UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| |

|

|

| þ |

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2009

or

| |

|

|

| o |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 333-84068

Crum & Forster Holdings Corp.

(Exact Name of Registrant as Specified in its Charter)

| |

|

|

| Delaware

|

|

04-3611900 |

| (State or Other Jurisdiction of

|

|

(I.R.S. Employer Identification Number) |

| Incorporation or Organization) |

|

|

305 Madison Avenue, Morristown, New Jersey 07962

(Address of principal executive office)

(973) 490-6600

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

None

THE REGISTRANT MEETS THE CONDITIONS

SET FORTH IN GENERAL INSTRUCTION I(1)(a) AND (b) OF FORM 10-K

AND HAS THEREFORE OMITTED CERTAIN ITEMS FROM THIS REPORT IN ACCORDANCE WITH THE REDUCED DISCLOSURE

FORMAT PERMITTED UNDER INSTRUCTION I.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of

the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or

Section 15(d) of the Act. Yes þ No o

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by

Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for

such shorter period that the registrant was required to file such reports), and (2) has been

subject to the filing requirements for the past 90 days. Yes o No þ

Indicate by check mark whether the registrant has submitted electronically and posted on its

corporate Web site, if any, every Interactive Data File required to be submitted and posted

pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months

(or for such shorter period that the registrant was required to submit and post such files).

Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K

(§229.405 of this chapter) is not contained herein, and will not be contained, to the best of

registrant’s knowledge, in definitive proxy or information statements incorporated by reference in

Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a

non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and

“smaller reporting company” in Rule 12b-2 of the Exchange Act.

| |

|

|

|

|

|

|

| Large accelerated filer o

|

|

Accelerated filer o

|

|

Non-accelerated filer þ

|

|

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the

Exchange Act). Yes o No þ

State the aggregate market value of the voting and non-voting common equity held by non-affiliates

computed by reference to the price at which the common equity was last sold, or the average bid and

asked price of such common equity, as of the last business day of the registrant’s most recently

completed second fiscal quarter. Not applicable

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as

of the latest practicable date:

| |

|

|

| Class |

|

Number of Shares Outstanding at February 25, 2010 |

| Common Stock, $.01 Par Value

|

|

100 |

Documents Incorporated by Reference

None

CRUM & FORSTER HOLDINGS CORP.

Form 10-K

Index

| |

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

PART I

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|

|

13 |

|

|

|

|

|

|

|

|

|

18 |

|

|

|

|

|

|

|

|

|

18 |

|

|

|

|

|

|

|

|

|

22 |

|

|

|

|

|

|

|

|

|

22 |

|

|

|

|

|

|

|

|

|

24 |

|

|

|

|

|

|

|

|

|

25 |

|

|

|

|

|

|

|

|

|

25 |

|

|

|

|

|

|

|

|

|

29 |

|

|

|

|

|

|

|

|

|

29 |

|

|

|

|

|

|

|

|

|

37 |

|

|

|

|

|

|

|

|

|

37 |

|

|

|

|

|

|

|

|

|

38 |

|

|

|

|

|

|

|

|

|

38 |

|

|

|

|

|

|

|

|

|

38 |

|

|

|

|

|

|

PART II

|

|

|

|

|

|

|

|

|

38 |

|

|

|

|

|

|

|

|

|

38 |

|

|

|

|

|

|

|

|

|

40 |

|

|

|

|

|

|

|

|

|

40 |

|

|

|

|

|

|

|

|

|

50 |

|

|

|

|

|

|

|

|

|

52 |

|

|

|

|

|

|

|

|

|

60 |

|

|

|

|

|

|

|

|

|

63 |

|

|

|

|

|

|

|

|

|

63 |

|

|

|

|

|

|

|

|

|

63 |

|

|

|

|

|

|

|

|

|

63 |

|

|

|

|

|

|

|

|

|

64 |

|

|

|

|

|

|

|

|

|

64 |

|

|

|

|

|

|

|

|

|

66 |

|

|

|

|

|

|

|

|

|

67 |

|

|

|

|

|

|

|

|

|

68 |

|

|

|

|

|

|

|

|

|

68 |

|

|

|

|

|

|

|

|

|

69 |

|

|

|

|

|

|

|

|

|

70 |

|

|

|

|

|

|

|

|

|

71 |

|

|

|

|

|

|

|

|

|

72 |

|

|

|

|

|

|

|

|

|

73 |

|

|

|

|

|

|

|

|

|

74 |

|

|

|

|

|

|

|

|

|

76 |

|

2

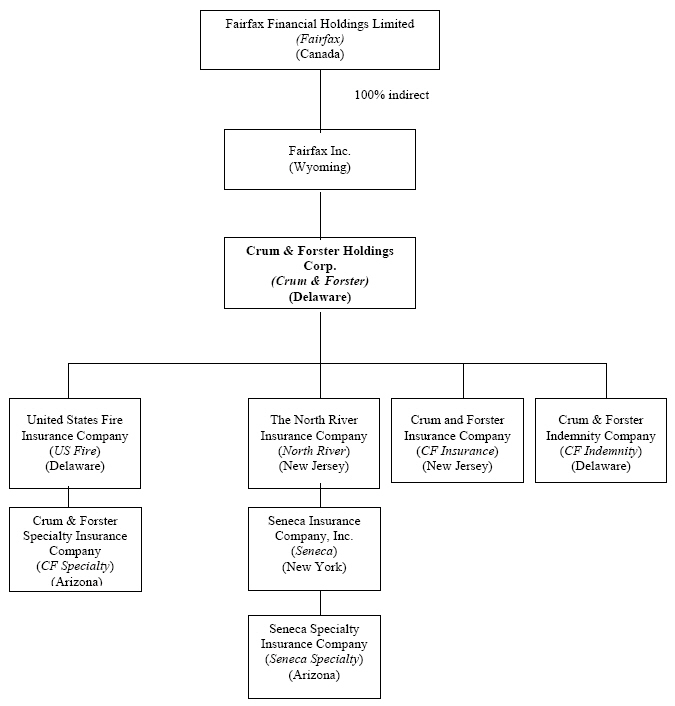

The following annual report on Form 10-K relates to the business operations and financial results

of Crum & Forster Holdings Corp. and its subsidiaries. References in this report to the “Company”

or “Crum & Forster” refer to Crum & Forster Holdings Corp. and its direct and indirect

subsidiaries, including United States Fire Insurance Company (“US Fire”), The North River Insurance

Company (“North River”), Crum & Forster Indemnity Company (“CF Indemnity”) and Crum and Forster

Insurance Company (“CF Insurance”). US Fire owns 100% of the stock of Crum & Forster Specialty

Insurance Company (“CF Specialty”). North River owns 100% of the stock of Seneca Insurance

Company, Inc. (“Seneca”) and its subsidiaries. Fairfax Financial Holdings Limited (“Fairfax”)

holds a 100% indirect interest in Fairfax Inc., Crum & Forster’s parent company.

The Company’s principal executive offices are located at 305 Madison Avenue, Morristown, NJ 07962

and its telephone number at that address is (973) 490-6600. The Company’s website is

http://www.cfins.com. The Company’s annual report on Form 10-K, quarterly reports on Form 10-Q,

current reports on Form 8-K and amendments, if any, to these reports filed or furnished pursuant to

Section 13 or 15(d) of the Securities Exchange Act of 1934 are available free of charge on this

website as soon as practicable after they have been electronically filed with, or furnished to, the

Securities and Exchange Commission (“SEC”). The Company’s website and the information therein does

not form a part of this Form 10-K and is not incorporated herein by reference.

STATEMENTS REGARDING FORWARD-LOOKING INFORMATION

Certain statements contained herein may constitute forward-looking statements and are made pursuant

to the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of

1995. The words “anticipates”, “believes”, “expects”, “intends”, “estimates”, “projects”,

“plans”, “target”, “potential”, “likely”, “may”, “could”, “should” and similar expressions identify

forward-looking statements. These forward-looking statements involve known and unknown risks,

uncertainties and other factors that could cause the Company’s actual results, performance or

achievements to differ materially from any future results, performance or achievements expressed or

implied by these forward-looking statements. These risks, uncertainties and other factors, which

are described elsewhere in this report, include, but are not limited to, the following:

| |

• |

|

Competitive conditions in the insurance market and the ability to attract and retain new

business; |

| |

| |

• |

|

Adverse effect of volatility in the global financial markets including changes in

interest rates, credit spreads, foreign currency exchange rates and other factors; |

| |

| |

• |

|

Current economic conditions; |

| |

| |

• |

|

Insufficient loss reserves, including reserves for asbestos, environmental and other

latent claims; |

| |

| |

• |

|

Occurrence of natural or man-made catastrophic events; |

| |

| |

• |

|

Inability to realize the Company’s investment objectives; |

| |

| |

• |

|

Inability to obtain reinsurance coverage on reasonable terms and prices, particularly

property catastrophe reinsurance; |

| |

| |

• |

|

Exposure to credit risk, in the event reinsurers or policyholders fail to pay the

Company amounts owed to it; |

| |

| |

• |

|

Lowering or loss of one of the Company’s financial strength ratings; |

| |

| |

• |

|

Loss of key producers; |

| |

| |

• |

|

Changes in the business or regulatory environment in which the Company operates as a

result of recent insurance industry investigations by government authorities and other

parties; |

| |

| |

• |

|

Exposure to emerging claims and coverage issues; |

| |

| |

• |

|

Restrictions on the ability of the Company’s insurance subsidiaries to pay dividends; |

| |

| |

• |

|

Subordination of debt securities to the obligations and liabilities of the Company’s

insurance subsidiaries; |

| |

| |

• |

|

Ability of Fairfax to determine the outcome of corporate action requiring stockholder

approval; and |

| |

| |

• |

|

Changes in governmental regulations. |

Additional risks and uncertainties are described in this report in “Item 1A. Risk Factors”.

Although the Company believes that its forward-looking statements are based upon reasonable

assumptions, management can give no assurance that the Company’s goals will be achieved. Given

these uncertainties, prospective investors are cautioned not to place undue reliance on these

forward-looking statements. Any forward-looking statements made in this report are made by the

Company as of the date of this report. Except as otherwise required by federal securities laws,

the Company undertakes no obligation to publicly update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise.

4

PART I

Overview

Crum & Forster is a national commercial property and casualty insurance company with a focused

underwriting strategy targeting specialty classes of business and underserved market opportunities.

The Company writes numerous lines of business including general liability, workers’ compensation,

commercial automobile, property, commercial multi-peril, accident and health, fidelity and surety,

personal automobile and homeowners. In 2009, approximately 44% of the Company’s gross written

premiums arose from the offering of general liability including umbrella, workers’ compensation,

commercial automobile and property policies to middle market commercial enterprises through the

Company’s regional branch network. The balance of Crum & Forster’s business is comprised of a

diverse portfolio of specialty businesses in which the Company has specific product, geographic or

customer group expertise. These include: products such as accident and health, directors’ and

officers’ liability and bail bonds; geographic specialties such as the Company’s coverage of

non-standard, inner-city risks not typically well served by the standard market and Crum &

Forster’s longstanding presence in the Hawaii market; and customer group expertise in the areas of

propane distributors, explosive contractors, agriculture enterprises, and construction contractors

written on a non-admitted basis.

The Company generally conducts business on a brokerage basis through its home office and regional

branch network, allowing it to control the underwriting process and build close relationships with

producers and policyholders. The Company may also conduct business through third parties such as

managing general underwriters where it is cost effective to do so and where the Company can control

the underwriting process such as in the Company’s niche accident and health business. The Company

has over 1,500 producers located throughout the United States including independent regional retail

firms, wholesale brokers, national brokers and managing general underwriters.

The Company’s objective is to expand opportunistically into classes of business or market segments

that have the potential to generate an underwriting profit. Additional growth in specialty lines is

a significant element of the Company’s business strategy. Management believes the Company’s

ability to identify profitable market opportunities where its underwriting expertise can be applied

provides it with a competitive advantage.

In 2009, the Company generated $863.8 million of gross premiums written, $716.4 million of net

premiums written and $1,095.1 million of total revenues. For the year ended December 31, 2009, the

Company’s combined ratio was 102.2%. At December 31, 2009, the Company had cash and invested

assets of approximately $4.0 billion, total assets of $5.3 billion, shareholder’s equity of $1.5

billion and statutory policyholders’ surplus of $1.6 billion.

Corporate Structure

Crum & Forster is a Delaware holding company that is 100% owned by Fairfax Inc., a Wyoming holding

company. Fairfax Inc. is ultimately owned by Fairfax, a Canadian financial services holding

company, which is publicly traded on the Toronto Stock Exchange. Crum & Forster is a major

component of the U.S. commercial property and casualty insurance operations of Fairfax, which is

principally engaged in property and casualty insurance, reinsurance and investment management.

Crum & Forster was acquired by Fairfax on August 13, 1998.

5

Each of the Company’s major subsidiaries is depicted below:

6

Crum & Forster’s insurance subsidiaries, except CF Specialty and Seneca and its subsidiaries,

participate in an intercompany pooling arrangement pursuant to which the premiums, losses and other

underwriting expenses of each participant are pooled by means of mutual reinsurance on a

fixed-percentage basis as follows: US Fire, 76%; North River, 22%; CF Insurance, 1%; and CF

Indemnity, 1%. The intercompany agreement provides that US Fire, acting as the lead company,

assumes from the other pool participants 100% of their premiums, losses and other underwriting

expenses, and, in turn, cedes to each pool participant its participating percentage of premiums,

losses and other underwriting expenses. The pooling arrangement permits each pool participant to

rely on the capacity of the entire pool, rather than solely on its own capital and surplus.

Further, it prevents any one pool participant from suffering undue losses, as all pool participants

share underwriting profits and losses in proportion to their respective pool participation

percentages. CF Specialty and Seneca and its subsidiaries operate independently from the pool.

Any transactions with pool participants are eliminated in the preparation of the consolidated

financial statements.

Lines of Business

Crum & Forster offers a broad range of property and casualty insurance coverages, primarily to

commercial accounts, located throughout the United States. Gross premiums written by line of

business are summarized as follows:

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Years Ended December 31, |

|

| |

|

2009 |

|

|

2008 |

|

|

2007 |

|

| (dollars in millions) |

|

$ |

|

|

% |

|

|

$ |

|

|

% |

|

|

$ |

|

|

% |

|

General liability |

|

$ |

188.5 |

|

|

|

21.8 |

% |

|

$ |

216.3 |

|

|

|

21.2 |

% |

|

$ |

251.5 |

|

|

|

20.2 |

% |

Workers’ compensation |

|

|

188.5 |

|

|

|

21.8 |

|

|

|

196.0 |

|

|

|

19.2 |

|

|

|

258.9 |

|

|

|

20.8 |

|

Commercial automobile |

|

|

96.8 |

|

|

|

11.2 |

|

|

|

164.0 |

|

|

|

16.1 |

|

|

|

203.4 |

|

|

|

16.3 |

|

Property |

|

|

87.4 |

|

|

|

10.1 |

|

|

|

155.6 |

|

|

|

15.3 |

|

|

|

272.0 |

|

|

|

21.8 |

|

Commercial multi-peril |

|

|

81.5 |

|

|

|

9.5 |

|

|

|

83.8 |

|

|

|

8.2 |

|

|

|

88.2 |

|

|

|

7.1 |

|

Accident and health |

|

|

190.9 |

|

|

|

22.1 |

|

|

|

159.7 |

|

|

|

15.7 |

|

|

|

127.6 |

|

|

|

10.3 |

|

Other1 |

|

|

30.2 |

|

|

|

3.5 |

|

|

|

44.2 |

|

|

|

4.3 |

|

|

|

43.4 |

|

|

|

3.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total gross premiums written |

|

$ |

863.8 |

|

|

|

100.0 |

% |

|

$ |

1,019.6 |

|

|

|

100.0 |

% |

|

$ |

1,245.0 |

|

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| 1 |

|

Other includes personal automobile, homeowners, surety and fidelity lines of

business. |

General liability provides coverage for third party liability exposures, including bodily

injury and property damage arising from products sold and general business operations. These

policies are written on both an admitted and non-admitted basis. General liability also includes

coverage to protect policyholders against third-party personal injury. This coverage is generally

written with a limit of $1 million. This line of business includes umbrella coverage, which

provides additional insurance protection to businesses for amounts that exceed the limits of their

primary liability policies with the Company or another insurance carrier. Approximately 76% of the

Company’s umbrella premiums are for accounts for which the underlying liability coverage is

provided by another insurance carrier. In 2009, approximately 69% of the Company’s umbrella gross

premiums written were associated with policies having an attachment point of $1 million, while the

average umbrella policy limit written was approximately $14 million. Gross limits offered on

umbrella policies did not exceed $25 million. The Company also writes specialty classes, such as

directors’ and officers’ liability, which involves coverage for liability arising from the actions

of directors and officers in their official capacities, and employment practices liability, which

protects the policyholder from liability arising from employment policies and plans, such as

liability related to discrimination and harassment. The average directors’ and officers’ policy

limit written in 2009 was approximately $5 million and gross limits offered generally did not

exceed $10 million.

The distribution of the Company’s total general liability gross premiums written by type of

coverage is summarized as follows:

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Years Ended December 31, |

|

| |

|

2009 |

|

|

2008 |

|

|

2007 |

|

Umbrella liability |

|

|

48.7 |

% |

|

|

46.3 |

% |

|

|

42.2 |

% |

Products liability |

|

|

17.4 |

|

|

|

19.7 |

|

|

|

22.7 |

|

Directors’ and officers’ liability

Directors’ and officers’

liability |

|

|

8.8 |

|

|

|

8.5 |

|

|

|

7.2 |

|

Employment practices liability |

|

|

3.3 |

|

|

|

2.6 |

|

|

|

2.6 |

|

All other general liability |

|

|

21.8 |

|

|

|

22.9 |

|

|

|

25.3 |

|

|

|

|

|

|

|

|

|

|

|

Total general liability |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

In 2009 and 2008, the umbrella liability percentage of the total increased due to a decline in

products and general liability premiums as a result of competitive market conditions, particularly

for non-admitted business.

7

Workers’ compensation provides coverage for the obligations of an employer under state law to

provide its employees with specified benefits for work-related injuries, deaths and diseases,

regardless of fault. Typically, there are four types of benefits payable under workers’

compensation policies: medical benefits, disability benefits, death benefits and vocational

rehabilitation benefits. The benefits payable and the duration of such benefits are set by statute

and vary by state and with the nature and severity of the injury or disease and the wages,

occupation and age of the employee. The Company offers three types of workers’ compensation

products:

| |

• |

|

guaranteed cost products; |

| |

| |

• |

|

large deductible policies; and |

| |

| |

• |

|

retrospectively rated policies. |

Premiums are primarily a function of:

| |

• |

|

the applicable premium rate, which varies by state according to the employee’s

duties and the business of the employer; |

| |

| |

• |

|

the policyholder’s experience modification factor; and |

| |

| |

• |

|

the policyholder’s payroll. |

Generally, a deposit premium is paid at the beginning of the policy period and periodic

installments are paid during the policy period. The final premium is determined at the end of the

policy period after the employer’s payroll records are audited. Premiums are continually reviewed

for adequacy using an actuarial analysis of current and anticipated trends.

The Company applies a comprehensive approach to workers’ compensation business that benefits both

Crum & Forster and its policyholders. Loss prevention services focused on workplace safety and the

prevention of accidents are provided to the Company’s policyholders. The Company emphasizes loss

cost containment methods, which involve employers, employees and care providers that focus on

cost-effective quality care and early return to work for injured employees. The Company also

strives to prevent costs associated with fraudulent claims by applying a proactive approach to

investigation and litigation of claims, where appropriate.

The distribution of total workers’ compensation gross premiums written by type of coverage is

summarized as follows:

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Years Ended December 31, |

|

| |

|

2009 |

|

|

2008 |

|

|

2007 |

|

Guaranteed cost |

|

|

89.4 |

% |

|

|

92.4 |

% |

|

|

91.0 |

% |

Large deductible |

|

|

7.8 |

|

|

|

6.5 |

|

|

|

7.7 |

|

Retrospectively rated |

|

|

2.8 |

|

|

|

1.1 |

|

|

|

1.3 |

|

|

|

|

|

|

|

|

|

|

|

Total workers’ compensation |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

With respect to large deductible policies, the average policyholder retention is approximately

$217,000 and the average premium discount from standard premium, recognizing the reduced net loss

exposure, is approximately 74%.

Commercial automobile provides coverage for businesses against losses arising from bodily injury,

bodily injury to third parties, property damage to a policyholder’s vehicle, property damage to

other vehicles and other property resulting from the ownership, maintenance or use of vehicles in a

business. The Company targets policyholders with fleets of 25 to 100 vehicles, particularly those

with low driver turnover and good driving records. The majority of the Company’s commercial

automobile business consists of local and intermediate operations where drivers can return to their

garage location within the same day. The commercial auto business declined significantly in 2009

as a result of both soft market conditions and specific underwriting actions taken by the Company

to reduce exposure to unprofitable transportation accounts.

Property provides coverage for loss or damage to buildings, inventory and equipment and financial

loss due to business interruption resulting from covered property damage. Policies written are

typically “all risk” in nature, providing protection from natural disasters, including losses from

hurricanes, windstorms, earthquakes, hail and severe winter weather, and other events, such as

theft and vandalism, fires, explosions, storms, and at the policyholder’s option, terrorism. It is

industry practice, as well as that of the Company, to exclude certain risks, including war and

nuclear risks, from all property policies. Gross limits offered on property business averaged

approximately $14 million and generally did not exceed $25 million per policyholder. Property

insurance is principally provided through fire and allied lines, inland marine and difference in

conditions coverages. Fire and allied lines coverage insures real and personal property from

direct physical damage from the perils covered as well as the loss of business income that might

result from such loss. Inland marine covers insureds specializing mainly in, but not limited to,

the transportation, communications and construction industries. Difference in conditions coverage

insures real and personal property from direct physical damage and the associated loss of business

income resulting primarily from earthquake and flood perils as well as other perils excluded from

standard fire and allied lines policies. Policies written on an excess basis comprised

approximately 4%, 8% and 9% of property gross premiums written in 2009, 2008 and 2007,

respectively, with the decline in 2009 related to underwriting actions discussed below.

8

The distribution of total property gross premiums written, by type of coverage, is summarized as

follows:

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Years Ended December 31, |

|

| |

|

2009 |

|

|

2008 |

|

|

2007 |

|

Fire and allied lines |

|

|

73.5 |

% |

|

|

78.7 |

% |

|

|

82.5 |

% |

Inland marine |

|

|

24.0 |

|

|

|

15.5 |

|

|

|

10.7 |

|

Earthquake |

|

|

2.5 |

|

|

|

5.8 |

|

|

|

6.8 |

|

|

|

|

|

|

|

|

|

|

|

Total property |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

The significant decline in overall property gross premiums written and the change in the percentage

distribution of fire and allied lines over the last two years is due to competitive market

conditions and underwriting actions taken to improve the profitability of the Company’s fire

business. These underwriting actions significantly reduced certain property business, primarily

large garden apartment accounts and national accounts with multiple locations written on the basis

of total insured value. These actions also reduced the Company’s catastrophe exposures and

corresponding property reinsurance costs. The greater share of inland marine is due to the decline

in fire and allied gross premiums written.

Commercial multi-peril combines property and liability coverage under one insurance policy. The

Company typically writes these package policies for smaller businesses where expense advantages can

be gained by combining these coverages rather than purchasing two separate policies. This business

is primarily written by Seneca, which accounted for 69% of 2009 commercial multi-peril premiums.

For the years ended December 31, 2009, 2008 and 2007, approximately 47.3%, 50.9% and 53.6%,

respectively, of commercial multi-peril gross premiums written were attributable to liability

coverage.

Accident and health includes an array of coverages as follows: employer stop loss insurance

produced by agents and brokers; student medical insurance produced by agents and brokers, which

includes college accident and sickness, intercollegiate sports, international student insurance and

blanket special risk; pet insurance sold primarily online; travel insurance including wholesale and

retail coverage, which can be sold on a brochure basis through travel agents, online or through

insurance brokers; and other medical insurance, including (i) fully insured organ transplant,

provider excess of loss for physician and hospital groups, and health maintenance organization

reinsurance sold through insurance brokers; and (ii) limited medical coverage for associations and

employer groups and short term medical insurance sold online or through agents.

The distribution of the Company’s total accident and health gross premiums written, by type of

major coverage, is summarized as follows:

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Years Ended December 31, |

|

| |

|

2009 |

|

|

2008 |

|

|

2007 |

|

Employer stop loss insurance |

|

|

39.5 |

% |

|

|

27.9 |

% |

|

|

21.8 |

% |

Student medical insurance |

|

|

24.9 |

|

|

|

30.6 |

|

|

|

29.7 |

|

Pet insurance |

|

|

14.9 |

|

|

|

15.6 |

|

|

|

10.1 |

|

Retail travel and accident insurance |

|

|

13.2 |

|

|

|

16.1 |

|

|

|

24.7 |

|

Other medical insurance |

|

|

7.5 |

|

|

|

9.8 |

|

|

|

13.7 |

|

|

|

|

|

|

|

|

|

|

|

Total accident and health |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

Other includes bail bonds, personal insurance (including personal automobile and homeowners’

policies) and fidelity and surety coverages. Bail bonds provide for the issuance of financial

security to a court to guarantee the return, at a specific date, of a person facing criminal

charges. Fidelity insurance provides for loss due to misappropriation of funds by an employee.

Surety coverages include contract and commercial bonds. Contract bonds secure a contractor’s

performance and/or payment obligation, generally with respect to a construction project, and are

typically required by federal, state and local governments for public works projects. Commercial

bonds cover obligations typically required by law or regulation such as license and permit and

fiduciary bonds. The Company also writes a small amount of personal automobile and homeowners’

policies which are limited to the state of Hawaii.

9

The distribution of the Company’s total other gross premiums written, by type of coverage, is

summarized as follows:

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Years Ended December 31, |

|

| |

|

2009 |

|

|

2008 |

|

|

2007 |

|

Bail bonds |

|

|

34.5 |

% |

|

|

27.0 |

% |

|

|

30.2 |

% |

Personal automobile |

|

|

21.8 |

|

|

|

17.5 |

|

|

|

21.8 |

|

Fidelity |

|

|

21.7 |

|

|

|

40.4 |

|

|

|

30.3 |

|

Homeowners |

|

|

19.8 |

|

|

|

14.0 |

|

|

|

15.4 |

|

Contract and commercial bonds |

|

|

2.2 |

|

|

|

1.1 |

|

|

|

2.3 |

|

|

|

|

|

|

|

|

|

|

|

Total other |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

Geographic Distribution

The Company is licensed and currently writes insurance in all 50 states, the District of Columbia,

Virgin Islands and Puerto Rico. For the year ended December 31, 2009, the top ten states

represented 67.0% of direct premiums written. The distribution of direct premiums written by

state, as a percentage of total direct premiums written, is summarized as follows:

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Years Ended December 31, |

|

| |

|

2009 |

|

|

2008 |

|

|

2007 |

|

California |

|

|

15.1 |

% |

|

|

13.9 |

% |

|

|

14.5 |

% |

New York |

|

|

10.6 |

|

|

|

10.1 |

|

|

|

9.0 |

|

Florida |

|

|

8.6 |

|

|

|

9.5 |

|

|

|

9.9 |

|

Texas |

|

|

7.7 |

|

|

|

8.4 |

|

|

|

8.9 |

|

New Jersey |

|

|

5.9 |

|

|

|

6.9 |

|

|

|

7.2 |

|

Hawaii |

|

|

4.6 |

|

|

|

4.4 |

|

|

|

4.5 |

|

Pennsylvania |

|

|

4.6 |

|

|

|

4.5 |

|

|

|

4.5 |

|

Massachusetts |

|

|

4.1 |

|

|

|

3.9 |

|

|

|

3.4 |

|

Illinois |

|

|

3.7 |

|

|

|

3.7 |

|

|

|

3.6 |

|

Virginia |

|

|

2.1 |

|

|

|

2.1 |

|

|

|

2.0 |

|

All other states |

|

|

33.0 |

|

|

|

32.6 |

|

|

|

32.5 |

|

|

|

|

|

|

|

|

|

|

|

Total direct premiums written |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

As a result of significant regulatory reforms of the California workers’ compensation system

enacted in 2003 and 2004 and strong rate increases, which resulted in a dramatic improvement in the

industry’s workers’ compensation accident year loss ratios, the California workers’ compensation

marketplace evolved to one where there were numerous carriers aggressively seeking growth in recent

years. As a result, the Company was affected by declining market prices and additional

competition, resulting in declining California workers’ compensation gross premiums written from

2003 to 2008. After several years of declining market prices, the Company has seen modest price

increases in California workers’ compensation pricing during 2009, resulting in gross premiums in

that line increasing by approximately 12% for the year ended December 31, 2009 as compared to

declines of approximately 15% and 20%, for the years ended December 31, 2008 and 2007,

respectively.

Business Development and Methods of Distribution

The Company’s gross premiums written are derived from renewal of in-force policies, generation of

new policies and endorsement activity, including additional or return premiums due upon audit.

Central to the Company’s premium production management are efforts to maintain or improve renewal

retention rates and to increase the Company’s new business production through improvements in the

“quote ratio” (the ratio of quotes issued to submissions received) and the “hit ratio” (the ratio

of new policies bound to quotes issued), while first and foremost maintaining adequate rates for

the exposures.

Crum & Forster depends on producers to provide it with access to a wide range of business

opportunities. The Company’s ability to develop strong and mutually beneficial relationships, and

successfully market its products and services to producers, is paramount to its success.

Generally, the Company’s business is distributed through more than 1,500 producers located

throughout the United States. Crum & Forster intends to continue to expand its producer force.

The Company offers its producers underwriting expertise and timely policy processing, which assists

them in placing business in underserved markets. The Company’s service extends to loss control and

claims management services, particularly on large accounts where this expertise is highly valued by

both the producer and the policyholder.

10

Producers are compensated principally on the basis of commissions negotiated between the producer

and the Company on an individual policy basis. Additionally, the Company pays contingent

commissions to certain producers based on achievement by the producer of agreed-upon targets.

Total producer compensation incurred in 2009, 2008 and 2007 was $117.5 million, $132.3 million and

$152.9 million, respectively, of which contingent commissions expense incurred in those years

totaled $5.3 million, $4.8 million and $4.7 million, respectively.

Crum & Forster’s producers generally fall into three categories: independent regional retail firms,

wholesale brokers and national brokers. Each of these channels has its own distinct distribution

characteristics and customers. Independent regional retail firms generally operate in a limited

geographic region. These producers often focus on mid-size accounts. Wholesale brokers primarily

produce business that retail firms have difficulty placing due to its unique, unusual or hazardous

nature. National brokers generally have a significant number of locations throughout the United

States and target larger risks requiring complex insurance analysis and placement.

The accident and health business is managed by approximately 40 producers, third party

administrators and managing general underwriters. These producers, third party administrators and

managing general underwriters may perform various aspects of program administration, including

pricing and underwriting. Those who have underwriting authority are required to follow strict

underwriting guidelines which are provided by the Company and are subject to annual audits by the

Company to ensure adherence to those underwriting guidelines.

The percentage of business from these categories of producers, based on gross premiums written,

excluding the accident and health and surety lines of business, is summarized as follows:

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Years Ended December 31, |

|

| |

|

2009 |

|

|

2008 |

|

|

2007 |

|

Independent regional retail firms |

|

|

47.8 |

% |

|

|

43.3 |

% |

|

|

38.5 |

% |

Wholesale brokers |

|

|

33.0 |

|

|

|

36.1 |

|

|

|

41.5 |

|

National brokers |

|

|

19.2 |

|

|

|

20.6 |

|

|

|

20.0 |

|

|

|

|

|

|

|

|

|

|

|

Total direct premiums written |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

The increase in the percentage of gross premiums written attributable to independent regional

retail firms and corresponding decrease in business from wholesale brokers in 2009 as compared to

2008 and 2007 is largely due to decreases in non-admitted business as well as property and

transportation business written through wholesale brokers. The decrease is due to the combined

effects of market conditions, whereby accounts previously produced by wholesale producers have

moved to retail channels, the negative impact of the economy on the construction business and

specific underwriting actions taken by the Company to improve profitability.

Pricing and Underwriting

The Company adheres to a disciplined underwriting strategy that focuses on profitability without

regard to premium growth or market share. Other than in the accident and health and bail bond

lines of business in which third parties have underwriting authority, each policy is individually

underwritten by the Company’s underwriters based on the particular risk and class of business.

Prices are set based on these risk characteristics and consider other factors such as estimated

frequency and severity of expected losses, the expenses of producing the business and managing

claims and an allowance for an underwriting profit. The Company’s disciplined underwriting

strategy may restrict its premium growth when market conditions do not meet pricing and

underwriting standards.

The Company’s underwriting process is primarily controlled centrally by profit center managers in

the home office who have extensive experience in the insurance industry. Each executive is held

accountable for the underwriting results of his or her line of business. Underwriting authority

levels are established based on characteristics such as class of business, hazard grade and policy

limits and are assigned based on the experience and expertise of the underwriter. Regional

underwriting product line managers generally report to the home office profit center managers on

all underwriting matters.

The Company’s casualty business is either manually rated or loss rated, generally depending on the

size of the risk to be priced. Manual rating begins with a classification rate provided by an

industry rating bureau. Deviations from this rate based on the individual characteristics and loss

history of the risk, as well as the desirability of the class of business, are then determined.

Loss rating is a methodology utilized for large casualty risks wherein an individual risk’s

credible loss experience is the basis for rate and premium development for the risk. A portion of

the Company’s business is large enough to be rated on its own loss history. This loss rated

business is within the workers’ compensation, general liability and commercial automobile lines of

business and includes guaranteed cost policies, where policy premiums are fixed, and loss sensitive

rating programs, where the ultimate costs to the policyholder are dependent upon its loss

experience. The underwriting of loss rated business generally requires approval by home office

underwriting and actuarial personnel.

11

For workers’ compensation business, the Company considers aggregation of insured employees during

the quotation process at an account and location level. On a monthly basis, management monitors

insured employee aggregations, particularly in target cities, in proximity to target sites and in

earthquake-prone zones, in order to manage the Company’s potential exposure to terrorism and/or

earthquake losses.

Loss sensitive business includes large deductible policies, in which the policyholder must

reimburse the Company for any losses within the deductible and retrospectively rated policies, in

which premiums are adjusted based on the actual loss experience of the policyholder. Both of these

loss sensitive products expose Crum & Forster to potential credit risk since the Company may be due

payment from the policyholder after coverage has been provided. Loss sensitive policies are subject

to extensive financial analysis prior to binding and generally require that the policyholder

provide collateral as a condition to writing the policy. For further discussion of such credit

risk, see “Item 1A. Risk Factors—The Company bears credit risk with respect to its reinsurers and

certain policyholders, and if one or more of them fails to pay, the Company could experience

losses, which would reduce its net income”.

Property risks are underwritten on an individual risk basis. Underwriting considerations that

factor into the pricing of individual property risks include, but are not limited to, building

construction, occupancy classes and inherent internal exposures to loss, physical protection of the

property and external exposures to loss, as well as past loss experience. Approximately 96% of the

Company’s property business is written on a primary basis. The underwriting and pricing of such

risks requires significant underwriting expertise due to the complexities of individual risk

exposures. Inland marine is typically rated individually by the underwriter based on the

characteristics of the risk and the class of business, without the use of an industry manual rate.

The Company’s underwriting of any property risk always considers the aggregate exposures to natural

and man-made catastrophic losses and attempts to mitigate such exposure. The Company monitors

exposures in areas most susceptible to a hurricane, earthquake or terrorist event.

The accident and health business is a diverse portfolio of largely low policy premium specialty

products. College accident and sickness policies are generally experience rated based on a minimum

of three years’ historical premiums and claims experience. Travel insurance products are typically

rated based on portfolio or case experience, with rates fixed on trip cost and traveler age. The

various medical products are priced using industry standard, actuarially derived manuals obtained

from several industry actuarial sources. Pet insurance is rated using an actuarially derived

matrix based on coverage, type, policy limit, pet age and breed. Due to the short tail nature of

the accident and health products, results emerge more quickly allowing for rates to be adjusted as

needed.

Crum & Forster conducts its bail bond business through numerous agents across the U.S. who have

authority to underwrite and issue bonds, subject to limits established by the Company. The Company

must approve, prior to binding, all bail bonds with values in excess of each agent’s underwriting

authority, which can range from $5 thousand to $0.5 million. While collateral may be required as a

condition to writing the bond, the bail agent is required to indemnify the Company for any payments

made in respect of defaulted bonds.

Catastrophe Risk Management

The Company has exposure to losses caused by various natural and man-made events. Natural

catastrophic events include hurricanes, earthquakes, tornados, windstorms, hailstorms, explosions,

severe winter weather and fires. Man-made catastrophic events include terrorist acts, riots,

crashes and derailments. The incidence and severity of catastrophes are inherently unpredictable.

The extent of losses from a catastrophe is a function of both the total amount of insured exposure

in the area affected by the event and the severity of the event. Most catastrophes are restricted

to small geographic areas; however, hurricanes, earthquakes and windstorms may produce significant

damage in large, heavily populated areas. Catastrophes can cause losses in a variety of property

and casualty coverages and lines of business for which the Company provides insurance.

Seasonal weather variations may affect the severity and frequency of losses. Insurance companies

are not permitted to reserve for a catastrophe until it has occurred, and actual losses could

exceed expectations despite measures the Company might take to attempt to protect itself. It is

therefore possible that a catastrophic event or multiple catastrophic events could adversely affect

the Company’s net income, financial position and liquidity. Increases in the value and geographic

concentration of insured exposures and the effects of inflation could increase the severity of

claims from future catastrophic events. In addition, states have from time to time passed

legislation that has had the effect of limiting the ability of insurers to manage catastrophic

risk, such as legislation prohibiting insurers from withdrawing from catastrophe-prone areas.

The Company closely monitors catastrophe exposure on an individual risk and book of business basis.

Each property risk is written in accordance with the company’s underwriting guidelines which

determine the allowable limits given the buildings location and structure. Crum & Forster monitors

its aggregate property exposure in catastrophe-prone areas based on total exposed policy limits,

number of locations, total insured values and other information by region. In areas most

susceptible to a hurricane or earthquake event, the Company also runs a catastrophe model each

quarter to assess its average annual loss and its probable maximum loss for both a 250-year and

100-year return period event. The Company also monitors its aggregate exposed policy limits by

target city to mitigate terrorism risk.

12

The Company has established underwriting guidelines regarding its concentration of workers’

compensation exposures in target cities, in proximity to target sites and in earthquake-prone

areas. As a result of database enhancements and increased information gathered on the Company’s

policyholders, the majority of employees are captured by location in the Company’s systems,

permitting ongoing monitoring of compliance with concentration guidelines. The Company is required

to provide terrorism coverage under its workers’ compensation policies and has developed specific

underwriting and pricing guidelines for this coverage. For those classes where coverage is not

mandatory, policyholders may choose not to accept terrorism coverage. Based on experience through

December 31, 2009, approximately 30% of policyholders in the Company’s property lines of business

accepted terrorism coverage. Direct premiums written from terrorism coverage in 2009 were

approximately $7.2 million. The Company purchases property and workers’ compensation catastrophe

reinsurance to mitigate its losses in the event of catastrophes.

Reinsurance

In order to control the exposure to losses and protect capital resources, the Company cedes a

portion of its gross policy premiums to reinsurers in exchange for the reinsurer’s agreement to

share a portion of the covered losses. Reinsurance is a practice whereby one insurer, called the

“reinsurer”, agrees to indemnify another insurer, called the “ceding insurer”, for all or part of

the potential liability arising from one or more insurance policies issued by the ceding insurer.

The Company’s purchase of reinsurance does not discharge the Company from primary liability to its

policyholders. The net liability retained on individual risks varies by product and by the nature

of the risk. Insured liabilities can be reinsured either by treaty, wherein reinsurers agree in

advance to provide coverage above retained limits or for a specified percentage of losses

attributable to specific policies, or by facultative arrangements, wherein reinsurance is provided

for individual risks based on individual negotiations.

Crum & Forster’s underwriting results are significantly affected by reinsurance. The net impact of

ceded reinsurance transactions for each of the fiscal years 2009, 2008 and 2007 is summarized as

follows ((decrease) increase in components):

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Years Ended December 31, |

|

| (dollars in millions) |

|

2009 |

|

|

2008 |

|

|

2007 |

|

Earned premiums ceded to reinsurers1 |

|

$ |

(151.1 |

) |

|

$ |

(141.3 |

) |

|

$ |

(149.0 |

) |

Commissions earned on ceded reinsurance premiums |

|

|

32.9 |

|

|

|

31.3 |

|

|

|

25.8 |

|

Claims incurred ceded to reinsurers |

|

|

68.0 |

|

|

|

(44.4 |

)2 |

|

|

52.3 |

|

Provision for uncollectible reinsurance |

|

|

(2.0 |

) |

|

|

(7.7 |

) |

|

|

(8.0 |

) |

|

|

|

|

|

|

|

|

|

|

Net impact of ceded reinsurance transactions |

|

$ |

(52.2 |

) |

|

$ |

(162.1 |

) |

|

$ |

(78.9 |

) |

|

|

|

|

|

|

|

|

|

|

| |

|

|

| 1 |

|

For the years ended December 31, 2009, 2008 and 2007, accident and health earned

premiums ceded to reinsurers were $60.7 million, $42.1 million and $18.6 million,

respectively. |

| |

| 2 |

|

For the year ended December 31, 2008, claims incurred ceded to reinsurers include

$75.9 million related to losses on commutations. |

The majority of reinsurance contracts purchased by the Company provide coverage for a one year

term and are negotiated annually. The ability of the Company to obtain reinsurance on terms and

prices consistent with historical results reflects, among other factors, recent loss experience of

the Company and the industry in general. The Company’s current maximum retention and reinsured

limits per risk or per insured for the major lines of business subject to significant reinsurance

are summarized as follows:

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Maximum

Retained |

|

| (dollars in millions) |

|

Maximum

Retention |

|

|

and Reinsured

Limits |

|

General Liability: |

|

|

|

|

|

|

|

|

Umbrella |

|

$ |

5.0 |

|

|

$ |

25.0 |

|

Management Protection1,2 — primary and excess policies |

|

$ |

5.1 |

|

|

$ |

10.0 |

|

Property Per Insured/Per Risk |

|

$ |

5.0 |

|

|

$ |

25.0 |

|

Employer Stop Loss |

|

$ |

0.5 |

|

|

$ |

5.0 |

|

| |

|

|

| 1 |

|

Management protection includes directors’ and officers’ liability, errors and

omissions liability, employment practices liability, fiduciary liability and miscellaneous

professional liability. |

| |

| 2 |

|

The Company has a 30.0% co-participation in the excess layer, with the remaining 70%

ceded to Wentworth Insurance Company Limited (“Wentworth”), a Fairfax affiliate. |

In general, other general liability policies and commercial automobile policies are written

with limits of $1 million per occurrence and are not reinsured. General liability policies

typically contain a $2 million aggregate limit.

13

Effective April 1, 2009, the Company placed its workers’ compensation catastrophe treaty. Workers’

compensation risks are reinsured on a per occurrence basis only. This treaty provides coverage of

$80 million in excess of $20 million in two layers of $30 million and $50 million, excluding

California earthquake losses in the first layer, whereas the expiring treaty provided $130 million

of coverage in excess of $20 million per occurrence in three layers of $30 million, $50 million and

$50 million, with Company co-participation on the first layer of 30%, and excluded California

earthquake losses in that layer. The reduced coverage in 2009 recognizes the Company’s reduced

exposures. Odyssey America Reinsurance Corp (“Odyssey”), a Fairfax affiliate, has a 9.0%

participation in the $30 million in excess of $20 million layer. Wentworth, a Fairfax affiliate,

has a 5% participation in the $20 million in excess of $30 million layer and a 5% participation in

the $50 million in excess of $50 million layer. The Company is obligated to pay reinstatement

premiums equal to 100% of the original premium.

The Company’s property catastrophe reinsurance treaty protects it in the event of property losses

arising from one defined catastrophic occurrence or series of events. Effective June 1, 2009, the

Company placed its property catastrophe reinsurance treaty covering its standard property business.

The new treaty provides coverage of $35 million in excess of $40 million, whereas the expiring

treaty provided coverage of $85 million in excess of $65 million in two layers of $35 million and

$50 million. The reduced coverage in 2009 recognizes the Company’s reduced exposures. There was

no affiliate participation in this treaty. The Company is obliged to reinstate any limits used at

100% of the original premium.

Effective May 1, 2009, Seneca placed its property catastrophe treaty providing coverage for the

Company’s inland marine and non-admitted fire business along with Seneca’s property business. The

new treaty provides coverage of $45 million in excess of $15 million, whereas the expiring treaty

provided coverage of $50 million in excess of $10 million. There was no affiliate participation

in this treaty. Seneca is obliged to reinstate any limits used at 100% of the original premium.

In general, the Company’s reinsurance contracts provide coverage for domestic acts of terrorism.

Certain casualty contracts have additional terrorism coverage for acts of terrorism certified under

the Terrorism Risk Insurance Act of 2002 which was extended through December 31, 2014 with the

passage of the Terrorism Risk Insurance Program Reauthorization Act of 2007 (collectively,

“TRIPRA”). In particular, the workers’ compensation contract has coverage up to $80.0 million and

the umbrella contract has coverage equal to two times the coverage limit, up to a maximum of $40.0

million. None of the contracts covers acts of terrorism involving use of nuclear, biological or

chemical agents. For further discussion of TRIPRA, see “Insurance Regulatory Matters—Terrorism Risk

Insurance Program Reauthorization Act of 2007” and “Item 1A. Risk Factors—Catastrophic events could

cause unanticipated losses and reduce net income”.

For further discussion of the Company’s reinsurance agreements, see Notes 7 and 10 to the

consolidated financial statements included in “Item 8. Financial Statements and Supplemental Data”.

At December 31, 2009 and 2008, reinsurance recoverable was $892.7 million and $968.2 million,

respectively, net of uncollectible reinsurance reserves totaling $54.2 million and $56.0 million,

respectively. Reinsurance recoverable at December 31, 2009 was due from approximately 265

reinsurers. Credit exposure exists with respect to the Company’s reinsurance recoverable balances

to the extent that a reinsurer may not be able or willing to reimburse the Company under the terms

of the relevant reinsurance arrangements. The Company has guidelines and a review process in place

to assess the creditworthiness of the reinsurers to which it cedes. Internal guidelines generally

require reinsurers to have strong A.M. Best credit ratings and maintain certain capital and

surplus requirements. In addition, where contractually provided for, the Company has collateral

for outstanding balances in the form of cash, letters of credit or assets held in trust accounts.

This collateral may be drawn on for the amounts that remain unpaid beyond contractually specified

time periods on an individual basis. The Company held total collateral of $306.9 million (excluding

collateral in excess of the related recoverable exposure) at December 31, 2009, representing 34.4%

of total reinsurance recoverable.

Set forth below is a table showing the ten largest reinsurance recoverable balances by reinsurer:

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

At December 31, 2009 |

|

| |

|

A.M. Best |

|

Security |

|

|

Reinsurance |

|

|

% of |

|

| (dollars in millions) |

|

Rating1 |

|

Provided |

|

|

Recoverable |

|

|

Total |

|

North American Specialty Insurance Company |

|

A |

|

$ |

236.3 |

2 |

|

$ |

349.0 |

|

|

|

39.1 |

% |

TIG Insurance Company (“TIG”) 3,4 |

|

B+ |

|

|

— |

|

|

|

129.4 |

|

|

|

14.5 |

|

Fairmont Specialty Insurance Company3 |

|

B++ |

|

|

— |

|

|

|

37.7 |

|

|

|

4.2 |

|

Swiss Reinsurance America Corporation |

|

A |

|

|

— |

|

|

|

29.0 |

|

|

|

3.2 |

|

Munich Reinsurance America Inc. |

|

A+ |

|

|

— |

|

|

|

20.7 |

|

|

|

2.3 |

|

Wentworth3 |

|

NR5 |

|

|

18.5 |

6 |

|

|

19.2 |

|

|

|

2.2 |

|

Lloyds Syndicates |

|

A |

|

|

— |

|

|

|

17.0 |

|

|

|

1.9 |

|

nSpire Re Limited3 |

|

NR5 |

|

|

14.0 |

6 |

|

|

12.4 |

|

|

|

1.4 |

|

Hannover Ruckversicherungs-Aktiengesellschaft |

|

A |

|

|

11.4 |

7 |

|

|

11.6 |

|

|

|

1.3 |

|

Travelers Indemnity |

|

A+ |

|

|

— |

|

|

|

10.7 |

|

|

|

1.2 |

|

Other |

|

|

|

|

48.2 |

8 |

|

|

256.0 |

9 |

|

|

28.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total reinsurance recoverable |

|

|

|

$ |

328.4 |

|

|

$ |

892.7 |

|

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| 1 |

|

The A.M. Best rating system includes ratings of “A++” and “A+” (which are

“Superior” ratings), “A” and “A-” (which are “Excellent” ratings), “B++” and “B+” (which are

“Very Good” ratings) and nine lower ratings categories. Ratings are as of February 20, 2010. |

14

| |

|

|

| 2 |

|

Funds held at December 31, 2009. The unsecured balance due from North American

Specialty Insurance Company is effectively guaranteed by an upstream affiliated insurer in the

Swiss Re Group. |

| |

| 3 |

|

Fairfax affiliate. |

| |

| 4 |

|

Effective December 16, 2002, International Insurance Company merged with TIG, a

Fairfax subsidiary. TIG had statutory capital and surplus at December 31, 2009 of

approximately $786.6 million. These recoverable balances arise principally from a

restructuring in 1993, prior to Fairfax’s acquisition of Crum & Forster. For further

discussion, see Note 10 to the consolidated financial statements included in “Item 8.

Financial Statements and Supplementary Data”. |

| |

| 5 |

|

Not rated. |

| |

| 6 |

|

Held in irrevocable trusts, principally comprised of cash and U.S. Treasury

securities. |

| |

| 7 |

|

Includes $5.4 million in trusts and $6.0 million in letters of credit. |

| |

| 8 |

|

Includes $26.9 million in letters of credit, $15.1 million in funds held and $6.2

million in trusts. |

| |

| 9 |

|

Includes reserves for uncollectible reinsurance of $54.2 million. 83% of these gross

recoverable balances are from companies having an A.M. Best rating of “A-” or better. |

Included in other in the table above are contingent obligations associated with structured

settlements with life insurance companies with a net present value of $141.0 million and amounts

recoverable from pools and associations in the amount of $15.2 million, which in the aggregate

amounted to $156.2 million, or 17.5%, of the total reinsurance recoverable balance at December 31,

2009. The three largest balances associated with the structured settlements are Genworth Life &

Annuity Insurance Company — $23.1 million; Life Insurance Company of North America — $20.9 million;

and Metropolitan Life Insurance Company — $17.6 million each of which has an A- rating or better

A.M. Best rating.

Affiliated Reinsurers

The Company has reinsurance agreements in effect with affiliates of Fairfax. As is the case with

all reinsurance agreements, Crum & Forster bears credit risk regarding ceded reinsurance

agreements, both with respect to reinsurance recoverable reflected on the Company’s balance sheets

as well as liabilities (development) associated with reinsurance recoverable on claims. For the

years ended December 31, 2009, 2008 and 2007, the Company ceded premiums of $12.9 million, $27.3

million and $36.3 million, respectively, to affiliates under these reinsurance contracts and

assumed premiums of $0 million, $0.1 million and $18.8 million, respectively, from affiliates under

these reinsurance contracts. The substantial decline in premiums assumed since 2007 is primarily

due to Fairmont premiums, which prior to 2007 were written by Fairmont and assumed by the Company

through a 100% quota share reinsurance agreement. Since the second half of 2007, substantially all

Fairmont business has been written directly by Crum & Forster resulting in negligible assumed

premiums in 2009 and 2008.

Reinsurance recoverable balances from affiliated reinsurers reflected on the consolidated balance

sheet are summarized as follows:

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

At December 31, 2009 |

|

| |

|

Total |

|

|

|

|

|

|

|

|

|

|

| |

|

Reinsurance |

|

|

Paid |

|

|

Outstanding |

|

|

|

|

| (dollars in millions) |

|

Recoverable |

|

|

Recoverable |

|

|

Reserves1 |

|

|

Collateral |

|

TIG |

|

$ |

129.4 |

|

|

$ |

— |

|

|

$ |

129.4 |

|

|

$ |

— |

|

Fairmont Specialty Insurance Company |

|

|

37.7 |

|

|

|

— |

|

|

|

37.7 |

|

|

|

— |

|

Wentworth |

|

|

19.2 |

|

|

|

0.1 |

|

|

|

19.1 |

|

|

|

18.5 |

|

nSpire |

|

|

12.4 |

|

|

|

— |

|

|

|

12.4 |

|

|

|

14.0 |

|

Odyssey America Reinsurance Corp. |

|

|

6.1 |

|

|

|

0.8 |

|

|

|

5.3 |

|

|

|

— |

|

Other |

|

|

1.6 |

|

|

|

0.1 |

|

|

|

1.5 |

|

|

|

3.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total affiliated reinsurance recoverable balances |

|

$ |

206.4 |

|

|

$ |

1.0 |

|

|

$ |

205.4 |

|

|

$ |

35.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| 1 |

|

Includes case and incurred but not reported (“IBNR”) reserves. |