 | 126.984 | 117.626 | 122.845 |

15

Table of Contents

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

Selected Financial Data

| (in thousands, except per share data) | 2009 | 2008 | 2007 | 2006 | 2005 | |||||||||||||||

| Infinity |

||||||||||||||||||||

| Gross written premium |

$ | 848,816 | $ | 896,902 | $ | 1,019,011 | $ | 986,741 | $ | 988,670 | ||||||||||

| Net written premium |

843,869 | 892,090 | 1,014,262 | 982,190 | 979,635 | |||||||||||||||

| Net written premium growth |

(5.4 | )% | (12.0 | )% | 3.3 | % | 0.3 | % | 6.7 | % | ||||||||||

| Net premium earned |

848,391 | 922,451 | 1,031,564 | 948,665 | 961,503 | |||||||||||||||

| Total revenues |

883,424 | 930,918 | 1,098,226 | 1,021,343 | 1,053,249 | |||||||||||||||

| Loss & LAE ratio |

66.5 | % | 70.3 | % | 70.5 | % | 67.0 | % | 68.7 | % | ||||||||||

| Underwriting ratio |

22.0 | % | 22.2 | % | 23.0 | % | 23.8 | % | 23.3 | % | ||||||||||

| Combined ratio |

88.5 | % | 92.5 | % | 93.5 | % | 90.8 | % | 92.0 | % | ||||||||||

| Net earnings |

$ | 70,594 | $ | 19,257 | $ | 71,944 | $ | 87,282 | $ | 106,308 | ||||||||||

| Net earnings per diluted share |

5.09 | 1.23 | 3.87 | 4.26 | 5.09 | |||||||||||||||

| Return on average common shareholders’ equity |

12.3 | % | 3.4 | % | 11.4 | % | 13.5 | % | 18.1 | % | ||||||||||

| Cash and investments |

$ | 1,285,831 | $ | 1,190,962 | $ | 1,359,002 | $ | 1,419,428 | $ | 1,456,397 | ||||||||||

| Total assets |

1,803,671 | 1,742,232 | 1,952,300 | 2,018,931 | 1,980,440 | |||||||||||||||

| Unpaid losses and LAE |

509,114 | 544,756 | 618,409 | 596,029 | 625,870 | |||||||||||||||

| Debt outstanding |

194,651 | 199,567 | 199,496 | 199,429 | 199,366 | |||||||||||||||

| Total liabilities |

1,185,511 | 1,216,901 | 1,351,075 | 1,354,330 | 1,353,846 | |||||||||||||||

| Shareholders’ equity |

618,160 | 525,331 | 601,224 | 664,601 | 626,594 | |||||||||||||||

| Cash dividend per common share |

$ | 0.48 | $ | 0.44 | $ | 0.36 | $ | 0.30 | $ | 0.24 | ||||||||||

| Common shares outstanding (a) |

13,497 | 14,146 | 16,200 | 19,617 | 20,649 | |||||||||||||||

| Book value per common share |

$ | 45.80 | $ | 37.14 | $ | 37.11 | $ | 33.88 | $ | 30.34 | ||||||||||

| Ratios: |

||||||||||||||||||||

| Debt to total capital |

23.9 | % | 27.5 | % | 24.9 | % | 23.1 | % | 24.1 | % | ||||||||||

| Debt to tangible capital |

26.4 | % | 30.7 | % | 27.5 | % | 25.3 | % | 26.6 | % | ||||||||||

| Interest coverage |

11.1 | 5.9 | 10.8 | 12.9 | 14.5 | |||||||||||||||

| (a) | Common shares outstanding exclude non-vested restricted shares of 45 at December 31, 2005. |

16

Table of Contents

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Management’s Discussion and Analysis (“MD&A”) of Financial Condition and Results of Operations

| Page | ||

| 18 | ||

| 18 | ||

| 18 | ||

| 25 | ||

| 25 | ||

| 26 | ||

| 27 | ||

| 27 | ||

| 27 | ||

| 28 | ||

| 28 | ||

| 28 | ||

| Fixed Maturity Investments |

31 | |

| 33 | ||

| 33 | ||

| 34 | ||

| 35 | ||

| 36 | ||

| 36 | ||

| 36 | ||

| 41 | ||

| 44 | ||

| 45 | ||

| 46 | ||

| 47 | ||

| 47 | ||

| 47 | ||

| 47 | ||

| 48 | ||

| 48 |

See “Cautionary Statement Regarding Forward-Looking Statements” on page 1.

17

Table of Contents

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

Management’s Discussion and Analysis of Financial Condition and Results of Operations

In 2009, weak economic conditions and rising unemployment continued to pose a challenge with regard to growing revenue. However, favorable loss costs trends throughout the year have contributed to strong earnings.

Net earnings and diluted earnings per share for the twelve months ended December 31, 2009 were $70.6 million and $5.09, respectively, compared with $19.3 million and $1.23, respectively, for the twelve months ended December 31, 2008. The increase in diluted earnings per share is primarily due to an increase in underwriting income and a decline in other-than-temporary impairment losses recognized in net earnings.

Included in net earnings for the twelve months ended December 31, 2009 was $42.5 million ($65.4 million pre-tax) of favorable development on prior accident period loss and LAE reserves compared to $19.1 million ($29.4 million pre-tax) for the twelve months ended December 31, 2008. See Results of Operations – Underwriting – Profitability for a more detailed discussion of Infinity’s underwriting results.

Infinity had net realized losses on investments of $14.8 million in 2009 compared to losses of $51.4 million in 2008. Included in the net realized loss for 2009 is $19.9 million of other-than-temporary impairments on fixed income securities compared with $61.8 million of impairments during 2008.

Total revenues declined 5.1% for the twelve months ended December 31, 2009 when compared with 2008. The decline is primarily attributable to a decline in earned premiums as a result of decreases in gross written premiums in states such as Arizona, Florida and Georgia. See Results of Operations – Underwriting – Premiums for a more detailed discussion of Infinity’s gross written premium growth.

Infinity’s book value per share increased $8.66 or 23.3% from $37.14 at December 31, 2008 to $45.80 at December 31, 2009. This increase was primarily due to earnings and change in unrealized net gains on investments, net of shareholder dividends, for the twelve months ended December 31, 2009. Return on equity for the twelve months ended December 31, 2009 was 12.3% compared with 3.4% for the twelve months ended December 31, 2008.

(See Note 1- Significant Reporting and Accounting Policies of the Notes to Consolidated Financial Statements)

The preparation of financial statements requires management to make estimates and assumptions that can have a significant effect on amounts reported in the financial statements. As more information becomes known, these estimates and assumptions could change and thus impact amounts reported in the future. Management believes that the establishment of insurance reserves, the determination of “other-than-temporary” impairment on investments and accruals for litigation are the areas where the degree of judgment required to determine amounts recorded in the financial statements make the accounting policies critical.

Insurance reserves, or unpaid losses and LAE, are management’s best estimate of (i) the ultimate amounts that will be paid for all claims that have been reported up to the date of the current accounting period but that have not yet been paid, (ii) an estimate of claims that have occurred but have not yet been reported to the Company (“incurred but not reported” or “IBNR”), and (iii) unpaid claim settlement expenses.

IBNR reserves are established for the quarter and year-end based on a quarterly reserve analysis by the Company’s actuarial staff. Various standard actuarial tests are applied to subsets of the business at a state, product and coverage basis. Included in the analyses are the following:

| • | Paid and incurred extrapolation methods utilizing paid and incurred loss development to predict ultimate losses; |

| • | Paid and incurred frequency and severity methods utilizing paid and incurred claims count development and paid and incurred development to predict ultimate average frequency (i.e. claims count per auto insured) or ultimate average severity (cost of claim per claim); and |

18

Table of Contents

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

Management’s Discussion and Analysis of Financial Condition and Results of Operations

| • | Paid and incurred Bornhuetter-Ferguson methods adding expected development to actual paid or incurred experience to project ultimate losses. |

For each subset of the business evaluated, each test generates a point estimate based on development factors applied to known paid and incurred claims and claim counts to estimate ultimate paid claims and claim counts. Selections of factors are based on historical loss development patterns with adjustment based on professional actuarial judgment where anticipated development patterns vary from those seen historically. This estimation of IBNR requires selection of hundreds of such factors. A single point estimate for the subset being evaluated is then selected from the results of various tests, based on a combination of simple averages of the point estimates of the various tests and selections based on professional actuarial judgment. During recent years, paid methods have been less reliable as a result of changes in settlement practices, so Infinity has more heavily relied on incurred methods.

While the ultimate liability may be greater or lower than recorded loss reserves, the development period for personal auto coverage is shorter than that associated with many other property and casualty coverages and can therefore be established with less uncertainty than coverages developing over longer periods, such as environmental coverage.

Estimating the liability for unpaid losses and LAE is inherently judgmental and is influenced by factors that are subject to significant variation. Infinity estimates liabilities for the costs of losses and LAE for both reported and unreported (IBNR) claims based on historical trends in the following areas adjusted for deviations in such trends:

| • | Claims settlement and payment practices; |

| • | Business mix; |

| • | Coverage limits and deductibles; |

| • | Inflation trends in auto repair and medical costs; and |

| • | Legal and regulatory trends affecting claims settlements. |

Where deviations from historical trends in these key areas exist, when possible, quantitative and qualitative modifications to, or selections of, such factors are made to reflect such deviations. Management analyzes the adequacy of reserves using actuarial data and analytical reserve development techniques, including projections of ultimate paid losses, to determine the ultimate amount of reserves. The list of historical trends provided above are non-exhaustive examples of major factors taken into account in developing these estimates.

Infinity reviews loss reserve adequacy quarterly by accident year at a state and coverage level, while it reviews reserves quarterly for the Assumed Agency Business only at the coverage level. Reserves are adjusted as additional information becomes known. Such adjustments are reflected in current year operations. Loss and LAE reserves are also certified to state regulators annually.

During each quarterly review by the internal actuarial staff, using the additional information obtained with the passage of time, factor selections are updated, which in turn adjust the ultimate loss estimates and held IBNR reserves for the subset of the business and accident periods affected by such updates. The actuarial staff also performs various tests to estimate ultimate average severity and frequency of claims. Severity represents the average cost per claim and frequency represents the number of claims per policy. As an overall review, the staff then evaluates for reasonableness loss and LAE ratios by accident year by state and by coverage.

Factors that can significantly affect actual frequency include, among others, changes in weather, driving patterns or trends and class of driver. Estimates of average frequency can be affected by changes in claims settlement and reserving practices. Loss severity can be affected by auto repair and medical cost inflation, jury awards and changes in policy limit profiles. Estimation of LAE reserves is subject to variation from factors such as the use of outside adjusters, frequency of lawsuits, claims staffing and experience levels.

Management believes that Infinity’s relatively low average policy limit and concentration on the nonstandard auto driver classification help stabilize fluctuations in frequency and severity. For example, approximately 91% of policies included within the nonstandard book of business include only the state-mandated minimum policy limits for bodily injury, which somewhat mitigates the challenge of estimating average severity. These low limits tend to reduce the exposure of the loss reserves on this coverage to medical cost inflation on severe injuries since the minimum policy limits will limit the total payout.

19

Table of Contents

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Ultimate loss estimates, excluding corporate litigation losses, usually experience the greatest adjustment within the first twelve months after the accident year. Accordingly, the highest degree of uncertainty is associated with reserves for the current accident year because the current accident year contains the greatest proportion of losses that have not been reported or settled, and these elements must be estimated as of the current reporting date. The proportion of losses with these characteristics typically diminishes in subsequent years.

Considering all methods of estimations of loss and LAE, as compared with loss and LAE reserves held at December 31, 2009, the indicated results could range from a deficiency of approximately 8%, or $39.7 million, to a redundancy of approximately 25%, or $123.8 million. However, certain test results were excluded from consideration due to actuarial judgment. Excluding these tests, the indicated results could range from an adequate reserve position, to a redundancy of approximately 20%, or $100.8 million. These ranges do not present a forecast of future redundancy since actual development of future losses on current loss reserves may vary materially from those estimated in the year-end 2009 reserve tests. Reserves booked are management’s best estimate of the ultimate amounts that will be paid.

Corporate litigation losses represent estimates of losses incurred from actual or threatened litigation by claimants alleging improper handling of claims by the Company, which are commonly known as “bad faith” claims. Oftentimes, the onset of such litigation, subsequent discovery, settlement discussions, trial and appeal may occur several years after the date of the original claim. Because of the infrequent nature of such claims, each case is accrued based on its own merit in accordance with the Loss Contingency topic of the FASB Accounting Standards Codification, which requires that such accrual be probable and estimable. As such, no estimate is permissible for IBNR for threatened litigation yet to occur on accidents with dates prior to the balance sheet date. Consequently, the effect of setting accruals for such items likely will result in unfavorable reserve development in the following reserve table.

Calendar year losses incurred for corporate litigation losses, net of reinsurance, over the past eight calendar years have ranged from $0.2 million to $18.6 million, averaging $10.8 million per year. Gross of reinsurance, corporate litigation losses have ranged from $0.2 million to $21.1 million, averaging $13.1 million over the past eight calendar years.

The following tables present the development of Infinity’s loss reserves, net of reinsurance, on a GAAP basis for the calendar years 1999 through 2009. The Infinity table includes the loss reserves of the NSA Group through December 31, 2002, the addition of the Assumed Agency Business on January 1, 2003, and those of Infinity combined for 2003 and all subsequent years. The top line of each table shows the estimated liability for unpaid losses and LAE recorded at the balance sheet date for the indicated years. The next line, captioned Liability for Unpaid Losses and LAE - as re-estimated at December 31, 2009, shows the re-estimated liability as of December 31, 2009. The remainder of the table presents intervening development as percentages of the initially estimated liability. The development results from additional information and experience in subsequent years. The middle line shows a cumulative deficiency (redundancy) which represents the aggregate percentage increase (decrease) in the liability initially estimated. The lower portion of the table indicates the cumulative amounts paid as of successive periods as a percentage of the original loss reserve liability.

These tables do not present accident or policy year development data. Furthermore, in evaluating the re-estimated liability and cumulative deficiency (redundancy), it should be noted that each percentage includes the effects of changes in amounts for prior periods. Conditions and trends that have affected development of the liability in the past may not necessarily exist in the future. Accordingly, it is not appropriate to extrapolate future redundancies or deficiencies based on these tables.

20

Table of Contents

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

Management’s Discussion and Analysis of Financial Condition and Results of Operations

INFINITY

| (in millions) | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | ||||||||||||||||||||||||||||||||

| Liability for unpaid loss & LAE: |

|||||||||||||||||||||||||||||||||||||||||||

| As originally estimated* |

$ | 543 | $ | 630 | $ | 611 | $ | 719 | $ | 707 | $ | 669 | $ | 610 | $ | 568 | $ | 590 | $ | 524 | $ | 491 | |||||||||||||||||||||

| As re-estimated at December 31, 2009 |

544 | 716 | 717 | 799 | 712 | 615 | 522 | 484 | 510 | 459 | N/A | ||||||||||||||||||||||||||||||||

| Liability re-estimated: |

|||||||||||||||||||||||||||||||||||||||||||

| One year later |

95.3 | % | 98.5 | % | 101.5 | % | 103.2 | % | 99.2 | % | 97.5 | % | 94.9 | % | 97.6 | % | 95.0 | % | 87.5 | % | |||||||||||||||||||||||

| Two years later |

92.9 | % | 102.1 | % | 108.7 | % | 107.1 | % | 100.3 | % | 94.2 | % | 91.5 | % | 91.3 | % | 86.5 | % | |||||||||||||||||||||||||

| Three years later |

94.4 | % | 106.4 | % | 112.1 | % | 108.5 | % | 99.5 | % | 93.7 | % | 89.1 | % | 85.2 | % | |||||||||||||||||||||||||||

| Four years later |

96.0 | % | 108.5 | % | 112.8 | % | 108.4 | % | 100.2 | % | 93.6 | % | 85.6 | % | |||||||||||||||||||||||||||||

| Five years later |

97.3 | % | 108.5 | % | 112.9 | % | 109.6 | % | 101.5 | % | 91.9 | % | |||||||||||||||||||||||||||||||

| Six years later |

97.2 | % | 109.1 | % | 114.8 | % | 111.6 | % | 100.6 | % | |||||||||||||||||||||||||||||||||

| Seven years later |

97.9 | % | 111.0 | % | 117.6 | % | 111.1 | % | |||||||||||||||||||||||||||||||||||

| Eight years later |

100.0 | % | 113.7 | % | 117.5 | % | |||||||||||||||||||||||||||||||||||||

| Nine years later |

100.1 | % | 113.7 | % | |||||||||||||||||||||||||||||||||||||||

| Ten years later |

100.2 | % | |||||||||||||||||||||||||||||||||||||||||

| Cumulative deficiency (redundancy) |

0.2 | % | 13.7 | % | 17.5 | % | 11.1 | % | 0.6 | % | (8.1 | )% | (14.4 | )% | (14.8 | )% | (13.5 | )% | (12.5 | )% | N/A | ||||||||||||||||||||||

| Cumulative deficiency (redundancy) excluding corporate litigation losses |

(4.2 | )% | 6.2 | % | 8.7 | % | 3.1 | % | (8.0 | )% | (16.3 | )% | (21.1 | )% | (20.5 | )% | (17.1 | )% | (12.5 | )% | N/A | ||||||||||||||||||||||

| Cumulative paid as of: |

|||||||||||||||||||||||||||||||||||||||||||

| One year later |

53.0 | % | 53.3 | % | 51.3 | % | 50.3 | % | 48.4 | % | 52.6 | % | 50.3 | % | 48.4 | % | 54.6 | % | 46.8 | % | |||||||||||||||||||||||

| Two years later |

69.6 | % | 76.2 | % | 80.2 | % | 77.1 | % | 75.8 | % | 72.6 | % | 66.5 | % | 69.1 | % | 67.4 | % | |||||||||||||||||||||||||

| Three years later |

81.4 | % | 92.0 | % | 96.3 | % | 94.3 | % | 87.7 | % | 80.1 | % | 77.4 | % | 74.8 | % | |||||||||||||||||||||||||||

| Four years later |

89.4 | % | 100.0 | % | 105.6 | % | 101.5 | % | 91.6 | % | 87.3 | % | 79.9 | % | |||||||||||||||||||||||||||||

| Five years later |

93.1 | % | 104.9 | % | 109.2 | % | 103.7 | % | 97.4 | % | 88.5 | % | |||||||||||||||||||||||||||||||

| Six years later |

95.7 | % | 106.5 | % | 110.4 | % | 108.8 | % | 98.1 | % | |||||||||||||||||||||||||||||||||

| Seven years later |

96.4 | % | 107.3 | % | 115.8 | % | 109.3 | % | |||||||||||||||||||||||||||||||||||

| Eight years later |

96.8 | % | 112.2 | % | 116.0 | % | |||||||||||||||||||||||||||||||||||||

| Nine years later |

99.2 | % | 112.4 | % | |||||||||||||||||||||||||||||||||||||||

| Ten years later |

99.4 | % | |||||||||||||||||||||||||||||||||||||||||

| * | 2002 includes $126 resulting from the addition of the Assumed Agency Business. |

21

Table of Contents

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following is a reconciliation of Infinity’s net liability to the gross liability for unpaid losses and LAE (in millions):

| 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | |||||||||||||||||||||||||||||||||

| As originally estimated |

|||||||||||||||||||||||||||||||||||||||||||

| Net liability shown above* |

$ | 543 | $ | 630 | $ | 611 | $ | 719 | $ | 707 | $ | 669 | $ | 610 | $ | 568 | $ | 590 | $ | 524 | $ | 491 | |||||||||||||||||||||

| Add reinsurance recoverables |

10 | 13 | 37 | 33 | 32 | 27 | 16 | 28 | 28 | 21 | 18 | ||||||||||||||||||||||||||||||||

| Gross liability |

$ | 553 | $ | 643 | $ | 648 | $ | 752 | $ | 739 | $ | 696 | $ | 626 | $ | 596 | $ | 618 | $ | 545 | $ | 509 | |||||||||||||||||||||

| As re-estimated at December 31, 2009: |

|||||||||||||||||||||||||||||||||||||||||||

| Net liability shown above |

$ | 544 | $ | 716 | $ | 717 | $ | 799 | $ | 712 | $ | 615 | $ | 522 | $ | 484 | $ | 510 | $ | 459 | N/A | ||||||||||||||||||||||

| Add reinsurance recoverables |

44 | 51 | 79 | 74 | 56 | 46 | 36 | 30 | 28 | 22 | N/A | ||||||||||||||||||||||||||||||||

| Gross liability |

$ | 588 | $ | 767 | $ | 797 | $ | 873 | $ | 767 | $ | 661 | $ | 558 | $ | 513 | $ | 538 | $ | 481 | N/A | ||||||||||||||||||||||

| Gross cumulative deficiency (redundancy) |

6.3 | % | 19.3 | % | 23.0 | % | 16.1 | % | 3.7 | % | (5.1 | )% | (10.9 | )% | (13.8 | )% | (12.9 | )% | (11.7 | )% | N/A | ||||||||||||||||||||||

| Gross cumulative deficiency (redundancy) excluding corporate litigation losses |

(0.2 | )% | 9.3 | % | 11.9 | % | 6.0 | % | (6.6 | )% | (14.1 | )% | (19.9 | )% | (19.9 | )% | (16.7 | )% | (11.8 | )% | N/A | ||||||||||||||||||||||

| * | 2002 includes $126 resulting from the addition of the Assumed Agency Business. |

22

Table of Contents

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following table presents (in millions) the development of loss reserves for the Assumed Agency Business through December 31, 2002. Development for 2003 for the Assumed Agency Business is included in the Infinity table above. Under the reinsurance agreement entered into with GAI, Infinity’s insurance subsidiaries assumed the net reserves from GAI. Accordingly, gross reserves and net reserves are the same.

ASSUMED AGENCY BUSINESS

| 1999 | 2000 | 2001 | 2002 | ||||||||||||

| Liability for unpaid losses & LAE: | |||||||||||||||

| As originally estimated |

$ | 118 | $ | 106 | $ | 116 | $ | 126 | |||||||

| As re-estimated at December 31, 2009 |

116 | 108 | 115 | N/A | |||||||||||

| Liability re-estimated: |

|||||||||||||||

| One year later |

102.9 | % | 104.9 | % | 106.8 | % | |||||||||

| Two years later |

100.6 | % | 106.8 | % | 101.6 | % | |||||||||

| Three years later |

101.1 | % | 102.8 | % | 103.4 | % | |||||||||

| Four years later |

98.9 | % | 104.5 | % | 103.7 | % | |||||||||

| Five years later |

100.7 | % | 104.2 | % | 101.5 | % | |||||||||

| Six years later |

99.8 | % | 102.7 | % | 101.3 | % | |||||||||

| Seven years later |

98.8 | % | 102.8 | % | 100.6 | % | |||||||||

| Eight years later |

98.9 | % | 102.1 | % | 99.5 | % | |||||||||

| Nine years later |

98.4 | % | 101.9 | % | |||||||||||

| Ten years later |

98.4 | % | |||||||||||||

| Cumulative deficiency (redundancy): |

(1.6 | )% | 1.9 | % | (0.5 | )% | |||||||||

| Cumulative paid as of: | |||||||||||||||

| One year later |

47.5 | % | 47.0 | % | 43.6 | % | |||||||||

| Two years later |

69.5 | % | 70.8 | % | 60.2 | % | |||||||||

| Three years later |

83.3 | % | 80.8 | % | 79.7 | % | |||||||||

| Four years later |

88.1 | % | 91.6 | % | 90.4 | % | |||||||||

| Five years later |

93.2 | % | 96.3 | % | 94.6 | % | |||||||||

| Six years later |

95.4 | % | 98.6 | % | 97.1 | % | |||||||||

| Seven years later |

96.5 | % | 100.0 | % | 98.4 | % | |||||||||

| Eight years later |

97.4 | % | 100.9 | % | 98.9 | % | |||||||||

| Nine years later |

97.8 | % | 101.4 | % | |||||||||||

| Ten years later |

98.2 | % | |||||||||||||

23

Table of Contents

INFINITY PROPERTY AND CASUALTY CORPORATION 10-K

Management’s Discussion and Analysis of Financial Condition and Results of Operations

The Company finds it useful to evaluate accident year loss and LAE ratios by calendar year to monitor reserve development. The following table presents, by accident year, loss and LAE ratios (including IBNR).

| Accident Year Loss and LAE Ratios Through Calendar Year End | ||||||||||||||||||||||||||||||

| 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | |||||||||||||||||||||

| Accident Year |

||||||||||||||||||||||||||||||

| 2000 |

87.8 | % | 88.8 | % | 90.2 | % | 91.6 | % | 92.1 | % | 92.2 | % | 92.2 | % | 92.2 | % | 93.6 | % | 93.5 | % | ||||||||||

| 2001 |

82.5 | % | 81.8 | % | 83.2 | % | 83.9 | % | 84.4 | % | 84.0 | % | 84.0 | % | 84.0 | % | 83.8 | % | ||||||||||||

| 2002 |